ISSUE#28

ON THE HOMES FRONT ADDRESSING RETAIL LENDERS’ BIGGEST CLIMATE RISK, WITH ING ‘OPEN’ TO SUGGESTIONS LESSONS AND SOLUTIONS, POST-PSD2 FINCRIME TIMES LEXISNEXIS ASKS: HOW LONG CAN THE INDUSTRY BEAR THE COST? SunTec ● Wahed ● Worldline ● LexisNexis ● Nationwide ● tbi bank ● Glint NAB ● Nuapay ● EcoVadis ● Zopa Bank ● Neonomics ● FIDO Alliance ● Barclaycard Payments INSIGHTS FROM G +D and Netcetera: Shaping the future of payments GABRIELLE BUGAT & COLLEAGUES ON TRUST, ACCESSIBILITY AND SUSTAINABILITY GOOD BOT, BAD BOT ACI WORLDWIDE , RABOBANK & HSBC ON AI, ETHICS AND EXISTENTIAL THREATS

FIGHTING

∞ Networking 10 0 CEOs on stage 50 Participants 4 0 Countries ∞ Networking 10 0 on stage 50 0 Participants 4 0 Countries Paris ∞ Networking 50 0 Participants 4 0 Countries Paris ∞ Networking 4 0 Countries Paris ∞ Networking Paris parisfintechforum.com JOIN US 30 - 31 MAI F. VILLEROY DE GALHAU Banque de France (FR) Governor V. ROSS ESMA (FR) Chair L. DAVID BNP Paribas (FR) Deputy CEO / COO JP. MAZOYER Crédit Agricole (FR) Deputy CEO P. AYMERICH Société Générale (FR) Deputy CEO S. BOUJNAH Euronext (NL) CEO M. ROUSO La Banque Postale (FR) CEO Retail Banking JM. CAMPA European Banking Authority (FR) Chair J. LAMBERT Mastercard (US) Chief Digital O cer G. GRAPINET Worldline (FR) CEO H. KARONIS Viva Wallet (GR) CEO C. HOGG Visa Europe (UK) CEO F. SIMONESCHI TrueLayer (UK) CEO P. GAUTHIER Ledger (FR) CEO P. TAYLOR Thought Machine (UK) CEO M. TAYENTHAL N26 (DE) Co-CEO S. PARK Anthemis (UK) Co-Founder E. GUEZ Papaya Global (IL) CEO JC. SAMUELIAN Alan (FR) CEO J. JANARDANA Zopa (UK) CEO

FINTECH FOCUS

13 Lemmings don’t run off cliffs… intentionally, anyway What does the SVB story tell us about human behaviour – and could new uses of AI amplify it?

26 Parents don’t teach kids financial literacy… apps do Kids’ finance is a hotly contested market in the UK, and not before time, says Stuart Thomas.

49 Rock on, fintech!

If Ohio isn’t on your destination list, it should be, says the state’s fintech flagwaver Ron Rock. And fellow Buckeye Jim Marous tends to agree!

82 Where now for startups?

The curious demise of TechNation in a period of investment uncertainty

COVER FEATURE

6 Shaping the future of payments

How Giesecke+Devrient and Netcetera plan to tackle the industry’s biggest challenges together

NEOBANKS

16 Keeping the faith

The rise of Sharia-compliant products is a way of righting age-old inequalities in finance, says Junaid Wahedna, Founder and CEO of Wahed

18 Retail banking reimagined

tbi bank took a new look at retail banking seven years ago and built an entirely new model that leverages the power of alternative payments for the benefit of merchants and consumers, as Petr Baron explains

21 Credit where it’s due Zopa Bank’s Chief Strategy Officer Merve Ferrero explains what a responsible BNPL product looks like

24 Glittering success

We ask Jason Cozens, CEO of Glint, what’s next for gold-backed challengers?

THEFINTECHVIEW

ISSUE #28 2023

At the risk of adding to an already crowded debate, in which the world and its dog and Elon Musk hold a view, how have we come so far in the development of AI and yet made so little progress on deciding how/if to regulate it in some key jurisdictions – notably the UK and US?

OpenAI’s ChatGPT made history in January by becoming the fastest-growing consumer app, accruing 100 million daily active users in just 40 days – it took TikTok nine months to achieve such popularity.

The unprecedented speed of adoption, and the step change that generative AI presents in the way we interact with machines, has prompted a host of concerned commentary, government hearings and tech bosses themselves to call for closer scrutiny and control of the technology. And yet civil society groups, academics and developers have all been highlighting concerns for years about potential problems with large language models like these.

Not everyone has been sleepwalking into a regulatory and moral mess. The EU is in the process of introducing legislation that, once approved, will be

the world’s first on AI. Biometric surveillance, emotion recognition and predictive policing AI are set to be outlawed and there will be tailor-made regimes for general-purpose AI and foundation models like GPT, with regulatory categories for low, limited, high and unacceptable risk. The rules also allow for complaints to be made about AI. Welcomed by civil society groups, the rules go for a vote before the whole parliament this month.

AI is a thread that runs through this issue – sustainability, open banking, regulation, and the discussion on how to monitor and eliminate AI bias in financial services on p68 is particularly interesting.

When asked recently if AI was a threat to humanity, ChatGPT replied: “It is up to us, as the creators and users of AI, to ensure that it is used in a responsible and ethical manner.” There was a deal too much species confusion in that sentence for me. Regulators need to get a grip. Our last issue’s spine tingler, “How many people had that kind of crazy dream and yet lived to see it come to fruition?”, was by Dee Hock, founder of Visa (1929-2022). Sue Scott, Editor

CONTENTS

Issue 28 | TheFintechMagazine 3 24 26 6 16

OPEN BANKING

28

Layer cake

Open banking hasn’t disintermediated legacy providers to the extent they feared – not yet. As more players build layers of services on top of the data banks hold, Brian Hanrahan, CEO of Nuapay, shares how they can ensure their slice of the action

30 Breadth and depth: open banking at opposite ends of the world

The UK’s NatWest and National Australia Bank recently compared and contrasted the two countries’ approach to open banking and came up with five recommendations for the next stage of their respective journeys. Here, the report’s authors, Clare Melling and Brad Carr, look at what the future could hold

34 Open to change

PSD2 hasn’t unlocked quite as many doors in Europe as its architects hoped. But Nikolaj Hartvig from Neonomics and Tom Wijnen from Worldline – the first ‘pan-European pure PSD2 API providers’ – are optimistic it can still fulfil its potential

REGULATION & TRUST

40 Heroes and villains: the UK’s fincrime debate

Eddie Vaughan from LexisNexis Risk Solutions, Jim Winters from Nationwide Building Society and David Callington from HSBC ask if it’s time for a new approach to fighting economic crime

44 Kill or cure?

Is Secure Customer Authentication just a sticking plaster for a patient that’s bleeding out? Linda Weston, MD and Head of Core Products for Barclaycard Payments, Andrew Shikiar, Executive Director of the FIDO Alliance, and Quintin Stephen, Director of Global Strategy at Giesecke+Devrient discuss vital signs and possible interventions

SUSTAINABILITY

52 Be the change you want to see Is sustainability slipping down the banking agenda? Mobiquity’s Peter van de Venn urges banks to keep their eye on the prize – being a brand with a purpose

55 The heat is on ING’s Anne-Sophie Castelnau explains how the bank is tackling one of the biggest polluting sectors in its lending portfolio… and it’s not who you think

