Renewable energy

Issue 13 • 2023/2024

Eamon Ryan TD on the long-term vision of Ireland as an exporter of renewable energy

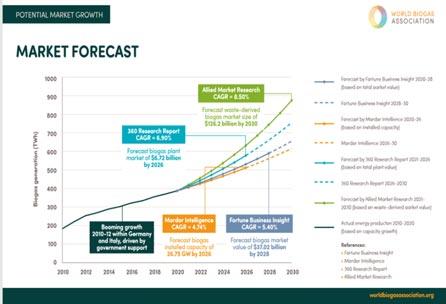

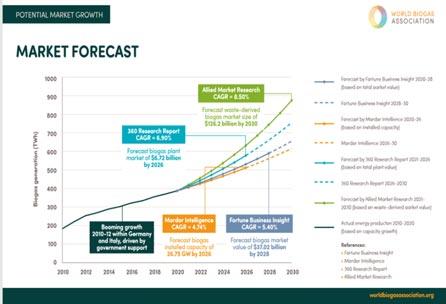

Association’s Charlotte Morton discusses the role of biogas in meeting the Global Methane Pledge

Offshore wind • Bioenergy • Storage • Hydrogen • Solar Ireland’s clean electric future ESB Networks’ Nicholas Tarrant magazine

The European Commission’s Tom Howes discusses electricity market design for future stability

Contents RENEWABLE ENERGY MAGAZINE 04 Climate Action Plan 2023 overview 08 Minister Eamon Ryan TD discusses Ireland’s energy transition 12 Cover story: ESB Networks’ Nicholas Tarrant on driving the electricity network for Ireland’s clean electric future 16 ESRI Senior Research Officer Muireann Lynch on the impact of planning and regulatory delays 24 Overview of the National Hydrogen Strategy 28 Round table discussion: The biomethane opportunity in Ireland 34 DECC Assistant Secretary Barry Quinlan on decarbonising Ireland’s heat demand 44 Head of Energy in Northern Ireland’s Department for the Economy Richard Rodgers on the need for acceleration towards a totally decarbonised energy system 52 MaREI Director and UCC professor Brian Ó Gallachóir on accelerating the energy transition 82 European Commission Bioenergy Policy Officer Biljana Kulišić outlines Europe’s biomethane opportunity 88 Katy McNeil, Head of the Scottish Government’s Ireland Office, explains Scotland’s hydrogen journey 92 Charlotte Morton, Chief Executive of the World Biogas Association, on meeting the Global Methane Pledge 104 Renewable Energy Magazine directory 116 Ryze Ireland Managing Director Catherine Sheridan on establishing the guiding principles to net zero 12 116 92 Editorial Owen McQuade David Whelan Ciarán Galway Fiona McCarthy Odrán Waldron Joshua Murray Design Gareth Duffy Jamie Hogan Advertising/Commercial Sam Tobin sam.tobin@energyireland.ie Publishers Energy Ireland www.energyireland.ie info@energyireland.ie @energyireland Dublin office: Clifton House Lower Fitzwilliam Street Dublin 2, D02 XT91 Tel: 01 661 3755 renewable energy magazine 1 16 28 08 Hosted by KPMG

22 & 23 May • Croke Park, Dublin 2024 For more information +353 (0)1 661 3755 • www.energyireland.ie • info@energyireland.ie Sponsorship opportunities available Save the date!

Expanding the renewable mix…

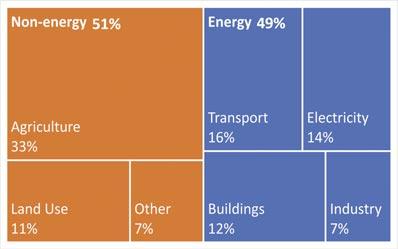

Ireland’s decarbonisation transition is predicated on the heavy lifting being done by wind energy, both onshore and offshore, but the implementation of carbon budgets and sectoral emissions ceilings has offered a firm insight into the necessity of those technologies previously regarded as being on the fringes.

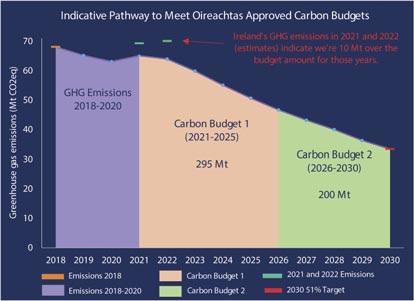

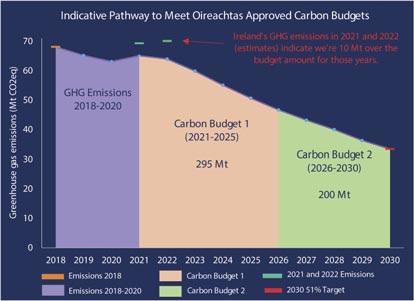

Climate Action Plan 2023 (CAP23) has set some ambitious targets for the acceleration of renewable generation out to 2030, perhaps best illustrated by the shift from a solar energy target of 1.5GW in CAP21 to 8GW in CAP23, but it also implements the first binding carbon budgets and sectoral emissions ceilings.

Early analysis shows that the State has spent almost half of its carbon budget in the initial two years of the first five-year period, necessitating a significant reduction in carbon emissions over the remaining years.

Clearly, the realisation of net zero ambitions will require a rapid acceleration of renewable energy technologies, spearheaded by renewable electricity to assist with the electrification of heat and transport.

The provisional results of RESS 3, which point to a lower volume of renewable energy and higher prices than the previous auction, highlights that more needs to be done to facilitate this acceleration, particularly in relation to planning delays.

However, decarbonisation requires more than renewable generation at scale, it requires a diversity of technologies, the upgrading of infrastructure, and system flexibility. Biomethane, for example, now has an elevated role reaching those hard to abate sectors. Solar PV and storage are recognised not only as a source of renewable electricity, but as a key enabler of consumers, industry, and agriculture to play their part in the transition.

Crucially, these ‘fringe’ technologies are now being advanced in recognition of their role in ensuring security of supply.

Enabling as many people as possible to play a part in the transition will be crucial to not only ensuring demand-side flexibility but also driving a mindset shift to reduce consumption, another necessary requirement that has been made evident from analysis of carbon budget performance to date.

The 2023/2024 edition of the Renewable Energy Magazine explores in detail the role of renewable energy in Ireland’s decarbonisation journey so far, and the technologies and policies driving the net zero agenda.

Aptly, in the context of the acceleration of renewable generation, and the requirement for demand-side flexibility, our cover story interview with ESB Networks’ Nicholas Tarrant discusses the delivery of an electricity network for Ireland’s clean electric future. Other highlights include KPMG’s round table discussion with key stakeholders on the future role of biomethane, and we have expert analysis of the short, medium, and long term outlook for renewable energy across the island.

David Whelan, Editor

3 renewable energy magazine

CAP23 ups the ante for renewable energy

The Government

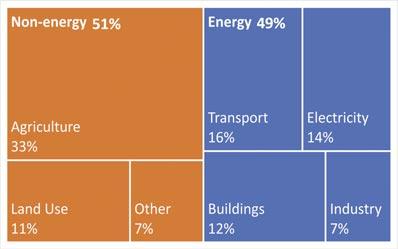

goals for electricity decarbonisation

the Climate Action Plan

Electricity

The most notable of CAP23’s targets in terms of the decarbonisation of electricity comes in the form of increased ambitions for the deployment of renewable energy generation that will “strengthen the electricity grid and meet the demand for flexibility”. As part of these measures, the Government has increased its aim for the proportion of renewable electricity to 80 per cent by 2030; the 2021 Climate Action Plan (CAP21) had previously aimed for “up to 80 per cent where achievable and cost effective, without compromising

security of electricity supply”, meaning that what was once seen as a maximum is now the minimum target for the Government.

Sustainable Energy Authority of Ireland (SEAI) data shows that the Government’s target of 40 per cent by 2020 was just narrowly missed, with renewables accounting for 39.1 per cent of electricity generation in 2020, but that the 2020 proportion then fell in 2021, the latest year for which full data is available, with renewables accounting for 36.4 per cent of electricity generation. This means that the State’s

proportion of electricity coming from renewable sources would need to more than double from 2022 to 2030.

The Government’s aim to reach such a revolution in renewable energy production is to be powered by increasing ambitions in various forms of renewable generation:

• the aim for onshore wind capacity by 2030 has been raised to 9GW, from “up to” 8GW in CAP21;

• 7GW of offshore wind is aimed to be developed by 2030, with 2GW dedicated to green hydrogen

4 renewable energy magazine

once again increased its

with the publication of

2023 (CAP23). However, doubts remain as to whether or not the new goals are achievable.

production, this target retains the CAP21 target of 5GW – although it adds the caveat “at least” – of offshore wind production of electricity and adds the 2GW specific to hydrogen; and

• 8GW of solar energy will be produced by 2030, a significant increase from the targets set out in CAP21, where between 1.5GW and 2.5GW were aimed at for 2030.

Published in September 2022 in the run up to the publication of CAP23, the Government’s Sectoral Emissions

Ceilings set out an aim of circa 75 per cent reduction in electricity emissions by 2030, with CAP21 having contained a guiding agreed range of between 60 per cent and 80 per cent when compared with 2018 levels of emissions. In June 2023, the Environmental Protection Agency (EPA) warned that “increased renewable energy generation, from wind and solar, if delivered as planned, can reduce energy industry emissions by 60 per cent”, although the EPA did also state that the goals would achieve the 80 per cent renewable electricity generation target by 2030.

The EPA notes that the continued dependence on coal due to the unavailability of gas-fired generation due to the Russian invasion of Ukraine and the slow implementation of renewable electricity targets has “undone some of

the good work of recent years”. Such ‘good work’ as carried out under CAP21 is listed in CAP23, including: 2022 being a record year for connection of renewable electricity to the grid; the enactment of the Maritime Area Planning Act 2021 and the creation of the Maritime Area Consent regime; 1,836MW of renewable generation through the RESS 2 auction, which represented an increase of almost 20 per cent in Ireland’s renewable electricity generation capacity; and the connection of the first grid-scale solar project to the grid.

CAP23 outlines plans to have the renewable electricity share up to 50 per cent by 2025 as a steppingstone to 80 per cent by 2030, with onshore wind and solar to have capacities of 6GW and “up to” 5GW respectively by 2025. The plan also calls for demand side flexibility to be between 15 per cent and 20 per cent by 2025 as Ireland builds toward 30 per cent by 2030.

CAP23 lines out three themes to deliver abatement in electricity: accelerate renewable energy generation; accelerate flexibility; and demand management. Cumulatively, these three themes will deliver an abatement of 9.56 MtCO2eq by 2030 if key performance indicators (KPIs) are met. These KPIs include the capacity generation and demand flexibility goals mentioned above, the

production of green hydrogen from surplus renewable electricity, the putting in place of required long-term storage, zero-emission gas-fired generation from biomethane and hydrogen commencing by 2030, and a rate of renewables ongrid at any one time of between 95 per cent and 100 per cent being achieved.

Associated actions included in CAP23 for the achievement of such KPIs include some already achieved, such as the establishment of the Maritime Area Regulatory Authority and the completion of the Offshore Renewable Energy Development Plan. The plan contains 27 actions for 2023 relating to electricity, including the completion of new analysis by EirGrid in order to update Our Electricity Future to accommodate the new target of 80 per cent renewables.

Heat

Two of the three key targets in CAP23 relating to industry come under energy usage: the drive towards achieving between 70 per cent and 75 per cent carbon neutral heating by 2030 and a 10 per cent reduction in fossil fuel demand by 2030 through energy efficiency. The plan states that the Government plans to provide carbon-neutral heat for industry through high efficiency heat pumps powered by renewables for low and medium temperature heating, while indigenously produced biomethane and

5 renewable energy magazine 4

green hydrogen (in the longer term) will power high temperature heat demands. Industrial heat and processing is named as the fourth priority usage for hydrogen in the National Hydrogen Strategy, published after CAP23, with the likely market energy timeframe given as 2030-2035.

SEAI’s Energy in Ireland 2022 report identifies that fossil fuels are the heat source in 73 per cent of the State’s dwellings and the built environment section of CAP23 attempts to get to grips with this, detailing government plans to have up to 0.8 TWh of district heating installed capacity by 2025, due to rise to 2.7 TWh by 2030, to have 170,000 new dwellings using heat pumps by 2025 and 280,000 by 2030, and to have 45,000 existing dwellings doing the same by 2025 and 400,000 by 2030. Also notable is the plan to have “up to” 0.4 TWh of heat provided by renewable gas by 2025, rising to 0.7 TWh by 2030. Under the National Retrofit Plan, 500,000 dwellings should be retrofitted to BER B2 cost optimal or carbon equivalent by 2030, a move that, along with the 400,000 heat pumps to existing dwellings, would abate 2 MtCO2eq.

Transport

CAP23 notes that 20.2 per cent of transport’s first sectoral carbon budget (lasting until 2025) was expended in 2021, a figure that would be consistent with compliance were it not for the fact that finalised 2022 figures are expected to report a further increase in transport emissions. The plan states that fleet electrification and the use of biofuels will “provide the greatest share of emissions abatement in the medium term” for one of the most difficult-to-decarbonise sectors.

Of the 6.08 MtCO2eq of transport emissions the Government plans to have abated by 2030, electrification and vehicle technology coupled with biofuels make up 5.82 MtCO2eq. By 2030, the Government plans to have 845,000 private EVs, 1,500 EV buses, and 95,000 commercial EVs on the roads, along with a biofuel blend rate of E10:B20, meaning a blend of up to 10 per cent of bioethanol in petrol and 20 per cent of biodiesel in diesel. CAP23 also contains a commitment to study opportunities to “broaden supply of a more diverse range of renewable transport fuel types and feedstocks – in particular, the supply of advanced biofuels and renewable fuels of non-biological origin”.

While CAP23 does not contain much with regard to the use of hydrogen in transport, the National Hydrogen Strategy has since ranked road and rail transport as the seventh priority area for hydrogen, specifically for road transports “requiring long duty cycles and longer distances” and for rail “where electrification [is] not feasible/or as a backup”.

6 renewable energy magazine

Headwinds and tailwinds on the journey to 80 per cent by 2030

priorities would support necessary grid development.

Planning

• introduce clearly defined realistic timelines for planning decisions and response times from statutory consultees;

• introduce an oversight function to measure performance by local councils and Department for Infrastructure of KPIs set against statutory targets; and

• increase resource at local council and Department for Infrastructure levels to cope with expected increased demand for applications and create a central pool of resource to be deployed to areas of high demand.

Route to market

• publish timeline for implementation of support scheme;

• no mandatory participation in any new support scheme so that investors/generators have flexibility around investment models; and

The renewables sector in Northern Ireland is facing serious headwinds. That is not news to anyone working in the sector over the past six years or so. It is striking though that only 30MW of additional renewables capacity was added last year, compared to up to 400MW annually in the period of peak development to 2016.

A recent report commissioned by Renewable NI, the industry body, and produced by KPMG, confirms that Northern Ireland will struggle to meet the target set for renewable electricity generation without significant reform.

The factors contributing to those headwinds are grid capacity for both new and existing assets, the absence of a support scheme for new projects and the planning system, notably timelines in progressing applications and inconsistencies in decision-making across councils. Again, these factors are well known to the industry and should be well known to policymakers.

The report concludes that, based on our current regime, it will simply not be

possible to achieve the target, set by the Northern Ireland Executive just before it collapsed in 2022, of 80 per cent renewable electricity consumption by 2030. It makes a variety of recommendations garnered from consulting with stakeholders about how the deployment of renewables might be accelerated, including:

Grid

• anticipatory investment in grid network so that capacity is available for new projects ahead of time could significantly decrease overall deployment times;

• closer collaboration between NIE and industry to enable considered planning for future demand in terms of project location and scale;

• incentivising the development of generation close to areas of high demand would facilitate reduced costs and facilitate more rapid development of the network; and

• empowering the Utility Regulator to consider environmental and climate

• fast tracking of new renewables projects through planning and grid to allow participation of new projects in initial auctions.

The sector rose to the previous challenge set by government achieving the 40 per cent target ahead of the 2020 deadline. Let us hope that a functioning Executive resumes and acts as the tailwind to facilitate successful achievement of the 2030 targets.

If you have any queries relating to any this article or for more information on Carson McDowell’s renewable energy team and experience, please contact Neasa Quigley, Head of the Energy and Renewables team.

E: neasa.quigley@carsonmcdowell.com

W: carson-mcdowell.com

7 renewable energy magazine

Significant reform is required if Northern Ireland is to meet the target set for renewable electricity consumption by 2030, writes Carson McDowell’s Neasa Quigley.

energy transition

The Minister, who at the time of speaking had just returned from the African Climate Summit, speaks of the changing landscape of global politics, outlining that national leaders in Africa and China are now fully “bought into” the need for action to address the climate crisis.

“When it comes to renewable energy, the Chinese are racing ahead. They will be producing 200GW+ of solar power this year; the United States’ total solar capacity is 140GW, to put that into perspective. The Chinese are planning the triple the production of polysilicon over the next few years.”

