GOPA AFC Financial Sector Development

We advise financial sectors. We shape development.

GOPA AFC stands as a leading German development consultancy, leveraging 50+ years of deep sector knowledge in agriculture, financial services, climate solutions and water systems throughout developing and emerging markets. As part of GOPA — one of Europe’s leading international cooperation consultancies — we provide strategic advisory services and technical expertise that catalyze sustainable development and economic growth in challenging environments.

Enabling us to engage specialized professionals for our projects

Financial Sector Development (FSD)

As GOPA’s dedicated Financial Sector Development hub, GOPA AFC’s FSD team drives financial inclusion through tailored product innovation and institutional strengthening. We craft bespoke credit and savings mechanisms, design blended finance programs, establish sound regulatory frameworks, and build supervisory capacity that transforms financial landscapes. Our expertise serves diverse stakeholders—central banks, commercial lenders, mortgage companies, microfinance institutions, and apex bodies— alongside governments and end-users including MSMEs and smallholder farmers seeking improved financial access.

GOPA AFC is actively involved in GREEN & CLIMATE FINANCE by advising financial institutions globally on developing and implementing green strategies. We help create climate-friendly financial products, train staff on climate risks, and support the transition to sustainable economies. Our services include developing green loan products, performing environmental and social due diligence, and assisting companies in preparing green investment loan applications. We implement projects such as regional off-grid electricity access in West Africa and renewable energy initiatives in Bangladesh.

We use BLENDED FINANCE strategically in our development projects to catalyze private capital for climate and development goals. Our innovative solutions enhance private sector leverage, enabling for instance MSMEs to access finance in Egypt and supporting biodiversity-friendly enterprises in Uganda through the Biodiversity Financing Facility. This model combines concessional and commercial financing, making investments more attractive to private investors while achieving social, environmental, and developmental outcomes. By de-risking investments, we foster sustainable growth and impactful change.

We further specialize in AGRICULTURAL FINANCE by providing tailored advisory services to farmers and agribusinesses. We offer capacity-building activities, training, and support for developing financial products and delivery channels. Our projects, like the "Promotion of agricultural finance for agri-based enterprises in rural areas" in Nigeria, help farmers access finance, improve their livelihoods, and promote sustainable agricultural growth. Additionally, we focus on climate smart agriculture finance, assisting banks in adapting loan products to better serve the agricultural sector, with an emphasis on digital solutions and financial inclusion.

We enhance SME FINANCE through capacity building and training for financial service providers. Our services include developing financial products, improving service delivery channels, conducting institutional diagnostics, and offering specialized training in credit risk management, business planning, and financial analysis. Additionally, we support SMEs with training in customer care, financial management, and business growth. By fostering effective financial markets, we improve access, usage, and quality of SME finance. For example, we implement projects like Access to Finance in Laos and Financing for Innovative Start-ups in Egypt.

43

COUNTRIES PROJECTS

PROJECT OFFICES 24 34

€33 M DONORS FUNDED BY 11 10

BENEFICIARIES GOPA AFC TURNOVER

60,893

THEMATIC FOCUS AREAS

Our e-learning course on green & climate finance:

Our e-learning course on agricultural finance:

Learn more about FSD’s daily work:

THE ‘MISSING MIDDLE PHENOMENON’ OR: BARRIERS TO FINANCE FOR AGRI-SMES

The challenge

SMEs regularly have excessive difficulty to access credit to smoothen their operations and to invest in expansion. More specifically, the literature suggests there is a ‘missing middle-phenomenon’ in access to finance: Micro-enterprises are provided loans by microfinance institutions (MFIs), and established corporations are provided large credit facilities by banks. However, few financial institutions anywhere in the world deliberately target SMEs, let alone agricultural value chains.

Moreover, the barriers to finance for (Agro-)SMEs have been studied seldom in a systematic way.

The goal

The German Corporation for International Cooperation (GIZ) commissioned a carefully designed study to qualify the barriers to finance for agricultural SMEs and thus contribute to a unified understanding of the challenges. The study was funded by the innovation fund of Germany’s Federal Ministry of Economic Cooperation and Development (BMZ).

This study generated recommendations how to strengthen SMEs in agricultural value chains in Ethiopia to play their important role as aggregators and (partial) processors. They link agro-export-businesses and local urban food markets with producers. All the while, they create jobs and build skills in the country.

Project name: Study to identify barriers to agricultural finance for SMEs in Ethiopia

Project region: Ethiopia

Financed by: GIZ / BMZ

Implemented by: GOPA AFC

Duration: 08/2021 – 03/2022

Our approach

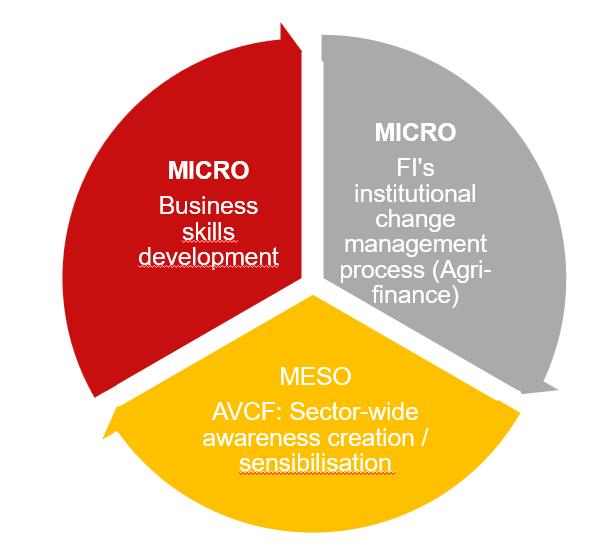

The project work plan translated into the flow of activities shown in the graph below, with three missions of international experts to support workshops and field work.

The follow-up project phase to implement some of the recommendations was cancelled due to political circumstances that unfolded later in 2022.

Tools and Techniques

1) An extensive desk review.

GOPA AFC’s team conducting field research, with a respondent on his farm.

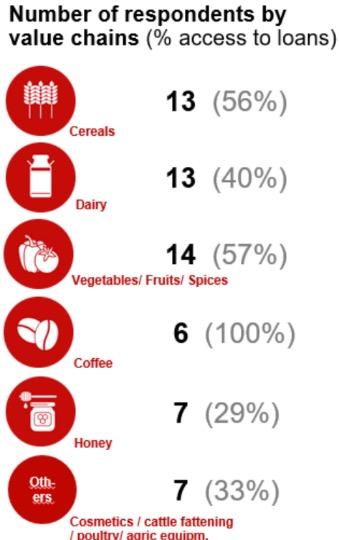

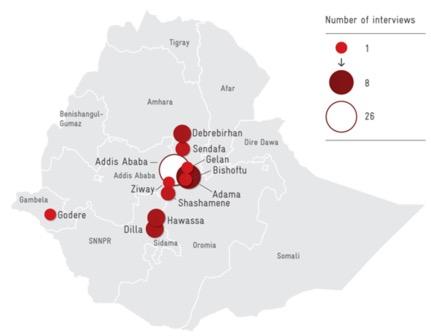

2) A field study surveyed a systematically drawn sample of 61 agro-SMEs; as well as selected representatives from 15 financial institutions across different regulatory classes.

To our knowledge, this is one of the most comprehensive qualitative surveys about SMEs working across all stages of major agricultural value chains from Ethiopia, and even from Sub-Sahara Africa.

On average, our responding 61 SMEs employ 25 fulltime staff, 10 part-time staff and 37 occasional or seasonal staff.

of respondents by value chains (% access to loans)

3) Two validation workshops to share the findings of the desk- and field study and take inputs on the research questions.

