2025 Your Retirement Planning Guide

This guide is a tool for Staff & Management team members that can be used during the retirement planning process.

This guide is a tool for Staff & Management team members that can be used during the retirement planning process.

This Retirement Planning Guide is designed to assist with the retirement planning process for ABM Staff & Management team members.

As you plan for your retirement, you will undoubtedly have questions about what happens to your active benefits coverage when you leave ABM and what you need to do to make sure available coverage continues without interruption.

This Guide can answer your questions and provide information that is helpful in the planning process. It includes:

• A “Retirement Preparation Checklist” that summarizes steps you can take now as you plan your retirement.

• A resource directory that lists contact information for various plans and programs.

• Charts that show when active benefits coverage ends.

• Information about how to continue Life and Accidental Death & Dismemberment (AD&D) Insurance coverage and other portable benefits after you leave ABM.

• A summary of the payment options available to you through the ABM 401(k) Employee Savings Plan.

• Information about your Employee Stock Purchase Plan (ESPP) options upon retirement.

• Information about your Equity Awards upon retirement.

Below are things to consider now and as you get closer to your retirement date, as well as a few items to address once you’ve retired. Whether you are leaving for a traditional retirement, launching your next adventure, or nearing the end of any severance payments, these steps are important for you to take.

Coordinate with your people leader…

□ Meet with your people leader to discuss your potential retirement date and determine a transition plan that will ensure both you and ABM are adequately prepared for the time you are no longer in your position.

□ Discuss with your people leader when you should return any ABM equipment in your possession, such as your ID, corporate credit cards, laptop, and Smartphone.

your

□ If you are enrolled in an ABM-sponsored Medical Plan on your retirement date, decide if you want to continue your coverage through COBRA. Generally, you may elect COBRA continuation coverage for up to 18 months at your own expense.

Determine your eligibility for Medicare…

□ If you or an eligible dependent will be age 65* or older on your retirement date, enroll in Medicare Parts A and B three months prior to your retirement date so that your Medicare coverage is effective on your requested retirement date. (*You and/or your eligible dependent may qualify for Medicare before age 65.)

□ If you contribute to the Health Savings Account (HSA), contributions must end when Medicare coverage begins. Since some Medicare enrollments are effective to a retroactive date, plan your HSA contributions carefully.

□ Regardless of whether you participate in the ABM 401(k) Employee Savings Plan administered by Merrill, schedule a free session with Merrill Participant Services at 877.637.1786 or register for a 30-minute consultation at go.ml.com/ScheduleAConsultation. Merrill can answer any general questions you have and help you understand how the financial and timing choices you make align with your personal retirement goals and overall retirement plan.

□ If you participate in ABM’s 401(k) Employee Savings Plan, make sure your beneficiary designations are up-to-date.

□ Planning for retirement doesn’t need to be daunting — you can take control by determining where you stand and then setting a specific goal. Try the Merrill retirement planning calculator.

□ Within 31 days after your last day worked, elect to convert your Life Insurance and AD&D coverage to an individual policy, if desired. You may do this on behalf of any dependents for whom you elected spouse or child coverage as an active team member.

□ If you convert your life insurance to an individual policy, make sure you provide information regarding your beneficiaries directly to the insurance carrier.

If you move or plan to change your address after retiring…

□ Make sure your contact information is accurate in TMG. This includes not only your mailing address, but your personal email address.

If you need additional information…

□ Detailed information about all your benefits is available while you are an active ABM team member at worklife.alight.com/abm. Go to the Benefits Information tab to find Benefits Enrollment Guides, flyers, plan documents, and more.

Refer to this chart for when your active coverage ends.

▪ Medical/Dental/Vision

▪ EAP

▪ Voluntary Life*

▪ Voluntary AD&D*

▪ Life Insurance with Long Term Care*

▪ Accidental Injury*

▪ Critical Illness*

▪ Hospital Indemnity*

▪ Identity Theft Protection*

▪ Legal Services*

▪ Gym & Wellness Resources*

▪ Flexible Spending Account (FSA)

▪ Short Term Disability

▪ Long Term Disability

▪ Basic Life & AD&D*

▪ Pre-Tax Commuter & Parking

▪ Marketplace Mall

▪ Pet Insurance*

Last day of the month in which you are no longer employed by ABM.

▪ 401(k)

▪ ESPP

At 11:59 p.m. the day you are no longer employed by ABM. For the FSA and Pre-Tax Commuter & Parking plans, you must submit claims within 31 days of your retirement.

At 11:59 p.m. the day you cancel coverage. If you leave ABM, your coverage will not be cancelled, however, you should notify MetLife of your termination. Your current rates will continue through your policy anniversary date, unless you cancel coverage earlier.

Your contributions, if any, and corresponding matching contributions to the 401(k) end with your last paycheck, provided the annual limit has not been met. You own all vested contributions in your account.

ESPP contributions stop at the time of termination. Any contributions made during the active offering period of your termination will be refunded to you if the purchase date has not passed (see page 14 for further details).

* You may be able to continue coverage for these plans after you retire. Please contact the carrier. A Directory of Resources is included on page 16.

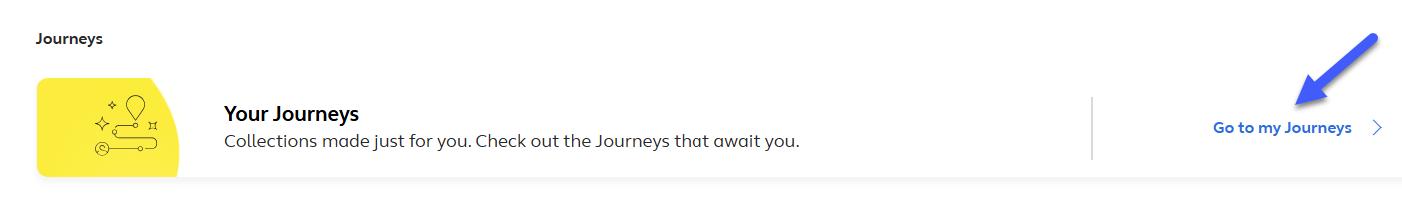

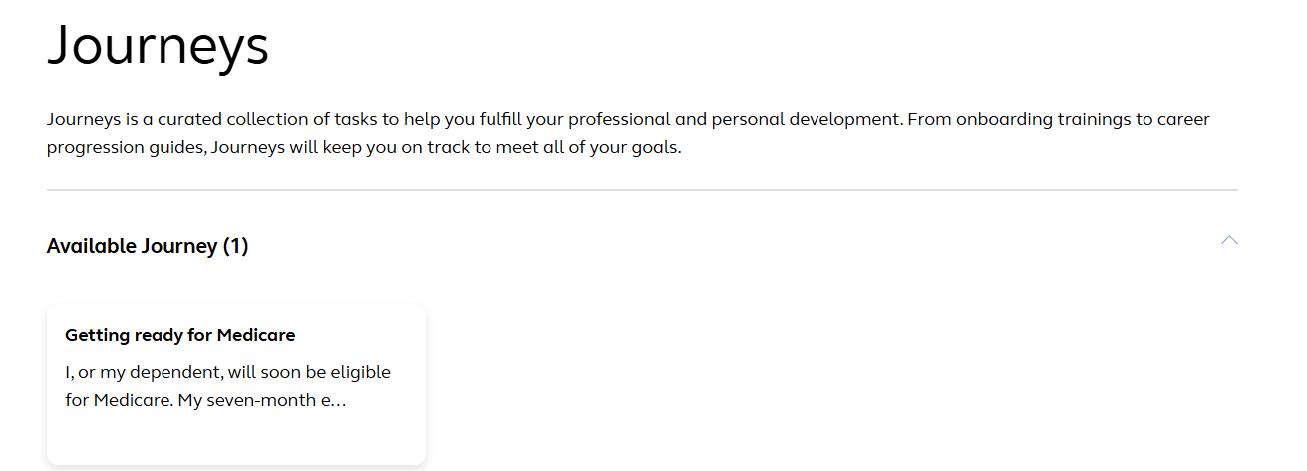

Once you turn age 64, Alight will notify you that you can access the Medicare Journey at worklife.alight.com/abm. Log in with your usual username and password. Journeys are found after the Recommended Tiles section on the homepage. Click “Go to my Journeys,” as shown in the screenshot below. Then click the “Getting ready for Medicare” tile.