Ryan states that the reason for this global shift is that “technology is evolving, particularly with photovoltaic and wind technology”. “The industrial revolution is with us; it is happening, and it is accelerating.

“The war in Ukraine,” he asserts, “is making these developments accelerate at an incredible speed. We in Ireland have to understand that and fit in to that wider context to be in the right place and thinking ahead.”

EU leadership and collaboration

Rationalising his government’s approach to energy policy, Ryan says: “We are positioning ourselves as green, renewable, electrified, sustainable, and low carbon in everything. That fits in with the EU’s ideal, the Commission has shown real leadership. The renewable strategy is the Green New Deal, and we risk falling behind unless we are really strong on that because all the technology will otherwise all come from China and America.

Eamon Ryan TD, outlines Ireland’s place in the global energy transition and how he believes it will enable the State to be a major exporter of renewable energy.

8 renewable energy magazine

Minister Eamon Ryan TD: The

Minister for the Environment, Climate and Communications, Eamon Ryan TD

“Our whole political focus now is on doing it quickly. We have 20 pieces of legislation in the Fit for 55 agenda, we have got through 19 of them, meaning that they are all deliverable now through directives and regulations, so there will be no going back.

“The fundamental direction we are on is strong and set. It is a direction which I do not see changing, no matter who is in the next government in Ireland or who is in the next European Commission.”

Hydrogen challenges

Speaking shortly after the Government’s publication of the National Hydrogen Strategy, the Minister alludes to how green hydrogen will play a “vital role” in Ireland’s energy system, but also states that there are challenges “on the technological side” that mean the State remains “a while off” from successfully producing mass quantities of green hydrogen.

“There is loads of hydrogen being used at the moment, but it is fossil hydrogen. Switching to green hydrogen is going to be the real challenge. Everyone in the world is looking at it, particularly our colleagues in Britain and in Germany, but also in the United States and elsewhere.

“The scale of investment and the scale of commitment we are seeing globally gives me the certainty to say that this will definitely come.”

Speaking on the recently signed memorandum of understanding between Germany and Ireland on the development of hydrogen, the Minister says: “The German estimate is that

around 550 TWh will be needed by 2045, and one of the main sources for that will be from renewable power.

“We are talking about hundreds of GW, particularly from offshore wind. This is the sort of scale, along with solar, which will give us the capability of giving us the opportunity to produce hydrogen in such big numbers.

“We will have a surplus of renewable electricity by the end of this decade. But by the next decade, in 2035 and 2040, as we roll out solar and offshore wind at an even bigger scale, we will be converting that electricity surplus into hydrogen.”

In spite of his optimism for Ireland’s high amount of scope for development, Ryan cautions that “we need to be careful about some false narratives with hydrogen”.

“I do not think it is going to be at the distribution level. I do not see blending as the key into the system. It is going to be the intense, high-level, industrial uses which will be the first applications which will come,” he says.

Biomethane ‘tried and tested’

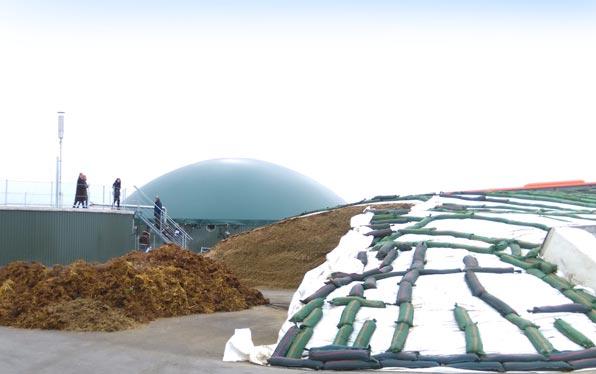

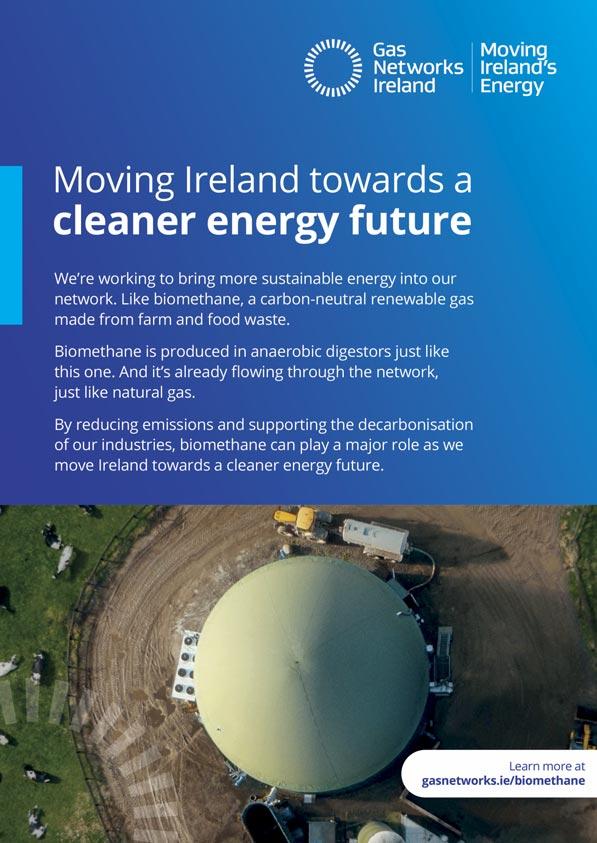

Although Minister Ryan believes that “we have to be willing to invest in both anaerobic digestion and hydrogen from the public sector to help overcome some of the initial capital hurdles,” he stipulates that biomethane is better understood and a more viable immediate term solution as it is “already tried and tested”. “Its problem is not around technology or application, it is about optimisation,” Ryan says.

9 renewable energy magazine 4

“The fundamental direction we are on is strong and set. It is a direction which I do not see changing, no matter who is in the next government in Ireland or who is in the next European Commission.”

With the Green Party leader confirming that the Government will soon be publishing its biomethane strategy, Ryan states: “We estimate that we can develop something like 5.7 TWh from biomethane by 2030.

“Our climate laws say we have to reduce emissions by 51 per cent by the end of this decade. We have seven more years, and we then have to go to net zero by 2050. That is a really challenging target.

“We will do this in two key fundamental ways. The first thing is that we reduce demand, reduce the use of gas dramatically as we have seen be done in Denmark. 85 per cent of our gas is going to power generation, to make the electricity and industrial use. 15 per cent is domestic. In that 85 per cent, it is going to be renewable electricity, onshore wind, offshore wind, solar, battery storage, and interconnection which powers our country by 2050.

“We will have a massive surplus; we will be interconnected with the UK and with

France, Spain, and the rest of the continent so that we have a balancing capability in the characteristics of the industrial revolution, balancing variable renewable power supply and variable demand.”

Changing the energy sector

Although Ryan views the development of biomethane and hydrogen as highly promising, he states that, in decarbonising industry, “all the lower heat demand sectors, such as dairy, will switch from fossil gas to heat pumps, rather than renewable gas”. “That takes out a good chunk of the 85 per cent which is used in power and industry. It is the area which remains that we can target to develop biomethane to meet our needs of a sustainable and industrial future.

“Reducing energy demand,” Ryan believes, is also key to ensuring that Ireland is enabled to reach its Climate Action Plan targets and complete its energy transition.

“The technology is leading us in this direction and solar and wind are cheaper and better, more secure, and it is going to take out the need for gas. In the short term, we will still need gas and we are producing an extra 2GW of gas in order to have the level of flexibility we need. By 2050, that gas will be gone as we switch to this new system. Similarly, industrial heat pumps have a key role to play because they are better technology, and they have 300 or 400 per cent gains in efficiency.”

Citing analysis by EirGrid, Ryan states: “On our existing plans, which we are going to deliver, 5GW of offshore wind will be delivered. This is already being done in the Irish Sea and in the west. It is coming.”

He adds: “Solar is already taking off, just as an example of this revolution, solar is taking off at a speed which nobody could have expected. By the end of this decade, we will have 13 TWh of surplus electricity that we will either have to spill or alter our demand system so that we are using power and using energy at the time when the surplus of renewable electricity exists.

“One of the real potentials is to convert it to hydrogen for use in a whole range of applications that will be the applications that are hard to reach with technology such as heat pumps, EVs, batteries, or other renewable electricity systems. There will still be a lot of that, we still want industry.”

