Foreword

The XRPL ecosystem is a galaxy of free particles. Our role as community builders is to act as a collider, accelerating these particles and forcing them to bump into each other under specific conditions, freeing a maximum of energy.

In the last six months, builders have met at APEX (Singapore) and the Core Dev Bootcamp (Paris), freeing up a lot of the energy that XRPL Commons funnels back into various initiatives: kicking off brand new education programs globally, hosting international meetups and hackathons, and accelerating projects. We have taken stock of what can be achieved through shared community effort.

The XRPL community is not only active but increasingly organized. For XRPL Commons, this represents a clear milestone: we are no longer simply facilitating–we are creating the foundation of a network with the community at its center. By enabling local XRPL hubs and strengthening ties across continents, we see our role to provide the structure that allows community members’ energy to converge, expand, and materialize into something larger.

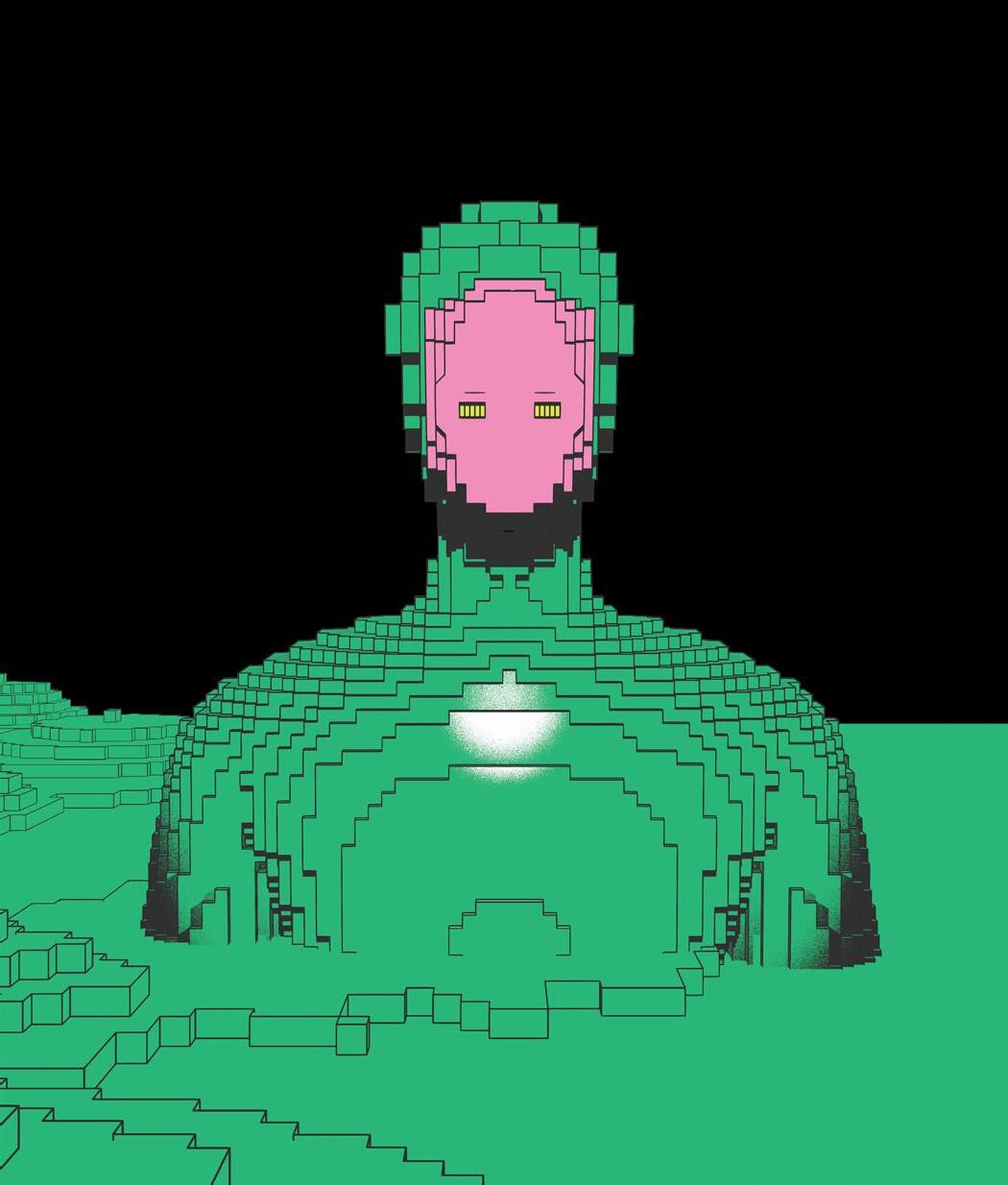

AI and Blockchain: Why XRPL Matters

With AI agents, we are entering the new paradigm of the Agentic Web, the era of delegation. Autonomous systems, powered by Artificial Intelligence, will reshape the way machines interact, transact, and contribute to the economy. For these systems to work, they need secure ways to act, exchange value, and be trusted.

Autonomous agents can now perform actions on our behalf, but only if they are identifiable, accountable, and empowered to transact securely. Blockchain provides this safe environment, where agents become first-class citizens with their own identity, credentials, and ability to sign transactions. This means that we can safely delegate powers to them, whether executing payments, accessing resources, or managing services.

From its inception, the XRP Ledger was designed for efficiency, scalability, and trust, making it uniquely well-suited to contribute to this paradigm shift. Features such as microtransactions, near-instant settlement, and a consensus model built for payments make it a suitable foundation for AI-driven systems.

For over 13 years, XRPL has been proving its resilience and reliability. It meets the requirements that AI agents need today, long before we imagined these use cases.

The implications of this are profound. Consider the HTTP protocol, which enables the internet today. Since its creation in the early 90’s, it has become the standard for seamlessly exchanging information between machines. Today, blockchain-based innovations such as the x402 or Google A2A protocols, enable instant stablecoin payments directly over HTTP. It allows APIs, apps, and agents to transact instantly, creating a real-time, pay-as-you-go model for the internet. On top of this elegant integration, agents benefit from built-in improved security, fraud protection, and dispute mitigation. It is one of the clearest examples of how XRPL will bring the “Internet of Value” to life.

To bring these ideas from concept to practice, the sixth cohort of our Aquarium Residency program explored the intersection of AI and Blockchain, giving researchers, entrepreneurs, and developers the space to test their projects, refine their ideas, and collaborate with others. The diversity and creativity of this cohort were striking. Projects such as KoVault (smart multisig vault securing crypto transactions), Whoom (AI-powered digital twins), or LexPal (decentralized language learning network) pushed the boundaries of what’s possible when leveraging both technologies, which you will discover in this edition of the Community Mag.

Looking Ahead

At XRPL Commons, technology remains anchored in the service of people. There is often a tension between longstanding aspirations, such as banking the unbanked, the

use cases being built today in DeFi, and the possibilities opened by emerging innovation. The community has a role in addressing all three: serving current needs while preparing for future opportunities, and never losing sight of the higher mission.

A significant enabler of this mission is the arrival of stablecoins. Over the past months, adoption has accelerated rapidly. From RLUSD to new issuances in Brazil, Singapore, and Europe, stablecoins are reshaping the landscape by reducing volatility, thus lowering barriers. Globally, events such as Circle’s IPO, the GENIUS Act, and pilots by companies like Walmart and Amazon point to a new chapter of adoption. The XRP Ledger, designed for efficient payments from day one, is ready to support this growth.

This is why our next Aquarium cohort will focus on Stablecoins and Yield Generation. By supporting entrepreneurs and developers focused on stablecoin use cases, we are helping the ecosystem prepare for mainstream adoption and build practical applications that benefit both individuals and businesses.

Looking ahead, XRPL Commons will double down on building community as a network. We are strengthening ties with new regions, including Bahrain, Kenya, and Madagascar, and creating a global approach to meetups. We are also supporting open-source projects through Glow, and facilitating collaborations, like the one with Baselight and XRPScan. Each of these steps brings different people and ideas together, reminding us of a simple fact: the whole is greater than the sum of its parts.

XRPL Community Recap: From Dublin to Thessaloniki, With Love

It’s 5 pm in Dublin, late May, and of course, it’s raining.

By Zsofi Borsi

Again. As we haul our gear through the gates of Trinity College, I silently make peace with the fact that every XRPL meetup I help organize seems to summon the clouds. We’re here for our first event of the quarter, and we’ve teamed up with Propto, Ripple Ireland, and Peerkat to explore all things tokenization and DeFi. By 6:15 pm, we’ve run out of merch and chairs, and I’m counting how many people squeezed into the room (giving up at around 75). Steven from Propto moderates his first-ever panel — nervous, but smiling— acing it. Later that night, we take blurry selfies with the team next to a parked tractor on our way home (don’t ask). I eat Tesco tomato soup in my hotel bed and scroll through the photos, tired and happy.

Fast forward to Brussels, June 24. A mellow Tuesday, we’re posted up at the Cryptosquare Hub, a cozy Web3 co-working space perfect for beginners and experts alike. This meetup is all about accessibility and XRPL 101. We craft a gentle intro session with former Aquarium Residents and XSpectar—no heavy jargon, just open conversation. The questions are honest and curious, and the interactions remind the team about why these entry-level sessions matter. You have to start somewhere.

Less than a week later, it’s June 30, and we’re in Cannes, where the air smells like sunscreen (the really

expensive kind). But inside the venue, the conversation is pure tech: it’s the launch of the EVM sidechain. We’re joined by Peersyst, Axelar, and Ripple, and the energy is electric. This is big: EVM compatibility is a game-changer for our ecosystem. People really showed up to understand what this launch actually means, and how they might use it. Some had tricky questions. Others were just quietly absorbing it all. But there was a real sense that this was something new opening up for XRPL, and people wanted to be there at the start.

Then it’s September in Thessaloniki. A warm breeze, a sea view, and palpable excitement as the Greek blockchain community gathers in the small conference room. Held together with Anodos Finance, this meetup, in founder Panos’s hometown, has been long in the making. The topic is on-chain finance and tokenization; it’s serious, but not stiff. The presentations go deep. The attendees are a mix of newcomers and well-versed devs, both types focused and full of questions. Midway through, the Deputy Mayor himself drops by, underscoring the city’s growing momentum. Anodos speaks of an ambitious vision: transforming Thessaloniki into Greece’s first and biggest blockchain hub.

In between all of this, there’s a special kind of magic in Malta. Though not officially “ours,” the conference—organized by Bithomp and Snwo.man – felt like home, just pure community

spirit. We talked RWA tokenization, wallets, and ecosystem funding in the most unfiltered and genuine way. “For the community, by the community,” wasn’t just a tagline–it was of the essence.

Looking back, this past quarter was about more than just meetups. Yes, we organized four community events, with over 300 people joining. But to me, what matters even more than numbers is how these events made people feel: curious, connected, and inspired. From Dublin to Brussels, Cannes to Thessaloniki, and even on the island of Malta, the XRPL community showed up with ideas, feedback, and good intentions.

There’s a quiet generosity here. A sense of momentum and goodwill that doesn’t need to be put on a pedestal. If this quarter taught me anything, it’s that real community can be simply built and cultivated by people who care.

So if you’re reading this, consider it your invitation: to attend the next event, to DM us with your idea, to raise your hand even if you’re unsure. We’re here, creating something real –together.

LEARN MORE

> Check out our next events!

Building the Future of XRPL: Inside the Core Dev Bootcamp

This past July, XRPL Commons organized a unique and ambitious event: the Core Developer Bootcamp.

If you’re excited about decentralization, performancecritical systems, or cryptographic protocols, join us in shaping XRPL’s future. Check out the presentations on our YouTube playlist, drop by our upcoming events, or apply for the next Core Dev Bootcamp! xrpl-commons.org/build/core-dev-bootcamp

By Thomas Hussenet

For two weeks, we brought together developers, mentors, and core engineers from around the world to dive deep into the internals of XRPL and rippled, the open-source C++ codebase that powers the XRP Ledger.

Led by Program Manager Denis Angell (Software Engineer, XRPL Labs), with talks and insights from some of the most influential minds in the XRPL ecosystem including David Schwartz, Vito Tumas, Qi Zhao, Mayukha Vadari, and Valentin Balaschenko, the bootcamp was more than just a learning experience. It was a catalyst for a new wave of contributors to XRPL core development.

A Global Cohort

Over 15 fellows from diverse countries and backgrounds were selected to attend, bringing their unique perspectives and enthusiasm for decentralized technologies. What was their shared aim? To become active contributors to the XRPL core, whether by drafting new amendments, optimizing existing code, writing unit tests, or improving documentation.

The Journey: From Rippled 101 to Real Contributions

The bootcamp was intense and hands-on. It kicked off with foundational sessions like “Rippled 101,” setting the stage for deeper dives into the rippled architecture, consensus protocol, UNL (Unique Node Lists), and smart contract mechanisms on XRPL.

Each day was carefully structured with morning lectures and interactive sessions on key topics such as:

> Anatomy of a Rippled: Transactors, ShaMap, Ledger Entries

> Consensus mechanics and Negative UNL

> Cryptography and Signature tracing

> WebSocket architecture and RPC handlers

> Smart Contracts on XRPL: Comparisons and Practical Implementations

Afternoons were for sprints, group challenges, and handson assignments. Fellows got to build custom RPC handlers, simulate forks and fix broken networks, trace transactions through consensus, and even prototype new amendments.

With a carefully structured curriculum, the bootcamp balanced deep technical lectures with hands-on coding through a sprint framework.

Learning By Doing: The Sprint Framework

The sprint-based structure helped fellows apply concepts quickly and effectively. Over several coding challenges, they explored RPCs, built and tested custom handlers, and integrated live data streams. The experience culminated in a “Code Quest,” tracing a transaction from key generation to full validation.

Inspiration from Experts

One of the bootcamp’s major highlights was the expert talks. David Schwartz joined for an intimate Q&A and shared his thoughts on the future of core development, the amendment process, and the evolving role of developers in maintaining decentralized protocols.

Valentin Balaschenko gave a deep technical dive into the ShaMap, XRPL’s internal data structure used to maintain the state of the ledger. Vito Tumas discussed the peerto-peer layer, explaining how nodes communicate and synchronize across the network. Mayuka Vadhari focused on smart contracts, especially smart escrow design, and led a detailed walkthrough on how to draft and propose new amendments. Finally, Qi Zhao brought valuable insight into performance testing, helping fellows understand the tools and methodologies for ensuring scalability. Each session combined high-level vision with deep technical content, inspiring and equipping the next generation of XRPL contributors.

What’s Next?

At XRPL Commons, we plan to continue this initiative, making core development more accessible and inclusive. If you’re a developer passionate about decentralization, performancecritical systems, or cryptographic protocols, we invite you to join us in shaping the future of XRPL.

Stay tuned for more bootcamps, open calls for contributors, and community-driven efforts.

Expanding Blockchain Education Worldwide

In 2025, XRPL Commons advanced its mission to make blockchain education accessible worldwide. Under the leadership of Dr. Vera Radeva, strategic collaborations,UBRI, and new academic alliances expanded our reach, deepened research, and opened opportunities for students and innovators alike.

Broadening our Academic Reach

This year saw the launch of a three-day immersive study trip with IE Madrid, now part of the Global Gateway Program. Our instructor network expanded to 30+ professors worldwide, while Academic Breakfasts became a platform for resource-sharing and XRPL updates. UBRI faculty, including Rasa Karapandza, Alexander Chevtaev, and Walter Hernandez, also added courses to OASIS, our internal teaching platform.

Pushing the Frontiers of Research

Collaboration remained central to our growth. Visits to University College London and Trinity College Dublin sparked new research partnerships, while a Cryptography & Blockchain seminar with Prof. Massimiliano Sala introduced valuable expertise into the XRPL ecosystem. Targeted trainings at Bayes University’s Master’s Program, IE Madrid, and ESGI Paris provided students with hands-on blockchain learning experiences.

A major milestone came with our first CIFRE contract from the French National Research Agency. Under the supervision of Prof. Parisa Ghodous and Dr. Vera Radeva, Mathis Sergent began a three-year PhD on interoperability, bridging academic theory with real-world blockchain challenges. Support for EPITA’s UBRI PhD program also continues to grow.

Student Engagement and New Milestones

Students remained at the center of our efforts. XRPL Commons co-sponsored hackathons at Paris Blockchain Week and partnered with universities to host international competitions in Rome (Nov. 2024) and Berkeley (Mar. 2025). In September, we also returned to the TUM Blockchain Conference for the third time.

Beyond Europe and North America, we expanded our footprint across Africa and the Caribbean through collaborations with the African Blockchain Institute and Crypto Mondays Africa/Caribbean, strengthening inclusivity across the XRPL ecosystem.

WHAT’S NEXT

Take a look at the next opportunities to learn, collaborate, and innovate with the XRPL Commons community.

