2023 MIDYEAR

CONVERTERS ROUNDTABLE

AICC member experts weigh in on the economy and industry in Miami

ALSO INSIDE

Where Sustainability Meets Branding

Members Meeting: Spring Meeting Recap

Member Profile: Royal Containers

July/August 2023 Volume 27, No. 4

A PUBLICATION OF AICC, THE INDEPENDENT PACKAGING ASSOCIATION

BOXSCORE www.AICCbox.org 1 BoxScore is published bimonthly by AICC, e Independent Packaging Association, PO Box 25708, Alexandria, VA 22313, USA. Rates for reprints and permissions of articles printed are available upon request. e statements and opinions expressed herein are those of the individual authors and do not necessarily represent the views of AICC. e publisher reserves the right to accept or reject any editorial or advertising matter at its discretion. e publisher is not responsible for claims made by advertisers. POSTMASTER: Send change of address to BoxScore, AICC, PO Box 25708, Alexandria, VA 22313, USA. ©2023 AICC. All rights reserved. Visit www.NOW.AICCbox.org for Member News and even more great columns. Scan the QR code to check them out! COLUMNS 3 CHAIRWOMAN’S MESSAGE 4 SCORING BOXES 6 LEGISLATIVE REPORT 10 MEMBERS MEETING 14 ASK RALPH 16 ASK TOM 18 SELLING TODAY 22 ANDRAGOGY 26 LEADERSHIP 30 MEMBER PROFILE 54 THE ASSOCIATE ADVANTAGE 56 WHAT THE TECH? 58 STRENGTH IN NUMBERS 68 THE FINAL SCORE DEPARTMENTS 8 WELCOME, NEW & RETURNING MEMBERS 29 AICC INNOVATION 62 FOUNDATION FOR PACKAGING EDUCATION 64 INTERNATIONAL CORRUGATED PACKAGING FOUNDATION TABLE OF CONTENTS July/August 2023 • Volume 27, No. 4 38 FEATURES 38 2023 MIDYEAR CONVERTERS ROUNDTABLE AICC member experts weigh in on the economy and industry in Miami 46 WHERE SUSTAINABILITY MEETS BRANDING A growing number of boxmakers are making sustainability synonymous with their products as well as their business 46

OFFICERS

Chairwoman: Jana Harris, Harris Packaging/American Carton, Haltom City, Texas

First Vice Chairman: Matt Davis, Packaging Express, Colorado Springs, Colorado

Vice Chairs: Gary Brewer, Package Crafters, High Point, North Carolina Finn MacDonald, Independent II, Louisville, Kentucky

Terri-Lynn Levesque, Royal Containers Ltd., Brampton, Ontario, Canada

Immediate Past Chairman: Gene Marino, Akers Packaging Service Group, Chicago, Illinois

Chairman, Past Chairmen’s Council: Jay Carman, StandFast Packaging Group, Carol Stream, Illinois

President: Michael D’Angelo, AICC Headquarters, Alexandria, Virginia

Secretary/General Counsel: David Goch, Webster, Chamberlain & Bean, Washington, D.C.

AICC Canada: Lee Gould

DIRECTORS

West: Sahar Mehrabzadeh-Garcia, Bay Cities, Pico Rivera, Califormia

Southwest: Jenise Cox, Harris Packaging/American Carton, Haltom City, Texas

Southeast: Michael Drummond, Packrite, High Point, North Carolina

Midwest: Casey Shaw, Batavia Container Inc., Batavia, Illinois

Great Lakes: Josh Sobel, Jamestown Container Cos.

Macedonia, Ohio

Northeast: Stuart Fenkel, McLean Packaging Pennsauken, New Jersey

AICC Canada: Terri-Lynn Levesque, Royal Containers Ltd., Brampton, Ontario, Canada

AICC México: Sergio Menchaca, EKO Empaques de Cartón S.A. de C.V., Cortazar, Mexico

OVERSEAS DIRECTOR

Kim Nelson, Royal Containers Ltd., Brampton, Ontario, Canada

DIRECTORS AT LARGE

Kevin Ausburn, SMC Packaging Group, Springfield, Missouri

Eric Elgin, Oklahoma Interpack, Muscogee, Oklahoma

Guy Ockerlund, Ox Box, Addison, Illinois

Mike Schaefer, Tavens Packaging & Display Solutions, Bedford Heights, Ohio

Ben DeSollar, Sumter Packaging, Sumter, South Carolina

Jack Fiterman, Liberty Diversifies, Minneapolis, Minnesota

EMERGING LEADER DELEGATES

Lauren Frisch, Wasatch Container, North Salt Lake, Utah

John McQueary, CST Systems, Atlanta, Georgia

Jordan Dawson, Harris Packaging, Haltom City, Texas

ASSOCIATE MEMBER DIRECTORS

Chairman: Greg Jones, SUN Automation Group

Glen Arm, Maryland

Vice Chairman: Tim Connell, A.G. Stacker Inc Weyers Cave, Virginia

Secretary: John Burgess, Pamarco/Absolute, Roselle Park, New Jersey

Director: Jeff Dietz, Kolbus America Inc., Cleveland, Ohio

Immediate Past Chairman, Associate Members: Joseph Morelli, Huston Patterson Printers/Lewisburg

Printing Co., Decatur, Illinois

ADVISORS TO THE CHAIRMAN

Al Hoodwin, Michigan City Paper Box, Michigan City, Indiana

Gene Marino, Akers Packaging Service Group

Chicago, Illinois

Greg Jones, SUN Automation, Glen Arm, Maryland

PUBLICATION STAFF

Publisher: Michael D’Angelo, mdangelo@AICCbox.org

Editor: Virginia Humphrey, vhumphrey@AICCbox.org

ABOUT AICC

EDITORIAL/DESIGN SERVICES

The YGS Group • www.theYGSgroup.com

Vice President: Serena L. Spiezio

Senior Director of Content Strategy: Craig Lauer

Managing Editor: Therese Umerlik

Senior Editor: Sam Hoffmeister

Copy Editor: Steve Kennedy

Art Director: Alex Straughan

Account Manager: Frankie Singleton

SUBMIT EDITORIAL IDEAS, NEWS, & LETTERS TO: BoxScore@theYGSgroup.com

CONTRIBUTORS

Cindy Huber, Director of Conventions & Meetings

Chelsea May, Education and Training Manager

Laura Mihalick, Senior Meeting Manager

Patrick Moore, Membership Services Manager

Taryn Pyle, Director of Training, Education & Professional Development

Alyce Ryan, Marketing Manager

Steve Young, Ambassador-at-Large

ADVERTISING

Taryn Pyle 703-535-1391 • tpyle@AICCbox.org

Patrick Moore

703-535-1394 • pmoore@AICCbox.org

AICC

PO Box 25708

Alexandria, VA 22313

Phone 703-836-2422

Toll-free 877-836-2422

Fax 703-836-2795 www.AICCbox.org

PROVIDING BOXMAKERS WITH THE KNOWLEDGE NEEDED TO THRIVE IN THE PAPER-BASED PACKAGING INDUSTRY SINCE 1974

We are a growing membership association that serves independent corrugated, folding carton, and rigid box manufacturers and suppliers with education and information in print, in person, and online. AICC membership is for the full company, and employees at all locations have access to member benefits. AICC o ers free online education to all members to help the individual maximize their potential and the member company maximize its profit.

WHEN YOU INVEST AND ENGAGE, AICC DELIVERS SUCCESS.

Leading Through Uncertainty

Iam thrilled to share with you that we had 800 members and guests in attendance at the just-concluded AICC Spring Meeting in Miami. This was an outstanding showing. The other reason this meeting was such a thrill for me was that my dad, Joe Harris, was in attendance.

The big question on everyone’s mind as we met was, “Where are we as an industry?” Are we in a recession? Or not? Consider the following.

Domestic production of consumer nondurable goods remained strong in March, rising by 1.4% during the month, as reported in Dick Storat’s Scoring Boxes (see p. 4). But wait! Retail sales slumped 1% in March, and general merchandise stores like Target and Walmart saw their sales decline 3%! But then again, nonstore retail sales rose 1.9%!

Anna Wong of Bloomberg Economics told us in Miami that the manufacturing recession was underway at the end of 2022 due to excess inventories at retail. Consumers were buying less stuff. But she also said consumers still have spending power.

After Wong spoke, our boxmaker panel confirmed the slowdown: Howard Bertram—flat; Brett Kirkpatrick—off 10% for the first two months of the year; Joe Palmeri—not convinced we’ve bottomed out.

In a survey released earlier this year by AICC, a majority of members predicted their business to be down by an average of 4% in 2023 and said their biggest concern was a “slowing economy.”

Yet, in the same survey, 80% of members said they have business or equipment acquisition plans in 2023.

Without a doubt, business has slowed. We’re coming off a time during which our industry’s capacity nearly reached a breaking point. So, considering all this information—much of it conflicting—how are we to react as business owners in the corrugated and paperboard packaging industries? How do we guide our companies through this period?

First, we arm ourselves with intelligence by coming to meetings and hearing from our peers about what’s going on in their businesses. Second, we focus on our business operations, learning best practices from others and applying them in our own shops. Third, we look to the future. If we’re in a recession, look post-recession. This reminds me of what Roger Poteet told me in 2008–2009. Poteet said his company, then Poteet Printing Systems, “simply refuses to participate in this recession.” He invested for the growth following. We are well advised to do the same. Finally, we should use this time to reeducate our employees and focus on their training. Who had time to do any of that in the past two years?

And here is where your Association comes in. In all of these steps, AICC provides us with the venues, tools, programs, and intelligence to lead our companies in uncertain times.

At AICC meetings, we gather, we talk, and we learn. In our CEO groups, leadership forums, and independent networks, we learn best practices and have the accountability to apply them. Through our valued suppliers, we have access to the best technologies, materials, and services to increase our efficiency and productivity to best serve our customers.

And finally, through AICC’s industry education material, our employees are trained and ready for the job at hand—and the job ahead.

So, recession? Or not? I’m going for “not.” We are a positive bunch, we AICC members.

Jana Harris CEO and Co-owner, Harris Packaging and American Carton Co. AICC Chairwoman

BOXSCORE www.AICCbox.org 3 Chairwoman’s Message

Nondurable Goods: The Largest Box Market

BY DICK STORAT

Year in and year out, one thing has remained constant: Some threequarters of U.S. box shipments have always gone to package nondurable goods. These fast-moving goods, assumed to be consumed within three years, provide the core destination for some 3 billion square feet of products made in the industry’s corrugated box plants.

By and large, the growing demand for these goods is driven by population growth and rising disposable incomes. A considerable share of these products is imported into the U.S., the largest goods-consuming country on the planet. When imports of these goods outpace exports as they have for decades, the domestic production of nondurable goods grows even more slowly than domestic consumption.

The top chart shows the indexed value of industrial production of nondurable consumer goods. True to its trend, only sluggish growth in output was achieved during the first quarter of this year. Through March, production rose by less than 0.4%. This past year’s growth was a little faster, growing 1.7%. Nondurable consumer goods account for 21% of the nation’s industrial production. The food and tobacco industries are the largest single group in that category, accounting for 44% of nondurable goods production.

The bottom chart shows domestic food production for the recent past. This past year, food production grew by 1.8%, within its long-term growth range. During the first quarter of this year, however, production growth slowed to 0.4%.

One reason for slower production growth this year, in addition to faster-growing imports of these goods, is that consumers are spending disproportionately more for services, as the travel, food service, accommodations, and entertainment sectors are

Industrial Production Nondurable Consumer Goods

U.S. Food Production

BOXSCORE July/August 2023 4 Scoring Boxes

J AN FEB MAR AP R MAY J UN J UL AUG S EP OC T NO V DEC 2023 2021 2022 Percent C hange Year to Dat e Index (2017= 100) 90 92 94 96 98 100 102 104 Source: FRB – 0.05% 0.00% 0.05% 0.10% 0.15% 0.20% 0.25% 0.30% 0.35% 0.40%

SHARES & GROWTH OF SELECT NONDURABLE GOODS INDEX COMPONENT SECTOR PERCENT CHANGE 2017–2022 2021–2022 Tobacco Manufacturing –4.3% –6.4% Apparel Manufacturing –1.5% 3.1% Paper Products –0.4% –2.1% Chemical Products 0.5% 2.9% Plastic and Rubber Products 0.6% 3.5% Source: FBA, FRB, Census, RSA Inc.

J AN FEB MAR AP R MAY J UN J UL AUG S EP OC T NO V DEC 2023 2021 2022 Percent C hange Year to Dat e Index (2017= 100) 85 90 95 100 105 110 Source: Federal Reserve 0.0% 0.2% 0.4% 0.6% 0.8% 1.0% 1.2% 1.4% 1.6%

among the last to recover from the economic effects of the COVID-19 pandemic.

In addition to food, several other nondurable consumer goods industries consume an above-average share of corrugated boxes. These include tobacco, clothing manufacturing, paper products, chemical products, and plastic goods. The table at the bottom of p. 4 provides average annual production growth rates over the past five years and for the past year.

Just as in the areas described, slow growth is also a characteristic of these goods. Over the past five years, tobacco production has dropped by 4.3% per year, as the number of smokers drops. This past year showed an even larger drop of 6.4%.

While few clothing items are made domestically, those that are consume corrugated packaging. After five years of shrinking at 1.5% per year, clothing production rose by 3.1% in 2022.

Paper products production has declined fractionally over the past five years. In 2022, the pace of decline increased to 2.1%.

Chemical and plastic products consume most of the corrugated packaging in the nondurable goods sector, excluding food. These industries supply household and industrial cleaning supplies as well as health and beauty products.

They too have shown only fractional growth over the past five years, but both recorded above-average growth in 2022.

Certainly, anyone supplying corrugated boxes or any other type of paper packaging would like to see customer demand growing faster than is the case for consumer nondurable goods. Yet, because these goods are necessities of life, one can count on demand being there even if it is not growing rapidly.

Dick Storat is president of Richard Storat & Associates. He can be reached at 610-282-6033 or storatre@aol.com

Nothing’s more rewarding than a couple made for each other. That’s why the engineers at ARC International have focused their skills and talents on crafting perfect matches between the components that must work in tandem on your flexo folder gluers and die-cutters:

• Anilox Rollers and Ink Chambers

• Anilox and Wiper Rollers

• Feed and Pull Rollers

You can achieve the press speeds and print quality you need to fill your most demanding orders by pairing your team with The ARChitects of Flexo.

Contact ARC today to learn how these engineered matches of flexo folder gluer and die-cutter components (new or reconditioned) can help you achieve a more perfect union of production and profits.

BOXSCORE www.AICCbox.org 5 Scoring Boxes

The Perfect Combo Get Peak Performance From Your Equipment with Matched Component Sets

ARCInternational.com 800-526-4569 The ARChitects of flexo Chambers and • Glue and Meter Rollers

us at Booth #606 Bronze Sponsor

Meet

Urgently Needed: Tax Certainty

BY ERIC ELGIN

Before the COVID-19 pandemic, when AICC members traveled to Washington, D.C., to attend our annual Washington Fly-In, we partnered with several like-minded organizations whose members were also manufacturing businesses so our pro-manufacturing message could be amplified. Printing Industries of America (now Printing United), the National Wooden Pallet & Container Association, and the National Association of Manufacturers were among that group.

If you ever attended a Washington Fly-In in those days, you might remember that we advocated for making certain tax code provisions permanent, rather than relying on annual or biennial authorizations to keep them in play. The R&D tax credit was one such provision that was dependent on this biennial authorization. Our argument in this was simple: The business community, and more specifically the manufacturing community, needs the certainty of knowing what tax provisions will be in effect for forecasting, capital investment decisions, and the like. Uncertainty is not an ally in our decision-making.

For this reason, AICC has joined 145 other business groups in supporting the Main Street Tax Certainty Act of 2023, a bill introduced by U.S. Sen. Steve Daines (R-MT). This legislation will make permanent the 20% deduction for small and individually owned businesses (Section 199A), providing certainty to the millions of S corporations, partnerships, and sole proprietorships that rely on the Section 199A deduction to remain competitive. Individually and family-owned businesses organized as pass-throughs are the backbone of the

U.S. economy. They employ the majority of private-sector workers and represent 95% of all businesses. They also make up the economic and social foundation for countless communities nationwide.

Without these businesses and the jobs they provide, many communities would face a more uncertain future of lower growth and fewer jobs. Despite this, Section 199A is scheduled to sunset at the end of 2025, even as the businesses it supports continue to recover from the COVID-19 pandemic and the price hikes, labor shortages, and supply chain disruptions that followed.

Making the Section 199A deduction permanent will help Main Street during this difficult time, leading to higher economic growth and more employment. Separate studies by economists Barro and Furman, the American Action Forum,

and DeBacker and Kasher found that making the pass-through deduction permanent would result in significantly improved parity and lower rates for Main Street businesses. The more quickly Congress acts to make Section 199A permanent, the sooner Main Street businesses will benefit.

