23 minute read

Legislative News

in the lobby

By: zoe baldwin

In the wake of our new, socially distanced reality, almost everyone is feeling vulnerable whether physically or financially, and it’s hard to know what to do in the face of such massive uncertainty. UTCA has been and continues to be in constant contact with the Governor's office, members of the Legislature, local governments, and various state agencies in an effort to mitigate economic impact to our industry. Below is a roundup of the state and federal government resources and response for business during the COVID-19 outbreak.

First off, the Feds. In Mid-March President Trump signed into law a more than $100 billion coronavirus aid package that includes new leave requirements for employers.

The new law requires governments and private businesses with fewer than 500 employees to provide up to two weeks of paid sick leave for those who miss work due to coronavirus or for those who have to take care of affected family members. An eligible employee is one who has worked at least 30 calendar days for the employer. USDOL will exempt companies with fewer than 50 workers if they risk going out of business. The provisions will only apply to coronavirus-related illnesses and would last only through the end of 2020.

This paid sick leave is in addition to existing paid sick leave or PTO time that is offered by or required of employers. Employers will receive 100% tax credit for paid sick time up to the ACT’s paid limitations (up to $511 per day, $5,110 total or up to $200 per day, $10,00 total when caring for children home from school). Please note that leave for employees caring for children under 18 years of age due to eligible school closing are only entitled to unpaid sick leave for the first ten days. Paid sick leave applies to both full and part time employees (on a pro-rata basis) and the requirement/benefit expires on December 31, 2020.

As of this writing, we do not have further details on how this new law will be implemented.

Congressional lawmakers are already working on another stimulus effort in response to the widening pandemic, and our national coalition, the American Road and Transportation Builders Association (ARTBA), has been working to ensure funding for infrastructure is included. The ARTBA co-chaired Transportation Construction Coalition sent a March 19 letter to Capitol Hill highlighting the short-term and long-term positive impacts of infrastructure investment on the U.S. economy. Senators Barrasso (R-WY), Shelby (R-AK), Cramer (R-ND), and Representative Peter DeFazio (D-OR) have publicly stated their support for including major infrastructure investment in the plan.

On the home front, the Small Business Administration (SBA) declared a disaster in the state, making businesses eligible for low-interest federal loans up to $2M. However, Governor Murphy has cautioned owners – especially those severely impacted – to hold off until there is a full picture of available resources. After Hurricane Sandy businesses rushed to get loans that ultimately made them ineligible for grants that were offered later.

Funding for the loans was included in the coronavirus spending bill described above. They carry a 3.75% interest rate for small businesses with up to 30 years to repay. To apply for loans, visit https://disasterloan.sba.gov/ela. Applicants also can call the SBA at 800- 659-2955 or email disastercustomerservice@ sba.gov. For more information visit https://sba.gov/page/guidance-businesses-employers-plan-respond-coronavirus-disease-2019-covid-19.

The deadline is Dec. 18 and the declaration also includes businesses in several counties bordering New Jersey: New Castle, Delaware; Bronx, New York, Orange, Rockland, and Westchester, New York; and Bucks, Delaware, Monroe, Northampton, Philadelphia and Pike in Pennsylvania.

Finally, just this hour, the US Treasury Secretary Steven Mnuchin has declared that Tax Day will be moved from April 15 to July 15. All taxpayers and businesses will have the additional time to file and make payments without interest or penalties.

Next, New Jersey At the time of this writing, the state is still working to put together a comprehensive relief package and corresponding guidance. The best resource right now is a new business information hub on COVID-19 that allows users to search for the specific information they need. It also has a livechat function which is available from 8am-9pm. You can visit the state's website at https://cv.business.nj.gov or call the Business Helpline 1-800-JERSEY-7.

Our partners at the New Jersey Business and Industry Association (NJBIA) have also been hard at work to protect employers and have created a resources page with a slew of invaluable

COVID-19 related business resources that is being updated constantly. Visit njbia.org/coronavirus. They have also put together a coronavirus impact poll to identify your business challenges and bring them to our decision makers. You can participate by visiting https://bit.ly/3dgzMEj.

