By Megan Sayles AFRO Staff Writer msayles@afro.com

For generations, Blackowned banks have played a crucial role in helping African Americans build economic security amid systemic barriers to financial services. As households across the country experience uncertainty about the future of the economy, leaders of two prominent Black-owned banks are sharing their strategies for savings and budgeting.

In honor of National Financial Literacy Month, the AFRO connected with John Lewis, CEO and president of The Harbor Bank of Maryland, and Teri Williams, president and COO for OneUnited Bank, to discuss their money management tips and the state of Black banks today.

Q: What savings account from your bank would you recommend to working people and why?

John Lewis: Our Statement Savings account. It can be opened with as little as $100 and supports our lending activity— the majority of which occurs in Greater Baltimore.

The Harbor Bank of Maryland is a member of the Federal Deposit Insurance Corporation (FDIC), meaning accounts held with us are insured up to $250,000 and backed by the full faith and credit of the U.S. government. Having a savings account allows our clients to separate their funds that exist for peace of mind and goals, like an emergency fund, retirement and down payment for a home purchase, from their checking account.

Teri Williams : Our focus for our community is to set up an automatic savings account where money is automatically going into an account before it reaches their pockets. This is because we recognize that what wealthy people know is that money needs to go from their paychecks into a savings account. If it goes into your pocket, you are more likely to spend it.

We also recognize the importance of keeping the change. We have an auto-save program where the change of your purchase is transferred into your savings account every time you spend. Our OneUnited Checking and OneUnited Savings account, in combination, provide both the automatic savings and keep the change opportunity, and there’s no cost to either of

those accounts.

Q: What are three pieces of advice you would give to someone who is trying to improve their saving and budgeting skills?

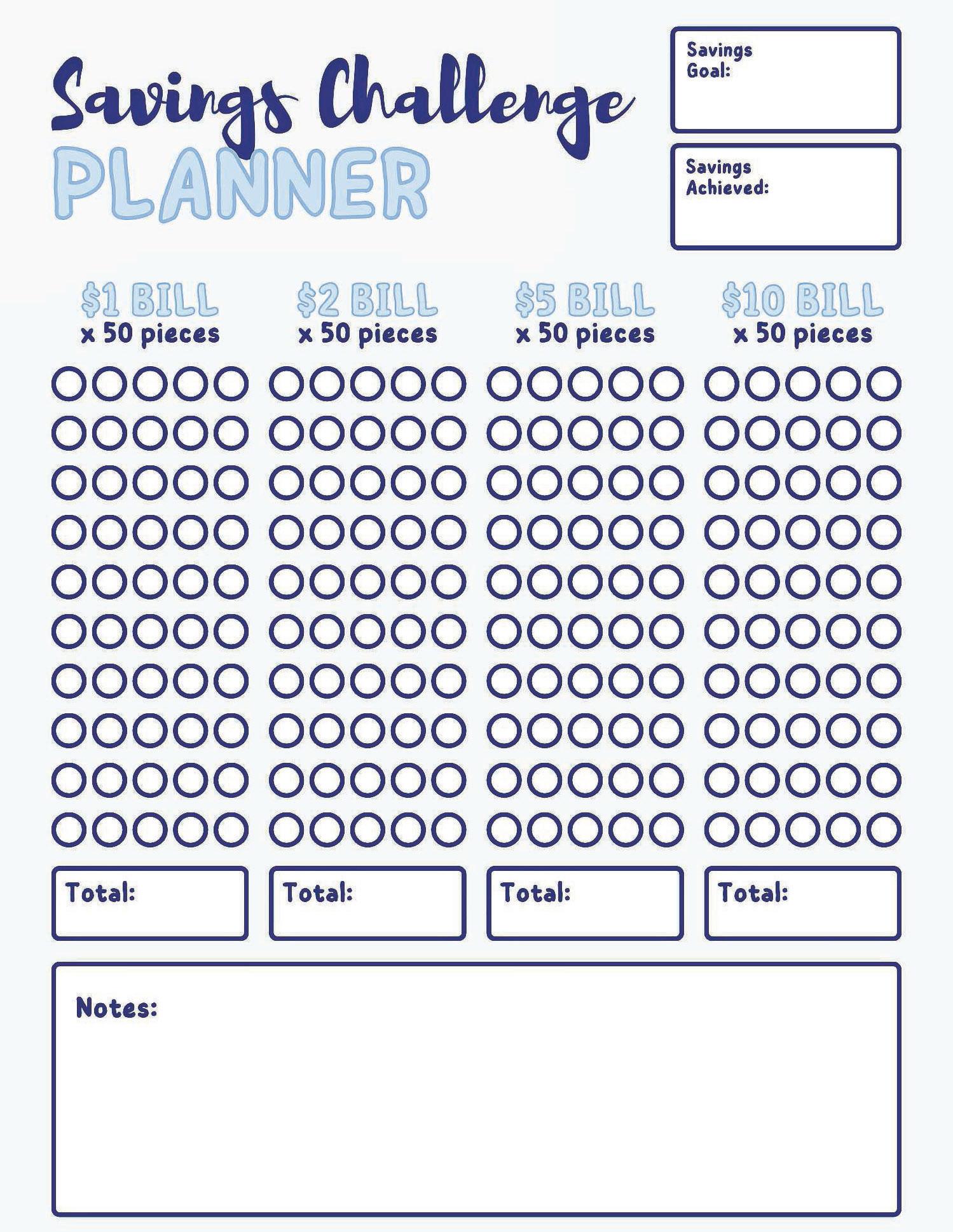

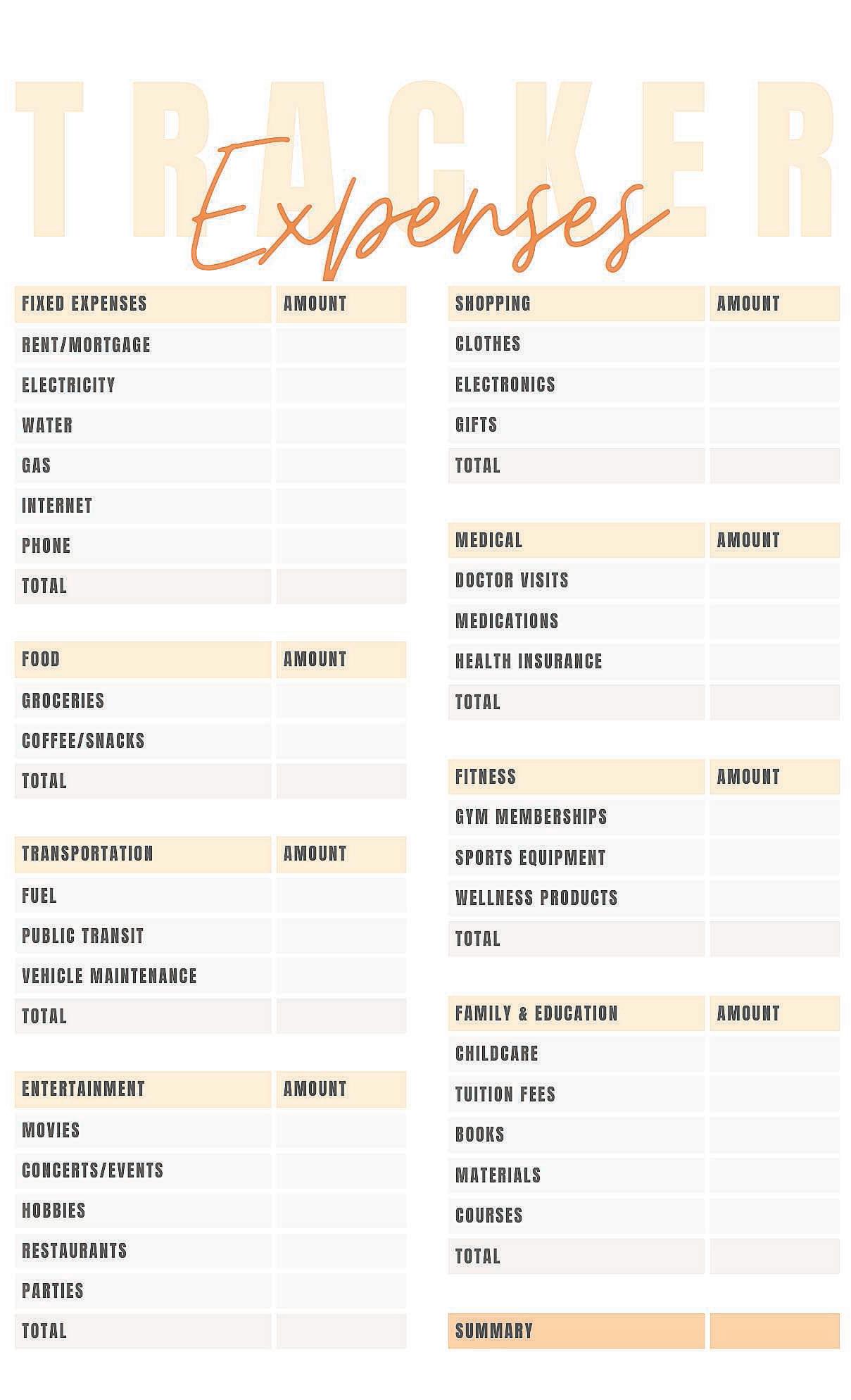

JL: Track every expense and understand where and how much you are spending. Simplify the process by paying yourself first and using automated tools and offerings, like direct deposit. Understand money as a tool enabling a full life, not as a goal.

TW: Set up an automatic savings plan or account. I guarantee you will not miss the money if you do that. I don’t care if it’s $1, $5 or $10 a month. You can even tell your employer to split your direct deposit between your checking and savings accounts.

The second thing is to save for home ownership. I know

people are complaining about interest rates during this time, but we strongly believe that even if you have to buy a hut, you should buy a home. Owning a piece of real estate has historically been the number one way in which Americans have built wealth, and that is largely due to the fact that your mortgage interest payments are tax deductible and, over time, real estate is a good investment.

The third thing I would recommend is to check out a Black fintech company called, Esusu. It’s a company that reports rent payments to help rebuild your credit. It also only reports positive payments, so it can’t hurt.

Q: Can you describe the state of Black-owned banks today?

JL: Overall, Black banks

are stronger, more profitable and better capitalized than ever. In an industry where many smaller and community-focused banks are increasingly challenged to compete and demonstrate their relevance to customers, we are finding support from customers who understand the value of an intentional banking relationship. We have also advanced our product and technology offerings with services, like Zelle, mobile-banking and online account opening.

TW: Black-owned banks are stronger today than they’ve been in a long time. Under the previous administration, a lot of Black-owned banks were able to partner with companies and raise capital. It’s a very strong industry at the moment.

Given what’s happening

By Megan Sayles AFRO Staff Writer msayles@afro.com

Baltimore native Nicolas Abrams has been working in the financial services industry for 25 years. The certified financial planner opened his own registered investment advisory (RIA) firm, Opulentia LLC, in Hunt Valley, Md. in 2009.

As an RIA, Abrams’ business has a fiduciary responsibility to act in the best interests of their customers.

“We are able to take a holistic approach to financial planning where we don’t have to push an individual product down a client’s throat,” said Abrams. “We can work with a wide range of money managers and insurance companies to find the best need for our clients.”

Abrams debunked some of the myths that could be holding people back from maximizing their savings and broke down the best savings account options based on different financial situations.

Common misconceptions about saving

For Abrams, one of the biggest misconceptions people face is that they should save less when the market is volatile. Though economic downturns may spread fear and uncertainty, Abrams said they

should refrain from becoming too conservative in how they reserve their money.

“Either your money has to work for you, or you have to work for your money. What I mean by that is that your money, at a bare minimum, has to keep pace with inflation, but it really needs to outpace inflation,” said Abrams. “If all of your money is in an account earning 2 percent interest, but inflation is at a 4 percent rate, all you’re doing is safely losing money.”

Another misconception Abrams noted is that people think they do not need specific savings goals and should just have a catch-all savings account.

“People should have money in different buckets for different reasons,” said Abrams. “You can’t save for retirement the same way you save for a down payment on a car or for your kids’ education. You have to make sure you’re choosing the right options for your goals.”

One of the most prominent ways people save for retirement, according to Abrams, is through a 401(k) plan at their employer.

“You choose an amount that comes right from your paycheck each pay period, and, generally, your employer will put some type of match in,” said Abrams.

If their employer does

in the world, it’s also a very important industry because our community needs financial institutions they can rely on. There are still a lot of companies out there that support Black-owned banks and Community Development Financial Institutions (CDFIs) because of the work we do in urban and rural communities. At the same time, we have to be cautious because there is backlash to diversity, equity and inclusion.

