IRS AND SOCIAL SECURITY FRAUD

What is your reaction when you see or hear the words YOU OWE THE IRS MONEY or THERE IS A PROBLEM WITH YOUR SOCIAL SECURITY ? These phrases are enough to make anyone’s pulse quicken. That is, of course, exactly why scammers use them.

Both approaches are designed to get your immediate attention and get you to send money or information they can use to steal from you. Unfortunately, scammers are often successful because they’ve fine-tuned their ability to trigger people’s fears. They usually present a problem that needs a quick solution in order to make their scam work.

Of course, no one wants to think they could be on the wrong side of the IRS. Many of our customers depend on Social Security for their livelihood, so the thought of a benefit payment being delayed or missed causes high anxiety. Because the con artists are continually creating new variations on these themes, you need to remain on the lookout. This quarter, we want to provide some tips and information you may use to keep from being scammed in these areas.

THE IRS WILL NEVER:

by TODD S. ADAMS chief executive officer

✔ Leave a message on your answering system that is pre-recorded, urgent, or threatening.

✔ Threaten a taxpayer with arrest, deportation, revocation of a license or SSN.

What are some red flags? Scammers may set themselves up as a fake tax agency and mail letters threatening an IRS lien falsely based on delinquent taxes owed to an agency that doesn’t exist, such as the “Bureau of Tax Enforcement.” Many Social Security scams involve robocall voicemails that threaten to cancel a person’s Social Security number (SSN) if “overdue taxes” aren’t paid. Fake or “spoofed” phone numbers can make it appear as though calls originate from an IRS office, local sheriff’s office, department of motor vehicles, or federal agency.

✔ Demand that taxes be paid without giving the taxpayer the opportunity to question or appeal the amount owed.

✔ Ask for credit or debit card numbers over the phone. Generally, the IRS will first mail a bill to any taxpayer who owes taxes. All tax payments should only be made payable to the U.S. Treasury and checks should never be made payable to third parties.

✔ Call to demand immediate payment using a specific payment method such as a prepaid debit card, gift card or wire transfer. The IRS does not use these methods for tax payments.

✔ Use text messages or social media to discuss tax issues like bills or refunds.

SOCIAL SECURITY WILL NEVER:

✔ Threaten you with the suspension of your Social Security number.

✔ Demand an immediate payment.

✔ Require payment by cash, gift card, or wire transfer.

✔ Ask for gift card numbers over the phone.

Even though the IRS and the Social Security Administration may contact people in some situations, they will never say or do the kind of things the con artists do. See the center of this article for a list of examples.

A willingness to simply hang up is one of your best defenses. If you have questions, you can always reach out to the real agencies directly using the contact information found on their websites.

When you receive a call demanding action that it appears to be unwarranted, make sure you don’t let a scammer rush you into a bad situation.

SERVING

|

NEBRASKA, COLORADO & KANSAS

800.422.3488 | INFO@ABTBANK.COM

3rd Quarter, 2021

WOMEN IN BANK LEADERSHIP

Two of our bank officers, Julie Piepho and Allison Closson, were recognized this year as Notable Women by Biz West magazine in Northern Colorado, with Julie also named Leading Lady in their Women of Distinction honors. We’re very proud of this recognition of their professional impact and volunteerism.

We are fortunate to have many talented employees who happen to be women, and my perspective

has been greatly enriched by women’s leadership over my many years in banking. My journey began watching my mother and grandmother serve on banking boards and interact with customers.

I know how important their influence was on team members and the communities we serve.

Women make up the majority of our employees and roughly half of the officers within Adams Bank & Trust, holding many of our senior

by CHAD S. ADAMS president - ADBANC, Inc

leadership positions. Their career paths and roles are as unique as they are. Some built careers here at the bank from the ground up; others were recruited from other institutions and career fields.

As I transition to the president of ADBANC, Inc., and look to the future vision of our organization, I was interested to hear some of their thoughts on their career experiences, and I wanted to share those with you in their own words.

MEGAN

JEHOREK

| talent development officer

“I think this bank occupies a very special niche in its industry. It’s both small enough and big enough. As a family-owned bank, it’s small enough to value family and work/ life balance - whatever that may mean to the individual employee. Adams Bank & Trust leadership has always embraced a very specific set of core values that foster that balance. They support those aspects of your life that are most important to you. They take the long view in order to fully realize an employee’s potential over the course of their career. I have greatly benefited from this leadership philosophy, both professionally and personally. The bank is also experiencing significant growth. So it’s large enough to attract talent that comes to the table with the specific skills and expertise needed to propel the bank to the next level. It’s large enough to develop our existing employees into new roles that support that growth. It’s truly exciting to be a part of this kind of team.”

