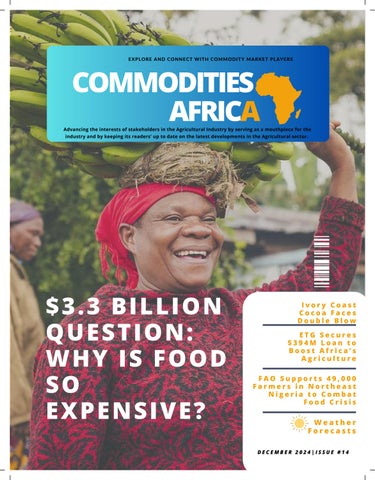

Welcome to Agricvendor Commodities Africa Magazine!

Dear Readers,

It is with great excitement that we present to you this latest edition of Agricvendor Commodities Africa Magazine, your trusted partner in navigating Nigeria’s dynamic agricultural industry. As we close another year filled with both challenges and opportunities, we reaffirm our commitment to serving as a vital bridge connecting farmers, agribusinesses, and stakeholders across the agricultural value chain. In this issue, we delve into critical trends shaping Nigeria’s agribusiness landscape, from financing, innovations in precision farming to opportunities in the global commodity markets, in fact, a lot of money was doled out this periods to support and strengthen the industry across vital parts of Africa. With the world increasingly focused on food security and sustainable practices, Nigeria’s role as a key player in African agriculture has never been more significant.

Our special focus this month highlights the Inflation crisis in Nigeria’s food sector and its impact on the economy, with expert perspectives to shed more light on the issue on the $3.3 billion question. As a B2B agro-magazine, we are dedicated to empowering readers with actionable insights and advertising platforms to grow their businesses. Whether you’re a farmer, agro-allied, agribusiness professional, or investor, this magazine is designed for you.

armers across Ivory Coast’s cocoagrowing regions are raising alarms about scarce rains and soaring heat, which could threaten the development of the main October-to-March cocoa crop As the world's leading cocoa producer enters its dry season, stretching from mid-November to March, the weather’s unpredictability has many worried

In most regions, except Soubre in the west and Agboville in the south, farmers reported insufficient rainfall Soubre received an impressive 16 4 mm of rain last week well above the five-year average while Agboville experienced slightly belowaverage rainfall However, in areas like Daloa, Bongouanou, and Yamoussoukro, rain was either scarce or entirely absent, leaving farmers anxious about February and March harvests.

"The heat is intense, and rain is almost nonexistent We’re very worried," said Arthur Brou, a farmer near Daloa, where rainfall fell 4 mm below the five-year average

The dry Harmattan winds, which can shrivel cocoa pods and dry out soil, have varied in intensity but caused no major damage so far. Farmers in regions like Soubre remain optimistic about a strong January harvest, while others, like those in Divo and Abengourou, are preparing for the upcoming mid-crop season

Temperatures last week ranged between 27.9°C and 28.9°C across the country

hana’s cocoa industry is navigating uncharted waters as international buyers pump millions of dollars into securing supplies upfront, trying to avoid another season of massive losses By midNovember, Cocobod the country’s state marketing board had received approximately $550 million in advance payments Yet, much of the cocoa remains undelivered

While Cocobod asserts the system is running smoothly and farmers confirm they are receiving payments, industry opinions are divided Last season’s contracts still loom over traders, with up to 350,000 metric tons of cocoa undelivered, costing companies over $1 billion in futures market hedges Although Cocobod disputes these figures, it admits to rolling over contracts, promising traders they’ll be fulfilled this season. The stakes are high. At current price levels, companies risk losing an additional $2,500 per ton for last season’s undelivered contracts. According to Tedd George, a commodities expert, filling the gap requires a harvest of about 900,000 tons 250,000 tons more than Cocobod’s optimistic estimate “It’s a significant shortfall,” George notes, adding that some traders and local processors may miss out on beans this season

