The interviews were conducted by GOPA AFC in May 2025, in the frame of the Project “Capacity Building for Banks in East Africa on Agricultural SME Lending” in Tanzania.

The Warehouse Receipt Finance Product from TCB allows agribusinesses to use stored commodities as collateral, providing flexible access to working capital without the need for conventional collateral. This enables businesses to pay suppliers promptly and remain competitive. Customers report that the loan terms and requirements are clear and suitable for seasonal needs. While interest and insurance costs can be relatively high, the product offers timely and reliable access to funds during peak periods.

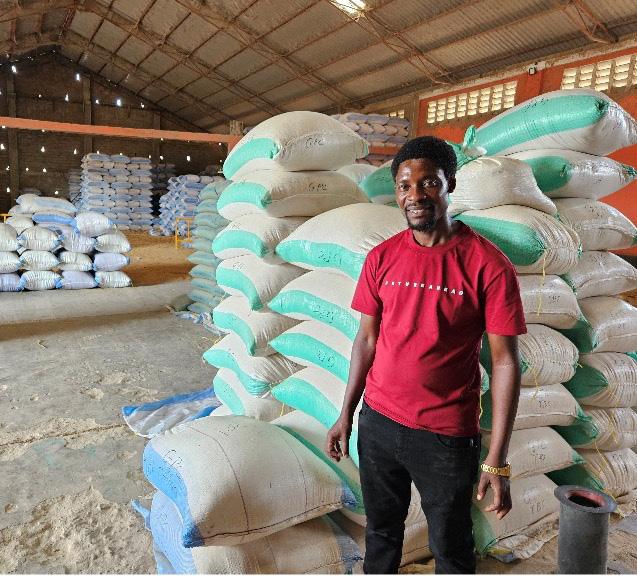

In Rwabwere, Tanzania, Anderson Kakulima Robert is part of a new generation of agricultural entrepreneurs finding innovative ways to add value to local coffee production. At 32, Anderson is the founder and company secretary of Kapama General Merchants, a business he established in 2024 with a vision to improve both his own prospects and those of the local farming community.

Kapama General Merchants works closely with a local farmer cooperative, which supplies the raw coffee beans. Anderson’s company processes these beans—removing the husks and preparing them for sale—before marketing them to buyers such as Aracay General Merchants Kayanga and Zoradia Trading, who then export the beans. This value addition not only allows Kapama to offer competitive prices to farmers but also ensures that more of the revenue stays within the community. “We developed this model ourselves because we didn’t want to exploit farmers. After selling the processed coffee, we give back around 20% of the sales price to the farmers,” Anderson explains.

With a team of six employees, including one woman, Kapama General Merchants is still a small business, but Anderson is proud of the impact it is having locally. By paying farmers based on the added value of their coffee beans rather than just the raw product, the company helps ensure that farmers are fairly compensated for their efforts. “If farmers sell to just anyone, they often get a lower price. Our approach helps them benefit more from their hard work,” he says.

The journey has not been without challenges. As a new business, Kapama General Merchants initially lacked the collateral required for traditional loans, and their recently acquired coffee peeling machine was not enough to secure significant financing. Competition in the sector is strong, and climate change brings additional uncertainties to each harvest. “We’re still new and learning, but my motivation is to grow the business, invest in better machinery, and eventually create more collateral to access bigger loans,” Anderson shares.

Access to finance is a recurring theme for many agricultural SMEs in Tanzania. Anderson first learned about the warehouse receipt finance product, which was developed jointly with GOPA AFC, through cooperative seminars, where financial institutions

presented their offerings. This product, offered by TCB, allows businesses like Kapama to use stored coffee as collateral for a loan. “What I appreciate most is that you don’t need conventional collateral. That’s a big advantage for young businesses like ours,” Anderson says.

Kapama General Merchants has been a TCB customer for three years, but only recently applied for the warehouse receipt product. The main motivation was to be able to pay farmers promptly—a requirement set by government regulations and a key factor in maintaining trust and good relationships with suppliers. “In our first year, we struggled to pay farmers right away. Now, with this loan, we can pay them immediately at market price, which also helps us stay competitive,” Anderson notes.

He is satisfied with the loan’s terms, including the documentation and collateral requirements, and finds the one-year loan period appropriate given the six-month coffee season. Anderson is confident that the loan will not only support his business’s growth but also increase profits and strengthen relationships with local farmers. “I would definitely recommend this product to others. It’s a good solution for businesses that want to grow but don’t have traditional collateral,” he says.

Looking ahead, Anderson plans to expand Kapama General Merchants’ activities beyond coffee, exploring opportunities in maize and beans sourced from the cooperative. His advice to other aspiring entrepreneurs is straightforward: “Financial institutions are ready to finance most businesses. People should make use of that opportunity.”

Through a combination of innovative business models, community focus, and new financial tools, Anderson and Kapama General Merchants are helping to build a more inclusive and profitable future for Rwabwere’s coffee farmers.

