JOURNAL ENTRY THE

THE UTAH ASSOCIATION OF CERTIFIED PUBLIC ACCOUNTANTS BRIDGING

15 W. South Temple, Suite 1625

Salt Lake City, UT 84101

801-466-8022

mail@uacpa.org www.uacpa.org

Managing Editor

Amy Spencer as@uacpa.org

2025 – 2026

UACPA Executive Board

President: Dan Frei, CPA

President-Elect: Amy Anholt, CPA

Vice President: Rusty Hansen, CPA

Treasurer: David Peaden, CPA

Secretary: Dan Greer, CPA

Member-at-Large: Clinton Armstrong, CPA

Member-at-Large: Noah Meyers, CPA

Emerging Professionals: Melanie Spencer, CPA

Immediate Past President: Jason Tomlinson, CPA

AICPA Council: Stacy Weight, CPA

CEO: Susan Speirs, CPA

UACPA Staff

CEO: Susan Speirs, CPA

CPE Director: April Deneault

Communications & Marketing Director: Amy Spencer

Member Engagement Manager: Debbie Dujanovic

Cover photo: Aspiring CPAs met with the AICPA vice chair Jan Lewis in December.

UACPA Statement of Policy

The Journal Entry is published four times a year by the Utah Association of Certified Public Accountants (UACPA). The opinions, views and articles expressed in this magazine are those of the authors and not necessarily those of the UACPA. This magazine should not be deemed an endorsement by the UACPA or its committees or editorial staff of any views, opinions or positions contained herein. Copyright © 2025 Utah Association of Certified Public Accountants

As I reflect on the past year serving as the volunteer president of the UACPA, three distinct themes have emerged. These themes represent not just where we are today, but where we are headed as a professional community.

The CPA remains the "gold standard" in the business world. Beyond the numbers, we are the bedrock of trust and the primary architects of financial strategy for businesses, nonprofits, and government entities alike. Our expertise is not just a luxury; it is critical infrastructure. Whether we are navigating complex tax codes, ensuring the integrity of financial reporting, or guiding a business through a transition, the CPA is the most trusted advisor in the room.

When I first stepped into this leadership role, I believed we needed some help to tell our story better. Our first Journal Entry issue focused on "storytelling", the idea that being a CPA is cool and that we are more than bean counters. We hired a branding firm to help us, originally thinking the focus would be internal storytelling and education.

However, this year has shifted my thinking: we need to improve our external message. It used to be that everyone knew the value and CPA brand; now, when I tell people my

profession, I’m sometimes asked, "What is that?" We also have an opportunity with students. Many can be held back by old stereotypes of the accounting major. If students understood that CPAs are high-level business advisory consultants, we may see additional interest in the profession.

This is why I’ve changed my mind about the value of the UACPA membership. I used to think the top benefits were networking and CPE. I now realize that advocacy is our number one benefit. This advocacy protects us against those who push for deregulation, and it fuels the image campaigns necessary to ensure the public and the next generation understand our true value.

The profession is changing rapidly. We have heard, and I have written much about, how AI is already impacting us. While some fear AI will eliminate jobs, I see a different future. AI will certainly automate entry-level transactional jobs, but it will also create a wealth of new roles centered in oversight, ethics, and system integrity. By moving away from boring, repetitive work, we are being pushed into more interesting, high-value consulting work. We aren't being replaced; we are being promoted.

We are at a crossroads where our traditional expertise meets a new era of technology and branding. The UACPA is committed to being the voice that guides this transition, protecting your license through advocacy, shifting the public perception of what we do, and preparing our members for a tech-forward future. It has been an honor to serve this year, and I am more confident than ever that the best days of the CPA profession are still ahead of us. n

Aswe turn the calendar and move into 2026, there is a familiar rhythm many of us are feeling. Regardless of where we practice or the type of work we do, CPAs across Utah have entered another busy season. This time of year is demanding, fast-paced, and critical for our clients and employers, as well as the broader public trust our profession upholds. It is also a reminder of the shared responsibility we carry as licensed professionals.

At the UACPA, busy season is equally active, though in a different way. One of our priorities this year is supporting the future of the profession, and we are excited to announce that the UACPA has launched a new member category designed specifically for CPA candidates. This category reflects our commitment to meeting aspiring CPAs where they are by providing access, community, and resources earlier in their journey while reinforcing the value and rigor of licensure. Supporting candidates today strengthens the profession tomorrow.

We are also heading into the 2026 legislative session; it promises to be a consequential one. Members can expect regular updates on tax policy discussions, particularly as they relate to the Big Beautiful Bill and its downstream implications. We will also be closely monitoring the Division of Professional Licensing (DOPL) ombudsman bill, which is expected to include technical corrections that matter to licensed professions, including our CPA profession. In addition, artificial intelligence continues to be a major focus for lawmakers, alongside energy and housing legislation that will shape Utah’s economic landscape. The UACPA will remain actively engaged advocating, educating, and ensuring the CPA voice is present and informed throughout the session. Watch for our weekly updates during session!

One of the most significant initiatives you will see from the UACPA this year is the rollout of our CPA image campaign. This campaign stands for a strategic, long-term effort to protect and elevate the CPA brand in Utah. Research confirms what many of us already know: While CPAs are highly trusted, our role is often misunderstood or narrowly

defined. The image campaign is designed to change that narrative by clearly communicating that CPAs are not just number crunchers or seasonal service providers, but essential financial navigators, strategic partners, and stewards of public trust.

The campaign will speak to multiple audiences: the general public, CPAs, business leaders, legislators and students. The purpose is to reinforce why licensure matters and why the CPA designation remains vital in an era of rapid technological and regulatory change. Just as importantly, it will empower CPAs to take pride in their role and confidently articulate their value.

This effort cannot succeed without you. A core part of the campaign will rely on members being willing to share their stories; what do you love about your work, why did you choose this profession, and how are you making a difference for your clients, organizations, and communities? By telling your story, you help humanize the profession.

As we navigate busy season, legislative developments, and the launch of the CPA image campaign, we thank you for the professionalism, resilience, and integrity you bring to your work every day. The UACPA is proud to serve you, and even more proud to stand alongside you as we shape the future of the profession together. n

You’ve put in the hours, earned the degree, and set your sights on the ultimate goal: the CPA license. But right now, you feel like you’re in limbo. You are no longer a student, but you haven’t quite crossed that finish line yet. Now you find yourself in the season of late-night study sessions, building your work experience hours, all while balancing the pressure of the Exam. That is why the UACPA is proud to announce the launch of our newest membership category designed exclusively for you: The CPA Candidate Membership.

We saw the gap when we recognized our student members have robust support on campus, and our fellow members enjoy established career networks. Aspiring CPAs have a need for study partners, meaningful mentors, and a commiseration crew.

With this new membership category, we are dedicated to addressing the hurdles and providing a toolkit for success. Some perks of this membership category include

• Exam Prep Support. We have partnered with industry leaders to ensure you have the tools for studying at the best rates.

• Mentorship. Let us find the mentor that can guide you on everything from study schedules to firm culture. We are offering Mentor Mondays on a quarterly basis, and you can bring your questions about careers and exams or just listen in to learn about where others are facing challenges.