> EPITECH 5-Day Masterclass on XRPL Paris, France (Nov. 2025)

> IXH25 Italian XRPL Hackathon Rome, Italy (Nov. 7-8, 2025)

Find out more about our education initiatives by scanning the QR Code! xrpl-commons.org/learn/get-started

Meet the Team

Engaging the Community with Zsofi Borsi

Zsofi moved to Paris to join XRPL Commons, leading its community-focused initiatives. Not exactly a “tech nerd”, she is interested in blockchain’s potential for decentralized governance across communities of all scales.

What

is your role at XRPL Commons?

As the head of the Engage pillar, my work revolves around community initiatives, such as the XRPL Community Magazine—the publication you’re currently reading, coproduced by the entire ecosystem. Another focus is the XRPL Meetup initiative; with Senior Event Manager Elisa Bailly, we cultivate in-person engagement via panel discussions and events with local members, startups, and universities. Finally, the XRPL Town Halls are online gatherings,to present ongoing projects and discuss the latest technical updates.

As someone with a non-tech background, how has your experience been engaging with the XRPL blockchain community?

It’s been great. Everyone is excited to make things happen together. And being more of a “generalist” can even be an advantage. I enjoy having a broad overview of niche topics, and bringing a fresh perspective to technical discussions – making them more accessible and relatable for larger audiences.

How did you find XRPL Commons (or how did it find you)?

While working at the OECD, I first got involved with blockchain, and became fascinated by how it can support

grassroots initiatives. The chance to join XRPL Commons and collaborate with people using this technology to make a realworld impact really appealed to me.

On a personal note, becoming the editor of a print magazine is super exciting! As David Bchiri likes to say, each issue captures a snapshot of where our ecosystem is at a certain moment—something valuable to look back on.

Sometimes, the blockchain space seems saturated and overwhelmed, with many initiatives fighting for regular engagement. As Head of Community Engagement, do you have any insights on keeping the community active and genuinely connected?

There are many “communities” out there, but online chats or chasing airdrops isn’t what creates real connections. What matters most are the conversations that spark curiosity and the challenges that we address collectively. I’ve seen familiar faces in the XRPL community who always come back and contribute—not because they have to, but because they genuinely care about what we’re building together. For it to last, there needs to be conviction: belief in the tech, alignment in values, and a feeling that what we’re creating can have a real impact in the world.

Postcards From APEX

In June, we traveled to Singapore for the APEX and UBRI conferences. Over three packed days of insightful talks to late-night networking, the experience left a lasting impact on our work and connections. Now we’d love to get the community’s experience!

Your testimonials from the 2025 XRPL Summit

Apex was…hot!

This was my second time attending Apex, and first time in Singapore in over twenty-five years. The energy of the XRPL community was as palpable as the equatorial heat. The talks, keynotes, workshops, and side events filled out my understanding of many parts of our ecosystem; however, it was the one-on-one interactions with developers or community advocates where I really felt rewarded. A bit in the weeds for some, but I was happy to talk in depth about the new squelching protocol for Ripple that should reduce global bandwidth requirements by about 20TB per day!

MATT MANKINS @mankins

SwissHacks

the spark to build. APEX showed us where we could contribute long-term.

gave us

In April 2025, our team joined SwissHacks - a fintech hackathon co-organised by Ripple, Tenity, and the Swiss Financial Innovation Desk. The challenge: to build a real-world solution to enhance stablecoin payments on XRPL using RLUSD.Our project NetiShield – a PSD2-like smart escrow solution with programmable fraud prevention, bringing compliance-grade protection to RLUSD transfers, earned first place in the Ripple Challenge. A few months later, we were invited to pitch NetiShield at APEX. Beyond the presentation, the real value came from conversations off-stage - with core developers, Ripple representatives, and community builders. Those discussions gave us a broader perspective on XRPL’s evolving needs - including integration challenges, tooling gaps, and the importance of regional ecosystem growth. That’s when we realized: our technical background could help address needs beyond just one product.

Thanks to the insights gained at APEX, we’re now exploring how to support XRPL as a long-term integration partner - simplifying onboarding, strengthening infrastructure, and contributing to growth in regions like Poland.

MATT SACZEWSKI, BD Lead at Neti

The XRPL is Multichain-Ready!

The XRP Ledger had been an isolated network in the broader Web3 ecosystem for way too long. But that has changed drastically this year, with the XRPL EVM Sidechain launch! What this means is nothing less than the introduction of cross-chain interoperability and EVM-based smart contracts accessible from the XRPL through Axelar’s [G]eneral [M] essage [P]assing and the integration of XRP into new DeFi ventures. Even though the XRP Ledger naturally cannot offer staking, as it’s a network without financial incentives for block production and doesn’t run on PoS, we will still be able to stake XRP in a tokenized form cross-chain on Flare. Or utilize Strobe, a money market protocol for DeFi lending on the XRPL, while bridging messages to smart contracts on the XRPL EVM sidechain. Basically, new yield-bearing possibilities that simply didn’t exist prior to XRPL and XRP opening up its borders.

Although it will take some time for these new connections to mature, we can already see the general direction in which things are heading: freedom to transact and not limited to the underlying source-chain. With Wormhole as an additional interoperability platform also in the pipeline, we can finally bring new liquidity to the XRP Ledger and tap into the massive $132B Web3 on-chain DeFi that was just waiting for us to join the fun!

A Celebration of Innovation, Community, and Real-World Impact

Right off the bat, the conversations were electric. The community has been actively engaging in online discussions for months, and seeing those discussions evolve in real time, in real life, was incredible. Builders presented projects that bridge blockchain with everyday life—from tokenised assets and stablecoins to real estate and gaming. The push toward smart contracts and interoperability was front and centre, with Mayukha’s developer workshop.

A highlight for many was the XRPL Commons lunch workshop, which created space for deep-dive collaboration. Seeing university teams from across the globe participate alongside seasoned builders brought a fresh perspective and reminded us how education and innovation go hand in hand.

A personal highlight was my opportunity to moderate a panel on tokenization, a topic at the core of blockchain’s tangible value. It was an honour to guide the conversation with experts who are pioneering tokenized assets on the XRPL. The depth, clarity, and forward-thinking shared on that panel truly reflected the maturity and momentum of the XRPL ecosystem.

Apex 2025 reminded us all of the power of community—not just in online channels, but when we gather, face-to-face, to share knowledge, spark innovation, and celebrate our collective journey. It’s clear that XRPL is no longer just a blockchain; it’s a thriving ecosystem of problem-solvers, creators, and change-makers.

DANELLA DRAPER @CryptoQueenAU

From a Researcher’s Perspective

My journey as an UBRI researcher began with my master’s thesis, where, with guidance from Professor Hitesh Tewari, I dove into the world of blockchain and post-quantum cryptography, eventually integrating CRYSTALS-Dilithium into the XRP Ledger.

UBRI Connect was a standout experience, bringing together researchers and students from UBRI-affiliated universities worldwide, with each team sharing innovative research. Presenting my work on post-quantum cryptography for the XRPL to such an engaged audience was both humbling and motivating.

The evening of UBRI Connect was truly memorable. The formalities gave way to a more relaxed vibe where I had the chance to connect with fellow researchers, students and Ripple team members on a personal level.

Apex 2025 further deepened my engagement with the XRP Ledger ecosystem. I found sessions on interoperability, zero-knowledge proofs, and amendments particularly insightful. Mayukha Vadhari’s talk on smart escrows and programmability in XRPL was a highlight, heralding the advent of smart contract functionality within the ledger.

Receiving the XRPL Contribution Award at UBRI Connect was an unforgettable honour, especially so early in my career. The event not only broadened my perspective but also reinforced my commitment to advancing cryptography and blockchain research within the UBRI consortium.

ATHARVA LELE, Trinity College Dublin

for Q3 2025

XRPL in Numbers XRP Ledger

Date range: June, July, August 2025

Total transactions

181,432,765

An average of 1,972,095 transactions per day

Successful transactions

148,286,763

An average of 1,611,812 transactions per day

Failed transactions

33,146,002

An average of 360,282 failed transactions per day

Total payments

107,973,764

An average of 1,173,627 payment transactions per day

Total fee burned

256,098 XRP

An average of 2,783 XRP burned per day

New accounts activated

462,370

An average of 5,025 accounts were activated per day

NFToken transactions

6,392,130

The total number of NFT transactions during the quarter was 6,392,130.

AMM Transactions

290,284

The total number of AMM related transactions during the quarter was 290,284.