MICHELLE KALIN | chief operations officer

“This family-owned bank has always understood that family is my ultimate priority because it is for them, as well. I’ve been encouraged to learn and grow here, and my career has allowed me to find work/life balance. I’ve also been fortunate to work alongside some very talented people who make most days rewarding and fun. Being able to fulfill both my personal and professional goals has brought me a lot of satisfaction. I’m grateful for all the opportunities and challenges.”

MANDY ADAMS HOOVER | chief financial officer, board member

MANDY ADAMS HOOVER | chief financial officer, board member

“For me, it’s just so empowering to be someplace where you are valued for what you bring to the table. I’ve been very blessed that, in my time here, I’ve been able to see some very strong, capable, competent women excel in their roles. It’s been so inspiring to watch them lead and thrive in nearly every area of the bank, have these great professional relationships, and mentor others. Coming back to the bank after working in a larger corporate culture for several years, I was able to see that the bank’s actions really do match the intent to prioritize balance. I love seeing the bank’s investment in the employees and growing their career, whatever their path may look like. For some of us, it has been a very straight path. And for some of us, it meant leaving and coming back years later, with a different perspective. I think that we have all been richer and improved for that.”

adams bank & trust | PAGE 2

ADAMS BANK & TRUSTwomeninbankleadership

Adams Bank & Trust is fortunate to have many talented women in senior bank leadership. Their perspectives enhance every facet of our organization, and their expertise benefits our customers every day.

PAGE

3 | your foundation for financial success

DEB BANG mortgage operations manager

LISA BEARD vice presidenttreasury management

AMANDA HOOVER chief financial officer

MICHELLE KALIN chief operations officer

JULIE PIEPHO presidentconsumer banking

JENNIFER SWANSON human resources director

MEGAN JEHOREK talent development officer

TERRI HOOVER bsa specialist

VICKI M c PHERRON board member

LANA SHAW marketing director

ALLISON CLOSSON vice presidentcommercial banking

DEB SCHILZ AIA agency manager

LISA KRAJEWSKI loan operations manager

MELANIE WASHA call center specialist

Chad Adams, president of ADBANC Inc

LACI MUELLER AIA operations manager

NEBRASKA

BRULE 308.287.2344

CHAPPELL 308.874.2800

GRANT 308.352.2114

IMPERIAL 308.882.4286 INDIANOLA 308.364.2215

LODGEPOLE 308.483.5211

MADRID 308.326.4223 NORTH PLATTE 308.532.5936

OGALLALA 308.284.4071 SUTHERLAND 308.386.4345

COLORADO BERTHOUD 970.532.1800 COLORADO SPRINGS 719.448.0707

FIRESTONE 303.833.3575

FORT COLLINS 970.667.4308 LONGMONT 303.651.9053 STERLING 970.522.0698

KANSAS COLBY 785.460.7868

TOLL FREE 800.422.3488 ABTBANK.COM

OUR LOCATIONS

ADAMS BANK & TRUST BALANCE SHEET AS OF JUNE 30, 2021 CASH Cash in our vault, plus cash on demand from other banks where funds are deposited. $ 92,145,804 GOVERNMENT AND AGENCY BONDS Marketable investments in bonds and other securities of the U.S. Government and its agen cies. 239,652,979 FEDERAL FUNDS SOLD Funds loaned to other banks for daily cash needs and payable on demand. 0 LOANS AND LEASES Total of all money loaned to customers for all types of

FIXTURES

loans, such as agriculture, commercial and consumer. 759,838,428 BUILDINGS, FURNITURE AND

Book value (after depreciation) of buildings, computers, equipment, etc. 11,743,414 OTHER ASSETS Interest on loans earned but not collected, expenses that have been prepaid, etc. 16,908,394 TOTAL ASSETS 1,120,289,019 DEPOSITS Money on deposit by customers of the bank in the form of checking accounts, savings ac counts, and certificates of deposit. 973,083,515 OTHER LIABILITIES Borrowings by the bank, interest on deposits that has accrued, payable at a future date, other expenses accrued but not yet paid, deferred taxes, etc. 32,179,892 CAPITAL Par value of the investment of the stockholders for the purchase of stock. 23,000,000 SURPLUS Additional money contributed by stockholders to provide extra financial strength. 17,000,000 UNDIVIDED PROFITS AND RESERVES Bank earnings left in the bank to provide added strength to meet possible future losses on loans and to replace buildings and equipment as they wear out. 75,025,612 TOTAL CAPITAL ACCOUNTS Total capital available for the safe operation of Adams Bank & Trust. 115,025,612 TOTAL LIABILITIES AND CAPITAL ASSETS 1,120,289,019

BONDS: EXAMINING THE RISKS

If you ask many people how they perceive fixed-income investments like bonds, they might say that bonds are “conservative” or a “less risky” choice than equity products, such as stocks.

