ADVISORS JAN 2023 ISSUE 112 magazine jim belushi the business of cannabis 5 ESSENTIAL TIPS FOR SMALL BUSINESS SUCCESS IN 2023 INFLATION. RECESSION. CASH. CANDID CONVERSATIONS

Andrew DeAngelo

leading industry entrepreneurs

Jesce Horton

Headquartered at: 2598 E. Sunrise Blvd., Suite 2104, Fort Lauderdale, Florida, 33304 (917) 325 4191

Advisors Magazine is published bi-monthly and printed by Magcloud, Inc. Reproduction of any material from this print issue or our digital issue or transmitted in any form of by any means without prior written consent of the publisher in whole or in part is strictly prohibited. ©2023 by Advisors Magazine Inc. All rights reserved.

For a free digital subscription email: editorial@advisorsmagazine.com To obtain a print issue, visit: www.magcloud.com/user/advisorsmagazine

ADVERTISING creative@advisorsmagazine.com

QUESTIONS & COMMENTS info@advisorsmagazine.com

ADVISORS MAGAZINE / 3

LETTERS TO THE EDITOR editorial@advisorsmagazine.com

Erwin E. Kantor

Lumi Subasic Michael Gordon Jude Scinta Lucas Rivera Eric Daniels Sean Rome Erwin Kantor

CEO & Publisher Managing Partner Managing Editor Editor-in-Chief Writer-at-Large Billing Creative Director Creative Editor Senior Writer Feature Feature Writer Feature Writer Business Reporter

GUESTS

Joe Innace Regina Johnson Bill Millar Harold Gonzales

Ty Young, Merilee Kern MBA, BPT, Mark Shields, Rick Grimaldi CONTRIBUTORS &

@advisors.magazine @advisorsmagazin @advisorsmag ADVISORS magazine

AN ADVISOR MAGAZINE PUBLICATION

contents JAN 2023 34 Put me in Coach... Identifying favorable tax situations 6 Inflation. Recession. Cash. Candid Conversations MADE FOR YOU Our picks from the around the globe 28 4 / ADVISORS MAGAZINE JAN 2023 26 12 features 14 Advice and insights from the industry’s major players ON THE COVER JIM BELUSHI’S FARM 26 It’s Tax Planning Season A case for elite advisors 36 The high priest of African Literature Ngugi wa Thiong’o 38 5 Essential Tips for Small Business Success in 2023 30 The Heart of Financial Planning Engaging in meaningful conversations 34 30 12 Find the right advisor to inspire you Discovering the Joy of Giving

VION Receivable Investments, headquar tered in Atlanta, Georgia, is an international provider of receivable investment ser vices to businesses managing consumer and commercial receivables. VION provides a single , comprehensive source of exper tise in commercial receivable factoring and consumer receivable purchasing, valuations, and process consulting VION Receivable Investments 400 Interstate North Parkway Suite 800 Atlanta, GA 30339 877.845.5242 phone 678.815.1557 fax Mesquite Corporate Center 14646 N. Kierland Blvd. Suite 122 Scottsdale, AZ 85254 480.729.6419 phone 866.260.1826 fax 123 North College Avenue Suite 210B Fort Collins, CO 80524 877.845.5242 phone 970.672.8714 fax 11921 Freedom Drive Suite 550 Reston, VA 20190 703.736.8336 phone VION Advisory Services 18017 Chatsworth Street Suite 28 Granada Hills, CA 91344 818.216.9882 phone 818.891.8738 fax VION Europa Paseo de la Castellana 95-15 (Torre Europa) Madrid 28046 Espanha +34 91 418 50 88 phone www.vioneuropa.es Atlanta • Phoenix • For t Collins • Reston • Los Angeles • Madrid RECEI V ABLE INVESTMENTS

By Joe Innace

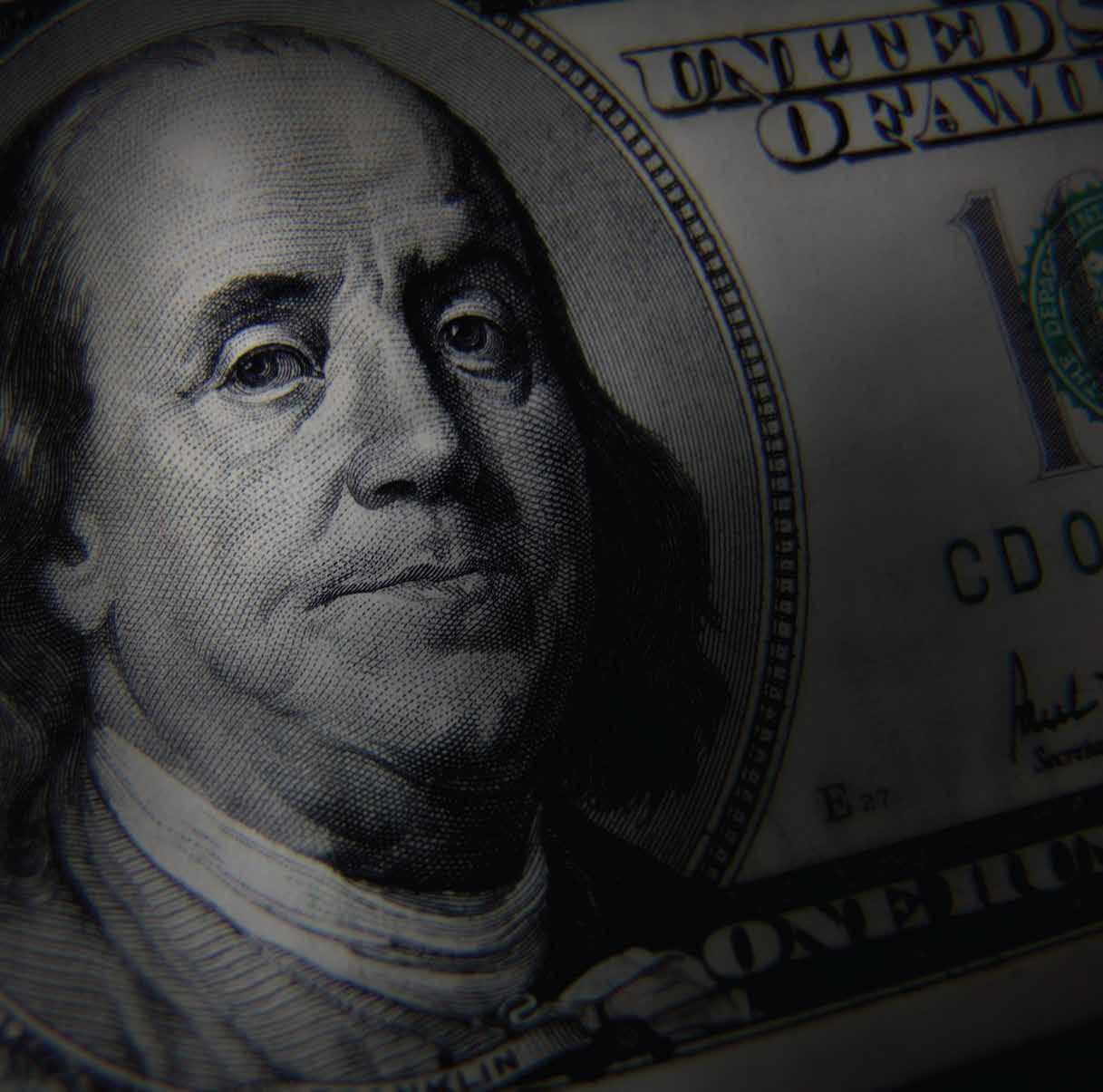

DEALING WITH INFLATION AND PREPARING FOR A RECESSION

Have the cash conversation...and other tips

Inflation is the headline that investors are hearing about every day and the possibility of a recession in 2023 is something that cannot be ignored, according to Frank Bonanno, managing director at StoneCastle Cash Management LLC, (Stonecastle) a firm dedicated to providing funding to community banks and to create unique cash products for institutional investors.

