Jennifer Daniel Aflac

Jack Holder EBIS

Rachel McCarter Mercer

Mark Rosenthal PwC

Steve Clabaugh CLU, ChFC

Editors

Heather Garbers | Trevor Garbers

Marketing Director

Marin Daniel

For Media and Marketing Requests Contact:

Heather@voluntary-advantage.com

Trevor@voluntary-advantage.com

Mailing Address

10940 S Parker Rd #257 Parker, Colorado 80134

Seif Saghri BenefitHub

Tim Schnoor Birch Benefits

Sydney Consulting Group A d v i s o r y B o a r d

Hunter Sexton, JD, MHA

Michael Stachowiak

Growing Global Presence & Expat Populations

Spur Interest in International Benefit Solutions

Maximizing Employee Benefit Program Enrollment & Engagement

Employees Desperately Need Help Getting Affordable Auto & Home Insurance

The Importance of Purposeful Learning & Growth

Is Crossing the Pond Possible For Voluntary

To be silent or say the unsaid? To tell someone what they need to hear rather than want they want to hear. Listening to solve rather than replying to be heard. These are just a few terms that mentors of mine have shared with me over the years when formulating a response to a conversation, situation, issue, etc

I’ll first start by saying the unsaid - Today, our society is faced with an unimaginable growing divide when discussing a given topic and someone has a different viewpoint It’s OK to agree to disagree and still be civil and friends In fact, we all get better when were able to see things from someone else’s perspective Based on history telling us what the future holds, I always like to refer to when South Africa made a transition from apartheid to a constitutional democracy, and I simply like to ask - what if Nelson Mandela didn’t say the unsaid? The same goes for our marketplace today in discussing the changes needed around re-heaping commissions, claims, utilization and both carrier representative and broker compensation models. It’s time to say the unsaid.

Trevor Garbers

Let’s discuss the value of telling someone what they need to hear rather than want they want to hear In most cases, this might seem tricky or nearly impossible to execute In fact, human nature naturally has us select the easiest route and we tell them what they want to hear However, I’m sure many of you will agree that some of your best friendships, partnerships and agreements all had a moment of addressing the brutal facts and sharing what needed to be said and heard I firmly believe our marketplace is slowly slipping away from telling people what they need to hear Without a doubt, I firmly want to share with you today that our marketplace legislation is still a major work in progress To succeed, we need to be continually adjusting and enhancing our products, services, loss ratios, claims experiences and overall delivery of our financial solutions to our valued policyholders. If we don’t adjust today as partners, others from outside our marketplace will adjust it for us.

Next, let’s discuss listening to solve rather than replying to be heard. If you know me personally, you know I’m guilty of this one. In fact, I’m probably a first-ballot hall of famer for being a quick replier. In January of 2024, I set out to correct this trait. As a result, I’ve learned a great deal about myself and to no one’s surprise, I’ve learned so much more about our marketplace, its people and its future. A simple question that should be asked from time to time – Are you listening to solve or just to be heard?

In closing, if I’m going to continually push for our marketplace to be a better place it wouldn’t be fair nor just, if I didn’t reflect from within to make sure I’m saying the unsaid about my own self and telling my own self what I need to hear rather than what I want to hear My hope is for our marketplace to continue its upward path with the best people leading it the right way Thank you all for joining us on this exciting journey!

“May your choices reflect your hopes, not your fears – Nelson Mandela

The United States has a long history of successfully exporting parts of its culture abroad, from hamburgers to hip hop But the same can’t be said for employee benefits, especially voluntary benefits Despite rapid, consistent growth for more than 20 years in this country, the employee-pay-all via payroll deduction model has not gained international traction This approach is uniquely American, largely due to the role of voluntary benefits in supplementing existing benefits and addressing gaps left by this country’s health care system.

Yet the primary driver for adopting this model abroad could be exactly the same as what makes it successful in the U.S.: understanding the nuances of employers in different industries and identifying and meeting their employees' unique needs needs employers are unable or unwilling to cover, but are open to facilitating through effective and accessible options

Can Workplace Benefits Work Abroad?

For a voluntary benefits market to develop in other countries, two factors are essential

First, distribution is crucial A promising market would include brokers already advising employers on paid coverage or retirement plans

And second, payroll deduction should already be in use for other programs That’s not a process you’d want to have to catalyze to launch voluntary programs Other payment methods are available, but both employers and employees have always preferred payroll deduction for truly linking the voluntary offerings to the group’s overall benefits program.

From there, enrollment methods and product offerings can vary by market.

Consider South Africa, where employers already work with brokers to offer benefits, and some compulsory coverages are even governmentmandated for employee contribution However, local market experts will tell you these minimums are indeed often minimal, and still leave employees with unmet needs. This scenario is similar to the demand for additional life insurance in the U.S. voluntary market, where brokers could introduce additional coverage to their existing employer clients, with employees opting in through payroll deduction. In South Africa, funeral coverage is a prevalent policy, reflecting cultural values that often prioritize funeral insurance over life insurance as an investment in a family’s well-being

Closer to home, the voluntary benefits industry has been slowly taking shape in Canada where the market holds significant potential, particularly as the landscape evolves with a growing emphasis on personalized and flexible benefit solutions, according to Karan Sabharwal, Partner, NMG Consulting

“The focus for growth in Canada is on complementing the relatively comprehensive health and wellness coverage already provided by employers and the government,” Sabharwal says “The key to success in Canada lies in leveraging existing broker relationships, where brokers can introduce voluntary benefits that address gaps in coverage and meet the diverse needs of employees.”