4) Recommendations

5) Publication

The study was published on two renowned, impactful platforms for financial sector development: • www.mfw4a.org/publication/barriersagricultural-finance-ethiopia

Voices from the field

In the validation workshops, FI-representatives of private and public FIs, government and donor agencies and SMEs gave feedback on the findings and observations.

“[Private banks are] rushing to sell collateral due to missed payments. They shouldn’t run for such options, but first attempt to support the borrower to change his situation in all possible ways – grace period, refinancing, etc.”

SME from Adama

Geographical spread of Agri-SMEs visited and interviewed

“Repayment is quarterly, but our cash flow only allows to make repayment every six months. The nature of the business is that we buy and store required inventory for the year, or at least buy to fulfil six months’ demand, not to fail on orders. Once we miss order, it will result in cancellation and it is difficult to get the customer back.”

SME from Oromia

by:

To learn more about GOPA AFC visit our websites:

For further information, please contact: oliver.schmidt@gopa.eu

Impression from the 1st validation workshop in Addis Ababa (Sept. 2021): Participants during break-out session.

Number

A PIONEER CREDIT LINE TO PROMOTE BIODIVERSITY IN UGANDA

The challenge

Loss of biodiversity is one of the massive effects of climate change. Uganda is among those endowed with the greatest diversity of animal and plant species and ranks among the top ten most biodiverse countries in the world. The largest proportion of Uganda’s economy is heavily dependent on biodiversity. In addition to direct gains in government revenues, biodiversity resources also support some of the poorest and most vulnerable sectors of Uganda’s population (NBSAP 2016).

The goal

To that backdrop, KfW and East African Development Bank (EADB) created the biodiversity finance facility to achieve positive biodiversity impact and address climate resilience.

The target sectors:

Project name: TA to EADB’s Biodiversity Finance Facility (BFF)

Project region: Uganda

Financed by: KfW

Implemented by: GOPA AFC, GOPA Worldwide

Duration: 01/2018 – 11/2024

Partners: EADB, Opportunity Bank Uganda Ltd (OBUL, from 2021), Finance Trust Bank (FTB, from 2021)

Our approach

KfW and EADB selected GOPA AFC to lead the consortium providing technical assistance to a pioneer credit line that finances biodiversity conservation. At the time of embarking on the project in 2018, ‘green finance’ was a new concept and few projects of development cooperation addressed it at all, and none other, as far as we know, focused on biodiversity finance.

We managed the project over five phases. Initially, EADB pursued a direct lending approach. To that end, our Team built a pipeline across all target sectors, interacting with more than 200 companies over this period.

For various reasons, including the tourism sector being hit by the COVID19-pandemic in 2020, we advised EADB and KfW to revise the strategy towards wholesale credit to partner financial institutions (PFIs).

Final Project Evaluation Mission, Nov. 2024. KFW, EADB and GOPA AFC (Team Leader Suzanne Akulu, 2nd from right), with BFF-borrower who created a pond for irrigation.

Tools

& Techniques

Biodiversity-impact model (3 pillars to minimize negative and to foster positive biodiversity effects, based on IF Performance Standard No 6.

Learner-centred e-learning course with 3 modules, to (a) understand IFC performance standards; (b) appraise investment projects that have positive biodiversity impact;

(c) case studies for several target sectors.

Lessons-learned report recommending specific fund vehicles over bank credit because of flexibility, topical focus and risk-appetite

Appraisal tool for loan officers to identify eligible investments.

Climate Proof Plan – part of loan contract (eligible measure to be financed)

2-day financial management training for women entrepreneurs.

Streamlined monitoring templates and M&E framework with field data collection instruments

Voices from the field

“I used the second loan for clearing the farm, planting seeds and buying mulches. It has enabled me to increase yields and incomes and I was able to pay workers with ease. I shared the practices with friends, however, some have tried to do the same and failed because they can not easily acquire the manure or mulches.”

Woman farmer in Southern Uganda who borrowed repeatedly under BFF-loan to grow pineapples, tomatoes and watermelons and subsequently maize and green peppers. She has also planted trees on her farm (in the picture 2nd fltr).

Impact story

On her over 25 acres of land in Bbaale, Annet Mbabazi farms fruit and vegetables, such as water melon, pineapples, green pepper, Matoke bananas, maize, eggplants and tomatoes. She employs five permanent and 15 non-permanent workers on her farm. The biggest climate issue Annet’s business faces is drought; especially in the dry season, when the water supply is so low that her crops are failing to bring yields. Therefore, she received a loan of UGX 15 million (~EUR 3,900) from the Biodiversity Financing Facility, to buy mulches and coffee husks for the watermelon, pineapples and tomato gardens. These mulches help to keep water in the soil, so it remains wet and fertile. Mulching her gardens turned out to be very successful, resulting in high yields of her watermelons. In addition, she acquired a water pump, to irrigate her crops during dry season.

“I further planted more trees in my garden to provide shade and employed more female workers. I’m now trying to save some of my additional income to buy a solar water pump, as an additional measure to cope with the dry season”, she says.

“I will sustain the same practices beyond the project because I have seen benefits like sufficient water from the constructed dam. Also, the constructed paddocks are beneficial for a sufficient supply of food to cattle.”

A client of OBUL in Masaka

FEASIBILITY STUDY FOR “PROMOTING OF WOMEN-LED BUSINESSES IN UGANDA”

The challenge

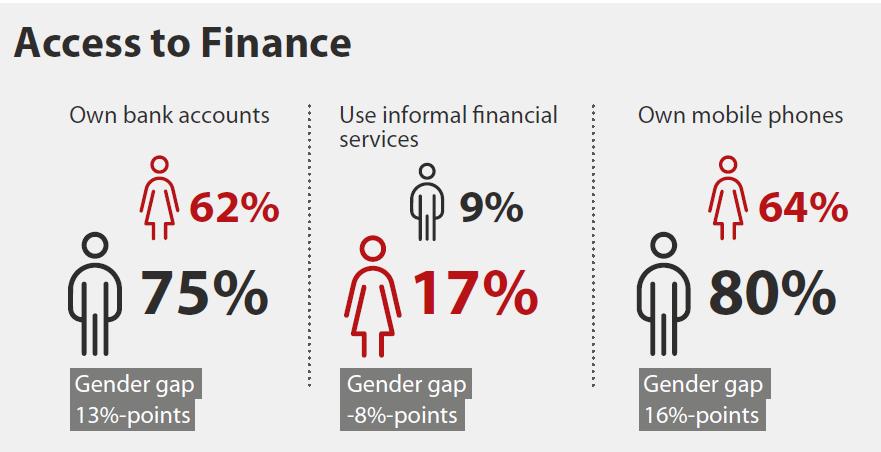

Women in Uganda experience significant social, economic, and financial disadvantages compared to men. Consequently, women-owned small and medium enterprises (WSMEs) possess fewer assets, achieve lower turnover, and exhibit reduced profitability relative to enterprises owned by men.

The Ministry of Finance, Planning and Economic Development (MoFPED) and KfW, the German Development Bank, commissioned a feasibility study of support women-led businesses, specifically focusing on access to credit.

Study design

Initially, the market overview examines and reflects structural factors through a literature review and primary data collection. Interviews were conducted with the head offices of ten Bank of Uganda (BoU)regulated financial institutions (FIs) from tiers 1 to 3, and 4 Uganda Microfinance Regulatory Authority (UMRA)regulated institutions (tier 4 microfinance institutions (MFIs) and FinTechs). Additionally, 53 branch managers and loan officers from 9 BoU-regulated FIs participated in an online survey. Interviews were also conducted with 22 key informants from ministries, government and donor agencies, including BoU, and sector/industry associations selected based on Uganda’s National Development Plan III (NDP III). Furthermore, 17 focus group discussions (FGDs) were held with women refugees and host communities in Northern and Western Uganda, women entrepreneurs near Kampala, and women involved in the oilseeds value chain in Northern Uganda.

Project name: Support to women-led businesses in Uganda – feasibility study

Project region: Uganda

Financed by: KfW

Implemented by: GOPA AFC

Duration: Nov 2024 – April 2025

Partners: Ministry of Finance, Planning and Economic Development

Moses Ogwapus, MoFPED Commissioner Financial Services Department, opened the stakeholder Workshop: “Over the years, the gender disparity in areas such as mobile money usage and access to financial services has been narrowing. Indeed, new technologies generate a lot of opportunities for both men and women, that is why information technology and digitization are among the core sectors of our Fourth National Development Plan (NDP IV) 2025 -

Voices from the field

“Women are not allowed to use family land as collateral.”

“Husbands control land and encroach on women’s loans”

“Many women operate early morning or late evening, outside of banking hours”

“Women in the North are not supposed to work.”

Stakeholder workshops – participants from MoFPED, BoU and financial institutions discuss study findings in Kampala.

Main findings of the study

The study identified a mismatch between credit demand and supply for WSMEs, shaped by various demand and supply-side barriers that constrain access to capital, as articulated by women in the FGDs.

Barriers to credit for WSMEs

Women in Uganda face challenges accessing credit from regulated financial institutions, which typically require traditional collateral (land and buildings) for loans over UGX 5 million (approximately EUR 1,300). Most women borrowers use group loans despite several women-oriented credit programs that include capacity-building and training funded by donor agencies.

Traditional collateral remains a significant barrier for growth-oriented WSMEs. A credit guarantee is crucial for MFIs to extend larger loans without such collateral. The Uganda Development Bank (UDB) and

However, some M/FIs, notably Centenary Bank, emphasized during the stakeholder workshop that comprehensive loan appraisal processes manage credit risk best, allowing loans above UGX 5 million without traditional collateral. These appraisals focus on WSMEs’ ability to present financial records, business plans, and formal registration. Proven programs by UDB and DFCU build WSMEs’ capacity and guide them through registration.

Environmental and Social Governance (ESG)

ESG increasingly influences MFIs’ risk management globally, with IFC’s performance standards being the most common reference. The study explored how M/ FIs in Uganda adopt and operationalize ESG policies. The Bank of Uganda and Uganda Bankers’ Association created a voluntary framework to guide M/FIs, but there is significant variance in ESG policy scope among them, with few integrating these policies into their operations. Gender-sensitive processes and products are relevant to ESG, but currently, no Ugandan MFIs report the number of women served or how loan and savings portfolios are divided between men and women.

Finance for refugees

Constraints of women-owned businesses (perspective by Kampalabased women); Source: FGDs in Greater Kampala, Nov/ Dec. 2024

by:

To learn more about GOPA AFC visit our websites:

The study team identified six Ugandan MFIs with dedicated competencies to run refugee finance programs. The outreach of these programs could be expanded outside the central region, especially considering the sudden disappearance of funding from USAID.

For further information, please contact: oliver.schmidt@gopa.eu

FGD with refugees and host community members in Northwestern Uganda.

INSTITUTIONAL GENDER STRENGTHENING & GENDER-LENS INVESTING IN FOUR DEVELOPMENT FINANCE INSTITUTIONS

The challenge

Women play a significant role in the African as well as Caribbean and Pacific economies, especially in the informal sector, yet they continue to face gender disparities across financial services, property ownership, and decision-making. Financial and nonfinancial services offered by the financial institutions are often gender blind and do not effectively reach women entrepreneurs. The ICR Facility supports development finance institutions (DFIs) in five countries to create better conditions for women’s businesses to thrive and for women’s economic

Our approach

The project supports the DFIs with institutional gender assessment and provides recommendations for gender mainstreaming in internal processes and external activities. We strengthen the banks’ monitoring and evaluation (M&E) frameworks to become gender responsive. Finally, we advise on refining financial and non-financial products to reach women entrepreneurs more effectively.