“While most advisory clients are high(er)-net-worth individuals, rising prices may not consume their every thought like the many that live paycheck-to-paycheck,” Bonanno told Advisors Magazine recently. “But that isn’t a reason that advisors should avoid obvious questions about short/mid-term cash and liquidity needs,” he added.

Bonanno explained that while a combination of laddered Treasuries and money funds are the norm for the small percentage of cash held within managed portfolios, the bulk of client cash lies outside of the advisory relationship. “It is important to speak about this held-away cash in conversations that address the ‘inflation’ and ‘recession’ buzz words,” he said.

Bonanno points out that rates on money center banks (which hold two-thirds of all cash deposits in the country) are low; And until recently these banks had no incentive to

increase their rates on savings accounts as many had excess liquidity and a lightening of the balance sheet was welcomed.

“Your clients will appreciate that you are mindful of these deposits and how you can help them increase their rate of return, insure more of their cash, and all the while deepen your relationship,” is Bonanno’s message to financial advisors. “With cash currently one of the best performing assets for 2022 (second only to commodities) it is prudent advisors have the cash conversation with their clients,” he summarized.

Chris Everett, president of Illinois-based Everett Wealth Solutions (Everett Wealth Solutions, Inc.) agrees that it’s possible to produce positive gains in a declining market and that during inflationary/recessionary times it’s vital to work with a money manager who can tap into such assets.

More specifically, she recommends working with a fiduciary financial planner.

“A good fiduciary should more than pay for themselves with the wealth leaks they find,” Everett told Advisors Magazine. “Leaks may be hiding in your cash flow, asset fees, tax documents, legal documents, insurance coverages, debt structure, employee benefits and more. And it may mean tens of thousands and usually much more over your life-

time,” she emphasized.

According to Everett, who’s also a published author, Millennials and Gen-Z may have the toughest time because of inflation.

“Millennials and Zillennials are in for a rude awakening,” she said. “If you wanted homeownership, you’ll need to cough up more for a mortgage payment than when interest rates were at 2%-3%,” Everett pointed out.

“Already, many have been priced out of the market. Rents are no picnic either. So, with rising food and household item inflation in the high double digits, rents rising, aging off a parent’s health insurance, the price of fuel . . . you can see the stress the Millennials and Zillennials will be under. . . especially if they have not

6 / ADVISORS MAGAZINE JAN 2023

been good savers,” she said.

Everett noted that during the inflation/recession of the 1970s-80s, many people took second jobs.

“Will Millennials and Zillennials consider that?” she asked. “I don’t know. The destination weddings, lavish dine-out dates, extracurricular child activities, new high-cost cars-may need to be curtailed.”

Lori Van Dusen, CIMA®, CEO and founder of Pittsford, NY-based LVW Advisors (Home | LVW Advisors), agrees that inflation has already hit younger generations the most.

“The reason millennials are being hit the hardest by price hikes has a lot to do with spending habits based on their life stage,” she told Advisors Magazine. “It’s the latest way the economy has financially hit the gen-

eration, who already struggle with student loan debt and now a significant decrease in the affordability of housing due to supply and demand issues and rising mortgage rates.”

Van Dusen notes, however, that inflation is cyclical; it doesn’t last forever, and younger generations can perhaps get ahead of it with some sound guidance.

“Financial planning is key and young borrowers also need to keep their credit lines as lean and efficient as possible, using them to build up credit worthiness,” Van Dusen said. “They’ll have limited options when it comes to rising energy bills but can switch or negotiate down other contracts like home broadband or car insurance policies when they come up for renewal. A good financial advi-

sor can help here,” she added.

There are some practical things, nonetheless, that younger people can do on their own, and Everett offers several tips:

• Buy necessities.

• Buy on sale.

• Find inexpensive fun things to do.

• Save as much as you can. Check out NerdWallet for the best savings accounts. You can get 3% as of this writing.

• You don’t need to upgrade your car if it gets you to where you need to go.

• Get a second job if you can.

• Some may even need to move back with mom and dad!

ADVISORS MAGAZINE / 7

Everest Consulting is a management and growth strategy consulting company that focuses on advising consumer branded lifestyle companies, from Fortune 500 companies to mid-sized organizations. With over 25 years of operating and management expertise, Everest Consulting provides the industry expertise along with the strategic and operational know how to help your brand achieve its fullest potential.

Everest Consulting is a management and growth strategy consulting company that focuses on advising consumer branded lifestyle companies, from Fortune 500 companies to mid-sized organizations. With over 25 years of operating and management expertise, Everest Consulting provides the industry expertise along with the strategic and operational know how to help your brand achieve its fullest potential.

www.everestconsultingcompany.com

www.everestconsultingcompany.com

8 / ADVISORS MAGAZINE SEPT 2022

Actionable

Breakthrough Strategies

www.everestconsultingcompany.com

DISCOVERING THE JOY OF GIVING

Americans gave $484.85 billion in 2021, a 4% increase in donations from 2020, according to the Pennsylvania-based National Philanthropic Trust. That equates to nearly $1,500 donated on a per capita basis—an indication that American generosity is surging and that so many people enjoy giving to charities.

A key motivation for giving is to have meaningful impact -- to do something significant. Wealth can spread joy, according to Crown Wealth Management of Costa Mesa, California. Its trademarked motto is ‘Live Abundantly, Give Generously™.’ In short, Crown Wealth Management’s purpose is to help clients discover significance.

“Many people think that to live abundantly they must accumulate an excess of resources,” Andi Y. H. Kang, founder and president, told Advisors Magazine in a recent interview.

“I’ve found that it’s more than that,” she added. “Life is not only having those resources, but also having a heart and a spirit of abundance. Abundance truly comes when we can let go and when we realize that all the physical wealth we have is temporary.”

Kang and her team believe that true abundance and generosity happen when we are alive and in what we send forward.

“When we have a heart of abundance, we hold on to our physical wealth very loosely and we’re eager to use it to bless others,” she added. “The five main principles behind abundant living and generous giving are Family Values, Intrinsic Treasures, Resource Stewardship, Engaging Society and Legacies of Wisdom.”

Kang emphasized that the more we can give of ourselves – the 4 T’s: Time, Talents, Treasure and Ties (peer network) – the more we are able to embrace a life of abundance and generosity.

Her journey in wealth management started at the University of Cincinnati. During her time there, she received mentorship from Professor Charles Barngrover, who was the assistant dean of the graduate school of business. Recognizing her academic excellence, two deans of the school wrote her letters of recommendation. The referrals proved

10 / ADVISORS MAGAZINE JAN 2023

ADVISOR FEATURE BY JOE INNACE

Find the right advisor to inspire you

instrumental in awarding her a full scholarship and fellowship to graduate school.

Kang became a graduate fellow for the university’s department of education, teaching student leaders how to lead effectively even though she was only a few years older than her pupils. She continued teaching and then developed an interest in finance and investments, thanks to Professor Barngrover’s classes—one of which focused on entrepreneurship.

“I loved the skills I learned in that entrepreneurship class,” Kang recalled. “I wanted to be an entrepreneur and start my own business. So, I continued to study financial planning and wealth management.”

Soon after college, she spent time selling insurance and annuities while working for a financial planning company. Kang realized, however, that clients were not often the

priority. She wanted to start her own firm with a client-centric focus, and she did just that in 2007 by founding Crown Wealth Management.

Kang and her team focus on a niche they are all passionate about, which is highcapacity donors. High-capacity donors are not synonymous with high-net-worth individuals; they are those who have grown their assets to a substantial level and are ready to experience the love that comes from giving.

“It’s about giving while living, especially should you find yourself with more than you will ever need and you wish to do something significant,” Kang said. “Such giving can change a person emotionally and spiritually, spreading good—in fact—through the broader community.”

As a firm, Crown Wealth Management also gives back to the community. Over the years it has partnered with organizations including Interval House, Junior Achievement, Mercy House, and the Ronald Simon Family Foundation.

Guiding clients toward significance

Collectively, the Crown Wealth Management team specializes in working with business owners, philanthropies, and executives by helping them make informed decisions about their wealth. While there are many ways the company helps its clients, the Crown Wealth team also concentrates on what it means to live a life of significance in the financial planning practice.

For example, clients have access to a tool called the ‘Significance Diagnostic,’ to help evaluate and determine how deeply a person is experiencing the pleasure and richness of living with significance.

Given Kang’s teaching experience, education plays a leading role at Crown Wealth.

“We are committed to helping our clients understand that the planning that we do is the integration of three different disciplines: traditional finance, neuroscience, and the psychology of behavior,” she said.

From Kang’s perspective, part of great planning is asking thought-provoking, relationship-building questions in conversations with clients. As a Behavioral

ADVISORS MAGAZINE / 11

Financial Advisor (BFA™), she is trained to help clients navigate the emotional, behavioral, and practical aspects of their finances.

“We educate them to make rational decisions, guiding them toward financial choices that are well thought out,” she said.

Kang also teaches Stanford PACS Effective Philanthropy material to other advisors as well as clients. The Stanford PACS Effective Philanthropy workshop is five hours of education for CERTIFIED FINANCIAL PLANNERS™ professionals.

A value statement is an integral part of Stanford PACS Effective Philanthropy workshops. “We help our clients create value statements so that they, with their families, can understand each other’s values and acceptance in their philanthropic planning,” Kang explained. “The freedom to embrace each other’s differences and to agree to disagree is vital; I practice this

with my clients as part of the education process.”

Crown Wealth Management also runs hypotheticals of living to age 120, which is based on what their clients want in terms of projections in retirement for maintaining their standard of living, according to Kang.

“The goal is to have the assets, income, and cash flow last beyond their life, enabling clients to pass those monies, assets, estate, and net worth to their children and to their children’s children,” she added.

“Every year we do longevity calculations to see how long the money will last for each client. It is part of the annual check-up. This review is part of the overall financial and estate planning that we do.”

Earlier this year, Crown Wealth Management downsized, pivoting to focus on clients who have the same heart, those who desire to share in their generous mindset.

Kang’s call to action is simple: “Join us on our mission of discovering joy and significance. Participate with us to grow your wealth to give more, give better, give now.”

For more information, visit: www.crownwm.com

Investment Advisory Services offered through Investment Advisor Representatives of Cambridge Investment Research Advisors, Inc, a Registered Investment Advisor Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, Member FINRA/SIPC, to residents of: California. Cambridge and Crown Wealth Management are not affiliated.

12 / ADVISORS MAGAZINE JAN 2023

Attorney Advertisement Elite N.Y. attorneys with over 40 years of combined experience! P: (914) 686-1500 • M: (914) 686-1504 E-mail: russell@yankwitt.com Please visit us a: www.yankwitt.com The Law Office of Civil | Commercial | Financial Securities | Healthcare 140 Grand Street, White Plains, New York 10601

cover story

by joe innace

14 / ADVISORS MAGAZINE JAN 2023

ADVISORS MAGAZINE / 15 BUSINESS OF CANNABIS: GROWTH OPPORTUNITIES THE ADVICE AND INSIGHTS FROM MAJOR PLAYERS

“The increasing demand for cannabis is likely to propel the entry of new companies in the future, fueled by increasing awareness and acceptance regarding cannabis use for medical purposes,” Nova One Advisor noted in a June 2022 market report.

What’s more, during the most recent U.S. midterm elections, voters in two states— Maryland and Missouri—joined the growing list of other states that have already legalized recreational marijuana. In fact, the list of states where marijuana is illegal is now much shorter than those where its use is fully legal, or where some mixed use is allowed.

In late November in New York state, the Office

of Cannabis Management awarded its first 36 retail licenses for selling recreational pot, with the dispensaries expected to open their doors by December/January. The first licenses were approved for individuals or their relatives with prior marijuana convictions now starting businesses and some nonprofit organizations that serve the incarcerated. With that came a lot of controversy as well as red tape.

For anyone thinking of getting into the cannabis business—whether at the seed or sale stage of the supply chain, or somewhere in between—the bureaucratic maze can be daunting. There is a lot to learn—and knowledgeable advisors can help.

16 / ADVISORS MAGAZINE JAN 2023

The cannabis market in the United States was valued at nearly $11 billion in 2021, according to Cleveland-based Nova One Advisor, and it is expected to reach $40.5 billion by 2030. The market research company estimates that demand for weed will grow at a compound annual growth rate of 14.9% from 2022 to 2030.

A consultant can make the difference

California-based Andrew DeAngelo works as a consultant and strategic advisor to the global cannabis industry. He co-founded Harborside Inc., a publicly traded cannabis company, is the co-founder and current chair of the board of directors for the non-profit, Last Prisoner Project, and the co-founder of the California Cannabis Industry Association trade organization.

In short, DeAngelo is one of the few people to have owned and operated cannabis companies in the legacy, medical, and adultuse markets on both coasts of the United States. As an activist for the last 35 years, Andrew helped legalize medical and adult-use cannabis in California and Washington, D.C.

He told Advisors Magazine in a recent interview that he collaborates with clients to build their businesses ‘from seed to sale’.

“Where you decide to start and operate your business is critical because every state has a different framework,” he said. “You have to do your due diligence. Because in every state where it’s either legal for medical

Photo Credit Jamie

Photo Credit Jamie

Soja

“WHERE YOU DECIDE TO START AND OPERATE YOUR BUSINESS IS CRITICAL BECAUSE EVERY STATE HAS A DIFFERENT FRAMEWORK, YOU HAVE TO DO YOUR DUE DILIGENCE.”

ANDREW DEANGELO

or adult use, or both, there are different rules of the road.”

DeAngelo emphasized that depending on the state, there are unique tax structures and various other compliance complexities. “You have to know all of that before you start spending money on building your business,” he said. “And I also recommend that people know something about the history of cannabis, prohibition, and the product itself. This doesn’t necessarily mean you have to start smoking a bunch of weed, but you should understand what weed does to people and why people are so drawn to it.”

Other than alcohol, DeAngelo says weed is the most popular intoxicant on earth. “Understanding why that is will help you sell more weed,” he laughed.

And whether one decides to grow it, distribute, manufacture, package or sell it—all those supply chain links are peopledriven businesses. “Organize your business plan accordingly so that

you can attract really good talent, because there are a lot of people who don’t know how to do this,” DeAngelo said.

For the most part, DeAngelo and his group of associated consultants offer soup-to-nuts solutions to aspiring cannabis business owners once they’ve received their license. “That’s our specialty zone right there,” he said, “from the moment you get your license to the opening day ribbon cutting. Now, I can also help you get the license; I do that too. And I also help coach people after they’ve opened their dispensary or their business.”

DeAngelo noted that a license is given to someone who already has other licenses or to a new entrepreneur just getting started. He works with both, and the common denominator is opening the business as quickly as possible.

“The period where you get bogged down the most is the time between getting the license and opening the business,” he explained. “It’s about managing

18 / ADVISORS MAGAZINE JAN 2023

“OTHER THAN ALCOHOL, WEED IS THE MOST POPULAR INTOXICANT ON EARTH.” ANDREW DEANGELO

Andrew DeAngelo, Co-Founder of Harborside Inc. / Photo Credit Jamie Soja

all the external factors that are beyond our control. There are all these inspections you must pass — there’s a local community and the state, and both have different inspection requirements at various times.”

