3 minute read

A Critical Need: Interest in Critical Illness Insurance surges in wake of pandemic

By Eastbridge Consulting Group, Inc.

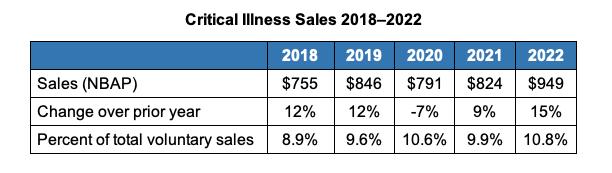

Not all products are created equal when it comes to the voluntary benefits industry’s continuing recovery from the pandemic. Life and disability insurance are still the market’s mainstays, but coming up fast on the outside are supplemental health products. Critical illness, hospital indemnity and accident all saw double-digit sales growth in 2022, outpacing the industry’s overall 5.4% increase.

Critical illness in particular has become a star performer, leading all other lines of business with a 15% sales surge last year. It was the highest sales increase in the past five years, driving new sales premium to a record high $949 million. In fact, 2022 was the second straight year of strong growth for critical illness, following a 9% leap the year before. The pandemic can claim much of the credit for these results, driving a greater understanding of the need for critical illness insurance as employees became more aware of the actual cost of a serious illness.

Employer Perspective

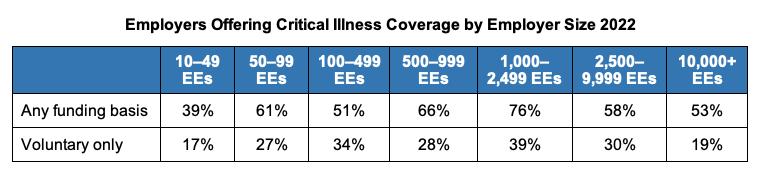

More than 42% of all employers regardless of size, offer critical illness insurance to their employees, either as an employer-paid, employer-employee shared cost or voluntary benefit, according to Eastbridge’s 2022 “MarketVision™ The Employer Viewpoint©” report. Only 6% of these employers pay the full cost of the premiums. Offering the coverage on a voluntary, employee-pay-all basis is much more common.

Employee Perspective

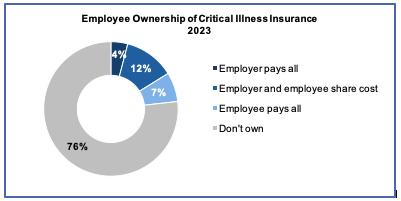

Even though one in four employers offer critical illness insurance as part of their benefits package, only 24% of employees own this coverage, according to Eastbridge’s “2023 MarketVision™ The Employee Viewpoint©” report.

But employees not currently covered report strong interest in buying critical illness on a voluntary basis, the report shows. In fact, critical illness has the highest purchase interest index a number based on the percentage of employees who don’t own a product and the percentage interested in purchasing it on a voluntary basis of any voluntary product. Of the 76% of employees who don’t currently own critical illness on any funding basis, more than half (51%) say they’re interested in purchasing it on a voluntary basis.

Broker Perspective

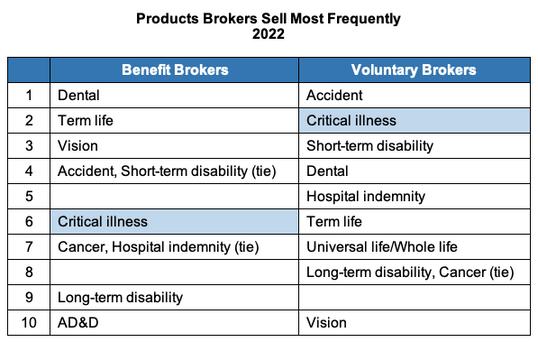

Brokers continue to value critical illness as a top voluntary offering for their clients, according to Eastbridge’s 2023 “Voluntary Benefits: Brokers Back in Business” Spotlight™ report. It’s the number two most commonly sold voluntary product for voluntary brokers and ranks number six for benefit brokers.

Learn more about the voluntary critical illness market in Eastbridge’s “Voluntary Critical Illness Products” Spotlight™ report.

Eastbridge is the source for research, experience, and advice for companies competing in the voluntary space and for those wishing to enter For over 25 years, they have built the industry’s leading data warehouse and industry-specific consulting practice Today, 20 of the 25 largest voluntary/worksite carriers are both consulting and research clients of Eastbridge.