• Networking that Fits Your Career Stage. Relationships are critical as you build a network that can cheer you on in your career.

When selecting membership, you will select "Affiliate," then "CPA Candidate"

Membership is $55

• Emerging Professional Events. The learning never ends, but it's better with friends. Attend quarterly Emerging Professionals events to connect, learn and grow.

• Career Advocacy and Resources. The accounting profession is moving fast. AI, regulatory changes, and new standards are constantly reshaping the landscape. As a member, you get a front-row seat to these changes. Our publications, newsletters, and town halls keep you informed so you can impress your employers with up-to-date industry knowledge.

This membership connects you to a professional network while focusing on your needs and champions your success. This in-between phase doesn't need to be a time of isolation.

As we roll out this membership category, we want to introduce you to some aspiring CPAs using the UACPA's toolkit.

Status: Graduated with a bachelor's from the University of Utah and now working on his master's Internships: Haynie & Company (Summer 2024); Deloitte (Summer 2026)

Jonathan Chan's path was originally aligned with chemical engineering, but after exploring various business fields and finding inspiration in his professor, Marci Butterfield, CPA, he found excitement in accounting. Now in his master’s program, Jonathan plans on going into tax accounting.

Chan recognizes that the CPA Exam requires a disciplined strategy. To balance his studies with his graduate program and work, he utilizes time blocking. By carving out non-negotiable hours in his calendar, he ensures that Exam prep remains a top priority, even when it means sacrificing extracurricular fulfillment or social time.

Chan has established a technique for preparing for the Exam. 1) Becker CPA Review: Utilizing textbooks and online modules; 2) Collaborative learning and leveraging the motivation of in-person interactions; 3) Utilizing career coaches and faculty for interviewing tips and industry insights.

Between work and studies, Chan expands his network by volunteering with the University of Utah's Beta Alpha Psi chapter and VITA programs.

When he isn’t grinding through task-based simulations, Chan maintains his "social battery" through physical outlets like pickleball and scuba diving (he recently explored the waters of Taiwan). As he moves toward his goals, his advice to others is to remain curious and never hesitate to ask mentors for guidance on time management and workplace navigation.

Status: Working on his Master's of Accountancy at Utah Tech University Work: Accountant at Hurst Ace Hardware in St. George

Jaden Robinson's path to accounting began in Mexico. While serving a full-time mission, Robinson was tasked with mission bookkeeping, an experience that turned into a lifelong passion. Now set to graduate in May 2026, Robinson is navigating the final stretch toward becoming a licensed CPA.

As Jaden studies for the CPA Exam, he maintains his mental stamina by rejecting the long study sessions in favor of intentional time blocking. By scheduling one or two hours of deep work followed by something active or fun, he keeps his brain engaged and prevents burnout.

His preparation relies on a mix of technical and social resources: 1) Becker Software: Utilizing practice questions to build technical proficiency. 2) Engaging with a study group of fellow master's students. 3) Mentorship and "emotional support" of experienced CPAs like his boss, Dale Knuckles, and family friend Shawn Gubler, CPA, who help him balance his goals with life.

To contrast the hours spent at a desk, Jaden turns to rock climbing. Living in Southern Utah provides the perfect backdrop for this hobby, which he uses to expend energy and stay mentally active.

As he prepares for his own licensure, Jaden believes the firsthand stories of licensed professionals who share the tangible rewards of client trust and job recognition are the ultimate motivators for students who may feel stuck in the complicated process of exam scheduling and study.

JONATHAN LISHENKO

Status: Graduating with a MAcc from Utah Valley University in May 2026

Not all CPAs go from the classroom to a Big Four firm. For Jonathan Lishenko, the path has been paved with blue-collar grit, heavy machinery, and a love for playing the violin.

Jonathan's transition to accounting wasn’t an overnight epiphany but a slow realization born from practical experience. While working as a parts manager for Penske, he found himself drawn to the "backend" of the business — reconciling inventory, managing entry adjustments, and using data analytics to optimize stock levels. However, he soon realized his skills lacked portability without a formal degree. This led him to an ambitious dual major in civil engineering and accounting.

Growing up on a ranch, Jonathan loved building tangible structures like irrigation systems and hay-sheds. Yet, a parttime role in Salt Lake Community College’s (SLCC) controller department ultimately tipped the scales. “I loved the work, culture, and the team,” Jonathan recalls. “Accounting won.”

He traded building physical bridges for building businesses, viewing his future CPA license as a way to drive the global economy.

When it comes to taking the CPA Exam, Jonathan has the precision of the engineer he once planned to be. Utilizing Becker’s CPA Review, he has structured a rigorous timeline: AUD in February, ISC in April, FAR in August, and REG in November.

To maintain his study hours, Jonathan applies techniques from his management control systems coursework to his personal life and uses his passion for music, specifically playing the piano and violin, as a performance-based incentive. He breaks down his time with 1) The 80% Rule: If he hits an 80% score on Becker’s submodule MCQs on the first try, he is rewarded with his full two-and-a-half-hour music practice time; and 2) The Opportunity Cost: A lower score reduces his practice time, redirecting those hours back into the books.

This discipline is necessary to overcome significant hurdles, including a three-and-a-half-hour daily commute on public transit that eats into his sleep and social opportunities.

Despite his focus, Jonathan acknowledges that the journey can be isolating. It sometimes comes up with his family of blue-collar workers who ask, "Why do you want to do taxes?" He explains accounting through familiar metaphors, likening the UACPA to local and national unions.

As he looks toward the future, Jonathan is eager to find a mentor who can provide more than just milestone checkoffs. He seeks real-world "working stories" that can turn complex, abstract concepts into memorable narratives.

With the support of the PCAOB scholarship, Beta Alpha Psi, and the faculty at UVU, Jonathan is proving that a background in building fences is the perfect foundation for a career in building financial integrity.

Status: Graduated with her bachelor's from Utah Valley University in December 2025.

Internships: Currently an intern at RSM

For Maddi Larsen, the path to becoming a CPA was influenced by a desire for flexibility and a transparent look at the profession from her own family. Initially considering dental hygiene, Maddi pivoted to business after realizing she wanted a career that offered diverse opportunities rather than the same routine every day.

Maddi was inspired by a professor who shared the wide variety of roles available to accountants.

"Every company needs an accountant, and there's so much flexibility," she noted, citing options from public accounting and travel opportunities to private bookkeeping and tax. Despite growing up in a house of tax accountants and remembering the stress of April deadlines, she realized that the trade-off of heavy work for four months in exchange for significant time off in the summer was a lifestyle she valued.

Maddi is currently navigating the transition from student to professional with a clear strategy: 1) Internships: She is currently a tax intern at RSM. 2) CPA Exam Strategy: Her goal is to pass one exam this summer and complete the rest within a year while pursuing her master’s degree. 3) Mentorship: While she feels supported by her family and professors, Madeline seeks to connect with recent Examtakers about their balancing acts between full-time work and studying.

When she isn't focused on tax boxes, Maddi recharges through shopping, thrifting, skiing, and traveling — hobbies that provide a vibrant counterpoint to the analytical world of accounting.

