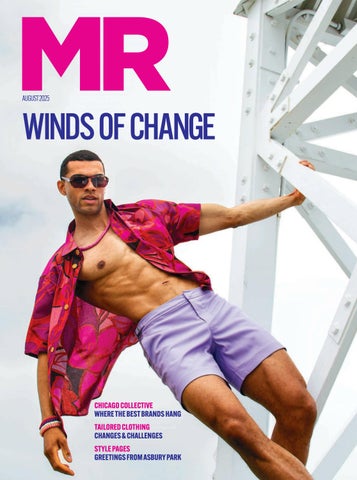

WINDS OF CHANGE

CHICAGO COLLECTIVE WHERE THE BEST BRANDS HANG

TAILORED CLOTHING CHANGES & CHALLENGES

STYLE PAGES

GREETINGS FROM ASBURY PARK

CHICAGO COLLECTIVE WHERE THE BEST BRANDS HANG

TAILORED CLOTHING CHANGES & CHALLENGES

STYLE PAGES

GREETINGS FROM ASBURY PARK

MEN’S EDITION

SAT/SUN/MON/TUE AUGUST 2-5, 2025 THE MART | FLOORS 4 & 7

The Chicago Collective is the premier menswear show in North America. Now on 2 floors at THE MART, Chicago Collective hosts the top brands and retailers from around the world. Shop the best brands, attend the iconic opening night party, enjoy exciting events and amenities.

chicagocollectivemens.com

WOMEN’S EDITION

SUN/MON/TUE AUGUST 24-26, 2025 THE MART | 7TH FLOOR

The Women’s Edition features everything you love about Chicago Collective. Enjoy a great selection of brands, an easy to shop floor, a fun opening night party, special pop-up events and our popular buyer hotel reimbursement program.

chicagocollectivewomens.com

EDITOR-IN-CHIEF KAREN ALBERG GROSSMAN

MANAGING EDITOR JOHN RUSSEL JONES

WEB & CONTENT

EDITOR BRETT EDWARD STOUT

ART DIRECTOR MIKE STEVEN FRANCOIS

CONTRIBUTING CREATIVE DIRECTORS

NANCY CAMPBELL/TREVETT MCCANDLISS

GROUP PUBLISHER LIZETTE CHIN

PUBLISHER CHARLES GARONE

PRODUCTION MANAGERS

LAURIE GUPTILL / FERN MESHULAM / KATHY WENZLER

MARKETING & PRODUCTION SPECIALIST

CATHERINE ROSARIO

OFFICE MANAGER

MARIA MARTUCCI

ACCOUNTING

KASIE CARLETON / URZULA JANECZKO / BRUCE LIBERMAN

NORDSTROM TINA ANIVERSARIO

STITCHED SAM GLASER

NO CHASER/GUERREISMS KARL-EDWIN GUERRE

BLACK DOG 8 SHOWROOM KATIE LIU & MICHAEL KREIMAN

HALLS ALAN LEINEN

BLACKS RETAIL STEVE PRUITT

CHAIRMAN CARROLL V. DOWDEN

PRESIDENT & CEO MARK DOWDEN

SENIOR VICE PRESIDENTS LIZETTE CHIN / RITA GUARNA

CHIEF FINANCIAL OFFICER/VICE PRESIDENT STEVEN RESNICK

VICE PRESIDENTS

NIGEL EDELSHAIN / THOMAS FLANNERY

NOELLE HEFFERNAN / MARIA REGAN

Irecently had the opportunity to interview the multi-talented guy who created some of the world’s favorite TV characters, most notably Julia, the first-ever Sesame Street muppet on the Autism spectrum.

Louis Henry Michael, Creative Director of Character Design at Sesame Workshop, first discovered Jim Henson and Kermit while watching an episode of The Ed Sullivan Show Even at age 6, he knew he’d found his calling. Although it was his dream to ultimately work for Sesame Street, he was told throughout his teens and 20s that he didn’t have a shot at it, told this by everyone but his mom and his 8th grade art teacher, both insisting he never give up on his dream. “My mom was my life champion,” Louis confides, “while my dad and the rest of the world believed I was reaching too high.”

At age 17, Louis was a struggling artist considering the Army when the art director of an ad agency hired him. From there, he worked as an artist for an entertainment company and did some comic book illustration. Miraculously, he finally managed to get a freelance gig with Sesame Street based on sending them one of his tiny drawings of Ernie. “I knew I could draw, I was good at animation; the Sesame Street art director would tell me he loved my work but there was no full-time spot for me at the company. I was so afraid to ask again but I eventually got the courage.

“Everyone is an artist. We create our lives, moment by moment, decision by decision. See your life as your work of art and live it with purpose, rather than by chance.”

—Louis Henry Mitchell

After hearing nothing from them for eight months, I received a phone message offering me a full-time position. I wore out the cassette tape playing that message over and over…”

In addition to landing his dream job where he’s now been for 25 years, Louis is often asked to teach (including at his alma mater--NYC’s School of Visual Arts), to lecture internationally (India, Jamaica, Bali), to do character design and toy design and illustrate children’s books. This past June, he finally published his own inspiring story, Qreative Evolution: How to Question Everything to Find Your Creative Fulfillment. The book is based on the premise that creativity is deeply engrained in the human spirit. It shows how we all can overcome self-doubt to reach our full potential in all aspects of life. “Most artists (and most people) struggle with self-doubt; this book deals with how to overcome it, how to get motivated, how to stay energized and passionate about your work, whatever that work is…” Louis explains. “It starts with defining your purpose and sticking with it. Taking care of yourself and becoming your most authentic self. For me, genuine change happened during the pandemic. I was able to spend quality time with my son. I reversed my Type 2 diabetes with proper nutrition. As I got healthier, my thinking cleared, and my true purpose became apparent. I wrote my book proposal and sent it to a friend who had offered to help me find an agent. Turns out, she wanted to be my agent! A new clarity transformed everything.”

The relevance of all this to menswear retailing should be obvious to wise merchants who understand that the way we dress reflects who we are. Says Louis (who most often wears Nehru-inspired shirts with minimal detail), “We’re all telling our stories with our clothing choices. So we should be very intentional about what we wear, and retailers about what they buy and how they merchandise their offerings. Present yourself (and your store) as a work of art: choose pieces with intention, with passion, with personal connection. No need to hide behind a particular uniform. Let your clothing reflect who you are.”

As a writer who’s spent the past 35 years trying to unleash my creative spirit as I attempt to analyze menswear business for retailers and brands, I’m still searching for that intrinsic creativity. Hopefully, wisdom from my ‘Qreative’ new friend Louis Henry Mitchell will help me discover it.

By Doug Hand

Since President Trump returned to office, he has made tariffs the centerpiece of his economic plan. With that, waves of uncertainty and unpredictability have followed, as these plans have continued to disrupt the economy and businesses both within and outside the United States. The impact of this lack of clarity is most starkly felt in the fashion industry, which relies heavily on international production and materials.

After announcing blanket tariffs on all imports into the United States under national emergency powers on April 2nd, Trump’s plans have continued to shift, as retaliatory tariffs were imposed by other countries, and tariffs continued to increase as Trump responded with even higher retaliatory tariffs. A few days later, on April 9th, Trump issued a 90-day pause on reciprocal tariffs almost everywhere except China, and after ratcheting up total tariffs on Chinese imports to 145%, the U.S. and China agreed in early May to roll back on reciprocal tariffs for 90 days as well.

More recently, on May 28th, a panel of judges on the U.S. Court of International Trade ruled that Trump overstepped his authority in imposing most of these tariffs, finding that Trump establishing these tariffs by invoking the International Emergency Economic Powers Act is unlawful in this case, as these tariffs are designed to deal with trade imbalances with the United States and the rest of the world, which the judges said should fall under non-emergency legislation. However, an appeals court ruling the next day paused this ruling, and reinstated the levies imposed for now. This confusion surrounding Trump’s tariffs, as well as the uncertainty regarding next steps following the 90-day pauses on reciprocal tariffs, and the overall lack of clarity regarding the future of our economy and trade with other countries, has made it incredibly difficult for business owners, particularly those in fashion and apparel, to plan

ahead. This has even led some brands to take drastic, even illegal, action.

There have been reports of the growth in trade fraud. More and more enterprises of dubious origin are now advertising services to import items into the U.S. for a small fee at lower tariff rates or even with no tariffs at all. How do they do it? These enterprises can achieve these lower tariffs through a few questionable routes, such as altering information about shipments given to U.S. customs or transshipping items. Information such as the declared value of an item, the material it’s made of, or where the item comes from can be altered, resulting in a lower tariff impact. Similarly, with the assistance of these enterprises, items can be moved to another country before they are shipped to the U.S. Then the enterprise falsely claims this new country is the country of origin, again resulting in a lower or even zero tariff. This practice is called transshipping, and to be clear, it is not legal.

According to multiple reports, these types of fraudulent practices are becoming increasingly common as more businesses struggle with the added costs of current and pending tariffs and lack clarity regarding what is to come next from the Trump administration. With the ranks of federal workers diminished, it remains to be seen how robust trade enforcement will be in step with the new tariff policies (whatever they ultimately are). But the growing instances of companies taking desperate and illegal measures shows clearly that these are increasingly desperate times.

By Craig Crawford

“Society is moving so fast. This is how customers live. They wake up with a device in their hands and life begins. The onus is on us to change everything we do to keep pace as fast as society is moving.”

—Angela Ahrendts, 2012 CEO Burberry

The 2007 launch of the iPhone sparked the American consumer shift from physical retail interactions to digital ones.

By 2015, mobile-first retail strategies became mainstream as product searches on mobile devices overtook those on laptops. Now, mobile commerce is no longer a trend; it has become the dominant standard. The smartphone is a consumer’s emotional glue to the world. Consumers reach for their phones because they want to know, go, buy, do.

The Millennial consumer (29-44 years old, also known as Gen Y), and the Gen Z consumer (13-28 years old) are digital natives and expect seamless digital experiences from retailers. The Gen X consumer (45-60 years old), while considered a digital immigrant/early digital adaptor, nevertheless also expects seamless digital retail experiences.

“We will move from mobile-first to AI-first,” CEO Google Sundar Pichai wrote in his first letter to shareholders in 2016. Today, Artificial

Intelligence (AI) is frequently discussed in retail. This rapid pace of technological change can be overwhelming to retailers. But not to consumers who expect digital interactions with retailers and brands.

More than 80% of consumers have been online at least two days before entering a shop. 40% of consumers won’t go into a store unless they can go online first. And 48% of purchases are heavily influenced by digital media and technology.

But what about retailers who haven’t embraced or prioritized mobile or digital? With less budget and smaller Information Technology (IT) Departments, how can they keep up? Even those with large internal IT departments can struggle.

From resale to direct-to-consumer, Amazon is rapidly becoming the new global fashion marketplace.

Whether it is the start of a consumer’s product search, a price comparison during shopping, or researching reviews, a visit to Amazon is on most consumers’ paths to purchase, even if purchases are made elsewhere.

Since 2019, Amazon has continued to steadily surpass Walmart in clothing sales. Having captured the value retail market, in April, Amazon launched Saks on Amazon within the US Luxury Stores section of the site. This brings more than 100 luxury fashion and beauty brands to the marketplace. When launched in 2020, Luxury was an invitation-only opportunity for some Prime Members. Analysts are now questioning if Amazon can indeed crack the luxury sector.

The online retail giant (US$17.1B Q1 2025 reported net income) has forever changed consumer behavior and shopping expectations. Prime membership offers free next-day (sometimes same-day) delivery, free 30-day returns, easy “buy now” one-click payments, and free streaming music and video content (in March 2022, Amazon acquired MGM studios).

Can Amazon Fashion allow those retailers who have stayed behind to catch up?

In a word, yes.

Amazon offers exposure to over 310 million consumers. During the first half of 2024, fashion and accessories represented 27% of sales.

Instead of setting up and maintaining an eCommerce site and an app (in both iOS and Android), Amazon can be a retailer’s digital footprint. In addition to offering what is expected on a website—product images, descriptions, sizes, prices, colors and size charts—for years, Amazon has used AI to drive:

• Personalized recommendations based on customer browsing, search, and purchasing history, as well as “Customers who bought this also bought that” and “You might also like” cross-selling sections

• Billions of size recommendations each month for hundreds of millions of customers through the analysis of millions of data points, reducing fit-related returns

• AI-generated product descriptions

• Shop the look image search

• Shop the show (app only) offering curated content based on movies, tv shows, sports and live TV

• Customer review summaries with images

• Rufus Virtual (chatbot) shopping assistant and Alexa (voice) shopping assistant

This allows retailers to focus on what they do best—curating carefully selected product assortments—and leverage Amazon’s technology expertise.

Let’s face it. A lot of men hate shopping, and when they find what they like, they buy one in every color, sometimes two, to avoid shopping again.

Amazon offers a subscription service that allows a consumer to save money and replenish product they enjoy when they sign up to the Subscribe & Save program.

The Amazon Influencer Program brings product-related content from influencers (anyone who has a meaningful social media following on YouTube, Instagram, TikTok or Facebook) onto Amazon to help customers research and discover products they might be interested in.

Amazon provides retailers robotic-empowered fulfilment centers, delivery route optimization, and demand forecasting—what will sell where and when, reducing overstock or shortages.

By building its own extensive last-mile delivery network, Amazon controls the speed, reliability, and quality of the delivery experience,

impacting customer satisfaction, loyalty, and trust. Continuous investment in last-mile solutions includes:

• Amazon Flex: Independent contractors using their own vehicles for deliveries.

• Delivery Service Partners (DSPs): Partnering with small businesses to operate their own delivery fleets.

• Amazon Hub Lockers and Counters: Providing secure and convenient alternative delivery locations.

• Route Optimization Technology: Employing sophisticated software to plan efficient delivery routes.

Retailers don’t always get the right product at the right price in the right place at the right time. Amazon Outlet allows retailers to offer product markdowns, closeouts, discounts, clearance and overstock deals, allowing for a “quiet” way to move inventory.

Finally, for retailers that aren’t prepared to hire an entire web sales department, AWS offers a host of cloud-based tools and pay-as-you-go cloud infrastructure developed specifically for retail, enabling efficient, agile, and customer-centric solutions development, deployment, and AI analytics. Retailers don’t have to be builders, as Amazon has thousands of partners that can help

