Report Overview:

Digital platforms and technologies that enable electronic transactions and money transfers without the use of physical cash or traditional banking methods.

The global Virtual Payment Systems market is experiencing rapid growth, driven by increasing e-commerce adoption, the shift towards cashless societies, and advancements in mobile payment technologies. Key players include PayPal, Stripe, and Square. In 2024, mobile wallet transactions accounted for 45% of the market value, with cryptocurrency payments growing at 22.5% annually. The industry is seeing significant innovation in biometric authentication methods, reducing payment fraud by up to 60% compared to traditional methods. There's rising demand for instant crossborder payment solutions, now offered by 80% of major virtual payment providers.

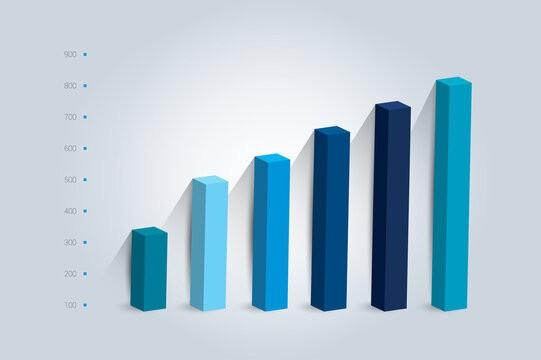

Market Value:

The global Virtual Payment Systems market size was valued at US$ 2.34 trillion in 2024 and is projected to reach US$ 5.18 trillion by 2030, at a CAGR of 14.2% during the forecast period 2024-2030. CAGR of 14.2% (2024-2030)