ARTIFICIAL INTELLIGENCE

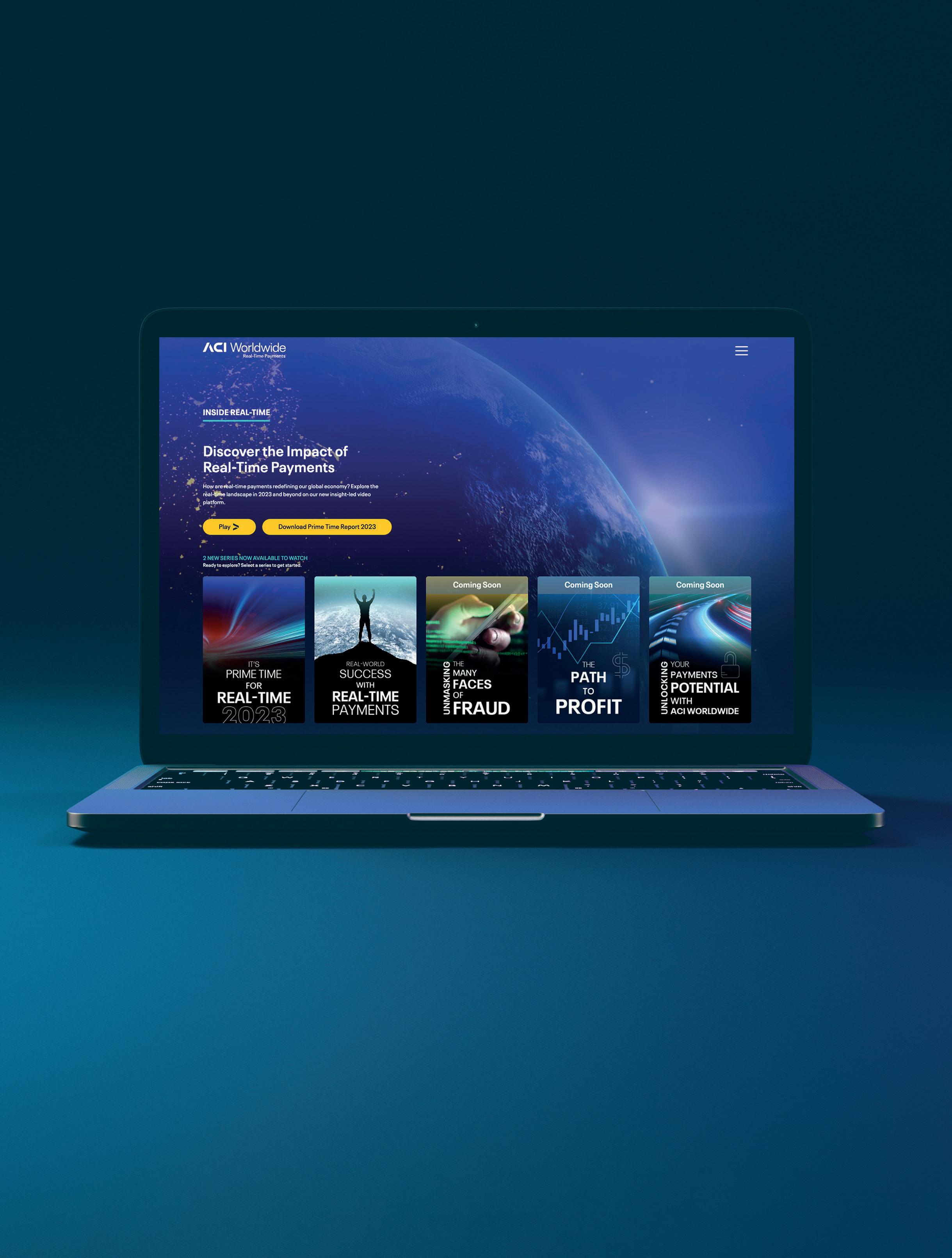

65 AI see the future

SmartStream CTO Roque Martinez reveals how the company’s significant investment in AI is taking it into new and surprising markets

68 Countering bias in financial AI

It’s become an indispensable technology in financial services, but how does the industry ensure it’s working to the benefit of everyone?

We find out with ACI Worldwide, HSBC and Rabobank

TECHNOLOGY STRATEGY

72 The power of partnerships

Justus Roux, Head of Solutions Engineering, EMEA, at Mambu, says that trust and compatible culture can deliver best-in-class customer journeys

74 Mix and MACH

The UK’s smaller banks and building societies could help ‘unleash’ economic growth in line with the government’s Edinburgh Reforms. But to take full advantage of that they need access to affordable tech… Rajesh Saxena from Intellect Design Arena believes he has the answer

TRADETECH

76 You can’t be it if you can’t see it

In a subbornly homogeneous industry, Man Group is leading by example on inclusion and diversity. It’s hard but worthwhile work, says Rachel Waters, its Deputy Head of Trading Platform Technology, who shares her experience of what it’s like to be in the minority

62

Short of turning off funding for fossil fuels tomorrow, Martin Richards from HSBC, Clinton Abbott of SunTec and Alex Garkov at EcoVadis explore how banks can effect positive change in the global economy

Traditional models underestimate the role of climate as a driver of past events. Jamie Rodney, CEO of Reask, explains why a new approach, using climate-aware AI, is needed

78 Brave new worlds

We speak to TradeTech chair and diversity champion Julia Streets about the opportunities and challenges the metaverse presents to invesrment

80 A thoroughly modern MAN

Gary Collier, CTO of investment manager Man Group’s Alpha Technology Division, describes how technology augments today’s traders and how it will in future

4

76 30 40

CONTENTS

TheFintechMagazine | Issue 28 ffnews.com All Rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, photocopying or otherwise, without prior permission of the publisher and copyright owner. While every effort has been made to ensure the accuracy of the information in this publication, the publisher accepts no responsibility for errors or omissions. The products and services advertised are those of individual authors and are not necessarily endorsed by or connected with the publisher. The opinions expressed in the articles within this publication are those of individual authors and not necessarily those of the publisher. EXECUTIVE EDITOR Ali Paterson GENERAL MANAGER Chloe Butler EDITOR Sue Scott PRODUCTION Taylor Griffin Trinity Yau HEAD OF CONTENT Douglas Mackenzie HEAD OF MARKETING Ben McKenna CONTACT US ffnews.com DESIGN & PRODUCTION www.yorkshire creativemedia.co.uk ART DIRECTOR Chris Swales PHOTOGRAPHER Jordan “Dusty” Drew ONLINE EDITOR Lauren Towner ONLINE TEAM Joshua Hackett FEATURE WRITERS David Firth l Tracy Fletcher Tim Goodfellow l Alex King Martin Heminway Natalie Marchant Martin Morris John Reynolds Frank Tennyson Stuart Thomas l Sue Scott Fintech Finance is published by ADVERTAINMENT MEDIA LTD. Pantiles Chambers 85 High Street Tunbridge Wells, TN1 1XP ACCOUNTS TEAM Jacob Bruce l Tom Dickinson Nicole Efthymiou Emillie Snelgrove VIDEO TEAM Lewis Averillo-Singh Alexander Craddock Max Burton l Luke Evans Louis Jean La Grange IMAGES BY www.istock.com PRINTED BY Print it 24 seven "PROUDLY NOT ABC AUDITED" THEFINTECHMAGAZINE 2023 ISSUE #28

The activist bank

58

Calm before the storms

THE POWER OF

PAYMENTS Download our latest whitepaper Scan the QR code to get your free copy

UNLOCK

DIGITAL

Shaping the future of payments

How Giesecke+Devrient and Netcetera plan to tackle the industry’s biggest challenges together

As a global security technology group, Giesecke+Devrient (G+D) is renowned for orchestrating seamless physical and digital customer payments journeys.

Its groundbreaking work on public currencies, cards and issuance, digital payment solutions and, most recently, around designing central bank digital currencies (CBDCs), are just some examples of how it’s not only shaped today‘s financial landscape but is also helping the payments industry prepare for that of tomorrow.

Recently, it’s taken a majority stake in Netcetera, a leading provider of secure digital payments, with whom G+D has worked as a key partner for several years. Together they are doubling down on G+D’s broad mission to ‘engineer the trust to secure the essential values of the world’.

The two companies’ objectives are complementary: G+D’s core value is to create confidence and to protect payments in the physical and digital worlds. Netcetera is dedicated to creating digital trust and value with a comprehensive portfolio of solutions. Together, they offer both plug and play and tailor-made products for clients’ specific needs.

Both are responding to an evolving and complex matrix of customer demands, not just to ensure payments are secure and convenient across every channel and device, but that they are also mindful of ecological costs to the planet and genuinely accessible to everyone on it.

“Payment has become a massively adopted everyday experience: whether online, on a smart device, or in-store, consumers expect a flawless experience where services are designed around their core needs,” says Carsten Wengel, CEO of Netcetera.

“The payment ecosystem faces the challenge of offering an intuitive, scalable, and secure customer experience while creating confidence in the designed payment solutions.

“G+D has more than 170 years of passion for currencies and payments, delivering solutions to the financial services industry, ranging from banks to fintechs, around the globe, while digitally born Netcetera has software-based innovation built right at the heart of its business.

“Collectively, G+D and Netcetera are the perfect match of innovation and trusted expertise.”

With Netcetera, G+D can offer an expanded set of solutions to further optimise e-commerce payments as well as elevate customer experience for digital payments and banking.

The companies’ combined development capabilities will, they say, accelerate innovation, creating a powerful force as ‘global partners supporting local flavours in the payments world‘. Netcetera has already announced that it will be making a multimillion investment in its international digital banking offering, the benefits of which will extend to G+D’s 500-plus banking clients.

DIGITAL PARTNERS

Netcetera is a Swiss-headquartered global software company, providing IT products and individual digital solutions in the areas of secure digital payment and financial technologies.

