ALEXANDRA GRANT REALTOR® alexandra@agrealestategroup.ca (613) 888-8365 Preparing to buy a home.Let us help you take those first steps! Preparing to Buy

A home can be a great place to build memories with friends and family and to build a financial foundation for your future. Buying a home can be exciting, but it can also be a challenging and confusing experience.

Ask us about our other Guides and support services

AG Real Estate Group is here to help you understand the home buying process. This guide will help you make an informed and responsible decision at each stage of the buying process.

Informed Buyers Guide

Guide to Downsizing Sellers Guide

Investment Properties and AirBnB

Preparing to Buy • 2022 1 REAL ESTATE GROUP Table Of Contents On Your Way To Home Ownership 2 Is Home Ownership Right For You? 3 Financial Readiness 4 How Much Can You Afford? 5 - 6 Figure Out The Upfront Costs 7 Typical Home Ownership Costs 8 Financing Your Home ........................................................................................................... 9 Mortgage Terms You Should Know And Questions To Ask 10 - 11 Don’t Leave Home Without Them – Pre-Approval Required Documentation 12 - 13 Not All Realtors Are The Same 14 Why should you choose the AG Real Estate team? 15 - 16 Early in the Process 17 We Take The Time ............................................................................................................ 18 What Our Clients Say 19 The AG Real Estate Group Home-Buyer Services 20 Meet Our Team 21 Our Key Partners 22 Our Key Professionals ........................................................................................................ 23 Choose Wisely, Choose RE/MAX 24 The AG Advantage 25 Assemble The Right Team And Weaknesses Will Be Irrelevant 26 Helpful Worksheet 27 - 39 Referral 40 Serving Prince Edward County, Belleville,Napanee and surrounding areas. .................................. 41

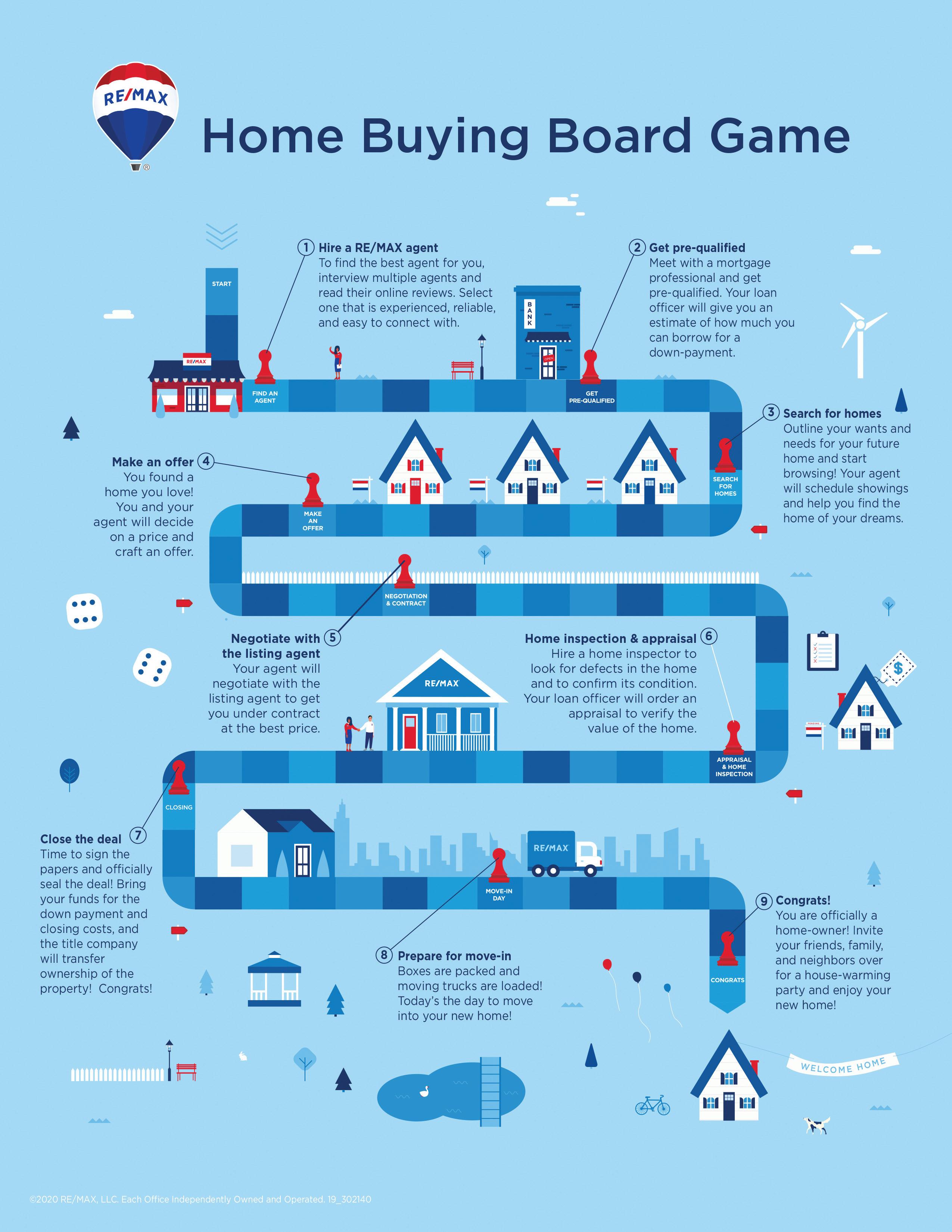

On Your Way To Home Ownership

Homeownership is a great goal for anyone who wants to own their own property. Whether you’re looking to buy a house, condo, townhouse, or even a single-family home, homeownership is something that everyone should strive for. Owning a home gives you the opportunity to build equity, save money, and live comfortably. There are many different types of homes out there, and each type offers its own set of advantages and disadvantages.

Preparing to Buy • 2022 2 REAL ESTATE GROUP

Is Home Ownership Right For You?

Buying a home is one of the biggest decisions you will ever make. To ensure that you make the best choice, ask yourself a few questions.... What do you want in a home? What is your current financial situation?

What are your financial and lifestyle needs?

UPFRONT COSTS

The initial amount of money you need to buy a home, including the down payment, closing costs and any applicable taxes.

ONGOING COSTS

The continued cost of living in a home you own, including mortgage payments, property taxes, insurance, utilities, routine repairs and maintenance (if applicable condo fees).

Are you ready to own a home?

MAJOR REPAIRS

Your home will eventually need large and expensive repairs and renovations such as roof replacement or foundation repair.

Buying a home is not for everyone. Before you make any decisions consider the following...

Am I financially stable?

Do I have the financial management skills and discipline to handle this large purchase?

Am I ready and able to take responsibility for all the costs that come with being a homeowner?

Can I devote the time to regular home maintenance?

Preparing to Buy • 2022 3 REAL ESTATE GROUP

Financial Readiness

Are you financially ready to own a home?

It is important to figure out how much you can afford to spend before you start looking for a home. Your mortgage payment will usually be the largest expense, but there are other costs you should be aware of. You don’t want to be “house poor” or uncover unpleasant surprises along the way. The more you know about your current financial situation the more prepared you will be to start searching for your dream home.

How much are you spending now?

Explore how much you spend now on a monthly basis to prepare to meet with a Mortgage advisor or lender.

Now that you know how much you spend in the average month let’s look at your net income.

Net Income $ (monthly income minus taxes and deductions) (subtract)Monthly Expenses $ = Monthly Surplus $

* for a more indepth household budget please refer to page 29 in the back of this guide. This is a great tool to complete and submit to your mortgage lender or advisor! We have also included an affordability chart.

Preparing to Buy • 2022 4 REAL ESTATE GROUP

HOUSEHOLD EXPENSES $ groceries $ tuition $ clothing $ gifts $ housing maintenance $ child care LOANS AND DEBTS $ credit cards $ car loads $ personal loans $ lines of credit $ student loans $ mortgages for properties already owned ENTERTAINMENT EXPENSES $ dining out $ spectator events $ magazines and books $ hobbies $ travel SAVINGS AND DONATIONS $ RRSP $ TFSA $ savings account $ charitable gits

How Much Can You Afford?

