Welcome to Agoda!

Internal Confidential © 2022 Agoda. All rights reserved. 1

Philippines payroll requirements and instruction by Data Management Team

Internal Agenda Confidential © 2022 Agoda. All rights reserved. • General Philippines’s payroll requirements for new hires • Personal Information • Philippines National IDs • Payment Election • Contact Information • Payroll cutoff Instruction • General Philippines’ payroll requirements for current employees who relocate to the Philippines • Personal Information • Philippines National IDs • Payment Election • Contact Information • Payroll cutoff Instruction 2

General Philippines’s payroll requirements for New Hires

Internal Confidential © 2022 Agoda. All rights reserved.

3

to your Workday inbox to complete

of the onboarding tasks in order to

with your payroll setup. Please

of the payroll requirements below;

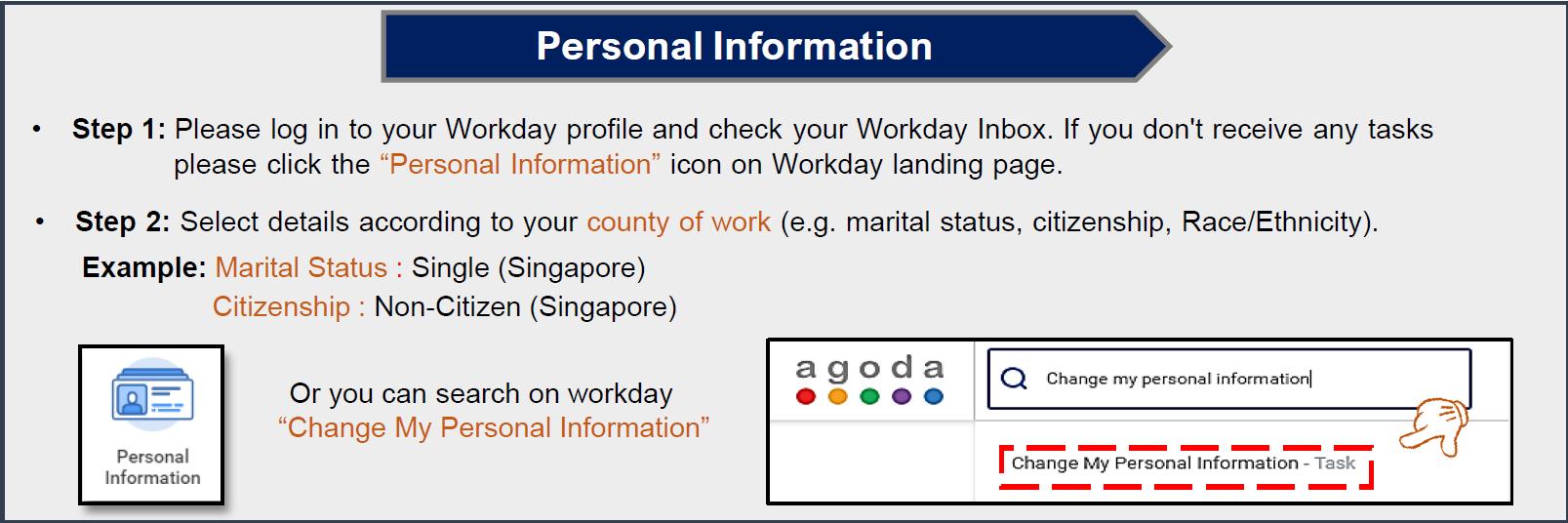

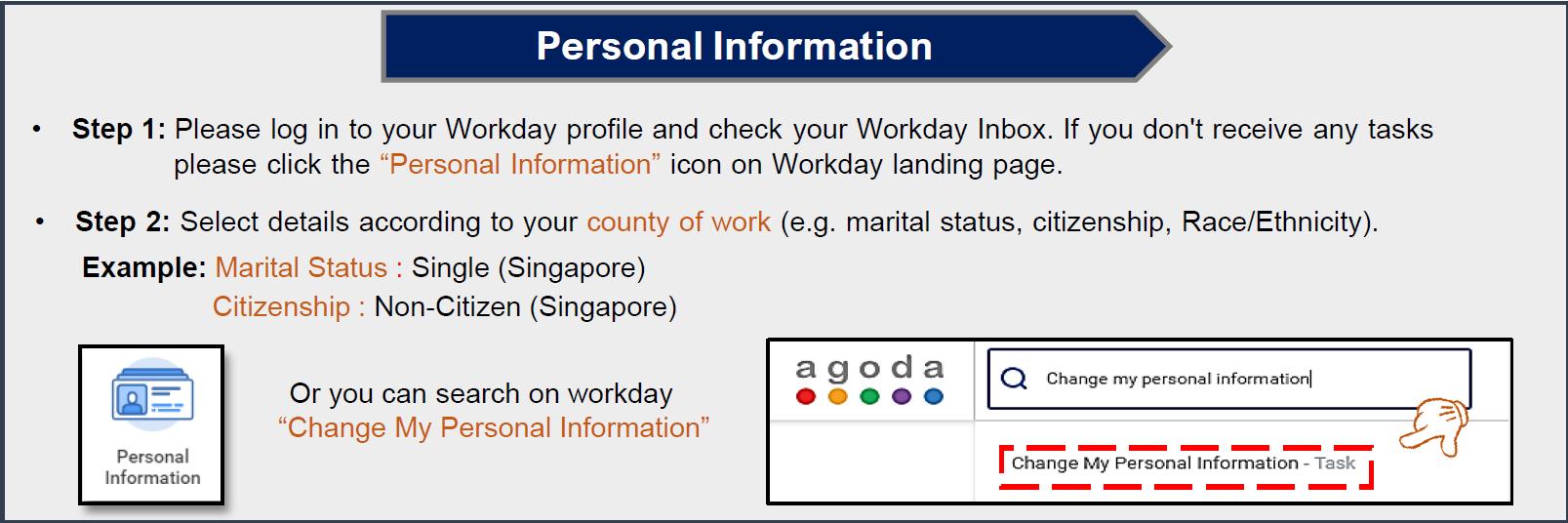

Personal Information: Please log in to your Workday profile and check your Workday Inbox to complete the personal information task. Please follow the steps below; Single (Philippines) Citizen by Birth (Philippines)

Please kindly go

all

proceed

find some

1.

Internal Confidential © 2022 Agoda. All rights reserved.

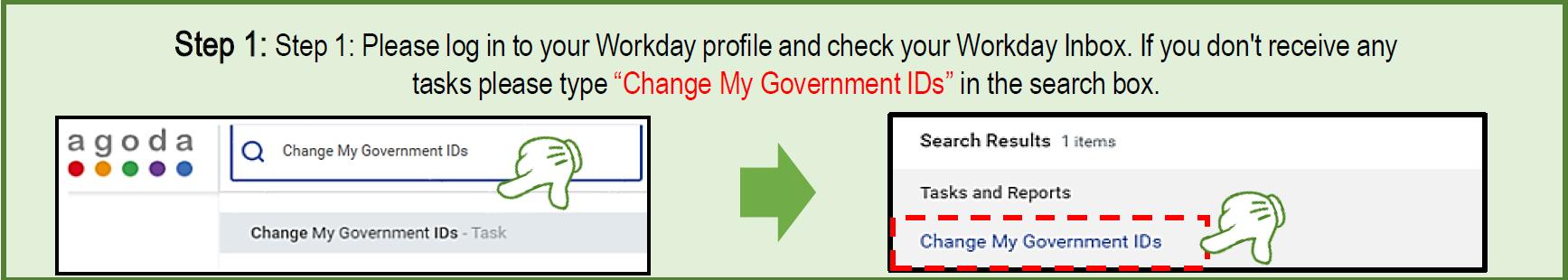

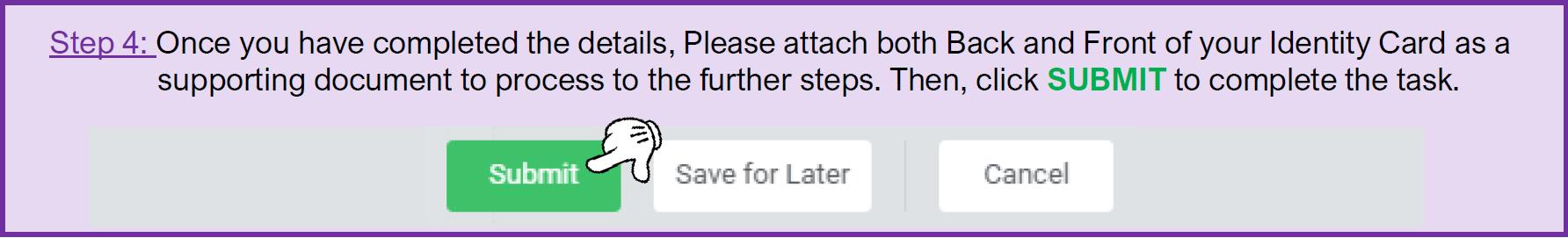

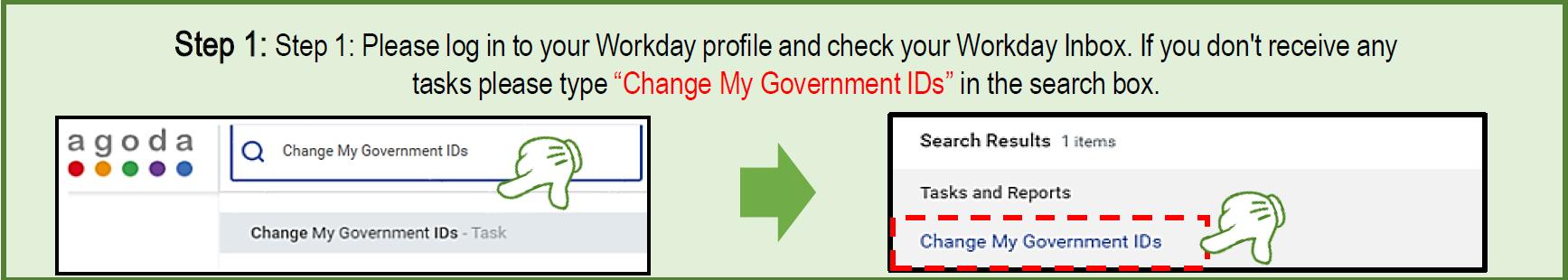

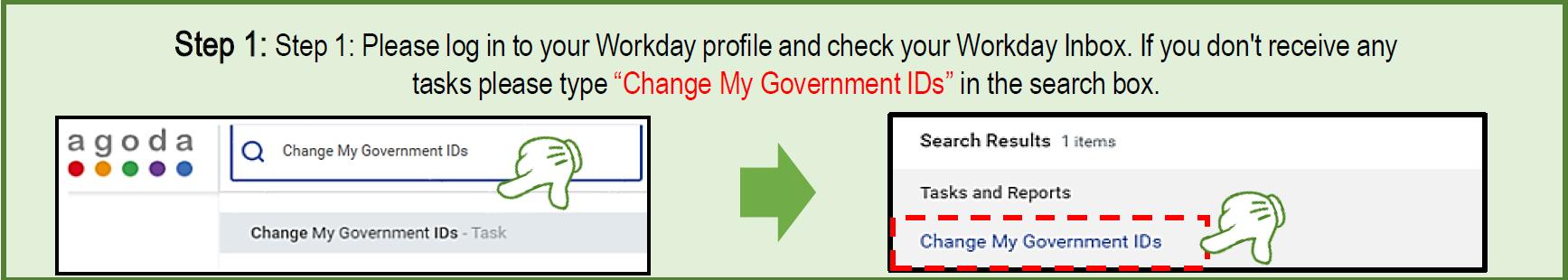

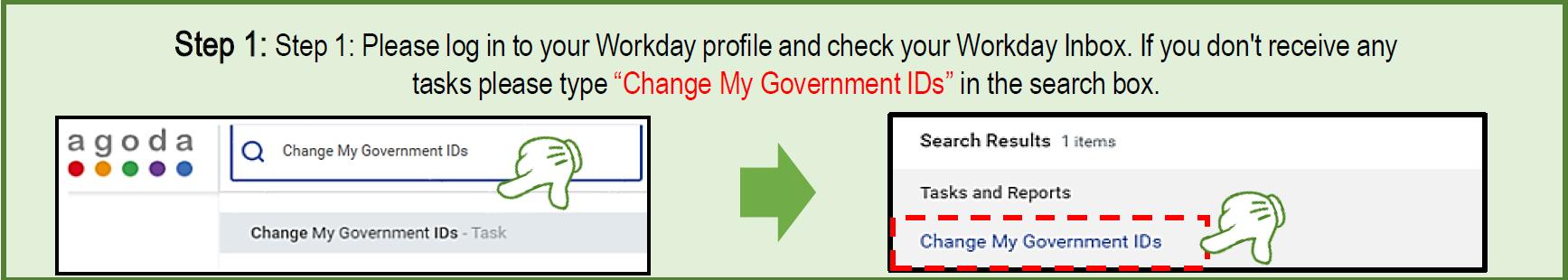

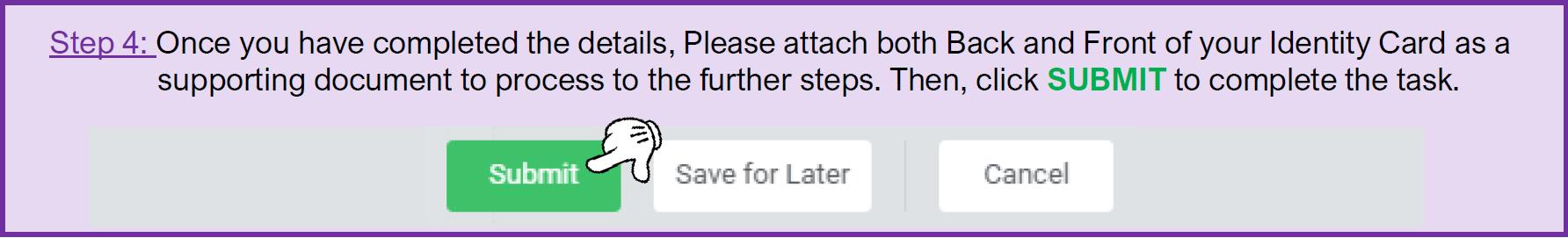

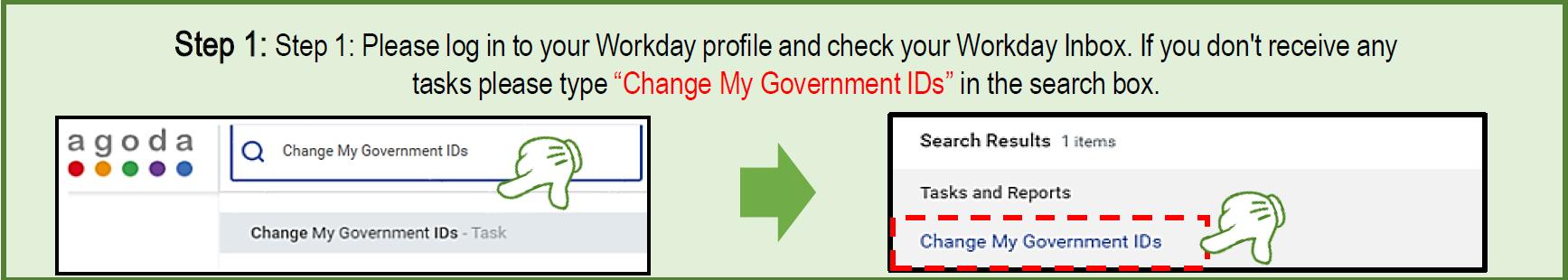

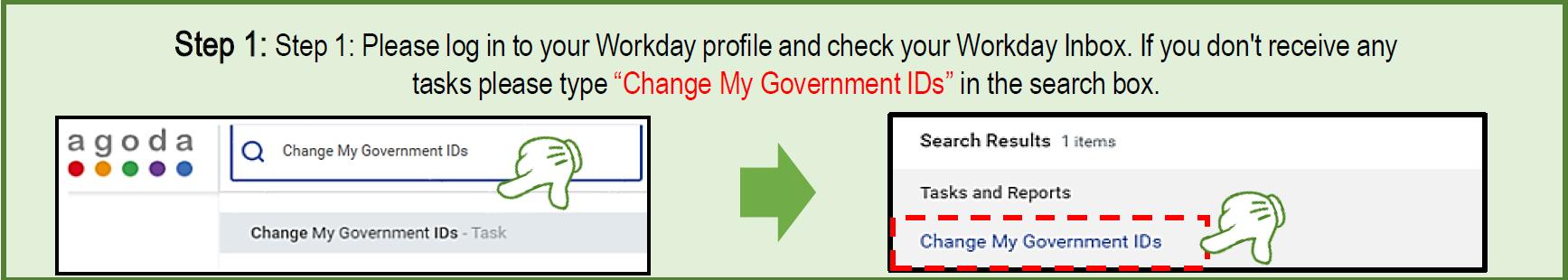

Philippines’s payroll requirements for New Hires 4 2. Edit Government IDs: Please go to your Workday inbox to update Philippines Government IDs. Also, please attach the supporting documents for all of your IDs There are a total of 4 IDs Numbers required for your Payroll: 1. Pag-IBIG MID Number 2. Tax Identification Number (TIN) 3. Social Security System (SSS) Number 4. PhilHealth Identification Number (PIN) Philippines

