4 minute read

Is XM Regulated in South Africa? Everything You Need to Know

In the ever-evolving world of online trading, Exness has gained global recognition for its transparency, fast execution, and wide range of trading instruments. Whether you're trading forex, commodities, cryptocurrencies, or indices, mastering your approach with Exness tools can make a major difference in your success. In this article, we’ll share key tips for trading with Exness instruments to help you enhance your strategy and manage risk more effectively.

👉 Ready to start trading with Exness? Open an account now and experience top-tier trading conditions.

Is XM Regulated in South Africa? Everything You Need to Know

If you’re a trader in South Africa considering XM as your broker, one of the first questions you might ask is: Is XM regulated in South Africa? This is a crucial point, especially when it comes to the safety of your funds and legal protections. In this article, we’ll clarify XM’s regulatory status in South Africa, discuss what that means for you as a trader, and guide you on how to get started with XM.

👉 Open a trading account with XM here and access over 1,000 instruments, tight spreads, and leverage up to 1:888.

Is XM Regulated in South Africa?

As of now, XM is not directly regulated by South Africa’s Financial Sector Conduct Authority (FSCA). However, that doesn’t mean South African traders are left unprotected. XM operates globally under the brand name of Trading Point Holdings Ltd, and it is regulated by several top-tier authorities, including:

CySEC (Cyprus Securities and Exchange Commission)

ASIC (Australian Securities and Investments Commission)

FSC (Financial Services Commission of Belize)

While it doesn't hold a specific FSCA license, XM does accept South African clients and complies with international regulatory standards to ensure transparency, client fund protection, and fair trading practices.

For South African traders, this means they can legally open and maintain an account with XM, but any regulatory disputes would fall under the jurisdiction of the relevant international authority, not the FSCA.

👉 Want to learn more about XM? Visit the official XM website.

Why South African Traders Choose XM

Despite the lack of FSCA regulation, XM remains popular among South African traders for several reasons:

Tight spreads and low fees

No deposit or withdrawal charges

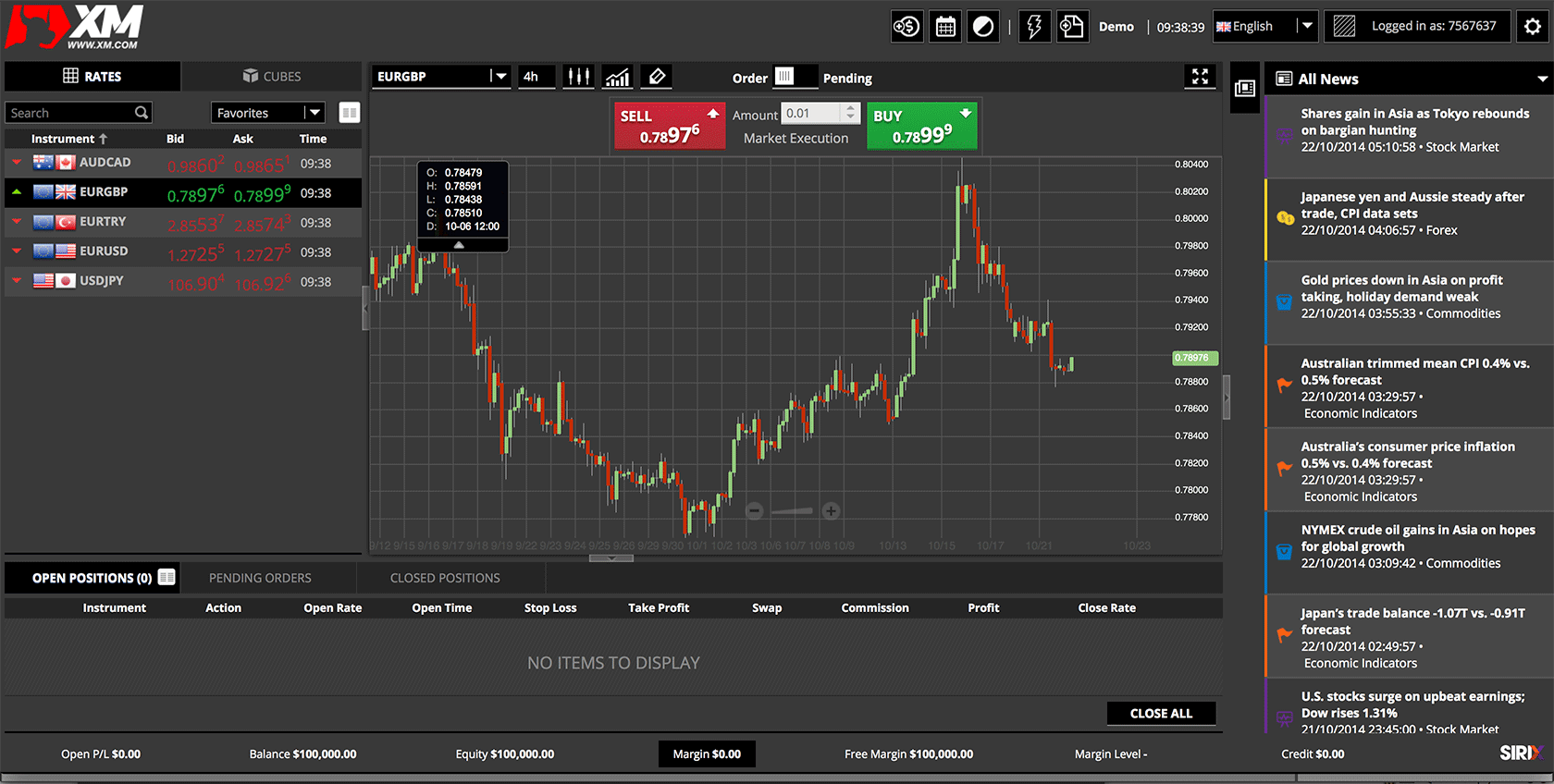

Advanced trading platforms including MetaTrader 4 and 5

Local deposit options, including bank transfers from SA banks

24/5 multilingual customer support

In addition, XM offers negative balance protection, ensuring you never lose more than your deposit — a feature that’s especially important in volatile markets.

👉 Open your XM account now and take advantage of their bonus offers for new traders.

Should You Trade with XM if You’re in South Africa?

If you’re a beginner or even a seasoned trader in South Africa, XM offers a strong combination of features, global reputation, and user-friendly platforms. While it would be ideal for XM to eventually obtain FSCA regulation, its adherence to strict international standards provides a level of credibility and protection you can trust.

Just remember to always do your own research and ensure you're comfortable with the broker’s regulatory framework before making a deposit.

👉 Ready to start trading? Click here to visit XM’s official website and explore their account types, tools, and offers.

Final Thoughts

XM may not be regulated in South Africa by the FSCA, but it remains a reliable and internationally regulated broker. With thousands of South African traders already on board, XM continues to be a top choice for Forex and CFD trading in the region.

👉 Get started with XM today and trade the markets with confidence.

See more: