TAKING INVENTORY OF YOUR FINANCIAL HEALTH

To take care of our health, we see our doctors for regular checkups. Regular checkups are just as important to our financial health.

As you organize the items on this checklist, know that it will be a helpful process not only for you, but also for your loved ones if something should happen to you.

CAN YOU (AND YOUR LOVED ONES) FIND THIS INFO?

✔ Financial Records

✔ Retirement Information

✔ Social Security Records

✔ Insurance Policies: Life, Property, Health

✔ Your Will & Other Estate Documents

Financial and Property Records: Make an inventory of your bank account information, real estate deeds, and vehicle titles. If you have a safety deposit box, does someone else know where to find the key?

✔ Financial POA, Medical POA, Advance Directive

✔ Digital Records & Passwords

Can you locate your most recent tax returns? What about contact information for professionals such as your accountant and family attorney?

Retirement Savings: Take a look at your retirement plan. Are you on track for what you want to do?

Have you checked your Social Security earnings lately? As you approach retirement, you’ll want to be well versed on your collection options.

Insurance Policies: Do you have adequate life insurance in place, and are the beneficiaries up to date?

As the year progresses, keep track of your health insurance deductibles and out of pocket expenses.

Given the rate of inflation, are the limits adequate on your homeowner’s and other property insurance policies? Adams Insurance Advisors, our sister agency, can help you with a policy review to make sure you’re mitigating risk with proper coverage in all areas.

by TODD ADAMS chief executive officer

Legal Documents: Are your will and other estate planning documents up to date?

If something happens to you, who is going to take care of your affairs? Do you have both financial and medical powers of attorney (POA) in place? What about an advance directive or living will?

Have you talked with the people you’ve selected as representatives so that they know their responsibilities and where to find things?

You might think a safety deposit box is the best place to keep power of attorney documents, but the need to access them may arise outside the bank’s business hours. Your purse or vehicle glovebox might be a good additional storage place for copies. Copies should also be placed with the representatives who will need them. Digital Records & Passwords: It’s also important to document the digital aspects of your life, such as your email, social media accounts, and any cloud-based storage systems or subscriptions that store photos or important documents. You’ll want to keep all your passwords safely organized and tell your family or representatives where to find them.

Periodically clean out your email inbox and addresses so that you’re maintaining just the records and contacts that you need.

Sometimes the future shows up unexpectedly. There’s no time like the present to prepare. If you fail to plan, you’re planning to fail.

SERVING NEBRASKA, COLORADO & KANSAS | 800.422.3488 | INFO@ABTBANK.COM

1st Quarter, 2024

STRATEGIES FOR YOUR SUCCESS IN 2024

As we reflect on the past year, we are inspired by the resilience our customers have shown in the face of a variety of economic hurdles. We’re committed to expanding the ways we can help you achieve your goals in 2024.

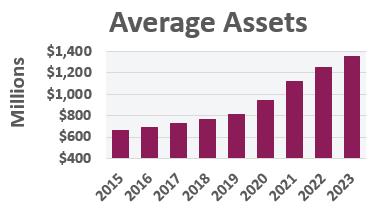

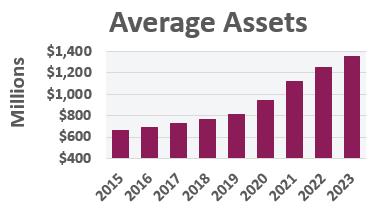

Life always presents challenges. However, Adams Bank & Trust continues to be well-capitalized and well-positioned to help you navigate those headwinds and prepare to take advantage of good opportunities.

What challenges will 2024 hold?

Although the Federal Reserve is expected to lower interest rates over the next year, we don’t know how much rates will drop. Will that be enough to stimulate the economy? The Fed continues to seek a soft landing, but how will that play out? In any case, compared to the environment of three or four years ago, interest rates are likely to remain relatively high.

The rate of inflation may slow further as rates soften, but high prices continue to cast a shadow over every sector.

It’s a challenge to run a profitable business, farm, or ranch in this type of economy. Input costs are higher across the board, and this may curtail expansion. Ag producers are facing higher prices

for fuel, feed, seed, and fertilizer. Finding employees is still difficult for all businesses.

The housing supply remains tight. As retirees downsize and pay with cash, first-time homebuyers may have trouble finding a home they can afford.

Above all, we want to help you control what you can control.

When stress occurs in the economy, it’s important to be as strategic as possible.

How can Adams Bank & Trust help you succeed in the coming year?

Above all, we want to help you control what you can control. When there’s stress in the economy, it’s important to be as strategic as possible. It’s a time to utilize help and expert advice, and AB&T is one of the best places to start. We are likely to have some solutions you haven’t considered.