General

General Philippines’s payroll requirements for New Hires

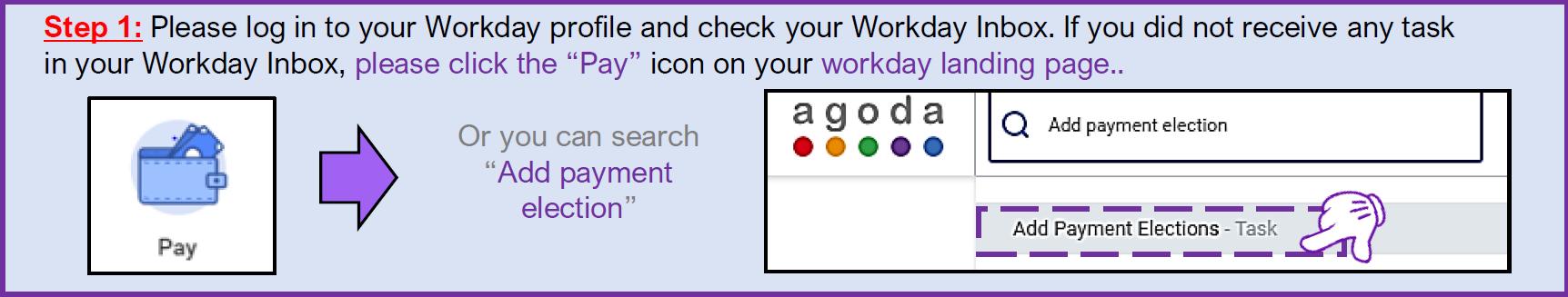

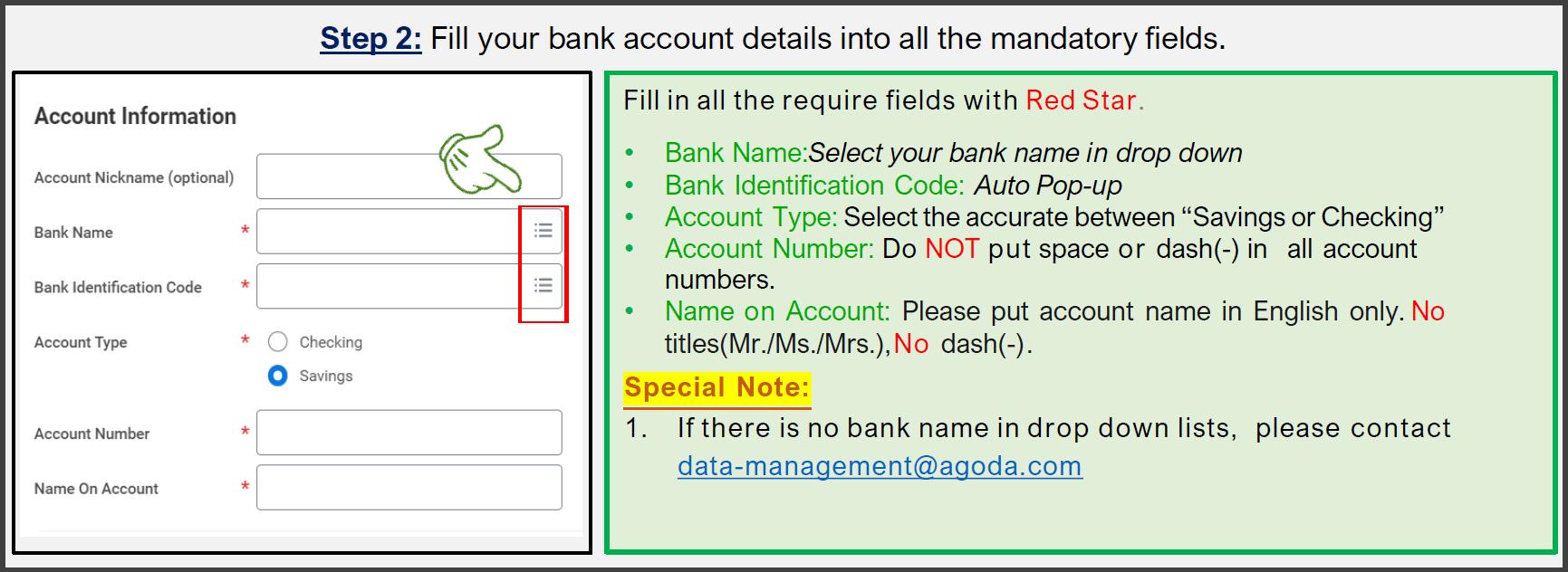

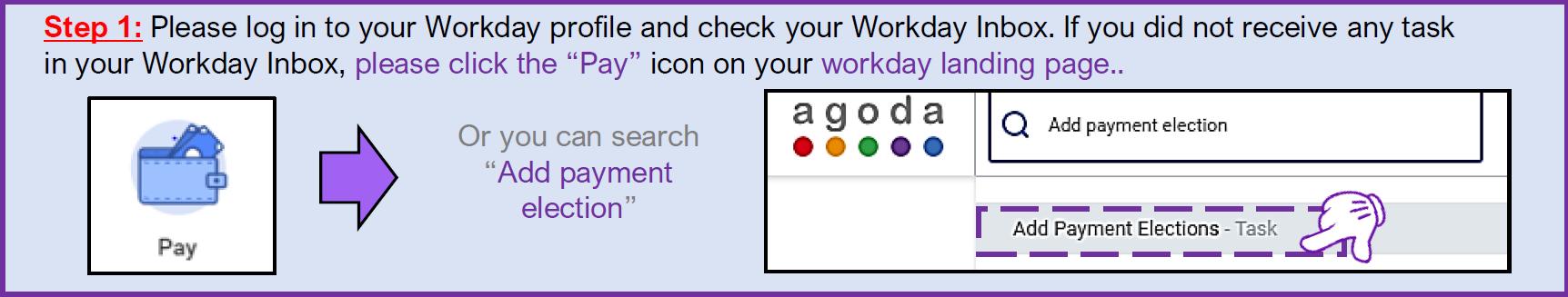

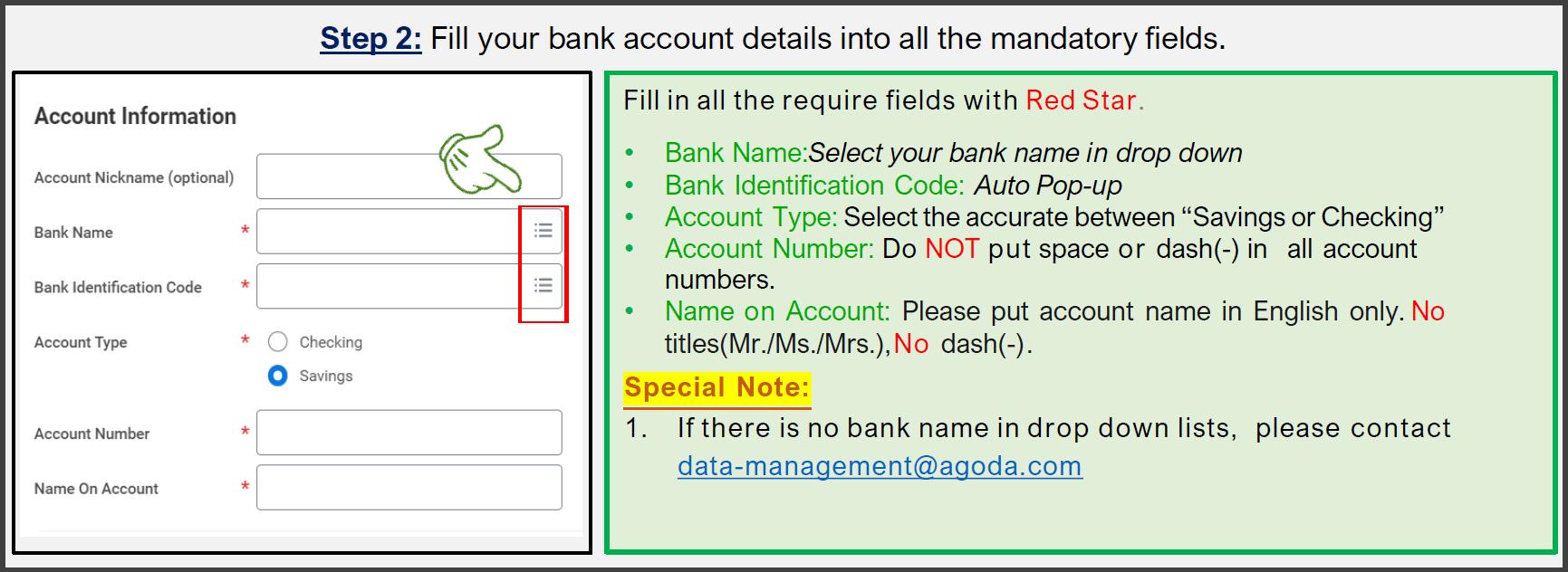

