SAP BRIM Integration with Vertex Tax Solution

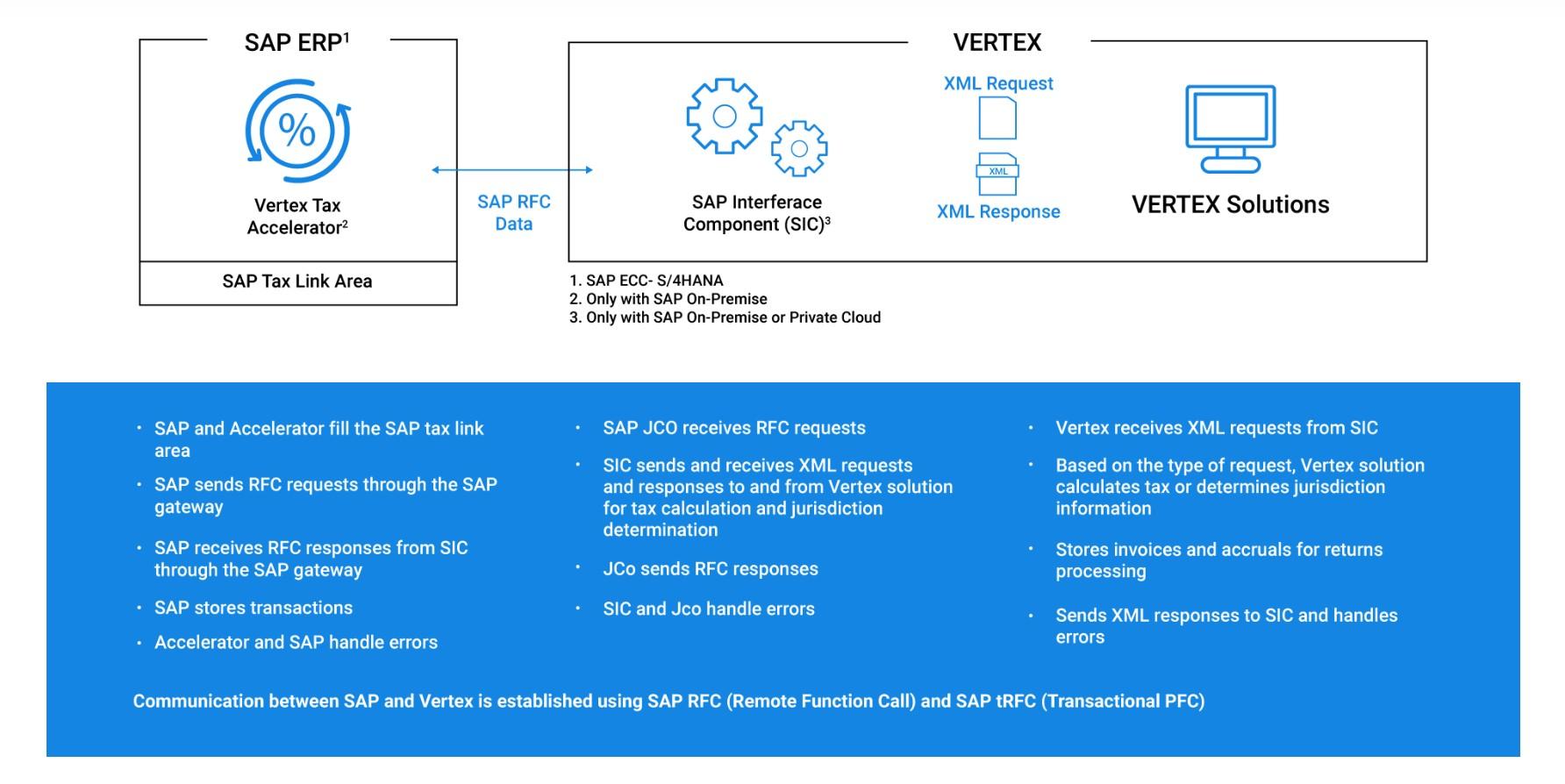

SAP provides a tax interface system that is capable of passing required data to an external tax system that determines tax jurisdictions, calculates taxes, and then returns these calculated results back to SAP. The tax interface system also updates the third party’s software files with the appropriate tax information for legal reporting purposes.

External tax systems, such as with subscription order management and contract accounts receivable and payable sales, use tax externally, and for a later tax return.

http://www.acuitilabs.co.uk

What is Vertex Tax Solution?