AG Real Estate Group deliver results. Homes come in every size, style and price range. Knowing what you can afford at the beginning of your search saves you time and disappointment later on. The following calculations outline the process financial institutions use to determine how much you can afford.

Affordability Rule 1

As a general rule, your monthly housing costs should be no more than 32% of your average gross (before-tax) monthly income. This percentage is known as your gross debt-to-income or gross debt service (GDS) ratio. CMHC restricts homebuyers to a 39% GDS ratio to qualify for an insured mortgage. Housing costs include:

• your monthly mortgage payment (principal and interest)

• property taxes

• heating expenses

• 50% of condo fees {if applicable)

Use the Affordability worksheet on page 31 in the back of this guide.

Affordability Rule 2

As a general rule, your monthly total debt load should be no more than 40% of your average gross (before-tax) monthly income. This percentage is known as your total debt-to-income or total debt service (TDS) ratio. CMHC restricts homebuyers to a 44% TDS ratio to qualify for an insured mortgage. Your monthly debt load includes:

• housing costs (amount calculated in rule 1)

• car loans or leases

• credit card payments

• line of credit payments

• other mortgage payments

Gross Debt Service (GDS)

A GDS ratio is the percentage of your income needed to pay all of your monthly housing costs, including principal, interest, taxes, and heat (PITH). You’ll also need to include 50 per cent of your condo fees, if applicable. The majority of lenders abide by a general standard of 35 per cent, so your GDS should be lower than that to qualify for a mortgage.

To calculate your GDS ratio, you’ll need to add all of your monthly housing-related costs and divide it by your gross monthly income. Then multiply that sum by 100 and you’ll have your GDS ratio.

Total Debt Service (TDS)

Your TDS ratio is the percentage of your income needed to cover all of your debts. The debt ratio formula calculation is the same as that of the GDS, except all of your monthly debts are taken into consideration. This includes car payments, credit cards, alimony, and any loans. The industry standard for a TDS ratio is 42 per cent.To calculate your TDS ratio, add all of your monthly debts and divide that figure by your gross monthly income. Then multiply that sum by 100 and you’ll have your TDS ratio. Alternatively for both GDS and TDS calculations, you could add up your monthly housing expenses/all of your monthly debts and multiply by 12 to get the total amount for the year, and then divide that number by your annual salary. Multiply that figure by 100 to get your GDS/ TDS ratio.

List of Affordability, Mortgage Calculators, Land Transfer Tax and CHMC Calculator:

Go to our website www.agrealestategroup.ca to find a helpful affordability calculator.

The maximum amount you can afford to spend on a home depends on these numbers and the size of your down payment. For buyers, saving a down payment can be the hardest part of buying a home.

Preparing to Buy • 2022 5 REAL ESTATE GROUP

You may want to consider taking advantage of different government programs. If you are not yet working with a trusted mortgage representative let us help! We can pair you with a representative in our professional network.

Government Support Programs to Assist You in Buying a Home

First-Time Home Buyer Incentive - The First-Time Home Buyer Incentive helps first-time homebuyers without adding to their financial burdens. Eligible first-time homebuyers who have the minimum down payment for an insured mortgage can apply to finance a portion of their home purchase through a shared equity mortgage with the Government of Canada. Visit the First-Time Home Buyer Incentive for more details. Home Buyers’ Amount The Home Buyers’ Amount offers a $5,000 non-refundable income tax credit amount on a qualifying home acquired during the year. For an eligible individual, the credit will provide up to $750 in federal tax relief. Go to the Home Buyers’ Amount webpage to see if you are eligible. Home Buyers’ Plan (HBP) The Home Buyers’ Plan (HBP) is a program that allows you to withdraw up to $35,000 in a calendar year from your registered retirement savings plans (RRSPs) to buy or build a qualifying home for yourself or for a related person with a disability. Review the Home Buyers’ Plan for more information.

GST/HST New Housing Rebate You may qualify for a rebate of part of the GST or HST that you paid on the purchase price or cost of building your new house, on the cost of substantially renovating or building a major addition onto your existing house, or on converting a non-residential property into a house. GST/HST New Housing provides all of the details on this rebate.

Mortgage stress test

You will need to pass a “stress test” in order to qualify for a mortgage loan with federally regulated lenders and credit unions. The stress test exercise ensures that you can afford payments at a qualifying interest rate that is typically higher than the actual rate in your mortgage contract. This helps ensure that homebuyers won’t take on too much debt and will have the means to make their mortgage payments if interest rates rise or their income decreases.

Mortgage loan insurance

If you have less than 20% saved for a down payment, you’ll probably have to get mortgage loan insurance. It protects banks and other lenders against the risk of mortgage default, just like property insurance protects you in case of loss. CMHC is a provider of mortgage loan insurance. Insurance premiums on mortgage loans are calculated as a percentage of your total loan amount. They’re based on factors including the size and source of your down payment.

You can usually pay your mortgage loan insurance premiums up front or have them added to your mortgage loan. You may have to pay tax on the total amount of the premiums if your province charges sales tax.

Preparing to Buy • 2022 6 REAL ESTATE GROUP

In general, the smaller the down payment is, the higher the insurance premiums will be.

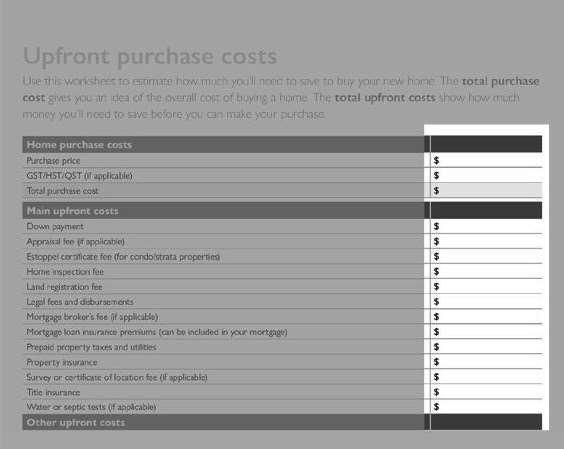

Figure Out The Upfront Costs

Figure out how much you need to save to cover the upfront costs associated with buying a home. For example, have you saved enough to pay the following expenses?

Down payment — the part of the home price that is paid when you make an offer to purchase Home inspection and appraisal fees

Insurance costs — including property insurance,mortgage loan insurance, etc.

Land registration fee — based on a percentage of the purchase price of the property Prepaid property taxes and utility bills — you may have to reimburse the seller for bills paid in advance

Legal or notary fees

Potential repairs or renovations

Moving costs

GST/HST/QST on the purchase price (for newly built homes) or on the mortgage loan insurance (if applicable)

Use the Upfront Purchase cost worksheet on page 37 in the back of the guide.

Preparing to Buy • 2022 7 REAL ESTATE GROUP

Typical Home Ownership Costs

Realty Taxes

Property owners have the option of paying their property taxes in installments over the course of the calendar year. Mortgage companies may insist that they pay the property tax and collect it with your monthly mortgage payment. Realty taxes range from $1,000 to $25,000 a year depending on the size and location of the property. Taxes are reassessed on an ongoing basis.

Heating

Home heating will usually be provided by natural gas, oil or electricity. Costs vary depending on the type of fuel, size of home, amount of insulation, exposure and usage.

Electricity

Costs vary greatly depending on usage, for example how many people you have in the home, the size of your home, and how many energy efficient cost measures you have undertaken (such as Energy Saver appliances). Usually billing is every second month, or you can go on equal billing and pay monthly.

Insurance

Insurance is essential for all homeowners and is required by your mortgage company before it will release funds to close the deal. Premiums are based on the replacement cost of the building and start at around $350 to $700 per year.

