By Ralph E. Moore Jr. Special to the AFRO

Pope Francis, from the very day he first spoke to the world from the balcony of St. Peter’s Basilica, was quite the man to follow.

Many observers (Catholics and non-Catholics alike) were very impressed by Pope Francis and his humble, non-traditional gestures as he assumed the papal position.

He announced his papal name, Francis, a

name with no Roman numerals following it, signifying no other pope had ever taken it. He carried his own luggage, fixed his own meals and rode buses and the subway in Rome as he did in his native Argentina.

Pope Francis was a most unusual man. Physically challenged with a lung partially removed as a young man, he still rose to become the first pope from South America. On March 13, 2013, he also became the first pope to be elected in roughly 600 years, after the resignation of his predecessor, Pope Benedict XVI.

By Jason Roberts

Rev. Jamal Bryant is urging Black Americans to keep the pressure on Target by continuing the national boycott that began as a 40-day economic “fast.” The move, sparked by the retail giant’s decision to end its diversity, equity, and inclusion (DEI) initiatives, has already cost the company

an estimated $12 billion, Bryant said. “Because of your fast, Target has lost $12 billion,” Bryant told his congregation. “I am so grateful that there is power in unity, and we know the strength of Black economics.” Since the fast began, Target’s stock has plummeted from $138 to $94 per share, and in-store foot traffic is down by 7.9 percent. The boycott gained traction

after Target announced it would wind down racial equity programs it introduced following the 2020 police killing of George Floyd.

The company, which operates nearly 2,000 stores and employs over 400,000 people, said it had always planned to sunset the programs after three years. However, many

As pope, he lived in a simple apartment in St. Martha’s House, nearby, but not inside St. Peter’s Basilica.

Though he was a pope, he never forgot his humble beginnings.

Named Jorge Mario Bergoglio at birth, Pope Frances hailed from Buenos Aires, Argentina. He was born on Dec. 17, 1936 as the eldest in a family with five children. His parents were immigrants from Italy to Argentina. Pope Francis attained a degree in chemistry before he entered a Jesuit seminary to study for

the priesthood. He was ordained a priest in 1969 and was elevated to bishop and then cardinal while in Buenos Aires before being elected to the highest position of authority in the Catholic Church in 2013, the papacy.

Around the world, his death is being mourned.

Joseph Ciancaglini, a lifelong Baltimore-born Catholic and educator at Catholic

By Quintessa Williams

In March, when The New York Times reported that 1 in 5 young Black men between the ages of 20 and 24 are neither in school nor employed, longtime educator Dr. David E. Kirkland was not surprised. The same article noted that Black men make up just 19 percent of enrollment at Howard University — one of the nation’s most prestigious HBCUs. However, in his view, the article focused on the wrong end of a young person’s educational journey.

Opting out of college and the workforce is a symptom of a much larger problem for young Black men, one that begins as early as preschool, long before college enters the educational picture. The lack of Black men in higher education stems from next to no institutional or emotional support for Black K-12 schoolboys, lingering systemic racism in public education,

“We treat Black boys like they’re problems before they even know how to write their names.”

and very few Black male teachers as role models.

“Most Black boys go to school and learn to hate school,” says Kirkland, founder and CEO of the nonprofit forwardED, a former NYU professor, and one of the country’s leading scholars on educational equity. “They’re told from day one that they’re a problem — that they’re unintelligent. They’re made to feel like a threat before they’ve even been given a chance.”

In other words, Kirkland believes the phenomenon of missing Black college men is the endpoint of a long, predictable breakdown, triggered almost as soon as their education begins.

“We didn’t just lose them after high school,” he says. “We’ve been pushing

them out since pre-K.”

The early pushout

The data doesn’t lie. According to the Department of Education, Black kids make up around 18 percent of preschool enrollment in the U.S., but nearly 48 percent of all preschool suspensions. Kirkland says that’s where the pattern and the pushout begin.

“We have evidence of disciplinary action and special education placements beginning as early as 2 years old,” Kirkland says. “We treat Black boys like they’re problems before they even know how to write their names.”

This hyper-surveillance — combined with implicit bias, adultification and racial anxiety from teachers, aides and

school administrators — creates a cycle of exclusion. Black male students are suspended and expelled at three to four times the rate of their White peers, often for subjective or vague offenses like “defiance” that don’t usually merit punishment in others.

Schools that punish Black boys early and often, Kirkland says, are not neutral spaces, but sites of harm. Many Black boys are improperly funneled into special education programs not to support their learning but to manage their presence. And the psychological and social impact of educational mismanagement — damaged self-esteem, increased self-doubt and frustration — can be deadly.

“Ten years ago, the suicide rate for Black boys aged 10 to 14 had jumped 144 percent,” Kirkland notes. “We’re talking about emotional and psychological death long before they ever drop out.”

By Rev. Dorothy S.

He installed Washington, D.C.’s first Black cardinal, connected with America’s first Black president, and appointed three Black men who are in contention to succeed him. He condemned racism as a “sin,” visited poor Black communities, and ministered to imprisoned Black men.

As accolades poured in from around the world on the death of Pope Francis, prominent Black Americans pointed to the pontiff’s legacy of advocating for the marginalized, including Black people. Others, however, speculated that Francis redirected church leadership in such a way that the possibility exists for the election of the first Black pope.

In a statement, President Barack Obama said Francis “shook us out of our

complacency and reminded us that we are all bound by moral obligations to God and one another.”

The pope was “a great leader and an example of faithful living,” The Right Rev. Paula Clark, bishop of the Episcopal Diocese of Chicago, said in a statement on April 21. “He embraced and advocated for all people and was forthright in encouraging peace everywhere.”

Throughout his life and ministry, Francis “has been a witness for the Gospel and a champion for the poor and marginalized,” said the bishop, who is Black. “Especially in this season, I give thanks for his powerful advocacy on behalf of migrants and refugees.”

The pontiff, leader of a church with 1.4 billion members worldwide, suffered a fatal hemorrhage and heart failure not long after recovering from double pneumonia — and mere hours after personally greeting worshippers in Vatican Square

Continued from A1

schools, is currently and coincidentally traveling in Italy.

“Pope Francis led from his heart, discerned with keen intellect and served those in need of pastoral care,” said Ciancaglini.

Pope Francis reminded Catholics and the rest of the world to be responsible with the environment, dubbing the planet as “our earthly home.”

His papal letter (called an encyclical), “Laudato Si, subtitled, On Care for Our Common Home,” was read, discussed and debated around the world.

In the letter, the pope criticized “consumerism and irresponsible economic development.” He also commented on “environmental degradation and global warming.”

Francis was strongly committed to world peace, speaking out early against the current wars in the Middle East between Israel and Hamas fighters in Gaza and the conflict in Europe after Russia’s invasion of Ukraine. His voice was very effective in inspiring many in the public to question the efficacy of war itself.

Yet for all his greatness and all the good he did, some expressed concern about a particular sticky issue for Black Catholics: there are no– as in zero– Black American Catholic saints to date.

on Easter Sunday. He was 88.

Shaping the Catholic church long-term

Anthea Butler, a professor of religion at the University of

Activist Mary H. Sewell is a former member of St. Ann Church, which was recently closed by the Archdiocese of Baltimore. She praised Pope Francis’ good character, but said she wished more was done to elevate African-Americans to sainthood within the Catholic church.

“Pope Francis was humble, merciful and kind. I’m sorry his passing came before he was able to canonize the first six African-American candidates for sainthood,” said Sewell, speaking of the 2023 initiative to secure expedited canonizations of the “Saintly Six.”

St. Ann Church, collected and mailed 4,600 signed letters from persons all over the world who urged the late pope to designate expeditiously Mother Lange, Father Tolton, Ms. Greeley, Sister Bowman, Mr. Toussaint and Mother DeLille as the first Black Catholic saints from the United States.

Still, Sewell said she’s “sad to see the world lose this good man.”

In response to the death, Governor Wes Moore announced that the U.S. flag and the Maryland flag will be lowered to half-staff immediately to honor the life and service of His Holiness Pope Francis. The flags will remain at half-staff until sunset on the day of Pope Francis’ interment, which is on Saturday, April 26.

“Pope Francis – the People’s

saw the decision as a retreat from commitments made to Black communities.

