M A G A Z I N E

Jennifer Daniel Aflac

Jack Holder EBIS

Rachel McCarter Mercer

Mark Rosenthal PwC

Steve Clabaugh CLU, ChFC

Editors

Heather Garbers | Trevor Garbers

Marketing Director

Marin Daniel

For Media and Marketing Requests Contact:

Heather@voluntary-advantage.com

Trevor@voluntary-advantage.com

Mailing Address

10940 S Parker Rd #257 Parker, Colorado 80134

Seif Saghri BenefitHub

Tim Schnoor Birch Benefits

Sydney Consulting Group A d v i s o r y B o a r d

Hunter Sexton, JD, MHA

Michael Stachowiak

Trends in Supplemental Health Insurance

Metrics that Matter: Deciphering Minimum Loss Ratios

Supplemental Health Products Today

Anonymously Speaking...

Relational Leadership: Not for the Faint of Heart

Supplemental Health Products Step Into Limelight

Is it time to change the narrative on positioning voluntary benefits or more specifically supplemental health plans such as Accident, Critical Illness, Cancer, and Hospital Indemnity plans?

Today we see positioning of these lines based on “pre-tax savings”, “because employees want them”, “to round out your benefits offering”, “to get subsidy dollars”, “because it doesn’t cost the employer anything to offer”, and more But is this type of positioning effective and does it represent the solutions we provide in this industry? Does the narrative resonate at the employer and employee level? Does positioning this way engage employees in these offerings and add value from a financial wellness perspective? Is it effective today in 2024?

I would dare to say no, this positioning does not tell the true story. The value prop for supplemental health plans should expel the significance that these benefits provide to the member from a financial wellness perspective, and their to support the employer’s overall benefits strategy. Some strategies for positioning that I’ve seen be successful are:

When health insurance rate increases lead the client to no other choice than to cost shift on the medical plan, offering supplemental health plans for employees to reinsure their risk, or even reinvesting some of the savings to the employer into plans for their employees to assist in reducing the risk

Acknowledging that health insurance seems to cover less and less today, and that these plans ensure employees are not in financial peril when balance billed for visiting an out-of-network provider, for emergency transport, covering RX copays, travel for specialized treatment, or even assistance in funding a caregiver or long term care services if needed. At the essence, should a catastrophic health event occur, these plans give employees options so they can pay for treatment and necessary lifestyle changes.

I dare to say that our industry should refocus our sales efforts on the solutions provided by these plans and their ability to help the consumer. Tell the story from the perspective of the value they provide to the employee. This is also why the claims experience is so important - when someone is filing a claim, it is due to a medical event that may leave them scared and worried, and so cumbersome claim processes and untrained and unfriendly customer service representatives, just add to that stress for them.

At the end of the day, why would you buy this coverage?

Life and disability insurance are the perennial divas of the voluntary benefits marketplace, but they’re far from the only players on the stage Supplemental health products including hospital indemnity, accident and critical illness are taking more active roles in many employee benefits packages. These plans got a boost during the pandemic, as more people saw the importance of the protection they provide and that strong growth is continuing.

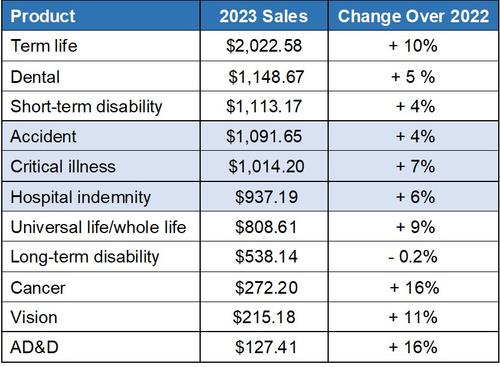

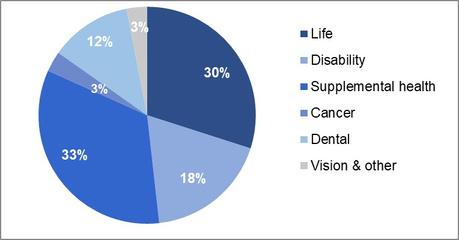

Accident, critical illness and hospital indemnity were three of the top six best-selling products last year, according to Eastbridge’s recent “US Voluntary/Worksite Sales Report,” at levels rivaling ever-popular short-term disability and dental insurance. In fact, supplemental health products as a whole hold a larger market share (33%) than life insurance (30%).