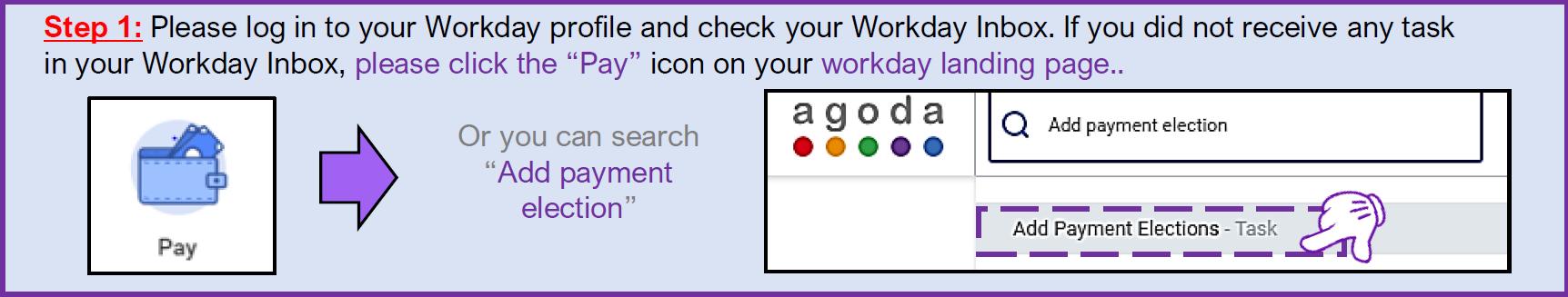

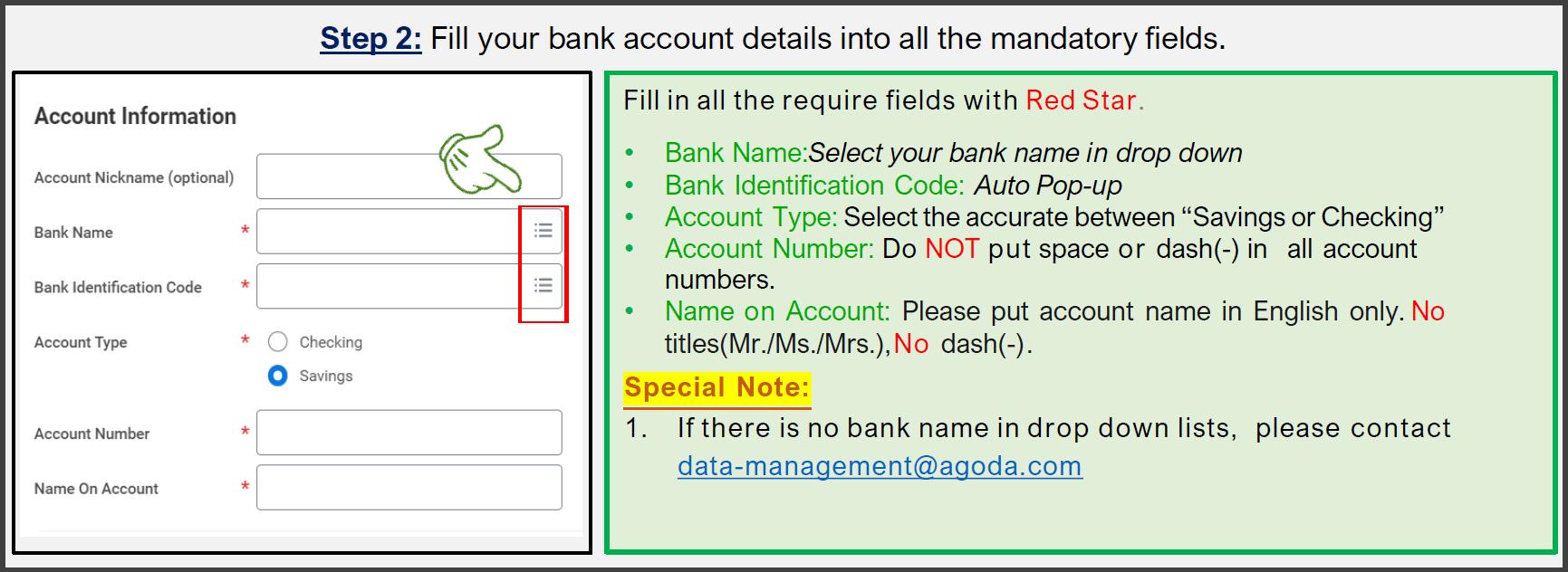

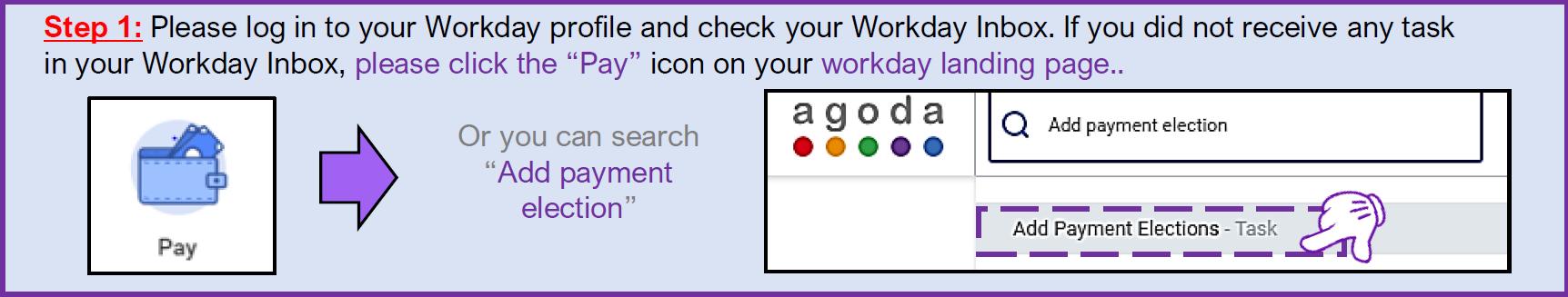

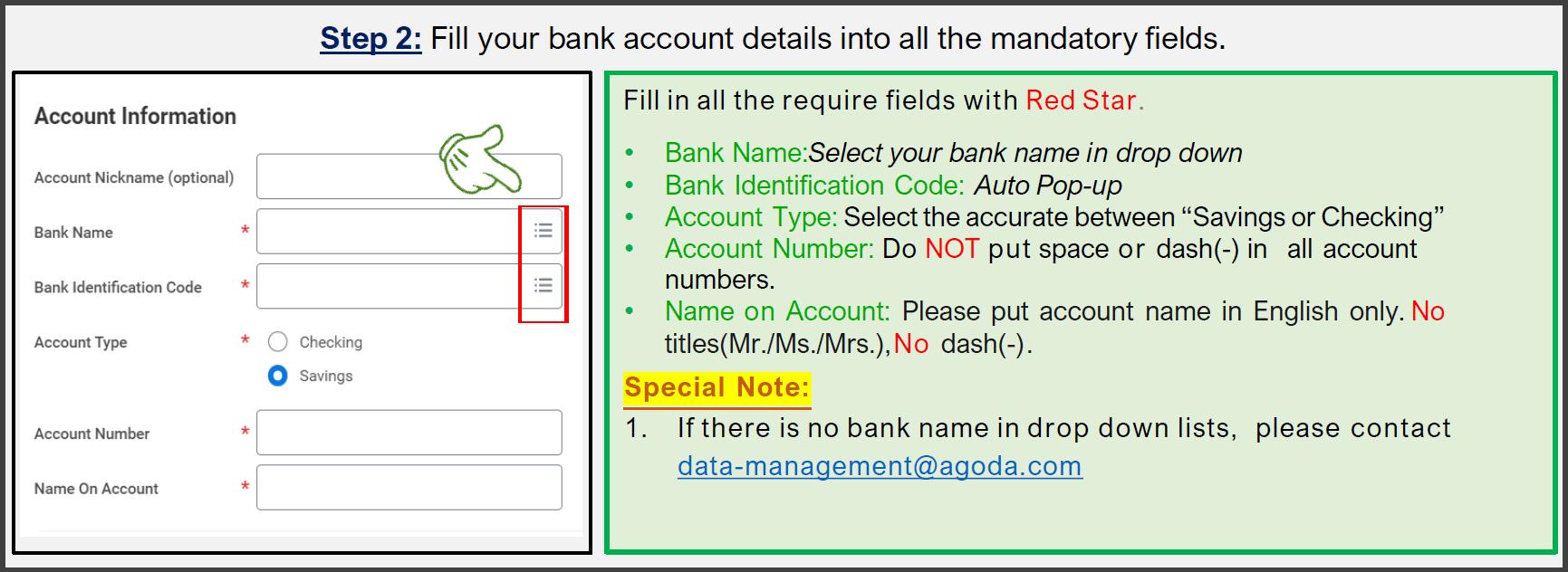

3. Payment Election: please follow the instruction below;

Internal Confidential © 2020 Agoda. All rights reserved. 5

General Philippines’s payroll requirements for New Hires

4. Contact Information: Please go to your Workday inbox to add your contact information i.e. Philippines address, phone number, and emergency contact.

