Quality Management and Control Software for Lending Institutions

ACES is the leading provider of enterprise quality management and control software for the financial services industry.

Improve Productivity, Efficiency and Loan Quality While Controlling Costs

"ACES affords me the ability to employ experts in their fields because I don't have to employ additional people to get the volume done."

Heather Morris Vice President of Quality Control, Zions Bancorporation

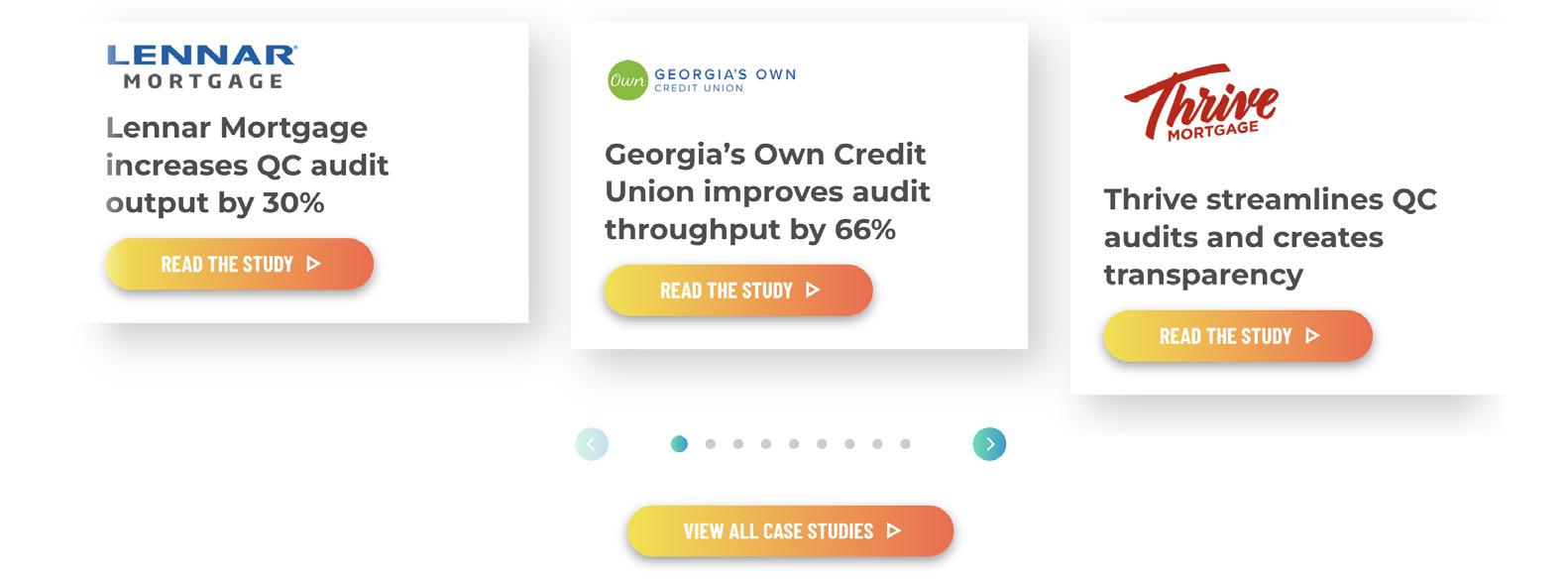

Success Stories

TOP

7 10 OF THE

TOP TOP Independent Mortgage Lenders Commercial Banks RELY ON ACES Servicers

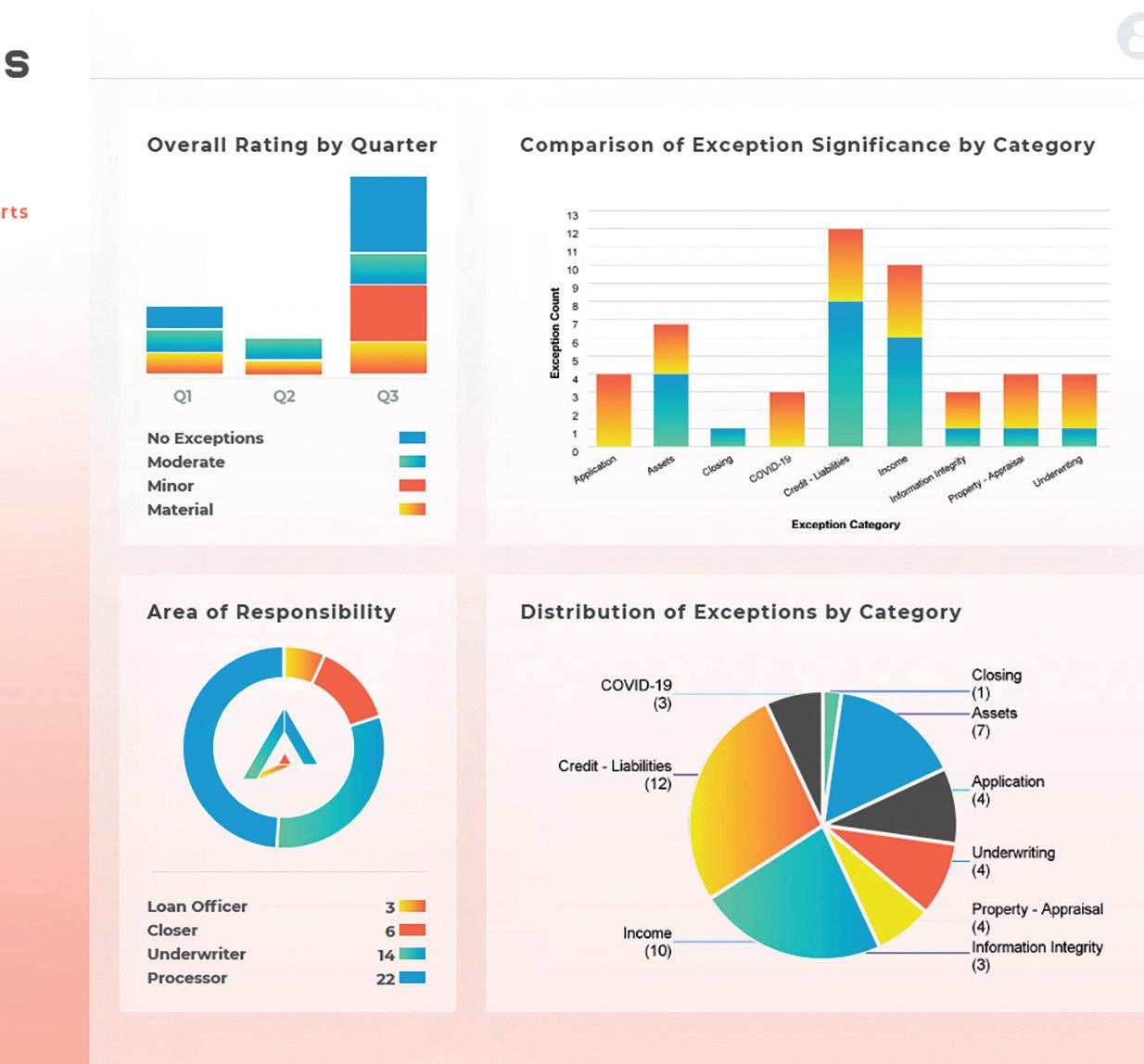

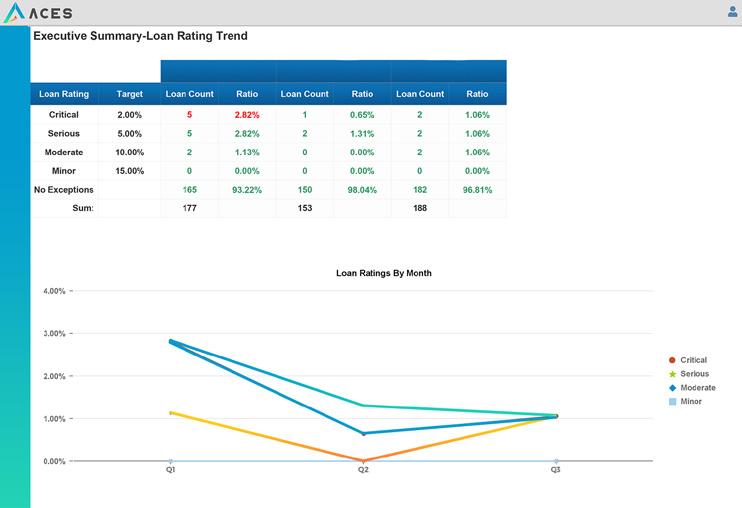

Data-driven Decision Making

2

Flexible Audit Technology Customer-Centric Approach Built for the Enterprise