More than 2,500 banks and issuers, and 160,000 merchants already rely on its digital payment solutions and globally certified 3-D Secure products. It’s recognised as a market leader in payment security.

G+D joined Netcetera as a strategic partner in September 2020 and it took a majority stake in the company in early 2023. It’s led by the CEO of Netcetera, Carsten Wengel.

6 COVER FEATURE:

COMPANY FOCUS

TheFintechMagazine | Issue 28 ffnews.com

7 ffnews.com Issue 28 | TheFintechMagazine

Our goal is to work with stakeholders across the industry to create solutions that ensure no one is left behind in the payment journey

Gabrielle Bugat, CEO of G+D Mobile Security, heading the Card & Digital Payments business of G+D

Collectively, G+D and Netcetera are the perfect match of innovation and trusted expertise in this fast-paced world, enabling safer, more convenient, more sustainable, and more accessible payments for everyone

Carsten Wengel, CEO, Netcetera

While banks might still – for now, at least – be customers’ chosen partner of trust when it comes to making life’s big financial decisions, many have lost ground to fintechs in the personalisation of services, innovative user experience, and in providing frictionless day-to-day banking.

Omnipresent Big Techs, meanwhile, with their big brands and big budgets, are encroaching into payments and disintermediating banks’ relationship with customers. Alipay, PayPal and Apple Pay. taken together, are now the leading payment method globally, taking a 49 per cent share of e-commerce transactions, and 32 per cent of point of sale transactions, according to the FIS Global Payments Report 2023.

Rather than simply presenting account holders with a menu of conventional banking services, G+D and Netcetera’s solutions are designed to help banks build offerings around their customers’ core needs while also allowing them to be fully personalised to consumers’ individual lifestyles and requirements.

How does that work? Well, a digital-first consumer journey could start with issuing a virtual card, to be used immediately while the customer waits for the physical card to be mailed. That virtual card can unlock a diverse range of added-value digital solutions that enable payments with effortless authentication, all of which exist alongside the consumer’s traditional physical banking journeys.

While that helps banks maintain their current position in the payments firmament, there is another vacancy in the digital ecosystem that they’re more than qualified to fill. And that’s as a custodian of what is arguably customers’ most valuable and most vulnerable asset: their digital ID.

By leveraging the trust they still hold and their unique access to customers’ financial and personal information, banks could be a one-stop shop for authentication within the transaction process – be that age verification for restricted purchases, assessment for insurance or a loan, or even paying their taxes.

For consumers, using the bank for

verification is reassuring, because data does not leave their bank’s domain, while it greatly accelerates their transaction process.

On another level, payments are also increasingly being seen as a way to strengthen a bank’s brand by demonstrating its actions on issues that matter – including tackling environmental challenges and addressing social inclusion.

G+D and Netcetera are addressing all these inflection points for banks by focussing their efforts on four key areas: redefining trust and customer experience in e-commerce; supporting the phygital

awareness to navigating through fraud, data security, and payment processing.

The act of payment is clearly the most vital concern for e-merchants and improving the customer experience is the top reason they add new payment methods, according to the Merchant Risk Council. And yet paying online is still one of the most significant friction points for customers: a trusted one-click checkout is still a long way from being the everyday experience.

Merchants continue to lose a quarter of all online sales because shoppers are

finance revolution; providing authentic eco-solutions; and making payments easier and accessible for all.

REDEFINING TRUST AND CUSTOMER EXPERIENCE IN E-COMMERCE

In 2022, worldwide e-commerce accounted for more than a fifth of overall retail sales, exceeding $5trillion for the first time, with the vast majority (almost 61 per cent) of those sales conducted over mobile.

By 2025, it’s forecast that a quarter of all spending will be online. But the e-commerce ecosystem is facing a multitude of challenges in its day-to-day operations – from supporting a plethora of new payment methods and increased ecological

confused or frustrated by the checkout process. That friction is more often than not caused by a clunky authentication experience. And yet secure authentication is essential to protect both the customer and the business from historic levels of fraud that sapped US $41billion out of the e-commerce market worldwide between 2020-2023. Those losses were compounded by false positive declines.

Online shoppers’ expectations leave no room for a poor payment experience anywhere on the journey, not just at the checkout, of course. G+D and Netcetera believe that the way to success for merchants is to improve all aspects of the customer journey, says Peter Frick, managing director of secure digital payments at Netcetera.

“The continuous growth in e-commerce

8 COVER FEATURE: COMPANY FOCUS TheFintechMagazine | Issue 28 ffnews.com

Improving CX: Merchants lose a quarter of all online sales because shoppers are confused or frustrated by the checkout process

The continuous growth in e-commerce fuels the importance of best-in-class user experience and the highest compliance to security in all façades of digital payment

Peter Frick, MD, Secure Digital Payments, Netcetera

fuels the importance of best-in-class user experience and the highest compliance to security in all façades of digital payment,“ says Frick.

“We strongly believe that both of these aspects are not yet available to consumers and businesses in everyday life, nor have we reached a level where fraud is cornered or even contained in our industry. That is why Netcetera and G+D, put their combined strengths at our customers’ and partners’ disposal.”

Netcetera covers the full spectrum of the digital payments industry, providing

reconciling the need to maintain physical as well as digital touchpoints and services – a duality that’s likely to exist for several years yet, as evidenced by the most recent Global Data Banking Survey.

It found that 80 per cent of neobanks acknowledge that a physical presence is important – it’s why the majority continue to offer customers the choice of a physical card as well as a digital wallet and why many invest in human call handlers to help customers with more complex issues.

between branch visits and phone app, laptop and letterbox – believes Heidari. And the payment card can act as the key to that new way of interacting as the customer’s physical and digital worlds converge.

“The payment card is a tangible symbol of the trusting connection between the bank and the customer,” says Heidari. “At the same time, it represents the entry ticket to the digital world by giving consumers access to a vast network of services and applications – tailored, individualised messaging, with print materials enhanced with cutting-edge alternative reality and video solutions; customer-generated payment card designs made available in digital formats instantly; and even unmanned, instantprint card kiosks.”

G+D and Netcetera can help implement all these and more, says Heidari.

“It’s about being open and creative, putting the customer at the centre of every activity and recognising their needs before they arise,” he adds. “The focus is not on blindly chasing every trend, but on keeping a finger on the pulse.”

DRIVING SUSTAINABILITY WITH AUTHENTIC ECO-INNOVATION

end-to-end solutions for issuers, acquirers, merchants and PSPs. With G+D, it’s committed to improving every aspect of the customer journey and addressing the biggest challengers that providers face –from enabling e-commerce transactions without exchanging vital account information, to providing a seamless checkout experience and everything in between. By enabling the e-commerce ecosystem to build a superior experience for their customers they can, in the process, enhance those business's success.

SUPPORTING THE PHYGITAL PAYMENTS REVOLUTION

G+D is one of the few payment technology providers covering both the virtual and physical worlds of payments. That gives it a unique perspective when it comes to

Meanwhile, both neo and incumbent banks are, at the same time, investing in the valuable data that can be collected via digital channels.

For Mehdi Heidari, head of product management digital issuance at G+D, phygital banking is the sweet spot between physical-only and online-only services. He believes it is the best way of creating a personalised customer experience.

“Customers’ lives already blend the physical and digital almost everywhere they go. From entertainment to transportation, smart digital services enhance, elevate, and personalise these experiences. Payment and banking solutions are no different,” he says.

Phygital services must be omnichannel – offering a seamless, consistent experience as the customer switches

With sustainability rising up the banking industry’s agenda, how we pay goes beyond just a technological choice.

“As a society, we have a responsibility to create a more sustainable future,” says Chitua Kalio, global head of client services in the Card & Digital Payment business of G+D. “The payment industry is stepping up to the challenge, leading the way toward a more eco-conscious payment landscape.

“By embracing these environmentally friendly business methods, banks and financial institutions can play a crucial role in influencing society’s sustainability journey and minimise the damage we leave behind.”

G+D has worked towards that goal since 2010, when it signed the United Nations Global Compact – a declaration of intent by commercial companies to adopt sustainable and socially responsible governance policies.

9

It’s about being open and creative, putting the customer at the centre of every activity and recognising their needs before they arise. The focus is not on blindly chasing every trend, but on keeping a finger on the pulse

ffnews.com Issue 28 | TheFintechMagazine

Mehdi Heidari, Head of Product Management Digital Issuance, G+D

It has made huge progress since – both on an individual corporate level and in putting the payments industry on a more sustainable footing. G+D has set transparent and clearly formulated targets, in line with the principles of the UN’s Sustainable Development Goals, and recently raised its own carbon neutrality target, committing to reduce its Scope 1, 2, and 3 emissions and thus achieve net zero across the group.

