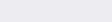

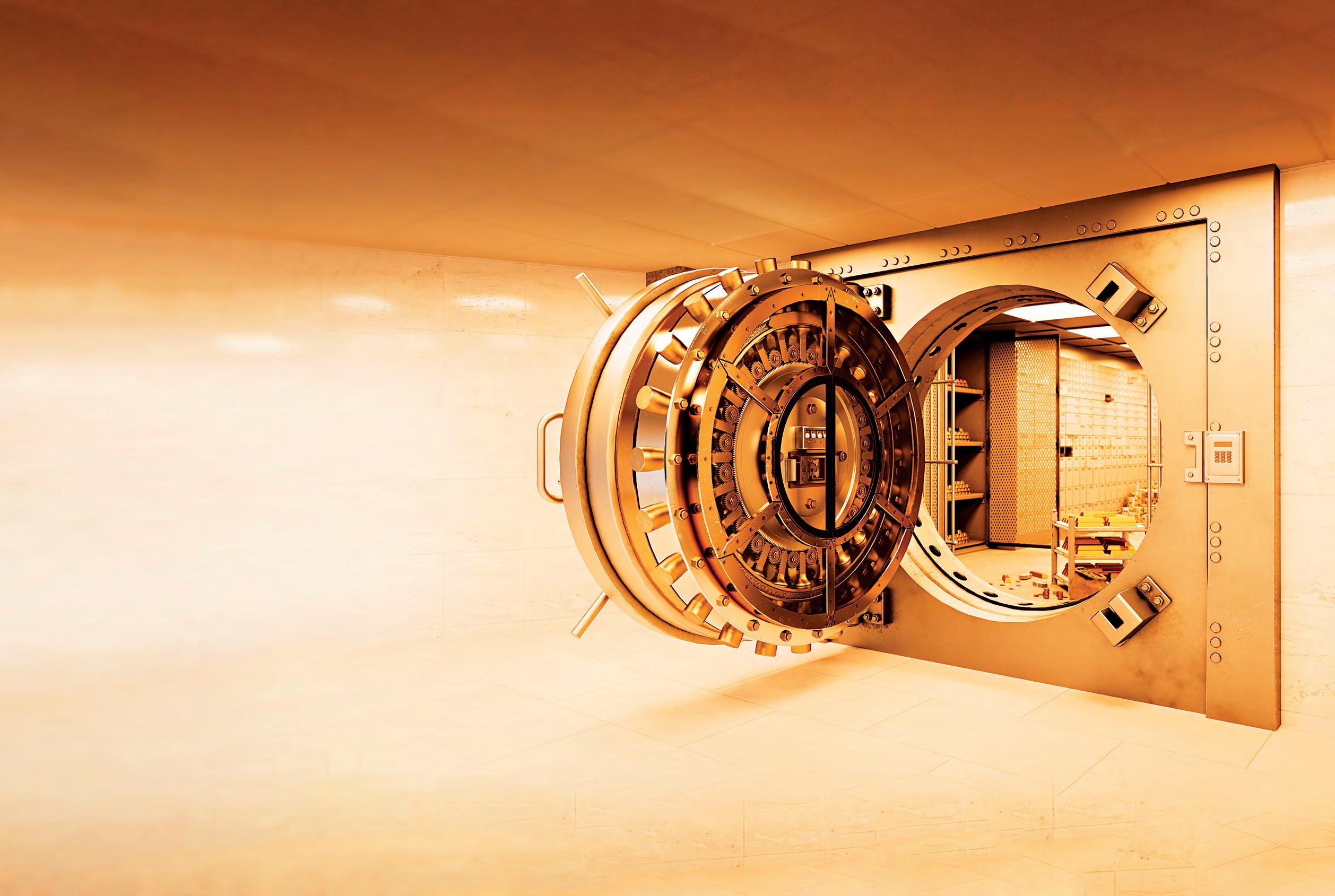

Gold fingers

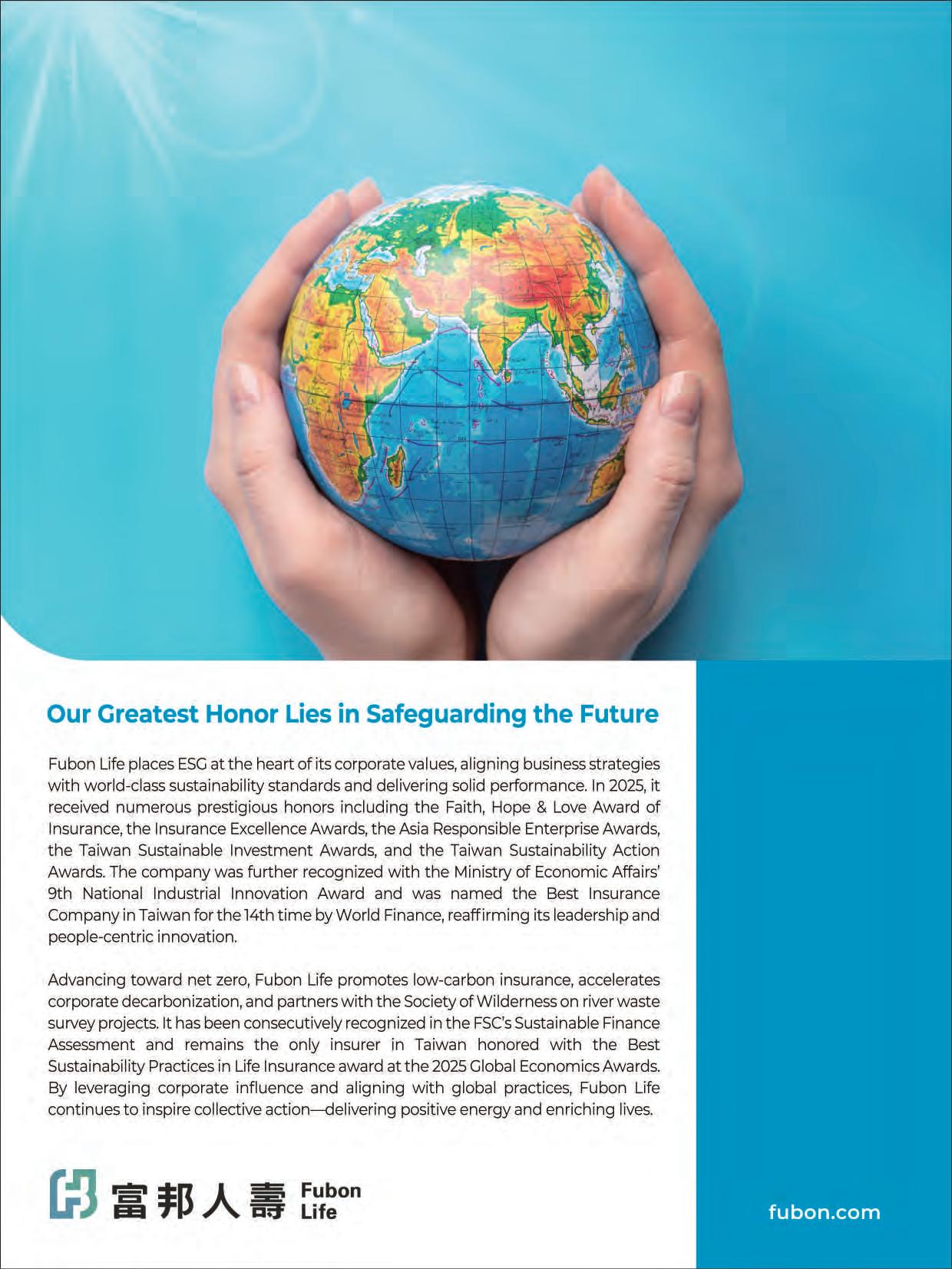

Surge in gold as central banks hedge against uncertainty

Casino economy

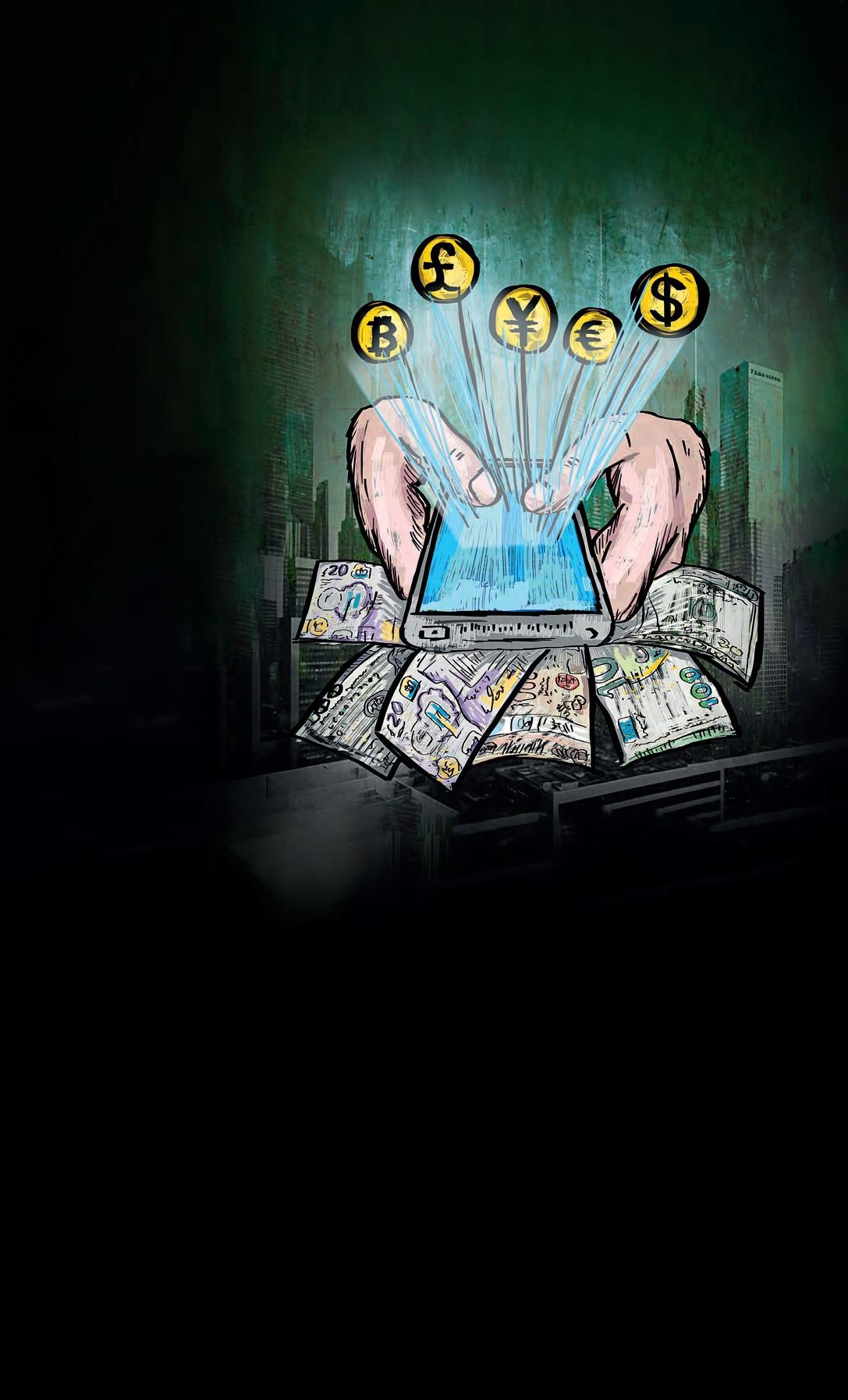

Trump’s crypto reforms ignite boom, raising fears of instability

Laundered legacy

The EU fights back against illicit flow of billions by forming AMLA

Surge in gold as central banks hedge against uncertainty

Casino economy

Trump’s crypto reforms ignite boom, raising fears of instability

The EU fights back against illicit flow of billions by forming AMLA

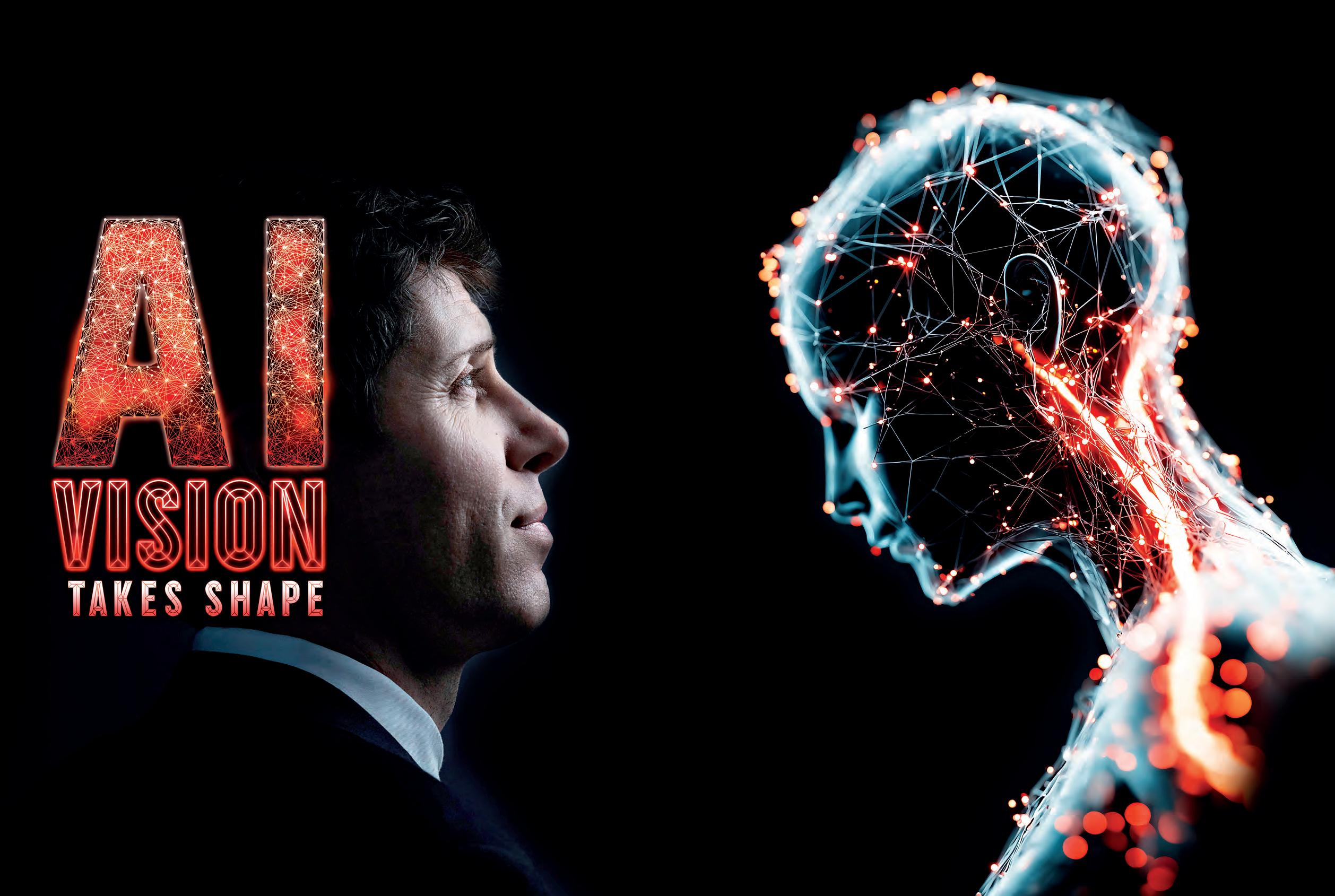

Sam Altman, OpenAI’s powerful CEO, dominates the booming AI industry with ChatGPT’s global success and trillion-dollar deals, but growing concerns over profits, ethics and a potential AI bubble threaten his legacy

Meet the world’s most advanced business jets.

Request your private consultation

Gatherings at Kiawah Island Golf Resort offer a new view of success. It’s where mindful moments transcend tasks on a calendar and achievement is measured by the depth of experiences. It’s an environment where discussions inspire innovations. Where collaboration is shaped by island adventures, and taking time to reflect is the ultimate path to progress. Here, a meeting is not only business, it’s a breath of fresh air.

Our presence in Miami, New York, and Madrid reflects more than growth, it represents our strategic vision to accompany our clients globally.

At Banreservas, we believe in building lasting relationships and creating value beyond borders.

We grow to serve you better.

Winter 2025-26

Sam Altman’s leadership at OpenAI has driven unprecedented AI growth, with record investments, global influence, and ethical challenges shaping the technology’s future, raising both opportunity and risks

Gold’s surge past $4,000 an ounce reflects geopolitical and economic uncertainty, dollar weakening, and central banks diversifying reserves, marking a structural shift in global capital flows

DESIGNER:

Sam Millard

REPROGRAPHER: Robin Sloan

PRODUCTION MANAGER: Richard Willcox

WEB AND MOBILE DEVELOPMENT:

Scott Rouse

VIDEO PRODUCER:

Paul Richardson

EDITORIAL:

Laura French

Courtney Goldsmith

Neil Hodge

Jemima Hunter

Graham Jarvis

Alex Katsomitros

Claire Millins

John Muchira

David Orrell

Selwyn Parker

Rachel Richards

Khatia Shamanauri

David Worsfold

The EU’s new AMLA agency aims to harmonise anti-money laundering rules and supervise high-risk institutions, but limited resources and fragmented oversight create persistent enforcement challenges

The Trump administration’s GENIUS Act promotes dollar-backed stablecoins to sustain US dominance, but risks include regulatory gaps, illicit use, geopolitical tensions and potential systemic instability

CONTRIBUTORS:

Amanda Akien

Vikki Davies

Antonia Di Lorenzo

Ilan Goldfajn

Sergei Guriev

Nick Hodgson

Emma Holmqvist

Ruth Kibble

Anne Krueger

Indrabati Lahiri

Guillermo Ortiz

Maryam Shahvaiz

Hannah Smith

ACCOUNTS:

Gemma Willoughby

ILLUSTRATORS:

Richard Beacham

Jim Howells

BUSINESS DEVELOPMENT:

Bryan Charles

Tom Crosse

Michael Harris

Terry Johnson

James Watson

Monika Wojcik

Greece’s fiscal mismanagement triggered a decade-long eurozone crisis. Three bailouts and years of austerity and reforms later, and there are signs of economic recovery, but it has come at the cost of deep social hardship

At 80, the UN faces funding shortfalls, geopolitical gridlock, and rising conflicts. Reform initiatives aim to boost efficiency, but political will and Security Council constraints challenge its peacekeeping role

The information contained within this publication has been obtained from sources the proprietors believe to be correct. However, no legal liability can be accepted for any errors. No part of this publication may be reproduced without the prior consent of the Publisher.

World News Media Ltd, 2025–26 Printed in the UK - ISSN 1755–2915

Editorial on pages 34–41, 114, 126–127 & 152–153 © Project Syndicate, 2025

Web: www.WorldFinance.com

Email: enquiries@wnmedia.com

28 Financial History

We look at the evolution of robots, from early automatons, to more recent developments in AI research

30 Profile

In 15 years, Revolut CEO Nikolay Storonsky has journeyed from derivatives trading to being head of a global finance powerhouse

34 Comment

Anne Krueger on Trump’s private sector meddling, Sergei Guriev on Putin’s polycrisis, Ilan Goldfajn on reducing poverty and Guillermo Ortiz on Mexico’s economy

170 The Econoclast

Exploring the discipline-spanning problem posed by the replication crisis: the power of authority over evidence

98 Commodities

In a post-oil economy, copper and cocoa could become the ‘new oil,’ shifting global power towards the Global South

100 Infrastructure

MPC Capital is investing in niche European energy infrastructure for stable, long-term institutional returns

106 Artificial Intelligence

Exploring how AI must evolve to understand human emotion, not just language

108 Future of AI

Two paths to AGI have emerged: large language models and whole brain emulation, and their success may depend on one another

110 Trading

A look at how education, advanced tools and low-latency execution can empower traders

114 Technology

TikTok’s US transfer increases American control but leaves China influential via algorithm licensing

48 Africa

Nigeria’s economic renewal is being driven by domestic capital to fund infrastructure and support inclusive growth

52 Finance

The dollar remains dominant but faces gradual decline amid rising multipolarity

56 Mexico

Banorte is driving inclusive growth through innovation, trust and social commitment

58 Dominican Republic

Banco Popular Dominicano leads sustainable banking in the Caribbean, combining profitability with social impact

62 Digital

Hybrid banking blends technology, trust and permanence to empower millions financially

66 Qatar

Qatar is preparing for a future-ready economy by merging technology, green finance and innovation

122 Sustainability

ANAVRIN feed reduces livestock methane, boosts productivity, and generates carbon credit revenue for farmers

132 Pensions

AFP Capital is leading Chilean pensions with innovation, digital advice, strong returns and client-focused service

134 Armenia

Armenia is leveraging tech investment and diaspora support to reduce Russian dependence and boost innovation hub status

137 Ukraine

Ukraine’s financial sector remains resilient through digitisation, reforms, international support and war-time adaptations

74 Inheritance

As $124 trillion shifts generations, women emerge as the new stewards of global wealth

76 Private Banking

Italy’s wealth management sector is evolving fast � driven by generational change, innovation and rising HNWI wealth

78 Exchange-traded Funds

Despite volatility, ETFs are booming � driven by record assets and global demand

80 Investment

Modern investing replaced intuition with data � ushering in efficient markets and a legacy now challenged by AI’s rise

82 Insurance

Geneva Insurance is blending innovation, digital trust and governance excellence to keep pace with regulation

