TALENT | INNOVATION | ENTREPRENEURIAL & BUSINESS ENVIRONMENT | INDUSTRY CLUSTERS | LIVABILITY

Imagine More TM

COMPETITIVENESS REPORT 2019-20 Midlands Regional

The sixth edition of the Midlands Regional Competitiveness Report tells us two things.

First, the Columbia, South Carolina region has all the potential in the world: we have an educated talent pool, a diverse array of amenities and an affordable lifestyle. That’s why we were named the “#4 City Where Millennials Are Moving” by SmartAsset and the “#5 Upand-Coming Tech City” by CBRE.

Second, reaching that potential will require formal, intentionally collaborative efforts across our region.

There are many organizations doing valuable work that makes Columbia a better place. When we look across the country, we find that the most successful regions bring such groups together to develop a shared strategy for success and accountability.

Imagine what our region might look like if all of our efforts were aligned. Individually, we can make incremental changes. Together, we can make Columbia one of the best regions in the world.

Indicators of Competitive Communities Talent

A region’s ability to attract, develop and maintain a vibrant and skilled workforce

Innovative Capacity

A region’s capacity to support the creation of new ideas, products and processes

Entrepreneurial & Business Environment

A region’s relative ease of doing business and the strength of the support system for the startup, growth and maintenance of businesses

Industry Clusters

W. Lee Bussell

Chairman, EngenuitySC

A region’s ability to sustain and grow high impact industries that are competitive on an international scale

Livability

A region’s ability to build an inclusive and dynamic live, learn, work and play environment

2 2019-20 Midlands Regional Competitiveness Report

TM

-

Population: 22,402

Kershaw

Population: 65,592

Richland

Population: 414,576

Saluda

Population: 20,544

Lexington

Population: 295,032

Geography

Columbia

Calhoun

Population: 14,704

Peer MSAs

Anchored by the state capital, the Columbia Metropolitan Statistical Area (MSA) consists of six counties: Richland, Lexington, Kershaw, Fairfield, Saluda and Calhoun. As of 2018 Census Bureau Estimates, the Columbia MSA is the second-largest metropolitan statistical area in South Carolina, with a total population of 832,666. Shown in order of population

Raleigh, NC MSA*

Population: 1,362,540

Greenville-Anderson-Mauldin, SC MSA

Population: 909,626

Knoxville, TN MSA

Population: 883,309

Columbia, SC MSA

Population: 832,666

Charleston-North Charleston, SC MSA

Population: 787,643

Greensboro-High Point, NC MSA

Population: 767,711

Winston-Salem, NC MSA

Population: 671,456

Augusta-Richmond County, GA-SC MSA

Population: 604,167

Lexington-Fayette, KY MSA

Population: 516,697

Tallahassee, FL MSA

Population: 385,145

*Raleigh is an aspirational MSA, meaning it serves as a target for Columbia, as opposed to a peer MSA. Population data source: US Census Bureau, 2018 Census Bureau Estimates

How were the comparative locations chosen?

Our peer MSAs have comparable economic assets to our own, including at least one of the following:

• State capital

• Major research university

• Strong higher education system (2-year and 4-year)

• Population

• Entrepreneurial environment

• Strength in technology

• Geographic location and landscape

www.EngenuitySC.com 3

6.

1.

7.

2.

8.

3.

9.

4.

10.

5.

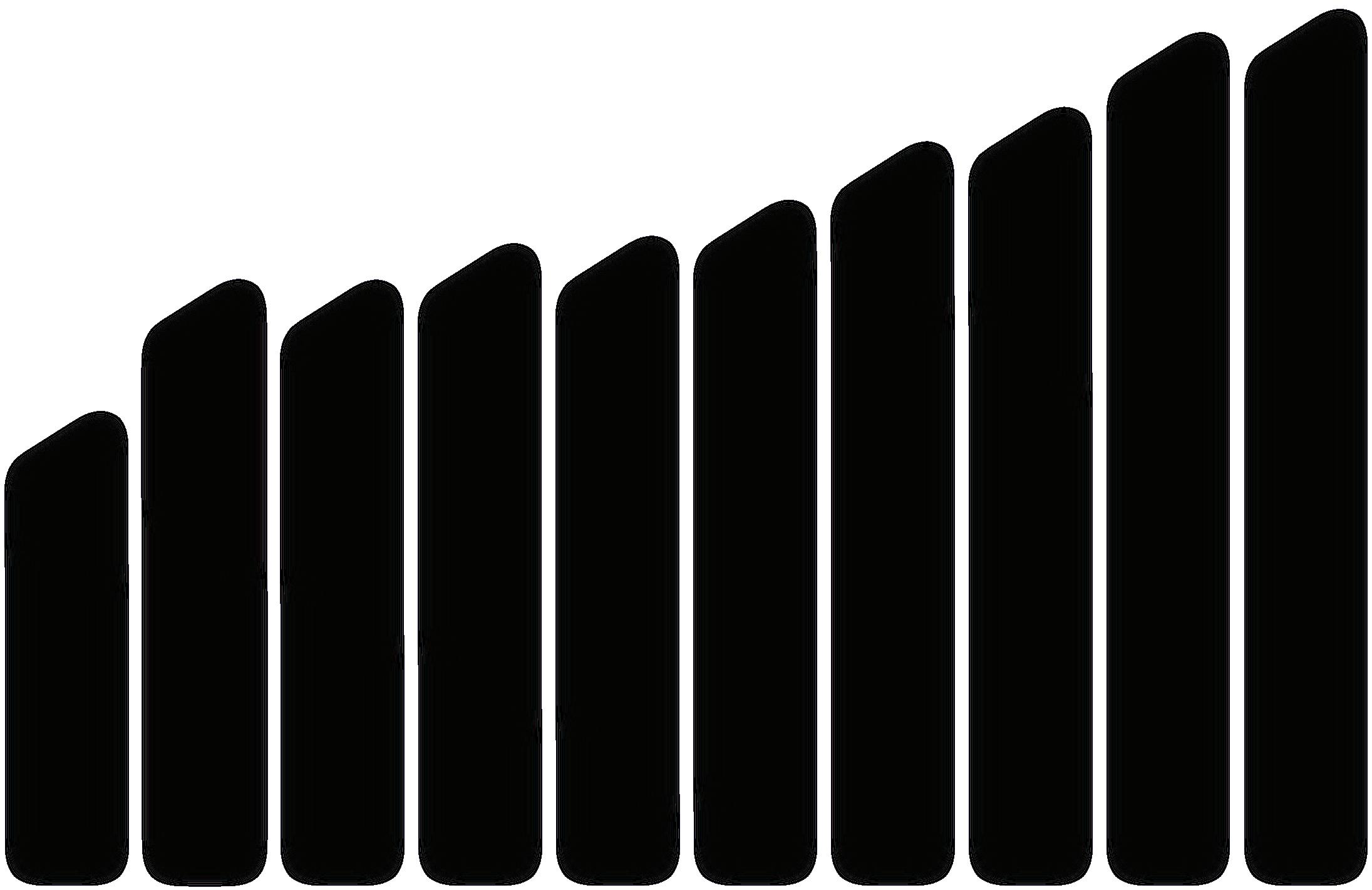

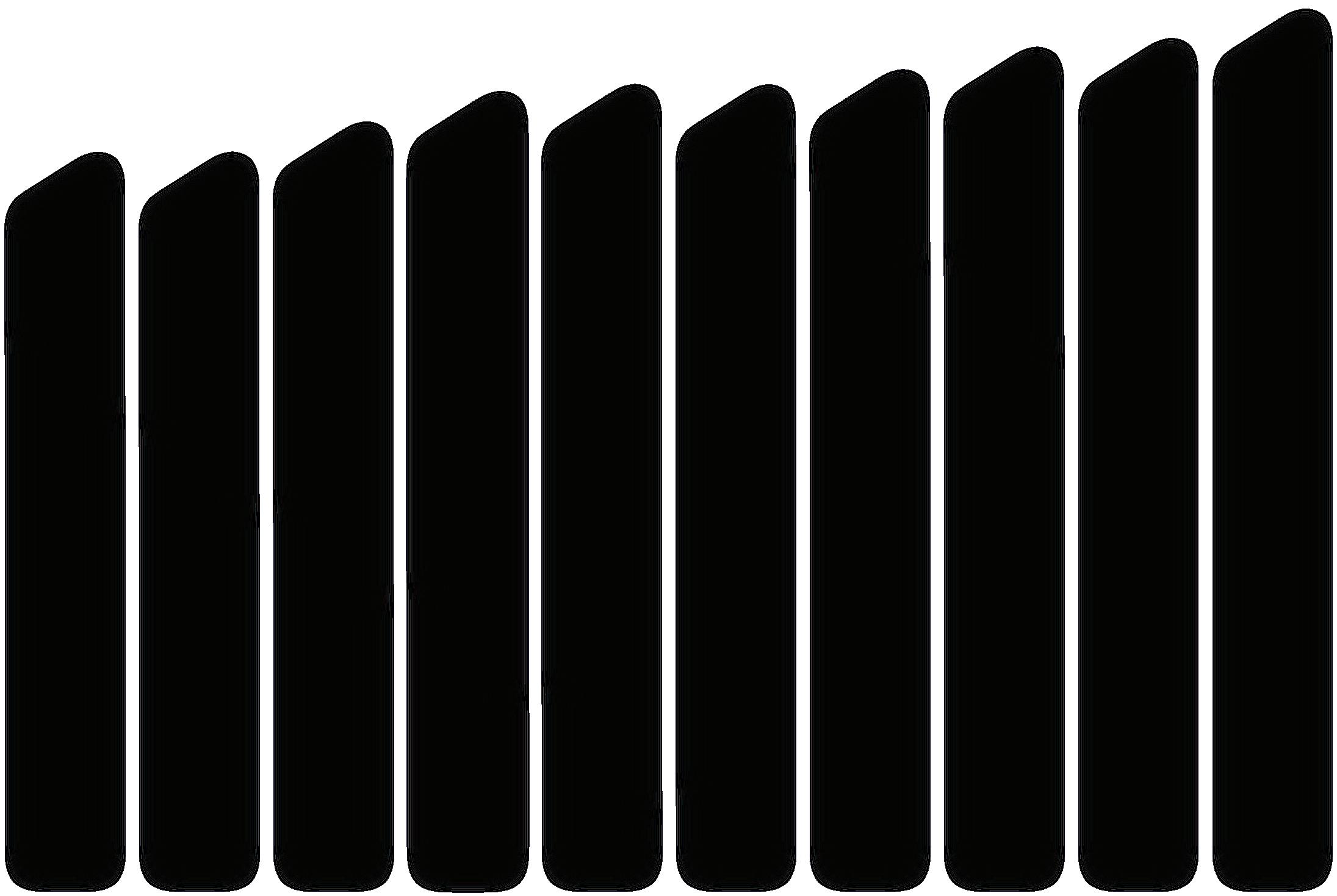

5 6 3 10 7 2 9 8 1 4

4

How to Read this Report

Methodology

This report examines five aspects of regional economic competitiveness and ranks our measurable achievement in each against the achievement of our peer and aspirant MSAs. The scores assigned to each MSA reflect a set of equally weighted data points. All data in the report is indexed against the national average to facilitate accurate comparisons. 100 represents the U.S. average, so an index value of 110 for the Columbia MSA means that our region is performing 10% above the U.S. average. Likewise, an index of 90 means our region is performing 10% below the U.S. average.

(Metric/U.S. Value) x 100 = Index Value

Data Sources

All data used is from publicly accessible federal sources, such as the Census Bureau and Bureau of Economic Analysis (BEA). Data was compiled and analyzed by the economists within the Division of Research at the University of South Carolina’s Darla Moore School of Business.

Other Content in this Report

Metrics

Individual indicators of success, with our rank among our peers indicated as: nth/10

Observations

Critical findings and regional trends, including metrics showing consistent progress or decline over multiple years of the report

Brags

Points of pride to share that highlight our region’s successes

Inspirations

Stories of success from other comparable regions to spark our collective imagination

Opportunities

Critical next steps to drive comprehensive improvement in this area of competitiveness

FAQs

Who determines what is included in the Columbia MSA?

The U.S. Office of Management and Budget (OMB) defines MSAs, which are used by the U.S. Census Bureau and other federal agencies for statistical purposes. An MSA is defined as a geographical region with a relatively high population density at its core and close economic ties throughout the area. Typically, MSAs are anchored by a single large city that has a significant influence over the region.

Why are some Midlands counties not included in this report?

Some counties commonly considered part of the Midlands, such as Newberry, Orangeburg and Sumter, are not included in the Columbia MSA. These counties include Newberry, Orangeburg and Sumter, among others. We use the geographical area of the Columbia MSA — not the loose definition of “The Midlands” — in order to compare regions in the fairest way possible.

What are traded clusters and why do they matter?

Traded clusters are concentrations of businesses in industries whose primary customers are national or global in scope, rather than local to the area - think software companies, financial institutions and biotech companies. These companies produce about one-third of all jobs, but those jobs provide better compensation and they are responsible for over half of all GDP and 90% of innovation.

What is the timeframe of this data?

We use the latest available data to facilitate accurate comparisons. Most of the data in this report lags one to three years, depending on the source.

What are you doing about the results of this report?

Using input from our Board of Directors, staff and partners, recommended solutions are provided in the Opportunity section of each index in the report. However, acting on these recommendations will extend far beyond the EngenuitySC team. True progress will require partners from across the region working together toward a shared vision and plan.

What can I do?

Find an opportunity in the report where you can create an impact by getting engaged, collaborating with partners to drive action.

4 2019-20 Midlands Regional Competitiveness Report

The Big Picture

Key: Columbia MSA Peer Average U.S. Average

GDP Annual Growth Rate | 2006 - 2017

A Word from the Economists

As of September 2019, the United States remains in its longest economic growth cycle in recent history – more than 10 years and counting since the Great Recession. During this time, population migration trends have shifted south and west, and to some degree, businesses have followed. We also see a growing concentration of people and employment within major metropolitan areas. Although Columbia has grown in line with some of its peers, at a time when the national gap between high-growth and low-growth regions is expanding, Columbia remains well behind its in-state competitors and other high-growth areas across the Southeast.

Year-Over-Year Employment Growth Rate | 2006-2018

Household Income | 2006-2017

This is perhaps most easily observed by comparing Columbia’s overall rate of employment growth to that of the other in-state major metropolitan regions – most notably Greenville and Charleston. Since 2010, Columbia’s annual employment growth has been approximately 1.7%, which falls significantly below both Greenville (2.2%) and Charleston (2.9%) over the same time period. Since 2016, this gap has increased – with Columbia’s employment growth slowing to 0.4% as compared with growth in Greenville and Charleston at 1.6% and 2.2%, respectively. More broadly, Columbia currently ranks last among its regional competitors in employment growth within traded clusters. Weak employment growth, in turn, limits both income and GDP growth.

www.EngenuitySC.com 5

8 %

6 % 4 % 2 % 0 % -2 % -4 % 5 % 3 % 1 % -1 % -3 % -5 % $60K $65K 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 $55K $50K $45K $40K

Source | Joey Von Nessen, Division of Research, UofSC Darla Moore School of Business

Source | U.S. Bureau of Economic Analysis

Source | U.S. Bureau of Labor Statistics

Source | U.S. Bureau of Labor Statistics

Talent

A region’s ability to attract, develop and maintain a vibrant and skilled workforce

116

The Metrics

GDP per Worker: Measures a regional workforce’s productivity

7th/10

STEM Degrees:

Percentage of degrees awarded in science, technology, engineering and math

8th/10

STEM Salaries: Weighted average salaries in STEM occupations

9th/10

Knowledge Workers:

Percentage of population employed in knowledge-intensive occupations such as management, legal and STEM

5th/10

Educational Attainment:

Percentage of population with: Associate’s degree

7th/10

Bachelor’s degree or higher

Global Talent:

Percentage of population that is foreignborn

5th/10 7th/10

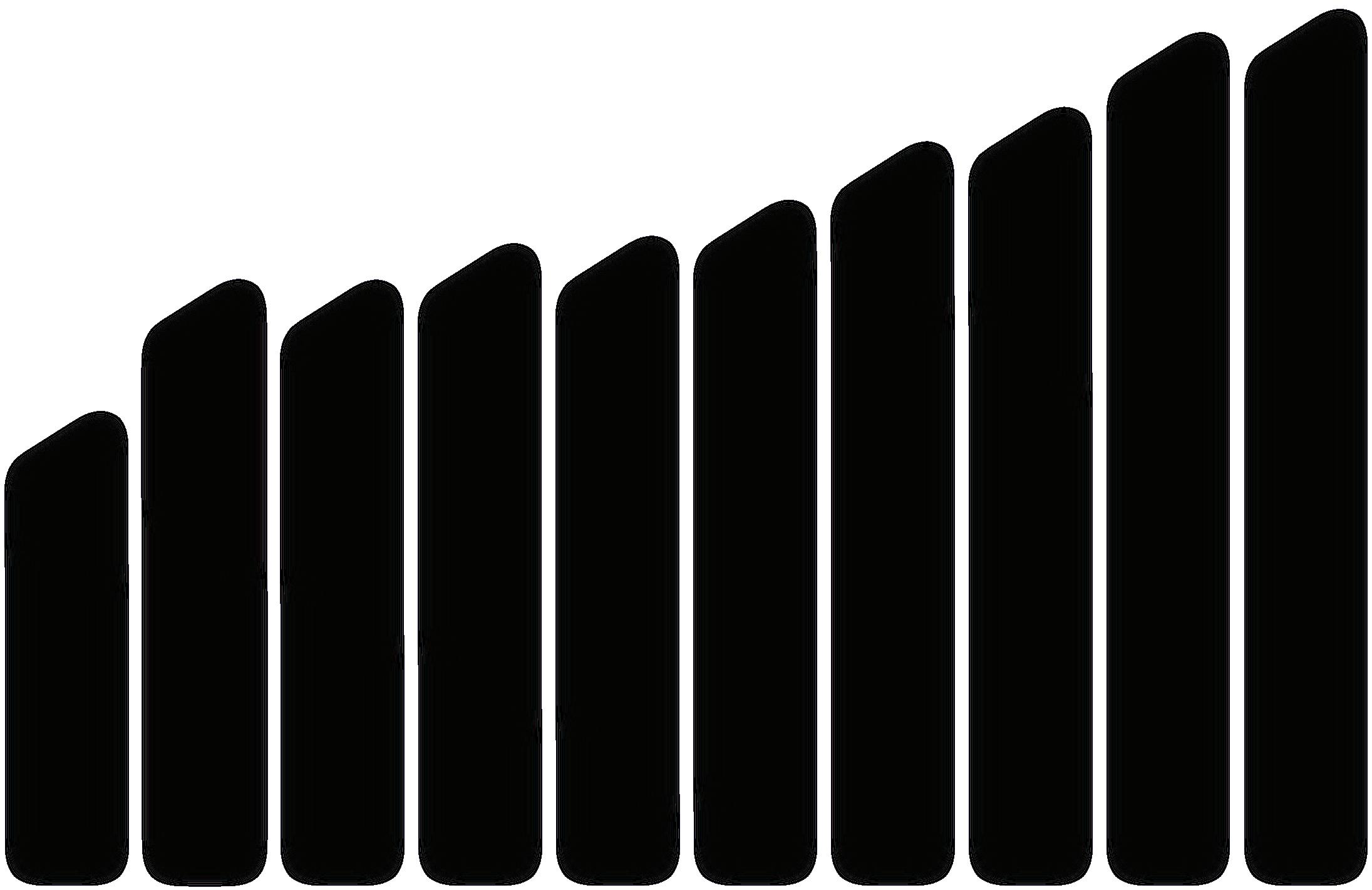

6 2019-20 Midlands Regional Competitiveness Report Tallahassee FL Augusta GA Charleston SC Greensboro NC Knoxville TN WinstonSalem, NC Greenville SC Raleigh NC Lexington KY Columbia SC 100 U.S. Avg. 84 85 87 88 88 88 88 89 90

TIME 5 th 8 th 7 th 7 th 8 th 10 th 2014 2015 2016 2017 2018 2019-20

OVERALL RANKING OVER

Photo Courtesy of SOCO

Observations

• Despite a ranking of 9th out of 10, STEM salaries in Columbia have trended positively over the past several years; a strong labor market should continue to drive improvement.

• Per capita GDP is moving in the wrong direction, likely tied to the increasingly high proportion of locally focused service jobs in sectors like retail and hospitality.

• Columbia’s proportion of knowledge workers has decreased steadily since the first report — not out of line with most of our peers, but also not growing in line with the national average as jobs across all sectors become increasingly tech-intensive.

• Columbia is already producing qualified talent (over 68,000 total higher education students), but we’re losing college graduates to positions outside the region. Meanwhile, our competitors are focusing on attracting those graduates to their regions to fill unmet workforce needs.

• Tennessee has made technical college free to qualifying in-state students, boosting Knoxville’s educational attainment ranking as well as their long-term pipeline.

Brag

The University of South Carolina is producing higherachieving talent than ever before. The Darla Moore School of Business, a key source for regionally important sectors such as financial services, supply chain and logistics management and professional services, achieved outstanding results in 2019.

1,086UNDERGRADS

84% Attained its highest job placement rate

Inspiration

Talent Development in Des Moines

In Iowa, the Greater Des Moines (DSM) Partnership serves as the primary regional development organization. Without a major research university to supply the region’s talent needs, the DSM Partnership has focused on talent attraction as a key part of its economic development strategy, taking a proactive approach to building Des Moines’ brand. Each year, the DSM Partnership travels to colleges and universities around the country to showcase opportunities and livability in the Des Moines region. It also provides resources such as intern retention and community engagement programs designed to keep talented employees in the region.

Opportunity

In an economic environment with high talent demand, we have the capacity to supply a greater number of businesses with educated employees. Columbia must develop a purposeful approach to retaining these graduates - and that strategy must include recruiting companies in desperate need of young talent. At the same time, we can engage these new graduates and early-career professionals by connecting them to each other and to the community through social and professional opportunities.

18-24 Ages 25-34

29,272

13,402

13,271

14,604

$$$$$$$$$$$$$$$$$$$$$$$$$ $$$$$$$$$$$$$$$$$$$$$$$$$ $$$$$$$$$$$$$$$$$$$$$$$$$ $57,837 Received the highest avg. starting salaries to date

18,833

11,783

$$$$$$$$$$$$$$$$$$$$$$$$$

In addition to our large base of college-age students, Columbia has been successful in attracting young professionals due to a high-value lifestyle, stable economy and wide array of diverse amenities. Source | Annual Migration Patterns, U.S. Census Bureau, 2017

www.EngenuitySC.com 7

Graduated its largest class in Spring 2019 Columbia

Talent Attraction by Metro Charleston Greenville

Talent

Innovative Capacity

A region’s capacity to support the creation of new ideas, products and processes

What are SBIR and STTR awards?

The Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs are two of the largest sources of early-stage capital for technology commercialization in the United States. They allow US-owned-and-operated small businesses to engage in federal research and development that has a strong potential for commercialization. SBIR awards can be procured directly by small businesses, while STTR awards require formal collaboration with a research institution.

The Metrics

Innovation Awards: SBIR and STTR Awards per 100,000 residents University Research & Development Expenditures:

8th/10

University and college R&D expenditures per 1,000 people

Academic Achievement:

Percent of population aged 25 years and older holding a graduate degree

5th/10

Research & Development:

Funding:

Amount awarded from all sources per 1,000 people

7th/10 7th/10

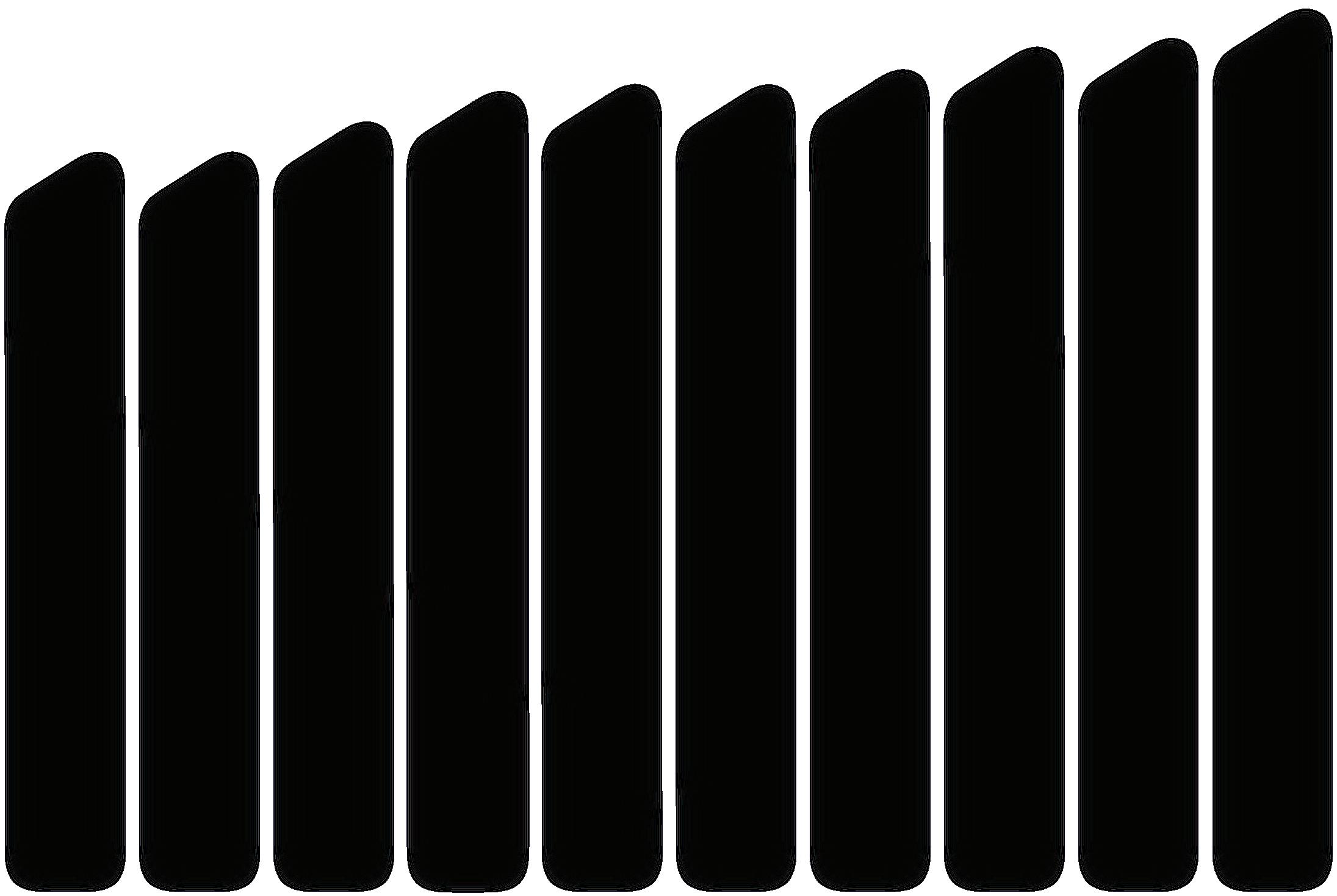

8 2019-20 Midlands Regional Competitiveness Report Tallahassee FL Augusta GA Charleston SC Greensboro NC Knoxville TN WinstonSalem, NC Greenville SC Raleigh NC Lexington KY Columbia SC 100 U.S. Avg. 67 71 75 85 86 102 104 123 144

200

OVERALL RANKING OVER TIME 7 th 7 th 7 th 8 th 8 th 7 th 2014 2015 2016 2017 2018 2019-20

Photo Courtesy of Robert Clark Photography / Nephron Pharmaceuticals

Innovative Capacity

Observations

• While we have not seen significant change over time in the Columbia region, it consistently serves as home to a higher-than-average percentage of advanced degree-holders.

• Columbia has slowly declined in the area of SBIR/STTR tech transfer awards, currently ranking last among our peers with major research universities — an indicator of limited commercialization activity. Overall, our research activity on a per capita basis is among the lower half of our peers.

• In line with the decline in knowledge workers, we’ve seen Columbia’s share of computer, science and engineering employees slip over the past few years.

• Previously, this index included measuring the number of utility patents per 10,000 workers. However, the U.S. Patent Office has stopped updating regional patenting information, so this metric has been removed.

• It’s no secret that the Columbia region is home to a large government and military presence (over 50,000 employees), along with a major research university. Yet, a minimal amount of federal defense research funding — one of the single largest pots of research funding — has gone to this region.

Brag Inspiration

The University of South Carolina’s McNAIR Aerospace Center is a model for groundbreaking research funded by both industry and federal sources. Its research portfolio includes the following:

• Advanced composites and materials — a partnership with Boeing

• Predictive maintenance analytics for aircraft — a partnership with the Department of Defense

• Unmanned aerial vehicles — a partnership/ collaboration with both private-sector and federal partners

Research Strategy at UCF

The University of Central Florida has developed exceptional research capacity, with a goal of doubling their research funding within a five-year span. Key strategies for their success include the following:

• Encouraging the pursuit of cross-disciplinary research projects, meant to address the wide-reaching challenges faced by industry and government partners

• Emphasizing entrepreneurship and industry-partnered research to create a system that rewards researchers performing high-value work

• Recruiting new research-focused faculty to broaden the University’s capabilities and enhance its global profile

• Developing and tracking consistent metrics in teaching, research and social impact to measure the University’s progress over time

Opportunity

Given Columbia’s existing research strengths, its developing connections to the Department of Defense, and its proximity to UofSC, Fort Jackson, Shaw Air Force Base and numerous federal and state government offices, the region has an opportunity to enhance its federal research capacity in areas such as cybersecurity, artificial intelligence and renewable energy. To capitalize on this, a coordinated approach to the pursuit of DoD research funding must be created, incorporating UofSC leadership, local governments, regional economic development organizations and the S.C. Department of Commerce to guide strategic investments in secure infrastructure and

www.EngenuitySC.com 9

Photo Courtesy of University of South Carolina McNAIR Aerospace Center

Entrepreneurial & Business Environment

A region’s relative ease of doing business and the strength of the support system for the startup, growth and maintenance of businesses

Proprietor’s Income Share: Percentage of income in a region generated by business ownership

3rd/10

Small Business Activity: Measure of a region’s capacity to produce new companies

5th/10

Business Density: Number of establishments per 1,000 employees

5th/10

Business Services:

Share of population employed in professional and technical services occupations

3rd/10

Establishment Growth Rate: Growth in number of business establishments, 2000-2016

3rd/10

10 2019-20 Midlands Regional Competitiveness Report Tallahassee FL Augusta GA Charleston SC Greensboro NC Knoxville TN WinstonSalem, NC Greenville SC Raleigh NC Lexington KY Columbia SC 100 U.S. Avg. 32 61 66 73 80 82 85 116 135 136

The Metrics

OVER TIME 7 th 7 th 7 th 9 th 3 rd 3 rd 2014 2015 2016 2017 2018 2019-20

OVERALL RANKING

Photo Courtesy of Lynn Luc / SOCO

Entrepreneurial & Business Environment

Observations

• Since the 2017 Competitiveness Report, we’ve seen big increases in the proportion of business services (such as accounting and legal) employment — a key indicator of a healthy overall business environment. This growth has been a primary driver for Columbia’s improvement in this index.

• Over a long horizon, we’ve been among the top group of our peers in overall growth of business establishments. While that’s closely tied to overall population growth, it’s also an indicator of dynamism at a time when entrepreneurship rates are dropping nationally.

• Despite our success in this index, our region is losing headquarters — at least seven in the past 18 months — and nationally, corporate relocations are trending toward a few select major metros. These economic cornerstones and their employees play a critical role in attracting talent from outside the region, and are often primary sources of philanthropic activity, meaning their loss presents a long-term threat to the region.

Opportunity Brag Inspiration

Lexington County-based Diesel Laptops, a developer of diagnostic software and equipment for the trucking and off-highway diesel markets, was one of the Southeast’s fastest-growing companies in the 2018 Inc. 5000 rankings. Founded in 2013 and now employing over 100 full-time workers, the company took advantage of an opportunity to enhance efficiency within South Carolina’s robust logistics sector by creating time-saving products.

Innovation Strategy in Raleigh

Raleigh, NC, has long leveraged the region’s leading universities and highly targeted recruitment efforts to build strong technology and life sciences sectors. By connecting the dots between ideas, capital and talent, the Raleigh MSA supports growing small businesses in high-tech areas. As a result, startup activity is extremely high, with a Brookings Institute study finding 171 Inc. 5000 companies per million residents. Innovate Raleigh was created in an effort to expand a strong ecosystem by acting as a central node for entrepreneurs and innovators in the region.

+1,188% 3-YEAR GROWTH

The University of South Carolina is now deploying a similar talent-based strategy through the Office of Economic Engagement (OEE): since OEE’s founding in 2013, its work has generated over $790 million in economic impact, attracting companies such as IBM, Siemens, Samsung and Boeing to the state.

Source | Brookings Institute, University of South Carolina Office of Research

Columbia’s greatest growth opportunity lies in building strong companies from within. While Columbia performs comparably to our peers in the number of Inc. 5000 companies, we lag well behind the fastest-growing of those: Raleigh, Charleston and Greenville. GrowCo, an organization whose goal is to triple the number of Columbia-based Inc. 5000 companies in the next three years, is an opportunity for the region to purposefully support successful companies by providing critical services such as founder mentoring, entrepreneurship-focused regional marketing and talent attraction.

Columbia-based Inc. 5000 Companies

www.EngenuitySC.com 11 2014 8 2019 8 2015 7 2016 6 2017 6 2018 9

Industry Clusters The Metrics

High-Impact Density: Share of regional employment in traded clusters

9th/10

Employment Diversity: Concentration of employment in top five occupations

2nd/10

High-Wage Employment: Concentration of jobs in high-wage occupations (annual pay greater than median household income)

5th/10

Traded Cluster Employment Growth:

Growth of employment in traded clusters, 2000-2016

10th/10

Household Income: Median Household Income, 2018

9th/10

12 2019-20 Midlands Regional Competitiveness Report Tallahassee FL Augusta GA Charleston SC Greensboro NC Knoxville TN WinstonSalem, NC Greenville SC Raleigh NC Lexington KY Columbia SC 100 U.S. Avg. 59 77 77 82 83 88 96 100 111 114

A region’s ability to sustain and grow high-impact industries that are competitive on an international scale OVERALL RANKING OVER TIME 9 th 7 th 7 th 8 th 9 th 9 th 2014 2015 2016 2017 2018 2019-20

Photo Courtesy of Robert Clark Photography / Nephron Pharmaceuticals

Industry Clusters

Observations

• Our economy has become increasingly diversified over the past several years, though we have few strong industry clusters to provide a private-sector backbone.

• Median household income levels have grown approximately in line with national trends and remain in the upper half of our peer cohort.

• The Columbia region’s traded cluster employment — the raw number of jobs in traded industries — has grown by just 0.03% since 2010. Industries in traded clusters — those producing products for a national or global audience — create higher-paying jobs, more innovation and greater GDP. That lack of growth is concerning.

• We’re seeing our overall percentage of employment in traded clusters decline significantly over time. The Columbia region is adding population and jobs, but not in high-value fields.

Brag Opportunity Inspiration

Columbia punches well above its weight with one of the nation’s strongest insurance clusters, with an employment concentration that is 345% the national average.

Largest Employers*:

• BlueCross BlueShield of South Carolina: 6,800

• Aflac: 1,200

• Colonial Life: 1,100

• DXC.technology: 500

• Seibels Group: 400

• Capgemini: 250

• Duck Creek Technologies: 150

A Collaborative Approach In Charleston

Across the nation, the most successful mid-sized metros use a coordinated strategy for regional economic development, often extending beyond recruitment to focus on areas such as targeted industry development, talent and livability. The Charleston Regional Development Alliance (CRDA) has approached economic development in this way, creating initiatives such as the Charleston Digital Corridor to build upon a nascent tech strength. Collaboration has been the bedrock for their success: a partnership with their regional Chamber, the One Region strategy, has led to coordinated branding and shared research, while direction from a regional CEO council has helped them tackle key challenges such as infrastructure, livability and talent.

EMPLOYMENT CONCENTRATION INSURANCE

345% THE NATIONAL AVERAGE

The Columbia region must take a coordinated, comprehensive approach to regional economic development - and the region has the opportunity to do so by supporting the implementation of Central SC Alliance’s new strategic plan. Developed in partnership with the same consultants behind successful plans in places like Columbus, OH, Houston, TX and Charleston, SC, the Central SC Alliance’s plan represents a chance to cohesively address challenges such as branding, infrastructure, talent and entrepreneurship. Concurrently, Richland County, along with many regional partners, is developing a complementary plan for targeted recruitment of high-value, knowledge-intensive industries. Together with the Central SC Alliance’s new strategy, this plan will provide new focus to industry sectors better suited for urban areas, such as insurance and financial technology, health sciences and back-office functions.

www.EngenuitySC.com 13

Source | Charleston Regional Development Alliance

*Local employment numbers approximate and subject to change, 2019

Livability

A region’s ability to build an inclusive and dynamic live, learn, work and play environment

The Metrics

Arts and Entertainment: Employment in arts, entertainment and recreation

5th/10

Healthcare Access: Physicians per 100,000 residents

5th/10

Commute Time: Length of average work commute

4th/10

Vitality:

Percentage of population aged 15 - 44 years old

3rd/10

Cost of Living Index: Relative cost of housing and everyday items

7th/10

Crime: Violent crime rate per 100,000 residents Gallup Well-Being Index: A five-part index measuring physical, community, financial, social and career well-being

14 2019-20 Midlands Regional Competitiveness Report Tallahassee FL Augusta GA Charleston SC Greensboro NC Knoxville TN WinstonSalem, NC Greenville SC Raleigh NC Lexington KY Columbia SC 100 U.S. Avg. 93 93 97 101 102 102 104 107 108 112

9th/10 10th/10

OVER TIME 3 rd 3 rd 5 th 5 th 8 th 7 th 2014 2015 2016 2017 2018 2019-20

OVERALL RANKING

Livability

Observations

• Columbia is one of the fastest-growing cities for the arts and entertainment industry, ranking either first or second in employment growth each of the past four years.

• We’re seeing steady, albeit slow, improvement in violent crime rates. This must remain an area of focus, however, as it’s an area where several of our peers have seen rapid improvement.

• The Columbia metro has steadily slipped in the Gallup Well-Being Index, from the top 20% of all regions when we first published the Competitiveness Report to the bottom 20% today. While a cause-and-effect relationship is not clear, factors affecting this perception-based index could include low wage growth, the loss of corporate headquarters and the spread of food deserts in lower-income areas.

Brag Inspiration

Columbia is rich with outdoor recreational assets:

• The Lower Saluda River is one of the only urban rivers with Class IV whitewater.

• Congaree National Park — the only national park in South Carolina — is also the nation’s closest to a metropolitan area, drawing over 160,000 visitors annually. It’s been named the #1 place to see synchronous fireflies by Smithsonian Magazine, and its River Trail has been named one of Backpacker Magazine’s “Eight Classic National Park Hikes Everyone Should Do.”

• Harbison State Forest is one of the nation’s largest urban green spaces. Its 2,177 acres offer mountain biking, hiking, trail running and river access.

• Boasting over 600 miles of shoreline, Lake Murray draws thousands of residents and visitors for world-class fishing and boating.

Trail Systems in Austin

Austin, TX, is home to one of the nation’s most comprehensive trail systems. Recognizing that a rapidly growing population needed access to the outdoors and an alternative to congested commuting routes, Austin developed a strategic plan that includes hundreds of miles of greenways, blueways and bike paths. Now, the system sees over 1.5 million users every year and draws visitors from around the country.

Opportunity

Columbia has the opportunity to build a world-class greenway system originating at Lake Murray, traversing downtown, and continuing to Congaree National Park.

To capitalize on this opportunity, a greenway system must be completed and embraced as a truly regional asset, connecting residential neighborhoods, attractions and business centers. That requires buy-in from counties, municipalities and the private sector — all possible funders and developers of the system. The potential benefits are widespread: in addition to increased recreational opportunities, potential spillover benefits include greater physical activity among residents, greener commutes and improved community interconnectivity.

The original 2.4 mile section bordering the Columbia Canal and the connected segments along the Congaree River from Cayce to West Columbia will soon be bolstered by the first section of the Saluda Greenway, while the next section — which will bridge the Broad River to the existing Columbia Canal — is in the works. Meanwhile, planning is underway for Phase 2, ultimately linking the Lake Murray Dam all the way to downtown Columbia.

www.EngenuitySC.com 15

Photo Courtesy of Brett Flashnick / Experience Columbia SC

Existing segments of Columbia’s Three Rivers Greenway (pictured) attract thousands of visitors for exercise and events.

About EngenuitySC

Governed by the highest-ranking regional leaders in education, government and business, EngenuitySC is a nonprofit that works to make the Columbia, S.C., region a standout choice for top talent and competitive companies. Structured as a neutral and independent project management team, EngenuitySC is known for achieving progress through partnerships using a unique, highly effective process. Whether it is equipping K-12 students with career-ready skills, elevating quality of life with the Midlands Business Leadership Group, or producing Competitiveness Week and the annual Midlands Regional Competitiveness Report, EngenuitySC is a trusted force, working behind the scenes to build a community cultivated for living, working, playing and learning. Learn more at www.engenuitysc.com.

Board Members

Lee Bussell — Chair

Chernoff Newman

Mayor Elise Partin — Chair-Elect City of Cayce

Councilman Paul Livingston — Secretary/Treasurer Richland County Council

Mayor Steve Benjamin — Founding Co-Chair City of Columbia

President Bob Caslen — Founding Co-Chair The University of South Carolina

Morgan Crapps Parker Poe Consulting

Scott Graves BlueCross BlueShield of South Carolina

Steve Hall Ovation Partners, LLC

Commissioner Cheryl Harris Richland County School District One Board of Commissioners

Platinum Sponsors Gold Sponsors

Silver Sponsors

Bill Kirkland

The University of South Carolina Office of Economic Engagement

Lasenta Lewis-Ellis LLE Construction, LLC

John Lumpkin

Mayor Tem Miles City of West Columbia

Councilwoman Chakisse Newton Richland County Council

Ted Nissen First Community Bank

President Ron Rhames Midlands Technical College

Dr. Keith Shah Optum

Councilman Scott Whetstone Lexington County Council

Bronze Sponsors

• Aflac

• Arnold Companies

• BullStreet District

• Central Carolina Community Foundation

• City Center Partnership

• Chernoff Newman

• Colliers International | South Carolina

• Columbia Chamber of Commerce

• First Citizens Bank

• First Community Bank

• Greater Lexington Chamber and Visitors Center

• John Lumpkin

• Lexington Medical Center

• LLE Construction

• Nelson Mullins

• SCRA

• Synovus

• The Cason Group

Public and Education Partners

1000 Catawba St., Suite 130 | Columbia, SC 29201 | 803.354.5720 | engenuitysc.com TM

Cover Photo Courtesy of River Alliance / E.P. Harkins