Water & Waste Management

Most properties in Ontario are now on water meters and are billed according to usage. As of November 1st 2008, you water bill will also include a fee for waste management. Your waste management fee will pay for garbage, recycling, green bin, litter prevention, landfill management and other diversion programs. These utility bills will be sent about three times a year.

Ongoing Home Improvements

When purchasing an older home you want to consider a budget to improve it as the systems and cosmetics go through normal wear and tear. If you buy in the rural regions you will want to save for a replacement for a septic system every 25 years (on average).

Preparing to Buy • 2022 8 REAL ESTATE GROUP

Financing Your Home

It’s time to meet with your mortgage lender or broker to discuss your financing options and confirm that you are financially ready to buy a home. They will discuss mortgage terms and interest rates and will explain what you must do to ensure that you get approved for a mortgage once you find your home.

What is a mortgage?

A mortgage loan is a loan, generally used to buy a property. How much you pay depends on how much you borrow (the principal), the loan’s interest rate, and how long you take to pay it back (the amortization period). Do not be afraid to negotiate rates and mortgage terms with different lenders. They are offering you a product and talking to more than one lender helps you make an informed decision. Once you find a lender you are comfortable with, or a broker who you trust to negotiate on your behalf, get a pre-approval.

Getting Pre-Approved For A Mortgage

It’s a good idea to get pre-approved for a mortgage before you start looking for a home. But first you need to understand exactly what being “pre-approved” means. A pre-approved mortgage lets you know how much you can afford, what your interest rate will be and what your monthly mortgage payments will look like. Knowing what you can afford at the beginning of your search saves you time and disappointment later on. It is important to be qualified or pre-approved for financing before you start looking for a home. This lets you and your realtor know what you can afford as well as providing a written confirmation or certificate for a fixed interest rate good for a specific period of time. Getting pre-approved can help you narrow your search down to a specific home type, size or neighbourhood. Getting pre-approved is not a guarantee of final approval for a mortgage. Once you find the home you want to buy, the property still has to be evaluated to ensure the price and condition of the home are acceptable to your lender. To obtain a pre-approval, We can connect you with recommended mortgage advisors. Ag Real Estate Group is here to assist you every step of the way through the pre-buying and buying process.

You will have many options when it comes to choosing a mortgage. Your lender or broker will help you find the mortgage that best matches your needs.

Preparing to Buy • 2022 9 REAL ESTATE GROUP

Mortgage Terms You Should Know And Questions To Ask

Become familiar with the following terms and options to help with your decisions. Amortization period: The length of time you agree to take to pay off your mortgage (usually 25 years).

Mortgage term: The length of time that the options and interest rate you choose are in effect. It can be anywhere from 6 months to 10 years. When the term is up, you can renegotiate your mortgage and choose the same or different options.

Types of interest rates:

Fixed rate - The rate doesn’t change for the term of the mortgage.

Variable rate - The interest rate fluctuates with market rates.

Protected (or capped) variable rateThe rate fluctuates but will not rise over a preset maximum rate.

Open and closed mortgages:

Open mortgage - Lets you pay off your mortgage in full or in part at any time without any penalties.

Closed mortgage - Offers limited (or no) options to pay off your mortgage early in full or in part, but it usually has a lower interest rate.

Conventional and high-ratio mortgages:

Conventional mortgage - A loan that is equal to or less than 80% of the lending value of a home . This requires a down payment of at least 20%.

High-ratio mortgage - A loan that is over 80% of the lending value of a home. This means the down payment is less than 20% and will likely require mortgage loan insurance.

How often can you make payments?

Payment schedule - How often you make your mortgage payments. It can be weekly, every two weeks (biweekly), once a month, or accelerated weekly or biweekly. By switching from monthly payments to accelerated weekly or biweekly payments, you can pay off your mortgage faster. Talk to your lender to see all possible options.

Preparing to Buy • 2022 10 REAL ESTATE GROUP

What mortgage features are best for you?

Portable Mortgages - An option that lets you transfer or switch your mortgage to another home with little or no penalty when you sell your existing home. Mortgage loan insurance can also be transferred to the new home. If you sell your existing home, you can transfer your mortgage while keeping your existing interest rate. You may be able to avoid prepayment penalties by porting your mortgage.

Payment Privileges - The ability to make extra payments, increase your payments or pay off your mortgage early without incurring a penalty. You can make lump-sum prepayments or increase your monthly payments without having to pay a charge. This can help you pay off your mortgage quicker and save on interest penalties.

What types of mortgage penalties might you have to pay?

You may have to pay penalties if you prepay large portions of your mortgage early or if you break your mortgage due to unforeseen life changes, such as marital breakdown, death of a spouse or relocating for a job.

It is your right to know how lenders calculate prepayment penalties. Read your mortgage contract carefully and make sure you understand how penalties will be calculated before you sign.

Down payment

A down payment is the portion of the property’s price not financed by the mortgage. You will need a down payment of at least 5% for a property value of $500,000 or less, and 10% for any amount above $500,000 of the purchase price of the home. For example, to buy a home for $300,000, you will need at least $15,000 as your down payment. If your down payment is less than 20%, you will need mortgage default insurance. You will also need to prove the amount and sources of your down payment. Some common sources include personal savings, an RRSP withdrawal, a non-repayable gift from an immediate family member, proceeds from the sale of other property, and funds borrowed against proven assets. Check with your lender for qualifying criteria.

Preparing to Buy • 2022 11 REAL ESTATE GROUP

Don’t Leave Home Without Them –Pre-Approval Required Documentation

Paperwork is the lifeblood of the mortgage industry. While the industry is gradually adopting paperless procedures (such as electronic signatures, or “e-signing”), there are still plenty of documents required in a typical mortgage pre-approval process. Here are some of the most commonly requested items.

Bring the following information when you meet with your lender or mortgage broker. This will help them determine whether you qualify for a mortgage.

Social Insurance Number for all borrowers who are listed on the mortgage loan. This information can be verified through a Social Security card, tax documents, or anything else that shows the SIN. The lender needs this to verify your identity, to request tax returns from the CRA, and also to pull your credit reports.

Proof of employment

Your mortgage lender will probably request a list of employers for the last two years (at a minimum). This document will also include each employer’s name, mailing address and phone number. They want to verify your employment, because it relates to your ability to repay the loan.

Proof of income

These mortgage documents are needed to validate your income for pre-approval and underwriting. It might come in several forms. Usually, it’s your two most recent pay stubs, or the electronic equivalent, that show your year-to-date earnings. It’s your average annual income the lender wants to know about. The lender might also use tax records to verify your earnings (see next item).

Tax documents

This is a standard document for mortgage pre-approval. So there’s a 99% chance you will have to provide tax documentation at some point. Most lend-

ers want to see your W-2 statements and tax returns for the last two years. Among other things, your NOAs show how much money you earned over the previous year(s). In many cases, the lender will request tax return transcripts directly from the CRA.

Place of Residence

This one is self-explanatory. For pre-approval and underwriting purposes, the lender wants to know where you’ve lived for the last couple of years (and maybe longer).

Bank account information

When you apply for mortgage pre-approval, the lender will want to know how much money you have in the bank. They need to ensure you have sufficient funds for your closing costs, down payment, and cash reserves (if applicable). So they will probably ask you for account statements and balances for any checking, savings, or money market accounts. This is another standard mortgage document for pre-approval. Nearly every lender will require this.

Credit information

Do you have other outstanding loans that you’re currently repaying (e.g., car loans, student loans, etc.)? If so, the lender may ask for documents related to those accounts. They need this information to measure your debt-to-income ratio, among other things.

Preparing to Buy • 2022 12 REAL ESTATE GROUP

Purchase agreement

(Also referred to as the real estate contract.) Once you have a signed contract with the seller, you’ll need to give a copy of it to the lender. You won’t have this mortgage document during the pre-approval process (the “pre” parts means you haven’t found a house yet). But you’ll need to provide it for underwriting and final approval, after you’ve made an offer on a house. This document shows the lender how much you’ve agreed to pay for the house. Later, they will have the property appraised to make sure it’s worth the amount you’ve agreed to pay.

