PREPARE

Abraham Lincoln once said, “Give me six hours to chop down a tree and I will spend the first four sharpening the axe.” This quote speaks volumes about the important role that preparation plays in our ability to achieve desired outcomes. Like Mr. Lincoln, farmers and ranchers can be proactive in how they approach their situation.

Winter is commonly seen as a season of preparation in agriculture. Now is a great time to reflect on the previous year and build a plan for 2023 and beyond. After all, the plans you make today matter.

Today’s world is filled with uncertainty. Concerns over inflation and interest rates are common. The threat of poor weather is an annual factor. A plan will not eliminate these challenges, but it will help you mitigate them.

One area to keep in mind are the resources available to you. AgCountry Farm Credit Services is one of those resources. We are dedicated to serving agriculture and rural America. As a cooperative, our member-owners are at the heart of everything we do. When you succeed, we succeed.

The reason we can and do serve as a valuable resource for farmers and ranchers is the highly qualified team we have assembled at AgCountry. Our staff is here to help you solve financial issues that come your way. Our team members specialize in all aspects of agriculture and rural life.

If you are looking to mitigate against weather-related risks, contact one of our insurance specialists. If you are exploring ways at restructuring your balance sheet, our loan officers can offer solutions based on your unique situation. If you have thoughts

of transitioning the farm to the next generation but don’t know where to start, our Succession and Retirement team is a call or click away. Ensuring your records are fully prepared and accurate is critical, which is why our Tax and Farm Accounting teams are here for you. When you need us, we will be ready to assist you.

There are other ways in which we serve as a resource in your planning. Education is an important tool to have as you prepare for 2023. We offer seminars and events that are free of charge. I encourage you to attend an AgFocus meeting this winter and learn from our knowledgeable staff. In addition to attending an event, we produce a host of helpful information that is made available through our website, our podcast, or this very magazine.

In keeping with the prepare theme, we are actively preparing for our patronage announcement. We take great pride in upholding the cooperative spirit by celebrating success with our member-owners. Please know we are doing everything within our control to manage interest rates and minimize the impacts of this rising interest rate environment on your business. Be sure to keep an eye out for that announcement in the coming weeks.

I wish each of you a merry Christmas and happy New Year. Thank you for your continued patronage of AgCountry.

Marc Knisely, CEO

Strategies for managing an operation’s overall interest expense in today’s economic and financial environment may be unfamiliar territory for young or new farmers and ranchers. Producers with experience in managing the cost of credit during uncertain times know to look to their cooperative for solutions.

The power of a financial cooperative can be derived from its ability to help operations manage expenses while navigating rising interest rates, volatile input prices, and challenges with unpredictable weather patterns. Today that means leveraging your cooperative, its resources, and the AgCountry team to help limit the disruption of rising interest rates to your operation.

The Federal Reserve has raised its interest rates again, and we want to ensure you are aware of what your cooperative is doing to help, and what tools you have available to you. We believe that if we can help farmers succeed – our cooperative will continue to grow and be here to assist future generations. The AgCountry team is committed to helping our customers manage overall interest expenses by leveraging the power of the cooperative through the following solutions:

> Absorbing a Portion of Federal Interest Rate Increases

> Supporting Young or Beginning Producers with the Starting Gate Program

> Awarding Cash Dividends with an Annual Goal of 1% Patronage*

In November, the Fed Funds rate increased by 0.75%; the cooperative absorbed 0.50% of the total 0.75% interest rate increase on variable rates. AgCountry typically follows the Federal Reserve with variable rate increases and decreases as these moves directly and immediately impact our funding costs. AgCountry understands the impacts that higher interest rates have on your finances and is in a position financially to absorb a portion of these higher interest funding costs. To continue to provide reliable credit at a reduced cost to our customers, we are absorbing a portion of the November increase.

As an ag co-op, we work to fulfill our mission by ensuring the future of agriculture has options for financing at all stages of their career. Focused on providing young or beginning producers with unique and preferential financing, the AgCountry team works with the producer to get them what they need. Along with offering financing, the team shares educational resources, scholarships, and networking opportunities with other ag professionals in similar phases of their careers. AgCountry is here to help, whether directly or assisting with external and government financing programs.

Member-owners of AgCountry are entitled to share in the financial success of the cooperative. Patronage, or cash dividends, are paid on eligible loans, significantly reducing total borrowing costs. Cash dividends paid in 2022 for business conducted in 2021 totaled $76 million. This marked the third year AgCountry achieved the patronage goal of a 1% dividend on all eligible business. If AgCountry continues to meet its financial goals and barring unforeseen events or significant changes in the environment, it is our intention to continue paying a 1% dividend going forward.

Producers have options when choosing how to finance their operations. When working with a lender focused on agriculture that has experience with rising interest rates and input costs, farmers and ranchers can truly leverage the power of the cooperative. AgCountry is Focused on Ag. Focused on You.

*Patronage is not guaranteed.

> Fire departments must serve a portion of our service area (see list on AgCountry.com/Rescue)

> No restrictions on size of fire department

> Selection is based on current department resources, geographic area served, and proximity to other grain bin rescue units in the area

> 10 panels that pivot for different rescue situations/ several with inside step

> Slide hammer

> Grain bin entry rescue kit: ropes, harnesses, probe, and much more

> Access to a grain bin rescue training video to be used when on-site training is delayed, for new fire fighters, or when retraining is needed

AgCountry is proud to donate grain bin rescue units to area fire departments to help support rural communities and promote farm safety.

As we look forward to the next crop year, our farmers will have a lot on their minds when it comes to their crops. Crop rotation, fertilizer, weather, new land, chemicals, marketing, equipment, prices, etc. The list goes on and on. But most important, is the farmer prepared to mitigate all these risks with their crop insurance plan? What are the best practices for farmers when thinking about this?

Let’s start with 2023 production reporting. This is reporting your 2022 crop yields to your AgCountry insurance specialist before the 2023 crop year. It’s important to get these production numbers to your insurance specialist in a timely matter so they can update your crop insurance policy's Actual Production History (APH) before they meet with you for your 2023 insurance renewal. It’s important for accurate quoting and for updated 2023 APHs.

This leads to having your planting intentions ready for your insurance specialist. We know planting intentions are exactly that - intentions. These can always change with a late spring, wet weather, dry weather, prices, etc., but having at least some sort of plan of what’s

going where can make a huge difference at renewal time. Some pieces of land have better APHs with the Trend Adjustment and some don’t. Some land can have a much better guarantee with the Personal T-Yield or Master Yield, but some years it may not make sense. Why pay for those options if they aren’t going to positively impact your APH for this year? What if that section of land that you’re putting dry beans on this year yields poorly more often than not? Should we increase the coverage level or discuss Enterprise Units vs Optional Units? These are all questions that can be answered at renewal time with updated APHs and planting intentions provided.

It’s also extremely important to know what your cost of production is with each crop. We offer break-even analysis here at AgCountry where we look at all your revenue and expenses, then analyze them along with your crop insurance plan. We help you find your break-even price, and then at sales renewal time, your insurance specialist will compare your numbers with AgCountry’s Optimum tool to see what coverage levels and plans of insurance make the most sense for your farm. Through comparing your history to county

averages, we can determine if area coverage is right for your Multi-Peril Crop Insurance (MPCI) plan.

Two area plans of coverage to look at closer to spring are Supplemental Coverage Option (SCO) and Enhanced Coverage Option (ECO). Both are subsidized area insurance plans that can be added on top of your MPCI to cover your underlying deductible. SCO can cover you from your MPCI coverage level up to 86% of the county’s expected yield and is available on any crop you have enrolled in Price Loss Coverage (PLC) with the Farm Service Agency. You can also buy ECO which protects your deductible from the 90% or 95% coverage levels, and is available on any farm program crop enrolled in Agriculture Risk Coverage (ARC) or PLC. For either of these plans to pay an indemnity, the final county yield or revenue would have to fall below the coverage level you choose.

