Breaking the Deadlock and Reborn: Thoughts on the Path to AntiInvolution in the Abrasives and Grinding Tools Industry

By Wu Qiaolin

In recent years, from the photovoltaic and new energy vehicle industries to traditional manufacturing, "involution" has become a high-frequency term in the development of Chinese industries. On July 8th, 33 construction enterprises jointly released an initiative against involution, once again bringing this issue to the forefront. In the abrasives and grinding tools industry and its upstream and downstream industrial chains, problems such as low-price competition, repeated investment, and overcapacity are equally severe. When the industry is trapped in the quagmire of "involutionary" competition, how can it break the deadlock? The answer may lie in returning to the essence of the market – improving quality through innovation and optimizing the ecosystem through integration.

As the "teeth" of industrial manufacturing, the technical level and product quality of abrasives and grinding tools directly affect the efficiency of downstream manufacturing industries. However, some enterprises, in order to compete for market share, blindly expand production and sell at reduced prices, leading to a continuous decline in the industry's profit margin. This kind of nonmarket-oriented competition not only squeezes the living space of high-quality enterprises but also makes the entire industry fall into "low-end lock-in" – enterprises are busy coping with price wars and unable to invest in technological research and development. Just as *People's Daily* warned about the photovoltaic industry: when production capacity far exceeds demand, the price collapse of the entire industrial chain will only drag all participants into a "lose-lose" predicament.

Anti-involution is not against competition, but against disorder and inefficiency. The Sixth Plenary Session of the Central Financial and Economic Commission clearly proposed to "regulate low-price and disorderly competition in accordance with laws and regulations," pointing out the direction for the industry. For abrasives and grinding tools enterprises, efforts need to be made in two aspects:

- First, build barriers through technological breakthroughs. Increase investment in research and development in fields such as high-end abrasives, precision grinding tools, and green preparation processes to get rid of homogeneous competition.

- Second, optimize the pattern through mergers and reorganizations. Looking at the history of global manufacturing development, Germany's precision tool industry has formed clusters of technologically leading "hidden champions" through multiple integrations, while Japanese abrasives and grinding tools enterprises have built complete industrial chain advantages through vertical integration. Domestic industries are in urgent need of leading enterprises to play a leading role and improve the efficiency of resource allocation through market-oriented integration.

The battle against involution in the abrasives and grinding tools industry is essentially a reform to return to market laws. Enterprises need to seek survival through innovation. Only in this way can the strange circle of "bad money driving out good money" be ended, and the industry can be promoted from "scale competition" to "value competition," laying a solid foundation for the highquality development of Made in China.

https://atge.com.au/

PREFACE

02| PREFACE

INDUSTRY INFORMATION

04| INDUSTRY INFORMATION

OVERSEAS INFORMATION

13| OVERSEAS INFORMATION

CENTURY-OLD ABRASIVES ENTERPRISE

17| Look at those abrasive, abrasive tool and grinding enterprises with a century of history (Series 9)

EXHIBITION

28| The Australian Hardware, Tools & Grinding Exhibition kicks off; ATGE2025 deepens China-Australia industrial cooperation

31| Moku Participates in Egypt's BIG5 Exhibition to Explore New Opportunities for Cooperation in the Middle Eastern Market

33| Go Global to North America, Focus on Global Metal Manufacturing - Moku Invites You to FABTECH 2025 Chicago Show!

MARKET ANALYSIS

35| Trend Analysis and Prospect Forecast of the Superhard Materials Market(2025-2033)

38| Traditional grinding industry and non-grinding technology: Competition or complementarity?

40| Is low-cost bauxite coming?What impact will Alcoa's expansion plan have on China's alumina and corundum industries?

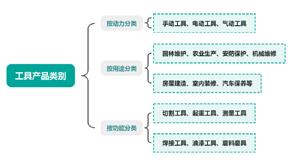

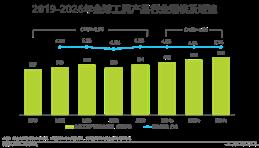

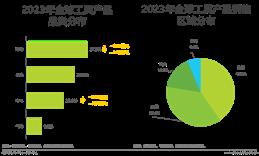

42| Consumption Trends of Tool Products in European and American Markets.

RAW MATERIAL PRICE TRENDS

55| Overview of China's bauxite, alumina and corundum markets in the first half of 2025.

TECHNOLOGY

62| The functional applications of diamond demonstrate its "kingly demeanor".

71| Cutting is not a brute-force job: Achieving smarter machining with cemented carbide band saw blades

73| How to select suitable grinding beads in wet grinding?

75| Ceramic cutting tools: A powerful tool for high-temperature and high-speed cutting, why haven't they been fully utilized?

Industry Information

Industry News

Moku and CUS - GROUP hold a practical sharing session on enterprise overseas - expansion in Zhengzhou, helping abrasive enterprises explore the Southeast Asian market

On July 4th, Moku and CUS-GROUP will jointly host the "Practical Sharing Session on Enterprise Overseas Expansion" at Futian Fortune Plaza in Zhengzhou. This conference aims to provide one-stop overseas expansion solutions for enterprises in industries such as hardware tools and abrasives, with a key focus on exploring markets in Southeast Asia, including Thailand.

The event will revolve around three core contents: guidance for enterprises with zero experience to get started in overseas expansion, practical case analysis on the conversion of overseas exhibition resources, and strategies for in-depth development of the Thai market. Moku will share practical experiences in areas such as site selection for factory construction in Thailand and docking with local enterprises. It will also introduce its overseas warehouse resources in places like Australia and Germany, as well as its channel layout in markets such as Turkey and India.

CUS-GROUP will share its experience in localized services in countries like Uzbekistan and Egypt. This sharing session offers valuable experience for enterprises planning to explore markets in Southeast Asia and the Middle East, especially for managers of enterprises that have achieved poor results in overseas exhibitions. It provides a full-chain overseas expansion solution from market research to on-the-ground operation through resource integration. (Source: Moku Network)

Henan University of Technology successfully held the Development Forum on Abrasives, Grinding Tools and Coated Abrasives Industry.

On June 29th, the "Forum on the Development of Abrasives, Grinding Tools and Coated Abrasives Industry" hosted by Henan University of Technology was successfully held in Zhengzhou. With the theme of "Technological Innovation, Creating the Future Together", the forum attracted numerous industry experts, scholars

and enterprise representatives to attend.

The forum included sessions such as special reports and technical discussions, focusing on cutting-edge technologies and development trends in the industry.

Zhao Zhiwei, Dean of the School of Materials Science and Engineering at Henan University of Technology, introduced the school's breakthrough achievements in fields such as high-speed rail track grinding and semiconductor processing. A number of experts shared innovative technologies such as low-temperature ceramic binders and the substitution of superhard tools, among which vacuum brazed products attracted much attention due to their environmental protection and high efficiency. Chen Peng, Secretary-General of the China Machine Tool & Tool Builders' Association, pointed out that although the industry is facing the challenge of weak supply and demand, its technological innovation capability continues to strengthen. Bai Ning, SecretaryGeneral of the National Abrasives & Grinding Materials Committee, put forward suggestions on enterprises' overseas development strategies, emphasizing the need to grasp policy dividends and expand international markets through exhibitions. Experts at the forum agreed that the industry will develop towards high precision and greenization in the future, and the in-depth integration of industry, academia and research is the key to promoting high-quality development.

This forum has built an important platform for collaborative innovation in the industrial chain, helping the industry seize new opportunities and cultivate new productive forces. (Source: Moku Network)

Zhengzhou High-tech Zone Establishes an 800-Million-Yuan Superhard Materials Fund

According to Zhengzhou High-tech Industrial Investment Group, recently, the "Henan Superhard Zhencai Equity Investment Fund" – the first subfund for superhard materials in the High-tech Zone, jointly established by Zhengzhou High-tech Industrial Investment Fund, Henan Investment Group, Henan Capital Group and other provincial-level platform companies – has been officially set up. This marks that the innovative practice of provincial and local capital collaborating to empower regional leading industries has entered a stage of substantive operation. Tianyancha (a corporate information inquiry platform) shows that the capital contribution of the aforesaid fund is 800 million yuan.

