Trevor Garbers

Trevor@voluntary-advantage.com

Heather Garbers

Heather@voluntary-advantage.com

For Media and Marketing Requests contact: Heather@voluntary-advantage.com and Trevor@voluntary-advantage.com

Steve Clabaugh CLU, ChFC

Mark Rosenthal PwC

Michael Stachowiak Colonial Life

Jessica DePhillips Mercer

Jack Holder EBIS

Michael Naumann Reliance Matrix

Jennifer Daniel Aflac

Seif Saghri BenefitHub

Steve Clabaugh CLU, ChFC

Mark Rosenthal PwC

Michael Stachowiak Colonial Life

Jessica DePhillips Mercer

Jack Holder EBIS

Michael Naumann Reliance Matrix

Jennifer Daniel Aflac

Seif Saghri BenefitHub

Vishal Jain, Head of

Wellness Strategy and Development for Prudential and Daniel Bryant, Senior Advisor and Operating Partner at the Vistria Group provide guidance

Insights from Kyleen Engelstad, Director, Claims Strategy, Voya Financial; Ann Sanchis, Regional Voluntary Benefits Practice Lead, UnitedHealthcare; and Matt Hall, VBS, GBDS, Voluntary Specialist Director, MetLife

The theme for our February 2023 edition of the Voluntary Benefits Voice is “Financial Wellness” and this is a strategy that many of us in the industry are passionate about If you think about it, our socioeconomic status is key to so many parts of our lives; it impacts the lifestyle we can afford, where we can afford to live, the type of medical care we receive, our level of stress, overall health and wellbeing and so much more

As we focus on providing innovative solutions for the Health-Wealth convergence in this edition, I also want to remind you of a basic first step that can directly impact the financial wellbeing of employee populations at a minimal cost to the employer or member The resources provided by many of the Identity Theft vendors in our market today can immediately help employees learn about credit and start improving their credit score How big of an issue is identity theft really? The impact identity theft can have on someone is not only financial, but emotional - as a result of identity theft:

40% reported being unable to pay their routine monthly bills

33% reported not having funds to buy food or pay utilities

14% reported being evicted for failing to pay rent or mortgage

14% reported not being able to make their car payment

8% reported not being able to afford child or elder care

32% of Americans impacted by identity theft reported having financial-related identity problems, including credit- and credit card-related fraud Of these:

100% indicated they had been contacted by debt collection services seeking payment for debts that were not their own

83% reported being turned down for credit or loan applications

83% reported difficulty renting apartments or finding housing.

Many Americans today do not yet know that they are the victim of identity theft fraud – and they may not find out until they apply for credit at which point the fraud may take months or even years to resolve, impacting their ability to apply for a mortgage or car loan in the meantime.

By Trevor & Heather GarbersThis coupled with the ability to have quick and convenient access to view your credit score and receive guidance on how to improve your credit can be invaluable to individuals today where many do notunderstandwhatcreditisinthefirstplace.

While this article appears to be a commercial for Identity Theft coverage, I wanted to take this opportunity to point out that unfortunately, this product has moved from being something that is convenient to offer on a group basis, to now being a necessity and a starting place for financial wellness initiatives.

In our market, we should be taking our time to vet the marketplace to find quality partners (there is much more to this product than price and commissions) and engage employees. This is a benefit that employees will hopefully use regularly and so knowing what monitoring services and features are available, how to activate them, how user friendly the website is and if it is mobile optimized,whatotherservicesareavailable(ex.VPN) are all questions I would recommend asking when lookingforcarrierpartners

When Financial matters are the #1 cause of workplace stress, identity theft coverage is a budget friendly way to start assisting clients of all sizes with improving the financial wellness of their employee population, and making sure you have the right partnersinkeytoseeingROIwiththeseprograms

https://wwwdebtcom/credit-score/credit-statistics/ https://wwwexperiancom/blogs/ask-experian/identity-theft-statistics/

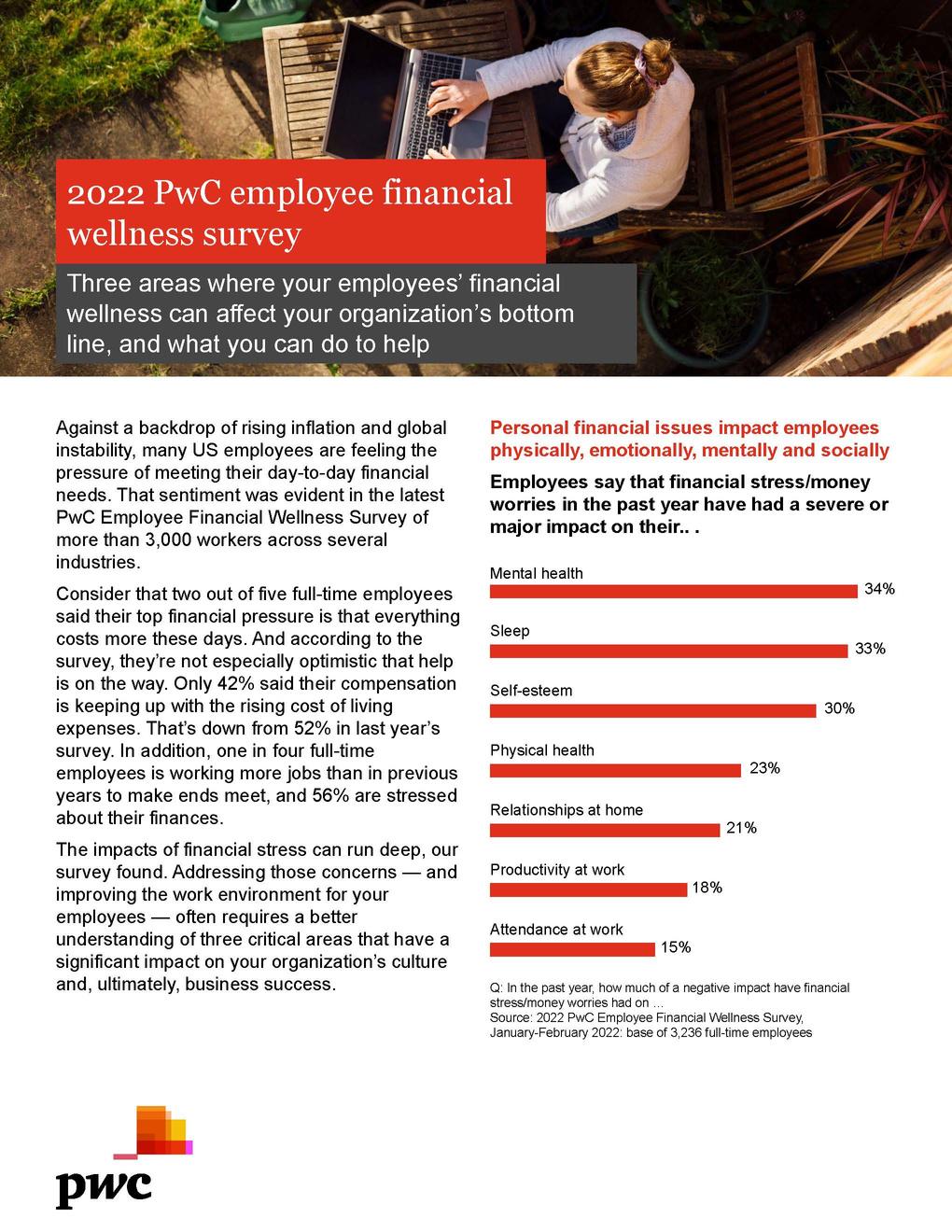

97%offull-timeemployeesreportedthattheyhavefinancialstress,and87%saiditaffectstheminsome way-PurchasingPowerReport,2022

Those reporting financial stress state they lose, on average, 11.4 hours in productivity every week—this translatesintoover$4billioninlostproductivityweeklyforU.S.employers-BrightPlanSurvey,2022

73%ofemployeeswhoseproductivityatworkisseverelyormajorlyimpactedbytheirfinancialworries also say that their finances have significantly affected their self-esteem - PwC Employee Financial WellnessSurvey,2022

Employeesareworriedaboutinflationandarehavingahardtimecoveringexpenses, manyareleftlivingpaycheck-to-paycheck.