Stating that the energy sector is “at the front line in addressing this climate crisis which is the greatest challenge of our time”, Ryan concludes: “We can provide prosperity and security for our people as we reach these solutions. It will not work by finger wagging, blaming, or telling the other person that they are the problem. It will work by switching to a better system; an energy system which is more secure because it relies on resources which are ubiquitous and which every country has access to, and which can be shared. A renewable system will give us security and prosperity.”

10 renewable energy magazine

Delivering the electricity network for Ireland’s clean electric future

strategy in January 2023, Managing Director of ESB Networks, Nicholas Tarrant, talks to David Whelan about the organisation’s central role in the energy transition.

12 cover story

“Our purpose in ESB Networks has always been to connect and distribute electricity safely and securely,” explains Tarrant. “But, by acknowledging the central role that electricity plays in climate action, our purpose has evolved to deliver a clean electric future through the electrification of heat, transport, and industry, as well as connecting renewable generation at scale to the electricity network.”

The Managing Director is speaking in the context of “stretching” targets set out in the Government’s Climate Action Plan 2023 (CAP23), which puts ESB Networks’ purpose at the centre of delivery of the sustainable social and economic development of communities, businesses, the country’s climate action response, and the transition to net zero.

As a commercial semi-state company regulated by the Commission for Regulation of Utilities (CRU), ESB Networks has responsibility for operating, maintaining, and building the distribution network as the electricity Distribution System Operator (DSO), Distribution Asset Owner (DAO), and onshore Transmission Asset Owner (TAO).

Tarrant explains that the new Networks for Net Zero strategy sets out ESB Networks’ role in enabling the delivery of CAP23 and supports the decarbonisation of electricity by 2040, key to the achievement of Ireland’s net zero ambition no later than 2050.

“Through our strategy, we are setting out a clear objective to develop a resilient electricity network that is flexible and smart, and will provide a foundation for a clean electric future in Ireland by 2040,” he states.

While the remit of ESB Networks in the decarbonisation of electricity generation, heat, and transport is large, the ambitions of the strategy are succinctly outlined within three core pillars of: decarbonised electricity; resilient infrastructure; and empowered customers.

Decarbonised electricity

Enhancing the role of electrification to decarbonise Ireland’s economy is reliant on a foundation of an electricity network that facilitates and distributes rising levels of renewable energy. In 2022, ESB Networks connected a record 688MW of wind and solar generation projects.

However, Tarrant explains that well in excess of that number will be needed

year on year, adding that ESB Networks is striving to play its part in the connection of 22GW of renewable generation by 2030.

“As the electricity system transitions towards a smarter, sustainable model, the operation and management of intermittent and renewable generation, coupled with new types of demand, will require a digital network that is both flexible and smart,” he states.

CAP23 sets out targets of 9GW of onshore wind, at least 5GW of offshore wind (including an additional 2GW of offshore wind for green hydrogen production), and 8GW of solar connected to the electricity system by 2030.

Highlighting the breadth of ESB Networks’ work in delivering a decarbonised electricity network for the future, the Managing Director points to its role in building the transmission projects onshore to facilitate offshore wind projects, and the increased connection of microgeneration. ESB Networks is also working to grow the electricity network to enable the expansion of electric public charging infrastructure to 20 times its current capacity in order to comply with EU regulations by 2030.

Outlining some of the successes to date, enabled by a 60 per cent rise in capital investment through the regulated price review for the period 2021 to 2025 (PR5), Tarrant says: “Last year, we connected a record 688MW of wind and solar projects to the network, however, significantly in excess of that will be needed every year out to 2030 if we are to make net zero a reality.

“We are also managing significant

growth of microgeneration. Currently, we have over 68,000 individual connections to rooftop solar, and those connections are growing at a rate of approximately 700 per week. In 2022, approximately 95MW was added to the network through projects classed as small-scale generation and below, (these are projects below 200 kW in size) which is a significant number when added to the 688MW also generated by large scale projects.

“This year, we expect to double that figure to reach 200MW, showing that we are managing the connection of microgeneration on rooftops right through to the large scale generation.

“To continue this progress, a growing programme of investment is needed to facilitate the increased connection of renewable generation to the network both on the transmission and distribution sides. In this regard, our upcoming Price Review 2026 to 2030 (PR6) is of critical importance, and we will continue to work with the CRU and our wide range of stakeholders to ensure continued momentum to achieve net zero.”

Resilient infrastructure

Ensuring that the electricity network has the capacity to connect and accommodate renewables, as well as serve the demand growth driven by projected population growth, and demand increase due to the electrification of heat, transport, and industry, is a key consideration for ESB Networks.

Tarrant explains that major investments are being made in network infrastructure at all voltage levels, 4

13 cover story

alongside the development of new tools and procedures to enable the use of new innovative technologies.

Key to managing these shifting demands is the building into the network of demand flexibility. The Networks for Net Zero strategy sets out a target for ESB Networks to manage 20 to 30 per cent of all electricity demand flexibly by 2030, with a 2025 target of 15 to 20 per cent, in line with CAP23. Tarrant points to the establishment in 2020 of the National Network, Local Connections (NN,LC) Programme, aimed at supporting the reduction in peak electricity demand and putting measures in place to improve electricity demand management, as key to future progress.

Outlining ESB Networks’ recognition that the continued partnership approach between the transmission and distribution system operator will be required to deliver an “optimal wholeof-system” solution, he explains: “As dependence on the electricity network increases, the quality, condition, and performance of the network will become increasingly important.

“We will continue to adapt and strengthen our network so that we can collectively transform our energy future and improve the resilience of the

network from the risk of extreme weather events and cyberattacks.”

The Networks for Net Zero strategy adopts a ‘build once for 2040’ concept, which Tarrant explains will see ESB Networks anticipate the needs of customers in 2040, and beyond, as electricity demand growth accelerates with the electrification of heat and transport. The proposed development of renewable hubs is set to explore advance build network reinforcements, increasing customer engagement to provide guidance on different pathways for connecting renewables.

Empowered customers

Tarrant stresses the importance of the design of Networks for Net Zero as a customer-centric strategy. Discussing the ‘empowered customers’ pillar, he says: “The way in which customers engage with the electricity network, and electricity in general, is changing rapidly, as shown by an uplift in the volume of people electrifying their transport, their heat, and availing of time-of-use tariffs.”

The public support for climate action is vital for this transition and Tarrant stresses the importance that ESB Networks delivers on the trust that has been placed upon it to connect, distribute, and build an electricity network that will meet future demand. This includes a target to connect up to

one million EVs and 680,000 heat pumps to the distribution system by 2030.

“Our commitment is to connect our 2.4 million customers with a great experience through proactive engagement, and by consciously placing their needs at the centre of everything we do,” he says.

“That also means enabling new opportunities for our customers to take part in the energy transition through selfgeneration and storage, demand management, energy efficiency opportunities, and selling electricity by exporting back onto the electricity network.”

Major progress in empowering consumers by ESB Networks can be seen in the roll-out of over 1.4 million smart meters to Irish homes through the National Smart Metering Programme, with Tarrant indicating a current instalment rate of some 10,000 per week.

“Alongside the instalment of meters, we have launched a new customer online account to enable customers to have access to their data, to be able to share it. The ESB Networks online account offers a range of digital services to empower customers with self-serve options such as applying for a new connection, finding their MPRN and learning about their energy consumption.

14 cover story

Economy

ESB Networks plays a large role in Ireland’s economic future. The organisation, which employs 3,600 people and has more than 1,000 Irish suppliers, invested €869 million in 2022 across all of its work programmes with the investment expected to grow to over €1 billion per year.

Alongside a key role in helping to deliver the Government’s energy policy ambitions, it is also a key enabler of other policies such as the Housing for All programme, facilitating a 36 per cent uplift in new connection requests in 2022.

Tarrant explains that ESB Networks is continuing with an intensive recruitment process of skills at all levels of the organisation, including the doubling of its apprenticeship intake to almost 100 in 2023, and the expansion of its contractor base.

On the challenges facing ESB Networks, Tarrant says: “We are coming from a good place in that there are very clear government targets set out in CAP23, and our ambitions were supported by an uplift in capital resources in PR5. For the second half of the decade, PR6 will be very important but we are already working to address those longer-term challenges we foresee, for example, through recruitment and ensuring we have the right skills to meet future demand.

“We are also working closely with our contract partners to ensure that they have sight of the long-term vision and can see the work programmes in front of them, which allows them to ensure they have the correct resources in place to deliver for the country.”

Nicholas Tarrant, Managing Director, ESB Networks

The Managing Director believes that proactively addressing future challenges will mean that ESB Networks, and ultimately, Ireland, will be able to stay ahead of the global competition for skills, resources, and supply chain.

“We know that change is happening at pace, and we are evolving our business processes, systems, and ways of working in anticipation of future network requirements,” he outlines.

Tarrant stresses the importance of ESB Networks’ flexibility and agility in the coming years to build resilience against any shocks, but also create space for new innovation and policy shifts. During PR5, major changes in policy, and therefore ESB Networks’ operating environment, included the EU’s REPowerEU strategy, the National Energy Security Framework, and CAP23. Praising the agile investment framework built into PR5, he expects a similar measure to be utilised in the

second half of the decade to enable ESB Networks to best meet the needs of customers in a dynamic environment. Concluding with his vision for what the success of the Networks for Net Zero strategy looks like, he says: “We must deliver, each year, on our commitments to make net zero a reality for the country. However, in a changing environment, we must also have the ability to be flexible. What is fundamental to our history as a company and for our future is customer service, and our aim is to support and enable customers to make this transition by delivering the electricity network for everyone’s clean electric future.

“Ultimately, for the transition to a net zero society no later than 2050, we need to ensure a net zero ready distribution network by 2040,” he states.

Profile: Nicholas Tarrant

Nicholas Tarrant was appointed Managing Director of ESB Networks in September 2021. Prior to this, he held the positions of Executive Director, Engineering and Major Projects and Managing Director, NIE Networks. He has held a number of senior management positions including Generation Manager with responsibility for ESB’s generation portfolio. He is a chartered engineer at the Institute of Engineers of Ireland, a Chartered Director and holds an MSc (management) from Trinity College Dublin (TCD).

15 cover story

“We know that change is happening at pace, and we are evolving our business processes, systems, and ways of working in anticipation of future network requirements.”

The impact of planning and regulatory delays

Economic and Social Research Institute (ESRI) Senior Research Officer Muireann Lynch discusses the cost of planning and regulatory delays for the energy system.

Contextualising her research, Lynch explains that the idea for the ESRI’s paper investigating the cost of planning and regulatory delays for the energy system was stakeholders querying losses incurred in the time it takes to get energy projects connected to the grid and generating power. Lynch and her colleagues analysed electric renewable energy (RES-E) projects due to such projects being a “major pillar of energy policy, both in terms of decarbonisation and of increasing security and affordability”.

16 renewable energy magazine

“RES-E projects face various planning and regulatory hurdles; you have to get over various jumps before you finally get your project onstream,” Lynch says. “Once you have got your planning permission, you are looking for grid connection, once you have that, you are often looking for subsidy support. The literature would suggest that delays impact on delivery and these issues are not unique to Ireland. Furthermore, there is anecdotal evidence of delays in the Irish system in terms of getting projects delivered.

“On that basis, we had a couple of research questions: what impact do the delays and regulatory setup have on delivery timelines? What are the knock-on impacts on the power system?”

The roles of various organisations had to be factored into this research, as Lynch explains. Firstly, planning permission must be obtained through the relevant local authority and/or An Bord Pleanála. The planning authorisation cycle is continuous, with a targeted decision time frame of 18 weeks, although the average time frame is 37 weeks. Grid connection is governed by EirGrid and ESB Networks, with a yearly authorisation cycle requiring applicants to enter in September of every year and a decision time frame of 12 to 15 months. Generation licenses and authorisations to construct are granted in a continuous cycle by CRU. The RESS scheme operated by the Department of the Environment, Climate and Communications makes yearly awards with a decision time frame of three months, and the Department of Housing, Local Government and Heritage’s authorisation cycle for foreshore licensing and leasing is continuous, with a decision time frame of 18 weeks.

“We want to consider the impact of these decisions being made faster if the time to get planning permission was reduced and also if there were an increased number of opportunities to apply for grid connection and RESS,” Lynch says, explaining the terms of the research. “We are going to track 2,000MW of approved capacity that will eventually overcome these hurdles and get built. The only question here is when this capacity will get on the grid, not if it will.”

Accordingly, the ESRI constructed a number of scenarios (as seen in Figure 1), where various possibilities were considered, such as the reduction of planning decision time to 25 weeks and the targeted 18 weeks, and increases in both RESS and grid offer opportunities per year from one to two.

“This is a linear least cost optimisation model which determines the socially optimal generation and transmission expansion assuming a benevolent social planner with

“These delays are not costless, they are having power system impacts. Increasing the number of opportunities and reducing An Bord Pleanála’s timelines would both be helpful.”

17 renewable energy magazine 4

Muireann Lynch, Senior Research Officer, Economic and Social Research Institute

perfect foresight,” Lynch says, surveying the results of the scenarios examined (see Figure 2 and Figure 3). “Years one, two, and three see nothing built in any model, and in year four there was no difference between them. From years five, six, seven, and eight, we were seeing up to a 3.3 per cent decrease in system costs just from those 2,000MW getting on those few years earlier.

The research shows a possible reduction of up to 4.2 per cent in CO2 emissions with the capacity being installed in year five, a possibility made all the more important, Lynch says, “now that we are in the era of carbon budgets” due to the fact that “if you get that the 2,000MW on by year eight, you still have the extra cumulative emissions from the power system in the meantime”.

It is on price where the biggest impacts of these imagined reforms would be felt, with a decrease in marginal price of 9.9 per cent with the capacity delivered in year five and 7.3 per cent if it were to be delivered in year six. “There is a big impact on the difference in price getting those megawatts on those few years earlier. That can make an impact on marginal prices,” Lynch says, before offering another key footnote: “All of this was run pre-the Ukraine crisis, so if we were to re-run this under the higher fuel prices we see now, we would expect the price decreases to be bigger again.”

Planning delays undoubtedly have an impact on RES-E rollout, Lynch says, and by providing further resourcing for An Bord Pleanála and/or allowing more opportunities per year to apply for grid connections and RESS, the process can be sped up “considerably”.

Concluding, Lynch states that taking on either approach would tackle the costs and increased emissions incurred by such delays: “What I was surprised at was the impact of those delays on the costs, emissions, and particularly prices. These delays are not costless, they are having power system impacts. Increasing the number of opportunities and reducing An Bord Pleanála’s timelines would both be helpful.”

18 renewable energy magazine

Y4 Y5 Y6 Y7 Y8 System cost 0.0% 0.3% -3.2% -3.3% -0.6% CO2 emissions 0.0% -4.2% -3.4% -1.0% 0.0% Marginal price 0.0% -9.9% -7.3% -0.6% 0.0% Status quo ABP#1 ABP#2 Grid offer Hybrid RESS Combined Weeks to ABP decision 37 25 18 37 37 37 18 Grid offers per year 1 1 1 2 n/a 1 2 RESS offers per year 1 1 1 1 1 2 2 Hybrid No No No No Yes No No Status quo ABP#1 ABP#2 Grid offer Hybrid RESS Combined Year four 0 0 0 0 <1% 0 0 Year five <1% <1% 17% <1% 75% <1% 58% Year six 50% 56% 75% 59% 100% 75% 100% Year seven 92% 95% 100% 100% 100% 100% 100% Year eight 100% 100% 100% 100% 100% 100% 100%

Figure 1: Scenarios

Figure 2: Percentage of 2,000MW installed per scenario

Figure 3: Results per year of installation of 2,000MW

YOUR LEGAL PARTNER Whether you’re interested in wind energy (onshore or offshore), solar PV, green hydrogen or energy storage, Beauchamps has the experience to help you get your project over the line. IN RENEWABLE ENERGY Beauchamps LLP | Riverside Two | Sir John Rogerson’s Quay | Dublin 2 | D02 KV60 beauchamps.ie Get in touch: Ainsley Heffernan | Partner and Head of Energy & Natural Resources T: +353 (0)1 4180600 | a.heffernan@beauchamps.ie beauchamps ReNews Engergy fp ad indd 1 26/06/2023 15:01

Secure, clean, and affordable energy for Europe

While many may now associate the relative urgency on display in energy regulation with the Russian invasion of Ukraine in February 2022, Howes points out that Brussels’ response to the European energy crisis began with its issuance of an energy prices toolbox in October 2021 in response to rising electricity prices. 2022 then saw the invasion and the response of the European institutions, which included the publication of REPowerEU, the proposal of the gas storage regulation, amendments to the Fit for 55 plan, emergency measures on high electricity prices, high gas prices, RES permitting, and an emergency market correction mechanism.

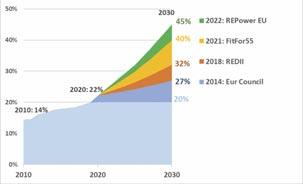

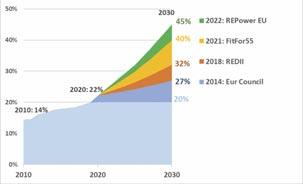

“For me, the important message is that there is lots coming out; existing laws and targets, and priorities that may change from time to time, but the direction of travel is clear and constant,” Howes says. “We get more ambitious, the targets go up

and there is more money to be spent, but the direction of travel is the same.