Status: Graduated with a master's from Utah Valley University in May 2025

Work: Tax associate at CLA

For Braden Morrison, becoming a CPA wasn't just about passing a test, it was about mastering a "hard skill" that offers a distinct professional identity. Originally leaning toward marketing, Braden desire to become a CPA was sparked through a required accounting course taught by Spencer Brown, a CPA whose lifestyle and expertise inspired him to pivot his career path.

Braden achieved the impressive feat of passing all sections of the CPA Exam on his first try while simultaneously completing his master's degree. His secret was a strategy he calls "dual reinforcement." His success came from 1) Synchronized Study: He aligned his Exam sections with his university coursework, for example, taking the audit exam while in an audit class. 2) Audio Immersion: While working at a small firm in South Jordan, he would listen to Exam review courses (utilizing Becker and UWorld) during the day and then attend in-person night classes at UVU. 3) Workplace Support: His firm encouraged his progress by providing paid study hours, a luxury that allowed him to maintain momentum during busy seasons.

Now working at CliftonLarsonAllen (CLA) as a tax associate, Braden remains focused on networking and mentorship. His criteria for a mentor goes beyond technical advice. He seeks professionals whose "lifestyle at home" aligns with his personal values, emphasizing that a career path must support family time to be truly successful. By combining academic rigor with a clear set of personal priorities, Braden is stepping into the profession as a well-rounded emerging leader.

Status: Graduated with a master's degree from Southern Utah University in 2025; Became a CPA in January 2026 Work: Audit staff associate at Tanner

The CPA journey can be a marathon, but Zach Reimann, an audit staff associate at Tanner, it was a sprint fueled by radical prioritization. Zach’s path to accounting began when he realized physical therapy wasn't his calling. After talking with a neighborhood mentor from Zions Bank, he realized the way his brain functioned was a perfect match for the accounting profession. Zach was able to pass all four sections of the CPA Exam before even graduating from his master's program. His secret was a "CPA-first" mindset. "I don't know if my professors would like to hear this, but I prioritized the CPA exams over school," Zach admits. Each morning, his first task was Exam prep, viewing it as a long-term investment that would pay dividends in his career.

Zach tackled the Exam with a robust toolkit. 1) Becker CPA's full suite of videos, simulations, and multiple-choice questions. 2) Strategic Resting: He scheduled exams for Mondays, taking the weekend off beforehand to recharge and distract himself from the stress. 3) Peer Mentorship: He followed a friend’s proven method of tackling one section per week followed by a ten-day intensive review.

Zach finds parallels in accounting to his favorite hobby: soccer. He says that just as a soccer player must use creativity to make an unexpected pass, an accountant must use judgment and creativity to navigate the "gray areas" of the field.

Now facing his first busy season, Zach’s focus has shifted from passing exams to professional survival.

Status: Currently enrolled at Ensign College Internships: Currently interviewing

While many students wait until their senior year to begin networking, Dylan Meyer is already laying the groundwork for a successful career as a CPA. Having discovered a passion for the field during an introductory class at BYU-Idaho, Meyer realized he didn't mind the "tedious" work because of its fundamental importance in helping businesses run smoothly.

Dylan's approach is centered on becoming a "fundamental" part of a business’s success. He has some time to take the Exam, but he has his plan laid out. 1) Securing Internships: He has already applied for a 2027 internship. 2) Prioritizing Certification: Meyer plans to pursue his CPA license potentially before his master’s degree, believing that becoming certified first will propel his career faster and provide better financial stability for future education. 3) Early Involvement: By attending professional conferences now, he is building the connections necessary to gain a "leg up" in future interviews.

One of Dylan’s primary goals is to transition from a student to a professional who understands the complex "jargon" of highlevel accounting. He views mentorship as a critical tool for this acceleration. His question for a future mentor revolve around career survival and how to bridge the gap between entry-level knowledge and the sophisticated discussions held in executive meetings.

Outside of the classroom, Dylan is a passionate runner and views physical activity as a necessary routine to maintain the mental and physical stamina required for the profession. By starting his professional journey early, Meyer is ensuring he doesn't miss out on the resources and opportunities essential for long-term CPA success.

Status: Graduating with a MAcc from the University of Utah May 2026 Internships/Work: Currently working at Eide Bailly as a tax associate; has previously interned with PwC

As the daughter of a medical school professor, Mariana Yukari's believed she may follow the family path toward dermatology. However her high school aptitude tests consistently flagged "accounting" as her ideal match.

Mariana's growing curiosity about accounting peaked when Elizabeth Holmes and the Theranos scandal showed the forensic power of financial statements. Watching the fallout of the multi-billion-dollar deception made her realize that "accountants were not just record-keepers; they were the guardians of truth in business," she says. "That realization sealed my fate."

While the Brazil native is in her master's program at the University of Utah, she has a three-pillar approach, built on discipline for taking the CPA Exam. 1) Consistency: She prefers doing a manageable amount of studying every day rather than cramming; 2) Sanity Checks: To avoid burnout, she maintains a consistent Pilates routine and finds solace in "heated workouts" in the sauna, where the only number on her mind is 125°F; 3) Modern Tools: Beyond the standard Becker Review, Mariana uses ChatGPT’s voice feature to work through complex problems while walking, allowing her to learn without being tethered to a screen. Mariana has additional support from her cuddly cat when she studies at home.

With her first exam in January, right before she gets into the thick of tax season, Mariana says the remaining exams will come after graduation. "I want to be realistic and give myself time and energy on finishing out school and allow myself to slow down after April 15."

Her path to becoming a CPA has come with sacrifices, including leaving her life behind in Brazil to work in America. The commitment to her full-time work and

school has forced her to miss birthdays, holidays, and even funerals to stay on track with her goals. Despite these hardships, she remains steadfast, viewing the pursuit as inherently worthwhile.

Mariana acknowledges that there is a social stigma that accounting is "boring." She has frequently been told she is "wasting her personality" on the profession. She strongly disagrees, finding the field engaging, impactful, and far more interesting than portrayed in pop culture.

As an international professional, she looks forward to finding a mentor who can help her navigate the nuances of American corporate culture and professional norms. "I'd really appreciate guidance on expectations, communications, and professional norms." n

ACCOUNTING STUDENTS

72

727

These numbers come from the AICPA, Journal of Accountancy and CPA Trendlines.

267,278

UNDERGRADUATE ACCOUNTING ENROLLMENT IN THE U.S. (A 12% INCREASE YEAR-OVER-YEAR)

12

PERCENTAGE OF ALL BUSINESS MAJORS WHO ARE ACCOUNTING STUDENTS

24

PERCENTAGE OF GROWTH IN ACCOUNTING ENROLLMENT AT TWO-YEAR COMMUNITY COLLEGES

PERCENTAGE OF MASTER'S IN ACCOUNTING PROGRAMS THAT REPORTED AN INCREASE IN APPLICATIONS FOR 2024 - 2025

NUMBER OF ACCOUNTING DEGREES FROM UTAH VALLEY UNIVERSITY, WHICH SAW A MASSIVE 67% GROWTH IN GRADUATES RECENTLY

BY JIM DELUCCIA

Reprinted with permission from the Pennsylvania CPA Journal, a publication of the Pennsylvania Institute of Certified Public Accountants.

F or some of life’s most difficult questions — How do I find a new job? How do I win new business? How do I become an organization or community leader? — there is actually a simple answer: networking.

