Urban Innovation Fund

Ethic

Intrinsic

Dataships

Jeeves

Livability

Ferrum

TestParty

Avela

Plenna

The Urban Innovation Fund invests in startups shaping the future of cities. We provide seed capital and regulatory support to entrepreneurs tackling our toughest urban problems – helping them grow into tomorrow’s most valued companies.

The Urban Innovation Fund invests in startups shaping the future of cities. We often get asked: what kind of entrepreneurs are you looking for? Our answer: startups reimagining the livability, sustainability, and economic vitality of cities.

Urban areas are powerful engines for economic growth. 56% of the world’s population currently live in cities, and that number is projected

Consumers are more comfortable than ever with tech-enabled services, and businesses and governments have used the past few years to experiment with new technology. We’re also seeing major regulatory action drive changes in climate technology, transportation, and consumer privacy. And new technology like artificial intelligence (AI) has the potential to dramatically enhance areas like healthcare and government service delivery.

Based on thousands of startups evaluated, we have developed a framework around how entrepreneurs are improving cities (see the graphic on the opposite page). The Urban Innovation Fund looks to find and invest in exceptional startups working in

$212M in assets under management

3 core funds

1 opportunity vehicle

100% woman-owned firm

Clara is a co-founder and Managing Partner of the Urban Innovation Fund. Previously, she co-founded Tumml, a startup hub for urban tech. Her work energizing urban entrepreneurship has been featured in numerous press outlets, such as TechCrunch and The Wall Street Journal. She began her career working in real estate development. Clara earned her MBA from MIT Sloan and BA from NYU.

Julie is a co-founder and Managing Partner of the Urban Innovation Fund. Previously, she co-founded Tumml, a startup hub for urban tech. Julie’s work in urban innovation has been featured in numerous press outlets,such as Business Insider and The San Francisco Chronicle. She began her career working in political polling and consulting. Julie earned her MBA from MIT Sloan and BA from Stanford.

Andrew is a Principal at the Urban Innovation Fund. Previously, he worked as Head of Finance & Biz Ops at Grain Technologies. Before that, he spent three years at the Urban Innovation Fund and also worked at Castellan Real Estate Partners. He began his career at Barclays, where he helped build the firm’s institutional fixed-income electronic trading platform. Andrew earned his MBA from The Wharton School and BS from Seton Hall University.

Jenieri is a Senior Associate with the Urban Innovation Fund. Previously, he worked as an Associate at AEW Capital Management, a real estate investment manager. Before that, he worked as a Real Estate Analyst at HFF. As a graduate student, Jenieri interned at venture capital firms Benhamou Global Ventures, Green D Ventures, Navitas Capital, and Dundee Venture Capital. Jenieri earned his MBA from The Kellogg School of Management and BA from Dartmouth College.

64 portfolio companies 8 years old $5.3B enterprise value created $1.1B capital raised

Headquartered in

24

12 Portfolio diversity woman/person of color on founding team woman/person of color on board

75%

58% cities US states

immigrant on founding team

16%

25%

23% of startups that have raised a round have at least one female founder

The venture capital industry suffers from an extreme lack of diversity. The Urban Innovation Fund is proud to play a role in pushing the industry to be more inclusive. Our team believes diversity across founders, employees, board members, and investors leads to better performance. Currently, 75% of our portfolio companies have a woman or person of color on the founding team. And 58% of our portfolio companies have immigrant founders. Our goal is to continue sourcing a strong and highly diverse portfolio. of VC-backed founders are people of color of VC firm decision makers are women

Data sources2, 3

Here’s an overview of our investment strategy to date, broken down by theme. We’ve included a handful of portfolio examples for context.

