UNIT MIX BREAKDOWN

ONE BEDROOM

1BR/1BA - Riverstone

Units

1BR/1BA - Riverstone 18 Units

1BR/1BA - Riverstone 20 Units

Totals / Wtd. Averages 56 Units

TWO BEDROOM

MARKET

SF

SF $12,918 $750.00 $1.30 SF $13,500 $925.00 $1.61 SF $16,650

SF $13,834 $775.00 $1.17 SF $13,950 $965.00 $1.46 SF $17,370

$1.08 SF $14,765 $745.00 $1.09 SF $14,900 $985.00 $1.44 SF $19,700

$1.16 SF $41,517 $756.25 $1.18 SF $42,350 $959.29 $1.50 SF $53,720

2BR/1BA - Riverstone 23 Units 850 SF 19,550 SF $818.15 $0.96 SF $18,817 $850.00 $1.00 SF $19,550 $1,150.00 $1.35 SF $26,450

2BR/1BA - Riverstone 8 Units 980 SF 7,840 SF $1,000.71 $1.02 SF $8,006 $1,030.00 $1.05 SF $8,240 $1,175.00 $1.20 SF $9,400

2BR/1BA - Immaculate Townhomes 12 Units 1,000 SF 12,000 SF $1,084.00 $1.08 SF $13,008 $1,100.00 $1.10 SF $13,200 $1,225.00 $1.23 SF $14,700

2BR/1BA - Mears Place 20 Units 850 SF 17,000 SF $771.15 $0.91 SF $15,423 $800.00 $0.94 SF $16,000 $989.00 $1.16 SF $19,780

Totals / Wtd. Averages 63 Units 895 SF 56,390 SF $877.05 $0.98 SF $55,254 $904.60 $1.01 SF $56,990 $1,116.35 $1.25 SF $70,330