After meeting with Target executives, Bryant confirmed that the company agreed to just one of the boycott’s four major demands: fulfilling its $2 billion pledge to support Black businesses through product placement, services and investments in Black-owned media. The company has yet to meet demands to deposit $250 million into Black-owned banks, reinstate DEI programs or fund community pipeline centers at 10 HBCUs focused on teaching retail business. Bryant said Target’s response wasn’t enough. “Target cannot selectively decide which parts of our dignity they’re willing to honor,” he said. A growing coalition of African American leaders and organizations—including the National Newspaper Publishers Association (NNPA)—has continued meeting to strategize further action. At the center of the discussion is the role of the Black Press, which Target has yet to acknowledge in a meaningful way, despite more than a year of outreach by the NNPA under President Dr. Benjamin F. Chavis Jr., with assistance from former U.S. Sen. Laphonza Butler. Chavis stressed that any agreement with Target must include investment in Black-owned media, including outlets like BlackPressUSA.com, The

By Stacy M. Brown

Pennsylvania, said Francis’s 12-year tenure as pope was inclusive in a way that has altered the church long-term — and could open the door for a successor from outside of Europe.

Along with his “charismatic” reign and willingness to battle Catholic institutionalists, Butler says Francis “will be

Pope Francis inspired millions across the globe—including many in Baltimore. His passing has prompted reflection.

Pope – led with humility, compassion, and love for all people. His strength in spiritual leadership will live on in the hearts of the faithful,” said Gov. Moore. “Dawn and I join Catholics across Maryland alongside the broader faith community, our country, and those all over the world who mourn his passing and honor with deep solemnity his legacy of service.”

“Target cannot selectively decide which parts of our dignity they’re willing to honor.”

Washington Informer, Philadelphia Tribune, and Chicago Defender. “The dissemination of this message and narrative is only accurately done by the Black Press in 2025 and beyond,” Chavis said. For nearly 200 years, the Black Press has played a pivotal role in American life, particularly for African Americans. From its inception in 1827 with Freedom’s Journal, the Black Press has informed, educated, and empowered Black communities while countering the negative portrayals that dominate mainstream media. As documented by the Oxford Bibliographies, the Black Press has served as “agents of social change” and “defenders of shared values and interests.” During Reconstruction and Jim Crow, Black journalists like Ida B. Wells used the press to expose racial violence and injustice. Wells’ work documenting lynchings and countering White supremacist propaganda laid the foundation for the Black Press to serve as a vital corrective force in American media. That legacy

Pope Francis will be taken to his final resting place on Saturday, April 26, 2025. His tombstone will feature only his name, “Franciscus.”

The simple gesture will be a lasting reminder of the gentle man, known as Pope Francis.

remains just as urgent today. Modern studies show that negative portrayals of Black people in media lead to harmful outcomes, from over-criminalization and over-sexualization to negative health effects and social exclusion. The Black Press continues to challenge that narrative.

Cheryl Smith, publisher of Texas Metro News and Garland Journal, said the importance of the Black Press cannot be overstated. “If we look back at every period in our lives since its inception, we can see how significant the Black Press was,” Smith said. “We need to see it and believe it every day we get up, and I promise you, we will be stronger, more vibrant, and more powerful people.” The NNPA currently represents more than 200 Black-owned newspapers across the country, continuing a legacy that is nearly as old as the United States itself. As America nears its 249th birthday, the Black Press marks 198 years of continuous service. “The largest Black population in American history are now openly and unapologetically demanding freedom, justice, equality, democracy and equity,” Chavis said. “And the only media institutions that have always stood with us are our own.” As Bryant calls for continued boycott efforts, he and Chavis are reminding Black America that real leverage comes not only from what it refuses to accept—but also from what it insists on valuing. “We’ve seen what happens when we stand together,” Bryant said. “Now we keep standing.” This

Rev. Al Sharpton recently met with PepsiCo leadership at the company’s global headquarters in Purchase, New York, following sharp criticism of the food and beverage giant’s decision to scale back nearly $500 million in equity, inclusion and diversity initiatives.

The more than hour-long meeting included PepsiCo Chairman Ramon Laguarta and Steven Williams, CEO of PepsiCo North America, and was held within the 21day window Sharpton had given the company to respond. Sharpton was joined by members of the National Action Network (NAN), the civil rights organization he founded and leads.

“It was a constructive conversation,” Sharpton said after the meeting. “We agreed to follow up meetings within the next few days. After that continued dialogue, NAN Chairman Dr. W. Franklyn Richardson and I, both former members of the company’s African American Advisory Board, will make a final determination and recommendation to the organization on what we will do around PepsiCo moving forward, as we continue to deal with a broader swath of corporations with whom we will either boycott or buy-cott.” Sharpton initially raised concerns in an April 4 letter to Laguarta, accusing the company of abandoning its equity commitments and threatening a boycott if PepsiCo did not meet within three weeks. PepsiCo announced in February that it would no longer maintain specific goals for minority representation in its management or among its suppliers — a move that drew criticism from civil rights advocates.

“You have walked away from equity,” Sharpton wrote at the time, pointing to the dismantling of hiring goals and community partnerships as clear signs that “political pressure has outweighed principle.” PepsiCo did not issue a statement following the meeting.

By Megan Sayles AFRO Staff Writer msayles@afro.com

The DowntownDC Business Improvement District (BID) hosted the State of Downtown Forum at Georgetown University Capitol Campus on April 22. The gathering brought together industry, government and business leaders to discuss key economic shifts and trends that are impacting the District’s Downtown neighborhood.

The day of the forum arrived after a series of freezes by Mayor Muriel Bowser to address the District’s $1.1 funding shortfall. The gap was spurred by a federal continuing resolution that forced D.C. to revert back to its 2024 budget levels in March, effectively slashing funding D.C. planned to have for 2025.

Though Bowser said she remains “very optimistic” about Downtown’s condition, she also acknowledged the fiscal pressure D.C. is under.

“If the CFOs estimates hold, within the next four years we have to replace the economic activity of 40,000 employed D.C. residents. We know who those people are, and we want them to stay in the District,” said Bowser. “We want them to get new jobs in the District, to go to District universities, buy D.C. houses and put their kids in D.C. schools.”

The employed residents D.C. stands to lose are federal workers. Since the 47th president came into office, he has charged Tesla billionaire Elon Musk and the Department of Government Efficiency (DOGE) with making massive cuts to the federal workforce. Compared to other states, D.C. has the highest percentage of its workforce employed by the federal government at 13.2 percent, according to the Economic Policy Institute.

Federal contracting, hospitality and transportation jobs are also expected to be lost as the blow to the federal workforce will cause a decline in demand for the sectors.

However, Bowser said investments in public safety, families, schools and clean and safe recreation could help to stimulate the District’s economic growth. She plans to prioritize these areas in her Fiscal Year 2026 budget.

The District’s budget woes being brought on by the federal government have illustrated the economic consequences of D.C.’s non-state status, according to Bowser. Because D.C. is a federal district and not a state, Congress has the power to modify or overturn its budget and laws.

The March continuing resolution was a way for the federal government to avoid

By Tashi McQueen AFRO

a shutdown and keep its agencies funded temporarily. Though the Senate has already approved a bill that would make D.C.’s budget whole again, the House has yet to move on it.

“The only way that this interference is rectified is when the tax-paying citizens of Washington, D.C. are full Americans.

The political and democratic problem is that we pay taxes, but we’re not represented with a voting member of Congress,” said Bowser. “The business problem is we literally have a balanced budget, unlike our federal partners. Every year, we balance our spending priorities with our revenue, yet we’re talking about a Summer of cuts.”

A strategy that has emerged to curb the District’s financial challenges is converting commercial spaces in Downtown to residential units. With more people working from home and shifts in D.C.’s employment base, some offices sit vacant.

District leaders are hoping to usher in a new era where Downtown thrives as a mixed-use community. One opportunity for this is in the Federal Triangle, a central part of D.C. where many government offices and institutions are situated. As it stands, some believe the Federal Triangle blocks visitors and residents from enjoying all of the District’s attractions.