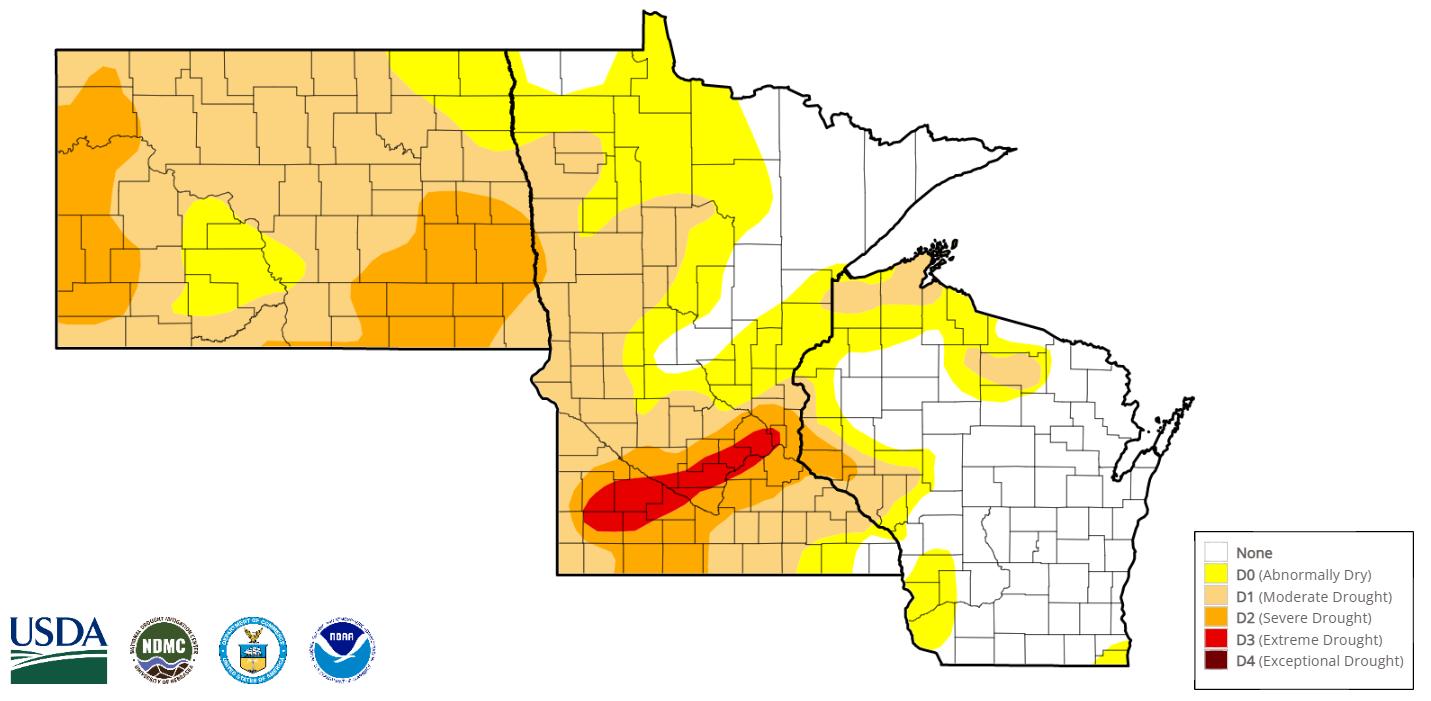

As we look into the current weather conditions and drought monitor maps, we will notice that our area in the upper Midwest is trending dry, once again. How will this affect the decisions you make this spring? Remember that SCO and ECO cover prices AND yields. If these higher prices stay consistent but our crop yields start suffering on a county-wide basis, having SCO and/ or ECO can help you mitigate your risk further above what your MPCI already covers on your own crops. Even looking at it the opposite way with higher yields and

lower prices will help in different scenarios. That’s why the products are here - to cover all possible situations.

Crop insurance renewal season should be more than “Let’s keep it the same as last year.” Your crop insurance plan is one of the most important pieces to a successful farm. That means knowing your break-even; and your revenue guarantees so you can use those numbers to pre-market your crop when prices are high. You should know how much prevent plant coverage you have if it’s a wet spring. You should explore what other products are available to you so you can mitigate not only your personal risk but also use the county yield and prices to cover your deductible. These important aspects of your crop insurance plan need to be addressed every spring before the crop year officially begins. Because the crop year begins much sooner than the preceding spring, we should always be thinking ahead to the next annual review. As a friendly reminder, crop insurance is no longer here to cover just yield losses…it’s here to protect the prices, which are your revenue and livelihood.

Crop insurance is a critical risk mitigation tool; our specialists help determine the best risk management options to deliver unique crop and revenue protection to each operation. We remind everyone to get your production in, plan your 2023 renewal with your AgCountry insurance specialist, and get ahead of the game.

Don't

Scan the QR code to view all events or visit AgCountry.com/Events

Join your local AgCountry team by attending an AgFocus meeting near you. Each meeting features unique presentations by local staff covering topics that are important for the success of your operation. Register today by scanning the QR code in the upper right hand corner.

02/01/23 Carrington, ND 01/11/23 Jamestown, ND

12/08/22 Perham, MN 12/15/22 Ada, MN 01/05/23 Minto, ND

02/01/23 Fosston, MN 01/13/23 Herman, MN

02/02/23 Marshfield, WI 01/17/23 Ortonville, MN

02/02/23 Warren, MN 01/18/23 LaMoure, ND

02/07/23 Crosby, ND 01/19/23 Grand Forks, ND

01/10/23 Madison, MN 01/12/23 Alexandria, MN

02/08/23 Rugby, ND 01/19/23 Graceville, MN

02/07/23 Hillsboro, ND 01/19/23 Granite Falls, MN

11/30/22 Wahpeton, ND 12/14/22 Nome, ND 01/31/23 Bottineau, ND

01/31/23

VIRTUAL MEETING

02/08/23 Fargo, ND

02/08/23 Carrington, ND 01/23/23 Cavalier, ND

02/08/23 Bowbells, ND 01/24/23 Crookston, MN

02/09/23 Williston, ND

02/09/23 Detroit Lakes, MN

02/09/23 Langdon, ND

02/08/23 Williston, ND 01/26/23 Thief River Falls, MN

02/10/23 Fergus Falls, MN 02/14/23 Roseau, MN 02/15/23 Devils Lake, ND 02/16/23 Hallock, MN 02/16/23 Minot, ND 02/21/23 Minot, ND

Changes are happening all around us and this holds true with changing tax laws. It's always important to prepare for what’s to come and plan for the uncertainty that future tax laws may hold. AgCountry has a highly educated staff that prides themselves on continuously staying up to date on tax law changes in order to best serve our customers.

Customers purchasing new assets should be aware of upcoming changes in the tax code. In 2017, former President Donald Trump signed into law the Tax Cut & Jobs Act (TCJA), which was set in place through 2025. Beginning January 1, 2023, the TCJA will begin phasing out bonus depreciation, which could affect your business strategy. With this in mind, and the sunset date approaching, customers should start preparing. Contact your tax specialist to discuss how to take advantage of the changes and look toward the future.

The combination of Section 179 and bonus depreciation made purchasing new assets a great way to lower income, which in turn lowers tax liabilities. Unfortunately, the sunset provisions of the TCJA are starting to take effect. These changes may lower the allowable amount of depreciation taken on the new assets customers have been accustomed to for the last few years.

The maximum Section 179 deduction for 2022 is $1.08 million and is phased out dollar for dollar after purchases exceed $2.7 million. Keep in mind that trades of equipment are treated as sales and not like-kind exchanges. This means that the full purchase price of the equipment obtained in the trade is available for accelerated depreciation.

Customers have been enjoying the temporary 100% expensing for business assets compared to the 50% prior to the TCJA. This temporary bonus depreciation is slowly coming to an end. The 100% depreciation will last until January 1, 2023. After this date, the deduction will change to the following amounts:

> 80% for property placed in service during 2023

> 60% for property placed in service during 2024

> 40% for property placed in service during 2025

> 20% for property placed in service during 2026

Customers looking to take advantage of higher depreciation expenses may want to consider placing assets into service sooner rather than later.

There are several Tax Cuts & Jobs Act provisions that will be expiring after 2025. The standard deduction increase that we saw will be going away. The State and Local Tax deduction limit of $10,000 will no longer have a limit. Along with that, the AMT provisions set in the TCJA will revert to the 2017 rules. The last major item that will be set to expire in 2025 is the tax rates that were decreased across the board in 2018. Rates will be changed as follows:

> 12% to 15%

> 22% to 25%

> 24% to 28%

> 32% to 33%

> 37% to 39.6%

Another change that will come when filing a 2022 return is the Child Tax Credit. In 2021, the American Rescue Plan allowed for a fully refundable credit of $3,000 per qualifying child, ages 6-17, and a $3,600 credit for those under 6. This plan also allowed taxpayers to receive half the credit during the tax year and half when filing their return. For the 2022 tax year, the Child Tax Credit will be reduced back to $2,000 for qualifying children under the age of 17 and will be refundable up to $1,500. Taxpayers must have at least $2,500 of earned income in order to qualify for the credit.

With all these changes coming, AgCountry strongly encourages customers to schedule a planning meeting with your tax specialist. Our tax team is continuously educating themselves on the changing tax laws and wants to use this knowledge to provide the best benefit to our customers, not only for the 2022 tax year but for the years to come. By taking advantage of tax planning, our specialists can advise you on upcoming business decisions and create the best tax benefit for you over the next several years.