Before an ounce can be sold legally, all the inspections must be passed with flying colors. “And if you don’t pass them, then you are forced to do a whole bunch of corrections and it can be really costly and enormously time consuming,” DeAngelo said. “But I’ve done this so many times that it’s pretty streamlined for us now— that’s my sweet spot.”

From license to startup, a dispensary typically can open in about a year, depending on the state it’s operating in and the specific framework, according to DeAngelo. “If someone is building a cultivation facility, it’s about the same time; a manufacturing facility can probably be up and running in about six months,” he added.

There are auxiliary business opportunities as well, such as a packaging company, or a PR firm that can be up and running in as quickly as 90 days.

As noted, DeAngelo founded, owned and operated Harborside — a major cannabis company — for nearly 15 years. He led the design and development of gold-standard cannabis retail by innovating many firsts for the industry.

These included introducing CBD medicines to heal severely epileptic children as documented in Discovery Channel’s Weed Wars, implementing the first labtesting program in the history of cannabis dispensing, creating child-resistant packaging for edibles, standardizing inventory tracking, initiating senior outreach, and successfully preventing the federal government from seizing Harborside in forfeiture actions

against the company in 2012. Today Harborside is one of the largest vertically integrated cannabis companies in California.

“The cannabis industry is a lot harder than people think,” DeAngelo said. “Nowadays, I like building things and I like helping people with their own business strategy.”

His extensive record allows DeAngelo to negotiate substantial consulting contracts that are usually paid monthly and can include a bonus after the business opens.

“I’m not cheap because I’ve been doing this a long time,” DeAngelo smiled. “It’s a little bit more money than maybe some others, but even in the short-term the possible delays I mentioned can cost huge amounts of money.”

He tells clients: “Every day you’re not open while holding a license is costing you money.”

The power of branding –and celebrity

DeAngelo emphasizes that effective branding is as critical as ever across today’s cannabis landscape. “The most successful companies have very strong branding that separates them from the noise,” he said.

Celebrity status can also help —

ADVISORS MAGAZINE / 19

“THERE REALLY IS A WEALTH OF OPPORTUNITY IF PEOPLE REALLY LOOK, AND LOOK AS DEEPLY AS POSSIBLE, INTO THAT PLACE OF VALUE.”

JESCE HORTON

Photo Credit Jamie Soja

and many have gotten into the cannabis trade, leveraging their already-existing brands.

What began with just 48 plants during Oregon’s medical marijuana program in 2015, today Belushi’s Farm encompasses a sprawling and spiritual 93 acres with 1,800 feet of Rogue River riverfront in Southern Oregon’s Banana Belt where the sun, water and air make the perfect combination to sustain naturally powerful and beautiful cannabis.

Second City and Saturday Night Live alumnus Jim Belushi, also star of the sitcom According to Jim, is the founder of Belushi’s Farm, home to a range of offerings: from Belushi’s Chasing Magic, to The Blues Brothers, to Captain Jack’s Gulzar Afghanica, a rare strain from the Hindu Kush region that became known in the ‘70s as “The Smell of SNL.”

Growing Belushi, a series on Discovery, is an inside look at Jim’s world and shows the incredible effort it takes to build a legal cannabis operation. Having suffered the loss of his brother John to an overdose and embarking on his own journey — learning and healing through cultivating cannabis — Jim’s an enthusiastic proponent

of the plant’s beneficial properties across a spectrum of uses.

“I love the magic of acting on stage, singing in front of an audience with The Blues Brothers, movies, television, directing,” Belushi told Discovery in advance of the series premiere. “And I enjoy the magic of agriculture on Belushi’s Farm. We always bring forward all our knowledge into each thing we do, so it was natural for me to bring a camera to the farm and discover a show around it,” he added, “a show that will help educate, inform, delight, and heal. It was a natural blend of two different worlds for me.”

When it comes to social activism,

the cannabis business community is tightly knit. Belushi, for example, is a strong supporter of the Last Prisoner Project co-founded by brothers Andrew and Steve DeAngelo.

“Steve DeAngelo, Andrew DeAngelo and Mary Bailey are great visionaries, and are the leaders of this organization that aims to release all individuals who are incarcerated for nonviolent cannabis offenses,” Belushi has noted in interviews. “Why? It’s just so obvious that there have been millions of dollars made on the backs of nonviolent cannabis prisoners--they are the pioneers of our industry,” he added.

20 / ADVISORS MAGAZINE JAN 2023

“I LOVE THE MAGIC OF ACTING ON STAGE, SINGING IN FRONT OF AN AUDIENCE WITH THE BLUES BROTHERS, MOVIES, TELEVISION, DIRECTING AND I ENJOY THE MAGIC OF AGRICULTURE ON BELUSHI’S FARM.”

Jim Belushi, Owner of Belushi’s Farm / Photo Credit Tyler Maddox

Photo Credit Tyler Maddox

— JIM BELUSHI

Recently, one of New York’s state’s first licenses went to a company part-owned by a franchise of Belushi’s Farm. It is operating a dispensary on Northern New York’s Saint Regis (Akwesasne) Mohawk Tribe territory in Franklin County near the U.S.-Canadian border. Belushi’s Farm also has affiliated outlets in Colorado, Oklahoma, Illinois and Massachusetts.

Another actor with a burgeoning cannabis empire is Seth Rogen who, along with writing partner Evan Goldberg and others, offers the Houseplant™ brand of pre-rolled joints, whole flower cannabis and more.

The plant.houseplant.com website has a shop locator — by zip code — which currently lists about 40 outlets in California that carry Houseplant.

Rogen is quick to leverage Twitter to announce Houseplant developments and products to his more than 9.3 million followers. He has also spun off a smoking accessories, ceramics and home goods website displaying an array of items designed by Rogen and crafted to his specifications.

Founded by Rogen, Goldberg, Michael Mohr, James Weaver and Alex McAtee in Toronto in 2019, Houseplant’s growth has been rapid.

“Houseplant is a lifestyle company rooted in cannabis that creates and curates thoughtful design-led and innovative products,” say its owners. “The company unifies the worlds of “House” and “Plant” to offer a top-tier cannabis experience through one-of-a-kind expert insights paired perfectly with well-designed, premium home goods.”

As with Belushi’s Farm, Rogen’s Houseplant also puts much

emphasis on social impact. For example, the company offers an in-house mentorship program to assist underinvested-in entrepreneurs build successful and sustainable cannabis industry businesses. Another company program focuses on supplier diversity in order to connect more BIPOC-, women-, LGBTQ-, disability- and veteranowned businesses to the

Houseplant ecosystem.

Fact is, cannabis-related businesses have been an attractive investment for a sizeable number of celebrities ranging from ones you might expect (Snoop Dogg and Willie Nelson) to some that might surprise (Gwyneth Paltrow and Martha Stewart).

ADVISORS MAGAZINE / 21

L/R: Dan Aykroyd & Jim Belushi - Growing Belushi / Photo Credit Tyler Maddox

Photo Credit Tyler Maddox

Think value, craft, premium

As with almost any other business, new players in the cannabis arena should consider where they can add the most value. That’s a key point made by Jesce Horton, CEO at Portland-based LOWD™, an awardwinning cannabis company that embodies the art of urban craft cultivation.

“First and foremost, find a place where you can truly add value to the market,” Horton told Advisors Magazine in a recent interview. “There are so many new solutions, so many services, so many products that are needed by consumers from other related businesses,” he added, “There really is a wealth of opportunity if people really look and look as deeply as possible into that place of value.”

For example, Horton recently entered an exclusive partnership with owtlet.com (971-Dat-Plug), an Uber Eats- or DoorDash-like service that provides ondemand delivery of LOWD products.

“I think this delivery model is certainly an innovation in the industry,” Horton said. “We’ve opened up our curing room to Owtlet™ for them to make on-demand deliveries directly from our precision, temperature-controlled curing room, which guarantees that customers get the freshest flower and most premium buds directly from us.”