90 Taxation

Former trader turned activist Gary Stevenson is redefining influencer economics

146 Residency

Portugal is attracting millionaires with IFICI tax incentives, lifestyle appeal, EU access and targeted professional benefits

148 Economics

Modern capitalism is in need of a reset, as long-term societal, ethical and economic value takes a back seat to short-term gains

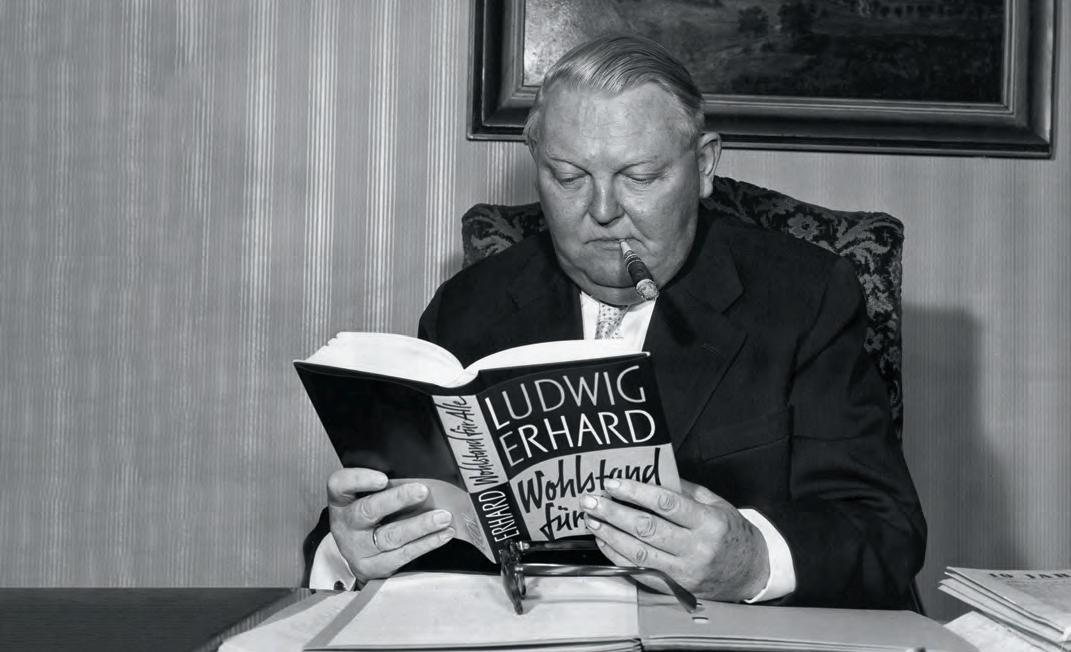

152 Politics

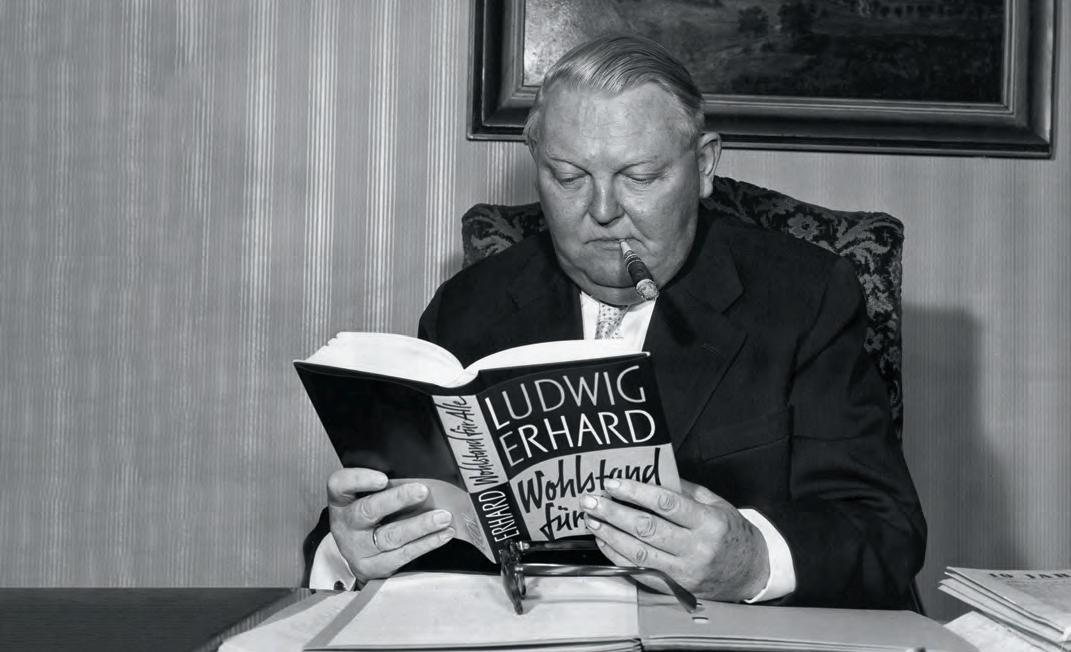

Reinvention is needed to help reproduce Germany’s postwar ‘economic miracle’

154 Leadership

Fintech success depends on founders’ integrity, self-awareness, cognitive agility, and balanced, ethical leadership

160 Cybersecurity

Africa’s digital growth faces escalating cybercrime, threatening economic stability

162 Lifestyle

Kiawah Island offers secluded luxury and elite accommodations along pristine South Carolina shores

India’s Prime Minister Narendra Modi inspects a guard of honour during the celebrations to mark the country’s Independence Day in New Delhi. The Indian government has allocated approximately $78bn to the Ministry of Defence for 2025 26, a nominal increase of about 9.5 percent over the previous year.

Many aspects of global national outlook and economics have been turned on their heads. The idea of free-flowing trades and open markets that came into action post-war has since faded, replaced by the rise of economic nationalism. Governments are again prioritising their own interests, protecting jobs and industries, even if it bruises relationships abroad. Until recently, Donald Trump used economic protectionism as a coercive mechanism in the form of tariff s in the US. The World Trade Organisation warned that new US tariff s and retaliations could cut global merchandise trade volumes by one percent in 2025; a big change after years of expansion. China struck back by implementing export controls on rare earth minerals. Now, in a brief pause to months of tension, both countries have agreed on a framework to ease trade tensions. The deal takes the pressure off the 100 percent tariff s on Chinese imports and delays China’s planned export restrictions on minerals. For now, the US and China have entered a period of cooling after what appeared to be an escalating trade war, but how long it will last is a whole other question. Japan’s newly elected Prime Minister, Sanae Takaichi, made it her promise to “make the economy stronger and remake Japan into a country capable of fulfilling its responsibilities to future generations.” Japan seems determined to put its interests first, and it seems other nations are catching on. Across Europe, right-wing parties are progressing with voters who want to tighten borders and reinforce their sense of national identity. Essentially, it is about protecting national self-interest – an understandable sentiment in itself, but one that risks unintended consequences. If countries start closing off trade, supply chains could become increasingly impermeable, resulting in escalating costs, punishing their very own consumers with higher prices and less choice. Manufacturers have increased safety stock and are holding more inventory than usual; a costly hedge against these tariff shocks. For investors, challenges are growing as the tariff rate in the US is the highest it has been since the 1930s. As US companies struggle with higher input costs and delays on shipments, markets have become particularly sensitive to every policy threat or trade retaliation.

TO READ MORE FROM WORLD FINANCE COLUMNISTS, VISIT: www.worldfinance.com/contributors

China’s export growth exceeded expectations towards the end of 2025, but uncertainty in the market continues to weigh on the world’s second-largest economy’s growth prospects. Recent customs data showed that China’s outbound shipments rebounded in September, rising 8.3 percent compared with 4.4 percent in August, notching the fastest rate of growth in six months after the country worked to diversify its export markets to protect itself from US President Donald Trump’s tariffs. The US now accounts for less than 10 percent of China’s exports. While exports to the US fell by 27 percent in the latest data, exports to the EU, Southeast Asia and Africa all grew by double digits (see Fig 1)

The International Monetary Fund still expects China’s economy to slow to 4.8 percent in 2025 from five percent in 2024, before dropping to just 4.2 percent in 2026, the group confirmed in its latest World Economic Outlook report. China’s slowdown has been driven by a reduction in net exports, which have

Since Donald Trump returned to the US Presidency, tensions have been high with trading partners, especially China. While so far China has proved to be more resilient than many feared in the wake of Trump’s sweeping tariff s, the constant threat of a trade

been at least partly offset by growing domestic demand fuelled by policy stimulus, the IMF said. The IMF also noted that while Asia sits at the centre of “the global trade-policy reset,” it will remain the biggest driver of growth, contributing about 60 percent this year and next.

war reigniting ensures a large level of uncertainty for investors. While many analysts expect the latest tensions to cool, with neither side really wanting another escalation in tariffs, it is no surprise to see China insulating itself by moving its export-reliant economy further away from the US.

CEO Johannesburg Stock Exchange

Valdene Reddy was named the CEO of the Johannesburg Stock Exchange, effective April 1, 2026, following the early retirement of outgoing chief executive Leila Fourie. Having spent more than a decade at the bourse, Africa’s largest, Reddy most recently headed up the capital markets division. There, she focused on listings and secondary market trade activity across all asset classes. “I am confident that Valdene’s deep industry expertise, strategic acumen and stakeholder relationships will position the JSE for continued success in a rapidly evolving financial landscape,” chair Phuthuma Nhleko said.

Philipp Navratil CEO Nestlé

Miels CEO GSK

Miels has long been considered next in line to lead the pharma giant. While Walmsley oversaw a step-change in GSK’s performance, she faced criticism for her consumer-focused background. With his strong pharma focus, Miels will be tasked with reaching the board’s goals of hitting £40bn in sales and launching 15 blockbuster medicines by 2031. appointments

VOICE OF THE MARKET

Fourie led the charge on a turnaround in the JSE’s earnings while diversifying the group’s revenue profile and modernising its core technology and regulatory frameworks. Reddy is well placed to be just as influential, focusing on accelerating innovation and enhancing competitiveness by continuing to drive earnings growth through diversified revenue streams.

Having spent more than two decades at Nestlé, Philipp Navratil was named the next CEO of the Swiss multinational food and drink maker. It followed his appointment to the board at the start of 2025 following a run of successes in his management of the firm’s coffee and beverage business. He played a pivotal role in strengthening the Nescafé brand in Mexico before being appointed to Nestlé’s Coffee Strategic Business Unit, where he shaped the global strategy for Nescafé and Starbucks coffee brands. “It is a privilege to take on the responsibility of leading Nestlé into the future,” Navratil said.

VOICE OF THE MARKET

Navratil’s appointment comes following the departure of Laurent Freixe, who was dismissed after an undisclosed romantic relationship came to light. Chair Paul Bulcke said the change in leadership did not equate to changes in the company’s growth plans. “We are not changing course on strategy and we will not lose pace on performance.”