Gift letters

Are your family members going to provide funds to help you cover your down payment expense? If so, you’ll need to provide a gift letter along with your other mortgage documents. The lender needs to verify that the money is truly a gift, and that your relatives don’t expect any form of repayment.

Monthly expenses

Some mortgage companies will ask for an itemized list of your monthly payments. This list might include your rent, credit cards, student loans, etc. It helps them evaluate your debt-to-income ratio and your ability to repay the debt.

Self-employment documents

Do you run your own business? If so, you might have to provide some additional documents during the mortgage pre-approval process. This might include balance sheets, a profit-and-loss (P&L) statement, or federal tax statements for the last two years.

This is a generic list of mortgage pre-approval documents. It includes some of the most commonly requested items. Depending on your situation and the type of home loan your are using, you might be asked to provide or sign additional documents that are not on this list.

Preparing to Buy • 2022 13 REAL ESTATE GROUP

Not All Realtors Are The Same

We often get the question: what does a real estate agent do for a buyer, or do I need a realtor to buy a home?

What does an agent do and why do you need one...

Your agent will help you to avoid potential pitfalls, guide you through the process, write and negotiate a legally binding contract, and help facilitate completion and possession of your new home.

Not all realtors are the same – so you should choose your realtor wisely.

There’s no shortage of real estate professionals out there, and deciding who to work with can be challenging.

Preparing to Buy • 2022 14 REAL ESTATE GROUP

Why should you choose the AG Real Estate team?

AG has made plenty of waves in the Prince Edward County, Napanee and Quinte market.

Helping 100’s of families buy and sell each year!

We are committed to bringing that knowledge and experience to the process of finding you a new home. That’s what you can expect when purchasing with AG.

Whether you’re a first-time homebuyer, a seasoned investor, or someone in between, our customized buying process ensures all your specific needs are met.

Everyone handles the buying process differently. And, we understand that.

We pride ourselves on our flexibility in remaining an objective third party. AG uses our hands-on experience to provide sound advice before, during, and after your purchase.

Preparing to Buy • 2022 15 REAL ESTATE GROUP

Preparing to Buy • 2022 16 REAL ESTATE GROUP

We grew up here, we live here, we raise families here, we sell here and we acquire properties here. It’s our town, our neighbourhhoods, our region, our homes.

Early in the Process

Early in the buying process, we host a Buyer Intake Session, where we address a number of important considerations. We want to get you thinking about the home buying process in a more structured and holistic way

One of the first thing we do is set up an introductory meeting to review your wish list, discuss market fundamentals and review the acquisition process so you’re set up for success from day one. It’s important to us that we do a lot of the heavy-lifting upfront so you’re empowered with knowledge and information from the get-go! For planning purposes, your onboarding session will be approximately 90 minutes in length and is definitely the best way to kick-off your search efforts!

Knowing that, buying with AG means we are investing time and energy in this critical first step. We believe that the more knowledgeable a homebuyer is, the more comfortable, stress-free (and, fun) the home buying process will be!

AG takes the time to understand your individual level of experience with home buying and ownership.

Preparing to Buy • 2022 17 REAL ESTATE GROUP

We Take The Time

It’s this special relationship with the area that makes us so good at what we do — working with clients to purchase a new home or condominium is a personal relationship. We learn a lot about who you are, what you like (or, don’t like), what worries you and what moves you into action. And buying a property doesn’t happen overnight – so, we will likely get to know you and how you drink your coffee faster than you think!

Whether you’re a first-time condo buyer, a seasoned flipper, or somewhere in between, you can trust our team to guide you through the experience of buying a home, while delivering unparalleled professionalism, integrity, service, and the right amount of personal TLC with every interaction.

Preparing to Buy • 2022 18 REAL ESTATE GROUP

At AG, we take the time to understand what your perfect home is. And then, we help you get there.

“Alexandra is a Real Estate industry leader, and my go-to resource for Eastern Ontario. She is someone that I am very comfortable referring to family, clients and friends!”

David Thomas

What Our Clients Say

“Alexandra was extremely helpful during the process of buying our first home. She showed us multiple homes in a variety of different areas. She was always responding to us extremely fast and setting up showings to work around our schedule. She was a pleasure to work with and we would recommend her to everyone. Could not have asked for this to be any easier!.”

Davis Sheridan

“We had a great experience working with Carol from AG Real Estate Group. We met Carol while viewing another property and she was really lovely and helpful when it came to us “city folk” looking for a rural property. We decided to work with Carol and have her help us find our first home. Carol was always professional, punctual and quick to reply. She answered ALL of our questions and addressed any concerns. As a first time home buyer - this was necessary, we had a lot of questions! She was personable, friendly and realistic. She never pushed us in one direction or another. A big thank you to Carol for helping us find our home.”

Nicole Pauker

Alexa is a wonderful agent! She is honest, responsive and personable to work with! My husband and I are moving from Hamilton to Yarker and Alexa has made this transition for us to be a smooth and stress free as possible. I would absolutely recommend Alexa to anyone looking for a home!! She is a wonderful person and a great agent to have on your team!

“There are not enough superlatives to describe our experience with Alexandra Grant. She has an extensive knowledge of the real estate market, of anything technical related to a house and of Prince Edward County. We felt extremely well taken care of and supported in our search for our home in PEC and Alexandra helped us with the learning curve around the issues living outside a big city. She was extremely professional, punctual, sharp, and fast and went above and beyond to look out for our interests and needs, both financial and about the vision for our new home. She answered all our questions right away and we were able to make easy and fast decisions. There is a gem in PEC’s real estate world and her name is Alexandra Grant. We will absolutely recommend AG Real Estate Group to anyone who is looking for a home in PEC and beyond. Alexa made our buying process a smooth and pleasant one.”

Sarah Palma Susan & Ombretta

Alexa is an excellent real estate agent. She is very personable, professional, honest, and always puts the needs of her clients first. Alexa made our selling and buying process as smooth and nice as possible while getting us the best value for our home. This is the type of agent you want to have on your side.

Andrew Pearce & Julie Pearce

WANT TO SEE MORE?

Go to our website or read our google reviews www.agrealestategroup.ca

Preparing to Buy • 2022 19 REAL ESTATE GROUP

The AG Real Estate Group Home-Buyer Services

We Work To Your Schedule

We know that between your work life and your social life, time can be hard to come by. Our team works hard to accommodate your schedule and make sure we’re there to help you when it’s most convenient for you.

We Craft A Detailed Profile For You

We go through your needs and your wants to create the big-picture blueprint for your ideal home. This is a vital point in making sure we understand what you would like to get, what you can afford, and what communities provide the best options for you.

We Arrange the Financing

We’ll pair you with one of our trusted mortgage brokers or bank professional to get you pre-approved for a mortgage. We like to help you with getting your documents ready and staying in the loop, because this process can be a little nerve wracking. Remember. We’re there for you!

We Start Visiting Properties

Our next step is taking you out to view three properties that are inline with what you’re looking for. We’ll take detailed notes of what you like about it, what you don’t like, and if you think it is something you would consider purchasing. This step helps to make sure our profile is correct, and if it isn’t we will make minor changes prior to our next outing.

We send you morning updates

Every morning we’ll provide you with an e-mail of new listings that meet your criteria that have come on the market. We do some pre-screening to gather whatever additional information we can get about the property (like if it backs onto a school) and provide that to you in our e-mail.

We Send You Weekly Updates

We provide a weekly market update to let you know what is selling and what it sells for. This helps familiarize you with the pricing of a certain area and to understand how they compare to other similar homes that are listed or have just sold.

We Build A Detailed Pre-Offer Analysis

We don’t just throw an offer together on paper. Ever. Instead, when you’re serious about a property, we’ll do a detailed market analysis and compare the property to similar listings in the area. This is the best way to make sure you’re making the most informed purchasing decision. But wait. There’s more. You see, the most important aspect of all is that we would never recommend that you purchase a home for a price that we ourselves wouldn’t pay. Ever. Many real estate agents are seemingly out for the deal and are not necessarily concerned with whether or not you’ll be happy with your choice a year from now. We’re different. We need to truly feel that you’re making the best choice possible, and this is why our clients know they are in good hands when they chose to purchase their home with us; it’s part of what sets us apart.

