SOCIAL MEDIA: A GOLD MINE FOR SCAMMERS

Since its inception, social media has been a magnet for scammers looking for information to steal and exploit. However, it was truly a gold mine for them in 2021.

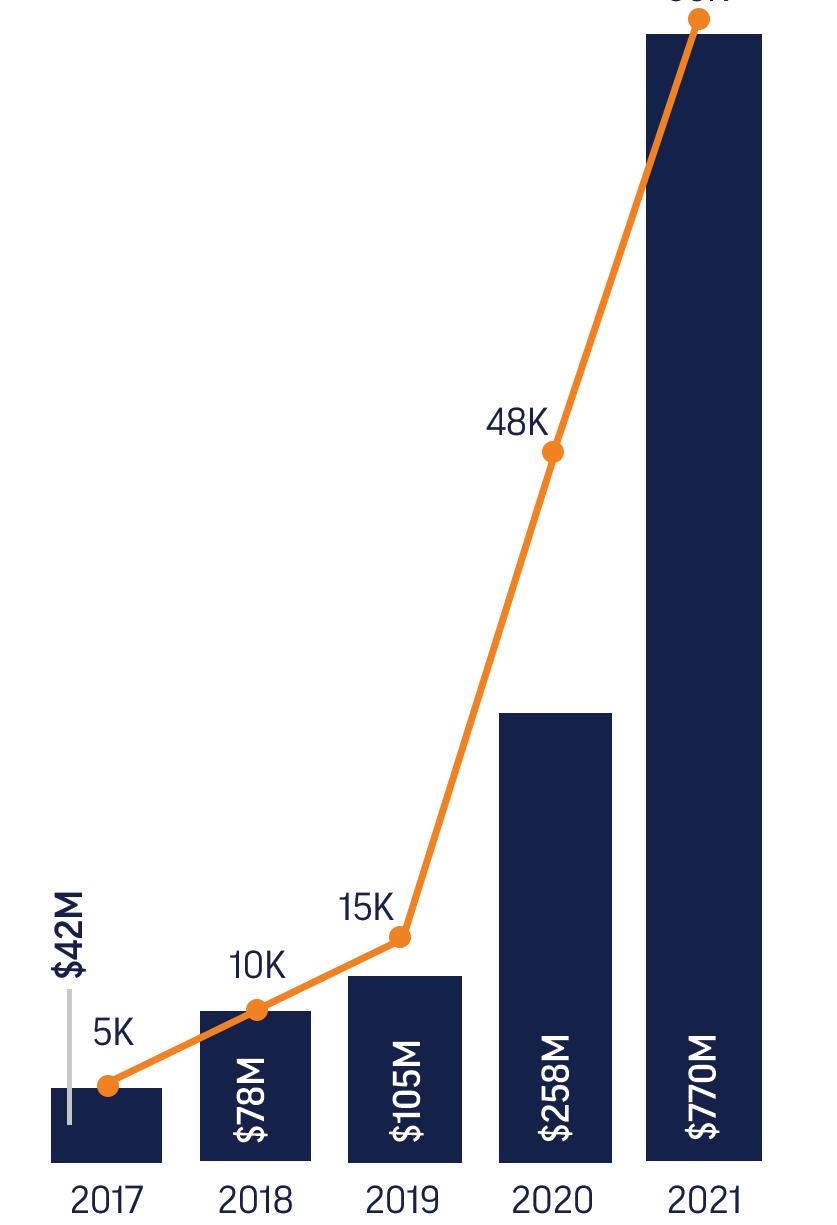

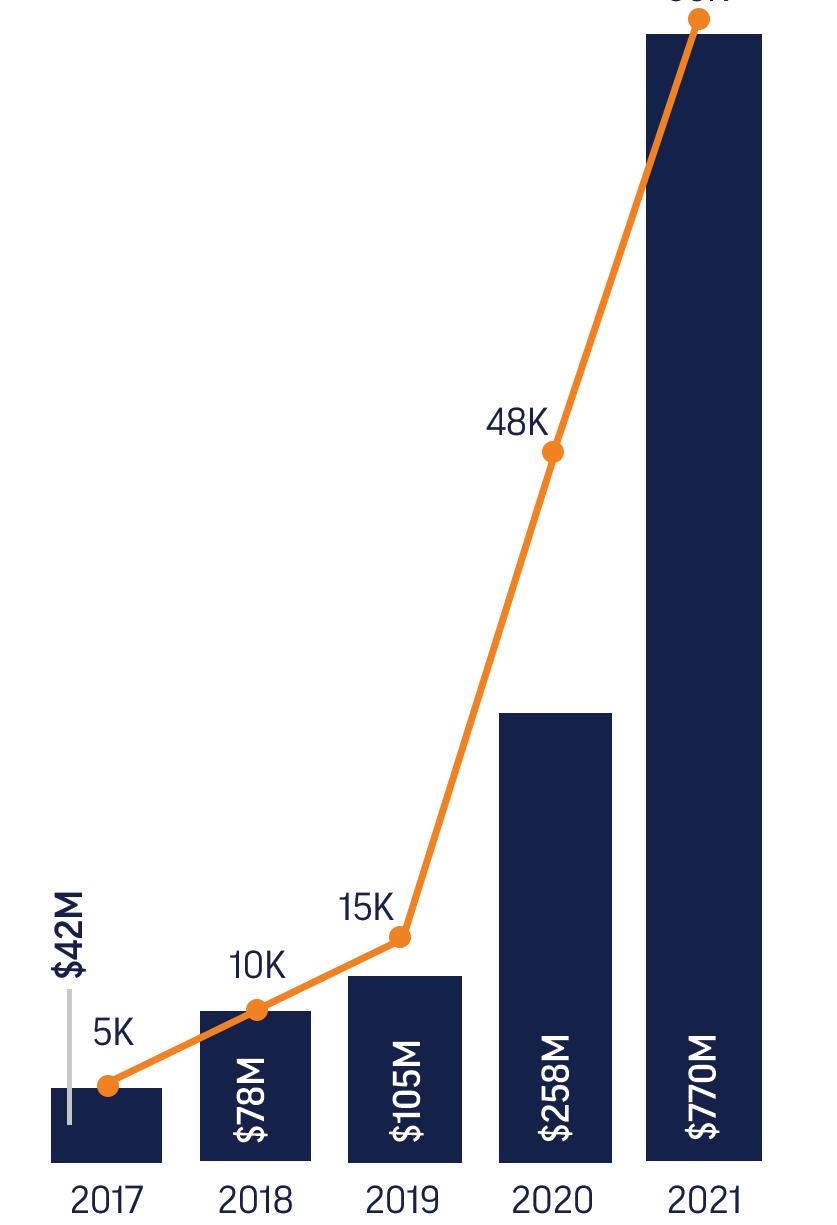

According to data collected by the Federal Trade Commission (FTC), social media was more profitable to fraudsters than any other single method of reaching people last year, accounting for about $770 million in losses. The graph to the right tells the story. Total reported losses to fraud originating on social media were 18 times higher in 2021 than in 2017.

The biggest financial losses reported in 2021 came from investment scams, including a huge surge in bogus cryptocurrency schemes. More than half of the victims reported that the scam started on social media. Often the crooks posed as supposed friends to encourage people to invest.

Reports about fraud originating on social media soared over five years 2021 total reported losses were about 18 times what they were in 2017, and the number of people who reported losing money in 2021 grew to 19 times higher than those reports in 2017.

by TODD S. ADAMS chief executive officer

by TODD S. ADAMS chief executive officer

orders for items they saw marketed on social media, but then never received them.

No age group is immune to scams, and bad actors troll for victims on every single social media platform, including the emerging “metaverse,” an online virtual reality world with its own alternate identities and economy. Scammers create bots, or automated programs that can steal financial details under the pretense of selling in-game currency and NTFs (non-fungible tokens).

How can you better protect yourself in any online social space?

• Be wary of anyone, including “friends,” encouraging you to make any kind of investment.

• Never send money to someone you’ve never met in person.

Figures based on fraud reports directly to the FTC indicating a monetary loss and identifying social media as the method of contact. (FTC.gov)

Online romance scams were the second most profitable fraud in 2021, and more than a third of victims who reported losses stated the communication began on Facebook or Instagram.

While investment and romance scams accounted for the most dollars lost, the largest number of people were affected by online shopping fraud. Victims often placed

• Keep in mind that scam websites can mimic trusted brands. Instead of clicking on social media ads or links, go directly to stores’ original websites. You can also opt out of targeted ads in your device’s privacy settings. In general, use caution when linking your real financial information to virtual worlds. It’s good to know who’s in your wallet; make sure it’s you!

