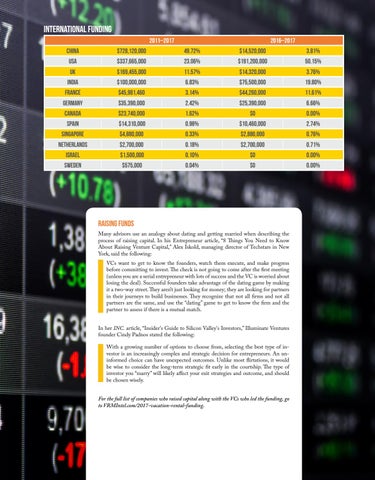

International Funding 2011–2017

2016–2017

China

$728,120,000

49.72%

$14,520,000

3.81%

USA

$337,665,000

23.06%

$191,200,000

50.15%

UK

$169,455,000

11.57%

$14,320,000

3.76%

India

$100,000,000

6.83%

$75,500,000

19.80%

France

$45,981,460

3.14%

$44,260,000

11.61%

Germany

$35,390,000

2.42%

$25,390,000

6.66%

Canada

$23,740,000

1.62%

$0

0.00%

Spain

$14,310,000

0.98%

$10,460,000

2.74%

Singapore

$4,880,000

0.33%

$2,880,000

0.76%

Netherlands

$2,700,000

0.18%

$2,700,000

0.71%

Israel

$1,500,000

0.10%

$0

0.00%

Sweden

$575,000

0.04%

$0

0.00%

Raising Funds Many advisors use an analogy about dating and getting married when describing the process of raising capital. In his Entrepreneur article, “8 Things You Need to Know About Raising Venture Capital,” Alex Iskold, managing director of Techstars in New York, said the following:

VCs want to get to know the founders, watch them execute, and make progress before committing to invest. The check is not going to come after the first meeting (unless you are a serial entrepreneur with lots of success and the VC is worried about losing the deal). Successful founders take advantage of the dating game by making it a two-way street. They aren’t just looking for money; they are looking for partners in their journeys to build businesses. They recognize that not all firms and not all partners are the same, and use the “dating” game to get to know the firm and the partner to assess if there is a mutual match.

In her INC. article, “Insider's Guide to Silicon Valley's Investors,” Illuminate Ventures founder Cindy Padnos stated the following: With a growing number of options to choose from, selecting the best type of investor is an increasingly complex and strategic decision for entrepreneurs. An uninformed choice can have unexpected outcomes. Unlike most flirtations, it would be wise to consider the long-term strategic fit early in the courtship. The type of investor you “marry” will likely affect your exit strategies and outcome, and should be chosen wisely. For the full list of companies who raised capital along with the VCs who led the funding, go to VRMIntel.com/2017-vacation-rental-funding.

VRM Intel Magazine | Spring 2017

83