In an attempt to shield itself from losses, Cocobod now requires traders to buy additional contracts at near-record spot prices This strategy helps balance the price gap but leaves companies with limited options Each ton sourced under last season’s lower prices reduces their financial exposure, compelling them to stay in the game. “All the ingredients for trouble are here,” warns a cocoa fund manager, citing concerns over the new marketing model, unpredictable crop yields, and Ghana’s upcoming election a potential game-changer for the sector. Cocobod has also shifted its financing model. For the first time since 1992, it bypassed syndicated bank loans, relying instead on upfront payments from international buyers and pre-financing from Licensed Buying Companies (LBCs) This decision aims to save $150 million in interest payments but raises questions about its sustainability

Traders report that Cocobod is blending last season’s contracts with current spot purchases, averaging out prices at around $5,000 per ton While this approach may offer some relief, the reliance on a strong production rebound remains a gamble If the harvest falls short, the ripple effects could disrupt Ghana’s cocoa supply chain and global markets alike.

TGlobal meat giant JBS is investing $2 5 billion to establish six meat-processing plants in Nigeria This ambitious five-year project is part of a partnership with the Nigerian government to boost the country’s meat production and enhance food security Through a signed memorandum of understanding, JBS will carry out feasibility studies, budget planning, and action steps to strengthen Nigeria’s meat supply chain In return, the government will ensure favorable economic, sanitary, and regulatory conditions for the projects success JBS’s initiative supports Nigeria’s National Food Security Plan by sharing expertise in agro-industrial development and sustainable farming This comes as the country battles severe food insecurity, with over 24 million Nigerians facing hunger, according to the World Food Programme With a population of over 220 million and growing meat demand, Nigeria’s meat market offers immense potential Currently, protein production meets just 40% of local demand. JBS aims to bridge this gap, creating opportunities for sustainable growth in the sector.

he OPEC Fund for International Development has joined forces with ETC Group (ETG) to strengthen Africa’s agricultural sector through a groundbreaking $40 million loan agreement This funding is part of a broader $394 million sustainability-linked financing initiative aimed at tackling key challenges in sub-Saharan Africa’s food systems

This marks a milestone for the OPEC Fund, as it’s their first venture into sustainabilitylinked loans a financing model that ties funding terms to achieving specific environmental, social, and governance (ESG) goals The initiative seeks to uplift smallholder farmers, boost food security, and minimize environmental harm

ETG, a major player in Africa’s agricultural commodity supply chain, will channel the funds into programs promoting sustainable farming practices and efficient resource management. These efforts are set to benefit over 600,000 smallholder farmers, enhancing agricultural value chains and food production capacity across the region.

OPEC Fund President Abdulhamid Alkhalifa emphasized that the partnership aligns with their mission to integrate sustainability into private sector projects “This agreement represents a coordinated effort to build resilience in Africa’s agricultural sector, addressing vulnerabilities exacerbated by climate change and global trade disruptions,” Alkhalifa noted

The loan is co-arranged by several international development finance institutions, underscoring global cooperation to tackle Africa’s pressing agricultural challenges With erratic weather patterns and disrupted supply chains amplifying food insecurity, this initiative is a timely intervention

This collaborative effort reinforces the vital role of small-scale farmers in bolstering Africa’s agricultural output, ensuring a more secure food future for the region.

Ivory Coast’s fisheries and aquaculture sector is set for a major upgrade, thanks to a $25 million loan from the African Development Bank (AfDB) This funding, approved for 2025–2029, aims to modernize fish farming and strengthen the blue economy, which has shown promising growth

The initiative, dubbed the Development of Competitive Aquaculture and Fisheries Value Chains, will directly or indirectly impact around 700,000 people Key focus areas include coastal hubs like Abidjan, Jacqueville, and Sassandra, as well as inland regions such as Bouaké and Yamoussoukro Upgrades will also target dam lakes like Kossou and Buyo

While Côte d’Ivoire’s seafood production reached an impressive 105,219 metric tons in 2019 a significant 60% increase over the past decade the country still grapples with a substantial supply-demand gap With domestic fish consumption climbing, Côte dIvoire imports roughly 182,000 tons of seafood annually to help meet a national demand of 650,000 tons Artisanal fishing continues to play a crucial role, accounting for 75% of the total catch, with industrial fishing contributing an additional 20%

For Advert Placements: team@agricvendor.com, teamagrimallltd@gmail.com Call: +234 704 671 8831, +234 913 771 5706

AGRIBUSINESS GROWTH BUNDLE

Looking for a comprehensive solution to boost your agribusiness?