We also provide sound advice to farmers who are looking to retire in the near future, as retirement is a several-year process. It is important to be aware of the potentially high tax that can come without proper planning. Your specialist will work closely with our Succession and Retirement team in order to ease the process of retirement for you.

In all, it is vital to stay up-to-date and prepared for tax law changes—and AgCountry tax specialists are always ready to provide help for the near and long-term future planning.

As you prepare your farm for the next year, you are busy making final decisions about crop rotation, securing inputs, marketing grain, working ground, finding and purchasing replacement heifers or bulls, fixing the fence, compiling year-end numbers, tax planning, securing financing, and so much more. This is by no means intended to be an exhaustive list of the items you must think about to prepare for next year, but rather an illustration of how endless the list is.

On top of everything else you are doing to keep your business thriving, you must start thinking about what you want the future of your business to look like. If you have a successor on your farm, you need to prepare for a business transfer whether that be during your lifetime or at death. If you do not have a successor, you still need to prepare for an asset transfer, which could also be during your lifetime or at death. The transition of a farm can seem like a daunting and overwhelming task, which is why it is often put on the back burner. Your farm or ranch is a direct reflection of your life’s work.

Why wouldn’t you want to prepare a plan that preserves the business and helps it flourish into the next generation?

When working with farms on a transition, the question I am frequently asked is, “where do we start?” A good starting point is to ask yourself, your family, and other key individuals some of the following questions:

> What are your expectations, both mom and dad, and farming/ non-farming children? Are the expectations reasonable? Is there a shared vision? If expectations aren’t clearly communicated, it can often lead to assumptions which then leads to issues within the family. Good and continuous communication is going to be the key to making a successful transition.

> What is your timeline for transitioning or retiring? It’s commonly believed that farmers and ranchers never fully retire, but allowing yourself time to ease out of the business

can help both financially and emotionally. Just because you plan for a transition doesn’t mean any or all aspects will be implemented right away. Implementation should happen in phases to allow involved parties to learn and prepare for what is ahead.

> What management duties are you currently responsible for and how do you get the next generation ready to take on some of these duties? Are you ready to give up control? A good mentor will educate and guide decisions when needed, which will build trust and gradually make you feel more comfortable to relinquish control.

> What kind of income do I need in retirement to service outstanding debt as well as provide for family living? Understanding the needs of the senior generation as well as what the farm can afford to pay is a balancing act and is different for every operation.

> Do you have an estate plan, and does it align with your transition plan? Have you shared your estate plan with your family? Sharing this information isn’t right for every situation, but generally, openly communicating your plan will allow the opportunity for your family to ask questions and prepare themselves for the future. Your plan will change over time, but proactive and continuous communication can help eliminate surprises and hopefully minimize future conflicts.

There is no clear-cut way to navigate a farm or ranch transition nor is there a cookie-cutter solution that works for everyone. Because each situation is unique, creating a plan can be challenging. Involve your team of Succession and Retirement professionals and utilize their experience and expertise. Define the process of the transition for your operation, review often, reflect on where you are in the process, and keep your future goals at the forefront of your business plan. Allow yourself time and give yourself permission to be flexible with the transition plan. When you are transitioning your operation, there is no such thing as too much communication!

If you need help with your transition plan, please contact your local AgCountry office.

Take advantage of AgCountry's Online Services and access your tax documents within minutes. With online access through My AgCountry and AgPay, accessing your tax documents, billing statements, transaction summaries, and much more is only a few clicks away.

To request online access through My AgCountry and AgPay, and to learn more, visit: AgCountry.com > Products & Services > Online Services Or, scan the QR code:

For existing My AgCountry users, please visit the My Documents page and open the Customer Statements tab to view and download your 2022* tax forms.

*2022 tax forms available in January 2023

We Serve Agriculture: Whenever. Wherever. 855-402-7849 | OnlineServices@AgCountry.com

bill that reshapes agriculture and nutrition policy or if it will pass a short-term extension to give members more time to complete the task. Over the past 30 years, Farm Bill extensions have become the norm. In fact, Congress has not passed any of the last five farm bills on time, using these extensions to give itself more time to finish negotiations.

Preparations are underway in Washington, D.C. for the intense work of crafting the 2023 Farm Bill. The House and Senate Agriculture Committees have held informational hearings and members of Congress, as well as agriculture and nutrition stakeholders, have started to identify initial priorities.