Mortgage: We offer solutions for every type of homebuyer and situation – from bridge loans to construction and lot financing. Even more importantly, our mortgage bankers are ready to sit down with you, talk through all the scenarios, and help find the best mortgage for you. Starting with prequalification, we can walk you through the entire process.

Business & Ag : AB&T has a deep and very knowledgeable bench, with hundreds of years of

by STEVE KRAUSE president

combined business and ag banking experience. Our bankers are here to serve as a sounding board for your ideas and help brainstorm through the challenges you’re facing. Just having a skilled outside perspective can be very helpful.

IntraFi Coverage : If you’re concerned about FDIC limits on large deposits, we have solutions. As a member of the IntraFi network, Adams Bank & Trust can provide multi-million dollar FDIC coverage. There’s no need to manage accounts at multiple banks and sort through multiple bank statements. You can have convenience and peace of mind with one banking relationship.

We’re not just lenders; we’re bankers. There is a difference.

Talk To Your Banker : We’re not just lenders; we’re bankers. There is a difference. We’re not just interested in the short-term transaction; we’re here for an ongoing full-service relationship.

If you haven’t talked to your banker lately, it’s a good time to make an appointment. No matter what circumstances you’re trying to navigate, our relationship bankers can offer valuable counsel.

We’re very optimistic for 2024 –both for our customers and the communities we serve. If we can help you succeed and accomplish your goals, that’s why we’re here.

adams bank & trust | PAGE 2

PAGE 3 | your foundation for financial success

OUR LOCATIONS

NEBRASKA

BRULE 308.287.2344

CHAPPELL 308.874.2800

GRANT 308.352.2114

IMPERIAL 308.882.4286

INDIANOLA 308.364.2215

LODGEPOLE 308.483.5211

MADRID 308.326.4223

NORTH PLATTE 308.532.5936

OGALLALA 308.284.4071

SUTHERLAND 308.386.4345

COLORADO

BERTHOUD 970.532.1800

COLORADO SPRINGS 719.448.0707

FIRESTONE 303.833.3575

FORT COLLINS 970.667.4308

GREELEY 970.330.8018

LONGMONT 303.651.9053

KANSAS

COLBY 785.460.7868

TOLL FREE 800.422.3488

ABTBANK.COM

ADAMS BANK & TRUST BALANCE SHEET AS OF DECEMBER 31, 2023 CASH Cash in our vault, plus cash on demand from other banks where funds are deposited. 118,718,784 GOVERNMENT AND AGENCY BONDS Marketable investments in bonds and other securities of the U.S. Government and its agencies. 420,599,954 FEDERAL FUNDS SOLD Funds load to other banks for daily cash needs and payable on demand. 0 LOANS AND LEASES Total of all money loaned to customers for all types of loans, such as agriculture, commercial and consumer. 866,742,529 BUILDINGS, FURNITURE AND FIXTURES Book value (after depreciation) of buildings, computers, equipments, etc. 17,169,690 OTHER ASSETS Interest on loans earned but not collected, expenses that have been prepaid, etc. 24,574,529 TOTAL ASSETS 1,447,805,486 DEPOSITS Money on deposit by customers of the bank in the form of checking accounts, savings accounts, and certificates of deposit. $ 1,176,088,151 OTHER LIABILITIES Borrowings by the bank, interest on deposits that has accrued, payable at a future date, other expenses accrued but not yet paid, deferred taxes, etc. 101,212,884 CAPITAL Par value of the investment of the stockholders for the purchase of stock. 41,000,000 SURPLUS Additional money contributed by stockholders to provide extra financial strength. 17,000,000 UNDIVIDED PROFITS AND RESERVES Bank earnings left in the bank to provide added strength to meet possible future losses on loans and to replace buildings and equipment as they wear out. 112,504,451 TOTAL CAPITAL ACCOUNTS Total capital available for the safe operation of Adams Bank & Trust. 170,504,451 TOTAL LIABILITIES AND CAPITAL ASSETS 1,447,805,486

INVESTING WITH THE END IN MIND

When the stock market is hitting record gains, it’s easy to fear you may be missing out on an opportunity for bigger returns. Should you change your investments?

It may feel like the market is only going to go up. But the market has a way of fooling everyone. You don’t want to allow your emotions to cause you to take on risk that goes beyond your comfort zone.

All investments involve risk. The important questions are – are you comfortable with the level of risk you’re taking, and does it align with your reasons for investing?

Risk should always be taken with your end goals in mind. The amount of risk you’re comfortable with shouldn’t be affected by whether the stock market is going up or down at any given time.