Emma Walmsley will step down as CEO of global pharmaceutical giant GSK, effective January 1, 2026, and will be succeeded by Luke Miels, who held responsibility for GSK’s global medicines and vaccines as chief commercial officer. Miels first joined the firm in 2017 and has played an instrumental role in building GSK’s speciality medicines portfolio. Having worked at AstraZeneca, Roche and Sanofi-Aventis prior to GSK, he has wideranging and considerable experience. “He is extremely well placed to lead, deliver and surpass the ambitions we have set for GSK,” said Jonathan Symonds, chair of GSK.

VOICE OF THE MARKET

Growing scrutiny from boards and shareholders has resulted in chief executives being removed at the fastest pace in two decades in the US, data shows. Think back over the year, and many significant CEO departures will likely spring to mind. At Nestlé, the board pushed out Mark Schneider after becoming increasingly concerned about weak growth and slowing product development following stock highs in 2022. Unilever lost its CEO, Hein Schumacher, when the board ousted him after around 18 months in the role to reignite the consumer goods firm’s turnaround plans. And drinks giant Diageo’s CEO Debra Crew departed after just two years after missteps sent earnings expectations down. As of July 2025, nearly as many CEO exits had occurred at S&P 500 companies than over the whole of 2024 – 41 compared with 49, according to data from the Conference Board, a nonprofit executive research group, and ESGAUGE, a data analytics company. It comes as activist investors benefit from an environment where underperformance is seen as a fireable offence. In fact, 42 percent of the S&P 500 companies that changed CEOs last year were trailing their competitors for total shareholder returns, lagging in the 25th percentile. At the same time, in the post-#MeToo era, companies are taking decisive action on any reputational risks. In Europe, CEO tenures are growing shorter, too, as boards get more involved in strategy and shareholder activism increases, Oliver Wyman Forum’s the CEO Agenda 2025 found.

European chief executives are spending nearly half their planning time on horizons of less than one year, the research found. With stocks hitting records, even amid wobbly economic growth and global uncertainty, investors have high expectations. And what’s more, no one wants to be the next international news story after a ‘Coldplay kiss cam’ scenario. So what is a chief exec to do? Aside from the obvious of avoiding unethical behaviour, it is worth remembering that your fiscal plans command more loyalty than your personality.

“If activist investors have bought into a company's five-year plan then they want someone to exercise it,” Jason Schloetzer, an expert in corporate governance, told Reuters. “And if the guy at the top can't do it, they will find the next one.”

TO READ MORE FROM WORLD FINANCE COLUMNISTS, VISIT: www.worldfinance.com/contributors

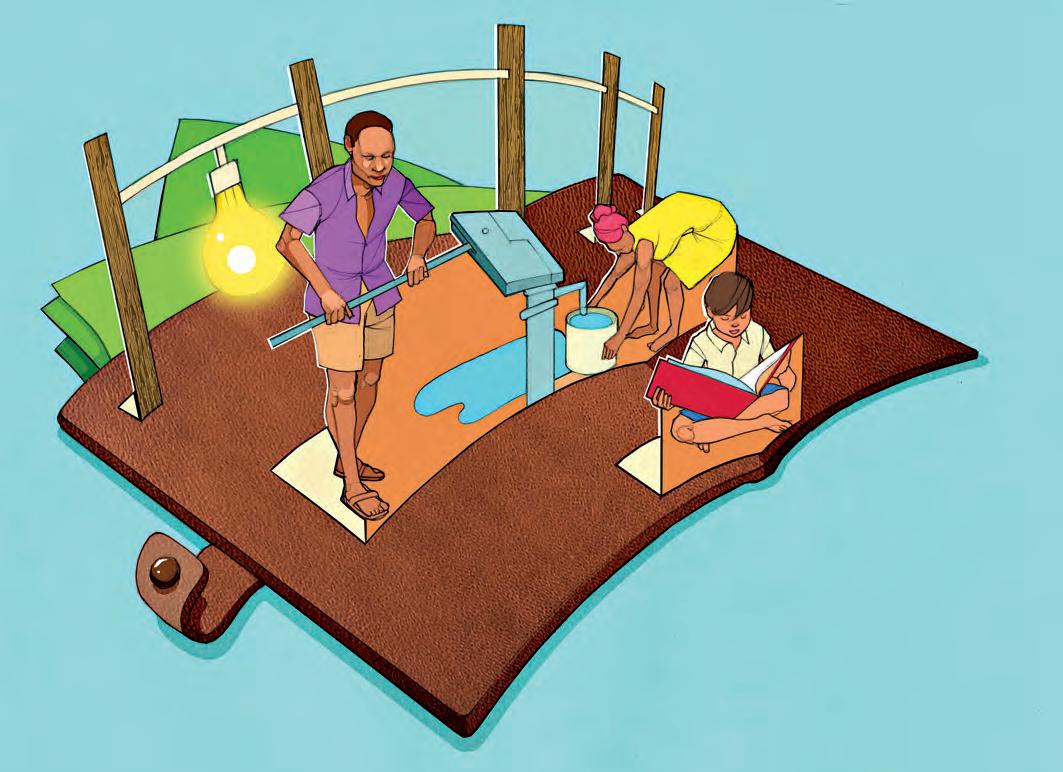

If once war-torn Rwanda needs a symbol of probably the biggest economic comeback in the history of sub-Saharan Africa, the sprawling brand-new international airport in the capital of Kigali will suffice. The numbers are inarguable. Thirty years after being a basket-case, the economy grew at a rate of nearly eight percent in the second quarter of 2025, roughly the same as in 2024. International reserves are robust and inflation is in control. Over the past two decades Rwanda has achieved remarkable progress.

In quality of life Rwanda has made giant strides too. There are mobile phones in most households and electricity in half of them, primary education is universal, medical services are much improved and clean drinking water becomes more available by the month. Most importantly, average life expectancy in this overcrowded, land-locked nation of 14.6 million people is 20 years longer than it was 30 years ago.

Compared with the quality of life in the western world, these gains may not look like much but it is a lot when you consider where the country was. “Rwanda in 1995 was a society shattered by violence, trauma and loss,” explains the World Bank. To get where it is today, the country had to overcome a genocidal immediate past, lingering internal violence, a massive refugee crisis, a collapsed justice system, a subsistence farming-based economy and high levels of poverty.

How did the comeback happen in a country famous only for its gorilla population? According to the IMF, the government of President Paul Kagame put together a plan that worked its dollars to the limit. “The recovery came from relatively modest increases in investment, education and health spending from $150 to $420 per person.” Instead of splurging on trophy projects, the focus was on value for money.

“The key is to make every penny of taxpayer resources count,” says the IMF, citing astonishing improvements of up to 11 percent in developing nations and four percent in developed ones if they follow the same discipline. And President Kagame isn’t planning on stopping here. He wants Rwanda to become an upper middle-income nation by 2035 and a high-income one by 2050. Ambitious, but look what has happened so far.

TO READ MORE FROM WORLD FINANCE COLUMNISTS, VISIT: www.worldfinance.com/contributors

Banking giant HSBC is paying $13.6bn to take over its Hong Kong-based subsidiary, Hang Seng Bank. The deal, believed to be the biggest bank buyout in Hong Kong in more than a decade, is designed to allow HSBC to capitalise on Hong Kong’s role as a ‘super-connector’ between China and global markets, as the lender redoubles its efforts on its Asian business. “Hong Kong is one of HSBC’s home markets and HSBC benefits from the proud heritage and brand strength of both HSBC Asia-Pacific and Hang Seng,” the bank said in a statement. Chief executive Georges Elhedery said the deal was “an exciting opportunity to grow both Hang Seng and HSBC,” adding that the Hang Seng “brand, heritage, distinct customer proposition and branch network” would be preserved while new strengths in products, services and technology would be unlocked. He continued, “Our offer also represents a significant investment into Hong Kong’s economy, underscoring our confidence in this market and commitment to its future as a leading global fi nancial centre, and as a super-connector between international markets and mainland China.” Elhedery, who was

M&A

appointed CEO in 2024, has announced a raft of measures shaking up HSBC, including cost cuts. Investors were spooked immediately after the announcement, with HSBC’s share price dropping six percent. Analysts speculate that this was more down to the bank’s plans to pause share buybacks for the next three financial quarters to fund the deal than a negative view of Hang Seng. In fact, Citigroup’s analysts had expected the bank to spend about $8bn on buybacks over the next three quarters. Hang Seng does come with some baggage, however, with significant exposure to Hong Kong and mainland China’s property sector, which has experienced a lengthy downturn.

M&A

Gaming giant Electronic Arts (EA) will be sold in a $55bn deal led by Saudi Arabia’s Public Investment Fund. The deal, which also includes buyers such as private equity firm Silver Lake and Donald Trump’s sonin-law Jared Kushner’s Affinity Partners, is said to be the largest leveraged buyout in history. It also slaps a 25 percent premium on EA’s market value, giving it a valuation of $210 per share. As one of the largest gaming companies in the world, EA is known as the name behind best-selling games like EA FC, the football game previously known as Fifa, The Sims and Mass Effect. While the deal has understandably raised eyebrows, it is only the second-most-valuable gaming purchase in history, after Microsoft’s huge $69bn deal to buy Activision Blizzard, a gaming empire known for making Call of Duty.

Goldman Sachs is shelling out $665m in cash and equity for ‘pioneering’ venture capital firm Industry Ventures. The deal includes an additional $300m based on the firm’s performance through 2030. The 25-year-old business has $7bn in assets under management and will boost Goldman Sachs’ $540bn alternatives investment platform. “Industry Ventures’ trusted relationships and venture capital expertise complement our existing investing franchises and expand opportunities for clients to access the fastest growing companies and sectors in the world,” Goldman CEO David Solomon said. “We are uniquely positioned to serve the increasingly complex needs of entrepreneurs, private technology companies, limited partners, and venture fund managers,” Hans Swildens, founder and CEO of Industry Ventures, added.

A general view of Coima’s ‘Bosco Verticale,’ two residential towers designed by Italian architect Stefano Boeri (currently under investigation) in Milan. Amid a corruption probe into Milan’s urbanplanning sector, real-estate investments in Italy surged 52 percent in H1 2025 to €5.3bn, with Milan accounting for roughly 30 percent.

“Everybody likes moving markets, but I think some of the stuff that we saw, particularly in April and May, was very, very extreme.” World Finance invited David Barrett, CEO of EBC Financial Group (UK), into our studio to discuss the first half of 2025 in trading, and he had one word to describe it.