4 5

5 OF THE OF THE

• Easily manage and customize

• Use our Managed Questionnaires and Quality Insight Reports

• Don't rely on IT resources or outside vendors

• Client-centered

• Proactive industry experts

• Supportive and responsive team

• Improve performance across all lines of business

• Use ACES across the entire loan life cycle

• Quickly scale to meet demand

• Best-in-class security

• Improve quality across the enterprise

Solutions You Need, Tailored Specifically to Your Line of Business

Use ACES for:

Mortgage Lending

ACES offers solutions for each point in the mortgage loan lifecycle from Pre Funding to Post Closing

Improve Productivity and Loan Quality

Consumer Lending

Gain valuable insights and reduce risk across all consumer lending channels

Manage Loan Quality and Mitigate Risk

Easily customizable to match your business processes and needs

Commercial Lending

Providing commercial lenders with powerful auditing tools to ensure quality and compliance throughout their loan portfolio

Reduce Risk Exposure

Credit Unions

Credit Unions can leverage a single platform to obtain a holistic view of loan quality

An Enterprise-grade Solution

Loan Servicing

Loan servicers are able to tackle all servicing QC challenges while keeping pace with ever-changing regulatory requirements

Gain Credibility and Confidence

Seamless Process

Service Providers

Third-party QC providers can ensure quality and compliance throughout their operations while providing the flexibility to scale as needed as volumes change

Power Your 3rd Party QC Reviews

ACES Quality Management & Control® software with

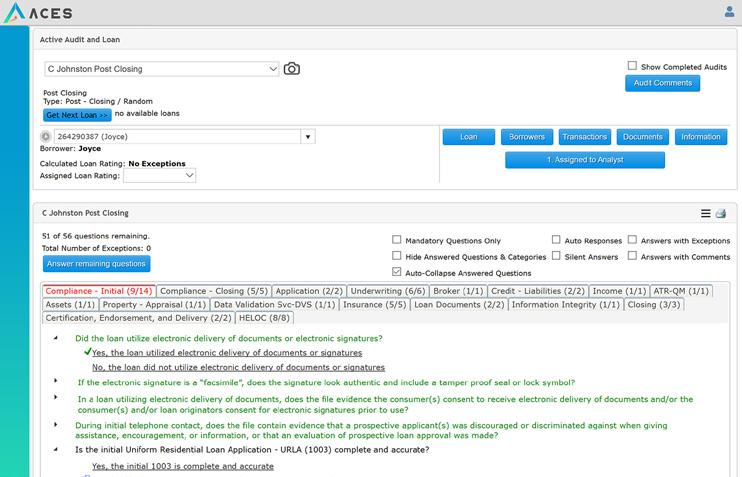

ACES Flexible Audit Technology®

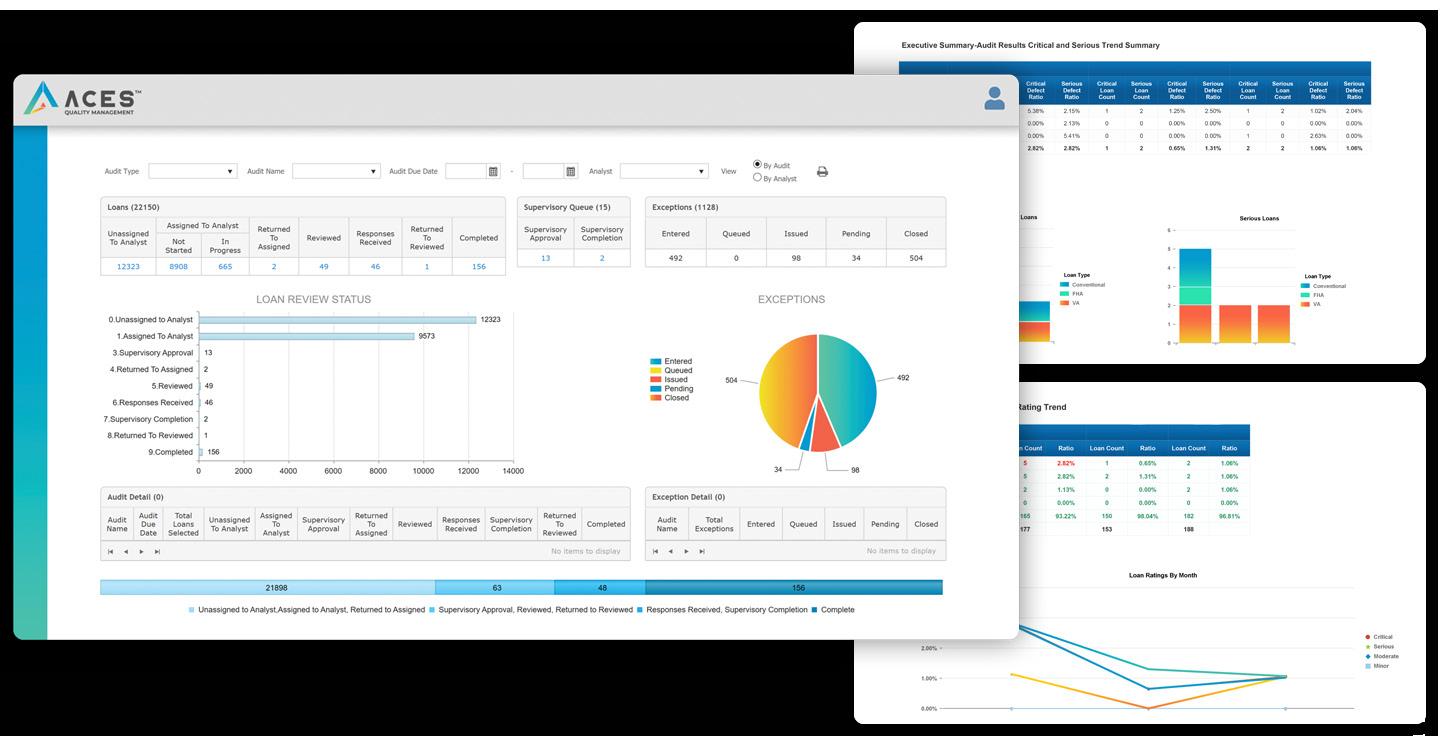

Impact Your Entire Audit Life Cycle

Whether you are looking to replace multiple spreadsheets, inflexible systems, or an inefficient outsourcing provider, ACES delivers the functionality and flexibility you need to improve audit efficiency, boost team productivity and make better informed decisions.

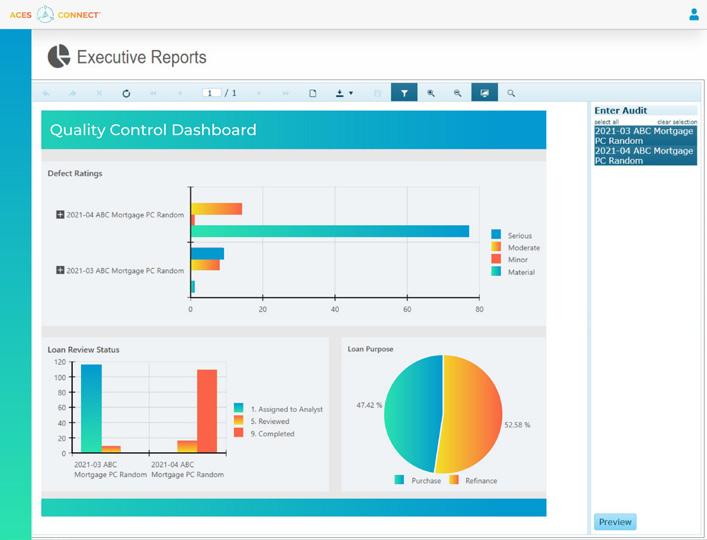

ACES Reporting

Generate reports in minutes vs. days

• Get real-time information to make more informed business decisions

• Use standard reports or easily customize your own

• Produce executive level reports

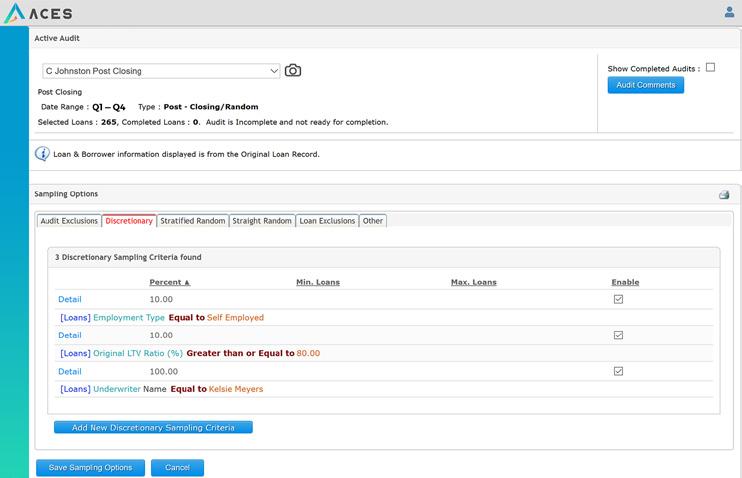

ACES Sampling

Go from hours to minutes to create better, larger samples

• Replace manual input from multiple files with ACES automated criteriabased sampling

ACES Review

Speed loan review while reducing defects

• Use our Managed Questionnaires, easily add your own questions to ours, or create your own

• Eliminate “N/As” & speed throughput by only presenting relevant questions

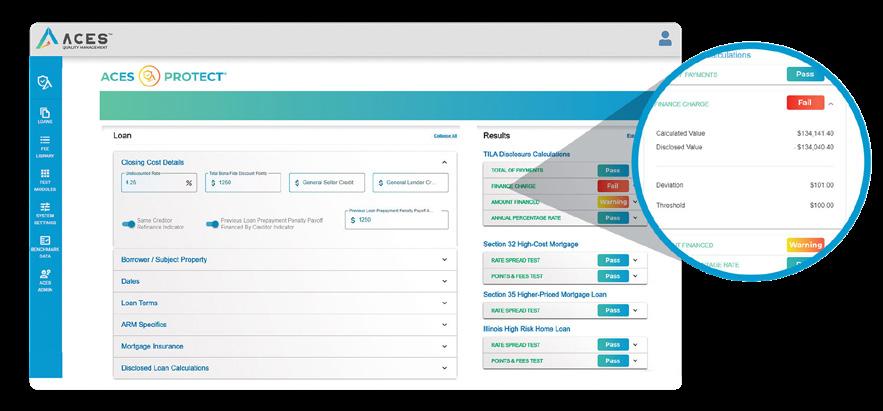

Automated Regulatory Compliance Testing

• Direct integration with the ACES platform

• Allows a seamless completion of necessary QC steps

• Saves time to assure calculations & disclosed amounts are accurate

• Confirms LOS calculations from a trusted third-party validation

ACES CONNECT®

24/7 access to real-time QC insights

• Monitor key data and metrics in real-time

• Review audit activity, remediate defects and manage corrective actions

• Provide secure collaboration between QC and Lines of Business

On-demand webinars provide best practices for navigating current quality control and risk trends

Subscribe now to ensure you are upto-date on the latest headlines and breaking news covering mortgage, credit, and compliance

Read white papers, guides, checklists and more authored by our team of quality and compliance experts

Quality People behind Quality Products

acheiving Quality Results®

FLEXIBLE AUDIT TECHNOLOGY

CUSTOMERCENTRIC APPROACH

BUILT FOR THE ENTERPRISE

Improve Productivity, Efficiency and Quality

While Controlling Cost

REQUEST A DEMO

PROVEN,