Trevor Garbers

Trevor@voluntary-advantage com

Heather Garbers

Heather@voluntary-advantage com

For Media and Marketing Requests Contact:

Heather@voluntary-advantage com and Trevor@voluntary-advantage com

Steve Clabaugh CLU, ChFC

Mark Rosenthal PwC

Michael Stachowiak Colonial Life

Jessica DePhillips Mercer

Jack Holder EBIS

Michael Naumann Reliance Matrix

Jennifer Daniel Aflac

Seif Saghri BenefitHub

Steve Clabaugh CLU, ChFC

Mark Rosenthal PwC

Michael Stachowiak Colonial Life

Jessica DePhillips Mercer

Jack Holder EBIS

Michael Naumann Reliance Matrix

Jennifer Daniel Aflac

Seif Saghri BenefitHub

There are some times in your life when it is a good idea to sit back and reflect Today I would like to pause and reflect on 2023 year-todate

This all started with a crazy idea that we needed to do something for the voluntary benefits industry that could bring us all together Every time we would get together with our colleagues and friends, the conversation would always seem to go to – we need to find a way to collaborate The only way we will grow as an industry is to work together. The only way to stop the commoditization of our solutions and the race to zero is to drive the conversation to what is important.

In that spirit, Voluntary Advantage was formed. Knowing that we would need diversity of thought to reflect the industry properly, our Advisory Board was formed. Each member of the Advisory Board is a part of Voluntary Advantage not only because of their unique perspective of the industry, but also their passion for doing business the right way in our industry I’ll stop here to say, not only are they amazing businesspeople – but they are just amazing people We have enjoyed watching many new friendships being formed and true collaboration among industry leaders We officially kicked off Voluntary Advantage in January of 2023, with really nothing

We built a LinkedIn page to share content and drive conversations

We have published a digital magazine each month featuring content submitted from individuals across our industry – with a goal that all content be educational/informative and not a sales pitch

We started a Speaker Series and have thus far featured a LinkedIn expert to assist in our individual marketing and an industry leader to talk about trends

And this brings us to "The Future of Voluntary Benefits is Now" – our inaugural, virtual, conference in July. We truly didn’t know what to expect. As a team, we just approached this from the viewpoint of what content would you find engaging at an event like this? Our Advisory Board stepped up to the plate and put together some excellent sessions Every single speaker during those 2 ½ days really brought it, and those 2 ½ days made me so proud to be a part of our industry “Together We Rise” was something I saw in every session as our industry came together to do better for the employers and employees we help

By Heather GarbersWe had panels of direct competitors discussing the future of our industry, our Board facilitated discussions on AI, engagement, DEI(b), recruiting the next generation of leaders, technology, what the new world of “work” looks like as we return to the office, our key contributors shared market updates and so much more

To put it simply – while we may have helped to provide the platform, our industry, the voluntary benefits industry, made this event a success. We know that there is more demand for the solutions we provide in voluntary benefits than ever before and this is just the beginning, there is so much more we can, and will, do together. Thank you all for your support and let’s continue to collaborate to drive innovation – the future really is now.

Join Us August 22 at 10:30 a.m. MT / 11:30 a.m. CT!

Join Sarah Oliver, Mike Estep, and Trevor Garbers for our next FREE Speaker Series event, where they will discuss:

The continued expansion of new benefits that address the needs of an ever-changing workforce How ongoing education and enrollment support tools continue to be critical factors in benefit utilization

Using data and integrations to simplify the claims experience while maximizing benefits

Hospital indemnity insurance sales have been growing by leaps and bounds in recent years and many watching the industry see a strong tie to the pandemic and greater awareness of the need for financial protection against high hospital bills

More than 40% of employers offer this coverage, placing it among the top 10 voluntary products in employers’ benefits packages.

Only about a third of employees have hospital indemnity coverage, but interest is strong: half of those without coverage are interested in buying it on a voluntary basis.

Brokers voluntary brokers in particular list hospital indemnity coverage among the top five products they sell.

Nick Rockwell President Danielle Lehman Senior Consultant

Eastbridge is the source for research, experience, and advice for companies competing in the voluntary space and for those wishing to enter For over 25 years, they have built the industry’s leading data warehouse and industry-specific consulting practice Today, 20 of the 25 largest voluntary/worksite carriers are both consulting and research clients of Eastbridge

Hospital Indemnity Insurance has become a highly sought-after employee benefit, gaining significant traction in recent years. With the rising costs of healthcare and a growing focus on employee wellness, this supplementary insurance coverage addresses the financial gaps left by traditional health plans In this article, we delve into the reasons behind the popularity of hospital indemnity insurance, explore different buying profiles, and discuss plan strategy options for employers

The demand for hospital indemnity insurance is evident, with 45% of employees surveyed in MetLife's 21st Annual US Employee Benefit Trends Study considering it a must-have benefit This trend is particularly prominent in firms with 2,500 to 9,999 employees, where 52% of companies offer this coverage, as reported in Eastbridge Consulting Group's Large Case Market Report.

45%ofemployeesindicate HospitalIndemnityinsuranceis a"musthave"benefit

*MetLife's21stAnnualU.S.EmployeeBenefitTrends

Moreover, hospital indemnity insurance ranks in the top 5 products for employee interest, with an average of nearly 30% [1].

Several factors contribute to the growing popularity of hospital indemnity insurance:

Rising Healthcare Costs: As traditional health insurance plans become more expensive, employees seek additional coverage options to fill the gaps in their primary coverage According to the Kaiser Family Foundation, the average cost of a hospital stay in the United States is a staggering $2,883 per day

Focus on Employee Wellness: Employers recognize the importance of supporting their employees' health and financial well-being. By offering hospital indemnity coverage, they can provide a comprehensive benefits package that addresses both healthcare needs and financial security concerns.

Advancements in Technology: Technology and data analytics are streamlining the administration and delivery of hospital indemnity insurance Employees now have increased customization and personalization options, allowing them to select coverage levels that align with their budgets, needs, and preferences

When designing and recommending a plan, it is important to understand the buying patterns so the plan itself can be designed to meet a client’s unique demographics.