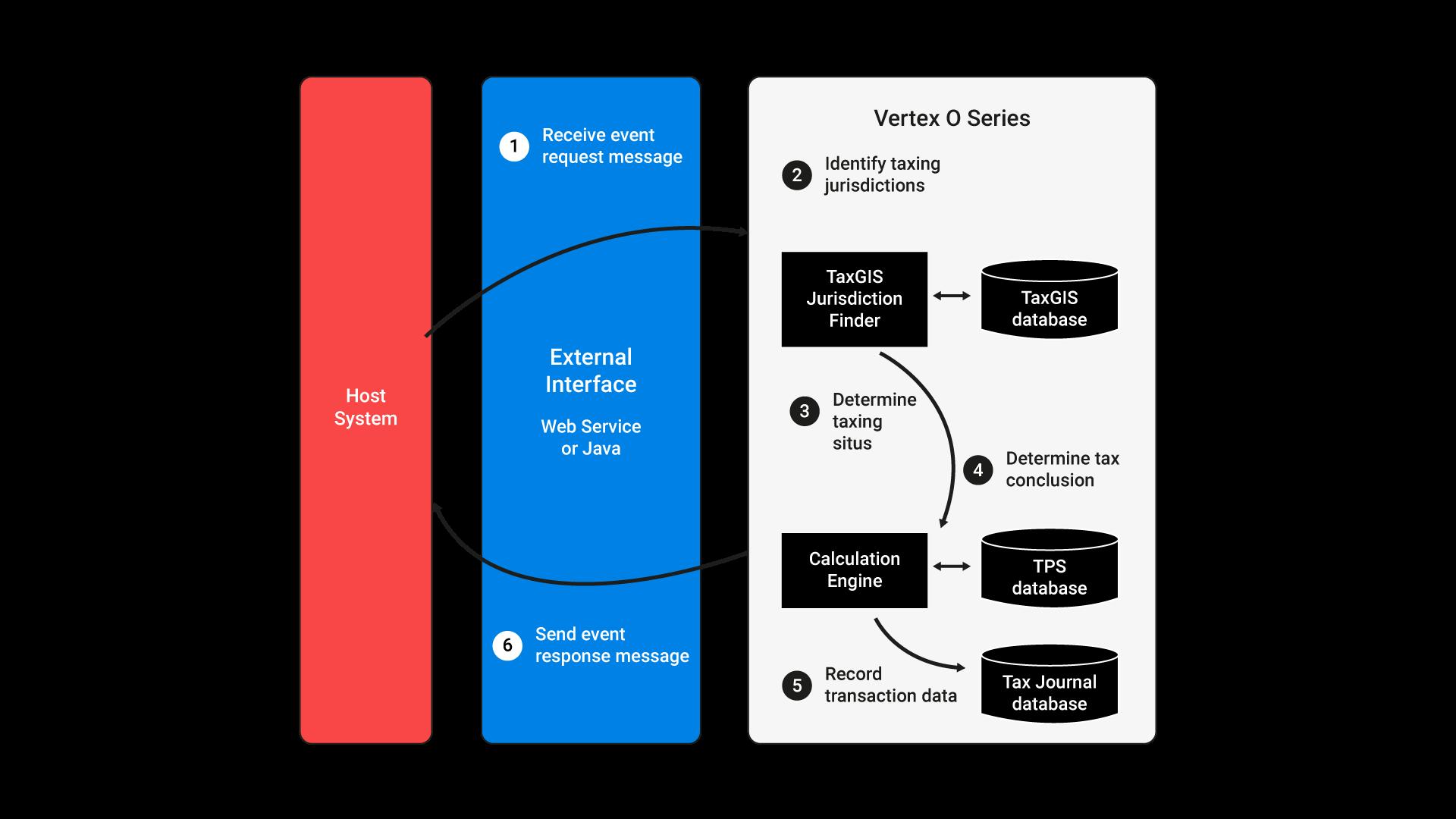

Vertex Tax Solution is a third-party tax software that integrates with SAP to automatically calculate the indirect taxes on sales and purchases of goods and services. It is an exception-based system. By default, all the transactions are considered “taxable,” unless you identify an exception.

Vertex’s product range includes various series, but the “Vertex Indirect Tax O Series” is the latest one. It can be deployed on the SAP cloud, on-premise, or as a hybrid.

The diagram besides explains the general process flow of the Vertex O Series:

http://www.acuitilabs.co.uk