Holder of USD Stablecoins

AMM Overview

Total XRP Pooled in AMMs: 11,580,086 XRP

Total active AMM pools: 22,352

Oracle Overview

Total active Oracles: 23

Total Oracle data submissions: 1,125,926

Credential Overview

Total credentials created: 6

Numbers provided by XRPSCAN

XRPSCAN is the leading blockchain explorer and analytics platform for the XRP Ledger. Used by over 50+ exchanges globally, including Coinbase, Binance, Bitkub, and Bitpay, among others, to look up XRP Ledger account information and show Proof-ofTransaction to their users. Via its powerful API service and Search platform, it provides wallet services, exchanges and forensics teams accurate insights into on-ledger activity.

> xrpscan.com

XRP Distribution

Total Activated accounts: 6,954,452

Total XRP Burned: 14,195,887 XRP

Total XRP Escrowed: 35,308,948,895 XRP

Total XRP Circulating: 64,662,659,331 XRP

XRPL Commons has teamed up with Baselight and XRPSCAN to usher in a new era of decentralized public analytics for the XRPL. The three organizations are making XRPL data fully indexed, queryable, and remixable via Baselight—allowing developers, researchers, and institutions to access structured, clean on-chain data without having to run their own infrastructure. Included in the offering are real-time datasets on liquidity in AMMs, token metadata, network metrics, validator behavior, child accounts, well-known accounts, and balance distributions. This initiative aims to fuel deeper insights, crosschain research, compliance tools, dashboards, and innovation across the XRPL ecosystem.

XRPL Founder Story: First Ledger

Interview by Zsofi Borsi

The 2024 launch of First Ledger rocked the XRPL ecosystem, making token issuance and trade possible through Telegram. What started as a simple idea triggered a wave of token creation on XRPL, fueling the rise of countless community-driven projects. Today, First Ledger is one of the XRPL’s fastestgrowing platforms. Behind it are Adam and Christopher, founders of xrp.cafe, the network’s leading NFT marketplace, who created First Ledger with a mission to lower barriers on XRPL. From NFTs to meme coins to token allocation models, their work has been at the center of some of the XRPL’s most important experiments.

Check out First Ledger > firstledger.net LEARN MORE

Why did you start First Ledger? Was it something you needed yourselves, a gap in the ecosystem, or something else?

We started our journey on the XRPL back in 2021 with an NFT project called PARC. We wanted to build something crypto-related, and being long-time XRP holders, it just made sense to check the ledger out. When we first came over, we saw there was a lack of open-source tooling allowing non-technical users to interact with the ledger. So we made that our mission to create open-source tooling for the greater community to use. Shortly after that, we teamed up with a couple of other members within the XRPL community to create xrp.cafe due to the lack of easy-to-use NFT marketplaces. As for First Ledger, we noticed that other networks’ users were gravitating towards community-run tokens, and that was one of the main things the XRPL was lacking. People have opinions on tokens of these sorts, but at the end of the day, it brings people

together and helps push the network and pull users from the outside in as they see people talking about the chain and what’s going on.

Were there moments where you genuinely doubted First Ledger would work?

Most people don’t know this, but First Ledger launched in March 2024 and was basically dead on arrival. We released a solution for a problem that was not yet there. The first revision of First Ledger was basically just a Telegram wallet to buy and sell tokens, but there was nothing to buy, so there was minimal usage. We had fewer than 100 users per week, and virtually no one was talking about the product. So we went back to the drawing board and thought, what does the ecosystem really need? That’s when the whole First Ledger ecosystem came together. First Ledger is now a full trading platform and token launchpad with some gamified aspects, such as a leaderboard for trading and a referral program.

A practical one: when did you actually start paying yourselves, and what had to be true for that to happen? So many builders never make it to that point. What did it take financially and structurally to turn the corner?

We received our first paycheck from First Ledger in December 2024, roughly 2 months after we re-launched. Prior to the revamp of First Ledger, Adam and I took the risk and quit both of our full-time jobs to pursue First Ledger around April 2024. During the time of development, we were 100% self-funded when it came to servers, but everyone was working for the love of the project and the potential that it had. When building a team with no external funding, you have to make sure everyone is on the same wavelength and understands the objective at hand.

What was the moment First Ledger stopped being a side project and became a real business?

The day First Ledger re-launched, it was basically an overnight success. Within the first week of release, we had over 10,000+ users on the platform doing hundreds of thousands of transactions with millions of dollars in volume. At that point, we knew we had something special, and this wasn’t going away anytime soon.

What changed with Joey Wallet? Did owning the wallet stack unlock growth for First Ledger?

Joey Wallet came into the picture due to feedback we received from newer users entering the ecosystem. Most of the feedback was centered on tedious onboarding into the XRPL ecosystem. The main goal for Joey Wallet was to make new users’ journeys as seamless as possible. At this moment, it takes around 15 seconds to onboard to the XRPL using Joey!

There’s a big gap between launching a useful tool and running a profitable business. What revenue models did you test, and what’s actually working now?

I feel like this is where most projects drop the ball. Not so much do you have to reinvent the wheel, but with other ecosystems being more established on the retail front, you get a free view of what works and what doesn’t. The main thing we did was see what worked in other ecosystems and create a somewhat Frankenstein build, combining multiple platform revenue and incentive models into one.

You’ve built multiple products in the XRPL space–what do most new builders get wrong when trying to turn a project into a sustainable business? Any patterns or traps you see over and over again?

Build, refine, and prepare to pivot to what is actually getting traction. On day 1, build out a business plan, sustainable revenue model, and go-to-market strategy, but keep it flexible enough to make adjustments throughout the execution plan. When coming up with ideas, talk to people, get community feedback, and build for what there’s a need for, not for what you personally want to see. It’s not all about your personal vision, but product market fit.

For XRPL builders trying to go full-time: what’s the one thing nobody tells you about building a business in this space, but they really should hear?

The XRPL isn’t a get-rich-fast chain; you have to sink blood, sweat, and tears into it and actually build a community before thinking about how much money you’re going to make.

Reflections on the Start and Future of the New XRPL Foundation

By Matt Mankins

My journey with the XRP Ledger Foundation started a year ago when a group of stakeholders came together in Paris for a multi-day workshop to gauge support for starting a new foundation to support the XRP Ledger community. I was fortunate to join the representatives from XRPL Commons, XRPL Labs, XAO DAO and Ripple, as well as numerous validators, developers, and entrepreneurs, as we debated what kind of a foundation was needed moving forward.

Like the wider community, each of us individually had our own reasons for supporting the XRP Ledger, but we knew that collectively we could do more. A distributed ecosystem has its merits, but a focused foundation can be the flywheel needed for progress. You could sense the excitement and urgency to get this foundation up and running as soon as possible so that our blockchain ecosystem could reach its full potential.

With that thought, we formalized the legal entity, allocated a budget to start operations, and began the process of setting up the new XRP Ledger Foundation. Like traditional tech startups, the early days involved a lot of volunteer work from the board members and the greater community. It was at this point that I joined as the interim director and applied my experience as a founder to doing whatever it took to jumpstart operations.

I’m proud to have spent these last few months doing something different nearly every day: we set up an intellectual property portfolio, created the outline for communityled working groups, held a trial infrastructure-focused working group, assembled the financial and technical back office, published our web presence, updated our branding,

automated the UNL publishing process and met our community members around the globe, including our recent sponsorship at Apex in Singapore. Recently, we’ve built our operating budget and are finalizing the recruitment of an executive director to lead the future foundation.

What stands out to me most, though, is the people in our community. The foundation is here to support you and your use of the XRPL. Whether in validator calls, GitHub discussions, or chance meetings at events, I’ve seen how deeply this community cares and wants to build a meaningful future with the XRPL. The passion, the energy, the thrill of a new amendment or server version going live gives me confidence that we have the momentum needed to take us well into the future.

Helping to stand up the XRP Ledger Foundation has been one of the most rewarding chapters of my career. I’m proud of how far we’ve come, and am even more optimistic about what’s next. With a new team in place and the global community of stakeholders behind them, I look forward to watching the XRPLF enact our dreams and add color to our outlines.

XAO DAO: A CommunityLed DAO Fueling XRPL Innovation

By Fabio Marzella

XAO DAO LLC is a Wyoming-registered decentralized autonomous organization designed to empower the XRPL community. It provides a structured platform where developers, creators, and supporters can shape the future of the XRPL ecosystem together.

XAO DAO is built for sustainability. Membership fees and its upcoming XAO HUB app will provide self-sufficient funding to keep community initiatives thriving. The DAO complements the XRPL Foundation (XRPLF) by giving the ecosystem a transparent, community-driven voice in decision-making and resource allocation.

OUR MISSION

XAO DAO exists to:

> Channel community proposals into actionable outcomes

> Engage diverse participants across the XRPL ecosystem

> Support aligned initiatives and builders

> Promote accountability and transparency in governance

In short, XAO DAO gives the XRPL community a structured way to elevate its needs and ideas, channeling them to the XRPL Foundation so they can be addressed at the highest level.

WHY IT MATTERS

XAO DAO isn’t just another DAO — it’s a grounded, community-powered engine for XRPL innovation. We’re taking a phased, practical approach so the DAO grows with its members. No hype, just solid, community-led progress.

Milestone 1 (by Aug 31, 2025): Building the Basics

> Launching the XAO DAO Governance App on the XRPL EVM sidechain

> Smart contract-based yes/no voting with a simple member dashboard

> Proposal submission form with easy UI/UX

> Non-transferable governance tokens proportional to XRP holdings

> Recruitment of developers, community managers, and contributors

Milestone 2 (by Oct 31, 2025): Growing the Community

> Upgraded governance app with timeclocks, quorums, and XRPL mainnet integration

> Local and online meetups, community chats, and conference participation

> First round of micro-investments (under $5k) for builders and creators

Milestone 3 (Coming Soon): Full Steam Ahead

> Release of the XAO HUB app — the all-in-one platform for proposals, project tracking, and participation

> Governance rules embedded directly into the app

> Monetized features to fuel long-term sustainability

> Larger funding rounds (up to $10k per project) and strategic partnerships

> Website: xaodao.io

> X/Twitter: @XAODAOLLC

> Email: info@xaodao.io

Xaman in Numbers: The Engine of the XRPL Ecosystem

By Robert Kiuru

Today, Xaman is not just a wallet but the engine of the interaction layer with the XRPL and Xahau.

Xaman is built on a single guiding principle: feature-complete self-custody at ecosystem scale. Every feature, release, and interaction with users has been shaped by the belief that people should have full control of their assets while enjoying a secure, seamless, and dependable experience.

Growth Without Compromise

THE PAST TWELVE MONTHS OFFER A SNAPSHOT OF XAMAN’S TRAJECTORY

735,000 active users, an increase of 45.8%

22 million actions taken within the app

461,000 new users, an increase of 85%

For more than half a decade, Xaman has been the go-to wallet for the XRPL. What began as an ambitious undertaking by Wietse Wind in selfcustody has grown into the most trusted hub for millions of users and thousands of builders.

The United States led the way with 251,000 active users, up 80.1 percent. The UK followed with 40.9 percent growth. Indonesia added 39,000 new users, up 21.2 percent.

Behind the numbers lies a story of trust. Since launch, Xaman has recorded zero security breaches. That track record allows adoption to expand quickly while keeping confidence intact. Users keep billions in self-custody with Xaman, a responsibility that demands nothing less than maximum security and maximum reliability.

Every action, from the smallest transaction to large-scale custody, carries the weight of real value and real trust. Xaman has embraced that challenge, proving that growth can scale without compromise.

Support That Scales With the Ecosystem

As the user base grows, world-class support has become critical. In the past year alone, more than 18,000 support tickets were handled, with 99.6 percent resolved within 24 hours. A dedicated support team ensures that issues are addressed promptly, reinforcing the feeling that Xaman simply works.

Xaman’s support team is the pillar of assistance across the XRPL, delivering every user a gourmet experience with real humans answering real questions.

Their knowledge covers every corner of the XRPL, making them the brains of the ledger itself. Whether it is a beginner’s first transaction or a developer’s advanced query, every question finds its answer.

This combination of transparency, openness, and responsiveness has created more than a product. It has created a brand that people rely on.

More Than a Wallet

Xaman is the central hub where users sign, explore, and engage with XRPL projects. With Xaman Cards, our coldwallet product, digital assets extend naturally into the physical world.

They offer a secure, tangible way for people to interact with their holdings, blending everyday usability with the highest standards of self-custody. Powered by Tangem’s proven Near Field Communication (NFC) technology, Xaman Cards are sleek, tap-to-use hardware wallets that make securing and spending assets as simple as using a contactless payment card.

The wallet has also become the default sign-in and signing solution for XRPL projects, enabling smooth interaction across the ecosystem. This is solidified by the massive ecosystem around xApps within Xaman.

xApps drive daily engagement. Over the past 12 months, the top five xApps alone were opened 8 million times. Across the ecosystem, 265 xApps were used during that same period. 26 of them surpassed 50,000 opens, and 54 passed the 10,000 mark. These numbers show how builders are using Xaman as a launchpad for meaningful products.

Empowering Builders

Xaman continues to serve as the bridge between developers and users. In the past 12 months, we have worked hard to make XRPL DeFi more accessible.

With Xaman 4.2.1, support was added for Credentials and for sending tokens without trustlines (via Checks).

Work on adding full support for batch transactions is already underway, alongside many special things that we have coming up in the pipeline. These are just a few examples of the many special things our team is delivering to push the ecosystem forward.

Developers benefit from a complete suite of resources. Clear documentation, reliable SDKs, stable infrastructure, and educational content provide the foundation to build with confidence. Weekly downloads of the Xumm SDK remain steady at around 3,500, a testament to the trust developers place in the tools we provide.

The Road Ahead

Looking forward, the focus remains on expanding utility and strengthening the experience. A new website is coming up. More Xaman Cards are on the horizon. Educational content will continue to evolve to serve both newcomers and experienced developers.

For millions of users, Xaman represents freedom and reliability. For thousands of builders, it represents trust and opportunity. For the XRPL and Xahau ecosystems, it remains the engine that drives participation and growth.

As Wietse Wind puts it: “Our goal is not to be just another wallet in the crypto space. It is to lead the charge, to listen to our users, and to shape the future of self-custody by building what the community truly needs.”

XRPL’s Cutting Edge: New Features and Amendments

By Krippenreiter

Since its inception, the XRP Ledger has been strategically evolving to make payments faster, more secure, and more flexible. With wise foresight, what many other ecosystems and founders realized only years later was that participants, such as institutions, must feel comfortable and understood. This naturally led to compliance efforts at the most fundamental level, layer-1.

Following discussions on social media or debates about new features, one thing becomes very clear: there is an overwhelming amount of technical advancements happening in our XRPL ecosystem right now, and it’s almost impossible to keep track of everything, let alone understand why these new changes to the core protocol are needed.

Protocol Amendments: Core Updates to XRPL Transaction Processing

Before we discuss the new features and upcoming changes to the ledger, let’s briefly recap what amendments are.

An amendment is essentially a set of proposed, fully functional code changes to the XRPL that change the way transactions are processed. As you may have guessed, this includes both new features and specific bug fixes.

This way, validators have the final say on which “major” code changes are actually enacted on the ledger and can coordinate their activation without jeopardizing the health of the XRPL as it makes steady forward progress.

NEW TOOLS

BUILDING BLOCKS FOR DEVELOPERS

Proposal: MPTokensV1

What’s added: Multi-Purpose Tokens as a new flexible token type on XRPL.

Why it’s needed: MPTs simplify the management of tokenizable assets, as they are less complex and use less space on the XRPL than the trustline-based token standard.

What’s the use case: RWA tokenization

Real-life example: Institutional tokenization and issuing of US Treasury Bills

Proposal: PermissionedDomains

What’s added: New access control mechanism to define purposely restricted environments for the XRPL.

Why it’s needed: Enabling compliance-driven on-chain finance by allowing anyone to define access requirements for specific instances of XRPL protocols

What’s the use case: Creating filtered spots for assets and users on XRPL by restricting access to those with valid credentials.

Real-life example: A bank sets up a domain for US citizens that can only be accessed by users with correct KYC credentials, similar to restricting app access to verified customers.

Proposal: PermissionedDEX

What’s added: New controlled trading environments based on order books, where users can offer assets based on limited access for authorized users on the basis of their credentials.

Why it’s needed: While the open and permissionless XRPL DEX allows trades with anyone, risking violations of regulations like sanctions, pDEXs allow for vetted trading to meet compliance needs.

What’s the use case: Building compliant trading spaces for regulated assets or currencies among verifiable groups like institutions.

Real-life example: A bank sets up a permissioned DEX order book to trade stablecoins exclusively with other authorized institutions within the US or with US citizens.

Proposal: PermissionDelegation

What’s added: Similar to RegularKeys, a mechanism for assigning privileges in order to delegate specific permissions to other accounts, allowing them to send specific transactions on their behalf.

Why it’s needed: Allows for multi-party workflows and advanced account key management strategies that help with regulatory compliance, such as approving users for restricted tokens.