Rising inflation (79%) is employees’ top financial concern, followed by adequate retirement planning (59%), with employees currently contributing significantly more to retirement. In addition, market volatility (56%), having sufficient emergency savings (55%) and paying off debt (44%) rank highBrightPlanSurvey,2022

80%ofemployeesareconcernedaboutinflationacrossalldemographics age,gender,race,andincome -BankofAmericaReport,2022

32%ofrespondentssaidthattheyorsomeoneintheirhouseholdhadtroublepayingmedicalbillsinthe last12months. Among this group, 50% reported that they had reduced spending on basic needs such as foodandclothingtorepaytheirmedicalbills-FinancialHealthNetworkReport,2022

54% of full-time employees were either unable to cover monthly living expenses or lived paycheck to paycheck,barelycoveringmonthlylivingexpensesoverthepastyear-PurchasingPowerReport,2022 72%ofAmericansarelivingpaychecktopaycheck-NationalPayrollWeekSurvey,2022

48% of consumers earning more than $100,000 per year lived paycheck to paycheck in January 2022, representingasix-percentagepointincreasefromDecember2021-PYMNTSReport,2022

54% of full-time employees have $2,000 or less/none in an emergency savings account to cover unexpectedexpenses-PurchasingPowerReport,2022

Workers reported having difficulty accessing or paying for housing (23%), healthcare (22%), or healthy food(19%)-WTWGlobalSurvey,2022

47% of respondents reported not being able to pay all of their bills on time in the last 12 monthsFinancialHealthNetworkReport,2022

Employeeswantemployerstoofferfinancialwellnessbenefits.

97% of employers say that they are in some way responsible for their employee’s financial wellnessBankofAmericaReport,2022

88% of employees expect their employers to provide tools and resources to help them with their finances-BrightPlanSurvey,2022

54%ofemployeessayfinancialwellnessbenefitsarethenumberonemostdesiredemployeebenefitBrightPlanSurvey,2022

As we are in uncertain financial times, our mission in this edition of the Voluntary Benefits Voice is to equip you with knowledge and solutions to proactively present financial wellness resources, tips and tools to your clients This author truly believes that it is our duty in this industry, to make a positive impact on the day-to-day wellbeing of everyday Americans We interviewed two individuals who are very passionate about financial wellness: Vishal Jain (VJ), Head of Financial Wellness Strategy and Development for Prudential; and Daniel Bryant (DB), Senior Advisor and Operating Partner at The Vistria Group, in addition to author of "Financial Wellness Mandate", for their advice on navigating employer based financial wellness strategy

Why would an employer want to take steps to improve the financial wellness of their employees?

DB - First, employers should want to take steps in this direction because it’s the right thing to do Employee benefits in general have become an everlarger part of an employee’s experience, expectation and total compensation Health, emotional and financial wellness are inextricably tied together, so these benefits are increasingly seen as equal in importance to health benefits You can’t have health wellness without financial wellness And vice versa VJ - Research shows most people are experiencing some level of financial stress and that can negatively impact someone’s mental and physical health This means two very important things for employers First, creating an engaged and productive workforce requires helping employees improve their financial wellness Second, employers should take a holistic approach to improving their employees’ overall wellness – which includes financial wellness – along with other aspects such as physical, mental, and social, given their connectivity to overall wellness Focusing on overall wellbeing is good for both employees and employers

Would you say there is room for improvement when it comes to financial wellness within the employee benefits industry today?

DB - The biggest issues today center around: the communication of the programs and the ultimate engagement of the services There is a lack of bandwidth within HR to articulate, outline, rollout, follow up and communicate these programs And without a longer term plan that utilizes both technology and coaching, adoption can be low

There are new vendors entering the industry every day, what benefits or services are meaningful, and how do we prioritize what and when they should be implemented?

DB - the makeup of the employee demographic and the cultural DNA of an employer ultimately determines what benefits should be implemented That said, the lack of financial literacy in this country really warrants a comprehensive and basic view of financial wellness After all, we can’t save what we don’t have I would prioritize efforts as follows:

1) Budgeting and Planning;

2) Emergency Fund Savings;

3) Credit Card Debt Management;

4) Student Loan Debt Management;

5) Care-Giving Services;

6) Retirement Income Planning

What are the steps to build a successful financial wellness program for employees?

VJ - We think there are three key steps to building a successful financial wellness program:

Try to determine your employees’ most acute financial challenges. Employee surveys and benefit plan trends can be good sources of insight

For example, a high rate of hardship withdrawals from 401(k) plans may indicate challenges with budgeting or managing debt The important thing is to prioritize two or three key needs so that you can build your financial wellness program accordingly and engage with relevant financial wellness providers

Design the financial wellness program in a way that maximizes engagement and impact. Include both financial education and solutions that help employees act to improve their financial health Leverage a multi-channel approach, including email communications, on-site and virtual events, and employee intranets to promote and provide access to financial wellness services Look for ways to integrate relevant financial wellness services into employee life events, such as having a child, when they need help Provide access to one-onone support – during the pandemic Prudential experienced a 100%+ increase in the use of our one-on-one financial education resources as employees could ask for help from the privacy of their home using virtual communications tools And finally, look for opportunities to optimize and/or expand employee benefit offerings, such as voluntary benefits, to address high priority employee needs

Measure what matters Start with measuring the engagement and usage of the financial wellness services you are providing to employees However, it is also important to measure the business outcomes you are striving to achieve

Are there any out-of-the-box or new solutions available in the marketplace that we should be talking to our clients about?

DB

There are a lot of financial wellness solutions that are readily available to help participants chart their own journey towards financial wellness Some are comprehensive, some are more tailored around specific solutions, suggestions include: eMoney’s Incentive, Brightside, Savology, Questis, and The Wealth Pool There are literally hundreds of players in the space There will ultimately be a lot shake up and consolidation in the fintech space as firms gain scale and market share

Is financial wellness in the workplace as important for high wage earners and white-collar groups as it is to rank and file employees and blue-collar groups?

VJ - We believe that financial wellness is relevant to all employees, though the specific needs and challenges may vary across employee segments We have developed our financial wellness offering to address a wide range of employee needs in several ways:

Providing financial education on topics ranging from budgeting basics to asset allocation. Offering specific solutions, such as student loan assistance and caregiving support, that will be relevant to employees at different stages of their lives.

Understanding the needs of underserved communities. For example, we introduced a housing counseling offering last year because the rate of homeownership lags for minority communities.

Our goal is to always show our clients the ROI of their efforts when it comes to benefit initiatives. How do you measure the success of a financial wellness program?

DB - The ROI on financial wellness programs is often difficult to quantify. That said, there are quantifiable aspects to these programs. Measurement can come in many forms and should be aligned with the company’s mission and value proposition. Some basic measures include reduced turnover, increased productivity, increased margins, a healthier and more content workforce, as well as improving the quality of life and the financial outcomes for your employeeswhich can easily be detailed in an employee’s ability to retire on time.

As you can see, there are many subject matter experts in this industry who are passionate about financial wellness that you can contact for guidance when building strategies for your clients There are also new solutions entering the marketplace every day as this topic grows in importance with both employees and employers alike, allowing you to customize solutions to the unique needs of each employee population

This is your sign to make Financial Wellness a key initiative in your client strategies this year!

Vishal Jain is the Head of Financial Wellness Strategy and Development for Prudential In this role, Vishal leads the definition of Prudential’s financial wellness strategy and the development of financial wellness capabilities to support Prudential’s businesses in the United States Prior to this role, Vishal was the Financial Wellness Officer for Prudential’s Workplace Solutions Group He led the development and delivery of financial wellness solutions for the Workplace Solutions Group’s institutional clients and their participants Earlier in his career, he was an engagement manager at McKinsey & Company, where he worked with retirement providers, asset managers, and insurers

Daniel earned his MBA from Northwestern University’s Kellogg Graduate School of Management and his undergraduate degree from Dartmouth College He began his career working in corporate finance for Sam Zell’s The Equity Group He then transitioned into a successful investment banking career for leading firms, such as Donaldson, Lufkin & Jenrette and Robertson Stephens He co-founded Sheridan Road in 2005, and acted as CEO and Managing Partner until he sold a majority of the business to HUB International at the end of 2018 He has also acted as an adjunct lecturer for over 50 programs in conjunction with The Plan Sponsor University at the University of Chicago, University of Denver, and Vanderbilt University

It’s tempting to think of Voluntary Benefits as a type of health insurance After all, many traditional voluntary products such as accident, dental, vision, cancer and critical illness insurance provide important protection for health-related concerns. But of course, Voluntary Benefits also fill a broader role: financial protection. From a simple sprained ankle to a serious stroke, treatment for and recovery from health problems can be costly, and Voluntary Benefits like these help cover those often-hefty unexpected expenses.