Horton has built his multi-million-dollar business for the premium market. By employing innovative processes aimed at peak plant performance, he says that LOWD’s flower is aimed at impressing even the most discerning of smokers.

The company prides itself on taking superior quality to another level. For instance, its Smoke Like A Grower a/k/a SLAG jars, contain intentionally

22 / ADVISORS MAGAZINE JAN 2023

LOWD™ Company Team / Photo Credit Sam Gehrke

Jesce Horton, CEO of LOWD™ / Photo Credit Sam Gehrke

Photo Credits Sam Gehrke

selected buds that are stick trimmed straight into LOWD’s one-ounce, half-ounce, and quarter-ounce collectible, ultraviolet resistant glass, providing the best slow cure. LOWD fans are literally the first to ever touch these buds.

Horton’s background is in engineering and energy management. Such expertise has allowed him to refine LOWD’s systems and processes and align them with the company’s premium craft ethos. Environmental controls, curing, trimming, and packaging processes all synergize to maximize freshness, shelf appeal and customer satisfaction.

More recently, Horton has delved into the consulting and advice world. He has also developed curriculum and is instructing at the first college in New York (LIM College) to offer a cannabis business major, as well as doing similar work at HBCU Medgar Evers College.

“We have a growing list of clients across the U.S.,” Horton said. “We’re working with them actively to build their facilities, design their standards, implement operating practices and help hire talent.”

“As a consultant, I’m able to find a lot of opportunities for these clients—not just in building their facilities,” Horton explained. “I’ll serve as an

interface between the architects, the engineers, construction, the permitting and regulatory steps that are required,” he added, “and I’ll also help to develop cultivation processes and facilities that can allow them to produce premium cannabis at lower costs.”

For now, LOWD cannabis products are available only in Oregon. Horton said, however, that through his consulting work some licensing deals are in the works that could bring LOWD to a few east coast states in 2023.

Current legal sales of cannabis are projected to be $29.3 billion by 2022, according to Portlandbased Whitney Economics and are forecasted to be $81.6 billion by 2030.

“There will be more legal supply than illicit cannabis supply in the U.S. beginning in 2026,” according to the now-available 2022 Whitney Economics U.S. Cannabis Supply Report.

The firm has calculated the total cultivated output of cannabis in the United States in 2022 to be in excess of 48.8 million pounds — including both legal and illicit cannabis supply for all delivery methods, such as flower, edibles, concentrates, and more.

ADVISORS MAGAZINE / 23

Sales in Billion U.S. dollars Cannabis

Sales Projections

WEED: Where it’s legal and where it’s not in the U.S.

While U.S. federal law still classifies marijuana as a Schedule I drug under the Controlled Substances Act, which means possession, cultivation, transportation, and distribution of the drug are federal felonies, there are now far fewer states where marijuana is illegal than legal. The laws vary greatly from

state-to-state, and whether individuals are looking to enter the business or become consumers, it’s wise to understand the legal nuances. For example, Colorado paved the way for legal recreational use in the United States. There, adults can carry up to an ounce of weed and grow as many as six plants, according to

CFAH.org, a health and wellness website. But bordering Colorado to the north is Wyoming, one of the most restrictive states in the country. Recreational marijuana is illegal there and Wyoming only allows low-THC CBD oil to treat intractable epilepsy, according to CFAH.org.

Marijuana Status State-by-State

FULLY LEGAL

Alaska Arizona California Colorado Connecticut DC Illinois Maine Massachusetts Michigan

Montana Navada New Jersey New Mexico New York Oregon Rhode Island Vermont Virginia Washington

MIXED

ILLEGAL

Idaho Kansas Nebraska North Carolina South Carolina Wyoming

INVESTING in cannabis

There are three outperforming cannabis ETFs that offer investors exposure to equities that have rebounded 15% in recent months, according to a November 21 report on the website Investopedia.com

“ETFMG Alternative Harvest ETF, AdvisorShares Pure US Cannabis ETF, and ETFMG U.S. Alternative Harvest provide exposure to companies that cultivate, distribute, and sell

cannabis and related products,” Investopedia noted. “The ETFs have beaten the Global Cannabis Stock Index, which lost more than two-thirds of its value in the past year, though they lag the 14% drop in the S&P 500 Index as of November 18, 2022.” Some of the publicly traded cannabis-related securities with a market capitalization of around $1 billion, which might be included in such ETFs are:

Green Thumb Industries (GTBIF) Innovative Industrial Properties (IIPR) Cronos Group (CRON)

Curaleaf Holdings (CURLF) Cresco Labs (CRLBF)

Trulieve Cannabis Corporation TCNNF) Verano Holdings (VRNO) SNDL Inc. (SNDL)

24 / ADVISORS MAGAZINE JAN 2023

Alabama Arkansas Delaware Florida Georgia Hawaii Indiana Iowa Kentucky Louisiana Utah West Virginia Wisconsin Maryland Minnesota Mississippi Missouri New Hampshire North Dakota Ohio Oklahoma Pennsylvania South Dakota Tennessee Texas

Issue80 SEPT2017ADVISORS magazine FinancialEducationPaysOff U.S.Placed9thinEducationalDevelopment DOLAttacksPrivateInvestmentPortfolios The“FiduciaryRule”What’salltheFussAbout? ADVISORS magazine A Sandwich Generation A full plate of financial concerns Independent Consulting Few deliver what clients want A Legacy Conversation and estate planning at crossroads NOV 2017 maria bartiromo financial media maven ADVISORS magazine ISSUE 82 JAN 2018 ADVISORS magazine The Longevity Race Living a long and fulfilling life Montana's Financial Planning Scene Helping people to enjoy retirement Advising With a 360-Degree View The priorities of a financial advisors ISSUE 84 finanCial nfl all stars Help Call the Plays off the Field ADVISORS magazine Bitcoin Bust That Wasn't High-profile figures bashing Bitcoin Volatile Stock Market Turns investors into gamblers Employee Retirement Plans Exploring the future of a "gig" economy Financial Planning Not a do it yourself endeavor ISSUE 83 MAR 2018 natasha lamb the woman warrior Moving the Needle on Gender Pay Disparity arJUna capital DOWNLOAD YOUR FREE DIGITAL ISSUE OF ADVISORS MAGAZINE TODAY! A free download of Advisors Magazine provides you with insightful and concise business observations about the nature of entrepreneurs, pressing issues around the country, and topical news events. www.advisorsmagazine.com/freedownload

By Joe Innace

‘TIS THE SEASON FOR TAX PLANNING

But that’s always the case for “Elite” advisors

The U.S. tax landscape is constantly changing—whether it be tax brackets, deductions or newer tax laws affecting retirement plans and estates like the SECURE Act. It’s a full-time job to stay on top of all the tax code changes every year, and Jane Bourette, owner of Coast to Coast Financial Planning, LLC likes to start early and do a deep dive.

“We do a lot to prepare for potential tax law changes,”

Bourette told Advisors Magazine in a recent interview. “We’re almost done with 2022 and are looking forward into 2023 and even all the way to 2025 when the current tax laws sunset.”

Bourette explains that many people are realizing that they are in the lowest tax brackets or seeing the lowest tax rates in history right now, but such times are probably not going to last.

“Based on what we see out there, taxation is a huge issue on the horizon,” she added, “and many of our clients are worried about their future tax rates especially in retirement.” The old adage “you’ll be in a lower tax bracket” may no longer be the case so better to be safe than sorry.

Bourette noted: “So, many clients are finally converting to Roth IRAs if they’re able to and spreading that out over the next couple of years as far as the tax implications.” There are many other tax-free strategies that might be appropriate depending on each client’s personal situation, she said, and some that can include Long Term Care

benefits, a potential expense people are very concerned about.

Bourette started Massachusetts-based Coast to Coast Financial Planning to help people with retirement income, long-term care, and leaving or inheriting the legacy planned for. In fact, it is her second career.

