6 minute read

RURAL MUTUAL

A Look at Accomplishments in 2020

Although a year unlike any other, 2020 continued to be another successful year for Rural Mutual Insurance from a business standpoint.

Advertisement

In addition, it gave us opportunities to give back to our policyholders and communities in ways that we haven’t done before.

As we look ahead to what 2021 will bring, we reflect on our accomplishments during the past year.

For the 12th consecutive year, Rural Mutual Insurance was named a Ward’s Top 50® Performer. The Ward Group is a leading provider of operational and compensation benchmarking and best practices studies for the insurance industry.

Jason Feist joined the executive team as vice president of customer acquisition and service.

For the fourth year, Rural Mutual Insurance paid a five percent farm dividend, rewarding Wisconsin farmers. The Farm Dividend program is one of the many ways it serves its farmers and reinforces its relationship with the Wisconsin Farm Bureau.

Because of the safer-at-home order, Rural Mutual Insurance received fewer personal auto insurance claims. The company introduced the Personal Auto Relief Program, which refunded active policyholders 15 percent on two months of personal auto premium.

Rural Mutual Insurance and Wisconsin Farm Bureau Federation established the Wisconsin Food and Farm Support Fund to raise money for established non-profits to help Wisconsin residents during the COVID-19 pandemic. As of December 2020, the fund raised $60,000.

During the pandemic, Rural Mutual Insurance agents supported Wisconsin families by providing donations of food and supplies to pantries and other support programs.

For the third year, AM Best announced that Rural Mutual Insurance earned a Financial Strength Rating of A+ (Superior). Rural Mutual Insurance is one of five single state insurers in the U.S. and the only single state insurer in Wisconsin to receive an A+ rating.

For the 55th year, Rural Mutual Insurance continued their support of the Wisconsin Interscholastic Athletic Association with their involvement in promoting good sportsmanship during youth athletic events.

Thank you to our partners and policyholders who continue to put their trust in us. We look forward to another successful year in 2021.

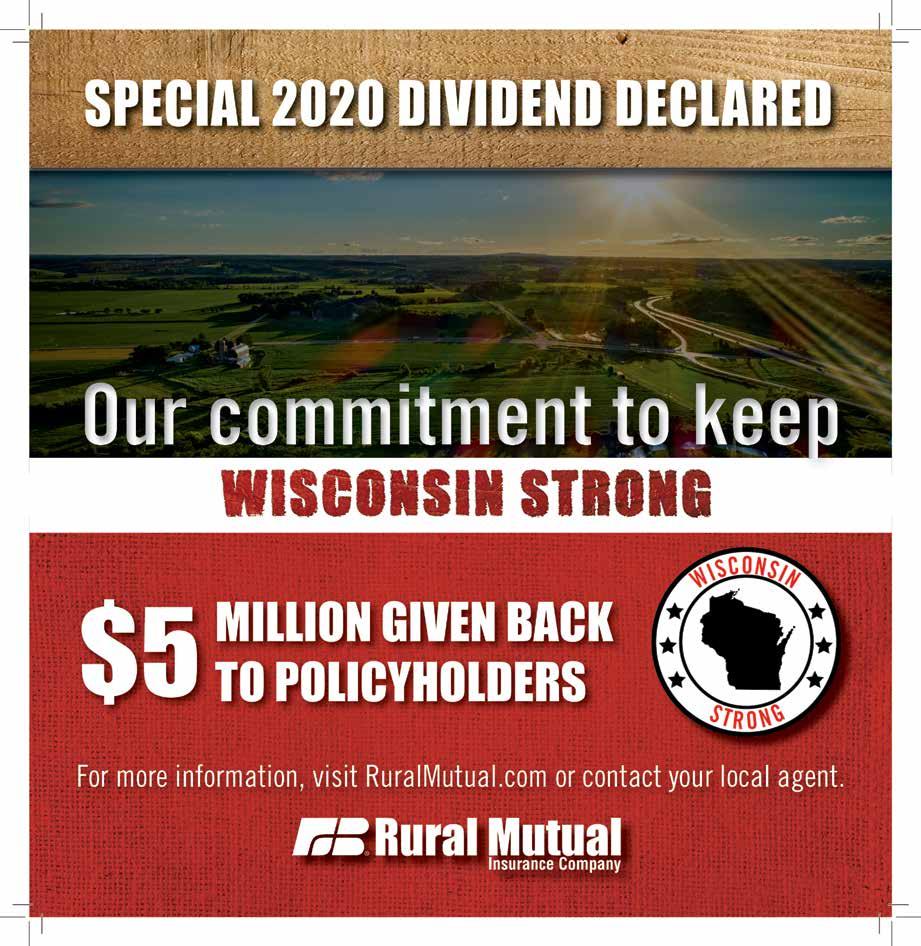

Rural Mutual Declares a Special 2020 Dividend

For the first time in its history, on Dec. 31, 2020, the Rural Mutual Insurance Board of Directors authorized a Special 2020 Dividend to be paid to Rural Mutual Insurance policyholders that had an active, in force policy effective Dec. 31, 2020. The dividend is either two percent of eligible policy term premium or $50, whichever is more, and will be paid in 2021. Rural Mutual Insurance is taking this action to help keep Wisconsin strong amidst one of the most difficult years.