Employers get it, and in growing numbers. Twothirds of U.S. employers now offer at least one voluntary product to their employees, according to Eastbridge’s 2022 MarketVision The Employer Viewpoint report. That’s up from 60% since 2020. This increase is driven primarily by the growing numbers of smaller employers (under 100 lives) now offering at least one voluntary benefit.

Employers in that survey cite “addressing the financial well-being of employees” as one of the top reasons they offer Voluntary Benefits, with 69% of employers overall saying it’s important or very important

Larger employers those with 500 or more employees feel even more strongly about this reason, with up to 87% saying it’s important or very important.

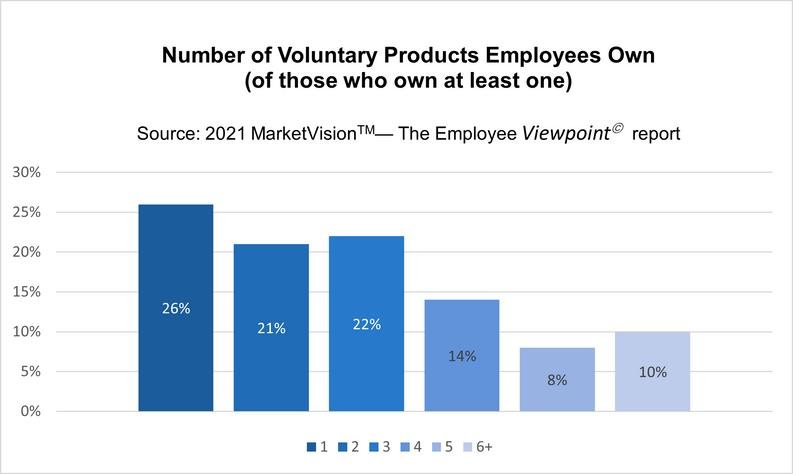

Offering benefits is one thing, but participation is another. And like their employers, employees see the financial value of Voluntary Benefits in growing numbers. According to our 2021 MarketVision The Employee Viewpoint report, nearly half of all employees own at least one voluntary product up from 44% just two years earlier. And nearly threequarters of those who own at least one voluntary product own two or more products.

In addition, employees surveyed indicate strong interest in buying a variety of products on a voluntary basis if given the opportunity. The highest interest is in purchasing dental, vision, prescription drug and long-term care insurance, followed by long-term disability and hospital indemnity coverage Employees are also very interested in purchasing pet insurance, legal plans, identity theft protection, cancer and critical illness on a 100% employee-paid, voluntary basis

Employees appear to take a broad view of financial protection. As proof, look no further than the continuing growth in ownership of nontraditional/additional benefits that also help protect their pocketbooks One in three employees surveyed own identity theft protection coverage, 26% own a legal plan and 24% own pet insurance, either employer-paid, employer/employee shared or 100% voluntary That rivals ownership rates of traditional coverages such as critical illness, cancer and hospital indemnity

Brokers are on the nontraditional bandwagon. It’s true brokers continue to sell traditional voluntary products most often dental, accident, critical illness, short-term disability, hospital indemnity and life insurance but about 60% also sell nontraditional products on a regular basis, according to our 2022 “Brokers and the ‘New Normal’ in Voluntary Benefits” report Identity theft coverage leads the list, followed by benefits such as wellness programs, discount health programs, legal plans and pet insurance

Even looking at financial protection through a very narrow lens a specific financial wellness/planning benefit our surveys show it’s very much a highdemand product Close to half (43%) of employees say their employer offers a financial wellness/planning benefit, second only to telemedicine

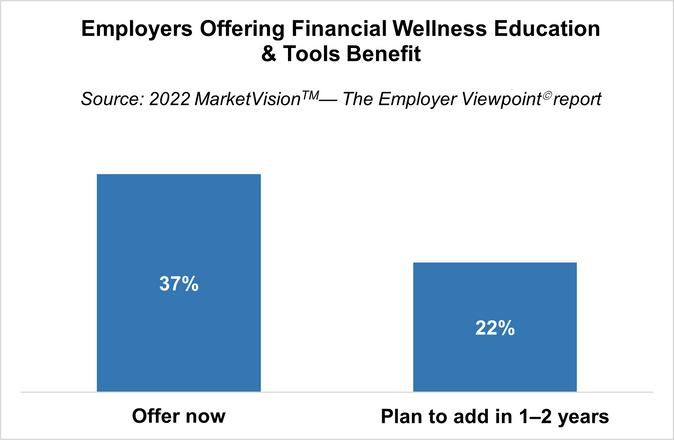

Employers report financial wellness education and tools is the most commonly offered and fastestgrowing nontraditional benefit: 37% of employers offer it now, up from just 21% two years earlier, and another 22% plan to offer it in the next one to two years Those trends hold across employer sizes

Nick Rockwell President

Nick Rockwell President

Danielle Lehman Senior Consultant

Danielle Lehman Senior Consultant

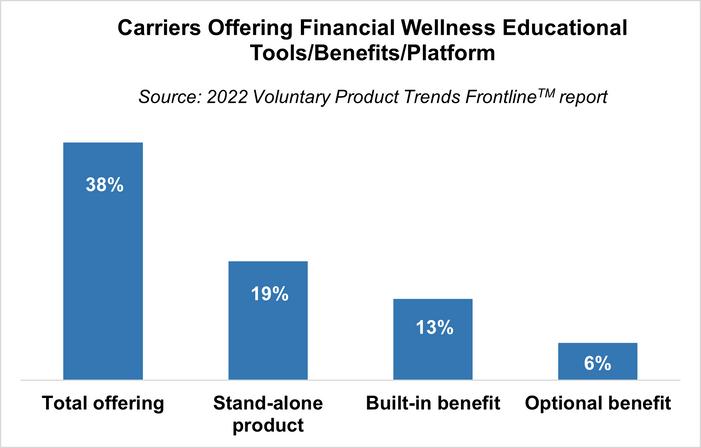

Carriers are supporting this trend of making financial wellness benefits more available. It’s the second-most common nontraditional benefit they offer, tied with identity theft protection and trailing only mental health benefits, according to our 2022 “Voluntary Product Trends” Frontline report. In fact, carriers surveyed say they offer this benefit at levels similar to more traditional Voluntary Benefits such as vision and cancer. It’s also by far the most common nontraditional benefit offered as a stand-alone product, rather than built-in or optional as part of another product.

TM

From carriers to brokers and employers to employees, financial wellness is clearly top-of-mind in the Voluntary Benefits industry It seems equally clear Voluntary Benefits will continue to provide a growing spectrum of traditional and nontraditional options that can meet the needs of these diverse groups

As a Key Contributor to Voluntary Benefits Voice, Eastbridge Consulting will be sharing content from our research and experience that aims to represent the perspectives and “voices” of the many different stakeholders in the voluntary market Eastbridge is the source for research, experience, and advice for companies competing in the voluntary space and for those wishing to enter For over 25 years, they have built the industry’s leading data warehouse and industry-specific consulting practice Today, 20 of the 25 largest voluntary/worksite carriers are both consulting and research clients of Eastbridge

If you’re helping to lead a financial services company, would you like a new way to deepen relationships with existing consumers, attract new ones and increase your relevance in an ever-more digital world? Using the metaverse to provide financial wellness services can be the answer When done right, the metaverse can let you offer financial education and advice in ways that delight consumers, while helping to strengthen your brand for trust and innovation

Financial education can strike many consumers as a painful duty: something they ought to do, because it’s good for them, but not something that excites them. Often enough too, the lessons don’t really stick. The metaverse can help change that, by letting consumers experience likely events in their own lives and how financial decisions could impact them.