Nearly a half or more of all employers offer supplemental health products to their employees, according to Eastbridge’s 2022 “MarketVision™ The Employer Viewpoint©” study. Most often these benefits are available on a 100% voluntary, employee-pay-all basis. A significant percentage of employers share the cost of coverage with their employees, but very few pay the entire premium for them

Employee ownership of and interest in buying supplemental health products shows a significant market opportunity. According to the most recent “MarketVision™ The Employee Viewpoint©” study, about a quarter or fewer employees own hospital indemnity/supplemental medical (28%) or critical illness (24%) insurance on any funding basis Ownership of accident coverage is higher, but still less than half (44%) of all employees However, about half of those who don’t already have these products are interested in buying them on a voluntary, 100% employee-paid basis Comparing nonownership and interest creates a buying interest index and supplemental health products have some of the highest scores of any employee benefit.

Supplemental health plans are among the top five voluntary products brokers sell, according to this year’s “Rising Tide for Brokers in Voluntary Business” Spotlight™ report Critical illness ranks number one for benefit brokers, while accident ties for number two The order flips for voluntary brokers, with accident first and critical illness tied for second

If supplemental health products aren’t already part of your benefits package or marketing portfolio, it might be time to consider raising the curtain on them You may not get a standing ovation, but you could increase your sales, customer satisfaction and employee retention

Eastbridge is the source for research, experience, and advice for companies competing in the voluntary space and for those wishing to enter. For over 25 years, they have built the industry’s leading data warehouse and industry-specific consulting practice Today, 20 of the 25 largest voluntary/worksite carriers are both consulting and research clients of Eastbridge

By John Allen

The Supplemental Health Insurance market is undergoing significant transformation, influenced by changing demographics, advances in technology, and shifts in consumer expectations As traditional health insurance plans continue to leave gaps in coverage, supplemental insurance is becoming necessary for individuals seeking comprehensive healthcare solutions Here are some key trends in the marketplace:

Consumers are increasingly seeking personalized insurance plans that cater to their unique healthcare needs Insurers are responding by offering more flexible and customizable supplemental plans. This trend is driven by the realization that one-size-fits-all policies often fail to address the specific health concerns of different demographic groups. Customization includes tailored coverage options for chronic conditions, maternity care, mental health services, and wellness programs.

Digital platforms are revolutionizing the supplemental health insurance market. Digital tools are enhancing the customer experience by simplifying the process of purchasing and managing insurance policies

From AI-powered chatbots providing instant customer service, to mobile apps enabling easy claim submissions, technology is making supplemental insurance more accessible and user-friendly Companies are also leveraging data and analytics to offer predictive insights, helping consumers choose the best plans based on their health profiles and needs

There is a growing emphasis on preventive care and wellness in supplemental health insurance offerings Insurers are increasingly incorporating benefits that encourage healthy living and proactive health management This includes coverage for: routine check-ups, fitness programs, nutritional counseling, and smoking cessation programs. By promoting preventive care, insurers aim to reduce the incidence of serious health issues and manage long-term healthcare costs more effectively.

The COVID-19 pandemic accelerated the need for telehealth services. This trend continues to influence the supplemental health insurance market.

Many supplemental plans now include coverage for telehealth consultations, allowing policyholders to access medical advice and care remotely Telehealth services offer convenience, reduce the need for in-person visits, and can be particularly beneficial for individuals in rural or underserved areas. This expansion is expected to persist as telehealth becomes a standard component of healthcare delivery.

Mental health is gaining recognition as a critical component of overall wellbeing. Supplemental health insurance plans are increasingly providing coverage for mental health services. This includes therapy sessions, counseling, and psychiatric care. The stigma surrounding mental health is diminishing, leading to higher utilization of these benefits. Employers and insurers are prioritizing mental health support, recognizing its importance in maintaining a healthy and productive workforce

Value-based care models are gaining traction in the supplemental health insurance market These models focus on delivering high-quality care while controlling costs by emphasizing outcomes rather than the volume of services provided Insurers are collaborating with healthcare providers to implement value-based arrangements, which incentivize positive health outcomes and patient satisfaction This approach aligns the interests of insurers, providers, and policyholders, promoting a more efficient and effective healthcare system

There is a noticeable trend toward designing supplemental health insurance plans that cater to specific demographic groups, such as seniors, women, and millennials For instance, plans targeting seniors may offer additional benefits for age-related conditions and home healthcare services

John Allen, President of EOI - executes and develops strategic marketing initiatives on a national level, specifically focusing on the enhancement of value-added services that EOI provides for its clients Since joining EOI in 2009, John has played a key role in the area of strategic marketing, building an outstanding implementation team in the Chicago office and tripling sales in the Midwest region

