Sponsored by:

AIBC 2024 Introductory Series: The Essentials of Sales & Trading

AIBCGlobalResearch|May2024

Table of Contents

1.

2. The Fundamentals of S&T

5 TheRoleofSales,TradingandPortfolioManagement

5 Whatismarketmaking?

6 KeyTermsinSalesandTrading

6 KeyRolesofTraders

3. Asset Classes, Trading Strategies and Market Dynamics

7 ThedifferenttypesofAssetClasses

8 CaseStudy:BankofJapan(BoJ)'sYieldCurveControl

11 TechnologicalDisruptionandEthicalChallengesinModernFinance

4. Appendicies

12 BNPPARIBASPresents:(Advertisementname)

13 EngagewithAIBC2024–AGatewaytoAPACRecruitmentOpportunities

14 AsiaInvestmentandBankingConferenceDisclaimerClause

Introduction

Foreword 4 MeettheThemes AIBCGlobalResearch|TheEssentialsofSales&Trading Introduction TheFundamentalsofS&T AssetClasses,TradingStrategiesandMarketDynamics Appendices

3

2

Foreword

AIBC Global Research Team continues to provide unparalleled student development opportunities in 2024

It is with great pleasure that we welcome you to the Asia Investment and Banking Conference (AIBC) 2024, where this year's theme, "Redefining Boundaries," encapsulates our commitment to shaping the future of finance In line with this vision, we proudly present the #AIBCResearch series an endeavour to merge academic research with industry insights, developed by our student analysts.

This curated collection of articles aims to provoke thought and challenge thinking AIBC's dedication to student development, strategic talent discovery, and meaningful industry connections is exemplified through our research initiative. These components are integral to our foundational goal of equipping emerging finance professionals with the tools to transcend traditional barriers.

We invite you to engage fully with this series, allowing the insights within to broaden your perspectives May your journey through the #AIBCResearch series inspire you to redefine your own boundaries and contribute to the ever-evolving narrative of the finance industry.

The Introductory Series

The Introductory Series is a practical collection aimed at providing a clear view of the foundational elements of finance It consists of eight research booklets, each one concentrating on a key area within the finance sector, topics which will be part of the AIBC 2024 conference discussions.

These booklets are created to cut through the complexities of finance, offering clarity to readers from all backgrounds Our objective is to equip you with a basic yet comprehensive understanding of each financial domain, underlining its specific functions, the challenges it encounters, and the potential it holds within the global financial framework.

AIBCGlobalResearch|TheEssentialsofSales&Trading Song Yi HeadofResearchDepartment research@aibcasia

3

FollowAIBConLinkedIn> Follow#aibcResearchonLinkedIn> DepartmentofGlobalResearch Meet the Authors Global Research Introduction TheFundamentalsofS&T AssetClasses,TradingStrategiesandMarketDynamics Appendices

AIBC 2024 Themes

Overviews and insight Follow the 8 themes unfolding throughout the conference

Investments in assets outside of stocks, bonds, and cash, including real estate, commodities, and collectables.

Private investment funds employ various strategies to earn active returns for their investors, often using leverage and derivatives.

The process of developing, operating, maintaining, and selling assets to maximise investor returns.

Banking services offered to high-networth individuals, providing personalised financial advice and solutions. The use of mathematical models and algorithms to identify trading opportunities and manage investments automatically.

Financial services dealing with the creation of capital for other companies, governments, or other entities through underwriting or acting as the client's agent in the issuance of securities.

Investment in private companies or buyouts of public companies, aiming to restructure or improve their operations and profitability before selling them for a profit.

The buying and selling of securities, commodities, and other financial instruments in financial markets, through either facilitating transactions for clients or trading on their own firm’s behalf.

Alternative Investments Asset Management (AM) Hedge Funds Investment Banking (IB) Private Banking (PB) Private Equity (PE) Quantitative Trading Sales & Trading (S&T)

4 Introduction TheFundamentalsofS&T AssetClasses,TradingStrategiesandMarketDynamics Appendices AIBCGlobalResearch|TheEssentialsofSales&Trading

The Fundamentals of S&T

The role of Sales

The sales team communicates directly with hedge funds, mutual funds, and other financial institutions to deliver information regarding securities and financial products They interact with institutional clients to provide updates on global market trends and potential investment opportunities A deep understanding of financial products brought about by the trading team is required in order to provide valuable insights to clients Additionally, the sales team works with traders to price and execute orders of desired trades

What is Market Making?

The role of Trading

Traders buy and sell securities on behalf of their clients while making a profit on a spread, which occurs when they purchase securities at a lower price than the price quoted (see key terms below) Traders specialise in trading different asset classes (mainly fixed-income, equities, commodities, foreign exchange, or derivatives)

Market making is an activity that provides the market with liquidity while helping the market makers profit from the difference in the bid-ask spread. Market makers are compensated for the risk of holding assets because they could see a decline in the value of an asset after it has been purchased before it is sold to a buyer. One famous example of a market maker is the US-based hedge fund Citadel, which made about $28 billion in revenue in 2022, managing just over $60 million in assets.

5 Introduction TheFundamentalsofS&T AssetClasses,TradingStrategiesandMarketDynamics Appendices

Revenue in 2022 $60M Assets Under Management AIBCGlobalResearch|TheEssentialsofSales&Trading

$28B

KEY TERMS IN SALES AND TRADING

Offer

The price at which a given product is available for sale

Spread

The difference between the bid and the offer

Bid

The price of at which someone is willing to buy a given product

The role of Flow traders

Copyright©2024EntrepreneurMedia KEY ROLES OF TRADERS

The role of Agency traders

Short for Profit and Loss, how traders refer to the financial performance of a trade

Flow traders actively take part in market making, making use of this opportunity to profit from the bid-offer spread while providing liquidity to the market Profit and loss are created by traders when executing these trades

Agency traders execute trades on behalf of the firm’s clients (usually high volume, followed by a high commission) When executing an order on the behalf of institutional clients, traders must strategically spread out their orders in smaller volumes that reduce their impact on the market to purchase the desired number of shares at a lower price.

The role of Quantitative traders

Quantitative traders create automatic, rules-based trading algorithms for clients who want to benefit from a low-fee, structured trading product. They get involved in markets with structural trading opportunities where algorithms perform better, especially with those requiring highfrequency trading to generate profit

6

PnL

Introduction TheFundamentalsofS&T AssetClasses,TradingStrategiesandMarketDynamics Appendices AIBCGlobalResearch|TheEssentialsofSales&Trading

Asset Classes, Trading Strategies and Market Dynamics

The different types of Asset Classes

EQUITIES

FIXEDINCOME

CURRENCIES

COMMODITIES COMMODITIES

Equity represents ownership held by shareholders in an entity, realised in the form of shares. Equity trading requires the analysis of companies using various financial metrics (Discounted Cash Flow (DCF) valuation, P/E ratio, EPS, EV/EBITDA multiple, etc).

Fixed-incomesecuritiesprovidereturnsintheformoffixedperiodicpaymentsknownascoupons.Themostcommonfixedincomesecuritiesarebonds,whichareissuedbycompaniesandgovernmentstoraisecapital.

Theyieldtomaturity(YTM)istherateofreturnonabondifitispurchasedtodayforitscurrentprice,heldthroughits maturitydate,andispaidoffinfullatmaturity.Normally,theyieldtomaturityisexpressedasanannualrate.

CurrenciesaretradedinpairsontheFXmarket.Acurrencypairincludesabaseandaquotecurrency,suchas“USD/GBP”, whereUSDisthebasecurrencyandGBPisthequotecurrency.

Spotratesarethepriceabuyerwillpay“onthespot”foraforeigncurrency.Theforwardrateisthepriceatwhich currencieswillbeexchangedatsomegivendateinthefuture.Theforwardrateisusedbyspeculatorsaswellas companieslookingtohedgetheirforeignexchangerisk.

Commoditiessuchasmetals(copper,iron,etc)orenergy-relatedproducts(oilandnaturalgas)canalsobetraded.In particular,investorsviewmetalsasareliableanddependableformofinvestmentbecausetheytendtoretaintheirvalue overtime.Preciousmetalssuchasgoldareoftenusedasahedgeagainstinflationandcurrencydepreciation.

Commoditiesareusuallytradedusingderivatives(explainedbelow),especiallythroughfuturesoroptionscontracts.For example,CrudeOilWTI(NYM$/bbl)FrontMonthinvolvesafuturetowardcrudeoil.

DERIVATIVES

Aderivativeisatypeofinvestmentthatderivesitsvaluefromthevalueofotherassetslikestocks,bonds, commodities,ormarketindexvalues(S&P500,FTSE100,etc) Somederivatesinvolvefuturescontracts,forward contracts,calloptions,putoptions,etc

Forinstance,acalloptiongivestheholdertherighttopurchaseanassetforaspecificpriceonorbeforeaspecified expirationdate Contrastingly,aputoptiongivestheholdertherighttosellanassetforaspecifiedpriceonorbefore aspecifiedexpirationdate

7 Introduction TheFundamentalsofS&T AssetClasses,TradingStrategiesandMarketDynamics Appendices

AIBCGlobalResearch|TheEssentialsofSales&Trading

Bank of Japan (BoJ)'s Yield Curve Control

The BoJ's monetary policy targeted short-term interest rates at -0 1% and the 10-year government bond yield at 0.5% to consistently achieve its goal of 2% inflation. After years of bond buying and quantitative easing failed to meet this persistent inflation target, the BoJ implemented negative shortterm rates since January 2016 to keep the value of the Japanese yen low. To increase long-term rates back again, the BoJ adopted Yield Curve Control (YCC) eight months later by adding a 0% target for 10-year bond yields to its -0.1% short-term rate target. The idea was to control the shape of the yield curve to suppress short, and medium-term yield rates. This would not decrease long-term yields by much while impacting corporate borrowers and reducing returns for pension funds and life insurers

STUDY 8 Introduction TheFundamentalsofS&T AssetClasses,TradingStrategiesandMarketDynamics Appendices