Preparing to Buy • 2022 20 REAL ESTATE GROUP

Meet Our Team

ALEXANDRA GRANT REALTOR®

Alexandra has grown up in the rural outskirts of Napanee where she currently resides. She has grown up with an expansive sense of how a rural household operates and has years of local connections and ties to not only Napanee but Prince Edward County & Quinte region. With extreme drive and motivation, she continues to grow her business by over 30% year to year. Adding new members to the team including a full-time buyer specialist Carol May and a full-time marketing administrator Olivia Rose. She has achieved many RE/MAX awards for her sales and is truly an industry leader. In her “spare time” she enjoys being with her family and 2 children. Her hobbies include gardening, golfing, and cooking. She is a Rotarian and believes in supporting the communities and the businesses that operate in them. She has a monthly draw giving back and supporting awareness of local businesses. As well as donating a portion of every sale to the Children’s Miracle Network. Alexandra is very honest and transparent so if there is anything you want to know about her she will be sure to let you know!

OLIVIA ROSE MARKETING & ADMINISTRATIVE SUPPORT

With over 24 years of marketing experience Olivia’s provides a tenacious and unapologetic spirit to the background functions of AG. Coordinating the production of materials and oversight of marketing efforts she helps your listing get noticed. Custom home marketing plans are a team effort but Olivia helps to ensure all the I’s are dotted and t’s are crossed to ensure our clients receive maximum exposure. Olivia helps identify business objectives, create strategies and implements them with a range of design, advertising, branding and marketing programs.

Carol grew up locally in Stirling and started her sales career at an early age helping in the shop selling products on her family’s 3rd generation farm. She moved away and raised a family for many years in the GTA which is where she started her Real Estate career. This helped her in gaining invaluable experience working in the busy and aggressive city market and now she brings that knowledge here to our Quinte and Prince Edward County region. Carol provides clients with local knowledge joined together with hard-earned GTA negotiation skills. Hard work and true passion for her business has helped Carol’s reputation as a qualified realtor quickly rise. Specializing in all aspects of real estate, whether it is navigating the process for first timers, trying to score that perfect fixer-upper, or providing help in the luxury market, she knows and has experienced it all. Her love of real estate makes her a trusted resource for buying or selling real estate throughout the region. Joining AG Real Estate Group, Carol connects her local and GTA networks and experience to deliver an exclusive level of knowledgeable service to her clients.

Jennifer Palmer – Freelance Graphic Design is a is a creative agency who works closely with AG to create our visual communication materials. With 24 years experience creating brands, graphic design & digital advertisements Jennifer Palmer - Freelance Graphic Design helps AG make your listing shine.

Preparing to Buy • 2022 21 REAL ESTATE GROUP

CAROL MAY REALTOR® JENNIFER PALMER GRAPHIC DESIGNER

Our Key Partners

As a home buyer you will appreciate the need for high quality photography. narrowing down all the listed homes to a handful you want to see is aided immensely by quality photography, floor plans and video tours, which is why AG Real estate group works with local experts. Buyers like yourself start searching for homes online and first impressions are very important. Buyers tend to skip past homes that don’t present well with good visual content. Professional photography draws people in, and if the pictures meet their approval, viewers will seek further verification in the virtual tours, and the written content describing the property. A listing with poor visual content will sit on the market for a much longer time period.

YourSocialStrategy.com, provides a professional and quality service to our business. They are driven to achieve our goals and objectives to assist with our Digital Marketing Strategy by bringing our plans to life. Your Social Strategy ensures our paid advertising is going where and to who we want.

It is very important to know any issues about a home prior to buying. As a buyert you will have the ability to try to negotiate a reduction in price should any problems be discovered. Having a detailed, orientated, and knowledgeable home inspector who will not only point out any current or potential future issues but who will also provide you with some maintenance tips and direction is immensely helpful. Many home owners choose to keep their home inspection reports as a reference tool in the future for maintenance schedules and even details about the home. the inspection report can also be a helpful tool when finalizing your mortgage.

Professional staging services are a huge part of buying and selling in today’s real estate market. As a buyer, being able to walk into a home and picture yourself in the space is important. AG understands the importance of home staging on both sides of the transaction. Staging is often the difference from a buyer feeling like a home has potential or that a home wont work or will be too much work. At AG we surround ourselves with industry experts like Dana Sullivans Designs so that we can provide the best possible service to our clients whether they are selling or buying.

Smart Tap Solutions believes in transparency, strategic thinking and access to better ad delivery technologies for SMBs. They work with a platform that provides premium features, used by major advertisers that also us to focus our marketing initiative on the right audiences. With custom solutions and measurable results across multiple devices targeting technology, combined with a diverse range of 3rd party data that enables AG Real Estate Group to stay ahead and infront of digital trends. Our approach offers many competitive advantages in terms of reach, audience refinement and scale. We work with Smart Tap Solutions because it is a better way to reach and target audiences in today’s fragmented advertising landscape.

Preparing to Buy • 2022 22 REAL ESTATE GROUP

Our Key Professionals

Carolyn Birney

Mobile

Quick, Professional, & Affordable Plumbing Services

Looking for a reliable plumbing company to provide you with a long-term fix? A1 Plumbing, are residential plumbing specialists. Whether you’re looking for general plumbing services, service for your pumps, water treatment, or drain cleaning, they’ve got the expertise to solve your plumbing problems. Their customers describe them as professional, courteous, and quick to respond.

Matthew Ward – Lawyer

Real Estate, Wills & Estates

Matthew Ward works as one of KDA Law Firm’s associates and currently practices in the areas of Real Estate and Wills/Powers of Attorney.

Matthew is a native of the Stirling area, has travelled and lived abroad, and when not working can be found enjoying everything Ontario has to offer with his lovely wife.

Matthew serves on the board of the Community Advocacy Legal Clinic (CALC) in Belleville and is proudly supportive of community law and efforts to remove barriers to justice.

At Dominion Home Inspectors, we approach every home inspection as though we were the ones buying the home for our family.

Jason Gravel – info@jrginspections.com

Phone: 613-382-1119

Mortgage Specialist

| RBC Royal Bank

Buying a home is a major decision. Whether you’ve just started your research or are actively house-hunting, I can help provide you with the personalized advice and solutions you need to make your home ownership goals happen. Whether it’s getting your first mortgage, refinancing or moving your mortgage to RBC, I can help! We’ll work together to ensure your financing suits both your current and future needs, you can feel confident that you’re working with an expert who has your best interests in mind

Karlee Moore, Mortgage Agent

Karlee joined the team in 2019 and as a second generation mortgage professional is proud to serve Prince Edward County and the Quinte area.

Karlee has a passion for being of service, guiding her clients along the mortgage process and answering any questions that come up. Her goal is to offer expert advice and help you select a mortgage that you feel confident about.