There are three steps based on the number of months before turning age 65: 9-12 months before turning 65

• I want to understand the Medicare initial enrollment period.

• Take me to the Medicare.gov site. 3 months before turning 65

• I’m waiting for my Medicare card.

• What should I do if I haven't received my Medicare card?

• I need to decide if I want to enroll in Medicare.

• I may need to delay Medicare Part B enrollment.

• I deferred my Medicare enrollment, so I have to return the card.

• Look out for a Creditable Coverage Disclosure Notice.

• I need to decide if I want to enroll in Medicare Part D or delay its enrollment. After turning 65

• Help me decide if I should enroll in Medicare when my coverage ends.

This section describes options you have for medical coverage during retirement, including COBRA continuation coverage, Health Care Marketplace options, and Medicare.

If you are enrolled in an ABM Medical Plan on your termination date, you can elect to continue your medical coverage through COBRA. If you elect COBRA continuation coverage, you may continue the medical coverage you had as an active team member under any of the coverage options under the Medical Plan for yourself and your eligible dependents for a period of up to 18 months* from the date of your retirement (or up to 29 months if you or a covered dependent is disabled, as determined by the Social Security Administration, at the time you retire or become(s) disabled within 60 days after COBRA coverage begins).

* If you and/or your covered dependent elect COBRA continuation coverage and you become entitled to Medicare (e.g., you reach age 65) during the 18-month COBRA continuation coverage period, COBRA continuation coverage will end on the date you become entitled to Medicare.

If you and/or your covered dependent will be over age 65 when you retire, and you decide to elect COBRA continuation coverage, Medicare Part A and Medicare Part B will be the primary coverage throughout the COBRA continuation coverage period. Therefore, you should enroll for Medicare Part A and Medicare Part B as soon as possible, so that your Medicare coverage is effective on your termination date. Although Medicare will be your primary coverage, you will pay the same COBRA premiums as other COBRA participants who are not eligible for Medicare.

If you elect COBRA continuation coverage, ABM does not contribute toward the cost of that COBRA continuation coverage. You will pay the full cost of active medical coverage, plus a 2% administration fee.

In addition to continuation of medical coverage, COBRA is also available for continuation of your Dental, Vision, and/or

Account (FSA) coverage. COBRA continuation coverage is available under the FSA only through the end of the calendar year in which you retire. Further, during COBRA continuation coverage, contributions to the FSA must be made on an after-tax basis. While the tax-favored treatment is lost, electing COBRA continuation coverage may be to your advantage if you retire in the middle of the year and have not yet incurred sufficient eligible expenses for which you could submit a reimbursement claim to use up your account balance. Eligible expenses must be incurred while you are covered under the FSA and during the calendar year in which you retire. Claims must be submitted within 31 days of your retirement for any expenses you incurred before you retired.

A COBRA package will be mailed to your last address on file within 30 days of termination. If you wish to continue your benefits under COBRA, you may complete and return your election/enrollment form along with your required premium within the time period specified in your COBRA package. You may also elect COBRA coverage by phone or online.

If you retire before age 65 without health care coverage

If you retire before you’re 65, you can use the Health Insurance Marketplace to buy a plan. Losing health coverage qualifies you for a Special Enrollment Period. This means you can enroll in a health plan even if it’s outside the Marketplace’s annual Open Enrollment Period. When you fill out a Marketplace application, you'll find out if you qualify for a private plan with premium tax credits and lower out-of-pocket costs. This will depend on your income and household size. You’ll also find out if you qualify for free or low-cost coverage through the Medicaid program in your state.

If you have Medicare coverage

Medicare isn’t part of (and doesn't work with) the Health Insurance Marketplace. If you have Medicare, you don't need Marketplace coverage.

If you or your dependent are not eligible for Medicare at the time of retirement, you should enroll for Medicare Part A and Medicare Part B through your local Social Security Office three months before you are Medicare eligible (typically age 65). You or your covered dependent may qualify for Medicare earlier than age 65 under other circumstances (i.e., if you or they are disabled and eligible for Social Security disability payments or you or they have end stage renal disease).

If at the time you retire you or your dependent are eligible for Medicare, you should enroll for Medicare Part A and Medicare Part B three months before your retirement date for coverage to be effective on your retirement date. Remember, contributions to an HSA must end when you become enrolled in Medicare, and in some cases Medicare enrollment is effective retroactively, so you will need to carefully plan your contributions to your HSA to avoid contributing too much.

Note: If you or your dependent are over age 65 at retirement, you will need to complete Form CMS-L564E (Request for Employment Information) to certify that you had active employee coverage beyond age 65 to avoid paying the Medicare late enrollment penalty. Open a case in Service Now to have the “Employer” section of the form completed.

The following benefits are portable — which means you may elect to continue your participation after you leave ABM.

If you elected Voluntary Life Insurance coverage while you were employed at ABM, you will have an opportunity to continue that coverage on an individual basis after you retire.

If you elected Life Insurance with Long Term Care coverage while you were employed at ABM, you will have an opportunity to continue that coverage on an individual basis after you retire.

If you elected Supplemental Insurance through Cigna (Accidental Injury, Critical Illness, and/or Hospital Indemnity), you will have an opportunity to continue that coverage on an individual basis after you retire.

Survivor Support Service specialists can assist you in obtaining death certificates, finding funeral services, assigning payments, and accessing grief and bereavement resources.

When you retire, any Pet Insurance coverage you elected will not be cancelled, however, you should notify MetLife of your retirement. Your current rates will continue through your policy anniversary date, unless you cancel coverage earlier.

If you elected Identity Theft Protection through Norton LifeLock, you will have an opportunity to continue that coverage on an individual basis after you retire.

If you elected Gym & Wellness Resources through Wellhub, your coverage will end on the last day of the month in which you are no longer employed by ABM. However, you should contact Wellhub to determine your options during retirement.

If you were covered under the Legal Services Plan at retirement, you have the option to continue coverage by direct bill through the end of the calendar year, and may renew coverage annually thereafter by making renewal arrangements with MetLife and paying the full annual premium.

Retirees must contact MetLife Legal’s Client Service Center at 800.821.6400 within 31 days of their retirement date to continue the coverage. Even if you don’t continue coverage, however, any open and pending matters (i.e., any covered matter that an attorney is actively working on) that were started before your termination date will be covered to completion at no additional cost.

Please note that continued coverage is subject to any terms and conditions imposed by MetLife from time to time, and the rules described in this paragraph may change in the future.

You should always consider your personal savings, as well as any potential benefits from Social Security, when contemplating retirement.

You have choices for your ABM 401(k) Employee Savings Plan account:

• Leave your account with ABM — While you can’t make new contributions or take loans, you will have access to familiar investment choices and can preserve tax-deferred growth potential.

• Take a full withdrawal with a lump sum distribution — This option gives you immediate access to your assets and allowed you to choose how to spend or re-invest the assets. Of course, you will need to consider the tax consequences.

• Roll over all of a portion of your account to an IRA — You can make new contribution to a rollover IRA and you will have potential for future tax-deferred growth.

• Move your account to a new employer’s retirement plan — Maybe you’re retiring from ABM, but intend to work elsewhere. If so, you should consider a rollover to your new employer’s plan, which will allow you to preserve the tax-deferred growth potential.

• Convert all or a portion of your account to a Roth IRA — Taxes are paid at the time of contribution, so withdrawals are tax-free. Again, you would want to consult with a tax advisor as to the applicability of this option.

Merrill Personal Retirement Strategy (PRS)

Personal Retirement Strategy can make planning for the income you’ll want in retirement easier. Available through ABM’s 401(k) Employee Savings Plan, PRS offers investment guidance, personalized advice, and resources to help you work toward your retirement income goal — which is the amount of income you need each year in retirement to maintain your current lifestyle.

Merrill suggests that you may need at least 85% of your pre-retirement, after-tax income to maintain that lifestyle. Based on your goal, PRS recommends an asset allocation strategy (how you could divide your retirement plan assets among stocks, bonds, and cash). Your personalized strategy takes into account your expected retirement age, Social Security, contribution rate, and account balance (if you’re already enrolled in your employer’s retirement plan). You can also provide additional personal and financial information, on a confidential basis, so that your strategy reflects your specific financial situation.

Visit Benefits OnLine® to learn more and/or review the Personal Retirement Strategy Fact Sheet. Any costs for this service will be listed in the Fact Sheet.

You may be entitled to receive Social Security benefits. Social Security benefits are calculated using your earnings subject to Social Security taxes paid during the years you worked.

Visit ssa.gov > My Social Security to check out your Social Security Earnings Statement, change your address, and manage your benefits online.

Social Security benefits are not paid automatically. Apply either online at ssa.gov or at the Social Security office nearest your home approximately three months before you want your benefits to begin.

You should have your Social Security card or a record of your number, your birth certificate or other proof of age, and your proof of earnings statement for the previous year. If you do not have these documents, contact your local Social Security office to determine if alternative documents are acceptable.

Please note that Social Security benefits are provided directly by the federal government and not by ABM.

You should also find out how much your Social Security benefits might be and analyze how to maximize them. Merrill offers a free Social Security calculator. This lets you see how different claiming options might impact your retirement income across your lifetime. Remember, you will select the age at which you want your Social Security benefits to begin: Early, Normal, or Late Retirement Age.

Check out Merrill’s Social Security webinar

Click the link below to hear a webinar delivered by Merrill that covers topics such as:

• Full retirement age

• Early and delayed benefits

• Benefits for spouses

• Overall financial wellness

Social Security - Maximizing your benefits

The following section discusses how your ESPP is handled when you leave ABM.

If you participate in the ESPP, here are some important things to keep in mind as you plan for your retirement.

• If you leave ABM after you have purchased shares, any shares of ABM stock that were purchased belong to you. You can:

▪ Hold the shares in your Merrill brokerage account,

▪ Sell them, or

▪ Transfer the stock to another eligible account.

• If you leave ABM during an offering period, your ESPP contributions would generally be refunded to you since the next purchase date hasn’t been reached. For example, let’s assume you leave ABM on September 1, which falls within the July 1 – September 30 offering period. In this case, you would be refunded any contributions you made during the offering period prior to your departure since you would not be an ABM team member on the purchase date of September 30.

• After you leave ABM, you are no longer eligible to participate in the ESPP, since the plan is only offered to active team members.

If you have questions about your ESPP contributions, go to benefits.ml.com.

Select “Contact us” at the bottom of the home page (or under “Menu” in the app). Alternatively, you may call Merrill at the number listed in the Directory of Resources on page 16.

The following section discusses how your Equity Awards are handled when you leave ABM.

All eligible awards need to be held at least one year in order to vest; otherwise, they will be forfeited.

What happens to your Equity Awards when you leave ABM depends on the type of award you’ve received, if the award has vested, and the terms and conditions of the awards:

• If you have vested Restricted Stock Units (RSUs) or Performance Shares (PSs), proceeds belong to you. Generally, you can hold, sell, or transfer any ABM stock in your Merrill brokerage account to another brokerage account.

• If you have vested stock options or stock appreciation rights, you may have limited time to exercise them after leaving ABM. After that time, the awards typically expire.

• If you have unvested awards, they are treated differently based on the circumstances of your departure from ABM, as follows:

Retirement*/ Death or Disability

Shares are prorated based on number of months from last vest to termination date and will be released to participant within 90 days of termination

Shares are prorated based on number of months from grant date to termination date and earned shares will be released on schedule vest date

Shares are prorated based on number of months from grant date to termination date and earned shares will be released on schedule vest date

* Retirement eligibility is 60+ or 55 years and older with tenure to bridge to 65.

If you have general or account-related questions about your Equity Awards, see the Directory of Resources on page 16 for contact information.

Here are a few resources that may come into play during retirement.

ABM Benefits Center

833.938.4635

Fax: 866.616.3558

Mon – Fri, 7 a.m. – 7 p.m. CT worklife.alight.com/abm

COBRA – UHC

866.747.0048 uhcservices.com

Flexible Spending Account – WEX

866.451.3399

Claims fax: 866.451.3245 wexinc.com

HSA – Optum Health Bank

866.234.8913 Optumbank.com

Disability, Life, & AD&D – The Standard

855.204.3126 for Standard Insurance Company (for all calls, except for NY)

855.204.3127 for The Standard Life Insurance Company of New York (for NY DBL) standard.com

Policy # varies by type of coverage

Value Added Services

Life Services Toolkit – Health Advocate℠ (included with Basic Life and AD&D insurance)

800.378.5742

English: standard.com/eforms/17526.pdf

Spanish: standard.com/eforms/17526spu.pdf

Travel Assistance – Assist America, Inc. (included with Basic Life insurance)

800.872.1414

English: standard.com/eforms/14684.pdf

Spanish: standard.com/eforms/14684spu.pdf

Health Advocacy (provided by Health Advocate℠) (included with Short Term Disability insurance)

844.450.5543

English: standard.com/eforms/18390.pdf

Spanish: standard.com/eforms/18390spu.pdf

Health Advocacy (provided by Health Advocate℠) (included with NY DBL Disability insurance) 844.450.5543

English: standard.com/eforms/18390.pdf

Spanish: standard.com/eforms/sny18390spu.pdf

Life Insurance with Long Term Care – Chubb

Claims & policy questions: 855.241.9891

Fax: 603.352.1179

Claims: claims@gotoservice.chubb.com

Policy questions: csmail@gotoservice.chubb.com

Supplemental Insurance – Cigna Healthcare

Accidental Injury, Critical Illness, Hospital Indemnity Claims/questions: 800.754.3207, Option 2 CignaSupplementalHealthPlans.com Policy # varies by type of coverage Claims filing: myCigna.com

Supplemental Health Solutions –Cigna Healthcare (included with Cigna’s Supplemental Insurance) Mental Health Resources Cigna.com/MentalHealth

My Secure Advantage

833.920.3895

Cigna.MySecureAdvantage.com

Healthy Rewards 800.258.3312 myCigna.com

Legal Services – MetLife

800.821.6400

Mon – Fri, 8 a.m. – 8 p.m. ET members.legalplans.com

Pet Insurance – MetLife

800.GET.MET8 or 800.438.6388 metlife.com/getpetquote

Identity Theft Protection – Norton LifeLock

800.607.9174 my.norton.com

Gym & Wellness Resources – Wellhub wellhub.com/en-us Help center: support.wellhub.com Download the Wellhub app

ABM 401(k) Employee Savings Plan – Merrill

800.813.9323

800.228.4015

888.221.9867

benefits.ml.com

Employee Stock Purchase Program

(ESPP) – Merrill 800.813.9323

benefits.ml.com

Equity Awards – Merrill & ABM

Account-related questions:

Merrill: 877.767.2404

Jennifer Kary, jennifer.kary@ml.com

General questions:

ABM: Nirvani Latcha: nirvana.latcha@abm.com

ABM: Ashley Hafeez: ashley.hafeez@abm.com

This Retirement Planning Guide is intended only to highlight some of the major benefits provisions of ABM’s benefits plans and should not be relied upon as a complete detailed representation of these plans. Please refer to these plans’ Summary Plan Descriptions (SPDs) for further details. Should this Guide differ from the SPDs, the SPDs prevail. The benefits described in this Guide may be amended, changed, or terminated by ABM at any time without prior notice to, or consent by, team members. These benefits do not create a contract of employment between ABM and any team member, nor an obligation by ABM to maintain any particular benefits plan, program, or process.