“Back in 2003, I was forced to change careers after the stock market crash of 2001-02, which created layoffs in the high-tech sector where I’d been working for 24 years,” she recalled.

At that time, Bourette was helping her mother with her estate planning, serving as her mother’s personal representative and meeting with her financial advisor. “I didn’t like what I saw happen to her at 75 years old, like a lot of people at that time,” Bourette said.

Fortuitously, at the same time, Bourette was invited to learn about the financial industry through a friend who was a broker dealer and a tax and estate attorney. “So, naturally I was intrigued because they were showing us technology tools to do retirement planning,” she said. “And having been

in the technology field, it was a comfortable fit; I liked what I was seeing, and of course, I was concerned about what was happening to my mother.”

Bourette’s education, nonetheless, has been ongoing. “It’s important for advisors to stay as educated as possible—especially with the tax laws changing as previously mentioned, and in terms of their impact on retirement plans,” she said.

This is why Bourette pursued her designation in early 2021 as a member of Ed Slott’s Elite Advisor Groupsm after completing the IRA workshop for advanced retirement distribution planning.

“While I am not an accountant” she says, “this gives me education on the tax topics directly affecting our clients as well as access to a team of experts.”

Ed Slott and Company, LLC is considered the nation’s leading provider of technical IRA education for financial advisors, CPAs and attorneys. Ed Slott’s Elite IRA Advisor Groupsm is comprised of over 500 of the nation’s top financial professionals who are dedicated to the mastery of advanced retirement account and tax planning laws and strategies.

For more information, visit: www. coasttocoastfinancialplanning. com

26 / ADVISORS MAGAZINE JAN 2023

Photo by Georgie Morley

Photo by Georgie Morley

“It’s important for advisors to stay as educated as possible— especially with the tax laws changing.”

— JANE BOURETTE

In a world of fast food and one-size-fits-all sensibilities, how often does something feel made especially for you? The "Made for You" section celebrates those items that are created with such high quality of hand workmanship and degree of customization that they become individual to you. In each issue, our editors will endeavor to bring you special things from anywhere on the globe, choosing them solely on the basis of outstanding quality. Our goal is to give you guidance on the best of everything.

1 BLEU DE CHANEL — EAU DE PARFUM SPRAY

A fragrance for the man who defies convention. A provocative blend of citrus and woody notes that liberates the senses. Fresh, clean and profoundly sensual. BLEU DE CHANEL unites the invigorating zest of grapefruit and the power of an aromatic accord with the whisper of dry cedar. A meeting of strength and elegance. BLEU DE CHANEL

2 IIRISH WHISKEY — REDBREAST 21 SINGLE POT

Redbreast 21 Year Old Single Pot Still Irish Whiskey represents a style that’s truly unique to the nation. It’s distinguishing flavor profile and taste makes it especially exclusive. The brand seperates itself from the rest in this category. The texture is oleaginous and light. Concentrated sips coat the palate with a lingering finish. It keeps the party going with thoughtful talking points and charm. Redbreast 21 year old whiskey

3 MONTBLANC MEISTERSTÜCK BALLPOINT PEN

Montblanc is a distinguished brand when it comes to preserving the art and culture of writing. Since 1924, the Meisterstück pen has stood the test of time to become an iconic model known for its sleek, functional and ergonomic design. This German-made ballpoint version, expertly crafted from black resin, is fitted with platinum-plated trims, the label’s white star emblem and an easy to use twist mechanism. Montblanc Ballpoint Pen

When you’re looking to buy a reliable Pickup Truck, the only one that comes to mind is the Ford F-150. This best-seller has not only evolved but has been built to perfection. A turbocharged powertrain, with a hybrid option and aluminum body comes with all of Ford’s best technology. Ford now offers an upscale Platinum and Limited trim luxury option. Best Pick Up Truck in 2023. Ford 150 2023

Davidoff Cigars – one of the most luxurious brands in the world. Zino Davidoff founded the brand and carried out the production of cigars in Cuba until 1990. Still, you’re probably wondering whether Davidoff cigars are any good or worth it. Without a doubt, these high-quality cigars are worth the hype. Davidoff Royal Release R

4 BEST PICK UP TRUCK — 2023 FORD 150 RAPTOR 5 DAVIDOFF — ROYAL RELEASE ROBUSTO 6

Verge Motorcycles announced it will start sales in select US states during 2023. By making a preliminary reservation, US fans can indicate their interest to be contacted when sales of the long-awaited electric motorcycles begin in the US. This groundbreaking technology enables a larger battery, longer range and stunning performance. In addition, the center of gravity is lower, which provides a better riding experience compared to traditional electric motorcycles. Verge Motorcycles

made for you

VERGE — THE NEW VERGE TS ULTRA MODEL 1 3 4 5 6

28 / ADVISORS MAGAZINE JAN 2023

2

At Trupiano & Associates, we are dedicated to people first - you as a Family-owned business and your employees.

Our priority is to help your Family Business thrive! That means that as an Independent Fiduciary Firm, we must by law do what is in our clients' best interest. We bring our exclusive approach, expertise, and experience to help your business and your employees work in a thriving and abundant environment.

CALL: 866 640 7897 EMAIL: Info@trupianoassociates.com www.trupianoassociates.com Investment advice offered through Safe Money Solutions, LLC, a registered investment adviser. Insurance services offered separately through Trupiano & Associates. A B U N D A N C E ! "Everyday, each of us tries to help somebody." Anthony Trupiano, CEO

Taylor, Director of Marketing

Trupiano, CFO P L A N B E T T E R . L I V E B E T T E R .

Brianna

Sally

We can help you do just that.

) ( Group Benefits Wealth Management Business Insurance Individual Insurance 401 k & Profit Sharing

Do you want to attract and retain employees and build the company you've envisioned?

by joe innace

THE HEART OF FINANCIAL PLANNING

Engaging in meaningful conversations

The landscape of investment products is broad and extends well beyond stocks, bonds, and mutual funds, which are familiar to many investors, according to FINRA—the group authorized by Congress to protect America’s investors by making sure the broker-dealer industry operates fairly and honestly.

And when it comes to retirement planning, there is no single product that’s the silver bullet, according to John Caserta, managing director, MSFS, ChFC®, at Caserta & DeJongh, LLC.

“If someone is going to a financial planner expecting some sort of transaction or product to be recommended that will solve all their problems, they’re probably not going to ultimately achieve their goal, ,” Caserta told Advisors Magazine in a recent interview.

He maintains that it comes down to educating people about all things money—how money works, all the things that money touches and the emotions involved. “If a financial advisor is not having those meaningful conversations with people, then the client ultimately does not get the most out of the relationship,” he said.

Based in North Haven, Connecticut, Caserta & de Jongh puts education at the core of its financial planning process. The process reflects the firm’s trademarked tagline: Our Knowledge. Your Vision.™

And it starts typically with information gathering about a

client’s current state and any plans they’ve had in the past.

“From there, we go to work in terms of educating them about not only what they’ve already done but the other strategies that exist that can help them achieve their goals,” he explained. “We’re also looking for the right fit, because we need somebody that is going to be open-minded, engaged, value that education, and realize that this isn’t a transactional relationship.”

Caserta added: “It’s a dynamic process where things are going to be changing and it’s our job to be educating them about those changes.”

He said he never wants a client to come across something they were not aware of, or something that was not discussed. “I always want to make sure that they have the latest information and know all the pros and cons about all the possible different decisions that can be made,” Caserta emphasized.

Back in college, Caserta knew that he wanted to run his own business where he could work with people in some capacity to help them with their issues. He

30 / ADVISORS MAGAZINE JAN 2023

John Caserta, MSFS, ChFC® Managing Director

considered many careers where he could potentially do that, but he always had an interest in personal finance.