While cryptocurrency bulls are fighting to shed Bitcoin’s reputation for dramatic jumps and dives, the digital currency still has volatility issues that can leave traders in shock. In October, the cryptocurrency sector suffered its largest liquidation in history. Bitcoin, which plummeted from near a record high to a low of around $103,000, lost more than $200bn in value in a short-lived but significant flash crash (see Fig 1). It came as US President Donald Trump threatened to revive his trade war with China. He posted on his social media platform, Truth Social, that a raft of new tariffs of 100 percent on Chinese imports would

take effect in mere weeks. Investors dumped cryptocurrencies like Bitcoin for safe haven assets like gold – which conversely flew to a record high of more than $4,000 an ounce. The sell-off was heightened by investors’ highly leveraged positions. Data from CoinGlass revealed the crash saw $19bn in liquidated positions. While Bitcoin saw a significant loss, speculative ‘meme coins’ were hit even harder. Trump’s $TRUMP coin tumbled 63 percent, even more than the 50 percent drop for Dogecoin. While Trump may have labelled himself the ‘crypto president,’ in the long run he may do more favours for gold.

“Chaos!” he said. “The volatility that we have seen this year, even just the first six months, has been extraordinary... There will be a lot of young retail traders that wouldn’t have seen this. And hopefully it has been a good education and a lesson for them, but I do suspect that some of them have kind of had a baptism of fire. April in particular was pretty nasty.” VIX, the index that tracks expected volatility in the S&P 500, leapt to a five-year high of 52.33 in April 2025, as traders responded to the opening salvos of Trump’s trade war – a jump exceeded only by those recorded during the global financial crisis in October 2008, and the Covid-19 lockdowns in March 2020. And, while markets have settled in the months following, ongoing geopolitical tensions, supply chain disruptions and monetary policy changes have kept volatility high.

“Our advice to clients has been: take it back a bit, smaller positions, less leverage and take your time,” Barrett said. “Because if you look at the volatility, you look at the extreme moves we have had, it has created a huge amount of opportunity to enter and exit positions at levels and at timing that you never would have thought would be there in ordinary markets.

“The opportunities given by the volatility mean that you can take your time, take a step back, and do it in a more methodical manner than just jumping in with both feet,” he said. EBC Financial Group offers trading solutions to a huge breadth of customers: from professional and eligible clients in the UK, to retail clients in Asia and Latin America – some of whom may just be starting their trading career. Supporting them with education and market advice is very important, Barrett believes. “Best clients are clients that stay,” he said. “Clients that stay are clients that make money. So it is important for us to help them.”

TO FIND OUT MORE: www.worldfinance.com/videos

The Mediterranean island of Malta announced changes to its permanent residency programme in July 2025, making the popular path to European residence more accessible, flexible, and financially competitive. “We always try to adapt, to take into consideration new realities, geopolitical shifts and industry trends,” said Jonathan Cardona, CEO of Residency Malta Agency, in a video interview with World Finance. “We now have a more competitive financial outlay, more flexibility with property subleasing and rentals, and importantly an introduction of a one-year temporary residence permit provided at the very start of the applications.” Following the European Court of Justice ruling that recipients of EU citizenship must demonstrate a ‘genuine link’ with their adoptive member state – not simply show receipts of a financial transaction – Europe’s direct citizenship-by-investment schemes were all outlawed. Residency-by-investment schemes still remain, allowing non-EU nationals residence in the programme’s country, freedom of movement in the Schengen area, and in some cases a path to citizenship – although it is expected schemes offering the latter will come under closer scrutiny from the European Commission in due course.

“I think the Malta Permanent Residency Programme (MPRP) is an important tool to help the government and its revenues. Because at the end of the day it was implemented to better our economy, and attract talent,” said Cardona. “We have had people who have come through this programme, who have established businesses here, who have helped in employing people, who have helped in increasing our economy – which at the end of the day are all important for the betterment of our quality of life,” he said. While the changes to the MPRP have reduced the total contribution required from applicants, Cardona was keen to stress that the programme is still rigorous in ensuring that the people welcomed to Malta’s shores will not jeopardise its reputation as a stable jurisdiction and a safe place to live. “What definitely has not changed is our quality of service, and the levels of due diligence, which continue to be at the heart of what we do.”

TO FIND OUT MORE: www.worldfinance.com/videos

Over the last two years, France’s President Emmanuel Macron has appointed five different prime ministers to tackle the country’s runaway deficit, which is nearly double the European Union’s three percent limit. The euro zone’s second-largest economy’s public finances are in chaos. Not only is France’s deficit the widest in the euro zone, but its debt-to-GDP ratio is nearly 118 percent as of October 2025, the third highest in the EU, after Greece and Italy. Macron, who, before winning France’s presidential election in 2017 worked as economy minister for three years, was known for his strong approach to state finances. Looking to spur growth, he cut taxes and spending and even lifted the retirement age from 62 to 64. Since then, government spending on business subsidies ballooned in the wake of the pandemic and an energy crisis sparked by Russia’s invasion of Ukraine. With interest rates also heading higher, France’s

France already has the highest tax burden in the European Union, at nearly 44 percent of GDP, but spending is also high, with a whopping 15 percent of the country’s economic output going towards pensions alone. Investors are beginning to lose confidence in the nation’s ability to manage its finances. In fact, the

deficit has swelled. Sebastien Lecornu, the prime minister at the time of writing, who was reappointed by Macron after standing down, presented a new budget to parliament that sets out to reduce the deficit to between 4.7 percent and 5.0 percent of GDP, down from the rate of 5.4 percent recorded in 2025. The plan presents a mix of cuts to corporate tax breaks, tighter rules on social welfare contributions and a raft of new tax measures. However, an independent fiscal watchdog warned that they are based on overly optimistic economic assumptions.

“Overall, the public balance forecast for 2026 submitted to the Haut Conseil des Finances Publiques is weakened by an optimistic economic scenario and, more importantly, by the risk that the projected revenue and savings measures may be under-delivered – or may simply not materialise at all,” the watchdog said.

International Monetary Fund (IMF) predicts that French public debt will hit 130 percent of GDP by 2030. There is a possibility, if financial markets are too spooked, that the European Central Bank could step in to buy French bonds. However, analysts expect that any genuine financial crisis is unlikely – at least for now.

*Based on assets under management and market share of USD fund categories from AIMC as of the end of September 2025

Warning : Investors should understand the characteristics, conditions, returns and risks of products before making investment decisions. Investing in mutual funds is not the same as depositing money and returns cannot be guaranteed. Past performance/comparison of performances of related capital market products are not a guarantee of future performance. For more information, please contact UOB Asset Management (Thailand) Co., Ltd. at 0-2786-2222 or www.uobam.co.th

Warning : Investors should understand the characteristics, conditions, returns and risks of products before making investment decisions. Investing in mutual funds is not the same as depositing money and returns cannot be guaranteed. Past performance/comparison of performances of related capital market products are not a guarantee of future performance.

Lot 23, a stainless-steel Patek Philippe Ref. 1518, believed to be the first ever made, sold at Phillips’ Geneva Watch Auction on November 8, for $17.6m, becoming the most expensive vintage Patek Philippe ever auctioned just shy of the record held by a Rolex ‘Paul Newman’ Daytona, which sold for $17.8m in March 2024.

Global fintech revenues hit $378bn last year, with challenger banks and digital payment platforms taking the largest slice of the pie. From global revenue growth to the number of fintech start-ups worldwide, we look at the stats behind this booming industry.

Number of fintech start-ups GLOBALLY 2019 2024

By REGION 2019 2024

$378bn

Global fintech revenues in 2024

$1.1trn

Projected value of the global fintech market by 2034

Projected growth of fintech revenue by segment COMPOUND ANNUAL GROWTH RATE

$126bn Of 2024 fintech revenues came from payment firms

21%

Growth witnessed in fintech revenues in 2024

$28bn

Global fintech funding in 2024

Fintech’s

Approximate number of fintech firms worldwide in 2024 3%

Projected growth of the global fintech market USD BILLION

30,000

24 Number of profitable

Scaled fintech revenues by region 2024

3x

The pace at which fintech firms outgrew incumbent banks in 2024

8.34bn

Number of projected digital payment users globally by 2030

Customer satisfaction by digital banks in the UK PERCENTAGE

The building materials industry today is in conflict. On one hand: how to satisfy the rising demand for housing and infrastructure? Europe, for example, currently needs 9.6 million extra homes, with that shortage likely to get worse before it – slowly – gets better. On the other: how to tackle its carbon footprint, and reduce greenhouse gas emissions (36 percent of Europe’s total) by 55 percent in the next five years, and become completely carbon neutral by 2050? For international construction materials manufacturer TITAN Group, offering innovative, sustainable products and solutions is a key pillar in its growth strategy, CEO Marcel Cobuz explained in a video interview with World Finance “2024 was our fourth year of top-line growth with record sales and an over-proportional EBITDA growth,” he said. “It was full of milestones, like building capabilities in attracting new talent in areas like low carbon products, decarbonisation of our processes, but also the New York Stock Exchange listing of our US business, TITAN America: a bold move which strengthens our growth platform and unlocks more growth potential.” 2024 also saw the launch of its TITAN Edge range of “innovative, high-performance, low-carbon cementitious products,” Cobuz said. “In Greece for instance, we have launched a new innovative product, VELTER, which demonstrates how we are advancing performance in superior low-carbon products and construction.”

VELTER promises up to 30 percent less CO2 emissions than standard concretes in the Greek market, while still offering the same durability and resistance to carbonation, chloride intrusion, and sulphate attack – making it suitable for urban and coastal use. It is currently being deployed in Greece’s Ellinikon project: the largest urban regeneration project in Europe, transforming the grounds of a disused airport into a smart and sustainable ‘15-minute’ city.

“Sustainability was at the core of our strategy for a long time,” Cobuz said. “We have committed to reduce emissions across the value chain, and achieve net-zero by 2050.”

TO FIND OUT MORE: www.worldfinance.com/videos

banks reported quarterly earnings, many of which beat analysts’ expectations. Despite fears of an unsettled economy, JPMorgan reported a 12 percent increase in profit in the three months to September compared with the same quarter last year. Profits swelled to $14.4bn on revenues of $46.4bn. “There continues to be a heightened degree of uncertainty stemming from complex geopolitical conditions, tariffs and trade uncertainty, elevated asset prices and the risk of sticky inflation,” Dimon continued in a statement.

Rival Goldman Sachs, meanwhile, reported a profit of $4.1bn in the quarter, a 37 percent year-on-year uplift, thanks to a boom in deals. It also boasted its highest-ever revenue for the third quarter of $15.2bn. Citi Bank also beat analysts’ forecasts with profit of $3.8bn, up 16 percent on the same quarter the previous

JPMorgan’s decades-long investment plan includes up to $10bn in direct stakes in select companies focusing on four key industries: supply chain and advanced manufacturing, defence and aerospace, energy independence and resilience and frontier and strategic technologies. These are then broken down into

year, on revenues of $22.1bn, up nine percent. Over at Wells Fargo, profits jumped nine percent to $5.6bn on revenues of $21.4bn. The bank’s chief financial officer Mike Santomassimo noted that credit and debit card spending increased both among high-earning and lower-income customers. “While some economic uncertainty remains, the US economy has been resilient and the financial health of our clients and customers remains strong,” Charlie Scharf, Wells Fargo’s CEO, said in a statement. With America’s banks looking surprisingly healthy, it is perhaps no surprise that at least one is taking the opportunity to make a large investment in boosting the country’s prospects – and leading the charge on US President Donald Trump’s ‘America first’ ethos. JPMorgan announced $1.5trn in financing and investments over the next 10 years, focusing on industries “critical to national economic security and resiliency” in the US.

