BRIDGING THE FINANCING GAP FOR MEETING THE DEVELOPMENT AND CLIMATE GOALS

Blended Finance Capacity Statement

Blended Finance Capacity Statement

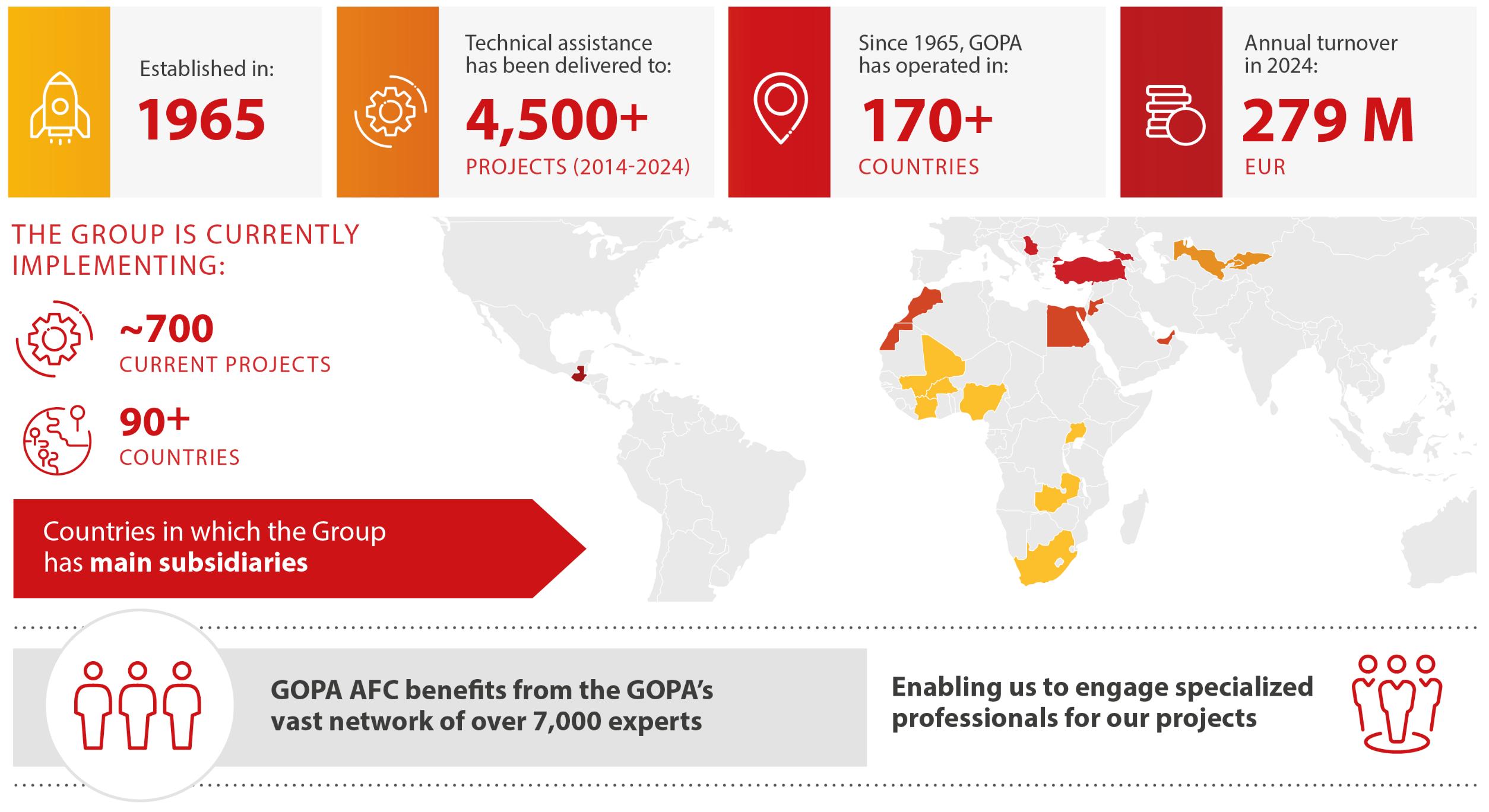

OUR IDENTITY: GOPA is an international multidisciplinary consultancy with strong German roots, combining tradition and global expertise to deliver impactful solutions worldwide.