In the heart of Kamagambo, Tanzania, coffee farming has long been the backbone of the local economy. For Christian Andrew Mugizi, this tradition is both personal and communal. At 60 years old, Christian has spent four decades cultivating coffee on his land and, for the past five years, has served as the chairman of AMCOS Kiruruma, a cooperative society dedicated to supporting local farmers.

AMCOS Kiruruma brings together 516 members—126 of whom are women—to collectively market their coffee, access agricultural inputs, and benefit from shared knowledge and capacity building. As chairman, Christian’s responsibilities include chairing meetings, communicating with stakeholders, and overseeing the cooperative’s operations. “Being elected chairman has opened many doors for me,” he reflects. “I’ve gained access to new opportunities, met people from different walks of life, and helped our farmers find better ways to market their crops.”

The cooperative’s approach is rooted in fairness and collective benefit. By selling their coffee through AMCOS, farmers avoid the exploitation often faced when dealing with individual businessmen. Profits are distributed among members according to their shares, and the cooperative invests in capacity building—something common buyers rarely offer. “AMCOS gives us regular buyers and training, which helps improve our livelihoods,” Christian says.

Despite these strengths, Christian and his fellow farmers face persistent challenges. The region’s reliance on agriculture, combined with unpredictable weather, pests, and plant diseases, makes income uncertain. “There are no other major economic activities here. Most of us depend entirely on farming, so we have to sell our crops regardless of market conditions,” he explains. Access to finance is another significant barrier, especially since most farmers inherit land without the formal documentation needed for traditional bank loans.

To address these issues, AMCOS Kiruruma became a customer of TCB in April 2024 and is now applying for the warehouse receipt financing product, developed in cooperation with GOPA AFC. This facility allows the cooperative to use stored coffee as collateral to secure funding, making it possible to pay farmers promptly and manage operations efficiently during the marketing season. “The loan product helps us collect coffee from farmers and keep our operations running smoothly,” Christian explains. “It’s not perfect— the interest rate and insurance costs are a bit high compared to some other lenders—but it offers us timely access to funds.”

Christian appreciates that the documentation requirements are fair and that the loan terms are generally suitable for the cooperative’s needs. While he notes the importance of further financial education among farmers and suggests that banks could do more to tailor products for rural clients, he believes the warehouse receipt financing model has clear benefits. “I would recommend this product to other cooperatives. Timely funding makes a real difference in our ability to serve our members,” he says.

Looking ahead, both Christian and AMCOS Kiruruma have ambitious plans. On his own farm, Christian is experimenting with new crops like sunflower, hoping to inspire others in the region to diversify. “Trying something new can be effective, even if others are

hesitant,” he says. The cooperative is also seeking to build its own warehouse and acquire processing equipment, aiming to reduce reliance on third-party services and improve efficiency. Additionally, AMCOS plans to purchase land for training purposes, so members can learn firsthand about new crops and techniques before scaling up.

Christian’s experience highlights both the challenges and opportunities facing agricultural cooperatives in Tanzania. By working together and embracing innovative financial solutions, AMCOS Kiruruma is helping its members secure better markets, improve livelihoods, and invest in the future.

In Kayungu, Tanzania, coffee farming is not only a tradition but a mainstay of the local economy. Gilbert Tinkamanyile Flugence, 33, serves as the Secretary of AMCOS Bushangaro, an Agriculture Marketing Cooperative Society that unites coffee farmers to improve their market position and access to resources. Like many in his region, Gilbert is both a coffee farmer and a cooperative leader, motivated by the opportunity to support his family and contribute to the community’s development.

AMCOS Bushangaro’s core activities include collecting coffee from member farmers, processing it, and seeking out favorable markets. The cooperative also provides training and capacity building to its members, aiming to improve farming practices and productivity. “By working together, we are able to negotiate better prices and support each other with knowledge and resources,” Gilbert explains. On a typical day, his tasks range from administration and sales to organizing training sessions and communicating with buyers.

However, the cooperative faces several challenges. Environmental factors such as unpredictable rainfall, high temperatures, and pest infestations regularly threaten yields. Additionally, access to finance remains a significant barrier for many agricultural SMEs in Tanzania. “Most farms here are inherited and lack formal documentation, which makes it difficult to meet banks’ requirements for loans,” Gilbert notes. This situation is common across the region and often limits the ability of cooperatives to operate efficiently.

One of the critical issues for AMCOS Bushangaro is managing cash flow. After collecting coffee from farmers, the cooperative processes the beans and waits for market prices to become favorable before selling. However, farmers need to be paid immediately for their produce. To bridge this gap, AMCOS recently applied for TCB’s warehouse receipt financing product which was jointly developed with GOPA AFC. The product allows the cooperative to use stored coffee as collateral, enabling them to access funds quickly and pay farmers on time.

“This loan is essential for our operations,” says Gilbert. “It allows us to pay our farmers promptly, even when we have to wait to sell our coffee.” He finds the documentation and collateral requirements fair and manageable, and appreciates that the loan terms are aligned with the seasonality of the coffee business. While generally satisfied, Gilbert suggests that a lower interest rate would be beneficial and that a faster loan approval process would help address the cooperative’s time-sensitive needs.

AMCOS Bushangaro has been a customer of TCB since June 2024, after previously working with another bank whose loan conditions were less favorable. TCB reached out to the cooperative, presented their products, and demonstrated how they could better meet AMCOS’s needs. “We switched because TCB offered more suitable terms and took the time to understand our business,” Gilbert explains.

Looking to the future, Gilbert aims to diversify both his own and the cooperative’s activities. Individually, he is interested in expanding into livestock, while AMCOS is planning to include food crops such as maize and beans, and has recently purchased a 10-acre farm for training and organic production. The cooperative also maintains a strong focus on inclusion, with half of its employees being women.

Based on his experience, Gilbert encourages other farmers to seek financial literacy and to overcome the reluctance many feel towards engaging with banks. He believes that more supportive government policies—such as improved irrigation infrastructure—would further help agricultural SMEs manage risks and grow sustainably.

Gilbert’s story highlights the practical benefits of tailored financial products for agricultural cooperatives, showing how access to the right kind of finance can improve business operations, support timely payments to farmers, and enable future growth.

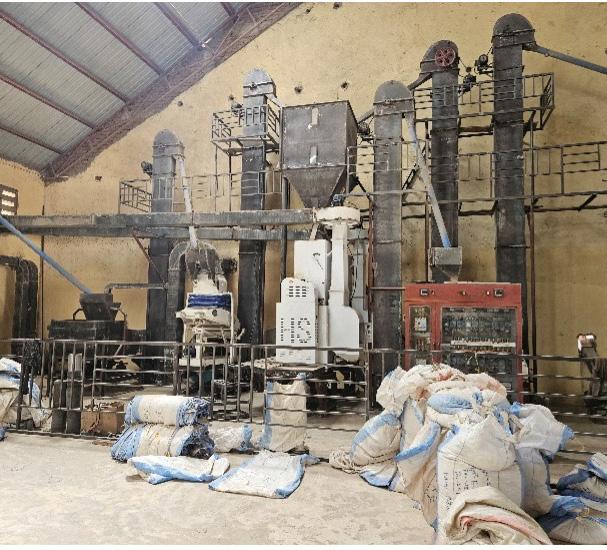

In Mengele, Chimala District of Mbeya Region, MT & David Company Limited has become a cornerstone of the local agricultural economy. Founded and managed by David Jackson Kiumba and his wife, the company has spent the past nine years supporting farmers, providing employment, and connecting rural production with both domestic and international markets.

David’s business is multifaceted. MT & David Company Limited not only sells agricultural inputs such as fertilizer, pesticides, and seeds, but also offers harvesting services and storage solutions for local farmers. Their warehouse can hold up to 120,000 bags of rice, and the company owns five harvesters, a truck, a tractor, and two rice milling machines. In addition to rice, they store and sell soybeans, beans, and maize, responding to the diverse needs of farmers and the market.

“We have a fixed list of about 600 regular farmer clients, but many more come and go each season,” David explains. The company handles a significant volume, selling around 120 tons of rice per month—amounting to over 1,400 tons annually. Most of the rice they process is the Salo5 variety, which is highly sought after in the region.

David is proud of the impact his business has on the community. “Some of the farmers we work with can now build houses and send their children to school because of the fair prices we pay for their rice,” he shares. The company employs nine permanent staff— four of whom are women—and up to 160 casual laborers during peak periods, with women making up a significant portion of this workforce. “I enjoy what I do because it provides employment and supports local livelihoods,” David says.

Despite the company’s growth, access to finance has been a persistent challenge. “Conventional collateral wasn’t enough to meet our needs for a regular loan,” David notes. In January 2025, he initially applied for TCB’s warehouse receipt finance product, which would have allowed him to use his stored stock as collateral and access the working capital needed to meet market demand and increase profits. However, after discussions with Daniel Mbotto, Director of Credit at TCB Head Office, David was advised to reduce his loan amount so that his warehouse could serve as sufficient

collateral for a regular loan instead. As a result, he secured a 400 million Tanzanian Shilling overdraft and, by the day of the interview, had received an 800 million Tanzanian Shilling term loan.

The impact of this financing has been significant. “Our profitability has increased, and we’re now able to sell to international markets,” David explains. He is satisfied with the loan terms and documentation requirements, though he notes that processes at the head office can be a bit slow. “For rice businesses like ours, it’s crucial that loans are approved early in the harvest season—ideally by the 10th of April—so we can buy rice when prices are low and supply is high.”

David learned about warehouse receipt finance through his experience in the sector and from other financial institutions. He has previously worked with NMB Bank and understands the importance of having enough own capital to bridge any delays in loan disbursement. “If you rely 100% on bank financing and there’s a delay, it can be a problem. It’s also important to have a reliable market for your products,” he advises other entrepreneurs.