By Karen Grossman

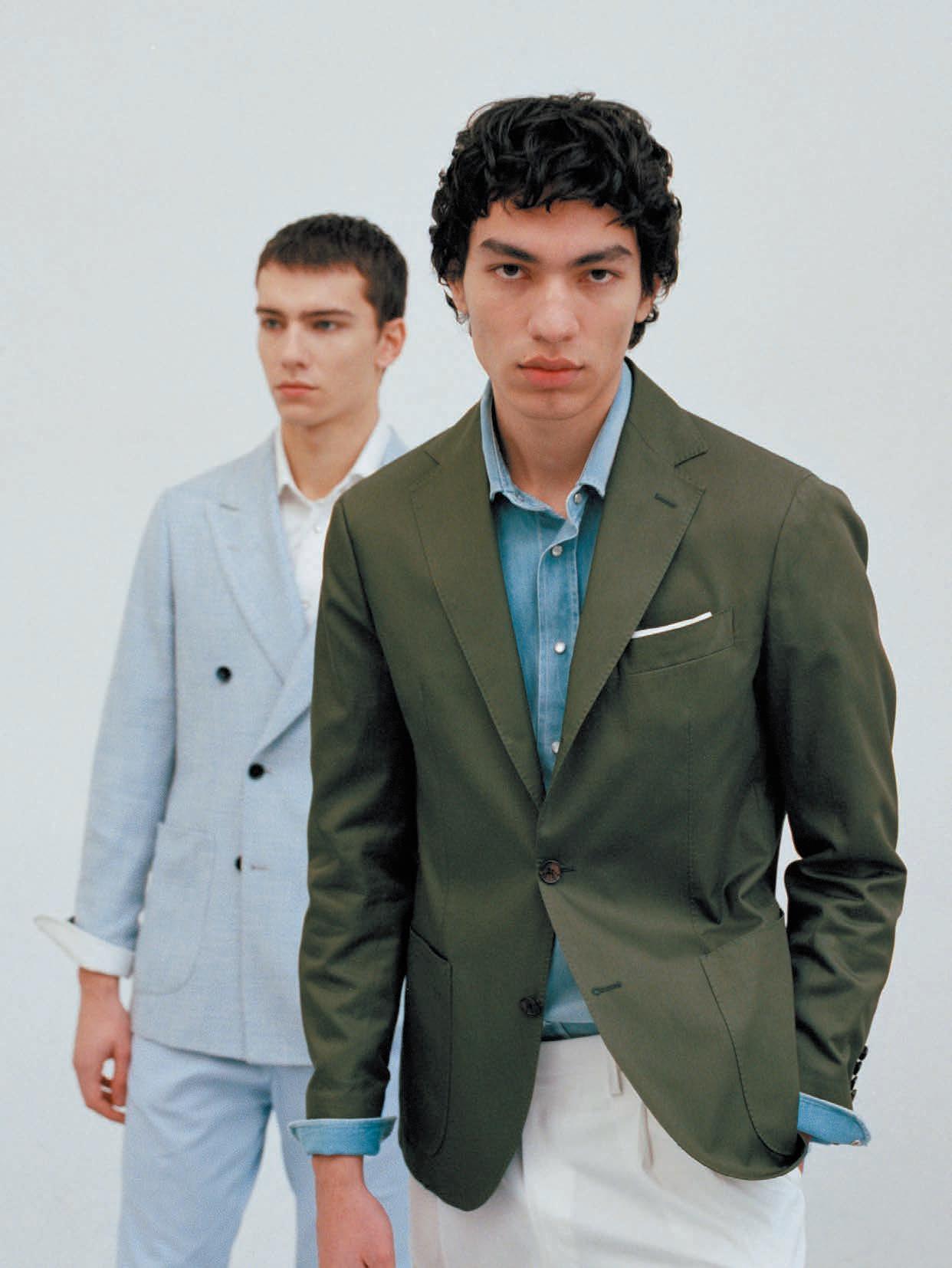

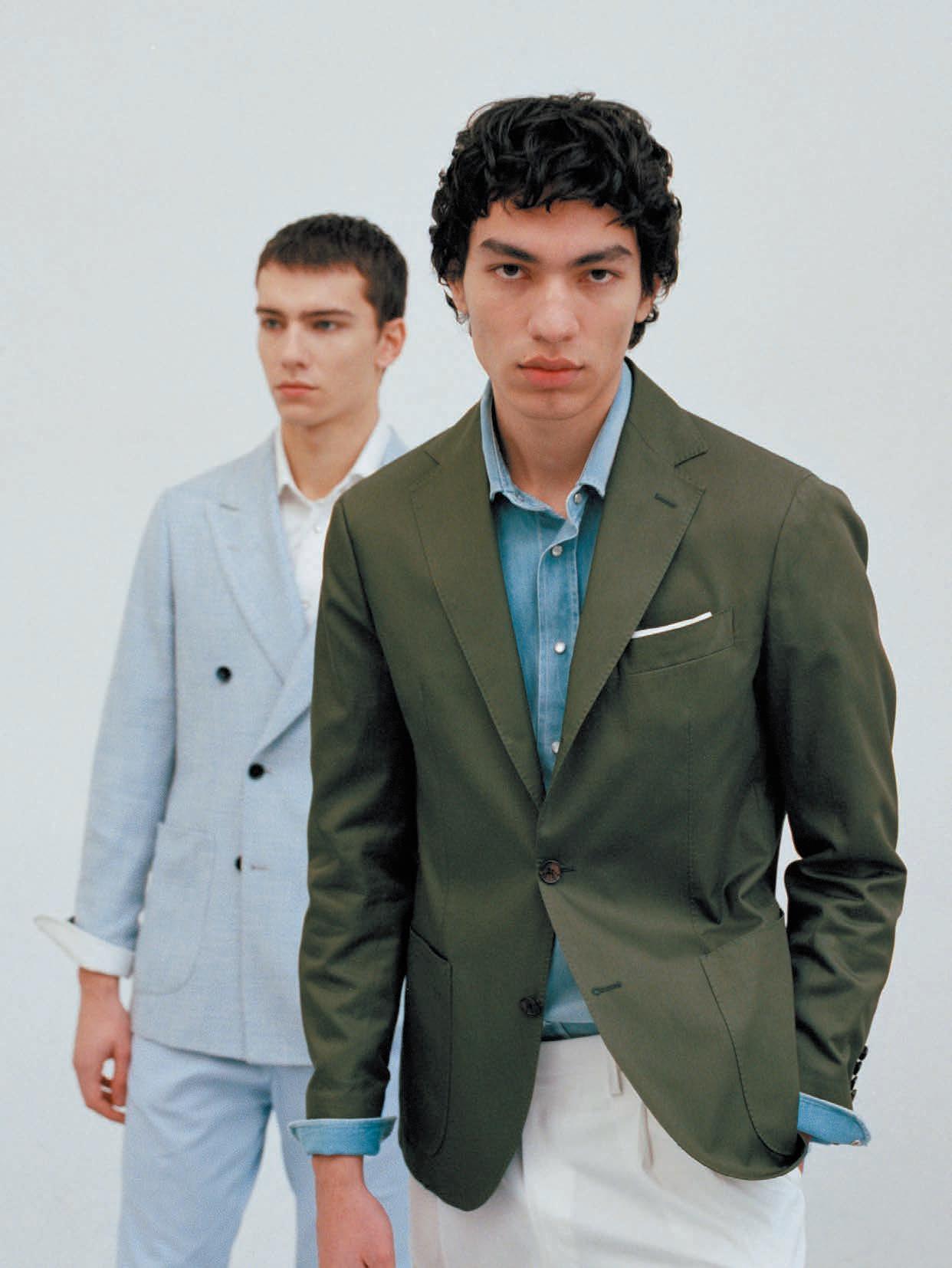

Selling Suits is an art form; meet a few artists.

With tariff uncertainty and fluctuating prices, it’s been tough for retailers to project tailored clothing sales. Here, we talk to a few smart merchants who are cautiously forging ahead.

Due to much consumer anxiety and uncertainty about the state of the world, business has been a bit difficult lately. It seems that when times are tough, men’s clothing falls to the bottom of the family priority list. It hasn’t helped that the weather this spring and early summer has been rainy and cold. So we’re working harder than ever, day by day, customer by customer.

As for tailored clothing in particular, suit business is flat, which I’m happy with. Men still buy suits for weddings and occasions, and they’re still investing in luxury. MTM business, in particular, is healthy, more in suits than sport coats, which are down a bit. I believe this is mostly because men consider sport coats more of a fun/frivolous/emotional purchase and less a necessity. DBs are selling mostly in made-to-measure.

Our plans going forward: we’re buying conservatively through the end of this year, hoping to react in season as needed. Of course, we can’t do business without inventory and sizes so we’ll have careful and measured assortments in all our stores (and online for those customers who choose to shop remotely). Although I have no crystal ball, I believe 2025 business will turn out okay. Special events continue to drive business, and people are still celebrating occasions.

That said, relationship building between our sellers and their clients is more important than ever. It’s about our clients wanting to come in to support their sales associate. Lately, we’ve been partnering with our vendors to discuss what more we can do to treat our customers like royalty. Waiting around for guys to wander in is no longer an option.

It’s interesting that so many brands are playing it very safe for Spring 2026. The overshirt craze that was so big for a while is still selling but not making up for lost volume in sport coats. That said, we’re promoting the importance of a great navy blazer: SBs, DBs, jersey, cashmere, woven, knit…. It’s not earth-shattering news but it’s a handle. As for the looser, more relaxed models in pants, it’s been slow to catch on beyond the occasional single pleat. Interestingly, we’re getting more requests for relaxed fits in denim.

How to get more young guys into the store? Our data shows that most of our new customers come into the store for a suit. Young guys who are graduating and/or looking for a job recognize the importance of owning a nice, well-fitting one. The challenge is how to keep them as customers after that initial tailored clothing purchase.

As for tariffs, we’re in a different position than our friends in the States since Canada does not impose tariffs on goods coming in from Italy. That said, the main impact of tariffs will surely be an abundance of uncertainty and declining consumer confidence, at least for a while. But these days, uncertainty is our middle name! Thankfully, our recent election brought a bit of stability to our federal government, or at least some clarity as to who’s in charge.

Fortunately, we’re in a good position to take advantage of several powerhouse store closures here in Canada. Hudson’s Bay, Saks, Nordstrom: there’s a lot of business up for grabs. Since we’re doing a good amount of renovating and updating our stores (including downtown Toronto), we’ll be in a great position to excite both our customers and our sales associates. With more guys back to working in offices, we’ll be cycling in a credible stable of new collections each season, with a goal to own the office!

I’m recently back from Italy and totally energized by seeing so much beautiful product. That said, it’s very hard to plan with the tariff situation so precarious and some vendors raising prices mid-season.

We came off a great May and then June/July came limping along…. Business for us is still dependent on guys going back to work in offices. So while clothing business has picked up since the pandemic, it’s not like it used to be. That said, the numbers seem okay because suit prices have gone up. Guys wearing suits less often can afford to buy more expensive models, albeit fewer of them. But some of the price increases are starting

to worry me: a sportcoat that was $1,695 is now $1,995; a suit that was $1,995 is now $2,500. I’m not sure how even the most brand-loyal customers will respond.

One new idea for fall: we’re offering a Young Executive program; a suit-shirt-tie package including alterations for $995, a second for $895 and third for $795. Young guys in college and grad school need suits; we think we can capture the Suit Supply customer with our attainable prices and exceptional tailoring.

We’ve seen much momentum in tailored clothing: suits and jackets are selling. Made to measure has been very active. Soft jackets have been excellent as they play to the elevated summer casual feel. Suits for special events like weddings and Bar Mitzvahs have sold well; plus it feels like men are dressing up a bit more to go to work.

importance and impact on our overall business. There aren’t many stores left that have the foundation and infrastructure that we have. It sets us apart and we’re proud of this.

Johnell Garmany, Garmany, Red Bank, N.J.: The Power of New! April and May were very tough months. Perhaps the prospect of tariffs were the issue, but nothing’s happening yet so shame on those vendors who have already implemented price increases.

I’m planning six percent sales increases for fall ’25, going aggressively after new business. I’ve found that my regular customers’ closets are full and it’s the newcomers who are spending big bucks. I also believe that in order to drive more business, it helps to have new fashion, so we’re aggressively promoting pleats on 85 percent of our trousers. From single pleats from Isaia to double pleats from Cucinelli to more moderate versions from Canali, we’re taking a strong stand on this new direction.

Our casual collections have been hit or miss. Some of the printed shirts and some of the linens have not sold well. We’ve had terrible weather for the beginning of the season so for some of the seasonal items, it’s been a struggle. Hopefully it’ll pick up as soon as the weather improves.

We were concerned about the impact of tariffs and played the fall 2025 season more conservatively. We bought almost 15 percent less in some categories. I’m forecasting a flat spring ’26 to this past spring.

We’ve seen some price increases due to tariffs: several companies incorporated these increases into their fall prices and in-stock services. We’d already bought fall, but since some brands maintained they couldn’t absorb the tariffs alone, we’re contributing. But we’ll surely be more price-conscious buying for spring ’26. I believe our customers will have a sharper eye.

Trunk shows have been great for us. We’ve hosted a few events to promote customization and personalization, which drives more business.

To attract younger customers, you need the right merchandise, the right sales team, and the right energy that makes young guys feel that they’re in the right place. We have a young group of sellers with lots of energy so when a young customer comes in, he feels instantly comfortable. We have a barber shop, a speak-easy and a bar. Younger guys enjoy the experience and see the value of coming into a store rather than shopping online.

We’re fully committed to tailored clothing and understand its

As for DB jackets, it has to be represented from all our vendors to have real impact. Although I don’t see DBs as a major portion of our clothing business, all the personals I’ve ordered for myself feature DB jackets worn with pleated pants.

But back to tariffs, if it’s a 4-6 percent increase over last year’s prices, the luxury customer likely won’t notice or won’t care. Our current retail prices on suits range from $795-$15,000 off the rack, five to 10 percent more on made-to-measure. We’re offering more of a selection at lower prices for younger guys, giving them a variety of fashion options beyond basic navy.

On a recent ABC morning news show, my brother Andre was interviewed about Seersucker Day, an annual event in New Orleans since 1996. The day after the broadcast, people from all over the country showed up in our store to buy Haspel’s seersucker suits. We sold 60+ suits retailing at $750: guys were buying two, three, four at a time, the same suit in many different colors. We ran out of inventory but have back-up arriving soon. And this at a time when in-store clothing sales are hardly booming. Another success for us in tailored clothing has been super soft clothing from an Italian company called Stile Latino. It’s not your typical hard crisp construction but rather a soft comfortable luxury garment at retails from $4400 to $7000.

Eleventy

Anonymous, Northeast Retailer: Broadening selection in special occasion

Suits/Suit Separates are up five percent season to date and sport coats are up eight percent. Seasonal fabrics and earth tone colors have been very strong, including just about anything in the shade of green. Larger patterns have been soft.

Fall/holiday 2025 is currently planned at four percent ahead of last year. At this point, our plans for spring/summer ’26 are flat with ’25, due to the strength of the 2025 season and uncertainty about prices. Some of our vendors have increased prices, some have absorbed the tariffs and have not increased prices. Price increases will likely result in ordering fewer units, as we anticipate selling less if prices increase.

The majority of our tailored clothing is being sold for special occasions, so it’s worn less often than work clothing. As a result, we need to show the special occasion customer more options in colors, models, and appealing patterns that he does not yet own to get him to buy again, or buy multiple units when he’s in. We find that most purchases are need-driven, and events/trunk shows mean less today than in the past.