CASE

AIBCGlobalResearch|TheEssentialsofSales&Trading

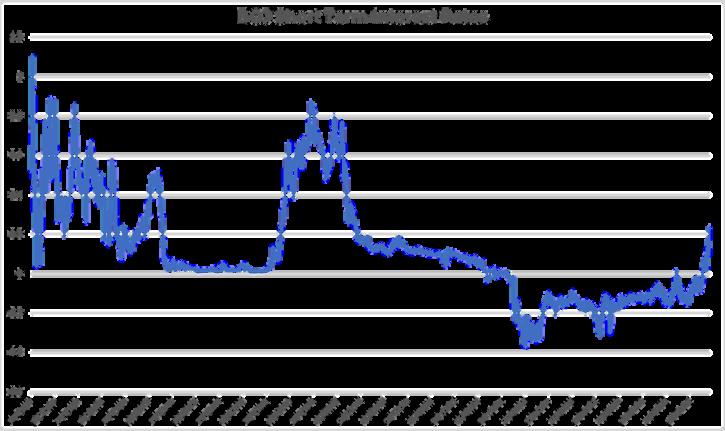

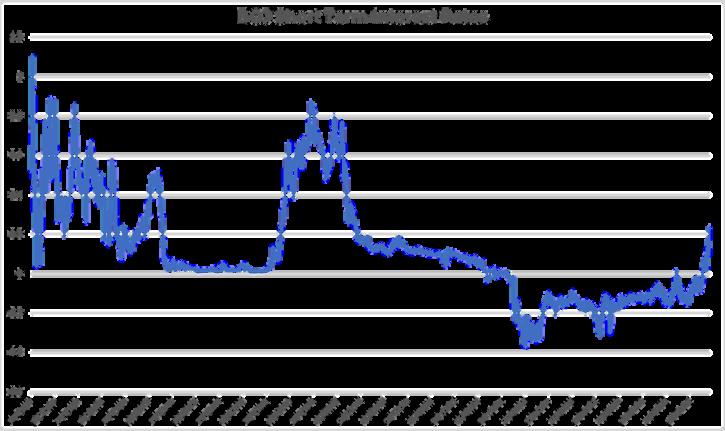

Impact on USD/JPY Exchange Rates

The adoption of this policy formulated a popular trade idea for FX traders due to the following rationale: the Japanese yen would appreciate against the dollar in the near future as the BoJ would eventually have to stop yield curve control due to market pressure. However, the BoJ's decision was completely opposite to the common trade rationale. During the meeting held on January 18th 2023, BoJ announced that it would continue the Yield Curve Control, enhancing its fund supply to make it even easier to control the yield curve. This announcement had a significant impact on the market as it meant a depreciation of JPY compared to the USD, boosting the USD/JPY index from 128 to 131 within a short time frame.

AchartoftheUSD/JPYexchangerate 9 Introduction TheFundamentalsofS&T AssetClasses,TradingStrategiesandMarketDynamics Appendices

Copyright©2022JunRongLoo

End of Negative Interest Rates and YCC

In March 2024, the BoJ announced Japan’s exit from negative interest rate policy and yield curve control The BoJ raised its short-term interest rates to 00 1% from -0 1% This marks the end of Japan’s negative rates regime, which had been in place since 2016 The BoJ cited the virtuous cycle between wages and prices, which will allow the BoJ to achieve its 2% inflation target The spring wage negotiations, known as ‘shunto’, has led to Japan’s biggest companies raising wages by 5 28% in 2024, the highest pay hikes in 33 years

AchartofBoJ’sshort-terminterestratesasobservedinJune2024

Implication on the Markets

Higherinterestratesofferbetterreturnsoninvestmentsandthusleadto highercurrencyvalue,theoreticallycausingtheyentoappreciate The historicalstabilityoftheJapaneseyenhasalsomadeitpopularfortraders placingcarrytrades,wheretheyen,alow-yieldingcurrencyisborrowedin ordertofundinvestmentsinhigher-yieldingcurrenciesorassets WithBoJ’s ratehike,sometradersareturningtotheSwissfranctofundcarrytrades instead(sinceSwitzerland’scentralbankunexpectedlycutinterestrates) This willpotentiallyfurtherreducepressureontheyen,allowingitsfurther appreciation

Thatbeingsaid,theyencontinuestoremainweak On27March2024,the yenhita34-yearlowof151 97againsttheU S dollar Japaneseratesremain muchlowerthantherestoftheworld USFedFundsRatesarecurrentlyat the5.25-5.5%band.Despitetheratehike,itisunlikelythattheBoJwillbe abletomeaningfullynarrowthisyieldgapinthenearfuture.BoJgovernor KazuoUedahassaidthatJapan’soverallpolicysettingswill‘remain accommodative’,implyingalowlikelihoodofsteepandfastratehikes. Marketsarealsospeculatingthattheyenhasnotweakenedfastenoughfor theBoJtointerveneandupliftthecurrency Theyenslidealsohasnotledtoa noticeableboostinJapaneseexports,withaBoJgaugeforinflation-adjusted exportsfalling3 3%sinceend-2020 Thislackofforeigndemandhasfurther resultedintheweaknessoftheyen

10

Introduction TheFundamentalsofS&T AssetClasses,TradingStrategiesandMarketDynamics Appendices

The release of generative AI ChatGPT in March 2023 has revolutionised Sales & Trading. Machine learning (ML) programmes can be used to derive and predict trading patterns, and natural language processing (NLP) can be utilised to read and understand large amounts of unstructured data. Generative AI also has significant uses in Sales, where it has the potential to take all interactions with clients and use them to create an “RM assistant.” It can help with tasks such as investment ideas, sales, and product policies nearly instantly, cutting down the time needed to respond to clients significantly. However, the rise in electronically executed trades, facilitated by the Internet and various alternative trading systems, has led to a significant reduction in trading commissions This is mainly because electronic trading typically incurs lower commission costs compared to traditional, non-electronic trading methods The bid/offer spread has also been compressed, creating greater competition for banks