OUR APPROACH: Your trusted partner for progress, a champion of sustainability, and a team dedicated to creating meaningful impact for generations to come.

OUR FOCUS: People. Planet. Prosperity.

OUR BRANDS:

• Financial Sector Development

• Blended finance

• Investment Readiness & Economic Competitiveness

• Private Sector Development

• Enabling Business Environment

• Sustainable Infrastructure & Advisory

• Natural Resources and Environment

• Climate Protection

• Rubble Removal

• Damage Assessment

• Critical Infrastructure

• Fund Management

• Power Systems

• Renewable Energy

• Transport & Mobility

• Water & Sanitation

• Architecture, Urban Development, & Civil Engineering

• Agriculture & Food processing

• Agribusiness Development along the Value Chain

• Access to Clean Water

• Outreach & Public Diplomacy

• Justice & Security

• Good Governance & EU Accession

• Civil Society

Public or philanthropic sources. Blending Concessional Funding Equity investments, local currency loans, credit guarantees, etc. with Private Capital

Social, Environmental & Developmental outcomes. for Development Impact

We adopt this strategic approach to de-risk investments, making them more attractive to private investors, while also achieving social, environmental, and developmental outcomes.

We use blended finance as a strategic approach that aims to de-risk investments, making them more attractive to private investors, while also achieving social, environmental, and developmental outcomes

OUR PRODUCTS AND SERVICES

• Grants management

• First loss capital

• Guarantees

• Technical assistance

OUR APPROACHES

• Patient capital

• Impact orientation

• Catalytically deploying development finance to de-risk capital

Administering TA Facilities

Impact assessment

Project structuring and feasibility

Climate finance

Fostering partnerships

Investment readiness and match-making

Innovation

Building capacity

Focus on greener solutions and climate resilience Just Energy Transition

Placing people and planet at the heart of solutions design. Sustainable Development

Catalytically mobilzing private capital. Private Sector Engagement

• GOAL: To improve agricultural competitiveness through productive and resource efficient agribusiness value chains.

• FUNDING SOURCE: Asian Development Bank (ADB).

• APPROACH:

o Financial and technical support to the agricultural sector in the form of grants for selected value chains.

o Facilitating investment in private businesses (Matching Grants) to upgrade their production capacity and technology and support Agricultural Production Groups (APGs), thus strengthening financial sector capacity for agricultural lending.

LEARN MORE

Key Highlights:

✓ 58 APGs (1,325 households), received investments worth $ 1.25 million.

✓ 35 agri-businesses trained.

✓ $ 1.45 million to 21 agri-businessesfor technology upgrade.

✓ Green finance lending skills of 50 staff (20 women) improved.

✓ 15,000 households Informed on risk mitigation instruments.

✓ Leveraged $0.96 m from private sector

• GOAL: To support the Micro Small Medium Enterprise Development Agency (MSME-DA) to promote financial inclusion for MSMEs

• FUNDING SOURCE: German Development Bank (KfW), and European Union (EU).

• APPROACH:

o €30 million SME Credit Line

o Feasibility Study.

o Risk Management Instruments.

o Training and technical assistance.

✓ Over 19,000 MSMEs beneficiaries.

✓ 96% of loans extended outside Greater Cairo.

✓ 44% of the total and 41% of the volume of loans went to female-owned businesses

✓ 46% of the loans extended to youth below 35 years old.

✓ 40,979 jobs created and sustained.

✓ Mobilised EUR 7,500,000from businesses

• GOAL: To finance biodiversity conservation through wholesale lending to three Partner Financing Institutions (PFIs), targeting sectors with direct biodiversity impact.

• FUNDING SOURCE: German Development Bank (KfW).

• APPROACH:

o Established a €6 million loan facility for biodiversity investments.

o Provided capacity building for PFIs on biodiversity financing

o Prepared pipelines of investment projects, developing appraisal model and standards for biodiversity friendly investments.

Key Highlights:

✓ €2.7 million disbursed to PFIs.

✓ Over 200 PFI staff trained in contact classes.

✓ Over 400 PFI staff trained in virtual training sessions.

✓ 993 borrowers operating agri-SMEs received loans, with women accounting for 25.4%.

✓ Development of an E-learning course “Climate Risk Finance”.

✓ 3-pillar model for Biodiversity Investments.

• GOAL: Improve MSMEs access to innovative financial services.

• FUNDING SOURCE: German Agency for International Cooperation (GIZ).

• APPROACH:

o Strengthening Financial Intermediaries: Developing innovative financial products to MSMEs.

o Regulatory Support: Supporting the Central Bank of Jordan in regulating alternative financing, such as leasing and crowdfunding.

LEARN MORE

✓ Over 13,000 MSME and individual users reached.

✓ 7,100+ women-led businesses and female clients reached.

✓ Over JOD 11 million in credit disbursed.

✓ Digital transformation strategies deployed in 4 partner financial service providers (PFSPs).

✓ 3 PFSPs equipped with credit scoring tools.

• GOAL: GOPA supports the Ministry of Environment to improve investment conditions for the sustainable use of biodiversity, giving companies better access to funding and promoting responsible resource use.

• FUNDING SOURCE: German Agency for International Cooperation (GIZ).

• APPROACH:

• SME Readiness Support: Identify and train biodiversity-friendly companies with scalable business models.

• Match Making: Support matchmaking events.

• Development of Innovative Financing Mechanisms.

Key Highlights:

✓ 3rd edition of the BioInvest matchmaking event (11/2024).

✓ 36 biodiversity-friendly businesses and 13 national and international investors connected.

✓ $13.8 million mobilized for projects that integrate biodiversity conservation with economic development.

• GOAL: In collaboration with GOPA TECH, our goal was to meet the demand of Central American MSMEs for adequate, efficient and sustainable financial products for investment in renewable energy and energy efficiency.

• FUNDING SOURCE: German Development Bank (KfW).

• APPROACH:

o Support CABEI to design, implement, and monitor the Credit Guarantee Fund (CGF) and select eligible projects.

o Analyze and advise on projects and business plans submitted by International Financial Institutions (IFIs).

o Develop tools, processes, and training programs.

Key Highlights:

✓ Value: EUR 1,8 million

✓ Period: 11/2018 – 07/2024.

✓ Countries: Honduras, El Salvador, Guatemala, Nicaragua.

• GOAL: To facilitate the EUR 120 million loan facility “Fruit Garden of Moldova” by advising SMEs, business development services (BDS) and partner Financial Institutions.

• FUNDING SOURCE: European Union (EU).

• APPROACH:

o Support the modernisation process throughout the entire value chain.

o Provide wider access to finance via intermediary banks.

o Support local entrepreneurs in accessing international trade.

o Work packages: (i) Visibility and communication; (ii) Consultancy in technology and markets; (iii) Financial brokerage; (iv) Sensitise partner banks to lend to horticulture; (v) Cooperation with educational institutions.

✓ Value: EUR 2.7 million.

✓ Period: 04/2018 – 06/2022.

✓ EUR 50.5 million for private sector investments allocated from EIB finance

✓ Leveraged EUR 76.05 million from non-EIB finance

✓ Together with the companies’ contributions, the project resulted in over 120 million EUR of private investments.

✓ Staff of 9 local financial institutions were trained.

✓ Above 40 thousand entrepreneurs were informed about the credit line.

✓ Above 22 thousand entrepreneurs attended trainings and webinars.

• GOAL: To enhance Sustainable Consumption and Production (SCP) progress in Asia by building on past experiences while scaling up and mainstreaming SCP policy and providing support to the SWITCH-Asia grant component.

• FUNDING SOURCE: European Union (EU).

• APPROACH:

o Partnerships with International Donors and Private Sector

Engagement: Strengthening partnerships with key regional and EU partners as well as international donors supporting the SCP agenda.

o Stakeholders engagement, communication and knowledge

management: Act as a unique platform for both components of the programme (PSC and grants component), catalysing and disseminating information on the programme’s activities and results/impacts.

Key Highlights:

✓ Value: EUR 17.3 million.

✓ Period: 01/01/2023 – 31/12/2026.

GOPA provides one-stop solution for delivering deeper and wider development impact due to our multidisciplinary team

GOPA has the technical competence and geographical coverage to think globally and act locally

Through innovative partnerships, innovative business models, innovative financing, we can deliver impact for people and the planet by blending development finance with private capital.

For more information, please contact: Mehnaz Bhaur, Senior Consultant E: Mehnaz.Bhaur@gopa.eu

Baunscheidtstr. 17 53113 Bonn

www.gopa.eu +49 (0) 228 92 39 40 00 info-afc@gopa.eu

THANK YOU!