Risk should always be taken with your end goals in mind. The amount of risk you’re comfortable with shouldn’t be affected by whether the stock market is going up or down at any given time.

Consider the last couple of years. 2022 was a volatile time in the economy. It appeared as though we might be headed for a recession in 2023. If you were only watching the news commentators and social media over the last year, it would have been easy to assume the markets were down or flat because the news was so negative. But in reality, the markets were up. In many ways, they were up substantially.

Adams

by JACOB HOVENDICK rjfs branch manager

The truth is that you don’t know when the market is going to go up or down. That’s why it’s so important to have a financial plan. Working with your financial advisor, you can build a plan that supports your comfort level for risk. Your plan is like your North Star – it helps guide you to wise investment choices throughout all the market’s inevitable up and down cycles.

Does having a financial plan mean you can never change it? No, the whole point of building the plan is being able to make adjustments to it as life progresses.

If you don’t have a budget, how will you know how much money you can save? If you don’t save, how can you accomplish your long-term goals?

What are the key building blocks of every plan?

Every step is important to the whole. If you don’t have a budget, how will you know how much money you can save? If you don’t save, how can you accomplish your long-term goals? If you haven’t evaluated your risk tolerance, how can you determine what types of investments are best for those goals?

• Your Budget: Your monthly budget is simply an outline of your short-term goals. What are your household expenses such as food, rent or mortgage payments, utilities, vehicles, medical care, insurance premiums, and childcare? Do you have an emergency fund? Once you have a firm grasp on these numbers, you’ll have a better idea of how much you can budget to investing in your future.

JAMES

INC.

RAYMOND

FINANCIAL SERVICES,

MEMBER FINRA/SIPC

Bank & Trust is not a registered broker/dealer, and is independent of Raymond James Financial Services. Securities offered through Raymond James Financial Services, Inc., Member FINRA/SIPC, are not insured by bank insurance, the FDIC or other government agency, are not deposits or orbligations of the bank, are not guaranteed by the bank, and are not subject to risks, including the possible loss of principal. Investment Advisory Services offered through Raymond James Financial Services Advisors, Inc.

1st Quarter, 2024

• Your Tolerance For Risk : This will depend on your age. What is your timeline for retiring and needing to use the assets you’ve saved? In general, as investors get closer to retirement, they tend to be more conservative with risk. They value preservation of wealth over growth. Your advisor can help you develop time horizons for your goals in all stages of your life.

• Your Goals: Why are you trying to build wealth? What kind of future and retirement do you want? Do you have family goals to meet such as funding children’s or grandchildren’s education?

What advantages do long-term investors experience over those who attempt to time the market in the short term? For one thing, they reap more of the benefits of compounding interest.

What advantages do long-term investors experience over those who attempt to time the market in the short term? For one thing,

they reap more of the benefits of compounding interest – the ability for your money to make interest on the interest.

Keep in mind:

• The sooner money is put to work, the sooner it may begin compounding.

• Excessive risk can contribute to large losses, which can cut into the long-term benefits of compounding.

Research shows that investors consistently cost themselves percentage points by trying to time the market. If you find yourself worrying that you’re missing out on an opportunity and wondering if you should take on greater risk, consider the risk of missing out on compounding interest over time. Ultimately, the amount of time you spend in the market will likely

be more important to your financial success.

What is a positive way to feel like you’re working toward your end goals in the present moment? Talk to your advisor. You can always reexamine your investing budget and the reasons you’re saving. You can always reevaluate your risk tolerance.

Whether you’ve recently made a change to your financial plan, or it’s been a while, talking to your financial advisor can help bring clarity and perspective.

As the saying goes, “The best day to start was yesterday. The next best day to start is today.” Don’t head off down the road to your financial future without a map/ plan to help guide you.

Opinions expressed are those of the author and are subject to change. This information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. This information is not intended as a solicitation. The material is general in nature. Investing involves risk; investors may incur a profit or loss regardless of the strategy or strategies employed. There is no assurance that any investment strategy will ultimately meet its objectives. Past performance may not be indicative of future results. Asset allocation and diversification do not guarantee a profit nor protect against a loss. Working with a financial professional does not ensure a favorable outcome.

For assistance in reviewing or creating your investment plan, please call any Adams Bank & Trust office or call toll free at 800.422.3488 for an appointment with a Raymond James

Jacob Hovendick , RJFS Financial Advisor and Branch Manager Jan Acker, RJFS Financial Advisor 308.284.4071 | 315 N SPRUCE STREET, OGALLALA, NE 69153

Investment Representative.