Proptech

Chemix

ClimateWells

Optiwatt

Solarcycle

Oscar AI

Popl

Stride

Synthetic Users

Apply Design

Builders Patch

Bundle

Codi

Cleancard Ferrum

Fintech

Transportation

Regulatory tech

Edtech

Public health Govtech

Milk Stork

Plenna

Allocate

Ethic

Jeeves

KarmaSuite

Electriphi

Joyride

Kyte

Route Reports

Commenda

Dataships

Intrinsic

TestParty

Avela

BookNook

Voatz

Many of the most highly valued private and public tech companies operate in regulated or politicized spaces – think: Uber, Palantir, and Airbnb. At the Urban Innovation Fund, managing for these issues is a core competency and a competitive advantage in both sourcing and advising portfolio companies. Our team regularly reflects on regulatory tailwinds that can inform investment decisions. Below are some tailwinds that have captured our team’s imagination this past year and informed some of our most exciting new investments.

The cost of regulatory compliance continues to grow for individuals and businesses of all sizes. In sectors like financial services, this burden is particularly acute. We’ve seen how this has impacted our own portfolio companies, with many struggling to access banking, legal, and tax support when doing business across borders.

A recent investment that speaks to our interest in this area is Commenda Commenda is a global tax compliance tool for cross-border companies. The CEO of Commenda bowled us away with his big vision of building a company “that could reduce the cost of following the law.” We have picked up this rallying cry as our own.

Both major US political parties have embraced the goal of building up American manufacturing – motivated by concerns for supply chain resiliency, sustainability, and geopolitical stability. This is evident in recent laws, such as the 2021 Bipartisan Infrastructure Law, the 2022 CHIPS and Science Act, and the 2022 Inflation Reduction Act. 4

A recent investment that drafts off of this trend is Stell. Stell is reimagining requirements, compliance, and engineering documentation for complex hardware development. This is particularly relevant in the energy, aerospace, and automotive industries. Stell’s platform has the potential to increase the speed to market for high quality, safe products critical to US competitiveness.

At the Urban Innovation Fund, we see a massive market opportunity around improving the sustainability of cities. Urban areas are responsible for about 70% of global CO2 emissions.5 Our portfolio companies are building greener and more resilient cities, embracing themes like electrification and the upgrading of inefficient legacy industries.

Stell is a software platform to manage compliance, customer requirements, and engineering documentation for hardware development. This is important for industries engaging in complex and highly regulated manufacturing, such as the automotive, aerospace, and energy sectors. The Urban Innovation Fund invested in Stell’s recent Seed round.

$1.24 MILLION

“My dream for Stell is that

Stell Co-Founders

Solarcycle recycles and repurposes solar panels. By recycling end-oflife solar panels, inverters, and battery packs, it can extract valuable metals such as silver, aluminum, and solar glass for resale. Today, over 90% of old solar panels end up in landfill. Solarcycle is changing this by creating a circular economy for the solar industry. The Urban Innovation Fund led Solarcycle’s Seed round and backed it through every funding round, including its $30M Series A.

Solarcycle currently operates two facilities, one in Texas and one in Arizona. The company is opening its third facility next year – a $344M solar glass plant in Georgia, where it will be able to take the crushed solar glass from its recycling facilities and use it to manufacture six gigawatts a year of new, American-made solar glass.

$30M raised in Series A funding

$344M

95%

Solarcycle extracts 95% of value in a solar panel and returns it to the supply chain

Solarcycle is opening a new $344M solar glass facility in Georgia next year

Solarcycle Co-Founders

Electriphi is building a software solution for electric vehicle fleets. It offers customers seamless charging & energy management tools.

Post acquisition update from CEO Muffi Ghadiali: “The Ford partnership has accelerated our vision and opened doors to new opportunities and markets. As part of the Ford Pro team, we are helping many industries make the shift toward an electric future, playing a major role in commercial fleets across the country – with United Rentals, Penske Truck Leasing, and Sunbelt Rentals shifting to zero emissions vehicles. And Ford Pro Charging already has hundreds of local government customers. For example, the City of Dallas is accelerating its Climate Action Plan with its goal of electrifying the City’s fleet by 2040 – signing a multi-year agreement with Ford Pro for EV charging infrastructure, including hardware and smart charging software.”