Operated by Henan Investment Group Huirong Fund Management Co., Ltd., the fund is aligned with the layout of regional strategic emerging industries. Its investment direction focuses on tackling key core technological issues in the field of superhard materials, while simultaneously extending to national strategic emerging industrial tracks such as semiconductor materials, new energy materials, and high-end chemical new materials. It will play the leading role of state-owned capital, realize the in-depth integration of provincial-level innovation resources with the solid industrial foundation of the High-tech Zone, help industrial chain enterprises break through "bottleneck" technical problems, and promote the formation of a collaborative development loop featuring "provincial capital guidance and regional industrial implementation". (Source: Dahe Financial Cube)

Henan Breaks Through Key Technologies in Diamond Semiconductors, Accelerating the Layout of Future Industries

Recently, Henan's superhard materials industry has achieved a major breakthrough. Huanghe Whirlwind Co., Ltd. has successfully developed 6-8 inch MPCVD polycrystalline diamond wafer technology, which can significantly improve the heat dissipation performance of chips and is expected to be applied in the optical field in the future. As "China's first listed company in the superhard materials industry", Huanghe Whirlwind

Industry Information

has jointly established a semiconductor company with a Suzhou-based enterprise to accelerate the industrialization of diamond heat dissipation materials.

Henan is a key hub of China's superhard materials industry, with its synthetic diamond output accounting for 80% of the national total and 76% of the global total. At present, the province has formed a complete industrial chain: Shangqiu Liliang Diamond's semiconductor heat sink project has been put into production, and Nanyang Zhongnan Diamond has successfully developed products such as large-size diamond single wafers. More than 20 national-level innovation platforms and over 80 breakthroughs in key technologies are driving the transformation and upgrading of Henan's diamond industry from the traditional "industrial teeth" to the "ultimate semiconductor material". The Department of Industry and Information Technology of Henan Province stated that it will deepen the integration of technological innovation and industry, continue to consolidate its leading position in the global superhard materials field, and provide new impetus for the development of future industries. (Source: Xinhua Daily Telegraph, Henan Daily Client)

The research team of Xidian University has made a breakthrough in (110) crystal plane diamond growth technology, aiding the upgrading of semiconductor devices.

Professors Zhang Jincheng and Zhang Jinfeng from the team led by Academician Hao Yue of Xidian University (Xi'an University of Electronic Science and Technology) published their research results in the international journal *Applied Surface Science*. They revealed for the first time the enlarged growth mechanism of (110) crystal plane single-crystal diamond, providing a new path for the development of high-performance semiconductor devices.

Industry Information

The research team adopted MPCVD technology and successfully improved crystal quality by optimizing methane concentration and introducing oxygen, with a growth rate reaching 16.6 microns per hour. The study discovered the synergistic mechanism of CH and C groups, which made the growth rate of the (110) crystal plane twice that of the (100) crystal plane. Through 100 hours of epitaxial growth, the team obtained a diamond single wafer with a thickness of 3.1 millimeters and a 75% expansion in the area of the (110) crystal plane, and confirmed that lateral expansion can effectively reduce dislocation density. This achievement fills the gap in the research on (110) diamond epitaxial growth, laying a foundation for applications in fields such as 5G communication and aerospace devices. The research is supported by projects including the National Key Research and Development Program and the National Natural Science Foundation of China. (Source: Wide Band Gap Semiconductor Technology Innovation Alliance)

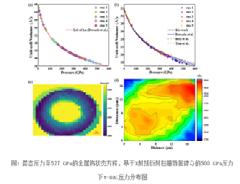

China

A research team led by Professor Huang Xiaoli from the School of Physics, Jilin University, in collaboration with Professor Cui Tian from Ningbo University and other researchers, has achieved a major breakthrough in the field of diamond anvil cell technology. They have, for the first time in China, realized ultra-high pressure loading exceeding 500 GPa, a pressure equivalent to 1.5 times the pressure at the Earth's core. The relevant results were published in the journal *Physical Review B*.

The research team innovatively improved the design of "masonry-type diamond anvils" (mt-DACs) and optimized the stress distribution of diamonds, successfully breaking through the 400GPa limit of traditional technologies. In the experiment, metal tungsten was selected as the calibration material, and it was found that it maintained a stable body-centered cubic structure even under the extreme pressure of 527GPa. This achievement provides key technical support for the study of Earth's internal structure and the development of new materials under extreme conditions. (Source: School of Physics, Jilin University)

A 265-million-yuan diamond semiconductor project settles in Xinjiang.

Recently, Urumqi Ganquanbao Economic and Technological Development Zone signed an agreement with Nanjing Chuxin Electronics and Fujian Dazhuo Holdings. The fourth-generation diamond semiconductor project with a total investment of 265 million yuan has been officially launched. The project is scheduled to start construction in September 2025 and put into production in May 2026, with an expected annual output value of 324 million yuan.

The project mainly produces heat sinks for highend GPU heat dissipation and cultivated diamonds, adopting chemical vapor deposition technology. After putting into production, it will achieve an annual output of 40,000 carats of products, filling the gap in related domestic fields. Ganquanbao Economic and Technological Development Zone stated that the project will drive the development of the regional semiconductor industry chain and help upgrade Xinjiang's strategic emerging industries. It is reported that Xinjiang's advantages in energy costs and policy support are the key factors attracting enterprises to invest. (Source: China News Network)

The Joint Laboratory for Semiconductor Superhard Materials was unveiled in Suzhou, aiming to tackle the challenges in the localization of high-end tools.

On May 16, the "Joint Laboratory for the

Breaks Through 500GPa Ultra-High Pressure Technology, Setting a New Record for Diamond Anvils

Application of Superhard Materials in Advanced Semiconductor Processes" was officially unveiled and established at the Gusu Laboratory. Co-founded by Gusu Laboratory and Suzhou Saier Technology, the laboratory focuses on the research, development and application of high-performance grinding and cutting tools for semiconductor manufacturing, aiming to solve the "bottleneck" problem that the localization rate of China's high-end process tools is less than 15%.

The laboratory will build an innovation base integrating a testing platform, a public service platform and a testing center, providing professional testing services for semiconductor enterprises in the Yangtze River Delta. Ran Longguang, Chairman of Suzhou Saier Technology, stated that the laboratory will be committed to breaking through the bottlenecks in semiconductor precision processing technology. Xu Wenqing, Executive Deputy Director of Gusu Laboratory, pointed out that the laboratory will promote technological progress and industrial upgrading in the field of semiconductor superhard materials. (Source: Gusu Laboratory)

Shengquan New Materials' pilot test platform for functional special resins has been included in the provincial list.

The Shandong Provincial Department of Industry and Information Technology recently announced the list of manufacturing pilot test platforms for 2025. The "Shandong Provincial Pilot Test Platform for Functional Special Resins" built by Shandong Shengquan New Materials Co., Ltd. was successfully selected. This platform focuses on the pilot test transformation of high-value-added products such as advanced

Industry Information

packaging materials, electronic phenolic resins, and special epoxy resins, and is committed to solving the problems in the industrialization of scientific research achievements.

As the world's largest producer of phenolic resins, Shengquan New Materials provides key materials for national key projects such as aerospace, nuclear power, and high-speed railways. The company has achieved counter-cyclical development through continuous innovation. The construction of this platform will focus on breaking through the research and development of functional resins with ultra-low dielectric properties and high temperature resistance, and accelerate the application and transformation of products in advanced packaging and other fields. In the future, the platform will open and share pilot test resources, strive to become a national-level pilot test base, and enhance the collaborative innovation efficiency of the industrial chain. (Source: Shengquan Group)

Scientists have assembled a new diamond structure using nanoscale tetrahedrons, which exhibits unique optical properties.

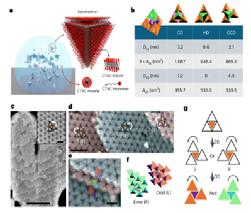

An international research team published the latest results in the journal *Nature Materials*, successfully self-assembling a new type of "octa-unit-cell diamond" structure using gold nanoscale tetrahedrons. The study was jointly completed by scientists from the U.S. Brookhaven National Laboratory, Columbia University, and the University of Michigan.

Industry Information

Researchers used the solvent evaporation method to enable CTAC-coated gold nanoscale tetrahedrons to self-assemble into a special crystal structure on a hydrophobic substrate. Scanning electron microscopy observations showed that the structure is composed of 64 tetrahedrons forming 8 cubic diamond sub-units, creating a double-layer "vortex" pattern with opposite chiral characteristics. Although the crystal is symmetric overall, its surface can produce a significant chiral optical response—in the wavelength range of 650-820 nanometers, the left-handed and right-handed regions show obvious differences in light scattering.

The uniqueness of this low-density diamond structure lies in the fact that four intersecting cubic unit cells can be observed along the [111] direction, and the tetrahedrons in the double layer rotate to form a honeycomb pattern. The study also found that the hydrophobicity of the substrate is crucial for structure formation, and a hydrophilic substrate will lead to different assembly results. This breakthrough not only reveals a new mechanism of nanoparticle self-assembly, but its special optical response characteristics also provide new ideas for the research and development of new optical sensors and encryption materials, and are expected to be applied in the field of optoelectronic materials in the future. (Zhengzhou Research Institute, China University of Geosciences (Beijing))

Meichang Co., Ltd. terminates two diamond wire projects, adjusts production capacity to cope with market changes.

On April 24, Meichang Co., Ltd. announced the termination of the subsequent construction of the diamond cutting wire substrate project and the highefficiency electroplated diamond wire production line project.

The diamond cutting wire substrate project was originally planned to have a total investment of about 159 million yuan, with three phases of construction to build a production line with an annual output of 6,000 tons of diamond cutting wire substrates. At present, the first-phase production line with an annual

output of 2,000 tons has been completed and put into operation, with a cumulative investment of 94 million yuan. The company stated that due to changes in the industry environment, market supply and demand, and product structure, the existing production capacity has met the demand, so it has decided to terminate the construction of the second and third phases.

The total investment of the high-efficiency electroplated diamond wire production line project does not exceed 400 million yuan. It was originally planned to build 210 production lines, forming an annual production capacity of 43 million kilometers of diamond wires. At present, 112 production lines have been completed and put into operation, with a cumulative investment of 255 million yuan, and another 72 sets of equipment have not yet been installed. The company said that affected by changes in the photovoltaic market, the existing and underconstruction production capacity can already meet the demand, so the remaining construction will be terminated.

Meichang Co., Ltd. stated that this adjustment is a prudent decision based on changes in the market environment and supply and demand. In the future, it will focus on the optimization of existing production capacity and business layout. (Source: CMM Jianghu Shuo)

The project with a total - investment of 5 billion yuan and an annual output of 3 million carats kicks off.

The Jiuquan Base started construction grandly on April 28, 2025. With an annual output capacity of 3 million carats, it leverages the new energy industry belt in the Hexi Corridor, integrates wind and solar power resources and policy dividends, and builds a green and low-carbon mass production system. The total investment is 5 billion yuan, with a total of 1,000 MPCVD diamond processing machines. In the near future, it will reshape the global MPCVD diamond competition pattern with large-scale and low-cost advantages, making "Made in China" single crystals shine in the world. (Source: Internet)

Miyou Group held the 40th anniversary celebration of its founding, embarking on a new journey of innovative development.

On May 8, Miyou Group Co., Ltd. grandly held the 40th anniversary celebration of its founding at its headquarters in Kunshan. Leaders from Kunshan High - tech Zone, experts from industry associations, scholars from colleges and universities, and corporate partners attended the event, reviewing the development history and looking forward to the future of cooperation.

At the celebration, Wu Jianming, Chairman of Miyou Group, delivered a welcome speech, thanking all sectors of society for their long-term support and emphasizing that the group will continue to adhere to technological innovation and market development. At the event site, Miyou Group signed technical cooperation and industry-university-research agreements with the Shanghai Institute of Ceramics, Chinese Academy of Sciences, and the School of Materials Science and Engineering of Henan University of Technology respectively. Meanwhile, it reached a distribution cooperation with Henan Tiancan New Materials Technology Co., Ltd., further promoting the coordinated development of the industrial chain.

With the traditional fortune-opening gong ceremony, the atmosphere of the celebration reached a climax. In the future, Miyou Group will take the 40-year accumulation as the cornerstone, deepen innovationdriven development, and work with partners to embark on a new journey of high-quality development.

The Federation of Trade Unions of Zhengzhou High-tech Zone, in collaboration with Moku, has launched the "Overseas Acceleration" series of activities.

On April 16, the matchmaking meeting themed "Overseas Acceleration: Policy Dividends + Exhibition Shortcuts + Overseas Warehouse Codes", hosted by the Federation of Trade Unions of Zhengzhou Hightech Zone, was successfully held at the Management Committee of the High-tech Zone. As an important measure of the Zhengzhou Federation of Trade Unions to assist enterprises in going global in 2025, this event focused on the new materials industry and provided support for enterprises' international development.

Bai Ning, General Manager of Moku.com, focused on sharing the light-asset overseas development model of "exhibitions + overseas warehouses + local distribution" at the meeting. He pointed out that international exhibitions can quickly establish market awareness, while overseas warehouses can improve supply chain efficiency, forming a business closed loop from brand exposure to continuous sales. As a leading platform in the industry, Moku.com provides enterprises with full-chain services such as policy interpretation, exhibition participation strategies, and overseas warehouse layout, helping enterprises efficiently expand overseas markets.

The Federation of Trade Unions of Zhengzhou High-tech Zone stated that in the future, it will continue to join hands with professional institutions such as Moku to deepen the three-in-one model of "policy + resources + services" and promote the international development of enterprises. The successful holding of

Industry Information

this event marks a solid step taken by the High-tech Zone in empowering enterprises to go global. (Source: Moku)

The Institute of Metal Research, Chinese Academy of Sciences has made a breakthrough in diamond high-temperature solar-blind ultraviolet detectors.

The research teams led by Sun Dongming and Huang Nan from the Institute of Metal Research, Chinese Academy of Sciences, have successfully developed a single-crystal diamond nanowire structure embedded with platinum nanoparticles, which significantly enhances the solar-blind ultraviolet detection performance of diamond in high-temperature environments. Combining the advantages of efficient carrier transport in nanowires, the plasmonic resonance effect of platinum nanoparticles, and the Schottky barrier, the device achieves a responsivity of 68.5 A/W under 220 nm ultraviolet light, which is 2,000 times higher than that of traditional diamond devices, with an ultraviolet/visible rejection ratio of 550. At a high temperature of 275°C, the responsivity further jumps to 3,098.7 A/W, and the stability is excellent.

This achievement provides new ideas for high-performance ultraviolet detectors in extreme environments, and the related research has been published in *Nano-Micro Letters*. (Source: Materials Science and Engineering)

Liaocheng breaks through the "bottleneck" technology of superhard materials, forging "industrial teeth" at 1500 ℃ high temperature.

Recently, Zhongke Runjing, a national-level specialized, sophisticated, distinctive, and novel "little giant" enterprise, has successfully broken through the artificial diamond micropowder preparation technology. It has produced diamond micropowder with a perfection degree of 99.97% under the conditions of 1500 ℃ high temperature and 5.5GPa ultra-high pressure, breaking the foreign technological monopoly. Through intelligent transformation, the enterprise delivers more than 150,000 carats of special diamond products per month on average, and its 8-inch diamond heat sink can increase the heat dissipation efficiency of high-power chips by 300%.

At present, the enterprise is investing 50 million yuan to build an ultra-precision processing laboratory and jointly tackling CVD diamond thin film technology with the Chinese Academy of Sciences. It is expected that after the production starts in the third quarter, it will achieve an annual output of 12 million special diamond products, driving the industrial chain to add more than 1 billion yuan in output value. As a national top 100 city in advanced manufacturing, Liaocheng has cultivated 19 "little giant" enterprises that have broken through 12 "bottleneck" technologies. (Source: Liaocheng Daily)

Recently, Shandong Liaocheng Junrui Superhard Materials Co., Ltd. announced that its R&D team has successfully overcome the key technology of catalyst formulation for high-grade diamond synthesis. By innovatively adopting a composite formulation of Junrui Diamond breaks through the technical bottleneck of catalyst, achieving the localization of high - grade diamond.

non-metallic, metallic and rare earth elements, this technology has effectively solved the technical problem that traditional catalysts are difficult to simultaneously "reduce synthesis conditions" and "control growth rate" in the diamond synthesis process. It has successfully filled the domestic gap in the synthesis of catalyst powder for high-grade coarse-grained diamonds and realized self-sufficiency in new catalyst powder.

The project for cultivating diamonds and materials with an annual output of 2.8 million sets, invested 100 million yuan by the company, has entered the final commissioning stage and is expected to be fully put into production by the end of April. After the project is put into production, it is expected to achieve an annual output of 400 million carats of diamonds, with a total output value of 150 million yuan. (Source: Liaocheng High-tech Zone)

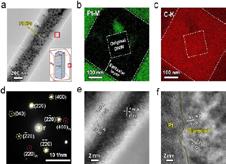

Harbin Institute of Technology has made a breakthrough in the key technology of 3D printing of high thermal conductivity diamond composite materials.