Marital Status: Married individuals often view hospital indemnity coverage as essential due to added financial responsibilities and concerns for their families. This insurance safeguards their shared assets, ensuring the financial well-being of both spouses during hospitalization

Age: Both younger individuals and those approaching retirement age find hospital indemnity insurance valuable Younger individuals, in the early stages of their careers or starting families, may lack sufficient savings to cover high medical expenses and may have dependents relying on them financially For them, voluntary hospital indemnity insurance acts as a safety net, safeguarding their financial plans and protecting their dependents On the other hand, retirees transitioning to a fixed income face challenges in managing unexpected medical expenses, making this coverage an essential support system during their golden years.

Hospital Indemnity Insurance provides vital financial protection for individuals and their families, regardless of their marital status or age. By addressing the financial burden associated with hospital stays, this coverage offers peace of mind and income protection, making it a valuable addition to any benefits package

While hospital indemnity insurance is already popular, employers can further enhance participation through proper plan designs, pricing, and effective communication with employees. Three plan strategies to consider include:

Straight Voluntary Offering: This approach serves as a tactical play and aids in the funding of communication and enrollment services, encouraging employees to opt into coverage

Auto Enrollment of Hospital Indemnity Insurance: In this solution, every employee is automatically enrolled in the coverage, funded with employee dollars The benefit is positioned as an enhancement to the current medical offerings, giving employees the option to opt out if they wish This "bundled" strategy is both tactical and strategic, enabling adjustments to deductible, copays, and out-of-pocket limits in preparation for medical renewal increases.

Embedding Hospital Indemnity with a HDHP: Integrating the hospital indemnity coverage with a High Deductible Health Plan (HDHP) allows for seamless addition to the employee's medical contribution or employer-sponsored coverage.

Hospital Indemnity Insurance provides vital financial protection for individuals and their families, regardless of their marital status or age. By addressing the financial burden associated with hospital stays, this coverage offers peace of mind and income protection, making it a valuable addition to any benefits package.

Employers who offer hospital indemnity coverage as part of their benefit package will undoubtedly attract and retain top talent in the highly competitive job market As the need for financial security and comprehensive coverage grows, hospital indemnity insurance continues to prove its worth as a valuable voluntary benefit

John is President of EOI where he executes and develops strategic marketing initiatives on a national level, specifically focusing on the enhancement of value-added services that EOI provides for its clients. Since joining EOI in 2009, John has played a key role in the area of strategic marketing, building an outstanding implementation team in the Chicago office and tripling sales in the Midwest region.

The average cost of a 3-day hospital stay is around $30,000. Hospital Indemnity insurance pays regardless of what your medical insurance covers.[1] Eastbridge Consulting Group's Large Case Market Report [pg 8, 25]

This publication is titled “the Voluntary Benefits Voice” because our goal is to share the voices of voluntary benefits leaders from across the industry to help us grow both in our own practices from learning from one another, and also as an industry We try to share insights from a diverse set of leaders and entities across the country in each edition and in that spirit, Michael Naumann, VB RPL at Reliance Matrix, has interviewed several VB leaders about the place for Hospital Indemnity plans in client strategies today, recommended improvements, and what sets carriers apart specific to Hospital Indemnity plans in the marketplace

For this article, I'll be interviewing Jen Daker (Jen), Voluntary Benefits Leader, West with Mercer Health & Benefits; Whitney Ehret (Whitney), a Benefits Consultant and Director of Voluntary Benefits at Burnham Benefits, a Baldwin Risk Partner; Raymond Chan (Raymond), Managing Partner of Insurance Marketplace, LLC; John Hickey (John), Senior Vice President & Voluntary Benefits National Practice Leader of AssuredPartners; and Megan Stavros (Megan), Voluntary Benefits Consultant at Gallagher.

Where is the place for Hospital Indemnity insurance within client strategies today?

Jen: According to the Fed’s 2022 Economic WellBeing of U.S. Households Survey, one in four Americans lack the funds to cover a $400 emergency expense, and the average per-day cost of a hospital stay is $2,883, the equivalent of 504 hours of work for the average hourly employee. With higher deductibles and out-of-pocket exposure, a hospitalization, planned or un-planned, can place an employee and their family’s financial security at risk At Mercer we are seeing client strategies focus increasingly on a hyper-personalized approach to employee benefits and the overall employee experience Hospital Indemnity insurance allows employers the ability to offer an inexpensive financial safety-net that strategically aligns with their healthcare plan(s) and provides employees with the ability to customize their benefits based on their unique needs Hospital Indemnity insurance is a vital component to an organization’s total reward strategy as it touches on several key themes important to both employers and employees: Physical & Mental Wellness, Financial Wellness, Talent Acquisition and Retention Strategies, Productivity and shows an employer’s commitment to Diversity, Equity, Inclusion and Belonging strategies by reducing barriers for underrepresented populations.

For certain clients, these plans can help reduce the overall cost of medical insurance. Increasing the co-pay for hospital confinement on the medical plan can significantly reduce its premium allowing for total aggregate cost to be reduced.

Raymond Chan, Insurance Marketplace LLCWhitney: The answer to this question shouldn’t be a secret to anyone in the employee benefits marketplace Having a hospital indemnity plan as part of your employee benefits line-up is table steaks As healthcare costs have continued to rise, employers are looking for creative ways to shift cost to employees, while still maintaining competitive benefits Hospital Indemnity plans have become more flexible in the market and employers are able to match hospital admission benefits with that of the deductible strategy they are trying to achieve Raymond: For certain clients, these plans can help reduce the overall cost of medical insurance. Increasing the co-pay for hospital confinement on the medical plan can significantly reduce its premium allowing for total aggregate cost to be reduced. For employees that are concerned about hospitalizations, structuring these plans without preexisting condition limitations can be a great add-on. This however is a case by case scenario and really depends on how the medical underwriter adjusts premium while only changing the hospital co-pay amount

John: There is still very much a need for hospital indemnity insurance for clients today With the increase of deductibles and out-of-pocket maximums, a hospitalization can result in the biggest risk of spend for an employee Especially when you consider that a family’s aggregate out of pocket expense on an HSA Plan can be as much as $15,000 With COVID-19 behind us, many employees recently witnessed the astronomical cost of intensive care and hospital expenses firsthand I personally saw as much as $800,000 during the peak of COVID for a hospitalization.