1.5 YEARS time between the Urban Innovation Fund leading Electriphi’s Seed round and the company being acquired by Ford

“Electriphi is at the intersection of mobility, energy, and enterprise software. And there are very few investors who understand the complexities of how all of these things interact and play with each other. We love working with the Urban Innovation team because they understand these

Electriphi Co-Founders Muffi Ghadiali & Sanjay Dayal

ClimateWells helps clean up American oilfields by creating energy transition credits when operators shut down their wells earlier. Many of the wells the company is looking to decommission are in urban areas like Los Angeles. The Urban Innovation Fund invested in ClimateWell’s recent Seed round.

“More than half a million people in Los Angeles live less than a quarter mile from an active oil well. Nearly a third of the city’s wells are located near schools, parks, homes, and other residential areas and disproportionately affect communities of color. The Los Angeles neighborhood of Wilmington is home to the third-largest oil field in the continental US and is now home to ClimateWells’ initiative with JPMorgan Chase to create economic incentives to help oil and gas producers permanently shut down old oil wells and the methane they emit.” 7

ClimateWells Co-Founders

Cities are massive drivers of economic growth. But COVID has exposed vast inequities across different sectors in the economy. The Urban Innovation Fund is excited to invest in startups that empower and protect individuals, independent workers, and small businesses. We’re proud to back entrepreneurs creating more economically vibrant communities.

financial goals

Ethic is a sustainable, tech-driven asset management platform with over $5B in assets. It partners with over 200 institutional clients to reimagine their investment experience. The Urban Innovation Fund invested in Ethic’s Seed round and has continued investing in every round through its $50M Series C.

“The

Urban Innovation Fund team have been terrific partners since the early days of Ethic. In particular, they’ve been tremendously helpful in supporting the growth of our community of institutional investors and advisors, as well as being great thought partners as we continue to expand our offering. Julie and Clara are also amazing people and a joy to work with.”

Doug Scott, Ethic CEO

Ethic Co-Founders

Jay Lipman, Doug Scott & Johny Mair

raised in Series C funding (The Urban Innovation Fund has invested in every round since Ethic’s Seed)

$50M in assets under management

$5B

Intrinsic builds software for trust & safety teams to better moderate user activity on their platforms. As spam, fraud, and illegal or harmful content proliferate online, companies of all sizes are building out trust & safety teams to fight back. Intrinsic harnesses the power of AI to help enterprises test, understand, and protect users from abusive content. The Urban Innovation Fund led the company’s Seed round.

98.3% detection accuracy

100M events moderated daily

“We started Intrinsic to bring world-class trust & safety tooling to any tech company. To ensure the internet remains great, it must be safe.”

Intrinsic Co-Founders

Karine Mellata & Michael Lin

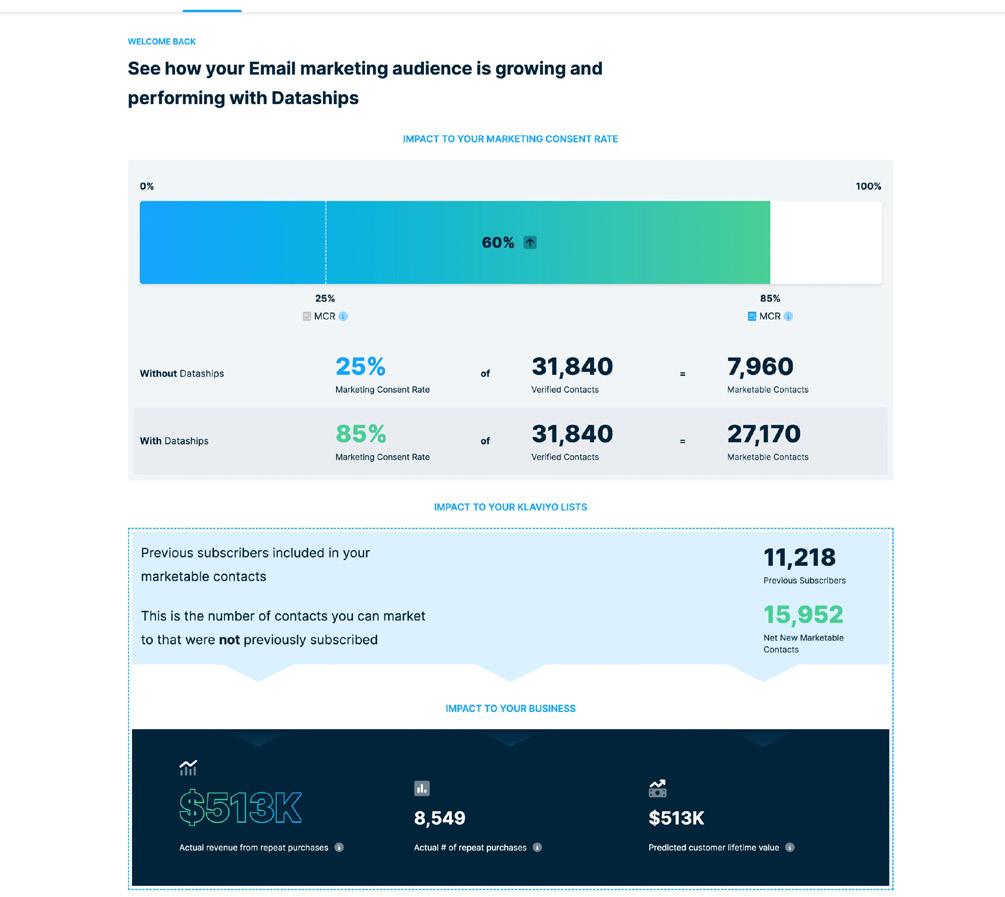

Dataships helps small and medium-sized businesses easily comply with privacy regulations and fuel business growth. With its tools, Dataships has demonstrated an ability to help customers grow their compliantly marketable audience by an average of 254%. The Urban Innovation Fund co-led Dataships’ Seed round and backed it through every funding round, including its recent $7M Series A.

Dataships Co-Founders

Michael Storan & Ryan McErlane

New laws have introduced a seemingly impossible matrix of requirements for customer data collection. Dataships tackles this.

12.3X revenue growth in the last year

254% Dataships helps customers grow their compliantlymarketable audience 254%

Jeeves empowers businesses around the globe with corporate credit, working capital, and expense management. It supports global payments across 22 countries. The Urban Innovation Fund led Jeeves’ Seed round and has continued investing in every round through its $180M Series C.

$265M raised in equity funding to date

$2.1B Jeeves raised its Series C at $2.1B valuation

“The Urban Innovation Fund was the largest check in our seed round. They’ve had the conviction on what we’re building since day one. They’ve been very helpful both in terms of intros for companies that are looking to onboard on Jeeves, but also thinking through some of the strategic components of how do you build out a company, how do you get from Series Seed to Series A, and so forth. And they’re all just really good people.“

Dileep Thazmon, Jeeves Founder & CEO

Livability is what makes cities great. People want to find a good place to live, educate their children, and be healthy. Each of these areas is ripe for innovation – offering multi-billion dollar market opportunities for startups.

Ferrum is a software platform that helps healthcare providers discover, validate, and deploy AI tools.

Ferrum’s big vision is to be the “Plaid for healthcare AI” – making intelligent healthcare accessible and cost effective at scale. The Urban Innovation Fund co-led

Ferrum’s Seed II round and invested in its recent $16M Series A.

77% more cancer detected at the early stage using Ferrum

23% highter survival rate of cancer patients using Ferrum

$16 raised in Series A funding

“The Urban Innovation Fund team always comes prepared to board meetings, they are our confidants during difficult decisions, and they are the biggest cheerleaders for our company’s successes. We recently closed our Series A, and the Urban Innovation team provided valuable feedback throughout the process and was

TestParty automates the process of writing software code that is compliant with accessibility regulations like the Disabilities Act (ADA) and European Accessibility Act is to make every website accessible to people who require screen readers or other assistive devices. The Urban Innovation Fund co-led

TestParty Co-Founders Michael Bervell & Jason Tan

96% although 16% of people in the world have a disability, 96% of websites do not meet digital accessibility compliance8

Fix issues directly in your source code editor, without writing a single line of code or new test

Showcase your accessibility scores to stakeholders through workflow integrations, custom dashboards, and page-bypage performance data

Avela manages a modern application and enrollment system for early childhood programs, K12 districts, and charter schools. Customers include school districts like Seattle, charter networks like KIPP, charter associations like Oakland Enrolls, nonprofits like Teach for America, cities like Philadelphia, and government agencies like the US Army. The Urban Innovation Fund invested in Avela’s Seed round.

Avela Co-Founders

Dr. Josh Angrist, Greg Bybee & Dr. Parag Pathak

200K applications processed in the last two years

School navigator to helps families find the right schools for their children

Application system with parent portal for streamlined applications and admin portal for workflow management

Student assignment and admission lottery service leveraging Nobel Prize algorithms for accuracy and fairness

Easy-to-use online registration, transfers, and enrollment platform

Plenna provides comprehensive healthcare for women in Latin America. The company offers care virtually and in-person at Casa Plenna (centers for checkups, vaccines, lab testings, and other exams). It currently operates out of three clinics across Mexico City. The Urban Innovation Fund led Plenna’s Seed round.

7.5K patients treated in the last 12 months

17.5K appointments held in the last 12 months

“Ever since we had our first conversation with UIF, we knew they understood the model we had. We are a women’s health startup, where every part of our offline and online experience needs to be superb. Both Clara and Julie supported our four-wall model and have helped us in every step of the way — from

Plenna Co-Founders

Lorena Ostos & Giovanna Abramo

The United Nations Sustainable Development Goals (SDGs) outline a road map to make the world better for people and our planet by 2030.9 While the Urban Innovation Fund portfolio companies do not officially report their SDG-related performance, we believe that many of our companies are working on problems that align with the SDGs.10

Cleancard, ClimateWells, Ethic, Ferrum, Route Reports, PairTree, Plenna

Affordable & Clean Energy

Byterat, Chemix, ClimateWells, Ethic, Electriphi, Optiwatt, Public Grid, Solarcycle

Decent Work & Economic Growth

Ethic, Grain

Industry, Innovation & Infrastructure

Bundle, Ethic, Jeeves, Route Reports

Stride

Sustainable Cities & Communities

Builders Patch, ClimateWells, Ethic, Route Reports

Responsible Consumption & Production

Ethic, Solarcycle

1 “Urban Development,” The World Bank. April 3, 2023. https://www.worldbank.org/en/ topic/urbandevelopment/overview.

2 “Custom Report for the Urban Innovation Fund,“ Pitchbook. July 3, 2024.

3 “Untapped Opportunity: Minority Founders Still Being Overlooked,“ Crunchbase. February 27, 2019. https://news.crunchbase.com/venture/untapped-opportunity-minority-founders-stillbeing-overlooked/

4 “A Reshoring Renaissance Is Underway,” MIT Sloan Management Review. November 2, 2023. https://sloanreview.mit.edu/article/a-reshoring-renaissance-is-underway/

5 “Cities and Climate Change,” UN Environment Programme. October 14, 2024. https://www.unep.org/explore-topics/resource-efficiency/what-we-do/cities/cities-andclimate-change/

6 “Ford Acquires Electriphi To Help With Key Commercial Fleet EV Strategy,” Forbes. July 16, 2021. https://www.forbes.com/sites/samabuelsamid/2021/06/17/ford-acquires-electriphi-tohelp-with-key-commercial-fleet-ev-strategy/

7 “JP Morgan Chase Case Study,” ClimateWells Website. September 23, 2024. https://www. climatewells.com/case-studies/jpmorganchase

8 “The WebAIM Million: The 2023 Report on the Accessibility of the Top 1M Home Pages,” WebAIM. February 1, 2024. https://webaim.org/projects/million/

9 “Transforming Our World: the 2030 Agenda for Sustainable Development,” United Nations. October 21, 2015. https://sdgs.un.org/2030agenda/

10 Only active Urban Innovation Fund portfolio companies are counted towards this calculation.