THE DISTILLERY

ALLEN BEL L C ONTRACTING

JORDAN DICKMAN

First Vice President Investments

Cincinnati Office

D. 513.878.7735

NICK

First Vice President Investments

Cincinnati Office

D. 513.878.7741

nicholas.andrews@marcusmillichap.com

jordan.dickman@marcusmillichap.com AUSTIN SUM

Senior Associate

Cincinnati Office

D. 513.878.7747

austin.sum@marcusmillichap.com

JORDAN DICKMAN

FIRST VICE PRESIDENTS DIRECTOR, NMHG

NICK ANDREWS

FIRST VICE PRESIDENTS DIRECTOR, NMHG

AUSTIN SUM

SENIOR INVESTMENT ASSOCIATE

BRIAN JOHNSTON

INVESTMENT ASSOCIATE

AUSTIN HALL

INVESTMENT ASSOCIATE

ALDEN SIMMS

INVESTMENT ASSOCIATE

SAM PETROSINO

VALUATION & RESEARCH

SKYLER WILSON

CLIENT RELATIONS MANAGER

LIZ POPP

MIDWEST OPERATIONS MANAGER

JOSH CARUANA

VICE PRESIDENT

REGIONAL MANAGER

INDIANAPOLIS | CINCINNATI | LOUISVILLE |

ST LOUIS | KANSAS CITY

JOHN SEBREE

SENIOR VICE PRESIDENT

NATIONAL DIRECTOR

NATIONAL MULTI HOUSING GROUP

MICHAEL GLASS

SENIOR VICE PRESIDENT

MIDWEST DIVISION MANAGER

NATIONAL DIRECTOR, MANUFACTURED

HOME COMMUNITIES GROUP

BRITTANY CAMPBELL-KOCH

DIRECTOR OF OPERATIONS

ALEX PAPA

MARKETING COORDINATOR

AB Contracting, Inc. is Ohio’s premier multi-family developer. We are your source for residential, commercial, and industrial structures. We have been building custom homes and businesses throughout West Virginia and Ohio for over 30 years. Our experience is evident in each job we undertake. The AB Contracting Team brings their knowledge and skill to each job. We strive to provide each customer with a quality product and exceptional customer service.

THE LANDING BRIDGEPORT, WV PAGE 13

900 ON LEE CHARLESTON, WV PAGE 8

HIGHLAND PARK TRIADELPHIA, WV PAGE 9

SUGAR MAPLE RIDGE MORGANTOWN, WV PAGE 11

UNION SQUARE MARYSVILLE, OH PAGE 10

THE BEND AT MEADOW VALLEY HURRICANE, WV PAGE 12

THE LANDING BRIDGEPORT, WV PAGE 13

900 ON LEE CHARLESTON, WV PAGE 8

HIGHLAND PARK TRIADELPHIA, WV PAGE 9

SUGAR MAPLE RIDGE MORGANTOWN, WV PAGE 11

UNION SQUARE MARYSVILLE, OH PAGE 10

THE BEND AT MEADOW VALLEY HURRICANE, WV PAGE 12

2022 | YEAR BUILT CHARLESTON | WEST VIRIGNIA

900 on Lee is located in Charleston, West Virgina. 900 on Lee unveils an exceptional portrait of living with 1- and 2-bedroom apartment units for rent. This unique fusion of style and sophistication, makes the apartment residences reflect contemporary flair. When residences live at 900 on Lee, their address says it all.

65 | UNITS

2022 | YEAR BUILT CHARLESTON | WEST VIRIGNIA

Overlooking West Virginia’s beautiful and majestic mountains, Highland Park offers one and two bedroom luxury apartments for rent as well as three bedroom townhomes for rent. It is conveniently located near shopping and dining off of exit 10 in the Triadelphia – Wheeling West Virginia area. Whether you’re an outdoor enthusiast, busy professional or empty nester, Highland Park has something to fit your lifestyle! Highland Park features a clubhouse equipped with a 24-hour fitness center and a community room, an outdoor pool for those hot summer days, children’s playground area with grill stations, and a half basketball court with Versa Court technology.