Yes, networking is about building and maintaining relationships with people in your personal and professional life, but it is all about reciprocity. You need to be able to help the people in your network just as much as you’re hoping they can help you. It involves sharing helpful information, collaborating on projects, and offering support. A network is the foundation of a successful career

and fulfilling life, but successful networking demands intention and attention.

Networking is a commitment. Period. Just like exercise, it has to be part of your everyday life to get the most out of it.

Build a list of at least 50 people who can help you grow professionally, expand your reach, and provide value. Be sure you can return the favor. Start with who you know: colleagues, classmates, former managers and clients, and friends. Ideally, your list should be a blend of strategic

contacts who have relationship-building potential.

There’s no need to cap your list specifically at 50, but there should be a limit. Keep your list to those people you can develop deep, meaningful relationships with. A massive network loaded with superficial connections will become cumbersome to manage and likely won’t be helpful.

Aim for a certain number of calls, emails, and text messages per day and meetings per week. Focus on activity — not specifically on finding a new job, client, or business opportunity. The more you’re proactive, the more meaningful and productive interactions you’re likely to have.

Goals should be aggressive, but attainable. Take a small amount of time to evaluate your progress and identify what’s working and what needs improvement.

Forming or rekindling connections within your network takes thoughtfulness and curiosity. You have to bring value to get the most out of your network; or, more succinctly, you have to give to get. You can’t expect your contacts to have a job or a new business opportunity upon first outreach. In fact, asking for something straight away may quickly shut down the conversation. In your outreach or conversations, make the focus about them.

Be curious and ask open-ended questions. People love to share their personal stories, and this often leads to valuable insight or connections.

Take a genuine interest in the issues your contacts are dealing with and determine how you can be helpful and add value. You might have an article to share, a connection to introduce them to, or an event to recommend. Even a suggestion that seems insignificant on the surface could make a lasting impression on someone. Take notes on your conversations so you have a reason to follow up.

Being thoughtful doesn’t have to wait until a conversation starts. Research contacts ahead of your outreach and proactively determine how you might be helpful. Find out if they’ve recently posted an update to their career or personal life on LinkedIn or Facebook.

Explore and join associations that meet regularly and host events, such as professional organizations, chambers of commerce, or university alumni networks.

If you’re passionate about a particular cause or initiative, volunteer for a nonprofit organization. The organization and its constituents benefit from your help and expertise, and you expand your network by mingling with other business and community leaders. Joining a nonprofit board is often a great stepping stone to for-profit board seats in the future.

Try to attend at least one networking event per month and take the same disciplined approach to these events as you would when building your network. For instance, review a list of attendees in advance and target 3–5 people you would like to meet. Research these targets to understand their roles, industries, and organizations. Stand near a hightrafficked area and introduce yourself. Fortunately, you likely won’t have to do all the talking. According to Jerry Maginnis, CPA, author of Advice for a Successful Career in the Accounting Profession, “You can stop talking and invariably people will start to carry the conversation.”

Many of us are good at meeting people, but we don’t always do a great job of maintaining relationships once formed. The follow-up is often more important than the initial meeting. Thank you notes are a personal and memorable touch. Be sure to cite a personal connection from the conversation in the message. Set up calendar reminders at intervals you’re comfortable with so you don’t lose touch with the connections who matter to you.

Successful professionals understand that building and nurturing relationships is an ongoing commitment rooted in authenticity, curiosity, generosity, and thoughtfulness. Whether you are navigating a career transition or seeking new business, your network can open doors that résumés and cold calls never will. n

Jim DeLuccia is director of operations and market research at Attolon Partners in Philadelphia. He can be reached at jdeluccia@attolon.com.

BY CRAIG AND RYAN PETERSON

The final quarter of the legislative interim was notably quieter than in recent years. While interim meetings continued across the usual committees and task forces, there were relatively few major policy initiatives advanced or resolved during this period. Much of the interim functioned as a holding pattern, with lawmakers receiving briefings, reviewing agency reports, and laying groundwork rather than actively pushing significant legislative changes forward.

That relative calm, however, did not mean the absence of high-profile issues. Public attention during the interim was largely dominated by the ongoing legal dispute surrounding Proposition 4 and the broader redistricting process. The resulting tension between the legislative and judicial branches became a recurring theme in media coverage, even though it was not the primary focus of most interim committee agendas. While the issue itself did not generate extensive interim legislation, it set the stage for what is likely to be a highly visible debate during the upcoming general session.

Another dynamic worth noting as the Legislature heads into the session is the growing number of announced retirements. Several lawmakers, in both the House and the Senate, have indicated they will not seek reelection. While this does not immediately change committee assignments or leadership structure, it can subtly influence how legislation is negotiated and how leadership approaches certain policy decisions. “Lame duck” legislators often have more latitude in how they vote, while leadership may weigh differently how much political capital to invest in members who will not be returning. These dynamics are not always visible from the outside, but they can meaningfully affect how legislation moves — or does not — during a session.

At the same time, broader movements in national politics may have downstream effects in Utah. Changes in voter engagement and turnout can alter the political landscape, particularly in districts currently held by Republican lawmakers with relatively narrow margins. While Utah remains a reliably conservative state, even modest shifts in turnout can impact close races and influence how lawmakers think about both policy priorities and messaging.

As the Legislature convenes for the 2026 General Session beginning Tuesday, Jan. 20, it is widely anticipated that bills dealing with the judiciary will be introduced and receive significant scrutiny. These proposals are expected to attract substantial media attention and could shape the overall tone of the session, even for legislators and stakeholders not directly involved in judicial policy.

Beyond those structural and constitutional questions, several substantive policy areas are expected to command attention. Affordable housing continues to be a major concern across the state, and lawmakers are expected to consider multiple approaches aimed at increasing supply, reducing costs, or adjusting regulatory barriers. Property tax policy is also likely to be in focus, particularly as lawmakers balance constituent pressure with local government revenue needs.

Water issues are expected to reemerge prominently this session as well. Utah’s unusually slow start to winter, coupled with abysmal early snowfall totals, has renewed concerns about long-term water supply and drought resilience. In addition, ongoing discussions about the health of the Great Salt Lake are likely to generate proposed legislation addressing conservation, water rights, and potential mitigation strategies. While many of these discussions have occurred in previous

sessions, current conditions may add urgency and political momentum to the conversation.

From a CPA perspective, several areas will be closely monitored throughout the session. Issues related to CPA education and licensure remain a priority, particularly as the profession continues to grapple with pipeline challenges and evolving national standards. Any proposed changes in this area will be evaluated to ensure they support the profession while maintaining appropriate safeguards and public trust.

As always, the Utah State Tax Commission and the work of the Revenue and Taxation committees will be of particular interest to CPAs. Even in sessions without sweeping tax reform, incremental changes, administrative adjustments, and technical corrections can have meaningful impacts on practitioners and their clients. Monitoring these developments early and consistently remains essential.

While the interim itself may have been quieter than usual, the upcoming session shows signs of being both busy and complex. High-profile institutional issues, combined with ongoing economic and environmental challenges, are likely to keep lawmakers engaged across a wide range of topics.