Recently, the Infrared Thin - film and Crystal Team of Harbin Institute of Technology published the latest research results in *Additive Manufacturing*. They successfully developed a new heterogeneous forming process for high - thermal - conductivity diamond composite materials based on the Binder Jetting (BJT) 3D printing technology.

The research first proposed the use of the

Gaussian Multimodal Fitting method (GMF) to establish a high - fidelity simulation model for the thermal debinding process, solving the technical problem of the unclear debinding mechanism in traditional BJT printing.

The study found that the use of Grayscale - based Binder Jetting Granular Printing (g - BJGP) technology can reduce the maximum monomer content during the thermal decomposition process to 1/10 of that in conventional printing, significantly reducing the risk of material contamination. This technology provides a new solution for the precision forming of high - thermal - conductivity composite materials such as diamond/ copper and diamond/silicon carbide, and is expected to be applied in high - performance heat - dissipation fields such as AI chips and new - energy vehicles.

Through multi - scale modeling and experimental verification, the research team established a complete theoretical system for process optimization, providing an innovative idea for solving the heat - dissipation problem of high - power electronic devices. (Source: Infrared Thin - film and Crystal)

35 items in superhard materials category! Henan Province issues the 2025 science and technology development plan.

Recently, the Henan Provincial Department of Science and Technology issued the notice of the "Henan Province 2025 Science and Technology Development Plan".

Industry Information

The science and technology development plan includes the key - R & D special projects in Henan Province, the Henan Provincial Natural Science Foundation, the scientific and technological research projects in Henan Province, and the soft - science research in Henan Province. Among them, 35 items are related to super - hard materials.

These projects cover many aspects of the superhard materials industry, ranging from the manufacturing process of precision grinding tools to the exploration of cutting - edge semiconductor materials and devices. It is expected that they will achieve good results in practical applications and contribute to the development of the super - hard materials industry in Henan Province and even the whole country. (Source: China Super - hard Materials Network)

implemented, among which the superhard materials industry has attracted much attention. Shangqiu will rely on relevant R&D institutions to consolidate industrial advantages such as diamond micropowder processing, carry out forward-looking explorations, promote the construction of key projects, and improve the industrial chain of "raw and auxiliary materialssingle crystal synthesis - diamond products - diamond jewelry". It will support the construction of green energy diamond production and manufacturing bases and accelerate the building of a national advanced manufacturing cluster of superhard materials.

In addition, the plan clarifies work objectives, measures and safeguard measures, aiming to cultivate emerging industrial clusters, build a new engine for the modern industrial system, and promote the high-quality development of Shangqiu. (Source: Dahe Financial Cube) Shangqiu issues an action plan for cultivating and expanding emerging industries, with the superhard materials industry attracting attention.

As of April 16, the General Office of Shangqiu Municipal People's Government has issued the "Shangqiu Action Plan for Cultivating and Expanding Emerging Industries (2025 - 2027)", with 39 enterprises and 38 projects included in the lists of key enterprises and key projects respectively. Centering on key tasks, the plan puts forward four major actions and focuses on developing 13 industries.

In the field of new materials industry, an action to accelerate growth and expand scale will be

Overseas information

Highland launches a new edge grinding machine.

Recently, Highland has launched a new edge grinding machine, Rehnen SK-2. With its innovative design and powerful performance, this edge grinding machine sets a new standard in the field of edge grinding. Different from traditional models, the SK-2 is equipped with a full spindle swing system, which can maximize the use efficiency of sandpaper, extend the service life of abrasives, and continuously deliver high-quality and consistent grinding results.

A major highlight of the SK-2 is its tabletop penetrating dust collection system, which can efficiently capture dust at the grinding point, keeping the workpiece clean and uninterrupted during the continuous grinding process on all four sides. (Source: https://www. woodworkingnetwork.com/product/sanding-and-finishing/ edge-sander-2)

Self-sharpening ceramic sanding discs achieve high efficient removal rate.

According to a report by The Fabricator on April 9, Walter has recently launched the XTRACUT XX sanding disc, which is designed to be suitable for various alloy materials, enabling efficient material removal while maintaining stable and consistent processing results.

The sanding disc features a triangular ceramic abrasive grain design, which can maximize pressure distribution at each contact point. Walter stated that this design can shorten the operation time without applying excessive pressure and improve operational comfort.

The coolant works in synergy with the ceramic abrasive grains, helping to maintain cutting performance and extend the service life of the sanding disc. The coolant can significantly reduce heat accumulation, prevent overheating and material discoloration, and is especially suitable for processing hard alloy materials such as stainless steel or high-carbon steel. (Source: https://www.thefabricator.com/)

Steel pipe cutting tools achieve precise straight cutting.

According to a report by TPJ on April 9, Milwaukee Tool has recently launched the M18 FUEL ½ to 1 - inch steel pipe cutter and its matching ½ to 1 - inch steel pipe cutting blade, which are specially designed for cutting both installed and newly installed steel pipes.

The cutter adopts a linear drive cutting method, which ensures that the blade cuts into the steel pipe in a precise straight line, eliminating the trouble of manually controlling the blade angle. According to the manufacturer, the blade features a tungsten - carbide tooth design, and each blade can complete up to 200 cuts.

The built - in limiting device helps prevent overcutting in narrow spaces. For new pipes, the equipped foldable cutting baffle enables one - handed vertical alignment, ensuring right - angle cutting without the need for pipe wrenches to fix. (Source: https://www. thefabricator.com/)

Meller Optics has launched Microlux alumina polishing powder, which is used for grinding and polishing of optical materials.

According to a report by PRWeb on April 8, Meller Optics, Inc. recently announced the launch of a series of high-purity calcined alumina optical polishing abrasives. This series of products offers seven different particle size specifications and can be directly mixed with deionized water for use.

According to the report from PRWeb on April 8, Meller Optics, Inc. recently announced the launch of a series of high-purity calcined alumina optical polishing abrasives. This series of products offers seven different particle size specifications and can be directly mixed with deionized water for use.

Meller Microlux alumina abrasives are divided into two grades, with seven particle sizes ranging from 0.05 microns to 3.0 microns. They are Microlux-R and Microlux-RZ respectively: Microlux-R contains larger particles, which can quickly remove materials during initial grinding and polishing, and will gradually break down under pressure to achieve the final polishing effect; Microlux-RZ has undergone deagglomeration treatment, with a controllable particle size distribution, making it suitable for fine grinding and uniform polishing.

Meller Microlux alumina abrasives can achieve a scratch-pit surface precision of 10-5 grade on both hard and soft substrates, and are suitable for precision processing of various materials such as barium or calcium fluoride, germanium, silicon, sapphire, stainless steel, zinc selenide and zinc sulfide. Among them, the purity of Microlux-R is 99.98%, and that of Microlux-RZ is 99.99%.

(Source: https://www.prweb.com/)

Walter has launched a new ceramic grinding wheel for efficient metal grinding.

Recently, Walter Surface Technologies has launched the new FLEXCUT XX ceramic grinding wheel, which is specially designed for efficient grinding of steel, stainless steel and scale surfaces, and is suitable for flat and curved surface processing.

The grinding wheel adopts self-sharpening ceramic abrasives combined with SMART RESIN technology, which can expose new abrasive grains at the optimal time, thereby balancing sharpness and durability and achieving more stable grinding results.

The FLEXCUT XX grinding wheel is available in 4½ to 7 - inch specifications and adopts a Type 29 structure, which can maximize the contact area, reduce the number of grinding times, avoid material contamination and ensure precise grinding results. (Source: https:// www.thefabricator.com)

Teqram has launched the EasyGrinder grinding system to achieve automated precision grinding.

Recently, Teqram has launched EasyGrinder, an autonomous grinding system that can simplify precision grinding processes and integrate with automatic shot blasting systems. Equipped with 3D vision and an AIdriven controller, the system can handle thermally cut steel workpieces without the need for programming or pre-loaded geometric data. This makes it highly suitable for steel structure construction companies that often deal with custom designs or small-batch production.

EasyGrinder features a flexible tool system that can automatically adjust according to the needs of different workpieces. A chisel is used to remove slag, stacked sanding sheets or pen grinders are for edge rounding, angle grinders are suitable for cutting edge processing, and chamfering tools can finely process drill holes, ensuring efficient and precise grinding results. (Source: https://www.thefabricator.com)

BHP and Australian mining company Cobre have signed a $25 million exploration agreement.