It’s true that balanced investment portfolios generally include both fixed-income and equity investments in order to balance the risks of market volatility.

But it’s important to remember that no investment is without risk, and bonds are no exception.

It’s especially critical to weigh the interest a bond will pay against the credit worthiness of the issuer.

Interest rates also play a part. Lower interest rate environments may require rethinking how you’ll meet your retirement goals. A heavy reliance on bonds may not be as effective a strategy as it once was.

by JACOB HOVENDICK rjfs branch manager

interest (usually annually or semiannually). They must pay back the principal in full on the date of maturity or risk default.

Maturity

No investment is without risk, and bonds are no exception. It’s especially critical to weigh the interest a bond will pay against the credit worthiness of the issuer. In addition, lower interest rate environments may require rethinking how you’ll meet your retirement goals.

Maturity is the lifetime of a bond. This is one of the first things to consider when choosing a bond that’s suitable for your goals and time horizon. Short-term bonds usually mature within one to three years, medium-term bonds normally reach maturity over ten years, and long-term bonds mature over longer periods of time.

Security

Before we dive into some of the risks associated with the bond market, let’s take a look of the basic mechanics of bond investing.

Bond Basics

A bond is a loan taken out by a borrower that pays investors a fixed rate of return over a specific timeframe. You can think of it like an IOU between the borrower and you, the lender. Bond securities include those issued by the federal government, state/municipal bonds, and corporate bonds. The borrower pays you

Some bonds are secured; others are unsecured. A secured bond promises collateral or specific assets to the bondholder if the company can’t repay the obligation. But unsecured bonds are not backed by any collateral, so the interest and principal are only guaranteed by the issuing company. This can make them a riskier investment than a secured bond.

As you consider investments, it’s important to weigh those potential risks versus benefits. What are some of the most common risks associated with bonds?

Interest Rate Risk

Bond prices have an inverse relationship with interest rates. So when interest rates go up, bond prices go down and when interest rates go down, bond prices go up.

RAYMOND JAMES FINANCIAL SERVICES, INC. MEMBER FINRA/SIPC

Adams Bank & Trust is not a registered broker/dealer, and is independent of Raymond James Financial Services. Securities offered through Raymond James Financial Services, Inc., Member FINRA/SIPC, are not insured by bank insurance, the FDIC or other government agency, are not deposits or obligations of the bank, are not guaranteed by the bank, and are subject to risk, including the possible loss of principal.

Investment Advisory Services offered through Raymond James Financial Services Advisors, Inc.

3rd Quarter, 2021

The risk comes in if interest rates change significantly from what the investor initially expected. If interest rates decline substantially, there is the possibility of prepayment. If interest rates rise, the investor is left with a bond yielding below market rates. The more time to the bond’s maturity, the greater the interest rate risk to an investor.