Contact your state’s senators today and let them know your view of this important legislation. Go to www.senate. gov or call the U.S. Capitol switchboard at 202-224-3121.

Eric Elgin is owner of Oklahoma Interpak and chairman of AICC’s Government Affairs subcommittee. He can be reached at 918-687-1681 or eric@okinterpak.com

BOXSCORE July/August 2023 6 Legislative Report

Italy knows a thing or two about quality & innovation.

maserati

michelangelo

lamborghini

Ducati

botticelli

LEONARDO DA VINCI

ferrari

alfa romeo

encore fd 618

Say Ciao to the Encore FD 618.

Next-level machinery, world-class quality.

hairegroup.com

BOXSCORE July/August 2023 8 Welcome, New & Returning Members KOHLER COATING MICHAEL KOHLER Vice President 10995 Wright Rd. Uniontown, OH 44685 330-499-1407 www.kohlercoating.com Welcome, AICC’s New Members!

Quality & Consistency

Produce Better Quality Graphics

ThermaFlo™ Brings HD Graphics To Corrugated Printing o

W ith a consistent cell geometry that promotes , ink metering and due to our multi-hit technology - you can get extended volume ranges

AICC Spring Meeting Delivers Strategic Alignment

The AICC Spring Meeting, April 24–26 in Miami, welcomed nearly 800 attendees for three days of general sessions, plant tours, workshops, and networking.

During the meeting, speakers addressed the state of the industry, what’s next, and strategies to increase profitability. Additionally, 240 members enjoyed the 9th Annual Independents’ Cup Charity Golf Tournament.

AICC President Mike D’Angelo says of the meeting, “We thank AICC members for the tremendous turnout at the Spring Meeting. Dynamic members, a strong program of speakers, tours, education, networking, and fun—keep moving independents, AICC events, and this great industry forward.”

The meeting began with tours of SupplyOne and Schwarz Partners Packaging, followed by the Focus Session, which offered an industry and economic outlook from Anna Wong, chief U.S. economist at Bloomberg L.P.; an extended producer responsibility and Federal Trade Commission update with Terry Webber, vice president of industry affairs at the American Forest & Paper Association; and a new look at recycling from Suzanne Fisher, CPP, of Fisher Packaging.

A panel of box and packaging manufacturers, moderated by Mike Schaefer, president of Tavens Packaging & Display Solutions consisted of Howard Bertram, president of Complete Design & Packaging; Brett Kirkpatrick, director of trade business at The BoxMaker; Joseph M. Palmeri, president of corrugated packaging at Jamestown Container Cos.; and Ben Urquhart, sales manager at NEWW Packaging

& Display. Panelists discussed current conditions, the economy, training employees, what keeps them up at night, and more. Check out our story on p. 38 for a key portion of the discussion.

Throughout the meeting, attendees heard keynote presentations about marketing sustainability from Susannah Enkema, vice president of research and insights at The Shelton Group, and the ideas in the book Build for Tomorrow, from Jason Feifer, book author and editor-in-chief of Entrepreneur magazine. The closing keynote speaker, Sheryl

BOXSCORE July/August 2023 10

Members Meeting

The Spring Meeting at Trump National Doral Resort in Miami drew nearly 800 attendees.

The Sales Management Forum was held on consecutive days to start the Spring Meeting, including a reception during the first evening.

AICC Chairwoman Jana Harris presented John Bird, chair and CEO of JB Machinery, with his AICC Hall of Fame induction plaque.

Photos by Jason Jackman.

STAY TUNED FOR MORE GREAT AICC EVENTS!

Upcoming national meetings include:

AICC 2023 Annual Meeting

September 18–20 | Louisville, Kentucky

AICC 2024 Spring Meeting & 50th Anniversary Celebration

April 8–10 | Palm Desert, California

AICC/TAPPI 2024 SuperCorrExpo

September 9–12 | Orlando, Florida

Connelly, leading futurist and global consumer trends expert at Ford Motor Co., gave a fresh view of today’s world and how to prepare for and incorporate change into your company.

Packed workshops gave attendees insight into attracting employees and the impact of social media on the industry, with Jake Hall, “The Manufacturing Millennial,” and succession planning with Daniel Prisciotta, CFP, CPA/PFS, ChFC, CBEC, managing partner at Equity Strategies Group. There was also a panel discussion with Greg Tucker, chair and CEO of Bay Cities; Kim Nelson, president and CEO of Royal Containers Ltd.; Larry Grossbard, vice president of President Container; and Jerry Frisch, president of Wasatch Container, on the future of their companies.

Over two days, supplier innovations were shared with a standing room-only audience. Presenting companies included:

• Baldwin Technology

• Young Shin USA

• EFI

• Kongsberg Precision Cutting Systems

• Sun Chemical

• Fosber

• SRC America

• HiFlow Solutions

• Motionalysis

• HP

• Kao Collins

• Kento Digital Printing

• A.G. Stacker

• Valco Melton

• Amtech

• SUN Automation

• Bobst

• OMP

• JB Machinery

• Flint Group

• Goepfert Machinery USA

• Koenig & Bauer

• MHI

• Durst Image Technology

During the meeting, John Bird, chair and CEO of JB Machinery, was inducted

into the AICC Hall of Fame for his many contributions to the industry.

AICC recognized AICC member milestones, with Deline Box & Display and Viking Packaging each celebrating 50 years of continuous independent operation.

The following locations were also awarded the Independent Safe Shop Award for their safety record this past year:

• Air Conveying Corporation (ACC Filter)

• Akers Packaging Group, including:

º Hoosier in Richmond, Indiana

º Michiana in Sturgis, Michigan

º Middletown in Middletown, Ohio

º Packaging Logic in La Porte, Indiana

º Webster West in North Vernon, Indiana

BOXSCORE www.AICCbox.org 11 Members Meeting

Over 200 meeting attendees took to the links for the 9th Annual Independents’ Cup Charity Golf Tournament, proceeds from which help to fund the Foundation for Packaging Education.

Members Meeting

º Webster West Evansville in Evansville, Indiana

• Lawrence Paper Co., American Packaging Division

• Royal Containers Ltd.

• Unicorr Packaging Group/ Vermont Container

• United Engravers

• Welch Packaging Group, including:

º Bridgeview, Illinois, location

º Columbus, Ohio, location

º Romulus, Michigan, location

º Toledo, Ohio, location

º Heritage in Lincoln, Illinois

º IndyCorr in Indianapolis, Indiana

º Welch Packaging Brown Box in Elkhart, Indiana

Before the meeting, sales professionals participated in a two-day Sales Management Forum in which bestselling author Ed Wallace and millennial sales strategist Omar Abdullah helped attendees develop targeted conversations that lead to revenue, deliver sales results aligned with a buyer-centric approach, and learn to use application exercises to create fluency within sales teams.

More photos from the meeting can be found on AICC’s Facebook page, and videos of the general sessions will be available to meeting attendees on AICC NOW (NOW.AICCbox.org).

Questions about the Spring Meeting and the value a well-connected workforce

brings to a company can be answered by Cindy Huber, AICC director of conventions and meetings, at chuber@ AICCbox.org or 703-836-2422, or by Laura Mihalick, AICC senior meeting manager, at lmihalick@AICCbox.org or 703-836-2422.

THANK YOU, SPONSORS!

AICC is grateful for the support of our many meeting sponsors, which include:

• Flint Group

• Domtar Packaging

• eProductivity Software

• SUN Automation Group

• Haire Group

• Kolbus

• Mitsubishi Heavy Industries

• Stafford Corrugated Products

• Kao Collins

• Oklahoma Interpak

GET READY FOR THE NEXT BIG THING

The AICC 2023 Annual Meeting, September 18–20 in Louisville, Kentucky, will bring members to the heart of Bourbon City and offer three industry plant tours, eye-opening workshops, and thought-provoking general sessions. Two days of concurrent workshop sessions will offer attendees valuable information, and the Innovator of the Year will be chosen.

The plant tours will include Independent II, Premier Packaging, and Greif CorrChoice. All attendees are then invited to a relaxing lunch and bourbon tasting at the historic Farmington Plantation, which once hosted Abraham

Lincoln. The day will continue with a Focus Session featuring Gene Marks, Tim Bergwall, Group President, Paper Packaging & Services at Greif, and George Staphos. The opening-night reception will be another can’t-miss networking opportunity.

Keynote presenters Stephanie Stuckey, CEO of Stuckey’s Corp., and Dakota Meyer, former U.S. Marine and Medal of Honor recipient, will give attendees a new way to look at their futures.