Australian mining company Cobre announced on March 10 local time that BHP will provide up to $25 million (approximately A$40 million) in exploration funding for Cobre's Kitlanya West and East copper

projects in Botswana, and will have the right to acquire a 75% stake in the Kitlanya project. (Source: Jiemian News)

PEER Chain & Sprockets offers custom hole machining for gears and keyway services.

PEER Chain & Sprockets recently announced that it can provide custom hole machining services for any gear with an existing keyway, with delivery within a few days.

Ray, the company's machinist and CNC operator, has rich experience and specializes in industrial sprocket processing. Since it is necessary to ream holes in gears with existing keyways, traditional processing methods are prone to damage cemented carbide tools and affect the accuracy of hole diameters. PEER Chain & Sprockets adopts an optimized process to ensure high-precision processing and avoid such problems.

The company offers ANSI-standard finished bore and plain bore sprockets. The finished bore sprockets are equipped with a keyway and two set screws to ensure installation stability. To improve response speed, Ray is also training team members to accelerate order delivery. "Many customers have extremely high requirements for delivery time. We can complete the processing within one or two days instead of waiting for up to 20 weeks," Ray said.

PEER Chain & Sprockets has optimized inventory management and eliminated minimum order restrictions by purchasing special lathes. President Drew Beadle stated that the company can customize hole diameters of any size according to customer needs to meet market demands at a faster speed. (Source: https:// industrialsupplymagazine.com/)

Overseas information

Band saw blade technology suitable for cutting work-hardened materials.

According to a report by FABRICATOR on March 10, Bahco has launched SINEWAVE technology. By designing a ramp structure on the back edge of the band saw blade, this technology enables the band saw to exert greater cutting force without increasing the machine tool pressure, improves cutting penetration and speed, reduces heat accumulation, and extends the service life of the saw blade. The technology is applicable to bimetallic and carbide band saw blades, can be customized according to user needs, and is particularly suitable for cutting work-hardened materials such as highnickel alloys, Rene-type materials, superalloys and hightemperature alloys. (Source: https://www.thefabricator. com/)

Despite the improved efficiency of semiautogenous grinding mills, St Barbara has still lowered its full-year production forecast.

On March 10, Australian mining company St Barbara adjusted its production and cost expectations for the second half of the 2025 fiscal year, mainly due to the failure to achieve two key mining locations at its Simberi mine in Papua New Guinea, resulting in the average mining grade being lower than expected.

The gold production of the Simberi mine for the halfyear ending June 2025 is expected to be between 32,500 and 42,500 ounces, with the AISC (All-in Sustaining Cost) expected to be between A$3,400 and A$3,800 per ounce.

Despite the challenges, St Barbara has made progress in improving operational efficiency. The commissioning of the crusher and the adjustment of the semi-autogenous grinding (SAG) mill in January and February have enhanced equipment availability and processing capacity. In addition, the company has added two excavators and plans to introduce multiple Volvo AH60 articulated trucks in succession to improve the production efficiency of the mine. These production figures do not include the ongoing gold recovery from the decommissioning Touquoy processing plant in Nova Scotia, Canada.

St Barbara has lowered its gold production forecast

from the previous 65,000 to 75,000 ounces to 55,000 to 65,000 ounces. The full-year AISC forecast has also been adjusted accordingly to between A$3,900 and A$4,200 per ounce. Managing Director Andrew Strelein stated that the company continues to improve operational efficiency and expects the performance for the half-year ending June 2025 to improve, but set at the average mining grade, it is difficult for the company to achieve its initial target. (Source: https:// www.miningweekly.com/article/st-barbara-lowers-full-yearproduction-guidance-2025-03-10)

L&T's Mining & Metals Division has secured major contracts in the steel and alumina sectors.

According to a report by Machine Maker on February 22, the Mining & Metals (M&M) Division of Larsen & Toubro (L&T) recently announced that it has secured a significant contract from Indian aluminum company Hindalco. Under the contract, L&T will be responsible for building an 850,000-tonne-per-annum bauxite green project smelter in Odisha. The scope of the contract includes engineering, procurement, construction, and installation (EPC), which further strengthens L&T's position as a key partner in Hindalco's expansion plans.

The collaboration between L&T and Hindalco has spanned over three decades. As an EPC contractor, L&T has been involved in the construction of Hindalco's alumina, aluminum, and copper smelters.

D.K. Sen, a member of L&T's Executive Committee and Advisor to the President, stated: "The M&M Division has successfully delivered numerous steel plants and alumina refineries in India and the Middle East, whether they are greenfield projects or expansion and renovation projects. The new order reaffirms L&T's leadership in executing largescale EPC projects in the steel and alumina sectors, and reflects our commitment to engineering excellence and customer satisfaction."

L&T's M&M Division provides end-to-end EPC solutions ranging from mining, mineral processing, industrial products to material handling. Its Products Division offers costeffective solutions for industries such as mining, cement, steel, fertilizers, and ports, which consolidates L&T's reputation as a reliable partner in industrial infrastructure development.(Source: https://www.globalminingreview.com)

Look at those abrasive, abrasive tool and grinding enterprises with a century of history (Series 9)

The ninth installment of the series featuring century-old abrasive, abrasive tool and grinding enterprises is here. Thank you for your continued attention. Today, we will continue to delve into the history and heritage of these enterprises. The enterprises we are introducing today are Elbe Schleifmittelwerk, Kuhmichel, Persch, and Heger.

ElbeSchleifmittelwerk

Elbe Schleifmittelwerk GmbH & Co. KG is a medium-sized company based in the Stuttgart area of Germany with a history of over 100 years, specializing in the production of high-quality grinding tools.

A keen awareness of tradition and progress is the driving force behind the company's development; these two principles complement each other perfectly at ELBE. Decades of experience combined with modern production technologies give customers confidence in the quality of its products.

1889 An abrasive factory was established, starting small-scale production of bonded abrasives made from abrasive powder and other natural grinding raw materials.

1895 The first factory building was constructed on Austrasse in Bietigheim-Bissingen.

1899 Production facilities were expanded by acquiring an independent grinding mill, where raw materials were ground and sieved until 1930.

1939 A welfare fund was established, and an

Century-old Abrasives Enterprise

additional pension scheme was provided.

1955 Switched from ceramic furnaces to innovative gas-heated furnaces.

Around 1960 Suspended the production of simple types of grinding tools (such as grindstones). A strategic transformation took place in 1960, focusing on the production of high-quality precision grinding tools for modern grinding processes.

1965 An additional production line was added, starting the manufacturing of formed abrasives for roller and drum grinding methods.

1989 Celebrated the 100th anniversary of its founding.

2016 Acquired by Comet Schleifscheiben GmbH.

2017 Newly developed and launched the Elbe CBN repairable grinding discs.

Kuhmichel

Kuhmichel was founded in 1880 and has always focused on a series of surface treatment processes such as sandblasting, grinding, and cutting – precisely because of this, the company boasts one of the most comprehensive product systems of sandblasting abrasives and grinding materials in the industry.

1880 Wilhelm Kuhmichel founded a company named after himself in Kandel, Rhineland-Palatinate, Germany. Leveraging the local mining industry, the company focused on blast furnace demolition operations and the sales of high-value refractory linings.

Since 1880, Kuhmichel has been committed to providing professional capabilities and innovative solutions – as a "leading European specialist wholesaler of blasting abrasives", Kuhmichel has its own production and recycling plants, offering customers professional all-round services.

Century-old Abrasives Enterprise

1982 Businessman Helmut Grundei acquired the company and changed its legal form to Wilhelm Kuhmichel GmbH. He keenly recognized that recycling would be the direction of future development.

1986 Dirk Grundei joined his father's company.

1994 Kuhmichel became the exclusive agent in Germany for MOTIM, a Hungarian high-purity corundum smelter.

1999 A sales company was established in Stafford, UK, named Wilhelm Kuhmichel GmbH, U.K. Branch.

2001 Wilhelm Kuhmichel GmbH was renamed Kuhmichel Abrasiv GmbH.

A subsidiary, Kuhmichel Abrasiv Austria GmbH, was founded in Tern, Austria.

A sales subsidiary, Kuhmichel Abrasiv B.V., was set up in Houten, the Netherlands.

2008 Kuhmichel took a stake in the South African stainless steel company SIGMA Stainless Steel (now known as SIGMA Wear Parts PTY Ltd.).

A sales subsidiary, Kuhmichel Abrasiv Hungária Kft., was established in Budapest, Hungary.

2009 A sales subsidiary, Kuhmichel Yüzey Islem Teknolojisi San. Tic. Ltd. Sti., was founded in Istanbul,

Turkey.

2011 Kuhmichel Recycling GmbH was established in Barenburg, Germany.

2012 Kuhmichel Recycling GmbH obtained the official business license.

2014 A Kuhmichel sales representative office was set up in Shanghai, China.

Since its founding, Kuhmichel has always attached great importance to environmental responsibility and actively practiced the concept of green environmental protection. We provide customers with a complete one-stop recycling and waste management service across Europe. The company is able to tailor efficient and sustainable resource recycling solutions for customers, and is responsible for waste transportation and disposal, helping customers achieve a winwin goal of environmental protection and economic benefits.

The company specializes in handling and recycling the following types of industrial solid wastes and residual materials:

- Residual blasting abrasives containing minerals and metals;

- Grinding wheel waste;

- Furnace demolition residues from the refractory materials industry;

- Ceramic and metal thermal spray powders (such as plasma spray powders);

- And dust generated during the abrasive manufacturing process.

Century-old Abrasives Enterprise

The company's sandblasting abrasive recycling plant in Germany has an annual processing capacity of up to 40,000 tons, making it one of the largest sandblasting material recycling bases in Europe currently!

Kuhmichel Recycling holds all the legal qualifications for handling sandblasting waste and assists customers in preparing all the necessary compliance documents.

Century-old Abrasives Enterprise

The company works closely with logistics enterprises with professional transportation qualifications to be responsible for the full-process transportation of recyclable materials to the recycling center. The entire process maintains close communication with customers to ensure traceability and compliant operations.

After the material processing is completed, only a very small amount of non-recyclable residues will be generated, and this part will also be disposed of in a standardized and environmentally friendly manner. Through cooperation with Kuhmichel, customers can reduce thousands of tons of carbon dioxide emissions every year.

As a family-owned enterprise with four generations of inheritance, Persch has consistently provided diamond and CBN tools of reliable quality, boasting a history of 140 years to date. Personalized service has always been the core philosophy we uphold.

In 1885, the company was founded by master metal craftsman Philipp Persch in Idar-Oberstein. As one of the long-established industrial enterprises in the region, Phil. Persch Nachf. KG is rooted in this famous gemstone city.

Since Mr. Philipp Persch had no children throughout his life, he designated his closest colleague, Rudolf Henn, as the heir to the enterprise, on the condition that the company name would continue to be "Philipp Persch Nachfolger" (Successor of Persch) in his memory.

In the 1950s, Fritz Henn, the son of Rudolf Henn, began to specialize in producing diamond cutting blades for local gem-cutting craftsmen.

Persch

By 1965, the company's product line had expanded from tools originally only used in gem processing to electroplated saw blades, milling cutters and drills suitable for the plastics, glass and ceramics industries.

Since the early 1970s, Kurt Henn, the son of Fritz Henn, has been helping the company to further develop. Shortly afterwards, the company started the production of metal-bonded sintered tools.

Century-old Abrasives Enterprise

In early 2003, the company relocated from the city center of Idar-Oberstein to a new factory building at Rothheck 16 in the Dickesbacher Weg industrial zone.

At the end of 2013, the company's legal form was changed to a limited partnership (Kommanditgesellschaft). Bert Henn, the son of Kurt Henn, joined the enterprise as a limited partner. Kurt Henn remained as the general partner and general manager of the company.

Century-old Abrasives Enterprise

What is the company's market share in the plastics, glass and ceramics industries?

For over a century, Heger has been renowned in the industry for the outstanding quality of German manufacturing. Its diamond tools are widely used in construction, surface treatment, refractory materials and industrial fields.

1908 Rudolf Heger founded the Heger-Hamedis diamond tool factory in Freiburg, specializing in the global sale of special saw blades. During the two World Wars, the company continued to produce and develop diamond saw blades and stone processing machinery. After the war, it relocated to Umkirch,

where the new factory focused on the research and development of diamond tools for the stone industry. In the 1960s, Heger was a pioneer in the application of sintering technology.

1991 Heger was sold to a private investor, and the business focus shifted to the construction industry.

Heger

1999 Heger moved to Hettersheim. 2001 Heger's European diamond tool company was acquired by the American corporate group ITW.

2004 Stefan Haag took over the management position.

2007 Günter Dreyer joined the company as an application engineer. In the following years, the company continuously improved the production processes and technologies of products for the construction industry.

2013 Heger separated from the American ITW Group and established a new company: "Heger –Excellent Diamond Tools by GD & SH". All employees were transferred to the new company. The production

of diamond segments, which had been outsourced to Belgium in 2007, was brought back to Hettersheim. The company also set up "Heger Excellent Diamond Tools B.V." in Hoogerheide, the Netherlands, to provide commercial and technical services for the Benelux market.

2015 Heger invested in the construction of a new factory building in Hettersheim, demonstrating its firm commitment to Germany as a business base. In July, it moved to the new production base in Hettersheim, Germany. The new base features higher production capacity and a more complete depth of production processes.

2016 Heger continued its rapid expansion. In 2016, we focused on the development and production of diamond segments for various applications. Therefore, we introduced more advanced equipment. The newly launched wall saws, floor cutting saw blades and new saw segment products have achieved remarkable success in the international market –which is one of the reasons for us to expand the sales team. "Made in Germany" remains the tenet we adhere to.

2018 1908-2018 | Heger has adhered to the concept of quality first for more than 110 years. The company celebrated its 110th anniversary in terms of local manufacturing in Germany, technological leadership and service commitment. Since its establishment in Freiburg in 1908, the company has continuously reached new heights through continuous product innovation and excellent services. To achieve flexible production and rapid delivery, Heger invests in the latest production equipment and technologies every year. 110 years of professional experience makes it trustworthy.

2019 Heger expanded its factory area to 8,000 square meters. To further increase production capacity and respond to customer needs quickly and flexibly, the company installed new laser welding machines for diamond saw blades.

2020 Heger joined the "Sustainable European Abrasives Manufacturers Alliance (SEAM)", committing to follow the three pillars of sustainable development and continuously improve in terms of the environment,

working conditions and production processes. The company installed a photovoltaic system, which can reduce carbon dioxide emissions by more than 100 tons every year. It is committed to creating sustainable jobs in Europe. At the same time, another new invention was made: the Titan Wave segment, which is used for diamond saw blades, came out.

2021 Continued investment in manufacturing: new laser welding equipment for drill bits was added, grinding and sharpening equipment was replaced, and a new energy-efficient air compression system was installed. These measures are aimed at securing the company's future. Heger also launched the Titan Wave (diamond wave segment) product for drilling.

2022 A significant milestone: as of May 1, 2022, Heger officially became part of the Husqvarna Group. Heger's extensive and advanced product range, highly flexible production capacity, and short delivery times will further complement Husqvarna's existing product portfolio in the construction business in Central Europe. Sales activities were integrated into Husqvarna's organizational structure. The production base in Hettersheim continues to operate with ambitious growth plans in place.

2023 The production base located in Heitersheim, Germany, focuses on manufacturing segments and drill bits for heavy-duty users in the Central and Southern European markets. It continues to grow and has invested in new cold-pressing and hotpressing equipment. Approximately 30 employees work in around 1,800 square meters of production and administrative areas. The focus remains on producing high-quality diamond tools made in Germany.

