Welcome to the Agoda

General Malaysia’s payroll requirements for new hires

• Personal Information

• Malaysia National IDs

• TAX ID

• Payment Election

• Payroll cutoff Instruction

• Date of arrival

General Malaysia’s payroll requirements for current employees who relocate to Malaysia

• Personal Information

• Malaysia National IDs

• TAX ID

• Payment Election

• Payroll cutoff Instruction

• Date of arrival

• After you activated your OKTA, please kindly go to your Workday inbox to complete onboarding tasks in order to proceed with the Malaysia payroll setup.

• Personal Information: Please log in to your Workday profile and check your Workday Inbox to complete the personal information task. Please follow the steps below;

• Malaysia National Ids (EPF Number, IC Number, Income Tax Number).

• ALL employees employed in Malaysia are required to pay income tax to the government. PleaseupdateyourtaxIDwithin 2 weeks.

• Click here to see how to apply

• New IC is required for Malaysian employees.

• Your legal name in Workday and Bank name should follow the format from your IC card.

• EPF number is mandatory for Malaysian employees to ensure continuous and accurate contribution to your retirement plans.

• Click here to see how to apply

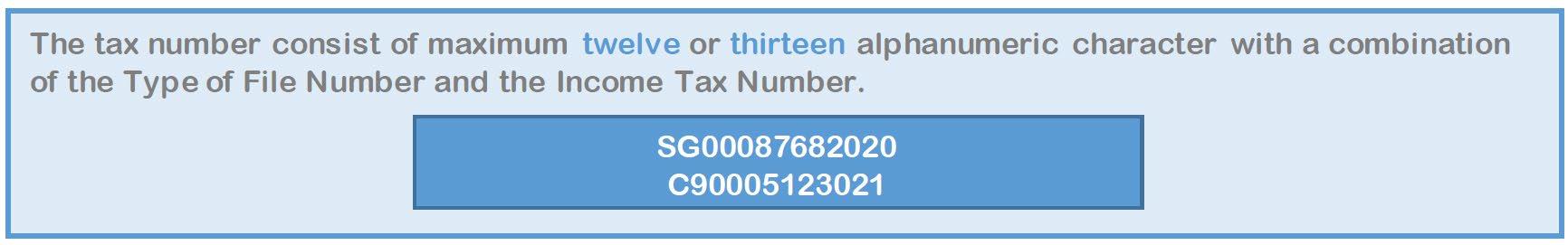

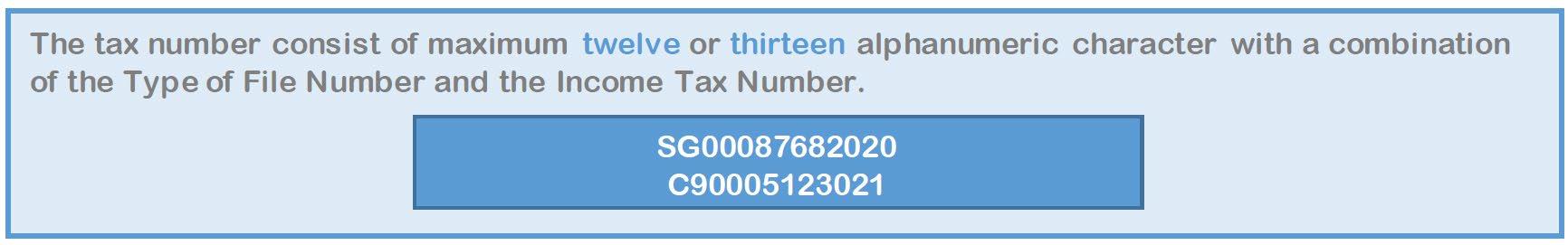

Income Tax Number: Need to tag your income tax deductions and use them during year-end filing/tax.

o If you haven't registered yet, please visit this link

o If you have it before, you can check the number with this link

You will receive “Payment Election Task” on your Workday profile, please follow the steps below to complete

After clicking “Submit”. You will receive the task in Workday inbox required you to attach supporting document

If you do not have the bank passbook you can use the screenshot of your e-statement as a supporting document.