Elevate Your Agribusiness with Our Growth Bundle. Get targeted leads, expert marketing, and exclusive farmers’ network access.

Enjoy exceptional value with our bundled packages. Free consultation included.

Limited availability. Money-back guarantee. Enroll today!

PARTNERSHIP ACCELERATOR BUNDLE

Our platform connects you with likeminded businesses for collaboration and joint ventures. Complimentary networking guide

Access to an exclusive community of agribusiness leaders Money-back guarantee Free consultation included. Limited. Enroll today!

L A S S I F I E D S A D V E R T I S E H E R E A D V E R T I S E H E R E

NIGERIA - Starlink Global and Ideal Limited has unveiled an ambitious plan to invest a whopping N7 billion (US$4 5 million) in cocoa and cashew production over the next five years This announcement came during the company’s 25th-anniversary celebration, marking a milestone in its commitment to transforming Nigeria’s agricultural sector

Speaking at the event, Starlink’s Managing Director, Adeyemi Murtadha Adeniyi, underscored the vital role of private-sector leadership in driving economic growth.

“If Starlink had waited for the government, we wouldn’t have been able to bail out millions of Nigerians thriving in cocoa today Despite facing challenges like bankruptcy, we’ve managed to reshape the cocoa industry and contribute significantly to Nigeria’s agricultural development,” Adeniyi stated

Starlink has partnered with Odu’a Investment, a key stakeholder owning about 25,000 hectares of land across West Africa This collaboration is central to Starlink’s backward integration strategy, which includes establishing two pilot sites to cultivate 5,000 hectares of cocoa The company’s vision is to scale up operations over time, ensuring sustainable growth and creating opportunities for local farmers

“If the government supports our efforts, we’ll welcome it But we won’t wait for them to act,” Adeniyi added, highlighting the company’s proactive approach. This investment aligns with Nigeria’s broader push to diversify its economy by strengthening non-oil

commodities. The Federal Government, represented at the event by the Minister of Industry, Trade, and Investment, Jumoke Oduwole, reaffirmed its commitment to fostering economic diversification “The commodity market plays a pivotal role in developing economies, particularly in Africa, where it drives exports, creates jobs, and generates revenue,” Oduwole noted

Starlink’s announcement follows closely on the heels of the African Export-Import Bank’s recent pledge of N33 billion (US$20.8 million) to establish a cashew processing facility in the region Afreximbank President Benedict Oramah emphasized the need to bridge the US$150 billion annual trade finance gap in developing countries, underscoring the importance of private-sector initiatives.

Ogun State Head of Service Kehinde Onasanya also weighed in, emphasizing cashew’s potential to drive economic growth “Cashew has long been a crop of economic importance in Ogun State, with the capacity to boost revenue, create jobs, and foster sustainable development in rural communities,” Onasanya said

Export Trading Group (ETG), a big name in Africa’s agricultural sector, has landed a massive $394 million syndicated loan to ramp up its farming initiatives across the continent Backed by the Dutch Entrepreneurial Development Bank (FMO) and the Trade and Development Bank (TDB), the funding aims to push sustainability in farming operations ETG is focusing on key crops like wheat, rice, soybeans, coffee, sugar, and cashews, with a goal to improve farming practices for one million smallholder farmers These efforts include better farming techniques, enhanced crop quality, and greater market access

Fatou Bouaré, Finance and Operations Director at FMO, called it a game-changer, saying it’s the largest loan of its kind in African agriculture She praised ETG’s role in providing technical expertise and resources that directly boost farmers’ yields

