CLIENT CARE LIFESTYLE FINANCIAL PLANNING Shop 12, Village Centre, St Francis Bay

Crafting a Personalized Investment Philosophy: A Path to Financial Clarity

I

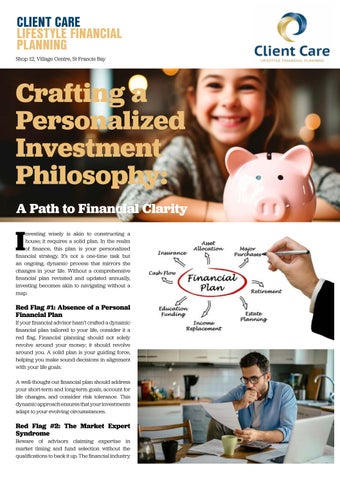

nvesting wisely is akin to constructing a house; it requires a solid plan. In the realm of finance, this plan is your personalized financial strategy. It’s not a one-time task but an ongoing, dynamic process that mirrors the changes in your life. Without a comprehensive financial plan revisited and updated annually, investing becomes akin to navigating without a map.

Red Flag #1: Absence of a Personal Financial Plan If your financial advisor hasn’t crafted a dynamic financial plan tailored to your life, consider it a red flag. Financial planning should not solely revolve around your money; it should revolve around you. A solid plan is your guiding force, helping you make sound decisions in alignment with your life goals. A well-thought-out financial plan should address your short-term and long-term goals, account for life changes, and consider risk tolerance. This dynamic approach ensures that your investments adapt to your evolving circumstances.

Red Flag #2: The Market Expert Syndrome Beware of advisors claiming expertise in market timing and fund selection without the qualifications to back it up. The financial industry