Challenges of SLBs

In 2023, Sustainability-linked bond issuance volume dropped 22%, amidst market volatility and diverging investor opinions. Sustainability-linked bonds (SLBs) have come under the spotlight for increasing concerns over their credibility and preference for explicit alignment with MiFID II and SFDR. Unlike green bonds, which are dedicated to fund projects with positive environmental impacts, SLBs have no restrictions on the use of proceeds and could be used to fund general corporate purposes, subjected to certain exclusion criteria. As SLBs’ financial characteristics are adjusted based on issuers’ predetermined sustainability performance targets, the credibility of the issuer’s ESG profile and overall corporate strategy remain the most important consideration for investors when assessing the integrity and credibility of the SLBs. In addition, clean energy stocks have underperformed against the oil and gas sectors admist the backdrop of continued global geopolitical tensions, with regional armed conflicts surging demand for fossil fuel-based commodities.

11 Introduction TheFundamentalsofS&T AssetClasses,TradingStrategiesandMarketDynamics Appendices AIBCGlobalResearch|TheEssentialsofSales&Trading

Use of Artificial Intelligence in Trading 1

2

12

Engage with AIBC 2024 –Your Gateaway

to APAC’s Recruitment Opportunities

Leverage our platforms to connect with AIBC 2024, whether you're a seasoned graduate or new to the world of investment and banking. Here's how you can get involved:

Connect with AIBC Research on LinkedIn

Search for and follow #aibcResearch on LinkedIn to access our extensive library of free-to-view research reports. Gain insights and expand your understanding of the global finance landscape.

Get updates for events on Instagram

Stay in the loop with event signups and the latest AIBC 2024 conference news on our Instagram account.

Join our conference in 28-30 August 2024

Interested in joining AIBC 2024? Visit our website to apply and secure your place at the conference.

Be part of the conversation that's shaping the future of finance.

Be part of conversation that's shaping the future of finance.

Introducing AIBC 2024 | Save the Date | AIBC

40+countries

140+universityparticipation

150+globalpartners

TopfinancialInstitutionalsposonsor

WanttolearnmoreaboutAIBC?Checkoutour introductorycommercialnow!

13 Introduction TheFundamentalsofS&T AssetClasses,TradingStrategiesandMarketDynamics Appendices

AIBCGlobalResearch|TheEssentialsofSales&Trading

Asia Investment and Banking Conference Disclaimer Clause

The information provided in this report (the "Report") on Asia Investment and Banking Conference is for general informational and educational purposes only. All information in the Report is provided in good faith. However, we make no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, availability, or completeness of any information in the Report.

The Report is not intended to provide, and should not be relied on for, investment, accounting, legal, or tax advice. You should consult your own investment, legal and tax advisors before engaging in any transaction. The views, thoughts, and opinions expressed in the Report belong solely to the author, and not necessarily to the author’s employer, organization, committee or other group or individual.

The Report may contain forward-looking statements that involve risks and uncertainties, and actual outcomes and results may differ materially from those expressed or implied in the forward-looking statements. Past performance is not indicative of future results.

Asia Investment and Banking Conference is not a registered investment advisor or broker/dealer. Neither Asia Investment and Banking Conference nor any of its affiliates or representatives are providing you with investment advisory services or with advice on the value of securities or on the advisability of investing in, purchasing, or selling securities, or on the merits of any investment strategy.

By accessing and using the Report, you agree to hold Asia Investment and Banking Conference, the author, and any affiliates associated with the Report harmless and waive any and all claims, losses, liabilities, costs, and expenses that you may have against them. This disclaimer may be subject to updates and changes.

14 AIBCGlobalResearch|TheEssentialsofSales&Trading Introduction TheFundamentalsofS&T AssetClasses,TradingStrategiesandMarketDynamics Appendices