AMENITIES

CLUBHOUSE

COMMUNITY ROOM

PLAYGROUND

FIRE PIT AREA

HALF BASKETBALL COURT

FITNESS CENTER

SWIMMING POOL

GRILLING STATIONS

WALKING TRAILS

Union Square is the newest luxury community located in Marysville, Ohio. Offering 1-, 2- and 3-bedroom floor plans. At Union Square, apartments are designed to meet your lifestyle needs. It offers exceptional amenities including a clubhouse that features a fitness room, movie theater, lounge area, and an outdoor swimming pool with a splash pad. It is one of the few pet-friendly communities in the area that not only cater to residents, but to their pets as well. If it is swimming, working out, playing a game of pickle ball, having coffee, or enjoying a community event, you can do it here.

Sugar Maple Ridge offers multiple floorplan to suit a variety of styles and needs. Detached homes, one level living, patio homes and townhomes! Quality finishes, granite counters, and stainless steel appliances come standard in every home.

AMENITIES

FITNESS CENTER

YOGA & BOXING STUDIO

HEATED SALTWATER POOL

PLAYGROUND

FIRE PIT

GAZEBO

CLUBHOUSE

BASKETBALL COURT

WALKING TRAILS

Rustic and Chic, This Patio and Townhome Community has open floor plan options, select customizations and main level owners suites.

55 STEVE CIRCLE HURRICANE, WEST VIRGINIA

Offering 1- and 2-bedroom floor plans. At The Landing its brought all to you with apartments designed to meet your lifestyle needs. The Landing offers exceptional amenities including a clubhouse that features a fitness room, pickle ball court, lounge area, and an outdoor swimming pool. It is one of the few pet-friendly communities in the area that not only cater to their residents, but to residences pets as well. If it is swimming, working out, playing a game of pickle ball, having coffee, or enjoying a community event, you can do it here.

AMENITIES

CLUBHOUSE

FIRE PIT

PLAYGROUND

FITNESS CENTER

POOL

CONFERENCE ROOM

LOUNGE

MAIL ROOM

Units 138

Occ at Sale 96%

Sale Price $30.2M

Price per Unit $218,841

Sale Date Oct 11th, 2021

UNITS 236 SOLD 2021 BUILT 2020

The Distillery is the newest luxury community located in Ashville, Ohio. Offering 1, 2 & 3 bedroom floor plans. At The Distillery, they bring it all to you with apartments designed to meet your lifestyle needs. The Distillery offers exceptional amenities including a clubhouse that features a fitness room, movie theater, lounge area, and an outdoor swimming pool with a splash pad. They are one of the few pet-friendly communities in the area that not only caters to their residents, but also to their pets as well. If it is swimmming, working out, playing a game of pickle ball, having coffee, or enjoying community events, you can do it here.

• 24 Hour Fitness Center

• Movie Theater

• Community Lounge

• Swimming Pool

• Splash Pad

• Dog Park

• Pickle Ball Court

• Half Basketball Court

• Fire Pit

• Grilling Stations

• Mailroom

• Rented Garage Space

Located just 20 minutes south of Downtown Columbus, Hutchison Place offers one, two, and three bedroom luxury apartments for rent. Whether you’re an outdoor enthusiast,

If a beautiful country atmosphere is your ideal location to call home, then The Lakes at Ashton Village was designed just for you! They have taken outstanding amenities, spacious

The property is walking distance to the library, the post office, dining and grocery shopping. It is also convenient to State Route 23. Residents attend Teays Valley Schools which re

Understanding real estate comparables and the state of the market in your local area is essential. It can help you make an informed decision about buying or selling a property.

UNIT

UTILITIES

4,772 POPULATION CHANGE (1 YEAR GROWTH)

+1.62% HOMEOWNERSHIP RATE 65.9%

DUPONT: chemical company, makes adhesives, printing solutions, construction materials, consumer products, electronics and industrial materials, fabrics, fibers, and nonwovens, healthcare solutions, and industrial films.

• 23,000 total employees, around 104 plants

PPG: short for Pittsburgh Plate Glass Company. Manufacture paint, stain, auto coatings.