Q: Why is it important that Black-owned banks remain sustainable and continue to serve communities?

JL: For there to be accelerated economic development in a community, investments and resources must be attracted to and remain held in that community. Banks are how individuals, corporations, nonprofits and governments store a considerable portion of their wealth. Banks invest and lend those resources in the places where they have a presence. Consequently, a bank that is dedicated to a community and geography is essential to local economic development.

TW: We have the interests of the Black, low-to-moderate, minority and urban communities at heart. The number one focus for us is helping our communities build wealth. Our institutions continue to be relevant. I would draw an analogy between HBCUs and Black-owned banks. When you look at the history of our institutions and the benefits we brought to the community, I think it speaks for itself.

not offer this plan, individuals have the option to open individual retirement accounts (IRAs) or Roth individual retirement accounts (Roth IRAs). One of their major differences is their tax treatment.

IRAs are tax deductible, giving people a tax break upfront that will be paid upon withdrawing the money in retirement. Money that goes into Roth IRAs are after-tax dollars, allowing people to make tax-free withdrawals in retirement.

“You can’t beat tax-free,” said Abams. “I’ll take taxfree all day long over something that’s taxable.”

When saving for college, Abrams recommended opening a 529 plan, which can be used for tuition; room and board; and books and supplies. The plan can also be used for K-12 education, but ,in this case, only $10,000 can be taken from it per year.

There are no income restrictions for contributing to a 529 plan. As long as the money from the plan is used for educational purposes, there are no federal taxes taken out.

“We tell our clients to structure their plan for college depending on their child’s needs. If you have a child who might have a special gift that’s going to get them scholarship money, you

may want to look at something different than a 529 plan,” said Abrams. “But, for most people, 529 plans are one of the easiest ways to save for college.”

According to Abrams, two of the best savings options for buying a home are high-yield savings accounts, certificates of deposit (CDs) and money market accounts. These accounts are good for medium-term goals of one to five years.

When evaluating these accounts, it’s essential to compare interest rates to maximize earnings.

“We find that online banks offer a higher rate because they don’t have a brick-andmortar building to pay for,” said Abrams. “But, some people are not comfortable with online banks. That choice can sometimes come down to comfort level.”

By Frances Murphy Draper AFRO CEO and Publisher

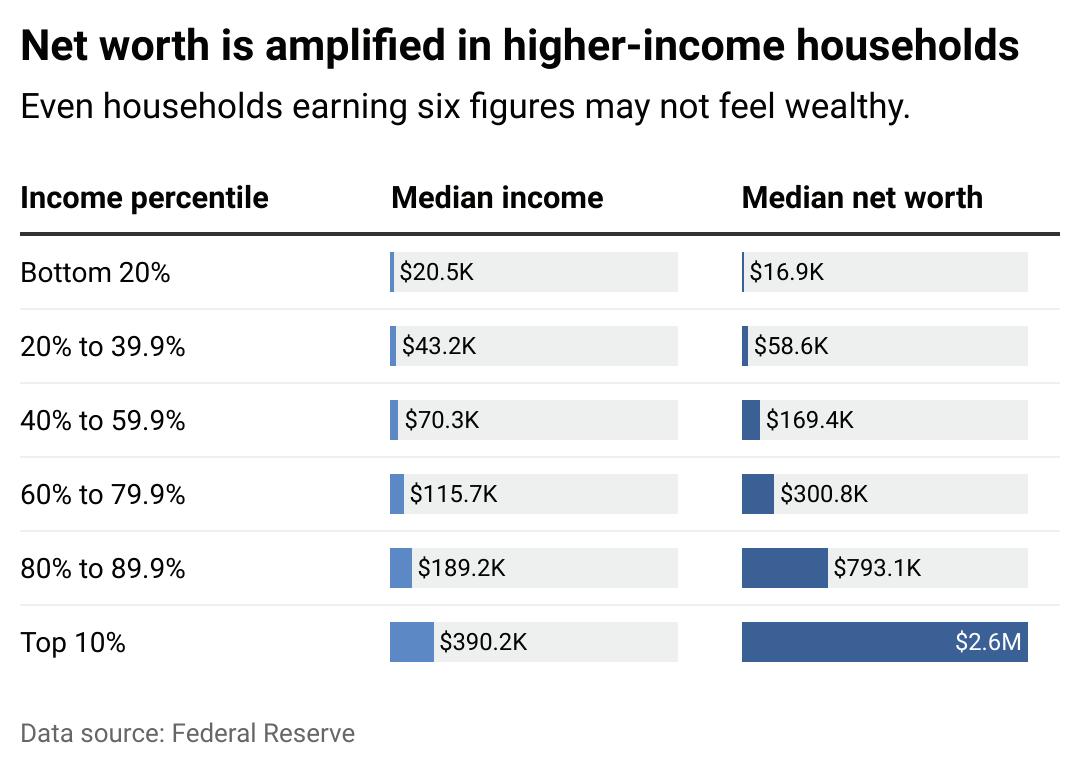

We’ve marched with purpose, prayed with conviction and built communities from the ground up— often with little more than faith, determination and each other. That same faith has carried us through generations of economic exclusion, systemic barriers and hard choices. And yet, despite contributing over $1.6 trillion to the U.S. economy each year, African Americans still face some of the nation’s most persistent wealth gaps. According to the Federal Reserve, the median net worth of white families is nearly eight times that of Black families.

These aren’t just numbers—they represent the distance between security and struggle, between surviving and thriving.

However, if history has taught us anything, it’s that we know how “to make a way out of no way.” From Black-owned banks and mutual aid societies to church building funds, savings clubs and the U.S. Savings Bonds our elders proudly tucked away, we’ve always had strategies for saving and investing—even when the doors of traditional institutions were closed to us. Today, we have an opportunity to build on that foundation with new tools and renewed commitment—one budget, one savings plan, one family at a time.

Let’s start with a budget. A budget is just a plan to spend. It’s not restrictive—it’s empowering. It tells your money where to go instead of leaving you wondering where it went. Regardless of your income level, having a plan helps avoid cycles of paycheck-to-paycheck living and opens the door to setting aside money for emergencies, education or even retirement.

In many of our households, money conversations come with fear, silence or shame. We may fear

facing how little is left after the bills. Or we hesitate to trust financial systems that haven’t always treated us fairly. Some of us simply don’t know where to begin. That’s okay. Start where you are.

Many years ago, when I was a stockbroker for a major brokerage firm, I saw firsthand how African Americans were often excluded— intentionally or otherwise—from meaningful financial conversations. It wasn’t simply a matter of disinterest. Many Black individuals and families weren’t approached, welcomed or educated about investment opportunities. For some, there was a deep and understandable mistrust of financial institutions rooted in a long history of discrimination and unequal treatment. For others, the products and services offered didn’t feel relevant or accessible. These barriers—some systemic, some social—led to missed opportunities to build long-term wealth. Today, there are more accessible tools and resources available, and the hope is that more people in our community will feel empowered to ask questions and explore what’s possible.

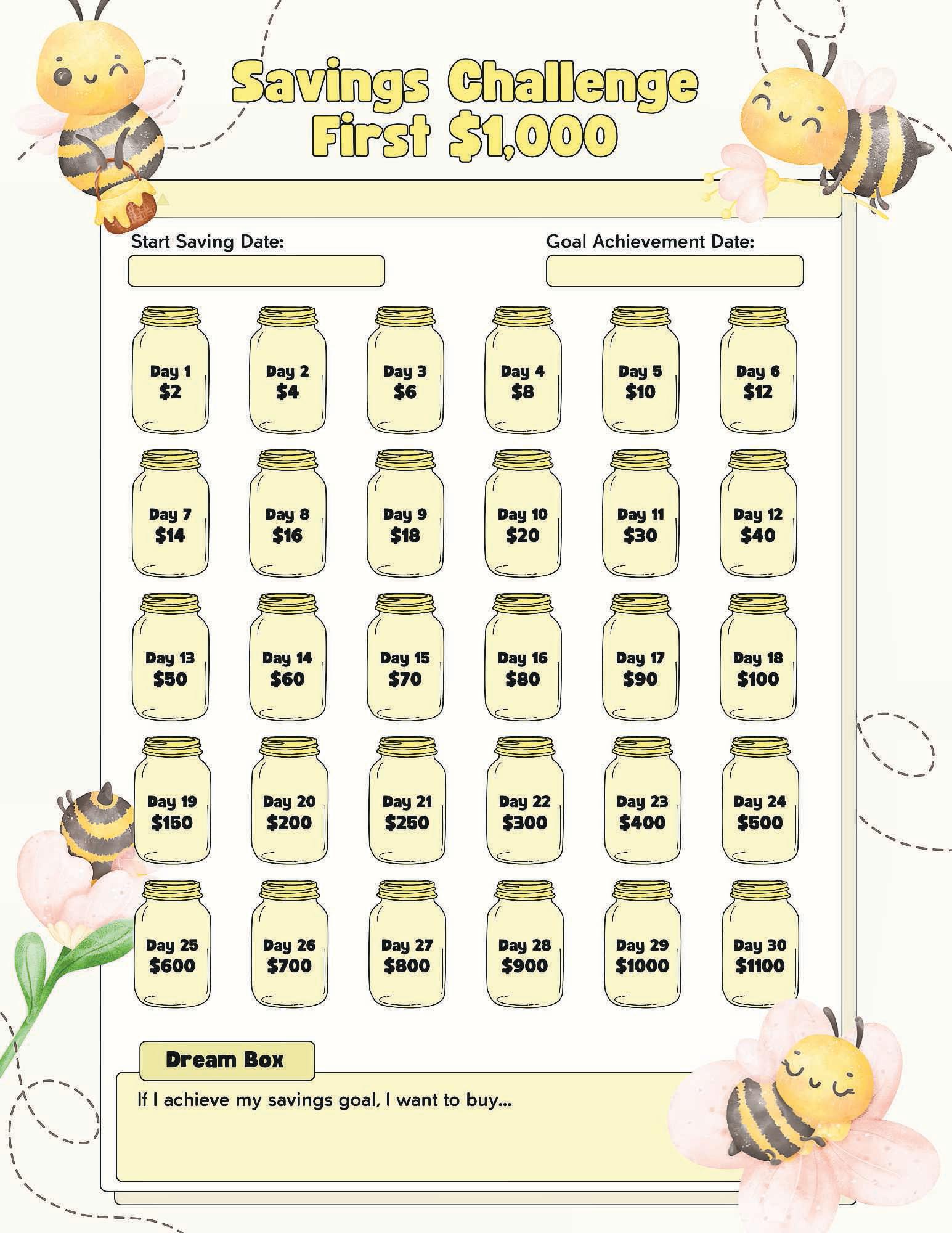

If you’re just trying to keep the lights on, saving might feel like a luxury. But even small steps make a difference. Track your spending. Cancel unused subscriptions. Cook at home a little more often. Save just $5 or $10 a week. Over time, small shifts build momentum—and momentum builds confidence.

Frances Murphy Draper is publisher and CEO of the AFRO

We can also tap into the power of community. Investment clubs— where people pool resources and learn together—are making a quiet comeback. They offer financial education, accountability and a sense of shared progress. And let’s rethink how we give. Instead of balloons or onesies at a baby shower, consider contributing to a child’s education savings plan. For a graduation, helping a young person open their first investment or savings account could be a meaningful, lasting gift.

Letting children and grandchildren see us make thoughtful financial choices can be a powerful example. And when the time feels right, introducing them to the basics of budgeting, credit, and saving can help them feel more confident about their own financial

future. Financial literacy doesn’t have to be a formal lesson; it can be a shared family value passed on over time.

This edition includes stories of resilience, ideas for managing money more intentionally and reflections on what financial wellness can look like in our community. I’m grateful to the editorial team for lifting up this important topic—and because April is National Financial Literacy Month, we’ll be sharing more throughout the month. Whether you’re just starting out or revisiting your financial goals, we hope these resources offer support, insight, a little inspiration and ultimately a more secure financial future.