Preparing to Buy • 2022 23 REAL ESTATE GROUP

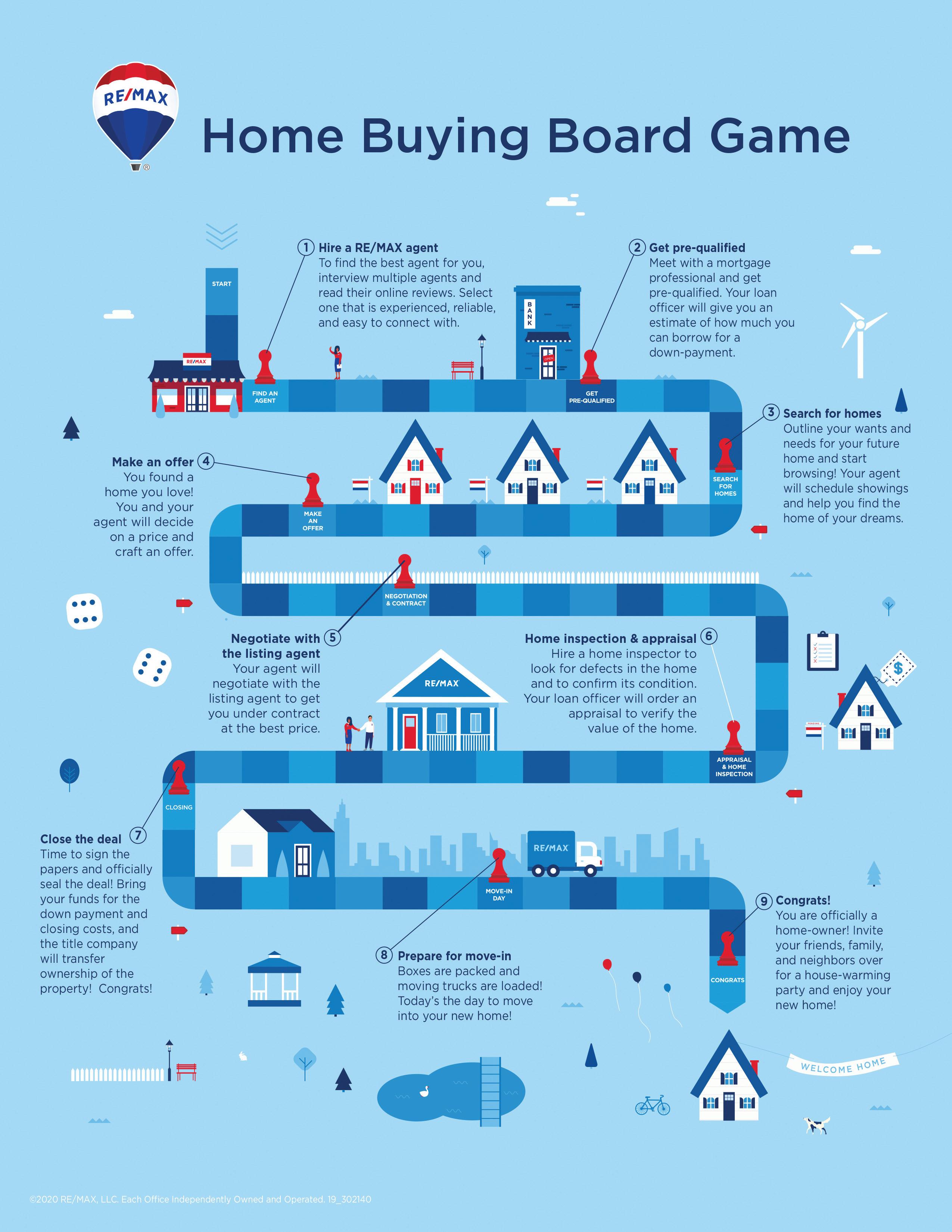

Choose Wisely, Choose RE/MAX

RE/MAX: the most widely recognized real estate brand in the world. For more than 20 years, RE/MAX has been the leading real estate organization in Canada.

When it comes to choosing a brand to help you sell your home, look no further than the RE/MAX balloon. RE/MAX is synonymous with professional.

Unrivalled Expertise

Experienced and knowledgeable agents are the reason RE/MAX is consistently ranked number one in several markets across Canada. REMAX provides their agents with exclusive tools and training to ensure they have the skills needed to effectively guide you through your real estate process.

A RE/MAX agent is able to bring that knowledge plus a network of over 104,000 agents to help you gain the best outcome. This means 104,000 agents with home listings we can review and receive direct feedback on.

Preparing to Buy • 2022 24 REAL ESTATE GROUP

The AG Advantage

OUR TEAM ADVANTAGE

We have a friendly and supportive team environment that fosters open communication, trust, and respect which also describes how we treat our clients. We pride ourselves on constant communication and around-the-clock quick response times.

We consider ourselves to be a strength-based team, compiled based on each other’s strengths and designed with different strengths to complement each other and cover weaknesses.

Preparing to Buy • 2022 25 REAL ESTATE GROUP

AG Real Estate Group is a family-oriented real estate team that services Belleville, Trenton, Wellington, Picton, Napanee, Hastings, Lennox & Addington, Prince Edward County. We have an abundance of knowledge in purchasing rural properties.

“ “ You can’t, of course, overcome the weaknesses with which each of us is abundantly endowed. But you can make them irrelevant.

- Peter Drucker

Assemble The Right Team And Weaknesses Will Be Irrelevant

Utilize the AG Advantage! We want to put our knowledge, experience, and our strengths to work for you.

Our team has experience with:

luxury market

commercial properties

investment properties

residential properties

farm & agriculture

waterfront

rural residential

military relocations

We understand what will make your experience exceptional! We offer unparalleled service at any price point, and as a team, are always available for our clients.

Award winning Realtors – Alexandra and Carol have both received several RE/MAX career awards.

Community Focused – All our team members are strongly involved with charities and local organizations.

Giving back- as a participant int he RE/MAX Sick Kids Foundation 1000’s of dollars each year are donated.

Preparing to Buy • 2022 26 REAL ESTATE GROUP

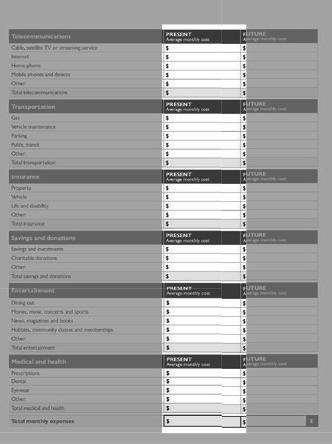

Helpful Worksheets

Preparing to Buy • 2022 27 REAL ESTATE GROUP

Are you n anci ally ready to o wn a home?

Complete the calculations on the following pages to see if you can afford a mortgage.

1. Household budget

First, record your net and gross monthly income in the Monthly income section.

Next, record your current monthly expenses and income in the “Present” column of the Monthly expenses section.

2. How much can you afford?

Complete the “Monthly maximum” column of the Affordability rules section

3. Purchase price and upfront costs

Complete the Upfront purchase costs worksheet to see if you have saved enough to buy a home

4. Your future budget

Revisit the Household budget worksheet and complete the “Future” column to calculate your expenses as a homeowner. Finally, complete the “Future” column of the Affordability rules section to see if you ʼll be able to afford your mortgage with your other expenses

Preparing to Buy • 2022 28 REAL ESTATE GROUP

Household b udg et

Preparing to Buy • 2022 29 REAL ESTATE GROUP Homebuying Step by Step:Workbook & Checklists –4

MONTHLY INCOME Income NET (after taxes and deductions) GROSS (before taxes and deductions) Your average monthly salary $ $ Your co-borrower's average monthly salary (if applicable) $ $ Other household non-employment income (for example, from investments, etc ) $ $ Total household monthly income $ A $ B MONTHLY EXPE NSES Include every possible expense you can think of. Housing PRESENT Average monthly cost FUTURE Average monthly cost Rent or mortgage (principal and interest) $ $ Property taxes $ $ Heating $ $ Condo fees (if applicable) $ $ Homeowners association fees (if applicable) $ $ Site rent for leasehold tenure (if applicable) $ $ Other: $ $ Total housing $ $ C Loans and debts PRESENT Average monthly cost FUTURE Average monthly cost Loans $ $ Vehicle loan or lease payments $ $ Unsecured lines of credit $ $ Secured lines of credit $ $ Credit card payments $ $ Other: $ $ Total loans and debts $ $ D Household PRESENT Average monthly cost FUTURE Average monthly cost Groceries $ $ Child and elderly care $ $ Child support and alimony $ $ Tuition and school activities $ $ Childrenʼ s activities $ $ Clothing $ $ Beer, wine, spirits or cigarettes $ $ Pet care $ $ Gifts $ $ Maintenance and repairs $ $ Other: $ $ Total household $ $