Peterson Consulting Group is honored to represent Utah’s CPAs on Capitol Hill and remains committed to working closely with Susan Speirs, CPA, and the UACPA as issues arise throughout the legislative session. n

Ryan Peterson is the managing partner of Peterson Consulting Group. He has been a contract lobbyist in the state of Utah for 12 years. He received a degree in economics from the University of Utah with a focus on statistics and econometrics. He is an avid golfer and resides in Salt Lake City.

Craig Peterson, senior partner of Peterson Consulting Group, has been involved in legislative processes for almost 40 years as a State Representative, State Senator, and Republican Senate Majority Leader. During the past 20 years, he has been a lobbyist, successfully representing a broad spectrum of clients.

BY TINA CANNON, UTAH STATE AUDITOR

The Office of the Utah State Auditor works to strengthen public trust in government by promoting accountability, transparency, and responsible stewardship of taxpayer resources. Over the past year, the Office has demonstrated the value of its independent authority and professional expertise through significant accomplishments across its five divisions: IT and Data Analytics, State and Local Government, State Privacy Auditor, Special Projects, and Financial Audit. Together, these efforts have helped safeguard billions of public dollars, improved governance practices statewide, and provided Utahns with clearer insight into how their government operates.

A cornerstone of the Office’s effectiveness is its independence. Independence allows the Office of the Utah State Auditor to initiate routine audits, conduct compliance reviews, and engage in special purpose audits on its own authority. This proactive approach enables the Office to examine public entities across the state before problems become entrenched, ensuring state statutes are followed and systemic risks are identified and addressed early.

In the past year alone, the Office identified millions of dollars that were misused or at risk of misuse, reinforcing the importance of independent oversight. These efforts not only protect public funds but also advance transparency and accountability by making information about government operations accessible and understandable to the public. Transparency and accountability, at their core, are crucial to portray an accurate picture of what government is doing and why — an essential foundation for strong and effective governance.

The IT and Data Analytics Division supports all of the Office’s work as its technology backbone and innovation engine. In response to a legislative request, the team partnered with the State Treasurer’s Office to develop a Cash and Cash Equivalents dashboard that aggregates data from multiple sources into a single platform, enabling long-term trend analysis across entity types and enhancing transparency, comparability, and risk assessment. The division also supports audit staff, governs protected and public data, and develops digital tools that improve transparency and efficiency.

Over the past year, the team created or updated 15 online resources to expand public access to information on state programs and spending, transformed complex datasets into clear visualizations, and advanced the use of data science, machine learning, and artificial intelligence; laying the groundwork for a searchable Annual Comprehensive Financial Report (ACFR). Through strong data engineering and database management, the division ensures information is secure, reliable, and accessible for informed decision-making.

The State and Local Government Division saw an 18% increase in report submissions compared to 2024, reflecting the growing number of government entities under the Office’s oversight. Despite the increase, the division met its review goals of 30 days for budgets and 60 days for all other reports. Timely reviews help ensure governing bodies are not making

decisions based on incomplete or inaccurate financial information.

The division strengthened education and compliance by providing board member and open meeting training to nearly 2,000 individuals. Additionally, the division issued five auditor alerts addressing financial reporting, transparency, and the use of peer-to-peer payment applications. Looking ahead, the division will continue to work with the legislature and local governments to clarify component unit reporting requirements and improve online reporting and training systems.

Last year was a transformative year for the State Privacy Auditor Division following a statutory transition that expanded the role from State Privacy Officer to State Privacy Auditor and broadened its jurisdiction to include both state and local entities. This change strengthened independence by separating training functions from oversight and audit responsibilities.

During the year, the division completed 11 privacy health checks, which found that most reviewed entities operated at an ad hoc or nonexistent level of privacy maturity. The team also supported 24 Privacy Impact Assessments, helping entities identify and reduce risks related to data collection, retention, and emerging technologies such as generative artificial intelligence.

In addition, the division issued seven public privacy alerts on topics including AI-enabled scams and biometric data. To evaluate publicly accessible privacy risks, the division conducted a statewide review of 1,614 governmental websites to assess the collection, use, and disclosure of personal information.

The Special Projects Division (SPD) provided critical investigative oversight through its hotline program, which serves as a key mechanism for identifying potential statutory non-compliance, as well as investigating fraud and misuse of public resources. In 2025, the division experienced an 89% increase in hotline activity compared to the prior year, reflecting expanded knowledge of the reporting process. The division managed the increased volume while maintaining effective case resolution.

Hotline matters resulted in formal written reports with findings and recommendations, verbal recommendations to governing bodies, and referrals to other entities better positioned to address specific concerns. The hotline program strengthens accountability by helping ensure government entities respond to concerns raised by the constituents they serve.

The Financial Audit Division continued to provide assurance over the state’s most complex and high-risk financial activities. During 2025, the division released 38 audit reports, with an additional 21 audits in progress by December 31, 2025. Among its most significant responsibilities are the audits of the State of Utah’s Annual Comprehensive Financial Report (ACFR) and the federally required Single Audit. The fiscal year 2025 ACFR audit covered $58.1 billion in revenues and $48.5 billion in expenditures, reflecting continued growth and complexity in state operations. The Single Audit evaluated $9.0 billion in federal awards, testing 18 major federal programs that accounted for more than 60% of total federal expenditures. In addition, the division conducted audits and agreed-upon procedures for numerous colleges, universities, technical colleges, and state entities, providing critical transparency and accountability across higher education and other sectors.

Taken together, these accomplishments underscore the Office of the Utah State Auditor’s commitment to independence, transparency, and accountability. By proactively examining government operations, educating public officials, leveraging advanced technology, and providing clear, objective reporting, the Office continues to strengthen public confidence and ensure that Utah’s government serves its citizens with integrity and responsibility.

Looking forward, there is even more great work to happen in 2026! n

Tina M. Cannon serves as Utah’s 26th State Auditor. She is a graduate of Utah State University’s School of Accountancy at the Jon M. Huntsman School of Business. She holds the historic distinction of being the first woman elected Utah State Auditor and the first independently elected Republican woman to any statewide office in Utah.

BY DJ DORFF

Succession is one of the most consequential strategic decisions an accounting firm owner will face. Yet in many firms, it exists only as a loosely defined idea rather than a clear and motivating path forward. Most firms have an informal sense of how leadership might transition “someday” but have not had to pressure-test those ideas against financial realities and complicated people dynamics.

In practice, succession is not a single event. It’s a multiyear process that affects firm value, client continuity, staff retention, and an owner’s personal financial security. Treating it as a distant milestone rather than a present-day strategy often limits options when they’re needed most.

The firms that navigate succession most effectively tend to start earlier than feels necessary and evaluate their choices more broadly than tradition alone would suggest.

Many owners associate succession planning with retirement. That framing alone can delay action. In reality, the purpose of succession planning is broader: It protects the firm, its people, and its clients under a wide range of circumstances.

Leadership transitions are often accelerated by factors outside an owner’s control. Health issues, family considerations, disability, or even sudden loss can force decisions to be made quickly. In those moments, firms without a defined plan are forced into reactive decisions rather than intentional ones.

Even absent unforeseen events, there are practical reasons why succession deserves attention well before an exit, including:

• Client relationships concentrated in one or two partners

• Decision-making centralized at the top

• Challenges recruiting, developing, or retaining future leaders

• Unclear or unaffordable ownership pathways for the next generation of leaders

These are not signs of poor management. They are signs of a firm that has reached a stage where long-term continuity requires deliberate design.