In 2021, G+D initiated its first partnership with a new breed of eco-innovator in the payments space, Doconomy. More recently, Patch was made part of an expanding G+D ecosystem of environmentally-focussed fintechs that are offering end-to-end eco-payments solutions that support G+D’s clients in their own sustainability commitments. They provide tools that can be embedded in banking and payment apps to track and measure consumers’ carbon emissions through their payments activity and encourage them to have a more sustainable lifestyle or offset their CO2 footprint.

our environment,” says Kalio. “[We want to] embark on an authentic transformation together and lay the foundation for a better, greener tomorrow."

MAKING PAYMENTS EASIER AND ACCESSIBLE FOR ALL

Alongside environmental sustainability, social responsibility is deeply ingrained into the foundational ethos of G+D. While it might not generate as many headlines as climate initiatives, tailoring services to meet the needs of an increasingly older population and improving the user experience for those living with impairments are equally vital.

According to UN, one in six people in the world will be over 65 by 2050, up from one in 11 in 2019, and life expectancy beyond 65 is set to increase by 19 years. These demographic shifts underline how important it is for socially responsible enterprises to meet the diverse needs of individuals.

“Payments are for all, aren’t they?,” says Gabrielle Bugat, CEO of G+D Mobile Security, heading the Card & Digital Payments business of G+D. “And, as we move towards a more digital and diverse society, payment methods must be easy, convenient, and secure for everyone. Technology has a critical role to play in fostering accessibility and inclusion.“

into the card, so users don’t have to enter a PIN at checkout; Braille-embossed cards, cards with larger font sizes, and highcontrast text for visually impaired users are all design features within G+D’s scope. Solutions have also been extended to the onboarding experience. By scanning a large QR code on the letter that accompanies a card, users can hear instructions on how to activate their card, obtain a PIN, and find out about the rewards and benefits associated with the card programme, with preferred language, layout or colour settings for greater accessibility.

Recognising that the eco-card is a symbol of change with a potentially powerful multiplier effect in the hands of the user, the company became the first in the payments card industry to pledge the elimination of virgin plastic in all its payment card bodies by 2030. Its Convego® Beyond card bodies already consist of 100 per cent recycled or compostable plastic, including a card body made entirely from plant-based materials. All this has required a true, cross-industry effort.

“We envision a future where the entire industry adopts truly sustainable practices, making a significant and positive impact on

With a rapidly ageing population globally, a new demographic structure will drive new demands on different forms of payment methods or experiences. A card is still, however, the most-used, non-cash daily payment method worldwide and represents not only the physical bond between banks and customers, but also a strong branding statement for banks.

G+D is supporting many of its clients in addressing the payment card issuance journey to make it easier for older people and those with visual impairments. Its More Accessible Payments (MAP) solutions provide a range of enhancements for its clients’ customers. Identification bumps on payment cards that signal to a user whether they are holding a credit or a debit card; a notch at one end of a card to help customers orient it the right way for insertion into an ATM or card reader; a biometric fingerprint reader embedded

The digital onboarding of vital services is also being enhanced. By identifying themselves via a secure ID process and facial biometrics, users don’t need to present themselves at a physical branch or get a notary public to confirm their identity. Meanwhile, Netcetera has launched the ToPay Senior wallet with design features that increase accessibility for any customer looking for a simpler mobile interface. Solutions that support customers with impairments provide a starting point for extending banking services to a broader population who may not benefit equally from the advance of innovative payment technologies. So, designing with different groups of users in mind can actually improve the experience for everyone, believes Bugat.

“At G+D, we believe in leveraging technology to create reliable payment solutions that empower customers and enable accessibility for all individuals,” she says. “Our goal is to work with stakeholders across the industry to create solutions that bridge the gap and ensure that no one is left behind in the payment journey.”

10 COVER FEATURE: COMPANY FOCUS TheFintechMagazine | Issue 28 ffnews.com

As we move towards a more digital and diverse society, payment methods must be easy, convenient and secure for everyone

Gabrielle Bugat, CEO of G+D Mobile Security, heading the Card & Digital Payments business of G+D

We envision a future where the entire industry adopts truly sustainable practices, making a significant and positive impact on our environment

Chitua Kalio, Global Head of Client Services, Card & Digital Payment, G+D

Giesecke+Devrient became the first in the payments card industry to pledge the elimination of virgin plastic in all its payment card bodies by 2030

We build so you can scale faster

We build so you can scale faster

We build so you can scale faster

One digital payments infrastructure witheverything you needto globalise your payment platform.

One digital payments infrastructure witheverything you needto globalise your payment platform.

One digital payments infrastructure witheverything you needto globalise your payment platform.

Let's meet at Money 20/20 Europe!

Let's meet at Money 20/20 Europe!

Let's meet at Money 20/20 Europe!

You deliver the experience, we power the payments. Seamlessly embed financial services into any user journey with our suite of functional APIs. eps.edenred.com Accounts & Payments Card Issuing Processing

I was sitting in a Soho bar on Coronation Day, talking to a tech entrepreneur about Silicon Valley Bank.

As the jazz duet played a little too loudly behind us, he told me how he’d emptied his SVB UK business account in March, when news reached him that the US parent ‘bank for the innovation economy’ was on the point of collapse. How he’d had to explain to – albeit very understanding – investors that the cash was now sitting in his personal account, held with another provider, until they figured out how badly exposed the UK arm of SVB was.

He’s an intelligent chap: he knew that he’d contributed to a run on SVB UK that, ultimately, would see it sold to HSBC in a Bank of England-brokered deal for £1 just a few days later. At which point, he returned the money to the bank.

So, one afternoon in March 2023, SVB

UK was the custodian of around £11billion on behalf of 4,000 or so business customers; by close of play the following day, many of them – spooked, like my drinking pal, by the knowledge that they had more sitting in their account than would be covered by the UK’s Financial Services Compensation Scheme if the bank failed – had withdrawn more than £4billion between them. SVB UK’s fate was sealed.

Under the Bank of England’s ‘resolution’ procedure, introduced after the financial crash in 2008, for a bank the size of SVB UK things would go one of three ways: a sale/transfer to another bank – and fast; a ‘bridge bank’, organised by the Bank of England, would take over the running of SVB UK’s core functions until a deal was done or it was wound down; or (nuclear option) the bank would be declared insolvent immediately, thousands of its bigger business clients would lose a heck

Lemmings don’t run off cliffs… intentionally, anyway

Sue Scott ponders if technology could accidentally exacerbate banking crises?

of a lot of unprotected money, and the taxpayer would be left with a stonking compensation bill for the rest.

It begs the question: if everybody had just sat tight, could SVB UK have been safely detached from its parent bank and survived intact? Perhaps. But panic has its own momentum and you can’t blame founders wanting to protect their assets and the interests of investors– not to mention the welfare of staff whose pay cheques they might otherwise not have been able to meet at the end of the month.

Bank runs are a regulator's worst nightmare. And yet technology appears to be conspiring to make them more likely – not less.

Elsewhere in this issue, SmartStream reveals that it’s actively looking at using its AI to detect subtle changes in patterns of bank behaviour that could raise a red flag for SmartStream clients who are among its counterparties.

13 FINTECH FOCUS: SVB

ffnews.com Issue 28 | TheFintechMagazine

While the decision on what to do as a result of receiving such a signal rests with a human, the immediate response, in the interest of self-preservation, is likely to be to stop transacting until further inquiries have been made. Thus, if enough red flags are raised at the same time, a non-critical event that could have been caused by any number of factors, including human error, could be turned into a major and possibly fatal incident for the bank.

SESAMm, the AI-driven award-winning French startup that started as a student project nine years ago and recently closed a €35million Series B funding round, keeps track of potential controversies and positive-impact events on companies around the world by trawling 20 billion articles and 10 million new documents on the internet daily. It then applies a series of filters, including, among others, risk, sentiment and severity, to come up with bespoke analyses for its clients. They tend to be major private equity firms, asset managers, index providers and global corporations who are increasingly interested in sentiment indicators to keep them ahead of financial markets.

Sylvain Forté, co-founder and CEO of SESAMm, told me that it had started to pick

DEATH OF A BANK

MARCH 8

In a statement to stakeholders, SVB in the US says it’s taken ‘strategic actions to strengthen our financial position’, which includes a share issue to raise around $1.75billion on top of a $500million investment pledge by one of its clients. It also sells its bond portfolio at a $1.8billion loss. The bank insists: “Our financial position enables us to take these strategic actions. SVB is well-capitalised, with a high-quality, liquid balance sheet and peer-leading capital ratios.” Credit ratings agency Moody’s downgrades its outlook on SVB from stable to negative.

