CHECK FRAUD STILL HAPPENS

by TODD S. ADAMS chief executive officer

With the availability of so many alternatives, people are writing fewer checks. Unfortunately, check fraud never goes out of style.

Organizations that track mail-related check fraud say thieves have been increasingly active over the past year, using stolen information to create fake checks. They use them to deposit money into their own accounts or they sell the counterfeits on the darknet.

We continue to see evidence of various types of check fraud in the communities we serve, as well.

WHAT YOU CAN DO TO PREVENT CHECK FRAUD:

✔ Order checks only through a reputable source, like your bank. We have vetted the check vendor and know their security measures.

✔ Limit the information provided on your checks to what is absolutely necessary. Avoid listing sensitive information such as your date of birth or driver’s license.

✔ Be selective when paying with a check. In any transaction, ask yourself how much of your personal information you want to be made available.

✔ When mailing bills with checks enclosed, drop them off directly at the post office. Placing the flag up on your home mailbox may attract identity thieves.

✔ Keep checks and checkbooks safe. Store them in a secure location at your home rather than carrying them around. Shredding is the most secure method of disposal for old or canceled checks.

There may be situations where checks are the only payment method accepted. However, because checks contain sensitive information such as your bank account and routing numbers, they pose unique security risks. While a compromised debit or credit card can be easily shut off, the process to stop payment on a check is more involved. Making an affidavit of forgery and opening a new account if yours has been compromised is even more inconvenient.

If you’ve already taken steps to reduce check use by using ACH payments, be aware that ACH fraud is also on the rise.

Beware of “phishy” emails requesting that you change the routing or account number on your ACH payments. Don’t change that payment information without first calling that vendor at a number you have on file to confirm the request is legitimate.

Regardless of what payment method you select, we encourage all customers to sign up for AdamsAlerts to help monitor account activity. Using online banking or your mobile device to view your check images can also help ensure they didn’t get “washed” or altered between you and the intended recipient. Please notify us immediately if a counterfeit or altered check is posted to your account.

For businesses, we offer Positive Pay as a business account feature. See the ad on page 4 of this issue or talk to your relationship banker to learn more.

QUICK TIP: Did you know the AdamsAlerts system offers special alerts just for check use? For example, you can choose to be alerted when a particular check number or any check number clears your account. AdamsAlerts is available through both the Adams Bank & Trust Mobile App and desktop login to your account at abtbank.com. *Message and data rates may apply. Some restrictions may apply.

SERVING NEBRASKA, COLORADO & KANSAS | 800.422.3488 | INFO@ABTBANK.COM

2nd Quarter, 2022

OUR 2022 EMPLOYEE AWARDS

In football, it’s not the quarterback or the wide receiver or the running back who wins the game; it’s the team as a whole.

But the team can’t succeed unless individual players step up and deliver above-average performances.

That’s why Adams Bank & Trust presents employee awards every year to recognize the individuals who have gone above and beyond expectations to be champions for the bank and its customers.

I think the most special part about these awards is that the employees are nominated by their peers. The people they work with every day notice their leadership and engagement.

The Best of Success award was presented this year to Kent Palmer, EVP of Commercial Banking and Drew Johnson, VP of Commercial Banking. This honor is awarded to individuals who contribute the most to customer and bank success by their dedication and teamwork.

The Exemplary Years of Service award went to Bob Sestak, VP of Ag Banking and Michelle Kalin, Chief Operations Officer.

Matt Kirchoff, VP of Commercial Banking received the Growth Award for significant contribution to the bank reaching its business growth objectives for the year.

The awards for Individual Service Excellence in a Retail/ Sales Role went to Gail Schreiter, Ag Relationship Coordinator,

by STEVE KRAUSE president

by STEVE KRAUSE president

Jenny Cribelli, Financial Services Representative, and Heather Rakowski, Commercial Relationship Coordinator. Lisa Krajewski, Loan Operations Manager, Mindi Wilson, Assistant Operations Officer, and Jenni Soper, Credit Analyst were honored with Individual Service Excellence in a Support Role

The Sting Award went to Jason Jones, SVP of Commercial Banking. This award honors employees who are able to “sting” our major competitors by obtaining new business.