If you don’t receive the task, please follow the below steps

For expats who don’t have a Malaysian bank…

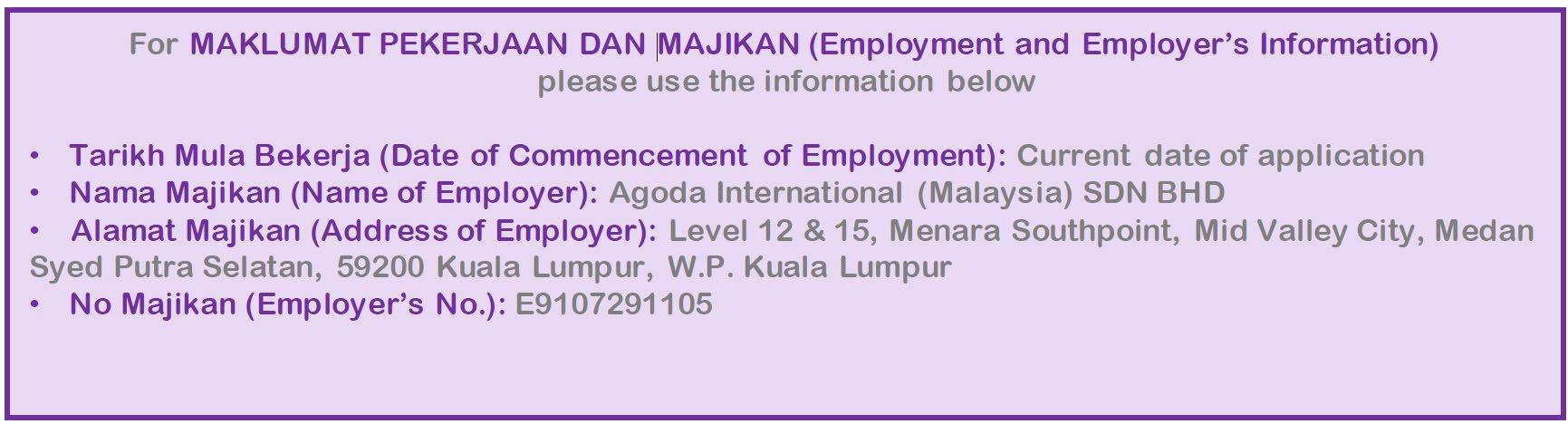

The bank will require you to provide the below items to submit to the bank.

o Passport/Work permit (EP)

o Employment Certificate issued by Agoda

MALAYAN BANKING BERHAD (MAYBANK) is recommended as this is a local bank. For those who'd like to open Maybank, we would suggest you open at Midvalley branch

Please request “Employment Certificate issued by Agoda” at data-management@agoda.com

• Arrival date is used to calculate the number of days you are physically present in Malaysia.

• If you have stayed in Malaysia for more than 182 days in the CURRENT year, you are deemed as a tax resident, thus, please declare your original arrival date.

• If you do not fulfill the 182 days, declare your latest arrival date.

Question: I was employed in Malaysia in the last 3 to 4 years. Am I eligible to be a tax resident?

Answer: There are some other exemptions apart from the 182 days rule. Please visit this LINK to check other criteria.

Question: I’m holding a Spouse Visa, should I add my Arrival date?

Answer: Yes, you still need to declare the arrival date as the 182 days rule is applicable to ALL, regardless locals or expats

After employee declare the arrival date, employee is required to submit the stamped page from the passport to us which you can check from employee’s workday under “document”

Payroll Period

If you join from 1st – 12th of the month, the deadline for completing Workday profile and submitting your bank account is 8th

Pay Date

2nd last working day of the month

If you join from 13th –31st of the month, the deadline for completing Workday profile and submitting your bank account is 24th

7th of following month

Any questions or more information about WD & requirements, contact Data-Management@agoda.com

Any questions or more information about Tax & Payroll, contact Malaysia.payroll@agoda.com

• After you activated your OKTA, please kindly go to your Workday inbox to complete onboarding tasks

• Personal Information: Please log in to your Workday profile and check your Workday Inbox to complete the personal information task. Please follow the steps below;

• Malaysia National Ids (Income Tax Number).

• ALL employees employed in Malaysia are required to pay income tax to the government. PleaseupdateyourtaxIDwithin 2 weeks.

• Click here to see how to apply

You shall receive “Payment Election Task” on your Workday profile, please follow the steps below to complete

After clicking “Submit”. You will receive the task in Workday inbox required you to attach supporting document

If you do not have the bank passbook you can use the screenshot of your e-statement as a supporting document.

General Malaysia’s payroll requirements for current employees relocating to Malaysia

For those who don’t receive the task….

For those who don’t have a Malaysian bank, or you are an expat…

The bank will require you to provide the below items to submit to the bank.

o Passport/Work permit (EP)

o Employment Certificate issued by Agoda

MALAYAN BANKING BERHAD (MAYBANK) is recommended as this is a local bank.

For those who'd like to open Maybank, we would suggest you open at Midvalley branch

Please request “Employment Certificate issued by Agoda” at data-management@agoda.com

• Arrival date is used to calculate the number of days you are physically present in Malaysia.

• If you have stayed in Malaysia for more than 182 days in the CURRENT year, you are deemed as a tax resident, thus, please declare your original arrival date.

• If you do not fulfill the 182 days, declare your latest arrival date.

Question: I was employed in Malaysia in the last 3 to 4 years. Am I eligible to be a tax resident?

Answer: There are some other exemptions apart from the 182 days rule. Please visit this LINK to check other criteria.

Question: I’m holding a Spouse Visa, should I add my Arrival date?

Answer: Yes, you still need to declare the arrival date as the 182 days rule is applicable to ALL, regardless locals or expats

After employee declare the arrival date, employee is required to submit the stamped page from the passport to us which you can check from employee’s workday under “document”

In addition, there will be other tasks for you to complete. In order to proceed with the payroll setup, please make sure that there is no task left pending in your Workday inbox to prevent the delay on your first payment.

• Below is the Pay Date

If you join from 1st – 12th of the month, the deadline for completing Workday profile and submitting your bank account is 8th

2nd last working day of the month

If you join from 13th –31st of the month, the deadline for completing Workday profile and submitting your bank account is 24th

7th of following month

Any questions or more information about WD & requirements, contact Data-Management@agoda.com

Any questions or more information about Tax & Payroll, contact Malaysia.payroll@agoda.com