“We have had Fit for 55, where we ratcheted up the targets and there are a lot of supplementary sub policies that are meant to support that, whether it is on the planning, innovation, or technology sides. Then, there is the EU money that is flowing; I think there have never been more pots of money available for supporting different dimensions of energy technology development, whether that is technical support to help local councils or others implement and understand the laws and process permits, or investment finance through the EIB or the EBRD. That is just the starting point.”

Along with Fit for 55, REPowerEU is the blueprint for the future of securing a clean, secure, and affordability energy supply for Europe. Formulated in the immediate aftermath of the Russian invasion, it aims

20 renewable energy magazine

Tom Howes, advisor on the green energy transition and energy market regulation for the European Commission, discusses measures taken and further measures to come to ensure Europe’s energy is clean, secure, and affordable.

to wean Europe permanently off reliance on Russia for energy supply. Due to the emergency nature of Europe’s response to the invasion, Howes explains that the plan contains both short-term measures, such as “going around the world for every bit of LNG we can possibly find”, and longterm ones, such as “speeding up the rollout of renewables, heat pumps, wind projects, and ratcheting up legislative ambitions with our targets”.

As Howes explains, gas market volatility also reached into the electricity market, creating another area where the European Commission would have to intervene: “There was a feeling that the electricity market that has given us these unacceptably high price spikes is not coping with this kind of crisis. That is why there is now an initiative to review electricity market design. Consultations around that are picking up different things; on the one hand, the spot market is working is as it should be, but everyone feels that there has been too much exposure to the marginal price and to gas playing a price-setting role at a time when gas prices are ridiculously high.

“There is a desire to make more of the longer-term markets, so we are exploring what we can do to make more use of Contracts for Difference, power purchase agreements, and hedging requirements so that these price spikes do not take everyone unaware in the future or cause the havoc that they did in 2022. We are looking at the prudential requirements for suppliers, for instance, in terms of changing strategies there so that suppliers do not suddenly go bankrupt, as has happened, as a result of being too exposed to the price spikes.”

Renewables Directive

In June 2023, political agreement was reached in Brussels on a revision of the Renewable Energy Directive, which saw the EU’s legally binding renewable energy target increase to a minimum of 42.5 per cent. Provisions included within the legislation also include the uncontroversial speeding up of permitting procedures. Under the revised directive, member states will be

Evolution of RE targets for 2030

required to introduce several measures that guarantee the speeding up of permitting processes for renewable energy projects.

“Nobody feels comfortable that the permitting process is fast enough, simple enough, or risk-free enough,” Howes says. “This is being amended in the Renewables Directive and we also introduced short-term emergency legislation to speed up the process. We are trying to make the application of EU environmental legislation easier by creating go-to areas, where you do not need to go through all the particular steps for a particular project and you can group assessments.

“The message is that EU policies and measures are all going in the same direction. Stakeholders thought they had investment opportunities under the 2020 targets, and they delivered. Targets have become more ambitious, which will hopefully mean more

investment opportunities, greater familiarity with the processes, and that it is becoming easier to invest.”

Concluding, Howes once again emphasises the need for coherence in planning and the importance of the message remaining the same: “We have got billions in the Recovery and Resilience Fund available to member states, but we have to make sure that these are consistent with each country’s own reform plans and the way they see things evolving. There is a need to continue to ensure complete coherence with the things we are pushing at the EU level and how that works out in each country.

“The direction of travel does not change. We do not want to bring surprises when we bring changes. We are making things better to address the problems stakeholders raise, to deliver the Green Deal for Europeans.”

21 renewable energy magazine

“We get more ambitious, the targets go up and there is more money to be spent, but the direction of travel is the same.”

Brown to Green: Climate solution expansion

In line with its Brown to Green transition strategy, Bord na Móna is fully committed to the continued expansion of its climate solutions and renewable energy portfolio. As we decarbonise industry, transport, and electricity production, our consumption of fossil fuel needs to be reduced and replaced by renewable energy as much as possible.

This will be best achieved by engaging in a multi-faceted approach that involves investing in, and developing, several renewable energy sources. Bord na Móna exemplifies this approach with its involvement in several important projects, centred around green hydrogen, offshore and onshore wind farms, solar farms and flexible technology.

Wind energy

Bord na Móna made significant progress over the past 12 months with €100 million invested in the expansion of its renewable energy offering, including wholly owned developments as well as joint venture projects. Wind energy milestones included the construction of the Cloncreen Wind Farm and the Oweninny Wind Farm, which is a joint venture with the ESB, as well as the commencement of work at the Derrinlough Wind Farm. These wind projects collectively represent an overall investment of €250 million. Bord na Móna also launched a joint venture with Ocean Winds to develop its first offshore wind farms around the coast of Ireland. The joint venture aims to generate up to 2.3GW of renewable electricity to power up to 2.1 million homes.

Another one of Bord na Móna’s latest onshore developments is the 105MW Derrinlough Wind Farm and the 110 kV Substation project. The site, comprising two bogs, Clongawny and Drinagh, exemplifies how Bord na Móna is transitioning from fossil fuels and peat production to sustainable energy. Comprising of 21 wind turbines with a total capacity of 105MW, the wind farm harnesses the power of nature’s resources to provide sustainable electricity for Irish communities.

Solar

An additional milestone in Bord na Móna’s renewable pipeline was announced in July 2023; Bord na Móna and its project partners ESB commenced construction of a new solar

Bord na Móna is a climate solutions and renewable energy company playing a pivotal role in the achievement of Ireland’s ambitious climate goals.

22 renewable energy magazine

farm at Timahoe North, County Kildare, as part of a wider solar energy joint venture between the two companies.

Timahoe North will be the first largescale solar project that both Bord na Móna and the ESB will bring to fruition as part of their respective renewable energy portfolios. It is expected that Timohoe North Solar Farm will be fully operational by the end of 2024, with an installed capacity of 108MW of renewable energy to the national grid.

This is enough energy to power around 25,000 homes, which will support the delivery of more green energy to communities and businesses across the country in line with Ireland’s renewable energy targets for 2030. The Timahoe North Solar Farm is part of a significant co-development agreement between Bord na Móna and the ESB to develop solar power across four midlands locations in Kildare, Offaly, and Roscommon. The joint venture will collectively deliver up to 500MW of power from solar farms based on Bord na Móna lands.

Green hydrogen

In summer 2023, Bord na Móna announced the development of a new 2MW pilot scale hydrogen electrolysis plant in Mount Lucas, County Offaly, having secured planning permission from Offaly County Council. Once operational, the new plant will generate over 200,000 kilograms of green hydrogen per annum.

This green energy produced at the Mount Lucas site will be used to help decarbonise certain elements of our national transport sector and will produce enough green energy every year to replace over half a million litres of diesel. The plant at Mount Lucas is part of the first phase of Bord na Móna’s overall hydrogen development strategy with construction set to commence in 2024, and production to begin by 2025. This project is the first of its kind in Ireland and an important step for the green hydrogen industry, as it will support the achievement of our national target of 2GW of green hydrogen energy by 2030.

In numbers…

Bord na Móna recently announced record financial results in its 2023 Annual Report, an outcome of a record performance across most areas of the business but driven particularly by Bord na Móna’s renewable energy portfolio which grew by 35 per cent in FY23 versus the previous year – including Cloncreen and Oweninny Wind Farms (both RESS 1 projects) which

collectively delivered an additional 175MW of electricity over the past 12 months. In line with these renewable energy projects, the company continues to invest in accompanying local community benefit schemes.

The ongoing expansion of Bord na Móna’s renewable energy portfolio not only aligns with Ireland’s climate action plan and its 2030 carbon emissions targets but also represents a significant milestone in the company’s transition from brown to green energy.

This underscores Bord na Móna’s dedication to further broadening its array of renewable energy and climate solutions initiatives into the future.

T: +353 45 439 000

W: www.bordnamona.ie

23 renewable energy magazine

“The ongoing expansion of Bord na Móna’s renewable energy portfolio not only aligns with Ireland’s climate action plan and its 2030 carbon emissions targets but also represents a significant milestone in the company’s transition from brown to green energy.”

Published in July 2023, the National Hydrogen Strategy is the Government’s first major policy statement on renewable hydrogen and is aimed at increasing certainty and reducing commercial risk to drive private sector investment.

The strategy explores the opportunity for Ireland, hydrogen production, enduses, transportation, storage, and infrastructure, alongside safety and regulation, research, cooperation, and scaling. In addition, it determines Ireland’s strategic hydrogen development timeline, seeking to “provide clarity on the sequencing of future actions needed and guide our [the Government’s] work over the coming months and years”.

Outlining the rationale for developing an indigenous hydrogen sector in Ireland, the National Hydrogen Strategy identifies three primary policy drivers:

1. Decarbonising the economy

Ireland requires a radical transformation of its entire economy if it is to achieve net zero emissions no later than 2050. Indigenously produced renewable or green hydrogen can play a significant role in this transformation, with its potential to be a zero-carbon alternative to fossil fuels in hard to abate sectors of the economy. This includes those in which electrification is unfeasible or inefficient.

National Hydrogen Strategy published

Long awaited by many in the energy sector, the National Hydrogen Strategy was launched by Minister for the Environment, Climate and Communications and Minister for Transport, Eamon Ryan TD, aboard a hydrogen-fuel-cellelectric double-deck bus.

2. Enhancing energy security

Ireland imports around three-quarters of its energy supply annually. However, by harnessing one of the world’s best offshore renewable energy resources and using the surplus to produce renewable hydrogen, Ireland has an opportunity to reduce reliance and potentially achieve energy independence. While fossil fuels are utilised as a backup to renewable energy sources, renewable hydrogen could become a zero-carbon replacement. As per the National Energy Security Framework, hydrogen is highly energy dense and, therefore, suited to the development of seasonal storage solutions at scale, helping to mitigate variability and seasonal demand.

3. Creating industrial and export market opportunities

In the long term, Ireland has the potential to produce excess renewable energy, including hydrogen. At the same time, many European countries have identified a long-term demand for renewable carbon imports to meet decarbonisation ambitions. As such, the establishment of an export market could be beneficial to the domestic development of renewable hydrogen.

In the short term, the National Hydrogen Strategy establishes a series of actions aimed at enabling the development of Ireland’s hydrogen industry. The strategy

aims to removal obstacles which could inhibit hydrogen projects while enhancing knowledge through targeted research and innovation.

Established in 2020, the Interdepartmental Hydrogen Working Group is tasked with monitoring the delivery of these actions, while identifying further actions to support progress as the sector evolves.

Combining long-term ambitions with 21 short-term actions, the National Hydrogen Strategy aims to:

• kickstart and scale up renewable hydrogen production;

• identify end use sectors, supply chains, and required quantities;

• determine what infrastructure is needed;

• ensure the implementation of rules around safety, sustainability, and markets; and

• establish conditions which foster continued technological advancement and innovation.

Minister

In his foreword to the National Hydrogen Strategy, Minister Ryan asserts that, alongside other decarbonised gases, renewable or green hydrogen will have a key role to play in Ireland’s energy transition. Describing hydrogen as a “major opportunity for Ireland”, he contends: “It provides the potential for long-duration energy storage,

24

Prepared bythe Departmentofthe Environment, Climate andCommunica ons www.gov.ie 4 24 renewable energy magazine

Hydrogen Strategy

Actions to be delivered through the implementation of the National Hydrogen Strategy

1 Develop and publish data sets showing the likely locations, volumes, and load profile of surplus renewables on the electricity grid up to 2030.

2 Establish an initial hydrogen innovation fund to provide co-funding supports for demonstration projects across the hydrogen value chain.

3 Adopt EU standards for renewable and low carbon hydrogen and develop a national certification scheme to provide end users with clarity as to the origin and sustainability of hydrogen.

4 Develop the commercial business models to support the scaling and development of renewable hydrogen, via surplus renewable electricity until 2030 and an initial 2GW of offshore wind from 2030.

5 Develop a roadmap to bring net zero dispatchable power solutions to market by 2030, supporting the establishment of a near net zero energy system by 2035.

6 Assess the role that integrated energy parks could play in the future energy system, including potential benefits and barriers.

7 Publish the draft National Policy Framework on Alternative Fuels Infrastructure and support the roll-out of hydrogen fuelled heavy vehicles and refuelling infrastructure as per the recast Renewable Energy Directive and Alternative Fuel Infrastructure Regulation.

8 Assess the feasible potential for end uses such as eFuels, decarbonised manufacturing, and export via the development of a National Industrial Strategy for Offshore Wind.

9 Determine the quantities and profile of zero carbon long duration energy storage required up to 2050 and develop a roadmap for its delivery.

10 Review the existing licensing and regulatory regimes relevant to the geological storage of hydrogen, progress the necessary legislative changes, and develop regulatory regimes to facilitate future prospecting and development of underground hydrogen storage solutions.

11 Continue to prove the technical capabilities of the gas network to transport hydrogen while working closely with network operators in neighbouring jurisdictions in respect to interoperability between the networks.

12 Develop a plan for transitioning the gas network to hydrogen, duly considering plans to develop a biomethane sector in Ireland; the prioritisation of end uses set out in the National Hydrogen Strategy and their likely locations where known; the need to maintain energy security through the transition; how existing end users can transition from natural gas to hydrogen or alternative energy solutions such as electric heating; and the potential use of hydrogen blends during a transition phase, associated costs, and how the transition from blending can occur.

The plan should look to identify where the network can be repurposed, or where new pipelines may be required, providing detailed costings and a programme of works.

13 Identify and support the development of strategic hydrogen clusters.

14 Review current approaches to energy systems planning and make recommendations to support a more integrated long-term approach across the network operators.

15 Establish a working group comprising relevant regulators, government, and industry representatives to develop a roadmap for delivering the necessary safety frameworks and regulatory regimes across the entire hydrogen value chain.

16 Adopt the hydrogen and decarbonised gases market package into legislation once approved by the EU.

17 Review the entire hydrogen value chain to identify any gaps within the spatial planning, environmental permitting, and licensing regimes.

18 Engage with Ireland’s research sector to ensure sufficient focus is given to renewable hydrogen development and commission relevant research to help close the knowledge gaps identified throughout the National Hydrogen Strategy.

19 Continue engagement in EU hydrogen related initiatives and develop cooperation in renewable hydrogen development with neighbouring jurisdictions and international partners.

20 Continue to assess, and support the future skill needs of the offshore wind and renewable hydrogen sectors via the expert advisory group on skills established under the Offshore Wind Delivery Task force.

21 Review and update the terms of reference of the Interdepartmental Hydrogen Working Group in recognition of its role in oversight and implementation of the National Hydrogen Strategy.

2023-2024

2023-2027

2023-2025

2023-2030

2024-2026

2023-2025

2024-2030

2024-2026

2024-2026

2024-2028

2023-2028

2023-2026

2024-2026

2024-2026

2024-2026

2024-2027

2024-2026

2024-ongoing

2024-ongoing

2023-ongoing

2023-2024

Number: Action: Timeline:

25 renewable energy magazine

dispatchable renewable electricity, the decarbonisation of some parts of hightemperature processing, as well as a potential export market opportunity.”

However, the Minister makes clear that the deployment of hydrogen technologies must be optimised to deliver the most efficient or advantageous solution.

“Hydrogen provides us with an incredible opportunity in Ireland, but its use must be targeted to the uses where it will deliver the greatest benefits. We must not become distracted by the possibility to deploying hydrogen technologies where direct electrification would deliver a better outcome,” he writes.

End-uses

Renewable hydrogen deployment, the new strategy asserts, will centre on hard-to-abate sectors where direct electrification and energy efficiency measures are unfeasible or cost ineffective. Meanwhile, heavy transport applications bound by EU targets for 2030 are expected to be the first end-use sectors to emerge, quickly followed by industry and flexible generation.

While identified as significant highpriority end-users, the aviation and maritime sectors will take longer to develop. Indeed, given the uncertainties which exist in demand projections, it is thought that domestic hydrogen demand could range between 4.6 TWh and 39 TWh by 2050, increasing to 19.8 TWh and 74.6 TWh when including non-domestic energy needs such as international aviation and shipping.

Consequently, more research is required to determine a better understanding of the potential demand of end-use sectors, as well as the role that renewable hydrogen will play in an integrated net zero energy system.

In order of priority, the strategy lists 11 envisioned hydrogen end-uses:

1. Existing hydrogen end-users: Renewable hydrogen will replace niche grey hydrogen uses with a likely market entry timeframe of 2025-2030.

2. Flexible power generation and long duration energy storage: Net zero flexible backup generation and long duration energy storage with a likely market entry timeframe of 2030-2035.

3. Integrated energy parks for large energy users: As a backup to renewable electricity to meet reliability needs with a likely market entry timeframe of 2025-2030.

4. Industrial heat and processing: For high temperature heating and processing needs with a likely market entry timeframe of 20302035.