For many owners, internal succession feels like the most natural solution. Transferring ownership to junior partners or next-generation leaders can preserve culture, protect client relationships, and maintain institutional knowledge.

When it works, it can work quite well.

Where these plans often struggle, however, is less about commitment to the idea and more about structure and execution. Common issues and limitations include:

• Capital requirements: Internal buyers often lack the financial resources needed to fund a buyout without placing significant strain on the firm.

• Risk tolerance: The next generation is often less

willing to assume personal guarantees or long-term debt.

• Timeline mismatch: Senior partners value certainty and liquidity, while junior partners tend to prioritize flexibility and a gradual transition.

Without addressing these constraints early, internal plans can stall or collapse when the time comes to act.

As internal succession has become more challenging, traditional private equity has emerged as a visible alternative in the accounting profession. For some firms, this path can be a solid fit as it provides liquidity, operational resources, and opportunities for scale that may otherwise be difficult to achieve independently.

However, traditional private equity is a specific ownership model with a specific set of incentives and tradeoffs.

Shorter investment horizons can introduce pressure to prioritize near-term growth over long-term stability. Centralized decision-making may reduce local autonomy. Cultural alignment issues sometimes surface after a transaction closes rather than during diligence.

These outcomes are not universal or inevitable, but they are common enough that firm owners should evaluate them carefully rather than assuming all external capital produces the same result.

One of the most limiting assumptions in succession planning is the idea that selling a firm necessarily means giving it up.

Today, accounting firm owners have access to a wider range of ownership structures than in the past, including:

• Internal transitions supported by external financing

• Strategic mergers with culturally aligned peer firms

• Entrepreneurial buyers with long-term operating intent

• Holding companies designed for long-term ownership and growth rather than an exit on a fixed timeline

Each approach allocates control, liquidity, risk, and decisionmaking differently. The right structure depends on the owner’s goals, the firm’s stage of development, and the expectations of

its future leaders.

The key distinction is intent. Some buyers optimize for exit. Others optimize for durability.

Understanding that difference allows owners to match their succession strategy to the future they actually want as opposed to the one that seems most familiar.

Regardless of the path a firm ultimately chooses, effective succession planning tends to share a few common traits:

• It begins early, while options are still available.

• It considers people dynamics as much as financial outcomes.

• It reduces concentration risk gradually rather than all at once.

• It creates clarity for staff and confidence for clients.

Most importantly, it treats succession as a strategic responsibility, not merely a personal milestone.

Firms that approach succession this way tend to make better decisions, preserve more value, and experience smoother transitions, whether ownership changes or not.

The most useful question for firm owners is not whether they should sell.

It is whether their current structure supports the future they envision for their firm, their people, and their clients.

Done well, succession planning does not force an outcome. It creates optionality. And in a profession built around managing risk, optionality may be one of the most valuable assets a firm can have. n

DJ Dorff is the founder and CEO of Baysora, a long-term holding company focused on building a family of best-in-class tax and accounting firms. Prior to founding Baysora, DJ served as a portfolio CEO at Alpine Investors, where he helped acquire and lead 23 companies in the IT and cybersecurity sector.

Here are nine of the most significant employee benefits trends shaping 2026

Healthcare costs are expected to climb in 2026 —reflecting growing pressure from medical inflation, specialty drug spending, and higher utilization as employees return to care they may have delayed. It can be challenging to maintain competitive coverage without shifting more costs to employees.

These days, employee benefits geared toward health and well-being go well beyond a health insurance plan. The interconnectedness between physical health, mental well-being, and financial wellness is driving employers to offer total health benefits that foster an emotionally, socially, and financially fit workforce.

Employers are expanding women’s health benefits to support every stage of life, from fertility and pregnancy through menopause and beyond. This shift isn’t just about equity. It’s about performance, productivity, and retention. Healthier women mean fewer lost workdays, greater participation, and stronger household income — all of which drive economic growth. For employers, that translates into a more stable, engaged, and loyal workforce.

Artificial intelligence is transforming how businesses deliver employee benefits. Modern benefits platforms use predictive analytics and chatbots to help employees select the right plans, track utilization, and receive real-time support. Mobilefirst access allows workers manage their benefits anytime — improving engagement and transparency. With digital platforms, employees can build packages that fit their lifestyle, health priorities, and financial goals.

In 2026, mental health is no longer an optional perk — it’s a core part of every employee benefits strategy. Employers are integrating behavioral health into their medical plans and daily culture, recognizing that employee well-being directly drives engagement and productivity.

Caring for children or elderly dependents often brings financial and emotional strain. As sandwich-generation pressures increase, employers are expanding family benefits beyond parental leave to include eldercare support, flexible scheduling, and resources for diverse family structures.

Employers are refining benefits to support both remote and on-site employees equitably. The focus for 2026 is on access, flexibility, and meaningful in-office experiences rather than revisiting the remote-versus-office debate.

Financial stress is an obstacle to employees' focus and productivity. Benefits that address immediate and long-term financial needs can help employees build stability and confidence.

Employees want to grow with the organizations they join — and they’re choosing employers who invest in their development. Professional development benefits signal that an organization values growth, learning, and long-term career potential. This is especially meaningful for employees who see skill-building as essential to career advancement.

A well-crafted benefits strategy remains one of the strongest tools for attracting and retaining a multigenerational workforce. In 2026, employers who integrate flexibility, personalization, and financial well-being into their programs will stand out in an increasingly competitive market.

Just like a good peanut butter and jelly sandwich, insurance and risk management work better together.

When you purchase CAMICO’s Accountants Professional Liability insurance , you are not just insuring your business. You also have access to CPA-focused risk management services and resources — such as unlimited guidance from in-house specialists, education and training, an online library of loss prevention resources (sample letters, articles, archived issues of CAMICO’s newsletter, alerts, and much more), and proactive claims support. With more than 39 years of experience protecting CPAs there is very little that CAMICO’s team of experts hasn’t seen. Visit www.camico.com to learn more.

What CPAs say about CAMICO.

Harris Hauptman Senior Account Executive

Congratulations to the following individuals who were approved for membership in the UACPA as of Dec. 31, 2025.

Matt Bartholomew CLA

Spencer Bishop Deloitte

Danior Martin Deseret Trust Company

Mathan Jackson Eide Bailly, LLP

Julianne DeSantis

Miranda P. Tholen

Ryan Stewart Haynie & Company

Chad Stewart Holthouse Carlin & Van Trigt (HCVT)

Tim Marvin Incite Tax

Rhett M. Haney Larson & Company, PC

Darin S. Mackintosh Nilson Homes

Heather D. Isaac PricewaterhouseCoopers

Kevin Reardon

RSM US LLP

TJ D. Gadd

Kateryna Pavlenko

Aaron D. Wheelwright

Tanner LLC

Alejandro Platas

Teuscher Walpole, LLC

Marit V. Burmood

Jacob Holt

Richard G. Ray

Emily A. Riner

Hyrum Andre Tirado Leon

Brigham Young University

Ganbaatar Ulziiduuren

Tyler Bennett

Ensign College

Ethan Brown

Olivia Jaime Obregon

Angela L. Marin Giraldo

Tyler North

Laila C. Jones

Geisa Reis

Dylan T. Meyer

Green River College

Cade M. Burke

Southern Utah University

Alexander D. Salt

Kiersti Fiedel

Carson Sawyer

Kanyon J. Gardner

University of Illinois UC

Caitlin Hamilton

University of Utah

Maria F. Sosa

Shulina J. Schnoor

Liam G. Oliver

Tyler Gomez

Logan Brady

Siena F. Ashdown

Spencer Snow

Lauren Lengel

Ava Zhao

Kate A. Knish

Jaqueline Carrillo-Valle

Samson R. Davis

Samantha Eliason

Jay Chaudhari

Utah State University

Hunter R. Pead

Gwen Holt

Charles Call

Dylan M. Phelps

David K. Forsythe

Zeb A. Benson

Jason D. Duersch

Jordan Olsen

Shane Amidan

Stephen Jerman

Jet Hunter

Gillian H. Luu

Monica Vasquez

Utah Tech University

Connor L. Lewis

Amira Hassan

Zach T. Robinson

Cooper Mills

Marcus A. Morgan

Jhonny L. Druding

Ryan D. Hatefi

McKyla Barlow

Karl Aust

Julia Carmichael

Aiden Simpson

Magalei J. Stevenson

Trevor Lamoreaux

Jace B. Bargar

Anthony Delgado

Son Huynh

Matthew C. Davider

Bryson Griffiths

Cooper D. Cox

Utah Valley University

Jessica Fernandes

Logen R. Dixon

Halle A. Henderson

Kirk B. Phillips

Morgan M. Hansen

Kyle Jeppesen

Hailey Reynolds

Gabriel Henry

Carlos E. Sarmiento

Aubry Quijano

Alysa Mellars

Andrew Walker

Cameron Orr

John R. Sawka

Madelyn J. McCracken

Kennedy H. Slagle

Jane Fredrick

Elizabeth Fullmer

Weber State University

Laurissa J. Solomon

Karla A. Gracia

Tyler D. Madsen

Shaina Widmark

Aaron T. Hyer

Mitchell B. Burr

Jonah C. Allred

Spencer R. Rindlisbacher

Carson Day

Kyle Francis

Carson R. Perkes

Western Governors

University

Sam Frost

Amy E. Thacker Anderson

Andrew Wilhelm

Tell us about your employment changes or what’s been happening at your firm. Send your news to Amy Spencer, as@uacpa.org.

Val Steed, the director of accountants at Zoho, was named among the top 100 CPAs in Accounting Today's 2025 Top 100 Most Influential People special edition. Val has brought a wealth of knowledge to many public appearances while introducing Zoho to the American market. Prior to Zoho, Val founded K2 Enterprises, a leading provider of technology-focused CPE. Val has frequently been recognized as an outstanding discussion leader and received the Alumni Professional Achievement Award from his alma mater, Utah State University.

Squire announced the acquisition of HintonBurdick, effective January 1, 2026. This move expands Squire's footprint across the Intermountain West, adding offices in Arizona and Nevada. Phillip Peine, Managing Partner at HintonBurdick says, "Joining Squire allows us to maintain that same level of client care while giving our team and clients access to expanded resources, specialized expertise, and innovative technologies. We're excited about what this partnership means for our clients, our people, and the communities we serve."

Eide Bailly celebrates being named to 2025 Accounting MOVE Project's list of best CPA firms for women and best firms for equity leadership. This recognition marks the sixth time Eide Bailly has been honored for its commitment to advancing women in the profession and equity leadership. To qualify for this recognition, firms must have women comprising at least 31% of partners and principals.

David Peterson

April 28, 1952 – Nov. 13, 2025

Member since 1982

Fredric Theodore Wunderli

March 15, 1935 – Dec. 17, 2025

Member since 1961

Thomas L. Neff

Oct. 14, 1940 – Dec. 30, 2025

Member since 1968

Douglas White

Jan. 11, 1947 – Oct. 11, 2025

Member since 1999

Douglas Morrison

April 7, 1940 – Nov. 24, 2025

Member since 1978

“As someone who didn’t follow the traditional CPA trajectory, I'll say the UACPA welcomes you with open arms. My advice is: Take all of the time you need to do it right and rely on mentors, study material, and the UACPA. While the CPA Exam requires discipline and technical mastery, the license is actually a passport to a much broader professional world. We wish you the best in your journey!”

“For all of the CPA candidates who are currently working professionals: Trust that the hands-on knowledge you have gained with your work experience will help you with some of the difficult concepts. Consider yourself ahead of the game. Experience matters!”

“When preparing for the CPA, don't think of it as a 'box-checking' exercise! The sooner you get out of that mindset, the more prepared you are to do the kinds of work that will matter to you. For example, find a topic on the Exam that really interests you and spend extra time learning what a career in that area would be like. It might open your mind to opportunities you didn't see before.”

“Stay consistent and steady and don’t expect perfection. Every small daily progress towards passing the Exam adds up. If you have a support system, lean on it. If you don’t, there are many of us who would love to mentor you through the process.”

Not pictured: Amy Anholt and Dan Greer

“Don’t procrastinate! While you are in school or newly graduated, you possess a 'study momentum' that is much harder to regain later. Furthermore, as your professional responsibilities grow, finding dedicated time for the exams will only become more challenging.”

“1) Set a schedule and follow it. 2) Reward yourself at each step along the way, don’t wait until you’re all done to celebrate. (Just don’t celebrate by taking a break from CPA study.)”

Clinton Armstrong, CPA

“Always remember that the exams are not an IQ test, they are tests of endurance. Plan out your calendar to give you enough time to properly prepare.”

“Stay focused and push through the extra study and demands on your time. The sooner you pass the knowledge test, the sooner you can focus on learning skills and becoming an expert.”

“Take the exam as soon as you can; I know you’re tired and ready to be done with school. This is the final push; life will only get busier once you graduate.”

Debbie Dujanovic

“My top work goal is to help launch the UACPA's 'Talk to Your CPA' public image campaign through compelling social and mainstream media content that positions CPAs as approachable, trusted, year-round advisors. My personal goal is to take an art class! I've been putting it off for decades and 2026 is my year to put a brush to canvas."

“One personal goal is to prioritize sleep and get to bed earlier, especially on weeknights. I’m tired of feeling exhausted, so I’m trying to make it a routine instead of an afterthought. A work goal is to take a QuickBooks class so I can understand it better. I use it enough that it makes sense to learn what I’m doing instead of guessing my way through it.”

Amy Spencer

“For work, I recently helped launch the CPA Candidate membership. The next goal is to ensure we have mentors for these aspiring CPAs. Personally, I'm having a big birthday this year so the pressure is on to get my affairs in order. It's the goal I have pushed to the backburner year after year."

8

State & Local Government Conference

The annual meeting is back.