The meeting will also feature a special presentation by R. Andrew Hurley, Ph.D., associate professor of packaging science at Clemson University of

• Koenig & Bauer

• CST Systems

• SRC America Corp.

• Global Boxmachine

• Huston Patterson

• Lewisburg Printing Co.

• Domino

• The BoxMaker

• Sun Chemical

• Durst

• Dusobox

• Hood Container

Clemson, South Carolina, on carbon neutrality.

Attendees are invited to a night at the Kentucky Derby Museum, with guided tours of the legendary Churchill Downs. Everyone is encouraged to don their derby attire to participate in mock racing, hat making, and mingling!

Other networking opportunities include a trip to the Hermitage Horse Farm, where they have bred champion thoroughbreds; a networking lunch with a keynote speaker; Emerging Leader events; and more.

Learn more and register at www.AICCbox.org/meeting

BOXSCORE July/August 2023 12

STATE-OF-THE-ART, HIGHLY ADVANCED DUST COLLECTION SYSTEM

SAFEST DUST COLLECTION SYSTEM ON THE MARKET

Engineered Recycling Systems takes decades of engineering experience and system integration expertise to provide our partners turnkey solutions.

We engineer, design and install world-class scrap collection and dust extraction systems providing our customers with equipment and system designs that deliver unprecedented levels of quality and craftsmanship, our solutions increase production and cut labor costs.

SIGNIFICANT ADVANTAGES OVER CONVENTIONAL DUST FILTRATION TECHNOLOGY

• Lower maintenance costs

• Less production downtime

• No compressed air, water, explosion vents or high-speed abort gates required

• Minimal time required for changing out filter media

• No makeup air required

• CCM® OCT Filters = SAFE operate and maintain

Visit us at Booth 323

CCM® OCT

www.engineeredrecycling.com info@engineeredrecycling.com

What Is Our Progress in Going Lighter?

BY RALPH YOUNG

Often, we are asked about the initiatives of using less fiber in our corrugated structures. Many times, these questions are asked by the investment communities. We are still overpackaging but not at the levels where we were before the pandemic.

Increases in strength ratios (i.e., Short Column Test [SCT]) versus basis weight offer greater opportunities. I have often been a proponent of access to on-site labs

or sheet feeders willing to provide certificates of analysis for final key combined board properties, regardless of the basis weight of the components.

“Performance” grades of linerboard and medium are often overused terms like that often dreaded term “sustainability.” While the former description works smoothly in written marketing communications, it is not a real indication of variation in raw materials that we need

to look toward for comparing stacking strength potential to basis weights to price. Look for a major research investment firm to bring to life a template for comparing packaging strength and costs per pound of fiber.

Additional production is brought on by the new containerboard or repurposed newsprint and printing and writing machines. Using 100% OCC, DLK, and/ or mixed paper waste, opportunities

BOXSCORE July/August 2023 14 Ask Ralph

abound: 18# can be used for low-strength corrugated boxes where there is primary interior packaging such as folding carton grades or products containing cores or tubes.

Also, one would expect that with extended producer responsibility legislation being enacted by a few states, users of single-use plastic containers would be investing in containerboard options. Although items such as clam sheets are the domain of lightweight kraft and recycled papers, corrugated still has a replacement option for many

carryout and bakery containers. This is especially true with the continued development of oxygen, moisture, and grease barrier solutions that are also repulpable for recycling. This can be accomplished without the use of forever chemicals, such as per- and polyfluoroalkyl substances, which we discussed in the May/June 2023 issue and earlier issues of BoxScore

The table below includes some statistics to explain the movements of basis weights over a 15-year period. Ranges in strength, as measured by

the SCT, are also included in the far right-hand column. The data here reports the combination of recycled and kraft linerboards.

One must choose wisely knowing the downward shift in nominal basis weights and the variations in ECT and stacking strength potential of the corrugated box based on the compression strength potential of the raw material SCT. The table does not include all of the 140-plus containerboard machines in the U.S. and excludes Canadian production.

Observations and Conclusion

• There are small increases in 26# and below-26# liners, as the newest recycled mills have introduced 23#, 21#, and 18# products for e-commerce and smaller lightweight boxes.

• Of greater significance in the light category is the replacement of 33# with 31# and 29# facings.

• The long-term mainstay 42# grade continues to fall to lighter liners combined with more substantial medium in the midweight category.

• The four heaviest grades have all declined. What started 30 years ago with 56# compression-based SCT engineered liner replacing 69# Mullen boards continues now with 52# liners and more significant mediums to meet ECT combinations.

• What I interpret as another movement to lighter-weight combinations and a move in the continued direction to reduce overpackaging is the large increase in 23# mediums.

Ralph Young is the principal of Alternative Paper Solutions and is AICC’s technical advisor. Contact Ralph directly about technical issues that impact our industry at askralph@AICCbox.org

BOXSCORE www.AICCbox.org 15

Ask Ralph

GRADE BASIS WEIGHT #/MSF TONS THEN IN THOUSANDS TONS RECENTLY IN THOUSANDS PERCENT CHANGE RANGE IN RECENT SCT STRENGTH Below 26# 215 460 113% 26# 397 471 19 10–17 27–32 561 1974 251 33 2144 1013 –53 16–23 34–41 5387 5957 11 42 3798 2675 –30 21–26 43–47 455 737 62 48–54 495 1084 118 55–68 3610 2437 –32 69 1402 1046 –25 33–42 70–89 365 1046 –26 90+ 170 115 –32 43–48 SCT GRADES MADE TO STRENGTH NOT BASIS WEIGHT 29–31# 14–19 32–35 15–19 34–40 16–23 43–56 21–35 52–56 26–35 MEDIUM MADE TO STRENGTH 23# 2938 4467 52% 9–14 26 2464 1047 –58 10–17 27–32 531 690 30 33–35 1885 1894 14–21 36–39 797 862 8 40 495 427 –14 20–27

Note: Some volumes are adjusted to allow for different data collection protocols between unbleached kraft and recycled liner.

Are Your Human Resource Events and Policies Hitting the Mark?

BY TOM WEBER

After three years of nearly continuous workforce turmoil, employers were hoping for relief in 2023. However, the unfortunate truth is that this postCOVID time has delivered a uniquely challenging array of circumstances that will be difficult for the U.S. packaging community to navigate, especially from an employee well-being perspective.

It is widely anticipated there will be some economic recession in 2023. Its duration and severity is impossible to know, but the high-level effect will be the same as in most economic downturns: Employers will need to tighten their belts and make do with reduced revenues and fewer resources. On its own, this wouldn’t be catastrophic— after all, the business cycle has always had its booms and busts. The problem is that the predicted recession by Q4 in 2023 will likely coexist with an extremely tight labor market, forcing employers into an unprecedented dilemma that puts significant strains on finite resources.

Employee Well-Being for the Rest of 2023

To balance the competing priorities of sustainable business performance and employee retention, leaders will need to implement and justify the investment in creative strategies that focus on the efficient delivery of wellness benefits employees want.

Traditionally, economic recessions have caused employees to cling to their current employer regardless of how satisfied they feel in their work because they do not want to jump into an unfavorable job market. However, if the job market remains strong during this recession, and workers are not as worried about their ability to find

employment elsewhere, they will not be willing to accept cuts to benefits packages and wellness programs companies typically make during tough times. Due to these unique circumstances, employers will need to devote more, rather than less, energy to employee benefits and well-being initiatives. Qualified employees are worth their weight in gold, and the realities of a long-term U.S. labor shortage mean that replenishing your employee head count once the economy recovers is no longer a sure thing. The brewing question for businesses in the coming year is how to satisfy elevated employee expectations around well-being, mental health, and flexibility without breaking the bank.

In the past, employee well-being would have been a different discussion from business profitability or performance. But today, intelligent employers position their people—or employee well-being—at the center of their business strategy. Forward-thinking leaders recognize that employee wellness is a prerequisite for business success.

With tight financial resources in mind, your engagement and well-being team should compile data from people leaders, industry experts, and employers across various industries to support business growth and power employee potential. Over the course of gathering this information, your team should be able to identify trends that leading organizations are embracing to boost employee well-being without overspending. The following bullets outline how each challenge provides an opportunity for employers to lean in and get strategic in solving shortand long-term workforce obstacles:

• Build a people-first culture.

• Find the balance between managing costs and supporting employee needs.

• Empower health, benefits, and financial literacy.

• Replace a one-size-fits-all approach with customized solutions.

• Tap into “purpose” as the secret weapon for higher employee engagement.

Reports consistently show that organizations that prioritize employee engagement and well-being experience up to a 21% increase in profitability due to higher retention rates and lower absenteeism.

Aligning Employee Well-Being With Business Objectives

To react quickly to support the needs of struggling employees or appeal to a shrinking talent pool, some employers have scrambled to meet the moment without thoroughly evaluating the needs of their business and people.

This results in many leaders finding themselves looking ahead unsure of where to focus their time and investments with the overwhelming number of options available. Additionally, factoring in the gap between solutions, employers want to combat health risks, drive costs, and satisfy employee interests.

Many businesses find themselves in the perfect storm of poor return on investment and unhappy employees. Studies show that employees who understand and are engaged with their benefits are 99% more likely to feel valued and appreciated and 78% more likely to be happy with their job. But without a clear business

BOXSCORE July/August 2023 16

Ask Tom

strategy built on a shared vision of communication and employee engagement, an organization is unlikely to see success. Leaders should avoid:

• Short-term programs implemented quickly without defined metrics to measure success.

• Insufficient time allotted to define processes and communications to effectively gain adoption and participation.

• Overspending on programs that go unused or creating redundancy.

• Misalignment with overall company goals and long-term workforce strategy.

When building holistic, people-centric benefit programs, many employers succeed by focusing on impactful, data-driven offerings rather than short-term perks. It’s wise to use data to develop a plan, such as:

• Surveying employees regularly to understand their needs.

• Evaluating the use of existing benefits and programs.

• Analyzing health risk and cost data (either through your medical carrier or a third-party analytics platform).

• Thinking critically about the diversity of your current workforce and desired future workforce. (A person’s ZIP code can impact their well-being more than genetics.)

• Providing innovative benefits that tangibly improve well-being inside and outside of work.

• Defining short- and long-term success metrics and tracking these over time.

Organizations that have responded to the call to fulfill their workforce’s needs have realized measurable cost savings by reducing turnover, absenteeism, and health care costs while fostering an engaged and highly productive workforce.

In summary, a strategic employee well-being and communications plan that is practical at scale and flexible enough to support individual needs will ultimately drive positive gains in performance, cost containment, recruitment, and retention for the long haul.

Additional information about the various webinars AICC includes in its All Access Pass can be found at NOW.AICCbox.org.

If you have any questions, contact Taryn Pyle, director of education and talent development, at tpyle@AICCbox.org or Chelsea May, education and training manager, 703-836-2422 or cmay@AICCbox.org

Tom Weber is president of WeberSource LLC and is AICC’s folding carton and rigid box technical advisor. Contact Tom directly at asktom@AICCbox.org

BOXSCORE www.AICCbox.org 17 Ask Tom

AI and Marketing Content Generation: Understanding the Risks

BY TODD M. ZIELINSKI AND LISA BENSON

It doesn’t seem that long ago that for the average person, artificial intelligence (AI) was something of an enigma seen only in sci-fi movies. While AI has been used for years in many applications (smartphone voice assistants, autonomous cars, “you may also like” on shopping sites, social media algorithms, etc.), generative AI has recently been thrust into the spotlight as easy-to-use webbased interfaces have skyrocketed in use and controversy.

AI is a broad term referring to computer systems that perform tasks usually requiring human intelligence, such as learning, reasoning, and understanding natural language. Generative AI is a specific type of AI that focuses on generating content in the form of text, images, audio, and video. While they can be built on different learning techniques, one of the most common is a deep-learning technique called the generative adversarial network, which generates content by training on copious amounts of existing data and mimicking structures and patterns found in that data.

Explosion of Generative AI Tools

Many companies have begun investigating generative AI because it allows for the quick creation of content with minimal effort. Creating an AI tool is time-consuming and expensive, so most will rely on third-party generative AI solutions, such as those from OpenAI, Stability AI, and Google AI, among others.

ChatGPT is a text generator that has been given much media attention since its release in November. It is an application that uses the generative pre-trained

transformer (GPT) language model developed by OpenAI. Google AI created Bard based on Google’s Language Model for Dialogue Applications. To make things more confusing, some applications developed by other companies, such as Jasper and Copy. ai, also use OpenAI’s GPT language model. Soon there will be hundreds of generative AI solutions that will be stand-alone or added to other products, creating integrated sales and marketing solutions. Salesforce just announced its addition of Einstein GPT.

Generative AI is not without controversy. Like many innovative technologies and ideas, how it was intended to be used isn’t always how it will be used. All of the implications and risks are still being worked out, and those who wholeheartedly support it think generative AI will revolutionize sales and marketing. Others are taking a more conservative view, and many companies have banned its use. As generative AI becomes mainstream, companies should look at educating themselves about it and take steps to ensure it is being used responsibly. While there are concerns about cybersecurity—which should be a societal concern as there is a potential for generating nefarious code that can bypass current protections—this article is looking

specifically at using generative AI for sales and marketing content creation.

Risks Associated With Generative AI

Although generative AI can be used to craft emails, provide research, write blog posts, consolidate reports, and more, risks associated with it could jeopardize intellectual property, create erroneous information, and negatively impact your company if it is misused.

INTELLECTUAL PROPERTY

When discussing intellectual property (IP), we are referring to your current intellectual property and the content that generative AI creates. Generative AI is trained on large data sets and information input by users. The tool retains this information to continuously learn and build its knowledge. An issue arises if an employee inputs confidential or proprietary information, for example, asking it to provide

BOXSCORE July/August 2023 18 Selling Today

a report summary that contains financial data or a quality issue that isn’t public knowledge. That data could be delivered to another user as an output, exposing sensitive information to the public. In addition, the information generated could contain another company’s IP, which may create legal implications with ownership.

Regarding ownership, the question of whether the information can be copyrighted has been brought to light. According to a Legal Sidebar issue by the Congressional Research Service, the Copyright Act protects “original works of authorship.” The U.S. Copyright Office recognizes copyright only in works created by humans and has denied applications to register work created by AI. Lawsuits are pending, so it will be interesting to watch how federal courts will handle the widespread use of AI and copyright.

There is also a question of copyright infringement. Keep in mind that works on the internet are not public domain as many erroneously believe. However, if an image is downloaded from the public domain, you have permission to use it. OpenAI acknowledges that the data for training is derived from publicly accessible data “that include copyrighted works.”

Could the output infringe on copyright? According to U.S. case law, if AI had access to copyrighted work and created a substantially similar output, owners may be able to show that the AI-generated content infringed on their copyright.

INACCURATE INFORMATION

When using generative AI to create content, users must be skeptical and vigilant about using other sources to validate facts provided as outputs.

Generative AI is trained on available information that may not be accurate and may have bias. In addition, some information may be fabricated. OpenAI states,

“ChatGPT will occasionally make up facts or ‘hallucinate’ outputs.” Similarly, Google says, “Bard may give inaccurate or inappropriate information.” Many users have found that ChatGPT will fabricate sources and include fake URLs when asked for citations.

CNET, a tech media site, came under scrutiny when it published 78 AI-generated articles riddled with errors over the course of two months. The company was forced to pause the use of AI for generating content. If inaccurate content is referenced in new content and passed off as fact unintentionally, either by a human or AI, the inaccuracies will be perpetuated until it becomes difficult to decipher fact from fiction.

IMPACT ON SEARCH ENGINE OPTIMIZATION

Much discussion is happening on whether generative AI content can negatively impact your search engine results page (SERP) rankings on Google. In February 2023, Google released its new policy on AI-generated content. Google’s ranking system rewards content that demonstrates expertise, experience, authoritativeness, and trustworthiness (E-E-A-T). Google states that “using automation—including AI—to generate content with the primary purpose of manipulating ranking in search results is a violation of our spam policies.” While the policy states that Google will not ban AI-generated content that doesn’t violate Google policies, those seeking to rank in SERPs will have “original, high-quality, people-first content demonstrating qualities E-E-A-T.” Google can predict when AI writes content.

Researchers have been studying the detection of AI content, and generative AI content detectors have been popping up on the internet—although they are not infallible and can predict incorrectly. While generative AI is great at mimicking and following patterns, it has trouble

with randomness and variance found in human communication. There is no originality. AI content often contains repetition of words, a lack of natural flow and rhythm, and no personality. You will usually find that it repeats the same ideas worded differently. Its content will likely be written in a straightforward style with little detail. As generative AI continues to be improved upon, there will likely come a time when it is indistinguishable from human-generated material.

Since generative AI follows patterns, lacks originality, and can be repetitive, the blog posts it writes for one company may be similar to those it writes for another if given the same prompt.

Should You Use Generative AI for Sales and Marketing Materials?