We know our people are our greatest asset and strength. If you feel one of our employees has delivered outstanding service, please let us know so that we can pass along the compliment.

adams bank & trust | PAGE 2

Every year, Adams Bank & Trust presents special awards to recognize excellence in our employees. A selection committee makes the final decisions from nominations submitted by their co-workers. This is a testament to these team members’ attitude, work ethic, and leadership, and we’re very proud of them. We want to congratulate all of the winners and nominees for their outstanding service to their customers, fellow employees, and the bank.

EXEMPLARY YEARS OF SERVICE

BEST OF SUCCESS

GROWTH AWARD

STING AWARD

INDIVIDUAL SERVICE EXCELLENCE - SUPPORT

INDIVIDUAL SERVICE EXCELLENCE - SALES

PAGE 3 | your foundation for financial success

JENNY CRIBELLI financial services representative

GAIL SCHREITER ag relationship coordinator

BOB SESTAK vice presidentag banking

MICHELLE KALIN chief operations officer

MATT KIRCHOFF vice presidentcommerical banking

JASON JONES senior vice president commercial banking

KENT PALMER executive vice president commercial banking

DREW JOHNSON vice presidentcommercial banking

LISA KRAJEWSKI loan operations manager

MINDI WILSON assistant operations officer

JENNI SOPER credit analyst

HEATHER RAKOWSKY commercial relationship coordinator

Steve Krause, President

733,037,431

NEBRASKA

BRULE 308.287.2344

CHAPPELL 308.874.2800 GRANT 308.352.2114

IMPERIAL 308.882.4286 INDIANOLA 308.364.2215 LODGEPOLE 308.483.5211 MADRID 308.326.4223 NORTH PLATTE 308.532.5936

OGALLALA 308.284.4071 SUTHERLAND 308.386.4345

COLORADO BERTHOUD 970.532.1800 COLORADO SPRINGS 719.448.0707 FIRESTONE 303.833.3575

FORT COLLINS 970.667.4308 GREELEY 970.330.8018 LONGMONT 303.651.9053 STERLING 970.522.0698

KANSAS COLBY 785.460.7868

TOLL FREE 800.422.3488 ABTBANK.COM

all money loaned to customers for all types of loans, such as agriculture, commercial and consumer.

BUILDINGS, FURNITURE AND FIXTURES

Book value (after depreciation) of buildings, computers, equipment, etc. 17,870,716

OTHER ASSETS

Interest on loans earned but not collected, expenses that have been prepaid, etc. 17,196,642

TOTAL ASSETS 1,227,202,187

DEPOSITS

Money on deposit by customers of the bank in the form of checking accounts, savings ac counts, and certificates of deposit.

OTHER LIABILITIES

Borrowings by the bank, interest on deposits that has accrued, payable at a future date, other expenses accrued but not yet paid, deferred taxes, etc.

1,071,191,576

31,259,290

Par value of the investment of the stockholders for the purchase of stock. 23,000,000

CAPITAL

SURPLUS

Additional money contributed by stockholders to provide extra financial strength. 17,000,000

UNDIVIDED PROFITS AND RESERVES

Bank earnings left in the bank to provide added strength to meet possible future losses on loans and to replace buildings and equipment as they wear out.

84,751,321

TOTAL CAPITAL ACCOUNTS Total capital available for the safe operation of Adams Bank & Trust. 124,751,321

TOTAL LIABILITIES AND CAPITAL ASSETS 1,227,202,187

OUR LOCATIONS

ADAMS BANK & TRUST BALANCE SHEET AS OF MARCH

31, 2022 CASH Cash in our vault, plus cash on demand from other banks where funds are deposited. $ 68,655,564 GOVERNMENT AND AGENCY BONDS Marketable investments in bonds and other securities of the U.S. Government and its agen cies. 390,441,834 FEDERAL FUNDS SOLD Funds loaned to other banks for daily cash needs and payable on demand. 0 LOANS AND LEASES Total of

