Board of Directors, May 15, 2024

“READ THIS” AGENDA SUMMARY

FY24 Quarter 3 Financial Report Highlights

Profit & Loss Sheet

• Income (line 11) and expenditures (line 21a) for the ArtCIE project are behind schedule. This is due to a delay in program implementation. There is no financial consequence to The Able Trust. These are pass through funds for subcontracts for which we are acting as the fiduciary and grant manager for FDOE/VR. Most of the subcontracts have been executed in the current quarter, and the project is underway.

• $40k in revenue from Project Venture (line item 12) will be recorded in the 4th quarter report.

• The 3rd quarter payment for HSHT appropriations (line 13) will be made in May ($254,000).

• We made a 3-year payment for our ERISA bond (line 71) for a discounted fee which resulted in over expenditure in this category. No payment will be made for the next 2 years.

• Audit expenses (line 94) exceed projected budget due to the added requirement of a Single Audit for state revenue which was not anticipated during the RFP process.

• Net income from bank and investment accounts totals $1,341,929.40 since July 1, 2023.

Balance Sheet

• The negative balance in line 108.000 reflects the nightly sweep of funds into the IntraFi banking system to protect deposits over $250,000 (not insured by FDIC). The actual balance of the Reserve account is a sum of line 108.000 and 109.003: $292,933.55

• Our total assets and endowments have gained $1,298,791 since March, 2023.

FY25 Budget Highlights

• Line 9 projects $500,000 in private donor donations. A goal for our first year of the major gifts campaign.

• Line 10 includes $1,018,000 in recurring legislative funds for HSHT; $300,000 to expand Futures in Focus; and $1,400,000 for a special project for youth with disabilities that is a priority of House Speaker Renner. FDOE is working with the Speaker’s office to negotiate the framework of that project and a contract with The Able Trust to administer to resulting grants.

• Line 29 is for the new HSHT Ambassador initiatives (presented at the February board meeting) to recruit, train, and showcase current and past HSHT students’ success.

• Line 30 includes state funds for expanding Futures in Focus to 20 sites and grants for the special initiative of the House Speaker.

• Line 30 funds are to create and implement a formalized program evaluation process for HSHT and Futures in Focus.

• Lines 36 and 37 are funds to support the major gifts campaign including consultant fees, events fees, marketing materials, and donor meetings.

• Line 87 includes a full year of lobbying fees compared to our current 8-month contract.

FY 2024 – 2025 Strategic Goals & KPIs

• We are in the third and final year of our strategic plan.

• Strategic Priorities and Key Performance Indicators have been updated to reflect our work for the coming year which include:

o Expanding Able Trust youth programs to serve 5,000 students annually by FY 20272028.

o Securing a more diversified funding base to ensure organizational stability and achieve exponential impact. Raise $26 million in 4 years.

o Provide focused support for VR – including an investment of $260,000 in FY 2025.

• Key Performance Indicators for each priority are included in the board materials.

Major Gifts Campaign

The Able Trust has launched a major gifts campaign in raise $26 million in a four-year period. This level of funding will allow us to expand youth programs to: serve over 5000 students per year; increase our support of VR; and increase our endowment accounts including private/family endowments. Our campaign theme is “Crossing the Stage.”

Key dates of the campaign in FY 2025 include:

• July 2025 – opportunity for board to provide feedback on case for support

• September 12 – Tallahassee-area Awareness Event

• October 2024 – March 2025 – opportunities for board to meet with prospective donors

• April 2025 – Tallahassee-area Ask Event

• April – June 2025 – opportunities for board to meet with prospective donors

• June 2025 – goal for $500,000 secured in private donations

Campaign Goals/Budget:

One-Time Capital Projects

Lease/Renovations

$ 4,026,858 $ 4,907,774 $ 6,323,272 $9,944,660

$100,000

Total $ 100,000

Total Program

$25,202,564 Total Capital $100,000 Total Planned Giving/Endowment $1,000,000 CAMPAIGN TOTAL $26,302,564

HSHT & Futures in Focus Program Evaluation

The Able Trust has secured a contract and begun work with Research Analytics Consulting (RAC) for the design and implementation of a formal program evaluation system of our youth programs (HSHT & Futures in Focus). Our goal is to become more comprehensive in our programmatic evaluations to ensure that we can accurately measure impact to student participants and demonstrate the value of our investments to stakeholders and potential funders.

Dr. Cindy Walker from RAC will make a full presentation and field questions from the board during the May 15th meeting.

BOARD Meeting Agenda – May 15, 2024, 9:00 AM – NOON, Zoom Link https://us02web.zoom.us/j/86060216426?pwd=UkNzRTJRamRQN1I1RnN5cml6M0luUT09

Meeting Call-In Number: 1 929 205 6099 Meeting ID: 860 6021 6426 Passcode: 882252

Directors are reminded that all Able Trust Board and Committee meeting are open and publicly noticed. Under Florida Sunshine Law, any meeting of 2 or more Able Trust Directors must be publicly noticed. Directors are prohibited from discussing Able Trust business outside of official meetings of the organization. Directors are reminded of conflict-of-interest provisions. In declaring a conflict, please refrain from voting or discussion and declare the following information: 1) Your name and position on the Board, 2) The nature of the conflict, and 3) Who will gain or lose as a result of the conflict.

I. II. III. Call to Order (5 Minutes) Roll Call and Establishment of Quorum Approval of Agenda – Action

IV. Consent Agenda – Action (5 Minutes)

a. Acceptance of December Meeting Minutes

b. 3rd Quarter Finance Reports

a. Profit & Loss Sheet

b. Balance Sheet

V. FY 2024 – 2025 DRAFT Budget– Action (15 Minutes)

VI. President & CEO Annual Evaluation (15 Minutes)

VII. President’s Update (15 Minutes)

a. FY 2024-2025 – Strategic Goals & KPIs

b. Major Gifts Campaign

c. HSHT & Futures in Focus Program Evaluation

VIII. Presentations

a. Program Evaluation (45 Minutes)

b. Responsibilities of a Florida Direct Support Organization (20 Minutes)

c. VR Updates (20 Minutes)

IX. New Business Public Comment Adjourn

NEXT Board Meeting: August 29, 2024, 9:00 – 11:00 AM

Pg. 1-9

Pg. 10-14

Pg. 15-16

Pg. 17-20

Laurie Sallarulo, Chair

Chip Byers, Secretary

Laurie Sallarulo

Laurie Sallarulo

Doug Hilliard, Treasurer Allison Chase, President & CEO

Pg. 21-23 Laurie Sallarulo, Chair

Pg. 24-25 Allison Chase

Donna Wright, VP Marketing & Development

Allison Chase

Pg. 26-33 Cindy Walker, PhD, Research Analytics Consulting

David Chappell, FDOE Deputy General Counsel

Victoria Gaitanis, Acting VR Director

Laurie Sallarulo, Chair

Please Note: Agenda subject to revisions and additions per the discretion of the Chair of the Board of Directors. Notification will be sent of any such revisions or changes. Members of the Public: Please notify Arnaldo Ramos at Arnaldo@AbleTrust.org if you wish to make public comment on particular agenda items no later than 1-hour prior to beginning of the meeting.

Florida Endowment Foundation for Vocational Rehabilitation, dba The Able Trust DRAFT - Meeting Minutes

Board of Directors Meeting – December 7, 2023 10:00 a.m. to 12:00 p.m.

Virtual Meeting

Members in Attendance

Chip Byers, Mavara Agrawal, Todd Jennings, Lori Fahey, Stephanie Westerman, Victoria Gaitanis, Laurie Sallarulo

Members Absent Doug Hilliard, Alexis Doyle

Staff in Attendance

Others in Attendance

Allison Chase, President; Arnaldo Ramos, Office Administrator and Executive Assistant to the President; Donna Wright, Vice President of Development & Marketing; Joseph D’Souza, Vice President, External Engagement; Justin Adams, Communications Manager; Leanne Rexford, Director of Partner Relations

Allison Harrell – Thomas Howel Ferguson, Tony Carvajal

Item Action/Discussion

I. Call to Order Laurie Sallarulo, Board Chair called the meeting to order at 10:09a m

II. Roll Call and Establishment of Quorum Chip Byers, Board Secretary completed roll call and a quorum was established at 10:11a.m.

III. Approval of Agenda –Action

IV. Approval of Consent Agenda – Action

a. Acceptance of September Meeting Minutes

b. Acceptance of FY24 Pettengill Donnor Fund

c. Acceptance of FY24 Family Endowment Funds

d. Committee Reports, Nov. 2023

Motion to approve the agenda, consent agenda, first by Lori Fahey and seconded by Director Byers.

Consent agenda approved first by Director Byers, and seconded by Director Westerman, motion carried unanimously

V. Action Items (30 Minutes)

a. Finance Report

Acceptance of FY23 1st Quarter P&L Statement –Action

b. Acceptance of FY23 1st Quarter Balance Sheet –Action

President Chase, presented the finance report with the following highlighted details:

• New Grants/Income – already over 50% for this year.

• Project Based Revenue – budgeted for just over 2 million dollars, this includes the ArtCIE Grant that the Able Trust is managing. Contracts for subcontractors are pending. Currently, we have brought in $25,000.

• Sponsorships/Unrestricted Gifts – we are currently at about $50,000, which brings us to about 50% of our goal.

• Erisa Bond – the reason it is currently over the budget allocation is because the renewal is for 3 years, and the current budget only reflects the cost for 1 year. The decision to proceed with a 3-year renewal is based on cost savings to maintain the bond.

• Total Expenses – we are currently at 22%, and we are on track for the first quarter of the year.

Balance Sheet

• Current Assets/Bank Accounts – it appears the account has a negative balance, however as previously explained we moved into a Cash Sweep Program to protect the funds as we have over $250,000, and the FDIC only protects up to that amount.

• Current Assets/Accounts Receivable – undeposited funds look like a negative number currently. However, these are pending funds being paid to the Able Trust due to outstanding invoices or awarded grants where funds have yet to be distributed to us. We are at about $103,000.

• Total Other Current Assets – as a comparison between last year and this year, we are at an increase. Allison Harrell from Thomas Howell Ferguson will be delving deeper into explaining the reason for this as she explains the performance of our investment accounts over the last year.

• Total Endowments – the family funds have increased over $300,000 which is good news.

A motion was made first by Director Jennings and Seconded by Director Sallarulo. The motion carried unanimously.

c. FY2023 Audit Report

Allison Harrell, Audit Shareholder – Thomas Howell Ferguson P.A. CPA’s

• Unmodified Opinion was issued, which is the highest level of assurance on audited financial statements.

• This year a Single Audit/Grant Compliance Audit was performed this year because the expenditures of state grant funds exceeded $750,000.

• Management Discussion Analysis – required by governmental accounting standards and provides a narrative for the financial result for the last year. Ms. Harrell proceeded to review the details of the audit and comparison of performance for various accounts as well as naming documentation issued by the CPA firm affirming all accounts.

Motion to accept the FY2023 Audit Report, first by Director Fahey, seconded by Director Byers. Motion passed unanimously.

VI. Legislative Research Study

a. Presentation of Findings

Tony Carvajal – Legislative Research Report Update and Findings

Over the last several months the Able Trust has been responding to SB240’s request for what was added to the Practice Act, which is a research report that addressed various areas. This report was completed collaboratively and has brought various stakeholders together along with input from the Department of Education and the legislature.

The report addresses incongruencies between laws and rules and challenges and barriers persons with disabilities face, not only in early years, such as the Pre-k through 12th school system, but particularly in transitioning out of high school into the workforce. Attention will be given to a section of the law called Employment First, which is supported by state agencies that provide services and products to persons with disabilities to coordinate bridging these gaps and assessing resources available for smoother transition into the workforce and independence. Also referenced in the report are the REACH Act and Florida Wins regarding best practices in and out of the state of Florida.

There is also discussion regarding the increase in employment in industries which will help further the Able Trust mission focusing on employment opportunities.

A special thank you to Sr. Chancelor Richey at the Department of Education, the Department of Vocational Rehabilitation, and the members of the Able Trust Board of Directors for reviewing the report and providing invaluable feedback and support in helping to create this report. President Chase also emphasized that this report helped to strengthen the relationships with the local legislative staff and mentioned Jason Fudge’s guidance on ensuring that the report provided information to support the legislators this session.

VII.

b. Use of Report 2024 Session

DSO Strategic Plan Updates

a. Youth Program Expansion, Collective Impact, VR Staff Support

In preparation for the upcoming legislative session, President Chase provided an update pursuant to conversations with Allen Suskey, Shumaker Consulting Lobbyist. Various requests have been received to meet with legislators to learn more about the report. These meetings will most likely take place in January. President Chase also encouraged the board members, reach out to their local legislators, and share this report or provide and introduction to the Able Trust to share the findings of this report.

President Chase and Sr. Vice President D’Souza provided good news regarding reaching and achieving our performance metrics for the first year of the strategic plan. The Able Trust’s strategic plan is to

• Make data driven decision.

• Solve issues using the Lean Impact Model.

b. Grant Committee Recommendations – Action

• Fail fast and iterate

• Everything underscores our role as a direct support organization

Year 1 – Data Resources & Methods

• Lean Impact: Testing Collective Impact in the Tampa area to further develop relationships between the Department of Vocational Rehab and local providers.

• Pathways and Legislative Research Study – our data sources.

• Discovery conversation with leadership at the Department for Vocational Rehab.

• Accomplishing 30 years of the High School High Tech Program

Year 2 – Strategic Priority Iterations

• Continue and strengthen practice of data-driven decision making. Currently working towards systems mapping of secondary and postsecondary systems for students with disabilities.

• Support the Department of Vocational Rehab in reaching PreETS/Transition Goals by expanding High School High Tech and starting the pilot program Futures in Focus.

• Supporting the Department of Vocational Rehab in staff retention, professional development, and leadership initiatives.

• Continuing increase of funds through diversified streams of income.

These priorities are in line with the priorities in other states as we have discovered through our data and research efforts.

Future Planning:

• 5-year goals for students served.

• 5-year goal for funding.

• Results of the High School High Tech Lite Pilot – Futures in Focus.

• Supporting the Department of Vocational Rehab on staff retention and professional development.

• Results of the Department of Vocational Rehab staff retention and professional development in Area 4.

Sr. Vice President D’Souza & Director Agrawal

Sr. VP D’Souza began by mentioning that we are partnering with the Consortium of Florida Education Foundation (“C.F.E.F.”) to issue and track grants for the Future in Focus program to further expand the reach of High School High Tech. This partnership will enable us to better serve students with disabilities. President Chase also stated that the C.F.E.F. has funding given to them by the state to match grants that meet certain criteria, so the sites selected for the Futures in Focus program who are selected could double their funding.

• $75,000 Grant – to support the Future in Focus pilot program being administered by C.F.E.F., which covers students from 6th grade to 12th grade.

VIII. Information Items

a. Project Venture

b. Conflict of Interest and Ethics Statements

IX. Mission Moment –Florida Blue DEAM Video

• $20,000 Grant – Broward College for systems mapping resources for students with disabilities.

Motion to approve the grant committee recommendations first by Director Mavara and seconded by Director Westerman. Motion carried unanimously.

Project Venture – April 9, 2024 | 2:30pm-5:00pm

Reminder to the directors to submit the Conflict of Interest and Ethics Statements.

Donna Wright, VP of Marketing and Development

VP Wright thanked the board of directors and shared a video featuring Director Westerman celebrating Disability Employment Awareness Month (“DEAM”).

Discussion Items – Full Board (1 Hour 15 Minutes)

Information Items N/A

New Business N/A

Next Board Meeting

Adjourn

Virtual Board Meeting on March 7, 2024, from 10am-12pm

Board meeting adjourned at 12:12p.m.

Respectfully submitted, James “Chip” William Byers IV, Secretary

Florida Endowment Foundation for Vocational Rehabilitation, dba The Able Trust DRAFT - Meeting Minutes

Board of Directors Meeting – March 7, 2024, 10:00 a.m. to 12:00 p.m.

Virtual Meeting

Members in Attendance

Members Absent

Staff in Attendance

Others in Attendance

Todd Jennings, Lori Fahey, Stephanie Westerman, Mavara Agrawal

Doug Hilliard, Alexis Doyle, Chip Byers, Laurie Sallarulo, Victoria Gaitanis

Allison Chase, President; Arnaldo Ramos, Office Administrator and Executive Assistant to the President; Donna Wright, Vice President of Development & Marketing; Joseph D’Souza, Vice President, External Engagement; Justin Adams, Communications Manager; Leanne Rexford, Director of Partner Relations

Item Action/Discussion

I. Call to Order N/A

II. Roll Call and Establishment of Quorum N/A

III. Approval of Agenda –Action

IV. Approval of Consent Agenda – Action

a. Acceptance of December Meeting Minutes

V. Action Items (30 Minutes)

a. Finance Report Acceptance of FY23 2nd Quarter P&L Statement –Action

Quorum was not met, and motions could not be made to approve the agenda or consent agenda.

President Chase continued the call for those who were able to join and spoke on the following points:

• Able Trust Profit & Loss Budget to Actual 07/01/22 – 12/31/23 (highlights)

o Line 11 - ArtCIE Federal Grant Project

✓ A federal grant awarded to the Department of Vocational Rehabilitation (“DVR”), to start a pilot program for 5 years to help move people with disabilities into competitive employment. It was meant to start in October however it has not started yet due to some unexpected delays. The Able Trust is acting as a grant manager and is to receive $2,000,000 to pay the vendors participating in this project. Currently there are 5 vendors/subcontractors identified to begin this work.

b. Acceptance of FY23 2nd Quarter Balance Sheet –Action

o Line 21a - ArtCIE Federal Grant Project

✓ This is where grant payments are being recorded, only expenses currently tracked are payments to the grant manager who will be managing the vendors/subcontractors.

o Line 36 – Research & Data Analysis

✓ The $60,000 expense recorded there is the payment to Tony Carvajal for the legislative research report which was due in December, and it has been submitted.

o Line 71 – ERISA Bond

✓ Insurance to protect the 401k plan from fraud. All businesses who have retirement packages have insurance on the benefits/retirement plans. The Able Trust made a lumpsum payment for the next 3 years and that is why it reflects as 200% over expenditure.

• Balance Sheet

o Line 108 – First Reserve Account

✓ Currently has a negative balance, due to the sweep program to protect the funds exceeding $250,000. The true amount is the sum of the Reserve Account amount and ICS716, true amount is $592,943. All cash accounts reflect that we are on track and mirror where we were last year.

o Total Other Current Assets

✓ Endowments are up by $800,000 from last year to this year, and this is considering that we are taking funds from our investments for our operational investments, so if that is added up, we actually are up around $2,000,000 from last year.

o Total Unrestricted Assets –

✓ Up $800,000

o Family Endowments

✓ Up $300,000

We are a little under halfway through the year regarding our expected expenditures for this fiscal year.

c. FY 25 Budget Process

VI. Legislative Session

Updated

a. Funding request

b. Legislative Study

c. FY25 Meetings

President Chase shared the process we will be using to review the proposed budget for the next fiscal year to better communicate to the board, a sample was shown and explained.

Director Jennings provided an update regarding legislative appropriations:

✓ $1,000,000 secured for HSHT ,

✓ 300k secured by lobbyist Alan Suskey for the expansion of HSHT, These are pending final budget approval with the governor.

President Chase shared results from the legislative study, Employment First Initiative and Collaborative which requires agencies and organizations that work with people with disabilities in the arena of employment to offer them competitive employment as the first option. The recent legislation that came from the research report is that there needs to be one central organization to coordinate those employment efforts. The REACH office is the organization that has been identified and tasked with coordinating these efforts.

I. Discussion Items – Full Board (1 Hour 15 Minutes)

a. HSHT Ambassadors Program

b. Major Gifts Ramp-Up

Leanne Rexford, Director of Partner Relations, spoke regarding the High School High Tech Ambassadors Program and shared the Ambassadors promo video. This program will consist of 15 of the best and brightest HSHT students who will participate in local events and represent The Able Trust and HSHT.

Primary goals:

• Build brand awareness among current and prospective donors.

• Fortify fundraising efforts.

• Provide high quality leadership development opportunities to the students.

Once selected the students will have the opportunity to attend leadership workshops and training courses. Additionally, the students will attend at least 2 reception style events throughout the year, meeting with legislators, state and regional foundations and mutual benefactors. Each Ambassador will receive a $500 scholarship for participating and completing the program.

There is an upcoming Ambassador event taking place in June at the Tampa Zoo.

Donna Wright, VP of Marketing & Development, shared the Major Gifts Ramp-Up (“MGRU”) video. MGRU is a donor development and fundraising consulting organization that aims at teaching and connecting organizations with high wealth donors in their area. The MGRU model provides support, guidance, and resources for the purpose of fundraising. First area of focus will be in Leon County.

c. Futures in Focus

Information Items

Joseph D’Souza, Sr. Vice President, shared an update on Futures in Focus.

• Entered into an agreement with the Consortium of Florida Education Foundation (“CFEF”).

• 18 applications we submitted to pilot this program.

• 8 programs are being funded throughout the state in different types of communities (rural and major city).

• Student access from grades 6-12.

• Over 600 students will be served.

• Exposure and introductions to agencies and organizations that assist and support people with disabilities in becoming gainfully employed.

Reminders:

• CEO Evaluation to be sent to the directors by VP D’Souza

• Project Venture Competition, in Jacksonville April 9th

• May Board Meeting will be virtual.

Announcement by President Chase, Tracey Lowe has been promoted to Vice President of Communications.

N/A

Next Board Meeting Virtual Board Meeting on May 15, 2024, from 10am-12pm

Adjourn N/A

Respectfully submitted, James “Chip” William Byers IV,

SecretaryAs of March 31, 2024

45

Allison Chase, President & CEO

Annual Evaluation by Board of Directors, 2024

The following ratings were provided by 7 of the 9 board members using the Rating Scale of: 4 –Exceeds Expectations; 3 – Meets Expectations; 2 – Somewhat Meets Expectations; 1 – Does Not Meet Expectations

1. Communicates the organization's vision internally and externally. Overall - 4

• Doug Hilliard - 4

• Chip Byers - 4

• Alexis - 4

• Dr. Mavara Agrawal - 4

• Stephanie Westerman - 4

• Lori Fahey - 4

• Laurie Sallarulo – 4

2. Manages and leads the organization in a manner that ensures excellence and impact. Overall - 4

• Doug Hilliard - 4

• Chip Byers - 4

• Alexis - 4

• Dr. Mavara Agrawal - 4

• Stephanie Westerman - 4

• Lori Fahey - 4

• Laurie Sallarulo – 4

3. Establishes effective working relationships with external stakeholders and partners Overall - 4

• Doug Hilliard - 4

• Chip Byers – 4

• Alexis - 4

• Dr. Mavara Agrawal - 4

• Stephanie Westerman - 4

• Lori Fahey - 4

• Laurie Sallarulo – 4

4. Ensures necessary oversight of all funds, including developing and maintaining sound financial practices. Overall – 3.85

• Doug Hilliard - 4

• Chip Byers - 4

• Alexis - 4

• Dr. Mavara Agrawal - 4

• Stephanie Westerman - 4

• Lori Fahey - 4

• Laurie Sallarulo – 3

5. Works effectively with the board, providing appropriate, adequate, and timely information. Overall - 4

• Doug Hilliard - 4

• Chip Byers - 4

• Alexis - 4

• Dr. Mavara Agrawal - 4

• Stephanie Westerman - 4

• Lori Fahey - 4

• Laurie Sallarulo – 4

The following responses were given to open-ended questions.

1. What are Allison's 2-3 greatest strengths?

• Knowledge in this space and a passion for the Able trust mission; Well organized and always pushing for growth. – Doug Hilliard

• Organization and making connections – Chip Byers

• Communication collaboration and concern – Alexis Doyle

• Willingness to openly discuss issues – Mavara Agrawal

• Ensures she meets with board, builds relationships and takes time to explain when needed –Stephanie Westerman

• Communicates effectively, builds talented working team, very innovative – Lori Fahey

• Transparency, passion, and knowledge of mission – Laurie Sallarulo

2. What areas of opportunity do you see for Allison's improvement or growth?

• More clearly defining the goals of the organization and sharing more responsibility – Chip Byers

• None – Alexis Doyle

• Overall communication is excellent, however. It may be helpful to provide Board members with more details during meetings on activities, organization activities, etc. and who is helping to support specific projects. Also, would like to see more information on what Able Trust employees spend their time working on, perhaps a report from each. – Mavara Agrawal

• Staff development on timely communication in advance, taking notes, providing action items and timelines when working on initiatives. – Stephanie Westerman

• Develop a strong relationship with external stakeholders in the disability community. Such as associations, provider groups, etc. – Lori Fahey

• Deeper Financial knowledge – Laurie Sallarulo

3. How can Allison help you become a more effective board member in the coming year?

• She does great already in helping me as a board member – Doug Hilliard

• More clearly convey what she needs from us. Don't hesitate to ask us for things. – Chip Byers

• Already awesome – Alexis Doyle

• Continue to focus on activities that increase the number of Floridians in a meaningful way. –Mavara Agrawal

• Invite me to connect with local leaders when she comes into the area and meets with them to build local network for able trust and drive goals and objectives. – Stephanie Westerman

• Keep up the good work! – Lori Fahey

• I feel very supported and informed. – Laurie Sallarulo

4. Additional Comments:

• I have certainly disagreed with Alison about n the past. That's a good thing. Different opinions are what make a board work. If ever I had a problem with how things are being run, I've always been able to bring it up to Allison and discuss without any sort of formal questionnaire. We have always had open communication. – Chip Byers

• Best CEO ever – Alexis Doyle

• None – Mavara Agrawal

• Thank you, Allison and team, for your leadership and efforts to continue to bring the most effective programs and services to our youth to prepare them for future employment. The need for this support is vast and complex to support a diverse state. My hope is that The Able Trust can grow in staff and resources to continue to build on the excellence they've achieved to reach more people with disabilities who are ready and willing to be productive members of the society with the right support. – Stephanie Westerman

• It has been a pleasure serving on the Able Trust Board of Directors. Thank you! – Lori Fahey

• I enjoy working with Allison. I'm confident in her ability to represent the organization. – Laurie Sallarulo

Vision: A Florida where all people with disabilities reach their employment potential.

Mission: To support Florida Vocational Rehabilitation in the advancement of employment for all Floridians with disabilities through engagement, investment, and collaboration.

Strategic Priority #1: Expand The Able Trust youth programs to serve 5,000 students annually by FY 20272028.

FY25 Key Performance Indicators

• Serve 1400 students.

• Fund & support 47 High School High Tech (HSHT) & 20 Futures in Focus sites.

• 100% of HSHT students referred to VR.

• Develop & implement a formal system of program evaluation.

• Create a research plan for youth programs.

Strategic Priority #2: Secure a more diversified funding base to ensure organizational stability and achieve exponential impact. Raise $26 million in 4 years.

FY25 Key Performance Indicators

• Raise $1.35 million in new funds, 50% of which will be unrestricted dollars.

• Maintain $2.8 million in current income (investments, legislative, grants, donors, sponsors).

Strategic Priority #3: Provide focused support for VR.

FY25 Key Performance Indicators

• Invest $60k in VR directed expenses for marketing materials and employee recognition.

• Refer 100% HSHT students to VR.

• Recognize VR in all communication tools.

• Act as ArtCIE subcontract manager.

• Invest $200k in VR professional development initiatives. Cross-Cutting Tools and Strategies

History and Mission

RAC was founded to meet the research and evaluation needs of organizations and community partners that contribute to positive change. RAC was officially established in 2020; however, we have assisted community partners and clients with their research and evaluation needs for over 25 years. Representing a team of experienced evaluation professionals, we have the technical skills, expertise, and passion needed for successful long-term partnerships

Our company is dedicated to empowering clients as catalysts for change, aiming to achieve their strategic objectives. Our expertise lies in the crafting of advanced data collection tools, including but not limited to assessments, tests, and surveys. We excel in performing detailed statistical and psychometric data analyses, and we pride ourselves on our ability to distill actionable insights from complex datasets. Moreover, we are adept at creating engaging interactive software and data visualizations that make data accessible and comprehensible. We have conducted numerous evaluation projects as a team, collecting and analyzing data from wide-ranging and diverse sources. Many of our consultants have dedicated much of their careers to teaching graduate students rigorous and high-quality quantitative evaluation methodologies. They are our backbone, enriching our team with their depth of knowledge and experience.

Our Approach and Experience

RAC’s collaboration with your organization is characterized by true partnership and reciprocal learning. We approach every project with the mindset of learners, keen to understand and integrate into your unique context fully. In doing so, we become more than consultants; we are active, contributing members of your project management team, focused on meeting your needs comprehensively.

Our extensive experience includes:

● Serving as the external evaluator for a consortium of health programs funded by the Federal Youth and Services Bureau (a division of the US Department of Health and Human Services) that support positive youth development and healthy relationships in Florida, Missouri, West Virginia, Nevada, California, New Jersey, Wisconsin, and Illinois.

● Serving as the external evaluator for a federally funded program designed to prevent teen pregnancy that was taught in local high schools by Gang Alternatives.

● Designing and implementing a study to determine how school districts in Wisconsin were implementing new federal guidelines for identifying students with specific learning disabilities for the WI Department of Instruction.

● Assisting a legal non-profit firm in Washington D.C., the First Shift Justice Project, designed to help working parents assert their workplace rights to prevent job loss, with the development and implementation of a data analytics system.

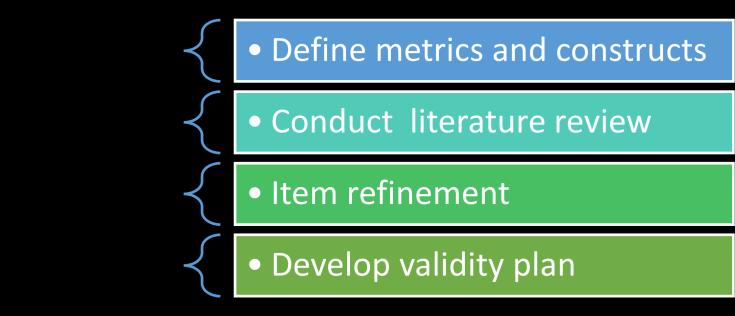

Figure 1: Evaluation Planning Phase

Figure 1: Evaluation Planning Phase

Figure 3: Qualitative Refinement Phase

Figure 3: Qualitative Refinement Phase