What’s the use case: Creating role-based transaction privileges for frequent approvals in token issuance or transaction handling without the need to regularly sign with main-account keys.

Real-life example: A stablecoin issuer like Ripple delegates user authorizations for trust lines to a third-party KYC-provider account while keeping Ripple’s master key securely offline for a secure configuration as a part of their defense-in-depth strategy.

UPCOMING PROPOSALS AND DRAFTS

WHAT’S ON THE HORIZON

Draft: Sponsored Fees and Reserves

What’s added: A way for users to transact and keep control of keys and accounts while another party (e.g., a platform) pays the fees and/or reserves for them.

Why it’s needed: It simplifies onboarding and lets sponsors handle fees and reserves for others to abstract away the complexity behind using the XRPL.

What’s the use case: Projects pay fees for the transactions of their user base and cover reserves for their customers’ new accounts or objects, such as trust lines.

Real-life example: A wallet app pays the reserve for each new customer account that is created as users start transacting on XRPL without buying XRP first.

Draft: Lending Protocol

What’s added: On-chain tools for utilizing pooled funds with pre-set terms for interest-accruing loans, including managers to set terms and agreements to track borrowing.

Why it’s needed: Boosts DeFi-based money markets on XRPL by enabling direct, uncollateralized loans.

What’s the use case: Lenders pool money for borrowers to draw and repay over set periods, with built-in protections like an optional first-loss capital protection scheme.

Real-life example: A small business borrows from a community vault to buy equipment, repaying in installments with interest added automatically.

Draft: Smart Escrows (+ WASM VM Configuration )

What’s added: WASM-based VM that supports custom code for escrow contracts to define release rules, with secure setup for execution limits and costs.

Why it’s needed: Extends basic escrow contracts with programmable release conditions, making XRPL escrows more versatile.

What’s the use case: Enables escrows for notary approvals, compliance checks, or rewards released based on the completion of milestones.

Real-life example: A betting platform that locks funds based on price oracle data so users can bet on whether XRP will ever reach a price of $5.89 by the end of 2025.

Wrapping up: XRP Ledger’s Future

The next wave of adoption will likely come from the aforementioned changes to the XRPL that should finally allow Ripple to come on-chain, which is something we’ve all envisioned since the beginning of our XRP journey. For this, three key pillars must be addressed and built to tackle the remaining pain points:

> Granular Control and Customization

> Compliance and DeFi

> Privacy and Auditability

Rising Nodes: XRPL Across the Asia-Pacific Region

From its towering financial hubs to its winding outbacks, the region holding nearly half of all XRPL NFTs is becoming the clear blockchain leader, for cutting-edge business and emerging markets.

From Japan all the way down to Australia, the AsiaPacific region (APAC) comprises over a quarter of the World population, and has been an engine for innovation and economic development over the past few decades. With APEX moving to Singapore in 2025, it is clear that the region has become a focus for growth of the XRP Ledger. But how can this be effectively put in practice, in a vast area comprising both cutting-edge cities like Singapore, Tokyo, and Shanghai, and regions still deep in development?

We start with a problem. Speaking with Nicole Nguyen, founder of APAC DAO (over 3000 members and 800 projects from 15 countries) and co-initiator of the XRPL APAC Alliance, “Our journey with XRPL started with a simple observation: despite the global scale of blockchain innovation, AsiaPacific remains one of the most diverse, dynamic, and community-driven regions — but its developers often lack the resources or recognition seen in other markets.” Indeed, activity on the XRP Ledger has not been limited to the vibrant developer communities in Singapore (the

By Simon Luling

base of the XRPL Accelerator in partnership with Tenity), or the tech powerhouses of Korea and Japan (where Ripple created a $500M fund in 2024). As XRPL’s major 2024 Seoul hackathon was wrapping up, APAC DAO organized the XRPL Sea Hackathon for developers from Southeast Asia–Indonesia, Vietnam, Singapore, and Thailand, culminating with a Demo Day in Bangkok. “With over 300 certified devs, 70+ XRPL developers, 15+ dApps launched, and participation from 20+ regional ambassadors, it became a real movement. Not just a competition — but a pipeline for building, funding, and scaling XRPL-native ideas,” Nguyen adds.

Diverse Faces and Use Cases On-Chain

In light of APAC’s diverse populations and circumstances, modularity within blockchain becomes key. Nguyen observes, “In Japan and Korea, the emphasis is often on security, compliance, and NFT innovation. In Southeast Asia, it’s more about access, remittance, and real-world

finance. These divergences help XRPL remain adaptable and modular — it’s not a one-size-fits-all network.”

Hong Kong’s regulatory environment has become increasingly supportive of digital assets, alluring entrepreneurs with traditional finance backgrounds to bridge the gap between traditional finance and institutional DeFi. This is especially relevant given the XRPL’s proven capabilities in supporting cross-border and financial use-cases, be it in the region or in other parts of the world.

Among the standout developments are dApps tackling cross-border payments, identity management, and even green finance — all tailored for the unique challenges of Southeast Asia. “One team in Vietnam built a remittance app streamlining fees for workers sending money home. In Thailand, another group prototyped a decentralized ESG data layer — bringing transparency to carbon offset markets,” Nguyen points out.

These projects aren’t one-offs. Thanks to follow-on support, several teams have continued building and pitching in regional demo days and incubators — showing that the XRPL is being taken seriously by emerging builders. “Blockchain allows smaller markets to leapfrog traditional infrastructure. From tokenizing real estate in Vietnam, to micro-financing in the Philippines, XRPL has potential to lower the cost of trust and access — two major friction points in emerging economies,” Nguyen explains.

Blockchain adoption in the Asia-Pacific comes with its challenges. Ecosystem fragmentation across the region is real — languages, regulations, and developer networks vary widely. Also, XRPL awareness outside of core crypto communities remains low. To tackle this, APAC DAO just launched the XRPL APAC Alliance, in partnership with XRPL Japan Association, Catalyze Research, and Tenity. Education and outreach campaigns are bringing awareness to individuals, enterprises and communities about the XRPL’s unique advantages and utility. The initial focal markets are Vietnam, Korea, and Japan, with plans to expand further.

A Vector of Growth across APAC Communities

All of APAC’s XRPL adopters that we spoke with are convinced that the XRPL, and blockchain in general, is poised to be a powerful driver of economic growth in the region’s developing economies, by increasing financial inclusion, enabling low-cost and fast cross-border payments, and

creating new job and business opportunities. By lowering barriers to credit and connecting local businesses to global markets, blockchain enables individuals and initiatives of all backgrounds to thrive–especially valuable in regions with large unbanked populations. “For example, in rural Vietnam, a team explored a voucher distribution model using XRPL to help NGOs disburse aid transparently. These experiments aren’t headline-grabbers, but they’re meaningful and highly localized,” Nguyen shares. Building on these trends, many would also like to see blockchain deployments at the statelevel, where transparent and tamper-proof ledgers help reduce corruption and improve trust in public institutions and markets.

Nicole Nguyen sums it up nicely: “To us, this is the power of XRPL in APAC: not just a technology stack, but a canvas for localized innovation. Through our hackathons and long-term programs, we’re building an ecosystem that is sustainable, inclusive, and builder-first.”

Indeed, this magazine has been published as Expo 2025 in Osaka, Japan, wraps up. In that context, Mai Furukawa, Director at XRPL Japan Association, shares compelling data insight, hinting at where the wind is blowing. “Attendees receive NFTs when visiting each pavilion on the app they downloaded on their device. As of July 29, 2025, a total of 4,838,450 NFTs have been minted on the XRP Ledger for the Expo. According to Bithomp , the total number of NFTs on XRPL at that point was 10,805,388, meaning Expo NFTs alone account for about 48% of all NFTs on XRPL. They’re collecting NFTs much like stamps, engaging with blockchain technology without even realizing it. I think this kind of seamless integration, where the tech is invisible but part of everyday life, is the ideal strategy for mass blockchain adoption, and we’re seeing it happen here in real time.”

This endeavor was led in part by SBI Group, one of Japan’s largest traditional finance groups. SBI Group, Mercari (Japan’s leading community-driven marketplace) and other financial actors see where the world is headed, and have been developing partnerships with Ripple to integrate blockchain to their solutions. Mercari enables its users to transact in XRP on an every day basis; in August 2025, SBI Group signed a deal with Ripple to bring the RLUSD stablecoin to Japan.

The Agentic Web: The Blockchain & AI CrossChain Interoperability Era

By Odelia Torteman

The fusion of blockchain and AI is ushering in new levels of automation, security, and transparency across industries. Smart contracts and predictive AI, coupled with blockchain’s assurances of data integrity and auditability, are catalyzing entirely new business models across sectors. This new Agentic Web unlocks a future where trust is algorithmic, operations are autonomous, and value flows seamlessly across ecosystems.