THREE BEDROOM

3BR/1BA - Immaculate Townhomes 4 Units 1,400 SF

3BR/1BA - Mears Place 2 Units

Totals / Wtd. Averages 6 Units

SF

SF $1,362.50 $0.97 SF $5,450 $1,400.00 $1.00 SF $5,600 $1,400.00 $1.00 SF $5,600

SF

$0.95 SF $1,900 $950.00 $0.95 SF $1,900 $1,300.00 $1.30 SF $2,600

SF $7,350 $1,250.00 $0.99 SF $7,500 $1,366.67 $1.08 SF $8,200

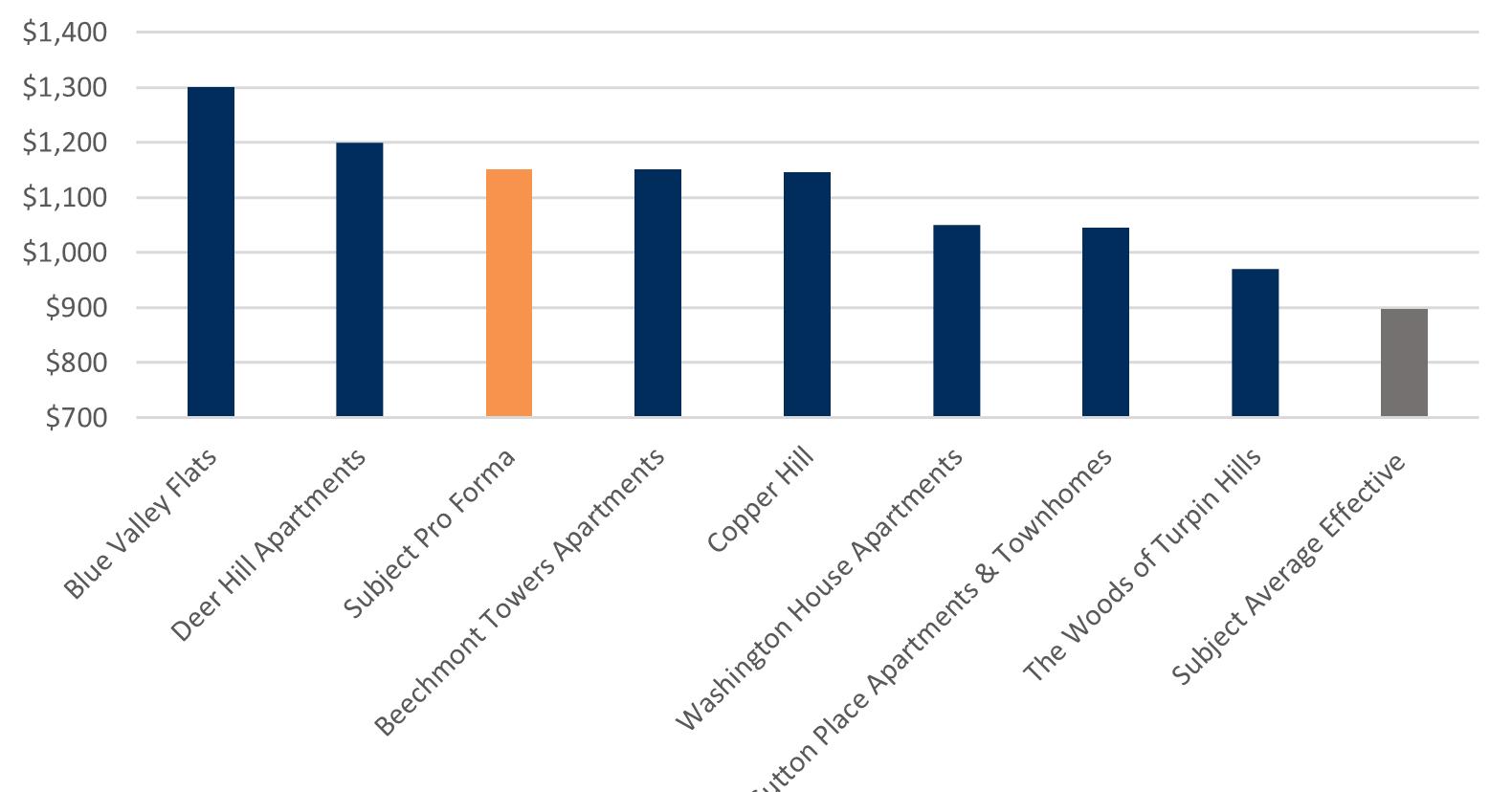

AVERAGE EFFECTIVE

PROJECTED UNIT TYPE NO. OF UNITS RENTABLE SF TOTAL SF RENT/UNIT RENT/SF TOTAL RENT POTENTIAL RENT/UNIT RENT/SF TOTAL RENT POTENTIAL RENT/UNIT RENT/SF TOTAL RENT POTENTIAL

18

575 SF 10,350 SF $717.69 $1.25

660 SF 11,880 SF $768.53 $1.16

685 SF 13,700 SF $738.27

642

35,930 SF $741.38

5,600

1,000

2,000

$950.00

1,267 SF 7,600 SF $1,225.00 $0.97

BEECHMONT - FINANCIALS ADG35 MULTIFAMILY

GROSS POTENTIAL RENT

All Units at Market Rent $1,265,760 T3 10,126 $1,587,000 12,696 Gain (Loss) to Lease ($23,389) T3 1.85% (187) ($95,220) 6.00% (762)

GROSS SCHEDULED RENT $1,242,371 9,939 $1,491,780 11,934

OTHER INCOME

Water Reimbursement $49,491 T3 3.98% 396 $50,976 3.42% 408 Pet Fees $15,716 T3 1.26% 126 $16,187 1.09% 129 MTM Fees $12,800 T3 1.03% 102 $13,184 0.88% 105 Late Rent Fees $9,800 T3 0.79% 78 $10,094 0.68% 81 Waste Disposal Reimbursement $7,947 T3 0.64% 64 $8,185 0.55% 65 Laundry Income $7,130 T3 0.57% 57 $7,344 0.49% 59 Utility Read Income $3,702 T3 0.30% 30 $3,813 0.26% 31 Collections $3,107 T3 0.25% 25 $3,200 0.21% 26 Collections- Eviction Filing Fees $2,080 T3 0.17% 17 $2,142 0.14% 17 Admin Fees $2,000 T3 0.16% 16 $2,060 0.14% 16 Application Fees $1,080 T3 0.09% 9 $1,112 0.07% 9