In a groundbreaking move to enhance women’s economic empowerment, the World Bank has disbursed N492 million to 41 women’s groups in Niger State, aiming to boost rice processing activities Each group received N12 million, a significant investment presented by Sarki Bello, the State Coordinator for the Nigeria for Women Project (NFWP) The initiative, announced by Imaan Sulaiman-Ibrahim, Minister of Women Affairs, represents a transformative leap in addressing the systemic barriers that have hindered women’s participation in the economy “This milestone signifies a journey towards redefining empowerment for Nigerian women,” Sulaiman-Ibrahim noted She described the project as a “beacon of hope” and a symbol of progress for women, especially in Niger State

A notable feature of the program is the integration of a childcare facility within the rice processing center. Funded by the World Bank, this creche is set to be upgraded into a primary healthcare center, addressing women’s medical needs while solving one of the biggest challenges they face balancing work and family life. “This step sets a new standard for inclusive economic planning,” Sulaiman-Ibrahim remarked, applauding the forward-thinking leadership behind the initiative The Minister highlighted that the NFWP exemplifies President Bola Ahmed Tinubu’s commitment to gender equality and socio-economic progress for women She described the project as a “long-term, multidimensional intervention” that tackles both market and systemic barriers.

“A GAME-CHANGER, IT’S THE LARGEST LOAN OF ITS KIND IN AFRICAN AGRICULTURE AIMED TO BOOST FARMERS’ YIELDS AND PROVIDE TECHNICAL EXPERTISE”

Founded in Kenya in 1967, ETG now operates in 25 countries, shaping Africa’s agriculture by managing the entire supply chain from storage to distribution This loan will power its mission to grow sustainable farming across the continent

Through collaboration with strategic partners, including the Federal Government and the World Bank, the NFWP has made remarkable strides in improving household welfare, fostering economic empowerment, and uplifting communities Sulaiman-Ibrahim expressed gratitude to the World Bank and Niger State Governor Mohammed Bago for their support, emphasizing that empowered women can better provide for their families and communities She also pointed out the project’s potential to reduce cases of sexual and gender-based violence by promoting financial independence and family cohesion. Michael Ilesanmi, representing the World Bank’s Country Director, shared success stories from the program He noted that each processing station produces two tonnes of rice daily, contributing to the state’s agricultural output across 29 rice factories. Additionally, the program has significantly reduced domestic disputes, as more women gain financial independence Governor Bago reaffirmed his administration’s commitment to supporting women’s empowerment initiatives.

L A S S I F I E D S A D V E R T I S E H E R E A D V E R T I S E H E R E

Côte d’Ivoire and the European Union (EU) have inked a new Sustainable Fisheries Partnership Agreement (SFPA), signaling a fresh chapter in their longstanding collaboration Effective from 2024 to 2028, the agreement aims to balance economic interests with environmental sustainability while boosting Côte d’Ivoire’s fisheries sector The deal, signed on November 21, 2024, by Sidi Tiémoko Touré, Côte d’Ivoire’s Minister of Animal and Fisheries Resources, and Francesca Di Mauro, EU Ambassador to Côte d’Ivoire, introduces notable updates These changes seek to ensure mutual benefits for both parties and align with global efforts toward sustainable marine resource management

Under the new agreement, 32 European fishing vessels are permitted to operate in Ivorian waters a reduction from the 36 vessels allowed under the previous six-year partnership. These vessels will have an annual tuna fishing quota of 6,100 tonnes, marking a 600-tonne increase from the previous limit of 5,500 tonnes This adjustment reflects growing demand while maintaining a focus on sustainable harvesting practices. Financially, the deal is a win for Côte d’Ivoire The compensation for fish catches has been raised to $779,000 annually, up from $735,000 in the prior arrangement Over four years, the EU’s total financial contribution will amount to $3 12 million, bolstering Côte d’Ivoire’s budget and supporting its fisheries development initiatives.