8

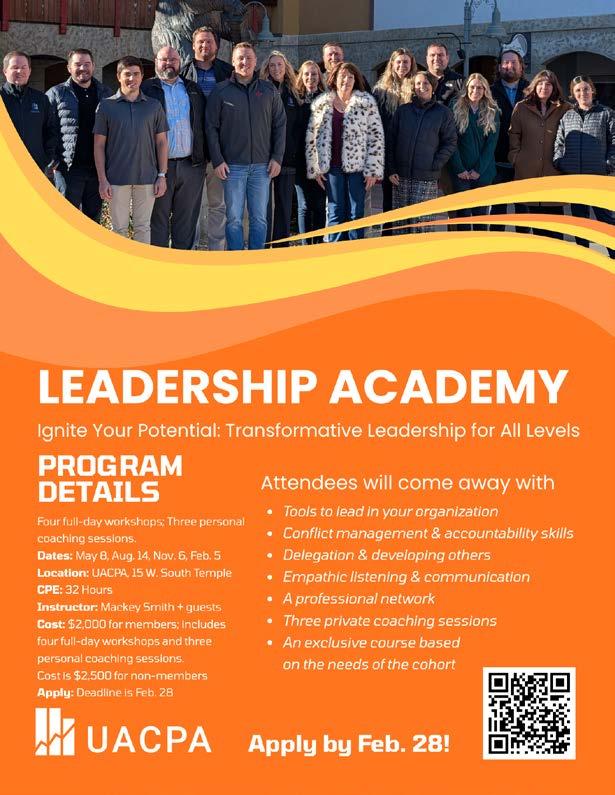

Leadership Academy

This select group of future leaders meet for the first of four training sessions.

14

Member Appreciation Day

We're giving four hours of free virtual CPE to members.

AUG. 20

Golf Tournament

Help raise funds for the Utah CPA Foundation while enjoying a day on the green.

25

Inauguration & Awards

Celebrate outstanding CPAs and new professionals at this annual lunch banquet.

OCT. 22

Member Appreciation Day

We're giving you another chance to earn four hours of free, virtual CPE.

DEC. 10 - 11

Annual Conference

This year-end conference will help you prepare for a new year with important updates.

Jacob Reschke, a supervisor in the assurance department at Richey May, was born and raised in Salt Lake City. He served a mission in Lima, Peru, and graduated from Brigham Young University with the MAcc and a minor in information systems. His previous jobs include lifeguarding, washing the BYU Cosmo Cougar mascot costume and working as an accounting intern on a walnut farm. Jacob married his high school sweetheart, Mckenna, and they have 5 children.

What do you do at Richey May and Ensign College? I have been with Richey May for five years. I work with some amazing clients and teammates. I specialize in audits of private equity, venture capital and hedge funds, but I have worked on a variety of industries including non-profits and single audits, employee benefit plans, construction, entertainment, and healthcare. I’ve also been involved with giving firm trainings, the mentorship program, and serving as a member of the AI and Software Committee. I’ve been an accounting adjunct instructor at Ensign for almost three years. I enjoy mentoring so many amazing students. I have taught a variety of courses and have also been involved with new curriculum development and piloting new courses.

How did you get involved as a volunteer with the UACPA? I have been mentored by so many amazing individuals.

Volunteering with the UACPA has been a rewarding way for me to give back. Volunteering has been a great way to help bring together members of Utah’s thriving business community.

What led you to become a CPA? I’ve enjoyed business for as long as I can remember. I enjoy solving puzzles and meeting new people. I love to dig into the details of how companies operate and what makes them successful.

What do you like about being a CPA? The variety of different projects and clients that I get to work with. Every day brings something new. I am also fascinated by the intersection of numbers and technology. I enjoy developing technological solutions to bring accuracy and efficiency to my work.

What would surprise people to know about you? I love history and exploring off the beaten path, including ghost towns. I also enjoy pushing the limits of Microsoft Excel, including being able to text my wife and turn the lights in our house on and off using Macros.

What is your favorite book or author? Born to Run and anything written by Malcolm Gladwell.

What do you like to do outside of work? Spending time outdoors with family. This includes camping, hiking, backpacking, fishing, geocaching, and running. I also love cooking and have been tinkering around with my new smoker.

What are some of your goals both personally and professionally? Run an ultramarathon and hike the Incan Trail to Machu Picchu with my family. Professional goals are (in no particular order) to identify fraud using a Benford Analysis, to become partner at my firm, and to be a helpful mentor to new professionals and students.

What advice do you live by? A quote from Steve Prefontaine, one of my favorite runners: “To give anything less than your best is to sacrifice the gift.” n

Tell us about your new job, recent firm developments, and key highlights. We love to celebrate your success!

Send news to Amy Spencer, as@uacpa.org

To view and post job listings, visit uacpa.org/jobs. Create your own post by selecting the yellow button in the upper left corner that says “Add Job Posting.” Posting is free for members and posts are active for 60 days.

Jobs currently posted

• Senior Accountant - Utah Inland Port Authority SLC

• Associate Director over Financial Reporting & Accounting

• Tax Examining Technician - IRS

• Tax Accountant, Financial Services

• Tax Director, Financial Services

• Senior Accounting Manager or Director Needed for Contract Administration

• Sparano + Mooney Architecture is Seeking a Controller

The UACPA supports and challenges members through advocacy, professional education, leadership development, networking, and community service, to help them succeed in a competitive and changing world.

At the UACPA, our vision is to be a world-class professional association essential to our members.

We unite a vibrant community of CPAs to enhance the success of our members and champion the values of the profession; Integrity, Competency, and Objectivity.

Advocacy: The UACPA represents the profession at the legislature and other regulatory bodies and promotes the value of the CPA to employers, the business community, and the public at large.

Leadership & Service: The UACPA provides leadership and service within the profession, within the UACPA, and within the community.

Professional Development: The UACPA supports and encourages continuing education and leadership development.

Professional Community: The UACPA reinforces peer accountability to encourage members to maintain integrity and high ethical standards. We provide memberto-member networking opportunities and networking opportunities with other professions. We value belonging to a distinguished organization and believe that we serve as the primary resource and point of contact for Utah CPAs.

Diverse Population Outreach: The UACPA believes in reaching out to under-represented populations, those returning to the profession or choosing it as a second career, and other professions.

Congratulations to the firms and businesses currently participating in the UACPA’s 100% membership program. This demonstrates their commitment to the profession, to the association’s high ethical standards and lifelong learning.

• A+P CPAs

• Baker Tilly

• CBIZ & CBIZ CPAs

• CLA (CliftonLarsonAllen)

• CMP

• Davis & Bott, Certified Public Accountants, L.C.

• Eide Bailly

• Haynie & Company

• HBME

• Jones Simkins LLC

• Richey May

• Sadler Gibb

• Savage Esplin & Radmall, PC

• Squire & Company, PC

• Tanner LLC

• Teuscher Walpole, LLC

• Utah Office of the State Auditor

Firms with 10 or more full-time CPAs are eligible to be a part of the 100% membership program. Call our membership team to sign up, 801.466.8022.

8am CPACharge has made it easy and inexpensive to accept payments via credit card. I’m getting paid faster, and clients are able to pay their bills with no hassles.

Trusted by accounting industry professionals nationwide, 8am™ CPACharge is a simple, web-based solution that allows you to securely accept client credit and eCheck payments from anywhere. – Cantor Forensic Accounting, PLLC

increase in cash flow with online payments of consumers prefer to pay electronically of bills sent online are paid in 24 hours