After college he spent a few years working in finance and insurance for larger companies. Caserta even spent some time as a journalist writing about the corporate bond market. Eventually, he received his licenses, joined a large financial planning firm, and then partnered with Bob de Jongh, retired founding

partner.

Caserta tells clients that financial products are commodities. Whether providing highly customized solutions or model portfolios as a portfolio manager, everyone uses the same tools. But it takes a craftsman to customize a solution.

“Our approach to retirement has always been a balance between having some level of guaranteed income for our clients and then some sources of funds to drive income,

and always having some level of predictability built into that retirement plan,” he summarized.

For more information, visit: caserta-dejongh.com

ADVISORS MAGAZINE / 31

Preserve your wealth with CitiTrust’s knowledge and Financial Management Solutions Belize | BVi | Malta | UK | SaMoa | BrUnei | BritiSh angUilla | CyprUS | giBraltar | iSle of Man | geneVa | JerSey | lieChtenStein | lUxeMBoUrg | United araB eMirateS | China | Switzerland | MarShall iSlandS international inc. www cititrust biz

Streamlining supply chains throughout the automotive, retail, pharmaceutical, pulp & paper, logistic, and food industries. STILL PUZZLED ... by your supply chain solution?

Contact Meade Willis today for a free consultation regarding your e-commerce, EDI, supply-chain requirements: (866) 369-1146 | www.meadewillis.com www.meadewillis.com

by joe innace

put me in coach...

In a favorable tax situation

There are more than 800 certified tax coaches in the United States –a relatively exclusive and elite network of specialists around the country trained by the American Institute of Certified Tax Coaches, an independent, not-for-profit corporation based in San Diego. The AITCT provides training to tax professionals including certified public accountants (CPAs), attorneys and enrolled agents (EAs), who wish to become expert in proactive tax planning.

Meet Heather L. Denehy, CPA, and one of the country’s 800 CTCs (certified tax coaches) whose firm is based in Lynnfield,

with small businesses,” Denehy said. “I feel that there’s a great need for small businesses to have somebody that they can lean on, ask questions, bounce ideas off of,” she added, “someone with an outside perspective who has their back.”

Denehy relies on her expertise in accounting, tax and financial analysis as a tool to help business owners understand their goals – and to then collaborate with them to fulfill those goals.

“A few people just want their 1040s done during filing season, but I get many more phone calls from people who are looking for additional guidance,” Denehy added. Most of her business

Massachusetts. She recently told Advisors Magazine that a tax coach’s training is not just about compliance but is focused on uncovering tax deductions and loopholes that most tax professionals don’t know how to find. Their extra special skill set is most effective in reducing taxes for successful small business owners, entrepreneurs, and high net worth individuals.

“I really enjoy working closely

clients are in New England thanks to existing clients who are quick to provide referrals, but she also has individual tax clients all over the country.

Regarding other services and ongoing tax guidance, Denehy says she may offer advice on how to prepare for retirement, how to transfer wealth to grandchildren, Medicaid/ Medicare planning, trusts, wills, and much more.

“I see my role as explaining those complex tax and accounting issues that are out there in the most basic of terms so that my clients easily understand it all,” Denehy said. “It’s like going to the doctor; You don’t want to hear the names of all the tendons and muscles around your knee, you just want to understand what’s going on and how it will be fixed.”

The medical analogy comes easily from Denehy who started college majoring in microbiology before ultimately graduating from Boston’s Northeastern University in 1997, earning a BS in business administration with a concentration in accounting. She became a CPA in Massachusetts in September of 2000. Her first

34 / ADVISORS MAGAZINE JAN 2023

“THERE’S A GREAT NEED FOR SMALL BUSINESSES TO HAVE SOMEBODY THEY CAN LEAN ON AND BOUNCE IDEAS OFF OF.”

INTERVIEW

job out of college was with Arthur Andersen LLP in Boston in the High Technology Division of the Audit Division where she worked exclusively with small business clients. In 2011 she took over the firm which now bears her name.

Denehy today likens her company to somewhat of a boutique firm.

“I choose to have a fewer number of clients, but I prefer to work deeply with the clients I do have,” she explained. “We tend to tailor our services based on what the client’s needs are.”

Denehy notes, for example, that a business owner during the first few years after starting up has a greater and distinct set of needs than the owner who has

been in business more than 10 years.

“In that sense, we’re a boutique because we mold and adapt our services to each client’s specific needs,” she said.

At the same time, Denehy is fully aware of the things her firm cannot do, or the areas in which it has limited bandwidth.

“For instance, I had a couple of clients recently that needed to get a business valuation completed, and my most suited role was to be the liaison with the valuation experts, working in conjunction with them,” she recalled. Denehy was comfortable serving as a mediator – being the clients’ eyes and ears at the table, understanding what was

happening and then able to convey all the information as needed to her clients.

“The clients found that process extremely helpful; In part, because I served a role they tend not to enjoy,” Denehy chuckled.

Increasingly for some people, social media platforms are touting financial advice and tax tips. Proceed with caution is the message from Denehy.

“Unfortunately, there’s a lot of incorrect information being disseminated across many social media platforms where people are interpreting an isolated piece of the tax law,” she said. “They will blast it out to the entire world claiming, ‘you can do X, Y, and Z,’ but a lot of us tax professionals are cringing and saying, ‘No. Not really.’”

Any tax recommendation from any source needs to be spot on because otherwise there may be problems down the road. Denehy maintains that part of her role is to get the correct information out there.

And she is quick to credit Dominque Molina, co-founder and president of the American Institute of Certified Tax Coaches (certifiedtaxcoach. org). “Dominique is the person who has personally – without knowing it – completely contributed to changing my life and the way I do things,” Denehy summarized.

For more information, visit: www.denehytax.com

ADVISORS MAGAZINE / 35

by l.a. rivera

Ngugi wa Thiong'o

The High Priest of African Literature

Despite being handcuffed and locked away at the Kamiti Maximum Security Prison for possessing banned books in December of 1977, he was convicted without court or trial for a year in Kenya.

Ngugi wa Thiong’o, vividly remembers writing his novel “Devil on the Cross” which was published in 1980 – on rough toilet paper – while tucked away in his cell. He didn’t want the prison guards to discover his manuscript. He later managed to smuggle out his opus from the “Kamiti Downs,” the prison’s original name.

Back then, Amnesty International dubbed Ngugi: “A political prisoner of conscience.” An international campaign resulted in his release in

December of 1978. In exile, he fled to Britain and worked with the London-based Committee for the Release of Political Prisoners in Kenya.

Several years ago, during a telephone interview from his home in California, Ngugi talked about his memoir, “Wrestling with the Devil,” where he discussed his long odyssey as a prisoner and exiled novelist, virtually speaking truth to power about Kenya’s elite, while lambasting the country’s troubled leadership.

Ngugi argued that “Devil on the Cross,” focused mainly on those leaders who favored a sort of elite class in Kenya. “People robbed from Kenya. But it wasn’t that they were hungry, or not because they were without clothes,” he explained. “They robbed

millions of dollars, and it was just a competition. So, this competition was being organized by the Devil,” he added with a faint laugh. “I was just having fun with this novel.”

Ngugi said that Kenya was a big folly under colonial rule. “For every oppressive act, there is a reaction,” he argued. “But, nevertheless, the oppressive act leaves scars on the oppressed as well as the oppressor. The damage done in the minds of an imagined African middle-class affects both Blacks and Whites.”

He referenced Jomo Kenyatta, a Kenyan anti-colonial activist and politician who served as Kenya’s Prime Minister from 1963-1964, and then later became president of Kenya from 1964 until his death in 1978. Under

36 / ADVISORS MAGAZINE JAN 2023

The stubborn scribe still wrestles with the devil, battling for the Nobel Prize in Literature

his rule, Kenya experienced economic growth for a short period.