Credit/Default Risk

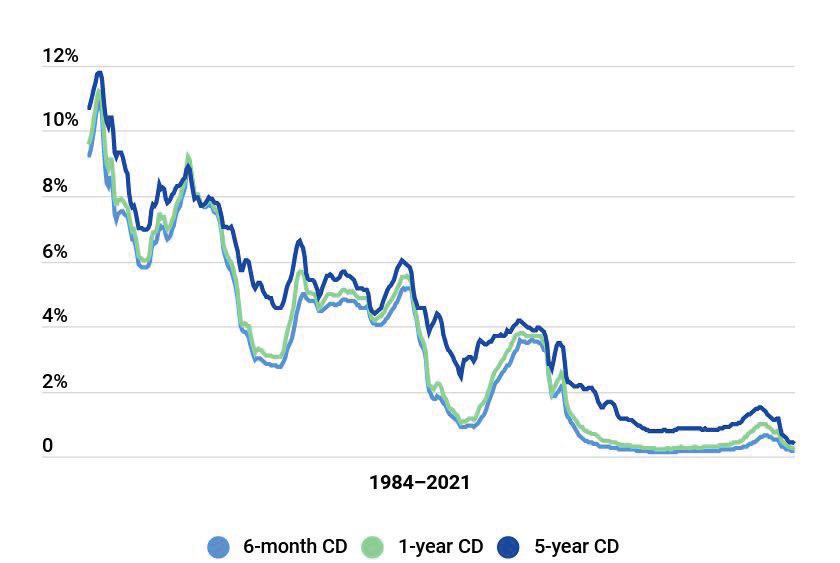

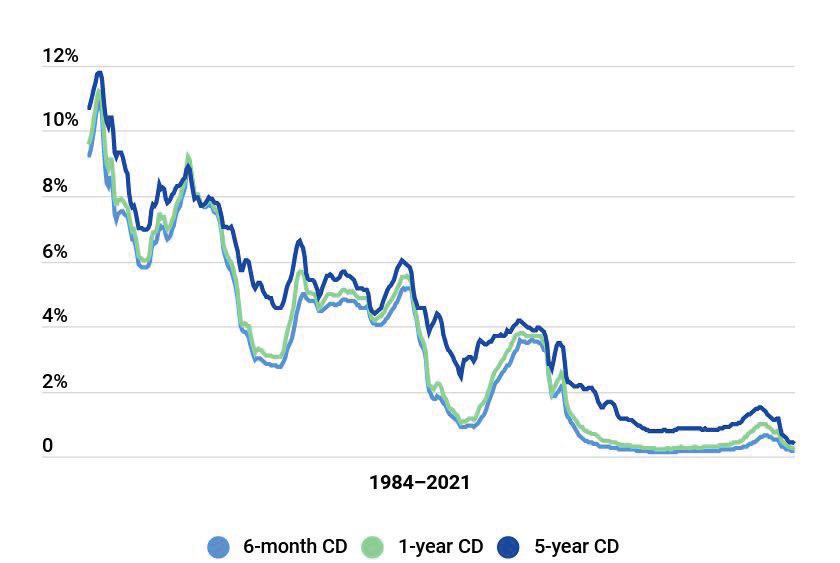

COMPARING INTEREST RATES OVER TIME

It was once a common recommendation for investors to swap the growth potential and risk of stocks for more stable bonds that provided more income as they got closer to or entered retirement. However, your parents or grandparents were able to retire with a heavier reliance on bonds than may be advisable today. Current interest trends need to be factored into your strategy.

Credit or default risk is the risk that interest and principal payments will not be made as required.

So when selecting a bond, don’t just look at the rate; look at the risk. You are the creditor. What is the likelihood that the issuer will make good on their obligation? Do they have good operating income? Does their debt outweigh their available cash?

An issuer may offer a great rate, but if they don’t have good cash flow or healthy profit margins, the bond may be a more risky investment.

Prepayment Risk

A bond issue may be paid off earlier than expected through a call provision. Call provisions let the issuer attempt to lower their debt cost by retiring high-rate bonds and replacing with low-rate bonds.

Prepayment is a risk for investors when interest rates have declined significantly and the issuer has this incentive. Then investors are left with funds to reinvest in a lower interest rate environment.

Inflation Risk

If there are price increases in the economy, the purchasing power of a bond’s returns may deteriorate. One way to limit exposure to this risk is a floating-rate bond that is adjusted periodically to match inflation rates.

What’s An Investor To Do?

When interest rates are low, bonds may not yield much. The same can be said for CDs or money market accounts. We can see how times have changed with this graphic comparing interest rates from the 1980s to the present.

But even in a low-rate environment, there are still opportunities to explore. Sitting down with an investment professional and putting a plan to paper is one of the most positive steps you can take. Finding the balance between fixed income and growth investments, while keeping in line with your life goals, time horizon, and tolerance for risk should be a higher priority than “what is the highest yield I can get.”

As an investor, becoming too narrowed in on yield will blind you to the risks taken to receive the higher yield. Investing for your stage of life is a moving target. Don’t become married to the “way it’s always been done!” at the expense of how it should be done moving forward.

Opinions expressed are those of the author and are subject to change. This information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. This information is not intended as a solicitation. The material is general in nature. Investing involves risk; investors may incur a profit or loss regardless of the strategy or strategies employed. There is no assurance that any investment strategy will ultimately meet its objectives. Past performance may not be indicative of future results. Asset allocation and diversification do not guarantee a profit nor protect against a loss.

For assistance in reviewing or creating your investment plan, please call any Adams Bank & Trust office or call toll free at 800.422.3488 for an appointment with a Raymond James Investment Representative. Jacob Hovendick , RJFS Financial Advisor and Branch Manager Jan Acker, RJFS Financial Advisor 308.284.4071 | 315 N SPRUCE STREET, OGALLALA, NE 69153

Bankrate.com

MANDY ADAMS HOOVER | chief financial officer, board member

MANDY ADAMS HOOVER | chief financial officer, board member