Prime Minister Robert Beugré hailed the agreement as a cornerstone of the country’s fisheries sector growth strategy “This partnership aligns with our national policy to sustainably develop fisheries while creating economic opportunities for our people,” he stated

Fishing is a vital industry in Côte d’Ivoire, contributing 0.5% to the nation’s GDP and providing jobs for over 680,000 people In 2023, local fish production reached 92,000 tonnes, according to the Ministry of Animal and Fisheries Resources. This partnership is expected to complement local efforts by improving resource management and driving sectoral growth

The SFPA between Côte d’Ivoire and the EU has been renewed every six years since its inception in 2008 With this latest iteration, both parties hope to strengthen ties while safeguarding marine ecosystems for future generations

Kenya’s coffee sector is currently in turmoil after a new directive from the Ministry of Cooperatives, requiring farmers to be paid directly for their coffee sales, bypassing cooperative management boards. This mandate, announced by Cabinet Secretary for Cooperatives and Micro, Small, and Medium Enterprises (MSMEs) Development Wycliffe Oparanya, has sparked strong opposition from various industry players, including cooperative boards, millers, and brokers The new system, which will be implemented by the Nairobi Coffee Exchange (NCE), means that coffee sale proceeds will be credited directly into farmers' accounts or sent via M-Pesa. The government argues that this will bring more transparency and ensure that farmers get paid on time. However, critics believe the move could weaken the cooperative movement and rural savings and credit cooperatives (SACCOs).

Cooperative in Mathira, Nyeri County, described the directive as “impractical.” He pointed out that farmers would struggle to open dollar accounts, as coffee is sold in dollars He also raised concerns about the impact on loan repayments, warning that direct payments could lead to defaults and financial strain on cooperatives The directive is part of ten reforms introduced by Oparanya aimed at improving the coffee sector’s competitiveness. Other measures include capping operational costs for cooperatives, digitizing weighing scales, and requiring coffee insurance against loss or damage

Nigeria is grappling with a sharp rise in food prices despite ambitious government efforts to boost agricultural productivity and food security Under the leadership of President Bola Tinubu, food inflation has skyrocketed by 60 88% since May 2023, when it stood at 24 82% By November 2024, it had surged to nearly 40%, according to the National Bureau of Statistics (NBS).

This sharp increase comes at a time when the federal government has secured $3 334 billion in multilateral loans and attracted $4.3 billion in investments aimed at strengthening the agricultural sector Yet, these measures seem to have provided little relief to Nigerian households, many of whom struggle to afford basic food staples.

The rising cost of living is hitting Nigerians hard Households now face an uphill battle to make ends meet, as the prices of essential food items climb higher month after month.

Transportation costs have spiraled due to the removal of fuel subsidies, while the naira’s massive devaluation and persistent insecurity continue to compound the problem. The mismatch between government promises and the reality

on the ground has led to growing skepticism about the effectiveness of current economic policies In his New Year’s address, President Tinubu outlined ambitious plans to cultivate 500,000 hectares of farmland to grow staple crops like maize, rice, wheat, and millet He also acknowledged the pressing issues of high inflation and unemployment

“To ensure constant food supply, security, and affordability, we will step up our plan to cultivate 500,000 hectares of farmlands across the country,” Tinubu assured Nigerians

Despite these promises, inflation particularly food inflation has consistently risen, with data showing a steady monthby-month increase from May 2023 to November 2024 The government’s ambitious agricultural projects have yet to translate into tangible benefits for most Nigerians An analysis of the Consumer Price Index (CPI) reveals a grim pattern. From May 2023, food inflation rose incrementally each month, peaking at 40 87% in June 2024 before temporarily dropping during the harvest season in July and August. However, by November 2024, it climbed back to nearly 40%

The figures are a stark reminder of the widening gap between policy intentions and actual outcomes While harvest periods offered temporary relief, the long-term trajectory remains deeply concerning for both consumers and policymakers

Under President Tinubu’s administration, the government embarked on an ambitious journey to secure $3.334 billion in loans and attract $4 3 billion in private-sector investments

These funds were intended to revolutionize Nigeria’s

agricultural sector, creating a pathway to food security and economic stability. But have these efforts borne fruit, or are Nigerians still waiting for the promised relief?

From international institutions like the World Bank and the African Development Bank (AfDB), the loans were aimed at addressing critical gaps in agricultural productivity and rural development For instance, $500 million from the World Bank was designated for the Livestock Productivity and Resilience Support Project, aimed at enhancing livestock production nationwide Another $500 million targeted the Rural Access and Agricultural Marketing Project, which sought to connect rural communities to broader markets and improve access to schools, hospitals, and agricultural hubs

to improved inputs Private-sector commitments were equally significant Investments totaling $4 3 billion were secured to bolster key areas such as fertilizer production, hybrid seed technology, and agricultural finance A notable partnership with Brazil’s Fundação Getulio Vargas promised to provide technical and financial support to agribusinesses across all 774 Local Government Areas of Nigeria over the next five years These collaborations aimed to create a ripple effect of innovation, efficiency, and productivity in the sector. Yet, the anticipated transformation has been slow to materialize Despite these financial interventions, many Nigerians continue to grapple with skyrocketing food prices

From international institutions like the World Bank and the African Development Bank (AfDB), the loans were aimed at addressing critical gaps in agricultural productivity and rural development.

The largest slice of the funding came from the AfDB, which committed $2.2 billion to develop Special Agro-Industrial Processing Zones These zones were envisioned as hubs to boost agro-industrial productivity, create jobs, and ensure that locally produced goods could compete both domestically and internationally In addition, $134 million was allocated for seed and grain production to enhance food security by increasing crop yields and ensuring that farmers had access

Stakeholders have voiced concerns about whether these funds are being effectively channeled to address the root causes of the crisis Critics point to issues such as inefficiencies in policy implementation, insecurity, and inadequate infrastructure, which have hampered progress and left millions questioning the actual impact of these investments Agricultural experts also highlight the challenges inherent in Nigeria’s farming landscape According to Associate Professor Unekwuojo Onuche of the University of Africa, Bayelsa, subsidizing the country’s millions of smallholder farmers is an unrealistic solution Instead, he advocates for increasing agricultural supply as a more viable approach "You increase supply so that demand remains fairly stable Prices will be forced to come down," he explains However, Onuche cautions that agriculture operates with a significant time lag Investments made today may take six months to a year before yielding tangible results, as farmers need time to plan, implement, and harvest their crops.

MOZAMBIQUE - Mozambique’s sugar industry is showing signs of recovery with exports generating an impressive US$14 7 million in the first half of the year This marks a 36% increase from the US$10 8 million recorded during the same period in 2023, according to data from the Bank of Mozambique However this rebound follows a challenging start to the year Adverse weather conditions in the first quarter led to a steep 70 7% year-on-year decline in revenue But as the skies cleared, so did the outlook for Mozambique’s sugar sector The Bank of Mozambique’s midyear report credits this upswing to improved production after last year ’ s climate-related setbacks Sugar remains a cornerstone of Mozambique s agricultural exports, with key production hubs in provinces like Sofala, home to the Mafambisse Sugar Mill Despite the recent progress Pascoal Macule, director of the Mafambisse facility operated by Tongaat Hulett cautioned that challenges persist Bad weather and the El Niño phenomenon have significantly affected us We lost around 8 000 hectares of sugarcane fields in Nhamatanda due to drought,” he said The Mafambisse mill with an annual production capacity of 92,000 tonnes, has struggled to reach its potential

To address these hurdles, Tongaat Hulett recently announced a 500 million rand (€25 million) investment aimed at modernizing its operations and safeguarding future output Adding to the financial pressures is the removal of the Value Added Tax (VAT) exemption on sugar, edible oils, and soaps at the end of 2023 Orlando da Conceição, executive director of the Association of Sugar Producers of Mozambique (APAMO), explained that the absence of this exemption has driven up operational costs “We advocated for the VAT exemption to remain, but we were unsuccessful This will impact our financial stability and cash flow,” he said