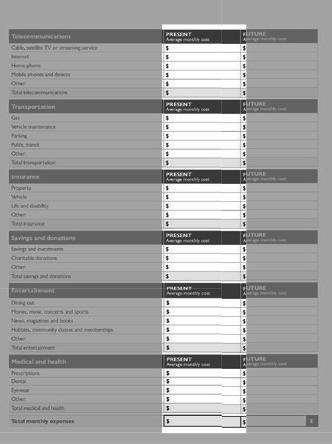

Preparing to Buy • 2022 30 REAL ESTATE GROUP Telecommunications PRESENT Average monthly cost FUTURE Average monthly cost Cable, satellite TV or streaming service $ $ Internet $ $ Home phone $ $ Mobile phones and devices $ $ Other: $ $ Total telecommunications $ $ Transportation PRESENT Average monthly cost FUTURE Average monthly cost Gas $ $ Vehicle maintenance $ $ Parking $ $ Public transit $ $ Other: $ $ Total transportation $ $ Insurance PRESENT Average monthly cost FUTURE Average monthly cost Property $ $ Vehicle $ $ Life and disability $ $ Other: $ $ Total insurance $ $ Savings and donations PRESENT Average monthly cost FUTURE Average monthly cost Savings and investments $ $ Charitable donations $ $ Other: $ $ Total savings and donations $ $ Entertainment PRESENT Average monthly cost FUTURE Average monthly cost Dining out $ $ Movies, music, concerts and sports $ $ News, magazines and books $ $ Hobbies, community classes and memberships $ $ Other: $ $ Total entertainment $ $ Medical and health PRESENT Average monthly cost FUTURE Average monthly cost Prescriptions $ $ Dental $ $ Eyewear $ $ Other: $ $ Total medical and health $ $ Total monthly expenses $ $ E

MONTHLY SURPLUS

Subtract your expenses from your income

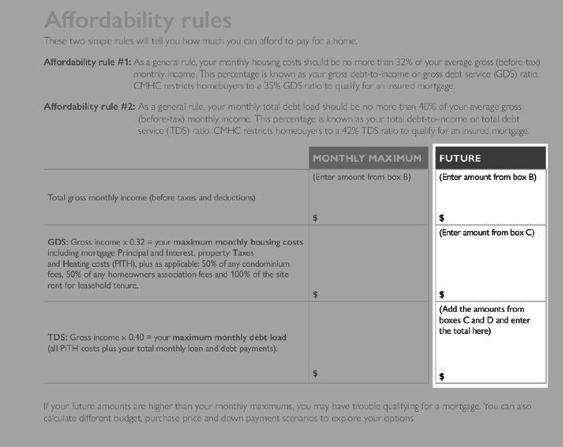

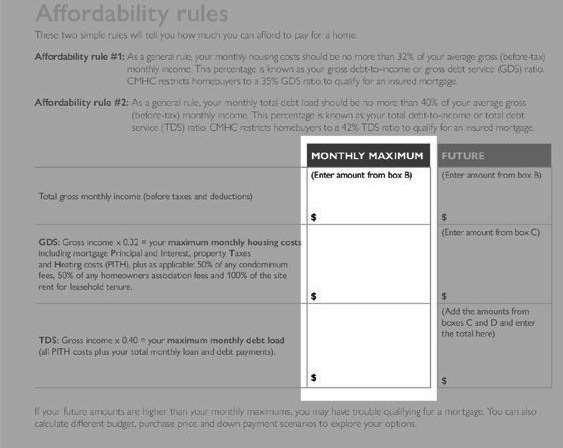

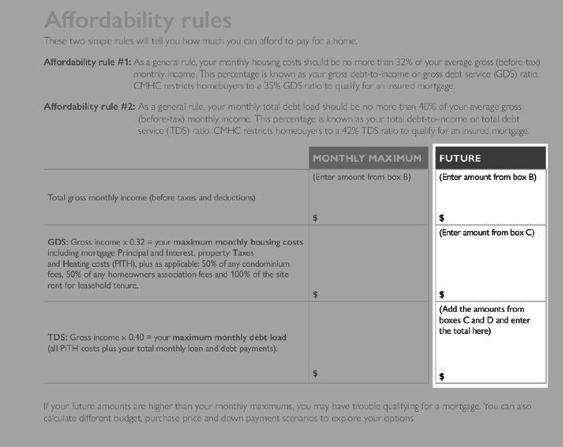

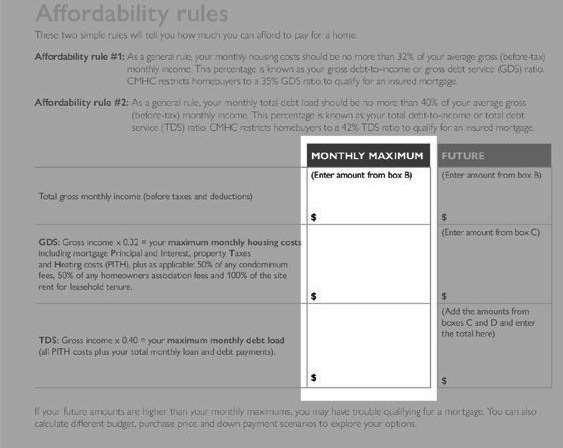

Affordability rules

These two simple rules w ill tell you how much you can afford to pay for a home.

Affordability rule #1: As a general rule, your monthly housing costs should be no more than 32% of your average gross (beforetax) monthly income This percentage is known as your gross debt-to-income or gross debt service (GDS) ratio CMHC restricts homebuyers to a 39% GDS ratio to qualify for an insured mortgage

Affordability rule #2: As a general rule, your monthly total debt load should be no more than 40% of your average gross (before-tax) monthly income. This percentage is known as your total debt-to-income or total debt service (TDS) ratio CMHC restricts homebuyers to a 44% TDS ratio to qualify for an insured mortgage

Total gross monthly income (before taxes and deductions)

GDS: Gross income x 0 32 = your maximum monthly housing costs including mortgage Principal andInterest, property Taxes and Heating costs (PITH), plus as applicable 50% of any condominium fees, 50% of any homeowners association fees and 100% of the site rent for leasehold tenure

TDS : Gross income x 0 40 = your maximum monthly debt load (all PITH costs plus your total monthly loan and debt payments)

If your future amounts are higher than your monthly maximums, you may have trouble qualifying for a mortgage You can lso calculate different budget, purchase price and down payment scenarios to explore your options.

Preparing to Buy • 2022 31 REAL ESTATE GROUP

PRESENT FUTURE as a homeowner Total net monthly income (box

$ $ (minus) Total monthly expenses (box E) -$ -$ Monthly surplus after expenses $ $

MAXIMUM FUTURE

A)

MONTHLY

(Enter amount from box B) $ (Enter amount from box B) $

$ (Enter amount from

$

box C)

$ (Add

$

the amounts from boxes C and D and enter the total here)

Affordability Worksheet

Home Feature Checklist

Your housing ne eds

Write down everything that’s important to you and your family before you start looking for a home.

Categories Your family’s needs and priorities

Location

(For example, downtown or the suburbs, the look and feel of the neighbourhood and the proximity to work, school, shopping, services, public transit, etc )

Size

(The square footage, lot size, number of bedrooms and bathrooms and whether it includes extra storage, a home office, a garage, etc )

Special feature s

(For example, a pool, air conditioning, adaptability or accessibility features, energy efficiency upgrades, etc.)

Lifestyle

(Consider the number of kids at home, whether you’re working or retired, what kind of services or recreation you want nearby, etc )

Type of home

(For example, detached, semi-detached, duplex, row house, apartment, condo, etc )

Preparing to Buy • 2022 32 REAL

GROUP

ESTATE

Ho me features che cklist

Use this checklist whenever you view a potential home so you can compare your options side by side. You can make or print several copies of this page if needed.