QUICK TIP: Adams Alerts help you stay on top of all account activity. You may not notice a fraudulent withdrawal or recurring payment immediately, but Alerts can do the legwork and tip you off in real time. Call us or stop in with any questions about setting up various alerts in our mobile app.

SERVING NEBRASKA, COLORADO & KANSAS | 800.422.3488 | INFO@ABTBANK.COM

1st Quarter, 2022

MAINTAINING OUR LEGACY OF CUSTOMER SERVICE

We’ve all heard the expression “the more things change, the more they stay the same.”

There are certain things that we hope never change at Adams Bank & Trust, even as the bank continues to grow and expand its footprint. We’re committed to preserving the most important part of our legacy: the way we take care of our customers.

Throughout our 100+ year history as a family-owned community bank, nothing has mattered more to us than delivering excellent customer service. Time after time, that’s what customers tell us they value most about our bank culture and our relationships.

We want you to walk out of the bank feeling good about the experience. We want you to feel our knowledge, expertise, and professionalism have helped you, and that you would recommend our bank to your friends.

To make sure our tradition of outstanding customer service continues, we’ve put together a culture committee. These team members are taking an in-depth

look at all the elements that add up to a great banking experience.

We know it all starts with the people who serve you. That’s why we’re developing new ways to recognize and reward staff who consistently go above expectations to serve customers.

We’re looking at ways to empower staff to ensure positive encounters in the moment.

Because it is our employees who convey our values to our customers and gain your trust, we invest in their growth and development.

We don’t want to just offer jobs to people; we want to build careers. Mentorship is a big part of that, and so is providing opportunities for deeper professional paths.

F inally, the culture committee is focused on making sure the bank continues to deliver a truly personalized experience. We will continue to invest in the technology platforms that make that possible. Even if a different person is helping you today than yesterday, you shouldn’t have to recite your story again. Our systems ensure that all team members are always up to speed on your account and your needs.

by STEVE KRAUSE president

This synergy extends across 20 (soon to be 22) branches in 3 states. We may not all be gathering around the same water cooler, but we are connected and interacting as a team to serve you in the same way, whether you walk into our original branch in Brule, NE, or our latest branch in Greeley, CO. Whether you phone our call center or reach out online, we want you to have the same “Grade A” experience.

Maybe you bank with us because your parents and grandparents did. Maybe you found us because you wanted a different kind of banking experience in a city full of bigbox banks. We may have reached the milestone of $1 billion in both assets and deposits recently, but we’re still committed to delivering the same personal service you’ve come to expect.

Toward that end, your feedback is very important to us. We’ll be checking in with customers to provide survey opportunities as well as banking tips, so watch your inbox for emails from hello@ abtbank.com. We look forward to hearing about your experiences with Adams Bank & Trust.

CULTURE COMMITTEE PURPOSE STATEMENT

The Culture Committee oversees the development and implementation of strategies that assist in the creation of an organizational culture best aligned with the mission and values of Adams Bank & Trust. The committee will promote best practices to foster a collaborative and inspiring environment. The committee will engage with the Executive Leadership team to enforce policies and practices that further this purpose.

adams bank & trust | PAGE 2

PAGE 3 | your foundation for financial success

NEBRASKA

BRULE 308.287.2344

CHAPPELL 308.874.2800

GRANT 308.352.2114

IMPERIAL 308.882.4286 INDIANOLA 308.364.2215

LODGEPOLE 308.483.5211 MADRID 308.326.4223 NORTH PLATTE 308.532.5936

OGALLALA 308.284.4071 SUTHERLAND 308.386.4345

COLORADO BERTHOUD 970.532.1800

COLORADO SPRINGS 719.448.0707

FIRESTONE 303.833.3575

FORT COLLINS 970.667.4308 LONGMONT 303.651.9053 STERLING 970.522.0698

KANSAS COLBY 785.460.7868

TOLL FREE 800.422.3488 ABTBANK.COM

GOVERNMENT AND AGENCY BONDS Marketable investments in bonds and other securities of the U.S. Government and its agen cies.

305,435,784

Funds loaned to other banks for daily cash needs and payable on demand. 0

FEDERAL FUNDS SOLD

LOANS AND LEASES Total of all money loaned to customers for all types of loans, such as agriculture, commercial and consumer.

