Global Composites in Oil and Gas Market is experiencing robust expansion, with its valuation reaching USD 1.61 billion in 2025 and projected to grow at a CAGR of 3.5%, approaching USD 2.05 billion by 2032. This momentum stems from the oil and gas industry's accelerating adoption of advanced composite materials to enhance infrastructure durability while addressing operational challenges in harsh environments.

The market growth is driven by increasing offshore exploration activities and the need for corrosionresistant infrastructure, with North America currently leading adoption due to its mature oilfield services sector. However, high material costs and complex manufacturing processes remain challenges.

Tanks and Vessels

Others

The increasing exploration and production oilfields are driving substantial demand for composite materials. With over 40% of glob coming from offshore fields, operators are pipelines, risers, and subsea equipment due corrosion resistance and lightweight proper

The integration of sensor technology and IoT capabilities into composite materials presents significant opportunities for market expansion. Smart composites with embedded sensors can provide real-time monitoring of structural integrity, stress factors, and potential failure points across oil and gas infrastructure. This capability becomes increasingly valuable as operators invest in predictive maintenance strategies to minimize downtime. Research indicates that such smart composite solutions could reduce unplanned outages by up to 30% while extending asset lifecycles by 15-20%.

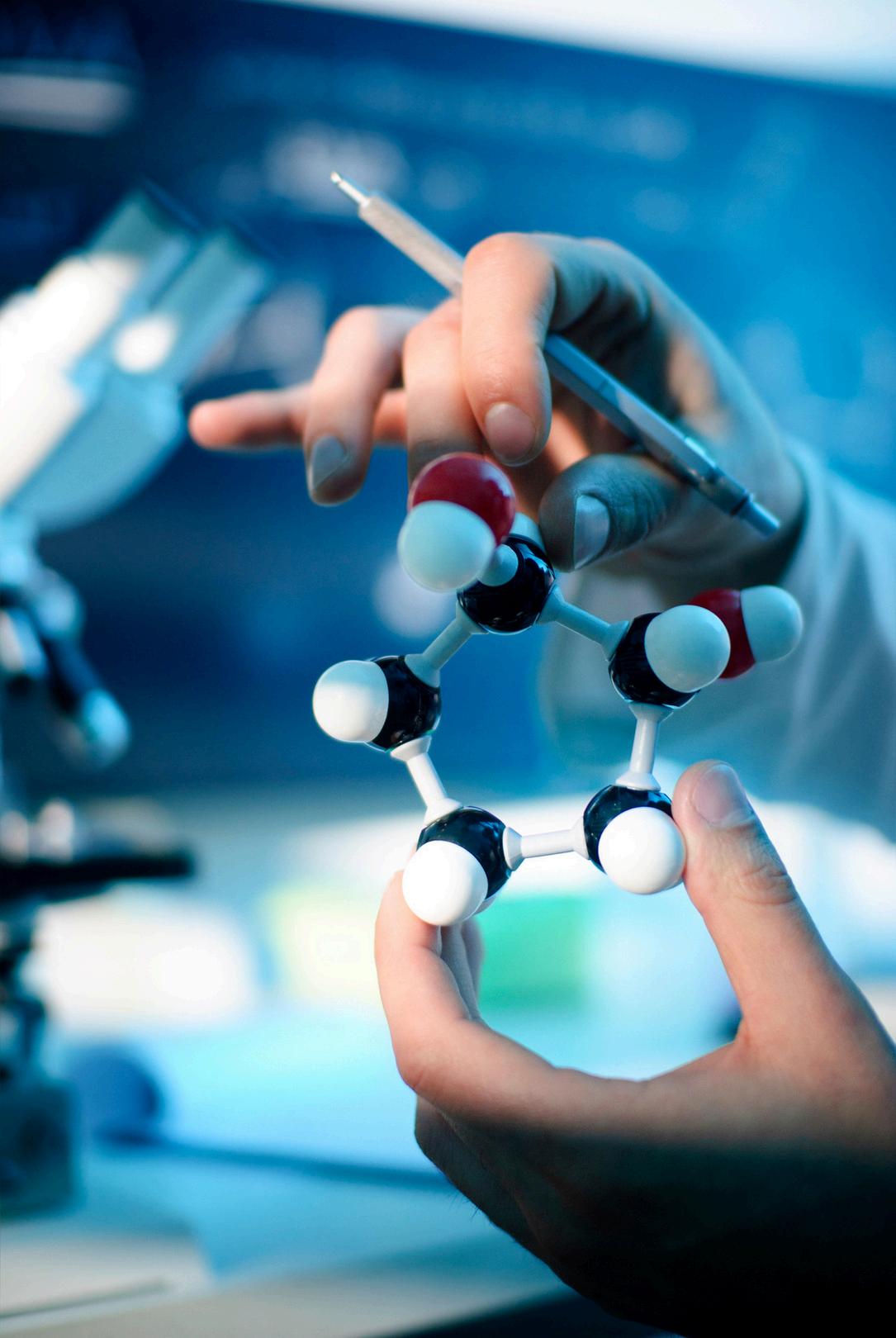

The oil and gas industry is increasingly adopting highperformance composite materials to replace traditional steel components in harsh operating environments. Composites like carbon fiberreinforced polymers (CFRP) and glass fiber-reinforced polymers (GFRP) offer superior corrosion resistance, reducing maintenance costs by up to 40% compared to metal alternatives. Recent innovations in thermoplastic composites are particularly gaining traction in offshore applications where chemical resistance and buoyancy properties are critical.

North America dominates the composites market in oil & gas, accounting for over 38% of global revenue share due to extensive offshore drilling activities and shale gas exploration. The U.S. leads adoption, driven by stringent safety regulations from agencies like API (American Petroleum Institute) and the need for corrosion-resistant materials in harsh environments. Composite pipes, tanks, and gratings are increasingly replacing steel in projects like the Permian Basin expansion.

Europe’s market grows steadily, focusing on sustainable and lightweight solutions for aging offshore platforms in the North Sea. EU directives pushing for reduced carbon footprints (e.g., Green Deal) accelerate the shift from metals to fiberglass-reinforced epoxy composites in pipelines and pressure vessels. Norway and the UK are key markets, with companies like Magma Global pioneering thermoplastic composite pipes for subsea applications.

Airborne Oil & Gas (Netherlands)

Enduro Composites (U.S.)

Baker Hughes (formerly GE Oil & Gas) (U.S.)

Halliburton (U.S.)

Magma Global (U.K.)

National Oilwell Varco (U.S.)

Schlumberger Limited (U.S.)

Strongwell Corporation (U.S.)

These companies represent some of the major key players driving innovation and growth in the market, contributing significantly to global supply and competitive dynamics.

Founded in 2015, 24chemicalresearch is a trusted name in global chemical industry intelligence. We specialize in delivering high-quality market research reports, empowering over 30+ Fortune 500 clients with data-driven insights for strategic growth. Our team of experienced analysts delivers customized, reliable, and timely research backed by a rigorous methodology. From mining regulatory trends to forecasting market opportunities, our reports help companies navigate industry challenges, stay competitive, and grow confidently.

As a one-stop platform for the chemical sector, we offer:

Deep specialization in chemical market analysis

Customized reports tailored to your needs

A robust portal with free samples, consulting, and competitive insights