The United Nations Food and Agriculture Organization (FAO) has rolled out a major initiative to provide essential agricultural inputs to 49,000 farmers in Northeast Nigeria. This move aims to curb the looming food crisis, with projections indicating a sharp rise in food insecurity by 2025 At the launch in Girei Local Government Area of Adamawa State, FAO’s Emergency Programme Specialist Coordinator, Luc Leger Manga, shed light on the critical factors fueling the crisis. He highlighted climate change, flooding, inflation, and the escalating cost of farming inputs as key challenges.

A recent food security report, the Cadre Harmonisé, revealed that over 25 million Nigerians currently face food insecurity, a number expected to surge to 33 1 million by mid-2025

FAO’s program, focused on Adamawa State, will assist 9,800 households across six local government areas: Girei, Madagali, Mayo Belwa, Mubi North, Numan, and Song. Beneficiaries will receive maize, rice, or vegetable seeds, along with fertilizers and solar-powered water pumps to enhance dryseason farming and mitigate flood impacts Governor Ahmadu Fintiri, represented by his adviser on food security, Dishi Kube, commended FAO’s efforts He urged farmers to use the resources wisely, pledging robust monitoring to prevent misuse. The initiative is part of FAO’s broader mission to build resilience and ensure sustainable agriculture in Nigeria’s Northeast.

200,000 LIVESTOCK, DAIRY INDUSTRY VACCINATED IN KOGI AGAINST ANTHRAX

Kogi State’s Ministry of Agriculture and Food Security is taking bold steps to protect livestock health with an ongoing statewide vaccination campaign So far, over 200,000 animals have been immunized, a critical effort in safeguarding livestock and their contribution to the state’s agricultural economy This initiative is being carried out in partnership with the State Livestock Productivity and Resilience Support Project (L-PRES). During a visit to a vaccination site in Lokoja, Dr Olufemi Bolarin, L-PRES State Project Coordinator, shared key insights into the campaign.

“We’ve allocated 540,000 doses of anthrax spore vaccines for cattle, sheep, and goats,” Dr Bolarin explained “This campaign is vital for preventing anthrax outbreaks and ensuring the well-being of our livestock ” The vaccination exercise, which began on October 14 and concludes on November 8, has been well-received Farmers across Kogi are encouraged to bring in their animals to ensure comprehensive coverage.

Livestock farming is a cornerstone of Nigeria’s economy, contributing 17% to agricultural GDP. With over 18 million cattle, 43 million sheep, and 76 million goats, initiatives like this not only protect animal health but also bolster meat production, projected to reach 1 6 million metric tons by 2028

ACOT Limited, a key player in the Tropical General Investments (TGI) Group, has awarded over N150 million (US$91,400) in sustainability bonuses to more than 3,500 cocoa farmers across 28 communities in Osun State, Nigeria

This recognition is part of the company’s ongoing sustainable cocoa initiative, which rewards farmers for their commitment to ecofriendly farming practices.

The Cocoa Sustainability Differential Award ceremony in Balogun Community, Ile-Ife, brought together local farmers to celebrate their efforts The bonuses are a nod to the farmers' adherence to global standards, including avoiding child or forced labor, using agricultural inputs responsibly, and protecting forest reserves

Yosola Onanuga, Head of Corporate Responsibility & Sustainability at TGI Group, expressed gratitude for the farmers' dedication "Sustainability is a core value for TGI," she said, emphasizing the company’s commitment to

promoting responsible farming at every stage, from harvesting to fermentation. WACOT’s sustainability program goes beyond financial rewards, offering training, highquality inputs, and fair compensation for crops like cocoa, cotton, rice, and sesame Farmers receive support through outgrower schemes, Good Agricultural Practices (GAP) training, and access to yield-boosting techniques

TGI Group’s broader vision focuses on local sourcing, skilled workforce employment, and advanced manufacturing, driving both local consumption and export growth. This award comes as the European Union extends the deadline for the EU Deforestation Regulation, aiming to reduce the impact of cocoa and other commodities linked to deforestation.