748,202,068

Book value (after depreciation) of buildings, computers, equipment, etc. 13,525,473

BUILDINGS, FURNITURE AND FIXTURES

OTHER ASSETS

Interest on loans earned but not collected, expenses that have been prepaid, etc. 16,181,120

TOTAL ASSETS 1,196,912,420

DEPOSITS

Money on deposit by customers of the bank in the form of checking accounts, savings ac counts, and certificates of deposit.

OTHER LIABILITIES

Borrowings by the bank, interest on deposits that has accrued, payable at a future date, other expenses accrued but not yet paid, deferred taxes, etc.

1,043,062,119

32,262,856

Par value of the investment of the stockholders for the purchase of stock. 23,000,000

CAPITAL

SURPLUS

Additional money contributed by stockholders to provide extra financial strength. 17,000,000

UNDIVIDED PROFITS AND RESERVES

Bank earnings left in the bank to provide added strength to meet possible future losses on loans and to replace buildings and equipment as they wear out.

81,587,445

Total capital available for the safe operation of Adams Bank & Trust. 121,587,445

TOTAL CAPITAL ACCOUNTS

TOTAL LIABILITIES AND CAPITAL ASSETS 1,196,912,420

OUR LOCATIONS

ADAMS BANK & TRUST BALANCE SHEET AS OF DECEMBER 31, 2021

CASH Cash in our vault, plus cash on demand from other banks where funds are deposited. $ 113,567,975

MAKING HEALTHY FINANCIAL CHOICES

One recent study showed that about two-thirds of people who make New Year’s resolutions have already abandoned them within a month.

The problem with resolutions is that they’re hard to stick to. Maybe it’s better to start with our habits.

My wife, Meagan, is a registered dietitian and nutrition therapist. Rather than asking patients to make big sweeping changes to their diet that rely on willpower, she first asks what they regularly eat. From there, she helps them consider how they might make habits of healthier choices. Meagan believes making these choices routine and convenient is the key. That’s why you’ll find healthy snack options at easy access in our fridge and on our pantry shelves. (It also helps that our children don’t do the grocery shopping!)

So what are the habits or choices that lead to financial health? How can we make it easier to ingrain those habits into daily life?

Using A Budget

Do you have a budget and spending plan? So many people don’t know where their money actually goes. But without that awareness, it’s nearly impossible to save

by JACOB HOVENDICK rjfs branch manager

money and build wealth. Tracking your expenses for a month can open your eyes to what you really spend. You may think you only spend a minimal amount on fast food or coffee, only to discover it’s much more than you thought.

So much of what we consume on a daily basis has moved to a subscription model. It’s easy to lose track of what we’ve subscribed to, what we actually use, and what we’re continuing to pay for that we’re not using. Budgeting a specific amount towards an area such as entertainment cuts out the guesswork.

What goals do you want to build into your budget and how can you automate the process? Whether you’re building an emergency fund, saving for the down payment on a house, or saving toward your retirement, it’s much easier to save that money if it doesn’t remain in the account that you use to pay out living expenses.

Pay yourself first each month into accounts earmarked for those purposes. If this money is out of easy reach, it’s harder to spend it impulsively. And you won’t miss money that was never in your regular bank account to begin with.

RAYMOND JAMES FINANCIAL SERVICES, INC. MEMBER FINRA/SIPC

Adams Bank & Trust is not a registered broker/dealer, and is independent of Raymond James Financial Services. Securities offered through Raymond James Financial Services, Inc., Member FINRA/SIPC, are not insured by bank insurance, the FDIC or other government agency, are not deposits or obligations of the bank, are not guaranteed by the bank, and are subject to risk, including the possible loss of principal. Investment Advisory Services offered through Raymond James Financial Services Advisors, Inc.

RAYMOND JAMES FINANCIAL SERVICES, INC. MEMBER FINRA/SIPC

Adams Bank & Trust is not a registered broker/dealer, and is independent of Raymond James Financial Services. Securities offered through Raymond James Financial Services, Inc., Member FINRA/SIPC, are not insured by bank insurance, the FDIC or other government agency, are not deposits or obligations of the bank, are not guaranteed by the bank, and are subject to risk, including the possible loss of principal. Investment Advisory Services offered through Raymond James Financial Services Advisors, Inc.