MARCH 9

SVB’s CEO Greg Becker calls on VC firms to ‘stay calm’ following a flurry of memos and Twitter posts by startup investors forecasting its collapse. Customer withdrawals continue apace and its stock plunges 60 per cent. SVB UK customers begin panic withdrawals.

up signals as early as January that a run on SVB in the US was possible – long before regulators – and most of the rest of us – were aware that anything was untoward.

“It was more reputational indicators. There was a dip in sentiment, particularly on social channels, like Twitter. I’m not saying we predicted the collapse, but [what we saw] was interesting,” he says.

a replacement for decision-making,” he says. Nevertheless, the impact of AI in both use cases – transaction monitoring and sentiment analysis – is clear. It gives a competitive advantage to those employing the technology – and, as a business leader, who wouldn’t want that? But it could also amplify any negative response to signals that might turn out to be benign. And, as we’ve seen, even if they are noteworthy, the speed with which panic sets in is already systemically alarming.

“We’re seeing more and more demand for risk monitoring in general, even of suppliers and clients. And SVB was a supplier to a lot of corporates.”

He’s keen to stress his technology should be seen as guiding management decisions. “It may indicate a need for exclusion or portfolio rebalancing, but it’s not

There is, as yet, no technology that prevents lemmings running off cliffs, which isn’t – as the Disney myth-makers would have us believe – because they are seized by a collective impulse to self-destruct. Rather, environmental signals – in their case of over-population – trigger them to up-sticks and move all at once. In the rush, there are fatalities, which perhaps could have been avoided if they’d moved slower or taken time to consider alternatives to mass migration, or, indeed, if the Chief Lemming had put rules around such things.

As regulators in the UK and US separately consider how to legislate for unintended consequences of AI, and especially how those might affect financial services, it’s worth thinking about those lemmings.

MARCH 10

SVB becomes the biggest bank crash in the US since the Great Financial Crisis. The regulator places it into receivership and $175billion in customer deposits are put under its control. Signature Bank, another business bank, mainly servicing real estate and law firms but which also banks crypto clients, starts haemorrhaging deposits. The Bank of England intervenes to prevent a disorderly collapse of SVB UK.

MARCH 12

US regulators close Signature Bank. New York Community Bancorp will acquire ‘certain financially and strategically complementary parts of Signature’ a fortnight later.

MARCH 13

HSBC agrees to buy SVB UK for £1. Its London-based staff will stay in their jobs and run the bank from its existing offices. HSBC will go on to hire

former SVB staff in the States for a new business, supporting tech companies and their investors – a move that will later see it sued by SVB’s new owner.

MARCH 16

Eleven of the biggest US banks inject a total of $30billion into teetering First Republic Bank.

MARCH 27

US-wide bank First Citizens acquires SVB in the States.

MAY 1

Regulators close First Republic and sell it to JPMorgan Chase.

MAY 2

HSBC’s Q1 results show a $1.5billion boost from the SVB UK takeover. “In the weeks that have passed since the time of doing the deal there have been no nasty surprises,” says group CEO Noel Quinn. “The UK business was well run and had a good portfolio of customers.”

FINTECH FOCUS: SVB

TheFintechMagazine | Issue 28 ffnews.com 14

There is, as yet, no technology that prevents lemmings running off cliffs, which isn’t – as the Disney myth-makers would have us believe – because they are seized by a collective impulse to self-destruct

MARCH 8 MARCH 9 MARCH 10 MARCH 12 MARCH 13 MARCH 16 MARCH 27 MAY1 MAY2

CONNECTING YOU TO ALL PARTS OF THE FINTECH ECOSYSTEM JOIN 300+ TRAILBLAZING FINTECH LEADERS ONSITE HEAR FROM 50+ LEADING SPEAKERS FROM FIS, CHALLENGER BANKS, MERCHANTS AND FINTECH FOR OUR FIRST YEAR IN-PERSON, MAKE SURE YOU’RE PART OF THE CONVERSATION REGISTER FOR FINTECH CONNECT NA 2023 TODAY! Who will be there?WHO WILL BE THERE? www.fintechconnect.com/north-america info@fintechconnect.com June 27, 2023 Convene Quorum, New York SAVE 20% Using Code FFNEWS20 2023 CONFIRMED SPONSORS

Window of opportunity:

Wahed’s Sharia-compliant offering addresses inequality in an interest-based system

The rise of Sharia-compliant products is a way of righting age-old inequalities in finance, believes Junaid Wahedna, Founder

With the democratisation of finance an accepted goal for most within banking services, it remains a challenge that the very building blocks of the industry are, on the face of it, anathema to big swathes of the global population who try to live by Sharia law.

KEEPING THE FAITH KEEPING THE FAITH

With interest considered riba – ‘an unjust, exploitative gain’ under the law and forbidden for Muslims – interest-earning bank accounts, interest on any form of lending or borrowing, including most mortgages, and interest-charging payment cards, are very much off the table.

and CEO of Wahed

Add into the mix the fact that for financial services to be compliant with the teachings of Islam, they cannot invest in companies associated with alcohol, tobacco, or gambling, and many Muslims living in non-Muslim majority nations face compromising on their faith simply to access basic facilities.

It’s clear that halal (permitted) alternatives are required. And where there is a need in finance, very often it is fintechs who take up the gauntlet. Wahed, which was first launched as a Shariah-compliant investment platform in the States, came up with just such a transaction banking

and savings alternative for British Muslims.

While it’s perhaps no surprise that the Islamic fintech market size in the 57 member states of the Organisation for Islamic Cooperation (OIC), totalled $49billion in 2020, and it’s anticipated to grow by 21 per cent to reach $128billion by 2025 (according to figures from Dinar Standard and Elipses), elsewhere, there is a widening gap between demand for Shariah-compliant finance and supply.

In the US, for instance, a study by think-tank the Pew Research Centre estimated there were 3.45 million Muslims (1.1 per cent of the population)

16 NEOBANKS: ISLAMIC FINANCE

TheFintechMagazine | Issue 28 ffnews.com

living in the States in 2017. Between 2010 and 2020, the number of mosques increased by 31 per cent and almost a quarter of worshipers attending them were Gen Z or young Millennials – the typical fintech demographic – according to research by the US Institute for Social Policy and Understanding. The figures give an insight into Islamic observance in a country that is woefully underserved by Shariah-compliant financial services.

New York-based Wahed, backed by Saudi oil giant Aramco, originally mobilised to cater for this ‘underserved sector’. Since its creation in 2017, Wahed claims to have served more than 300,000 customers in 100-plus countries around the world with offices in the US, Malaysia, UAE, KSA, Nigeria, Kazakhstan, Indonesia, India and Mauritius. It became the first halal investment platform to be approved by the UK’s Financial Conduct Authority in 2018 and went on to acquire startup Niyah, a British company that designed a digital banking app for the Muslim community, in December 2020.

CEO of Wahed, Junaid Wahedna, explains the company’s genesis: “I come from a practising Muslim background myself, and finance is a very nuanced issue. Put simply, Muslims aren’t allowed to deal with or be exposed to interest in any way, shape or form. And, as you can imagine, that’s an impossible thing to avoid, considering our financial ecosystem in the West completely works around interest.

“So that’s why Wahed was formed; to give a credible, regulated alternative to keeping your savings in your bank account.”

Wahed began by delivering a simple savings solution: instead of keeping money in a savings account or at a lending institution where it would be exposed to interest, customers could invest in a screened diverse portfolio with no interest element or related to any investees who could be regarded as unethical.

Earlier this year, Wahed upped its offering to UK customers by rolling out a gold-backed debit card, which will allow them to use Wahed as their main spend and save account, making purchases using their Wahed card with their money held in a gold exchange traded commodity (ETC).

“Customers didn’t want the money ever to be sitting in a bank because it would be used for interest-based lending and inequality creation, but they had been

asking, ‘why can’t we pay our salaries directly into our Wahed account?’, ‘why can’t we spend out of our Wahed account?’” says Wahedna.

“And that’s where this idea came about to have a transaction banking layer where you have a bank account number, a sort code, a debit card and the ability to make transfers, but all your money is always kept in assets. It’s very simple, but it’s never really been done for this specific use case.”

There are other advantages, too, that make it appealing to Muslim and non-Muslim users alike.

“Your money is usually kept in fiat currency in a high street bank, but with us, it’s always kept in a real asset, so you don’t have the same inflationary pressures. Your wealth grows over time, just as the high-net-worths’ do.

“There is no multi-millionaire keeping their money in cash. They are all in assets and portfolios. And that’s the solution we wanted to provide the everyday consumer. So, not only does it solve this faith-based restriction that we have, but it’s also better for them in the long term.”