Looking ahead, David plans to expand production and access new markets with higher demand and better prices, such as Kenya, Uganda, and South Africa. He believes that access to finance, improved infrastructure, and timely loan processing are essential for agricultural SMEs to thrive. “About 80% of farmers still work in areas without irrigation schemes, and the bureaucracy of loan processes doesn’t always match the agricultural calendar,” he points out.

With the support of TCB and innovative financial solutions developed with the assistance of GOPA AFC, MT & David Company Limited is well-positioned to continue empowering farmers, creating jobs, and expanding Tanzania’s presence in regional markets.

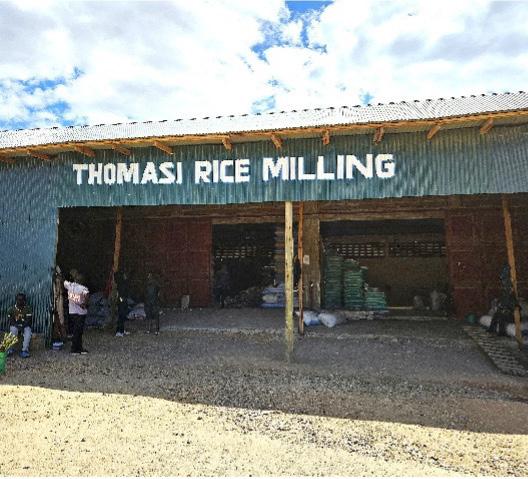

In the bustling town of Mabadaga, Mbeya Region, the rice business owned by Thomas Francis Maschambo has become a trusted partner for local farmers and a key player in the regional rice value chain. While Thomas himself was away during the interview, his sister and the company’s accountant, Rosalia Francis Maschambo, shared insights into their day-to-day operations and the impact of

financial services on their growth.

The business operates a well-equipped facility where raw rice from local farmers is received, stored, processed, and ultimately sold to wholesale buyers, including schools and businesspeople who further distribute the rice. With their own rice milling machine and warehouse, the company is able to handle significant volumes—on average, they buy three truckloads of rice per week, each truck carrying 28 tons. “We cover all transportation costs for the farmers who bring in rice,” Rosalia explains. “After processing, we manage the buyers, handle payments, and ensure the rice gets loaded and delivered.”

The business deals with four main types of rice grown in the region—Suppa, Tangatanga, Cherehini, and Salo—and stores rice for extended periods, typically six to ten months, to take advantage of better market prices. During the harvest season, prices tend to dip due to increased supply, so the business often waits before processing and selling, aiming for a higher return for both themselves and the farmers.

What sets the Maschambo business apart is its focus on supporting local livelihoods. Not only do they provide a reliable market for farmers, but they also offer practical assistance. “We help local farmers by giving them money for fertilizer and inputs, encouraging them to grow and bring their harvest to our facility,” Rosalia says. This support ensures a steady supply of quality rice and helps farmers manage their cash flow needs throughout the season.

Financial challenges, however, are a reality. Sometimes, the business does not have enough liquidity to pay farmers immediately for their produce or to cover transportation costs up front. Recognizing these gaps, they turned to TCB for financial support, becoming a customer in December 2024. In January 2025, they received a term loan of 500 million Tanzanian Shillings, which was used to supplement working capital—especially after recent investments in restoring their milling machine had depleted their reserves.

Rosalia notes that while this was their second experience with bank financing (having previously worked with NMB), the support from TCB has been crucial in maintaining operations and supporting the local farming community. The business has not yet applied for the newly developed warehouse receipt finance product, supported by GOPA AFC, but after discussions with TCB, it is clear that this solution could further ease their operations by providing more flexible access to working capital, especially during peak seasons.

Competition in the rice processing sector exists, but Rosalia is confident in their position. “There are many storage facilities in the area, but demand from farmers remains high. Our experience

and ability to process rice before selling gives us an advantage,” she says. The business employs five staff members, including two women, and is committed to expanding further. Plans are underway to develop an additional storage facility and to invest in a grading machine, which will enhance the quality and marketability of their rice.

Reflecting on her role, Rosalia finds satisfaction in helping people, especially when they are in need. Looking ahead, the business is poised for further growth, with continued support from TCB and the potential benefits of innovative financial products developed with the assistance of GOPA AFC. With a strong foundation and a community-focused approach, the Maschambo business is wellpositioned to keep supporting local farmers and driving economic growth in the region.

As Director of Credit at TCB’s headquarters in Dar es Salaam, Daniel Furaha Mbotto plays a central role in shaping the bank’s lending strategy and ensuring the quality and sustainability of its loan portfolio. Since joining TCB 14 months ago, Daniel has overseen a broad transformation in the way the bank approaches credit— especially for agricultural SMEs.

Daniel’s responsibilities cover the full credit cycle, from the initial appraisal of loan applications received from branches, to credit administration, disbursement, and ongoing monitoring. He also leads the special asset management and recovery unit, which supports customers in distress and manages debt collection. “I make sure to get regular reports to understand how our portfolio is behaving, and I’m involved in setting the bank’s risk appetite, diversifying our lending, and ensuring our portfolio risk remains within budget,” Daniel explains.