MEMBER FINRA/SIPC

BALANCING EMOTIONS AND INVESTING

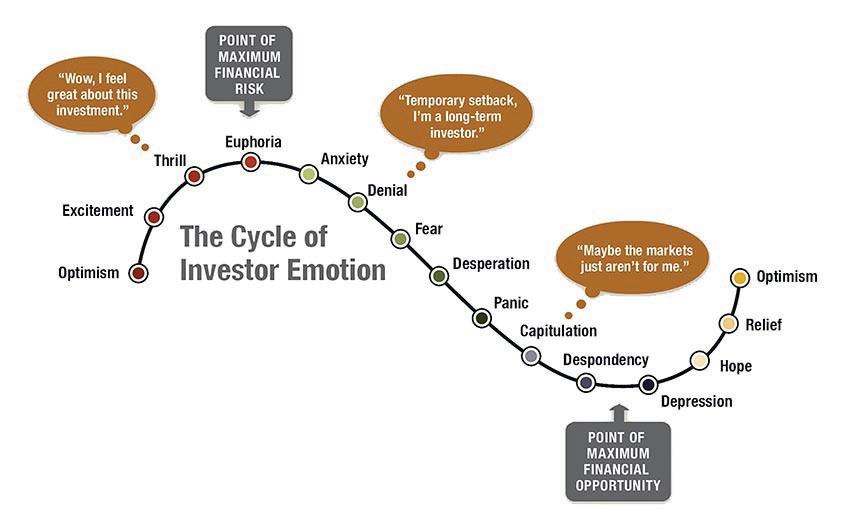

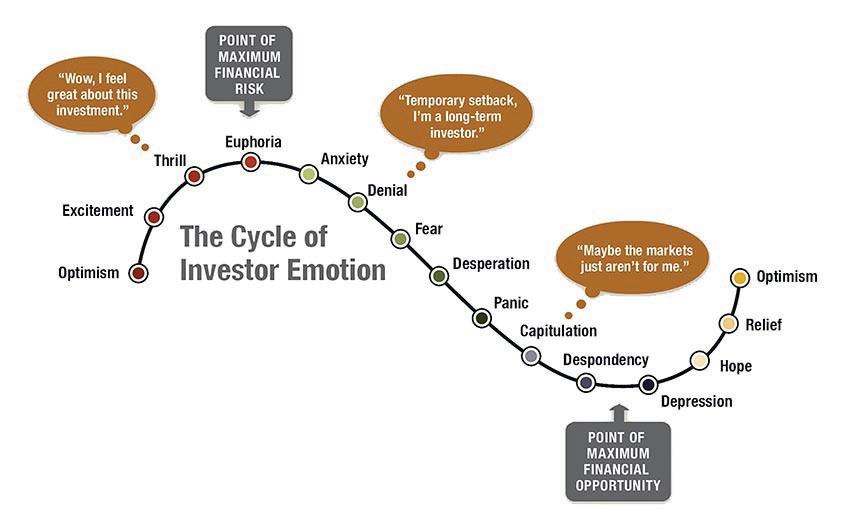

We know it’s never a question of if the market will experience volatility, but rather when. When volatility does occur, it always makes the headlines. And headlines can cause a variety of emotions in investors, including fear, anxiety, and confusion.

As ordinary citizens, we can’t control the factors that lead to market volatility. It’s also difficult to avoid the feelings that arise at those alarming headlines, and that’s only natural.

As humans, we tend to emotionally identify with our money. We understand that our ability to provide food, shelter and necessities for our family is tied to our financial security.

However, taking the emotion triggered by the news of the day and applying it to investments is probably one of the worst things an investor can do.

Given that there is so much beyond your control, what lies within it? Even as the stock market experiences its ups and downs, you can control your response — the actions you take.

Market volatility is one of the reasons you have put together a long-term investing plan with your advisor. Having a plan doesn’t mean that you will never alter

by JACOB HOVENDICK

rjfs branch manager

your course; it means you won’t do so impulsively, in the heat of the moment.

Exploring Opportunities

It may be useful to look at the opportunities available during periods of volatility. For one thing, these times bring the opportunity to connect with your financial advisor. They can serve as a sounding board for your concerns and help provide perspective on current events and your overall financial planning.

As shown in the graph to the left of the cycle of investor emotion, investors who panic and cash out may miss out on a big acceleration in the market.

Source: U.S. Bank

Source: U.S. Bank

There are traders who buy and sell all the time, trying to time the market’s every movement, but this isn’t likely to prove effective for the average investor and their long-term goals.