Of the UK’s 3.9 million Muslims, one-third are based in London where Wahed opened a physical branch on Baker Street in

it any harm. During the recession, when there has been huge market re-evaluation within the fintech space, Wahed has more than ridden the storm.

“The recession has been amazing for us,” says Wahedna. “Our customers are very sticky, and we’ve grown our revenue some 75 per cent over the last year.

“Previously, the trend has been for fintechs to come out with lending products or day trading apps – and that’s great as long as the markets are moving up. But once you have a recessionary environment, and markets are moving downwards, then people don’t want to trade anymore, they’re not making any money, and a lot of people get hit. We were lucky because ours was always a long-term savings product, it was always very conservative, and so we retained our client base.”

The past six years have not passed without controversy, as you might expect from a fintech that challenges fundamental norms. In February of last year, the US Securities and Exchange Commission (SEC) charged Wahed Invest, LLC with making misleading statements and breaching its fiduciary duty, and for compliance failures.

Without admitting or denying the SEC’s findings, Wahed agreed to its rulings, which included retaining an independent compliance consultant, among other undertakings. It went further, in May 2022, by recruiting a former director of the SEC itself – Lori A. Richards – as the first woman to sit on the company’s board.

January this year. With closures becoming the norm for many high street banks, Wahedna explained at the time of the launch why it was important it bucked the trend.

“In the UK, [the Muslim community is] actually one of the lowest socio-economic segments of the country, with low incomes and poor financial literacy,” he said. “They have trust issues and so they want to see a physical presence before they trust you with their money.”

Taking such a contrary approach is something of a USP for the business, says Wahedna and it doesn’t appear to be doing

Wahed, which is powered by investment infrastructure provider WealthKernel, continues to keep the faith. Last year, it launched an exchange traded product (ETP) on the London Stock Exchange that allows investors to track the Wahed FTSE USA Sharia exchange traded fund (ETF) – the latter having outperformed the S&P 500 over the last three years, according to Seeking Alpha analysis. And it is now acquiring a number of related Sharia-compliant services that can be accessed via its financial management platform in the UK: it offers pensions and savings and recently acquired iWill Solicitors in the UK.

Its mission is simple, says Wahedna: “We are helping solve the systemic issue of inequality created by the current financial system. By creating a genuine alternative to interest-based systems, we believe we can help beat inequality in the long run.”

17

ffnews.com Issue 28 | TheFintechMagazine

You have a bank account number, a sort code, a debit card and ability to make transfers, but all your money is always kept in assets. It seems simple, but it’s never been done for this specific use case

‘Retail’ banking reimag i ned

tbi bank took a new look at retail banking seven years ago and built an entirely new model that leverages the power of alternative payments for the benefit of merchants and consumers, as Petr Baron explains

Petr Baron isn’t a conventional banker, but then tbi is no longer a conventional bank.

Originally registered in 2002 as West-East Bank, it was the first to be founded in Bulgaria using Slovenian capital and its aim was to finance the flow of goods and services between the two countries while also providing banking services to Bulgarian SMEs.

Nine years later it was acquired by Netherlands-based investment group tbi financial services and renamed tbi bank; 2012 saw it establish a presence in Romania, using European passporting rights. In 2016 it was bought by 4Finance Holding SA, one of Europe’s biggest online and mobile consumer lending groups.

By that time, it was well on the way to redefining what a ‘bank’ could be by combining its merchant and consumer businesses to create what Baron, its CEO, describes as an ecosystem for financing and shopping, benefiting tbi bank‘s merchant clients as well as the retail customers it shares with them.

He joined the bank in 2016, having established a track record in creating other mutually rewarding communities – first for a bank in Ukraine, where he deliberately recruited staff with experience in fast-moving consumer goods to build a ‘financial services supermarket’, combining nine companies in banking, risk insurance, reinsurance, life insurance, pension, leasing, asset management, consumer finance and brokerage; and then again by launching the MAXI loyalty

programme for large Ukrainian mass merchants in the fuel, shopping, entertainment and food sectors.

At tbi bank, he’s headed up a team that has transformed a legacy institution into one of the most successful challengers in South Eastern Europe, operating principally in Bulgaria and Romania, and, from last year, in Greece. Perhaps what’s most surprising is that its success all turns on one of the most contested areas of financial services – payments, and, increasingly, on POS instalment plans.

“Banking, being in many ways a service that people dislike, or don’t want to deal with, has got to become embedded, has to become contextualised,” believes Baron. And one of the quickest ways for his own bank to do that was by tapping into the alternative payments trend.

“We are the leaders in the payment plan business in our region, and we have very strong embedded, long-term relationships with all types of merchants, from the largest e-commerce players to the mom-and-pop stores,” he says.

“We believe that bringing consumers closer to those merchants, by providing insight into their shopping habits and interests, is the contextualised future of our business.

“We’re bringing finance together, to help, on one side, merchants do better business, and, on the other, to give consumers the ability to spread their payment and get the best offers – to embed our tools into their journeys to save them time and money.”

Clearly not an archetypal banker, Baron says: “With a wave of fintechs pushing the boundaries, and making bankers really come out of their comfort zone, you have an opportunity to change the paradigm – and, actually, to enjoy what you do.”

Right now, he is clearly enjoying tbi bank being at the top of its game and on course to become a leading next-generation digital lender in South Eastern Europe. Full-year unaudited accounts for 2022 show a record net profit of €35.5million, up 29 per cent on 2021, and a big contributor to that was its alternative payment revenue stream, including point of sale loans. Through various digital channels and trusted partnerships with nearly 20,000 merchant locations, tbi bank issued nearly 550,000 loans in 2022 for a total of €726million, up 34 per cent year-on-year. In Romania alone, its general loans were up 26 per cent (September vs December), point of sale loans up 31 per cent and business banking up 30 per cent in the same period.

It is intent on rewriting the narrative of recent years, which says traditional banks are losing the payments race while retail-focussed fintechs like BNPL leader Klarna – which has its own banking ambitions – are rocket-fuelled by consumer demand for alternative ways to pay. It’s doing this by using immense amounts of data, and whatever rails are necessary to support alternative payments, delivering solutions through its own and others’ technology. An example of that is in the partnership it formed earlier this year with Skroutz, to provide a package of

18 NEOBANKS: BNPL

TheFintechMagazine | Issue 28 ffnews.com

personalised benefits and service automation to help e-commerce businesses better serve their customers and secure their sales funnels in difficult economic times.

As Baron says, it’s been helped by being able to leverage existing merchant relationships that the bank has built over more than 15 years of providing in-store payment solutions. By embedding interest-free payment plans for a period of four months or spread over four-to-48 months for a ‘small fee’ with a fully digitised experience, it has increased those SME customers’ conversion rates and average shopping basket value. It gained a degree of first-mover advantage by introducing zero per cent interest solutions in Bulgaria in 2021, but it also supports the merchants involved with 24/7 automated servicing and immediate payment of 100 per cent of sales proceeds, compared to other providers’ terms of seven days or more.

Alternative payments is now baked into tbi bank’s free mobile current account, neon solution, which also offers savingsrelated services.

“When you look at South Eastern Europe, digital adoption is still not as advanced [as in Northern Europe],” says Baron. “We saw a clear opportunity in being the first ones to bring much of that technology in, to show regulators and consumers that it’s safe, intuitive and user friendly – to educate the market.”

tbi bank is not alone in eyeing consumer spending as a space in which to diversify and monetise payments, but the players getting all the attention tend to be young fintechs, retailers and big tech. Amazon is dabbling with BNPL, while Apple is rumoured to be a bout to follow suit.

Market-leading Klarna boss Alex March believes banks’ omnipotence will be replaced by ‘smarter paytechs’ like his,

already a licensed bank in its Swedish home market and in Germany.

Marsh says Klarna, which chalked up a £1billion loss in 2022 but expects to enter profitability this year, is ‘actively targeting the traditional incumbent banks’, to become ‘one of the five big retail global banks’ in the next five to 10 years.

EY’s 2022 report How Can Banks Find A Winning Position In The Buy Now, Pay Later Market? suggested ‘BNPL is now the fastest-growing payment method in many economies’ and that banks who decided to participate in this increasingly tight market, needed to leverage existing strengths if they are to succeed – tbi bank is among only a handful to have done that at any scale.

which will evolve to become banks by leveraging the close relationships they have developed with consumers through embedded services.