However, Ngugi said Kenyatta’s policies eventually led to high disparities of wealth, which many critics claimed remained in the hands of the Kenyatta family and close associates.

“Colonialism is like a pyramid,” Ngugi said, referring to the Kenyatta regime. “The people at the top benefit and the Africans suffer. So, the pyramid was fractured because of this inherited colonial affair. There are only a few people that can get to the top.”

Ngugi Wa Thiong’o is one of the most prolific of all the African novelists, including premier writers, Chinua Achebe (who published 20 books and has never won a Nobel Prize) and Wole Soyinka (who penned 50 books and did earn a Nobel Prize). So far, Ngugi has published 30 books in his lifetime. But, still, there is no writer in African Literature that is more worthy of the Prize. Yet, for the past 23 years, Ngugi has been overlooked, passed over, and made to look as if he’s the invisible man. The Nobel Prize Committee, based-out of Sweden, refuses to honor him.

Unbelievable.

His story is straight out of an Alexandre Dumas novel. He’s more like

the “Count of Monte Cristo.” But, Ngugi is part Mahatma Gandhi, who helped free India from British rule, and part Steven Biko, the anti-Apartheid Freedom Fighter who died under police custody – except Ngugi lived to tell the tale. And in 1964, one year after Kenya’s independence, Ngugi published “Weep Not, Child,” chronicling the Mau-Mau Rebellion, under British Colonialism.

That’s why Ngugi is a fighter, oftentimes, throwing a few jabs in the air, suggesting he’s no push-over. He’s a heavyweight in the business: his work has been translated in over 100 languages, globally. Ngugi’s net worth is $60 million which he earned through his writing and teaching career and speaking engagements.

He’s a professional writer who has built a solid reputation, using his pen as a weapon to criticize and lampoon world dictatorships in Africa and even Latin America. He’s a distinguished professor of English and Comparative Literature at the University of California, Irvine and the director of the International Center for Writing and Translation.

At age 85, Ngugi is a veteran novelist, author of short-stories, a poet, essayist, playwright, and journalist who was a columnist for newspapers and several magazines. A gifted storyteller, who as a writer delves into the human condition.

Undeniably, a top-tier writer, Ngugi was vehemently attacked when he wrote a play in Gikuyu (his native language) introducing rural people to critique the post-colonial order under President Jomo Kenyatta. And, over the years, Ngugi felt the heat from the Daniel arap Moi regime.

But, Ngugi’s most magical moment, a novel called “Wizard of the Crow,” – a satire of the worst dictatorships which included: Mobutu Sese seko of Congo-Zaire, Ferdinand Marcos of the Philippines, and Augusto Pinochet of Chile. A world so

pathetic that the ruler is surrounded by mere sycophants, and idiots.

Over the years, Ngugi churned out a voluminous body of work. There’s the “Perfect Nine,” “Birth of a Dream Weaver,” “In the Name of the Mother,” “In the House of the Interpreter,” and countless others.

Yet, after being denied by the Nobel Prize in Literature for so many years, he continues to write with the passion and dedication of an old scribe. “My position is this,” he said. “I am a writer first and foremost; I have nothing to do with the jury. All I can do is write and write, and write, in my native Gikuyu language. Because writing in your native language is a prize in itself…” He pauses mid-sentence, then continues, “...because writing from the heart in your mother tongue is the true prize.”

After reaching out to the Nobel Prize Committee of Literature, via email, they refused to comment about Ngugi’s perennial denial into the Swedish canon.

But Ngugi wa Thiong’o doesn’t have to worry anymore. He’s in good company. Jean-Paul Sartre, the French novelist and philosopher declined the Nobel Prize in Literature in 1964. He said he didn’t want to be “institutionalized” by the prize. He believed that it would limit the impact of his writing. One thing is for sure. Ngugi has the Nobel Prize in his heart already. He doesn’t have to look outside of himself.

L.A. Rivera is a Writer-At-Large for Advisors Magazine. He's a veteran journalist who worked with Reporter Jack Anderson, considered one of the founders of modern investigative journalism. His articles have appeared in the Washington Post, San Francisco Chronicle, Village Voice, Vibe Magazine, and the New York Daily News, and other publications. He’s written two novels, “Living in the Shadows of Che Guevara,” and “Lucky Street Chronicles.”

ADVISORS MAGAZINE / 37

Presidents’ Leadership Council Provides Five Critical Tips for Small Business Success in 2023

For small business leaders, 2022 was challenging, particularly as they move into 2023 with more inflation fears and the prospect of a recession. Lori Dann, founder of the President’s Leadership Council, an exclusive forum for small business presidents, CEOs, and partners to engage, learn, and grow through peer support, relevant presentations, and round-table discussions, recently polled her membership and identified five Critical Tips for Small Business Success in 2023. Those tips follow.

Five Critical Tips for Small Business Success in 2023

Keep Your Pipeline Full -Small businesses often fall into the trap of creating a roller coaster sales cycle. Prospecting stops when new customers are onboarded, just to find that the pipeline is dry once that new client is operational. Salespeople must consistently be adding and nurturing qualified leads, even when customer needs are dominating their time. As a general rule, the pipeline should steadily remain at about three times goal.Establish and Measure KPIs -- Vision and goals are imperative, but the right activity is the only way to

reach the mark. Review each company goal (sales, revenue, web traffic, etc.), then determine what and how much of each relevant task is required to get there. Back the data into monthly, weekly and daily activity.

Drive a Consistent, Cohesive Branding -- Brand should define the company, target customers, and how the organization uniquely solves their problems. While the visual experience for an ideal client should be recognizable in terms of graphics, illustrations, colors, tone, and feel; and should be consistent across all mediums, remember Brand is about what your stakeholders think of you. It is import-

38 / ADVISORS MAGAZINE JAN 2023

ant you remain in control of that.

Create a Clear Marketing Plan -- A clearly defined target audience is crucial. Analyze the ways the company solves pain points, then build distinct buyer personas. Craft specific messaging for each vertical to promote meaningful relationships. Be consistent. Create a clear call to action.

Watch Your Wallet! Cash flow management is especially important in times of economic uncertainty. It is indicative of the overall health of the organization and allows for expense and revenue forecasting. Positive cash flow builds reserves that can help ride out economic

downturns, as well as provide a cushion to allow for long-term strategic planning and spending.

“I talk to small business executives every day and they are facing dubious challenges, given today’s economy and financial outlook for early 2023,” Dann said. “That’s why they really need to follow these tips and be sure they are addressing each issue thoughtfully and thoroughly. Small business is an exceptionally large segment of our economy and we want to see the small business sector prosper and grow strong in 2023 though good business practices.”

About PLC Presidents Leadership Council was created as an exclusive member organization for small business presidents, partners, and CEOs for participation in special councils with ability to tap into all members as a resource base. It acts as forum for small business presidents and partners to engage learn and grow through peer relationships, relevant presentations, and round table discussions. Businesses with three to 50 employees are eligible for membership. Learn more at www.myplc.club

ADVISORS MAGAZINE / 39

Give Your Employees Financial Education, And They’ll Give You More Productivity

Recent studies all point to one conclusion that impacts employers across the U.S.: The majority of employees worry more about their finances, now more than ever. That stress makes them less productive today, and every day. In fact, 15.3 hours of productivity and engagement are lost by each financially-stressed employee each week. And that affects the bottom line.

The Harmonize™ Retirement Planning Program partners with Vanguard® to customize retirement plans to fit the needs of each individual at every level. To find out more, contact Pat Harmon at harmonizefinancial.com.

The sooner you start, the sooner your workforce gets more productive.

Small Business Retirement Plans

HarmonizeFinancial.com

Business

Small

Retirement Plans

Source: Brightplan, 2021 Wellness Barometer Survey

Photo Credit Jamie

Photo Credit Jamie

Photo by Georgie Morley

Photo by Georgie Morley