• Roughly 60 employees

ALERIS: aluminum rolled products

• Roughly 1500 employees

INTEL: manufacture computer chips

• 3000 employees

AMAZON: distribution centers

• as of 2020, 2500 jobs in Etna Township (40 minutes north)

FACEBOOK:

• Will employ 1800 Contruction workers

• 300 jobs

GOOGLE:

• To employ 1000 construction workers

• Around 20 full-time workers once the plants are complete

THE DISTILLERY TO COLUMBUS

THE DISTILLERY TO GOODYEAR

26 MINS 20 MINS 15 MINS

THE DISTILLERY TO SCIOTO DOWNS

Intel said the name pays homage to Ohio’s “long and storied history in manufacturing and its track record of producing firsts, from the Wright brothers, who grew up in Ohio and first envisioned their historic planes here, to John Glenn, the first man ever in orbit, and Neil Armstrong, the first man on the moon.”

$20 BILLION COST

1,000 ACRES SIZE

“And now, Ohioans can add another first to the great state’s list –— ‘Ohio One’ — Intel’s first advanced semiconductor campus in the Midwest,” Intel Ohio General Manager Jim Evers said in a letter posted the Intel website. “Ohio One represents a nod to the past and a look to the future of technology innovation for the Midwest and America.”

3,000 EMPLOYMENT $135,000 AVG SALARY

The Columbus-based retailer was approved on Monday for a. 1.421%, eight-year Jobs Creation Tax Credit by the Ohio Tax Credit Authority for the project.

The estimated value of that credit is $1.8 million if the company hits its employment targets, according to information from the Ohio Development Services Agency.

The new facility will go up in Commercial Point. Bath & Body Works is expected to create 500 full-time positions there with $18.3 millio n in estimated new payroll and retain 3,655 jobs with an estimated $135 million in retained payroll at existing facilities in New Albany, Columbus and Reynoldsburg.

The operation will service Bath & Body Works’ rapidly growing online and direct sales business. Though always an option for consumers, online sales exploded for the brand during the Covid-19 pandemic as customers were unable or unwilling to go to physical stores.

Facebook is expanding its data center operations in New Albany — again.

Facebook parent Meta said Thursday that the company is adding two more buildings totaling about 1 million square feet to the site. The addition will boost Meta’s investment in New Albany by $500 million to $1.5 billion.

The expansion is needed to house the servers to handle the billions of users who post photos and videos on Facebook, Instagram, Messenger and WhatsApp.

Meta’s initial $750 million investment in New Albany was announced in 2017. When the first two buildings were up and running, Meta then announced an expansion in 2020. Meta said one of the new buildings will be completed in 2026; the second in 2028.

With the expansion, the number of construction workers on site will go from 1,200 to 1,800, and when the new buildings are finished the campus will have 300 workers , up from 200 currently.

Meta has 740 acres on the east side of Beech Road north of Morse Road in New Albany International Business Park.

Google is expanding its data center footprint around Columbus, Ohio.

The search and cloud company this week announced plans to build two more data centers in Columbus and Lancaster. The company has one facility operational in the New Albany area of Columbus. The two new locations will bring Google’s total investment in Ohio to more than $2 billion . Google broke ground on its $600 million data center campus in New Albany in 2019 and subsequently announced plans to invest an additional $1 billion to expand the site. The company’s Columbus cloud region launched in May 2022. The company is also planning another campus in Columbus on the site of a former snake oil farm and has bought land in Lancaster.

The $19 million project will completely rebuild the Hudson roadway. City leaders said they want to create better and safer access to jobs, education, transit, and other services in the community.

“The final plans set the vision for long transformation of one of our city’s oldest, proudest, and greatest neighborhoods,” Mayor Andrew Ginther said at the groundbreaking Tuesday. “Our shared vision is becoming a reality. Step by step. Block by block.”Council member Nick Bankston said the project will serve as a gateway to Linden and bring together neighborhoods.

CLOSE DEC (2023)