The African Export-Import Bank (Afreximbank) has approved a substantial $200 million corporate finance facility to support BUA Industries Limited (BIL), a key player in Nigeria’s industrial landscape and part of the larger BUA Group This funding marks a significant step in BUA's ongoing expansion across various sectors and continues the fruitful partnership between the two entities

The facility, which is split into two tranches, will help BUA accelerate its growth and expansion plans The first tranche, amounting to $150 million, was released on October 16, 2024, giving BUA the financial boost needed to pursue medium-term growth and strengthen its foothold in emerging markets With this support, BUA is poised to ramp up its activities in critical sectors like sugar and cement manufacturing, flour milling, and oil milling industries crucial to meeting regional demand and enhancing Nigeria's manufacturing and export potential Abdul Samad Rabiu, chairman of BUA Group, emphasized the significance of this facility for Nigeria’s industrial development He highlighted that the funding would help boost industrial capacity, foster sustainable growth, and create jobs, all while contributing to Africa’s stronger presence in global trade Afreximbank's Kanayo Awani, Executive Vice President for Intra-Africa Trade and Export Development, reinforced the bank’s commitment to advancing BUA’s industrial and export ambitions, ensuring Nigeria’s manufacturing base is better positioned to meet export demands BUA’s recent agreement with Turkish manufacturer IMAS to build four advanced flour milling factories further cements the company's plans to address Nigeria’s food security and manufacturing needs. These new facilities will process 3,200 tonnes of wheat per day, ensuring a steady supply of high-quality products to tackle food challenges.

NIGERIA: COMPANY

Dangote Sugar Refinery Plc (DSR) has set its sights on raising N50 billion (US$32.28M) from the debt capital market by issuing two new commercial papers, Series 6 and Series 7, as part of its N150 billion debt program. This move is aimed at boosting the company’s working capital and funding its ongoing operations

The Series 6 commercial paper comes with a 180-day maturity and is offered at a 24 99% discount rate, offering investors an attractive implied yield of 28.5%.

Meanwhile, the Series 7 commercial paper, which spans 270 days, comes at a 24.55% discount rate, delivering an even higher implied yield of 30% These commercial papers are open for investment until December 12, 2024.

Dangote Sugar, a subsidiary of Dangote Industries Limited, is a major player in Sub-Saharan Africa’s sugar industry. With a refining capacity of 1 49 million metric tonnes per year, it stands as the largest sugar refinery in the region. Beyond refining, DSR also supplies sugar to

wholesalers and industries like skincare, food and beverage, and pharmaceuticals. The company is not just sitting back but is actively working on a backward integration program

This plan aims to produce an additional 1 5 million metric tonnes of refined sugar from locally grown sugarcane in the near future, moving towards becoming a globally integrated sugar producer

However, despite its impressive revenue growth of 56% to N484 4 billion (US$307 1M) in the first nine months of 2024, DSR faced a setback with an after-tax loss of N184 4 billion (US$118 9M) This loss is primarily attributed to a massive 176% jump in finance costs, which soared from N108 7 billion (US$70 3M) to N300 2 billion (US$194.2M), as well as challenges in the supply chain and fluctuating sugar prices

C L A S S I F I E D S A D V E R T I S E H E R E A D V E R T I S E H E R E

PM10 (Particulate matter less than 10 microns) Good 246.25 µg/m3 SO2 (Sulphur Dioxide) Good 1.67 µg/m3 NO2 (Nitrogen Dioxide) Good 7.15 µg/m3

PM2.5 (Particulate matter less than 2.5 microns) Moderate

Commodities Africa Magazine proudly supports Sustainable Development Goals (SDGs) for a sustainable and inclusive agricultural future.