Waiver Fees $360 T3 0.03% 3 $371 0.02% 3

Total Other Income $115,424 9.29% 923 $118,886 7.97% 951

GROSS POTENTIAL INCOME $1,357,795 10,862 $1,610,666 12,885 Physical Vacancy ($51,322) T3 4.13% (411) ($74,589) 5.00% (597) Bad Debt ($38,014) T3 3.06% (304) ($7,459) 0.50% (60) Concessions Allowance ($400) T3 0.03% (3) ($7,459) 0.50% (60)

EFFECTIVE GROSS INCOME $1,268,059 90.93% 10,144 $1,521,159 88.00% 12,169

NON-CONTROLLABLE

Real Estate Taxes % of EGI Per Unit % of EGI Per Unit 2020 Taxes Paid $113,813 Auditor 8.98% 911 $113,813 7.48% 911 Adjustment for Sale $180,000 14.19% 1,440 $180,000 11.83% 1,440

Total Real Estate Taxes $293,813 23.17% 2,351 $293,813 19.32% 2,351 Insurance $21,361 T12 1.68% 171 $37,500 2.47% 300

Utilities

Gas & Electric $58,150 T12 4.59% 465 $59,313 3.90% 475 Gas & Electric Vacant $1,687 T12 0.13% 13 $1,721 0.11% 14 Water & Sewage $67,638 T12 5.33% 541 $68,991 4.54% 552 Trash Removal $13,943 T12 1.10% 112 $14,222 0.93% 114 Meter Reading Fee $3,431 T12 0.27% 27 $3,500 0.23% 28

Total Utilities $144,849 11.42% 1,159 $147,746 9.71% 1,182

Total Non-Controllable $460,023 36.28% 3,680 $479,059 31.49% 3,832

CONTROLLABLE

Contract Services

Snow Removal $6,638 T12 0.52% 53 $3,125 0.21% 25 Landscaping/Grounds $36,968 T12 2.92% 296 $18,750 1.23% 150 Pest Control $3,024 T12 0.24% 24 $4,375 0.29% 35

Total Contract Services $46,630 3.68% 373 $26,250 1.73% 210

Repairs & Maintenance $61,230 T12 4.83% 490 $62,500 4.11% 500

Marketing & Promotion $9,994 T12 0.79% 80 $9,375 0.62% 75

On-Site Payroll $164,813 T12 13.00% 1,319 $125,000 8.22% 1,000

Payroll Taxes & Benefits $18,187 T12 1.43% 145 $18,750 1.23% 150

General & Administrative $37,374 T12 2.95% 299 $12,500 0.82% 100

Management Fee $49,202 T12 3.88% 394 $60,846 4.00% 487

Telephone & Internet $2,382 T12 0.19% 19 $2,500 0.16% 20

Replacement & Reserves $31,875 Note 1 2.51% 255 $32,513 2.14% 260

Total Controllable $421,687 33.25% 3,373 $350,234 23.02% 2,802

TOTAL EXPENSES $881,710 69.53% 7,054 $829,293 54.52% 6,634

NET OPERATING INCOME $386,349 30.47% 3,091 $691,867 45.48% 5,535

CURRENT YEAR 1

INCOME & EXPENSES BEECHMONTFINANCIALS INCOME EXPENSE

$1,634,610 13,077 $1,683,648 13,469 ($32,692) 2.00% (262) ($33,673) 2.00% (269) $1,601,918 12,815 $1,649,975 13,200 $52,505 3.28% 420 $54,080 3.28% 433 $16,673 1.04% 133 $17,173 1.04% 137 $13,580 0.85% 109 $13,987 0.85% 112 $10,397 0.65% 83 $10,709 0.65% 86 $8,431 0.53% 67 $8,684 0.53% 69 $7,564 0.47% 61 $7,791 0.47% 62 $3,927 0.25% 31 $4,045 0.25% 32 $3,296 0.21% 26 $3,395 0.21% 27 $2,207 0.14% 18 $2,273 0.14% 18 $2,122 0.13% 17 $2,185 0.13% 17 $1,146 0.07% 9 $1,180 0.07% 9 $382 0.02% 3 $393 0.02% 3 $122,453 7.64% 980 $126,126 7.64% 1,009 $1,724,371 13,795 $1,776,102 14,209 ($80,096) 5.00% (641) ($82,499) 5.00% (660) ($8,010) 0.50% (64) ($8,250) 0.50% (66) ($8,010) 0.50% (64) ($8,250) 0.50% (66) $1,628,256 92.00% 13,026 $1,677,103 92.00% 13,417