Regarding competition, retailers like department stores and large specialty chains have always been our competition and the best way for a specialty store to compete is with better personalized service. The more significant competition today is from mono-brand stores like Suitsupply and DTC retailers like Indochino and State & Liberty.

we

—Northeast retailer “”

Bob Rosenblum, Rosenblum’s, Jacksonville, Fla.: Competing with Vendor Websites

Spring ’25 business has been fairly good in clothing, from suits to soft coats. Our basics like solid suits and blazers are outperforming seasonal fashion.

We’re seeing the luxury customer shopping less frequently. This could be because they’re traveling more often and longer. Our plans for spring ’26 are very bullish. I’m not too concerned about price increases, and more focused on making sure we have the right stuff to excite, service, and hopefully exceed our customers’ expectations. We’re pulling back from some of our fringe vendors and consolidating where we can in certain classes. This always enhances our vendor relationships and gives our customers a broader selection.

Sportwear continues to be an issue: it’s very difficult to compete with vendors’ websites that offer immediate discounts and give the customer larger selections than our edited assortments. We continue to look for things that are wearable and not too trendy.

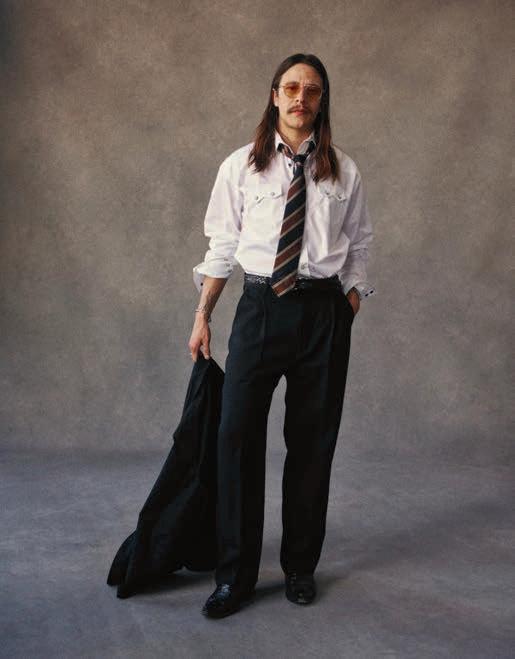

Dan Orwig, Peerless: “Overall, tailored clothing is making its way back into a man’s daily wardrobe, not left to special occasion or office attire. He’s styling new tailored pieces with his sportswear to create complete looks. Classic fit is still strong, with many modern brands embracing the silhouette. We’re seeing fashion suits feature pattern in both the jacket and the pant. Fabrics are getting more interesting: washed cottons, indigo blends and soft-construction jackets make suiting feel relaxed but intentional. Pant silhouettes are getting roomier with pleats; wider legs are becoming even more popular; and colors like antique rose, terra cotta, indigos and neutrals keep things grounded but modern. Standout items for spring 2026 are double-breasted jackets, peak lapels, extra soft constructed jackets, striped suits and even cargos done in suiting fabrics.”

Nelson Suriel, Jack Victor: “We had 34 pre-market appointments and 33 of those merchants were positive about clothing business. Our spring ’26 suits and sportcoats are softer, less structured, more textured models in pale shades of icy blues, grays and summer

browns, often mixed with blue. Fabrics are mostly linen-y looks in silk, wool, and linen blends. A three-on-two single breasted sportcoat did exceptionally well; DBs are about 8 percent of the mix, mostly because we stock them. Also doing well: pants with single pleats and side tabs. Clearly, we stand to benefit from many luxury clothing collections skyrocketing in price. Our sportcoats at retail are mostly in the $898-$1,398 range; buyers are finding both fashion and value in our spring ’26 collection.

Tony Maddox, Coppley “This season, we’re embracing a vibrant blend of bright colors and soft pastels, brought to life through luxurious fabrics like bamboo and textured blends of wool, silk, and linen. We’re also our Coppley Silver Label Collection. This will represent the next tier in craftsmanship, featuring full canvas construction and elevated detailing—something truly special for the discerning customer. Also, we’re continuing to expand on our softer side of tailoring, by offering more shirt, jackets, outerwear, and bombers that can be made in any of our fabrics. “Our Accu measure delivery time is 10 working days, 15 for our full MTM. We continue to offer both seasonal and replenishment programs, with an offering of 10 suits and 20 sportcoats. Retailers can order stock size singles mid-season at the advance placing price.”

Giovanni Bianchi, Lubiam: “The double-breasted blazer epitomizes iconic craftsmanship, showcasing the essential details cherished in the L.B.M. 1911 and Luigi Bianchi Sartoria collections. Pleated pants remain a hallmark of sartorial excellence, and the inclusion of a single or double pleat provides added volume and lightness, ensuring enhanced comfort. International buyers at Pitti expressed their appreciation for the contemporary interpretation of these sartorial pieces, especially featuring personalized details such as enameled buttons.”

Marco Baldassari, Eleventy, “We’re celebrating this spring ’26 season with the art and beauty of linen. The color palette is inspired by the sunrise over the sea, with shades floating between light and freshness. Alongside the brand’s iconic spectrum of refined grays, cream, and natural shades – we introduce new bright hues as deep and vibrant as the horizon.”

Patrick Chan, Renoir: “Our Renoir and Alessandro Vitello collections offer an updated-traditional point of view, including wider lapels and wool/linen blend fabrics. Our formalwear collection was just revamped with the addition of dinner jackets, new tuxedos in blue and grey with wide peak lapels and a DB tux. Wedding group business continues strong so our basic TR fabric is now available in 30 colors. Our soft collection, Pellagio, continues to grow with knits and blended fabrics. Our suit collection here features single pleat pants with drawstring waistbands in three spring shades. Last but not least: English Laundry is where our creativity shines with our widest lapels, ticket pockets and DB models. Fabrics in this collection are all done with stretch in a slimmer silhouette.”

By Karen Alberg Grossman

According to retailers, the excitement in denim (new models, fits, fabrics, washes, details) that’s creating notable sales gains in women’s business has been slow to catch on in men’s. Menswear merchants note that while denim is still a mainstay in men’s wardrobes, guys already own closets full of slim-fit jeans and are not rushing in to buy more. Might an aggressive change in model, fit, fabric, or wash inspire new purchasing? Unfortunately, not everyone is convinced.

Pat Mon Pere at California-based Patrick James acknowledges a dearth of innovation in the men’s denim market. “We’re having single-digit gains this season, but we’ve had to work our core fill-ins to get those. It’s usually a new fabric or model that drives growth, but things have been pretty static overall on the fabric side in terms of what’s perceived as ‘new’. Yes, wider legs and looser fits are being shown, but they’re not yet happening in our space. Best sellers for us continue to be Alberto’s lightweight T400

in multiple shades, and basics and fashion from 34 Heritage. Our brickand-mortar locations do a nice job with AG sateen and twills.”

Notes Ellen Levy from Levy’s in Nashville, Tenn., “Women have embraced change and are more open to trying new models, including looser fits and wider legs. Our men’s denim business has remained healthy, but the easing of silhouettes has been more gradual. We continue to sell the Tellis and Everett models from AG, and the Charisma model from 34 Heritage is a consistent top seller. Monfrere introduces new styles each season; our best-selling model is Brando. Teleria Zed is a leader in developing new fabrics, but their models remain consistent. All told, men’s denim business is doing well.”

John Braeger from Garys in Newport Beach, Calif., has a similar viewpoint. “I am by no means a denim expert anymore; I’m getting too old. But, with our casual lifestyles and great weather, Southern California is a big denim and five-pocket user. What’s working best for us is still our

staples− Alberto, AG, R51, and a few others. Newness is coming from the luxury denim brands out of Italy that we’ve been expanding: Pescarolo, Jacob Cohen, PT, and some lesser-known designer brands at even higher prices. These feature interesting washes and details that our customers are willing to pay for. Bottom line: jeans remain a key item in men’s closets. Although guys already own lots of them, they continue to replace their staples and look for newness.”

Fred Derring from DLS believes the excitement in pants and jeans is all about luxury fabrics: super-soft cotton, wool, silk, and cashmere in various blends. “I recently saw fabulous five-pockets at Pescarolo. They’re expensive—in the $595-$795 retail range—but I believe they’ll sell to upscale customers.”

That said, Derring finds plenty of newness at more moderate prices, including knit fabrics, lighter washes for warmer weather (white yearround!), boot-cut Western-inspired models, and fuller fits, especially for

big-and-tall guys. He also applauds Ballin’s new denim program featuring 15 great colors, at a limited-time wholesale price of $60 for a suggested retail of $185. (Grab these while you can!)

Says Kory Helfman at Ken’s Man’s Shop in Dallas, Texas, “Denim is still an important category for menswear retailers. Our authentic denim has slowed a bit in favor of stretch fabrics and slim-fit models. That said, many Dallas gents are asking for a slightly wider leg opening to accommodate their cowboy boots. Fidelity offers a perfect model: the best color is a dark blue wash, without any inflections, to be worn with sportcoats.

“We’re also selling lots of lighter color denim: tans, creams, even white. We’re planning spring 2026 denim business even with spring 2025, but we’re always looking for new brands to shake things up a bit!”

Spring ’26 Market Highlights:

Ugur Caymaz at DL1961, now selling both upscale department stores and 58 new specialty stores, believes that relaxed slim is the way to go for spring ’26. He’s showing leg openings at 14, 15, and 16.5 inches. New models come in 13 washes and three different inseams; buyers are especially loving the knit terry. Also strong in the collection: chore jackets and luxury cardigans in soft Zegna mill fabrics.

Mark D’Angelo from Liverpool Los Angeles says his denim business has never been better. “We saw that many merchants underbought for fourth quarter last year, forgetting that denim is the backbone of men’s everyday wardrobes. We’re offering leg opening options from 14.25 to 17 inches in vintage washes, black rinses, corduroys, and knits. Our suggested retails are $98 to $119, with average 58 percent margins. Most young guys won’t spend $200 for jeans. Middle-aged guys won’t buy pleats.