Women’s health plans might include expanded coverage for reproductive health, maternity care, and breast cancer screenings. Plans for millennials often focus on digital health tools, mental health services, and fitness benefits

The gig economy is expanding, with more individuals working as freelancers, contractors, and part-time workers. These workers often lack access to employer-sponsored health insurance, creating a growing market for supplemental health insurance plans tailored to their needs Insurers are developing affordable and flexible options that provide gig workers with essential coverage and peace of mind

The supplemental health insurance market is evolving rapidly, driven by changing consumer needs, technological advancements, and a greater focus on holistic health and wellness As insurers continue to innovate and adapt to these trends, consumers can expect more personalized, accessible, and comprehensive coverage options that better address their individual health requirements

Whether through digital solutions, preventive care, or specialized plans for different demographics, the future of supplemental health insurance promises to enhance the overall healthcare experience for all.

VoluntaryAdvantagehaspartneredwithNABIPtoupdatetheirVoluntary/WorksiteCertificationand itisliveandavailabletoyou24/7virtually.

ThecostoftheVoluntary/WorksiteCertificationcourseis$304.70forNABIPmembersand$401.50fornonmembers,whichincludesonlineinstructioninthreeone-hourwebinarmodules,afinalexamand continuingeducationcredits.Uponcompletion,youwillreceiveacertificateofcompletionas voluntary/worksitecertified.

CourseHighlights:

Mastertheproductwithinnovativesolutions

Understandcontractdifferences

Reviewimplementationandadministration

Obtaincrucialcomplianceinsights

The term minimum loss ratio (MLR) is incredibly important when discussing both a product’s regulatory compliance and profitability, but for such an essential term, it is often misunderstood or misused The National Association of Insurance Commissioners (NAIC) defines a loss ratio generally as “a measure of the relationship between claims and premiums” In the context of pricing and profitability in the supplemental health space, MLR refers to an incurred loss ratio; which is the expected incurred claims, plus any changes of reserves for active claims and claims incurred but not reported (IBNR). There may be several loss ratios described within an actuarial memorandum: 1) the target loss ratio; which is the loss ratio a Company is targeting when setting premium rates, 2) the anticipated loss ratio; which is the “expected” loss ratio at each duration based on financial modeling; and 3) the minimum loss ratio, which is the lowest acceptable ratio of claims to premiums that regulators will allow These loss ratios could all be the same or each could be different

By Kristi Hardenbergh, FSA, MAAA Consulting Actuary, Sydney Consulting Group

Knowing the MLR requirements at the state level is obviously important from a regulatory compliance perspective, but it is also important for determining the “ceiling” of how premiums will be shared between business partners If 50% of the premium is expected to be made up of benefit payments, that leaves the other 50% to encompass commissions, maintenance and acquisition expenses, enrollment firm subsidies, tech credits, premium taxes, licenses, and carrier profits Working backwards from a state’s MLR makes it easy to see how stretched profit margin can become in a state with high MLR requirements

In the group market, most states do not have specific regulations for the minimum loss ratio of supplemental products, though there are notable exceptions (Colorado, Delaware, Florida, and New York, to name a few). In the absence of a minimum required loss ratio, the industry typically looks to the NAIC Model Regulation No 134 for guidance While intended for the individual market, the model regulation provides table loss ratios based on renewability provisions and product type (medical expense and loss of income or other) and is standardly used as a benchmark for group filings as well

NAIC Model Regulation No 134 also provides a formula for reducing the table loss ratio if a policy is expected to have a low average annual premium, or for increasing it in the case of a high average annual premium. As most supplemental plans fall into the low average annual premium category, many products in the market are filed with minimum loss ratios of 50% or less. However, just like with differing state regulations, states can also vary on how this formula is applied and how much of a reduction in MLR they will allow.

There are a handful of states requiring higher minimum loss ratios and even a few states (eg, New Jersey, Washington) that have minimum loss ratio requirements expressly for specified disease (critical illness and cancer) policies

These required MLR’s can be as high as 75%. In the individual market, there are a greater number of states with specified regulations for all products, and when a state does not provide one, the NAIC Model Regulation No. 134 is an appropriate guideline

In general, despite pricing to statutory minimum loss ratios or higher, claim experience across the industry has been favorable and historical loss ratios have been low It is probably not a coincidence that we have also seen an increase in state Departments of Insurance requesting experience filings a few years after approval Additionally, brokers are requesting MLR experience in renewal and takeover opportunities, potentially trying to negotiate additional margin for low loss ratios In general, we caution carriers not to disclose MLR experience, particularly, as experience can be deceiving. For example, a critical illness product rated on an issue age basis might be priced to a 50% loss ratio over the lifespan of the product, however, the claim cost pattern for benefits such as invasive cancer and heart attack is a steep, increasing slope. As a result, the first years of the product may be expected to run a loss ratio below the minimum, whereas later durations will run loss ratios well over 100%

Miscommunication and lack of information from a carrier results in disgruntled customers. Give the customer multiple methods to file claims that allow them to pick the method they are most comfortable with

Customers in the digital age of accustomed to highly personalized customer experiences They expect a user experience that prompts them for information, simplifies the delivery of documentation, and shows them the real-time status of their insurance claim.

Streamlining the process using automation removes the repetitive and predictable tasks and places them in an automated process that can either collect the critical data or retrieve important documents from the customer and other parties directly

*Adapted from Ushur

In conclusion, here are a few main takeaways for understanding MLRs:

If the MLR is higher, more of the premium must go to paying claims, which leaves less to pay for other expenses that a carrier would incur It is imperative that teams work together to get a clear idea of all types of expenses, fees, commissions, profit targets, etc so actuaries can appropriately price the product to both abide by state regulations and company metrics States can differ on what they require, which results in added complexity of pricing and filing.

Kristi Hardenbergh is a Consulting Actuary for Sydney Consulting Group. She is based out of Denver, Colorado Kristi joined Sydney in 2020 after previously working as an associate actuary at Milliman in Tampa, FL She has spent her entire actuarial career in the supplemental benefits space, with extensive experience assisting clients in pricing, product development, rate filings, and valuation. Prior to entering the actuarial profession, Kristi was a professional ballet dancer with the Sarasota Ballet.

By Heather & Trevor Garbers

Accident, Critical Illness, Cancer, and Hospital Indemnity insurance are top of mind as they are now commonly blended into the core benefits strategy by employee benefits brokers The plans that are available on the market today have seen advances from the plans available 5, 10, or 20 years ago, but are still in many ways the same

If you aren’t family, these plans pay the member indemnity-based benefits for treatment received for a qualified event Accident insurance plans today may feature enhanced benefits for organized sports or rainy-day benefits Critical Illness plans now provide payouts for quite a few more conditions than they did in the past such as: Infectious Disease, Transient Ischemic Attack, Pulmonary Embolism, and Alzheimer’s Disease, and Hospital Indemnity plans now commonly feature waiver of pre-existing exclusion clauses. So, there has been some progression, but have these plans truly innovated to keep up with the market?

Heather Scott, Sr Director, Product & Innovation, with Trustmark Voluntary Benefits, shares her thoughts on trends she is seeing in the market today

Heather - In today’s group benefits market, we’re seeing more benefits that address mental health and substance abuse offered on hospital and critical illness plans With the focus on mental health in today’s culture, the insurance world seems to be embracing and adjusting to the needs of today’s employees Societal trends are also impacting the insurance world as seen with the rise in obesity and fertility benefits. There’s increasing discussion about how these types of benefits may interact with medical plans.

We are also seeing carriers move towards product customization and flexibility when it comes to supplemental group health products, through higher benefit payment options (particularly on accident insurance), expanded plan designs and more wellness options

Finding ways to pay more claims has become a higher priority, as well Carriers are driving this through claims autoadjudication, plan design changes that allow for more flexible coverage, and offering more benefits to pay by emphasizing preventative care

Has the positioning of these plans changed over the past few years?

Heather - Supplemental group health products are subject to more regulatory rigor at both the state and federal level This has forced some changes to plan designs While these changes can impact our ability to address the trends mentioned above, these products are still designed to fit the needs of today’s employees For example, in response to increasing out-of-pocket medical costs, we’re seeing plan designs customized to include higher benefit payment options for covered conditions. Despite the regulation, there are still ways we can adjust these plans to meet the needs of the market.

Where do you see the potential for future growth in these product lines?

Heather - The bottom line is that supplemental health plans continue to grow. Employees are starting to understand the value of these products, and in turn, employers are offering them as options to their employees. It all starts with employees recognizing and understanding the value, which is reinforced by carriers finding more ways to pay them.

Specifically, assistance for mental health, substance abuse and fertility are areas of potential growth. Those are areas of employee interest and need, and where supplemental health products have potential to increase policyholder value

Heather Scott, Sr. Director, Product & Innovation, Trustmark Voluntary Benefits - Heather joined Trustmark in 2022 As Senior Director of Product and Innovation, Heather is responsible for managing Trustmark’s health products. Her voluntary benefits industry experience includes product development, product management and integrating products into benefit administration systems Heather is based in New Brighton, Minnesota

Our question to you the reader is, where do you see the potential for growth with supplemental health products? Are there features not yet available that would make the plans more appealing to consumers? That would help promote employers’ overall benefit strategies? Are there changes we can and should make to how these plans are positioned to keep up with the marketplace today?

Let’s all think outside of the box as we work to evolve our industry to keep up with the needs of consumers tomorrow

By: Kimberly Landry, Associate Research Director, Workplace Benefits Research, LIMRA and LOMA

In recent years, supplemental health benefits such as critical illness, accident, and hospital indemnity insurance have proved to be a bright spot of consistent growth within the overall voluntary benefits industry In fact, the 5-year compound annual growth rate (CAGR) is 12% for voluntary critical illness and 10% for voluntary hospital indemnity in-force premium as of year-end 2023, the highest of any voluntary lines Moreover, in force premium for voluntary critical illness insurance has shown double-digit growth every single year since LIMRA began tracking it in 2004!

Structural characteristics of the workplace benefits market suggest that supplemental health products will have ample opportunities for continued growth in the future. However, there are headwinds that must be overcome for these offerings to reach their full potential.

With relatively low market penetration, supplemental health products have more room for organic growth than many more-established benefit lines As of 2022, 34% of employers offered accident insurance to their employees; 30% offered hospital indemnity; and only 28% offered critical illness insurance lower than the penetration rates for life, disability, dental, or vision benefits. With a majority of employers still not offering these products, carriers have more opportunities to sell brand new cases as opposed to takeover business. In addition, they can often leverage existing business relationships to cross-sell supplemental health products to customers that already offer other lines of coverage

Trends in major medical insurance also create opportunities for supplemental health products At least 42% of employees who receive health insurance through work are currently enrolled in high-deductible health plans, leaving them exposed to potentially high out-of-pocket medical costs, according to LIMRA’s Benefits and Employee Attitude Tracker (BEAT) study

When positioned correctly, supplemental health benefits often appeal to employees with highdeductible plans as a means of filling this gap in coverage

In addition, employee interest in supplemental health benefits implies significant opportunity for growth. Roughly half of workers view accident and critical illness insurance as important benefits to have available, while 43% say the same about hospital indemnity coverage. Notably, when looking only at benefits employees consider important but don’t currently have access to, supplemental health lines all rank among the highest unmet needs Younger workers tend to view these products as more important than their older counterparts, suggesting that demand may rise as these generations come to make up a larger share of the workforce (Figure 1)

Moreover, when supplemental health benefits are available, only 39 to 46% of employees feel they understand them well, far lower than the understanding they profess for medical, dental, and life insurance benefits. Indeed, research shows that many employees fail to comprehend basic details about what critical illness insurance covers and how it works. Without a clear understanding of what these products are and the financial protection they can provide, employees may be tempted to opt out of these coverages without giving them adequate consideration.

Benefits rated very or extremely important (4 or 5 on a 5-point scale) Employees rated the importance of having each benefit available, regardless of whether it is currently offered to them

Source: 2023 BEAT Study, LIMRA

Despite these opportunities, there are a number of obstacles preventing supplemental health benefits from achieving their full market potential Foremost among these is employees’ low awareness and understanding of these products Workers are often unsure of whether supplemental health benefits are even available to them at work Roughly 1 in 5 are unable to say whether their employers offer these products, while more than half express some degree of uncertainty about this.

In fact, the reasons employees cite for not enrolling in benefits indicate a number of misconceptions Among workers who are offered accident, critical illness, or hospital indemnity plans and choose not to enroll, about one quarter claim they “don’t need” the benefits even though it is nearly impossible to predict whether someone will experience an accident or adverse health event in the future In addition, more than 1 in 5 employees who opt out say they don’t think the benefits are worth the cost, suggesting that workers are not perceiving the value of these coverages.

Furthermore, approximately 1 in 10 claim they didn’t have enough information about the benefits to make a decision at the time of enrollment All of these objections point to a need for better employee education about the value of these benefits.