5. Aviation: As a zero-carbon synthetic fuel alternative to jet fuel with a likely market entry timeframe of 2035-2040.

6. Maritime: As a zero-carbon fuel (e.g. ammonia) with a likely market entry timeframe of 2035-2040.

7. Road and rail transport: For longrange road transport requiring long duty cycles and rail where electrification is unfeasible with a likely market entry timeframe of 2025-2030.

8. New non-energy uses: Such as fertiliser production and other chemical processes not currently undertaken in Ireland.

9. Export: Renewable hydrogen production exceeding domestic demand with a likely market entry timeframe of 2035-2040.

10. Blending: As a mitigation solution for end use variability and excess production with a likely market entry timeframe of 2023-2030.

11. Commercial and residential heating: In niche areas where electrification is unfeasible with a

Hydrogen explainer

likely market entry timeframe of 2035-2040.

Blending

Acknowledging a Gas Networks Ireland technical and safety feasibility study that determined transporting blends of hydrogen and natural gas via the gas network was both safe and feasible, the strategy recognises that “blending may offer an initial demand sink in the short term”. Notably, however, it concludes:

“Overall, blending is not seen as a high priority end-use for renewable hydrogen.”

Commercial and residential heating

Similarly, the strategy indicates:

“Hydrogen is not expected to play a role in commercial and residential space heating.” Rather, a combination of energy efficiency measures, direct electrification via heat pumps, and district heating are identified as “more efficient and cost-effective solutions” for the commercial and residential heat sector. Overall, the strategy contends that hydrogen will play a role in a small number of niche end use cases in commercial and residential heating which will “likely be required to work in parallel with energy efficiency measures such as hybrid heating systems where possible”.

Transportation, storage, and infrastructure

Ahead of hydrogen pipelines becoming the dominant mode of transportation, early hydrogen applications are anticipated to employ compressed

Hydrogen is most commonly chemically bonded to other elements, especially water (H2O) and hydrocarbons (CxHx). Hydrogen production relies on the chemical bonds between elements such as water to be broken, and the hydrogen separated and stored. This process requires an energy input, usually electricity or heat, the source of which, allied to the resulting byproducts, determines the carbon intensity of the production process.

Globally, most hydrogen is currently produced using hydrocarbons and in the absence of emissions abatement of the carbon byproduct. Grey hydrogen production is carbon intensive and unsustainable.

Electrolysis of water utilises electricity to split the molecule into hydrogen with oxygen as the byproduct. If the electricity used is generated via a renewable source, such as offshore wind, the resulting high purity hydrogen has no associated emissions and is therefore renewable or ‘green’ hydrogen.

26 renewable energy magazine

tankering solutions. Initial infrastructure is expected to be concentrated in regional clusters with co-located production, high priority demand, and large-scale storage. Subsequently, as the hydrogen market matures, these clusters will be linked in a national hydrogen network, repurposing existing natural gas pipeline infrastructure where feasible.

To date, the gas network has proven technical capability to transport hydrogen blends of up to 100 per cent. However, the strategy suggests that more work must be undertaken to better understand “the costs, phasing of transition, and potential impacts for existing network users”.

Meanwhile, long duration storage via geological solutions will be essential to ensure the cost effectiveness and price resilience of hydrogen supply.

Simultaneously, allied with network infrastructure, storage will be crucial in ensuring security of supply. Commercial ports, interconnection, and import/export routes will be vital to the establishment of a hydrogen economy in Ireland, and the longterm planning must identify the infrastructure requirements of an integrated net zero energy system.

Long-term vision

Recognising, that renewable hydrogen is a nascent technology with much uncertainty around costs, end-uses, infrastructure, skills, and supply chains, the National Hydrogen Strategy seeks to provide a long-term vision for hydrogen in the Irish economy.

Ultimately, the strategy outlines, the proportion of onshore and offshore renewable energy dedicated to the production of renewable hydrogen “will eventually be determined by the market”. Though the delivery of sufficient renewable energy to both meet indigenous demand and enable export opportunities hinges on optimising the offshore renewable energy potential.

Commentary

Broadly welcomed by academia and industry alike, the Renewable Energy Magazine spoke with several of Ireland’s hydrogen experts to gauge their reactions to the National Hydrogen Strategy.

Rory Monaghan, lecturer of mechanical engineering, College of Engineering and Informatics, University of Galway:

“Overall, the published hydrogen strategy is a great start. It delivered much more than I thought it would. The drafters really took the results of the public consultation seriously and have produced a very impressive document.

“Of particular note are the identification of end-use sectors and realistic timelines for hydrogen deployment in them. I am very happy to see heavy duty transport and public transport feature.

“The key next step for the sector is for the demo project fund to get established as quickly as possible so it can start dispersing support for projects. The commercial and research communities are ready to go.”

James Carton, assistant professor in sustainable energy, Dublin City University:

“Speaking with colleagues, we are quite impressed by the strategy. It is a nice piece of work. Both nationally and internationally, it has been well received. I have received positive feedback from my colleagues in academic, the public sector, and the private sector across Europe, the UK, and Ireland.

“It is a good document that sets out what Ireland is doing well, and that the interest mainly lies in hydrogen production and integrating it with renewable energy. It allows casts a light on some gaps which exist. One of the big gaps that it has identified is in end-use.

“There is a list of 21 actions, and each is very good; they all need to be actioned by the relevant bodies. Meanwhile, the Government has explicitly said that it is going to undertake pilots to learn, upskill, cultivate the knowledge and experience in the industry before building more larger scale projects.

“Government must quickly action the early points made in the action list of the National Hydrogen Strategy, while in parallel get going on ticking off these pilot projects so that we can enhance our experience and knowledge.”

Gillian Kinsella, co-chair of the policy and advocacy working group, Hydrogen Ireland:

“Hydrogen Ireland welcomes [the] release of the Government’s Hydrogen Strategy. The strategy marks a key milestone in the development of a green hydrogen sector in Ireland, one which can enable investment, increase skills and support regionally balanced economic growth. We look forward to supporting the implementation of the strategy in future to aid Ireland’s transition to a secure, net zero economy.”

27 renewable energy magazine

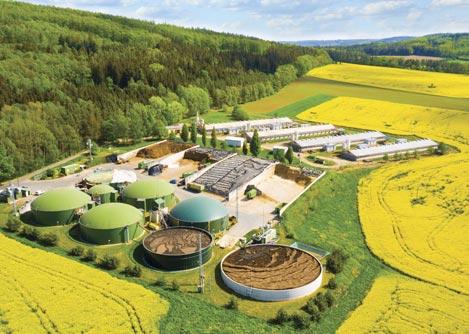

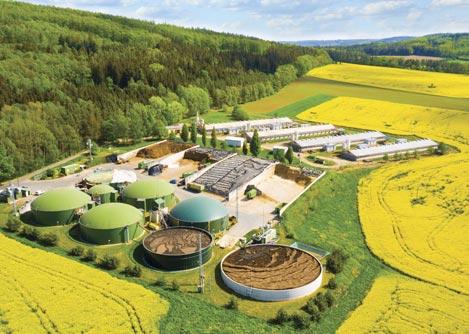

The biomethane opportunity in Ireland

KPMG hosted a round table discussion with key stakeholders to discuss the opportunity of developing a biomethane industry in Ireland.

What are the most significant benefits of establishing a biomethane sector in Ireland?

Ciara

Beausang

The SEAI National Heat Study assessed that around 80 per cent of the potential feedstock for biomethane would come from agriculture, signifying how important the sector is to that 5.7 TWh by 2030 target. The benefits are the opportunities for farmers to decarbonise, to diversify through anaerobic digestion, and realise alternative land use opportunities.

David Kelly

One of the major benefits of biomethane, which has really emerged in the last 18 months, is security of

supply, because it represents an opportunity to reduce our reliance on UK imported gas and give us greater certainty around gas supply. On the consumer side, biomethane is a relatively low cost solution because its similar make up to natural gas means little-to-no change to infrastructure and existing plant, while creating a pathway to the longer-term use of green hydrogen. Finally, Gas Networks Ireland’s recently published Biomethane Energy Report highlighted a large awareness of the local economy benefits of anaerobic digestion plant building, and an appetite to drive economic growth.

Russell

Smyth

What is so compelling about biomethane as an energy vector is its potential to align with so many national policy objectives which can deliver positive benefit. While security of supply benefit has only really emerged in the last number of years, there are a host of other benefits such as the decarbonisation of agriculture, the reduction in fertiliser usage, and the economic stimulus potential, for example. It is a tool that we can use to

drive so many other policy initiatives across the country.

Bill Callanan