Top-up life and living benefits coverage is already being increasingly provided as a voluntary product in the Canadian market, he adds. “With payroll deduction already a wellestablished practice for various programs, this method can be effectively used to facilitate voluntary benefits, making them an attractive option for both employers and employees”

For our part, it would be great to see a version of the US voluntary market take root in other parts of the globe To be sure, some semblances can be seen in Australia and the UK already, although most of those programs are not groupunderwritten or payroll-deducted but rather employer-marketed

The key for the voluntary value proposition is to identify those markets where critical infrastructure and trusted advisors already exist. When these components align, carriers may find strong opportunities for expansion and growth beyond our borders.

Nick Rockwell President Danielle Lehman Senior Consultant

Eastbridge is the source for research, experience, and advice for companies competing in the voluntary space and for those wishing to enter For over 25 years, they have built the industry’s leading data warehouse and industry-specific consulting practice Today, 20 of the 25 largest voluntary/worksite carriers are both consulting and research clients of Eastbridge.

VoluntaryAdvantagehaspartneredwithNABIPtoupdatetheirVoluntary/WorksiteCertificationand itisliveandavailabletoyou24/7virtually.

ThecostoftheVoluntary/WorksiteCertificationcourseis$304.70forNABIPmembersand$401.50fornonmembers,whichincludesonlineinstructioninthreeone-hourwebinarmodules,afinalexamand continuingeducationcredits.Uponcompletion,youwillreceiveacertificateofcompletionas voluntary/worksitecertified.

CourseHighlights:

Mastertheproductwithinnovativesolutions

Understandcontractdifferences

Reviewimplementationandadministration

Obtaincrucialcomplianceinsights

By Heather & Trevor Garbers

International benefits have gained significant attention in today's world, largely due to advances in technology that allow employees to "live where they love" while working remotely They may choose to relocate closer to aging parents or even to fulfill their dream of living by the ocean and are choosing to relocate to other countries where they are still able to do their job in a virtual environment. Medical tourism is also becoming popular as it is more common to pursue treatment outside of the U.S. According to the CDC, reasons individuals may seek medical care in another country include: [1]

Cost

Culture - to receive care from a clinician who shares the traveler’s culture and language

Unavailable or unapproved procedures - to get a procedure or therapy that is not available or approved in the United States

The CDC also reports that the most common reasons for medical tourism trips today include: dental care, cosmetic surgery, fertility treatments, organ and tissue transplantation, and cancer treatment

How is the insurance industry adapting to changing consumer needs? Anthony Llompart, Chief Operations Officer with MediExcel Health Plan, shares his insights on their strategy for assisting cross-border employees with healthcare benefits.

For those that are not familiar with MediExcel, they are a California-licensed HMO specializing in crossborder healthcare benefits They serve employers in San Diego and Imperial County and deliver care in Mexico Their customers are both large and small businesses that would like to offer a low-cost health benefit option for diverse workforces who live and work in the southern California border region (an estimated 2 million individuals commute across the border each year to work) According to Anthony, their premiums are 1/3 the cost of comparable US health plans, and they cover emergency and urgent care services worldwide – offering a unique value prop to employees who often desire more affordable options for coverage

MediExcel initially decided to build a plan for this marketplace as they discovered a gap in coverage for the middle to low-income workers who commute across the border daily With the rising cost of healthcare, the demand for quality healthcare in Tijuana, Mexico, has grown fast, and the healthcare infrastructure has vastly improved He does add that their most significant complication is border wait times, but they are already working on ways to improve access

To show the need for solutions like theirs, MediExcel shared this case study with us. They have a San Diego agricultural company as a client that had offered its employees Kaiser medical benefits for over ten years. Enrollment was consistently low and limited to mostly the management team. As premiums continued to rise, so did the number of employees who waived coverage.

Source: https://hospitalcmqcom/medical-tourism/affordable-surgery/

They found that the field workers could not afford to cover their families, and many lived in Tijuana and crossed the border daily to get to work. Seeing the need to provide equitable coverage to all employees that would appeal to them from a budget perspective and would also provide benefits in Mexico where members are more likely to pursue treatment, their broker positioned MediExcel Health Plan alongside Kaiser. This broader health benefit package was more effective at offering all employees attractive options and they saw a steep uptick in the number of field workers who were enrolled in healthcare

There is a great and growing need for multinational solutions in our marketplace can impact certain industries (eg Agriculture, IT, Hospitality) or clients in border states disproportionately

As you are working with multinational groups on these solutions, some questions that you may want to ask carriers when looking for solutions are:

Do you have a plan that would provide benefits for services received outside of the U.S.?

Which countries apply?

How is care accessed? Is there a network?

How are claims processed? Are benefits available to employees with a residence outside of the US?

How do the plans/rates deviate from “standard” plan designs?

Is an SSN required to enroll?