27 sub-industries. “It has become painfully clear that the US has allowed itself to become too reliant on unreliable sources of critical minerals, products and manufacturing,” Dimon said in a statement. The move had an immediate impact on US-based rare earth producers, whose shares jumped as much as 32 percent for one company.

Peace continues to deteriorate worldwide, according to the 2025 Global Peace Index. While Iceland, Ireland and New Zealand retain top spots, sharp declines in Russia, Ukraine and Sudan underline the economic and political costs of conflict, with only parts of South America bucking the trend

1 Iceland (Rank 1)

Iceland once again tops the Global Peace Index, a position it has held since 2008. Its strength lies in consistently high scores across all domains: societal safety and security, ongoing conflict and militarisation. With virtually no internal or external conflict and minimal military capacity, Iceland exemplifies how stability can become self-reinforcing. Public trust in institutions remains high, violent crime is low and political risks are negligible. While global peace has deteriorated overall, Iceland shows remarkable insulation from these pressures. For investors, its resilience underlines the value of stable governance and social cohesion as a foundation for long-term security.

2 Russia (Rank 163)

Russia ranks as the least peaceful country in the world in 2025. The war with Ukraine has driven severe declines across the ongoing conflict domain, with high internal conflict deaths, displacement and cross-border hostilities. While Russia registered a minor improvement in militarisation � mainly from reduced arms exports � this is overshadowed by escalating battlefield intensity and political instability. The costs are multidimensional: human, economic and reputational. Russia’s collapse in peacefulness illustrates how sustained external aggression and militarisation create a downward spiral that erodes security and longterm economic prospects.

3

Ukraine ranks second to last, reflecting the severe toll of its war with Russia. The ongoing conflict domain shows sharp deterioration, with high battle deaths, displacement and spill-over effects across society. Safety and security indicators have weakened as civil unrest and crime rise amid war fatigue. Militarisation remains elevated as Ukraine mobilises to defend itself, but this does little to offset the human and institutional costs of prolonged conflict. Ukraine illustrates how external aggression corrodes social trust, governance and economic stability. The war’s impact is a reminder of the far-reaching consequences of unresolved conflict on peace and development.

4 Ireland (Rank 2)

Ireland retains second place in the GPI, supported by strong societal safety and small improvements in crime perceptions, homicide rates and political terror scale. While Ireland hasn’t dramatically advanced its positive peace indicators, the country has maintained a steady path of resilience in a turbulent global environment. Ireland’s low militarisation is particularly striking against the backdrop of rising European defence spending. Ireland’s stability bolsters its reputation as a lowrisk hub for finance, technology and services. Its peacefulness offers a competitive edge at a time when geopolitical shocks are reshaping investor confidence.

5

New Zealand climbs to third, reflecting gains in societal safety and reductions in ongoing conflict. Improvements in terrorism impact, violent demonstrations and public perceptions of crime underpin its strong showing. However, the country has edged higher on militarisation metrics, notably through rising defence spending and increased weapons imports � echoing a global trend toward strategic preparedness. This mix of improved social peace and heightened security posture illustrates how even highly stable nations are responding to increased global uncertainty. Its trajectory shows that even peace leaders must adapt to shifting regional dynamics during these times.

Bangladesh records one of the steepest declines among populous nations in 2025. Its fall stems from growing political repression, curbed civil liberties and rising militarisation. Indicators such as political terror, external conflict and military expenditure have worsened, pointing to an increasingly securitised state response to internal pressures. While some measures of societal safety remain stable, the overall trajectory is negative. Bangladesh’s slide reflects a broader pattern � when governments tighten control rather than fostering inclusion, the erosion of peace can trigger economic volatility alongside social unrest.

Peru stands out as a rare bright spot in the 2025 index, with peacefulness improving by nearly three percent. Gains were strongest in safety and security, where reductions in violent demonstrations, homicide rates and political terror scale offset regional volatility. The ongoing conflict domain remains a drag, but the overall direction is positive. For South America � uniquely the only region to improve in 2025 � Peru exemplifies how democratic stability and incremental reforms can yield peace dividends. Improved peacefulness not only reduces domestic risk but also enhances Peru’s appeal for investment, tourism and regional partnerships.

Sudan remains near the bottom of the rankings as civil war between the Sudanese Armed Forces and the Rapid Support Forces grinds on. The conflict has produced soaring internal conflict deaths, widespread displacement and humanitarian crises. Indicators in safety and security have worsened sharply, with violent crime, political instability and limited humanitarian access undermining any prospects for stability. Militarisation remains high, with significant shares of GDP directed toward warfare. For the global community, Sudan’s plight is a sobering reminder of how weak institutions and armed rivalries can dismantle social and economic foundations.

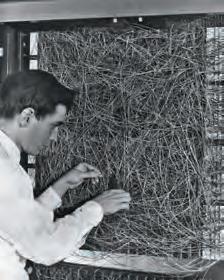

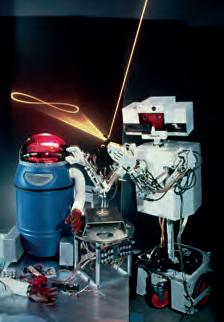

Humans have long been fascinated by the idea of automation, and the past century has seen breakthrough after breakthrough, turning sci-fi visions of AI into an eerie reality. Here we trace its evolution across the decades – from the dawn of robots in the 1920s to Alan Turing’s work on machine intelligence in the 1950s, AI-powered NASA rovers in the early 2000s to the explosion of generative AI in the 2020s.

1920 s

Records from 400BC refer to ‘automatons’ that could move without assistance, but it was only in 1920 that the term ‘robot’ was first coined, in a play by Czech playright Karel Čapek. In the play, the robots revolt, destroying humanity. In 1928, the basic robot vision became reality when Professor Makoto Nishimura built Gakutensoku, a humanoid robot that used an air pressure mechanism to move.

In 1950, Alan Turing published ‘Computing Machinery and Intelligence,’ introducing the idea of the ‘imitation game’, now known as the Turing Test, to measure machines’ intelligence. In 1955, the term ‘artificial intelligence’ was officially coined, ahead of a workshop focusing on the field. The first trainable artificial neural network, the Perceptron, was meanwhile developed in 1957 by psychologist Frank Rosenblatt.

2000 s

Unimate, the world’s first industrial robot, began working on a General Motors assembly line in New Jersey in 1961, transporting car parts. In 1966, the world’s first chatbot, ELIZA, arrived, using natural language processing. Around the same time, Shakey the Robot was also created at the Stanford Research Institute, using sensors and a camera to perceive, reason and solve basic problems about its surroundings.

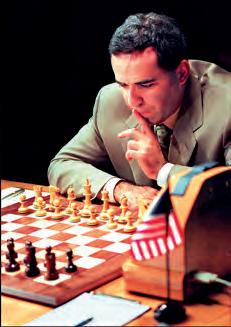

the end of the human era as we know it in his essay ‘The Coming Technological Singularity.’ In 1997, IBM’s chess-playing programme Deep Blue beat world chess champion Garry Kasparov. The same year, Dragon Systems released the first voice recognition software, paving the way for the likes of Siri and Alexa, and putting the spotlight on AI once again.

NASA sent two AI-equipped Rovers to Mars in 2003 to search for evidence of past water and life. Apple integrated virtual assistant Siri into its iPhone 4 in 2011, and Amazon launched its first Alexa device in 2014. Meanwhile, platforms such as Facebook, Twitter and Netflix started deploying AI to tailor recommendations and advertising.

Interest in AI waned during the 70s but was revived in the 1980s, with several key developments. The Association for the Advancement of Artificial Intelligence (AAAI) was founded in 1979 to encourage progress, while Japan launched its Fifth Generation Computer Project in 1982, investing around $850m in AI projects. The first self-driving vehicle was meanwhile developed in Germany in 1986.

In 2016, Hanson Robotics created Sophia, considered the world’s first ‘robot citizen’ thanks to her ability to mimic emotion. Facial recognition also progressed, with Apple introducing Face ID in 2017. The same year, two chatbots were trained to speak with each other at Facebook’s AI Research lab; they began communicating in their own shorthand language without human intervention, and the experiment was stopped.

In 2021, DeepMind’s AlphaFold2 accurately predicted protein structures from their amino acid sequences displaying the substantial potential for AI in healthcare research. 2022 saw the arrival of OpenAI’s advanced conversational chatbot ChatGPT, later launching video generation model Sora in 2024. These highlight the huge opportunities of AI as it continues to take on an ever-greater role in our lives.

is a new address for luxury hospitality in Italy: a 5-star hotel in the capital of business, fashion and design, that stands out for its style and welcome.

NEMI offers a refined experience , rich in new , just a short walk from the heart of Milan. a in a vibrant, trendy and well-connected area restaurants, historic shops, art galleries and showrooms Milan.

Nikolay Storonsky CEO AND CO-FOUNDER, REVOLUT

Words by: Courtney Goldsmith

As the founder of Europe’s most valuable fintech, Nikolay Storonsky is at the helm of a digital-first bank pushing back against the traditional grain. But as Revolut’s valuation soars, can he walk the line between agile start-up and global banking powerhouse?

In the mid-2010s, Europe’s fintech sector was booming. A novel band of financial technology companies were rewriting the script on everything consumers thought they knew about banking. Buzzy names with swelling valuations stole the spotlight from traditional lenders – in fact, in the second half of the 2010s, fintechs raised record capital. Venture capital funding grew from $19.4bn in 2015 to $33.3bn in 2020, according to a report by McKinsey & Company.

In recent years, the feverish rush to fintech has cooled slightly. But one company that remains as ambitious today as it was in its exhilarating early years is Revolut, the app-based bank and current holder of the title of Europe’s most valuable fintech. Revolut has successfully made the leap from start-up to unicorn to profit-turning institution. In 2024, its profits more than doubled to £1bn, and more recently customer numbers have surged to 65 million. It is clear that Revolut CEO and co-founder Nikolay Storonsky is doing something right.

Founded in 2015, Revolut started its days as a pre-paid card with free currency exchange. After years of experimentation in new verticals, alongside steady growth of the bank’s main operations, Revolut now offers everything from cryptocurrency trading to in-app eSIMs for travellers. Indeed, Storonsky

has stated he wants to create the “Amazon of banking.” While Revolut has taken a ‘jack of all trades’ approach, the caveat is that Storonsky expects to be master of all.

While Revolut’s success so far is undeniable, global banking domination is not a given. Banking licences have not been easy to come by, and, as with many ambitious, fast-growing tech companies, ex-employees have complained of an excessively demanding workplace culture. What’s more, after a secondary share sale bumped the firm’s valuation up to $75bn over the summer from $45bn the year before, some critics are calling Revolut’s price tag into question.

