3 minute read

Does XM Broker Charge Commission? Full 2025 Fees Breakdown

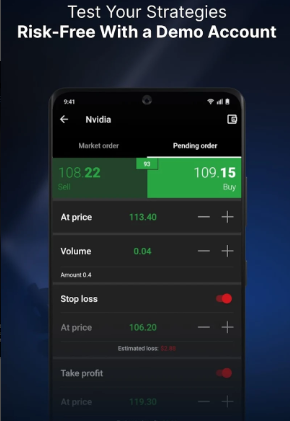

Choosing the right broker means understanding how they charge you. If you’re asking, “Does XM broker charge commission?”, you're doing the smart thing. Understanding commissions, spreads, and potential hidden costs helps you trade smarter and keep more profits in your pocket.

Let’s break down XM’s pricing structure, account types, and real trading costs in this complete 2025 guide.

👉 Want to trade with low or zero commissions? Open your XM trading account now and choose the best option for your budget.

Zero Commission Accounts at XM

Most XM traders choose:

Micro Account – Small lot sizes, no commission

Standard Account – Full lots, still no commission

Ultra Low Account – Tight spreads with no extra charges

How XM Profits Without Charging Commission

XM builds its revenue into the spread. Instead of charging per trade, they slightly widen the bid-ask spread to generate income.

XM Accounts That Charge Commission

Shares Account

This is the only account type at XM that charges a direct commission, and only when you trade real stocks.

No leverage

No spreads (market price execution)

Transparent commission per trade

XM Spread Overview and Hidden Costs

What Is a Spread?

A spread is the difference between the buying (ask) and selling (bid) price. XM’s spreads vary depending on account type and market conditions.

AccountAvg. Spread on EUR/USDMicro1.6 pipsStandard1.6 pipsUltra Low0.6 pips

There are no hidden fees outside spreads on these accounts.

Comparing XM Fees with Other Brokers

XM’s zero-commission accounts are competitive when compared to brokers like:

BrokerCommissionAvg. Spread (EUR/USD)XM Ultra Low$00.6 pipsExness Raw Spread$7 per lot0.1 pipsIC Markets$6 per lot0.1 pips

If you're a beginner or trading on a small budget, XM offers one of the most cost-effective setups.

How to Avoid Unnecessary Fees at XM

No deposit or withdrawal fees (except via third-party banks)

No commission on most accounts

Inactivity fee: $5 per month after 90 days of no login

Tip: Stay active and use free e-wallet methods to avoid all charges.

Real User Experiences with XM Costs

Traders on forums and review platforms like Trustpilot and Forex Peace Army praise XM for:

Transparent pricing

No surprises with fees

Easy to calculate trade costs

How to Open a Commission-Free XM Account

Visit the XM sign-up page

Choose Micro, Standard, or Ultra Low

Complete your verification

Deposit $5+

Start trading—no commissions needed

Final Verdict – Does XM Charge Commission?

XM does not charge commission on most accounts, including Micro, Standard, and Ultra Low. Only the Shares Account has trade-based commissions.

This makes XM a perfect fit for beginner traders and those looking to save on costs without compromising on service quality.

👉 Want to trade commission-free? Open your XM account today.

FAQs About XM Commission and Fees

Is XM truly commission-free?

Yes, Micro, Standard, and Ultra Low accounts are commission-free.

Which account has the lowest cost?

The Ultra Low Account offers the tightest spreads with no commissions.

What’s the difference between spread and commission?

Spreads are built into the price. Commissions are separate fees per trade—XM only uses spreads (except on Shares Account).

Does XM charge for deposits or withdrawals?

No, XM does not charge for most deposit and withdrawal methods.

Can I reduce trading costs?

Yes, choose the Ultra Low account and use low-spread instruments during major market hours.

What hidden fees should I know about?

None—just keep your account active to avoid the $5/month inactivity fee.