Project name: Institutional gender strengthening and gender-lens investing in four development finance institutions

Project region: Tanzania, Mozambique, Nigeria, Botswana, Jamaica

Financed by: The Investment Climate Reform (ICR) Facility co-funded by the European Union (EU), the Organisation of African, Caribbean and Pacific States (OACPS) under the 11th European Development Fund (EDF), the German Federal Ministry for Economic Cooperation and Development (BMZ), and the British Council.

Clients: Development Bank of Jamaica, Bank of Industry (Nigeria), TIB Development Bank Tanzania, Gapi Sociedade de Investimento (Gapi), Mozambique, National Development Bank of Botswana

Implemented by: GOPA AFC

Duration: April 2024 – September 2025

The goal

Through gender responsive internal practices, the banks will promote gender equity within their organisations and their networks. By introducing gender responsive offerings, directly and through partner financial institutions, access to finance for women entrepreneurs will improve, giving them a chance to grow their business. Finally, strengthened M&E functions with clear targets and tracking of sex-disaggregated data will help the DFIs to tap international funding for women’s economic empowerment and advocate for gender-responsive national policies.

Picture: GOPA AFC expert in an interview with Gapi’s client in Ribaue, Mozambique.

Key highlights

Conducted institutional gender assessments of five DFIs

Developed gender policies, gender strategy and action plans for five DFIs

Conducted training on the implementation of gender strategies and gender lens investing for five DFIs and over 400 bank staff

Reviewed M&E functions and developed gender responsive M&E framework for five DFIs

Conducted market research and financial landscape study on the financing needs and opportunities of women in business for two DFIs

Provided recommendations for financial and non-financial products refinement to meet the women’s needs for three DFIs

Conducted mapping of international funding sources for three DFIs and advised on an action plan to tap the sources.

Examples of our success

Within the 12 months of the project we:

Accomplished assessment of and delivered recommendations for institutional strengthening for five DFIs

Conducted training on gender policies, strategies and gender lens investing, M&E and product development for over 400 bank staff

Developed a gender responsive M&E framework for five DFIs

Conducted market research on financing needs and opportunities of women in Mozambique and Botswana

Advised two DFIs on refinement of financial and non-financial products

Impact story

During the institutional assessment, the participation was drawn from various departments to ensure a comprehensive understanding of gender dynamics within the banks. Clients were segmented into groups, and focus group discussions included women, men, and youth.

The participating banks particularly enjoyed this comprehensive inclusion of stakeholders.

Voices from the field

“I had a wonderful and impactful experience working on the assessment with the consultants. The process was smooth and meaningful. The aspect I most enjoyed included working together to collect information within the Bank. My participation allowed me to get insight into the Bank and ensured that I could claim some level of ownership of the final product of this consultancy.”

Kristina

Neil, Gender Specialist, Development Bank of Jamaica

“The process was intensive and allowed full participation of all key stakeholders. The assessment revealed the current position and areas requiring intervention.”

Adebola Oruma, Bank of Industry, Nigeria

For further information, please contact:

Picture: TIB Development Bank’s management and staff, and GOPA AFC expert after workshop on the results of the bank’s institutional assessment.

EMPOWERING EAST AFRICA’S FINANCIAL SECTOR FOR MSME GROWTH

The challenge

Micro, small and medium enterprises (MSMEs) are the backbone of East Africa’s economy, driving employment, innovation and inclusive growth. Yet, many face significant barriers when it comes to accessing finance. Financial institutions often lack the capacity and tools to serve MSMEs effectively, while MSMEs themselves may be unfamiliar with banking processes or lack the skills to present bankable business plans.