“I’ve come to view the Federal Triangle as our local version of the Berlin Wall. It separates the cultural part of our city from our commercial core, and it deprives the city of the energy of 28 million tourists who annually visit Downtown,” said Shalom Baranes, founding principal of Shalom Baranes Associates, a D.C.based architecture firm. “This energy would manifest itself in additional tax dollars and revenues, more housing and certainly more jobs.”

Baranes recommended that the District convert federal office buildings built before 1940 into residential buildings. He explained that their designs are nearly identical to modern apartment buildings today, which would make their redevelopment less expensive.

Rather than sell these buildings to the private sector, Baranes suggested that the federal government lease them to private companies on a long-term basis. This means no public dollars would be required for converting the buildings.

“This is a generational opportunity to breathe life into our Downtown, and I don’t believe that this moment will last very long,” said Baranes. “Our city is teaming with developers who would jump at the opportunity to sign longterm ground leases and renovate these beautiful, historic buildings. I think someone needs to create a Federal Triangle master plan that could direct this development and create a vibrant, new mixed-use community.”

By D. Kevin McNeir Special to the AFRO

Thousands of residents took advantage of a beautiful, sunny April 13 day to enjoy a diverse lineup of entertainers, a festive parade and fireworks in observance of D.C. Emancipation Day.

The event, held at Freedom Plaza located just blocks away from the U.S. Capitol, kicked off with a parade led by a contingent of public safety officials. D.C. Mayor Muriel Bowser and her daughter, Miranda, were accompanied by dozens of supporters – all of them decked out in green. The evening concluded with spectacular fireworks which lit up a cloudless evening sky. While Bowser did not speak, a statement was sent to the media which indicated her thoughts about the 20th anniversary of the annual celebration.

In the statement, Bowser recognized that “D.C. Emancipation Day events celebrate D.C.’s progress in advancing racial equality” while also amplifying civil rights work and “the importance of the continued fight for D.C. statehood.”

The mayor’s office served as the sponsor of the event, in collaboration with the Office of Cable Television, Film, Music and Entertainment, which captured the sights and sounds of the celebration. Attendees were invited to dance to the

soulful sounds of go-go, gospel and R&B.

Some attendees, like friends Rekaria Baker, 42, and Evony Smith, 47, both from Southeast D.C, moved along the parade route, while others watched with pride.

“This is my first time attending Emancipation Day, but it won’t be my last,” said Baker, who added that while her main goal was to enjoy the weather, she was surprised by how much fun she had.

Smith, a native Washingtonian, said this year marked her third time attending the event.

“This is more than just a celebration of the end of slavery in Washington, D.C. – it’s about Black people being afforded the opportunity to finally control their own lives and destinies,” said Smith. “Unfortunately, more than a century later, we’re killing one another instead of coming together to strengthen our communities.”

Lest we forget

C.R. Gibbs, an author, lecturer and exhibitor of historical information and artifacts, provided insight on the history and significance of D.C. Emancipation Day on the city’s website, www.emancipation.dc.gov.

“April 16, 1862, marks the abolition of slavery in the District of Columbia. Over 3,000 enslaved persons were freed eight months before the Emancipation Proclamation

By D. Kevin McNeir

Thousands gathered at Freedom Plaza on April 13 to celebrate D.C. Emancipation Day with a vibrant parade, live entertainment and fireworks. The day marked the 20th anniversary of its official designation as a public holiday. The event commemorated the abolition of slavery in D.C. in 1862 and served as a powerful reminder of the ongoing fight for racial equality community unity and D.C. statehood.

Credit: AFRO photos / D. Kevin McNeir

slavery during the Civil War, and Jim Crow-era segregation in the pews was common.

Washington, allowing Obama to become just the third president to host the leader of the Catholic Church at the White House.

At the same time, Francis quietly began rebuilding church leadership, giving particular attention to Africa in selecting the cardinals who would eventually vote to replace him. Since his death, two of the three Black cardinals considered serious contenders to succeed him are from Africa: Peter Turkson of Ghana and Robert Sarah of Guinea.

The third is Cardinal Wilton Gregory, archbishop emeritus of the Washington archdiocese. Francis appointed him the first African American cardinal in 2020 and just the third in the history of the Catholic Church. Although Gregory is retired, he will still vote during the upcoming conclave to name Francis’ successor.

While the pope gave more attention to Black people than many of his successors, the church as an institution still has work to do when it comes to race, experts say.

Two years ago, the church formally repudiated the colonial-era “doctrine of discovery” — official declarations that justified European conquests of Africa and the Americas. Catholic churches were complicit in — and sometimes benefited from — the African slave trade. The church did not stand unified against

Francis, however, issued several declarations and letters to bishops condemning the “sin” of racism, and spoke out after the murder of George Floyd in 2020. He addressed the issue again in 2023, declaring that instances of racism “continue to shame us, for they show that our supposed social progress is not as real or definitive as we think.” In a visit to Philadelphia in 2015, the pontiff ministered to inmates at Curran-Fromhold Correctional Facility just outside the city.

Baltimore City Comptroller Bill Henry, a Black Catholic, said that Francis perhaps “didn’t fight all of the good fights that some of us wanted him to, but he certainly fought more than anyone else who has held his job in my lifetime … Requiescat in pace et in a more, papa.”

But for Father Daniel Green, a 39-year-old priest, Francis’s push for the marginalized is arguably the most important part of his legacy.

“Black Catholics have always been hyper-focused on ‘the least of these,’” the priest, who was ordained just weeks into Pope Francis’ papacy, told The New York Times. “For many of us, we said, ‘Finally somebody is speaking about what we are speaking about, and not just doing it as a tangential.’”

This article was originally published by Word In Black.

Continued from A1

By the time they reach high school, many Black boys have endured years of suspension, exclusion and invisibility. When college becomes an option, it’s often one they’ve been conditioned to believe isn’t meant for them.

“That’s why many of them are not in college,” Kirkland says. “They’ve already experienced school — and what they experienced didn’t honor their humanity.”

Black teachers fill gaps - We need more

Only 6 percent of public school K-12 teachers are Black, according to the National Center for Education Statistics. Kirkland says while their presence is limited, they are mighty in what they do. “For me, it was Black women,” he adds. “They told me I mattered. They told me I belonged. They didn’t give up on me.”

Still, the representation gap is staggering. Only 1.7 percent of U.S. public school teachers are Black men, according to federal data. Kirkland agrees that a lack of cultural connection and mentorship contributes to the disengagement that drives so many young Black men out of school.

“When Black men do make it to college,” he says, “there’s pressure to go into high-paying fields. Teaching isn’t seen as sustainable. And for many of us, school was a place of trauma — and why would we want to return to that?”

Overall, Kirkland says it’s not just about getting more Black men into classrooms — it’s also about transforming those classrooms into places

The absence of young

in college reflects a long-standing pattern of systemic exclusion that begins in early childhood, with disproportionate discipline and a lack of support in K–12 education. Experts call for reimagining schools as spaces of healing, affirmation and culturally sustaining education that honor the full humanity of Black boys.

worth returning to. “We don’t just need more Black men in schools. “We need to reimagine schools that deserve Black boys in the first place.”

A system that deserves them

When asked how he’d redesign education for Black boys, Kirkland flips the question: “What deserves them?”

He calls for an education system rooted in radical love, trust and imagination — a system that teaches Black boys how to be world-builders, not just rule-followers.

“We need a culturally sustaining curriculum, restorative discipline, healing-informed care and assessments that highlight what they can do,” he says. “A system that doesn’t just measure their deficits, but also reminds our boys that they’re not problems. They’re miracles.”

This article was originally published by Word In Black.

liberated slaves in the South,” wrote Gibbs. “The District also has the distinction of being the only part of the United States to have compensated slave owners for freeing enslaved persons they held.”

While the late Mayor Marion Barry was the first to support celebrating DC Emancipation Day as a holiday, it was just 20 years ago, in 2005, that then-Mayor Anthony Williams signed legislation officially making April 16 a public holiday in the District of Columbia.

Black history is American history

For fourth-generation Washingtonian Cerise Turner, Ms. Senior D.C. 2023, statehood remains the seminal issue on her mind.

“We were brought to America against our will, we were forced into slavery and somehow, we survived,” Turner said.

“Emancipation Day in D.C. gave us control over our lives, over our resources and gave us the freedom to govern ourselves as we desired. We must follow the example of our ancestors and keep hope alive.”