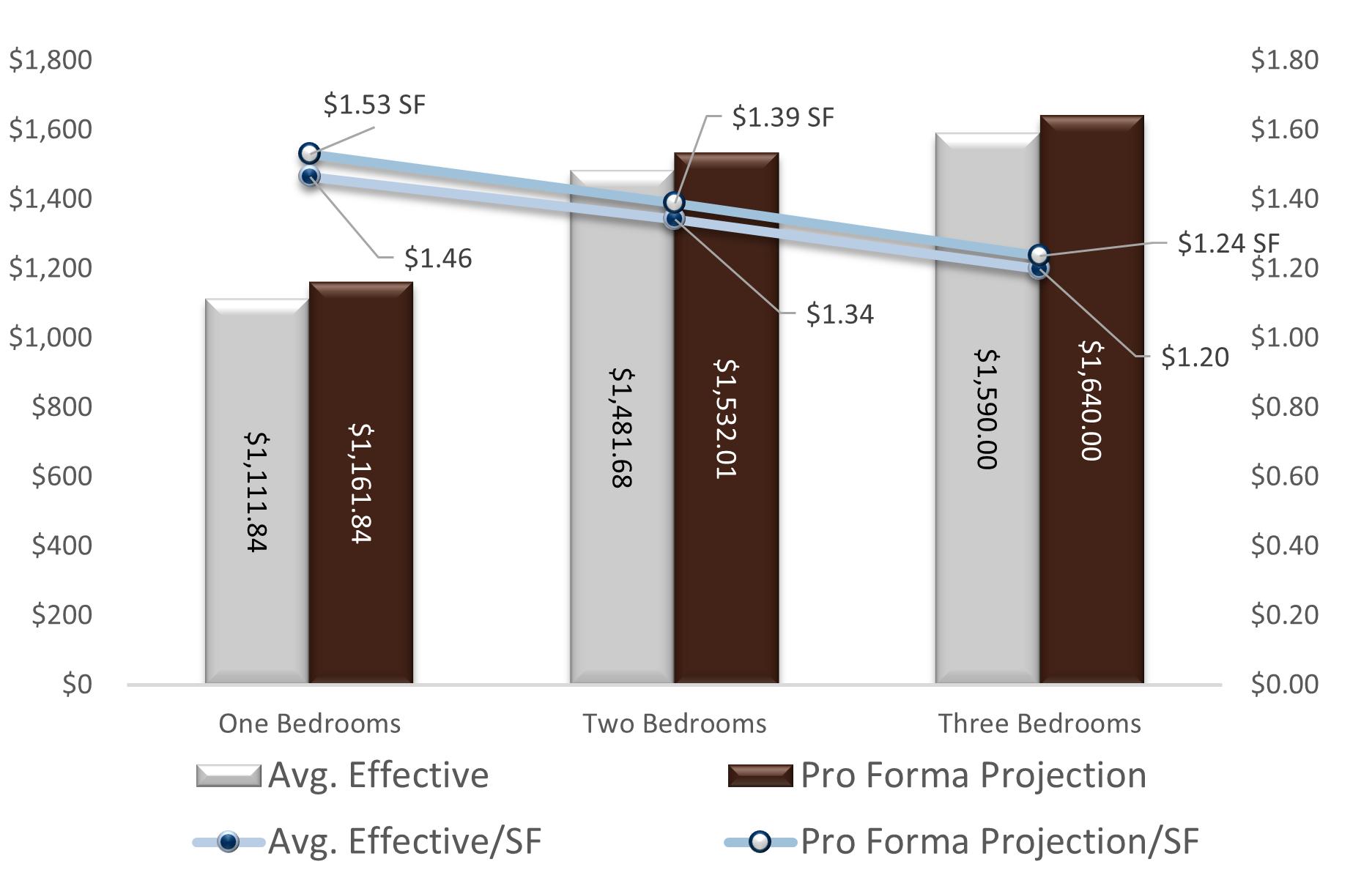

BASED ON PROJECTION ON INCOME AND EXPENSES AND AN EXTIMATED TAX VALUE OF THE PROPERTY FROM THE PRIOR YEAR 2022

YEAR 1 (2024)

BASED ON PROJECTION ON INCOME AND EXPENSES AND AN EXTIMATED TAX VALUE OF THE PROPERTY FROM THE PRIOR YEAR 2023

YEAR 2 (2025)

BASED ON PROJECTION ON INCOME AND EXPENSES AND AN EXTIMATED TAX VALUE OF THE PROPERTY FROM THE PRIOR YEAR 2024

YEAR 3 (2026)

BASED ON PROJECTION ON INCOME AND EXPENSES AND AN EXTIMATED TAX VALUE OF THE PROPERTY FROM THE PRIOR YEAR 2025

*Calculated as a percentage of Gross Potential Rent | **Calculated as a percentage of Effective Gross Income