Wallet share is also a growing problem. As of 2024, employees say they are willing to spend an average of $223 out-of-pocket per month on insurance benefit premiums (the median is $120). These spending targets have declined in recent years as inflation eats up a larger share of household budgets At the same time, benefit costs are rising, particularly for medical coverage the average employee contribution for single coverage under a major medical plan is now $117 per month, while family coverage costs an average of $548 per month[1]

This leaves workers with very little money left over to pay for supplemental health plans, even when these benefits might save them money on out-of-pocket medical costs in the future

Kimberly Landry - Kim conducts quantitative and qualitative research on hot topics within the employee benefits industry, with a specific focus on employer and employee perspectives. She is also responsible for LIMRA’s worksite and supplemental health research programs. She is a frequent speaker at industry conferences and events. Kim joined LIMRA in 2008. She received her bachelor's degree from Wesleyan University and her master's degree from the University of Hartford

Despite headwinds, supplemental health benefits have significant potential for future growth. To overcome the challenges facing these products, the voluntary benefits industry must improve benefits education to help employees truly understand and recognize the value provided by their supplemental coverages By doing so, the industry can fully capitalize on growth opportunities while increasing workers’ defenses against the financial risks of unexpected health events

[1] Employer Health Benefits: 2023 Annual Survey, KFF, 2023

By Heather & Trevor Garbers XXX

As you may be aware, we take submissions from subscribers on topics that they would like to read about in the Voluntary Benefits Voice This month’s VB Voices article is based on the submission of this question:

GA overrides, panel subsidies, and heaped commissions are a hot topic in the industry today. What is your perspective on brokers and platforms requiring these types of payment arrangements as an entry point for doing business?

This is a highly contested question in our industry today with all stakeholders having something to say We interviewed individuals from across the industry and allowed them to stay anonymous to get their honest and uncensored responses

Rebating is the practice of returning the broker's commission, or a portion of it, to the insured with the desire of inducing an insurance sale The rebate is typically funded by the insurance agent

Rebating can also be referred to as “inducement” However, inducement can also apply to indirect forms of payments or benefits offered by the broker or agent

Rebating is a way of making a potential insurance client buy the insurance product by returning the commission meant for the broker or agent as compensation or payment for the sale. The insurer might also promise discounts on premiums or even gifts. Insurance commissioners think that this is not a good practice because it develops unfair competition and might lead to insurer insolvency.

Unfortunately, many brokers in the voluntary benefits industry have created a pay to play situation for carriers. Benefit and company selection should be based on product features, company ratings, rates, loss ratios and service. Instead, it becomes who will give the biggest tech credit or who will pay heaped commissions, plus overrides, plus marketing fees and also pay for decision support tools. We are also seeing many brokerages move to panels which means carriers have to pay a hefty upfront fee to even have their products on the list to be quoted. There is no regulation around these types of fees/credits/charges and it limits carriers’ ability to be innovative, expand product offerings and enable technology, because those dollars are going towards tech fees and overrides.

There are only so many dollars to go around, when carriers are asked to pay all these extra fees and commissions, we all know who ultimately is paying for those… the employee. That is NOT right. Brokers who are truly servicing their clients look at the big picture, they help clients see the benefits of engaging with platforms but also the VALUE of doing so, and that it is worth an investment to simplify benefits administration. Employers who have “free” benefit administration systems do not engage with them and therefore there are more issues rather than less, they need to have some commitment to the system they are using.

Not all brokers are doing these things, in fact some are using it as a sales tool to show prospective clients just how much their current broker is making in heaped commissions and holding them accountable. If the only way you are providing value as a broker is getting your client a discount on their platform fees, you need to step up your game. Get back to the basics of why we are all in this business which is to make sure employees have the RIGHT benefits in their time of need, that it’s easy to get those benefits and it makes their lives somewhat easier. Isn’t THAT why we are in this business?

Unfortunately, many brokers in the voluntary benefits industry have created a pay to play situation for carriers. Benefit and company selection should be based on product features, company ratings, rates, loss ratios and service.

Like most things today, this once select privilege has quickly turned into an entitlement. At the root, cases should and can be written without the need for an override, heaped commissions, subsidy, etc. Heaped commissions are not entitled – they are earned when good persistency, performance, and partnership takes place between the carrier and broker. Only then, should a heaped commission be offered.However,we’velostsightofthevalueofpartnershipbetweenatradingpartnerandbroker.If offered,itshouldbeonlybeafterafullreviewhasbeencompletedontheoverallbrokerageblockand individualbrokerblockandtoinclude,casebycaseparameters.Ibelievethepressureofnewentrants intothevoluntarymarkettodayhasonlyincreasedthisoverallrequestbybrokers.Ifullybelieveweare doing more for the client when remove the override and subsidy and pass along that savings to the policyholderandinvestthosedollarsintotheclaimsexperience.Thisshiftisalreadyoccurringtodayby atopcarrierandtheyarequicklywinningmarketshareatarecordpace.

More focus on transparency means that any commission arrangements other than standard need to have value. I believe that using commissions and subsidies to support services valued by a client and benefiting employees has a place, as long as it isn’t negatively impacting the employee benefits or experience. Furthermore, I will seek to understand why a carrier wouldn’t load rates for heaped commissions on supplemental health plans, when they usually benefit from the services it’s paying for like decision support be it digital or human capital.