Charlene Louis, also a native Washingtonian, said she began to attend the annual festivities five years ago.

“I’m over 40 years old and I don’t remember learning about this in school, but it’s part of our culture – our history – and it matters,” Louis said. “It’s great to see more people attend each year to celebrate and embrace this historic milestone. And because

D.C. is a melting pot, this is a day for all Washingtonians to honor.”

Daisha Singletary, 25, and Lauryn Turnage, 26, both from the District, said they hope others from their generation will keep the celebration alive and thriving from year to year.

“Last year I worked with the mayor’s office to teach others about Emancipation Day – to share what happened and how it marked a new beginning for Black people,” Singletary said. For Turnage, the day is one

of reflection.

“When you think about the circumstances and the injustices that our ancestors faced, it’s amazing that we’ve come as far as we have today,” Turnage said. “Whether they teach it in school or not, we’ve got to pass on this history to youth. We’re free today, but we weren’t always free. Freedom did not come easily. But sometimes I wonder if it could be easily taken away.”

“Emancipation Day in D.C. gave us control over our lives, over our resources and gave us the freedom to govern ourselves as we desired. ”

for

Planning and Economic Development via grants from the U.S. Department of Commerce Economic Development Administration Travel, Tourism and Outdoor Recreation program.

“Events D.C. is focused on creating unique experiences that result in jobs, economic impact and lasting memories for residents, tourists and guests,” said Angie M. Gates, Events D.C. president and CEO, in a statement. “Through the Large Event Grant Program, we will support even more remarkable events this year that build community connections, celebrate our distinctive culture and contribute to our local economy.”

Broccoli City Festival is a Black-owned music festival focused on social impact and entertainment. It has welcomed performances by top Hip-Hop, Rap and R&B artists, such as Megan Thee Stallion and Victoria Monét.

According to the Mayor’s Office of Community Affairs, 1.6 million people attended the National Cherry Blossom Festival in 2024, topping the pre-pandemic estimate of 1.5 million attendees in 2019. Visitor spending in D.C. during the festival totaled $202 million. Around 58 percent of visitors lodged in D.C., and of those, 77 percent choose hotel accommodations.

The grant funding can be used toward expenses related to event hosting, such as government fees, venue rental, security, staffing costs and equipment. Events were chosen by considering the impact each event has on the community via increased hotel room nights, jobs created, additional tax revenue and more.

The 11 grant recipients include the Restaurant Association of Metropolitan Washington, Inc., which will use the funds to support its Signature Taste of DC Series, and the National Cherry Blossom Festival, Inc., which will use the monies to support its annual event. Asia Heritage Foundation; Broccoli City Inc.; Capital Pride Alliance; the U.S. Soccer Federation; the USA Rugby Football Union; Washington Tennis and Education Foundation; DC Jazz Festival; Woolly Mammoth Theatre Company and Fiesta DC, Inc. also received funds.

According to the Mayor’s Office of Community Affairs, 1.6 million people attended the National Cherry Blossom Festival in 2024, topping the pre-pandemic estimate of 1.5 million attendees in 2019. Visitor spending in D.C. during the festival totaled $202 million. Around 58 percent of visitors lodged in D.C., and of those, 77 percent choose hotel accommodations.

The grant funding can be used toward expenses related to event hosting, such as government fees, venue rental, security, staffing costs and equipment. Events were chosen by considering the impact each event has on the community via increased hotel room nights, jobs created, additional tax revenue and more.

By Megan Sayles AFRO Staff Writer msayles@afro.com

Mayor Brandon M. Scott delivered his 2025 State of the City address at the M&T Bank Exchange at the France-Merrick Performing Arts Center on April 21, touting accomplishments in public safety, education, public health, housing and community and economic development.

The speech was given under the theme “Built Different, Building Different,” underscoring Baltimore’s unique identity and the need for distinct strategies to improve the city. Scott notably took on the current White House administration in his address, which has lodged attacks against federal workers and their agencies, immigrant communities and equity, diversity and inclusion efforts.

current president has never spent a day in City Schools. He highlighted several strides in public education, including kindergarten readiness reaching its highest level in nearly a decade, a decline in chronic absenteeism and Baltimore ranking second in the country for reading progress.

He committed the city’s school system to increasing the share of students who are reading and writing on grade level by 10 percent in the next two years. He also pledged to double the percentage of students on grade level in math by that time.

“I’ll be straight with you, federal funding cuts won’t make any of this easier, but we’re not going to let their problems derail our children’s progress or prevent young Baltimoreans from finding great careers after graduation,” said Scott.

During his remarks, Scott recalled the doubt he was met with regard-

community violence intervention ecosystem, empowering residents to help us make their neighborhoods safer and offering real alternatives for those who want to change their lives.”

Scott’s address came two days after the 10th anniversary of 25-yearold Freddie Gray’s untimely death in Baltimore police custody. In his remarks, the mayor said the Baltimore Police Department (BPD) is doing their work with fewer officers while continuing to make reforms.

He noted that police-involved shootings and complaints have fallen by 67 percent and use of force incidents have experienced a 50 percent decline.

“It should have never been up to BPD alone to keep our streets safe,” said Scott. “But, building a stronger, better department is still a critical part of this work.”

“We know that when we create opportunity for all of our citizens— especially our young people— everybody is better off.”

“We know that when we create opportunity for all of our citizens— especially our young people— everybody is better off. Equity and DEI may be under attack in Washington, but they are alive and well in Baltimore,” said Scott. “So, call us the DEI capital of the United States. Call us whatever you like– we are never gonna apologize for investing in the people of our city.”

In March, the 47th president blasted Baltimore City Public Schools for underperforming math scores. The criticism came as he signed an executive order to dismantle the Department of Education.

Scott denounced the rhetoric from Washington, pointing out that the

ing his Comprehensive Violence Prevention Plan. The blueprint, which was released in 2021, set out to reduce homicides by 15 percent every year.

Since then, homicides have fallen from 335 in 2020 to 201 in 2024, a 40 percent decline. Non-fatal shootings also dropped 43 percent in that time.

Last year, robberies decreased by 23 percent, auto thefts by 40 percent and carjackings by 19 percent. Scott said Baltimore has less violence today than it’s experienced in the last 50 years.

“Ending violence in Baltimore is going to take all of us working together,” said Scott. “That’s why this strategy is built on: bringing together all of the pieces of the

Scott boasted public health as a strength for Baltimore institutions, like Morgan State University, Coppin State University and Johns Hopkins University.

He noted that the city has delivered $2 million in grants to aid home health care workers. He also expressed plans to support first responders. Baltimore is not only actively recruiting more paramedics and firefighters, it is also expanding Tele911. The service will enable residents who do not require emergency care to connect with telehealth services on demand.

Scott explained that first responders have played an integral role in combating the city’s opioid crisis. Fatal opioid overdoses were down 35 percent last year.

“That’s progress,” said Scott. “But, it will take time and resources to repair the damage done to our communities, and that takes accountability for everyone responsible for the spread of opioids in our communities— not just dealers but

residents receive skills training

By Megan Sayles AFRO Staff Writer

The Maryland Digital Equity Coalition (MDEC) is in the midst of hosting a bi-weekly webinar series to arm individuals and organizations with the skills and knowledge to build digital inclusion programs, forge partnerships and secure digital equity grant funding.

On April 9, experts explored the relationship between workforce development and digital skills. The webinar addressed the necessity of digital skills in entering today’s job market and progressing in a career. It also discussed strategies for reaching underserved populations who face greater barriers to digital inclusion.

“Digital skills are now essential for workforce participation and economic mobility. In Maryland, addressing the digital divide is a cross-sector effort spanning education, health, housing and employment systems,” said Teri Mumm, digital navigator program manager for the University of Maryland Extension. “I like it when people refer to digital inclusion as a super social determinant of health because it really does cross against all those things that we need to do and can

do to live healthier, happier lives as Maryland residents.”

Digital skills are needed for nearly all jobs today

According to a report from the National Skills Coalition in collaboration with the Federal Reserve Bank of Atlanta, 92 percent of jobs require digital skills. If an individual lands a job that demands even one digital skill, they earn an average of 23 percent more than a position requiring no digital skills.

Without digital skills, individuals may miss out on these opportunities.