Project name: Technical Assistance Programme to Support EIB Operations in East Africa

Project region: Kenya, Tanzania, Uganda, Rwanda, Somalia, Democratic Republic of Congo

Financed by: European Investment Bank (EIB)

Implemented by: GOPA AFC, INTEGRATION

Duration: May 2014 – October 2020

The goal

Our approach

To tackle these challenges, the project provided targeted technical assistance (TA) to 37 partner financial institutions (PFIs) across six East African countries: Kenya, Tanzania, Uganda, Rwanda, Somalia, and the Democratic Republic of Congo. Over 1,000 TA activities were implemented, focusing on building the capacity of banks, training internal trainers, and supporting MSMEs directly. Trainings covered key areas such as credit risk, environmental and social risk management, gender finance, agricultural value chain finance, and leadership development. Special attention was given to priority groups, including women, smallholder farmers, and refugees. The project also fostered regional knowledge sharing by organizing the EIB East Africa Microfinance and SME Banking Forum in 2018 and 2019, as well as a SME Business Plan Competition.

Our goal was to strengthen the ability of local financial institutions to better serve MSMEs, promote financial inclusion, and contribute to sustainable economic development. By improving the skills of both bank staff and MSME clients, and by supporting inclusive and responsible banking practices, the project aimed to increase access to finance for underserved groups, support job creation, and foster resilience in postconflict environments.

Voices from the field

“We acquired expert knowledge and technical skills aimed at the development of our staff and clients, which also enhanced the bank’s performance in 2019/2020 and helped reduce considerably our Non-Performing Loan Portfolio over time. The participant’s feedback was largely very positive. We can fully recommend working with the EIB and AFC.”

Elijah

Kariuki, Head of Human Resources, Family Bank Kenya

Key highlights

Over 1,000 technical assistance activities delivered

11,353 bank staff trained (29% women)

25,786 MSMEs trained (47% women)

243 internal trainers (ToT) trained

557 staff at 13 PFIs trained in Environmental and Social Risk Management

Facilitated financial literacy and business skills training for over 1,500 smallholder farmers and 1,745 refugees, promoting financial inclusion

Support provided to PFIs in post-conflict Somalia and DRC

Examples of our success

Trained over bank staff and MSMEs across six countries, building local expertise and confidence in serving MSME clients.

Supported 37 PFIs to improve credit risk, portfolio management, and customer service, including specialized training in environmental and social risk management.

Enabled 243 internal trainers to cascade skills and knowledge within their organizations, ensuring long-term sustainability.

Organized dedicated MSME forums for 753 women entrepreneurs and delivered women’s leadership programmes at two PFIs, strengthening gender inclusion.

Provided TA and capacity building in challenging post-conflict environments, including training for 23 bank staff from 5 Somali PFIs and support to DRC institutions in agricultural value chain finance.

Fostered regional knowledge exchange through two EIB East Africa Microfinance and SME Banking Forums and a regional SME Business Plan Competition.

Impact story

by:

To learn more about GOPA AFC visit our websites:

Building Better Roads & Teams: Mary Wangari’s Story

Mary Wangari, Operations Manager at Territorial Works Ltd in Juja, Kenya, improved her company’s workplace after attending an EIB-supported HR training through Family Bank. “I found the training very useful, particularly as I learnt how to do job descriptions for all staff… This has led to increased productivity as everybody is now clear on their roles. Our staff is also more motivated now through the incentive scheme we introduced,” she says.

With support from Family Bank, Mary’s company was also able to secure a performance bond and asset finance, enabling them to grow and take on larger road construction projects—helping boost the local economy and create better jobs.

Mary says: “Family Bank was able to approve the performance bond within two days. We also availed ourselves of an asset finance facility from Family Bank which we used to buy two trailers to add to our fleet of construction equipment. This was critical to our company as we needed to increase our scale to handle larger projects”.

“Without meaning to exaggerate, the EIB technical assistance programme and the long-term expert selected were a God-sent opportunity for us. We can demonstrate that since HFBU started benefiting from the project, the loan portfolio volume has gone up, asset quality improved greatly, and the bank has become increasingly profitable. Part of the credit for this goes to EIB for the good training and capacity building.”

Mathias

Katamba, Managing Director, Housing Finance Bank Uganda