The current Farm Bill, dubbed the Agriculture Improvement Act of 2018, is set to expire on September 30, 2023. The law’s five-year lifespan provides lawmakers with the opportunity to keep programs and policies up to date. If Congress does not act and allows the Farm Bill to expire at the end of September, there would be a reversion back to price support programs established under the 1949 bill and most current programs would be eliminated.

This creates some urgency for Congress to act, and movement on legislation is expected. However, it is not yet known if that means Congress will pass a new

Congress has kicked off the process by holding a series of informational hearings. The House Agriculture Committee held more than 15 hearings on the Farm Bill in 2022, as well as several listening sessions in farm country. Topics covered most of the current Farm Bill titles, including Commodities, Conservation, Rural Development, Nutrition, Crop Insurance, Horticulture, and Forestry. The Senate Agriculture Committee held field hearings in Michigan and Arkansas. Both of these meetings included input from a wide variety of Farm Bill stakeholders. In November, the committee held its first hearing in Washington, D.C. on Rural Development and Energy programs. Individual members of Congress have also been hosting their own Farm Bill listening sessions and roundtable conversations.

Commodity groups and farm organizations provided testimony during these congressional hearings and at other public forums. While many of the organizations are still crafting their formal Farm Bill positions, there seems to be consensus around the following broad priorities:

> The current cornerstone of the farm safety net is crop insurance. Protecting and strengthening the program to keep it strong and affordable is a key priority for farm organizations.

> Farm and nutrition programs need to be kept together. To have a Farm Bill coalition strong enough to pass a bill, stakeholders identify this as a necessity.

> The Department of Agriculture’s (USDA) risk management tools need increased funding and flexibility to benefit farmers and ranchers:

- Increase reference price and loan rates for Title 1 commodities.

- Simplify the risk management decisionmaking process for farmers. When Agriculture Risk Coverage (ARC) or Price Loss Coverage (PLC) is triggered, allow payments to be the higher of the two.

- Increase the five-millionpound limit in Tier I Dairy Margin Coverage (DMC) to provide adequate assistance that better reflects the current dairy farmer.

> Conservation programs and climate-smart initiatives should remain voluntary, incentivebased, and farmer-led.

> Efforts to expand market access for U.S. farmers and ranchers should be supported through increased funding for USDA’s trade assistance programs: the Foreign Market Development

(FMD) program and the Market Access Program (MAP) are effective, cooperative, costshare programs.

> U.S. farmers and ranchers work to help feed the world. To assist their efforts, additional resources need to be provided for agricultural research and education.

AgCountry and the Farm Credit System have been working to develop Farm Bill priorities over the past year. It starts at the grassroots level, with the feedback our farmer customers provide in individual conversations and from the insights gained during customer focus group and committee meetings. The resulting ideas and proposals are considered in a process that includes discussions with Farm Credit association directors from across the AgriBank District, before then being forwarded on to the directors of the Farm Credit Council for additional discussion and consideration for final approval. The Farm Credit Council Board of Directors are farmer-elected directors of Farm Credit associations from across the country, including one from AgCountry. Farm Credit priorities for the Farm Bill are not yet finalized, but two key issues for the system will be to:

> Protect and enhance the crop insurance program; and

> Increase USDA Farm Service Agency (FSA) limits on both direct and guaranteed loans.

AgCountry board members and staff have engaged Congress during this early phase Farm Bill process. There have been meetings with members of Congress, both in Washington and at branch offices, to discuss the next Farm Bill.

Senator John Hoeven (ND) hosted a Farm Bill listening session in Fargo with Ranking Member of the Senate Agriculture Committee Senator John Boozman (AK) in the fall of 2022 where AgCountry’s input was provided, and Congressional staff stopped by for meetings with AgCountry team members.

There will be a significant focus on the Farm Bill in 2023. It’s expected Congress will continue with informational hearings before moving into detailed negotiations. Commodity groups, farm organizations, and other agriculture advocates will refine priorities, monitor developments, and reassess positions regularly. At AgCountry, we will continue to stay active and engaged as we advocate for agriculture and rural America throughout the process.

We’re proud to announce our annual photo contest winners! Each winner was awarded a cash prize along with having their photo featured in our 2023 calendar. Thank you to all who submitted images. We had a lot of great entries. Be sure to enter into AgCountry’s photo contest next year for a chance to win a cash prize and be featured in our 2024 calendar!

Photos can be submitted at AgCountryPhotos.com.

Second