While agriculture currently represents only about 3% of TCB’s lending portfolio, the bank has made notable strides in supporting agri-SMEs and value chains such as tobacco, coffee, cassava, rice, maize, and cashews. “We’ve been working closely with cooperatives and aggregators, especially in warehouse receipt finance, which is easier to administer and provides real value to traders and growers,” Daniel says. Recent investments in the tobacco and coffee value chains, as well as successful pilots in cassava, are paving the way for further growth.

The recent technical assistance and capacity building activities provided by GOPA AFC have played a crucial role in this shift. “The training helped our staff build confidence in agricultural lending. We now have a dedicated agriculture unit with four people, and our front-line staff are better equipped to compete with other banks,” Daniel shares. He points to improved credit manuals, a new agristrategy, and better documentation as concrete outcomes of this support. “Workshops for management brought much-needed awareness, and the operational improvements have helped turn the bank profitable again in 2024.”

Daniel has observed clear improvements in loan approval rates, risk assessment, and customer satisfaction since the interventions. “Our staff—like Emma Liwa in the agriculture department—now handle credit applications with greater skill and efficiency. The quality of applications has improved, and we’re able to process and approve loans more effectively,” he says. The bank’s approach to agricultural SME lending has evolved, with greater receptiveness at the board level and a stronger emphasis on supporting clients through challenges, rather than resorting to asset sales.

TCB serves over 800,000 customers, with a portfolio that has traditionally been dominated by personal loans. In recent years, however, Daniel and his team have worked to diversify the bank’s lending, expanding into sectors such as trade, construction, transport, and increasingly, agriculture. “Personal loans used to make up 70% of our book; now it’s below 50%. We’re making a conscious effort to grow our business lending, and agriculture is a key part of that strategy,” he notes.

Broader institutional changes have followed. TCB now has comprehensive credit manuals, an agri-strategy, and a growing agriculture unit. Daniel is optimistic about the future: “With the right products and support, agriculture can become a much larger part of our portfolio by 2026.

Despite the progress, challenges remain. “Collateral is still a major barrier for agri-SMEs, and many applicants struggle to present clear business structures, cash flow projections, or risk mitigation strategies,” Daniel notes. He advises entrepreneurs to thoroughly understand their business models, clearly identify their suppliers and markets, and be upfront about potential risks and how they plan to address them. “Stick to your plan, and if you’re an aggregator, don’t mix business funds with your own farming activities,” he cautions.

Reflecting on the journey so far, Daniel is confident that the recent changes have set TCB on a path toward more impactful and sustainable agricultural lending. “The support we’ve received has been key. As our agriculture team grows and our processes improve, we’re committed to making a bigger impact on Tanzania’s agricultural sector in the years ahead.”

As Director of Retail and SME Banking at TCB in Dar es Salaam, Lilian K. Mtali brings over 27 years of banking experience to her leadership role. Since joining TCB in August 2024, she has overseen strategy, sales, and profitability for 82 branches and is responsible for guiding 70% of the bank’s employees. Her focus is on ensuring that the bank delivers on its strategic goals—particularly in supporting Tanzania’s vital agricultural sector.

Lilian recognizes that agribusiness is a cornerstone of the Tanzanian economy, with SMEs accounting for about 31% of national output, and the majority of these businesses engage in agriculture. Under her leadership, supported by GOPA AFC, TCB has established a dedicated unit to drive agricultural business, reflecting the sector’s importance to both the bank and the broader economy.

However, she notes that agricultural lending comes with its own set of challenges. “The agri portfolio requires real expertise,” Lilian explains. “It’s essential to understand the unique nature of agri customers—their production cycles, risks, and market dynamics. Without that knowledge, it’s difficult to grow the portfolio effectively.”

Lilian credits the collaboration with GOPA AFC for elevating her understanding of agricultural finance. “Every day I learned something new, especially about products like warehouse receipt financing and how they work. The capacity building and partnership have been first-class and very timely for our portfolio growth,” she says. This collaboration has also helped her identify the right skills when hiring for the agriculture department and has informed the formulation and structure of new agricultural finance products.

She rates the technical assistance provided as 4.5 out of 5, describing it as excellent but noting there is always room for improvement. She advocates for ongoing assessment of training effectiveness before scaling up to new groups, ensuring that the skills gained are truly making an impact.

The results of these efforts are already visible. “Our books have grown, and our staff’s knowledge and expertise have improved. Relationship officers are now better equipped to assess agricultural

customers, and our agriculture portfolio has increased from 1% to 5%,” Lilian reports. Notably, the non-performing loan (NPL) ratio has also declined, from 5.2% to 4.5%, while the overall portfolio has reached TZS 38 billion. Improved reporting and a greater appreciation for the seasonality of agriculture have shortened turnaround times and strengthened relationships with partners such as the Tanzania Agriculture Bank.

Lilian emphasizes the need for continuous learning and skills development. “Regulations and markets are always changing, so ongoing training is crucial—especially in such a technical area as agricultural finance. We should continue to invest in our people and expand training to smallholder farmers and AMCOS, helping them understand key aspects like insurance for their crops.”

Challenges remain, particularly in adapting to climate change and supporting customers through difficult periods, such as the recent floods that devastated cassava harvests. “We weren’t fully prepared for that, but now we’re better positioned to support our clients,” she says.

Lilian has seen a noticeable increase in customer uptake for agricultural facilities, with more clients approaching TCB after seeing the success of their peers. “Corporate clients and AMCOS are now actively seeking our products, and we’re able to provide timely support and channel government inflows more efficiently.”

Institutionally, agriculture is now a central pillar of TCB’s strategy, driving balance sheet transformation and business growth. “Agribusiness is our number one focus for improving the balance sheet,” Lilian says, noting that the bank’s commitment to the sector is stronger than ever.

For entrepreneurs, Lilian offers practical advice: “Understand your own capabilities and financial status before seeking a loan. Know your market and have a clear plan for production and sales. Financial literacy is essential—don’t rely on a bank statement alone. And make sure any facility you request is used for its intended purpose; misallocation can lead to difficulties in repayment.”

She concludes by expressing appreciation for the ongoing support and evaluation. “The team has been fantastic, but we still have a long way to go. Our department is just getting started, and continuous support and learning will be key to our success moving forward.

At the heart of Tanzania Commercial Bank’s (TCB) efforts to support agricultural SMEs are professionals like Mwinga Sudi Hakungwe, Principal Relationship Officer for Agribusiness, and Emma Liwa, Principal Credit Officer. Based at TCB’s headquarters in Dar es Salaam, Mwinga and Emma bring over two decades of combined experience to the bank’s Retail and SME Banking and Credit Department. Their work is central to TCB’s mission of expanding access to finance for small-scale farmers and agribusinesses across Tanzania.

TCB’s nationwide presence and focus on agriculture set it apart in the financial sector. “We offer credit facilities to small-scale farmers and agri-businesses, and our partnership with stakeholders like TADB Bank allows us to provide guarantees and offer more affordable products,” Mwinga explains. Despite these efforts, challenges remain—especially high interest rates, which currently stand at 14%. “We’ve seen competitors offer lower rates, and while the market is large, we hope to eventually reach single-digit rates for our clients,” Emma adds.

One of the key hurdles TCB faced in the past was a limited understanding of the agricultural value chain. “We used to think only about farmers as the main actors, but we now realize the importance of supporting the entire value chain, from input suppliers to processors and traders,” says Mwinga. This shift in perspective was significantly influenced by the Agricultural Value Chain Finance (AVCF) training provided by GOPA AFC, which they attended in November 2024. The training combined online and inperson sessions, offering a comprehensive learning experience.

The training was a turning point for both officers. “We learned how to mitigate risks, structure loans according to the needs of different value chain actors, and use tools like warehouse receipt financing,” Emma reflects. “Before, we treated agribusinesses like any other trading customer, but now we’re developing products that are truly aligned with the realities of farming and processing.”

The training also covered cash flow analysis, risk management, and the importance of timely loan disbursement to match agricultural seasons.

After the training, both Mwinga and Emma noticed immediate changes in their daily work. “Our efficiency and confidence increased. We now receive and process more loan applications from branches, and the quality of these applications has improved,” Emma notes. The new approach has helped TCB’s agriculture portfolio grow, and the bank has taken steps to ensure that lending processes start earlier, so loans are available when farmers need them most. “We used to have only one person in the agribusiness department; now there’s a dedicated team, and more officers are being added,” says Mwinga.

The impact is measurable: the quality of customer data has improved, the non-performing loan (NPL) rate has dropped from 8% to 4.8%, and customer satisfaction is on the rise. “We now ensure that lending structures are tailored to match the cash flow patterns of different agricultural activities, and we’ve also adjusted our collateral requirements to make it easier for more farmers to access loans,” Emma explains.

Mwinga and Emma have also played a role in sharing their new knowledge with colleagues, providing informal training sessions to branch staff and encouraging a more proactive approach to agricultural lending. “The training motivated us to see the potential in supporting women and youth in agribusiness. We want to be part of this growth area,” Mwinga says.

Despite these gains, challenges persist. Access to reliable information, collateral requirements, and the need for more time to supervise and visit clients remain ongoing issues. “We’re beginning to address these by reviewing our staffing and processes, but there’s always room for improvement,” Emma notes.

For entrepreneurs seeking finance, both officers emphasize the importance of record-keeping, formalizing business activities, and seeking training before taking out loans. “Treat agriculture as a business. Keep your records straight, and don’t mix household and business finances,” advises Emma. Mwinga adds, “Take advantage of training opportunities from financial institutions—being prepared will help you maximize profits and repay loans without difficulty.”

Looking ahead, Mwinga and Emma are optimistic. “The support and technical assistance we’ve received have been invaluable. Our agribusiness department is growing, and we’re committed to continuous improvement,” Mwinga concludes. Their story illustrates how targeted training and a shift in mindset can transform agricultural lending—benefiting both the bank and the communities it serves.

Franciana Mbatia, a relationship officer in the credit department at TCB’s Kayanga branch, has seen firsthand how targeted training can make a difference in agricultural lending. At just 26 years old, Franciana manages a diverse portfolio of around 1,000 accounts and 1,500 loans, many of which support local farmers and agriSMEs. With four years at TCB, she is deeply involved in daily branch operations, profit maximisation, back office management, and customer engagement.

Agriculture is at the heart of TCB’s business in Kayanga. The bank offers specialized products like the “Farmers Quick Account”, which provides farmers with accessible, low-fee banking and ATM services—even in areas without a TCB branch. “We have 340 farmers using quick accounts,” Franciana notes. “We also support microcredit for business people and even help retired agricultural workers to stay active in farming.”

Despite these efforts, Franciana recognizes the challenges TCB faces in serving agricultural clients. High interest rates, competition, and operational hurdles—such as long distances to reach customers—can make it difficult to fully meet farmers’ needs. She advocated internally for agriculture to have its own desk within the bank, ensuring that dedicated staff understand the unique requirements of agri-SME clients. “Sometimes agriculture customers are treated like any other microcredit client, but their needs are different. Having a specific person for agriculture helps us serve them better,” she explains.

In April 2025, Franciana participated in the Agricultural Value Chain Finance (AVCF) training provided by GOPA AFC, which she rates as excellent. “The training opened my eyes to the importance of thoroughly assessing the land before financing a crop. It’s not enough to just look at financial statements; you need to understand the actual farming operations,” she says. The course highlighted the need for deeper agricultural knowledge among bank staff, including how to properly evaluate land suitability, analyze crop-specific cash flows, and ask the right questions during loan appraisals.

One of Franciana’s key takeaways was the need for more practical and sector-specific expertise within the bank. She now collaborates more closely with local agricultural officers to verify the quality of

land and farming practices. “We learned that office-based analysis isn’t enough. You have to be present in the field and really engage with the client’s business,” she shares. After the training, she passed on her new knowledge to seven colleagues, helping to raise overall standards in the branch.

Franciana is confident that these changes will soon translate into higher loan approval rates, better risk assessment, and improved customer satisfaction. “It’s too early for hard numbers, but I’m sure we’ll see positive results over the next year,” she says. She also now provides clearer guidance to customers, helping them understand why their applications succeed or fail.

The training also introduced Franciana to the newly developed agri-SME loan product, specifically the warehouse receipt financing, which has already been provided to three local AMCOS cooperatives. She believes these products are making a real difference: “The warehouse receipt product helps farmers get paid on time and manage seasonal cash flow. It’s a good fit for their needs.”

However, challenges remain. “Loan processing time is still a hurdle, especially because agricultural clients need funds quickly at the start of each season. There are also price fluctuations in the market, which can complicate risk assessment,” Franciana notes. She emphasizes the need for ongoing green finance training and better alignment between bank policies and the realities of agricultural businesses.

Franciana’s advice to entrepreneurs is practical: “Understand the risks and benefits of your business before applying for a loan. Have a fallback plan—don’t rely solely on agriculture if you can diversify.” She also encourages aspiring borrowers to learn more about their sector and to be realistic about what it takes to succeed.

Through her dedication and the knowledge gained from recent training, Franciana is helping TCB Kayanga strengthen its support for agricultural SMEs, ultimately contributing to a more resilient and inclusive rural economy.

As the branch manager of TCB’s Mwanjelwa Branch in Mbeya, Simon Mlelwa has witnessed firsthand the evolving landscape of agricultural SME lending. With 12 years at TCB, Simon oversees operations for nearly 4,800 customers, including over 1,100 loan clients. Yet, he acknowledges that the bank still has considerable room to grow in supporting the agri-sector. “We have the capacity to do more,” he states, reflecting a drive for continuous improvement.

Simon’s daily responsibilities are broad: overseeing branch operations, maintaining stakeholder relationships, evaluating credit analyses and appraisals, approving loans within his mandate, and conducting customer visits—especially after loans are disbursed. Among the branch’s loan portfolio, only 21 are dedicated to the agricultural sector, highlighting the opportunity for expansion.

One of the main challenges, Simon notes, has been a lack of specialized knowledge and resources. “Until recently, we didn’t have a proper agriculture lending policy, and most training focused on other sectors. Visiting customers also requires a budget that’s often not available, so the bank has concentrated on less costly sectors than agriculture.” Liquidity challenges and loan-to-deposit ratios have further limited the branch’s lending capacity.

The turning point came with the AVCF training and capacity building activities delivered by GOPA AFC. “The collaboration with GOPA AFC opened my eyes to the fact that agriculture finance is a sector in its own right. Lending in agriculture requires assessing the entire value chain—from farm to fork—so that we can properly advise our clients,” Simon explains. He found the training well-organized and relevant, particularly appreciating the mentorship from GOPA AFC expert Albert Mkongwa.