For those who is an expat (Non-Philippine Locals), you can add a temporary address in the Philippines first. Once you have permanent residence, please update it again in Workday.

Internal Confidential © 2020 Agoda. All rights reserved. 6

General Philippines’ payroll requirements for New Hires

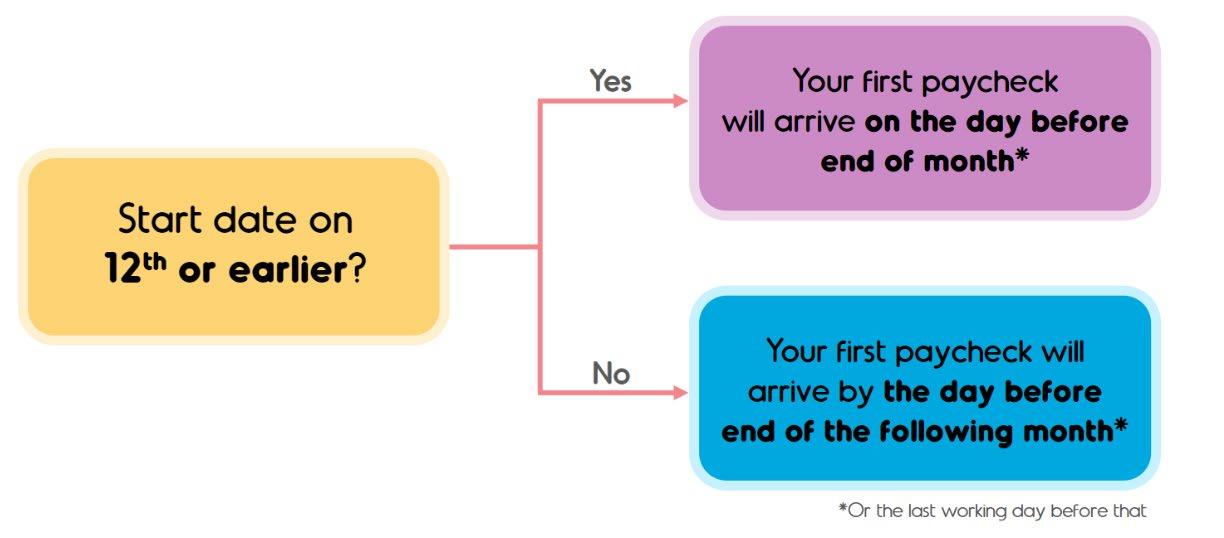

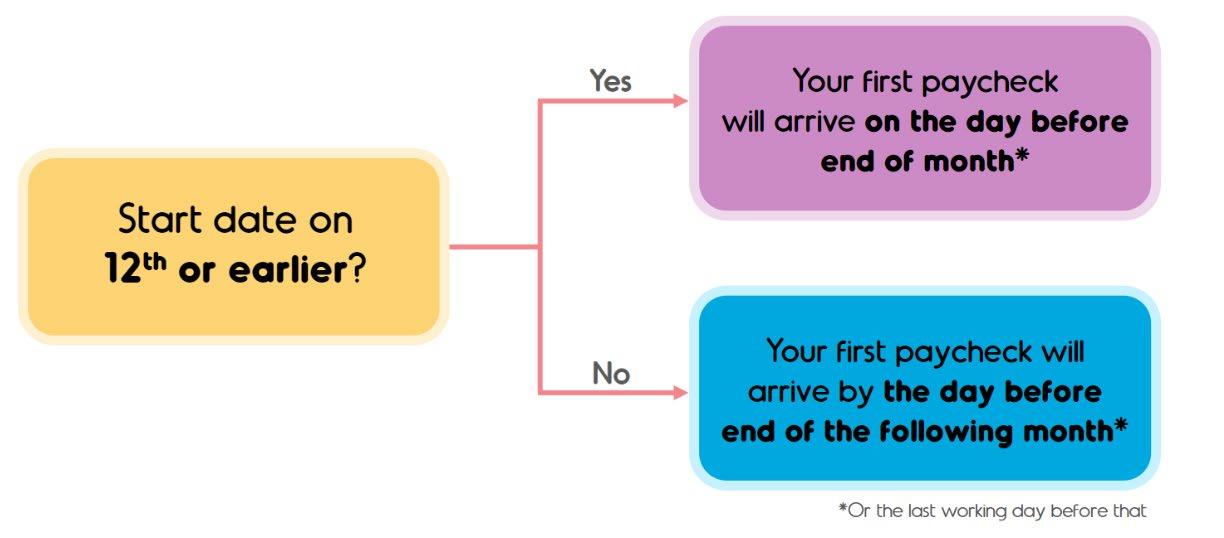

• In addition, there will be other tasks for you to complete. In order to proceed with the payroll set up, please make sure that there is no task pending in your Workday inbox to prevent the delay on your first payment.

