OPTING OUT OF OFFERS AND MONITORING YOUR CREDIT

When you apply for a mortgage or other types of credit, certain documents are required by law to be filed, and they become publicly available to various entities.

Under the Fair Credit Reporting Act (FCRA), companies like Equifax, Experian, Innovis and TransUnion are permitted to include borrowers’ names on lists used by creditors or insurers to make pre-screened offers of credit or insurance that are not initiated by the borrower.

HELPFUL RESOURCES:

by TODD ADAMS chief executive officer

It is important to note that OptOutPrescreen.com is the only internet website authorized by Equifax, Experian, Innovis and TransUnion for consumers to opt out of pre-screened offers of credit or insurance. Be aware that Opt Out Prescreen does not make outbound phone calls. If anyone calls to ask you to opt out, simply hang up.

For your convenience, scan these codes with your cell phone camera to access the sites.

www.OptOutPrescreen.com

Opt out of receiving unwanted pre-screened credit offers for five years.

Here at the bank, we never pass on your credit file information. Unfortunately, we’re not the only ones with access to this information. Because your name appears on these lists, you may be bombarded with phone calls, texts, and emails with additional offers of prescreened credit very quickly. Some of our customers report getting over 200 calls within a couple of days of applying for a mortgage.

www.AnnualCreditReport.com

Receive your free annual credit reports at this website or call 1-877-322-8228.

We’d also like to remind you of the importance of monitoring your credit reports on a regular basis. Under federal law, you’re entitled to a free copy of your credit report every 12 months from each of the three nationwide credit bureaus. Changes to your credit report can signal identity theft and fraud.

You can order your free reports at the same time or stagger your requests throughout the year to get a broader picture.

If you do not want to receive these offers, you have the right to “opt out.” By completing the online form at www.OptOutPrescreen.com , you may opt out of receiving firm offers for five years. Opting out will not affect your ability to apply for credit or insurance.

If you know you’ll be applying for credit for a large purchase soon and you don’t wish to be solicited for other offers, you can proactively opt out before applying. It typically takes 14 business days to be removed from the lists.

Other advertised domains may refer to “free credit reports,” but they may not be free. The only ways to order your free annual credit reports are outlined in the center of this article. If you get an email or pop-up ad that claims to be from AnnualCreditReport.com or any of the credit bureaus, don’t reply or click on the links. It’s likely a scam.

Helping you protect your financial information is an important part of our relationship. Please reach out to your local branch with any questions.

SERVING NEBRASKA, COLORADO & KANSAS | 800.422.3488 | INFO@ABTBANK.COM

3rd Quarter, 2023

THANK YOU FOR TELLING A FRIEND

No matter what kind of business you’re in, referrals are so important.

When one customer refers another to the bank, it’s the greatest compliment we can receive.

It’s a testament that we’re doing a good job for them, and they believe we’ll take good care of their friend or family member, too.

Being a bank that people want to recommend is the standard we live

by. It comes back to the relationships we nurture, the service we provide, and the knowledge and expertise we’re able to share.

It’s the ultimate satisfaction when we get to serve multiple generations of a family or the new owners of a business we’ve worked with for years. We embrace the opportunity to continue these traditions and relationships in the same communities, providing ongoing local economic benefit.

by STEVE KRAUSE president

When you’re our customer, you’re not on your own. It’s not just about a deposit or a loan. We’re here for a relationship – to give advice and contribute to your success over the long haul. When you succeed, we succeed.

If we’ve provided you with good service over the years, and you think highly enough of the bank to recommend us to someone, please know we appreciate it very much.

DREW KRAB chief banking officer

Drew Krab, Chief Banking Officer, says Adams Bank & Trust gets a great deal of new business through customer referrals, and those referrals tend to have a snowball effect.

Krab says, “We offer very competitive deposit rates on both the consumer and business side but value and rate are not the same thing. Our loyal customers are looking for something more from a bank, and so are the friends they refer to us.”