Preparing to Buy • 2022 33 REAL ESTATE GROUP

House 1 House 2 House 3 House price $ $ $ Address Occupancy date Square footage Operating costs (annual) Property taxes $ $ $ Utilities $ $ $ Insurance $ $ $ Condo fees $ $ $ Other: $ $ $ Total $ $ $ Features checklist New or resale New Resale New Resale New Resale Home type Detached Semi-detached Townhouse Duplex/triplex High-rise Low-rise Detached Semi-detached Townhouse Duplex/triplex High-rise Low-rise Detached Semi-detached Townhouse Duplex/triplex High-rise Low-rise Ownership type Freehold Leasehold Condominium Co-op Freehold Leasehold Condominium Co-op Freehold Leasehold Condominium Co-op Age of home Lot size Small Medium Large Small Medium Large Small Medium Large Exterior nish Brick Aluminum siding Wood Vinyl siding Combination brick and siding Stucco Brick Aluminum siding Wood Vinyl siding Stucco Brick Aluminum siding Wood Vinyl siding Combination brick and siding Stucco Exterior condition Fair Good Excellent Fair Good Excellent Fair Good Excellent

Preparing to Buy • 2022 34 REAL ESTATE GROUP Roof Asphalt shingles Metal Rubber roo ng Other Asphalt shingles Metal Rubber roo ng Other Asphalt shingles Metal Rubber roo ng Other Roof condition Fair Good Excellent Fair Good Excellent Fair Good Excellent Windows Wood Vinyl Aluminum Other Wood Vinyl Aluminum Other Wood Vinyl Aluminum Other Window condition Fair Good Excellent Fair Good Excellent Fair Good Excellent Foundation Concrete Concrete block Preserved wood Concrete Concrete block Preserved wood Concrete Concrete block Preserved wood Foundation condition Fair Good Excellent Fair Good Excellent Fair Good Excellent Number of bedrooms One Two Three Four Five+ One Two Three Four Five+ One Two Three Four Five+ Number of bathrooms One Two Three+ One Two Three+ One Two Three+ Heating Gas Oil Electric Wood Gas Oil Electric Wood Gas Oil Electric Wood Age of heating system Energy rating

Preparing to Buy • 2022 35 REAL ESTATE GROUP Air conditioning Yes (central air) Yes (window) No Yes (central air) Yes (window) No Yes (central air) Yes (window) No Age of air conditioning system Bathroom in the master bedroom (“ensuite”) Yes No Yes No Yes No Bathroom on the ground oor Yes No Yes No Yes No Eat-in kitchen Yes No Yes No Yes No Separate dining room Yes No Yes No Yes No Family room Yes No Yes No Yes No Basement Un nished Finished Un nished Finished Un nished Finished Fireplace or woodstove Yes No Yes No Yes No Is there a spare room for an of ce or a hobby? Yes No Yes No Yes No Is the basement large enough for storage or a workshop? Yes No Yes No Yes No Deck or patio Yes No Yes No Yes No Private driveway Yes No Yes No Yes No Garage or carport Garage Carport Neither Garage Carport Neither Garage Carport Neither Garage or carport attached to the house Yes No Yes No Yes No Security system Yes No Yes No Yes No Accessible for seniors or people with a disability Yes No Yes No Yes No

Proximity to key places and services

(Approxim ate distance or travel time.)

Your work: Your spouse ’ s work:

Schools:

Public transportation:

Shopping: Parks or recreation:

Restaurants:

Place of worship: Police and re station:

Doctor and dentist:

Hospital:

Items included in the sale (“chattels”)

Washer and Dryer Fridge and Stove Curtains

Other:

Your work: Your spouse ’ s work:

Schools:

Public transportation:

Shopping:

Parks or recreation:

Restaurants:

Place of worship: Police and re station:

Doctor and dentist:

Hospital:

Washer and Dryer Fridge and Stove Curtains

Other:

Your work: Your spouse ’ s work:

Schools:

Public transportation:

Shopping: Parks or recreation:

Restaurants:

Place of worship: Police and re station:

Doctor and dentist:

Hospital:

Washer and Dryer Fridge and Stove Curtains

Other:

Needed repairs or renovations in the short and long term

(Talk to your lender or mortgage broker about nancing these repairs and renovations before you close the deal.)

Preparing to Buy • 2022 36 REAL ESTATE GROUP Neighbourhood Fair Good Excellent Fair Good Excellent Fair Good Excellent Quiet street Yes No Yes No Yes No

Immediate: Cost estim ate: Immediate: Cost estim ate: Immediate: Cost estim ate: In 1–5 years: Cost estim ate: In 1–5 years: Cost estim ate: In 1–5 years: Cost estim ate: In 5–10 years: Cost estim ate: In 5–10 years: Cost estim ate: In 5–10 years: Cost estim ate:

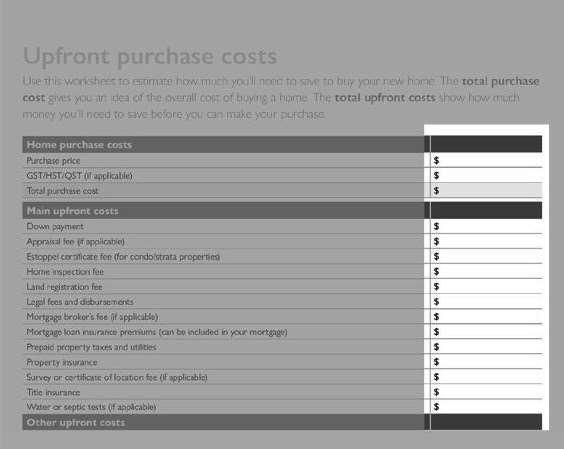

Upfront purchase costs

Use this worksheet to estimate how much you’ll need to sa ve to buy your new home. The total purchase cost gives you an idea of the overall co st of buyin g a h ome The total upfront costs show how mu ch mon ey you’ll need to save be fore you can make your purcha se.

Preparing to

37 REAL ESTATE GROUP

Buy • 2022

Home purchase costs Purchase price $ GST/HST/QST (if applicable) $ Total purchase cost $ Main upfront costs Down payment $ Appraisal fee (if applicable) $ Estoppel certificate fee (for condo/strata properties) $ Home inspection fee $ Land registration fee $ Legal fees and disbursements $ Mortgage broker’s fee (if applicable) $ Mortgage loan Insurance premiums (can be included in your mortgage) $ Prepaid property taxes and utilities $ Property insurance $ Survey or certificate of location fee (if applicable) $ Title insurance $ Water or septic tests (if applicable) $ Other upfront costs Appliances $ Cleaning costs $ Initial condo fees $ Decorating materials $ Dehumidifier $ Gardening tools $ Hand tools $ Moving expenses $ Renovations or repairs $ Service and utility hookup fees $ Snow clearing equipment $ Window treatments or coverings $ Other: $ Total upfront costs $

Personal And Financial Information Checklist

Personal and nancial information checklist

Bring as much information as possible when you meet with your lender or mortgage broker. They will use the following documentation to decide if you qualify for a mortgage.

government-issued photo IDs with your current address

proof of address and your address history

contact information for your employer and your employment history

proof of income

proof of down payment (including the amount and source)

proof of savings and investments

details of current debts and other financial obligations

Preparing to Buy • 2022 38 REAL ESTATE GROUP

Homebuying Step by Step:Workbook & Checklists –8

Financing your h ome

Preparing to Buy • 2022 39 REAL ESTATE GROUP

Preparing to Buy • 2022 40 REAL ESTATE GROUP Did we blow your mind?? If your answer is yes, share us with a friend… it’s easy!

Information Name: Address: Phone: Cell: Email: Referral Name: Phone: Email: Fill out the form below and mail it in or use the QR Code to enter online. Enter online with the QR Code or cut and mail this referral form to 75 Abrams Rd. Napanee, ON K7R 3K8 CONTACT INFORMATION

Your

Frankford

Wooler

Trenton

Stirling

Belleville

Tyendinaga

Prince Edward County

Consecon

Wellington

Picton

Bloom eld

Tamworth

Roblin Newburgh

Napanee

Camden East Bath

agrealestategroup.ca

Serving Prince Edward County, Napanee, Belleville and area.

®