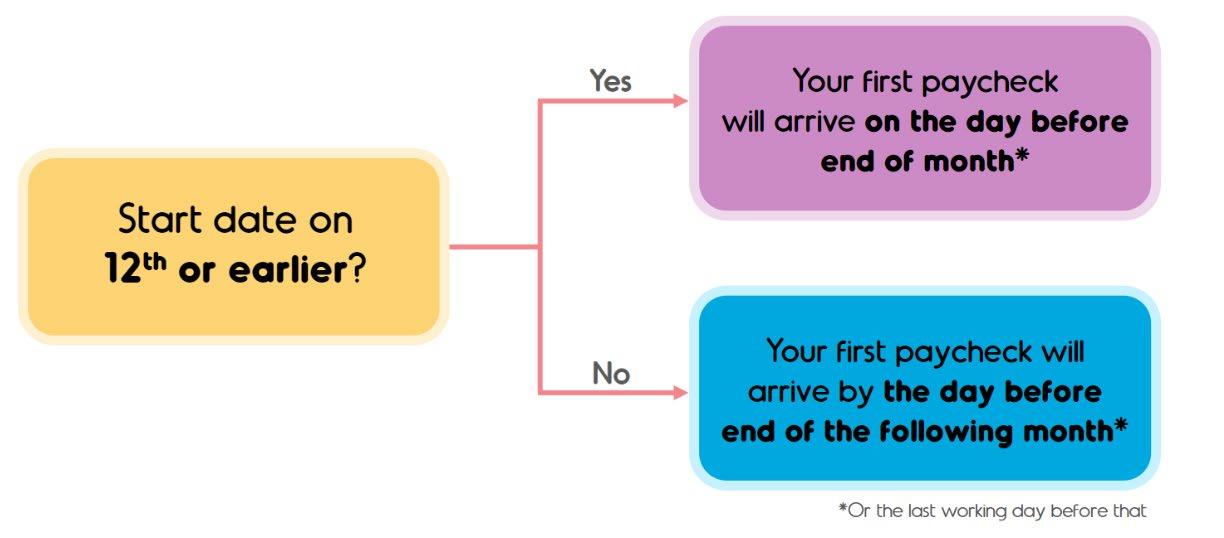

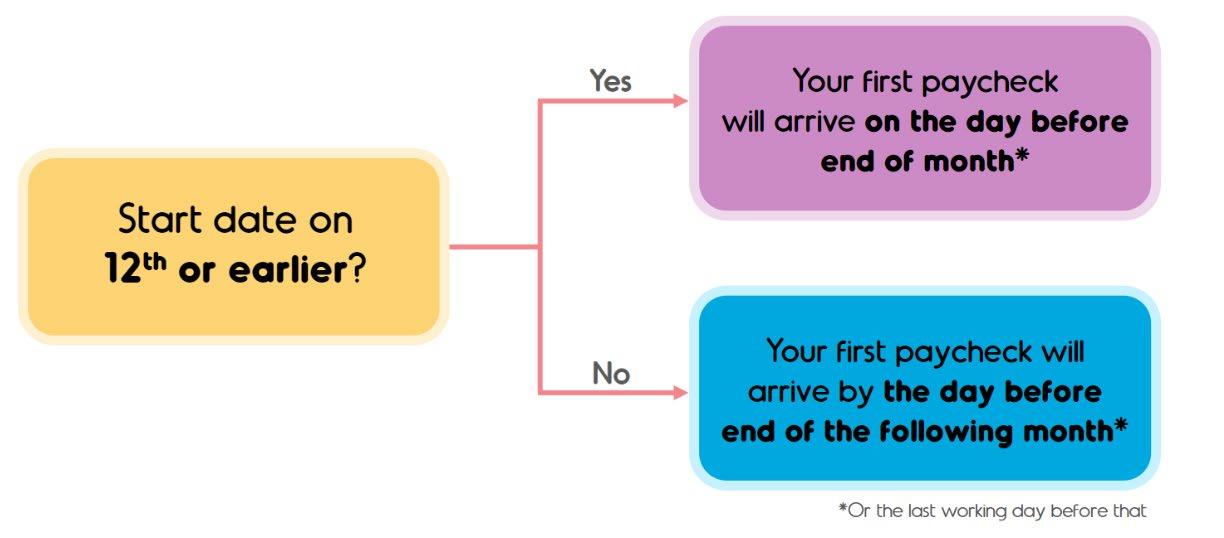

• Please find the payroll cut off instruction below;

Got any issues or questions about instructions, please reach out to our team: Data-Management@agoda.com

Internal Confidential © 2020 Agoda. All rights reserved. 7

General Philippines’ payroll requirements for current employees who

Internal Confidential © 2022 Agoda. All rights reserved. 8

relocate to the Philippines

General Philippines’s payroll requirements for current employees who relocate to Philippines

Internal Confidential © 2022 Agoda. All rights reserved. 9

You will be able to add the required information on the first day at your new entity. Please find some of the payroll requirements below;

1. Personal Information and Legal name: Please follow the instruction below; Non citizen(Philippines) Single (Philippines)

General Philippines’s payroll requirements for current employees who relocate to Philippines

• Philippines National IDs: Please go to your Workday inbox or search “Change my government IDs” on Workday. Please upload and attach NRIC or FIN number and card. If you have not received the card yet, you can provide IPA letter.

Remarks: For further information, please click here

Internal Confidential © 2022 Agoda. All rights reserved. 10

Internal Confidential © 2022 Agoda. All rights reserved. 11 2. Edit Government IDs: Please go to your Workday inbox to update Philippines Government IDs. Also, please attach the supporting documents for all of your IDs There are a total of 4 IDs Numbers required for your Payroll: 1. Pag-IBIG MID Number 2. Tax Identification Number (TIN) 3. Social Security System (SSS) Number 4. PhilHealth Identification Number (PIN) Note: If you haven’t worked in the Philippines before, you may not have a Tax Identification Number (TIN), Please inform us at data-management@agoda.com Philippines General Philippines’s payroll requirements for current employees who relocate to Philippines

General Philippines’s payroll requirements for current employees who relocate to Philippines

3. Payment Election: please follow the instruction below;

Internal Confidential © 2020 Agoda. All rights reserved. 12

General Philippines’s payroll requirements for current employees who relocate to Philippines

4. Contact Information: Please go to your Workday inbox to add your contact information i.e. Philippines address, phone number, and emergency contact.

For those who is an expat (Non-Philippine Locals), you can add a temporary address in the Philippines first. Once you have permanent residence, please update it again in Workday.

Internal Confidential © 2020 Agoda. All rights reserved. 13

General Philippines’s payroll requirements for current employees who relocate to Philippines

• In addition, there will be other tasks for you to complete. In order to proceed with the payroll set up, please make sure that there is no task pending in your Workday inbox to prevent the delay on your first payment.

• Please find the payroll cut off instruction below; Got any issues or questions about instructions, please reach out to our team: Data-Management@agoda.com

Internal Confidential © 2020 Agoda. All rights reserved. 14

Thank you

Internal