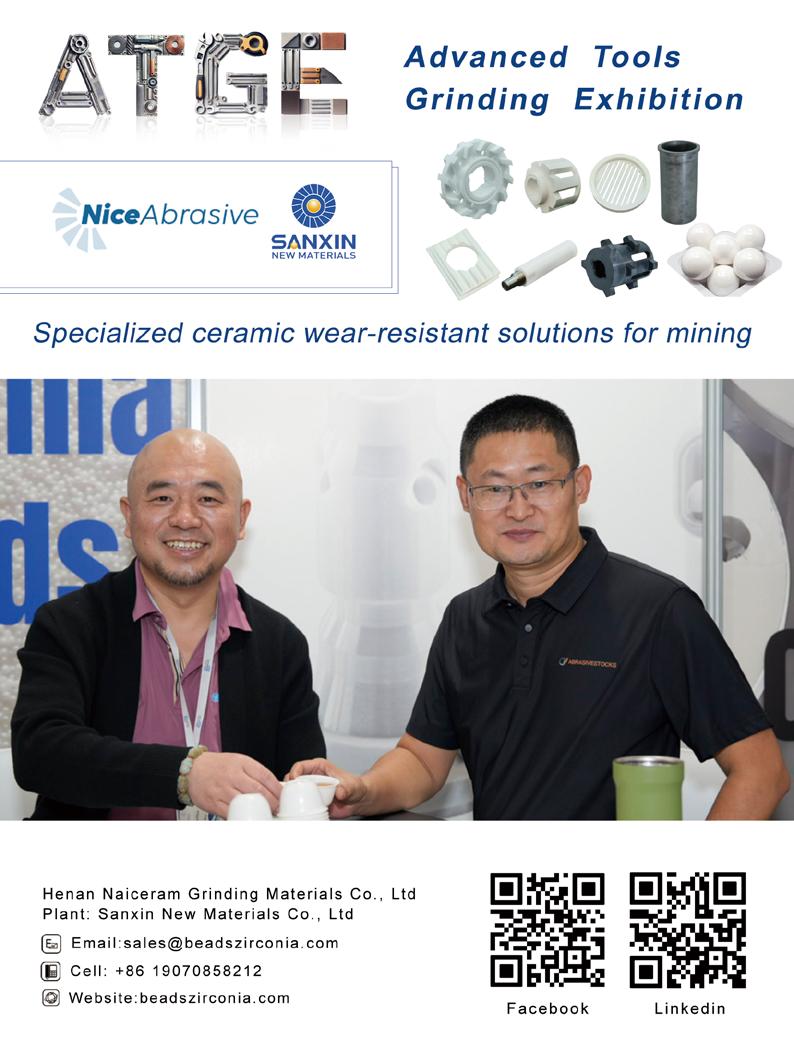

The Australian Hardware, Tools & Grinding Exhibition kicks off; ATGE2025 deepens China-Australia industrial cooperation

On April 29th, the 2025 Australian Hardware, Tools & Grinding Exhibition (ATGE) opened at the Brisbane Showgrounds. As Australia's first professional trade show focusing on abrasives, grinding tools, hardware, and tools, ATGE is co-hosted by Moku and the China National Hardware Association. It not only showcases the outstanding strength of Chinese manufacturing but also builds a bridge for in-depth cooperation between the Chinese and Australian manufacturing industries.

Enterprise Feedback: Overseas Warehouses Become a Focus of Cooperation

After the first day of the exhibition, many participating enterprises reported that the customers at this exhibition were highly professional, the visiting audiences raised precise questions, and the onsite exchanges were pragmatic and efficient. Some enterprises distributed all their promotional materials in a short time, gained several intended customers, and even some buyers directly expressed their intention to purchase samples. Through in-depth communication with local purchasers, exhibitors further grasped the specific needs of the Australian market in application fields such as woodworking and metal polishing.

In addition, Moku's overseas warehouse service in Australia has attracted extensive attention from

enterprises. Compared with the traditional trade model, overseas warehouses have obvious advantages in sample circulation, customs clearance and delivery, local fulfillment, etc. Many enterprise principals said that they will conduct in-depth docking with Moku after the exhibition to promote the accelerated launch of products and realize localized operations.

ATGE 2025: An "Accelerator" for China-Australia Industrial Cooperation

Against the backdrop of the restructuring of the global industrial chain, ATGE 2025 has been endowed with multiple strategic significances.

Since Moku established its Australian subsidiary, Abrasivestocks Australia, in 2023, it has successfully connected a number of Chinese abrasive and tool brands with Australian purchasers.

The products showcased at the exhibition, such as precision diamond tools, high-performance bonded abrasives, high-end coated abrasives, and professional hardware tools, will help the manufacturing industry in Queensland reduce production costs, improve processing efficiency, and form a complementary industrial cooperation model.

This exhibition publicly recruited Australian strategic partners and investment institutions for the first time, committed to establishing a long-term cooperation network integrating "technology + channels + brands" to achieve resource sharing and value co-creation.

Faced with the complex and ever-changing international trade environment, more and more Chinese enterprises have realized that "exhibitions are just the starting point, and in-depth localization is the key".

Moku: Empowering Chinese Enterprises to Take Root in Australia

Against this backdrop, the full-chain localized service system of Moku's Australian company is becoming a "breakthrough solution" for enterprises to expand into the Australian market.

Moku has set up an overseas warehouse in Brisbane, which is like a "rear base" for enterprises in Australia, providing comprehensive services such as warehousing, logistics, collection and payment on behalf of others, solving the logistics problems of enterprises in overseas operations. At the same time, Moku also provides services such as brand promotion, market development, and agent recruitment to help Chinese enterprises achieve real "local operation".

As a member of the National Woodworking and Hardware Association and the Australian Stainless Steel Association, Moku integrates Chinese and Australian industrial resources to achieve accurate connection between upstream and downstream.

ATGE is not only an exhibition, but also a window, allowing more Chinese enterprises to see the real ecological environment of the Australian market, and enabling local Australian users to re-recognize the height and breadth of Chinese manufacturing. In the future, Moku will continue to promote the coconstruction, sharing and win-win of Chinese and Australian manufacturing industries with platform-based and professional services.

Moku Participates in Egypt's BIG5 Exhibition to Explore New Opportunities for Cooperation in the Middle Eastern Market

The 2025 Big5 Construct Egypt will be held at the Egypt International Exhibition Center from June 17 to 19. Moku enters the Middle Eastern market for the first time, aiming to "promote sales through exhibitions" via the exhibition platform and integrate its products into the local market system. In addition, Moku has reached a strategic intention with local partners. In the future, it will carry out market promotion with the help of their localized marketing network and provide efficient warehousing and logistics services for Moku's customers relying on the partners' well-established overseas warehouse layout.

Exhibition Overview

The Big5 Construct Egypt has been successfully held for 26 sessions. Over the years, it has continuously integrated the entire construction value chain, gathering elites and leading enterprises from the global construction industry. As one of the most influential construction industry exhibitions in North Africa, this session is expected to attract more than 300 exhibitors from over 20 countries, with the number of professional visitors exceeding 20,000 and the exhibition area reaching more than 20,000 square meters. The exhibition not only provides a platform for exhibitors to display their latest products and technologies, but also creates valuable opportunities for business exchanges and cooperation among industry professionals.

Market Opportunities

As Africa's third-largest economy, Egypt's construction market has reached a scale of 570 billion US dollars, and is expected to grow at a compound annual growth rate of 8.39% from 2024 to 2029. The Egyptian government plans to invest more than 100 billion US dollars in infrastructure construction, including large-scale projects such as the New Administrative Capital (55 billion US dollars) and the Ras Al-Hikma project (35 billion US dollars). At the same time, the accelerated urbanization process and the development of tourism have also brought an additional market demand of 2.56 billion US dollars to the construction industry.

Exhibition Scope

The exhibits of this exhibition cover the entire industrial chain of the construction industry, including building interiors and finishes, mechanical and electrical services, digital construction, doors, windows and facades, building materials, urban landscapes, construction equipment, green buildings, etc.

Exhibition Highlights

The 2025 Big5 Construct Egypt pays special attention to digital construction technologies and sustainable development solutions. Innovative technologies such as artificial intelligence and 3D printing will be the focus, while solar energy products and green building technologies will also attract extensive attention. The exhibition provides an excellent opportunity for participating enterprises to expand into the North African market, helping them establish direct contacts with local decision-makers and professionals. As a new member of the BRICS and an important member of COMESA, Egypt's increasingly open trade environment offers more investment opportunities for international enterprises.

Go Global to North America, Focus on Global Metal Manufacturing – Moku Invites You to FABTECH 2025 Chicago Show!

FABTECH 2025, North America's largest-scale exhibition for metal forming, welding and surface treatment, will be held in Chicago, USA from September 8 to 11, 2025!

Moku to Showcase at FABTECH with an 182Booth, Inviting Joint Participation

At this year's exhibition, Moku will make an appearance with an 182 double-opening booth, which measures 3m × 6m, boasting an excellent location and eye-catching display effect.

Now, we are opening up opportunities for joint display on exhibition boards: Each board (90cm in width × 220cm in height) can showcase enterprise logos, product images, slogans, etc., and the boards will be uniformly designed and printed.