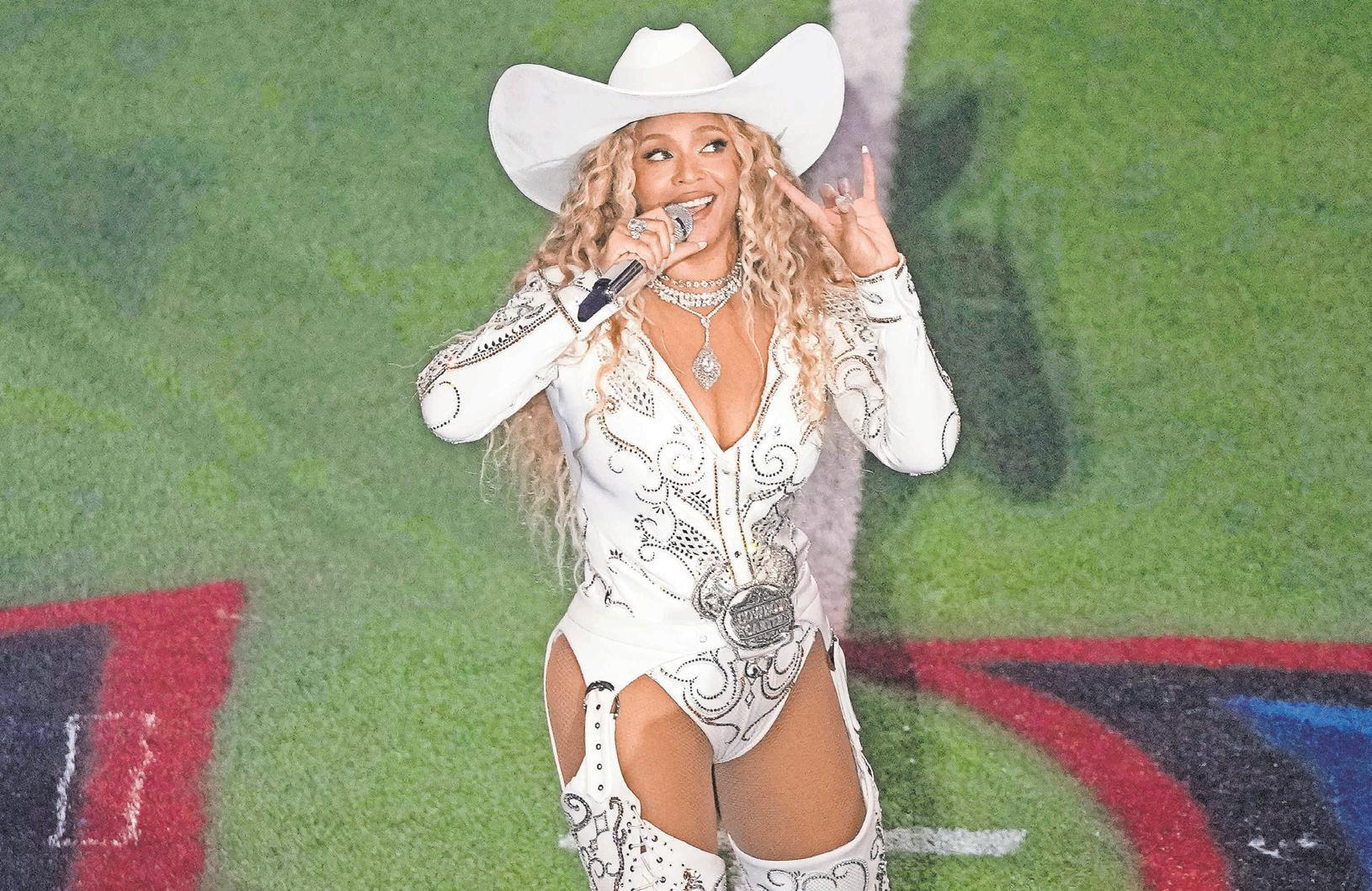

By Alexis Taylor AFRO Managing Editor Ataylor@afro.com

“Why are we still talking about slavery?”

I get this question multiple times a year— from Black people, in fact.

Tired of seeing themselves portrayed as slaves on the big and small screen, many African Americans believe it’s time to leave the horror of what our ancestors endured in the past.

Aside from the obvious answer of understanding history and “knowing where you came from,” there are deeper reasons to explore not only chattel slavery but the Reconstruction Era that immediately followed, from 1865 to 1877.

Contrary to those who hold the opinion that exploring slavery yields nothing but trauma, I often draw inspiration from the stories of those who lived in antebellum America.

There are countless tales of men and women who were brave enough to walk out of slavery– even after the Fugitive Slave Act of 1850– which empowered federal government officials and everyday citizens to act as slave catchers in both the slave and “free states.”

There was Henry Box Brown, clever enough to mail himself to freedom and the many who devised a plan to slip away on

the waterways. And then there are ancestors who purchased their freedom by saving every penny earned. Can you imagine?

In 2025, many find it hard to save– in 1825, if enslaved Black people were lucky, they could take on extra work after their backbreaking tasks in the field and save their way to freedom.

Born May 3, 1789 in Goochland County, Va., John Berry Meachum worked and saved enough to purchase freedom for himself and his father by the

age of 21. But he didn’t stop there. The two men then walked more than 590 miles from Hanover County, Va. to Hardin County, Kentucky to purchase Meachum’s mother and his siblings. In Kentucky, he married a slave woman whose master soon moved to Missouri.

“I followed her, arriving there in 1815, with three dollars in my pocket,” says Meachum in his book, titled “An Address to All the Colored Citizens of the United States.”

“Being a carpenter and cooper I soon obtained business, and purchased my wife and children. Since that period, I have purchased about twenty slaves, most of whom paid back the greatest part of the money, and some paid all,” he writes, proving to the masses that “industry will do a great deal,” when it comes to changing circumstances.

While it may seem like a small feat to some, these are the types of “slave stories” that interest me: A man, at the bottom of the economic chain, saving pennies to purchase freedom

for himself and others. Surely there were days when he wanted to spend his money on the finer things in life or simple pleasures. Instead, he understood that the path to freedom was an economic one that would quickly evaporate with no financial literacy or discipline.

In putting together this edition of the AFRO, I kept hearing a whisper… “if they could do it- you have no excuse.”

Surely, in 2025, I can add more than crumbs to my savings account each month.

According to the National Humanities Center Resource Toolbox, “in 1839 almost half (42 percent) of the free Blacks in Cincinnati, Ohio — across the Ohio River from slave territory — had bought their freedom.”

In saving their earnings, these people – still in the shadow of slavery– knew being smart with money could lead to generations of freedom for future descendants. They were clear on their mission, as many started businesses and bought land.

For these people, the act of budgeting, working and saving every possible penny was an act of resistance. If it were anything else, we wouldn’t have the race riots and terrorist attacks that followed the economic rise of Black people time and time again through history.

This National Financial Literacy Month, I call on all members of the Black community to honor the ancestors and engage in the same revolutionary act they did: save your coins. Target doesn’t need them and Walmart won’t miss us… until they do. Now is the time to be strategic about our collective finances. What land should we purchase? What historically Black institution shall we support? What Black company should we invest in?

None of this can be done without a firm foundation rooted in the practice of budgeting and saving…and that’s a lesson straight from the slave cabins of yesteryear.

By Janet Currie

Tax season is upon us—and with it comes the usual sense of dread that many experience this time of year. However, there are several steps that can be taken to mitigate these feelings of financial unease. Here are some tips for tackling your taxes like a pro this year:

Gather the right paperwork – Your tax forms should have arrived by February. If you have not received them, you will need to obtain these documents as soon as possible. W-2s show earnings and tax withholdings for full-time employees, while 1099s report freelance or contract income. You might also get forms for investment earnings, student loan interest, or tuition payments—all of which can impact your taxes. Having everything ready makes filing easier ahead of Tax Day. Watch your deadlines – Filing early helps you avoid last-minute stress and even protects you against tax fraud. But before you submit, make sure all your documents are in order — such as forms for childcare expenses or tax credits. Otherwise, you might miss out on potential savings.

• Pro Tip: If you need extra time, you can file for an extension until October, but keep in mind that any taxes owed are still due by April 15 to avoid penalties.

Protect yourself from tax fraud – Unfortunately, tax season is a prime time for scammers

trying to steal personal information and refunds. Reduce your risk by filing early, using strong passwords for online tax filing, and never sharing financial details unless you’ve verified the source. When in doubt, don’t give it out. If something feels off—like getting a tax refund notice when you haven’t filed yet— reach out to the IRS right away.

Know that assistance is available – The CASH Campaign of Maryland (Creating Assets, Savings and Hope), a nonprofit dedicated to promoting economic development for low-to-moderate income individuals and families, offers free tax preparation and filing services performed by IRS-certified volunteers. Households with incomes under $67,000 can go online or call to schedule an appointment hosted at tax sites in Baltimore and via

tax partners across the state. CASH also offers online tools for those filing taxes on their own.

www.Cashmd.org

Tackle debt or build your emergency fund

– A tax refund might feel like extra spending money but putting it toward your financial health can make a big difference. If you have high-interest debt, like credit cards, using your refund to pay it down can save you a lot in interest. If debt isn’t a major concern, consider boosting an emergency fund. An emergency fund is your financial safety net, set aside for unexpected expenses like medical bills, car repairs, or job loss. Aim to save anywhere from three months to a year’s worth of living expenses, but even a small start with your refund can provide peace of mind. Invest in your future – Once your

By Aswad Walker

We’re all familiar with the common refrain about needing Black dollars to stay in Black communities. But how do we make that happen specifically? And what are the actual benefits of circulating Black dollars in Black communities?

Multiple economists are pushing back on the idea that a dollar circulates in the Black community for six hours, compared to 17 days in the white community, 19 days in the Jewish community and 28 days in the Asian community. Some, like former President Obama’s Labor Department official William Spriggs, call that assertion an urban myth.

Still, it’s no myth that 43 million Black people in the U.S. have about $1.6 trillion in spending power, according to a Nielsen study. Couple that fact with the documented spending habits of Blackfolk on goods and services provided by companies we don’t own, and it doesn’t take a Ph.D. or multi-year survey to know that so much of Black wealth misses Black businesses and Black service providers.

But it doesn’t have to be that way. Even if we simply started by focusing on Black service providers alone, that would improve our economic reality tremendously.

Despite the dialogue that says Black people are horrible about spending money with Black businesses, there’s a growing movement to support Black-owned businesses, leading to increased spending.

In Houston, in the wake of the murder of Michael Brown in 2014, Nailah Nelson, head of the Shrine of the Black Madonna’s Cultural and Event Center, founded the Buy

“One strategy we could deploy in 2025 is to make a concerted and targeted effort to up our spending with Black service providers:

etc.”

Black Marketplace.

Since then, several other Buy Black venues have come online, BLK Market being one of them. These venues allow those who want to direct their dollars to businesses owned and run by Blackfolk to do so.

Still, the lion’s share of our $1.6 trillion goes into the coffers of “other-owned” businesses.

Black service providers

One strategy we could deploy in 2025 is to make a concerted and targeted effort to up our spending with Black service providers: healthcare professionals, attorneys, plumbers, interior decorators, landscapers, freelance writers, mechanics, etc.

Just looking at the positive impact of utilizing Black doctors alone should be enough to convince us that when it comes to service providers, regardless of the industry, we should do like Wesley Snipes said in the movie Passenger 57, “Always bet on Black.”

Black patients may have better health outcomes when treated by

Black doctors, including lower mortality rates and increased life expectancy. Black patients report having much better communication with Black doctors, who hear and relate to their concerns. This level of cultural understanding leads to improved health outcomes, greater patient/doctor trust and greater patient satisfaction.

Additionally, in study after study, it has been found that Black patients receive far less preventative care, fewer care options, fewer medicines for treatment and on and on. Black patients of Black doctors, however, are far more likely to receive preventive care, such as blood tests and flu shots, recommendations on multiple treatment paths and more.

Nearly 60 percent of today’s medical school students still believe the myth that Black people feel less pain than whites. This means Black people often receive diagnoses from non-Black doctors that leave Black patients in more pain and in danger of worsening

immediate needs are covered, think about how your refund can support your long-term goals. Consider putting some of it toward retirement savings—whether it’s adding to your 401(k) or opening an IRA. You could also put it toward a personal goal, like saving for a down payment on a house, starting a business, or even funding your dream vacation. A little planning now can turn your refund into long-term financial security.

“Unfortunately, tax season is a prime time for scammers trying to steal personal information and refunds. Reduce your risk by filing early, using strong passwords for online tax filing, and never sharing financial details unless you’ve verified the source.”

By planning ahead and avoiding common mistakes, taxpayers can reduce stress and potentially save money. Be sure to always speak to a tax professional about your specific situation.

health outcomes.

In every way, when Black patients utilize the services of Black doctors the existing health disparities are reduced. There is no reason to think that the same overwhelmingly positive results wouldn’t happen if and when more Blackfolk utilize other Black service providers.

How to get started

Find a listing of Black-owned businesses and Black service providers in your city (Houston has several: Black Book Houston, the Houston Black Pages and Houston Buy Black), then employ them.

But it doesn’t stop there. Be a cheerleader for the work of Blackowned businesses and Black service providers. And if you experience some bumps in the road, give Black businesses and Black service providers the same grace we traditionally

give “other-owned” businesses. Some families and households set spending goals. This is a great way to include your children in the process of making this support a habit that transcends generations. Additionally, thought leader Lurie Daniel Favors mentioned a report that says Black people spend three cents per dollar with Black businesses. But if we raised that to spend merely one dime out of each dollar with our own, those businesses could afford to grow, hire more staff and scale for increased success.

So, with everyone, from the White House to Walmart to the NFL and a gazillion other “other-owned” entities turning their backs on Blackfolk, let us turn our dollars’ backs on them and direct them back to us. This op-ed was originally published by The Houston Defender.

By Tory Lysik

Acronyms have long been a staple in political and financial conversations, but recently, a new crop of shorthand terms has emerged to describe different income groups. If you’ve come across ALICE (asset limited, income constrained, employed), DINK (dual income, no kids), or HENRY (high earners, not rich yet), you’re not alone. These acronyms help categorize financial realities for millions of people trying to navigate work, savings and long-term stability. They aren’t just catchy. They highlight broader economic trends and the shifting realities of financial security. To reveal insights into where people fall in the wealth hierarchy, US Banks and Branch Offices explored the origins of popular financial acronyms like ALICE, DINK and HENRY.

ALICE households represent working individuals and families struggling to afford basic necessities despite being employed. DINKs, often viewed as financially flexible, are seeing both benefits and drawbacks to their dual-income, child-free lifestyle. Meanwhile, HENRYs earn high salaries but still struggle to build wealth due to cost-of-living pressures and economic conditions. Understanding where these terms come from and what they reveal about financial mobility, especially in the United States, is crucial for grasping one’s economic future.

So who are the ALICEs?

Working but struggling.

The term ALICE was coined by the United Way in 2009 to describe the growing segment of people who earn above the poverty line but still can’t afford essential household expenses. According to United For ALICE, these individuals and families often fall through the cracks and are unable to qualify for government assistance yet unable to build financial security.

ALICE households struggle with the rising cost of living, stagnant wages and job

instability. Their budgets are often stretched thin, leaving them vulnerable to unexpected expenses like medical bills or car repairs. Many ALICE workers hold jobs in essential industries—retail, health care support, child care—but their wages don’t match the cost of basic necessities. ALICEs can be anyone from a supermarket cashier, waiters and waitresses to a child care worker.

Many struggle to afford homes in major cities or save for basic necessities at the levels they expected, like Melissa Hedden of North Carolina. Hedden was struggling to make ends meet, but the COVID-19 pandemic and the reemployment checks she received provided much-needed financial stability. She was able to go back to school and become the valedictorian of her GED class, even while helping her children through online school.

When the checks stopped coming, however, the picture changed dramatically. She ended up in a series of Airbnb rentals and hotels and dropped out of her program in the fourth semester. Her daughter was also suspended from public school because Hedden could not afford a routine physical to get her daughter’s annual medical records updated.

Hedden told Business Insider that $1,000 a month for a year would make such a difference. That money could set her back on the path toward a good education. She added, “It would mean not having to cry because I don’t know how to tell my daughter that I don’t know if we’re gonna be here in two weeks.”

Census Bureau data shows that ALICE thresholds vary by location, with housing and child care costs pushing more families into financial precarity. However, about 29 percent of U.S. households fall under the ALICE description. Without savings or assets to fall back on, these households remain at high risk for longterm economic hardship.

The HENRYs: Highearners who aren’t wealthy yet HENRYs are typically

young professionals earning at least six figures annually.

The term was first coined by Shawn Tully, who, writing for Fortune in 2003, used it to describe individuals in highskilled jobs with advanced degrees or education who remain financially insecure due to high expenses and lifestyle inflation—when people increase spending on luxuries as their disposable income rises. Their income goes toward expenses rather than wealth-building, despite working high-income jobs.

The paradox of HENRYs is that even with their high income, wealth accumulation and a lack of diverse investments remain challenges. Besides taxes and a mortgage, children are often major expenses.

When Tully revisited HENRYs in 2008 for Fortune with another writer, Joan Caplin, he spoke to Lindsay Mayer and her husband, Zach, an attorney in Dallas. The couple’s income was in the high range of HENRYs at $500,000, but even at that level, the two didn’t feel wealthy. At the time, they paid $2,200 a month for child care, which “is the real killer,” Lindsay said. “We’ve achieved so much. We can’t understand why we’re still worrying about money.”

While HENRYs have the potential to build wealth, many may find themselves stretched thin. Consequently, their net worth may not be as high as expected, especially compared to their annual income.

HENRYs are often younger people with particularly high student loans and rapid life changes, like more frequent job changes or marriages. They also may not have the financial experience to know how to grow their assets.

Without significant investments or inheritance, HENRYs remain in financial limbo and are commonly more vulnerable to economic downturns than their income might suggest.

What about the DINKS? The financial advantages and challenges of dual incomes.

DINKs represent a growing demographic of

households that benefit from two salaries without the financial obligations of raising children. While DINKs often enjoy higher disposable incomes and flexibility, their financial advantages vary depending on location, career stability, and longterm planning.

Married couples usually have a higher median income than single-income families. In 2023, married couples had the highest median income at $119,400 versus $81,890 and $59,470 for households maintained by men and women, respectively, according to Census Bureau data. Still, these households don’t always accumulate significantly more wealth. Child-free couples tend to have more money for discretionary spending and commonly put it toward things like travel and luxury items. They may also have more ability to put their money into long-term assets like homeownership or retirement savings.

In 2018, and again in

2023, the Pew Research Center asked childfree couples how likely they were to have children. In 2018, fewer than 2 in 5 (37 percent) were unlikely to, but by 2023, the number rose to nearly half (48 percent). “Just didn’t want to” and “wanted to focus on other things” were among the top reasons cited by nearly 4 in 5 (77 percent) childfree adults aged 50 and older who never want children, a 2024 Pew survey found. The wealth gap between couples with and without children, especially in the higher income brackets, also raises questions about financial security. A study published in Children and Youth Services Review using data from the Bureau of Labor Statistics shows that households with children often build more wealth over time through homeownership. In contrast, DINKs can sometimes fail to prepare enough for retirement, perhaps due to a lack of urgency, according to the OCBC Financial

Wellness Index 2024.

Why these financial labels matter These acronyms—ALICE, HENRY, DINK—are more than just labels; they reflect real economic divisions. Understanding these categories helps explain why financial planning looks different depending on income level, location, and lifestyle choices. Of course, these aren’t the only acronyms shaping financial conversations. FIRE (financial independence, retire early) and YOLO (you only live once) represent different economic mindsets, each influencing how people approach saving, spending, and investing. The former is intensely frugal, saving as much as two-thirds of their income in the hopes of retiring early; the latter tries to make the most of the present moment and spends with more abandon. As income inequality continues to grow and economic conditions shift, these terms provide a snapshot of where people fall in the wealth hierarchy and what challenges and opportunities lie ahead for each group. ALICEs can benefit from financial planning strategies that focus on building stability and resilience. HENRYs may want to take a long hard look at their expenses to see how they can counter lifestyle inflation. DINKs, on the other hand, can already explore investments that can set them up comfortably for retirement. Recognizing where you fit can help shape smarter financial decisions and longterm strategies for stability and growth.

By Tashi McQueen AFRO Staff Writer tmcqueen@afro.com

For many Americans, a conversation about money can be stressful, overwhelming and uncomfortable. Thinking about when and how to have that financial conversation with kids can be even more difficult, especially if no one in the family has a good relationship with money.

“We have to teach them to be their own financial safety net,” said Ebony Beckford, a financial literacy advocate and founder of Fin Lit Kids. “Statistically, most families don’t have $500 saved for an immediate emergency.”

Beckford and Sharita Humphrey, a financial consultant, offered their advice on simple ways parents can have healthy conversations about money with their kids. Fin Lit Kids is a company that provides financial literacy resources for children ages three to seven. The organization focuses on parents and students in kindergarten through second grade.

Humphrey suggested parents start teaching their children about money as soon as their kids can have basic conversations.

“I started teaching my little one at two years old about money,” said Humphrey. “Just enough time for him to comprehend that when mommy took the dollar away, he spent it, and when he put it away in his little wallet, that means he was saving it.”

Humphrey said it’s about “starting that pattern” and showing them that the items they desire often come with a cost.

Beckford, who began teaching her daughter about money around age three, echoed Humphrey’s sentiments.

“Research shows that most kids start to recognize that money has a value at around three, and the spending habits that impact our decision-making as adults start to form by age

seven,” said Beckford. Humphrey said talking about savings and budgeting is a great place to begin with children. She suggested parents put together a realistic budget with their children to help them start tracking and earning their own money. She advises putting them on a payment schedule and giving them a specific date so the child can plan for it with their budget as they would in the working world.

Beckford shared a few tools parents can use to help their children budget, save, invest and more.

Beckford highlighted her book, “Madison’s First Budget,” which helps teach youth that “money is not something that we just take and get anything that we want, but we have to have a strategy for it.”

The book presents open-ended questions that naturally present opportunities for parents to talk about money with their children. Through Fin Lit Kids, she has various fun and engaging activities, such as U.S. coin flashcards, a money-matching card game and a collection of financial literacy songs on YouTube.

There will also soon be a bingo game where parents and children can build out their financial vocabulary as a family.

Humphrey encourages chores and allowances in Black households to teach healthy money practices.

“In Black households, especially for those who may not have come from a lot, when we come into a situation where we feel like

we’ve made it, we want to give our children everything that we didn’t have,” she said. “We want to be able to set them up for future financial success, but giving without boundaries is crippling, especially financially.”

“If they never learn to stand on their own financial two feet, then what’s going to happen if you’re not able to or you’re not there?” she added.

Humphrey shared advice for parents who want to take steps to educate their children about money but do not have a healthy relationship with finances themselves.

“Have those difficult but important money conversations,” she said. “Be the financial trailblazer in your family.”

year-by-year financial plan for

financial goals and eventually explore investment opportunities as

By Megan Sayles AFRO Staff Writer msayles@afro.com

For Tammira Lucas, assistant professor of business at Coppin State University, it’s never too early to start teaching young people about money management. As a mother of a ninth grader, Lucas taught her daughter, Ryann, about finances long before she got to high school.

Ryann owns a vending machine company, and Lucas requires her to save 20 percent of her monthly income and invest another 20 percent. The educator said it’s critical that youth understand the functionalities and value money, especially as they may feel the urge to spend any cash they receive.

“Typically when kids get money, they say, ‘Hey, can

Lucas ensures her daughter witnesses the hard work she puts in to afford their lifestyle. As she put it, young people are sponges and will pick up information if financial conversations are had at an early age.

“It’s not just having money in your pocket, but understanding how you can make money grow so you don’t spend your life working and not being able to enjoy the fruits of your labor,” said Lucas.

To help high school students build a strong financial future, Lucas outlined yearby-year guidance to improve their budgeting and saving skills.

“Especially for high schoolers in Baltimore who may come from underserved areas, it’s important that they understand that money can set them up for success.”

you take me to the store?’ They don’t understand the long term value of money and how appreciating money can change their trajectory and future as adults,” said Lucas. “Especially for high schoolers in Baltimore who may come from underserved areas, it’s important that they understand that money can set them up for success.”

Though young people might not yet have a job in their first year of high school, they may receive an allowance or money for gigs, like cutting the grass, babysitting or shoveling snow. Lucas said they should be intentional about saving a portion of these funds.

“You don’t need a lot of

money to start saving. You just have to start,” said Lucas. “You could just save $5 a week so that you can build the habit of saving money and understand how to grow your income.”

Freshmen should also sit down and set goals for the path they want to pursue following high school, according to Lucas. She said they should consider whether they want to go to college or enter the workforce and—if they choose higher education— whether they want to live on campus or stay at home.

These questions can help them to start thinking about a financial target to strive for throughout high school.

In their second year, Lucas said high school students should establish a concrete savings goal.

“You know you have junior and senior activities, like prom, coming up. This is the time when you’re starting to get summer jobs,” said Lucas. “You need to start having a savings mindset to afford those things.”

Having a summer or after school job can help teach young people to have more respect for money, according to Lucas. When they are deciding whether to purchase something new, they may think twice because they are spending their own money.

