6 minute read

The end of an era

from Whitonomics 2020

Does China’s slowdown spell the end of its state-owned enterprises?

Ryan Ho On the 2019 Fortune Global 500 list, Chinese companies accounted for 129 of the world’s largest corporations in terms of revenue. This number was the first time in the many years since the debut of the Global 500 list that a nation other than the US had the highest number of the world’s largest corporations by revenue. (The number of American companies was 121). Out of the top 5 companies in the world, 3 of them were from China (Sinopec Group, China National Petroleum and State Grid). According to Fortune, the most prominent nationality among the bottom fifty of the Global 500 were Chinese. With the trend indicating that Chinese companies are on the rise, it can be seen that this increase in Chinese prominence in the Global 500 is going to continue to grow. These companies look set to continue to rise to the top as they aim for the “fully developed, rich, and powerful” goal that Xi Jinping, the President of the People’s Republic of China, set for the country. However, while the growth of Chinese firms has been indeed remarkable, what is more remarkable is that of the 129 Chinese firms that were in the Global 500, 82 of them were state-owned enterprises (SOEs). These SOEs receive large subsidies from the Chinese government which gives them an advantage over private firms in the West.

According to the State-owned Assets Supervision and Administration Commission of the State Council, from January to April of 2018, the total operating income of SOEs

in China was 2.73 trillion USD. This figure represented an increase of 9.7% from the previous year. After costs were subtracted, the total profit for SOEs reached 142 billion USD, a figure that was a year-onyear increase of 18.4%. This figure was touted as a “historic high”. According to the spokesman of the state-owned Assets Supervi-

sion and Administration Commission, this was achieved partly due to “supporting measures by the government”. One such supporting measure used by the government in order to ensure that Chinese SOEs thrive both overseas and domestically is the use of subsidies. A prominent example can be seen from China’s state-owned Baowu Steel Group. A subsidiary of the Group, Baoshan Iron and Steel Co Ltd, re-

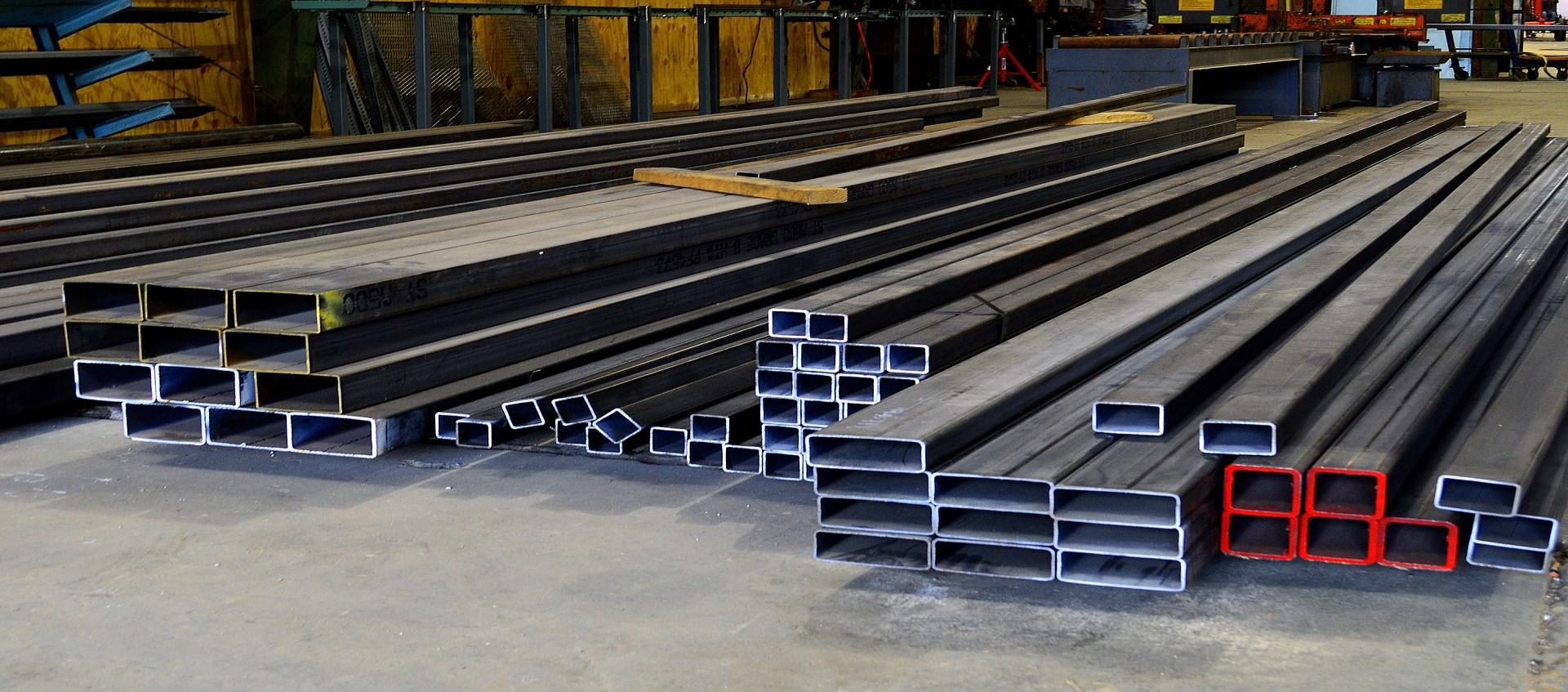

ported in their 2018 annual report, that it received a total of 85 million USD in the form of grants from the central government. Grants are a form of subsidies which are payments by the government to firms in order for the firms to enjoy lower costs of production. In short, a subsidy is the government helping in paying for some of the costs that occur when producing an item (e.g. for steel, costs of pro-

duction include transportation and the prices of the raw materials used in its production). This lowering of the costs of production mean that the SOEs are then able to lower the prices of their goods as even if they gain less revenue, they will see the same profit margins as before due to the lower costs. While it is not credited by the group itself, it can be seen that it is through this system of subsidies that Baowu Group has become the world’s second largest manufacturer of steel in the world. These subsidies also enable those SOEs to sell their goods abroad at very low prices that are below market value in a practice known as dumping (the offloading of goods at below the costprice level leading to predatory

Subsidies have enabled SOEs to sell their goods at below the cost-price level.

pricing.) As most companies in the west are not given the same level of grants as the SOEs in China, this means that they are only able to lower prices to a certain level before they start making losses. Typically, these firms are unable to match the pricing strategies of the SOEs of China meaning that when those SOEs export, they can dominate the market in many places as they are able to offer much better prices to the consumer for the same product. This is not to say that Chinese firms dominate foreign markets. Foreign governments and trade blocs retaliate by imposing duties on Chinese duties. An example is the US government which through its Commerce Department imposed duties of up to 79.9% on Chinese-made kegs and duties up to 1,731% on mattresses on the 29th May in 2019 in retalia-

tion to Chinese dumping. As of the 10th October 2019, the European Union (a trade bloc) imposed tariffs as high as 66.4% on steel road wheels from China. This is because the EU stated that the imports caused “material injury” to European Union based manufacturers of steel road wheels. However, even though these duties have hurt the Chinese manufacturers, the truth is that Chinese goods are essential to the world economy, at least in the short term. With the world’s largest industrial output, Chinese goods are typically cheaper than that of their Western competitors meaning that firms that use Chinese goods in their production process typically have lower costs of production than the firms that use domestic products. Therefore, firms may try to get around these duties in order to keep their costs and profits the same, meaning that these tariffs may not be of any use at all. Of more pressing concerns for Chinese domestic manufacturers is the slowdown of the Chinese economy. In 2018, official statistics from the National Bureau of Statistics of China placed the growth of real GDP

(GDP adjusted for inflation) at 6.6%, a rate that is the lowest since 1990. This slowing of growth is also confirmed by the McKinsey Global Institute’s Economic Activity Index which echoes the trend line of the official GDP numbers released by China. As China’s economy starts to cool down, private firms in China may see less investment as investors become wary of the way that the economy is trending towards. This decrease in

investment means that those firms have less capital to increase their production and means that they are unable to lower costs of production to compete with competitors in other countries which are not faced with slowing economic growth. This could mean that Chinese private firms would see decreased profits as consumers switch from them to firms in other countries that are able to offer better prices. This decreased profit

for firms would result in decreased tax-revenue for the Chinese government meaning that the government would have to scale back the extent of its grants to SOEs thereby resulting in the costs of production of those SOEs going up, causing a decrease in their ability to dominate markets domestically and abroad as they would have to push prices up to avoid making losses. While this may be the case, in reality, China is still a country that as Nick Leung, a senior partner of McKinsey, puts it “continues to rack up one of the most enviable growth rates in the world”. While there is a slowing of the economy, the sheer size of the Chinese economy means that even a slowdown still provides large economic growth in absolute terms. Though China’s economy is slowing, in reality there will be little

impact on the SOEs and it can be seen that they will be on track to continue to dominate the Global 500.