As Mumm pointed out, 84 percent of Marylanders are “covered populations,” groups of people the National Telecommunications and Information Administration (NTIA) considers the most impacted by the digital divide.

This includes incarcerated individuals, older adults, veterans, people with disabilities, immigrants and people of color.

“We see that at least 84 percent of our population falls into at least one of those categories, and most often they’re intersectional. They fall into several categories,” said Mumm. “One in three residents cannot fully engage in online education, employment or health because

“Digital skills are now essential for workforce participation and economic mobility.”

they don’t have that access or skill development.”

The recent end of the Affordable Connectivity Program (ACP) and Maryland Emergency Broadband Benefit (MEBB), which provided low-income households with a subsidy for internet service and devices, has left cost and access gaps in their wake.

One point of hope is support from the State Digital Equity Capacity Grant Program, which is set to deploy $800 million in grant funding to U.S. states and territories for plans to equip communities with the tools and skills needed to benefit from access to affordable, reliable, high-speed internet service. Maryland was awarded $13.4 million dollars through the program last December.

The state will use the funding to deliver sub-grants to organizations implementing key digital equity initiatives, including enhancing digital literacy and skills training. However,

also Big Pharma companies who profited from the overprescription of these drugs.”

The city of Baltimore has sued a number of pharmaceutical companies and has racked up nearly $700 million in settlements and damages. Scott said the money amassed will be invested directly into neighborhoods impacted by the opioid epidemic.

The mayor also reflected on his 2023 vision to end the vacancy crisis within 15 years in collaboration with Baltimoreans United in Leadership (BUILD) and the Greater Baltimore Committee. He announced an official name for the $3-billion plan for the first time: Reframe Baltimore.

Currently, there are less than 13,000 vacant properties across the city, the lowest number in more than 20 years. In its next step, the city will be reviving the Baltimore Industrial Development Authority to rehabilitate 1,000 abandoned properties. It’s also bringing tax breaks to every Baltimore neighborhood for the transformation of vacant properties into affordable housing.

Permit and zoning processes are

also being streamlined in Baltimore to help tackle the crisis.

As Baltimore’s population experienced an increase for the time in a decade, Scott addressed efforts to promote homeownership and affordable housing. In 2024, Baltimore deployed an additional $900,000 in incentives for new homebuyers and over $750,000 in “Buy Back the Block” grants.

Scott also committed the city to bringing property tax rates under $2 by 2028. This would be the lowest level on record in 50 years.

“From housing, to health, to education and safety, we have a clear vision for our city’s future. But, we also know that with this unpredictable crew in charge in D.C., the only certainty is uncertainty,” said Scott. “They’re coming after everything that really makes this country great: the right to speak your mind, to make choices about your body, to live your life and educate your children; your right to worship the God of your choosing; your right to exist as a Black, brown or gay person. It’s the same stupidity and hatred we’ve heard for generations. Baltimore is not going to sit and take it.”

the current White House administration has created uncertainty. The 47th president has already sought to freeze digital equity funding as part of his attack on equity, diversity and inclusion.

At this time, no local grants have been awarded by Maryland.

“The Office of Statewide Broadband is working very hard to get that grant program up and running— give or take what happens with the federal government— but everybody is moving forward,” said Mumm.

Organizations are working to bridge digital skills divide Mana McNeill is the co-founder of CareerCatchers, an organization that provides one-on-one counseling to low-income and underserved residents who are seeking stable employment with upward mobility.

The nonprofit specializes in serving foreign-born individuals

and those experiencing domestic violence or homelessness. Nearly 85 percent of their clients are Black, Indigenous and people of color (BIPOC).

“Digital literacy is a really significant employment barrier, and since our inception, we’ve seen that when a client comes in and can’t even create their own resume because they don’t have a computer or they don’t have access to the skills needed to write their resume,” said McNeill.

In the face of the COVID-19 pandemic, which spotlighted the pervasive repercussions of the digital divide, McNeill said her clients were heavily impacted by not being able to meet in person. They didn’t have the skills needed to join virtual meetings.

This story is part of the Digital Equity Local Voices Fellowship lab. The lab initiative is made possible with support from Comcast NBC Universal.

By AFRO Staff

The AFRO, in partnership with Real Times Media, hosted the “Who’s Who in Black Baltimore” awards reception on April 9 at the Baltimore Marriott Waterfront. The event celebrated excellence and leadership in Charm City’s Black community. Changemakers across various industries were honored, including legal icon William H. Murphy Jr., and Whitney Brown of the Baltimore Symphony Orchestra.

A highlight of the evening was the Lifetime Achievement Award presented to Dr. Thelma T. Daley, the nationally recognized educator and civil rights leader. The reception featured networking, an awards ceremony, and the launch of a commemorative coffee table book profiling each honoree.

Chanda Brigance, co-founder of the Brigance Brigade Foundation, makes an appearance.

By AFRO Staff

On April 19, local officials, family and community members gathered in West Baltimore to honor Freddie Gray, the 25-year-old man who died on April 19, 2015 as a result of injuries sustained in police custody. The memorial, held at North Mount and Presbury Streets—near the site of Gray’s arrest—featured remarks from Baltimore Mayor Brandon M. Scott, attorney William “Billy” Murphy, and Gray’s sister, Fredericka “Missy” Gray. Together, they

a

and

By AFRO Staff

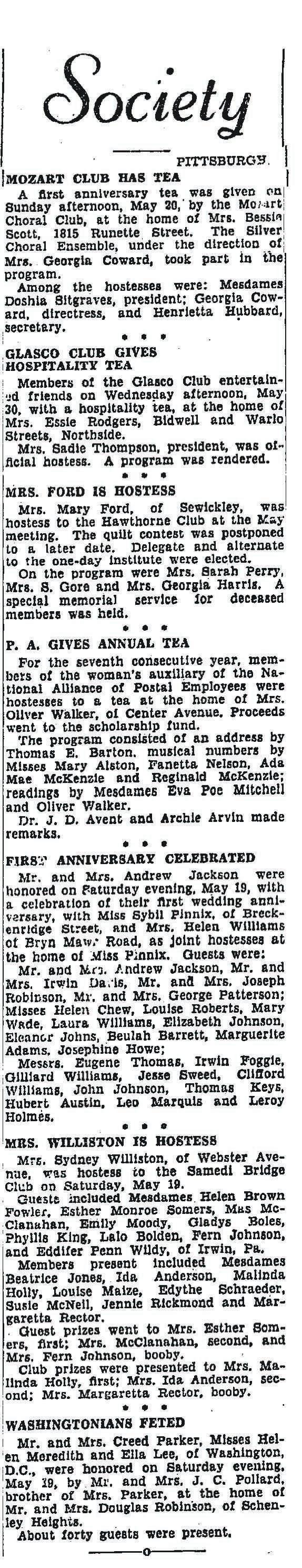

Over the years the

fellowship and reassure social bonds, gathering for tea has long been a favorite Spring pastime. Take a look below to see how the AFRO has covered tea events in the Black community through the decades.

In Spring 1959, the

women attend the Friendship Tea of the National Council of Negro Women in Washington, D.C. Shown here (left, front) Charlotte Downing; Dora Hutchinson; Delsie Smith, Irene Dotson; Dr. Dorothy Ferebee, president of the Council in Washington; Mrs. Olga Rodney, Dr. May. Belle Weaver; Catherine Mayo; Verda Welcome; Vivian Alleyne; Miss A. Dukye Woode (second row, left); Mae Allen; Cordtland Brown; Marione Croxton; Pearl Ward; Hilda Higgins; Jennie Goldring; Muriel Jenkins; Martin Jenkins (back row, left) Elizabeth Farmer, Waltye Doles and Odelle Payne.

Philadelphia,

and

Jack and Jill committee members are pictured during their ‘Spring Happening’ held at The

and Shirley Hill; Mabel Hubbard (back,left), Arnette Hargrove; Ruth Hunt; Frances Pennington; Flossie Johnson; Dolores Sykes and Geraldine Desbordes.

By Megan Sayles AFRO Staff Writer msayles@afro.com

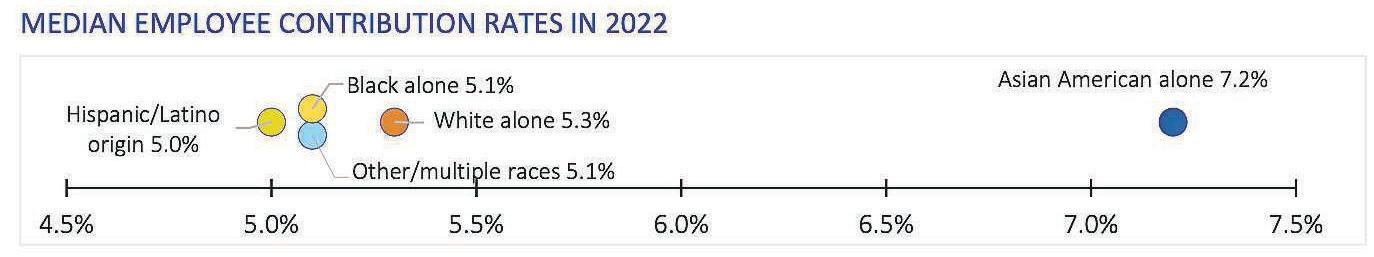

For many Black Americans, the dream of a secure retirement is increasingly out of reach. Despite decades of work, a combination of wage disparities, unequal access to employer-sponsored retirement plans and other economic inequalities have left Black workers with significantly less savings than their counterparts.

This divide can be referred to as the “retirement gap.”

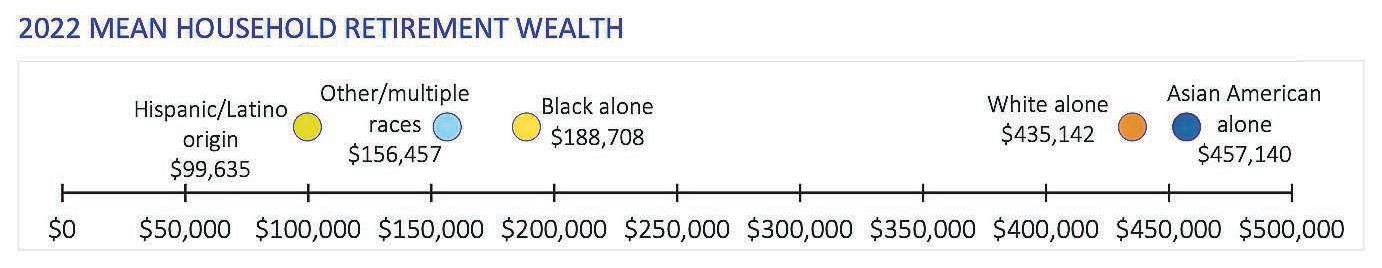

“On average, African Americans have less than half the retirement wealth of White households, and, among those with a retirement account, Black households have less than one third of the median balance of White households,” said Christian Weller, senior fellow at the Center for American Progress and public policy professor for the University of Massachusetts, Boston. “There is also no trend toward shrinking those gaps.”

Weller and two other researchers published a report titled, “Retirement Wealth by Race and Ethnicity:

Differences, Trends and Contributing Factors,” in April 2024 for the Society of Actuaries. The study found that the average retirement savings for Black households was $188,708, compared to $435,142 for White households in 2022.

Weller explained that there are a number of factors that have contributed to the racial retirement gap. He groups them into three buckets: access to an employer retirement benefit, contributions to retirement accounts and the chance of adverse economic outcomes that make it more challenging for African Americans to save for retirement.

According to Weller, Black adults are less likely to work for an employer that offers a retirement plan, like a 401(k), compared to White adults.

The study discovered that 74 percent of Black households had access to an employer-sponsored retirement benefit compared to 82 percent of White households. Even if they do work for a company that offers retirement benefits, Weller said they are less likely to qualify for them due to factors like minimum tenure and hour requirements.

One common misconception that the

report helped to debunk is that Black Americans, as individuals, save less than their White counterparts. When income levels are similar, Black households often save at comparable rates to White households. Lower contributions for African Americans are not a result of differences in saving habits but rather a result of systematically lower earnings, according to Weller.

One other element that influences the retirement gap between Black and White adults is that African Americans have a higher chance of experiencing costly economic challenges.

“Those adverse economic effects include more unemployment, longer spells of unemployment, greater income instability, higher chances of falling ill or becoming disabled, greater financial demands from friends and family, less stable and more costly housing, less access to healthy and affordable food and more widespread and more costly interactions with the criminal justice system,” said Wellers. “These are some of the most widespread economic risks that impose greater costs on Black households than White households.”

The generational wealth gap makes African Americans even more vulnerable to economic hardships and unexpected expenses, according to Weller.

“The lack of generational wealth means that there is less wealth and thus fewer financial protections among Black households. At the same time, African Americans are more likely than White households to experience adverse economic effects,” said Weller. “They cannot rely on their own savings because they have fewer. They then turn to family and friends for help. Those that provide informal financial support have the money to help. But, they need to forego higher rates of return to keep that money liquid.”

He explained that caregiving responsibilities, which fall more heavily on Black families than their counterparts, create financial obligations that increase the need for liquidity. His study found that African Americans are saving more for retirement when they have to account for support to family and friends. However, this causes them to take out more 401(k) loans and can hinder their ability to build long-term wealth.

Weller recommended several strategies

for closing the retirement gap between White and Black households. They include: broader access to retirement savings plans, like automatic individual retirement accounts sponsored by state governments; automatic increases in contributions rates for retirement plans, like the upcoming Saver’s Match; and expanding social programs.

He suggested increasing access to social security, unemployment insurance, workers’ compensation, paid medical and family leave and affordable health insurance. This can help to aid Black households who face greater economic obstacles.

“An equitable retirement system is one where everybody has the same chances to save for their retirement, including equal access, progressive savings incentives and help in reducing risks and costs of adverse economic events,” said Weller. “For one, this is fair, but it’s also critical in the U.S., since public policy has always expected people to shoulder some of the costs of saving for the future. That expectation then also means that public policy needs to make it possible for people to save for their future.”

There is no evidence to suggest that African Americans save less than their White counterparts. Shown here, a chart created from SOA Research Institute data, showing that Hispanic, Black and White households had similar contribution rates in 2022.

courtesy of

Black households have less than half the retirement savings than their White counterparts. Shown here, a chart showing how Black household retirement wealth was $188,708 in 2022, compared to $435,142 for retirement wealth in White households in the same year.

By Tashi McQueen AFRO Staff Writer

tmcqueen@afro.com

Saving can be hard for anyone, but for African Americans– who have to fight bias and discrimination on multiple financial fronts– it can be even harder.

This reality is why people like Jason Brown, a stock market expert and founder of the Brown Report, aim to help Black Americans as they navigate systemic challenges on the way to financial wellness. With the Brown Report, the finance wiz aims to provide stock market education to the masses.

He recently shared perspectives on the plight of Black Americans who are saving for retirement and the best ways to persevere through those obstacles.

“We’ve historically been underpaid compared to our counterparts,” said Brown, 43. “We’ve had less disposable income to put away. We’re spending a good portion of our lives trying to meet our basic needs.”

Brown pointed out how this results in Black Americans starting retirement savings later in life than other groups.

“I also have seen a financial education gap for Black Americans,” said Brown. “They get into [financial] trouble in their early years– college or early into marriage. They have to spend a good portion of their adult life correcting bad credit and getting into debt, versus spending their adult life putting money away or investing

and allowing it to grow and compound.”

He recommends Black Americans make sure they are educated about the status of their own finances.

“Know the numbers,” said Brown. “If you don’t know the numbers, you can’t have a plan. If you don’t have a plan, you’re never putting anything away to work towards.”

Brown said people should know how much they want to save annually toward retirement based on the lifestyle they want to live. They should also know the stock market numbers, what they can cut from their lifestyle to help meet their goals and what investment accounts may provide the best returns.

“Know the numbers. If you don’t know the numbers, you can’t have a plan.”

For families caring for a loved one with special needs, planning for retirement can be even more complex. Mary Anne Ehlert, president and founder of Protected Tomorrows, spoke to those challenges in an AFRO interview. Protected Tomorrows is a financial planning company that aims to help people with special needs live

more securely and independently.

“Families of persons with disabilities always have in the back of their minds, ‘when I’m gone, how will my loved one be protected, have a place to live and have access to the care they need?’” said Ehlert. “That’s why financial planning for special needs families takes on many different dimensions. All of these dimensions must be considered if a family is to achieve peace of mind.”

In 2024, the University of New Hampshire Institute on Disability found that more than 3.6 million Black adults are living with disabilities. African-Americans with disabilities are 51 percent more likely to live in poverty, 84 percent more likely to lack proper housing and 22 percent less likely to have a job.

“If you think of future financial planning as a pie, there are pieces we already know…college funding, retirement planning, investment strategies, estate planning, tax planning and risk management,” said Ehlert. “For a family with a special needs family member, there’s another big slice: special needs planning – which affects all of the other pieces.”

Ehlert recommends that caregivers ensure their retirement plan includes a line item and expense summary for the future care of the loved one with disabilities, at all stages of their life. She also recommends taking on the process holistically.

Brown noted that access to financial education has been easier in recent years with the rise of Black and Brown creators online sharing their wealth journeys and providing advice. Creators are sharing how they got out of debt

and how they learned to stop trying to look wealthy and opted to work to get out of debt and be financially stable instead.

Brown debunked a misconception that Black Americans typically have: that retirement has to happen late in life or after 40-plus years of service for a job they dislike.

“Retirement can happen at any age,” said Brown. “I think the new definition of retirement is being financially independent and having a choice of if you want to work or not.”

By Megan Sayles

AFRO Staff Writer msayles@afro.com

For many Americans, especially those shut out of traditional retirement systems, thinking beyond an employee-sponsored retirement plan or pension may be a financial necessity.

Though alternative options, like real estate or small business ownership, can support long-term retirement savings building, they can pose risks. This week, the AFRO spoke with Katherine Lucas McKay, associate director at the Aspen Institute Financial Security Program, to discuss the non-traditional strategies that exist and their reliability.

AFRO: What are some alternative retirement savings strategies and how do they work— or not work— for people of different socioeconomic and racial backgrounds?

Katherine Lucas McKay: It is important to start by recognizing that the dominant retirement strategies—like investing in markets through tax-advantaged accounts such as a 401(k), 403(b), Individual Retirement Account (IRA) or a pension— have the strongest proven track record compared to alternatives, like investing in real estate, owning a business that you sell upon retirement or investing outside of retirement accounts. But, even these proven strategies do not serve everyone well.

The National Retirement Risk Index from Boston College finds that 39 percent of non-retired people in 2022, were at risk of not maintaining

their standard of living in retirement.

There are two key reasons: millions of workers do not have access to retirement savings plans at work where it can be easiest to sign up and, even for those who do have retirement accounts, it is difficult to save the amount of money needed for a secure retirement.

That drives many people to consider alternative strategies, especially if they lack access to a pension or workplace retirement account. Those people tend to be workers who are Black, Latino or immigrants, and people who are not in the workforce, such as those who are full-time caretakers for a family member. Alternative strategies can be risky to rely on for retirement

security. With real estate, it’s almost always an all-or-nothing investment. People must save up until they can make large down payments on each property and take out debt to finance the purchase. This delays asset purchases, leaves less time for assets to appreciate and concentrates risk in a single sector of the economy. Property is also expensive to own and maintain.

For business ownership, the risk is that when you need to retire there may not be a buyer. Also, very few small businesses are worth hundreds of thousands of dollars, which is what people need to retire without a reduction in their quality of life. Only 14.6 percent of households have business equity, and the median amount

is $90,000. Millions more people run successful small businesses, but they don’t generate enough profit to motivate someone else to buy their business.

Finally, when people invest outside of retirement accounts, they lose out on tax benefits that save them thousands or tens of thousands of dollars over their working years. For those reasons, alternative strategies are harder to make pay off compared to dominant strategies. They can work, but they are less dependable.

AFRO: What role can homeownership, real estate or small business ownership play in retirement planning—even if those endeavors aren’t a primary strategy?

KLM: I discussed some of the risk of relying on real estate and small business ownership as primary retirement savings strategies, but they can and often do have a place alongside traditional retirement accounts. Some small landlords, for example, plan to have a few rental properties during retirement that can provide additional income. Many small business owners also invest some of their profits in retirement accounts. They may also sell their businesses, but that does not provide all the funds they will need. What is most common is for homeowners to pay off as much of their mortgage as possible before retiring so they can sell their home and move to a less expensive place that they buy with cash. They use the additional funds from selling the larger, more expensive home to supplement their retirement savings.

AFRO: What trends are you seeing for how younger generations, like Millennials and Gen Z, are approaching retirement planning?

KLM: Millennials and Gen Z workers are starting to save for retirement earlier in life. They open retirement accounts at higher rates in their 20s than Gen X did, for example. The oldest Gen Zs are 29, so this generation is the young people in the workforce. As of 2022, 49.6 percent of households under age 35, owned retirement accounts. Back in the late 90s, that number was closer to 40 percent.

They also have more saved in these accounts than young workers of previous generations. However, they’re not just investing in the traditional, dominant retirement strategies. Almost one in four households under 35 directly own stocks outside of retirement accounts. A 2022 study of who owns cryptocurrencies found that 20 percent of people aged 26 to 40 owned crypto, a much higher rate than people over 40.

AFRO: How might you be able to merge a traditional strategy with an alternative one for longterm retirement savings?

KLM: People who are interested in alternative strategies should consider how to pursue those alongside a traditional strategy. That way, they can benefit from long-term increases in various investment markets and compound interest but also put money into strategies that they are more personally interested in or feel that they are likely to succeed in.

By Andrea Stevens AFRO Staff Writer astevens@afro.com

As the stock market reacts to tariff decisions made –and reversed– in the White House, many baby boomers and near-retirees have seen significant losses in their 401(k) plans. Byron Deese, CEO of Engage Wealth, is urging those preparing for retirement to take a closer look at their portfolios and consider reallocation strategies. He also encourages using this downturn as a chance to reassess additional retirement accounts and treat it as a wake-up call for anyone who hasn’t started planning.

Byron Deese specializes in providing retirement services and employee benefits for small businesses. He is a Certified Exit Planning Adviser (CEPA), and is a licensed insurance agent in Life, Health, and Annuity by the State of Maryland. He is a native of Sanford, Florida, Byron is a graduate of Tuskegee University in Alabama, with a bachelor’s degree in finance.

“A 401(k) is an employer sponsored retirement plan that employees can contribute to and receive a tax deduction for their contributions,” explains Deese.

Deese stresses the importance of reviewing how funds are allocated within retirement accounts. Many employees begin contributing to their 401(k) plans when they start a new job but never revisit their investment choices. With market instability, this oversight can have serious consequences, especially for those within a decade of retirement.

“If you are investing in a 401(k) plan for the long term, when markets are down like this it could create great buying opportunities,” Deese said. “The younger you are, the more risk you can afford to take—because you have the time to ride out market swings and benefit from recovery.”

Deese highlights the value of contributing to Roth options when available. While younger workers might overlook the benefits of after-tax contributions, he emphasizes the long-term payoff.

Vanguard, an investment advisor group, explains a Roth Individual Retirement Arrangement (IRA) as “an individual retirement account that offers tax-free growth and potentially taxfree withdrawals in retirement.” You pay taxes on the money deposited prior to putting it into the account, so it grows tax free.

“If your company offers a Roth contribution option, take advantage of it. The taxfree growth and withdrawals in retirement can be a game changer,” he said. “It may not seem like a big deal in your 20s or 30s, but by the time you’re 60, you’ll be glad your retirement contributions were already taxed.”

Diversification beyond a 401(k) is also essential. Deese recommends indexed universal life insurance policies, which allow for tax-deferred growth and tax-free access through policy loans, while also providing life insurance coverage. These policies offer more flexible contribution limits than Roth IRAs and provide life

“Each

insurance with living benefits.

Investing in real estate is another way to build long-term wealth. Whether through long-term rentals, mid-term leases or shortterm vacation properties, real estate can generate consistent income and strengthen overall financial stability. He also encourages individuals to consider entrepreneurship.

“I think it’s important for everyone to have their own LLC (limited liability company) to market the things they know and understand,” Deese said. “It’s a way to share your value with others and get hired for your expertise.”