Based on the company’s positive operating results, it’s estimated that more than $5 million will be paid to policyholders in early February.

“As the pandemic has caused financial uncertainty for everyone, we asked the question, ‘How can we do more to help?’” said Rural Mutual Insurance's Executive Vice President and Chief Executive Officer Dan Merk. “This dividend is in recognition of these challenges and a way to support our policyholders.”

The Special 2020 Dividend is one of the many ways Rural Mutual has supported their customers during the last year, from the Farm Dividend to the Auto Relief Program.

The goal of this continued customer support is helping Wisconsin farms, families and businesses. Rural Mutual is proud to only do business in Wisconsin and looks forward to helping our great state get through this pandemic together.

Rural Mutual Insurance values its customers’ business and looks forward to serving their insurance needs for many years.

For more information about Rural Mutual Insurance’s Special 2020 Dividend, please contact a Rural Mutual agent.

RURAL MUTUAL

Protect Your Online Privacy

1. How often do you share your information online and what do you

share? It is important to value and protect all types of data about you—including your address/location, phone number, purchase history, family, travel habits and financial information. a. Social media. Carefully consider what your text and photo might reveal about you, who will see it and how that information can be used now and in the future. b. Online accounts. When you shop online, keep your primary email address and phone number private. Use a burner email for most online activities to protect important accounts. 2. How do you lock access to your accounts? You should use a unique password for every online account. Consider using a password manager tool to generate and remember these passwords. When available, use two-step or two-factor authentication to add another protection.

3. How many secure internet browsing practices do you

follow? Though many people do remember to clear their browser history and cookies from time to time, how often do you? Do you use ad-blocking extensions? These are important tools you can use to prevent third parties from following you on the internet and learning more about you. 4. How many mobile apps have you downloaded? Every app or browser extension you download represents a potential security risk and threat to your privacy. Too many mobile apps default to tracking your location and collecting your data, even in apps designed for children. Be sure to audit each app’s privacy permissions to ensure that you are only sharing what you need to. 5. Can you spot a phish? Fraudsters use email or text messages to impersonate a company you know and trick you into giving them valuable personal information. Nearly 38 percent of people who are not cyber aware fail phishing tests. Learn what you can about common phishing tactics.

To learn more about digital defense tools that you can use to protect your information, contact your Rural Mutual Insurance agent or visit ruralmutual.com.

‘Tis the Season for Slips and Falls

Every year thousands of people end up in emergency departments from injuries sustained when slipping on ice.

Injuries range from torn ligaments to broken bones, concussions to fatalities. Many are lucky enough to walk away only bruising an elbow, knee or their pride.

Living in Wisconsin, spring can be some of the most treacherous walking conditions as air temperatures increase faster than the ground temperatures. This combined with more sunlight can cause surface snow and ice to melt and re-freeze overnight. Here are some common-sense tips to avoid a dangerous fall. • Wear boots with textured soles constructed with rubber. Boots with stiff rubber soles can increase your chances of slipping. • When practical, wear traction aids such as cleats. Try different styles for your work conditions to find what works best. Some variations include cleats along the entire bottom of the sole, some have cleats at the heel. Be careful when using cleats climbing in and out of vehicles or entering a building. • When walking, keep your stride short attempting to place your foot flat on each step. Shuffling your feet can cause build-up of ice and snow in the treads of your footwear reducing your traction. Avoid long strides as the heel contacts the walking surface first and is likely to slide out from underneath you. • Keep your hands out of your pockets to help maintain your balance. • If you do fall, try to remember NOT to put your arms out to brace your fall. This is the number one cause of broken and dislocated bones in falls on ice. Pull your arms in, try to squat down quickly to decrease your fall distance and try to turn to land on your side to reduce the risk of striking the front or back of your head. • Keep a bucket of salt or sand near outside doors to throw on walking areas when ice forms. • Keep floor mats inside building entrances clean and dry to avoid slipping when walking into a building. • Use mats at entryways into areas with concrete flooring to reduce the risk of slips.