BOARD Meeting Agenda – December 7, 2022, 1:00 – 4:00 PM

Zoom Link: https://us02web.zoom.us/j/84638308467?pwd=VkYrSFN1d0p5VE0zMXBnSVkrdWkxUT09

Meeting Call In Number: 1 929 205 6099 Meeting ID: 846 3830 8467 Passcode: 137937

Directors are reminded that all Able Trust Board and Committee meeting are open and publicly noticed. Under Florida Sunshine Law, any meeting of 2 or more Able Trust Directors must be publicly noticed. Directors are prohibited from discussing Able Trust business outside of official meetings of the organization. Directors are reminded of conflict of interest provisions. In declaring a conflict, please refrain from voting or discussion and declare the following information: 1) Your name and position on the Board, 2) The nature of the conflict, and 3) Who will gain or lose as a result of the conflict.

I. II. III.

Call to Order (5 Minutes) Roll Call and Establishment of Quorum Approval of Agenda Action

IV. Consent Agenda Action (5 Minutes)

a. Acceptance of September Meeting Minutes b. Acceptance of FY23 1st Quarter P&L Statement c. Acceptance of FY23 1st Quarter Balance Sheet d. Acceptance of FY23 Pettengill Donor Funds e. Acceptance of FY23 Family Endowment Funds f. Committee Reports a. Executive & Finance b. Marketing & Development c. Grants d. Legislative

V. Action Items (10 Minutes)

a. Election of Nominating Committee‐ Action b. Election of Bylaws, Ethics, & Policies Committee Action c. Acceptance of FY2022 Audit ‐ ‐ Action, Contingent Upon Committee Acceptance

VI. DSO Strategic Planning Discussion (30 Minutes)

VII. Lightcast Presentation of Preliminary Findings & Recommendations Joel Simon, Vice President ‐ Strategy & Growth (30 Minutes) a. BOD Written Feedback– return by December 16th

VIII. Board Discussion What Does It Mean to be an Able Trust Ambassador? (30 Minutes)

IX. Information Items (5 Minutes)

a. Project Venture & BOD Retreat Save the Date: February 28th & March 1st, Orlando, Margaritaville Resort b. Conflict of Interest and Ethics Statements sign and return by December 16th

X. Public Comment

Next Board Meeting: February 28 March 1, 2023 Orlando, FL Adjourn

Laurie Sallarulo, Chair Chip Byers, Secretary

Laurie Sallarulo, Chair

Laurie Sallarulo, Chair

Laurie Sallarulo, Chair

Laurie Sallarulo, Chair Doug Hilliard, Treasurer

Brent McNeal, VR Director Allison Chase, President & CEO

Allison Chase, President & CEO

Laurie Sallarulo & Donna Wright

Allison Chase, President & CEO

Laurie Sallarulo, Chair

Please Note: Agenda subject to revisions and additions per the discretion of the Chair of the Board of Directors. Notification will be sent of any such revisions or changes. Members of the Public: Please notify Arnaldo Ramos at Arnaldo@AbleTrust.org if you wish to make public comment on particular agenda items no later than 1 hour prior to beginning of the meeting.

Florida Endowment Foundation for Vocational Rehabilitation, dba The Able Trust

DRAFT - Meeting Minutes

Board of Directors Meeting – September 15, 2022, 9:00 a.m. to 11:00 a.m. Virtual Meeting

Members in Attendance

James “Chip” Byers; Alexis Doyle; Lori Fahey; Todd A. Jennings; Brent McNeal; Laurie Sallarulo; Dr. Mavara Mirza Agrawal; Alexis Doyle;

Members Absent Todd Jennings

Staff in Attendance

Coleen Agner, High School High Tech Coordinator; Allison Chase, President; Joseph D’Souza, Vice President, External Engagement; Arnaldo Ramos, Office Administrator and Executive Assistant to the President; Tracey Lowe, Strategic Communications Manager; Donna Wright, Vice President of Development & Marketing; Leanne Rexford, Director of Strategic Initiatives; Justin Adams, Communications Manager.

Others in Attendance

Alan Suskey, Lobbyist; Amy Ragsdale, Spring Impact; Meredith Lobel, Spring Impact.

Item Action/Discussion

Call to Order

Laurie Sallarulo, called meeting to order at 9:02a.m.

Roll Call and Establishment of Quorum Secretary Chip Byers completed roll call and a quorum was established.

Approval of Agenda

Consent Agenda

a. Acceptance of May Meeting Minutes b. Acceptance of FY22 4th Quarter P&L Statement c. Acceptance of FY22 4th Quarter Balance Sheet d. Committee Reports a. Executive & Finance b. Grants c. Legislative d. Marketing & Development

Action Items

a. FY23 Budget Amendments

Upon motion by Chip Buyers and seconded by Lori Fahey

• Chip Byers made first motion and seconded by Lori Fahey to approve the meeting agenda. The motion carried.

• Motion to pass consent agenda items A-F, first by Alexis Doyle, second by Dr. Mavara Agriwal. The motion carried.

Allison Chase, in the stead of Doug Hillard, reviewed the FY23 budget amendments and explained that upon board approval, it would support The Able Trust in the following areas:

• Travel arrangements for staff

• Lobbying fees

Page 1 of 3

Discussion Items – Full Board

• Grant writing fees

• DVR staff events

Motion to approve budget amendments, first by Alexis Doyle and seconded by Chip Byers. The motion carried.

The board held discussion on the following items to provide staff with guidance. No motions or votes were made:

• Allison Chase introduced Able Trust new staff o Justin Adams, Communications Manager o Arnaldo Ramos, Office Administrator & Executive Assistant o Leanne Rexford, Director of Strategic Initiatives (and Willow, service dog).

• Allison Chase, Able Trust President/CEO – Items for follow-up

o The development of a CEO Evaluation Process.

o Marketing & Development Committee, the Executive Committee decided to make this a full subcommittee. Request for volunteers was made.

o Board vacancies, 2 total. To be discussed at the next executive meeting.

o The Lightcast presentation on research findings and recommendations will be made in a special board meeting within the next month.

o FDOE Office of Inspector General is currently conducting an audit which was initially slated for FY22. However, it was deferred to allow the organization time to develop a new strategic direction and plan. The results of the audit are anticipated in early 2023.

• Alan Suskey, Shumaker Advisor – Legislative Update

o Meeting with House and Senate staff regarding reauthorization. Positive tone and are conducted monthly.

o Saddlebrook Event, cohosted by Director Alexis Doyle and Sen. Danny Burges was a great success. Allison will work with other board members who want to host similar events after the November elections.

o Committee meetings to be held in November, January, and then Legislative Session begins in March.

• Joey D’Souza & Donna Wright – DEAM Presentation. o Events & Other Updates

Jacksonville EDGE Training & DEAM Event at end of October.

Rise & Nye, a coffee shop with a job training and employment program in Sarasota hosting a kick-off on October 5.

Proclamations for city/county governments and corporate statements of support. Currently working on the following for proclamations in Pasco, Fernandina, Sarasota counties.

Page 2 of 3

Report from VR Director

New Business

a. Lean Impact

Next Board Meeting

Adjourn

DEAM Theme #CupOfAmbition, 5,000 coffee sleeves to be shared around the state to raise awareness. Board members asked to take a photo with a sleeve for SoMe.

o DEAM Sponsor Opportunities for the month of October.

Director McNeal gave an update on the VR Program and thanked the Board and Staff for becoming a valued partner as the direct support organization to VR.

• Updates

o Field Staff Engagement Conference.

o VR legislative budget request to increase salaries of frontline staff.

o New case management system.

o DOE has included $1,000,000 for HSHT in FY24 legislative budget request to fully fund current contracts and allow for expansion.

o Sub minimum Wage to Competitive Integrative Employment Grant by the US Dept. of Education application was submitted.

o Integrating with the “Education Meets Opportunity Platform”, a data platform with the REACH Act.

o Moore Consulting, working towards more community outreach to increase awareness of VR.

• Jerry Perish, PH.D., Private Consultant – Research Schedule

o Economic Impact Report overview. Release date of September 15, 2022.

o 2nd Quarter report to focus on 2021 American Community Survey Data

o 3rd Quarter poverty issues related to disability in Florida

o 4th Quarter prevalence of disability and availability to work in Florida

• Amy Ragsdale & Meredith Lobel – Spring Impact Presentation

o Overview of the Lean Impact model and how it will be used to meet The Able Trust’s goal of closing the workforce gap by 10% within the next 10 years.

The Able Trust Board of Directors next virtual meeting is scheduled for Wednesday, December 7, 2022, from 1: 00p.m – 3:00p.m.

There being no further business and upon motion by Laurie Sallarulo and seconded by Lori Fahey, the meeting adjourned at 11:02a.m.

Respectfully submitted, James “Chip” William Byers IV, Secretary

Page 3 of 3

Trust Payroll Summary

July 2022 through August 2022

Adams, JustinAgner, ColeenChase, AllisonD'Souza, Joseph W.Hinojosa, Jesse DLowe, TraceyParrish, Delaina LRamos, Arnaldo ORexford, Leanne CWright, Donna H.TOTAL

Employee Wages, Taxes and Adjustments

Gross Pay

Salary1,538.4611,666.6822,500.0017,500.001,250.0013,333.320.007,788.469,999.9917,500.00103,076.91

Hourly rate0.000.000.000.000.000.005,662.500.000.000.005,662.50

Bonus0.000.000.000.000.000.000.000.000.000.000.00

Retroactive Pay0.000.000.000.000.000.000.000.000.000.000.00

Severance Pay0.000.000.000.00425.480.000.000.000.000.00425.48

Cell Phone Reimbursement0.00134.00134.00134.0067.00134.000.00134.0067.00134.00938.00

Total Gross Pay 1,538.4611,800.6822,634.0017,634.001,742.4813,467.325,662.507,922.4610,066.9917,634.00110,102.89

Deductions from Gross Pay

401k Employee Deduction0.000.00-1,354.20-2,100.000.00-840.000.000.000.00-525.00-4,819.20

Dental Premium Deduction0.000.000.000.000.00-49.680.000.000.000.00-49.68

Health Ins-Employee Ded (Use)0.00-3,432.320.000.000.00-703.800.000.000.000.00-4,136.12

Total Deductions from Gross Pay 0.00-3,432.32-1,354.20-2,100.000.00-1,593.480.000.000.00-525.00-9,005.00

Adjusted Gross Pay 1,538.468,368.3621,279.8015,534.001,742.4811,873.845,662.507,922.4610,066.9917,109.00101,097.89

Taxes Withheld

Federal Withholding-111.00-712.00-2,744.00-2,429.000.00-1,388.00-393.00-661.00-2,010.00-2,560.00-13,008.00

Medicare Employee-22.31-121.34-328.19-255.69-25.26-184.35-82.11-114.88-145.97-255.69-1,535.79

Social Security Employee-95.38-518.84-1,403.31-1,093.31-108.04-788.26-351.08-491.19-624.15-1,093.31-6,566.87

Medicare Employee Addl Tax0.000.000.000.000.000.000.000.000.000.000.00

Employer Taxes and Contributions

Federal Unemployment9.230.000.000.000.000.000.006.630.000.0015.86 Medicare Company22.31121.34328.19255.6925.26184.3582.11114.88145.97255.691,535.79 Social Security Company95.38518.841,403.311,093.31108.04788.26351.08491.19624.151,093.316,566.87 FL - Unemployment13.380.000.000.000.000.000.0060.9060.900.00135.18 401k Company Match0.000.001,125.00875.000.00666.680.000.000.00875.003,541.68

The Able

Total Taxes Withheld -228.69-1,352.18-4,475.50-3,778.00-133.30-2,360.61-826.19-1,267.07-2,780.12-3,909.00-21,110.66 Net Pay 1, 309. 77 7 016 18 16, 804. 30 11, 756 00 1, 609. 18 9, 513 23 4, 836. 31 6, 655 39 7, 286. 87 13, 200. 00 79, 987. 23

T o tal Empl o yer T axes an d Con trib u ti on s 140. 30 640 18 2, 856. 50 2, 224 00 133. 30 1, 639 29 433. 19 673 60 831. 02 2, 224. 00 11, 795. 38 Admin/Restr Carvajal Admin/Restr Chase Total Admin/Restr Operations Split between various classes. See formula in cells on main worksheet. TotalCheck 701.000 ꞏ Salaries 22,500.0022,500.0086,239.41 108,739.41108,739.410.00 701.220 ꞏ Severance Pay 425.48425.48425.480.00 701.230 ꞏ Cell Phone Reimbursement 134.00134.00804.00 938.00938.000.00 701.240 ꞏ Allowance for Incentives 00.000.00.000.000.00 702.000 ꞏ Payroll & Unemployment Taxes 1,731.501,731.506,522.28,253.708,253.700.00 704.000 ꞏ 401(k) Match & Expenses 1,125.00 1,125.002,416.73,541.683,541.680.00 Page 1 of 1 Unaudited for Management Purposes Only

ASSETS

UNRESTRICTED

Current Assets/Bank Accounts

The Able Trust Balance Sheet

As of August 31, 2022

August 31, 2021August 31, 2022 UNRESTRICTEDRESTRICTED

108.000 The First Reserve933,816.67946,971.93946,971.93 109.000 The First Operating25,039.2573,351.8573,351.85 109.200 The First Admin Sinking252,769.79421,425.07421,425.07 109.001 Petty Cash62.81 78.81 78.81 110.061 Morgan Stanley Smith Barney (2)161,729.49 237,514.49 237,514.49 110.200 Wells Fargo36,601.52 38,524.28 38,524.28

Total Current Assets/Bank Accounts 1,410,019.53 1,717,866.43 1,441,827.66 276,038.77 -

Current Assets/Accounts Receivable

120.001 Accounts Rec - General- 65,000.00 120.006 Accounts Rec - Comm/DEAM7,500.00120.007 Accounts Rec - SOF/DOE/VR137,455.75 -128.000 Prepaid Expense6,875.00 6,875.00 6,875.00

Total Current Assets/Accounts Receivable 151,830.75 71,875.00 6,875.00 - -

State Endowments

110.061 Morgan Stanley Smith Barney (2)11,339,461.00 8,986,957.33 8,986,957.33 110.200 Wells Fargo11,650,471.41 9,251,617.71 9,251,617.71

Total Other Current Assets 22,989,932.41 18,238,575.04 - 18,238,575.04 -

Long Term Assets

260.000 Present Value-Deferred Contrib.658,311.99 773,700.99 773,700.99

Total Long Term Assets 658,311.99 773,700.99 - 773,700.99 -

Fixed Assets

205.000 Computers33,438.24 19,829.88 19,829.88 208.100 Leaseholder Improv (T'ville Rd)164,921.13 -211.000 ꞏ Furniture & Fixtures132,880.79 94,079.70 94,079.70 230.000 Accumulated Depreciation(210,977.51) (110,489.03) (110,489.03)

PARTIALLY RESTRICTED

Total Fixed Assets 120,262.65 3,420.55 3,420.55 - -

Page 1 of 2 Unaudited for Management Purposes Only

Other Assets 250.100 Surety Deposit (Thomasville Rd)4,000.00 4,200.00 4,200.00 255.000 Rec. re: Griffith Ins. Policy Estimated97,750.00 97,750.00 97,750.00 257.000 ꞏ PFG Stock (273 shares @ $59.96)16,369.08 16,369.08 16,369.08 258.000 Lease Asset- 142,611.19 258.100 Accumulated Amortization- (23,768.53) Total Other Assets 118,119.08 237,161.74 118,319.08 -TOTAL UNRESTRICTED ASSETS 25,448,476.41 21,042,599.75 1,570,442.29 19,288,314.80 -

The Able Trust Balance Sheet

As of August 31, 2022

August 31, 2021August 31, 2022 UNRESTRICTEDRESTRICTED

Private Endowments

110.020 Pettengill Ability Fund 5.30 5.30 5.30

110.216 McKeon Ability Fund 798,926.03 647,460.72 647,460.72

110.217 Ward Ability Fund 628,739.71 437,956.80 437,956.80

110.215 Hibbard Ability Fund 374,133.04 317,667.66 317,667.66

110.231 Gallimore Ability Fund 641,008.00 566,363.54 566,363.54

110.232 Thomas Ability Fund 888,718.51 783,575.44 783,575.44

110.233 Pettengill Ability Fund 30,083.13 26,610.05 26,610.05 26,610.05 110.234 LeRoy Ability Fund 168,677.66 147,766.08 147,766.08

Total Endowments 3,530,291.38 2,927,405.59 - 2,927,400.29 26,615.35

TOTAL ASSETS AND ENDOWMENTS 28,978,767.79 23,970,005.34 1,570,442.29 22,215,715.09 26,615.35

LIABILITIES & EQUITY

Current Liabilities

320.000 Accounts Payable24,244.16 18,930.13 18,930.132110 ꞏ Direct Deposit Liabilities- (1,606.83) 320.993-999 Payroll Liabilities2,283.61 (526.55) (526.55)

329.000 Accrued Leave20,950.00 20,950.00 20,950.00 321.000 Unearned Revenue- 50,000.00 50,000.00

Total Current Liabilities 47,477.77 87,746.75 18,930.13 70,423.45 -

Long Term Liabilities

330.000 Lease Liability- 116,934.67 Total Long Term Liabilities 116,934.67 Deferred Inflow of Resources

270.000 Deferred Inflow of Resources658,312.21 773,701.21 773,701.21 Total Deferred Inflow of Resources 658,312.21 773,701.21 - 773,701.21TOTAL LIABILITIES 705,789.98 978,382.63 18,930.13 844,124.66 -

Equity

Retained Earnings 5,098,171.20 44,978.86 690.000 Fund Balance 22,860,187.63 22,860,187.63 Net Revenue 314,618.98 86,456.22 Total Equity 28,272,977.81 22,991,622.71 - -TOTAL LIABILITIES & EQUITY28,978,767.79 23,970,005.34

PARTIALLY RESTRICTED

AND UNRES

TOTAL MANAGED FUNDS AND ASSETS RESTRICTED

28,978,767.79 23,970,005.34 1,570,442.29 22,215,715.09 26,615.35

Page 2 of 2 Unaudited for Management Purposes Only

Initial Assets: $475,000Initial Assets: $138,365 Balance7%AwardedOver/Under FundedBalance7%AwardedOver/Under Funded FY19 578,28740,48024,000 16,480FY19 FY20574,82540,23821,000 19,238FY20138,3059,6815,000 4,681 FY21606,62442,46420,900 21,564FY21133,3059,3318,298 1,033 FY22617,55943,229100,51057,281FY22166,66811,66717,3815,714 FY23632,46544,27344,000 272FY23171,62212,01412,0140 Balance for Funding272.00Balance for Funding0.00

Thomas & Gallimore Family Funds are for two specific organizations: Friends of Arrowrock in Missouri and Emerald Coast Children's Advocacy Center in Niceville FL. In 2019, Tony Carvajal negotiated a funding formula used annually to determine payments. A one time catch up fee was paid in FY20 to each organization for past years' contributions which didn't reach that funding level.

John Pettengill provides a list of nonprofit organizations each year amongst which $50,000 is divided. The Able Trust verifies that each organization is in good standing with the IRS and distributes the payments.

In addition to the grant disbursements, The Able Trust takes an annual 1.5% FY23 Family Endowment Grants for Board Approval administration fee from all family funds except Pettengill.McKeon$56,254Miami HSHT (2 grants) ‐ $44,000 Arc Jax (HSHT)‐ $12,254 Ward$44,000Bay HSHT ‐ $22,000 Palm Beach HSHT ‐ $22,000 Hibbard$26,343Okaloosa HSHT ‐ 13,000 Escambia HSHT ‐ $13,343 LeRoy$12,013Leon HSHT

The Able Trust Family Endowment Funds 3‐

Internal

Year

Audit

Ward Fund ‐ for agencies providing employment & PCA

LeRoy Fund ‐ for agencies in Leon County

Board of Directors

FY2023, 2nd Quarter Committee Reports

Executive Committee and Finance Committee, 11/1/2022

• Accepted FY23 1st Quarter financial reports

• Doug & Allison gave an update on the annual audit which is still process. A draft is expected for review by the Audit Committee the week of November 28th and for the full board’s review at the December 7th meeting.

• The Spring board meeting will be held in Orlando and in conjunction with the HSHT Project Venture event. The dates for the meeting are February 28th and March 1st.

• The committee accepted the 2023 slate for the Nominating Committee and the Bylaws, Ethics, and Policies Committees They will move to the full board for acceptance at the December meeting.

Legislative Committee Postponed Committee leadership, staff, and lobbyist are working with the Florida DOE Commissioner’s Office to ensure legislative activities are aligned the goals and activities of DOE for upcoming session. Further guidance from FDOE will be provided to the committee in early 2023.

Grant Committee, 11/15/2022

• Spring Impact Consultant Overview of Lean Impact update

o Amy Ragsdale and Meredith Lobel, the Spring Impact consultants working with The Able Trust to implement the Lean Impact methodology in the grant making of The Able Trust provided a high level overview of the work The Able Trust staff has done with implementing the Lean Impact methodology.

o Lean Impact is currently being used to test the Able Network project. The Lean Impact methodology is currently being implemented in numerous other facets of the organization including development and communication.

• Approval of family endowments disbursement.

o The Able Trust serves as fiduciary for four private family endowments: Hibbard, McKeon, LeRoy, Ward. The disbursements of these four endowments total $99,010 and are currently being used to support High School High Tech. The disbursements are being brought into alignment with the new disbursement policy passed by the Board of The Able Trust.

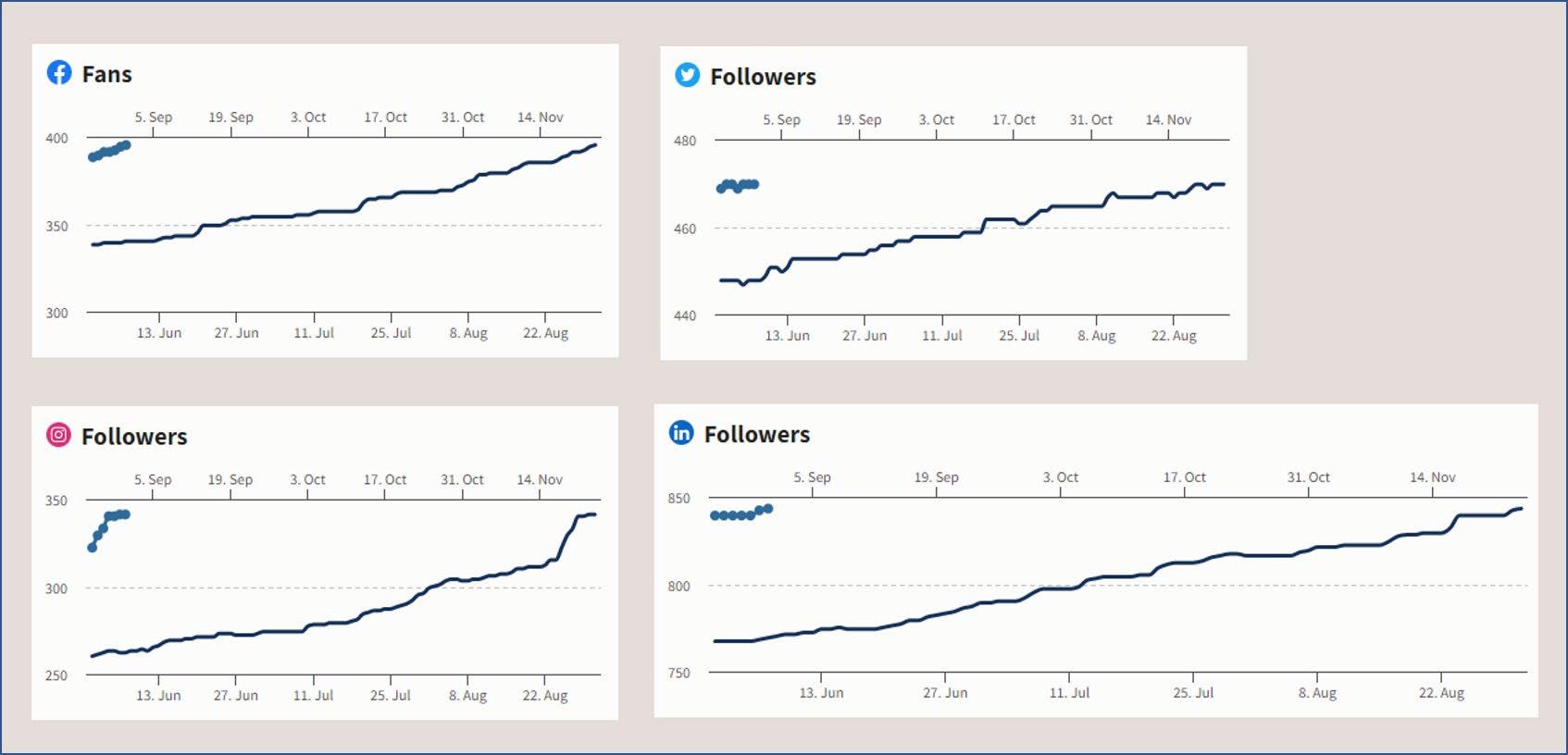

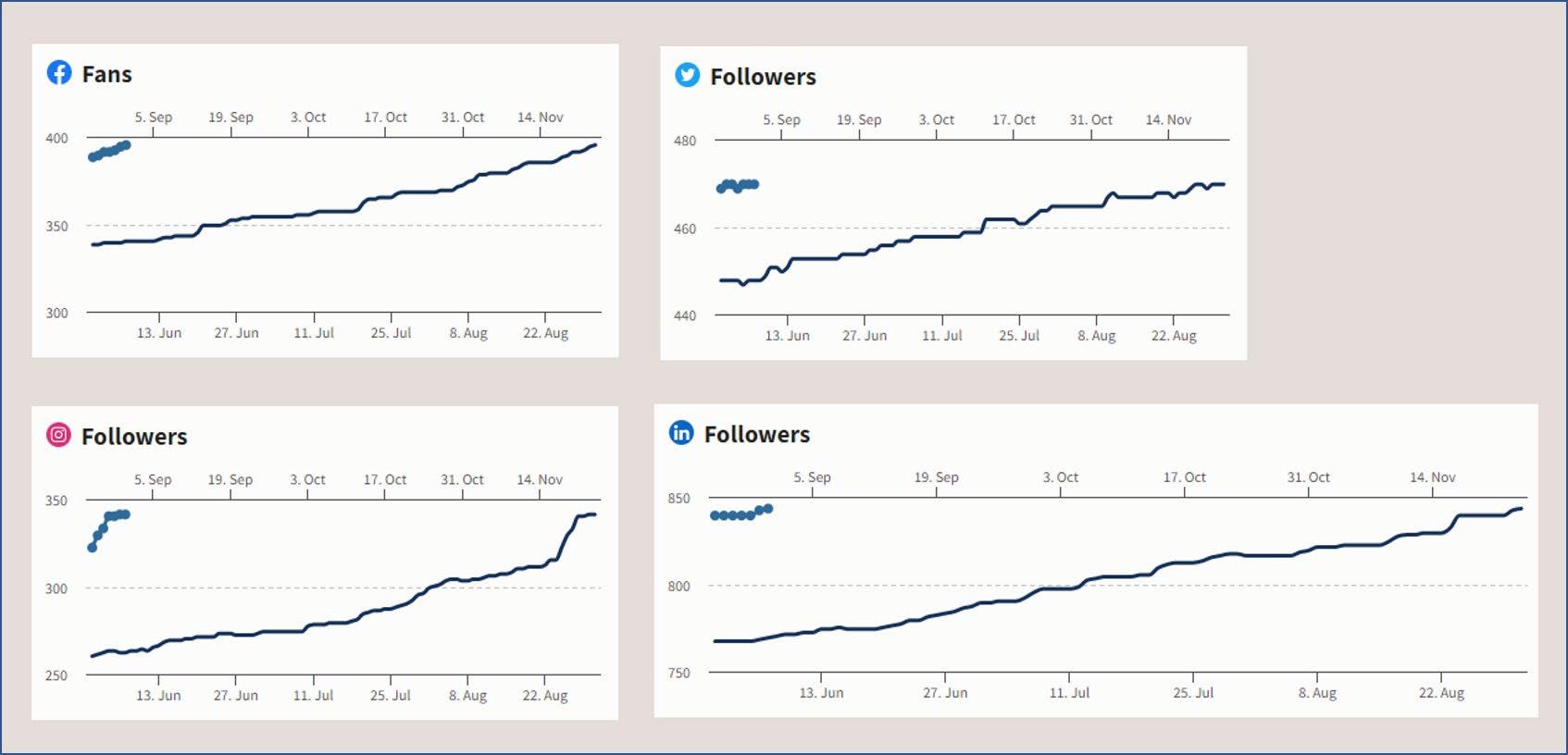

Marketing & Development (Ongoing)

• Website Launched – www.abletrust.org

o Increase in new users

o Secure site

o New analytics and tracking capabilities

o Added online course for employers

o Launched Disability Employment Awareness Month webpage

• Share website and encourage others to show their support

•

• Users Website Growth in July-August

Newsletters and Other Messaging

o Monthly CEO, Partner Focus and HSHT newsletters

• Please share with colleagues, other contacts

• Let us know if you have any suggested topics

• Click here to view past newsletters

o Promotion of new report: Solving Florida's Labor Shortage: The Hidden Solution

o Latest News The Able Trust Selected as Visit Orlando Magical Dining Beneficiary

DEAM

•

Campaign #cupofambition

Top Performing Social Media Posts

•

Executive Committee, November 2022

FY23 Nominating Committee Slate

• Alexis Doyle

• Todd Jennings

• Chip Byers

FY23 Ethics, Bylaws, and Policies Committee Slate

• Alexis Doyle

• Lori Fahey

• Doug Hilliard

• Todd Jennings

Report of Independent Auditors on Internal Control Over Financial Reporting and on Compliance and Other Matters Based on an Audit of Financial Statements Performed in Accordance with Government Auditing Standards

Board of Directors

The Florida Endowment Foundation for Vocational Rehabilitation, Inc. d/b/a The Able Trust

We have audited, in accordance with the auditing standards generally accepted in the United States of America and the standards applicable to financial audits contained in Government Auditing Standards issued by the Comptroller General of the United States, the financial statements of the Florida Endowment Foundation for Vocational Rehabilitation, Inc. d/b/a The Able Trust (the Foundation) which comprise the statement of net position as of June 30, 2022, the related statement of revenues, expenses, and changes in net position, and cash flows for the year ended, and the related notes to the financial statements, and have issued our report thereon dated November 8, 2022.

Internal Control Over Financial Reporting

In planning and performing our audit of the financial statements, we considered the Foundation’s internal control over financial reporting (internal control) as a basis for designing audit procedures that are appropriate in the circumstances for the purpose of expressing our opinion on the financial statements, but not for the purpose of expressing an opinion on the effectiveness of the Foundation’s internal control. Accordingly, we do not express an opinion on the effectiveness of the Foundation’s internal control.

A deficiency in internal control exists when the design or operation of a control does not allow management or employees, in the normal course of performing their assigned functions, to prevent, or detect and correct, misstatements on a timely basis. A material weakness is a deficiency, or a combination of deficiencies, in internal control, such that there is a reasonable possibility that a material misstatement of the entity’s financial statements will not be prevented, or detected and corrected, on a timely basis. A significant deficiency is a deficiency, or a combination of deficiencies, in internal control that is less severe than a material weakness, yet important enough to merit attention by those charged with governance.

Our consideration of internal control was for the limited purpose described in the first paragraph of this section and was not designed to identify all deficiencies in internal control that might be material weaknesses or significant deficiencies. Given these limitations, during our audit we did not identify any deficiencies in internal control that we consider to be material weaknesses. However, material weaknesses may exist that have not been identified.

27

Compliance and Other Matters

As part of obtaining reasonable assurance about whether the Foundation’s financial statements are free from material misstatement, we performed tests of its compliance with certain provisions of laws, regulations, contracts, and grant agreements, noncompliance with which could have a direct and material effect on the financial statements. However, providing an opinion on compliance with those provisions was not an objective of our audit, and accordingly, we do not express such an opinion. The results of our tests disclosed no instances of noncompliance or other matters that are required to be reported under Government Auditing Standards.

Purpose of this Report

The purpose of this report is solely to describe the scope of our testing of internal control and compliance and the results of that testing, and not to provide an opinion on the effectiveness of the entity’s internal control or on compliance. This report is an integral part of an audit performed in accordance with Government Auditing Standards in considering the entity’s internal control and compliance. Accordingly, this communication is not suitable for any other purpose.

Tallahassee, Florida November 8, 2022

Page Two 28

Management Letter

Board of Directors

The Florida Endowment Foundation for Vocational Rehabilitation, Inc. d/b/a The Able Trust

Report on the Financial Statements

We have audited the financial statements of the Florida Endowment Foundation for Vocational Rehabilitation, Inc. d/b/a The Able Trust (the Foundation), as of and for the fiscal year ended June 30, 2022, and have issued our report thereon dated November 8, 2022.

Auditors’ Responsibility

We conducted our audit in accordance with auditing standards generally accepted in the United States of America; the standards applicable to financial audits contained in Government Auditing Standards, issued by the Comptroller General of the United States.

Other Reporting Requirements

We have issued our Report of Independent Auditors on Internal Control over Financial Reporting and Compliance and Other Matters Based on an Audit of the Financial Statements Performed in Accordance with Government Auditing Standards. Disclosures in those reports, which are dated November 8, 2022, should be considered in conjunction with this management letter.

During our audit, we became aware of the following deficiencies in internal control, other than significant deficiencies or material weaknesses, and other matters that are opportunities for strengthening internal controls and operating efficiency.

We will review the status of these comments during our next audit engagement. We have already discussed these comments and suggestions with various Foundation personnel, and we will be pleased to discuss them in further detail at your convenience.

Prior Audit Recommendations

Procurement Policy in Accordance with Florida Administrative Code (FAC)

Management has taken corrective action for this recommendation. This corrective action is complete as of June 30, 2022.

Documentation of Allocation Methodology for Functional Expenses

Management has partially taken corrective action for this recommendation. This corrective action is not complete as of June 30, 2022.

29

Capital Asset Listing and Management

Management has taken corrective action for this recommendation. This corrective action is complete as of June 30, 2022.

Travel Policy and Related Documentation

Management has taken corrective action for this recommendation. This corrective action is complete as of June 30, 2022.

Current Audit Recommendations

Documentation of Allocation Methodology for Functional Expenses

During our audit, we noted management lacked written policies and procedures for the allocation of expenses into the functional categories and lacked documentation concerning the current year allocation percentages applied.

We recommend the Foundation include the frequency of the evaluation performed over the methodology utilized for their allocations of expenses between functional expense categories and retain supporting documentation to substantiate the methodology for year-end reporting. The time study performed should be analyzed no less frequently than on a quarterly basis. Particular attention should be given to the allocation of expenses as administrative to mitigate risk of noncompliance with Florida Statutes 413.615.

Purpose of this Letter

Our management letter is intended solely for the information and use of the Florida Commissioner of Education, the Florida Department of Vocational Rehabilitation, and the Board of Directors and management of the Florida Endowment Foundation for Vocational Rehabilitation, Inc. d/b/a The Able Trust and is not intended to be and should not be used by anyone other than these specified parties.

Tallahassee, Florida November 8, 2022

Page Two 30

To the Board of Directors

Florida Endowment Foundation for Vocational Rehabilitation, Inc. d/b/a The Able Trust

We are pleased to present this report related to our audit of the financial statements of Florida Endowment Foundation for Vocational Rehabilitation, Inc. d/b/a The Able Trust (the Foundation) as of and for the year ended June 30, 2022. This report summarizes certain matters required by professional standards to be communicated to you in your oversight responsibility for the Foundation’s financial reporting process.

Generally accepted auditing standards (AU-C 260, The Auditor’s Communication with Those Charged with Governance) require the auditor to promote effective two-way communication between the auditor and those charged with governance. Consistent with this requirement, the following summarizes our responsibilities regarding the financial statement audit as well as observations arising from our audit that are significant and relevant to your responsibility to oversee the financial and related compliance reporting process.

Area Comments

Our Responsibilities With Regard to the Financial Statement Audit

Our responsibilities under auditing standards generally accepted in the United States of America and Government Auditing Standards issued by the Comptroller General of the United States have been described to you in our arrangement letter dated August 11, 2022. Our audit of the financial statements does not relieve management or those charged with governance of their responsibilities, which are also described in that letter.

Overview of the Planned Scope and Timing of the Financial Statement Audit

We discussed with members of the Board and the Foundation’s management various matters about which generally accepted auditing standards require communication. These include matters concerning two-way communication, our independence, the audit planning process, the concept of materiality in planning and executing the audit, our approach to internal control relevant to the audit, and the timing of the audit.

Area Comments

Accounting Policies and Practices Adoption of, or Change in, Accounting Policies

Management has the ultimate responsibility for the appropriateness of the accounting policies used by the Foundation. The Foundation did not adopt any significant new accounting policies, nor have there been any changes in existing significant accounting policies during the current period.

Significant or Unusual Transactions

We did not identify any significant or unusual transactions or significant accounting policies in controversial or emerging areas for which there is a lack of authoritative guidance or consensus.

Management’s Judgments and Accounting Estimates

Accounting estimates are an integral part of the preparation of financial statements and are based upon management’s current judgment. The process used by management encompasses their knowledge and experience about past and current events, and certain assumptions about future events. Management has informed us that they used all the relevant facts available to them at the time to make the best judgments about accounting estimates, and we considered this information in the scope of our audit. Estimates significant to the financial statements include:

The present value of deferred contributions

The Board may wish to monitor throughout the year the process used to determine and record these accounting estimates.

Audit Adjustments

Uncorrected Misstatements

Audit adjustments proposed by us and recorded by Foundation are shown on the attached Exhibit A

There were no uncorrected misstatements that management determined to be immaterial.

Page Two

Area Comments

Departure From the Auditor’s Standard Report

The Report of Independent Auditor includes an Other Matter section in regards to the inclusion of required supplementary information and other information. Our opinion is not modified in this regard.

Other Information in Documents Containing Audited Financial Statements

Our responsibility for other information in documents containing the Foundation’s audited financial statements is to read the information and consider whether its content or manner of its presentation is materially inconsistent with the financial information covered by our auditor’s report or whether it contains a material misstatement of fact. We read the Foundation’s Schedule of Budget and Actual Revenues and Schedule of Budget and Actual Expenses and agreed the amounts to the underlying account balances and functional allocation methodology. We did not identify material inconsistencies with the audited financial statements.

Disagreements With Management

We encountered no disagreements with management over the application of significant accounting principles, the basis for management’s judgments on any significant matters, the scope of the audit, or significant disclosures to be included in the financial statements.

Consultations With Other Accountants

Significant Issues Discussed With Management

We are not aware of any consultations management had with other accountants about accounting or auditing matters.

No significant issues arising from the audit were discussed or the subject of correspondence with management.

Significant Difficulties Encountered in Performing the Audit

We did not encounter any significant difficulties in dealing with management during the audit. We received full cooperation and appreciate the assistance provided by the Foundation’s financial and accounting personnel.

Page Three

Area Comments

Letter(s) Communicating Significant Deficiencies and Material Weaknesses in Internal Control Over Financial Reporting

We have separately communicated any significant deficiencies and material weaknesses in internal control over financial reporting identified during our audit of the financial statements as required by Government Auditing Standards. This communication is included in the Report on Internal Control over Financial Reporting and Compliance and other Matters Based on an Audit of Financial Statements Performed in Accordance with Government Auditing Standards section of the financial statements.

Additionally, we have communicated control deficiencies that did not rise to the level of a significant deficiencies or material weaknesses. This communication is included within the Management Letter directly following the Report on Internal Control over Financial Reporting and Compliance and other Matters Based on an Audit of Financial Statements Performed in Accordance with Government Auditing Standards.

Significant Written Communications Between Management and Our Firm

See Exhibit B for a copy of the representation letter provided to us by the Foundation’s management.

This report is intended solely for the information and use of the Board of Directors and management of the Foundation and is not intended to be, and should not be, used by anyone other than these specified parties. It will be our pleasure to respond to any questions you have regarding this letter. We appreciate the opportunity to continue to be of service to Florida Endowment Foundation for Vocational Rehabilitation, Inc. d/b/a The Able Trust.

Tampa, Florida

November 8, 2022

Page Four

The Florida Endowment Foundation for Vocational Rehabilitation, Inc. d/b/a The Able Trust

Year End: June 30, 2022

Journal Entries: Adjusting Date: 7/1/2021 To 6/30/2022

Number Date Name

Account No

Reference Annotation

Debit Credit Recurrence Misstatement

AJE #1 6/30/2022 Present Value-Deferred Contrib. 260 TFEFFVR 89,484.00

AJE #1 6/30/2022 Deferred Inflow of Resources 270 TFEFFVR 89,484.00

To adjust present value of split Factual interest agreements as of 6/30/22.

AJE #2 6/30/2022 Accounts Payable 320 TFEFFVR 6100. 1 20,000.00

AJE #2 6/30/2022 Projects & Consultants 808.515 TFEFFVR 6100. 1 20,000.00

To record accrued expense as of Factual 6/30/22, which was originally recorded in FY23.

AJE #3 6/30/2022 Lease Asset 258 TFEFFVR 5603 2/ 10,668.00

AJE #3 6/30/2022 Lease Liability 330 TFEFFVR 5603 2/ 10,668.00

AJE #3 6/30/2022 Lease Liability 330 TFEFFVR 5603 2/ 3,001.00

AJE #3 6/30/2022 Lease Liability 330 TFEFFVR 5603 2/ 50,223.00

AJE #3 6/30/2022 Interest Expense 731 TFEFFVR 5603 2/ 3,001.00

AJE #3 6/30/2022 Amortization Expense 739 TFEFFVR 5603 2/ 1,778.00

AJE #3 6/30/2022 Accumulated Amortization 258.100 TFEFFVR 5603 2/ 1,778.00

AJE #3 6/30/2022 Current - Lease Liability THF.6500.100 TFEFFVR 5603 2/ 50,223.00

To breakout current vs. Factual non-current portion of lease liability and to adjust lease asset utilizing US Treasury rate in accordance with GASB 87.

AJE #4 6/30/2022 Allowance for Doubtful Accounts THF.5400.200 TFEFFVR 5401 60,000.00

AJE #4 6/30/2022 Bad Debt Expense THF.5.9.104.900 TFEFFVR 5401 60,000.00

To record allowance against DVR Factual receivable as of 6/30/22.

AJE #5 6/30/2022 Accrued Leave 329 TFEFFVR 10,322.00

AJE #5 6/30/2022 Salaries 701 TFEFFVR 10,322.00

To adjust accrued leave liability

AJE #6 6/30/2022 Grants/Gifts - Unrestricted 603.1 TFEFFVR 60,000.00

AJE #6 6/30/2022 Data/Economic Analysis 808.601 TFEFFVR 60,000.00

To reclassify revenue from expense.

PBC - AJE 6/30/2022 Other Support to DVR 781 TFEFFVR 7,500.00

PBC - AJE 6/30/2022 Staff Training & Development 710.500 TFEFFVR 7,500.00

PBC AJE for pinnacle performance consulting LLC.

PBC - AJE 6/30/2022 Prepaid Expense 128 TFEFFVR PBC 6,875.00

PBC - AJE 6/30/2022 HSHT Annual Training 807.15 TFEFFVR PBC 6,875.00

Adjust prepaid expense that is to be recognized as an expense as of 6/30/22. 319,851.00319,851.00 Net Income (Loss) (4,891,267.00)

11/21/2022 9:57 AM Page 1 Exhibit A

November 8, 2022

Thomas Howell Ferguson P.A.

2615 Centennial Blvd. Ste 200

Tallahassee, FL 32308

1709 Hermitage Blvd., Suite 100 Tallahassee, FL 32308 850.224.4493

This representation letter is provided in connection with your audit of the Florida Endowment Foundation for Vocational Rehabilitation, Inc. d/b/a The Able Trust (the Foundation) financial statements as of and for the years ended June 30, 2022 and June 30, 2021 for the purpose of expressing an opinion on whether the financial statements are presented fairly, in all material respects, in accordance with accounting principles generally accepted in the United States of America (U.S. GAAP).

We confirm, to the best of our knowledge and belief that as of the date of this letter:

Financial Statements

We have fulfilled our responsibilities, as set out in the terms of the audit arrangement letter dated August 11, 2022, for the preparation and fair presentation of the financial statements referred to above in accordance with U.S. GAAP.

We acknowledge our responsibility for the design, implementation and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error.

We acknowledge our responsibility for the design, implementation and maintenance of internal control to prevent and detect fraud.

Significant assumptions used by us in making accounting estimates, including those measured at fair value,] are reasonable and reflect our judgment based on our knowledge and experience about past and current events, and our assumptions about conditions we expect to exist and courses of action we expect to take.

Related-party transactions including those with the primary government having accountability for the Foundation and interfund transactions, including interfund accounts and advances receivable and payable, sale and purchase transactions, interfund transfers, long-term loans,

Exhibit B

leasing arrangements and guarantees, have been recorded in accordance with the economic substance of the transaction and appropriately accounted for and disclosed in accordance with the requirements of U.S. GAAP.

All events subsequent to the date of the financial statements, and for which U.S. GAAP requires adjustment or disclosure, have been adjusted or disclosed.

The effects of all known actual or possible litigation and claims have been accounted for and disclosed in accordance with U.S. GAAP.

The following have been properly recorded and/or disclosed in the financial statements:

a. Guarantees, whether written or oral, under which the Foundation is contingently liable.

b. Agreements to repurchase assets previously sold.

c. Amounts of contractual obligations for construction and purchase of real property or equipment not included in the liabilities or encumbrances recorded on the books.

d. All other liens or encumbrances on assets or revenues or any assets or revenues which were pledged as collateral for any liability or which were subordinated in any way.

e. All liabilities that are subordinated to any other actual or possible liabilities of the Foundation.

f. All leases and material amounts of rental obligations under long-term leases.

g. Risk financing activities.

h. The fair value of investments.

i. Deposits and investment securities categories of risk.

j. Arrangements with financial institutions involving compensating balances or other arrangements involving restrictions on cash balances, line of credit, or similar arrangements have been properly disclosed.

k. Impairment of capital assets.

l. Net positions and fund balance classifications.

m. All significant estimates and material concentrations known to management that are required to be disclosed. Significant estimates are estimates at the balance sheet date that could change materially within the next year. Concentrations refer to volumes of business, revenues, available sources of supply, or markets for which events could occur that would significantly disrupt normal finances within the next year.

With respect to assistance with the preparation of financial statement services performed in the course of the audit:

a. We have made all management decisions and performed all management functions;

b. We assigned an appropriate individual to oversee the services;

c. We evaluated the adequacy and results of the services performed, and made an informed judgment on the results of the services performed;

d. We have accepted responsibility for the results of the services; and

e. We have accepted responsibility for all significant judgments and decisions that were made.

We have no direct or indirect legal or moral obligation for any debt of any organization, public or private that is not disclosed in the financial statements.

We have complied with all aspects of contractual agreements that would have a material effect on the financial statements in the event of noncompliance. In connection therewith, we specifically represent that we are responsible for determining that we are not subject to the requirements of the Single Audit Act, because we have not received, expended, or otherwise been the beneficiary of the required amount of federal awards during the period of this audit.

Information Provided

We have provided you with:

a. Access to all information of which we are aware that is relevant to the preparation and fair presentation of the financial statements such as records, documentation, and other matters.

b. Additional information that you have requested from us for the purpose of the audits.

c. Unrestricted access to persons within the Foundation from whom you determined it necessary to obtain audit evidence.

d. Minutes of the meetings of the governing boards and committees, or summaries of actions of recent meetings for which minutes have not yet been prepared.

All transactions have been recorded in the accounting records and are reflected in the financial statements.

We have disclosed to you the results of our assessment of risk that the financial statements may be materially misstated as a result of fraud.

We have no knowledge of any allegations of fraud or suspected fraud affecting the Foundation’s financial statements involving:

a. Management.

b. Employees who have significant roles in internal control.

c. Others where the fraud could have a material effect on the financial statements.

We have no knowledge of any allegations of fraud or suspected fraud affecting the Foundation’s financial statements received in communications from employees, former employees, analysts, regulators, short sellers or others.

We have disclosed to you all known instances of noncompliance or suspected noncompliance with laws and regulations.

We are not aware of any pending or threatened litigation and claims whose effects should be considered when preparing the financial statements. We have not consulted legal counsel concerning litigation or claims.

We have disclosed to you the identity of all of the Foundation’s related parties and all the relatedparty relationships and transactions of which we are aware.

We are aware of no significant deficiencies, including material weaknesses, in the design or operation of internal controls that could adversely affect the Foundation’s ability to record, process, summarize and report financial data.

We have informed you of all communications from regulatory agencies concerning noncompliance with, or deficiencies in, financial reporting practices.

We have no plans or intentions that may materially affect the carrying value or classification of assets. In that regard:

a. The Foundation has no plans or intentions to discontinue the operations of any activities or programs or to discontinue any significant operations.

b. We have reviewed long-lived assets and certain identifiable intangibles to be held and used for impairment whenever events or changes in circumstances have indicated that the carrying amount of the assets might not be recoverable and have appropriately recorded the adjustment.

We are responsible for making the accounting estimates included in the financial statements. Those estimates reflect our judgment based on our knowledge and experience about past and current events and our assumptions about conditions we expect to exist and courses of action we expect to take. In that regard, adequate provisions have been made:

a. To reduce receivables to their estimated net collectable amounts.

b. To reduce obsolete, damaged, or excess inventories to their estimated net realizable values.

c. To reduce investments, intangibles, and other assets which have permanently declined in value to their realizable values.

d. For pension obligations, post-retirement benefits other than pensions, and deferred compensation agreements attributable to employee services rendered through June 30, 2022.

e. For any material loss to be sustained in the fulfillment of, or from the inability to fulfill, any service commitments.

f. For any material loss to be sustained as a result of purchase commitments.

There are no:

a. Material transactions that have not been properly recorded in the accounting records underlying the financial statements.

b. Violations or possible violations of laws or regulations whose effects should be considered for disclosure in the financial statements or as a basis for recording a loss contingency.

c. Other material liabilities or gain or loss contingencies that are required to be accrued or disclosed.

The Foundation has satisfactory title to all owned assets.

Net positions invested in capital assets, net of related debt; restricted; and unrestricted are properly classified and, when applicable, approved.

Expenses or expenditures have been appropriately classified in or allocated to functions and programs in the statement of activities, and allocations have been made on a reasonable basis.

Revenues are appropriately classified in the statements of activities within program revenues and general revenues and contributions to term or permanent endowments, or contributions to permanent fund principal.

Capital assets, including infrastructure assets, are properly capitalized, reported, and depreciated.

During the course of your audit, you may have accumulated records containing data that should be reflected in our books and records. All such data have been so reflected. Accordingly, copies of such records in your possession are no longer needed by us.

Supplementary Information

With respect to supplementary information presented in relation to the financial statements as a whole:

a. We acknowledge our responsibility for the presentation of such information.

b. We believe such information, including its form and content, is fairly presented in accordance with U.S. GAAP.

c. The methods of measurement or presentation have not changed from those used in the prior period.

d. When supplementary information is not presented with the audited financial statements, we will make the audited financial statements readily available to the intended users of the supplementary information no later than the date of issuance of the supplementary information and the auditor’s report thereon.

With respect to Management Discussion and Analysis presented as required by Government Accounting Standards Board to supplement the basic financial statements:

a. We acknowledge our responsibility for the presentation of such required supplementary information.

b. We believe such required supplementary information is measured and presented in accordance with guidelines prescribed by U.S. GAAP.

c. The methods of measurement or presentation have not changed from those used in the prior period.

Compliance Considerations

In connection with your audit conducted in accordance with Government Auditing Standards, we confirm that management:

Is responsible for the preparation and fair presentation of the financial statements in accordance with the applicable financial reporting framework.

Is responsible for compliance with the laws, regulations and provisions of contracts and grant agreements applicable to the auditee.

Has identified and disclosed to the auditor all instances that have occurred, or are likely to have occurred, of identified and suspected fraud and noncompliance with provisions of laws, regulations, contracts, and grant agreements that have a material effect on the financial statements.

Is responsible for the design, implementation and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error.

Acknowledges its responsibility for the design, implementation and maintenance of internal controls to prevent and detect fraud.

Has taken timely and appropriate steps to remedy identified or suspected fraud or noncompliance with provisions of laws, regulations, contracts, and grant agreements that the auditor reports.

Has a process to track the status of audit findings and recommendations.

Has identified for the auditor previous audits, attestation engagements and other studies related to the objectives of the audit and whether related recommendations have been implemented.

Has provided views on the auditor’s reported findings, conclusions and recommendations, as well as management’s planned corrective actions, for the report.

Acknowledges its responsibilities as it relates to non-audit services performed by the auditor, including that it assumes all management responsibilities; that it oversees the services by

designating an individual, preferably within senior management, who possesses suitable skill, knowledge or experience; that it evaluates the adequacy and results of the services performed; and that it accepts responsibility for the results of the services.

Florida Endowment Foundation for Vocational Rehabilitation

Allison Chase President and Chief Executive Officer Delia Finnerty Finance Consultant

Allison Chase President and Chief Executive Officer Delia Finnerty Finance Consultant

Financial Statements and Other Financial Information

The Florida Endowment Foundation for Vocational Rehabilitation, Inc. d/b/a The Able Trust

Year ended June 30, 2022 with Report of Independent Auditors

The Florida Endowment Foundation for Vocational Rehabilitation, Inc. d/b/a The Able Trust

Financial Statements and Other Financial Information

Year ended June 30, 2022 Contents

Report of Independent Auditors ..............................................................................................1 Management's Discussion and Analysis ..................................................................................5

Financial Statements

Statement of Net Position ..........................................................................................................11 Statement of Revenues, Expenses, and Changes in Net Position ..............................................12 Statement of Cash Flows ............................................................................................................13 Notes to Financial Statements ...................................................................................................14

Other Financial Information

Schedule of Budget and Actual Revenues ................................................................................25 Schedule of Budget and Actual Expenses .................................................................................26

Other Reports

Report of Independent Auditors on Internal Control Over Financial Reporting and on Compliance and Other Matters Based on an Audit of Financial Statements Performed in Accordance with Government Auditing Standards ...........................................................................................27 Management Letter ....................................................................................................................29

Report of Independent Auditors

Board of Directors

The Florida Endowment Foundation for Vocational Rehabilitation, Inc. d/b/a The Able Trust

Opinion

We have audited the financial statements of The Florida Endowment Foundation for Vocational Rehabilitation, Inc. d/b/a The Able Trust (the Foundation) which comprise the statement of net position as of June 30, 2022, the related statement of revenues, expenses, and changes in net position, and cash flows for the year then ended, and the related notes to the financial statements.

In our opinion, the accompanying financial statements referred to above present fairly, in all material respects, the net position of the Foundation, as of June 30, 2022, and the changes in its net position and its cash flows for the year then ended in accordance with accounting principles generally accepted in the United States of America.

Basis for Opinion

We conducted our audit in accordance with auditing standards generally accepted in the United States of America (GAAS) and the standards applicable to financial audits contained in Government Auditing Standards, issued by the Comptroller General of the United States (Government Auditing Standards). Our responsibilities under those standards are further described in the Auditor's Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of the Foundation and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audit. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Emphasis of Matter

As discussed in Note 1 to the financial statements, the Foundation adopted new accounting guidance, Governmental Accounting Standards Board Statement No. 87, Leases. Our opinion is not modified with respect to this matter.

Responsibilities of Management for the Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error.

1

Responsibilities of Management for the Financial Statements (continued)

In preparing the financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Foundation's ability to continue as a going concern for twelve months beyond the financial statement date, including any currently known information that may raise substantial doubt shortly thereafter.

Auditor’s Responsibility for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor's report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS and Government Auditing Standards will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the financial statements.

In performing an audit in accordance with GAAS and Government Auditing Standards, we:

Exercise professional judgment and maintain professional skepticism throughout the audit.

Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements.

Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Foundation's internal control. Accordingly, no such opinion is expressed.

Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the financial statements.

Page Two 2

Auditor’s Responsibility for the Audit of the Financial Statements (continued)

Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Foundation's ability to continue as a going concern for a reasonable period of time.

We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control-related matters that we identified during the audit.

Required Supplementary Information

Accounting principles generally accepted in the United States of America require that the Management's Discussion and Analysis on pages 5 through 10 be presented to supplement the financial statements. Such information is the responsibility of management and, although not a part of the financial statements, is required by the Government Accounting Standards Board, who considers it to be an essential part of financial reporting for placing the financial statements in an appropriate operational, economic or historical context. We have applied certain limited procedures to the required supplementary information in accordance with GAAS, which consisted of inquiries of management about the methods of preparing the information and comparing the information for consistency with management’s responses to our inquiries, the financial statements, and other knowledge we obtained during our audit of the financial statements. We do not express an opinion or provide any assurance on the information because the limited procedures do not provide us with sufficient evidence to express an opinion or provide any assurance.

Other Information

Our audit was conducted for the purpose of forming an opinion on the financial statements that collectively comprise the Foundation’s basic financial statements. The budgetary comparison schedules, included on pages 25 and 26, are presented for purposes of additional analysis and are not a required part of the basic financial statements.

The budgetary comparison schedules are the responsibility of management and were derived from and relate directly to the underlying accounting and other records used to prepare the basic financial statements. Such information has been subjected to the auditing procedures applied in the audits of the basic financial statements and certain additional procedures, including comparing and reconciling such information directly to the underlying accounting and other records used to prepare the basic financial statements or to the basic financial statements themselves, and other additional procedures in accordance with auditing standards generally accepted in the United States of America. In our opinion, the budgetary comparison schedules is fairly stated, in all material respects, in relation to the basic financial statements as a whole.

Page Three 3

Other Reporting Required by Government Auditing Standards

In accordance with Government Auditing Standards, we have also issued our report dated November 8, 2022 on our consideration of the Foundation's internal control over financial reporting and on our tests of its compliance with certain provisions of laws, regulations, contracts, and grant agreements and other matters. The purpose of that report is solely to describe the scope of our testing of internal control over financial reporting and compliance and the results of that testing, and not to provide an opinion on the effectiveness of the Foundation's internal control over financial reporting or on compliance. That report is an integral part of an audit performed in accordance with Government Auditing Standards in considering Foundation's internal control over financial reporting and compliance.

Tallahassee, Florida

November 8, 2022

Page Four 4

The Florida Endowment Foundation for Vocational Rehabilitation, Inc. d/b/a The Able Trust

MANAGEMENT’S DISCUSSION AND ANALYSIS

The Florida Endowment Foundation for Vocational Rehabilitation, Inc. d/b/a The Foundation’s (the Foundation) management discussion and analysis presents an overview of its financial activities for the fiscal year ended June 30, 2022. Please read it in conjunction with the Foundation’s financial statements. This section of the report is intended to provide a brief, objective, and easily readable analysis of the Foundation’s financial performance for the year and its financial position at fiscal year end June 30, 2022.

Overview of the Financial Statements

The Foundation is considered an enterprise fund and utilizes the accrual basis of accounting. The basic financial statements for an enterprise fund include a statement of net position; a statement of revenues, expenses and changes in net position; and a statement of cash flows. The basic financial statements provide readers with a broad view of the Foundation’s finances, in a manner similar to a private-sector business. The notes provide additional information that is essential to a full understanding of the data provided in the basic financial statements.

Financial Analysis

A comparison summary of the statement of net position is presented below: FY 2022 FY 2021 % Change

Current Assets $ 19,964,253 $ 24,300,478 (17.8%) Restricted Assets 2,879,803 3,521,244 (18.2%) Other Assets 786,167 875,451 (10.2%) Capital Assets 3,421 120,261 (97.2%) Lease, Right-of-Use Asset 127,732 -100%

Total Assets $ 23,761,376 $ 28,817,434 (17.5%)

Current Liabilities $ 172,856 $ 105,546 (63.8%) Noncurrent Liabilities 74,379 -100%

Total Liabilities 247,235 105,456 (13.4%)

Deferred Inflows of Resources 684,217 773,701 (11.6%)

Net Position

Invested in Capital Assets, Net 3,421 120,261 (97.2%)

Nonexpendable Contributions 2,879,803 3,521,244 (18.2%) Unrestricted 19,946,700 24,296,772 (17.9%)

Total Net Position 22,829,924 27,938,277 (18.3%)

Total Liabilities and Net Position $ 23,761,376 $ 28,817,434 (17.5%)

5

The Florida Endowment Foundation for Vocational Rehabilitation, Inc. d/b/a The Able Trust

MANAGEMENT’S DISCUSSION AND ANALYSIS (continued)

Current assets comprised primarily of cash, investments, and funds receivable from state agencies decreased by $4,336,225 from the prior year.

Restricted assets decreased by $641,441 from the prior year due to a decrease in investment income and an increase in unrealized losses on investments.

Other assets are comprised of contributions receivable from deferred gifts and premium advances on a life insurance policy of a former executive.

A comparative summary of changes in fund net position is presented below:

FY 2022 FY 2021 % Change

Operating Revenues $ 786,889 $ 637,746 23.4% Operating Expenses 2,920,938 2,659,967 9.8%

Operating Loss (2,134,049) (2,022,221) (5.5%)

Nonoperating (Expenses) Revenues (3,030,313) 5,613,847 (153.9%)

Endowment Contributions 50,000 50,407 (.1%)

Change in Net Position $ (5,114,362) $ 3,642,033 (240.4%)

Net Position

The decrease in net position during the current year is primarily due to a decrease in investment income and an increase in unrealized losses on investments.

Nonoperating Expenses

Nonoperating expenses for the fiscal year ended June 30, 2022 primarily consist of net realized gains on investments of $24,693, interest and dividends of $1,687,305, and net unrealized losses on investments of $4,916,172. The Foundation uses interest and dividends to cover operating expenses.

6

The Florida Endowment Foundation for Vocational Rehabilitation, Inc. d/b/a The Able Trust

MANAGEMENT’S DISCUSSION AND ANALYSIS (continued)

Graphic presentation of revenues follows to assist in the analysis of the Foundation’s activities for fiscal year 2022.

Fiscal Year 2022 Revenues by Source

Interest and Dividends Grants Contributions Program Events Other

As graphically portrayed above and discussed earlier, the Foundation received a portion of its income during the fiscal year ended June 30, 2022, from grants from the State of Florida. Income on investments provided 67% of total revenues. Grants from DOE/DVR made up 22% of total revenues. The balance of the revenues are from contributions and fundraising events.

7

67% 22% 7% 2% 2%

The Florida Endowment Foundation for Vocational Rehabilitation, Inc. d/b/a The Able Trust

MANAGEMENT’S DISCUSSION AND ANALYSIS (continued)

Graphic presentation of operating expenses follows to assist in the analysis of the Foundation’s activities for fiscal year 2022.

Fiscal Year 2022 Operating Expenses

8%

23%

Grants and Programs Management and Operations Administrative

69%

Operating expenses increased $260,971 from the prior year.

Budgetary Highlights

The Foundation’s revenue budget for fiscal year 2022 was $3,056,569. This was an increase of $877,220 from the previous year budget.

Other Highlights

1. Our goal for FY2022 was, first and foremost, to rebrand and rebuild trust as the direct support organization to the Florida Department of Education, Division of Vocational Rehabilitation (FDOE/VR). In pursuit of this goal, we have made it our priority to listen and learn from FDOE/VR and other stakeholders including government, business, and education leaders; community service providers; and persons with disabilities and their families. We have learned a great deal regarding how to best serve as the direct support organization for Florida’s vocational rehabilitation system. Rebuilding trust takes more than one conversation. It is a long-term dialogue coupled with demonstrated action and results. We believe we are on that road and are excited to share more details of our vision and intended outcomes in our three-year strategic plan, Inclusive Florida: Powered by The Able Trust. Highlights of the strategic plan include:

8

The Florida Endowment Foundation for Vocational Rehabilitation, Inc. d/b/a The Able Trust

MANAGEMENT’S DISCUSSION AND ANALYSIS (continued)

An overarching goal of closing Florida’s workforce participation gap between people with disabilities and the general population by 10 percentage points in 10 years. This translates to bringing 300,000 more individuals with disabilities into the workforce.

Being the leader for disability employment data and research for Florida.

Being the leader in building system capacity and scaling evidenced-based solutions that increase employment outcomes on a statewide basis.

Securing a more diversified funding base to ensure organizational stability and achieve our exponential impact.

2. Adopted Investment Spending Policy: The Able Trust was created by the Florida legislature to be a long-term, stable, and growing source of revenue. The purpose of a spending policy is to resolve the tension between the competing goals of preservation of an endowment and stability in budgetary support. The policy spending rate for the endowment funds are set forth as follows:

FY22 – 8% of assets determined on December 31, 2020

FY23 – 7% of assets determined on December 31, 2021

FY24 – 6% of assets determined on December 31, 2022

FY25 and henceforth – 5% of assets determined on December 31, 2023, and each December 31st of future years.

3. Established 10-Year Targets for Diversified Funding: For nearly 30 years, the state provided a revenue stream to the organization through a percentage of civil citations and funds generated from temporary disabled parking permits. These funds allowed the organization to build an endowment which primarily funds current operations for the organization. To achieve our mission and fulfill our duty to expand resources in support of vocational rehabilitation in Florida, we intend to secure a more diversified and growing funding base. To that end, we have established ten-year targets to achieve our goals (see Inclusive Florida report). These targets represent a diverse funding stream and are aligned with national nonprofit and foundation standards.

4. Developed Formalized Partnerships with CareerSource Florida (CSFL), Florida Small Business Development Network (SBDC), and Florida Makes: A significant part of the value we bring to the state vocational rehabilitation program is our ability to secure commitments from business leaders and organizations for the inclusion of persons with disabilities in the Florida workforce. This year we signed official partnership agreements with CSFL, Florida SBDC, and FloridaMakes that include specific ways we will partner to bring more persons with disabilities into their talent development programs and industry employment.

5. Showcased High School High Tech (HSHT) Project Venture: This year we held the first in-person event for Project Venture. Project Venture is a business development competition, focused on creating a hands-on experience for HSHT youth. The goals of Project Venture are to: introduce students to entrepreneurism and the entrepreneurial spirit; facilitate students working in teams on real-world applications; allow students to develop workplace communication skills and other soft skills; and enable students to learn by doing. As part of the competition, students create a plan for a business or product, in any sector of their choice. The only limit is their creativity. Twelve teams competed in this year’s competition. Three teams advanced to the finals where they competed for a panel of judges of six industry executives. In addition to being a significant learning experience for students, we used Project Venture to showcase HSHT and invite others to become program partners and funders.

9

The Florida Endowment Foundation for Vocational Rehabilitation, Inc. d/b/a The Able Trust

MANAGEMENT’S DISCUSSION AND ANALYSIS (continued)

6. Increased Fundraising Revenues by Over 600%: A six-hundred percent increase in raised revenues sounds like an astounding achievement but comparing the raw numbers between FY2021 ($25,000) and FY2022 ($156,000) has a less astonishing effect. Regardless, we intend to maintain aggressive gains in FY2023 by setting our fundraising targets to $600,000, an annual increase of over 350%, which will be pursued through legislative appropriations, program income, corporate and private donors, partnerships, and grants.

7. Launched Data and Research Analysis Project: In FY2022, we began an extensive analysis of national, state, regional, and local economic data/research which defines the existing condition of disability workforce inclusion in Florida. We believe, and our stakeholders have confirmed, that our state needs this type of analysis to make the most informed decisions to improve disability workforce inclusion in Florida. We have partnered with the international research firm, Emsi Burning Glass, for the first phase of research and expect to release a full report by early September 2022. Beyond this phase, we have partnered with FDOE/VR to develop data specific to workforce education programs and attainment of persons with disabilities. Future research will include testing of solutions through impact projects and studies of fiscal cliffs specific to the employment of Floridians with disabilities.

Contacting the Foundation’s Financial Management

This financial report is designed to provide a general overview of the Foundation’s accountability for the money it receives. If you have questions about this report or need additional financial information, contact Allison Chase at Allison@abletrust.org or 850-224-4493.

10

Assets

The Florida Endowment Foundation for Vocational Rehabilitation, Inc. d/b/a The Able Trust

Statement of Net Position

June 30, 2022

Current assets: Cash and cash equivalents 1,458,486 $ Investments 18,344,580 Due from DOE/DVR for High School/High Tech Program 137,456 Accounts receivable - other 23,731 Total current assets 19,964,253

Restricted assets: Restricted cash 109,200 Restricted investments 2,770,603 Total restricted assets 2,879,803

Noncurrent assets: Contributions receivable from deferred gifts, net 684,217 Capital assets, net 3,421 Lease, right-of-use asset 127,732 Deposits and other noncurrent assets 101,950 Total noncurrent assets 917,320 Total assets 23,761,376 $

Liabilities

Current liabilities: Accounts payable 62,423 $ Accrued expenses 10,210 Unearned revenue 50,000 Lease liability, current 50,223 Total current liabilities 172,856

Noncurrent liabilities: Lease liability, noncurrent 74,379 Total noncurrent liabilities 74,379

Total liabilities 247,235

Deferred inflow of resources: Contributions from deferred gifts, net 684,217 Total deferred inflow of resources 684,217

Net position: Net investment in capital assets 3,421 Restricted - nonexpendable contributions 2,879,803 Unrestricted 19,946,700 22,829,924 $

Total net position

See accompanying notes.

11

The Florida Endowment Foundation for Vocational Rehabilitation, Inc. d/b/a The Able Trust

Statement of Revenues, Expenses, and Changes in Net Position

Year ended June 30, 2022

Operating revenues

Public support: DOE/DVR High School/High Tech 549,823 $ Program events 56,500 Contributions 120,875 Other revenues 59,691 Total operating revenues 786,889

Operating expenses

Program services: Grants and program expenses 2,008,115 Total program services 2,008,115

Supporting services: Management and operations 664,253 Administrative 248,570 Total supporting services 912,823 Total operating expenses 2,920,938

Operating loss (2,134,049)

Nonoperating expenses

Investment loss (3,030,313)

Total nonoperating expenses (3,030,313)

Loss before endowment contributions (5,164,362)

Endowment contributions 50,000

Change in net position (5,114,362)

Net position, beginning of year 27,944,286

Net position, end of year 22,829,924 $

See accompanying notes.

12

The Florida Endowment Foundation for Vocational Rehabilitation, Inc. d/b/a The Able Trust

Statement of Cash Flows

Year ended June 30, 2022

Cash flows from operating activities

Receipts from public support 667,198 $

Other cash receipts 54,838