“We introduced a loose (not oversized) fit, the Sutton, for spring ’25, which sold very well, so we’re moving forward with it for fall ’25 and spring ’26. What I’m seeing in the market is a return to selvedge cotton, rich (comfort stretch 99/1) denim, looser fits, and trouser pockets. French terry is still going strong, and color is still key for us. Tinted/vintage washes are trending in the casual market; lighter washes and lighter weights (under 10 ounces) are booking well for spring ’26.

“We believe that Western is on the verge of a comeback, with bootcuts strong for fall ’26. We also project increased demand for athletic fits.”

Galina Mironoff at MAC Jeans notes that silhouettes are getting wider and wider, while fabrics are getting thinner and lighter. “We have lots of new washes in our Rick model (16.5-inch opening), and we added an even wider fivepocket style, Richie (20-inch opening).

In fabrics, we’re showing a new super lightweight twill that’s only 3.8 ounces. Our famous Driver jeans are also offered in a lightweight option. Driver pants (always in high demand as customers buy ithem in every color) will be offered in 15 colors, 10 of them in-stock. This style is a hybrid between jeans and dress pants, made in stretch denim with unprecedented comfort and a dressier, more polished look.

“Overall, we’re offering more natural fibers like linen, hemp, and nettle denim. Key colors are soft brown and beige tones to mix with rose, mint, and ice blue pastels. White, ecru, and light grey are also key for spring ’26.”

The team at Citizens of Humanity agrees that men are gravitating toward fabric-first dressing, where comfort, stretch, and structure work in perfect balance. “We know that for men, it’s all about the feel, and we’ve put a huge emphasis on soft-yet-structured, high-performing materials that move and wear beautifully over time.”

Daniel Mann at Jack of Spades is showing bold, vibrant colors and innovative fabrics. “We

feature a mix of relaxed and tapered fits, with a focus on comfort and versatility. We’re also experimenting with sustainable materials and production methods to reduce our environmental footprint. In terms of models, we’re seeing a shift towards more relaxed silhouettes and a blend of classic and modern styles. Knit denim continues to gain traction; we’re expanding our offerings to include more fits and colors in knits. But it’s our focus on healthy in-stock programs that clearly sets us apart in a crowded market.”

Volkan Ureten at 34 Heritage, a core backbone resource for many better menswear stores, believes strongly in a new bootcut model. “For fall ’25, we introduced our take on the classic American bootcut, an elevated Western look featuring a regular rise with a 17¼-inch leg opening. It’s the ideal fit over your boot without being too wide or too full in the body. Crafted in a comfortable, substantial fabric and finished with premium hardware, it’s available for spring ’26 in light brushed and mid-brushed washes, and for fall ’26 in darker shades. Our timeless ‘vintage’ fabric made with cotton and elastane and finished with soft seasonal washes makes these jeans the ideal day-to-night pants, both classic and versatile.”

By Michael Fisher

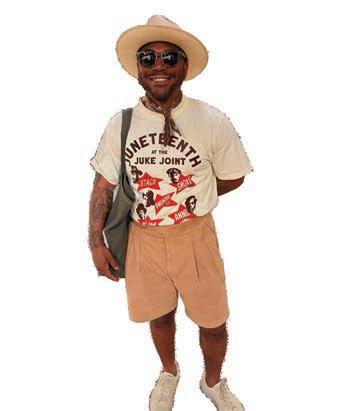

“Simplicity is somehow looking fashion-forward to consumers who are eager to have to make fewer decisions on a daily basis.”

Just a few years ago, after months of cozy athleisure and DIY tiedye, trend forecasters like myself proudly proclaimed the dawn of a new era of occasion dressing and post-pandemic peacocking. We anticipated a grand return to formality—a reaction to being shut out from celebrations and social circles for so long.

What emerged instead was a very different reality: a world that continued down a road of strife, chaos, and uncertainty. Where was the new Roaring Twenties we were promised after such darkness? While opportunities to don suits and trade Birkenstocks for horsebit loafers certainly existed, this golden era of dapper dressing never quite materialized as expected.

Five years after the world changed, we’ve settled into what I call a new “age of average”—a new normal defined by boldly boring basics, charming nods to the past, and ’90s-inspired styling that comforts and consoles us amid economic downturns, international conflict, and cultural clashes. We are returning to the much-needed baseline basics that are lovingly humdrum. After constant overstimulation and bombardment from excess in design, simplicity is somehow looking fashion-forward to consumers who are eager to have to make fewer decisions on a daily basis.

In our increasingly digital, AI-dominated world, we’re witnessing a resurgence of analog-inspired design and leisurely pursuits. The return of print magazines and scrapbooking signals a hunger for physical media, where handheld objects become more desirable than ever, inspiring a wholesome aesthetic for the season.

Simultaneously, we’re seeing movement toward leisure time as a way to nurture social bonds and promote well-being. Crafting circles, casual sports clubs, and walking groups are pioneering a new era of hobbyist culture, where people find solace in life’s simple joys. This cultural shift coincides with fashion’s casualization, blurring lines between daywear and leisurewear.

A new generation entering the workforce brings fresh perspective that transcends traditional corporate binaries, inspiring what we call “Boredcore.” Traditional office items have become so unfamiliar in this hybrid work era that they’ve achieved novelty status. Young men are fully romanticizing a nine-to-five uniform they never knew—one that builds confidence nonetheless.

The numbers support this trend. According to McKinsey, US retail clothing sales for tailored clothing are projected to increase 3.1% yearover-year in 2025, with Gen Z and Millennials expected to drive nearly half of all luxury sales. While they may not be ready for maximum peacocking, they’re rebelling against the status quo by embracing classic ensembles of the past.

The sudden prevalence of oversized silhouettes after years of slim fits tells a deeper story. Beneath the baggy denim shorts trending this summer and the elongated dress shirts Gap has returned to their shelves, lies an era of ease and design for all—a more holistic, inclusive approach to daily dressing that doesn’t take itself too seriously. It’s working, too, as the perennial mall brand just announced six consecutive quarters of comparable sales growth along with an embrace from younger consumers who appreciate the light touch of current trends with classic quirk.

Also, consider the increase in linen, especially among Millennials who previously deemed it too traditional. According to Archive Market Research, the global linen market is experiencing robust growth in 2025,

driven by increasing demand for sustainable, breathable, and comfortable fabrics. Combined with the uptick in quarter-zip knits, it’s clear that “dadcore”—with over 180 million TikTok mentions—remains a dominating force in menswear as younger guys find solace in commonplace classics that never disappeared.

Recent collections perfectly capture this moment. When industry favorite Drake’s dropped its high summer lookbook, it brimmed with late ’90s-inspired cues: crewneck tees layered under linen shirts and madras blazers, bucket hats, and oversized yarn-dyed stripe shirts. The sudden TikTok influence of Dawson’s Creek is teaching a new generation about oversized rugbies, rollneck cotton sweaters, pleated khaki shorts, Johnny collar polos, and button-front sweaters. Speaking of the ’90s, Ryan Murphy’s newest show, American Love Story, is filming around NYC all summer with JFK Jr. and Carolyn Bessette-Kennedy the focal point, and reminding everyone once again why this couple and their chic approach at classic dressing remains a constant on brands’ moodboards season after season.

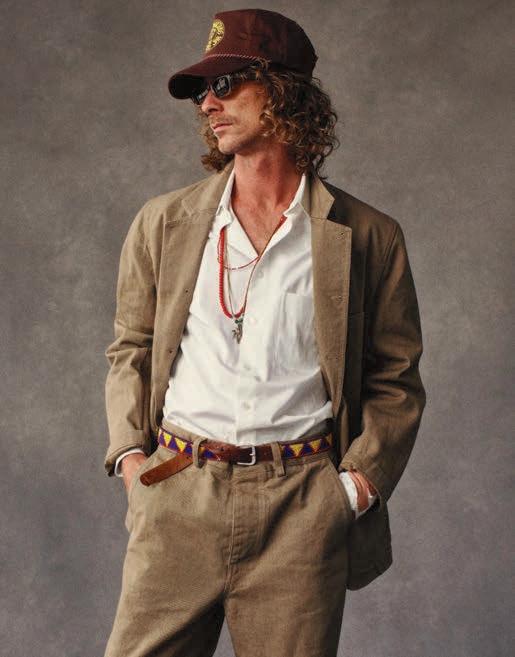

Aaron Levine’s Collection 1.0, released in early June, offers a soulful, wanderlust-filled expression of classics. The designer provides his audience with clothes that have permanence—far more meaningful than the soulless “quiet luxury” that plagued last year’s market. His broken-in flannels, wool suits, chore jackets, and classic cargos, all made in America with Italian fabrics, represent “workwear, outdoor, country living, prep, surf shop culture... all filtered through a tailored lens.”

Gap’s recent collaboration with golf lifestyle brand Malbon premiered a 33-piece collection borrowing the best elements of early aughts prep: pleated plaid shorts, cable-knit sweater vests, herringbone utility vests, and polos. While easy to dismiss as new preppy incarnations, these pieces represent something deeper—what we call “nowstalgia,” winks and nods to the past’s best parts while feeling completely relevant to the present.

The clothes filling Instagram feeds this season remind us to slow down, enjoy the scenery, and take a breath. This return to uncomplicated design reclaims “boring” as a beacon of authenticity and a heartfelt invitation to find meaning in the understated.

With constant emphasis on change and technology, mundane and mainstream have come to represent an authentic life well-lived. We’re watching nostalgia evolve in real-time through new summer classics and comforting familiarity via sun-worn fabrics, retro silhouettes, rumpled layers, and playful color usage that evokes cherished memories and reminds us to romanticize the everyday.

Brands like Bode and retailers like J.Crew now merchandise across lifestyles rather than by demographics—abandoning an antiquated, limiting

approach to how men shop. This shift toward lifestyle-based merchandising reflects our broader cultural movement toward authenticity over aspiration, comfort over ostentation.