We have looked at some of the risks associated with generative AI tools; however, they can offer many benefits, especially for companies that lack the resources to create sales and marketing content. Lower costs, scalability, and increased efficiency are attractive benefits to many. The answer to whether it should be used depends on how risk averse your company is and how your company intends to use it. Generative AI has been progressing at a rapid rate. Educating yourself on the changes (risks and benefits) will put you in the best position to make that decision.

Todd M. Zielinski is managing director and CEO at Athena SWC LLC. He can be reached at 716-250-5547 or tzielinski@athenaswc.com

Lisa Benson is senior marketing content consultant at Athena SWC LLC. She can be reached at lbenson@athenaswc.com

BOXSCORE July/August 2023 20 Selling Today

WhyAgonize.com Info@AskHitek.com 262-842-1700 Manual or Fully Automatic Flat Die Storage Systems by BCM Rack up more space, productivity and efficency CUTTING DIE STRIPPING DIE BLANKING DIE CUTTING PLATES MAKE READY SAFELY IN CASSETTES

Andragogy

Summer Lovin’, Had Me a Blast

BY JULIE RICE SUGGS, PH.D.

Summer is in full swing, and for many of us, that means enjoying picnics, toes in the sand at a favorite beach, backyard barbecues, outdoor DIY projects (those pesky ones lingering since the new year), crisp beverages while basking in the sun, and hearing the local ice cream truck blaring that nostalgic tune.

Recently, I was at the store with my co-worker, Alli, where we were shopping for barbecue supplies for a Packaging School celebration. A pack of 12" plates that looked perfect for serving up burgers, hot dogs, and all of the fi xings literally spoke to us with the word “barbecue” splashed right on the front of the plate. After said plates were securely in the cart, our minds started spinning about package designs that celebrate summer togetherness. We decided to go on a scavenger hunt, so to speak, looking for new products, limited-edition designs, summery imagery, and seasonal color trends that embody summer moments.

First, we saw this freezer pop display that basically screams, “Summer’s here!” There’s no mistaking that this product earns its keep during the summer months, with images of sailboats, clear skies, and smiling kids placed all over the point-of-purchase display. Their slogan—“Kick back and beat the heat with a Fun Pop freezer pop!”—invokes a trip down memory lane of sweaty days, sticky hands, and colored tongues.

BOXSCORE July/August 2023 22

Photos by Julie Rice Suggs, Ph.D.

SHINKO SUPER ALPHA

MORE BOXES EVERY MINUTE . . . PERIOD!

Since 1955 we have been serving the corrugated industry with both new and used equipment. Now more than ever, we offer practical and affordable solutions to meet the needs of today’s boxmaker.

SHINKO Super Alpha

High Speed Quick Set

Flexo Folder Gluer

• Fast 2 minute set up

• Fast run speeds up to 450 SPM

• Fixed frame architecture

• Fully servo driven

• Set-up while running

• Extremely accurate registration

• Energy efficient

Sizes Available: 23” X 71” to 47” X 106”

Available for immediate shipment.

SINCE 1955 1486 St. Paul Avenue, Gurnee, Illinois 60031 USA 847-949-5900 800-621-4343 www.boxmachine.com

Andragogy

at the pool (if we can’t get somewhere tropical). However, Smirnoff plans to sell this product year-round, so they are looking to diff erentiate themselves in this space during the cold months, as well.

Lastly, since you can’t think of summertime and cool treats without it, we took to the ice cream aisle. The relaxed summer schedule sets the stage for parties with family and friends, where we gather and enjoy delicious meals complete with yummy desserts—and ah, the fresh fruit is ripe and abundant. Speaking of fruit and dessert, Häagen-Dazs’ Summer Berry Cake

we saw was a 12-pack of hard cider called “Vacation Mode.” The brand, Blake’s Hard Cider, is clearly ready for warm weather, with new tropical fl avors and bright hues commonly associated with summer. Using scarcity marketing to capitalize on a customer’s fear of missing out, this colorful pack is available only from Memorial Day to Labor Day.

Pop ice cream gave us all the summer feels. Th is velvety strawberry ice cream is made with sweet cream ice cream, fluff y cake pieces, and raspberry sauce. Information is limited as to whether this will be a summer-only fl avor, so we’re going to enjoy it as often as possible while we can.

And, yes, this product is available all year round, but moving the display to the front of the store means it can be noticed more readily and becomes more tempting during these scorching summer months.

Next up, we headed to the beverage section because, who are we kidding, no summer barbecue is complete without a cold drink (and a strong one at that, for those 21 and older). The fi rst package

Moving over to the seltzer section, it took no time at all for us to spot the Smirnoff Ice Neon Lemonade variety pack. The bold use of palm trees on the primary display panel drew us in and is echoed on the lively, fun cans, and it made us long for a tropical vacation of some sort. Th is 12-pack boasts the perfect combination of tart, yet sweet fruit fl avors. Though Smirnoff says this hard lemonade will be a hit on any occasion, we think it pairs perfectly with an out-of-office message and at least a day

Th is trip was a fun break from our normal, run-of-the-mill shopping experience, and we had a blast searching for packaging that embodies summer with its vibrant colors, nostalgic images, and memorable design layouts. But what do you think? Did these brands successfully leverage a seasonal element into their packaged products? Let us know by emailing julie@packagingschool.com .

Julie Rice Suggs, Ph.D., is academic director at The Packaging School. She can be reached at 330-774-8542 or julie@packagingschool.com

Alli Keigley, who contributed to this article, is production coordinator at The Packaging School. She can be reached at alli@packagingschool.com

BOXSCORE July/August 2023 24

Machinery and Handling for the Corrugated Board Industry EVERYTHING CORRUGATED UNDER SUN IS THE OFFICIAL REPRESENTATIVE FOR TAIWAN-BASED LATITUDE MACHINERY CORPORATION, ITALY-BASED PARA, AND ISRAEL-BASED HIGHCON 1-410-472-2900 sunautomation.com Data in the Drivers Seat Improve your Converting Equipment’s Performance with Data-Driven Decisions EVERYTHING CORRUGATED UNDER powered by Determine when to perform key maintenance based on use, not set schedules Analyze operator and machine behavior to reveal training or tooling needs See a live demo at in Booth 101 OEM Agnostic IIoT Platform Easily Integrated with existing ERPs

Killing Dumbo

BY SCOTT ELLIS, ED.D.

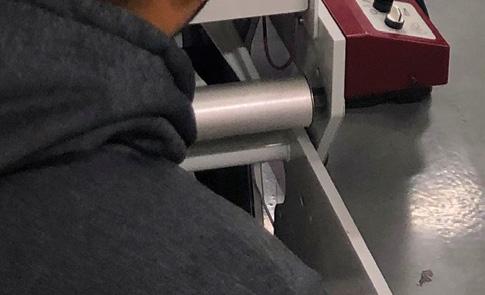

Let’s talk about the baby elephant in the room. For 20 years, we have been addressing the Packaging Pachyderm: Independents live or die by the changeover, and most do not optimize setup speed by delivering job-ready materials, tooling, and information. The good news is that many have now taken on Jumbo and reduced changeover time by up to 70%. Their crews don’t look for stuff or fix stuff; they just make boxes and do fast and predictable changeovers.

Those that have dealt with Jumbo are in a continual hunt to solve smaller bottlenecks. Enter Dumbo, the baby elephant. Technological advances in flexography allow many machine print stations to be set up while the press is completing another job, but this capability is ignored in most plants. Why would a plant that averages four-color jobs purchase a sevencolor machine? The answer: flexibility. Easy use of alternative anilox rolls and other considerations are included, but the ability to set while running was part of the purchase decision. The reason for so much time and money being wasted must be that the machine technology has outpaced the processes and preparation required to capitalize on this capability.

Having worked on setup reduction and overall equipment effectiveness with thousands of packaging folks, I know we have failed to measure and improve set while running capacity. The metric will include potential time savings versus actual time saved. More to the point, it will expose the reasons we missed that potential. Those reasons will then be explored, and systems will be improved. I hope it will become sufficiently understood to add a reliable algorithm to the enterprise resource planning software, but first it will need to be done close to the process and by hand.

Myriad factors are affecting the outcome. The mix of work, the preferred color sequence, and the average pieces per job are just a few considerations that determine the optimal utilization for a particular machine. However, Dumbo is hiding in the gap where we do not measure. Someone has said, “You cannot change what you are willing to tolerate.” To stop tolerating this loss, priorities will need to be made explicit, the crew will need a scoreboard, savings will need to be quantified, and the whole team will need to focus on improvement.

Prioritization

Gather the team of experts to determine the best use of the machine for the company. This sets a target for a desired future state. This team could include representatives of crew, supervision, prepress, scheduling, design, etc.

Target Machine Potential

The team will then be able to estimate the potential of the optimized machine. Data needed for this calculation will include:

• Average colors per job.

• Average time to set up a print station.

• Number of jobs per shift.

• Dollars per minute of production (sales or contribution).

Next, use a fishbone diagram to help the group generate common reasons for not optimizing set while running capacity. Once this is complete, the group might focus on the three most common issues. They don’t need to solve the problem yet, but only to estimate the impact, expressed in minutes and dollars saved. Then you will have Dumbo in the crosshairs.

BOXSCORE July/August 2023 26 Leadership

STATIONS IN USE # OF COLORS IN NEXT JOB POTENTIAL TO PRESET ACTUAL # PRESET IF DELTA, WHY? (E.G., MATERIAL, TOOLING, RUN LENGTH, DESIGN) 4 2 2 0 Plates were not press-side 2 3 3 2 To keep black ink in first station 3 4 4 2 Lack of time/staff 4 3 3 1 Spacing in the machine for drying flood coat 3 2 2 2 WINNER!

MACHINE: FLEX0 #1 NUMBER OF PRINT STATIONS: 7

Machine-Side Measures

Equipped with a measurement tool, the crew will compare potential versus actual on each job. Behind the scenes, you may calculate the percentages and potential savings,* but the critical data at this point is why the crew was unable to set while running. Those reasons can be captured on a whiteboard. I use a whiteboard because a list on paper or a screen is less likely to be seen and discussed by crew, shifts, and supervisors. Once a month’s data is collected, assign a cross-functional group to complete root-cause analysis.

Continuous Improvement

The cross-functional group will look at frequent issues that prevent set-whilerun optimization. The issues chosen for root-cause analysis will be discussed by the group to the point that the scope and the potential savings are understood. The issue will then be assigned to an individual or team to explore and describe a course of action for improvement. The potential savings of set-whilerunning optimization include the obvious decrease in changeover time but extend to reduced overtime, increased employee engagement, and improved productivity. And you will believe that an elephant can fly—away.

Scott Ellis, Ed.D., delivers training, coaching, and resources that develop the ability to eliminate obstacles and sustain more eff ective and profitable results. He recently published Dammit: Learning Judgment

Th rough Experience. His books and process improvement resources are available at workingwell.bz . AICC members enjoy a 20% discount with code AICC21.

*Contact me for a spreadsheet and other measurement resources.

Get On Board With Quality.

BOXSCORE www.AICCbox.org 27 Leadership

CONVENTIONAL ANILOX ENGRAVINGS apexinternational.com

Print Finer Screens, Stronger Solids & Sharper Edges

Headline

BYLINE

Member Communications

Digital BoxScore Has Moved

You can now read BoxScore ’s digital version at NOW.AICCbox.org. As AICC continues to evolve and adapt to your needs, this move will enhance your reading experience and provide you with a more integrated platform. You will see BoxScore in the left-hand menu under Browse Channels. From there, you can read the latest full issue flipbooks, peruse the newest features and columns, and access past features and columns— now all in the same place as other AICC member content.

SCAN TO PERUSE BOXSCORE ON AICC NOW!

With BoxScore on AICC NOW, you can take advantage of:

• Enhanced Searches: The new website offers an improved search that will allow you to fi nd the information you want, whether it comes in a BoxScore article, webinar, or an answer from one of AICC’s experts.

• Responsive Design: Whether you prefer browsing on a computer, tablet, or smartphone, our new

website ensures a consistent and enjoyable reading experience across all devices.

• Recommendations: On each page, you will fi nd related articles, webinars, and other resources you might be interested in.

Visit NOW.AICCbox.org/boxscore or scan the QR code on this page to check out the new-look digital BoxScore.

BOXSCORE www.AICCbox.org 29

Royal Containers’ New St. Thomas Plant a Showcase of Smart Design

BY STEVE YOUNG

COMPANY: Royal Containers Ltd.

ESTABLISHED : 1980

J OINED AICC : 1980

PHONE : 978-632-3600

WEBSITE : www.royalcontainers.com

HEADQUARTERS: Brampton, Ontario

PRESIDENT AND CEO: Kim Nelson

Kim Nelson, president and CEO of Royal Containers Ltd., has created in her company’s new plant in St. Th omas, Ontario, an elegant marriage of effi ciency and style.

The 152,000-square-foot plant, which hosted its grand opening this past September, strikes visitors with its architectural appeal and engages employees with a fluidly flowing office and production environment. And though the St. Thomas plant stands today as the product of a deliberate, creative plan, the site was nearly ruled out at first. “When we looked at the outside of this building, and where we’re sitting today, it would be one of those moments when you say, ‘You really need a great vision to see this,’” says Kim. “So, we dismissed it at first.”

Royal Containers is based in Brampton, Ontario, in the Greater Toronto area,

colloquially known as the “GTA.” It was founded as a single sheet plant in 1980 by Ross Nelson, and Kim Nelson joined the company in 1992. In 2009, Ross handed on the leadership to his next generation, and Kim became president and CEO. In addition to its sheet plant locations in Brampton and St. Thomas, Royal Containers is also a shareholder in TenCorr, a sheet feeder in neighboring Mississauga, founded in 1983 by Ross, and nine other independents. In 2013, Royal further integrated vertically when the company, along with Cascades, TenCorr, and Jamestown Container Cos., became a shareholder in Greenpac Mill, a 600,000-ton-per-year recycled containerboard mill in Niagara Falls, New York. Royal Containers employs 300 people in its two converting operations.

The long road to Royal’s new plant in St. Thomas began in 2010, when Royal acquired Morphy Containers Ltd., a sheet plant in London, Ontario, 120 miles west-southwest of Toronto. Continued growth in this market, combined with the physical limitations of Morphy Containers’ existing building, were two of the reasons forcing the decision to relocate. The third was Royal’s 2020 acquisition of C&B Display Packaging in Mississauga. “We were having to do some major infrastructure changes, and the building was quite old,” Kim says of the Morphy site. “We were starting to burst at the seams in London, and then in January 2020, we purchased C&B.”

Now faced with two existing plants, both overcapacity in a very tight commercial real estate market in southern

BOXSCORE July/August 2023 30 Member Profile

Photos courtesy of Royal Containers Ltd.

Royal Containers’ St. Thomas leadership (from left): Greg Marcella, vice president of operations; Kim Nelson, president and CEO; and Michel Alvarez, plant manager.

STILL the Industry Experts 580 Sylvan Avenue, Suite M-A Englewood Cli s, NJ 07632 (201) 731-3025 • Fax: (201) 731-3026 info@klinghernadler.com Planning for the future is one of your most important jobs. Selling your business, succession planning, equipment decisions and expansions require the best advice and strategy. We’ve been providing Business Planning Services to the independent converter for over 30 years. Need to make a big decision? Call us now.

Ontario, Kim had a decision to make: Invest in a new building in Toronto or find a location farther west and combine both plants. “We initially said, ‘Let’s go find something in the GTA,’ but we exhausted everything that was buildto-suit with nice highway exposure,” she recalls. “So, we started looking toward Cambridge,” referring to the city of 150,000 people about 50 miles west, “and there’s nothing available there either. So, we expanded the search geographically, and we found this spot.”

Kim possesses a key strength that makes her a great entrepreneurial leader: She knows her own limitations and has surrounded herself with a great team. Royal’s key management team consists of Chief Financial Officer Connie VanBoxtel, Production Manager Brent Hill, Sales Manager Kirk Cormier, Customer Service Manager Terri-Lynn Levesque, and Human Resources Manager Steve Robinson.

Greg Marcella, vice president of operations at the St. Thomas site, has been with Royal for 10 years. He was a key player in scouting out a new location for Royal. After earning a degree in packaging development technology at Mohawk College in Hamilton, Ontario, he began his career at Unilever in Brampton, where he dealt with the company’s vendors of plastics, film, paperboard, and corrugated. “That got me experience with everything,” he says.

After leaving Unilever, he worked for other industries in their packaging needs, ending up squarely on the paper side of the business at Sonoco. From there, in 2013, he joined Royal. “I’ve been here 10 years,” he says, “and I was the plant manager, then vice president of operations, now the general manager.” Pointing to the conference room around him, he adds, “It’s been a crazy journey to realize something like this.”

Marcella recounts the first visit to the prospective location: “I said, ‘Kim, I think we found a building.’” The building was the former site of an injection-molding company that had gone bankrupt. “Just watching Kim’s face as we drove up, I thought, ‘This isn’t going to work. I don’t think we can sell the vision or paint the picture for her to believe we can get there,’” he recalls. “It was a gut moment, for sure.”