Simon learned to differentiate how assets and collateral are appraised for farmers compared to other SMEs, and the concept of warehouse receipt finance was entirely new to him. “The training taught us to treat stock of seeds as assets, and to assess cash flows for farmers differently,” he says. These insights have led to measurable improvements in branch performance: “I used to spend a lot of time coaching staff on how to appraise farmers. Now, there

are minimal errors in the files they submit, and they know which products to recommend to agriculture sector businesses.”

The impact has been tangible. “Loan amounts for agri-finance customers have increased, and we’ve attracted clients who switched from other banks. Our agri-finance portfolio is growing,” Simon reports. The branch has even developed an agricultural calendar to align loan processing with the cycles of key value chains, such as rice and Irish potatoes, ensuring that farmers receive support when they need it most.

Simon believes the bank’s approach to agricultural SME lending has fundamentally changed. “I feel much more comfortable and confident in supporting agri-business clients. The training has equipped both me and my staff with the skills needed to analyze clients, evaluate collateral, and handle client objectives more effectively. Before, many cases were escalated to me, but now my staff can handle them independently.”

Despite these advances, Simon recognizes ongoing barriers: the need for more specialized staff to serve agri-business clients, the unpredictability of rain-fed agriculture, limited insurance options, and the overall challenge of liquidity in the financial sector. He emphasizes the importance of further capacity building for both bank staff and farmers, many of whom lack financial literacy. “We need to transfer knowledge from staff to farmers so they can make informed decisions,” he says.

Simon’s advice to entrepreneurs is clear: “Before seeking a loan, know what you need and understand your sector. Too often, clients rely solely on information from the bank, so it’s crucial that we have the right people in place to guide them.” Once a loan is disbursed, he urges clients to stick to the agreed purpose to ensure success.

He concludes with appreciation for the ongoing support: “I congratulate GOPA AFC and hope they continue their work. What they are doing is essential for the growth of agricultural finance in Tanzania.” At 39, Simon is optimistic about the future, confident that continued training and strategic partnerships will help unlock the full potential of agri-finance in the region.

At the Mwanjelwa Branch of TCB in Mbeya, Nuru Brighton plays a vital role in supporting the financial needs of agricultural SMEs and other business clients. As a relationship officer in the credit department, Nuru brings four years of experience to her work, managing credit applications, advising clients, and ensuring that customers can comfortably meet their loan obligations. She works with a diverse portfolio—including agribusinesses and hardware stores—ranging from small to large enterprises.

Nuru’s day-to-day responsibilities go beyond processing loans. “I help customers identify the right products, manage their loans after disbursement, and make sure they have the support they need to succeed,” she explains. Her approach includes regular visits or calls to clients, providing guidance and building strong relationships that support both the bank’s and the customers’ goals.

She sees TCB’s role in the local economy as crucial, particularly for agri-SMEs. “We help them access facilities, give them advice, and manage them so they can use loans well and repay comfortably,” Nuru says. However, she acknowledges some challenges, especially around the speed of loan processing. “The approval process can take up to a month, as branches must wait for decisions from head office, which can be slow for customers needing quick access to funds.”

Nuru participated in the Agricultural Value Chain Finance (AVCF) online training delivered by GOPA AFC in November 2024. She rates the training as “very nice” and highlights how it shifted her perspective from focusing solely on farming to understanding the entire value chain. “I learned how customers can add value after harvesting—through processing, packing, or even exporting. It’s about seeing the bigger picture and helping clients do more than just farm,” she reflects.

The training also equipped Nuru with practical skills for identifying potential customers, understanding their needs, and matching them with suitable products. “Now I go out and talk to people who are selling, producing, and distributing, asking about their challenges and explaining how the bank can help,” she says. This proactive approach has made it easier for her to advise clients and has led to more successful client relationships.

Since the training, Nuru has noticed positive changes in her work. She feels more confident in recommending the right financial products and is more comfortable guiding customers through the application process. “We used to focus only on farmers, but now I understand the whole value chain and can support clients at different stages,” she says. This broader understanding has also made it easier to attract new customers to the bank.

Nuru has introduced the newly developed agri-SME loan product to her clients, but in some cases, she has been able to recommend even more suitable products based on their specific needs. She believes that warehouse receipt financing, in particular, can help customers use their stored products as security for loans, rather than relying solely on traditional collateral.

Despite these advances, Nuru points out that complex application procedures and stringent requirements remain barriers for many agri-SMEs. “Farmers often find the procedures complicated and may not realize that collateral is still needed,” she notes. She encourages entrepreneurs to familiarize themselves with banking requirements and to understand the importance of timing and proper documentation when seeking finance.

Looking ahead, Nuru sees ongoing training as essential for serving potential customers even better. “We need more trainings in AVCF to keep improving our service,” she says. With the continued support of GOPA AFC and a focus on value chain finance, Nuru and her colleagues at TCB are well-positioned to help agricultural SMEs grow and thrive in Tanzania’s evolving market.