As we navigate this age of average, the industry is learning that consumers crave connection over perfection, meaning over flash. The clothes that resonate most deeply aren’t those that scream luxury or innovation, but those that whisper stories of simpler times while serving contemporary needs.

This isn’t about lowered expectations—it’s about evolved ones. In a world of constant digital stimulation and economic uncertainty, the greatest luxury may simply be feeling comfortable, authentic, and connected to something real. And that, perhaps, is anything but average.

By John Russel Jones

“Men are becoming more intentional about the details, and accessories are where we’re seeing the most growth and creativity right now.”

—Natalie Huey, Signature Stag

Actress, singer, and designer Jane Birkin’s original Hermès Birkin bag sold for a record-breaking €7 million ($10.1 million) at Sotheby’s in Paris earlier this year. It seemed like a fitting moment for a time when accessories, particularly bags, appeared poised for growth. The sale wasn’t just an indicator of good times in women’s accessories: A recent report by Persistence Market Research states that the men’s luxury bag market is expected to reach $15.6 billion by 2031, growing at a 4.5 percent annual rate starting in 2024. The key factors driving this growth are cited as men’s increasing fashion awareness, “increasing disposable incomes, and a growing preference for premium products that signal status and style.” The report further states, “These individuals often view luxury bags not only as utility items but also as fashion investments and status symbols.” With the threat of tariffs increasing prices across categories, it seems that status-oriented conspicuous consumption will be even more expensive—and perhaps all the more appealing—as bag prices continue to rise.

“This is the first time in my 40 years of business that I’ve really been affected by the political structure,” says Bill Adler of Will Leather Goods. “The tariffs are affecting us when we bring in goods from China, Vietnam, India, and even Europe. We will be raising our prices a little bit to cover the costs of tariffs, but more importantly, air freight, because we are concerned about getting product in on time to have in stock for the holiday.”

Other accessories manufacturers share Adler’s concerns.

“Internally and externally, tariffs have been the ongoing conversation over the past few months,” says Carolyn Benitez of Unified Accessories and Boconi. “If our margins allow it for both the larger retailers and our specialty stores, we’ve made a strategic choice to absorb the extra costs. We prefer to keep prices steady for our retail partners and their customers. It’s been a complex issue to navigate, though, since the goalposts keep shifting. Many of our leather materials come from Italy, so that’s one tariff. Depending on the country of origin, the applicable tariff varies. Who knows what will happen in the coming months? It’s incredibly challenging to plan business this way. We’ve tried to hold back from making quick decisions since the tide could turn again at any time.”

The team at Ghurka says, “Fortunately as an American heritage brand, Ghurka crafts the majority of our bags, backpacks, duffles, totes, and business accessories in the USA, so we have not had any impact on our core manufacturing from the tariffs. Yet, we are contending with the 10

percent reciprocal import tariffs on our leathers from Italy. Still, we are nowhere near as severely affected as offshore brands.”

Despite worries about rising prices, retailers are looking to accessories—especially belts—as statement-making purchases that consumers seem to be excited about.

Jon Simon of Paul Simon in Charlotte, N.C., says that while he likes to have great bags in the store, the turnover on them is slower. “Belts are number one for us right now. The category just continues to grow. There’s been a lot of innovation, and vendors are bringing color and great design to the market. As independent retailers, we also appreciate those who keep a good stock position. We’re also doing well with wallets, especially Secrid from Holland: It blows my mind how many of those we’ve sold!” When asked about tariff concerns, Simon thinks that it’s too soon to tell, and that he’s seeing that vendors, at least for now, are holding price.

ESCLUSIVO ITALIANO

ALESSANDRO GHERARDI

ALESSANDRO GILLES

L’IMPERMEABILEZEROSETTANTA STUDIO

CHICAGO COLLECTIVE | AUGUST 2-5, 2025

The Italian Trade Agency presents 62+ Italian menswear collections, featuring tailored clothing, sportswear, outerwear, denim, footwear, leather goods & accessories. While at the show, don’t forget to visit the ITA lounge; to rest, re-group & refresh!

AGF MAROSTICA | 2104

ALESSANDRO GHERARDI | 2122

ALESSANDRO GILLES | 2106

ALTA MODA BELT | 4095

ANDREA BOSSI/ITAL WEAR | 5100

ANGELO ROMA | 3123

ANT45 | 3111

ARCURI TIES | 3103

ARMERIA MESCHIERI | 5094

ASTORFLEX | 4093

ATHISON | 3101

BARMAS | 2120

BELVEST | 2124

BOB | 4094

BRETELLE & BRACES | 3105

CALABRESE 1924 | 2118

CALVARESI SARTORIA | 5103

CAMICERIA SANNINO | 4100

CAMOUFLAGE AR AND J | 5101

CASTORI | 2102

CORDONE1956 | 2096

DI BELLO BY FONTANI | 4096A

EDO CAMICIE SARTORIALI | 5106

EMANUELE MAFFEIS | 5096

ENZO PISANO NAPOLI | 3113

E. FORMICOLA | 5102

ESCLUSIVO ITALIANO | 3107

FEFÈ NAPOLI | 2108

FLY3 | 6099

FRAY | 3100

FUGÀTO | 3123

GALLIA | 2100

GERMANO | 2110

GRAN SASSO | 2126

GUERCILENA 1944 | 4099

ITALO FERRETTI | 3095

KB NAPOLI | 3093

LENOCI | 4096

L’IMPERMEABILE -

ZEROSETTANTA STUDIO | 3099

MANZONI24 | 2114

MAURO BLASISARTORIA PARTENOPEA | 2116

MOMA | 4094A

MONTECHIARO | 5099

MORGANO | 3094

PAOLO ALBIZZATI | 3123

PAOLO SCAFORA NAPOLI | 4100A

PASHMERE | 6093

PASOTTI | 5093

PIETRASALATA NAPOLI | 2112

PLOUMANAC’H | 2094

SAINT GREGORY

TAILORS IN NAPLES | 5105

SALVATORE

MARTORANA | 6095

SERÀ FINE SILK | 6101

SILVIO FIORELLO | 3123

SOZZI MILANO | 3123

STEFANO CAU | 5095

TALARICO | 6105

TOMBOLINI | 3125

TORRAS LUXURY | 5104

VIBE-SCIAMAT | 6103

VITALIANO | 3109

VOGLIO | 3096

“People are looking for personal expression. Even a man who must dress conservatively for work can still express his personality with a belt, as it’s only revealed when his jacket is unbuttoned or taken off,” says Allen Williams of W.Kleinberg. “Luxury is about the individual: there’s nothing luxurious about wearing a designer belt with a logo when everyone in the room has one. You can spend twice as much money on a couple of belts that won’t last, or you can buy a quality belt that you’ll enjoy for years. We make belts for people to keep.”

Creative designs and alluring hues that make an accessories purchase stand out seem top of mind, but quality and durability are also part of the equation.

“At Signature Stag, Will Leather bags have been one of our top-selling accessories this year,” says Natalie Huey, Owner of Signature Stag in Midland, Texas. “They’re pieces that really last and tell a story over time. From a retail perspective, they’re an easy win: stylish, functional, and giftable. As we head to market, I’m excited to see even more thoughtful men’s accessories that blend utility with personal style. Men are becoming more intentional about the details, and accessories are where we’re seeing the most growth and creativity right now.”

One thing seems certain: making a statement is about to cost a lot more.

By Michael Macko

According to the National Retail Federation, Father’s Day spending in 2025 reached a record $24 billion, up from last year’s $22.4 billion and exceeding the previous record of $22.9 billion in 2023. Clothing at 55% was the second highest gift category after Greeting Cards at 58%. Armed with this information, MR reached out to some of the best independent menswear stores we know to ask them what some of their best gift categories and items were, not just for Father’s Day, to show that there are more gift-giving options than “Half-Zip or Crew Neck?” [All prices quoted below are suggested retail.]

MILWORKS Milwaukee

Milworks, the Milwaukee, Wisconsin based men’s store, has carried gifts since it opened in 2015 and sees its customers purchasing a lot of gifts for others, but slightly more for themselves. Best-selling categories are men’s apothecary, books, bags and men’s jewelry. They feel that “Gifts are an important category that sometimes gets overlooked in other men’s shops. It’s evolved into an important part of our business,” according to Jason Ellis, who owns the store with his brother Jesse and Tim and Heather Ellis.

JAMESTOWN HUDSON Hudson, New York

Tom Mendenhall and James Scully are co-owners of Jamestown Hudson, the youngest store on our list. They say that “we have carried gift items from the time of opening and consider them an essential part of the store mix and are critical to the overall assortment of the shop for both gifting/ sales and visual merchandising and display.” They feel that “It’s a pretty even split, but our clients buy more for themselves than they do as gifts for others. Candles are our best sellers, and books are second. James curated the book selection around his favorite design titles rather than carrying just the usual latest releases, and people appreciate the assortment.”

SID MASHBURN Atlanta, New York, Nashville, Dallas, Washington, DC, Houston, Los Angeles, and Charlotte opening up this Fall Sid Mashburn opened his eponymous Atlanta store in 2007 with a pretty robust assortment of gifts. “From a mind/space perspective, they occupy a pretty large and important portion of our assortment. We have a whole ‘Unexpected’ category on our website for the stuff you may not have known you were looking for. A perfect example is the Blo-Poke… a brass fireplace tool we’ve been carrying for over a decade. It has nothing to do with the rest of our business, but it’s something we use and love and want to tell our friends about. All of our gifts kinda go through those filters. Some of the most popular categories are in the snack world, interestingly enough. We sell tins and tins and tins of Hubs, these unbelievable roasted peanuts from Virginia. And this great biscotti from Tuscany that comes in these beautiful Yves Klein Blue bags. We love the brass products from Craighill and the playing cards from Misc. Goods Co. We sell vinyl records just like the ones we play in our stores. Stationery and office items are also quite popular: Original Crown Mill stationery from Belgium, Kaweco fountain pens from Germany, Caran d’Ache ballpoint pens from Switzerland, and Italian staplers. And then some wild-card stuff… Swedish forest axes, incense burners, or extra-long matches that you can use to light a candle or an outdoor fireplace. All the stuff we use and believe in and want to share with our customers. Those quick, size-free pick-ups can act like a souvenir.”

When speaking with STAG co-owners Steve Shuck and Don Weir, they said that “We’ve carried gifts since opening day, and it’s always been an important part of our business. We see it as a compliment to the clothing we carry, and we vary up the assortment seasonally to keep it fresh, but aimed at the same customer as our clothing, and we certainly get a lot of folks buying for themselves when they’re in the store or online. Our biggest categories are books and home fragrance (candles & incense). They appeal to the broadest audience and are great gifts by themselves or as an add-on to a clothing purchase. Barware is also an important category for us - bar books, custom cocktail glasses, bar tools, etc. We also sell a lot of cologne, watches, and jewelry as gifts; items that he may not buy for himself, but is happy to receive. We like the gift business, as it adds to the overall personality of STAG and gives our customers more reasons to shop with us. This includes folks who may not be our apparel customer, but love the shop and find a way to participate through our gift selections.”

Shoes, facing the same tariff dilemmas as the rest of the industry, is stepping up with fashion.

By Nancy Prentice

Retail experts and store owners who have navigated many seasons know that buying footwear is a complex cocktail (that sometimes begs for one), infused with Pitti Uomo, Paris street style, Pantones, emerging brands, heritage brands, licensed brands, designers, suppliers, numerous raw materials, all garnished these days with ever-changing tariffs and new international trade practices. If consumers only knew all that goes into their shoes!

With a macroeconomic environment of unpredictable taxes on imports and the industry’s pre-existing condition of inflation due to higher costs of sourcing and labor, one could say there’s a perfect storm swirling around shoe buys for next spring. According to respondents of the 12th edition of the World Footwear Business Conditions Survey, the cost of merchandise, specifically raw materials, is a significant concern because it squeezes profits.

This could be a moment for tarot or fortune tellers, but we have trusted industry sources such as Matt Priest, President and CEO of the Footwear Distributors and Retailers of America (FDRA), who leads the largest related association in the country. He is an industry sherpa who has guided the heads of brands, manufacturers, retailers, and distributors through turbulent times and regularly lobbies on the Hill for fair practices. He recently wrote to Congress urging a smart trade policy to protect jobs and families, in collaboration with major apparel advocacy groups, including the AAFA and CFDA.

demographic.” Priest fully expects sales to decline as prices go up with increased tariffs. “This is inevitable,” he predicts.

Some brands, including Birkenstock, Nike, and Keen, have chosen (for now) to eat costs and spare their customers. Earnings reports declare a different strategy for other public companies, who, like investors, are worn out and stretched thin. If you have a 30% tariff on Chinese imports, in addition to a 20% tariff on sneakers, that’s a 50% tax per shoe, a lot to absorb.

The strategy, says Priest, is to do everything possible to advocate, and they are actively reaching out to Senators and Reps, where they’ve not found anyone on either side of the aisle to agree that tariffs on shoes are a good idea. The focus on the tax bill has taken up most of the attention of Republicans, who declare intentions of boosting the economy and are now heading into the midterms, looking to save their seats.

“This new reality suggests that U.S. brands and retailers should diversify their sourcing and explore reliable partners.”

—João Maia, APICCAPS

“Air freight coming out of Europe and Asia is astronomical in anticipation of higher prices as the reciprocal pause ends,” says Priest. He references the University of Michigan Surveys of Consumers, available online for anyone looking to gauge what’s on customers’ minds across the country. He points out the historical decline in demand, which has plummeted over the past few months, and since inauguration day, affecting shopping habits across the entire income spectrum. “This is not only going to hurt working families buying products at Walmart and Target. Surveys reveal an index that shows people are pulling back in every single

Ninety-nine percent of footwear is imported, which may be a vulnerable statistic, but the conversation around moving manufacturing to the U.S. is a non-starter. “There are some very cool companies doing very cool things here at home, but it’s all niche,” says Priest. “We will never be the country that produces the majority of its footwear because that would mean downgrading our cost of living to the point where we could afford it.” There is a reason that 95% of all footwear imported into the U.S. comes from three countries: China, Vietnam, and Indonesia.

That said, we look to another industry stakeholder and leader, João Maia, the General Manager of APICCAPS, the Portuguese footwear association, who is meeting this moment of shifting alliances with a solution. “This new reality suggests that U.S. brands and retailers should diversify their sourcing and explore reliable partners. Portuguese manufacturers are ideally positioned for this. In addition to a culture steeped in tradition and innovation, over the past two decades, we have transformed our production model to be more agile, responsive, and capable of smaller, high-quality runs. This has made us the trusted partner of premium

European brands – and now, we’re bringing that same value to the U.S. market,” he informs. He backs that up with €600 million invested in automation, marketing, and sustainability by the end of this decade.

Deeply embedded in the global fashion scene with an ecosystem of manufacturers, tanneries, and leather goods producers, there is designer collaboration, craftsmanship, and vertical integration, adds Maia, “with over 1,500 companies and 40,000 skilled workers who produce 80 million pairs of shoes annually.” Their reliability, creativity, and high quality are here to stay.

How can we make the best of those driving mocs (a big trend for Spring 2026) and keep our collective feet on the merchandising gas? Be aware, find a workaround, and be cautious of how cost-cutting might impact quality. The economics here foresee two options: either wholesale prices increase, or production costs decrease as companies fight for survival.

Moving dated inventory out and making room for what your customers really want feels important now. Consider a service like Max Retail, devoted to maximizing cash flow for inventory. An easy tech platform ensures less waste and more customer satisfaction.

Trending upward with signs of positivity, travel is on the rise, and the takeaway from the bigger trends at Pitti was resort dressing. This likely signifies a trickle-down effect for footwear, with styles suitable for vacations, from the mountains to the Mediterranean. Top resort-inspired footwear includes boat shoes, laid-back loafers (woven or in light-colored suedes), next-gen Superga sophistication, and even espadrilles, are some likely winners. Sandals ruled the runway at Milan Fashion Week, where designers also featured slip-ons, super-flats, and a fresh crop of retro sneakers.

Ethical and sustainable practices remain a priority, and for those merchants who fill their shelves with premium items, there are high-quality, handcrafted cobbler brands like Danner (Portland, Oregon) and Allen Edmonds (Wisconsin), both made in America.

By John Russel Jones

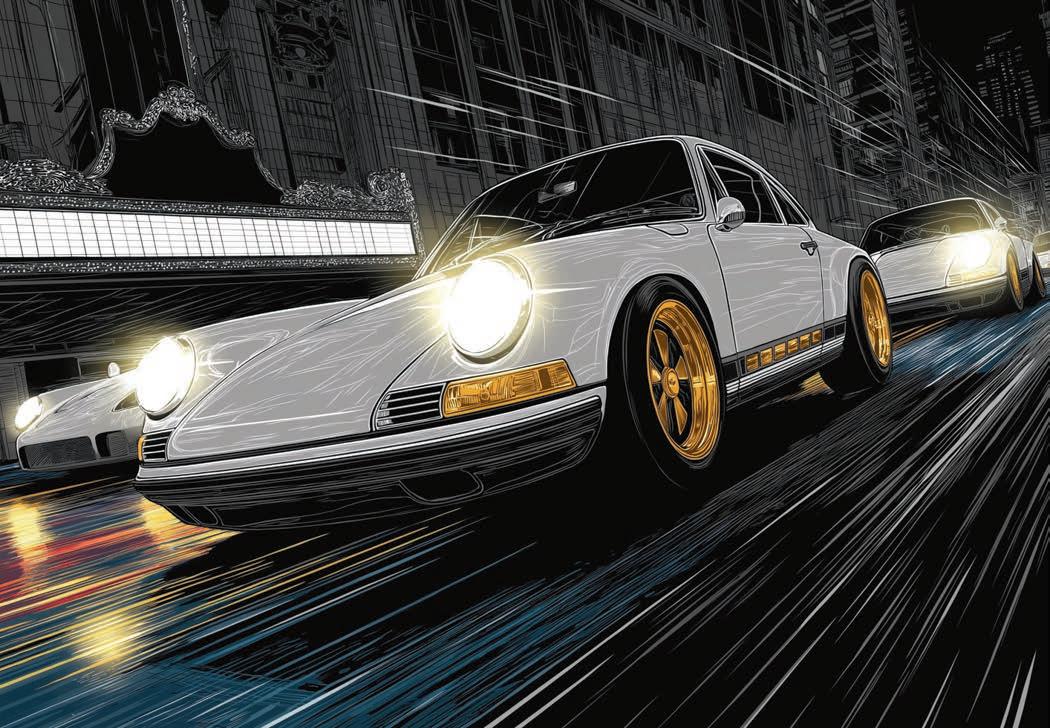

Ladies and gentlemen, start your engines—the Chicago Collective: Men’s is about to wave the green flag for the Spring/Summer 2026 buying season, showcasing more than 500 of the finest men’s apparel, accessories, and footwear exhibitors from across the country and around the world.

The race—er, show—begins with a preview day on Saturday, August 2nd, at noon, and continues on Sunday, Monday, and Tuesday, August 3rd, 4th, and 5th. Once again, this season, the show will take place across the 7th floor and part of the 4th floor of the historic Chicago Merchandise Mart, located on the banks of the Chicago River.

Of course, beyond the grand prix buying opportunities, the Collective is also renowned for its thrilling networking events, featuring high-octane cocktails and parties, as well as showcase seminars and meetings.

This season’s opening night party, sponsored by Piloti, will be a celebration of motorsports culture, craftsmanship, and design. This exclusive event brings Piloti’s heritage to life with curated automotive displays, footwear showcases and a vibrant social atmosphere. Whether you are a driving enthusiast, designer, or simply love gear – this is your invitation to connect and celebrate. Sunday, August 3rd from 6:00 pm to 8:00 pm.

Stretch it out and get ready to show off some serious speed for The Chicago Shakeout Run with UYN on Sunday, August 3rd at 6:00 am. Participants can pick up a pair of UYN RUNNER’S ONE socks and a KYMRA running T-shirt at the UYN Booth (#8118) on Saturday. The run starts at the Westin River North Hotel, 320 North Dearborn Street. Contact terir@uynsports.com, or RSVP at chicagocollectivemens.com/events.

MR’s legendary Karen Alberg Grossman will moderate a custom-clothing panel for Gladson New York, titled Are You Leaving Money on the Table by Not Selling Women’s Custom? on Monday, August 4th, at 1:30 pm on the Mart’s Second Floor, Room B2.

Burning up all those calories will leave you thirsty and in need of sustenance: join the Italian Trade Agency (ITA) in the Center Lounge on the 7th floor. Accelerate your mornings with complimentary espressos on Sunday, Monday, and Tuesday from 8:00 am to 10:30 am, and an apertivo on Sunday and Monday from 3:00 to 5:00 pm. ITA spotlights a curated group of more than 60 Italian brands at this season’s Collective.

Check out the complete event schedule at chicagocollectivemens.com/ events for sponsoring brands, times, and details, but don’t miss:

• Complimentary coffee, breakfast, and lunch

• Espresso martinis

• Bloody Marys

• Beer and wine bars

• Mimosa bars

• Bourbon

• Lemonade

• Iced tea

• Chicago-style hot dogs

• Gelato, and many more snacks and libations.

Walk those tired feet over to The Cozy Earth Sock Giveaway. And, if you’re going to take a break anyway, be sure to check out The Drawing Room sponsored by Stone Rose, featuring illustrator Kristine Steiner.

Brought more than you carry for the day? Drop your jackets, bags, and other items at The Barbour Coat and Luggage Check and give your back a break.

The Chicago Collective: Men’s is thrilled to welcome 60 new brands to the show this season, including:

Adesi Cashmere

Anatomie

ANT45

Arksen

Armeria Meschieri

Aspesi

Barba Napoli

Barefoot Dreams

Belvest

BFD Malibu

Borsalino

Bretelle & Braces

Calvaresi Sartoria

CHE Studios

City Sport Caps

Cougar Footwear

Damat - Tween

Del Vecchio Leathers

Enzo Pisano Napoli

Errico Formicola

Ferilli

Fernández y ROCHE

Giangi Napoli

Hemingsworth

Henderson

Ipanema

Kangra

Khalhon

Kleman

Laulhére

Les Tien

Liberty of London

London Tradition

LT Bowery 1826

Mack Weldon

Mason Cruz

MOMA

My Power Brands

Officine Generale

Oliver Cabell

Oncept

Open Era

P448

Pal Zileri

Philippe Model

Piloti

Richard James London

Rider

Saint Gregory Tailors in Naples

Scaglione

Stewart

Sundek

Talarico

Tenōre

Torras Luxury

Vibe-Sciamat

VinceTailored Clothing

Vitaliano

Voglio

Zaxy

Chicago is known for much more than its fantastic trade show (or so we hear—who has time to leave the Mart?). It also boasts a vibrant arts scene and a thriving shopping and fashion culture that extends into its lively neighborhoods. Here we catch up with some of the city’s brightest—and newest—retail stars.

COWBOYS AND ASTRONAUTS

1478 W Summerdale Ave, Chicago, IL 60640

773-944-4400 cowboysandastronauts.com

Owner: Tyler Leasher and Brian Mamassian

Cowboys and Astronauts launched initially in 2017, but when the owners decided they were ready for another journey, longtime customers Tyler Leasher and Brian Mamassian chose to take the baton. They’re keeping the spirit of this beloved shop in Chicago’s Andersonville neighborhood alive, while adding a bit of their own unique style.

When did you take over the store?

We officially took over Cowboys and Astronauts on April 30, 2025, then officially reopened on June 13th.

What was your motivation? What did you guys do before this?

We’ve both been customers of the shop for years, so when the chance came to take it over, it felt like fate – or at least the kind of opportunity you don’t pass up. It’s not every day you get to carry on something you truly believe in. We believe that good design, great conversation, and thoughtful details make life better. things run smoother than ever.

Who is your customer?

Cowboys and Astronauts’ customer is a modern, style-conscious individual, mostly between 25 and 65, who values quality, confidence, and a sense of discovery. We see a real mix: professionals, creatives, longtime locals, and newer transplants. What they all have in common is an appreciation for well-made goods with a story – whether it’s a perfect-fitting shirt, a niche fragrance, or a vintage-inspired bar tool. They come to us because they trust our eye, feel welcomed, and know they’ll walk out with something that feels just right.

What’s the neighborhood like?

Andersonville is one of Chicago’s most charming and tight-knit neighborhoods, rich in history, community spirit, and independent

business culture. Originally rooted in Swedish heritage, it has evolved into a diverse and progressive area that celebrates inclusion and individuality.

How do you choose the brands you carry?

We look for brands with a strong point of view – whether that’s a unique design, being made locally, instilling sustainable practices, or having a compelling backstory. We continued to carry quite a few brands when we reopened, as we knew they did well for the customer. The goal is to have pieces that truly fulfill the idea of Supplies for Modern Kind.

How do you discover new brands?

We discover brands in a mix of ways – word of mouth, customer feedback, Instagram, and unique vendor relationships. Since we announced our takeover, I have been asking everyone about the brands they love and would like to see in the store. We’re very excited to be attending my first trade show this August with Chicago Collective.

What is your best-selling category? Are there any brands you’d like to highlight?

Apparel is our strongest category, especially everyday staples with a twist – Les Deux, Bridge and Burn, Marine Layer, and OAS have been big hits in the summer assortment!

What do you find are the biggest challenge(s) and the advantage(s) of being an independent retailer?

The biggest challenge is scale – balancing inventory, cash flow, and time. But the advantage? Agility. We can react quickly, take creative risks, and create a space that truly reflects who we are and what our customers love. That freedom is powerful. [Editor’s note: extended versions of these profiles will be available at mr-mag.com.]

1911 W. Division St., Chicago, IL 60622 (773) 394-1034 geminishop.com

Owners: Joe Lauer and Jena Frey

Gemini proprietors Joe Lauer and Jena Frey opened their store in 2019 as a sister shop to their original concept, Penelope’s, which opened in 2002.

What was your motivation for opening Gemini? What did you do before this?

Before opening Penelope’s, which is right next door, we worked in shops and restaurants around Chicago, gaining experience and connecting with the community. We wanted to create a space of our own that showcased emerging designers and offered a fresh, relevant perspective to the neighborhood we loved. Opening Penelope’s was our way of contributing to the area’s cultural and creative energy, and Gemini is a natural extension of that vision.

What percentage of the store’s business is men’s vs women’s?

Our business is split almost evenly between men’s and women’s wear. In addition to apparel, we also carry a curated selection of accessories and small home goods.

How do you identify your store?

We view ourselves as a community-focused, neighborhood shop that offers clothing and goods that strike a balance between style, quality, and value. Everything we carry is carefully selected, featuring pieces that feel special, are wearable, and are well-made. Our goal is to create a welcoming space that reflects the spirit of the neighborhood while supporting independent designers who are doing thoughtful, original work.

What’s the neighborhood like?

We’re located on the border of Wicker Park and Ukrainian Village, just a few miles west

of downtown Chicago. It’s a creative enclave with a mix of quiet, tree-lined residential streets and lively main avenues filled with world-class shops, restaurants, and galleries. It’s the kind of neighborhood that feels great to live in, laidback and community-driven, but it also draws visitors who come to shop, eat, and soak up the area’s energy.

How do you choose the menswear brands you carry?

Many of the brands we carry have been introduced to us through conversations with our customers, staff, and fellow shop owners in other cities. We put a lot of thought into what our shop and our community are looking for in terms of style, quality, and price.

How do you find/discover new brands?

We discover new brands through conversations, travel, and simply being engaged consumers of design. While we like to introduce a few new collections each season, our primary focus is on building and maintaining strong relationships with the brands we already work with. That long-term connection is vital to us.

What is your best-selling menswear category?

Our best-selling menswear pieces are shirts and trousers that strike a balance between casual and polished, styles you could wear to a design meeting or out to a neighborhood cocktail bar. Brands like Wax London, Corridor, and Original Madras Trading Company excel in that space. We also see a lot of demand for thoughtful, well-made basics. T-shirts and core essentials in natural fabrics continue to perform well, with Jungmaven standing out as a longtime customer favorite for their American-made hemp and organic cotton styles.

How are you and your store involved in the community?

We and many of our staff live in the neighborhood, so staying engaged with the community is vital to us. We host and participate in events like sweater swaps, mending parties, and art openings, things that bring people together around creativity and sustainability. We’re also involved with local organizations, such as the neighborhood chamber of commerce and the Apparel Industry Board, which help support small businesses and strengthen connections within the local retail and design communities.

By Ken Giddon

Let’s start with the obvious: it’s held in Florence, within the walls of a centuries-old fort. Dorothy, we’re not in Las Vegas anymore.

“” is a

Florence, as many of you know, is one of the most beautiful cities in the world. Combine that with world-class food and the full Italian experience, and you’ve already got three great reasons to go. After the show, I extended my trip and headed south to Puglia, which only added to the magic.

Pitti Uomo isn’t what I’d call a “writing” show. There’s a lot of connecting, a lot of chatting—but very few order pads in sight. Compared to the Chicago Collective, where booths are packed and orders are being written all day, Pitti feels more like a stylish summit. I’m not sure I saw a single order being written in my three days there. Maybe the Europeans are just more discreet about their deals.

What Pitti does beautifully is remind us that we’re in the fashion business. Back home, it’s easy to get consumed by open-to-buys, markdowns, and spreadsheets. At Pitti, you’re surrounded by thousands of people from around the world who are genuinely passionate about menswear. And if you, like us, buy a lot of product from Italy, you’re right next to the source—many brands drive just an hour or two from their factories to show their latest collections.

The sense of discovery is real. You’ll see hundreds of brands you’ve never heard of. No one knows who you are, and most of the conversations are happening in Italian—except, of course, when it comes to price. Asking for cost and retail seems to be a universal language.