Megan: Hospital Indemnity plans can have a place for many different kind of employers. For example, employers who need to find cost savings can adjust their medical plan design, by increasing deductibles or out-of-pocket maximums, which will lower their overall premium spend. But they can help offset the increased out-of-pocket exposure to employees by adding a hospital indemnity plan, which will pay them a cash benefit for unexpected hospital visits

This allows the client to save money on medical spend, but also enhance their benefit offering by adding an additional plan that protects employees financially. Conversely, an employer who is not in need of cost savings, but instead wants to differentiate from their peers may offer a hospital indemnity plan as an employer paid benefit. The simplicity of hospital indemnity plans allow them to be applicable for many types of employers and employees – those who need it for financial protection or those who are proactively protecting their families Megan: We have seen voluntary benefit carriers come a long way in the last few years with their hospital indemnity plans For example, carriers who used to intentionally exclude mental health and substance abuse visits from their plan are now including additional benefits for those suffering from behavioral health issues. Additionally, restrictions that used to be extremely prevalent in these plans, such as waiting periods and pre-existing conditions, are now being waived to allow for payment right away on benefits that historically may not have been covered. These changes have allowed hospital plans to be much more straight-forward and meaningful for a larger population of employees, which attribute to its enrollment growth over the last few years. If carriers can continue to expand coverage to include things like fertility or transgender benefits it will help to meet the growing needs of employers regarding their diversity and inclusion initiatives

Jen: My recommendations for creating a more inclusive hospital indemnity plan centers around the contract basics Are the premiums affordable? The top stressors for US workers are largely financial, with 35% living paycheck to paycheck Removing barriers to receiving benefits, ie, waiting periods, preexisting condition limitations, onerous benefit qualification language, and purpose for admittance limitations Does the policy allow hospitalization due to mental health and substance abuse? Providing coverage for time in the emergency room and/or observation and/or counting this time toward the hourly hospital admission requirement. Overstressed hospital systems have been unable to accommodate patients in a timely manner, which can be a result of lack of space and/or lack of specialty nurse or physician availability. Lastly, ensuring the language used in certificates, and employee communication material is gender neutral, inclusive of all family structures and free of complex jargon - the right language can reinforce an employer’s commitment to DEIB

John: We need to see more coverage for substance abuse and mental illness admissions. Mental Health is a big part of our conversation today and most carriers are still adapting to this need. I would also like to see more benefits for the proper steerage. Employees should receive a larger benefit based on the quality and cost of care provided by the hospital. The employer should have buy-in with this, knowing employees are making the right decision based on platforms like Healthcare Bluebook Whitney: Over the last couple of years, we’ve seen a dramatic increase in the amount of conversations regarding mental health, but what are we actually doing about it? Having the conversation is certainly a start and better than not addressing it at all, but the insurance market has not caught up with this trend despite common misconceptions I recently had a client that had an employee admitted to the hospital for a mental health reason, and the claim was denied on their hospital indemnity plan because mental health wasn’t covered This is something you have to specifically check for in your hospital insurance policies or ask for as an added benefit. I would love to see inclusion of this type of coverage be adopted by all carriers in the space.

Megan: Carriers that can provide intuitive, or proactive, claims filing on behalf of the employee are starting to set themselves apart. This process solves for one of the biggest issues with voluntary benefits, which is an employee forgetting to file their claim. This additional step is very important because we want to make sure employees are receiving a payout for a benefit they pay for, at a time when they have unexpected expenses from a hospital visit and need it the most Additionally, carriers who are expanding the definition of their eligible payouts for things like mental health, substance abuse, pregnancy or newborn benefits, and wellness claims are winning more opportunities because their benefit resonates with more employers and larger populations The more we can design plans to meet employees where they are at in different life stages, while encouraging them to be good consumers of their health, the more valuable and essential voluntary benefits become

Over the last couple of years, we’ve seen a dramatic increase in the amount of conversations regarding mental health, but what are we actually doing about it?

Whitney Ehret, Burnham Benefits, a Baldwin Risk PartnerRaymond: Having a thorough review of the medical plan options and pairing it with a hospital indemnity product where it includes benefits in areas of highest out-of-pocket expense Adding more benefits to a hospital indemnity plan can jeopardize the pre-tax status of a HSA plan An improvement would be for us as Benefit Advisers to make sure that the enrollment method can support plan based restrictions on who can enroll in a hospital plan. Having a HSA compatible option paired with a nonHSA compatible option with all the bells and whistles would be the best approach. Mental health has also been of greater interest post pandemic. Ensuring that the carrier does not have exclusions for mental health will also make the product more desirable.

Raymond: Full claims integration would be great however I believe there are too many technology/security/compliance hurdles that need to be overcome before it can be seen as a benefit. Not all enrollment platforms and methods can support capturing the authorization to disclose information for claims. The next iteration would be to see full claims integration where a claim on medical insurance also triggers all benefits payable on the hospital indemnity plan I would not discount the integrations that are available now but there is a ton of room for improvement with technology

John: Fortunately but unfortunately it’s a race to zero with premiums However, the lower cost plans don’t cover as much when it comes to benefit and we really want to make sure the plan pays for what the employee is needing As mentioned before, I would also love to see more mental health coverage on these plans If carriers could assist with steerage and reward for good behavior, employers would have more buy in

Jen: Some of the things I am most excited to see introduced center around heath equity in underrepresented groups and family focused benefits. In 2021 the maternal mortality for Black Americans was 3x higher than for White women according to the National Institute of Health.

Carriers that can provide intuitive, or proactive, claims filing on behalf of the employee are starting to set themselves apart. This process solves for one of the biggest issues with voluntary benefits, which is an employee forgetting to file their claim.

Megan Stavros , Gallagher

Megan Stavros , Gallagher

We have seen carriers broadening the definition of a hospital to include birthing centers, the use of which has increased 30% among Black, and 26% in Native American birthing parents since 2019. Autoadjudication of hospital admission and daily confinement benefits prior to delivery can provide earlier financial support that can be used for prenatal care or to fund upfront hospital costs. Plans are also paying a healthy baby admission benefit, and routine wellness benefits for newborns. We are also seeing the removal of gender confirmation surgery from cosmetic surgery limitations present in some contracts, and the expansion of the definition of a dependent to include parents which will resonate in today’s multigenerational workforce

Whitney: The selection of the carrier is dependent on a few key factors for us, ranked in order: 1) the technology system in which the benefit will be deployed, 2) the client’s core carrier relationships, and 3) product competitiveness. Technology is first and foremost because not every carrier’s product can be built on any system, despite what they tell you. Some carriers are restricted on their structures for rates and that can be limiting. The technology implementation will determine the entire projects success when it comes to administration and enrollment The next factor is considering the client's core carrier relationships Oftentimes, you can leverage a financial incentive for the client by choosing one of these carriers Additionally, it can lead to an easier implementation since there is already a relationship established Lastly, the rates and product design come into play Affordability, while important, is not the main selling point A carrier’s ability to be flexible and generous with underwriting is key Perpetual guarantee issue and no pre-existing condition limitations, even for pregnancy, is becoming common in the market With the big medical carriers entering this space now, they are forcing the existing voluntary benefits market, as we know it today, to get more competitive by lowering rates, making underwriting concessions more easily, and, finally, getting many carriers to do some level of claims automation.

The average length of hospitalization is 6.2 days

As you can see, the increased awareness of the solutions provided by this coverage has driven its growth in the marketplace. We also should now be cognizant as we market these plans to request plan designs that meet consumers' growing needs including things such as: removing exclusions for hospitalizations due to mental illness or pre-existing exclusions and including provisions to help with inclusivity. Most importantly, we should continue to focus our efforts on educating employees on topics such as how these plans work and how to file eligible claims throughout the year.

Thank you to our VB leaders who took the time to contribute to this month's edition of VB Voices!

John Hickey, Senior Vice President & Voluntary Benefits National Practice Leader with AssuredPartners. John holds positions on several carrier Advisory Councils and participates in carrier-sponsored workshops throughout the year. He has become a product expert for voluntary benefits, Long Term Care and carve-out executive disability plans. He has also recently been appointed AssuredPartners Voluntary Benefits National Practice Leader

Whitney Ehret, Benefits Consultant and Director of Voluntary Benefits at Burnham Benefits, a Baldwin Risk Partner. Whitney is passionate about discovering new insurance strategies to save employer's money while enhancing benefit offerings for employees In addition to having her own book of business, she is responsible for leading the marketing, sale and implementation of voluntary benefits for Burnhams’ clients.

Raymond Chan, Managing Partner of Insurance Marketplace, LLC. Raymond and his closest colleagues created Insurance Marketplace, LLC, an enrollment firm, to help broker and insurance carriers market and place voluntary benefits Their focus is taking employer interest in voluntary benefits and matching it with carriers that are competitive and suitable for an easy enrollment experience Insurance Marketplace offers communication and enrollment solutions nationally while based in the DC metropolitan area.

Megan Stavros, Voluntary Benefits Western Regional Practice Leader, Gallagher. As the Southern California practice leader for Voluntary Benefits, Megan helps clients with their strategic approach to enhance their employee benefits package She assists CEOs, CFOs, and HR Directors to understand their organization’s ability to attract and retain key talent, while brainstorming ideas for their company to stand out among the competition.

Jen Daker, West Market Voluntary Benefits Sales Leader, currently residing in Phoenix, Arizona. Jen has become an expert in designing and implementing industry leading voluntary benefits programs that addres the unique needs of diverse and multi-generational workforce. Throughou her career, Jen has helped organizations of all sizes and industrie integrate voluntary benefits programs into comprehensive total reward strategies, with an emphasis on inclusivity and enhancing employee satisfaction and retention.

By Kimberly A. Landry, LIMRA and LOMA

By Kimberly A. Landry, LIMRA and LOMA

As employers, carriers and other benefit providers prepare for another open enrollment season, improving employee understanding of benefits should be high on their list of goals Currently, only 55 percent of workers feel that they understand their insurance benefits well However, those with a good understanding are much more likely to be satisfied with their benefits packages, which in turn contributes to overall job satisfaction

To enhance employee understanding, it is necessary to improve the benefits education process, including a reexamination of what information is conveyed and how it is communicated

Regarding the “what” of benefits education, benefit providers need to communicate the key details of these offerings as clearly and succinctly as possible. Strategies from behavioral economics, such as anchoring, storytelling and social norms, can be leveraged to make the most of employees’ limited attention and nudge them toward better decisions.

When it comes to the “how” of benefits communication, an omnichannel approach that provides multiple ways for employees to learn about their benefits is essential Employees who have more resources available to learn about benefits are much more likely to feel they understand their benefits well They’re also more inclined to say their employer communicates about benefits well and to feel more confident in their enrollment decisions

When designing their benefits education strategies, employers today have a wide variety of options to choose from, including emails, digital resources, printed materials, in-person and virtual meetings, and videos The more types of resources employers provide, the better their results are likely to be However, companies with limited resources will still need to prioritize the strategies on which to focus When evaluating potential communication methods, there are three facets of the employee experience to consider: which resources employees prefer, which ones they are most likely to use and which resources employees find to be the most helpful An evaluation of these factors sheds light on the relative merits of several common communication strategies:

Email: Employers often communicate benefits information to employees through email, and this is one of the strategies employees prefer most, probably due to its convenience 51 percent of employees prefer to receive benefits information this way. However, only about half of workers say they actually use emailed information to learn about their benefits when it is provided, and email ranks at the very bottom of educational resources employees find to be helpful

Represents the percent of employees who say the given resource was one of the most helpful they used Based on employees who are offered insurance benefits and say they used the given resource to learn about their benefits during open enrollment Multiple responses allowed Source: 2023 BEAT Study: Benefits and Employee Attitude Tracker, LIMRA, 2023

Part of the issue may be that email is often used to convey logistical information about when and how to enroll, rather than content that truly helps employees learn about and understand their benefits While email is clearly an important tool for employers to leverage in their communication strategy, it is not sufficient to rely on email alone

Digital Resources: Digital benefits resources, and particularly online benefits portals, are among employees’ most-preferred communication methods, as well as being one of the most frequently used and most helpful resources. Given employees’ positive engagement with this approach, digital communication should be a key component of benefits communication strategies for most employers. Despite its popularity, however, only about two-thirds of employees use a digital portal to learn about their benefits when one is available, so employers should not rely exclusively on this approach

Beyond benefits portals, employers can also leverage other digital solutions, such as mobile apps, virtual meetings, social media content, text messages, online chat and videos Among these, employees respond most favorably to mobile content, with about half saying they used a mobile app when one was available (and they were aware of it) and 76 percent of those who used a mobile resource finding it helpful As mobile transactions become the norm in many aspects of everyday life, carriers should ensure they have a mobile strategy for benefits communication, especially when providing benefits to workers whose jobs are not computer-based.

Printed Materials: As benefits communication shifts online, printed educational materials are becoming less prevalent. However, more than a third of employees still prefer to receive printed benefits information. These materials rank in the middle of the pack in terms of helpfulness but are among the top five resources employees are most likely to use when they are available

While they may not be the wave of the future, printed materials still have a place in a multichannel communication strategy and are a useful option for communicating with employees who do not want to engage with digital resources Notably, printed materials are more likely to be preferred and used by older workers

resources.

In-Person Meetings: In-person meetings or benefit fairs are another strategy for reaching employees who do not want to learn about benefits digitally About 4 in 10 employees prefer to receive benefits information through in-person channels However, it’s worth noting that three of the top five most helpful education resources are in-person group or one-on-one meetings and benefit fairs These personal interactions provide unique opportunities for someone to explain benefits information to employees in detail and for employees to ask questions Members of Generation Z, who often need the most help understanding their benefits, are the most likely to prefer in-person meetings

Given its value, in-person communication should still be viewed as an important component of a comprehensive benefits education strategy, even as more resources are digitalized. Notably, in-person events are considered to be more helpful than virtual events, perhaps because they foster better engagement. When employers make benefit meetings available, it is important to take steps to make sure employees are aware of these opportunities and encourage attendance

Digital benefits resources, and particularly online benefits portals, are among employees’ most-preferred communication methods, as well as being one of the most frequently used and most helpful

There is no single approach to benefits education that will resonate with all employees, so companies looking to enhance their communication efforts must consider multiple strategies. By leaning into popular digital approaches, while also supplementing these efforts with offline and in-person options, benefit providers can maximize their chances of delivering benefits information in a way employees will understand, positioning them to make the best possible benefit decisions to secure their futures.

Originally published on LIMRA.com.

Kimberly A Landry, Associate Research Director, Workplace Benefits Research, LIMRA and LOMA

Kim is an accomplished market research professional responsible for conducting primary research for the employee benefits industry Hands-on experience managing quantitative and qualitative research projects from start to finish, including project conceptualization, design of questionnaire or discussion guide, data analysis, report-writing, and presentation of results at conferences and events. She has experience conducting research with insurance companies, agents/brokers, employers, and consumers Topical areas of focus include group insurance, voluntary benefits, small business, sales compensation, and health care reform

By Shaun Walti, MASA Medical Transport Solutions

By Shaun Walti, MASA Medical Transport Solutions

Imagine you are traveling on a well-earned but long overdue family vacation A lot of time went into planning for this once-in-a-lifetime experience with the whole family, and the first few days have been amazing Then you notice that you didn’t wake up feeling as refreshed as you might expect You chalk it up as a little jet lag catching up with you and remind yourself that you’re on vacation, and when is there ever a better excuse for a nap and no better day than today!By that afternoon, that not so good feeling has worsened, and what really grabs your attention is a feeling of uneasiness and pressure in your chest.

Better to be safe than sorry, so let’s get this checked out. The first stop for this unplanned family field trip is an urgent care clinic not too far from where you are staying. It is then that one of your worse fears is seemingly coming true when the initial workup done confirms a potential cardiac event, but this clinic is not equipped nor staffed to handle the level of care that you need So, the staff calls 911, and an ambulance arrives shortly thereafter You are taken to the nearest hospital for additional tests and radiological imaging The good news is that you made the right decision to get checked and caught this early, the bad news is that you need advanced care only a specialized cardiac unit can provide, and, unfortunately, this hospital does not have what you need

So, after you’ve been stabilized, another ambulance is dispatched to transport you to a more advanced facility, and you’re admitted You’ve also been prioritized for an angiogram first thing in the morning where you received two stents and are held for additional treatment, observation, and recovery, a recovery that spans beyond the remainder of your planned vacation days If you wish to be close to home for the remainder of your recovery, you will need a specially equipped and staffed aircraft to do so safely, and you choose to proceed with getting yourself to a facility where your family and friends can visit which only improves your recovery.

This chain of events may sound like an outlier, but it is not unusual for an initial transport to result in one or more subsequent transports. There are many reasons for this, it could be due to the patient requiring a higher level of care, or maybe the scene of an accident does not have a safe area nearby for a helicopter to land thus requiring a ground transport to deliver the patient to a safer zone In fact, the transport journey I just took you through is very similar to an actual claim where MASA Medical Transport Solutions covered the member’s outof-pocket costs associated with all three transports: 1) his initial ground transport from the urgent care to the first hospital, 2) his subsequent ground transport to the second hospital, and 3) his repatriation transport to a facility near his home A sequence of events that could have cost him a pretty penny if not for having a medical transportation benefit in place

So, how significant is this problem? Let’s look at the impact on medical transportation frequency and costs in the US

In terms of frequency, according to the National Association of State EMS Officials in 2022, there are roughly 28 million emergency transports dispatched by 911 every year. When broken down by type, this trend translates to approximately 1 ground transport for every second of each day and 1 air transport for every minute of each day. As the U.S. population grows and ages, that trend looks to only increase over time.

Regarding costs, the National Association of Insurance Commissioners in 2022 determined the average full billed amounts to be $40,000 for helicopter ambulance and $1,500 for ground ambulance HealthCare Insider in 2021 stated that “employees may be responsible for total full billed ambulance charges if their claim is denied” Add to this data, the industry has seen a demonstrative increase in costs for several reasons with increased fuel and supply costs playing a key role

Now, the No Surprises Act, which went into effect in January 2022, has provided protections for patients against “surprise” balance bills. However, this legislation only addresses air transportation claims which represent just about 2% of the problem. The vast majority of claims every year are for ground transports, and, in most states, the No Surprises Act does not include protections for this type of ambulance service.

So, what are the ways that folks get hit with these costs? First and foremost, regardless of how a patient is transported, the employee will likely be on the hook for their coinsurance and deductible as defined by their medical plan since medical transports often result in first-dollar deductible exposure There is also a potential for ground transport balance bills producing an additive effect on the overall amount that employees must come up with to settle their claims Consumer Reports touched on this in 2021 where it was found that “79% of all ground ambulance rides could result in an out-of-network bill,” which is not surprising as there are over 21,000 ground providers and roughly 300 air providers overlapping one another in coverage areas across the U.S. Lastly, some transport claims, such as inter-facility, non-emergent, or repatriation, may be deemed not medically necessary and denied by the medical plan, placing the entire cost burden squarely on the employees’ shoulders.

When considering the prevalence and financial impact to families, it is plain to see that significant risk exists, and it is warranted to offer a Medical Transportation Benefit to protect employees from these sizeable and unplanned expenses Truly, a legitimate case can be made that the proven reasons for offering employees solutions such as Critical Illness or Hospital Indemnity plans are the very same reasons to offer a Medical Transportation Benefit Doing so would be an enhancement to the overall employee benefits program strategy, and it would not only add much needed coverage for employees but also provide protection against a medical transport claim potentially eroding the benefit amounts paid by other voluntary benefits in place

Take for instance, a Critical Illness policy with a $10,000 face amount for an employee with a $4,000 CDHP in the beginning of the plan year. Likely, this employee has not yet met much, if any, of their deductible limit and unfortunately experiences a heart attack for which they require medical transportation. As most transports result in first-dollar deductible claims, along with the additional claims associated (hospital admission, treatments, and procedures, etc.) that $10,000 face amount really only nets out to a $6,000 benefit, and then, if that ground transport provider balance-bills the patient, further erosion of the CI benefit occurs What if that employee requires some time off work to recover and needs extra funds for rent or other bills? Or, what if the employee was traveling when this occurred and wishes to be repatriated to a home facility? Or, worse yet, what if that critical illness event results in a lasting disability requiring a home modification to accommodate the employee’s “new normal?” These are all possible scenarios where a surplus of the CI benefit would be a much-needed saving grace, and having a Medical Transportation Benefit in place would at least protect against the ambulance costs

Another important factor to consider is how this plays out with the employer As with the traditional cause and effect of employees’ financial stresses leading to deleterious effects at work, surprise expenses due to medical transportation are no different. The effects are many: decline in overall wellbeing and employee morale, decreased productivity, increased absenteeism, reduced employee engagement and risk of increased turnover. The added stress could even lead to further poor medical outcomes for some employees leading to more cost burden to the medical plan

It’s safe to say that there’s enough skin in the game for both parties here to necessitate evaluation and offering a solution

In terms of the discovery process, it is worth discussing the impact of medical transport costs with every group client When evaluating this cost, it is important to ensure all data sets are considered One might not realize that there are several HCPCS codes to include when reviewing claims reports In fact, MASA Medical Transport Solutions comes across almost 30 common codes when processing claims for our members Some analysis might find that a group’s medical plan is so rich in coverage that there isn’t much exposure to the employee. However, in most cases, substantial risk will be identified.

Though working through this discovery is valuable for every client, there are some industry verticals where those clients’ decision makers will already have a keen understanding of the need for medical transport risk mitigation Public Sector, for instance, is acutely aware of the EMS and 911 budgeting strain experienced in efforts to ensure their communities are well served with desirable response times

State and local officials appreciate the value of a private sector payer in place to ensure solvency of their municipal funds. Hospital clients, often the providers delivering the medical transport needs to their communities, are very well versed in the process of collecting on those transport claims from their patients, and, in many cases, these claims are considered “bad debt.” Schools and Education clients employees find value as well where, often, they take advantage of the breaks in the school calendar for travel, and a Medical Transportation Benefit would provide the peace of mind they need There are many other sectors such as transportation and logistics companies, companies in rural settings or with remote employees, and companies where travel is a key component of doing business

As we all know, group clients will continue to challenge us to find and deliver new and unique ways to improve their benefits programs and protect their employees These benefit enhancements are at the core of their talent recruitment and retainment efforts, and Medical Transportation Benefits are a unique and fairly new entrant to the group space For many years, memberships have been offered by transport providers and a few payers on the individual market, but, in recent years, a payer solution offering a relatively novel and new employee benefit approach has emerged, and there’s no better time than right now to strike up the conversation and determine if a medical transportation benefit solution could be just what your client is looking for!

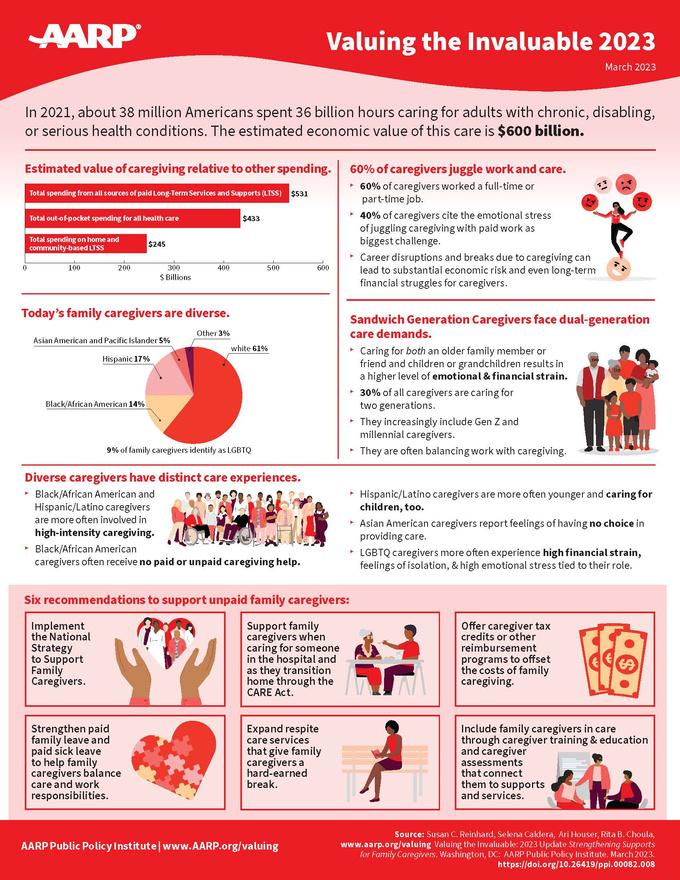

Shaun Walti is Vice President of Sales, Group Benefits Division at MASA Medical Transport Solutionswhere he has almost 30 years of experience, with over 15 years in the employee benefit space, developing collaborative partnerships and delivering sound customer excellence In his current role, Shaun leads a team of sales professionals with a focus in cultivating employee benefits broker and consultant relationships and a passion for delivering valuable solutions to their employee benefit clients.As someone who is a long-distance caregiver for my mother, regularly traveling from California to Michigan, there was a number that jumped out at me from a recent AARP report “Valuing the Invaluable: 2023 Update” The number that troubles me is 36 billion, because that’s the estimated number of hours of care that family caregivers performed in 2021 That is a staggering data point but one that includes my own experience with an aging parent. You may not be a caregiver now, but it will likely impact your future, or the future of a friend or a loved one. Being aware of the problem is the first step. Finding workable solutions is the more difficult part.

AARP Public Policy Institute has provided an updated analysis of the current state of family caregiving in the United States, highlighting the challenges and opportunities for supporting this vital workforce Family caregivers are individuals who provide unpaid care to a relative, friend, or neighbor who needs assistance with daily activities or health care They are essential for the well-being of millions of older adults and people with disabilities, as well as for the sustainability of the long-term services and supports (LTSS) system

By Gretchen Barry, BuddyIns

By Gretchen Barry, BuddyIns

Let’s recap the most important numbers: There were about 38 million family caregivers in 2021, providing an estimated 36 billion hours of care worth $600 billion The value of the care is based on an average hourly wage of $1659 for home health aides, but it does not capture the full economic and social costs of caregiving

More important than the above data, it is well documented that family caregivers face financial risks, such as lost income, reduced career opportunities, and lower retirement savings and benefits. They also experience physical, emotional, and mental health impacts, such as stress, depression, and chronic conditions. We can and should do more to relieve some of that burden.

More important than the above data, it’s well documented that family caregivers face financial risks, such as lost income, reduced career opportunities, and lower retirement savings and benefits. They also experience physical, emotional, and mental health impacts, such as stress, depression, and chronic conditions. We can and should do more to relieve some of that burden.

The report identifies several prominent issues that affect family caregivers, such as:

The sandwich generation: These are caregivers who also have children or grandchildren living in their household They represent about 30% of family caregivers and tend to be younger and more diverse than other caregivers They face multiple competing demands and responsibilities that affect their work-life balance and well-being

Working caregivers: These are caregivers who are employed either full-time or part-time They account for 61% of family caregivers and often struggle to balance their work and caregiving obligations. They may need flexible work arrangements, paid leave policies, and other workplace support to manage their dual roles.

Direct care workforce shortage: These are paid workers who provide personal care or home health services to older adults and people with disabilities. They are in high demand but face low wages, poor working conditions, and high turnover rates They are essential partners for family caregivers, who often rely on them for respite and assistance

Diverse caregivers: These are caregivers who belong to racial and ethnic minority groups, LGBTQ+ communities, rural areas, or other underserved populations They represent a growing share of family caregivers but face unique challenges and barriers to accessing services and support They may need culturally competent and linguistically appropriate interventions that address their specific needs and preferences

The report also reviews recent developments and promising practices at the federal and state levels that aim to strengthen support for family caregivers. Some examples are:

The RAISE Family Caregivers Act: This is a federal law that was enacted in 2018 to create a national strategy to recognize and support family caregivers It established a Family Caregiving Advisory Council that includes representatives from various sectors and stakeholders The council issued its first report in 2020 with recommendations for improving the coordination and delivery of services and supports for family caregivers

The CARE Act: This is a state-level model legislation that was developed by AARP to help family caregivers when their loved ones are hospitalized and discharged It requires hospitals to identify, record, inform, and instruct family caregivers about the care plan and tasks they need to perform at home As of 2020, 43 states and territories have enacted some version of the CARE Act

The Lifespan Respite Care Program: This is a federal grant program that was authorized in 2006 to help states develop coordinated systems of accessible, affordable, and quality respite care services for family caregivers Respite care is a temporary break from caregiving that can reduce stress and improve the well-being of both caregivers and care recipients. As of 2020, 37 states have received funding from this program.

The Paid Family Leave Program: This is a state-level program that provides partial wage replacement for workers who take time off from work to care for a seriously ill family member or bond with a new child It can help working caregivers maintain their income and job security while fulfilling their caregiving responsibilities As of 2020, nine states and the District of Columbia have implemented some form of paid family leave

The report concludes with specific recommendations for policymakers, employers, and healthcare providers Some of the key recommendations include:

Expand access to affordable and high-quality long-term services and supports (LTSS) that meet the needs and preferences of older adults and their family caregivers. This includes increasing funding for home- and communitybased services (HCBS), implementing LTSS insurance programs, and promoting consumerdirected care models

Strengthen workplace protections and support for working caregivers, such as paid family and medical leave, flexible work arrangements, caregiver discrimination protections, and tax credits

Enhance training and education for family caregivers, especially on how to perform complex medical and nursing tasks at home This includes providing standardized assessments, care plans, instructions, and demonstrations by health care professionals, as well as offering online and in-person training programs and resources.

Improve coordination and communication between health care providers and family caregivers, such as by recognizing them as members of the care team, involving them in care transitions and discharge planning, and sharing relevant health information with them.

Increase recognition and representation of family caregivers in popular media, such as by featuring diverse stories of caregiving experiences, challenges, and solutions in films, television shows, podcasts, books, and social media platforms

These recommendations aim to improve the awareness and quality of life of both older adults and their family caregivers By valuing the invaluable contributions of family caregivers, we can create a more compassionate and sustainable long term services and supports system for everyone The LTSS system varies in each state, but more states, caregiving organizations, and employers are looking at ways to take some of the stress and burden off family caregivers by improving on the support that is available Given that the number of caregivers and those needing care will continue to increase, it will take a village and a variety of programs, including those that provide outreach to underserved and diverse communities, to make a dent in the challenges, but there’s hope in those opportunities on the horizon.

Gretchen Barry, Director of Marketing Strategy - With over 20 years of marketing leadership experience, Gretchen has built an extensive marketing portfolio As director of marketing strategy for BuddyIns, Gretchen works closely with the BuddyIns team and its partners to identify ways to advance the company's brand and mission With first-hand experience as a caregiver, Gretchen understands the growing challenges facing caregivers and the long term care planning industry. Gretchen can be reached at gretchen@buddyins.com.

There are thousands of books about leadership in business and, I have a confession to make, I have read and learned from a lot of them. “Thriving on Chaos;” “The Discipline of Market Leaders’” “On Becoming a Leader;” “One Minute Manager;” “Built to Last;” “Predictably Irrational;” “The Experience Economy;” “New Ideas from Dead CEOs;” “Billion Dollar Mistakes;” “The Seven Habits of Highly Effective People;” and a lot more - but you get the idea

My business career was focused primarily on turning around struggling organizations or creating and building new ones Many of these organizations were in the field of voluntary employee benefits – what we used to call worksite benefits In the process I experienced some successes and, unfortunately, some failures as well But succeed or fail, I learned from each and every opportunity and challenge

Here’s one important lesson I learned. If called upon to lead an organization today (stranded on a business desert island so to speak) the book I would bring is Jim Collin’s classic “Good to Great.”

A team of graduate students, working with Jim, reviewed the stock performance, covering a 40 year period, of 1,435 publicly traded companies They selected, out of that group 11 to study more intensively Those chosen had a 15 year period of stock returns at or below the general market Then they had a transition point resulting in a minimum of 15 years of cumulative returns at least 3 times better than the general market return “Good to Great,” published in 2001 is the story of the principles used in common by each of the 11 companies as they achieved a remarkably high bar of success

The book’s honesty impressed me by its willingness to acknowledge findings that differed from their original assumptions. One of those acknowledgements was about the importance of leadership in building a great company. The bias was that leadership at the top was not likely to be one of the key ingredients in a company transitioning from good to great. The facts of their research, however, led them to conclude otherwise. Not leadership from the high-powered inspirational CEOs whose names were often mentioned in the press but from some very unique individuals who demonstrated what they labeled as “Level 5” leadership

“Someone asked me if I were stranded on an island what book would I bring? How to Build a Boat.”

Steven Wright, Comedian

“Those who build great companies understand that the ultimate throttle on growth for any great company is not markets, or technology, or competition, or products. It is one thing above all others: the ability to get and keep enough of the right people. The management team”

― James C. Collins

While there are many different definitions of leadership and leadership levels, (over 1 billion - yes that’s with a “b” - hits on Google), I really like the 5 Levels as described by Collins and his research team. Here they are with some thoughts about how they can impact our own work and that of our organizations today

“Makes productive contributions through talent, knowledge, skills and good work habits.”

This person is often the star of a sales organization, administrative or support organization They understand the processes and importance of their work and have an enthusiastic attitude about excelling at it Level 1 leaders have a positive influence on the attitudes and performance of those they work with, both peers and supervisors

“Contributes individual capabilities to the achievement of group objectives and works effectively with others in a group setting.”

The Level 2 leader loves working with a team, helping it to meet or exceed its objectives and celebrating together its successes. They are quick to help others on the team be successful with ideas and hands on support. Level 2 leaders are a major key to company success serving as department managers, supervisors, team leaders and in technical roles.

“Organizes people and resources toward the effective and efficient pursuit of pre-determined objectives.”

In my experience, Level 3 leaders make up the majority of director, vice president and higher roles, often including C-suite positions These are highly intelligent, well trained and successful men and women who provide positive direction and motivation for those they are privileged to lead

“Catalyzes commitment to a vigorous pursuit of a clear and compelling vision, stimulating higher performance standards.”

A careful study of the most successful companies in our industry will, most likely, find a Level 4 leader at the top. These men and women are comfortable in their roles, passionate about their organizations and driven to succeed. They are good at motivating employees and producers to achieve ever higher goals and mentoring those they identify as having the qualities needed for current and future leaders

“Builds enduring greatness through a paradoxical blend of personal humility and professional will.” Collins further describes the Level 5 leader as having “ambition first and foremost for the company and its success rather than for one’s own riches and personal renown” In my experience it is very rare to find a true Level 5 leader in any industry Over the course of a 40+ year working career, I only had the privilege of working with 1 individual who displayed the characteristics of Level 5 leadership

So, how can you use this information to benefit you and your organization as our leaders of today and tomorrow in this vital industry? First, buy a copy of “Good to Great” and read it multiple times (I have read it no less than 25 times over the years and just recently re-read it learning something new to emphasize each time). Second, give yourself an honest evaluation of your leadership level. It can be a bit painful (at my best I evaluated myself as good Level 3 with some characteristics of Level 4). Third, work on understanding and working towards the qualities of the next higher level It will benefit you and your company in more ways than you can imagine

As always, feel free to reach out if you have questions, comments or want to explore more about this or any other subject we have written about My email address is: sjcsr@hotmailcom

Steve Clabaugh, CLU, ChFC started his career in insurance as a Field Agent, moving on to Sales Manager, General Manager, Regional Manager, Vice President, Senior Vice President, and President/CEO A long time student of professional leadership, Steve created the Relational Leadership program that has been used to train home office, field sales associates, mid-level managers, and senior vice presidents.

If you are interested in working with Steve on an individual or organizational basis, contact him at sjcsr@hotmail.com.