It’s ironic that when people walk into their favorite stores and see a big reduction in prices, they’re inclined to shop the sale and pick up bargains. But when they see the stock market “on sale” at 10 to 20%, they default to emotions like fear, anxiety and panic.

Temporary pullbacks in the market may come with opportunities to shop and add to your portfolio. Your advisor can help you explore those opportunities.

RAYMOND JAMES FINANCIAL SERVICES, INC.

Adams Bank & Trust is not a registered broker/dealer, and is independent of Raymond James Financial Services. Securities offered through Raymond James Financial Services, Inc., Member FINRA/SIPC, are not insured by bank insurance, the FDIC or other government agency, are not deposits or obligations of the bank, are not guaranteed by the bank, and are subject to risk, including the possible loss of principal.

Investment Advisory Services offered through Raymond James Financial Services Advisors, Inc.

“If you cannot control your emotions, you cannot control your money.” Warren Buffett

2nd Quarter, 2022

Looking At History

A historical perspective can help you base decisions on strategy rather than emotion.

Looking at the market’s performance over a long period of time, there is evidence of its resiliency. No one denies that market declines are uncomfortable. The declines that occurred in the past undoubtedly felt just as uncomfortable as they do today. But when balanced against the market’s overall growth, the value of patience and persistence is clear. It’s helpful to remember:

• The stock market is cyclical.

• Over time, the stock market has shown resilience. The upturns have been stronger than the downturns in the long run.

• As a long-term investor, you will likely see many pullbacks.

Hedging Against Inflation

Emotions are also triggered by inflation — the general price level rise of goods and services.

Inflation always hits close to home. We see it at the grocery store and gas pump, and when buying homes and vehicles.

How can investors combat inflation and its impact on their retirement plans? Owning stocks is one of the best long-term inflation hedges.

Previous generations were able to retire with a heavier reliance on CDs and bonds than may be advisable today. It was a different

interest rate and bond market environment. For the last decade, inflation has been averaging between 1.5 and 2.5%. While it’s true that cash accounts and bonds were paying low interest, they were at least keeping up with inflation. But at 7 to 8% inflation, assets start to feel the impact.

It’s a particular struggle for those investors who are already in their retirement years.

Traditionally, retirees felt that fixed-income assets like bonds were “safer.” However, today’s retirees may need to maintain more of their retirement funds in stocks.

So emotions come into play again as investors try to balance wealth preservation with providing the income needed to see them through their lifetime, especially for those who will live into their 80s or 90s.

If people can’t sleep because they’re overly worried about risk, that’s not healthy. But if a bondheavy portfolio is averaging 4%, and inflation is running at 8%, that’s not realistic.

Traditionally,

“The stock market is a device for transferring money from the impatient to the patient.”

Warren Buffet

maintain more of their retirement funds in stocks.

Inflation was high in the 1980s, but CDs paid between 10 and 12%. You won’t find an 8% CD today.

It can be a hard thing to recognize that if you’re not keeping up with inflation, you’re losing money even if your investments or account balances are positive.

Being patient and not allowing emotion to rule decisions is difficult. But financial decisions made with the heart rather than the head typically don’t end the way we want them to.

There will always be volatility in the market. The question is, how do you react in the face of it?

Your response during volatility dictates whether you’re more likely to contribute to your success or limit it.

Opinions expressed are those of the author and are subject to change. This information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. This information is not intended as a solicitation. The material is general in nature. Investing involves risk; investors may incur a profit or loss regardless of the strategy or strategies employed. There is no assurance that any investment strategy will ultimately meet its objectives. Past performance may not be indicative of future results. Asset allocation and diversification do not guarantee a profit nor protect against a loss.

For assistance in reviewing or creating your investment plan, please call any Adams Bank & Trust office or call toll free at 800.422.3488 for an appointment with a Raymond James Investment Representative. Jacob Hovendick , RJFS Financial Advisor and Branch Manager Jan Acker, RJFS Financial Advisor 308.284.4071 | 315 N SPRUCE STREET, OGALLALA, NE 69153

It can be a hard thing to recognize that if you’re not keeping up with inflation, you’re losing money — even if your investments are positive.

retirees felt that fixed-income assets like bonds were “safer.” However, today’s retirees may need to

by STEVE KRAUSE president

by STEVE KRAUSE president

Source: U.S. Bank

Source: U.S. Bank