How, then, did Kim Nelson and her team arrive at the decision to lease the St. Thomas facility that was, for all intents and purposes, ruled out? First, consider its location. St. Thomas is 18 miles south of London on the north shore of Lake Erie. Thus, for the employees of former Morphy Containers in London, the new location was convenient. “We could have moved to northern London and added 45 minutes to everyone’s commute and still be in the same city,” says Marcella.

However, he adds, they saw in the St. Thomas site an opportunity to give the employees “an improvement that

we could deliver to everybody’s life.” The town is an attractive destination, having been named in 2021 by Maclean’s magazine as the best place to live in Ontario and the third best place in all of Canada. The region is largely agricultural, although St. Thomas itself, historically a railroad center, has maintained some of that heavier industry such as metal stampings. Automotive is also moving in, with Volkswagen AG building what it calls “the world’s largest” electric-vehicle battery plant, which is slated to open in 2027.

Kim explains the larger reason for the change in their first impression of the site: “Driving away I said, ‘Greg, we have a decision to make: We can invest in real estate—it’s always a great investment. Even if we have to put in $20–$25 million to build a building and own it, we can do that. We’ll put everything from the two companies there with existing equipment.’”

This option, however, did not sit well with her because she felt that level of investment would not benefit the next generation of owners—a real estate play would be too long a payback for them, and they would be limited in the marketplace with the older equipment from the former Morphy and C&B sites. The other option was to lease a building and invest $15 million in new equipment, a choice she made because of a lesson she says she learned from her father, Ross. “I can’t be expert in everything. Ross taught me to stick to what I know, which

BOXSCORE July/August 2023 32

Profile

Member

Royal Containers’ plant in St. Thomas, Ontario.

is manufacturing boxes. I don’t know the real estate market. I don’t know the large investment markets. I know how to manufacture boxes.”

Readying the St. Thomas plant to run that first box fell to Marcella and his team, while newly appointed Plant Manager Michel Alvarez managed the London plant during the transition. Alvarez spent the first 10 years of his career at Kruger’s packaging division, where he started on the machine take-off crew. He worked his way up to supervisory positions, eventually becoming an ISO auditor and a health and safety trainer. “Kruger gave me a lot,” he says, “and one of the things I learned from a human resources person there was whenever the company gives you an opportunity to get educated, take it. If you ever leave, you take that with you.”

While still at Kruger, he met Bill Routledge, then sales manager for Royal in Brampton. “I’m very familiar with equipment, and I knew what Royal could do,” he says. “I knew what Royal could sell. That’s when I became a sales rep at Royal.”

After seven years at Royal, Routledge returned to Kruger, spending another seven years in ISO, Six Sigma, and process improvement before being recruited by Menasha for a position at

the company’s plant in Brampton. He spent three years there creating training, motivation, and incentive programs to improve the workplace culture. While at Menasha, he happened to be guiding a tour of the facility, and Kim was in the group. He remembered the conversation: “‘If you ever leave,’ she told me, ‘Don’t you dare take another offer until you talk to me.’” He returned to Royal in June 2021.

In working to set up the new plant in St. Thomas, Marcella and his team were given a blank canvas. The conscious decision to lease, rather than buy, a building meant dealing with the building’s new owner, but this also provided unforeseen advantages. Marcella explains, “Our landlord purchased the building and all the contents just before we signed the lease. The prior tenant—the injection-molding business—had invested a great deal of electrical infrastructure, which was left behind and destined to be scrapped. We were able to build the entire electrical services using only labor; we repurposed switchgears, breakers, panels, transformers, and multiconductor wire. Th is saved us roughly 40% on the budget for electrical and allowed us to stay on track.”

In addition to the electrical infrastructure, the site had an enclosed rail siding

for receiving carloads of plastic resin and pellets. Marcella and his team converted it to house the dust- and scrap-collection machinery, isolating it from the converting equipment, thus creating a cleaner and healthier plant environment.

In choosing the St. Thomas location, Kim and her team ensured their equipment investments complemented the company’s entire mix of business. The workhorse is a 37" x 98" three-color Bobst 924NT flexo folder gluer. In addition, Royal St. Thomas has two Bobst die cutters—a 66" x 113" Bobst DRO 1628NT and a 66" x 113" Bobst Masterline DRO, both with A.G. Stacker’s XRI SERIES stackers; a 64" x 100" Stock laminator; a 47" x 63" Cobra fl atbed die cutter; a 55" x 67" Baysek C-170 die cutter; a Brausse specialty gluer; and a Bobst Expertfold 230 specialty gluer. Th is mix of high-speed converting, die cutting, and fi nishing equipment allows Royal to accommodate the display business it picked up in the C&B Display Packaging acquisition, as well as to serve the predominantly brown-box customer base it shares with Royal’s Brampton location.

“We don’t really sell geographically,” Kim explains, describing the mix of customers in the southwest Ontario market and how the plant’s equipment mix serves them. “We’ve got 1,500–1,700 active customers between both our plant locations, and we schedule to our capabilities in each,” she says, noting that the customer base is so diverse it insulates Royal from being top-heavy in any one industry.

“If I could sit here and say to you that 10% of our sales goes to this one industry, I would, but we can’t,” she says. “We do not still to this day have a customer that accounts for more than 6.5% of our sales.”

Showing pride in the accomplishments of her team, Kim adds, “Last year, Royal Containers reached $100 million in sales. Th is is a humongous milestone in our company.”

BOXSCORE July/August 2023 34

Member Profile

St. Thomas Bobst flexo folder gluer crew (from left): Tika Ram Humagain, Mohammed Ali, and B.J. Desmond.

Breaking Do n Bo es Breaking Down Boxes Compelling Conversations with Successful Entrepreneurs in the Packaging Space AICCbox.org/Boxes

Member Profile

Mohamed “Mo” Azzouz is Royal’s continuous improvement manager in St. Thomas. From the start, he worked with Marcella and Craig Andrews from C&B to ensure the optimum layout and workflow through the new facility. (Andrews has since moved over to TenCorr.) Azzouz came to Royal in 2017 and assumed the role of continuous improvement lead in 2019. He was instrumental in supporting the acquisition of C&B and the move of its assets to London.

Azzouz and the Royal St. Thomas team set and measure their improvement metrics utilizing the obeya principle, a practice of lean manufacturing first put in place in Brampton in 2019. Obeya (Japanese for “big room”) is a tool in which a dedicated room is set aside for employees to meet and make decisions about a specific topic or problem. The idea behind an obeya is to break down the barriers that prevent employees from collaborating and sharing information. Azzouz credits Les Pickering of Quadrant 5 Consulting for laying down the foundation of workplace organization and standardized work. Azzouz then introduced kaizen events and lean training to target specific improvements or work areas. A tour of the St. Thomas plant will likely include a visit to its obeya room, high on a mezzanine, so operators can see nearly every machine center and

the work in process. The room’s walls host an array of visual information about lean kaizen events’ key performance indicators, showing progress and potential problem areas. “At Royal Containers,” Azzouz says, “our utmost priority is the well-being of our employees. We firmly believe that fostering a culture of continuous improvement can have a profound impact on employee retention, morale, and customer satisfaction. Royal’s commitment to continuous improvement is not merely a concept but an absolute necessity in our commitment to delivering the highest value to our customers.”

In agreement, Kim adds, “We bought into lean manufacturing from the very beginning. I would say now we are a professional lean manufacturing company; we live it and breathe it every day.”

Royal Containers has a strikingly simple mission statement: “Building Partnerships in Packaging.” This ethos is infused in the company and extends not just outwardly to the company’s customer base but to its suppliers and, notably, to its employees as well. Kim and her team are passionate about the Royal Containers culture. “Luckily for us, we have defined our culture,” she says. “We know what it means—what it looks like, smells like, and sounds like.”

At Royal, she explains, the company’s culture sounds like, “If I want to be

responsive, how can I help you? What are we doing? What can I do to support you with that? Everything is transparent; it’s authentic.”

These values are reflected in the St. Thomas plant’s physical space. “If I want to be happy, I want to be in a beautiful place,” says Kim. “If I’m in a dark and dingy place, I can’t be happy. You want everyone to feel and have a beautiful working environment, and that’s what we’ve done here.”

Michel Alvarez agrees, adding, “There’s transparency, too. You look at this whole place, and it’s all open space. There’s nothing blocking the windows—no secrets.”

As a footnote to this story, the St. Thomas business community has welcomed the Royal Containers’ relocation with open arms. Says Marcella, “When local business leaders came in and did our tours, they clued into the fact that we’re producing a 100% recycled product and that we’re not a hazardous business. We are a very clean industry. The town absolutely loves that story.”