Are materials available in the primary languages spoken by employees throughout the globe?

https://wwwnc.cdc.gov/travel/page/medical-tourism1. https://hospitalcmqcom/medical-tourism/affordable-surgery/ 2

Anthony Llompart, Chief Operations Officer at MediExcel Health Plan - is a seasoned healthcare executive with expertise in commercial development and operational performance Under his leadership, the small regional plan has seen its membership triple to 16,000 active subscribers. He is responsible for strategic planning, marketing, sales, channel development, client service, subscriber growth and experience, leadership development, and performance. Mr. Llompart completed postgraduate studies in healthcare leadership at Cornell University and earned his Executive MBA from the Naveen Jindal School of Management in Texas

By Heather & Trevor Garbers

We had the opportunity sit down with Kim Landry, Associate Research Director at LIMRA, to discuss the results of their 2024 Benefits & Employee Attitude Tracker and found the results quite interesting. As we all head into the 4th quarter renewal cycle, you may want to keep in mind some of the major highlights of this study.

One of the key things LIMRA evaluates in this study is how well employees understand their benefits. This year they found that overall, they don’t really understand them very well (fewer than half understand disability and supplemental health products). In addition, employees that don’t understand their benefits are less likely to enroll, are less confident in their decisions, and might not be able to use their benefits effectively after enrollment, including failing to file claims that they should

Employees don’t even seem to know whether their employer offers particular benefits or not – for example, 26% of employees are not sure whether their employer offers a Hospital Indemnity plan or not, and more than half are uncertain.

On the other hand, employees that say their “employer communicates about benefits well”, are more confident in their elections and are more likely to say they understand their benefits

About half of employees report only receiving information about their benefits during open enrollment, but 73% reported that they would like to get more frequent info throughout the year

Employees have a wide variety of preferences when it comes to the medium that benefits information comes in, ranging from email, to paper, and so a multiple-channel communication approach seems to be best to meet the overall needs of an employee population

LIMRA found that benefit costs are going up, but employees’ budgets for benefits is going down.

The median amount employees are willing to spend on benefits is $120/month, down $30 from the prior two years

This can make employees less likely to enroll in benefits which will impact the nonmedical benefits (eg disability insurance and supplemental health plans) Employers will need to make sure that the benefits being offered are affordable to employees and that they provide adequate coverage

The long-term consequence of this is that we will see employees opting out of coverage that they will later need, and it will be to the detriment of their long-term financial health

The study also asked employees how well they think their employers are supporting each aspect of wellness for them – and financial wellness fared the worst. Financial wellness is the second most important type of wellness to employees, but was ranked the worst and so employees do not feel that their employers provide enough support or resources for their financial wellness

LIMRA did a deep dive into mental health benefits in this study this year While they expected the need for mental health services from employers to be high, Kim reported that they were surprised at how high the need is

The median amount employees are willing to spend on benefits is $120/month, down $30 from the prior two years.

In fact, 75% of workers say they have struggled with mental health challenges at least sometimes during the past year, and 37% said they struggled often within the past year

They also found that more than 1 in 10 workers have thought about suicide sometimes or often during the past year – and the stats get worse when you look at younger demographics particularly, Gen Z

From a solution perspective, employees reported that they prefer paid time off to deal with stress or mental health issues as this was the #1 requested way to help deal with their mental health Employees also indicated a desire for access to free or discounted therapy sessions, and would like mental health visits covered by health insurance without a fee

From a solution perspective, the insurance industry needs to strive to better align employee needs, with the solutions their employers provide in their consulting services

A key area is to improve benefits communication - Employees need to see the value of their employer’s offerings in order to purchase them. The insurance industry can help our clients to create robust communication strategies to meet the overall needs of the group. This can be a market differentiator as we know that Human Resources & Benefit teams at the client level are strained and anything their designated broker can do to make this a simple process for them would enhance employee engagement.

According to Kim, the insurance industry should take a good hard look at the financial wellness of employees We need to look at financial wellness benefits to see if they meet needs, need to be enhanced, and how we can better communicate them to employees

Workers that have struggled with mental health challenges at least “Sometimes” during past year

75%

Workers that have struggled with mental health challenges at least “Often” during past year

37%

A key area is to improve benefits communication - Employees need to see the value of their employer’s offerings in order to purchase them.

They found that only about half of employees say they are happy with their jobs (which is down from two years ago), but employees that are highly satisfied with their benefits are more likely to say that they are happy with their jobs and employers As retention of trained employees is a key cost-savings and growth mechanism of most employers, offering robust benefits touching these key areas and enhancing the communication offered to employees will help employers better meet the needs of their employees to meet this objective.

Kimberly Landry - Kim conducts quantitative and qualitative research on hot topics within the employee benefits industry, with a specific focus on employer and employee perspectives She is also responsible for LIMRA’s worksite and supplemental health research programs She is a frequent speaker at industry conferences and events Kim joined LIMRA in 2008 She received her bachelor's degree from Wesleyan University and her master's degree from the University of Hartford

By Mark Head

Improving overall employee engagement with employers depends at least in part on the benefit programs the employer is offering And the effectiveness of benefits plans, in turn is largely dependent on whether employees actually enroll in and use them And that’s directly impacted by the outreach communications, marketing and technology used to get employees enrolled and to keep them engaged over time

GenAI and LLMs Generative AI (GenAI), powered by Large Language Models (LLMs), is accelerating the advancement and increased capability of Benefits Administration (BenAdmin) systems and Benefit Engagement Platforms (BEPs) These tools are improving the user experience as they become more intuitive and more adaptive, thus streamlining and simplifying the enrollment process and making ongoing usage easier and less time-consuming.