In a 2021 interview with The Verdict magazine, Marsh indicated that 2023 could be the year it enters UK banking territory to counter the ‘woeful’ service the traditional players offer consumers. It is

“Kaspi Bank, in Kazakhstan, has managed to combine overall e-commerce with payments. Russia’s Tinkoff Bank has also done a great job of it,” says Baron. “[But] I don’t see yet too many great examples… except I think what Klarna is doing is very smart. It’s done shopping very well. It’s not yet done banking very well and this is exactly what we are looking at: how to really grow both sides of that equation in parallel, because if one outweighs the other, you don’t achieve that synergy effect.

“Things will converge, one way or another,” says Baron. “Banking is a financial vein of the economy, fintech is how you do it, how you innovate, design and communicate a product, recognising that, at the end of the day, it’s still a financial services business.”

19

Turning alternative payments to banking’s advantage: tbi bank has led the way in South Eastern Europe

ffnews.com Issue 28 | TheFintechMagazine

We believe that bringing customers closer to merchants, by providing insights into their shopping habits and interests, is the contextualised future of our business

Credit

where it’s due

Buy now, pay later and achieve profitability. This could be UK neo Zopa Bank’s story in 2023.

The former peer-to-peer finance pioneer, which morphed into a savings and lending bank just three years ago, believes that its BNPL offer, bolstered by the acquisition of fellow British lendtech DivideBuy in January, will boost revenues by at least 20 per cent as consumers battle a cost-of-living crisis.

But, just as it blazed a trail when it launched the world’s first P2P lending platform back in 2005, this new incarnation of Zopa will be doing things slightly differently – this time in the POS instalment loans space.

“BNPL exploded in the pandemic as people looked to push out costs over a longer period for safety and security,” says chief strategy officer Merve Ferrero.

“Now, Juniper Research estimates the economic downturn will drive a 157 per cent increase in BNPL use and that BNPL users will surpass 900 million by 2027. We have to make sure this growth is sustainable and responsible.”

To that end, last year Zopa Bank set out a vision for what it calls BNPL 2.0,

introducing credit checks and data sharing in an as-yet-largely-unregulated lending space to stop consumers burying themselves in debt.

Ferrero says the acquisition of DivideBuy, with its strong product offer and modern technology stack, was a clear fit in achieving a digitally native suite of responsible BNPL products, which puts customer protection first.

Staffordshire-based DivideBuy already had 400 participating merchants – many in the soft furnishings and beds space. Shoppers can spread the cost of

higher-value items matches Zopa Bank’s existing strategy to offer BNPL loans of between £250 and £30,000.

“Unlike most BNPL offerings, we are focussing on big-ticket items and our customer communications are designed to be fair and not misleading,” says Ferrero.

“While with BNPL shoppers are not usually charged interest on their purchases, they are still at risk of overextending themselves with debt. And they are not entitled to forbearance or compensation if things go wrong because providers are not yet regulated in the UK.

“It will take some time before the Financial Conduct Authority starts overseeing the sector, so, until then, we must ensure customers are treated fairly and understand the impact of BNPL on their financial positions. BNPL 2.0 is an evolution of today’s model. It gives consumers access to affordable credit but with clear protections in place.”

purchases over a two to 12-month period, interest free, and it claims to improve checkout conversion rates by around 40 per cent. Its focus on

Zopa Bank’s BNPL product draws heavily on its experience in data analytics and risk assessment programmes, built by teams in-house teams in London and Barcelona. Just as with its other lending decisions, the system runs credit checks and affordability assessments before giving customers an automated decision on an application for BNPL in seconds.

21 NEOBANKS: BNPL

ffnews.com Issue 28 | TheFintechMagazine

BNPL 2.0 is an evolution of today’s model. It gives consumers access to affordable credit but with clear protections in place

Zopa Bank’s Chief Strategy Officer Merve Ferrero explains what a responsible BNPL product looks like

Crucially, that loan decision is also shared with credit rating agencies so other lenders have a fuller picture of the consumer’s debt position. And, to support the borrower, Zopa Bank provides proprietary online tools so they can better manage those financial commitments.

With a product portfolio that features personal loans, savings accounts, car loans and credit cards, Ferrero stresses the bank does not operate in the sub-prime or pay-day loan space, perhaps because, as its CEO said in an interview with McKinsey last year: “Being a bank born after COVID hit, we never had the luxury of not being cautious.”

Ferrero says the bank’s customers tend to be resilient but, faced with the current cost-of-living squeeze, she splits them into two groups.

“We have customers who came out of the pandemic with higher savings and a good credit score but are feeling the pinch with inflation and less disposable income. They will likely try to protect their savings and limit their credit exposure, leading to less volume in discretionary spending.

“The other group are customers who either lost income or are now in low-pay jobs and did not manage to save through the pandemic, who have been left without a financial buffer.

“They will likely be the ones most immediately impacted by double-digit inflation and may rely on their credit cards to cover day-to-day payments and balance their books. Against this backdrop, it is important for consumers to be able to access sustainable and affordable credit.”

CUSTOMER DATA IS KING

Zopa Bank has used models based on machine learning since 2015. Credit decision-making is fast, which ensures a slick experience for customers borrowing directly or via a merchant’s point-of-sale terminal or website. While it doesn’t offer current accounts, it uses current account turnover data from other banks to verify income, as well as harnessing intelligence gleaned from data acquired via open banking.

A recent innovation created to account for increased risk due to the cost-of-living crisis has been harnessing data taken via an API that allows the bank to assess the size of a credit applicant’s home and, therefore, the impact of soaring energy bills.

Also, in February, Zopa announced it had partnered with Experian so the credit rating

agency’s Boost data could be used in the bank’s credit card decisioning process.

Experian Boost allows consumers to improve their credit score by considering transactional data – such as current account credits and debits, regular payments to digital service providers, plus savings accounts and utility bill payment data.

The Boost data is considered, regardless of whether customers apply for a Zopa Bank credit card directly, or via Experian or a third party, and it can result in lower APRs being offered.

Ferrero says: “We continuously adjust our credit risk, based on the macroeconomic

half of customers keeping savings with the bank when a fixed-term product came to an end. He told McKinsey: “If I look at my loans, about half of our customers will take a loan again with us within five or six years of the first one. And when they do that, they come directly back to us – we are not spending marketing money on that.”

BEST IN CLASS

A unicorn within 18 months of transitioning to a bank, to date the neo has attracted £3billion in deposits and issued around 400,000 cards. Its savings app is rated one of the best on the market and the bank is currently offering one of, if not the best easy-access savings rate in the country.

Like many others, it’s talked about an early IPO, but following a top-up £75million fundraise in February, Ferrero says ‘we will not be rushed to make hasty decisions and will carefully evaluate the investment climate when markets reopen’.

Consumer protection: Sustainability of credit is as important as accessibility

conditions, pulling back on loan origination and credit risk when needed.”

Notwithstanding the current pressures on consumers, taking a cautious approach has paid off: a low level of loan defaults compared to rivals during 2020 and 2021 accelerated the company’s journey toward profitability. It nudged in and out of positive monthly accounts last year.

Another key move was the decision not to offer a current account after witnessing rivals attract large numbers of customers who then only maintained balances averaging around £500. Even with the potential to cross-sell other products to current account holders, Zopa deemed the economics did not stack up. Its decision was validated when its CEO reported the bank enjoyed strong repeat behaviour with

Meanwhile, the bank is doubling down on efforts to create more of those financially responsible customers it cherishes. It launched the 2025 Fintech Pledge alongside credit rating agency ClearScore in September, which aims to drive 10 million actions by 2025 that build the financial resilience of consumers. Thirty-four financial institutions have since joined to help people take action to boost their savings, improve credit scores, consolidate debt and lower their bills.

It also recently announced a partnership with The Money Charity to create an online course and a series of financial education workshops to reach consumers who may need it most, and these will launch in the coming months.”

Running until December 2025, Zopa Bank and ClearScore will fund the first year of The Money Charity’s work, which will include a free online course, plus more targeted personal finance help for community groups and individuals.

By then, the UK’s Consumer Duty law, which demands financial services providers ‘act to deliver good outcomes for retail customers’ as well as, potentially, a legislative framework for BNPL, will be in place. Ferrero welcomes both of those.

“Regulation will undoubtedly help the BNPL space,” she says, “by providing necessary safeguards for customers and creating a level playing field for responsible companies to grow.”

22 NEOBANKS: BNPL TheFintechMagazine | Issue 28 ffnews.com

Seen as a reliable commodity for millennia, many increasingly believe gold has untapped potential in the modern payments sector. Jason Cozens, the founder of the UK-based gold-backed savings and payment app Glint, even goes as far as to say it’s right up there with Bitcoin as a genuine ‘alternative to banking, payments, and money itself’.

”Bitcoin is a friend of Glint,” he declares. “We are both dealing with the same problems in the monetary system. Personally, I think people should have some Bitcoin and some gold."

An oversubscribed first crowdfunding campaign that reached £3.1million in November 2022 and a 100 per cent increase in registered Glint users last year to 190,000 – leading to double the amount of gold (two tonnes, or $110-120million-worth at the time) that it had stored in a Brink’s vault in Switzerland – suggests that many are already keen to get their hands on it.

The self-styled ‘goldfi’ (as opposed to altfi) challenger has come a long way since we

last spoke with Cozens, soon after the app’s launch, in 2020. At the time, pandemic-panicked investors were fuelling a gold rush, the flight to bullion-backed assets a typical response to economic uncertainty. From a £1,517.61/ounce high in August of that year, gold has continued a staggered rise – as it has done for a few thousand years. Neither Bitcoin nor gold, of course, is immune to price swings. But, as Cozens points out, they are at least immune from the whim of government monetary policy. An ounce of gold would have bought a Roman senator a very nice toga; an ounce today would get you’re average MP a long way on Savile Row.

Bitcoin, meanwhile, since its launch in 2010 has more than held its value, despite the well-publicised highs and lows. If you'd bought $1,000 of Bitcoin in 2010 and done nothing with it, it would be worth more than $350million today.

Compared to the fiat currencies whose value evaporates in our pockets as a result of inflation, gold holds up pretty well. Its value has grown by more than 500 per cent

over the last 50 years, while the dollar and the pound have lost 85 per cent of theirs.

Bitcoin hasn’t yet lived up to its promise to be a democratising influence on finance, though: it’s been estimated that 95 per cent of its value is in the hands of just two per cent of investors. Gold's ownership, on the other hand, is much better distributed. Even central banks only own 17 per cent of it.

Glint wants to extend that ownership even further, to ’100s of millions of customers worldwide’ (and, just as an aside, the platform doesn't need the energy requirements of a large country to make that happen, as crypto mining does).

However, like crypto, it must use the very financial system it seeks to disrupt to reach the mainstream as a payment utility. As one Bloomberg article put it: “Many digital-asset companies need traditional finance firms to help provide customers with a reliable on-and-off ramp between their platforms and the world of hard currency.” Goldfi is no different in that regard.

Glint is a market leader in this niche, providing a payment app and a Mastercard

24 NEOBANKS: NEW MONEY

TheFintechMagazine | Issue 28 ffnews.com

We ask Jason Cozens, CEO of Glint, what’s next for gold-backed challengers?

to customers who can use their gold deposits to make payments anywhere in the world. They can invest in as little as a gram in a gold bar that’s co-owned with other Glint users, or amass their own private horde of reserved gold. The app allows them to transact in USD, Euro or GB pounds at will, so they can choose fiat currencies or gold at any given moment, whichever is the most advantageous at the time and so long as they hold sufficient in their account.

If achieving Glint’s vision means leveraging mechanisms inside the existing banking system, Cozens is happy to play by its rules. He welcomes, for instance, the introduction of the ISO 20022 standard across the payments industry. “The ability to be able to share rich information, through the standard, between different financial institutions is going to allow us to do better KYC and combat money laundering,” he says.

Cozens continues: “Our back-end is gradually becoming a platform with APIs. We’re already talking to some very big financial institutions about integrating our product with theirs, so they can offer the Glint experience to their customers, and

BULLY FOR BULLION!

I’d like to think that could expand around the world.” Ultimately, Cozens says, Glint wants to ‘build a global gold-based financial services ecosystem, making gold payments across the planet’.

It recently added a new portal for wealth managers and its crowd investor pitch last year indicated plans to add subscription tiers, business accounts and additional currencies. Cozens teases a further

have’, says Cozens, whereas ‘goldfi’ is a true disruptor, but with a pedigree almost as old as civilisation itself – so even traditional investors see merit in it.

Well before the crowdfund, Glint had brought in $38million through a slate of institutional and accredited investors, including Sibanye-Stillwater’s BioCube Innovation Fund, Sprott Asset Management, the Tokyo Commodity Exchange, and Craig Dewar, the co-founder of GPS that powers neo banks like Revolut and Starling.

While they might not all share Cozens’ view that gold is ‘the future of money’ they clearly believe it has a big part to play in it.

development, too; an invite-only ‘X Account’, that comes with its own card. Meanwhile, the app has had a Version 3 upgrade, which went live in April.

DEMOCRATISING MONEY

Clearly, something is piquing interest in products like Glint, beyond the wider hype in investment apps. Perhaps it’s because a lot of fintech is about making ‘iterative improvements to [products] we already

An architect by training, Cozens was motivated to found Glint because he was tired of seeing people without significant wealth or assets forced to rely on financial systems that disadvantaged them.

“Some countries have incompetent central banks, where inflation is over 80 per cent. Even in developed countries now, base inflation is at around 10-12 per cent,” he says. “People need something more reliable. And there’s nothing more proven than gold. With Glint’s technology, it is a viable alternative that can make a difference in their lives.”

THREEGOLDFIPROSPECTORS

The UK-based fintech app allows you to buy, sell and transfer gold and other precious metals seamlessly. The attribution of real physical gold to the customer is a key part of its USP but whilst its gold comes from a London Bullion Market Association (LBMA) approved delivery partner, the specific details are unknown.

Each user’s dashboard shows the value of their investment, provides controls over regular savings plans and the sign-up process is seamless. It also has an API service, allowing other businesses to integrate gold and precious metal trading features, called Minted Connect.

Founded in 2018 and regulated by the UK’s Financial Conduct Authority, Minted saw success in the wake of the pandemic and the soaring price of gold.

The company is driven by Islamic ideals, although it is not primarily targeted at Muslims. Gold as an asset-backed

investment is more compliant with Islamic Sharia banking, so it fits the ethics of the founder whilst serving a wider market.

inventory, but instead routes clients’ orders to a selection of international vaults in the gold market. This, it says, saves money on trades, avoids price manipulation and improves transparency over charges.

Championing gold as the ultimate store of wealth and value, Goldex was also founded in 2018, raising more than £1million in initial funding. Founder and CEO, Sylvia Carrasco has previously spoken of the necessity of partnering with business clients and institutions to further their own business success.

Aimed at retail investors as well as businesses, its marketplace is accessible 24/7 and it also has a ‘vault’ of informative expert-driven content in its Goldex Academy. It allows other businesses to integrate its marketplace in other products, too.

Unlike Glint, it does not hold any gold

Another female-led, gold-backed fintech, Rush Gold is an Australian-based company co-founded by Jodi Stanton. Its services are available in more than 13 countries. Users can pay with gold as well as save, transfer, and send it to others. In 2020, it saw monthly transaction volumes increase by more than 1,000 per cent.

Rush Gold has also formally signed the LBMA’s new Global Precious Metals Code of Conduct. And its gold is stored in a Sydney vault, managed by Brink’s Australia. Like Glint, it is insured by Lloyd’s of London.

25

ffnews.com Issue 28 | TheFintechMagazine

People need something more reliable. And there’s nothing more proven than gold

Parents don’t teach kids about money... apps do!

study showed that financial education for kids can boost their earning prospects as young adults by 28 per cent.

available, based on the user’s age group and parents’ choice.

As a child, money had no real tangible meaning for me. This consequently meant I had a bit of a tumultuous relationship with finance as a young adult.

The aggressive children’s advertising of the 1990s drew me into ads for toys like Stretch Armstrong, Mr Frosty or ProYo Yo-Yo’s, and, as if by magic, my parents would eventually acquire one for me. Which is all well and good, but I didn’t have any concept of how or where these came.

It would be unfair to pin the entirety of this lack of financial preparation on parents; our education system seems largely to abscond from preparing children for ‘real life’. I spent my school years learning about Pythagoras theorem, photosynthesis and the Russian Revolution of 1917.

Instead, I wish I’d learned financial management, how to submit a tax return and save to buy a house, because funnily enough, my extensive knowledge about the Russian revolutionary Vladimir Ilyich Ulyanov, has been little used since I left high school in 2005.

According to Santander, I’m not alone. Still today, only 38 per cent of children and young people in the UK say they’ve had some financial education at school, although it’s been a compulsory part of their secondary curriculum since 2014 – although life-long solid financial habits start to be formed much earlier than that.

As a young adult, I often lived to the bottom of my bank account, emptying it before the end of the month. I can’t help but feel that had I had the correct teaching and tools available as a child, then it might have provided a stepping stone to earlier financial successes in life. Indeed, one

During the time that I was becoming more financially independent, there was a rapid change in financial technology. In the space of around five years, people went from managing their entire accounts on a little book of transactions that the teller would stamp every time you visited the building society, to logging onto a website to manage your fortune (or lack of) from the palm of your hand.