Lucas also recommended that sophomores use tools, like Oportun, that allow users to create distinct savings buckets to prepare

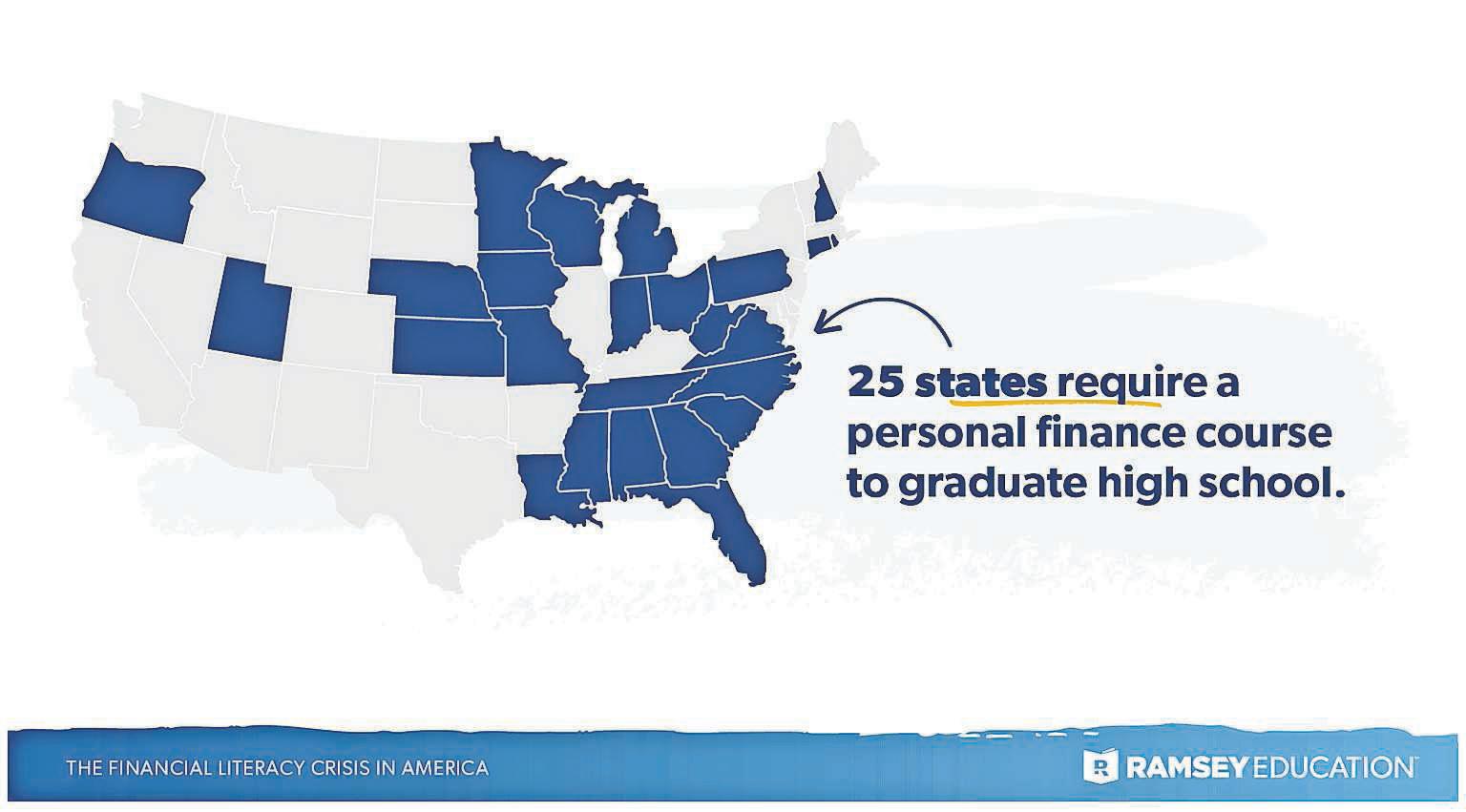

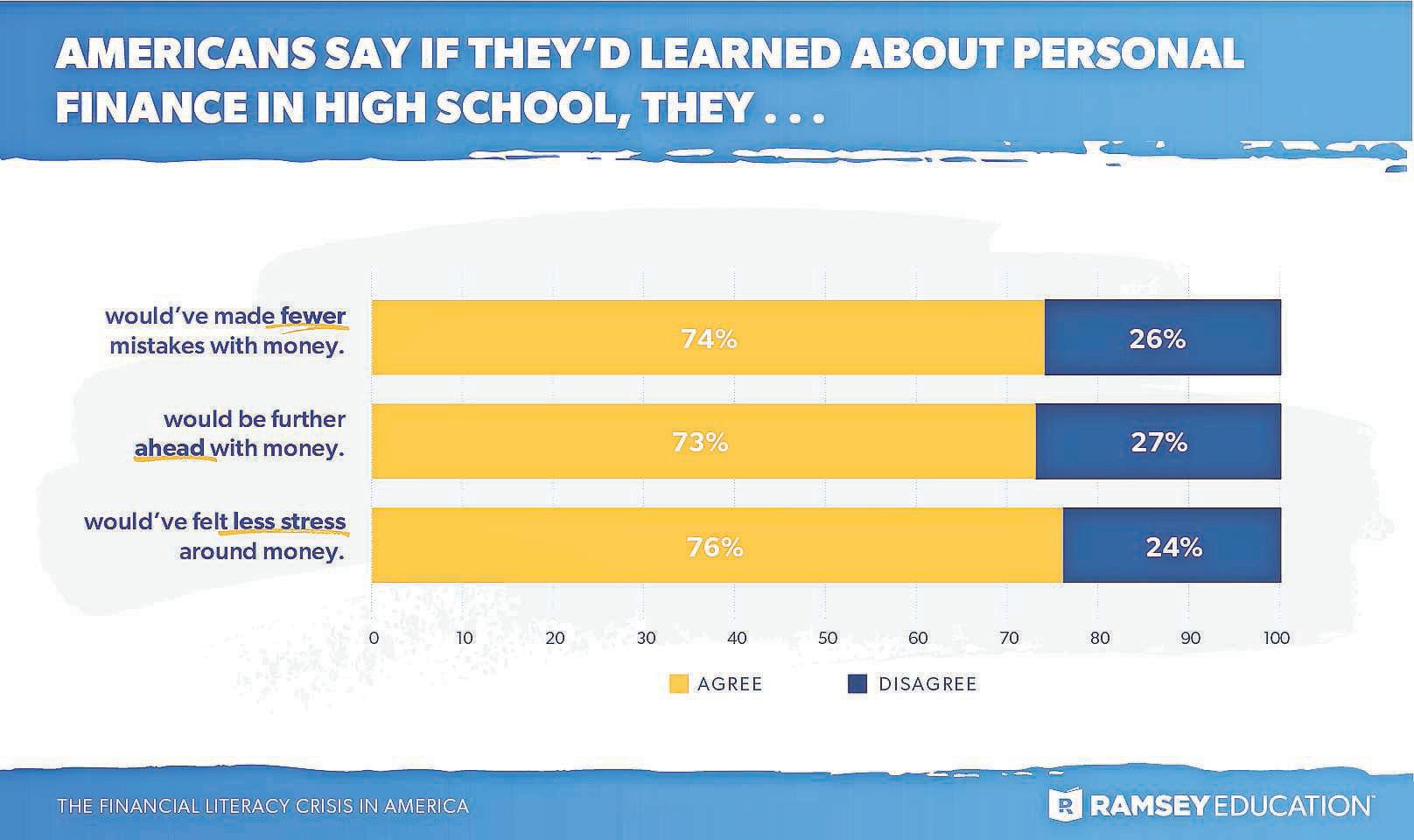

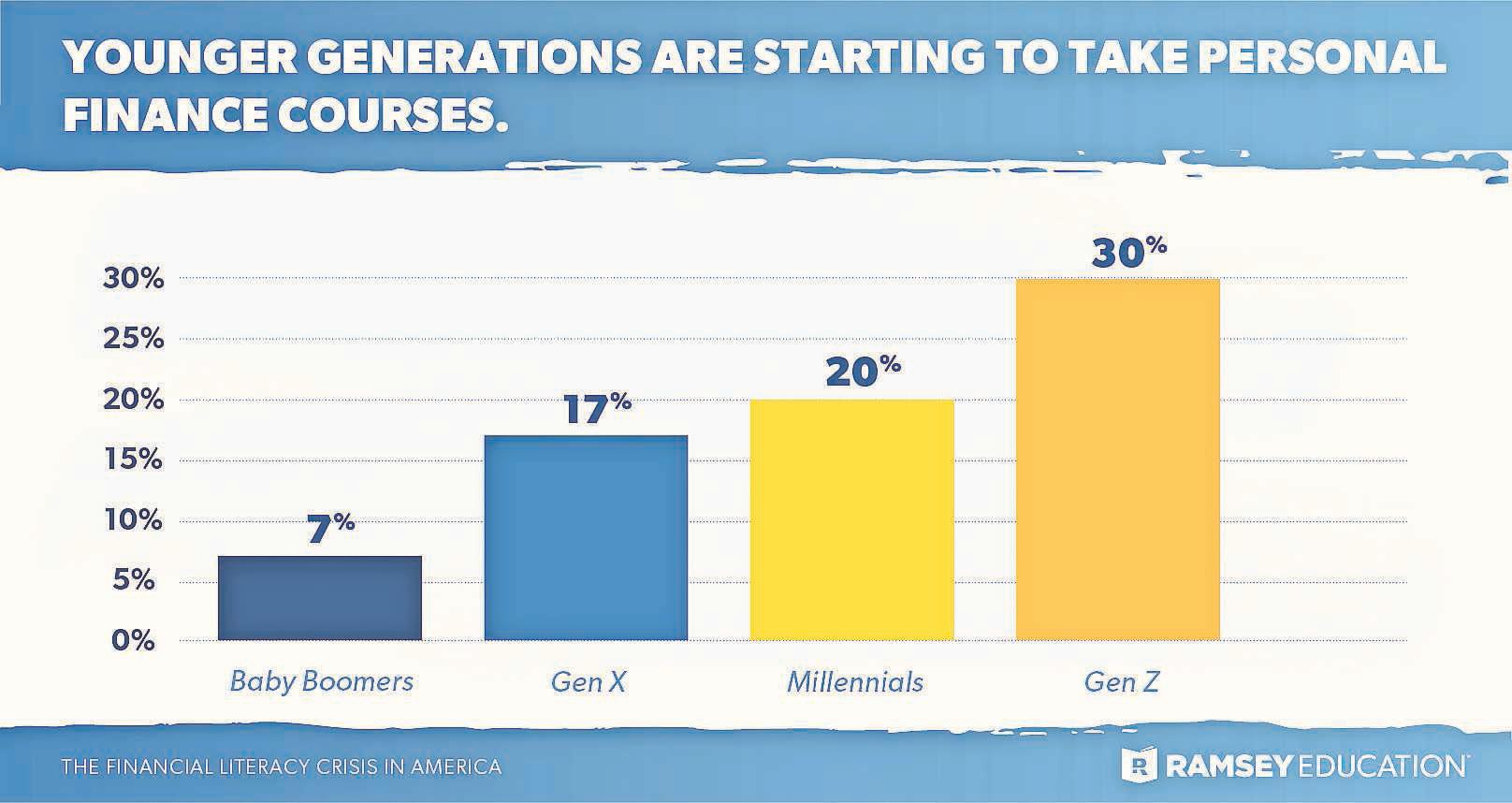

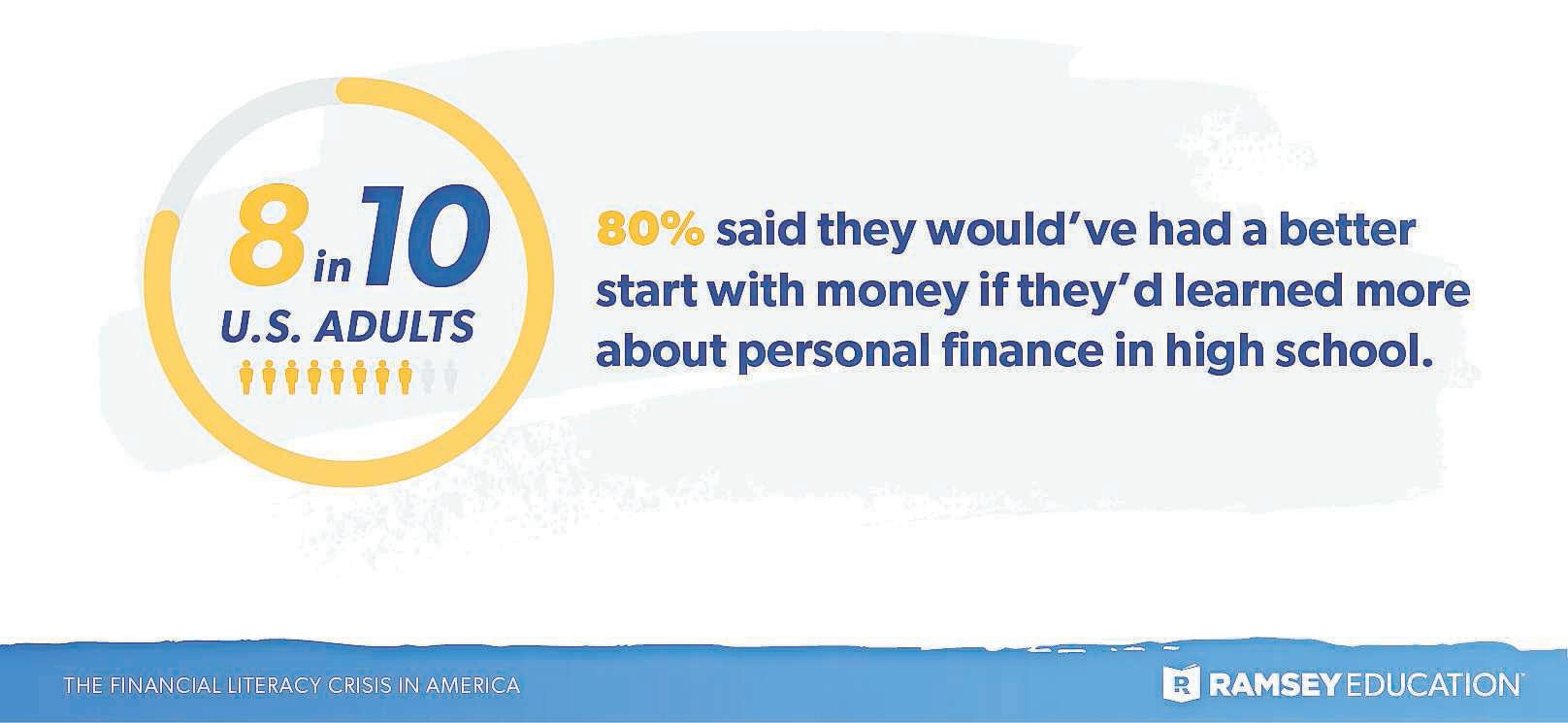

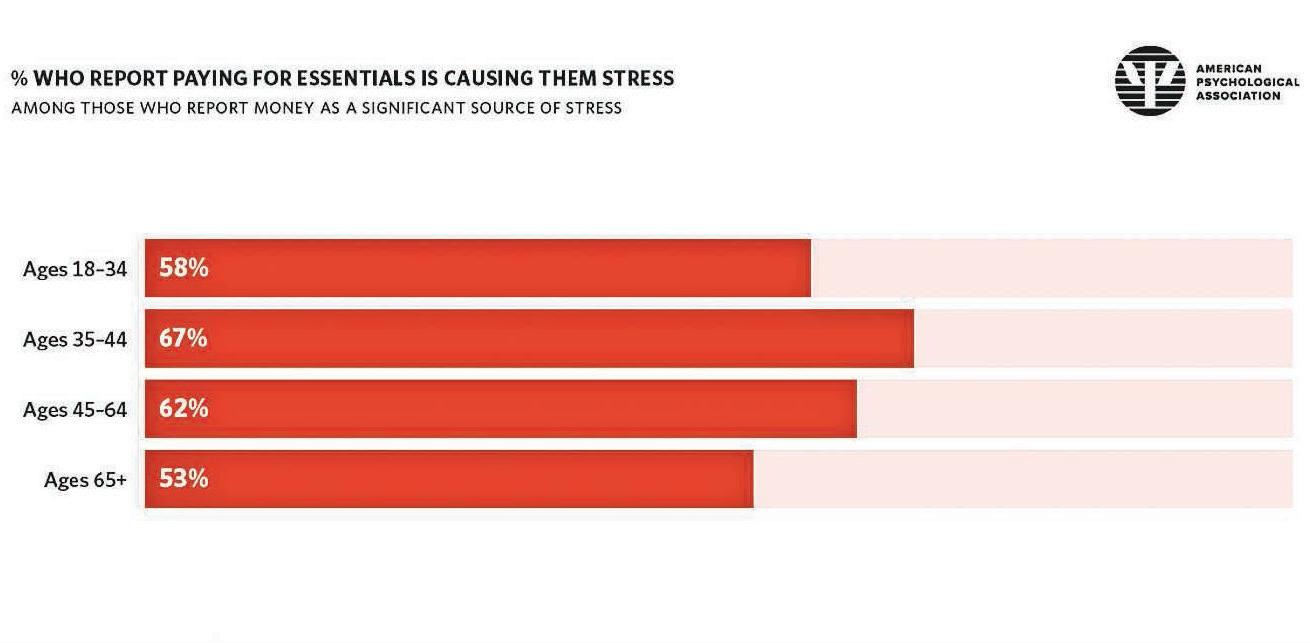

The charts on this page are sourced sourced from Ramsey’s “Financial Literacy in America: 2023 Report.” The information highlights key insights into the current state of financial education across the country. Ramsey Solutions is a financial education company known for providing tools, resources and educational content to help individuals and families manage money, get out of debt, and build wealth.

for various expenses. It also automates the savings process.

“They will take $5 here and $10 there, and you won’t notice that it’s gone,” said Lucas. “By the time you get to your goal in 90 days or six months, you have a larger amount saved by smaller increments.”

Junior Year

If a high school student has yet to open a savings account, Lucas said this is the year to do it. They should also be learning about banking basics, including what it means to have a bank account and how to balance their bank accounts.

“You’re preparing for the

next phase of your life, and it’s about to hit you fast whether you’re going to college or into a job,” said Lucas. “These are the times when you start thinking about long-term, bigger expenses. Making sure you have a bank account by your junior year is very important.”

Senior Year

Though it may seem like a lofty objective, Lucas recommended that high school students begin to invest in their senior year.

“I know some high schoolers who do well for themselves. They might do hair, lashes or nails,” said Lucas. “Don’t make money

to spend it on crazy things, like clothes and shoes. Start thinking about how to make your money grow.”

Though a traditional savings account is good, Lucas pointed out that there are a range of ways for seniors to invest their money. These include a Roth Individual Retirement Account (IRA), a high-yield savings account, bonds or stocks.

“Especially if you are getting a full ride to school, you don’t have a huge overhead of costs associated with going to college,” said Lucas. “This is a great time to take all of the money you’re earning and put it into an account that’s going to grow at a decent rate.”

By Nima Mehran

Prescription drug spending in the United States has been on a steady rise for years, with Americans paying some of the highest prices in the world for their medications. Even those with insurance often face high out-of-pocket costs due to rising premiums, copays and deductibles. With the increasing financial burden on consumers, prescription discount cards have emerged as an alternative to help mitigate costs. These cards, offered by third-party companies, work by negotiating discounts with pharmacies and pharmacy benefit managers (PBMs) to provide lower prices on prescription medications. Unlike insurance, they do not require a monthly premium and can be used by anyone, regardless of coverage status, explains SaveHealth, a prescription discount website. But how effective are these programs and can they provide meaningful savings in the long run?

The growing burden of prescription drug costs

According to a 2023 report from the Centers for Medicare and Medicaid Services, total healthcare spending in the U.S. reached approximately $4.9 trillion, marking a 7.5 percent increase from the previous year. Within this, prescription drug expenditures saw the highest growth rate at 11.4 percent, largely driven by specialty medications and price increases by pharmaceutical companies. The burden of high drug costs does not only affect the

uninsured. Even those with employer-sponsored insurance or Medicare Part D plans often find that their medications remain unaffordable due to factors such as high-deductible health plans and noncovered drugs. A 2022 Kaiser Family Foundation study found that nearly 30 percent of Americans reported not taking their prescribed medications due to cost concerns.

Why are prescription drug prices increasing?

1. Specialty medications and new drug pricing

One of the primary drivers of increasing prescription costs is the growth of specialty medications, which are often used to treat chronic or life-threatening conditions such as cancer, multiple sclerosis and rheumatoid arthritis. These drugs often cost thousands of dollars per month and now account for nearly 50 percent of total prescription drug spending in the U.S., up from just 19 percent in 2004. Pharmaceutical companies justify these high prices by citing extensive research and development (R and D) expenses. However, critics argue that drug pricing strategies lack transparency, with many companies raising prices on existing medications without any corresponding increase in R and D costs. In early 2025 alone, over 800 prescription medications saw list price increases, with a median hike of 4 percent, according to a Wall Street Journal report.

2. Pharmacy benefit managers and pricing markups

PBMs play a significant role

in the drug pricing system. Acting as intermediaries between drug manufacturers, insurance companies and pharmacies, PBMs negotiate rebates and determine which drugs are covered by insurance plans. While they claim to help lower costs through negotiated discounts, critics argue that PBMs often inflate prices by keeping a large portion of these rebates rather than passing savings onto consumers.

Recent lawsuits have revealed that some PBMs have been suppressing reimbursements to independent pharmacies, effectively limiting competition and contributing to higher drug prices. The Federal Trade Commission and lawmakers have increased scrutiny on PBM practices, yet significant reforms have yet to take effect.

3. Lack of pricing regulation

Unlike many other countries that regulate drug pricing, the U.S. allows pharmaceutical companies to set their own prices with minimal government oversight. While Medicare can now negotiate some drug prices under the Inflation Reduction Act of 2022, these measures will only impact a limited number of medications and take years to implement fully. As a result, most consumers will continue to see rising costs for the foreseeable future.

The role of prescription discount cards

As drug prices continue to soar, many consumers are turning to prescription discount cards as a potential solution. These cards provide

discounts on prescription medications at participating pharmacies. While they are not a replacement for insurance, they can offer substantial savings, particularly for those without coverage or with high out-of-pocket costs.

How do prescription discount cards work?

Discount card providers partner with pharmacies and PBMs to negotiate lower drug prices. When a consumer presents a discount card at a pharmacy, they can often receive a reduced price—sometimes even lower than their insurance copay. Some discount programs also provide comparison tools that allow users to see which pharmacies in their area offer the lowest price for their medications.

The benefits of using discount cards

Immediate cost savings:

Unlike insurance, which often comes with deductibles and copays, discount cards provide an instant reduction in price.

No restrictions on pre-existing conditions: Consumers do not have to worry about eligibility criteria or coverage limitations.

Works with generic medications: Many discount cards offer significant savings on generic drugs, making them more affordable than purchasing through insurance.

Limitations and considerations

Despite their benefits, prescription discount cards are not a perfect solution. In some cases, they can offer better prices than insurance copays,

Unsplash/ Towfiqu Barbhuiya

The cost of prescription medications in the U.S. continues to rise, placing a significant financial strain on individuals and families. While factors such as specialty drug pricing, PBM influence and regulatory gaps contribute to high prices, prescription discount cards offer a temporary reprieve for consumers struggling with out-of-pocket expenses.

particularly for generic medications or prescriptions not covered by insurance plans. However, their effectiveness depends on the specific medication, pharmacy and available discounts at the time of purchase. Some key limitations include:

Not a substitute for insurance: Discount cards do not cover hospital visits, surgeries or other medical services. Cannot be used with insurance: Consumers must choose between using their insurance or the discount card for each prescription, which can be confusing.

Privacy concerns: Some discount card companies collect user data for marketing purposes, raising privacy concerns among consumers.

Are discount cards a long-term solution?

While discount cards can help alleviate the burden of high drug costs in the short term, they do not address the systemic issues driving up prescription prices in the U.S. Broader policy changes could

tackle the root causes of rising drug prices, such as lack of transparency in pricing and the role of intermediaries like PBMs. The reliance on discount cards reflects a broader problem—many Americans are struggling to afford essential medications despite having insurance coverage.

A more sustainable solution requires broader healthcare reforms, such as: Increased pricing transparency: Requiring pharmaceutical companies and PBMs to disclose pricing structures and rebate distribution could help reduce excessive markups. Government negotiation of drug prices: Expanding Medicare’s ability to negotiate drug prices would help bring costs down for a larger population. Regulating PBM practices: Implementing policies that prevent PBMs from profiting excessively from rebates and requiring them to pass savings on to consumers could help lower overall drug costs. This article was produced by SaveHealth and reviewed and distributed by Stacker Media.