1st Quarter, 2022

Living Within Your Means

Being realistic with your finances is one of the healthiest choices you can make. On the other hand, engaging in wishful financial thinking is one of the most damaging practices in the long term.

Although it can be a challenge, living below your means is important at any stage of life, from your twenties to your retirement years. Your first job after getting out of school will likely be your lowest-paying one, and it can be a stretch to meet all your expenses in those years.

However, your expenses generally increase in your 30s and 40s as you begin a family or buy a house. If you can control your expenses and start building savings while you’re relatively young, you’ll reap the benefits of time and compound interest.

The habit or ability to live within your means will also pay off when you’re older and wanting to retire.

Running up credit card debt on a fixed income won’t be sustainable.

As you go through your earning years, you’ll want to beware of lifestyle inflation, or spending more money just because you’re making more. You may be able to

Giving Yourself Permission To Make Mistakes

Thanks to the internet, we all have access to an amount of information that can be overwhelming. Sometimes we can experience “paralysis by analysis.” It’s easy to become so afraid of making a financial mistake that we don’t do anything. But not making a choice is still a choice.

absorb more expenses before you feel the impact, but you’re limiting your ability to build wealth. Will you be able to make ends meet in retirement if you don’t alter your habits now? Get in the habit of mindful spending and identifying needs vs. wants.

Making Pro and Con Lists

This is a great practice for all financial decisions, especially if you make a list for both now and in the future. How else can you consider every angle? What are the risks and trade-offs? And how is “Future You” going to feel about the choice you’re making today?

Let’s say you want to make a special purchase that amounts to $5,000. That may feel great in the short term, but that $5,000 you didn’t save or invest today might have grown to $7,000 five years from now.

The penalty of standing still may be missing out on good opportunities. We’re human, and we’re not going to make perfect decisions one hundred percent of the time. Allowing ourselves to make some mistakes helps us make better decisions in the future.

Using Tools Vs. Rules

We can follow a “diet” made up of rigid personal finance rules, or we can strive to stick to good habits, knowing that they can be excellent tools for financial success.

At any age or stage in life, it is our habits that can put us on the path to better choices.

Opinions expressed are those of the author and are subject to change. This information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. This information is not intended as a solicitation. The material is general in nature. Investing involves risk; investors may incur a profit or loss regardless of the strategy or strategies employed. There is no assurance that any investment strategy will ultimately meet its objectives. Past performance may not be indicative of future results. Asset allocation and diversification do not guarantee a profit nor protect against a loss.

For assistance in reviewing or creating your investment plan, please call any Adams Bank & Trust office or call toll free at 800.422.3488 for an appointment with a Raymond James Investment Representative. Jacob Hovendick , RJFS Financial Advisor and Branch Manager Jan Acker, RJFS Financial Advisor 308.284.4071 | 315 N SPRUCE STREET, OGALLALA, NE 69153

Although it can be a challenge, living below your means is important at any stage of life, from your twenties to your retirement years.

It’s easy to become so afraid of making a financial mistake that we don’t do anything. But not making a choice is still a choice.

Get in the habit of mindful spending and identifying needs vs. wants.

by TODD S. ADAMS chief executive officer

by TODD S. ADAMS chief executive officer

RAYMOND JAMES FINANCIAL SERVICES, INC. MEMBER FINRA/SIPC

Adams Bank & Trust is not a registered broker/dealer, and is independent of Raymond James Financial Services. Securities offered through Raymond James Financial Services, Inc., Member FINRA/SIPC, are not insured by bank insurance, the FDIC or other government agency, are not deposits or obligations of the bank, are not guaranteed by the bank, and are subject to risk, including the possible loss of principal. Investment Advisory Services offered through Raymond James Financial Services Advisors, Inc.

RAYMOND JAMES FINANCIAL SERVICES, INC. MEMBER FINRA/SIPC

Adams Bank & Trust is not a registered broker/dealer, and is independent of Raymond James Financial Services. Securities offered through Raymond James Financial Services, Inc., Member FINRA/SIPC, are not insured by bank insurance, the FDIC or other government agency, are not deposits or obligations of the bank, are not guaranteed by the bank, and are subject to risk, including the possible loss of principal. Investment Advisory Services offered through Raymond James Financial Services Advisors, Inc.