% of EGI Per Unit

% of EGI Per Unit $113,813 6.99% 911 $113,813 6.99% 911 $180,000 11.05% 1,440 $180,000 11.05% 1,440 $293,813 18.04% 2,351 $293,813 18.04% 2,351 $38,250 2.35% 306 $39,015 2.40% 312 $60,499 3.72% 484 $61,709 3.79% 494 $1,755 0.11% 14 $1,790 0.11% 14 $70,371 4.32% 563 $71,778 4.41% 574 $14,506 0.89% 116 $14,796 0.91% 118 $3,570 0.22% 29 $3,641 0.22% 29 $150,701 9.26% 1,206 $153,715 9.44% 1,230 $482,764 29.65% 3,862 $486,543 29.88% 3,892 $3,188 0.20% 26 $3,251 0.20% 26 $19,125 1.17% 153 $19,508 1.20% 156 $4,463 0.27% 36 $4,552 0.28% 36 $26,775 1.64% 214 $27,311 1.68% 218 $63,750 3.92% 510 $65,025 3.99% 520 $9,563 0.59% 77 $9,754 0.60% 78 $127,500 7.83% 1,020 $130,050 7.99% 1,040 $19,125 1.17% 153 $19,508 1.20% 156 $12,750 0.78% 102 $13,005 0.80% 104 $65,130 4.00% 521 $67,084 4.00% 521 $2,550 0.16% 20 $2,601 0.16% 21 $33,163 2.04% 265 $33,826 2.08% 271 $360,305 22.13% 2,882 $368,163 22.49% 2,930 $843,069 51.78% 6,745 $854,705 52.49% 6,838 $785,187 48.22% 6,281 $822,398 50.51% 6,579