Key industry use cases are paving the way for new developments in 2025.

The convergence of blockchain and AI, especially with enhanced interoperability frameworks, is set to transform industries by enabling smarter, more secure, and automated processes. This analysis explores several central areas of progress:

1. Interoperability Layers and Cross-Chain Technical Enablers

> Cross-Chain Data Sharing and Interoperability Middleware: Interoperability frameworks, crosschain protocols, and bridges now allow AI systems to aggregate and process data across multiple blockchain networks, powering dApps to function across ecosystems.

> Decentralized AI Networks: By distributing computation and model validation, these networks reduce reliance on centralized AI infrastructures and enhance trust.

> Decentralized AI Marketplaces: Networks of data providers, model creators, and service consumers interact via blockchain-based AI marketplaces where tokenized incentives drive collaborative problemsolving at scale.

> Data Oracles: Oracles are crucial for feeding real-world data securely into smart contracts, allowing AI to make actionable decisions based on external events in real time.

2. AI-Powered Smart Contracts and Automated Decision-Making

> AI-Enhanced Smart Contracts: Smart contracts are evolving to leverage AI for predictive analytics, contract negotiation, and exception handling. In the Financial Service Industry, they can automate loan approvals, adapt to market changes, and trigger settlements or compliance actions without manual oversight.

> Dynamic Risk Management: Blockchain-traced AI models enable real-time risk assessments, fraud detection, and adaptive countermeasures in banking, insurance, and capital markets.

3. Tokenization of Unconventional Assets

> The practice of tokenizing assets is expected to expand to unconventional areas, making previously inaccessible assets liquid and part of the global economy.

> AI agents are accelerating this trend: businesses are converting invoices and assets into digital tokens for instant liquidity, with AI optimizing financing terms and automatically validating transactions on-chain.

> AI agents act as programmatic market makers, setting prices, narrowing spreads, and ensuring healthy trading volume and reliable bid/ask levels.

4. The New Agent Economy & Business Models

> The rapid convergence of AI agents and blockchain is giving rise to an “Agent Economy,” where autonomous digital entities transact, create, and manage wealth.

> New Commerce: AI Agents are already engaging in commerce with each other, such as AI agents buying assets (i.e. digital assets, art) from other AI agents.

> Diversified Revenue Streams: AI agents are exploring diversified revenue streams like creator payouts from social media, music streaming, advertising, and validator staking.

> AI Agents in Investment Dows Agents- AI agents in Investment DAOs analyze governance proposals and market data, automate portfolio rebalancing, vote on behalf of members, and execute smart contracts for trades, liquidity provision, and capital allocation with little human oversight.

> Agentic Finance will soon enable AI agents to autonomously represent users and enterprises— negotiating, buying, or selling tokenized assets, managing on-chain treasuries, and automating realworld transactions—using purpose-built systems designed for agent-initiated payments and decisionmaking in both digital and physical marketplaces

5. Data Security, Privacy, and Trustable AI

> Blockchain is being explored as a way to ensure the fairness of AI models and provide the critical “Proof of Humanity” across agents’ digital identities.

> Immutable Audit Trails: Blockchain records every interaction and decision of AI systems, creating tamperproof, auditable logs—critical for regulated industries, healthcare, and compliance-heavy sectors.

> Data Sovereignty and Digital Identity: Enterprises are now using blockchain for decentralized identity management, where AI-verified credentials can be shared freely but remain user-owned – rapidly replacing legacy ID verification in the finance and SaaS sectors.

> Bug Detection & Swarm Intelligence: LLMs are being used to find bugs and vulnerabilities in code, improving the security of smart contracts. This approach is foundational to the next generation of decentralized AI, agent economies, and even on-chain governance systems.

*A Swarm Intelligence refers to a collective of AI agents cooperating, either privately (in a “cabal” for secrecy/resource pooling), or publicly (in a “trust” governed by openness/reputation)—to solve problems and create value far beyond what solo agents can achieve.

NEW CHALLENGES AND RISKS

> Lack of Standards and Regulatory Uncertainty: Lack of clear, universal legal frameworks for AI-powered smart contracts poses compliance and liability risks.

> Interoperability Gaps: AI and blockchain platforms still function in silos, limiting cross-chain and crosssystem collaboration.

> Ethics & Bias: There are currently no robust, blockchain-based solutions to ensure AI fairness or audit bias.

> Security Concerns: Increased risk of hacks and “blackhat” AI agents exploiting open protocols.

> Complexity & Scaling: Both technologies are complex and challenging to scale reliably.

> Hype Risk: Overhyped expectations could spur bubbles and misaligned investment.

As AI and blockchain converge, innovation accelerates, networks interconnect, and programmable value flows freely. Those who build the underlying infrastructure for agent interaction will shape the future, as the rise of agentic, on-chain intelligence redefines what’s possible in the new digital world.

AI Projects on the XRP Ledger

In a fast-evolving sector, XRPL is hosting a solid and ever-growing network of AI-driven projects.

AnChain.AI

Web3 risk management and security solutions firm specializing in AI-powered products.

BEI API

Free version of an AI/ML risk engine via API, built and provided by AnChain.

ChartXRP

AI-powered chat app utilizing XRPL and extended APIs for real-time data.

Zynara

AI-powered talent liquidity pool linking freelancers in Africa to the global economy.

CarbonSustain

Web3 carbon accounting, using AI to automate carbon footprint measurement and carbon reduction solutions.

Liisa

Using AI to gather, analyze, and display data on NFT collections.

Nimanode

Revenue-generating AI agents for web3 strategy development, with no-code interfaces.

Aigent.run

Token and AI Agent generator for activities on the XRP Ledger.

LayerAI

AI interface application for crypto activity on the XRP Ledger.

LexPal

Decentralized language learning network bringing DeFi to video calls with AI agents, smart contracts, and stablecoin payments.

Atua AI

Automation of complex financial transactions on XRP Ledger (and other chains).

Snowledge

Helps educational content creators leverage their community’s intelligence to create high-impact content.

KoVault

Multi-signature protocol with AI co-signing and multichain support to help crypto teams secure assets.

The Intention Web:

Ethical and StrategicConsiderations

We sat with Benoit Bergeret, ESSEC professor, co-founder of Hub France IA, and member of the OECD Network of Experts on AI, to discuss the intersection of AI and blockchain, and their combined future-defining potential.

Interview by Simon Luling

What are your thoughts on the “Post Web” concept? What roles do AI and blockchain have therein?

As an AI practitioner watching blockchain mature, I think we are witnessing the emergence of the “intention web”, moving towards autonomous software agents that negotiate, transact, and optimize on our behalf. Agents are only one expression of an AI stack that is simultaneously shrinking (Small Language Models), deepening (world models), and hybridizing (neurosymbolic reasoning).

I see this evolution as favoring blockchain architectures like XRPL, because they prioritize efficiency and real-world usefulness over energy-intensive consensus mechanisms. The pairing seems compelling, with AI supplying the cognition layer (sensing, reasoning, decision-making) and the ledger providing the trust infrastructure. However, technical challenges remain: how do we establish interoperability between AI inference models and blockchain settlements? What about governance mechanisms that can adapt to AIdriven decisions? Are there business models that make this integration complexity viable?

What will be the key use cases at the intersection of blockchain and AI technology?

The most compelling opportunity I see is AI enhancing blockchain applications: Intelligent transaction routing that optimizes fees and predicts congestion across networks; real-time fraud detection systems analyzing DeFi transaction patterns; predictive tokenomics models that stress-test governance proposals before implementation; or dynamic fee optimization responding to demand fluctuations in realtime.

Regarding XRPL, it could be suitable for deploying AIdriven agents that automate complex financial strategies, DeFi tasks, and cross-market trades. Real-time AI service marketplaces (Bittensor, Render, Akash) could potentially benefit from the ledger’s speed and economy, but integration will take time. XRPL also looks well suited for cross-border AI data monetization, though challenges around programming logic and compliance might make it difficult to implement complex regulations required for largescale, regulated cross-border data flows.

“This shift, paired with blockchain’s ability to anchor models and data on-ledger, is dispersing strategic leverage away from a handful of hyperscale players to those who excel at data stewardship and algorithmic innovation.”

On the ethical front, will blockchain bring AI away from real/perceived lack of transparency (the “black box AI” problem)?