The state legislature is also moving quickly to help with damage control. At the time of this writing, the legislature has passed several bills not yet signed by the Governor. One bill, sponsored by Assemblymen Freiman, Greenwald, and Dancer authorizes the New Jersey Economic Development Authority to provide grants during periods of emergency declared by the Governor and for the duration of economic disruptions due to the emergency.

Probably the most significant bill was one that will expand both the state’s temporary disability and family leave insurance programs to cover the novel coronavirus. Prior to passage, a person quarantining due to COVID-19, the disease caused by the coronavirus, or caring for a family member would not necessarily qualify for payments under the disability or family leave programs.

In total, the body passed more than two dozen bills enabling emergency protections and assistance to the people, schools, businesses, and local governments grappling with the medical and financial impacts of the public health crisis. The measures

cover a range of issues from a freeze on all evictions, funding for food pantries and other essential food/meal services, enabling expanded use of telemedicine and virtual learning, requiring insurance carriers to cover coronavirus testing and treatment, and ensuring no employee is fired due to a medically necessary quarantine.

Eventually, elections Although it seems like a lifetime away, the government has also made provisions for upcoming elections that may occur while public attendance restrictions are in place. The Governor has ordered that all elections set for May 12th will be conducted by vote-by-mail only, so please keep an eye out for ballots. At this time, there are no changes announced for scheduled June 2nd primary elections.

Please consider supporting the UTCA PAC, Constructors for

Good Government UTCA continues to be the leading voice for the infrastructure construction industry in Trenton and Washington DC. Whether it is providing expert testimony before business and legislative groups or positively effecting the legislative process, UTCA stands alone in its record of achievement for our industry. This success is only possible with your support and more importantly, with your support of the industry’s PAC: Constructors for Good Government. Please consider contributing as a robust PAC greatly strengthens our voice. Thank you for your continued support.

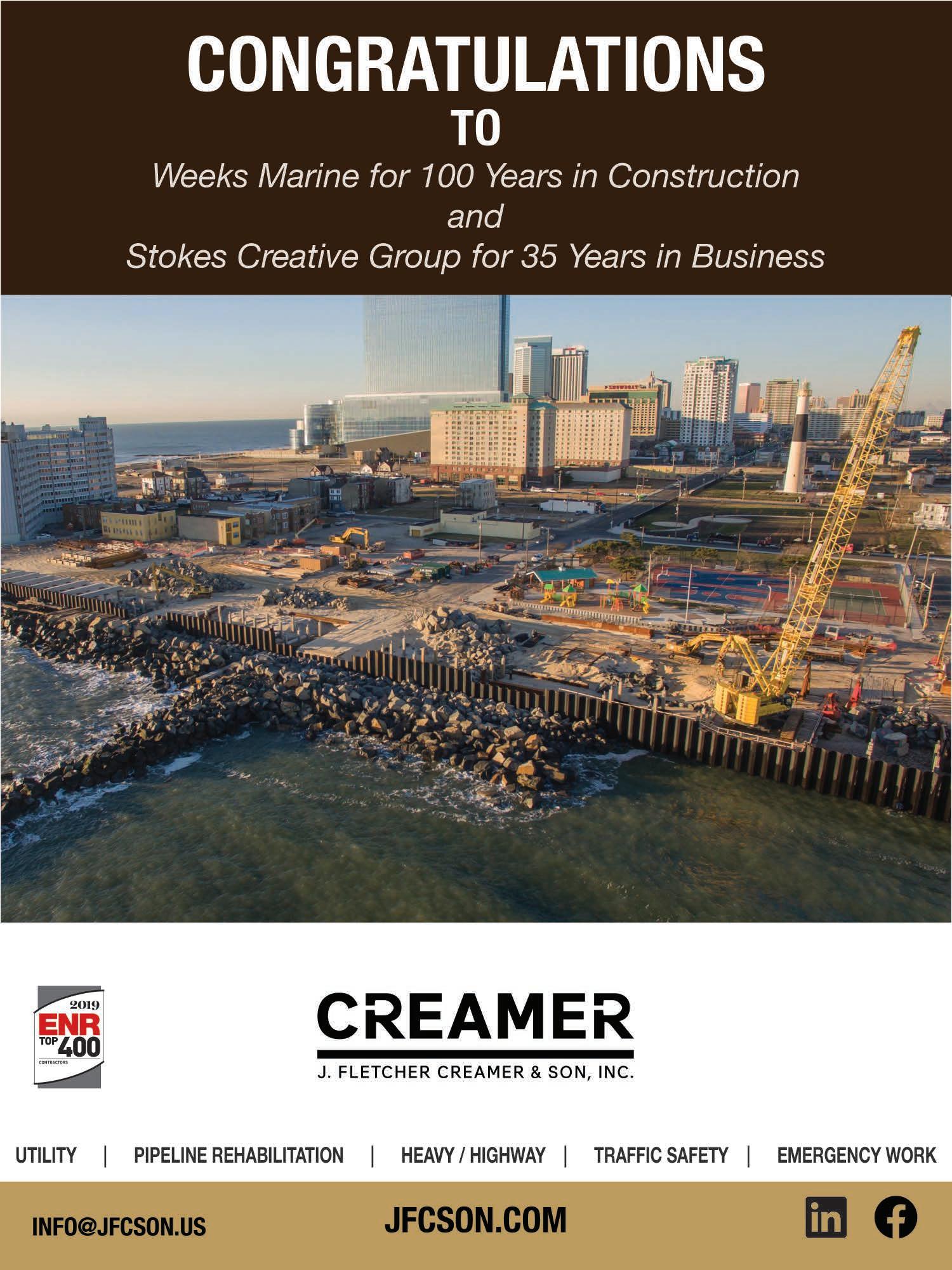

weeks marine completes 100 years in business

By: zoe baldwin A mix of organic growth and strategic acquisition, good timing, and a King Midas touch for old iron seem to be hallmarks of the Weeks Marine empire, which just completed its 100th year in business. Current CEO Richard S. Weeks sat down with us recently, plumbing the depths of family and company history we ambled through the past century of maritime business and growth.

In the beginning, the Weeks family owned the NY Clason Point Ferry until World War I pulled Richard B. away from his home and into the US Army Air Corps as a second lieutenant. Upon his return in 1919, Richard B. and his father, Francis, started Weeks Stevedoring by purchasing unassembled, land-based steam cranes and putting them on barges to perform ballast and coal bunker work.

“NY accounted for over half of US maritime commerce back in those days,” Richard S. tells me. “There was this phenomenally deep world of maritime enterprise - railroads, bulk stevedores, barge companies - a lot going on. So, they went into that milieu of activity and, if you can handle coal you can handle ore, soda ash, salt - all your bulk commodities. Back then, if you had floating cranes that you could move around, it was enough to get your foot in the door.”

Through the 1920s the fledgling firm strengthened its foothold in the world of stevedoring, ultimately securing enough of a mar

The Goethals Bridge Replacement Project, completed in 2018, was a joint venture between Weeks, Kiewit and Massman Construction Co.

ket share to help them through the austere years following the market crash of 1929. “During the Great Depression they kind of eked it out where they could. With the onset of World War II, things exploded in terms of demand and as the family lore goes, they kind of ran the equipment into the ground and then had to build it back up from there.”

By the start of WWII, the business had expanded its fleet to include seven cranes and the company was poised and ready for the deluge of war time projects to come. The original fleet was made of wood, but the proliferation of work during the war allowed Weeks to replace wooden crane hulls with durable steel. By 1947, Richard B.’s sons, Ted and Richard N., had started working with the firm part time while students at Rutgers University, and by 1954 both had joined their father full time.

“My father [Richard N.] was very mechanically oriented,” says Richard S., “You know, takes cars apart and puts them back together, that kind of a thing; but another thing about him is that he has always thought for himself. He has a very independent brain; he isn’t a follower of the herd. So, he began looking at what else we could do besides bulk stevedoring with bulk stevedoring cranes.”

It was that thrifty ingenuity that secured Weeks its first work for the government removing abandoned vessels and piers for the US Army Corps of Engineers, a move that opened up a new clientele. Richard N. saw an opportunity in branching out by putting his stevedoring assets to a broader purpose. According to Richard S., “It was a big deal back then - working for the government was a whole other operation. Bulk stevedoring was a world where you did business on handshakes. You didn’t have contracts, maybe you had a letter that listed the rate, but often not. Up to that point we’d had a bunch of private, long term customers and were in heavy with scrap iron in particular.”

Through the 1950s and early 60s, Weeks worked throughout the region diversifying its portfolio of public and private clients while continuing to invest in its fleet. Just a decade earlier they had moved from wooden hulls to steel; In the 1960s they moved from steam to diesel. The newly outfitted vessels were much better equipped for the bitter winter months out on the water, and the updates helped secure Weeks’ standing in a competitive industry.

The Weeks No. 7 Stevedoring crane unloading material into a hopper.

In those days, the firm was based in Jersey City on Pier 7 just south of the Jersey Central Railroad terminal, which was at the time a bustling center of port commerce fed by a series of finger piers in what is now Liberty State Park. The railroads had immense marine operations – car floats, barges, tug boats - and Richard N. would frequently buy surplus railroad equipment to supplement his operation. “We were there, we could husband it, and there was a phenomenal amount of it. He bought a lot and he sold some. He even sold barges to Nigeria - I’ll never forget that. The Nigerians had all kinds of port congestion problems and they needed a quick fix so they came in and bought a lot of barges from us and others.”

That prime location in Jersey City combined with Richard N.’s eye for opportunity led Weeks from those early government contracts into dredging, a completely new line of business where the firm would truly make its mark. According to Richard S., “You needed a floating crane which we had, and you needed a workforce which we had in longshoremen, so he started going after smaller government jobs. He was diversifying using the assets that were there and the skill set was there. Dick would look at what they had and put his thinking cap on. Back then the port had numerous finger piers that meant you could do a hundred dredging jobs in a year. Just one- or two-day jobs, private and paid by the scow load. If you needed a permit you’d just call into New York and you got it. It was very easy back then to get in from a regulatory stand point. But you ultimately needed to rent and then build a dump scow.” And build one they did. Once he had his foot in the door, Richard N. built three more dump scows and hired Bill McPhilips to run the dredging business. Weeks Stevedoring started clamshell dredging and gradually grew the operation, primarily working in the Northeast. When Richard S. started on in 1977, they had picked up some jobs in Puerto Rico and Jacksonville, FL.

“The first clamshell dredge of size was something called the 500, which we still own. The crane was built in anticipation of the invasion of Japan. We bought it surplus, and then we changed the hoist, the boom, and modernized the crane, but it was still working on anchors, not on spuds. The big move for them was to get some clamshell work in Puerto Rico. We were pipsqueaks at the time, but nobody was really maintaining a presence there, which kind of leveled the playing field. Anybody can bid a job as long as they can get a bid bond and a performance bond.”

Taking on the new specialty was a step away from stevedoring, but one that brought Weeks into a whole new arena. “My grandfather and his brother were not particularly interested in it,” Richard S. says of the founders. “They had been through tough times and weren’t up to taking on the risk… But at the time, the stevedoring was still chugging along.” In fact in 1966, the largest dry cargo ship to ever call at the port of New York was loaded with the heaviest scrap iron and steel shipment on a single vessel – thanks to Weeks’ stevedoring expertise.

The 1970s ushered in the containerization of port operations, but by that point Weeks had branched into several arenas of work, giving the firm a solid base from which to grow. Richard N. – known for his savvy with all things mechanical – continued to build the company’s fleet and capabilities. In addition to the stevedoring operation, they had added dredging, demolition, sludge disposal, two tug boats and a growing fleet of floating equipment.

Current CEO, Richard S., joined the firm in 1977 after graduating Harvard Business School. Although his name suggests otherwise, it was not a fait accompli that he would join his father at the firm. “I was kind of torn between science and social studies, and I landed in international relations,” he tells me. “But that segued into business which segued into business school, and in the

Fully loaded sand scows on route to a customer.

meantime there’s this business back in New Jersey that my father is running. My father had lots of really interesting ideas about where he might expand the business, and they were well capitalized for a company their size. It presented a lot of opportunity so I tailored my courses and came here, to Weeks.”

And just like his father, Richard S. would take the family business into previously unchartered waters as he put his newly minted business skills to work. “One of the ideas when I came in – there was a company called American Dredging and they were publicly traded. Unfriendly tender offers were a new thing then, and I ran with that idea. We took a run at American but were unsuccessful because another company – under the smoke screen of our efforts – were able to accumulate enough stock to do an unfriendly tender offer subsequently.” But life has a funny way of working out.

“The firm was Tweedy Browne, and it didn’t turn out to be that great of an investment for them. About ten years later, we bought all of their assets except their land, which really expanded our dredging footprint. Their equipment hadn’t been well maintained but that was a strong suit of ours, cleaning up messed up iron.”

The 1980s brought several more expansions for the company, including their first real foray into construction in which they repaired a US Coast Guard slip on Governors Island, NY. As Gene Kelley, retired head of Weeks’s Construction Division, put it, “[It] had a little bit of everything in marine construction. It had piling, it had fender systems, it had some marine demolition. And it wasn’t that big of a job, but it had to be done all from the water so it fell right into Weeks’ strong point – the floating equipment.”

Decades earlier, Weeks had stuck its proverbial toe in the water with a pair of lighthouses and a project for Northeast Monmouth Sewerage, but it was a crowded field at the time and the firm wasn’t yet ready to make its move. As Richard S. tells it, “My agreement with Gene always was that if we had competitive advantages, then we should pursue that work. So if you have a construction job that has a lot of heavy lift, or demolition, or a dredging component in it and its not labor-intensive diver-intensive work (at the time we didn’t have divers) I’m interested; if it plays on our strength, I’m okay with it.” Construction firms have a number of avenues for growth, be it a new specialty like dredging, or a derivative business--like rentals, but geographic expansion can be a game changer. In the late 1980s Weeks made a significant acquisition with the purchase of Healy Tibbitts, overnight giving the firm a strong presence on the West Coast, in the Gulf of Mexico, and in Hawaii.

“We were doing this subaqueous pipeline work,” says Richard S., “And there was another marine construction company that was part of a West Coast operation and they were a customer of ours. We would do dredging for them or rent them barges and they were part of Raymond International, which was a very large company. Raymond had a job to replace the Shinnecock Bridge. It was a joint venture with Schiavone Construction and both companies had some problems. They had equipment on rent from us and had wrecked one of the barges, so we had this ongoing dispute. I’ll never forget, Dick Smith from Healy Tibbitts comes to Dick Weeks and suggested we buy Healy Tibbets because otherwise there might not be a Healy Tibbitts to deal with. I wasn’t interested, I mean they were probably number four in that segment of marine construction, whereas we were arguably number one. Why would I want to buy number four?”

But as Weeks had found in previous scenarios, good things come to those who wait. A few years later Raymond International declared bankruptcy. “We kind of took a couple days to penetrate into the workout group – they had to move fast and Healy had jobs all over kingdom come – but we did penetrate and what was interesting was that they had one job in Owls Head, Brooklyn that reportedly had problems – there were issues and the job was pretty far afield for them - but our construction people looked at it and realized it could be stabilized if we had our dockbuilders come from a different job in Staten Island. I said that I would consider entering this arena but only consider it if I know that everybody was going to stay on. I mean they could have gone anywhere, the company had work in Micronesia, Hawaii, all over the place. We’d never worked on the West Coast let alone Micronesia! We had an agreement, and we bought the assets and the contracts. There was no way to do due diligence, but the irony is that there were no shenanigans. So, we acquired a company that was headquartered in San Francisco with divisions on the East Coast, one in Hawaii, one in Southern California, and one in the Gulf.”

The purchase brought with it a culture change for Weeks. As Richard puts it, “The Raymond guys were like whale hunters. They were used to doing larger jobs working for large multi-nationals – it was their heritage and they’re geographically in the right place to do that work which is in Houston, but they had no meat and potatoes underlying that. Their portfolio was feast or famine – it was one big job for two years and then nothing.” Now the operation is very well established in the Gulf, and has built several LNG design-build projects in the region.

The 1980s and 90s represented a period of growth generated by acquiring the assets of other marine companies. In 1998, the firm went through the largest acquisition to date with the purchase of

the dresging assets of TL James, a very large construction contractor based in Louisiana. “American Dredging and TL James were strategic acquisitions. Some acquisitions over the years were in alignment with down periods in industry where there’s a shake out or people are kind of fading away like in stevedoring, but mostly they were strategic opportunities that presented

Weeks participated in a joint venture to replace the Willis Avenue Bridge with a new swing bridge 2010.

themselves. We didn’t go pounding on the door and say we want to buy TL James. They looked at their empire of businesses and decided to sell some things and we knew it was now or never. So we did that but at the same time, our growth over the past decade has been more from within.”

In 2011, Weeks expanded to the North and “underground,” acquiring Ontario based McNally International, one of North America’s preeminent tunneling contractors, a firm also heavily into marine construction in the Canadian Maritimes, lower Great Lakes and Arctic. The synergies, both technical and cultural, were very convincing; as with Healy Tibbitts in the Pacific, Weeks chose to continue doing business as “McNally” in both tunneling and Canadian marine construction, out of respect for a long record of expertise and achievement.

It can be hard to be big, and Weeks knows first-hand the difficulties of scale. “Every year everything is another year older. We’re a big fish in the pond, which means if we need a state-of-the-art hydraulic dredge, we have to build it ourselves. If we want a really strong team of people, we have to develop it ourselves.” It was this mentality that launched Weeks’ most recent endeavor, North American Aggregates.

Bob Manis, who runs Aggregates Sales and Business Development for the firm joined us to talk about the new start up. “We’re hopefully going to sell over 2 million tons of sand in the next couple of years. We’re stepping into a market that really needs sand; there’s a shortage throughout the country right now we’re helping to fill the void here in the Northeast.”

As many of our readers have had to contend with, a sand shortage has hampered operations in our industry. “With sand it’s all about transportation costs,” Richard S. tells me, “Every time you touch it, it costs more money. There was a lot of shuffling around trying to figure out how to cover the market.” North American Aggregates recently opened a depot in the Bronx, and will soon open another in Long Island City, Queens. The operation has a permit on sand mined from the Ambrose Chanel, one of the few sources still available. Despite a more stringent regulatory structure, Bob sees the future of the industry moving toward offshore sand sources. “We have a little more oversite because we’re regulated by the Army Corps of Engineers in addition to the NJDEP and NY Waterways, as opposed to sand pits which the DEP solely regulates . The biggest factor with overmining is that those [landbased] plants start to get into the water table, which creates an issue for drinking water. Down in South Jersey, some people are advocating to shut those plants down, even the ones that have permits. It’s becoming a real issue, but that’s where we come in as a safe alternative.”

Looking toward the future, Richard. S sees a field abundant with opportunities and challenges. Weeks invests heavily in its workforce and strongly believes that this industry can be rewarding for everyone. He does however, see great challenges ahead in the ever-increasing size of projects. “There’s been a tendency for the government to make jobs very large or very small. In that process what’s also going on is an effort to push more risk onto the contractor, and our industry hasn’t been very successful at dealing with that. As a result, you have a lot of European entities that are willing to come in and pick up that work and presumably assume that risk. But the work is there and somebody has to build it. On the Tappan Zee Bridge Project we were a significant subcon

The FDR Drive Rehabilitation Project was completed by Weeks in 2007. This contract was a joint venture of Weeks Marine and Slattery Skanska.

tractor. We did dredging, the stone placement, the load test pilot program, we mobilized their batch plants…we just weren’t part of the joint venture.”

As Weeks has learned over the past century in business, do more with what you have and be ready when opportunity presents itself. Simple strategies that helped a humble, two crane stevedoring company blossom into six divisions that operate more than 500 cranes, tugs, dredges, barges, and other pieces of waterborne equipment. We congratulate Weeks Marine on 100 years in business and wish them all the best in the century to come.