Yet Storonsky continues to set his sights high, targeting continued innovation in new verticals and plans for geographic expansion, too. Does he have what it takes to build the world’s leading financial services provider?

The collapse of Lehman Brothers in 2008 sent shockwaves across the global financial services sector. For Storonsky, it had a significant, personal impact. Born in Russia, Storonsky moved to the UK in 2004 with a degree in general and applied physics from the Moscow Institute of Physics and Technology and a degree in applied economics and finance from Moscow’s New Economic School. There, he

soon began working for the lender as a derivatives trader. When Lehman Brothers filed for bankruptcy, Storonsky was stunned. “It was a big and powerful investment bank, so the announcement came as a shock,” he told CNBC. “We were told without much warning, and it seemed to happen quite quickly.”

Storonsky told the Financial Times in an interview that the crisis not only cost him around half a million pounds, but it also taught him the value of backing every decision with data and logic. After moving to Credit Suisse, where he worked from 2008 to 2013, Storonsky began to hatch an idea to simplify financial services through an easy-to-use app that would reduce fees when spending in different currencies. In 2015, he co-founded Revolut with British-Ukrainian Vladyslav Yatsenko, a software developer who cut his teeth at UBS and Deutsche Bank, and who remains the company’s chief technology officer today.

Outside of Revolut HQ, similar innovations in financial technology were unfolding. The global financial crisis shook consumers’ confidence in the biggest banks, leading to an upswell in support for a new generation of tech-forward digital banks – not only Revolut, but also Germany’s N26 and Fidor, Brazil’s Nubank and America’s Chime. These firms promised convenience, improved user

“Banking has historically avoided disruptions by technology, but that is all about to change on a big scale”

Nikolay Storonsky

CURRICULUM VITAE

Born in Dolgoprudny, Russia, Storonsky made the move to the UK in 2004 after having studied in Moscow. He would later gain citizenship for himself in the UK.

Storonsky was working at Lehman Brothers when the investment banking giant filed for bankruptcy, which was a pivotal moment in the global financial crisis.

experience and the agility needed to chop and change their services as required. Many of them were founded by the very employees who were left high and dry after the collapse of Lehman Brothers – and who, like Storonsky, dreamt of something better. As he told CNBC, “A number of successful entrepreneurs rose from the ashes who were pretty disillusioned with the financial system.”

Following its launch, Revolut experienced rapid growth. In 2018, Storonsky announced a cash injection of $250m that propelled the fintech’s valuation to more than $1bn, making it Britain’s first digital bank unicorn – and one of the fastest tech companies in Europe to reach unicorn status.

After a stint at Credit Suisse from 2008 to 2013, Storonsky cofounded Revolut with CTO Vladyslav Yatsenko with a dream of simplifying financial services.

Revolut achieved unicorn status following a $250 million funding round, becoming one of the fastest companies in Europe to grow to a valuation of more than $1bn.

Even then, he hinted that Revolut was nowhere near finished. “Our focus, since we launched, has been to do everything completely opposite to traditional banks,” he said in a statement at the time. “We build worldclass tech that puts people back in control of their finances, we speak to our customers like humans and we’re never afraid to challenge old thinking in order to innovate.

“Banking has historically avoided disruptions by technology, but that is all about to change on a big scale,” Storonsky said, taking aim at the banking establishment. His vision for an alternative global banking system – one where, “Anyone in the world can just download the Revolut app and set up a local bank account to access any services they need,” as he told Business Insider in 2017 – is grounded in

Storonsky started up a venture capital and growth equity firm called QuantumLight, which uses an AI model to fund fintech and related start-ups.

When a secondary share sale propelled Revolut’s valuation to $75bn, Storonsky’s personal wealth shot up to over $18bn, making him one of the richest people in the UK.

an approach that ensures the company never stands still. This is most evident in Revolut’s engine for growth in new verticals: its ‘new bets’ division.

‘Move fast and break things’ is the Mark Zuckerberg-coined ethos that tech companies have long lived and breathed, and Revolut is no different. The lender is known for its ability to quickly launch into new revenue streams –everything from mobile phone plans to an air mile points offering.

These have the potential to become quick moneymakers for the business, with cryptocurrency trading being a case in point. The division helped to boost Revolut to its first annual profit in 2021 as retail traders jumped at the chance to join in the crypto boom. “Nikolay Storonsky’s leadership of Revolut highlights

how speed and adaptability can really define success in fintech,” Ed Gibbins, co-founder and CEO of ChaseLabs, an AI sales development system, told World Finance. “His approach reflects a deep understanding of tech disruption: launch quickly, scale globally, and then refine using real user feedback. This ability to treat global markets as testing grounds means Revolut can adapt features faster than rivals and align its offerings closely with consumer demand.”

Each ‘new bet’ at Revolut begins with a small team of around 10 people led by an employee with a strong entrepreneurial background, as reported by Sifted earlier this year. With a budget of around £2m to £3m, they work to build experimental products on tight timelines of just 18 months, though many have been launched even more quickly.

By moving faster than traditional banks, and even many challengers, Revolut has built a reputation for agility that resonates with tech-savvy consumers, Gibbins explains. “The strategy of rapid feature deployment and constant iteration allows the company to test ideas across markets and double down on what works. This cycle of innovation and responsiveness has enabled Revolut to outpace competitors and strengthen its position as a leading player in global fintech,” Gibbins said.

If a new bet makes money, it’s scaled up; if it doesn’t, it is either tweaked, scaled down or ditched. To date, 45 ‘new bets’ have been approved, with some of these still in the development pipeline, a Revolut spokesperson told Sifted. They described the unit as operating “on a venture capital-inspired model.” Storonsky is no stranger to VC. In 2022, he started up his own VC firm, QuantumLight, which uses an AI model to fund fintech and related start-ups.

Revolut’s agility and its comprehensive offering are key selling points among customers. “Revolut’s rise has been driven by a clear focus on tech-savvy consumers who expect more than traditional banking can deliver,” Michael Foote, founder of Quote Goat, an insurance comparison tool, told World Finance. “By combining everyday money management with trading and payments inside one app, the company positions itself as a lifestyle tool rather than a conventional bank. This multifunctional approach has given it strong appeal among younger customers who value speed, convenience, and variety without juggling multiple providers.”

As of September 2025, Revolut said it had surpassed 65 million customers worldwide. Its success has driven financial winnings for Storonsky, too, who is thought to own around a 25 percent stake in Revolut. According to Forbes, he has a net worth of $7.9bn.

While Revolut can boast growing customer numbers and profits, the firm’s financial success may disguise challenges that have dented its reputation. For example, Revolut’s aggressive corporate culture has come under intense scrutiny in recent years, with some former employees claiming they were set unachievable targets, forced to do unpaid work and put under enormous pressure.

For many years, the company’s tough culture was an open secret. “We are not about long hours – we are about getting shit done,” Storonsky explained to Business Insider in 2017. “If people have this mentality, they work long hours because they want it.”

The company has thousands of reviews on Glassdoor, an employer review site. Even with an overall rating of 4.0, as of October 2025, reviewers frequently mention a lack of work-life balance and management’s prioritisation of targets above all else. However, many reviewers appear to recognise that while the environment at Revolut is not for everyone, some thrive in its high-pressure conditions.

“No one is sitting there telling them they have to work long hours,” Storonsky continued telling Business Insider. “They are really motivated, really sharing the vision of where we want to go and as a result, they work long hours – they work at least 12 or 13 hours a day. All the key people, all the core team. A lot of people also work on weekends.”

Since that interview, Storonsky has claimed that changes have been made. “We are a different company than we were two to three years ago,” he said in a 2019 interview with Reuters. “We have learned lessons.” But in 2023, still seeking to address the feedback, the firm assembled an internal team to track whether its employees were being ‘inclusive,’ ‘approachable’ and ‘respectful,’ the Guardian reported, encouraging a more ‘human’ approach.

Francesca Cassidy, editor of Raconteur, a business news website, questioned whether change would really be effective if it wasn’t happening from the top. “Storonsky wants Revolut to be the ‘Amazon of banking.’ In pursuing this objective, he works tirelessly and expects much the same from his colleagues. With such a dedicated, driven character at the helm, it is little wonder that Revolut’s culture has developed as it has,” she wrote in an opinion piece.

Yet the company’s plans to revamp performance reviews and launch a recognition and reward programme, “do little to address the high-performance culture that seems to be the source of much of the negative feedback,” Cassidy wrote. “How can employees be expected to pour their energy into being

pleasant, collaborative colleagues if they are overworked, under stress and burnt out?”

In addition to a thorny working culture, Revolut has for years battled with a slow approval of its full UK banking licence. In 2018, the company gained its EU banking licence through Lithuania, but after a three-year application process that finally resulted in approval in July 2024, Revolut’s full UK banking licence was still being held up by regulators’ concerns at the time of publishing. The Bank of England has highlighted concerns over the start-up’s ability to maintain its risk management controls in line with its rapid international expansion, the Financial Times revealed.

Storonsky has admitted that not prioritising securing a full UK banking licence in Revolut’s early stages, and instead going all-in on growth, was a rare misstep for the business. A full UK banking licence will allow Revolut to offer a broader range of financial products and services. For example, it will finally be able to enter the UK lending market, allowing it to compete more directly with traditional banks in areas like mortgages and savings accounts.

Equally as importantly, the approval could open the door to further licences in countries including the US, Australia and Japan. It could also be seen as a stepping stone to the company’s stock market flotation, which is likely to be in London or New York.

While Storonsky has global ambitions for Revolut, his focus isn’t narrowed to the digital bank alone. QuantumLight, his venture capital firm, this year announced the close of its inaugural $250m fund. Created with an aim of backing ‘exceptional’ founders across AI, web3, fintech, software as a service (SaaS) and healthtech, QuantumLight is further evidence of Storonsky’s obsession with data. The VC is described as, “on a mission to bring scientific precision to venture capital.”

“Our ambition is to build the world’s best systematic venture capital and growth equity firm,” Storonsky said in a statement. QuantumLight is also a handy promotional vehicle for Revolut. The business releases public ‘playbooks’ that promote Revolut’s expertise in order to help founders replicate its successes.

Its most recent launch was Hiring Top Talent. Co-authored by Storonsky, the playbook is designed to share the operating principles Revolut developed to ‘systematically scale world-class teams.’ It promises to offer a ‘blueprint’ for implementing the structured recruitment approach behind Revolut’s ‘hiring engine’ that helped the company scale to more than 10,000 employees in just 10 years.

“Our goal is to make the invisible operating systems behind iconic companies like Revolut visible and replicable,” said Ilya Kondrashov,

$75bn

Revolut’s valuation in 2025

£1bn

Profit achieved in 2024

2018

Year Revolut achieved unicorn status

65 million

Customer numbers as of 2025

This year, he set out his aim to hit 100 million retail customers globally by mid-2027 and to enter more than 30 new markets by 2030, becoming “the world’s leading financial services provider.”