I believe that using commissions and subsidies to support services valued by a client and benefiting employees has a place, as long as it isn’t negatively impacting the employee benefits or experience.

Ithinkthatnationalbrokersshouldinvestintheirinternalprocessesandpeopleratherthanlookingto outsource marketing and placement through GA’s. The GA override is priced at the case level which increases overall expenses both to the customer and to the carrier, oftentimes with very little operational lift. For GA’s to be successful, they need to refine their value prop to truly simplify the enrollment, billing and administrative process with proven results to carriers to reduce operational expenses.

There has always been an element of Fee Based Access in our industry. Funding of platforms, supp comp,techincentives,overridesandpanelfeesareallpartofthecostofdistributionandasacompany you need to decide where to invest. Transparency is critical so employers know what portion of their premiumsarebeingallocatedtotheseexpenses. Intheendtheemployershoulddecideifthevalueis thereforthem.

Theyhavebecometablestakestobeintheconversationasacarrierthatallowsyoutocompete,butit isn’talwayscleariftheROIisthereforthecarrier.

Lastly, with the need to increase utilization, it will be interesting to see how this changes the carriers abilitytobalancehigherlossratiorequirementsbasedonmarketdemandandthesetypesoffees.

Relational Leadership is defined as a leadership core value that prioritizes building long-term positive, meaningful and growing relationships with associates that lead to ever improving personal and professional growth In other words, a relational leader cares as much about the wellbeing of the employee as they do the success of the organization

I’m not sure why, but some folks seem to think that relational leadership is somehow for those who are, by nature, always gentle and kind, or in other words - weak. I once had a manager tell me that “your kum-ba-yah and sing around the campfire stuff isn’t going to work in our company. This is a tough outfit and we need managers who are strong to make it around here.”

The notion that relational leaders are anything but strong leaders is far from reality In fact, relational leadership requires a great deal of strength and courage to face the challenges of building and leading a high-performance team

By Steve Clabaugh, CLU, ChFC

There are examples of strong leadership demonstrated by relational leaders in virtually every type of organization from sports teams, to service organizations, to military units, to businesses

Grace Hopper overcame age, size and gender discrimination to become the first woman to ever achieve the rank of Rear Admiral in the history of the United States Navy A mathematics professor, she was rejected when she tried to join the Navy during World War II because she was too old (34) and too small (barely more than 100 pounds). She persevered and was finally accepted in the Naval Reserve. Even then she had to battle the sexism that confronted her throughout her career and limited her opportunities for advancement. She was dedicated to the defense and security of her country and fiercely loyal to her staff even when many of them resented the fact that a woman was their boss in “this man’s Navy ” Today the cybersecurity building on the grounds of the United States Naval Academy bears her name – the only woman to have such a building named after her

AP Giannini was an outstanding relational leader from an earlier generation When the big banks shut them out, he fought to give working class men and women access to banking and other financial services so they could have the opportunity to pursue the great American dream At one point, the Wall Street bankers who had taken over the bank’s leadership during the Great Depression decided that the bank was going to fail They determined to declare bankruptcy and liquidate all the bank’s assets. A.P. left his sick bed, still weakened from a very serious illness, and led a stockholder revolt against the leadership team. Thousands of his customers who had become stockholders of the bank joined him in voting to throw them out and restore A.P. and his team to leadership. In case you’re wondering about whether that bank survived the Great Depression the answer is a resounding yes and, in fact, Bank of America is still thriving as one of the major banking institutions in our country

There are many challenges in business leadership that require exceptional strength and courage Here are some examples of the many

Maria had worked in the policy processing department of a life insurance company for many years Part of her responsibility was to prepare and send out a memo to the company’s managers and officers, at the end of the business day, reporting the number of applications received and the number of policies issued for that day It seemed unusual when she started sending out the memo not at the end of the day but several times throughout the day with numbers that didn’t seem to make sense This went on for several weeks before her managers came to see me about the situation

They had recently learned that Maria was suffering from a rapidly worsening form of dementia Her doctor had been telling her and her family that she should not be working and, in fact, needed to be in a memory care program for her own safety Maria refused to accept this diagnosis and insisted on continuing in her job Finally, her children came to meet with our managers secretly to request that the company terminate her employment for her own good

Her managers were also long-time friends and this request was very difficult for them as they wanted to be able to maintain a relationship with her. So, since I was the new guy and didn’t really know her that well, they requested that I be the one to fire her. It was an uncomfortable duty to complete but I tried to do it in as gracious a manner as possible.

As you might imagine, Maria did not respond well to this news She was extremely angry with me and told everyone she knew about my unfair and undeserved decision Her children and her managers, however, privately expressed their appreciation and respect for the decision that had been made in Maria’s best interests

Sonny was a Vice President who had been with the company for 29 years He knew a lot about the company’s history and was well known by all the employees and agents of the company Unfortunately, no one could figure out exactly what he was responsible for, nor any contribution he was making to the company’s success My predecessor actually apologized to me for not having dealt with the situation before

I had learned many years ago about the “1–10–100 Rule” which says that: the first opportunity you have to deal with an issue is the easiest it will ever be; if you don’t address the problem then it is 10 times more difficult to deal with when it comes back up; and if you still don’t deal with it – it becomes 100 times harder to correct the third time. While I had learned the “1-10-100" Rule long ago, I hadn’t applied it in this situation.

Instead of addressing the situation with a specific plan of improvement or resulting termination; we kept moving him to different departments and different supervisors Nothing worked and I began to hear from department managers that his apparent “special employee” status was actually hurting the productivity and morale of their teams When the difficult decision to terminate Sonny’s employment was finally made, we expected some negative blowback especially from long-time employees Instead, the reaction was exactly the opposite. Employees actually appreciated the fact that the company had some real productivity standards and that doing a good job was what would be rewarded – not longevity.

Anna was a customer service representative – a very good one. Sales associates and customers alike appreciated her caring and thoughtful manner. One day as her manager was walking by her work area, she noticed that Anna was crying. Through her tears, Anna explained that one of the sales representatives was very upset by her decision not to approve the sale to a specific customer He screamed at her, on the phone, and informed her that she would immediately change her decision or he would have her fired

Her manager was an excellent relational leader and did not believe the old falsehood that “the customer or the sales representative is always right” First, she made sure to understand the actual details of the sale and, as expected, Anna had made the exact right decision Next, she called the manager of the sales representative and explained the situation to them Her instructions to the manager were that, within the hour, the representative would call Anna, apologize for his actions and promise that he will never engage in such behavior again. If that action failed to occur, the company would terminate the sales representative's employment immediately.

The sales representative did make the call and was a model of cooperation and respect ever after that occurrence As for Anna, she was very grateful for her manager’s support and continued to do an outstanding job for the company in supporting both sales associates and customers

I had the opportunity, over the years, to attend many rewards trips both as a qualifier and later as a corporate officer. These trips to exotic and beautiful locations gave opportunity to celebrate the prior year’s success. In addition, they provided a relaxed environment for relationship building between corporate executives and field sales leaders

While primarily focused on exciting fun activities, trips also included a brief business meeting used to announce new products, programs and company progress They also were a requirement so the company could receive a tax write off for a significant portion of the trip’s expenses My experience over the years was that the business meetings were a significant waste of time as company leaders basically “mailed in” their presentations with little pre-planning or creativity

When it became my responsibility for managing rewards trips, I established a standard of preparation for the business meeting that was not very popular – to say the least. Months before the trip each presenter was required to describe their subject and how they planned to present it. Then several weeks before leaving, we scheduled rehearsals for each person to actually give their presentation to the team while receiving feedback on how they could improve it This took place twice before leaving A final dry run was held in the actual meeting room generally the afternoon or evening before the presentation

The majority of our leaders, maybe all of them, disliked this disciplined approach and many of them felt free to complain about them I agreed that it was hard work and uncomfortable to hold each other accountable for what we were saying in our presentations I pointed out that I held myself to the same standard

Following our first rewards trip presentation together or team was delighted to receive high praise from our attendees with many of them saying it was the best such meeting they had ever attended. Being tough about setting a high standard turned out to be well worth the effort although they didn’t like it any better during subsequent years.

If you take some time to think about it, I’m sure you can come up with other examples where strong relational leadership was used or, sadly, neglected I hope you will take these situations into consideration the next time you face a challenge or an opportunity that requires strength and courage

As always, please feel free to contact me to discuss a particular case, situation or to request a proposal for your client company

You can learn more about Relational Leadership Experience through the weblink now located on the Voluntary Advantage website

Steve Clab FC - started his career in insurance as a Field Agent, moving on to Sales Manager, General Manager, Regional Manager, Vice President, Senior Vice President, and President/CEO A long time student of professional leadership, Steve created the Relational Leadership program that has been used to train home office, field sales associates, mid-level managers, and senior vice presidents

Select and train the right employees

Implement effective mentoring

Develop positive conflict management

Determine and implement the best outcomes

Achieve