YEAR 2 YEAR 3

ADG37 MULTIFAMILY

INCOME

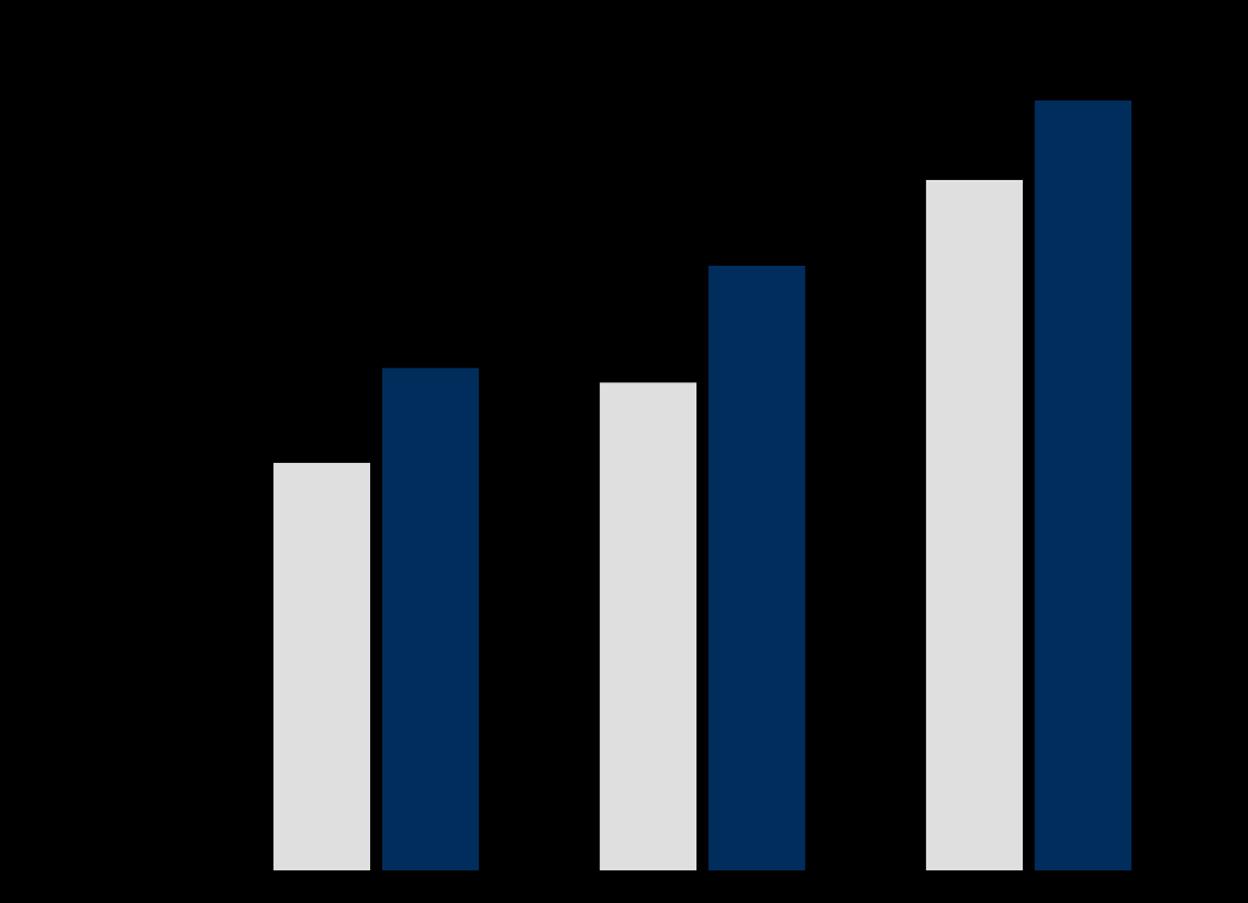

GROSS POTENTIAL RENT All Units at Market Rent $1,265,760 $1,587,000 $1,634,610 $1,683,648 $1,734,158 $1,786,182 $1,839,768 $1,894,961 $1,951,810 $2,010,364 $2,070,675 Gain (Loss) to Lease ($23,389) ($95,220) ($32,692) ($33,673) ($34,683) ($35,724) ($36,795) ($37,899) ($39,036) ($40,207) ($41,414)

GROSS SCHEDULED RENT $1,242,371 $1,491,780 $1,601,918 $1,649,975 $1,699,475 $1,750,459 $1,802,973 $1,857,062 $1,912,774 $1,970,157 $2,029,262

Total Other Income $115,424 $118,886 $122,453 $126,126 $128,649 $131,222 $133,846 $136,523 $139,254 $142,039 $144,880

GROSS POTENTIAL INCOME $1,357,795 $1,610,666 $1,724,371 $1,776,102 $1,828,124 $1,881,681 $1,936,819 $1,993,585 $2,052,027 $2,112,196 $2,174,141 Physical Vacancy ($51,322) ($74,589) ($80,096) ($82,499) ($84,974) ($87,523) ($90,149) ($92,853) ($95,639) ($98,508) ($101,463) Bad Debt ($38,014) ($7,459) ($8,010) ($8,250) ($8,497) ($8,752) ($9,015) ($9,285) ($9,564) ($9,851) ($10,146) Concessions Allowance ($400) ($7,459) ($8,010) ($8,250) ($8,497) ($8,752) ($9,015) ($9,285) ($9,564) ($9,851) ($10,146)

EFFECTIVE GROSS INCOME $1,268,059 $1,521,159 $1,628,256 $1,677,103 $1,726,155 $1,776,653 $1,828,641 $1,882,161 $1,937,261 $1,993,986 $2,052,385

EXPENSES

Real Estate Taxes $293,813 $293,813 $293,813 $293,813 $299,689 $305,683 $311,796 $318,032 $324,393 $330,881 $337,498 Insurance $21,361 $37,500 $38,250 $39,015 $39,795 $40,591 $41,403 $42,231 $43,076 $43,937 $44,816

Utilities $144,849 $147,746 $150,701 $153,715 $156,789 $159,925 $163,124 $166,386 $169,714 $173,108 $176,570 Contract Services $46,630 $26,250 $26,775 $27,311 $27,857 $28,414 $28,982 $29,562 $30,153 $30,756 $31,371 Repairs & Maintenance $61,230 $62,500 $63,750 $65,025 $66,326 $67,652 $69,005 $70,385 $71,793 $73,229 $74,693 Marketing & Promotion $9,994 $9,375 $9,563 $9,754 $9,949 $10,148 $10,351 $10,558 $10,769 $10,984 $11,204

On-Site Payroll $164,813 $125,000 $127,500 $130,050 $132,651 $135,304 $138,010 $140,770 $143,586 $146,457 $149,387 Payroll Taxes & Benefits $18,187 $18,750 $19,125 $19,508 $19,898 $20,296 $20,702 $21,116 $21,538 $21,969 $22,408 General & Administrative $37,374 $12,500 $12,750 $13,005 $13,265 $13,530 $13,801 $14,077 $14,359 $14,646 $14,939 Management Fee $49,202 $60,846 $65,130 $67,084 $69,046 $71,066 $73,146 $75,286 $77,490 $79,759 $82,095 Telephone & Internet $2,382 $2,500 $2,550 $2,601 $2,653 $2,706 $2,760 $2,815 $2,872 $2,929 $2,988 Replacement & Reserves $31,875 $32,513 $33,163 $33,826 $34,503 $35,193 $35,896 $36,614 $37,347 $38,094 $38,855

CURRENT YEAR 1 YE MAR-2023 YEAR 2 YE FEB-2024 YEAR 3 YE FEB-2025 YEAR 4 YE FEB-2026 YEAR 5 YE FEB-2027 YEAR 6 YE FEB-2028 YEAR 7 YE FEB-2029 YEAR 8 YE FEB-2030 YEAR 9 YE FEB-2031 YEAR 10 YE FEB-2032

TOTAL EXPENSES $881,710 $829,293 $843,069 $854,705 $872,420 $890,507 $908,976 $927,833 $947,088 $966,749 $986,825 NET OPERATING INCOME $386,349 $691,867 $785,187 $822,398 $853,735 $886,146 $919,665 $954,328 $990,173 $1,027,237 $1,065,561 CASH FLOW BEECHMONTFINANCIALS INCOME EXPENSE 38 ADG MULTIFAMILY

CASH FLOW PROJECTION GROWTH RATE ASSUMPTIONS

Income

Gross Potential Rent 25.38% 3.00% 3.00% 3.00% 3.00% 3.00% 3.00% 3.00% 3.00% 3.00% (Loss) / Gain to Lease* 6.00% 2.00% 2.00% 2.00% 2.00% 2.00% 2.00% 2.00% 2.00% 2.00%

Other Income 3.00% 3.00% 3.00% 3.00% 3.00% 3.00% 3.00% 3.00% 3.00% 3.00% Expenses

Expenses 2.00% 2.00% 2.00% 2.00% 2.00% 2.00% 2.00% 2.00% 2.00% Management Fee** 4.00% 4.00% 4.00% 4.00% 4.00% 4.00% 4.00% 4.00% 4.00% 4.00%

CASH FLOW PROJECTION GROWTH RATE ASSUMPTIONS

YR

Physical Vacancy 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00%

Non-Revenue Units 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% Bad Debt 0.50% 0.50% 0.50% 0.50% 0.50% 0.50% 0.50% 0.50% 0.50% 0.50% Concessions Allowance 0.50% 0.50% 0.50% 0.50% 0.50% 0.50% 0.50% 0.50% 0.50% 0.50%

Total Economic Loss 6.00% 6.00% 6.00% 6.00% 6.00% 6.00% 6.00% 6.00% 6.00% 6.00%

*Calculated as a percentage of Gross Potential Rent | **Calculated as a percentage of Effective Gross Income

LOAN MASTER LIST

Updated: 1.12.2022

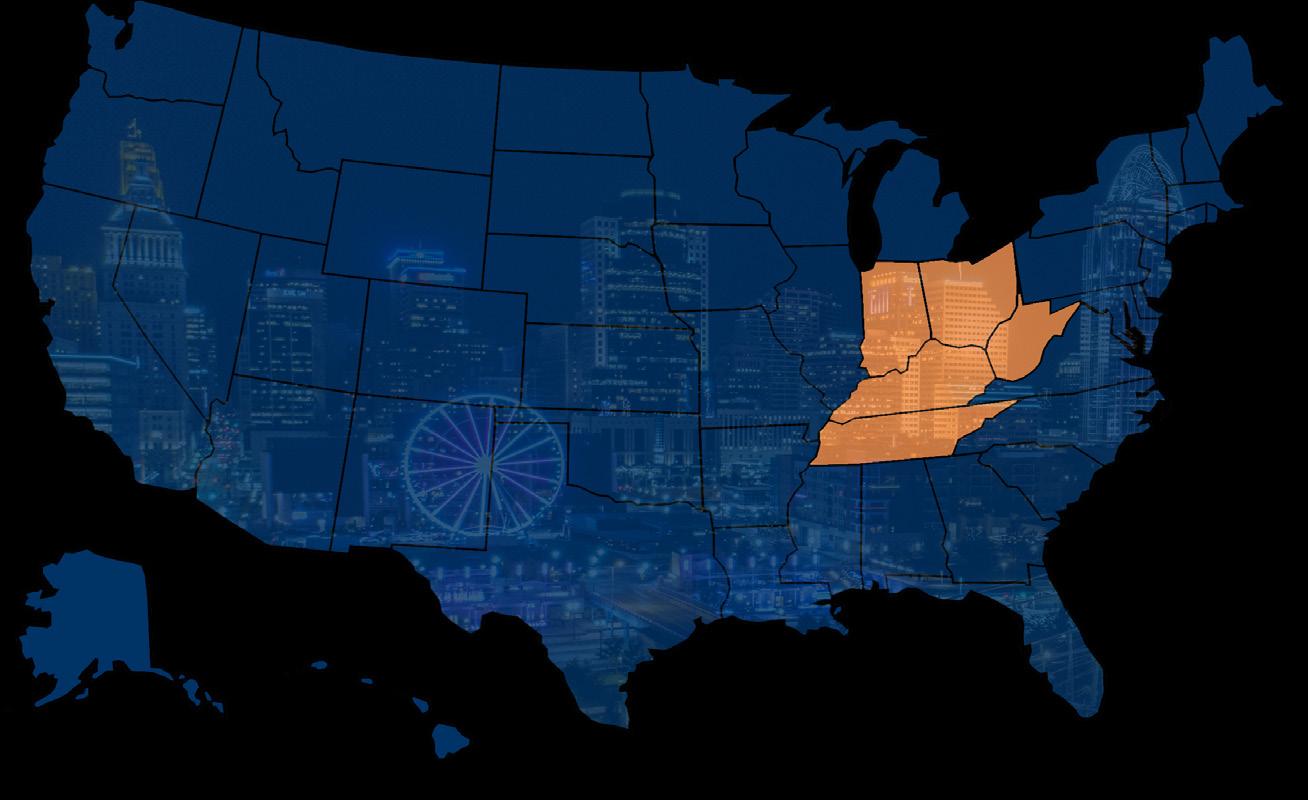

Immaculate Townhomes LLC 1277 Immaculate Lane Cincinnati, OH

Mears Place LLC 1802-1804 Mears Ave. Cincinnati, OH

PMT

Pinnacle Bank (Freddie Mac) Refinance 12/10/21 1/1/42 $1,505,000.00 3.56000% 2/1/22 30-year AMO

Bank (Freddie Mac) Refinance 12/3/21 1/1/42 $1,400,000.00 3.460% 2/1/22 30-year AMO

YR 1 YR 2 YR 3 YR 4 YR 5 YR 6 YR 7 YR 8 YR 9 YR 10

1 YR 2 YR 3 YR 4 YR 5

YR 6 YR 7 YR 8 YR 9 YR 10

ENTITY ON TAX RETURN PROPERTY ADDRESS LENDER LOAN DATE MATURITY DATE LOAN AMOUNT INTEREST RATE FIRST

COMMENTS

45255

45230 Pinnacle

ADG39 MULTIFAMILY

04SECTION LOCAL

Brittany

Brittany