Contact: accstobalance@gmail.com

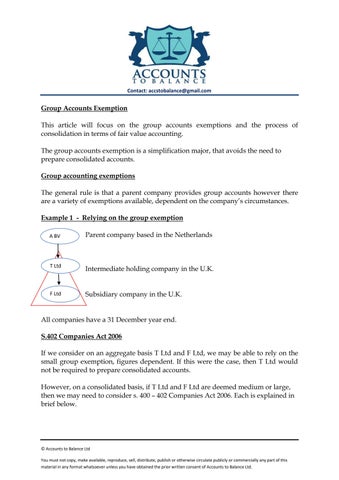

Group Accounts Exemption This article will focus on the group accounts exemptions and the process of consolidation in terms of fair value accounting. The group accounts exemption is a simplification major, that avoids the need to prepare consolidated accounts. Group accounting exemptions The general rule is that a parent company provides group accounts however there are a variety of exemptions available, dependent on the company’s circumstances. Example 1 - Relying on the group exemption A BV

Parent company based in the Netherlands

T Ltd

Intermediate holding company in the U.K.

F Ltd

Subsidiary company in the U.K.

All companies have a 31 December year end. S.402 Companies Act 2006 If we consider on an aggregate basis T Ltd and F Ltd, we may be able to rely on the small group exemption, figures dependent. If this were the case, then T Ltd would not be required to prepare consolidated accounts. However, on a consolidated basis, if T Ltd and F Ltd are deemed medium or large, then we may need to consider s. 400 – 402 Companies Act 2006. Each is explained in brief below.

© Accounts to Balance Ltd You must not copy, make available, reproduce, sell, distribute, publish or otherwise circulate publicly or commercially any part of this material in any format whatsoever unless you have obtained the prior written consent of Accounts to Balance Ltd.