Cost: 24,000 RMB per board

Excellent enterprises are welcome to share this platform and make your brands quickly "stand out" in the North American market!

Moku's Group Exhibition Tour Officially Launches!

To help enterprises participate in the exhibition efficiently, Moku has specially launched the "FABTECH 2025 China Exhibition Group" service package, ensuring a worry-free exhibition experience for enterprises throughout the process!

The itinerary is 11 days in total, including the exhibition and business visits:

September 5: Gather in Hong Kong and fly to Chicago

September 6: Arrive in Chicago

September 7: Booth setup

September 8-11: Participate in the FABTECH exhibition

September 12-15: Travel to other cities in the United States for customer visits or inspections

September 16: Return to Shanghai or Hong Kong

Group tour fee: 38,000 RMB per person

The fee includes round-trip air tickets, exhibition registration, hotel accommodation (a surcharge is required for single rooms), vehicle transfers, meals, translation assistance, etc. A professional team will ensure an efficient and orderly

itinerary.

PS: The above arrangement is a tentative plan. If adjustments are needed, we will confirm with group members in advance, and any additional costs incurred will be borne by the participants; Moku reserves the right of final interpretation for the event.

About the Exhibition

The exhibition area of this year's FABTECH will exceed 79,000 square meters, and it is expected to attract more than 1,500 exhibitors from 40 technical fields and tens of thousands of professional visitors, making it the preferred platform for global manufacturing exchanges and cooperation.

As a key barometer of the global manufacturing industry, FABTECH provides a "one-stop platform" that gathers worldleading enterprises in key fields such as metal forming, cutting, welding, and surface treatment. It is an ideal choice for you to explore new technologies, expand overseas markets, and connect with global buyers!

Abrasive and Grinding Tool Enterprises Gather to Continuously Expand Industry Influence

As an important support for metal manufacturing, many internationally renowned abrasive and grinding tool-related enterprises participated in this exhibition, showcasing products covering abrasives, grinding wheels, cutting discs, polishing products, sandblasting systems, grinding equipment, etc.

List of some participating abrasive and grinding tool enterprises:

3M、Abrasives Inc、Abrasivestocks、AKS Cutting Systems Inc、Anhui Advanced Grinding Tools Co.,Ltd.

Anxin Abrasives、BevelTools、Brodbeck Ironworks、Brush Research Manufacturing、CGW Abrasives

Changzhou Uni-Star International Co Ltd、Continental Abrasives、Continental Tool Group-APT/UT

DCM Tech Inc、Doringer Cold Saws、Ervin Industries、ESCO Tool、Fandeli Abrasives、Fladder

FLEX Power Tools、Flexovit USA Inc、Flow International、Fortress Abrasive Blast Systems

GMA Garnet(USA)Corp、Gruppo Itexa Srl、Hangzhou Xiangsheng Abrasive Machine Manufacturing Co.Ltd

Hangzhou Zhanqi Brush Co Ltd、Hanhang Abrasives、JBright Abrasives&Tools、Jia County Yihong Abrasives Co Ltd

Joysun Abrasives、Jun Shiau Machinery Co Ltd、Keying Abrasives、Kocour Company、LISSMAC Corporation

Marpol、Napoleon Abrasives、Norton Abrasives、OMAX Corp、Osborn、Pearl Abrasive Company、PFERD INC

RHODIUS Abrasives、SHANGHAI BASIC AIM ENTERPRISE CO.,LTD.、Sia Abrasives Inc USA

Suzhou Wanpo Grinding Material Co Ltd、Toyev Abrasives、Uneeda、United Abrasives Inc/SAIT

VSM Abrasives Corp、Walter Surface Technologies、Weber、Weiler Abrasives

Weldcote Metals

Introduction:

Trend Analysis and Prospect Forecast of the Superhard Materials Market (2025-2033)

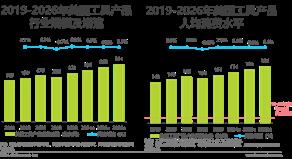

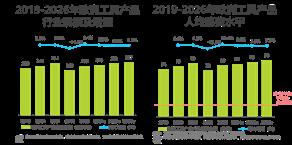

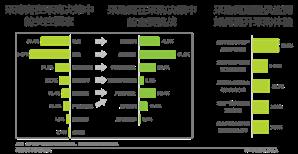

According to MRU's forecast, the global superhard materials market will achieve significant growth from 2025 to 2033, with a projected compound annual growth rate (CAGR) of 8%. This round of growth is mainly driven by the following key factors:

Firstly, technological advancements in the field of materials science continue to break through the limits of hardness and performance, promoting the development of new superhard materials with better performance. This includes the continuous improvement of synthesis technologies, resulting in larger crystal sizes, higher quality, and more precise control of material properties.

Secondly, the growing demand for highperformance tools and equipment in various industries is a major catalyst for market development. The requirements for high precision and efficiency in the manufacturing process have promoted the widespread application of superhard materials in products such as cutting tools and grinding wheels.

Thirdly, the global emphasis on sustainable development and resource efficiency is also driving the market forward. Superhard materials can reduce waste and extend tool life, which is in line with environmental protection practices. For example, the use of superhard materials in cutting tools can significantly reduce material loss during machining, contributing to the construction of a circular economy.

In addition, the application of superhard materials in energy-saving technologies is constantly expanding. Their excellent hardness and wear resistance make them perform well in high-pressure applications in the renewable energy field, improving

the overall efficiency of energy and the performance of energy storage systems.

The superhard materials market is playing a key role in addressing global challenges, helping to optimize resources, improve manufacturing efficiency, and promote the wide application of advanced technologies.

Market Scope and Overview:

The global superhard materials market is expected to grow continuously at a CAGR of 8%.

The market covers the production and application of superhard materials, mainly including synthetic diamonds and cubic boron nitride (cBN). These materials are widely used in multiple industries such as stone and construction, abrasive manufacturing, tool production, and other special fields. The market scope includes everything from the synthesis and processing of materials to their integrated application in various tools and components.

Technological progress plays a key role in the entire industrial chain, profoundly affecting production processes, material properties, and overall performance.

From a global development perspective, the importance of this market is reflected in the following aspects:

- Promoting the progress of manufacturing technology and improving the precision, efficiency, and productivity of various industries;

- Enhancing the performance of tools and equipment, bringing cost reduction, efficiency improvement, and waste reduction;

- Driving the development and application of

Market Analysis

various high-end technologies.

The growth of the superhard materials market is closely related to global technological progress and the demand for high-precision and high-efficiency manufacturing. Its role in achieving material efficiency and reducing waste has further consolidated its position in the global economy.

Market Definition:

The superhard materials market refers to the commercial field covering the production, circulation, and application of materials with extremely high hardness and wear resistance.

Key components include:

- Raw materials: such as carbon, boron, nitrogen;

- Production processes: such as high-pressure high-temperature synthesis (HPHT), chemical vapor deposition (CVD);

- Main products: synthetic diamonds, cubic boron nitride, polycrystalline diamond compact (PDC);

- End-use products: cutting tools, grinding wheels, polishing materials, etc.

Core Terms:

- Synthetic diamond: Artificially synthesized diamond with extremely high hardness and excellent thermal performance;

- Cubic boron nitride (cBN): More stable than diamond at high temperatures, suitable for processing ferrous metals;

- Polycrystalline diamond compact (PDC): A composite material composed of numerous tiny diamond crystals;

- High-pressure high-temperature synthesis (HPHT): A common method for synthesizing superhard materials;

- Chemical vapor deposition (CVD): An important technology for preparing superhard coatings.

Understanding these terms is helpful for indepth understanding of market trends, technological progress, and competitive patterns.

Market Segmentation:

By type:

- Synthetic diamond: With its excellent hardness, thermal conductivity, and chemical inertness, it dominates the market. It is widely used in cutting tools and abrasive products. The optimization of synthesis processes has promoted cost reduction and efficiency improvement.

- Cubic boron nitride (cBN): It has better thermal stability than diamond at high temperatures and is widely used in processing ferrous metals. With the increasing demand for high precision in the metal processing industry, the CBN market continues to grow.

By application field:

- Stone and construction: Used for cutting, grinding, and polishing stone and concrete, greatly improving construction efficiency and precision. Benefiting from the growth of global infrastructure construction.

- Abrasives: Including grinding wheels, polishing pastes, abrasive films, etc., widely used in surface treatment in manufacturing and metal processing industries. Technological innovation and the development of special abrasives continue to drive market growth.

Market Driving Factors: