5 minute read

Is Exness Regulated in Kenya: Comprehensive Broker Review 2025

from Exness Guide

Forex trading has become increasingly popular in Kenya, with traders looking for reliable brokers to enhance their trading experience. Among these brokers, Exness stands out as a globally recognized platform. But an essential question remains: Is Exness regulated in Kenya? This comprehensive article explores Exness’ regulatory status, features, and why it’s a preferred choice for Kenyan traders in 2025.

Understanding Forex Regulation in Kenya

In Kenya, forex trading is regulated by the Capital Markets Authority (CMA), a body tasked with ensuring financial market stability, transparency, and trader protection. The CMA provides licenses to brokers operating in the country, ensuring compliance with strict regulatory standards. However, many international brokers, including Exness, operate under global regulations without direct CMA oversight.

Start Exness Trade: Open Exness Account and Visit site

Is Exness Regulated in Kenya?

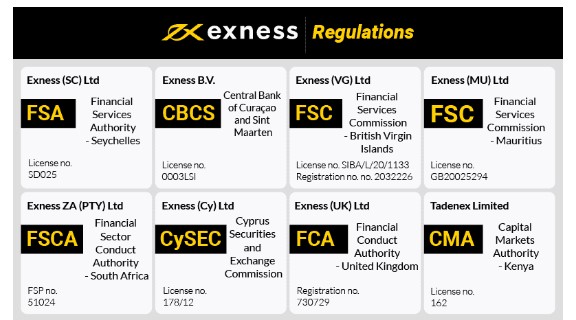

Exness broker is a globally licensed broker regulated by several reputable authorities, including:

Financial Conduct Authority (FCA) in the UK

Cyprus Securities and Exchange Commission (CySEC)

Seychelles Financial Services Authority (FSA)

While Exness does not hold a CMA license, its global regulatory framework ensures a high level of safety and transparency. Kenyan traders can legally trade with Exness, leveraging its international licenses and compliance standards.

Implications for Kenyan Traders

Legal Operations: Kenyan traders can access Exness’ services under its global regulatory licenses.

High Standards: Regulations from authorities like FCA and CySEC ensure Exness adheres to stringent financial practices.

Responsibility: Traders must comply with Kenyan financial laws, including tax reporting and local trading regulations.

Start Exness Trade: Open Exness Account and Visit site

Why Kenyan Traders Prefer Exness

Exness has established itself as a top choice for traders in Kenya due to its diverse features, competitive pricing, and localized services. Below are detailed insights into what makes Exness appealing:

1. Wide Range of Account Types

Exness accounts tailored to suit traders of all experience levels:

Standard Account: Designed for beginners, featuring low spreads and no commissions.

Exness Raw Spread Account: Provides ultra-tight spreads suitable for scalpers and professional traders.

Exness Zero Account: Offers zero spreads on major instruments during most trading hours.

Exness Pro Account: Aimed at experienced traders, with fast execution and competitive pricing.

2. High Leverage

Exness provides some of the highest leverage options in the market, up to 1:2000 or more, allowing traders to maximize their market exposure with minimal capital. However, high leverage carries significant risk and should be used cautiously.

3. Localized Payment Methods

Exness supports popular Kenyan payment methods, including M-Pesa, Airtel Money, and local bank transfers. This makes deposits and withdrawals fast, secure, and convenient for Kenyan traders.

4. Comprehensive Trading Platforms

Exness provides access to industry-standard platforms such as:

MetaTrader 4 (MT4): Known for its reliability and advanced trading tools.

MetaTrader 5 (MT5): Offers enhanced features, including additional timeframes and technical indicators.

Exness Trader App: A user-friendly mobile platform optimized for trading on the go.

5. Educational Resources

Exness is committed to empowering traders with knowledge through:

Webinars: Live sessions covering market trends and strategies.

Tutorials: Step-by-step guides on using trading platforms and tools.

Market Analysis: Daily updates on market movements and trading opportunities.

Start Exness Trade: Open Exness Account and Visit site

Exness Review 2025: A Detailed Evaluation

Strengths

Global Regulation: Licensed by top-tier regulators, ensuring high security and transparency.

Low Costs: Competitive spreads, no hidden fees, and minimal commission charges.

User-Friendly Platforms: Accessible to both beginners and professionals.

24/7 Support: Round-the-clock customer service in multiple languages, including Swahili.

Local Adaptation: Supports Kenyan payment systems and offers localized services.

Weaknesses

No CMA License: Lack of local regulation may deter some traders.

High Leverage Risks: While advantageous, high leverage can lead to significant losses if misused.

Limited Focus on Kenyan Markets: Exness focuses primarily on global forex pairs, with limited emphasis on Kenyan-specific trading instruments.

How to Get Started with Exness in Kenya

Getting started with Exness is a straightforward process. Follow these steps:

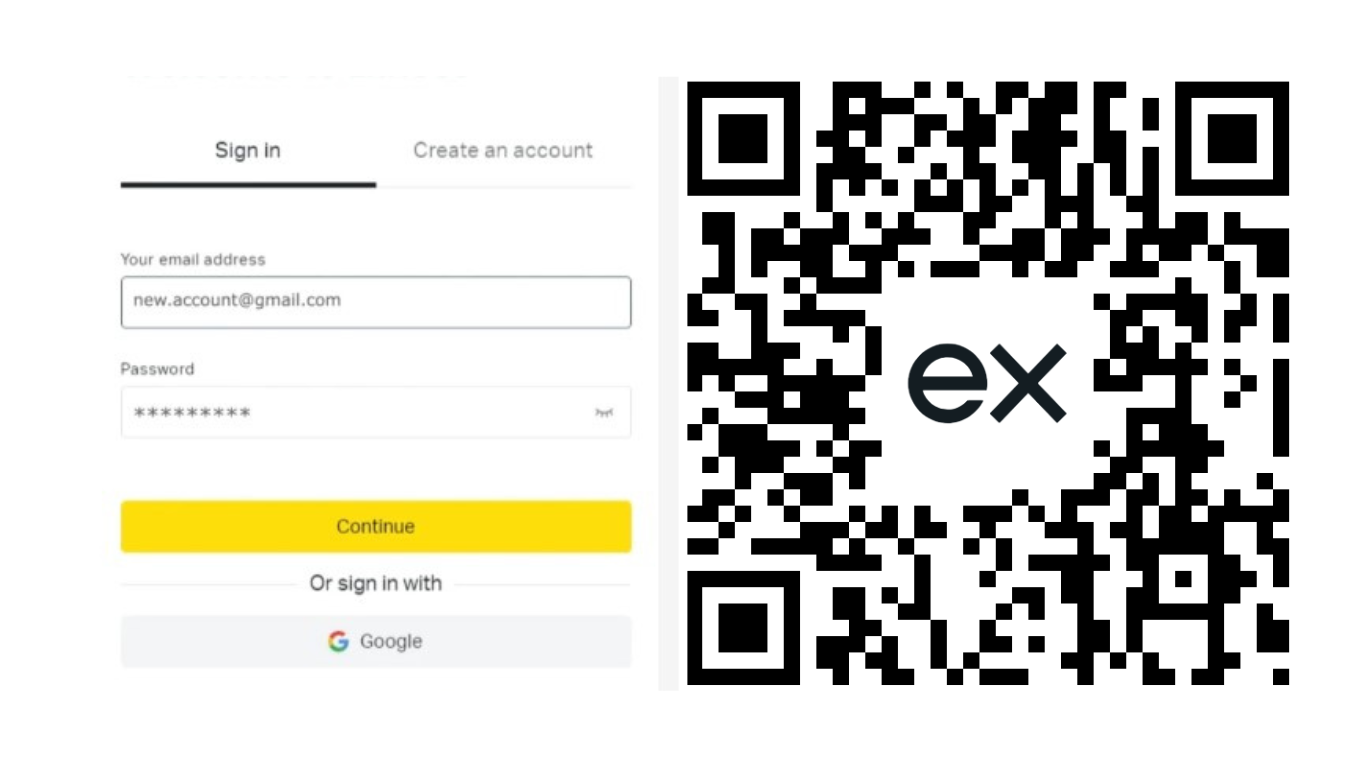

Open an Account: Visit the Exness website, register, and choose an account type that suits your needs.

Verify Your Identity: Upload your ID and proof of residence to complete the KYC process.

Deposit Funds: Use M-Pesa or other supported payment methods to fund your trading account.

Access Trading Platforms: Download MT4, MT5, or the Exness Trader App to start trading.

Start Trading: Explore the available instruments, apply strategies, and begin your trading journey.

Tips for Safe Trading with Exness

Understand the Risks: Forex trading is highly speculative. Only trade with money you can afford to lose.

Use Risk Management Tools: Employ stop-loss and take-profit orders to control your exposure.

Educate Yourself: Take advantage of Exness’ educational materials to improve your skills.

Start Small: Begin with a demo account or minimal capital to gain confidence.

Start Exness Trade: Open Exness Account and Visit site

Conclusion: Is Exness the Right Choice for Kenyan Traders?

Exness is a globally renowned forex broker offering excellent features, robust platforms, and localized services for Kenyan traders. While the lack of CMA regulation might be a concern, Exness’ adherence to international standards ensures a secure and reliable trading experience.

Traders should approach forex trading with caution and leverage the resources available to them for informed decision-making. With its competitive edge and trader-centric services, Exness continues to be a top choice for Kenyan traders in 2025.

FAQs

1. Is Exness regulated in Kenya? Exness is not directly regulated by the CMA but operates under global licenses from authorities like FCA and CySEC.

2. Can I use M-Pesa to deposit funds with Exness? Yes, Exness supports M-Pesa and other local payment methods for deposits and withdrawals.

3. What account types does Exness offer to Kenyan traders? Exness provides Standard, Raw Spread, Zero, and Pro accounts to cater to different trading needs.

4. Is Exness suitable for beginner traders? Yes, Exness offers beginner-friendly accounts, a demo account, and extensive educational resources.

5. What leverage does Exness offer in Kenya? Exness provides leverage of up to 1:2000 or more, depending on the account type.