Importantly, as generative AI applications become more sophisticated, the possibilities are extending beyond the open enrollment transaction, to improving the year-round benefit plan engagement

To continue improving the effectiveness of benefits communications, the shift toward benefits marketing recognizes that to “enroll” in a benefit program is to “buy” it. Which means we need to adapt our communications and messaging cascades towards a more salesoriented process – without becoming “salesy” This is where personalization, psychographics, and sophisticated tech systems (email, text messaging, push notifications in apps) can make a huge difference

When an employee is getting the right message, at the right time, on the right device, the heightened “impact” is significant It’s the opposite of piecemeal, fragmented and inconsistent messaging

One increasingly-common use of generative AI is to create high-quality benefits education and marketing content – with broader range and greater depth – than what most of us can develop from scratch. And talk about fast!

This will continue to become more important as employers demand more from BenAdmin, BEP, and Open Enrollment / Voluntary Benefit vendors –especially when it comes to year-round outreach, communications, and messaging After all, employers always want to drive enrollment into all of their well-being programs, their navigation and advocacy support tools, financial well-being programs, and other point solution plans

Why *shouldn’t* BenAdmin systems begin to support enrollment into these non-O/E vendors’ programs – at any time throughout the year –using APIs?

Personalization - This is another key area where technology can make a big impact on the benefits experience. Employers are showing significant interest in leveraging personalization to help employees optimize their benefit coverage selections and improve the utilization of available care management programs and point solutions. Data analytics programs support delivering targeted messages to employees throughout the year via online platforms, mobile apps, emails, and SMS text messages. Such approaches ensure employees receive relevant and timely information that aligns with their specific needs and preferences

Employers can leverage psychographic profiling to understand employees' values, beliefs, priorities, and preferences better By categorizing employees into segments such as Planners and Doers, Living for Today, and Duty to Family and Colleagues, companies can align their benefits communication and offerings more effectively When you know how someone sees the world, you can “filter” the recommendation languaging to proactively address “What’s In It for Me?” and “Why Should I Care?”

Planners and doers – These employees are detail-oriented and proactive in planning their future. They value comprehensive health plans, retirement savings options, and educational benefits. Personalized content that highlights long-term financial planning and preventive healthcare is crucial for this group.

Living for today - Employees in this segment focus on immediate benefits that enhance their current lifestyle. They may prioritize flexible spending accounts, wellness programs, and benefits that offer immediate perks Communication strategies emphasizing the tangible, short-term benefits and convenience of using various plans will resonate well with them

Duty to family and colleagues - These types prioritize benefits that support their family and work responsibilities They might be interested in dependent care, family health insurance plans, and employee assistance programs Tailoring messages that highlight how benefits can support their loved ones and help them maintain work-life balance will engage this segment.

AI and machine learning can be applied to benefits data to understand sources of costs and employee behaviors, leading to interventions and better cost management. These algorithms empower employers to make well-informed strategic decisions regarding coverage and programs based on employee needs and interests. For example, stratifying employees by which type of voluntary programs they’ve bought / enrolled in – compared to the health plan they chose – can provide insights into how each type approaches risk management

Another emerging use of AI in telephonic or zoom sessions is to monitor employee “sentiment” by analyzing voice tone and inflection

Generative AI improves efficiency beyond content creation by assisting in resolving queries from employees. Enterprise software providers integrate AI and LLM features within their technology suites for faster integration in health and benefits recordkeeping applications For instance, Microsoft’s Azure Cognitive Services for Language enhances chatbots' understanding of user inquiries, providing efficient resolutions Tools such as Microsoft’s GitHub Copilot further assist in automating routine tasks and providing high-quality assistance, freeing up HR resources to focus on strategic initiatives The ways that vendors adapt and incorporate such technologies into their platforms will help them differentiate from their competition

AI can also improve call center efficiency, leading to faster resolution of queries and an enhanced customer experience AI-powered chatbots manage routine questions, allowing human agents to focus on complex issues. Predictive and intelligent routing connects callers with the right resources effectively. Moreover, customer service representatives benefit from real-time call transcriptions that provide proactive knowledge article suggestions and generative AI-drafted call summaries.

Effective employee benefits technology is vital for optimizing benefits offerings and boosting employee engagement Addressing communication and marketing challenges, providing robust support, and focusing on key technology features ensure maximum value from benefits investments Implementing a strategic plan and partnering with technology experts can further enhance benefits administration, ultimately fostering a more engaged and loyal workforce

Staying ahead with the latest technological advancements, including psychographic profiling that aligns with employees' values and beliefs, is crucial for long-term success This nuanced approach allows vendors and consultants to support their employer clients in connecting with their employees on a deeper level, which is key to driving more enrollment and ongoing engagement in benefit program investments.

Mark Head, President, Benefit Personas - - Mark Head has 40+ years of experience in insurance, employee benefits, health management and engagement methodologies. He focuses on innovation, strategy, business culture, business intelligence and analytics, as well as sales and marketing Starting as an independent benefits consultant, he moved into the well-being industry in 2001, and was a co-founder and Chief Solutions Officer of Viverae – now a part of Virgin Pulse / Personify Health In 2015, he established BenefitPersonas™ in recognition of the need to drive increased enrollment and engagement in benefit programs He works with enrollment firms, consultants and other benefit vendors to develop personalized, values-based communications using behavioral science and psychographic profiling.

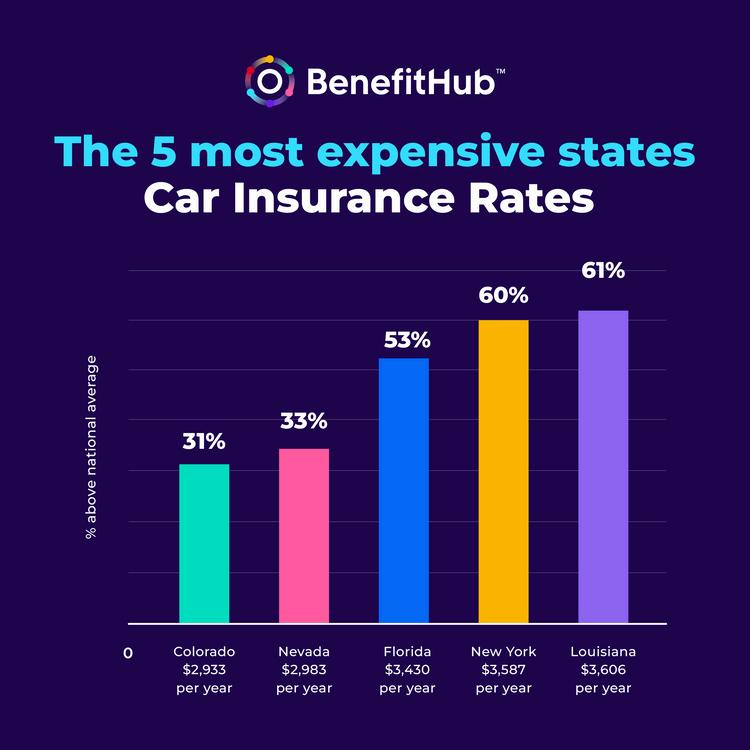

By Seif Saghri

For the last 18 months, consumers have been heavily pummeled by the worst auto and home insurance market in over 50 years With over 280 million registered vehicles in the United States and 89% of Americans aged 25 and over licensed to drive, nearly every adult is feeling the pain Make no mistake, your employees are feeling this pain So, what are we talking about?

Auto insurance rates soared 24% in 2023, pushing the average annual cost of fullcoverage auto insurance above $2,000. Although the rate of increase is expected to slow to about 7% to 10% in 2024, this still represents a significant rise compared to historical norms. The average cumulative threeyear rate increases since 2021 for major insurers is approximately 43%.

Just how expensive can insurance be? Very Here are the 5 most expensive states and their average annual full coverage premium car insurance rates for 2024:

national average Nevada: $2,983 per year

Colorado: $2,933 per year

national average

Several factors are causing insurance companies to pass higher costs to consumers:

1. Inflation: General economic inflation has driven up the cost of auto parts, repair services, and labor

3

Increased Claims and Payouts: The frequency of accidents and the cost of repairs and medical expenses have increased, leading to a rise in the number and severity of claims.

2. Supply Chain Disruptions: Global supply chain disruptions, exacerbated by the COVID19 pandemic, have led to shortages of auto parts and vehicles, driving up costs for repairs and replacements

4

Rising Medical Costs: The cost of medical care has been increasing, impacting the cost of claims related to bodily injury

In 2023, many of the largest insurers announced they were no longer writing new business in dozens of states, affecting millions of policy holders. For example, in Florida, Farmers Insurance stopped writing new policies and renewals for home, auto, and umbrella policies, affecting around 100,000 policies.

In addition to premium increases, employees face several other challenges:

6

Increased Driving and Accidents: As COVID19 restrictions have eased, more people are returning to the roads (up over 4% in last two years), leading to more accidents and claims

5 Legal and Regulatory Changes: Changes in laws and regulations, such as increased minimum coverage requirements in some states, have also contributed to higher premiums.

Home insurance premiums have seen similar significant increases, with average annual costs rising to around $1,700 in 2023, up a whopping 46% from $1,175 in 2019 This increase is largely due to rising construction costs, a high number of claims from catastrophic events, and supply chain issues Many homeowners are now facing premium increases of 10% to 15% for 2024, and in high-risk areas, the hikes can be even more substantial

Larger Down Payments: Many insurers no longer offer to spread the premium payments monthly and require large down payments or the full premium upfront. This is tough on employees living paycheck-to-paycheck.

Six-Month Policies: Insurers are mostly only offering six-month policies instead of annual ones, giving them the opportunity to raise rates again as soon as the shorter policy ends.

Insurers Leaving the State: In 2023, many of the largest insurers announced they were no longer writing new business in dozens of states, affecting millions of policy holders For example, in Florida, Farmers Insurance stopped writing new policies and renewals for home, auto, and umbrella policies, affecting around 100,000 policies

Coverage Being Denied: As insurance companies have been changing their underwriting criteria or exiting certain markets or states, there has been a substantial increase in insurance coverage being denied

While there's no easy solution to combat the market forces driving up prices, there are several ways employers can help their employees save money:

1

Offer Auto and Home Insurance as a Voluntary Benefit: There’s no employer cost and minimal effort

3.

2 Offer Group Discounted Rates: Primarily offered by Liberty Mutual, MetLife, and Travelers to employers that can provide a sizable pool of potential policyholders. Include these carriers and their rates in the multi-carrier quoting tool to enable employees to compare group discounts with other carriers’ pricing

4

Provide Access to a Multi-Carrier, Side-by-Side Insurance Quoting Tool: This allows employees to input their information once and instantly receive multiple quotes from different insurance carriers A good tool will find an employee’s cars and drivers as soon as they enter their home address, enabling the application process to be completed in just a couple of minutes.

Seif Saghri, Founder & Vice Chairman, BenefitHubBenefitHub is a lifestyle benefits company offering the world’s largest selection of employee and member discounts, voluntary benefits and rewards There are currently over 10,000 clients in 15 countries that use BenefitHub to delight and engage their 20 million+ employees and members

Give Employees Access to Licensed Agents: Over 80% of employees choose to speak to an agent, even when they can self-bind the policy online Agents can help if the employee has blemishes on their driving record and explore discounts from insurance companies who reward customers who have safety features in their car Or provide tips for lowering insurance premiums by raising the deductible, bundling auto insurance coverage with home insurance and making sure the employee is not paying for more mileage than they're actually driving

5

Avoid Offering Limited Carriers: Offer a single carrier or even two or three carriers These carriers may not be appropriate for your employees’ risk profile, location, demographic, etc. It also means they will have to input their information multiple times.

On average, employees can save $590 annually on auto insurance premiums by switching carriers using a combination of a multi-carrier, side-by-side insurance quoting tool and advice from licensed agents (BenefitHub) This savings can increase to $1,092 when bundling home with auto insurance

By taking the above steps, employers can provide meaningful support to their employees in navigating the challenging auto and home insurance market

By Michael Stachowiak

In a world characterized by rapid advances in technology and shifting market dynamics, the need for continuous personal and professional development cannot be overstated I often share with the teams that I have served, “In a changing marketplace, if you are not getting better with purpose, then you are getting worse on purpose,” this captures a fundamental truth: growth is not a passive process but a result of deliberate, intentional efforts Those who neglect this imperative do not merely stagnate; they regress, and the marketplace passes them by This is true for individuals, teams, leaders, and companies

Purposeful learning and growth means making a choice, a decision, and a commitment to improve continuously. This approach stands in stark contrast to passive development, where individuals and organizations may evolve slowly through incidental experiences or in response to market shifts, crises, or competitor moves. The proactive pursuit of new knowledge, new skills, and new abilities is essential because the baseline of competency is always moving forward as innovation and new methodologies emerge

Stagnation in a changing industry will have a compounding impact in a changing market.

In professional settings, this is particularly evident Industries evolve under the pressure of new technologies, regulatory changes, and competitive landscapes Professionals who do not engage in learning and growth with intention and rigor are often left behind, finding themselves less relevant in their fields This is not merely a matter of missing out on an opportunity or an edge, but rather it can create a serious risk of obsolescence

From a psychological perspective, adopting a mindset focused on intention growth is empowering. It aligns with the concept of a growth mindset, which posits that abilities and intelligence can be developed through dedication and hard work. This belief encourages resilience and a positive attitude towards challenges and failures, viewing them as opportunities for learning and improvement.

Furthermore, purposeful growth fosters a sense of control and autonomy Individuals who actively seek out learning experiences feel more in control of their destinies, boosting their motivation, satisfaction, and overall well-being. This proactive stance helps cultivate a sense of purpose, aligning daily activities with broader personal and professional goals.

This is a terrific purposeful learning opportunity, and you may be surprised what comes from pushing yourself outside of your comfort zone These purposeful growth champions are invaluable in today’s changing landscape

3

1. Seek Feedback and Reflect: Regular feedback is invaluable for improvement Coupled with self-reflection, it allows individuals to understand strengths and weaknesses and to plan growth activities more effectively Feedback can be gathered from trusted critics, clients, industry experts, or mentors and is one of the most valuable tools to ensure growth. Companies should also seek feedback on how they show up for stakeholders if their strategy addresses growth needs, market opportunities, and challenges. Producers, employees, and customers can feel when a company’s strategy and investments are tone-deaf to what their teams or customers have been asking for to win in the marketplace Feedback and reflection are critical strategies for individuals and companies who seek purposeful growth

Set Clear Learning Objectives: Establishing specific, measurable, achievable, relevant, and time-bound (SMART) goals is crucial. This focuses effort and provides clear metrics for progress as you learn and grow. In other words, what do you want to learn, how will that impact you, your role, your team, your customers, and/or the company, what needs to be true for you to learn those things, and when will you learn them and who are you sharing these goals with to help keep you accountable and on track

2 Embrace Challenges: Stepping outside your comfort zone is essential for development Challenges stimulate learning and adaptation, providing deeper insights and fostering capabilities that routine tasks cannot Consider taking on a task that is outside your understanding and capabilities, make it known that you’re pursuing something outside of your comfort zone but are happy to help, step up, and assist

4 Leverage Learning Resources: Today’s digital age offers abundant resources for learning from online courses and webinars to podcasts and virtual conferences Engaging with these tools and resources can provide fresh perspectives and up-to-date knowledge Chances are that most companies have internal resources and will often sponsor external resources, consider diving into these internal or external resources to learn and grow in alignment with areas you want to focus on, you’re learning objectives. Compound the impact of these resources by choosing to focus on areas where you have received feedback from a trusted critic, or in an area that you are less familiar with but have offered to take on a stretch assignment in the spirit of learning and purposeful growth If learning resources are not readily available there are many other resources out there, consider LinkedIn Learning, Coursera, or following Voluntary Advantage for up-to-date and cutting-edge industry research and commentary from leaders

5 Cultivate a Supportive Network: Building relationships with mentors, peers, and experts can facilitate growth and accelerate your personal growth goals Networks can provide support, advice, and accountability, all of which are crucial for sustained development. Informal networking with people outside your immediate team or organization can often be the most valuable, it is healthy and important to broaden your perspective when it comes to your learning and growth.

Agile leadership emphasizes flexibility, collaboration, and swift adaptation to change In the context of our industry, this means leaders must be able to pivot strategies quickly, respond to market shifts, and make decisions with speed and precision. Agile leaders are characterized by their willingness to embrace uncertainty and experiment with new approaches. This adaptability is critical because the insurance market is affected by various unpredictable factors like regulatory changes, economic fluctuations, and technological advancements

A key aspect of agile leadership is decentralized decision-making Integrating agile leadership with a learning mindset creates a dynamic organizational culture that can navigate the complexities in the insurance market today

Agile leaders who are learners themselves model behaviors that reflect curiosity, flexibility, and strategic and tactical competence They foster an environment where failure is seen as a stepping stone to innovation They enable speed in problem-solving, collaboration, and efficiency by demonstrating the inherent value of choosing to learn and grow.

The importance of learning and growth in a purposeful manner cannot be overstated It is a decisive factor that separates those who advance in their careers and personal lives from those who regress. Individual learning in a changing marketplace also increases the ability to deliver customer value and drive organizational transformation and strategy. Those who choose to learn and grow also tend to be innovative, curious, and forward-thinking and often drive a significant impact inside the teams they are on. They are often able to problem-solve, self-reflect, and demonstrate agility

By choosing to get better with purpose, individuals and organizations can maintain relevance, achieve their potential, and ensure success in an ever-changing world These elements are crucial for adapting to change, driving innovation, and delivering superior customer value Companies that embrace these principles are better positioned to meet the challenges of today’s market and lead the way in the future As the Insurance industry continues to evolve, the most successful firms will be those who prioritize agility, speed, and continuous learning at every level of the organization. When it comes to learning and growth, the choice is fundamental not just a strategic advantage but a necessary engagement for thriving in today’s complex and changing market.

Michael Stachowiak, Consultant - Michael has worked in the Voluntary / Workplace Benefits industry in sales leadership capacities at leading carriers nationwide He has a passion for sales coaching and leadership development in our industry. He resides in South Carolina with his wife Caroline and 3 adorable daughters where they enjoy exploring the world.

By Steve Clabaugh, CLU, ChFC

Relational leaders demonstrate that they care for their team members as much as the organization. They create, build and lead highperformance teams that consistently achieve excellence.

A few months after I had started working for Ameritas Life Insurance Corp , I received a meeting request from Ken Louis, then President and CEO As a new employee, I didn’t know Ken well at the time and I was, to be honest, a bit nervous about meeting with him After exchanging pleasantries, he asked a series of wide-ranging questions about the worksite marketing industry, products, distribution and my experience

Then he paid me one of the nicest compliments I had ever received “Steve,” he said “I’ve been watching how you interact with your fellow associates throughout the company.

I think your style of relational leadership is the future of how leaders ought to interact with their employees. I hope you will infect as many people as possible with that approach.”

That was the first time I’d ever heard the phrase “relational leadership” and I’ve never forgotten it Ever since, I have sought to promote the concept for use by leaders in all types of endeavors and organizations Over the years it has led to the development and teaching of the concepts we share today as part of Relational Leadership Experience

Long before I began studying, learning, applying and teaching these concepts; Mike Petty was already using them to create championship cultures during his career as an Army Officer, Executive Director of a non-profit organization, soccer coach and leader in his community. His is a real-world story of the importance and effectiveness of relational leadership.

Michael Petty, Retired Army Lt Col, enlisted for airborne infantry right after graduating from high school He had the audacity as an 18-year-old Private to apply for Officers Candidate School He passed both the written exam and oral interview and at 19 years of age was commissioned as the youngest 2nd Lt In the Army He served a total of 3 tours in Vietnam as an Engineer and later as a Cobra helicopter pilot After the end of the Vietnam War, he led companies providing for the defense of NATO weapons then in military corrections - including serving as the Deputy Commandant of the military prison at Ft Leavenworth, KS.

During his military career, Mike was recognized for his leadership and valor earning: 2 Purple Hearts; 1 Silver Star (3rd highest award that can be achieved); 2 Distinguished Flying Crosses; 1 Bronze Star; 19 Air Medals for combat flying missions; 2 Meritorious Service Medals and 1 Good Conduct Medal. His service to our country undoubtedly qualifies him as an American hero He has been my hero for the past 36+ years that he has been my closest friend Out of respect, admiration and love our entire family simply refers to him as “the Colonel”

As a result of his upbringing and the challenges he faced in life, Mike developed a natural relational leadership style that he applied throughout his career in the Army I have learned as much about relational leadership from him as I have from any of the authors and mentors who have influenced me along the way

As a commander, Mike believed it was important that his troops understood what they were doing, how it fit into their mission and why it was important. This was in contrast to the then common approach of simply barking orders and expecting immediate compliance. He felt that the more they understood, the better the job they would do. He believed that you have to have people who want to accomplish the same goal together in order to be successful

In an environment that stressed not fraternizing with enlisted personnel, Mike played softball and other sports with his troops, many of whom were enlisted He expected them to call him Mike when they were competing or involved in some social occasion off duty On duty they honored Army regulations related to command This was not always appreciated by his superiors who sometimes questioned whether he was personally too close to his troops. In reality his troops never once abused command structure. And many of them have maintained their relationships with him long after their service together.

Diversified Opportunities, Inc. - Wilson, NC (1987 – 2005)

Diversified Opportunities is a non-profit community rehabilitation program for people with disabilities (both physical and mental) Rather than keeping folks isolated and ignored, Diversified provided them with training and employment opportunities benefiting the clients and the community

When Mike accepted the role of Executive Director, it was an organization facing an existential crisis More than $600,000 in debt with few prospects of much improvement, it was considered by many community leaders as likely to be shut down

Mike created a positive work environment that treated staff, clients and the community with dignity and respect Working together as a championship team, they learned new skills, obtained new projects with local businesses and continually improved their financial condition even while certain aspects of local funding were being reduced. Mike and I became friends during this time as we worked together to create a meaningful benefits program for his staff. Despite battling health insurance premium increases as high as 279%, we were eventually able to provide a package including health, life, disability and retirement benefits

Often when I went to meet with Mike about some aspect of their benefit program, I would find him on the plant floor patiently teaching the staff and clients how to assemble, disassemble, sort or otherwise perform the functions of the project they had recently acquired One weekend he asked me to help him and his wife Sherry move into their new home It turned out that he had hired 4 of the clients to also help At first, I was uneasy about working with these folks who had various disabilities but as the day went on, I found out they were just like me in wanting to be accepted, respected and appreciated for who they were. The guys not only taught me a valuable lesson about relationships but also some practical techniques for moving large pieces of furniture.

When Mike retired in 2005, Diversified Opportunities had paid off the mortgage on their building (3 years after purchasing it), had zero debt and more than $800,000 surplus in the bank

Soccer Coach and Community Leader –Wilson, NC (1987 – 1994)

As a youth, Mike was an excellent athlete playing football, baseball and basketball His daughters, however, were excellent soccer players and he devoted himself to learning and coaching the game After coaching his youngest daughter’s travel team to winning a national championship he accepted a position coaching the Hunt High School Girls Soccer team. Once again, he applied the principles of relational leadership in developing a highly competitive program.

Tragedy struck their program and the community-at-large when one of his players, Brittany Willis, was kidnapped, raped and murdered by a fellow classmate a few weeks after graduation. Family, friends, fellow soccer players and community leaders (including Mike) were overwhelmed with anger and grief There are no words of consolation or comfort that can overcome such an incomprehensible horror

They needed to take some type of positive action to help replace the sense of hopelessness in the community Because of the relationships he had built over the years, community and school leaders responded positively to the idea of creating a soccer showcase in honor of Brittany In 1994 the first “The Brittany” was held with 12 girls teams from around the state invited to participate Mike met each bus as it arrived at the soccer fields Before letting the team off the bus, he told them the story of Brittany Willis and gave them practical advice on how to protect themselves and their fellow teammates

“The Brittany” grew to 30 teams the next year and a boy's showcase was added in the Fall due to the popularity of the girl's event Mike believed that the program would be good for 6 or 7 years before teams would begin to lose interest However, the program continues to thrive, and currently hosts 90 teams each season at the community soccer complex now boasting of 8 fields. “The Brittany” has raised money to provide hundreds of scholarships and has been an economic boon for the community. Thousands of young people have been told her story and taught ways to protect themselves. More importantly, Brittany Willis has not been forgotten and her family and friends have been comforted and supported the entire time.

Those who read our articles each month or who have participated in a Relational Leadership Experience program will know that I believe relational leadership applies in all types of organizations and in the community itself The life and career of, my best friend, Col Petty is a primary example of why I believe it so strongly

Steve ChFCstarted his career in insurance as a Field Agent, moving on to Sales Manager, General Manager, Regional Manager, Vice President, Senior Vice President, and President/CEO A long time student of professional leadership, Steve created the Relational Leadership program that has been used to train home office, field sales associates, mid-level managers, and senior vice presidents