“As you approach retirement,

begin reallocating. Each year, move 10 percent of your investments from equities to safer, fixed-income options to protect your savings,” said Deese. Failing to make timely adjustments, he warns, can lead to delayed retirement or additional working years. With inflation, interest rate changes and global market shifts adding uncertainty, Deese emphasizes the need for an active, informed approach to planning. Whether through increasing contributions, diversifying assets or working with a financial advisor, now is a critical time to strengthen retirement strategies and safeguard future income.

Charming Home Loan* is tailored to help you unlock the door to your dream home in Baltimore.

By Michelle Guissinger

Everyone has their own unique retirement timeline, needs and strategies. But thanks to factors like Social Security, Medicare and IRS rules, just about everyone will face retirement planning milestones in approximately the same order and at the same stage in life.

As National Financial Literacy Month comes to a close, the Wealth Enhancement Group has outlined the major milestones faced in retirement and the ages at which you’ll face them—starting with right now.

Navigating your journey to retirement is much easier with a financial advisor at your side. While you can partner with an advisor at any stage of your life, choosing one sooner rather than later is best. Your advisor can then help you evaluate your situation, plan for these milestones and get you through your retirement years with your best interests in mind.

In your 40s

Max out your retirement accounts

You need to save a lot of money for retirement—especially in your peak earning years. This is a time when you’re likely benefitting from an employer-sponsored health plan, and you may even be enjoying a hard-earned break from the expenses of raising and educating children. Take advantage of it by contributing as much as possible to your retirement accounts. Make Roth IRA contributions

There are limits to how much you can contribute to your Roth IRA. In 2023, if you’re under age 50, you can only contribute up to $6,500 for the entire year. If you’re over 50, you can contribute an extra $1,000 in catch-up contributions. Even then, the amount you can contribute is dependent on your income. Once you reach a certain limit, the amount you can contribute starts to phase out. Contributing to your Roth IRA early allows for longer tax-free growth and ensures you don’t lose the opportunity to make contributions. Start building tax diversification

Tax diversification is intentionally distributing your assets between various investment accounts that are taxed differently. Just like you should have diversification in your investments, you should also have diversification in how your retirement accounts are taxed.

Essentially, this means you should start spreading your assets around various accounts that are taxable, tax-deferred, or tax-advantaged. This strategy allows a more even distribution of your tax burden throughout your life by allowing you to vary what sources you draw income from based on your circumstances.

In your 50s

Make a plan for long-term care

It’s estimated that 7 out of 10 people will require long-term care (LTC) at some point in their lives, so you’d be wise to plan how you can pay for it, should you need it. You could pay for it on your own or look into LTC insurance, which can help you pay for services generally not covered by Medicare. If

Photo

From age 40 to your 70, retirement milestones follow a familiar path—even if every personal journey is unique. Here is a breakdown of key ages and strategies to help navigate Social Security, Medicare, long-term care planning and more with confidence.

you decide to go the LTC insurance route, your early 50s are a great time to start. The older you enroll, the higher your annual premiums will be.

Catch-up contribution eligibility begins at age 50

There are limits to how much you can contribute to your various retirement accounts each year. However, once you turn 50, the IRS allows you to contribute an additional amount on top of the existing limits, called “catch-up contributions.” These get adjusted annually, so keep an eye out for them.

Early, penalty-free withdrawals from 401(k)s may begin at age 55

Under certain conditions, it’s possible that you can start taking withdrawals from an employer-sponsored 401(k) account without incurring the 10 percent early withdrawal penalty fee. However, it would help if you retired in the year you turn 55, and you can only take these penalty-free withdrawals from a 401(k) account that’s sponsored by the employer you’re leaving. Additionally, it’s only recommended that you start taking these withdrawals if absolutely necessary. Your advisor can help you devise a withdrawal strategy that works for you.

Penalty-free withdrawals from all retirement accounts beginning at age 59½

You can start withdrawing from all qualified retirement accounts and IRAs at this age without incurring the 10 percent penalty fee. However, those withdrawals may still be taxed as regular income, depending on the account.

In your 60s

Nail down your retirement plans

People typically retire in their 60s, so if this sounds like you, make sure you plan for it and set a date. Then, book that trip, spoil those grandkids, and do what makes you happy. You earned it.

Consider doing Roth conversions

After you retire but before you start drawing Social Security—and before required minimum distributions (RMDs) kick in—it can be an excellent time for Roth conversions. The thinking here is that you have less income after you retire, so you should be in a lower tax bracket and will be taxed less on your Roth conversion. A financial advisor can help you determine if Roth conversions make sense for your situation, when, and how much. Social Security survivor benefits may be

available at age 60

If your spouse dies, you can start claiming off their Social Security benefit at age 60. How much you’re entitled to depends on a few factors, but it will be at a reduced amount. However, once you turn 62 and are eligible for your own Social Security benefit, you can switch to the higher monthly benefit amount.

Social Security eligibility begins at age 62

At this age, you can begin drawing from your Social Security benefit, albeit at a permanently reduced amount—monthly payments will be approximately 75 percent of your full benefit. Medicare eligibility begins at age 65

This is when most Americans are eligible for Medicare. However, Medicare comes in four segments (Parts A, B, C and D), so educate yourself on what you’re getting into and what you’re signing up for. You must also make some sort of election once you’re eligible for Medicare; if you don’t, you could be permanently penalized.

Social Security full retirement age at 66 or 67 (depending on when you were born)

Full retirement age (FRA) refers to the age at which you are eligible to receive 100 percent of your Social Security benefit. For those born between 1955 and 1959, FRA is 66 plus two months for each year you were born after 1954 (so, if you were born in 1957, your FRA is 66 years and six months). For those born in 1960 or later, FRA is 67.

In your 70s

Ensure your estate plan is in order

While it’s a good idea to have your estate plan in place well before you reach your

70s, the older you get, the more critical it is to ensure your ducks are in a row. Five key documents/legal entities are essential in any good estate plan (like your will, beneficiary designations, power of attorney, etc.), so make sure you have them all in order and review your estate plan regularly. A financial advisor can work closely with your attorney to ensure all aspects of your finances are addressed in your estate plan.

Your last year to claim Social Security is age 70

Not only is age 70 the final year you can claim your Social Security benefit, but it’s also the age at which you can receive the maximum monthly benefit amount. Your Social Security benefit increases by about 8 percent annually between FRA and age 70, so if you can wait until you turn 70 to start claiming, you can receive 132 percent of your full Social Security benefit. Qualified charitable distribution eligibility begins at age 70½

Qualified charitable distributions (QCDs) are direct transfers of funds from your IRA to a qualified charity. These can be counted towards your annual RMDs and keep your taxable income lower.

RMDs kick in at age 72

At this age, you have to start taking distributions from qualified retirement accounts like 401(k)s, 403(b)s and Traditional IRAs. RMDs are counted towards your taxable income, so planning for them is essential.

By Tashi McQueen AFRO Staff Writer tmcqueen@afro.com

Americans are increasingly turning to self-employment to live fulfilling lives, but the inconsistent nature of self-employment could make planning for retirement a significant challenge.

In honor of National Financial Literacy Month, Felicia Gopaul, investor coach at Financial Control Mastery, and Dana Artzer, owner and founder of Arizona Insurance and Retirement Services, spoke with the AFRO on how self-employed individuals can save for retirement.

“The most common mistake the self-employed make is waiting until their finances smooth out before they start saving for retirement,” said Gopaul. “It can take a while until their business income starts to be predictable, and in the meantime, time is passing.”

According to a Pew Research Center analysis of government data in 2023, around 15 million U.S. individuals are self-employed, making up around 10 percent of U.S. workers. Black people make up 8 percent of America’s self-employed workforce.

Gopaul recommends self-employed individuals start saving for retirement wherever they are in their career journey and whenever they can. “If you are unsure about your business income, start

with a personal IRA (Individual Retirement Arrangement) or Roth IRA,” she said.

Gopaul explained that if needed, people can withdraw the amount they contributed without penalty through the Roth IRA.

“Once your income is more predictable, consider starting an SEP (Simplified Employee Pension plan),” she said. “It can be easy to start and easy to maintain. It allows you to put in a significant amount–up to $70,000 or 25 percent of compensation.”

out–flip-flops. Sometimes you have a good week and sometimes you have a bad week.”

Still, she echoed the importance of saving early for retirement.