He adds, “Adams Bank & Trust is a home for customers who are looking for high value, not just the highest interest rate. They want to work with people they know and trust. They want consistent, proactive customer service.”

A recent customer story emphasizes the referral effect. “We had a customer who was really happy

with one of our bankers, and a friend asked who he banked with and why,” Krab says. “He recommended both the bank and his banker. That’s a key component. The customer has to be comfortable with both the institution and the people they work with.”

Conversely, Krab says, “We’ve also seen scenarios where current customers are wooed by other institutions and decide to take their deposits and loans elsewhere solely because of rate. However, it typically doesn’t take long before they come back to Adams Bank & Trust. Other institutions make big promises, but in the end, they don’t deliver the service the customer is used to. They come back for the value proposition that we offer.”

In some ways, Krab says banking can be commoditized. “Big banks have certainly led the charge on the messaging that all banking is the same or similar,” he says. “But we don’t view banking that way.” What makes Adams Bank & Trust the kind of bank customers want to recommend?

Krab adds, “Not only did we get an introduction to some great new customers and partners, but they also turned around and introduced us to someone else because of their positive experience.”

According to Krab, there are many factors involved. He says the bank takes care to cultivate a mix of value propositions and core values that appeal to certain communities, individuals, and types of businesses.

adams bank & trust | PAGE 2

“Adams Bank & Trust is a home for customers who are looking for high value, not just the highest interest rate. They want to work with people they know and trust. They want consistent, proactive customer service.”

Knowledge & Expertise

“First of all,” Krab says, “we are experts in our field. We don’t want people to feel that they are making important decisions on their own or just relying on their own online research. We work with a vast array of types of customers and so we’ve seen a lot. We can offer realworld, practical advice in a timely manner so that people can make the best judgements and decisions for themselves.”

Krab adds, “Customers know that if they have to pivot, they have us by their side to help them transition and enact action plans.”

Staffing Consistency

Staffing consistency is another factor in customer satisfaction and comfort level with making referrals. Krab says, “The bank has a long track record of retaining great staff. We attract talented bankers, and they want to stay here because they enjoy the way we do business. Banking here is relationship-oriented, not sales driven.”

“Trust in business is extremely

important,” Krab explains, “When you’re working with the same people all the time, you just gain higher and higher levels of trust, from the standpoints of both integrity and expertise.”

same banker and the same loan processor throughout the entire process. These people are available by phone, email, and text. If the customer wants to do all the forms and signatures electronically, we certainly have the technology. However, if they want the personal experience of coming in the branch or talking to their banker on the phone, that’s always available.”

Local Decision-Making

Krab says, “Because customer needs are paramount to our senior management, they give local bankers a lot of authority. We can make decisions very quickly. That’s something that customers value and mention to their friends.”

Convenience & Communication

Krabs says, “If someone takes out a mortgage with us, for example, we can really tailor the experience. They’re never talking to a rep in a different state who hasn’t seen their file before. They don’t have to keep retelling their story because we pair them with the

The bank views customer referrals as both a compliment and a responsibility. Krab says, “When people make referrals, they’ve put their own name and relationships on the line. We’re borrowing their credibility, so to speak, in order to establish that new banking relationship. We appreciate that and take it very seriously.”

PAGE 3 | your foundation for financial success

“The bank has a long track record of retaining great staff. We attract talented bankers and they want to stay here because they enjoy the way we do business. Banking here is relationship-oriented, not sales driven.”

ADAMS BANK & TRUST BALANCE SHEET AS OF JUNE 30, 2023

such as agriculture, commercial and consumer.

Book value (after depreciation) of buildings, computers, equipments, etc.

NEBRASKA BRULE

308.287.2344

CHAPPELL 308.874.2800

GRANT

308.352.2114

IMPERIAL 308.882.4286

INDIANOLA 308.364.2215

LODGEPOLE 308.483.5211

MADRID 308.326.4223

NORTH PLATTE 308.532.5936

OGALLALA 308.284.4071

308.386.4345

Money on deposit by customers of the bank in the form of checking accounts, savings accounts, and certificates of deposit.

Borrowings by the bank, interest on deposits that has accrued, payable at a future date, other expenses accrued but not yet paid, deferred taxes, etc.

Par value of the investment of the stockholders for the purchase of stock.

Additional money contributed by stockholders to provide extra financial strength.

Bank earnings left in the bank to provide added strength to meet possible future losses on loans and to replace buildings and equipment as they wear out.

OUR LOCATIONS

SUTHERLAND

COLORADO BERTHOUD 970.532.1800 COLORADO SPRINGS 719.448.0707 FIRESTONE 303.833.3575 FORT COLLINS 970.667.4308 GREELEY 970.330.8018 LONGMONT 303.651.9053 KANSAS COLBY 785.460.7868 TOLL FREE 800.422.3488 ABTBANK.COM

CASH

in our vault, plus cash on demand from other banks where funds are deposited. 62,952,318 GOVERNMENT AND AGENCY BONDS

investments in bonds and other securities of

U.S.

and its agencies. 422,767,877 FEDERAL FUNDS SOLD Funds load to other banks for daily cash needs and payable on demand. 0 LOANS AND LEASES

of all money loaned to customers for all types of loans,

808,507,287 BUILDINGS, FURNITURE

FIXTURES

Cash

Marketable

the

Government

Total

AND

17,854,435 OTHER ASSETS

expenses that

etc. 22,772,812 TOTAL ASSETS 1,334,854,729 DEPOSITS

Interest on loans earned but not collected,

have been prepaid,

$ 1,072,946,002 OTHER

LIABILITIES

103,562,979 CAPITAL

35,000,000 SURPLUS

17,000,000 UNDIVIDED

PROFITS AND RESERVES

106,345,748 TOTAL CAPITAL ACCOUNTS

158,345,748 TOTAL LIABILITIES AND CAPITAL ASSETS 1,334,854,729

Total capital available for the safe operation of Adams Bank & Trust.

FINDING VALUE IN THE RIGHT RELATIONSHIPS

What does it cost to work with a financial advisor? It’s a question we’re often asked as people are weighing investment options. But maybe there are better questions. Is professional financial advice a cost or is it an investment? Can you look at what you’re getting out of the relationship rather than what you’re paying in fees?

Is professional financial advice a cost or is it an investment?

Can you look at what you’re getting out of the relationship rather than what you’re paying in fees?

Some people may not need a financial advisor. Those who have the three Ts (the appropriate Talent, Temperament, and Time) might prefer to handle their own investments.

However, handling these decisions all on your own can be overwhelming and time-consuming. The average investor may find value in having a coach, and that role is in the financial advisor’s wheelhouse.

There’s a reason athletes work with coaches and personal trainers. Knowing that someone with skill and experience is focused on your success is impactful. How do financial advisors coach clients to make wise financial decisions? One of the most important steps is to truly get to know the client. Professional advisors want to know who you are, and why you want

by JACOB HOVENDICK rjfs branch manager

to invest. What drives you? What kind of retirement do you envision? What is your timeline? What family situations should be considered? A well-informed personal relationship serves as the foundation of the financial plan that the client and advisor build together. One hallmark of a good coach is the ability to offer an objective viewpoint. This is important because successful investing requires keeping emotions in check. Of course, it’s natural to have an emotional response where money is concerned. It’s natural to feel anxious about your ability to provide for your household and afford life’s necessities. But while these emotions should inform your planning, they should not drive or control your financial decisions.

Investing will have its ups and downs. A financial advisor can provide guidance through positive and negative cycles, and encourage you to stay focused on your goals.

Investing will have its ups and downs. A financial advisor can provide guidance through positive and negative cycles and encourage you to stay focused on your goals.

How can you select a qualified financial advisor? It’s important to pay attention to professional credentials. What is the advisor’s educational background? Are they a Certified Financial Planner (CFP)? CFPs renew certification annually, and they must confirm

Investment Advisory Services

Financial Services

Inc.

RAYMOND JAMES FINANCIAL SERVICES, INC. MEMBER FINRA/SIPC Adams Bank & Trust is not a registered broker/dealer, and is independent of Raymond James Financial Services. Securities offered through Raymond James Financial Services, Inc., Member FINRA/SIPC, are not insured by bank insurance, the FDIC or other government agency, are not deposits or orbligations of the bank, are not guaranteed by the bank, and are not subject to risks, including the possible loss of principal.

offered through Raymond James

Advisors,

3rd Quarter, 2023

that they are adhering to the CFP Board’s code of ethics and standards of conduct. They must also complete a certain number of continuing education hours. Advisors may also hold degrees/ certifications in related specialties. There are many other credentials that could be impactful, and having an understanding of their focus is essential.

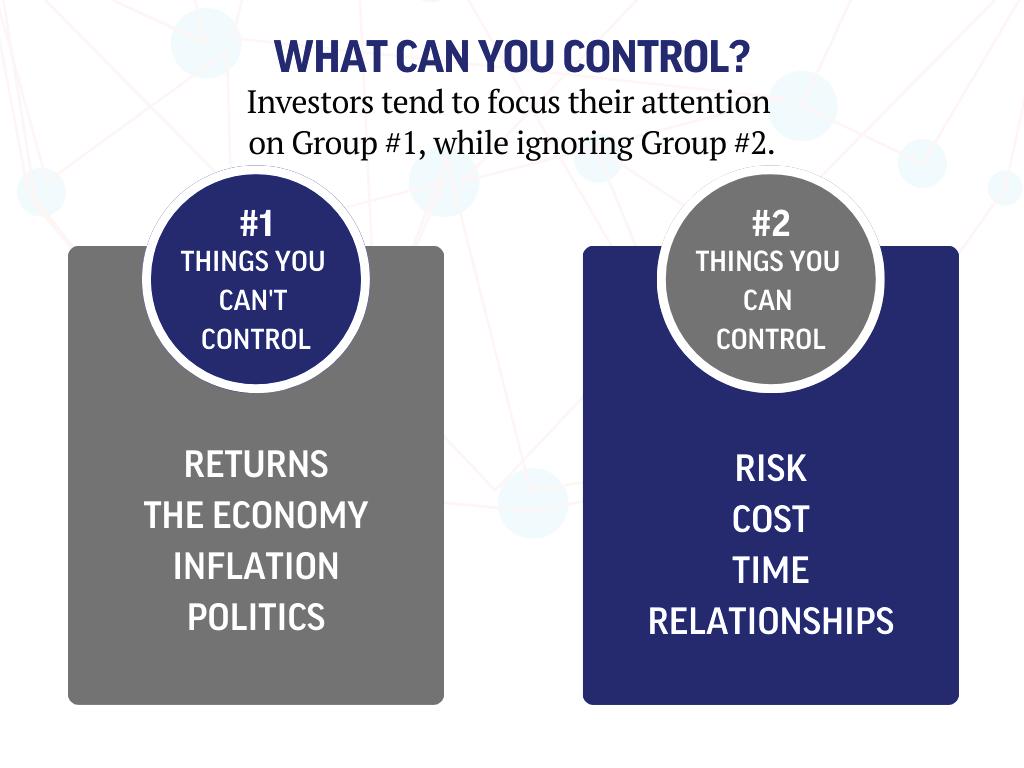

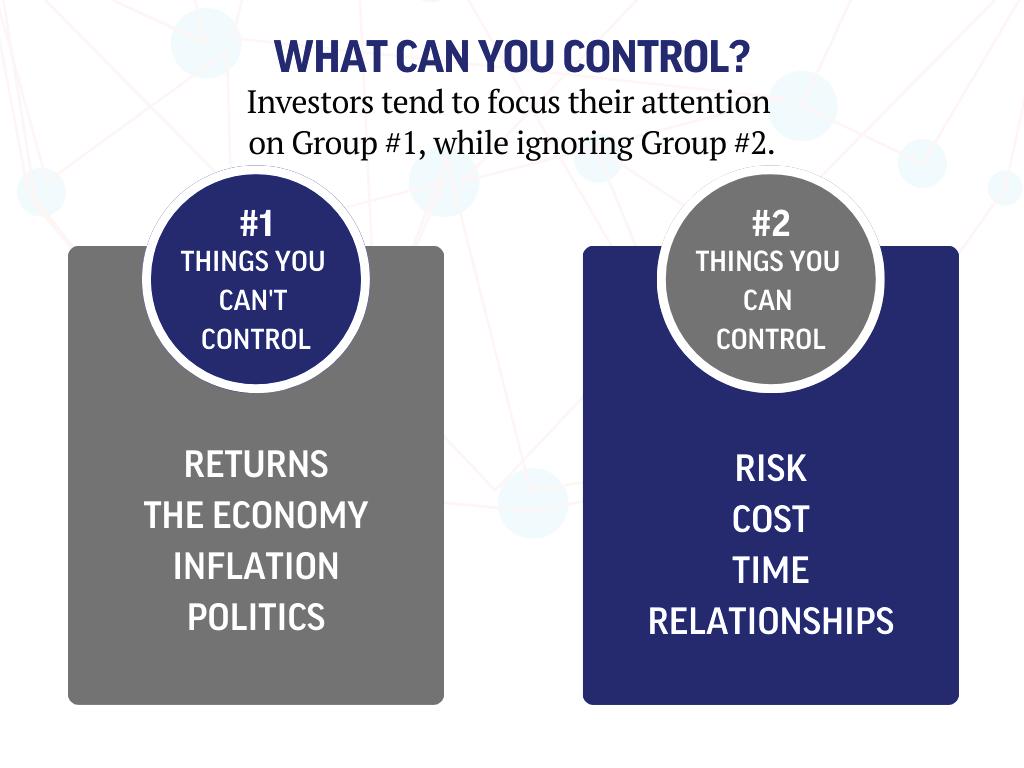

How can an advisor help you focus on what you can control rather than what you can’t?

Whether you take on risk in the stock market, real estate, or another kind of investment, volatility comes with it. You can’t control returns. Returns are the byproduct of all the factors you can’t control, such as the economy, inflation, and the political environment.

Your returns are not always going to go up, but you can make certain choices that influence the volatility of your investments.

put in. You can choose your advisor relationships. In general, if you focus on those areas, the returns tend to take care of themselves over time.

What is the ROI (return on investment) of your relationship with a financial advisor? Qualified, experienced financial guidance is not just an expense, it’s an investment in your future.

But in the end, that relationship will likely pay off in both tangible and intangible ways as you work toward your goals. Finding the right professional relationship can often lead to a lifelong friendship.