Blockchain’s audit capabilities may become valuable for AI governance, but the solution is more nuanced than often presented. Blockchain adds genuine transparency value in tracking training data provenance, model version control (cryptographic hashes of model checkpoints, hyperparameters, and training configurations), decision audit trails (high-stakes AI decisions logged with tamper-proof timestamps), or possibly compliance verification (zero-knowledge proofs demonstrating AI systems meet regulatory requirements without revealing proprietary model details). The same pattern extends to SLM checkpoints and neurosymbolic rule-sets, whose smaller footprint could make on-chain anchoring inexpensive and legally defensible. But the efficiency of the underlying blockchain matters significantly. Recording every AI inference on-chain would be prohibitively expensive on most networks. Ledgers such as XRPL may make comprehensive audit trails economically viable for high-value decisions. Ultimately, I see blockchain as complementary to, not a replacement for, explainable AI research. The combination of blockchain audit trails with interpretable AI methods might offer the most promising path forward.

Like AI, would you consider blockchain a geostrategic asset? How and to what extent?

Having considered this question deeply for AI, I see important differences in how AI and blockchain function as strategic assets. AI is widely recognized as a General Purpose Technology because it drives productivity gains across virtually all sectors and serves as a foundation for other technologies. In contrast, blockchain’s strategic value is more domain-specific, centering on financial infrastructure and data integrity. This makes its strategic profile closer to that of critical infrastructure (like industrial IoT or 5G networks) rather than a broad technological catalyst.

The landscape is also evolving: advances in smaller, verifiable AI models mean substantial capabilities can now be deployed with limited computational resources, undermining the need for massive, centralized AI infrastructure. This shift, paired with blockchain’s ability to anchor models and data onledger, is dispersing strategic leverage away from a handful of hyperscale players to those who excel at data stewardship and algorithmic innovation.

In practice, nations that control scalable blockchain infrastructure (especially for financial settlements) may gain an edge in international commerce and monetary policy. However, blockchain’s strategic impact today remains largely focused on specific applications like international finance and supply chain authentication, rather than enabling broad economic transformation.

Ultimately, both AI and blockchain do function as geostrategic assets by lowering barriers to capital movement, information flow, and regulatory enforcement. However, they also introduce new systemic risks, such as security vulnerabilities, political instability, and regulatory fragmentation—underscoring that their strategic value is closely tied to how they are governed and deployed.

How can AI help blockchain applications achieve transformation in the digital sphere?

The synergy between these two technologies is, in my view, where some of the most immediate and meaningful digital breakthroughs are likely to happen: Starting with network optimization, where AI stands to make blockchain far more efficient. Machine learning models analyze live network data to predict congestion and recommend the best timing for transactions. AI is checking on the performance and trustworthiness of validators. AI-powered agents comparing network conditions, automatically routing transactions across different chains, UX improvements, real-time risk assessment, etc.

With AI, tokenomics can become adaptive: picture a protocol that continuously tweaks supply, reward, or fee parameters

by learning from real-time usage and economic signals. AIpowered agents could rebalance and optimize yields across dozens of DeFi protocols with minimal manual oversight. And then there’s the real-world integration, the real frontier for digital transformation. In supply chains, IoT sensors could feed real-time data to AI, which would automatically trigger blockchain-backed settlements the moment goods change hands, cutting paperwork and trust gaps. The energy sector might see blockchain-based, peer-to-peer trading platforms, where AI constantly optimizes grid loads and pricing for maximum efficiency. Financially, I envision AI managing complex strategies for institutions, executing trades and settlements automatically across global markets with blockchain’s security and transparency as the backbone. Having experienced the rapid pace of progress in multiple tech areas, my sense is we’re just at the start of what AI and blockchain can do together in the digital sphere.

BEYOND AGENTS: THREE AI PARADIGMS THAT MATTER

Agents are in the limelight, yet they are only one face of a fast-diversifying AI stack. Three parallel tracks deserve equal attention because they map cleanly to complementarity with the blockchain.

> Small Language/Vision Models are sub-billion-parameter networks trained on curated, debiased datasets; I can picture them embedded in a wallet plugin. Their tiny checkpoints fit inside a cheap on-chain hash anchor, giving auditors a single-source-of-truth for “what was deployed when”.

> World-Model Architectures are AI systems that learn internal simulations of their environment, allowing them to imagine and evaluate multiple possible futures before taking action, ultimately enabling risk-free, pre-transaction simulations that let users test complex multi-step decentralized finance (DeFi) workflows virtually.

> Neurosymbolic/Hybrid AI stacks neural nets atop symbolic rule engines. Each inference leaves a deterministic logic trace that pairs neatly with XRPL’s tamper-proof logs; regulators get a line-by-line “why” instead of a black-box “trust me.”

Gen3 Labs on Aigent.run & the Future of AI Agents on XRPL

Interview by Zsofi Borsi

AI and blockchain are converging — and two builders are bringing that future to XRPL. Guillaume and Shen, cofounders of Gen3 Labs and creators of Aigent.run, share how they’re building an AI-powered terminal that makes blockchain interaction as easy as speaking your intent.

How did your journey in the XRPL world begin?

G: Hi, I’m Guillaume, an engineer with 10 years in blockchain. I began in Bitcoin and Ethereum, working in consulting, banking, and finance before joining the first MICA-compliant crypto fund. Later, I co-founded an NFT-based game, which led me to XRPL Commons as a Senior Technical Partner. There, I organized workshops, hackathons, and dove deep into the XRPL tech stack. During that time, I met Shen, who was part of the residency program, and together we went on to co-found Gen3 Labs — the parent of Aigent.run.

S: I’m Shen Morincome, co-founder/CEO of Gen3 and lead for Aigent.run. My journey into XRPL came from exploring how blockchain could unlock permissionless value exchange in gaming and AI. I worked in DeFi, including ThorChain, but XRPL’s speed and reliability drew me in. We launched Zerpmon, a creature-collecting auto-battler, then expanded into Aigent.run, a platform for AI agents to interact with XRPL natively.

What drew you to explore the intersection of AI and blockchain?

Blockchain UX has long been too complex. We asked: what if AI could make it intuitive? Imagine typing or speaking, and the AI handles the blockchain actions. AI also enables a future where autonomous agents transact and collaborate on-chain — something only decentralized systems can truly support.

Tell us the story behind Aigent.run — how did the idea originate?

It started in November in the Philippines with a fun idea: let AI help people create tokens. That playful experiment quickly grew. We realized we could build a full AI-powered app where anyone can interact with XRPL features simply by typing or speaking. Aigent.run became a smart terminal solving one of Web3’s biggest challenges: accessibility.

What makes Aigent.run unique?

It’s an AI terminal built natively for XRPL. Users can send tokens, trade, and manage trustlines through natural language. Beyond that, we’re pioneering AI-driven SocialFi — autonomous accounts that engage, run experiments, and reward communities. Our $AIXRP token demonstrates this stack in action. Unlike others, AI isn’t just an overlay here — it’s the operating system for blockchain interaction.

How does it work in practice?

Visit aigent.run, type or speak commands, and instantly perform actions on XRPL. We give free inferences to try, then users can top up. On X, our agent @aixrp_agent autonomously rewards community engagement with $AIXRP. Underneath, a custom AI stack merges inference, blockchain execution, and community logic.

How do you ensure transparency, safety, and trust?

We use multi-step inference workflows, MCP (Model Context Protocol) for constrained tool use, and never let identifiers be processed directly by the model. Blockchain itself adds transparency — every agent-triggered transaction is traceable on XRPL, with agent IDs logged for auditing.

Who are you collaborating with?

We’re integrating widely: Doppler Finance, Strobe, Squid, XPmarket, Victus Global, Futureverse, Joey Wallet, Dhali, Catalyze Research, Cool Cats, Coingecko, and Dune Analytics.

Biggest challenges so far?

Technically, keeping pace with AI innovation while maintaining security. On the community side, legitimacy is key — many projects ride the hype. We released $AIXRP early to prove real progress. Another challenge: building programmable, interoperable agents, which led us to create our XRPL-native framework, aigentOS.

How do you envision Aigent.run shaping AI in Web3?

There will be a before and after. Once users see blockchain become as simple as “tap and go,” they won’t go back. Long term, this will be the default interface for decentralized systems.

What’s

next for Aigent.run?

We’re building a personal finance agent to help users manage on-chain assets intelligently — portfolio management, trading, automated logs, even tax-ready reporting. Long term, we’re creating an ecosystem where anyone can design, share, and borrow AI agents. A marketplace of communitybuilt agents — for DeFi, NFTs, DAOs, education — will unlock collaborative intelligence across XRPL.

By Simon Luling