“Our mission has always been to simplify money for our customers, and our vision to become the world’s first truly global bank is the ultimate expression of that,” Storonsky said. Alongside the announcement, Revolut noted that it had earmarked $500m to accelerate its operations in the US. The company’s US CEO confirmed reports that it is looking into whether to apply for its own banking licence in the US or acquire a US bank, which would allow it to expand more quickly.

CEO of QuantumLight. “Founders shouldn’t have to reinvent the wheel when it comes to building high-performing teams. By sharing these tools and frameworks, we’re helping scale-ups move faster from day one.”

Beyond venture capital, Storonsky has also shown a penchant for the finer things with Utopia Design, a luxury travel company that Forbes revealed he had quietly set up in 2023. Building on a personal passion for kite surfing, the project includes high-end luxury villas in destinations including the Dominican Republic, Brazil and Barcelona.

While these passion projects have the potential to line Storonsky’s pockets, his main moneymaker continues to be Revolut. In fact, he is said to have set up a multibillion-dollar payout if he can catapult the fintech’s valuation to $150bn, the Financial Times revealed. The deal, similar to one approved by Tesla’s board for Elon Musk, would offer Storonsky shares in Revolut, paid out in stages, that could be equal to a further 10 percent stake.

Back in 2019, Storonsky said Revolut’s success would hinge on whether it could gain enough customers. “The whole idea was we provide the product for free, then we cross-sell other services. So we just need to have large customer numbers,” he said in an interview with CNBC.

Overall, Revolut is investing $13bn over the next five years in its global expansion – which continues apace. The firm’s launch in Mexico is expected in early 2026, and an opening in India is also on the cards in the not-distant future. A new global tech hub in the Philippines was set up to support operations in Australia and New Zealand, where Revolut is seeking to obtain banking licences. The company is also beginning to make its first push into Africa, with South Africa in its sights, and it has received an in-principle licence in the UAE to facilitate an expansion into the Middle East. Reports have even surfaced that Revolut is mulling a move into China.

Meanwhile, Revolut’s ‘new bets’ unit is likely to continue cooking up new financial products to explore, but what those will be, exactly, is less clear. In September 2025, a company announcement revealed that the main areas of focus would include AI and private banking. However, if Storonsky’s plans to continue opening in new markets is successful, these new verticals may need to be tailored to the countries in which they are launched, as regulatory requirements could vary region to region. While this could create opportunities for unique products, it also has the potential to take the wind out of the division’s sails as more red tape arises.

“Nikolay Storonsky’s strategy has centred on rapid global expansion and aggressive feature rollout,” Foote said. “The combination of constant innovation and international reach has set the business apart, showing how fintechs can compete with traditional banks by being faster to market and more responsive to customer demand.”

Despite Revolut’s boundless appetite for growth and its achievement of profitability, there are still worries in some corners that the company’s $75bn price tag is too high. However, if Storonsky can pull off his ambitious plans for global expansion and continue to bring to market exciting new products, there is no doubt he will silence the critics. n

Anne Krueger FORMER WORLD BANK CHIEF ECONOMIST

For more than a century, the US economy thrived on private enterprise and limited government interference. But Donald Trump’s latest interventions – from steel and chipmakers to media and research – suggest that America’s market model is being reshaped by politics, not productivity

For at least the last 150 years, state intervention in picking individual industries and firms to support has been shown to undermine productivity and weaken economic performance. When political considerations outweigh sound commercial judgment, companies may be compelled to keep unprofitable factories open, maintain loss-making activities, favour government-owned suppliers over private vendors, or appoint unqualified but politically connected individuals to leadership positions.

By contrast, when private companies are inefficient or producing goods people do not want, they exit the market, and more productive companies enter. The profit motive drives businesses to recruit capable employees, produce quality goods that meet demand, innovate, and embrace cutting-edge technologies. When subject to political influence or control, companies generally have weaker incentives to pursue these goals precisely because government ownership shields them from competition. In the US, as in most advanced economies, the private sector has long been

the primary driver of GDP growth. With governments playing a relatively limited role – establishing regulatory frameworks, supporting basic research and innovation, and curbing monopolies – competition has flourished, delivering decades of economic prosperity.

A break from tradition

But under President Trump, the US – once an avatar of free-market capitalism – has broken with this tradition. Since the start of his second term, Trump has repeatedly meddled in private-sector decision-making. His administration has targeted law firms, universities, think tanks, semiconductor and battery manufacturers, media companies, research, and more.

And, taking a page from the playbook of state-controlled communist economies, his administration has gone even further, moving from intimidation to direct government ownership of private firms. In June, for example, Japan’s Nippon Steel was permitted to acquire US Steel but had to grant the federal government a ‘golden share,’ giving American

policymakers veto power over the company’s business plans. Even before Trump’s intervention, Nippon Steel had pledged to make major investments in US Steel, retain all employees, and honour newly negotiated contracts with union-represented workers. The Trump administration’s added demands thus send a mixed message: while it courts foreign investment, it erects unnecessary barriers.

Trump’s deal with chipmakers Nvidia and AMD illustrates this contradiction. In April, the administration halted the sale of advanced semiconductors to China on national-security grounds. Yet by July, Nvidia and AMD were permitted to resume sales, provided they hand the US government 15 percent of the revenues.

The administration’s deal with Intel is even more brazen. In August, Trump announced that the US government had acquired a 10 percent stake in the company, paid for with $5.7bn Intel had already been promised under the CHIPS and Science Act and another $3.2bn from the Secure Enclave programme.

The agreement also effectively shackles Intel to its loss-making foundry while giving the government the option to buy an additional five percent if the foundry is ever sold. Notably, by converting anticipated CHIPS grants into equity, the agreement does not provide Intel with new government funds. Meanwhile, private shareholders bear the cost of dilution: the US government purchased its stake at $20.47 per share – well below the $24.80 closing price on the eve of Trump’s announcement.

Although the government will hold no seats on Intel’s board, even without formal representation, the administration’s shadow

will loom over the company’s decision-making. Policymakers could lean on Nvidia, AMD, and other firms to buy semiconductors from Intel, pressure the company to build new factories in unprofitable locations, or force it to hire workers chosen for political loyalty rather than competence.

Intel’s prolonged decline underscores the poor economics driving Trump’s investment. In the 1990s, the company was the leading semiconductor manufacturer; in 2000, it even briefly became the world’s second most valuable company.

Against this backdrop, Trump’s Intel deal looks especially misguided. What the company truly needs is new financing to service its existing obligations, swollen by years of heavy losses, and fund the turnaround plan developed by its new CEO, Lip-Bu Tan. SoftBank, the Japanese investment conglomerate, recently announced a $2bn investment in Intel, though whether that move reflects genuine confidence in Intel’s future or an effort to curry favour during tense tariff negotiations between the US and Japan remains an open question. Industrial policy is often said to be about ‘picking winners.’

“Trump’s brand of state capitalism does little to strengthen either industry or the broader US economy”

Today, however, it doesn’t even crack the top 15 chipmakers by market capitalisation. Intel has also been the single largest beneficiary of the CHIPS Act, using federal funds to develop new production facilities in Arizona. But construction faced repeated delays, with executives blaming a shortage of skilled labour. Similarly, an Ohio plant already under construction has had its completion date pushed back from 2025 to 2030.

But given Intel’s recent performance, the Trump administration seems intent on picking losers. While few dispute the importance of steel production, or that semiconductors will drive future growth, Trump’s brand of state capitalism does little to strengthen either industry or the broader US economy. Instead, it exposes the dangers of government meddling in markets: wasted taxpayer money, distorted incentives, weakened competition, and less dynamism and innovation. n

Sergei Guriev

DEAN AND PROFESSOR OF ECONOMICS

Economic strain, demographic decline and sanctions are eroding Russia’s wartime resilience. Still, Vladimir Putin sees continued fighting as his best investment – a gamble the West must now counter with sharper economic pressure

As the war in Ukraine drags on, the economicpolicy debate in Russia has shifted from celebrating war-driven growth to arguing over whether the economy is stagnating or has entered a recession. In the first quarter of 2025, GDP declined by 0.6 percent compared to the previous quarter, and then grew by only 0.4 percent in the second quarter.

Even the most optimistic forecasts expect Russia’s growth to be around one percent in 2025, down sharply from 4.3 percent in 2024 and 4.1 percent in 2023. Despite this deceleration, inflation remains a challenge. As a result, the Russian Central Bank recently lowered its policy rate by 100 basis points – a smallerthan-expected cut – to 17 percent. Russian consumers are already feeling the pinch. Car sales, for example, are forecast to fall by 24 percent this year.

President Putin is also facing a fiscal challenge. Russia’s budget deficit in the first eight months of 2025 hit 1.9 percent of annual GDP and is projected to grow to 2.6 percent of GDP by the end of the year – low by American or European standards, but problematic for a

country that has been cut off from international borrowing as a punishment for invading Ukraine. Over the same period, oil and gas tax revenues fell by about 20 percent year on year, thus draining the sovereign wealth fund. The liquid part of this fund now stands at $50bn, or 1.9 percent of GDP.

Understanding that under the current economic model he will run out of cash in less than a year, Putin just announced a budget for 2026–28 that includes substantial tax hikes. This will depress the economy further and could trigger a public backlash.

In addition to mounting economic pressures, Russia faces a deepening demographic crisis. Around one million troops have been killed or wounded in the war, and roughly the same number of people have fled the country, many of them men avoiding conscription. It is telling that this year Russia has stopped publishing demographic data. Moreover, the West’s sanctions regime has limited Russia’s access to crucial technologies, undermining invest-

ment in the economy and modernisation efforts. Given these conditions, it is no surprise that a substantial majority of Russians have grown tired of the war. In a recent poll, 66 percent of respondents were in favour of starting negotiations rather than continuing military actions in Ukraine.

Despite these multiple challenges, Putin seems undeterred. That is because the situation is not yet catastrophic. After all, the Russian economy may be stagnating, but it is not collapsing. And with a labour force of more than 72 million, Putin can still recruit about 30,000 soldiers per month by paying men from Russia’s poorest regions 10 or 20 times their average wage. These factors, coupled with his apparatus of repression, have likely convinced Putin that he has the means to keep his war economy running and suppress domestic discontent for as long as necessary.

Perhaps more importantly, Russian forces continue to advance on the battlefield – a critical element of Putin’s strategy. To be sure, the process is slow and costly in terms of lives and money. But so long as Putin continues to seize

“Under the current economic model Putin will run out of cash in less than a year”

more Ukrainian land, he has no incentive to negotiate, regardless of what the US government offers him. That is not to say that Western sanctions have failed. Putin has limited access to cutting-edge military technology and must rely on China, North Korea and Iran for spare parts and other supplies.

He has less cash to recruit soldiers, and he may need to spend even more to quell civil unrest. In the new fiscal plan for 2026, he has to budget the same amount for military and security spending in nominal rubles – thus de facto reducing this expenditure adjusted for inflation.