Your advisor can encourage you to focus on the areas where you have some agency. For example, you can control your level of risk. You can pick different types of investments and time horizons, and you can control the amount of money you

You’re investing not only in advice about financial planning, but also in related topics such as taxes, insurance, and estate planning. It can take some time and effort to find the right advisor with the right background and resources. You need to feel comfortable that they will work in your best interest.

A coach can help you focus on the small things that help make the largest impact. This is true in sports and in finance.

Opinions expressed are those of the author and are subject to change. This information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. This information is not intended as a solicitation. The material is general in nature. Investing involves risk; investors may incur a profit or loss regardless of the strategy or strategies employed. There is no assurance that any investment strategy will ultimately meet its objectives. Past performance may not be indicative of future results. Asset allocation and diversification do not guarantee a profit nor protect against a loss. Working with a financial professional does not ensure a favorable outcome.

For assistance in reviewing or creating your investment plan, please call any Adams Bank & Trust office or call toll free at 800.422.3488 for an appointment with a Raymond James Investment Representative.

Jacob Hovendick , RJFS Financial Advisor and Branch Manager

Financial Advisor

Jan Acker, RJFS

308.284.4071 | 315 N SPRUCE STREET, OGALLALA, NE 69153

Your advisor can encourage you to focus on the areas where you have some agency.

A coach can help you focus on the small things that help make the largest impact.