By Charlene Crowell

Many Americans continue to find it challenging to keep up with the rising cost of living. Most Americans’ household finances feel insecure – especially people who live paycheck to paycheck with little or no savings. The financial marketplace has responded to this ongoing consumer cash crunch with an emerging predatory lending product designed to take full advantage of consumers’ financial mismatch: earned wage advances (EWA). These cash advance products are small, short-term loans, typically ranging from $40 to $200, that are repaid on the consumer’s next payday either directly from a bank account or as a payroll deduction. They’re also conveniently available with a few clicks on borrowers’ smartphones. But as with other predatory loans, wage advances also create a deceptive and highly profitable cycle of debt built upon repeated reborrowing with interest equivalent to 300 percent annual percentage rates or more. In many cases, these cash advances lead to more frequent overdraft fees. The combined repeat borrowing and high costs result in unsuspecting consumers learning the so-called convenience brought more – not less – financial hardship.

The Consumer Financial Protection Bureau last year shared early analysis of this growing market segment, including key data points: The number of transactions processed by these providers grew by over 90 percent from 2021 to 2022, with more than 7 million workers accessing approximately $22 billion in 2022; • The average transaction amount ranged from $35 to $200, with an overall average transaction size of $106, and the average worker accessed $3,000 in funds per year.; and The average worker in their study had 27 earned wage transactions per year, and a

Nappy.co/ Nappy Stock

Predatory earned wage advance (EWA) apps are trapping low-income workers in cycles of high-interest debt, with borrowers often reborrowing at rates equivalent to 300 percent APR or more. Consumer advocates and regulators warn that without stronger financial protections, these apps will continue to exploit vulnerable Americans, deepening financial insecurity rather than alleviating it.

strong growth in frequent usage of at least once a month rising from 41 percent in 2021 to nearly 50 percent in 2022.

The Center for Responsible Lending’s (CRL) research report entitled, “A Loan Shark in Your Pocket: The Perils of Earned Wage Advance,” is another resource showing the dangers of predatory lending.

“By offering predatory credit with just a few taps on your cell phone, cash advance apps are a loan shark in your pocket. This report shows many cash advance app borrowers are trapped in a cycle of debt like that experienced by payday

loan borrowers,” said Candice Wang, senior researcher at CRL. “Cash advance app companies issue loans with triple-digit annual interest rates in nearly every corner of America – even where those rates are illegally high – inflicting financial pain on a growing number of consumers.” CRL’s analysis of EWA in Maryland found similar harms to those described by the CFPB. Analyzing the bank account data of the state’s EWA users, CRL found three key things: Maryland cash advance app borrowers are trapped in a debt cycle and the heaviest users drive the business model. Repeat use

of advances is common and high-frequency users accounted for 35 percent of users and 80 percent of advances.

• Many users borrowed from multiple apps simultaneously. Nearly half of all borrowers had used multiple companies in the same month.

• App use is associated with increased overdraft fees and payday loan use.

The CRL, citing the federal Government Accountability Office (GAO), finds that the amount of EWA app users earning less than $50,000 a year ranged from 59 percent to 97 percent across four different advance companies that separately provided these percentages. A survey of low-income workers receiving government benefits found that 51 percent had used or downloaded direct-to-consumer apps and 16 percent had used them once a week. Most importantly, this report included comments by consumers who used cash apps to make ends meet.

“I usually use them every time I get paid because they take out their payment and usually my check is short because I use the apps and I have to go back and re-borrow almost every time I get paid,” said one user, named Ayanna. “It has been harder to save money, because I often find myself paying back more than what I borrowed every time and that sets me back for paying off other things.”

Resolving this growing predatory product would best be addressed by a vigilant combination of more state and federal financial regulation. It took decades of consumer advocacy before 20 states – including Maryland – and the District of Columbia enacted payday lending rate caps that outlawed loans above 36 percent annual percentage rate. Even so, the other 30 states without comparable regulation still drain around $2 billion in fees on an annual basis. This article was originally published by The Crusader Newspaper Group.

By Andrea Stevens AFRO Staff Writer astevens@afro.com

For those experiencing intimate partner violence (IPV), searching for light at the end of the tunnel can be a daunting task. Though ending a domestic violence situation can be difficult– and dangerous– it is possible and includes one major step: achieving financial independence.

Shanna Norwood, director of crisis response at the House of Ruth Maryland, offers advice to those seeking a way out. Establishing a savings account allows them to begin creating a safety net, which is essential for financial independence. These accounts serve as vital tools that help survivors plan for the future, prepare for emergencies and escape unsafe living situations.

“Creating an escape plan and having hidden funds or separate accounts gives survivors the ability to prepare for their future and escape safely,” Norwood said. “If they’re only able to put $10 in there a week, we highly recommend an account where they can start putting away for their own stability.”

In addition to financial resources, job readiness programs are a cornerstone of the support system. Survivors receive opportunities to gain certifications and develop skills that improve their employability. By building résumès and developing soft skills, they are empowered to enter the workforce with confidence and increase their financial autonomy.

“One of the biggest challenges

we regularly face is unemployment, which makes it difficult for survivors to regain stability. We work hard to help them secure employment and income,” Norwood said. “The first step toward financial freedom is identifying what it looks like for the individual, and then we help them take the necessary steps to achieve it.”

Financial independence is not easily achieved for all survivors, particularly those without prior work experience or education. Many face barriers such as difficulty securing housing. Housing support programs often step in to provide rental assistance and negotiate with landlords, ensuring that survivors have access to safe, affordable housing. Collaboration with property managers helps overcome challenges related to high rent costs, making housing more accessible for those in need.

“Seeing a survivor purchase their own home after working hard to save the money is one of the most rewarding outcomes of our program,” Norwood said.

Knowing the legal implications of an escape savings account is also critical for domestic violence victims seeking safety. Criminal defense attorney Lauren Corbin explains the legal accessibility of funds acquired for emergency savings.

“Married individuals should consult a family law attorney to determine if an escape savings account could be considered part of marital assets in a divorce,” Corbin said. “For unmarried people, an escape savings account in their name only is not subject to asset division in court, but it could be considered in child support cases.”

“Seeing a survivor purchase their own home after working hard to save the money is one of the most rewarding outcomes of our program.”

Through financial education, job readiness programs and housing support, survivors of domestic abuse are provided with the tools and opportunities they need to create a secure, independent future.

If you or someone you know is a victim of domestic violence, seek help at https://houseofruth.org to find a help center near you.

• Plan for your safety by contacting your local domestic violence program to discuss your options and learn about the community resources you can access for support (i.e., emergency assistance funds, shelter, utility and/or rent assistance, public benefits, and affordable housing). To locate a program in your community, contact the U.S. National Domestic Violence Hotline by phone (1-800799-SAFE), TTY (1-800-787-3224), chat (TheHotline.org), or text (START to 88788). Language translation is available.

• Obtain a copy of your credit report and monitor your credit regularly. Most financial institutions provide credit monitoring services such as Privacy Guard at a low cost. You can get a copy of your credit report by contacting one of the three credit bureaus: Equifax (866-349-5191), Experian (1888-397-3742), or TransUnion (800888-4213), or from FREE Annual Credit Report (1-877-322-8228).

• Consider opening a post office box for mail and any financial information you may receive before you leave or immediately after you leave an abusive situation. You can obtain a post office box from the United States

Postal Service or vendors such as Parcel Plus, Mail Boxes Etc. or The UPS Store. Call your utility companies, wireless telephone service, the IRS, and financial institutions such as credit bureaus to secure your private financial information with special PIN codes and passwords. Be sure to do the same on all new credit, wireless, and/or utility accounts. Ask these companies to use identifiers other than your Social Security Number, date of birth, or mother’s maiden name to authenticate your identity.

• Change all ATM and debit card PIN codes, online banking passwords, and online investing passwords. Also, be sure to change the password on your email account(s). Add multi-factor authentication to all online and appbased financial services.

• Be sure to make necessary changes to your insurance plans, will, or trust beneficiaries to appoint a new person if your partner is your current designee. The advice above is from the National Network to End Domestic Violence (NNEDV) and available on their website at nnedv.org/content/ financial-tips-for-survivors/

Monthly credit card statements are causing consumers ongoing stress and concern.

After years of high inflation and rising interest rates, consumers are having trouble keeping up with their credit card bills. According to industry data compiled by BankRegData, nearly 3 in 4 consumers carry outstanding balances on their credit cards, and more than 9 in 10 live paycheck to paycheck and struggle to pay their bills.

As of late 2024, credit card interest rates reached a record high of nearly 22 percent. When borrowers aren’t paying off their monthly balances and overextending on purchases, they can still accrue a mountain of debt due to compounding interest.

This, in turn, exacerbates the challenges of getting out of debt, and more borrowers are also making late payments and falling into delinquency. The Federal Reserve Bank of New York found that in the third quarter of 2024, about 1 in 14 credit card accounts had become seriously delinquent, missing payments for 90 or more days. Though accounts are considered delinquent after 30 days, they usually aren’t reported to credit agencies until 60 days. These high interest rates, coupled with growing credit card fees, contribute to an ever-growing wave of debt. Falling behind on credit card payments can damage credit scores, impacting consumers’ chances of obtaining the best mortgage rates or getting a loan. It can even affect a borrower’s likelihood of qualifying for a rental before rental applications are approved.

US Banks and Branch Offices analyzed resources from the Consumer Financial Protection Bureau and other consumer-focused groups to explain how various credit card fees work and illustrate their impact on consumers.

Recent efforts to ease the burden of rising credit card fees on consumers have not come without resistance. Building upon the Biden administration’s pledge to cut down on so-called “junk fees,” the Consumer Financial Protection Bureau went after the most common credit card fee: the late fee. In 2022, credit card companies charged $14.5 billion in late fees, a fee affecting nearly 1 in 5 adults.

In March 2024, the CFPB issued a rule to cap late fees at $8. This rule aimed to close a loophole banks found in the Credit Card Accountability Responsibility and Disclosure Act of 2009, a law designed to ban excessive penalty fees. When that law was implemented in 2010, the Federal Reserve Board of Governors issued a regulation that allowed credit card companies to charge fees that were “reasonable and proportional” to the cost of

doing business.

That regulation paved the way for card issuers to charge up to $25 for a cardholder’s first late payment, and up to $35 for additional late payments. Late payment fees were tied to inflation, so they’ve risen accordingly—as high as $41. This means extra costs for consumers already struggling with debt, particularly people with lower incomes and people of color, according to a September 2023 Consumer Reports nationally representative survey of nearly 2,100 adults.

Although it would provide some economic relief for the more than 45 million people charged with late fees, the ruling was blocked in court after trade groups representing businesses and banks filed suit against the CFPB.

Even with higher interest rates and credit card fees, the strategies below can help consumers get better rates, avoid being shocked by fees, and help get them out of debt.

Avoid late payment penalties

Banks expect credit card holders to make monthly payments on their balances and will assess late fees if they don’t receive at least the minimum monthly payment on time. Those fees accrue interest just like an outstanding balance. The easiest way to avoid late fees is to pay your bill on time—be aware of the hour of the day it’s due and if your payment could be delayed by a weekend or holiday.

Still, avoiding late fees can be difficult sometimes. If you miss a payment, check whether your credit card agreement offers a grace period and contact your credit card issuer to see if they will waive the fee.

Get the lowest possible annual percentage rate

A credit card is essentially a short-term money-lending tool, so if you don’t repay the money you’ve borrowed every month, the

credit card issuer will charge you interest on the outstanding balance. The amount of interest you pay is the APR, or annual percentage rate. That percentage is based on the Federal Reserve rate plus an additional percentage based on several factors, including credit scores and on-time payment rates.

Average APRs climbed to nearly 23 percent in 2023, the highest rate since the Federal Reserve started tracking the data in 1994. It’s possible to negotiate for a better APR with your current credit card company, particularly if you’ve been a loyal customer and have a good credit score, defined as a score in the high 600s or above. It also helps if you’ve avoided late payments. Pull your personal information, research other cards to see if they offer better rates, and contact your card issuer to make your case for a lower APR.

Pay your balance in full to avoid compound interest

Knowing your APR is one step in the right direction, but even with a low rate, interest will still accumulate if you carry a balance. Most cards levy interest charges daily (your APR divided by 365), adding to your total balance. That means you’ll pay interest upon the outstanding amount, plus the previous day’s interest charge. The bigger your balance, the more interest you’ll pay—and compound interest can add up quickly. Paying your balance in full before your grace period ends eliminates any interest charges. Carrying a balance from month to month, however, means interest will accrue based on your average daily balance.

Be on the lookout for convenience fees

Anyone who’s ever gone online to buy a ticket to a concert, sporting

event, or movie has experienced some form of sticker shock from convenience fees. These fees help merchants, landlords, schools and even the IRS cover the costs of accepting alternative payment methods. For example, landlords generally prefer taking checks and ACH transfers for rent payments; however, some accept credit card payments via a third-party processor that charges them a fee—and then they’ll pass those charges onto the borrower. Merchants typically must disclose the fee in advance, so you do have the option to pay via a different, preferred payment method to avoid the convenience fees.

Don’t fall for overdraft fees

Overdrafting is a term usually associated with checking accounts, but credit cards have limits, and hitting it means card issuers should deny further transactions.

However, some credit cards allow consumers to make over-the-limit purchases, which may sound great if you’re right at your credit limit and want to make a purchase that would otherwise be denied. That service can come with an overdraft fee up to $25 for the first instance and up to $35 if another overdraft occurs within six months.

Over-the-limit transactions aren’t automatic—CFPB regulations stipulate that credit card issuers must clearly inform consumers of overdraft policies and fees. Consumers must opt-in to this service, so avoid making over-the-limit purchases to save yourself from excess fees and future financial headaches.

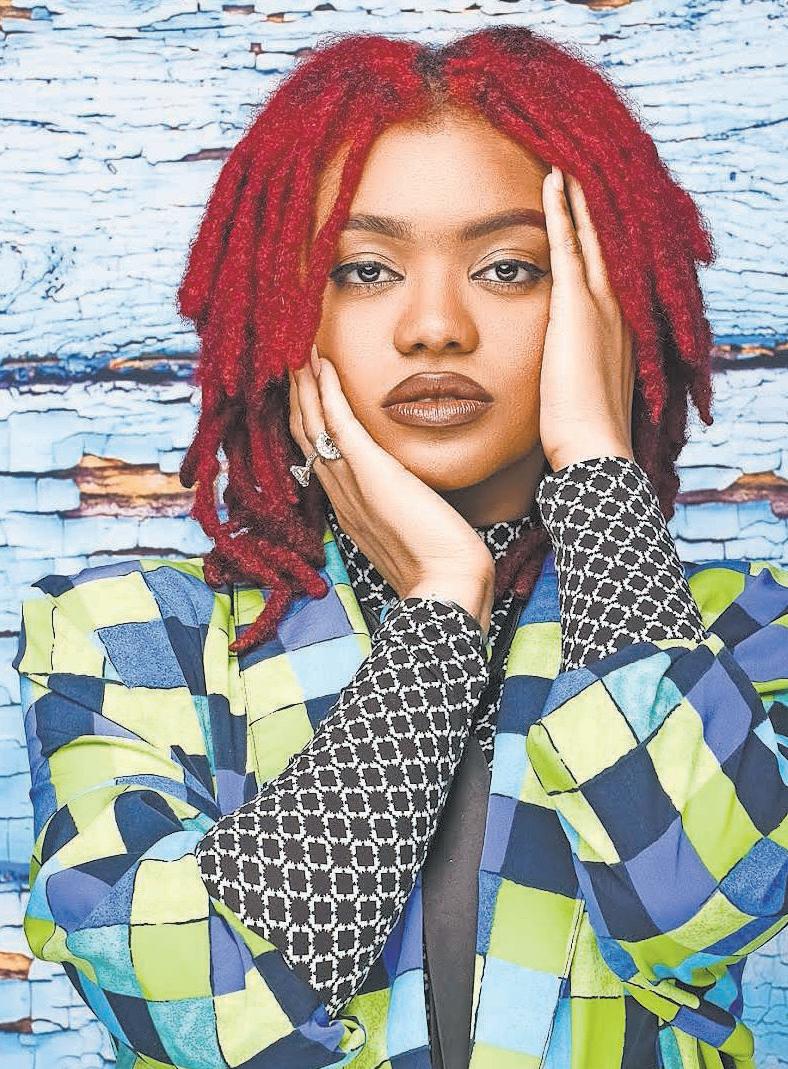

By Tashi McQueen AFRO Staff Writer

Now more than ever younger generations are turning to social media for their finance tips, including advice on how to budget and save.

According to the Federal Reserve Bank of Philadelphia, “TikTok has been rapidly growing as young adults’ go-to source for financial information, with content tagged with the hashtag #FinTok reaching more than 1.4 billion views. This has led to the rise of so-called ‘finfluencers’ — social media influencers who post on topics related to personal finance.”

The same agency highlights a 2023 Bankrate survey, which found that “30 percent of Americans used social media for financial advice, making it the third most popular source after friends and family (47 percent) and financial advisors and professionals (35 percent).”

As the Black-White wealth gap increases and federal job opportunities decrease under the 47th president’s administration, financial literacy for Black Americans is of the utmost importance.

Experts are branching out, finding creative ways to engage Black Americans in need of financial advice. Using social media videos, humor and photos, they build online communities and provide accessible advice in an unconventional way.

“When you understand the basics, you understand your means and you’re able to build your more,” said Nadia Vanderhall, a financial planner and educator, highlighting the importance of financial literacy for Black Americans.

Rahkim Sabree and Vanderhall are just two of the Black financial experts currently working to ensure people know how to save, budget, grow their wealth and more via social media apps.

According to the Black Economic Alliance Foundation, a non-profit affiliate of the Black Economic Alliance, the median White family has $285,000 in wealth, while the median Black family owns $44,900. The Black Economic Alliance is a non-partisan group of Black entrepreneurs and executives advocating for enhanced wages and wealth in Black America.

Nadia Vanderhall

On her platform, Vanderhall focuses on creating engaging videos, teaching the basics of money, using social media as a marketing research tool, community building and an “incubation lab” to teach people about money.

Vanderhall creates content on Instagram, LinkedIn, YouTube, TikTok and Pinterest. Through these five platforms, she’s amassed nearly 20,000 followers. On Instagram, YouTube, TikTok and Pinterest Vanderhall’s username is “nvknows.” On LinkedIn she uses her first and last name.

“What I do on social media is treat it as a group chat for finances,” said Vanderhall. “I am keen on talking about the basics while

showing people how to build [their money].”

Vanderhall said she enjoys getting commentary from people online and educating them based on their discussions. Through social media, she ensures that people of color and women have an accessible, relatable alternative to mainstream financial education, which can be full of jargon and overly critical.

“A lot of people cannot afford a financial planner,” said Vanderhall. “That’s why I’m going to get my CFP (certified financial planner certification). Not only to make my fees affordable for most people, but also to give commentary on the basis of money within social media.”

According to the Certified Financial Planner Board, out of 103,206 CFP’s, only 1.9 percent are Black and only 23.8 percent are women.

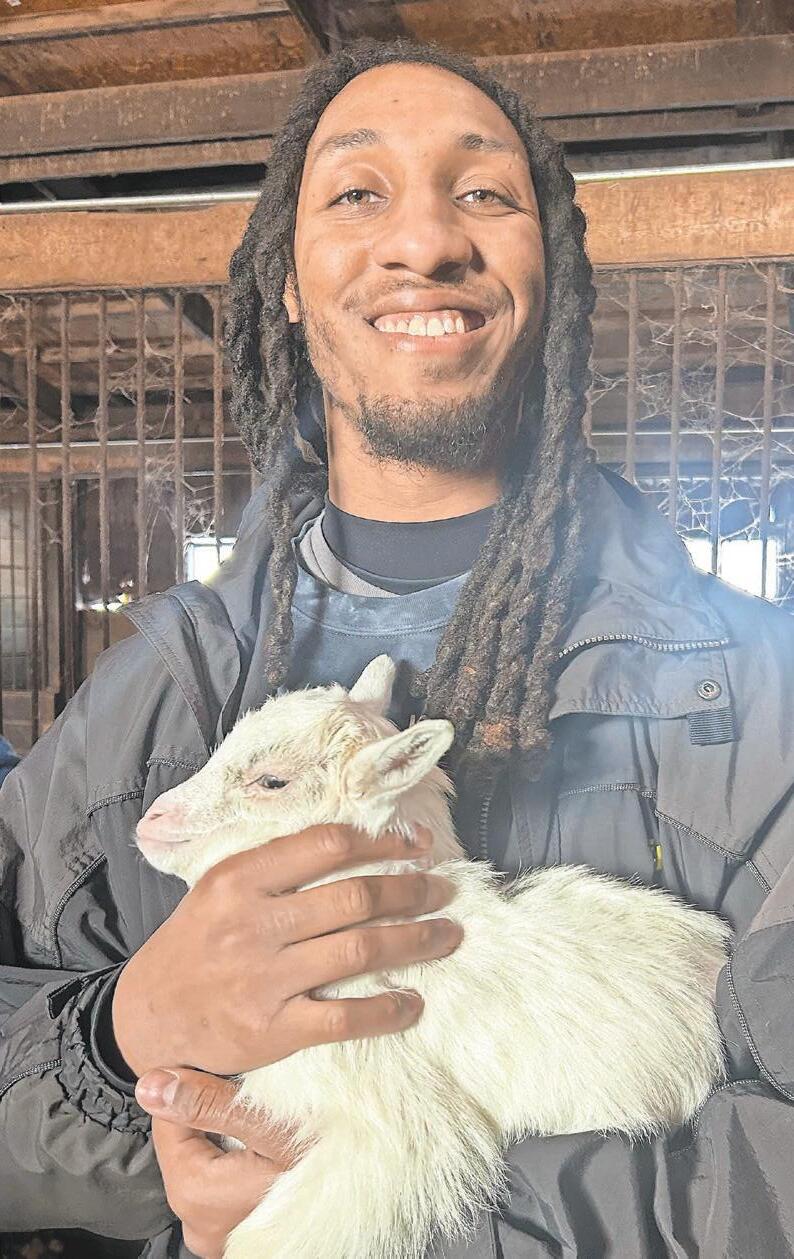

Rahkim Sabree

Rahkim Sabree, a financial therapist, holds many titles and uses social media mainly to discuss financial trauma, a subject he’s done much work in, and educate people on best practices within personal finance.

He makes content on Instagram, YouTube and TikTok, and has amassed nearly 16,000 followers. His first and last name is his social media handle on Instagram, TikTok and YouTube.

On social media, Sabree shares insights on poor spending habits resulting from emotional regulation issues and personal anecdotes about money, including his experiences with financial trauma.

Sabree said his goal in discussing and centering financial trauma is to draw connections between the systemic causes of trauma-induced reactions to money, especially in consideration of his Black viewers.

“People don’t realize that financial trauma is real,” said Sabree.

“They think it’s just bad money habits, but it’s deeper than that— it’s generational, it’s systemic.”

Sabree said the heightened stress that Black people experienced in centuries gone by has resulted in an “intergenerational transfer of trauma,” especially when it comes to money.

He shared the story of a client whose grandparents did not trust banks – and for good reason– their parents had money taken by a bank. As a result, his client’s family only used check-cashing locations during their childhood, which experts say can be predatory.

Sabree used the example to show how past experiences in one generation can “absolutely have an impact” on the way younger generations “perceive and view money.”

“It’s not just about making bad choices—it’s about survival–about history,” he said.

Sabree didn’t get into creating content about money on social media just to become an influencer. He hopes to share and encourage others with his own journey with money.

“I want to share that journey with people, particularly because my own foundation financially growing up was one of scarcity and lack,” said Sabree. “I want to demonstrate what is possible.”

“When you understand the basics, you understand your means and you’re able to build your more.”

Is artificial intelligence key to economic mobility or will it increase disparities?

By Leah Mallory

Artificial Intelligence is definitely a tool for financial empowerment, but not the key to economic growth since the racial wealth gap predates AI, experts explained.

“I don’t think AI is an end-all-be-all and the mothership to Black economic mobility because the systemic issues that Black communities have faced on a general scale have not been rectified,” said Lamar Laing, founder and CEO of Copiafy, a personal financial management platform.

Historically, Black people have been barred from banking institutions subjected to lending biases and Black neighborhoods faced systemic denial of financial services through a process known as redlining. These are just a few of many discriminatory practices that have inhibited economic mobility.

Today, that discrimination prevails. Data reveals that mortgage applicants of color are more likely to be denied loans by lenders than their White counterparts despite similar financial standings. Not only that, Black and Hispanic households are five times more likely to be unbanked compared to White households, with mistrust noted as a deterrent from banking. A 2024 analysis by the Federal Reserve Bank of St. Louis also indicated that Black households averaged $311,000 in wealth while White households averaged $1.4 million.

Throwing AI into the mix, financial experts said it could assist in closing the wealth gap. For businesses, it provides ways to streamline menial tasks such as verifying documents and answering customer queries. For consumers, AI can help detect fraudulent activity or make recommendations.

“I think AI is great for operations and productivity — helping you plan things out, helping you with redundant tasks. It definitely has helped us optimize our pipeline from idea to product,” said Laing.

With Copiafy, Laing explained that users can consolidate their financial information into one place. This enables them to keep track of expenses like payment deadlines or credit reports more efficiently.

Though not an AI company, Laing said he plans to leverage AI to help users, emphasizing the need for ethical implementation.