The metaverse can let them virtually explore different communities, to understand how appealing and affordable they might be Are they saving for retirement? They can experience how possible retirements might be for them specifically at different ages, in different places, and with different amounts of assets Are they shopping for insurance? They can virtually experience the impacts of property loss, disability or a death in the family and how insurance might help Do they like (as many consumers do) to learn about finance from their peers? You can create a metaverse community, where consumers can share experiences and strategies in an exciting, 3D environment under your brand umbrella and with guidance (if desired) from your advisors

It can be expensive to offer truly personalized financial advice It’s often so expensive that most financial institutions today only offer it for high net worth clients But the metaverse can help make it affordable to offer this advice broadly, while also transforming the advising experience for consumers of every wealth level

Want to meet with every client, without spending too much? Use the metaverse to offer virtual offices to host those meetings Thanks to generative AI, you can create these virtual offices, even if you don’t have any technical skills, at a very reasonable cost That can let your advisors, anywhere in the world, meet clients wherever they may be Are your human advisors already overworked? Then use generative AI to staff your virtual offices with “metahumans”: virtual simulations of humans that come across as lifelike, not just in their appearance, but in how they speak and interact with your clients

You can also equip your financial advisors (whether human or metahuman) with a client’s personal financial history. The client and advisor can then together go through immersive simulations of possible life scenarios, supported by AI-generated forecasts. That can help you deepen relationships, provide more personalized advice and help your clients understand their choices.

But why would anyone do this? Rethinking gamification

TThere’s often been a problem with financial institutions’ attempts to make financial wellness services more appealing through gamification. Consumers just aren’t likely to come to your website (or metaverse space) looking to play games. You are not, after all, in the entertainment business.

But there is a place for gamification, as shown by an area where it’s often successful: upskilling Employees who should pick up new skills are more likely to do it and for the training to stick if the process is fun and full of discrete challenges and rewards Gamification can work best when it’s integrated into things that people are already doing So, as you consider your metaverse space for financial wellness, you may want to keep this idea in mind: Very likely, no one is going to come just to play games But if you create a space full of personalized education and advice with the ability for them to easily take action to help achieve goals that are important to them, then gamify parts of it too? You’ll likely have a powerful tool for engaging consumers

The “hype” around the metaverse is relatively new, but its building blocks aren’t At PwC, we’ve been developing and working with them for years Now that these innovations have converged into the metaverse, we’ve invested in tested strategies by designing, executing and overseeing metaverse initiatives

Based on this experience, we’ve found that three guidelines can help a metaverse project not only deliver attractive ROI, but also can enhance trust and help strengthen your brand

Start with outcomes. Don’t view your financial wellness offerings in the metaverse as an “experiment” Instead, start by setting measurable business goals, such as for attracting new customers, deepening engagement with existing ones or growing revenue

Embed trust by design It’s often critical for metaverse initiatives to enhance trust not undermine it Since the metaverse creates new kinds of risk, help reduce them early: design trust from the start into your approach to metaverse data, transactions and experiences

Stay true to your purpose and brand Continuously assess your financial wellness metaverse initiatives for a consistent brand message Remember too that customers may trust your metaverse presence more if it’s guided by a corporate purpose that matches their values

When to start? Consumers and your peers say: right now

If you’re still in wait-and-see mode with the metaverse, you may want to reconsider In the PwC 2022 US Metaverse Survey, 82% of executives said they expect metaverse plans to be part of their business activities within three years Half or more of consumers said that they’re interested in the metaverse for activities such as attending courses / training (52%) and discovering and interacting with new brands (50%).

If you haven’t gotten started in the metaverse, or you’re only using it for internal processes like onboarding and upskilling, developing a financial wellness offering can be an opportunity to go further: start using the metaverse to help transform your relationship with existing clients and potentially gain new ones too

LinkedIn has been instrumental in helping the world’s professionals maintain a sense of connectedness while managing radical change during pandemic times LinkedIn, too, is changing, increasing in scope and complexity Use of the site is at an all-time high, placing new demands on businesses trying to engage their clients, stakeholders, and teams Undoubtedly, LinkedIn will play a pivotal role in the future of work, helping organizations drive culture change, attract top talent, and identify new growth opportunities as they navigate a hybrid environment

When it comes to capitalizing on the potential of LinkedIn, JD Gershbein knows what works and what doesn’t He has educated thousands of professionals on the transformative power of the site During this engaging, interactive program, JD brings the rich history and presen hints at what lies ahead He outlines what businesspeople must do profiles, and open conversations that can generate wins and advance

During this webinar, you will learn:

Reimagining and futureproofing your LinkedIn profile

Critical strategic shifts for optimizing the LinkedIn experience

Cultivating a unique and identifiable “LinkedIn style”

Tapping the hidden value within your existing LinkedIn network

The creator economy vs the attention economy

Leveraging original content on LinkedIn to expand your LinkedIn f

The role of applied improvisation in increasing LinkedIn effectivene

March 16, 2023

9 a.m. PT / 10 a.m. MT / 11 a.m. CT / 12 p.m. ET

Since 2006, JD Gershbein, Founder and Principal of Owlish Communications, has been at the forefront of the LinkedIn conversation

One of the world’s first independent LinkedIn consultants and a pioneer in LinkedIn education, JD serves ambitious professionals striving to make their mark in the Digital Age As a speaker, facilitator, writer, and media producer, he draws upon his diverse academic background a fusion of psychology, neuroscience, and the humanities and the improvisation skills he honed at Chicago’s famed Second City to bridge the knowledge gap that exists between businesspeople and the online world

Widely regarded as an authority in personal branding, social networking strategy, and social entrepreneurship, JD is blazing a trail as one of the most original personalities in the leadership development arena

Providing employees with access to financial wellness resources can give employers greater insight into the challenges their staff are facing, allowing them to offer:

Financial wellness is an increasingly important topic for employers to consider, as it has a substantial influence on the overall success of their employee base. Recent studies show that more than 60% of households have less than three months of savings, while 70% of those in the workforce experience financial stress Additionally, 39% of the workforce spends at least three hours each week dealing with monetary issues at work, and 81% report financial concerns impacting their productivity To alleviate this stress, many employees have begun to request assistance to achieve greater levels of financial wellness, which employers can accommodate by offering resources to help them reduce stress, increase productivity, and benefit the organization's bottom line

A majority of employees consider their financial situation to be "only fair" or "poor" and the effects of financial stress on employee morale and productivity can be incredibly damaging Studies have shown that the levels of stress caused by money worries can reduce an employee's ability to concentrate, leading to a decrease in overall performance, as they are distracted by thoughts of their financial situation This can make employees feel overwhelmed and powerless to improve their circumstances It has also been reported that employees devote nearly 30 minutes daily to dealing with financial stressors, which adds up to three weeks of lost productivity per employee every year

Financial stress also leads to an increase in absenteeism and tardiness, as employees struggle to juggle work with focusing on finding ways to manage their money This stress can cause an increase in conflicts among colleagues, as they may be competing to get ahead and fulfill their personal financial goals, disrupting the team environment and leading to decreased productivity levels According to HR leaders, employees who have access to financial wellness resources report higher job satisfaction and retention, improved decision-making, and an overall increase in performance

Valuable support that improves loyalty and retention

Reduced stress due to money worries, resulting in improved morale and productivity

A positive work culture that leads to increased job satisfaction and engagement

The opportunity for employees to develop skills needed for budgeting and money management

The help employees seek need not be expensive or complicated Employers can encourage employees to use direct deposit as a way to split paychecks between savings and spending Employers can implement automatic enrollment with 401(k) safe-harbor autoenrollment and auto-escalation provisions, which can increase participation rates from 67% to over 85% Additionally, providing employees with online resources when implementing a financial wellness program can help employees reduce financial stress from the beginning Some companies have also experienced success in leading peer-to-peer support programs, where they gamify financial planning and training to remove feelings of judgment and encourage support between employees Some of the positives of this approach include positive peer pressure from colleagues to make better financial decisions and that employees have expressed a high level of satisfaction with this approach Employers can also offer a suite of group discounted voluntary benefits including home, auto, pet, and other insurance products, as well as ID protection and legal plans There are also dozens of providers offering debt consolidation, emergency funds, short-term loans, payroll advances, and other debt-related solutions Ultimately, financial wellness programs should seek to empower employees so they can learn to responsibly manage their finances without judgment or embarrassment

By investing in their employees' financial well-being through personalized advice, resources, and guidance, employers can not only help them make better decisions now but also ensure they are set up for success in the future

By Trevor & Heather GarbersThe future is here. Somewhat.

The claim process in the Voluntary Benefits industry has become a hot topic over the past few years as buzzwords like claims integration, claims autoadjudication, intuitive claims and 360 claims have hit the marketplace To address where the industry is today and where it is going in terms of claims, this will be the first of a three part series on the topic of supplemental health claims

In our first edition, we have interviewed claim experts at some of the leading carriers in the marketplace to get their perspective: Kyleen Engelstad (KE), Director, Claims Strategy, Voya Financial; Ann Sanchis (AS), Regional Voluntary Benefits Practice Lead, UnitedHealthcare; and Matt Hall (MH), VBS, GBDS, Voluntary Specialist Director, MetLife

What does the term claims integration mean?

MH - Claims integration today, at a minimum, means the ability to recognize and pay claims across a related set of coverages For example, a Critical Illness policyholder files a disability claim for maternity If this policyholder also has Hospital Indemnity, they are likely eligible for admission and confinement benefits

However, this has continued to evolve We now see carrier passing data back and forth to create a connected experience for identifying and in some cases auto-adjudicating potential claims

AS - In today’s supplemental health market, claims integration refers to providing a better claims submission experience to the member Carriers may provide this by reminding participants to file, all the way to auto-adjudication of claims

However, true claims integration, in the broadest sense, is key to creating a more seamless, coordinated and personalized health care system Integrating claims administration for services like accidents, critical illness, disability, dental, vision and more, helps customers in a variety of ways, such as improving the identification and management of chronic conditions; increasing engagement in clinical care programs; and enabling health care providers to better collaborate to flag gaps in care or provide earlier identification of disease for low care utilizers Therefore, claims integration can provide employers with an opportunity to save by promoting a better overall medical claims experience and supporting improved health outcomes; and it offers employees more value for their premiums

KE - Claims integration means a lot of different things to different carriers, and there are certainly different layers to it within each carrier From my perspective, claims integration in Voluntary Benefits broadly means, that there is some level of connection or added simplicity at claims time, between one or more policies that an insured individual is enrolled in, requiring less work on the claimant’s part to receive the benefit that they are due for a qualified event under a policy they are enrolled It certainly needs to keep evolving though, as carriers, we owe it to our insureds to keep doing better For example, industry research shows nearly 70% of American workers consider supplemental benefits as important as employerbased health insurance and retirement benefits

However, even though employees value supplemental health benefits, it’s not uncommon for individuals to overlook them when it comes time to file a claim For example, when Voya’s research team interviewed employees with current supplemental benefits coverage, only 1 in 10 responded they had ever filed a claim for those benefits

Why are medical carriers entering the supplemental benefits arena – and what advantages do they have (or should they take advantage of) when it comes to claims administration?

KE - It started with simply seeing there was an opportunity in the supplemental health insurance market. For many years, there were only a handful of carriers with the majority of the market share, and it was a significant revenue generator for those carriers. As the premium increases of health insurance plans started to increase at a higher rate than inflation, more cost shifting started taking place impacting deductibles, copays, out-of-pocket maximums, and networks, this highlighted the significant need for supplemental health insurance solutions to fill gaps for the insured. It just continued to make sense for the medical carriers to enter the marketplace, (along with many other carriers) due to the opportunity. There are different advantages and disadvantages of having supplemental health insurance with a medical carrier, as well as with a non-medical carrier. From my perspective, I believe a case can be made in both directions It just depends on the primary goals of the client and finding the partner medical carrier or not that is the right fit for that client

AS - Health insurance carriers have long been in an advantageous position to offer supplemental health plans as part of a comprehensive benefits package Offering accident, critical illness and hospital indemnity insurance helps give employers flexibility to craft their health plans in a cost-effective way, while providing options for lower-premium coverage and additional products to help cover increased financial risk for their employees By bundling medical and supplemental plans through a single carrier, employers’ benefit through a coordinated effort and operational simplicity This is one reason we have seen more medical carriers enter this market By having direct access to medical claims data, medical carriers can provide members with a superior claims experience for ancillary and supplemental health benefits, giving them an additional leg up

Offering accident, critical illness and hospital indemnity insurance helps give employers flexibility to craft their health plans in a costeffective way, while providing options for lowerpremium coverage and additional products to help cover increased financial risk for their employees

MH - The data on claims integration is still fairly immature but all early indications are that claims integration has increased claim payouts across the board The further automated the process is, the more effective the integration becomes KE - This is really a tough question to answer due to the many layers that exist in claims integration today across carriers Overall, the important thing is that the claims integration employed at each carrier is increasing utilization. The integrations are finding claims that may have otherwise gone unpaid. As a result, it’s helping to improve the customer experience and satisfaction. For example, as a result of Voya’s integrated claims experience, a Voya client recently had an employee who suffered a serious motorcycle accident that prevented him from working for several months. The employee filed a short-term disability insurance claim, which was approved. However, thanks to auto-pay integration, Voya determined that this individual was also eligible for both accident and hospital indemnity benefits. As a result, the employee received an additional $13,365 in benefit payments for the covered events he experienced.

Overall, the important thing is that the claims integration employed at each carrier is increasing utilization. The integrations are finding claims that may have otherwise gone unpaid As a result, it’s helping to improve the customer experience and satisfaction

AS - The impact claims integration has on utilization is very specific to the method being used According to a 2022 Eastbridge study, 16 of 19 carriers offering claims integration reported that utilization volumes had not changed However, if members are given a simpler and more user-friendly claims submission experience, this can lead to higher utilization of Voluntary Benefits as members no longer feel burdened by a cumbersome claims process Based on our experience, an integrated claims process can significantly increase member payouts under supplemental benefit plans For instance, when we compare our integrated employer customers to those without this approach, our integrated clients experience an 85% increase in claims paid under accident plans, a 74% increase in critical illness claim payouts, and a 118% increase in hospital indemnity payments In up to 80% of claims, integration has enabled member claims that otherwise would have gone unpaid

What are limitations to claims integration today?

MH - Common limitations may be fees charged by carriers and/or platforms for file passing, authorization of data sharing at the group level, and the distinction of auto-adjudication vs autonotification of claims

AS - Privacy concerns are top of mind when creating an integrated claims process The right steps and precautions must always be taken when dealing with a members private health information Another limitation is access to data Carriers that do not have access to medical data are limited to reviewing disability and life claims or other supplemental health claims, which leaves a significant gap in overall eligible claims under the plans Another limiting factor is the complexity that comes with creating an integrated process, which can require detailed programming of benefits and their related codes This can be resolved through time and attention spent at the beginning of an integration

How can we increase utilization outside of claims integration?

KE - This is easy to define, but hard to implement and achieve It’s engagement Workplace benefits as a whole are a big spend for employers and employees alike, and it also has a huge impact on each party throughout the year Yet, a universal issue is that workplace benefits are confusing The reality is most employees are busy juggling competing priorities and don’t have the time to educate themselves on all the benefits This is where digital tools can help employees make informed decisions Voya research found that majority of employees (73%) are interested in guidance and support tools that would help them understand how much money to put aside for retirement, emergency savings and health care expenses As we look to increase engagement, creating powerful and connected experiences is the future in supporting employers as they focus on helping their employees optimize their workplace benefits and savings needs

Where do you anticipate claims integration to be 2 -3 years from now?

AS - The requirements for wellness claim submissions have become simpler across most carriers in the market for a couple of years already, so having these claims move to passive payment will be a next step in claims integration for supplemental health For major plan benefits, the movement toward a more streamlined claims submission process will depend on the carrier’s ability to develop their own internal processes and secure access to data along with their appetite for higher loss ratios. Many carriers today are providing claims integration through email notification of membership or an eligible claim, and those that are not will move toward this first step into “claims integration.” Organizations that are currently integrating through notification will likely move toward a more streamlined submission process.

KE - Technology will be a huge factor in where we go as an industry to broaden the funnel and build upon the claims integration that exists today. From my perspective, I believe we’ll be at a place where some level of “auto-pay” will exist in all of our supplemental health insurance policies. I truly believe that similar to the last few years in the Voluntary Benefits space the next 2-3 years will equate to 15 years of advancement in other industries.

MH - Future state of claims integration has to include auto-adjudication of claims wherever possible. Carriers will continue to use the data they have to hand to simplify the claims process or eliminate the need for claim submission altogether

MH - Outside of claims integration, the most important thing that we can do is insist on strong educational and communication campaigns with customers As consultants on VB, we need to ensure that potential policyholders understand the role of these benefits in tandem with Medical insurance, where their personal needs lie, and how much they can afford When employees are empowered with this knowledge they become more mindful consumers of the Group Benefits that are offered to them

AS - The best way we can do this is through active member education This includes teaching people about the process that is now available to them, whether that be ease of use or specific details about the claims process itself. Another is by crafting plan designs that include coverage for emerging and/or frequently experienced medical events, such as diabetes, to create greater value for the plans. Finally, when medical plan data is available, providing plan designs that will positively influence member behaviors and engagement in their coverage based on current experience. The goal should be to give the member the tools they need to navigate the health care system and have a smooth experience when seeking care.

As consultants on VB, we need to ensure that potential policyholders understand the role of these benefits in tandem with Medical insurance, where their personal needs lie, and how much they can afford

Privacy concerns are top of mind when creating an integrated claims process The right steps and precautions must always be taken when dealing with a members private health information.Our industry experts have shared some great insights into the future of supplemental health claims To help us in the present, we also believe that when it comes to claims integration, we should establish common terminology that the industry can use to correctly identify what type of “integration” is offered by each vendor, and that we start to ask detailed questions on what the impact is to the member experience Here is our recommended terminology:

Auto-notification

When a Member experiences an event that potentially qualifies for payment, they are automatically notified of a potential claim on their Supp Health plan

Reality: Great reminder for Members, but they must opt-in to receive alerts and still file the claim as usual. Can be helpful if the Member reads the notification and takes an action.

Auto-submission

When a Member experiences an event that potentially qualifies for payment, the claim is automatically submitted, and the Member receives a notification.

Reality: there is great resistance to share medical data, especially with third party vendors.

Most worksite products are also not covered under HIPAA and the Carriers must bear data responsibilities and account for missing information

When a Member experiences an event that potentially qualifies for payment, the claim is automatically processed and paid with minimal human intervention from Member or carrier

Lifts a large burden off members, gets the funds in the members hands quickly and results in higher utilization BUT very few carriers have autoadjudication available and some add a premium load (for all members, not just those on the medical).

In summary, we are in the business of selling a promise to pay (for qualified events) in your time of need and there needs to be greater emphasis placed on the value of that. Cumbersome claims processes and paper claim submission are not our future. True claims integration and App / Mobile based submission of claims is our future. As we evolve as an industry, innovation is not the race to zero when it comes to premium – innovation needs to be improving the value of the plan and the quality of the member experience.

Kyleen Engelstad, has been in the insurance industry for more than 20 years. The majority of her experience has been heavily focused in voluntary benefits. She is currently the Director of Claims Strategy at Voya Financial, joining the Voya team in September 2022. Prior to her time at Voya, she led the Voluntary Benefits Practice for Marsh McLennan Agency's (MMA) Minneapolis office for several years, before moving to San Diego to lead the Voluntary Benefits Practice for MMA's West Region. Before taking on her role at MMA, she also spent time at Unum in their Minneapolis Sales office with a large focus on growing their Voluntary Benefits block

Matt Hall is Voluntary Specialist Director of the West for MetLife’s Regional Market In this role, Matt is responsible for supporting Account Executives on sales and strategy of MetLife’s suite of Voluntary Products He has been with MetLife since 2020 From 2016 to 2020, he was a Worksite Benefit Specialist for the Alera Group where he supported the build-out of their Voluntary Benefits practice Matt earned a Bachelor’s degree from West Virginia University He also holds Voluntary Benefits Specialist (VBS) and Group Benefits Disability Specialist (GBDS) designations from the Hartford School of Insurance

Ann Sanchis is a Regional Practice Leader for Voluntary Benefits at UnitedHealthcare. Ann has 20+ years of experience in the voluntary benefits industry working both on the broker and carrier side. On the brokerage side, Ann consulted on key voluntary benefits initiatives for several Fortune 100 corporations and helped expand the voluntary practice regionally and nationally. In Ann’s current role, she develops and supports producer relationships with Voluntary Benefits in the West and Central regions. Ann provides strategic oversight and quoting support for all size employee groups ranging from midmarket through jumbo case opportunities with a strong focus on streamlining internal processes supporting supplemental health.

Even befo world was ease of on informatio through a improving administer attractive digital so technolog

But the p between w of COVIDtheir insur expectatio employer’s job marke need to compete remote, hy a wider a employers effectively

While adv many op benefits administration, it also has uncovered weaknesses in the data management ecosystem. As more employers move from paper to online benefits enrollment, growth in technology companies providing online benefits administration using varying data formats has increased Without effective data standards, all of the stakeholders employers, technology companies and benefits providers struggled through the time-consuming and costly process of managing the multiple data feeds and ensuring accuracy

To address this issue, LIMRA brought together a group of insurers (representing 90% of the nonmedical benefits market) and technology providers to establish common data standards that would improve data quality, reduce costs and simplify the exchange process

In 2020, LIMRA launched the first set of data exchange standards, focused on automating the application and enrollment processes for most insurance product lines. This enabled quicker turnaround times and eliminated the potential for mistakes By 2022, the LDEx Standards expanded to allow for two-way data exchange of postenrollment data between carriers and benefits administration companies, as well as:

Evidence of insurability status and decision support; Eligibility management; Beneficiary management; and Error report handling

The workplace benefits industry responded positively to the LDEx Standards To date, more than 230 companies have downloaded the freely available standards From the original working group, 7 in 10 companies (benefits providers and technology companies) have adopted the standards and another quarter have plans to adopt them With an understanding that the standards only work with universal compliance, one third of companies say they require their partners to use the standards before agreeing to work with them

The LDEx Standards are just the latest shared industry solution to help address common challenges By creating universal data standards, they provide significant cost savings and helps companies reduce errors, saving time and resources that can be reallocated toward future growth opportunities

Some of the feedback includes:

“We don’t have to customize per carrier”

“Less time spent on problems”

“Faster setup, fewer file rejects, and faster acceptance testing”

“The LIMRA Data Exchange Standards creates consistency in the market It just levels the conversation that we have between technology partner and insurance carrier and results in a better quality product for our customer”

In the coming months, LIMRA expects to further enhance and refine the LDEx Standards, based on user feedback New release functionality will allow for the exchange of an insurance carrier's benefit plan design with a technology provider leading to case configuration simplification and acceleration In addition enhancements of the current LDEx Standards will allow for transactional real-time/near real-time enrollment and change management utilizing a RESTful API strategy

About LIMRA

Serving the industry since 1916, LIMRA offers industry knowledge, insights, connections, and solutions to help more than 700 member organizations navigate change with confidence Visit LIMRA at wwwlimracom

EDITORSNOTE:ThetopicforthisarticlewassubmittedbyoneofourSubscribersandSydneyConsulting Groupwashappytoaddressitforourreaders.

Legal Notices are ubiquitous in insurance contracts. From both an overarching product perspective and from the viewpoint of individual provisions within products, the content of notices and the methods for providing effective notice can become quite diverse. Toss into the mix additional complexities associated with regulatory requirements, and legal notice questions become even more puzzling However daunting, these requirements are worthy of understanding and embracing Materials that are appropriately implemented and distributed ultimately provide critical protections for carriers, policyholders, and certificate holders alike In this article, we will examine a common issue associated with providing notice of continuity options when coverage under an Accident, Critical Illness, or Hospital Indemnity plan terminates: who is responsible for informing insureds?

Notice, most essentially, is one party furnishing another party with certain information that would lead such other party to engage in informed action or inaction A deceptively simple idea Yet the particulars of who, what, when, where, why, and how remain to be addressed for almost every conceivable application of notice

Recall, these Accident, Critical Illness, and Hospital Indemnity products are “excepted benefit plans” precisely because they are spared from the requirements that otherwise control the administration of health benefit plans.

Insurance contracts are no exception to this, especially provisions controlling continuity of coverage for excepted benefit plans Unfortunately, on this issue, there is no one resource that holds universally applicable answers.

While regulating other types of insurance that are closely related to those in question, the apex source that is Federal law is inapplicable here. Recall, these Accident, Critical Illness, and Hospital Indemnity products are “excepted benefit plans” precisely because they are spared from the requirements that otherwise control the administration of health benefit plans. Thus, the question of who distributes notice of continuity options for these types of excepted benefit plans will be answered by disparate State Laws – if it is addressed at all.

States are frustratingly silent on this issue. Insurance laws and regulations simply do not address the specifics of continuity options insofar as they relate to these excepted Accident, Critical Illness, and Hospital Indemnity products. While not silent, still other states have adopted provisions that include detailed continuity rules, yet those materials are also written to expressly prevent their own application to specific types of coverage. Conversion privileges in Accident, Critical Illness, and Hospital Indemnity plans, for example, are certainly not mandated or regulated as they are for products like Group Term Life or Major Medical insurance. Most of these rules unambiguously omit Accident, or Disability Income insurance, or any combination of Accident and Disability Income insurance; coverage for Specified Diseases or Illnesses; or Hospital Indemnity or other Fixed Indemnity insurance If not explicitly, the rules may also tacitly divest themselves from such excepted benefits because they are written to apply only to plans that provide benefits on an expenseincurred basis Since the products provide benefits regardless of expenses, these rules wouldn’t control notice requirements This, of course, is where the previously discussed challenges arrive in earnest While regulatory voids and omissions can liberate carriers to design administrative provisions that are aligned with business needs, Departments of Insurance are similarly free to muddy the waters by applying catchall “fairness” laws and unpublished “desk drawer rules”

Conversion privileges in Accident, Critical Illness, and Hospital Indemnity plans, for example, are certainly not mandated or regulated as they are for products like Group Term Life or Major Medical insurance.

Nevertheless, when notice requirements are established in insurance laws and regulations, and those materials address questions of continuity in the form of conversion or portability of health insurance benefits, there are certain thematically common configurations adopted It bears repeating that, while these approaches are not wholly uncommon, they are of limited applicability here due to the broad categorical exemptions that apply to most excepted benefit plans

Generally, notice must be provided to insureds by:

the insurer; or the policyholder; or both the insurer and the policyholder; or either the insurer or the policyholder

South Dakota provides an example of a state allocating distribution of notice to the insurer. Under SD Codified L § 58-18-7.14, a notification of the continuation and conversion rights are required to be included in each certificate of coverage. As its author, the insurer will be responsible for the content and distribution of the notice provision the certificate must contain. Iowa provides an example of a state that allocates notice requirements to the policyholder. Under IA Code § 509B.5, within 10 days of termination of employment or membership, written notice of continuation rights must be delivered in person or mailed to the last known address of an insured by the employer or group policyholder Continuation rights may not be denied because proper notice was not provided California provides an example of a state that establishes a shared duty to provide notice Under CA Ins Code § 12689, the certificate or any other document required by law to explain the coverage must include a notification of conversion rights However, notification of the availability of conversion must also be provided by the policyholder to its members within 15 days of the date the coverage terminates Rhode Island provides an example of state that permits notice to be provided by various entities Under 230-RICR-20-30-182, written notice presented to the employee or member by their employer, the policyholder, or insurer or mailed by their employer, the policyholder or insurer to the last known address of the employee or member, as furnished by the master policyholder, constitutes the giving of notice Pennsylvania falls into this category too, but also explicitly allows for certain variations Under 40 PS § 7562, written notice by the policyholder given to the certificate holder or mailed to the certificate holder at their last known address, or written notice by the insurer mailed to the certificate holder at the last address furnished to the insurer by the policyholder, shall be deemed full compliance with the provisions of the clause for the giving of notice However, the code then indicates that a group contract issued by an insurer may contain a provision to the effect that notice of such conversion privilege and its duration will be given by the policyholder to each certificate holder upon termination of their group coverage

The following state rules are examples of each form of notice requirement.In the end, insurance professionals are left staring into a bit of a quagmire. With federal law abstaining and state laws and regulations converging here and diverging there, the path forward appears perilous. The most prudent approach will be a careful review of the specific jurisdiction’s regulatory landscape by sound experienced regulatory compliance professionals. Sydney encourages curious readers to contact internal or external legal representatives for guidance, allowing your business to have the requirements on hand when the need arises.

Ben serves as Compliance Counsel for Sydney Consulting Group He is in Omaha, Nebraska Ben joined Sydney in 2021 after 13 years with the group benefits division of a Fortune 200 company, where he specialized in providing a wide variety of compliance services for Hospital Indemnity, Term Life, and Accident Indemnity He also has extensive experience supporting Short and Long-Term Disability, Statutory Disability, Critical Illness, and Dental Ben holds a Juris Doctor from the Creighton University School of Law, a Master of Fine Arts from the Savannah College of Art and Design where he received the Malcom C Propes Fellowship and Mary Rene Whelan Scholarship, and Bachelors of Arts in both Philosophy and Anthropology from the University of Colorado at Boulder

By Brite

By Brite

Let’s face it. Benefit packages are confusing, and even intimidating to most. In order for employees to feel comfortable with their benefits elections, they need the resources to learn and understand how their insurance works.

The insurance industry as a whole has been slow to adapt to the digital age.

PDFs and paper flyers are difficult to house and even more difficult for employees to refer back to when they need them most. Employees want access to these materials anytime, anywhere, and ideally, on any device. In addition, each year, employers add more benefits to their packages in hopes of addressing ongoing employee concerns and demands but struggle with engagement because employees are left unaware of benefit changes, how the product works, or the product’s existence altogether

To help employees effectively utilize their benefits, they need to feel comfortable choosing the options that are right for them, their families, and their personal situations.

This is where decision support tools come in

Not only do employees want benefit content that is easy to understand, easily accessible, and in one place, they want to make better decisions when electing their benefits. It is important to remember that monthly premiums and costs can make or break an employee’s budget, but with the help of a support tool, they can get a better understanding of how and why a more expensive plan might be worth the additional premium. Supplementing benefits education with decision support tools provides employees with additional insight into their benefits and aids employees in making well-informed decisions regarding their benefits.

At the core of all benefits packages, employers and consultants have the goal of offering plans that cover diverse populations with different needs and desires. Offering a decision support tool to employees that provides tailored recommendations should be an influential part of a consultant/employer strategy A successful strategy requires easy-to-understand education on benefits, a support tool to help employees choose and elect their benefits, ongoing and open communication with employees throughout the year, and a place that employees can refer back to with questions or to access additional materials about their benefits

Decision support tools, when used and implemented correctly, will boost employee satisfaction and reduce workload for employers and consultants. When offering decision support resources, a big part of success comes from how the tool is embedded in the education process. Integrating a decision support tool and introducing the tool beforehand, allows employees to familiarize themselves with their options, and excites them to engage with the content. A strong foundation of product offerings, coupled with effective education and communication of benefit products, assists employees in engaging with, and utilizing their benefit programs year-round

Tools that feature benefit admin system integrations, feed elections on behalf of employees, and streamline the process; however, employees need to be thoroughly educated on product offerings and might be forced to “opt-out” if they aren’t interested in enrolling in a specific benefit In addition, these types of integrations require an extra lift to collect data and implement the tool and potentially require additional employee effort in the process No employer is the same, so it’s important to evaluate the pros and cons of both approaches as well as each employer’s wants and needs in a program

Another tricky aspect of employee benefits is tracking returns on investment or ROI, and many people have concerns about how much they will save when implementing a decision support tool and how to track those costs

So how exactly do support tools boost ROI? From an efficiency perspective, a support tool, along with proper benefit education, provides local HR teams with time savings, which directly ties to a reduction of workload and effort. The same can be said for consultants, reducing the time and effort spent answering the sheer amount of redundant, frequently asked questions that arise during open enrollment and throughout the year.

Another ROI metric is based on enrollment migration between plans (if applicable) and increased participation in overall product offerings

Value of investment, or VOI, is another factor to be considered. Although there isn’t a measurable, numeric metric for VOI, when HR teams experience a reduction in their workload and employees are happier in general, the result can be invaluable.

The future of benefits enrollment, in our opinion, is going completely digital With the increase in hybrid and remote workplaces, employees are more spread out than ever Educating and communicating with employees is becoming increasingly challenging and even more crucial to employee satisfaction The generational shift of the workforce as a whole will continue to change the ways employees engage with their benefits and their desire for resources that support learning and meaningful decision-making Subsequently, the days of long-winded paper benefit guides, PDFs, and long OE meetings will eventually come to an end and digital resources will take their place

At a time when inflationary pressure and financial stress are hitting employers and employees alike, employers nationwide are carefully identifying how to simultaneously cut down on spend and provide comprehensive benefits to attract and retain talent.

HR leaders know all too well how lost time and productivity from employee turnover can affect your bottom line, too In fact, according to the Society for Human Resource Management, it costs the average employer $4,129 to hire one employee, and it will take that employee about 42 days to get acclimated and work at capacity Additionally, the average company loses between 1% and 25% of its total revenue during the time it takes for an employee to be brought up to speed

Voluntary Benefits, however, have the ability to offer a happy medium between boosting retention and possibly reducing employer spend, especially if they are precisely tailored to your specific workforce population

One trendy yet fairly underutilized Voluntary Benefit that could prove especially enticing in 2023 is pet insurance

According to a recent report from MetLife, of the over 90 million families with pets in the US today, only 3% of those pets are insured The same report found that 84% of pet parents reported increased pet care costs in 2022, and 65% of employees with pets are interested in their employer offering pet insurance

Pet insurance is also becoming increasingly popular, growing at a rate of 221% over the past five years according to the North American Pet Health Insurance Association Furthermore, an unexpected visit to the veterinarian can cost anywhere from $800 to $1,500 on average This could be a significant financial setback for many pet owners

Data from Mployer Advisor’s 2023 Insights Report found that 16% of employers nationwide said they offer pet insurance to employees and that it is a benefit more commonly offered among large employers From a benefits prioritization perspective, it’s unsurprising that pet insurance did not rank as highly as other more traditional benefits think vision, dental, retirement but 10% of employers still said it was an important benefit

What’s more, a whopping 30% number of employees said that pet-related benefits would influence them to stay with their employer, according to a 2022 survey from Nationwide The survey also found that Voluntary Benefits, including pet insurance, could be a differentiator for employees who own pets (especially among Gen Z and Millennials)

Now, imagine that a community hospital adds pet insurance to its benefits package At no additional cost, the hospital boosts morale and productivity by demonstrating a vested interest in their employees’ lives outside of the workplace The employees feel grateful to have this additional financial and emotional security, and they feel comforted knowing their pets will be well taken care of in an emergency.

Above anything else, employees want to feel valued and trusted. When they see that their employer will go the extra mile in providing voluntary insurance options, they are more likely to stay with their company. And retaining employees is good for both employee morale and your out-of-pocket costs.

Eager for more exclusive content? Check out the Mployer Advisor blog for more trending content and industry news.

2022 has been quite a year when I look at the longterm care planning snapshot. In my 25-year career as a long- term care specialist, trainer, wholesaler, and spokesperson, I have never seen more individuals and families plan for this reality than I do today! In all honesty 2022 may have hit some bumps in the road when it comes to overall national sales, but as I have traveled both the country and gave numerous webinars, I can attest to meeting many financial professionals whose long -term care conversations and sales soared like never before!

As we begin this New Year, I thought I would gather my notes and share with you the winning strategies that proved successful for BuddyIns specialists and financial professionals throughout the country

As I mentioned, the issues surrounding the need for long-term care is a driving force for consumers and that means your clients are finally, after years and years of objections, coming to the realization that a long-term care need will never go away What I have found this past year is younger age groups are opening their educational ears to their financial professionals

Over the entire year these professionals have told me repeatedly that it is the younger age group (40-55) that is more interested in finding their own financial solutions to this increasingly costly problem I have to say, when I gave presentations this year, I found most audiences consisted of people under 55

Just a few years ago the average age of attendees and interested consumers was well into their 60’s! One of the reasons for the interest in this younger demographic group is they are experiencing within their own families the many burdens that a longterm care situation can create. Another trend that has become clear in 2022 is that older adults (over 65) are finding it difficult to health qualify for Traditional LTCi. Part of the reason for this is that American men, women, and children are at the unhealthiest levels in the history of our country! With that stated, top financial professionals have had to become “critical thinkers” for these individuals and find other solutions for this large segment of the population.

They clearly have acted with both their healthy and unhealthy clients regardless of age, because as each one has said to me, “Wendy, everyone deserves this conversation, and they deserve it with me!”

Solutions that top professionals have incorporated into their practice:

Hybrid Products: This is both a life insurance and long-term care product in one! Today there are numerous companies that offer these types of solutions and all of them vary in underwriting, age, single or couples, and price Also, they differ in how benefits are provided at the time of claim and of course the ease of both the application and submission of the application

In essence the amount of long-term care benefit is often expressed in terms of a percentage of the life benefit Although these have been a part of the industry for several years, they really can be quite comprehensive depending on the carrier Also, these can be a perfect fit for many clients who fail to health qualify for a traditional long term care policy (less restrictive underwriting) In addition, there are many clients with what we call “lazy money” It’s sitting in a CD earning minimal interest so financial professionals move that money to this single pay premium and purchase the combination product One other note, there are many people who fear that their investment premiums will not be used if they do not need care, therefore this product does become their financial solution!

Annuity Based LTC: These do vary significantly but in general they allow an individual to purchase a fixed deferred annuity with an LTC rider. This annuity may pay out for a certain number of years OR for life. This may seem attractive for some, and it is, but it is less flexible than a stand-alone LTCi policy. It may not cover home care or include inflation protection. It also may not cover enough of the LTC when you need care. Still, it’s an option many of these top performers have researched to fit that specific client who is seeking another option. The number of companies that provide annuity-based longterm care is one in which you should come to understand the differences and the sweet-spots for clients

Small Business Solutions: It doesn’t seem that long ago that businesses weren’t given any tax incentives for themselves as business owners, their spouses, or those they wish to provide an LTC solution That is not the case any longer What has worked for these top pros is working with CPA’s and spreading the word to those owners The end results are very happy business owners, huge long term care sales growth, and a constant stream of business and individual referrals

Employer Group LTCI (Worksite LTCI) and Employee Benefit Policies: We are seeing more and more being written now than ever before (not including what happened in 2021 with the Washington State mandated LTCI) With great companies like Chubb, Trustmark, and Allstate to name a few, the growth was happening in 2022 and will continue to play a key role in the future

True Freedom: Although not an insurance policy, this option is described as a membership service policy No deductible/elimination period and no age limit! Time and time again the specialists at BuddyIns have had the opportunity to provide a great alternative to so many people who otherwise would have been without financial help when it comes to care

Short Term Care: The Aetna product continues to have a place with more lenient underwriting and the less healthy Again, a viable solution for many

Critical Cash-GTL: This is a Critical Illness Policy, not LTCI Critical Cash is designed as an alternative product, and it is classified as such I have found many LTC specialists layer this coverage with an already existing long-term care policy if the client feels they are underinsured

The conversation over long-term care planning involves a full discussion not only with the client, but many are tackling this topic head on with their loved ones sitting next to them. The issues pertaining to long-term care planning involve not only care, but expenses, the physical demands of caregiving, and jobs put on hold or lost in the overwhelming effort to be a care provider for a loved one (50+ million caregivers in our country today with the majority as family caregivers). These professionals fully recognize the possible financial casualties associated with an LTC need both today and in their client’s future.